Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Yesterday’s (Jun. 3) daily slide came as a surprise that seems temporary… to most investors. But you know that it’s just the first crack in the golden dam.

The Downswing Is on the Way

Gold has ridiculously good fundamentals. We have open-ended QEs – money is being pumped into the system at an unprecedented pace, even when stocks are well beyond their all-time highs. The world has been in a pandemic for over a year, and the economies were hit hard. And yet, despite all these positive news, gold – the king of safe havens – did not manage to soar above its 2011 highs and then stay above them. Given how extremely positive the fundamental situation is, gold’s reaction is even more extremely bearish. This market is simply not ready to soar without declining significantly first. Bull markets and bear markets move in stages, and even though this time the final slide was postponed multiple times, it’s clear that gold is not ready to soar to new highs without completing its final stage – the downswing.

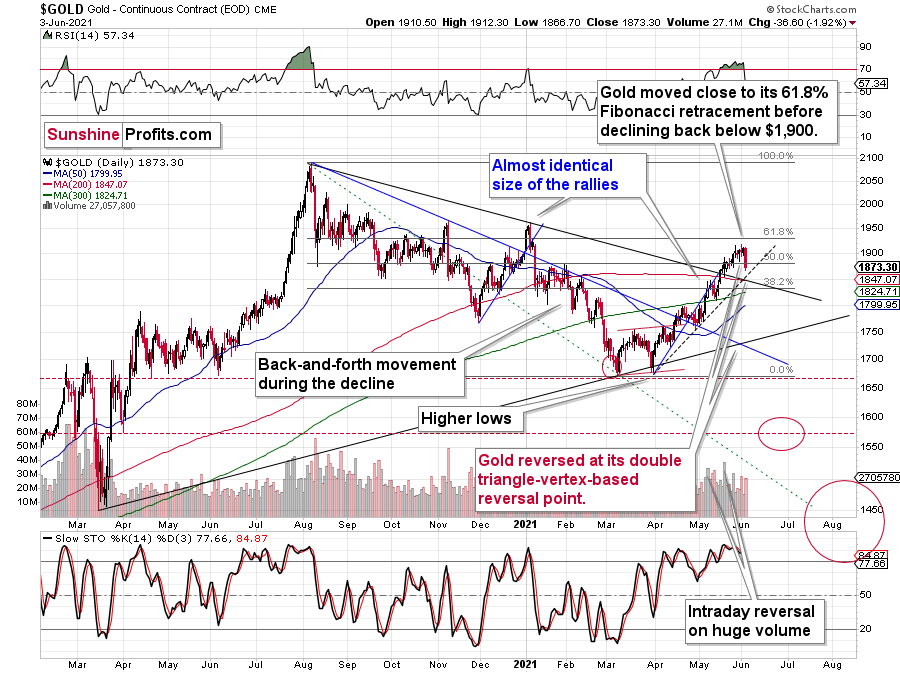

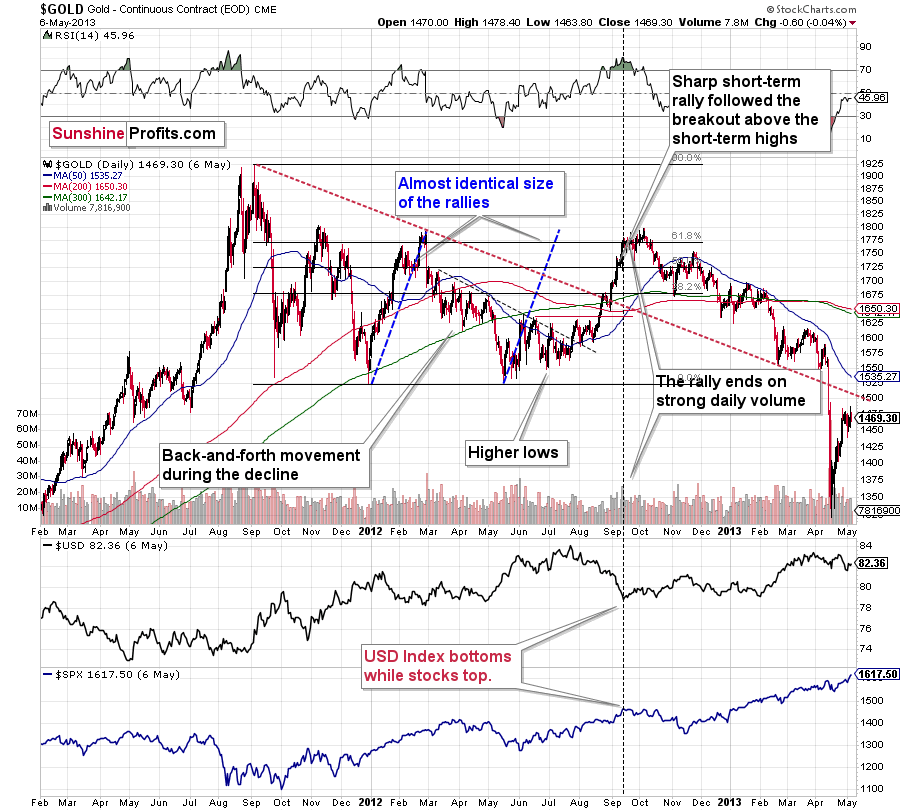

The history is rhyming regarding the shapes of the price moves as well. Just as gold moved back and forth, forming three distinctive tops in 2008 and 2011-2012, we saw the same thing now – between the August 2020 top and the recent top, which seems to have been the final breath of the short-term bull.

I’ve been emphasizing this self-similar pattern for many weeks, and it seems that the bullish part thereof is now over. Also, it seems that it ended at the combination of two triangle-vertex-based reversal points.

The triangle-vertex-based reversal points have worked multiple times on the precious metals market, and it’s no wonder that we just saw them work once again.

On Wednesday (Jun. 2), gold closed ~$5 higher, and this move took place on relatively low volume. In fact, gold hasn’t rallied on volume this low since Apr. 26. This was a bearish sign for the short term, and indeed after the Apr. 26 session, gold moved lower in the following days.

And, right on cue, gold declined by $36.60 in yesterday’s trading. While this decline might seem surprising to some, it’s actually a perfectly natural thing for gold to do right now.

The low-volume daily rally was only a confirmation, as we knew that Tuesday’s daily reversal was critical all along – based on the triangle-vertex-based reversal we recently saw. Combination of this with highly overbought RSI, a sell signal from the stochastic indicator, and, most importantly, the analogies to how the situation in gold developed in 2008 and 2012, provides us with an extremely bearish price prediction for gold.

Many other factors are pointing to these similarities, and two of them are the size of the correction relative to the preceding decline and to the previous rally. In 2012 and 2008, gold corrected to approximately the 61.8% Fibonacci retracement level. Gold was very close to this level this year, and since the history tends to rhyme more than it tends to repeat itself to the letter, it seems that the top might already be in.

In both years, 2008 and 2012, there were three tops. Furthermore, the rallies that took gold to the second and third top were similar. In 2008, the rally preceding the third top was bigger than the rally preceding the second top. In 2012, they were more or less equal. I marked those rallies with blue lines in the above chart – the current situation is very much in between the above-mentioned situations. Also, the current rally is bigger than the one that ended in early January 2021 but not significantly so.

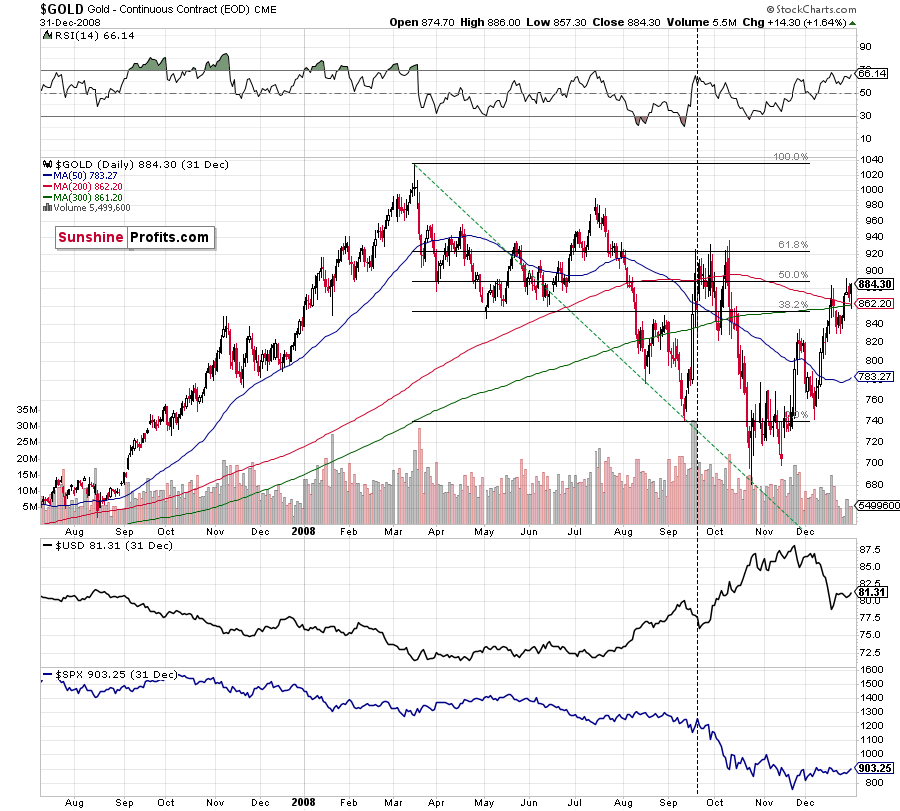

Remember what happened when gold previously attempted to break above major long-term highs? It was in 2008 and gold was breaking above its 1980 high. Gold wasn’t ready to truly continue its bull market without plunging first. This downswing was truly epic, especially in the case of silver and mining stocks; and now even gold’s price patterns are like what we saw in 2008.

My previous comments on the analogies to 2008 and 2012 remain up-to-date:

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

What would change my mind with regard to gold itself? Perhaps if it broke above its January 2021 highs and confirmed this breakout. This would be an important technical indication on its own, but it would also be something very different from what happened in 2008 and 2012. If that happened along with strength in mining stocks, it would be very bullish. Still, if the above happened, and miners didn’t react at all or they declined, it would not be bullish despite the gains in the gold price itself.

The March 2021 low formed well below the previous low, but as far as other things are concerned, the current situation is similar to what happened in 2012.

The relatively broad bottom with higher lows is what preceded both final short-term rallies – the current one, and the 2012 one. Their shape as well as the shape of the decline that preceded these broad bottoms is very similar. In both cases, the preceding decline had some back-and-forth trading in its middle, and the final rally picked up pace after breaking above the initial short-term high.

Interestingly, the 2012 rally ended on huge volume, which is exactly what we saw also on May 19 this year. Consequently, forecasting much higher silver or gold prices here doesn’t seem to be justified based on the historical analogies.

The thing I would like to emphasize here is that gold didn’t form the final top at the huge-volume reversal on Sep. 13, 2012. It moved back and forth for a while and moved a bit above that high-volume top, and only then the final top took place (in early October 2012).

The same happened in September and in October 2008. Gold reversed on huge volume in mid-September, and it was approximately the end of the rally. The final top, however, formed after some back-and-forth trading and a move slightly above the previous high.

Consequently, the fact that gold moved a bit above its own high-volume reversal (May 19, 2021) is not an invalidation of the analogy, but rather its continuation.

There’s one more thing I would like to add, and it’s that back in 2012, gold corrected to approximately the 61.8% Fibonacci retracement level – furthermore, the same happened in 2008 as you can see in the below chart. Consequently, the fact that gold moved above its 50% Fibonacci retracement doesn’t break the analogy either. And even if gold moves to $1,940 or so, it will not break it. It’s not likely that it is going to move that high, as in both cases –in 2008 and 2012 – gold moved only somewhat above its high-volume reversal before forming the final top. So, as this year’s huge-volume reversal took place close to the 50% retracement and not the 61.8% retracement, it seems that we’ll likely see a temporary move above it, which will create the final top. And that’s exactly what we see happening so far this week.

The lower part of the above chart shows how the USD Index and the general stock market performed when gold ended its late-2012 rally and was starting its epic decline. In short, that was when the USD Index bottomed, and when the general stock market topped.

Also, please note that while it might seem bullish that gold managed to rally above its declining black resistance line recently (the one based on the 2020 top and the 2021 top), please note that the same happened in 2012 – I marked the analogous line with red. The breakout didn’t prevent gold from sliding. When the price reached the line, we saw a short-term bounce, but nothing more than that – the gold price fell through it in the following weeks.

Oh, and by the way, the Fed wants to convince the market that inflation is just transitory in order to prevent the 10-year yield from rising. Let’s ask ourselves now what the Fed would appreciate with respect to gold prices. Exactly, it would be awfully convenient for the price of gold to decline in order to prove the point of the transitory nature of inflation.

Inflation? What inflation? Even gold prices are declining…

Now, as you know, I’m not a fan of all the conspiracy theories that are out there, and I’m not the first to shout gold manipulation or silver manipulation every time the yellow or while metal goes down, but I also know that being realistic is one of my strengths. With the situation being what it is, and since the communities of top investment bankers and the community of officials interlace, I think that we have yet another reason to expect that the gold price is going to slide in the following weeks/months.

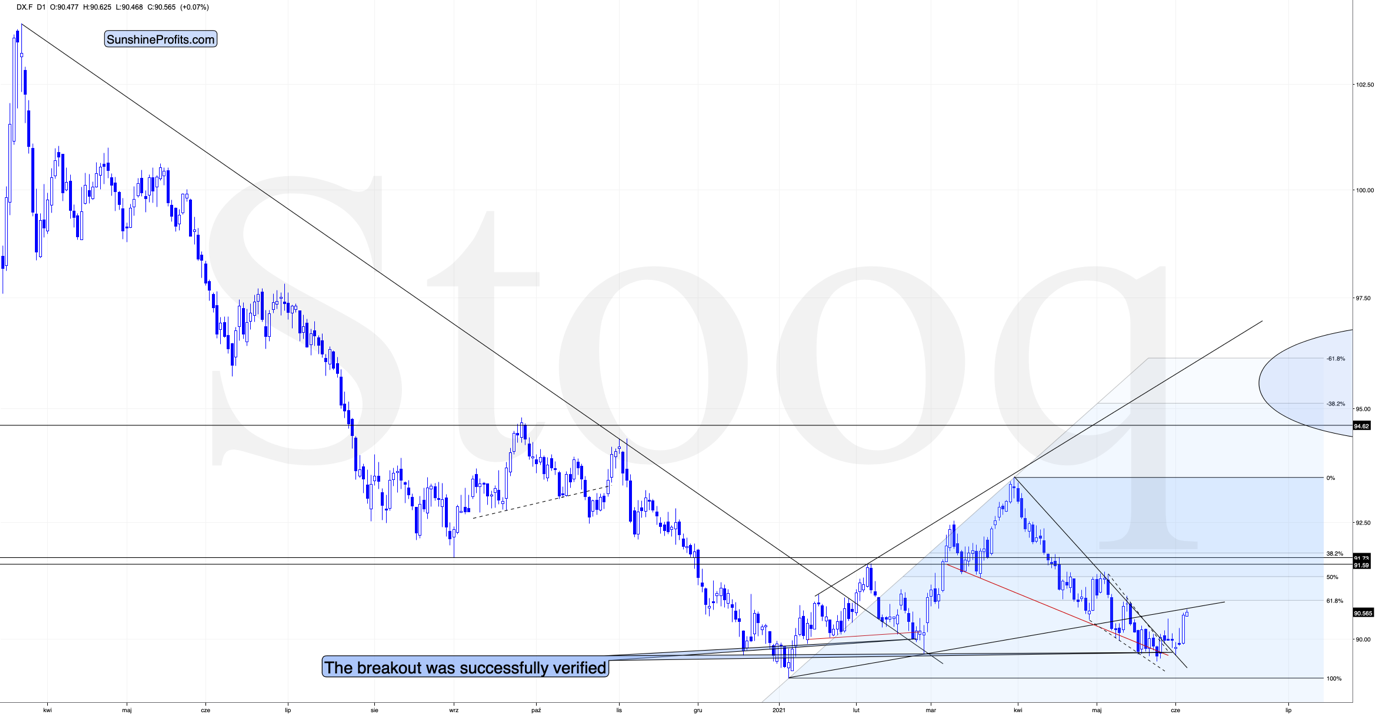

Meanwhile, the USD Index soared right after confirming its short-term breakout, suggesting that the analogy to 2016 and the similarity to how it bottomed (triple bottom with lower lows) in mid-2020 remains intact. And so does the bullish outlook for the universally-hated-and-massively-shorted U.S. currency.

The USD Index paused at the rising resistance line based on the previous lows, and once it rallies back above it, it will be clear to many traders that the trend has already reversed. It will even be clearer when the rally gains more strength and when the precious metals decline even profoundly than yesterday.

Having said that, let’s take a look at other markets.

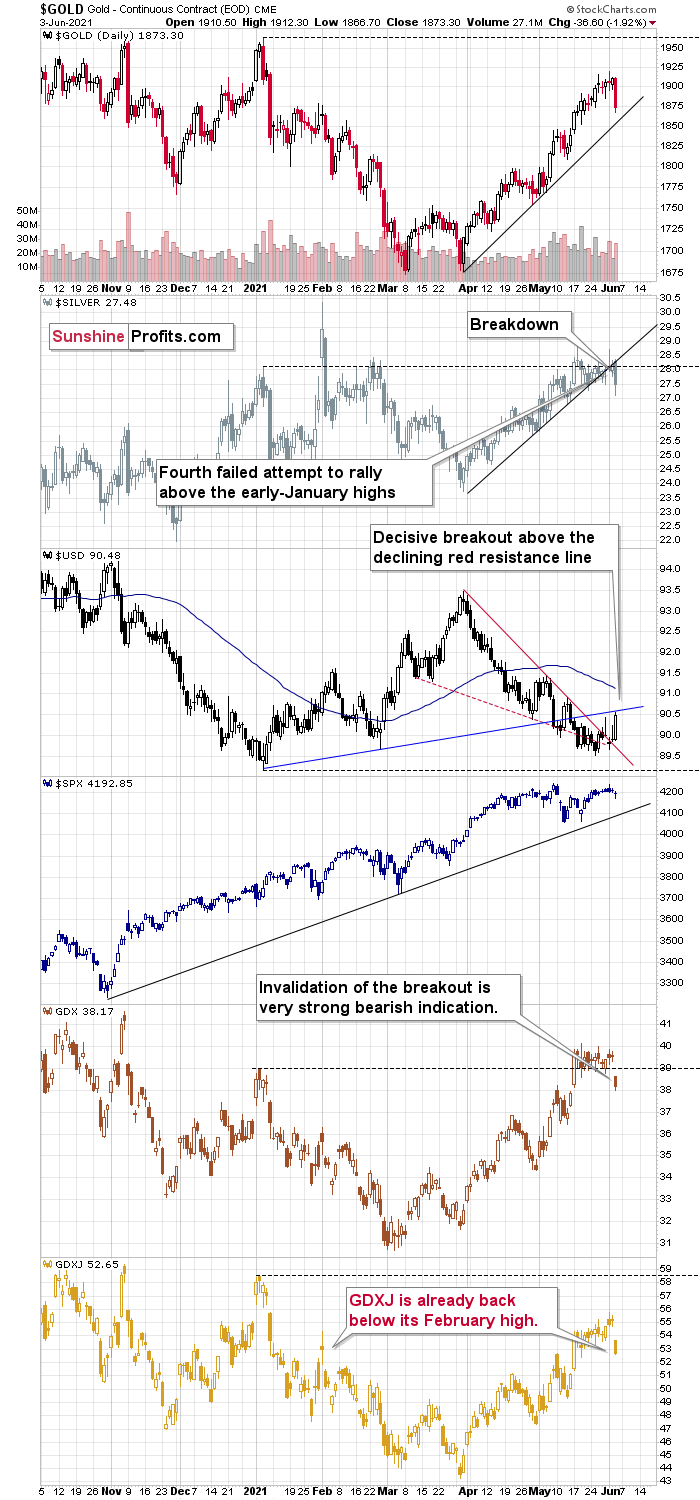

The three notable events that we can see on the above chart are:

- Silver has just broken below its rising support line right after it failed to break above its early-January highs for the fourth time. And this decline happened right after the intraday reversal when silver had outperformed gold. This is exactly how big silver declines tend to start.

- The GDX ETF – a proxy for senior miners – has just invalidated its breakout above its January highs. Invalidations of breakouts are strong bearish signals in general, and this one is crystal-clear.

- The GDXJ ETF – a proxy for junior miners – has never reached its January highs, but it has just invalidated a breakout above its February high. It has also declined more (4.58%) than the GDX (3.46%). The juniors are declining more than the seniors – in tune with my previous analyses.

Overall, it seems that the big downswing has just begun.

Having said that, let’s take a look at the markets from a more fundamental angle.

Buckle up

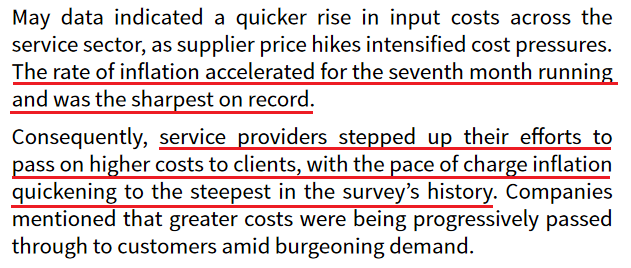

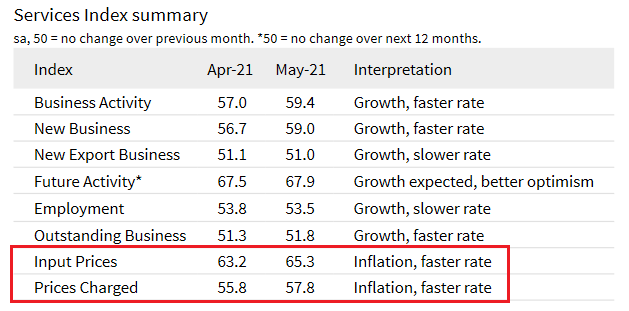

With the USD Index and the U.S. 10-Year Treasury yield rattling the PMs on Jun. 3, the summer months are likely to elicit similar fireworks. Case in point: with manufacturing PMIs garnering all of the attention on Jun. 1, services entered the spotlight on Jun. 3. And with IHS Markit’s U.S. Services PMI hitting another record high, an excerpt from the report read:

“The rate of input cost inflation accelerated to a series high amid ongoing supplier price hikes. In an effort to pass on greater costs, service providers raised their charges at an unprecedented pace.”

Please see below:

In a similar fashion, the J. P. Morgan Global PMI Composite Output Index hit a 181-month high on Jun. 3, and the report revealed that “input costs rose to the greatest extent since August 2008 and output charges at the quickest rate on record (since at least October 2009).”

Please see below:

Source: J.P. Morgan, IHS Markit

Source: J.P. Morgan, IHS Markit

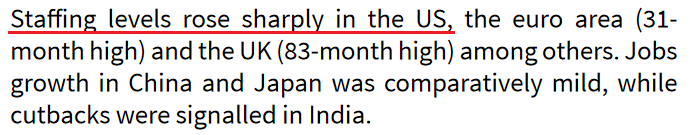

More importantly, though, with rising employment likely the final nail in the U.S. Federal Reserve’s (FED) liquidity coffin, the strong PMI prints also revealed some other meaningful details.

On Jun. 3, I wrote:

With employment the last piece of the U.S. 10-Year Treasury yield and the USD Index’s bullish puzzle, outperformance on Jun. 4 could be the spark that lights the pair’s fire. However, to curb expectations, note that the changes in enhanced unemployment benefits don’t take effect until mid-to-late June or early July. Thus, while the Jun. 4 print may not capture the building momentum, a material shift is likely to occur in the coming months.

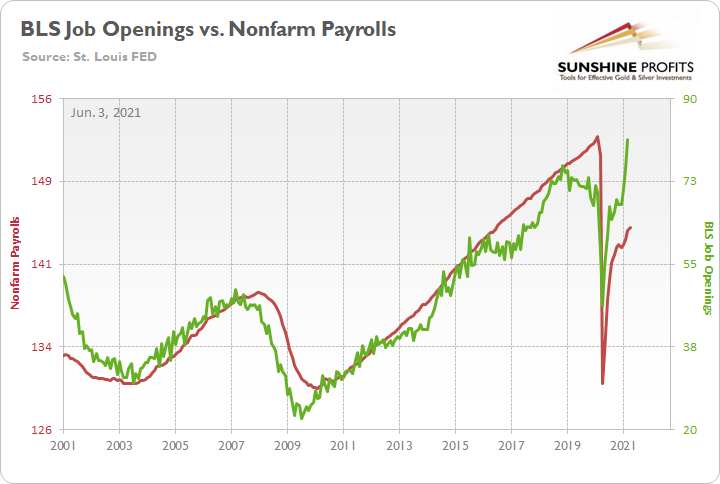

Please see below:

To explain, with half of U.S. states already ending enhanced unemployment benefits and the federal government officially shuttering the program on Sept. 6 (expected), it won’t be long until the nonfarm payrolls reconnect with the BLS job openings once again. Furthermore, with the U.S. 10-Year Treasury yield and the USD Index waiting for the signal, if the U.S. labor market improves, the FED will face even more pressure to taper its asset purchases.

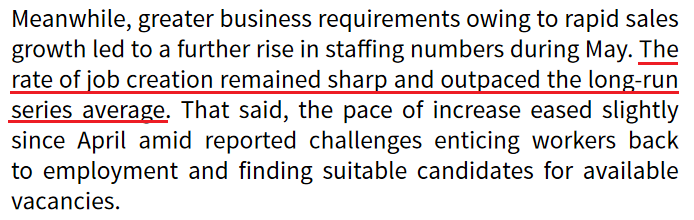

Furthermore, with the PMI releases also providing some reliable employment signals, the final destination likely isn’t far away. To explain, data from the U.S. Services PMI was compiled from May 12 to 25, while data from the J. P. Morgan Global PMI was compiled during the month of May. And while the former cautioned that “the pace of increase [in employment] eased slightly since April amid reported challenges enticing workers back” (a function of enhanced unemployment benefits), job creation is steadily rising.

Please see below:

Likewise, while the latter characterized the employment situation as “growth, slower rate,” the U.S. elicited strength and a surge in momentum is likely to occur once enhanced unemployment benefits are a thing of the past.

Source: J.P. Morgan, IHS Markit

Source: J.P. Morgan, IHS Markit

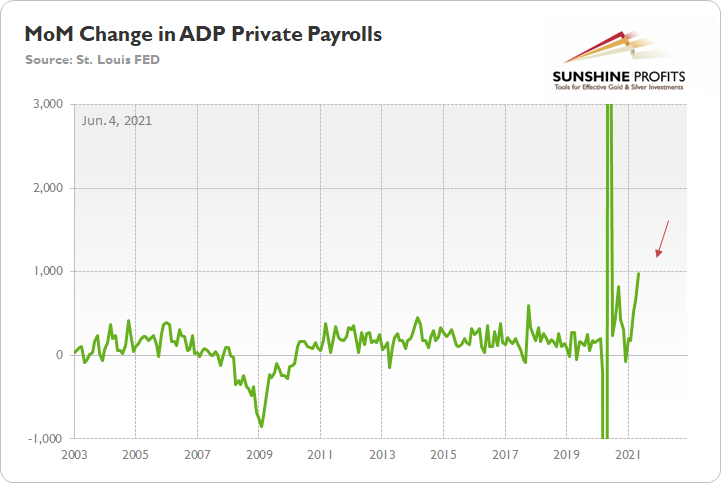

To that point, ADP’s private payrolls were released on Jun. 3, with the 978,000 jobs created coming in above the consensus estimate of 650,000. For context, the ADP National Employment Report measures the monthly change in U.S. private employment and covers nearly 26 million U.S. workers.

Please see below:

Keep in mind though: ADP’s private payrolls aren’t the best predictor of U.S. nonfarm payrolls. However, when you combine the record job openings with the elimination of enhanced unemployment benefits, U.S. nonfarm payrolls should move materially higher in the coming months. Moreover, with high unemployment the only rebuttal left in the FED’s too-soon-to-taper argument, a hawkish shift will likely occur at the same time.

As further evidence, the Institute for Supply Management (ISM) released its Services PMI on Jun. 3. And following a familiar script, an excerpt from the report read:

“Prices paid by service organizations for materials and services increased in May, with the index registering 80.6 percent. The only time the Prices Index has been higher was in September 2005, when it hit 83.5 percent. The May figure is 3.8 percentage points higher than April’s reading of 76.8 percent, which was the highest reading since July 2008 (77.4 percent).”

Even more revealing, while “all 18 services industries reported an increase in prices paid during the month of May,” one respondent had this to say about the current state of affairs:

“Small businesses in the area are reporting stimulus checks and extension of unemployment are hampering their ability to hire workers. Seasonal labor and H-2B (visa) workers are in very short supply, causing an uptick in cost per hour. Some employers are reporting they are offering cash incentives of (US) $50 if you show up for an interview.” [Professional, Scientific & Technical Services]

For context, the ISM requires written permission before redistributing any of its content, and that’s why I quoted the findings rather than including a screenshot of the report. However, if you want to review the source material, you can find it here.

What Can the Shelter CPI Tell Us?

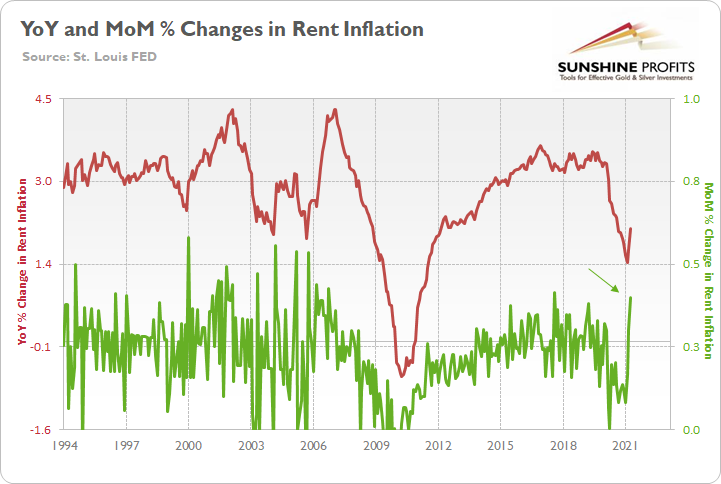

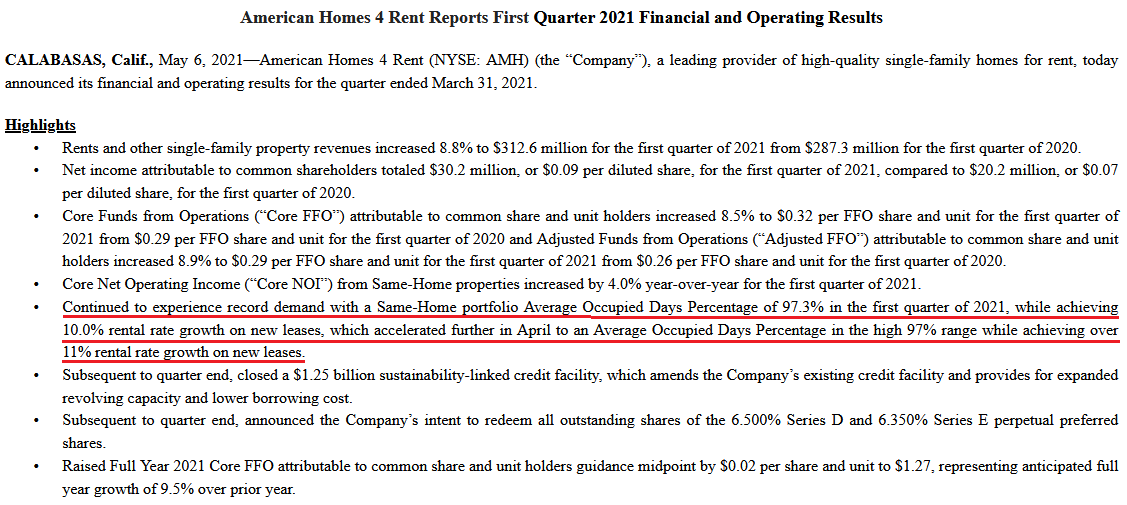

Adding more fuel to the fire, I warned on Jun. 3 that rent inflation could put major upward pressure on the headline Consumer Price Index (CPI) in the coming months. For context, the Shelter CPI accounts for more than 30% of the movement of the headline CPI.

I wrote:

If you exclude the one-time jump in 2017, April’s 0.40% MoM increase in rent inflation was the highest since 2006.

Please see below:

To explain, the red line above tracks the year-over-year (YoY) percentage change in the Shelter CPI, while the green line above tracks the MoM percentage change in the Shelter CPI. If you analyze their behavior, you can see that the YoY figure has only moved slightly higher. However, with MoM rents rising at a torrent pace (follow the green arrow), the COVID-19 grace period is officially over. And with rising rents likely to put upward pressure on the CPI in the coming months, taper-talk should grow even louder over the summer.

To that point, American Homes 4 Rent – a publicly-traded real estate investment trust (REIT) that owns 53,984 properties across 22 states (as of Mar. 31) – revealed in its first-quarter regulatory filing that the firm achieved “10.0% rental rate growth on new leases” in Q1 and “11% rental rate growth on new leases” in the month of April.

Please see below:

Source: American Homes 4 Rent 8-K

Source: American Homes 4 Rent 8-K

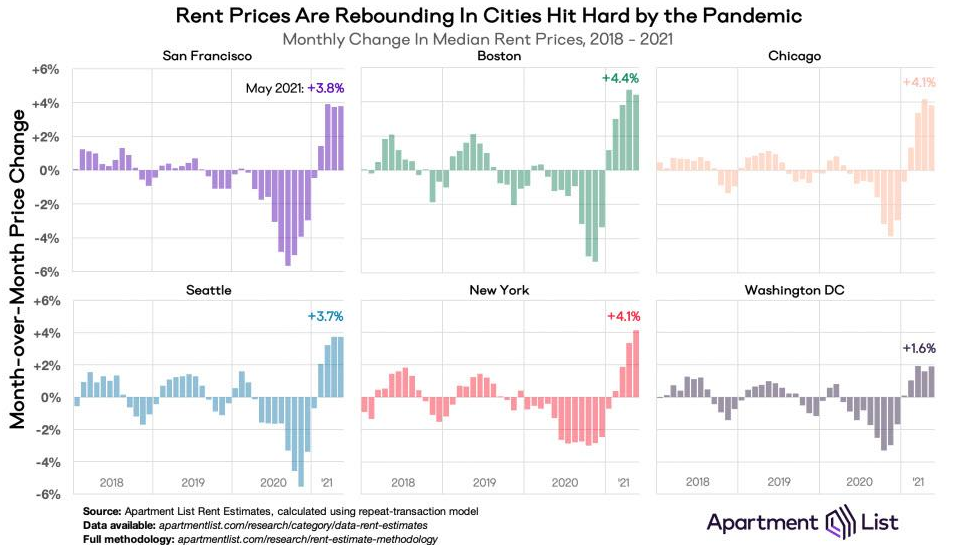

If that wasn’t enough, the U.S. cities that were hurt the most during the pandemic now have rents rising at a much faster pace MoM than the Shelter CPI.

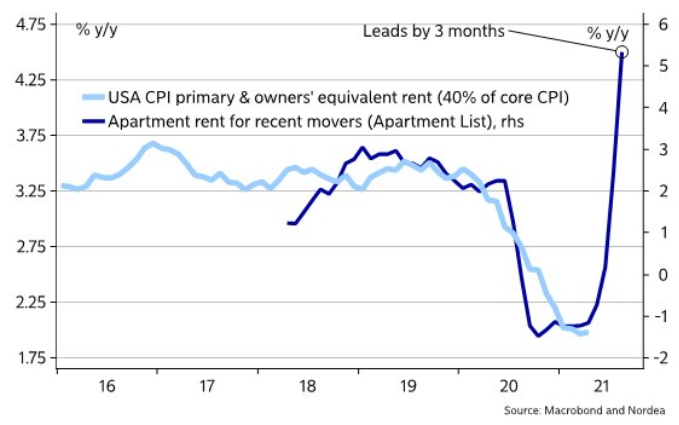

Furthermore, providing an appetizing update on Jun. 3, Nordea found that Apartment List data (the chart above) is often ahead of the Shelter CPI by three months.

Please see below:

To explain, the light blue line above tracks the YoY percentage change in primary and owners’ equivalent rent (OER) – which is similar to the Shelter CPI – while the dark blue line above tracks the YoY percentage change in Apartment List’s pricing model. If you analyze the gap on the right side of the chart, you can see that rent inflation is poised to rock the OER over the medium term.

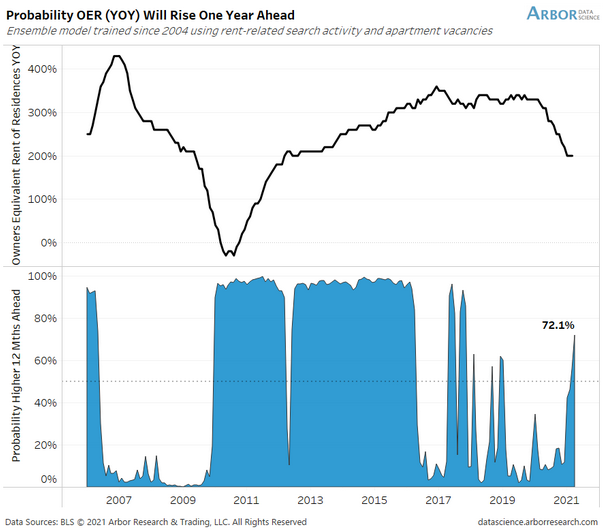

In a similar fashion, Nordea’s internal model also signals that the Shelter CPI is about to make a material move higher.

Please see below:

To explain, the light blue line above tracks the YoY percentage change in the Shelter CPI, while the dark blue line above tracks the YoY percentage change in Nordea’s internal model. If you analyze the right side of the chart, you can see that there is a visible gap. And with the Apartment List data supporting the conclusions drawn from the model, it’s only a matter of time before the Shelter CPI seeks higher ground.

Google? How Is My Rent Going?

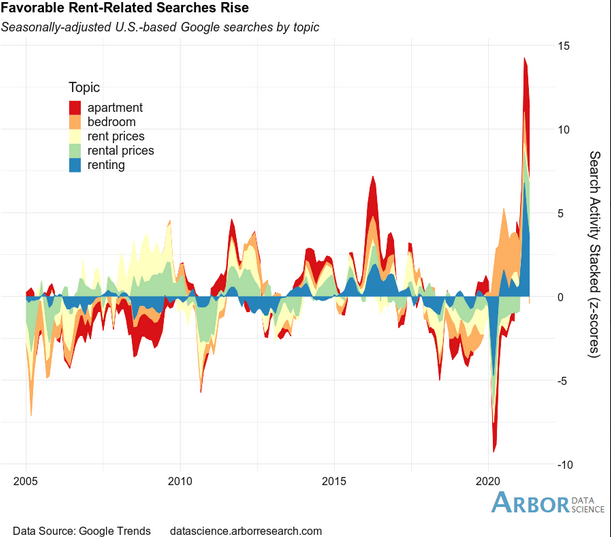

Also, supporting the thesis, rent-related Google searches have spiked in recent weeks, and landlords are likely to capitalize on the increased demand by further increasing rents.

Please see below:

To explain, the colored lines above track rent-related Google searches. If you analyze the right side of the chart, you can see that the coronavirus-induced weakness is completely gone and consumers’ behavior is now tilted toward the high side of the inflationary trend. To that point, Arbor Data Science predicts that there is a 72.1% chance that the YoY percentage change in the OER increases when the headline CPI is released on Jun. 10.

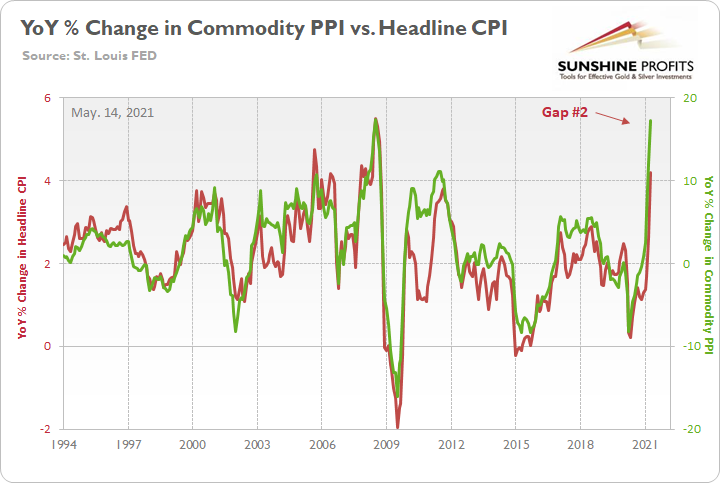

If that wasn’t enough, with the Commodity Producer Price Index (PPI) surging by 17.25% YoY in April – the second-largest YoY percentage increase since December 1974 – I warned on May 14 that the FED was running out of places to hide.

I wrote:

The commodity PPI often leads the headline CPI and that’s why tracking the former’s movement is so important. And if the merry-go-round continues, reconnecting with the green line implies another ~5.50% YoY percentage increase in the headline CPI.

Please see below:

Is the EUR/USD Driven Only by Misguided Optimism?

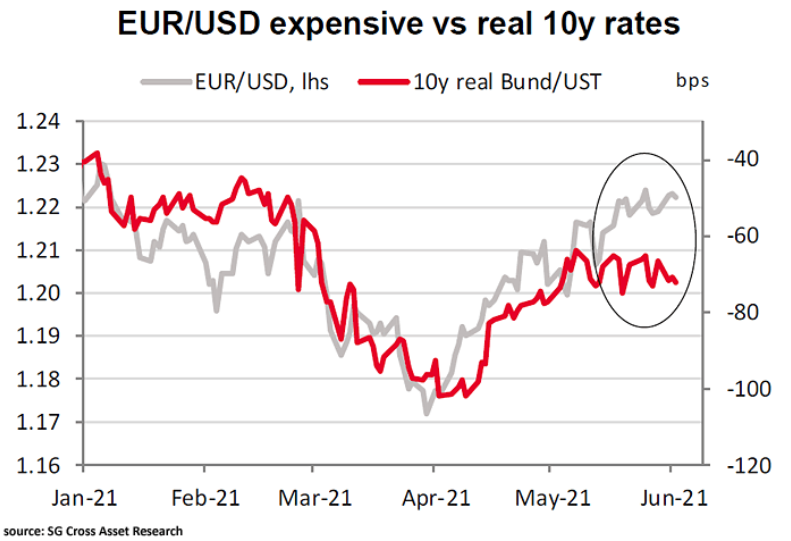

Turning to the U.S. dollar, with realized U.S. inflation drastically outperforming the Eurozone, not only is the FED more likely to taper than the European Central Bank (ECB), but nominal and real (inflation-adjusted) interest rate spreads signal that the EUR/USD remains in la-la land.

Please see below:

To explain, the gray line above tracks the EUR/USD, while the red line above tracks the spread between the real German 10-Year Bund yield and the real U.S. 10-Year Treasury yield. If you analyze the right side of the chart, you can see that a material gap is present. Thus, despite all of the hard data signaling the opposite, the only thing keeping the EUR/USD alive is misguided optimism.

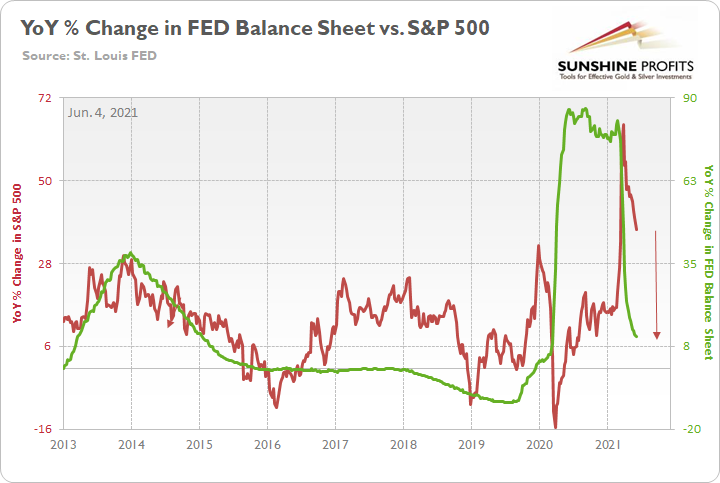

Finally, while I’ve been warning for some time that the FED is quietly draining liquidity from the system (with another $479 billion worth of reverse repos sold on Jun. 3), not only has the YoY percentage change in the FED’s balance sheet peaked and rolled over, but the metric is likely to fall even further in the coming months.

Please see below:

To explain, I wrote on May 28:

The red line above tracks the YoY percentage change in the S&P 500, while the green line above tracks the YoY percentage change in the FED’s balance sheet. If you analyze the relationship, you can see that investors’ optimism often rises and falls with the pace of the FED’s asset purchases. To that point, the FED’s YoY rate of expansion of its balance sheet peaked (for good) during the third week of February and has been in free fall ever since. Similarly, the S&P 500’s YoY rate of expansion peaked during the third week of March and has declined substantially.

The bottom line? With the weekly metric hitting a 2021 low on Jun. 3 and a reduction of the FED’s bond-buying program poised to push the YoY percentage change into negative territory in the coming months, the S&P 500’s best days are likely in the rearview.

In conclusion, the PMs received a dose of reality on Jun. 3, and the mood music is slowly shifting from sanguine to somber. Moreover, with rising U.S. employment the last piece of the USD Index’s and the U.S. 10-Year Treasury yield’s bullish puzzle, the seeds are sowed for a dramatic shift in the coming months. On top of that, with the taps running dry and the FED’s hands all but tied, the S&P 500 looks increasingly vulnerable. And while it takes more than a few cuts to slay the emperor, if the S&P 500 suffers a severe laceration, the pain will likely be felt across the precious metals market.

Overview of the Upcoming Part of the Decline

- It seems likely to me that the corrective upswing is over, given gold’s similarity to what happened in 2012 and 2018 and its turnaround at the double triangle-vertex-based reversal point, USD’s similarity to 2016 and the situation in the general stock market.

- After miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-2 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,450 - $1,500 and the entire decline (from above $1,700 to about $1,475) would be likely to take place within 1-12 weeks, and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might happen with gold close to $1,475, but it’s too early to say with certainty at this time. In other words, the entire decline could take between 1 and 12 weeks, with silver declines occurring particularly fast in the final 1-2 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops. If the general stock market puts the final top in the first half of May (which seems quite likely given NASDAQ’s top in late April), then we might expect the precious metals sector to bottom sometime in August.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: I think your call lower for the precious metals has been right and very courageous. Ralph

A: Thank you, Ralph. Courage is one of the key Stoic virtues (along with moderation, wisdom, and justice), so I particularly appreciate your comments. You can count on me speaking my mind regardless of how many others are speaking the opposite if I find it justified based on my thorough analysis.

Q: Thank you PR for the comprehensive report. Just for my knowledge, what could be the consequence for the financial market if FED continues to keep rates low disregarding inflation?

It seems that a rising USDX is critically needed for PMs to go down. I noticed that the USDX tends to turn close to the change of the month. Is that just a coincidence or is there any reason behind it?

Yes, I agree the gold bull seems tired unless there is another decline in the USD. It could also be a bull trap here, but we will have to wait and see.

A: If you mean the operations aimed at keeping long-term rates low, then gold could rally in the short term, then burn out and then decline profoundly anyway. Just like gold was unable to hold the breakout above its 2011 highs despite the announcement of the open-ended QE and pandemic, I doubt that it would be able to hold any sizable gains on the above-mentioned piece of news. And based on what we saw yesterday in gold, silver, and mining stocks, it seems that the rally is already over.

I saw that too – the turnarounds happen in the USD Index close to the turn of the month, and it’s something that I’ve seen for many years. As with any cycle – it doesn’t work in all cases, but it does indeed work quite often. It’s not clear why it works – perhaps based on the monthly economic data being available only after the month is complete – but it works often enough for one to keep that in mind.

Summary

To summarize, it seems likely to me that the corrective upswing is over, given gold’s similarity to what happened in 2012 and 2018 and its turnaround at the double triangle-vertex-based reversal point, USD’s similarity to 2016, action in the silver, and gold miners, and the situation in the general stock market.

After the sell-off (that takes gold to about $1,350 - $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $24.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $39.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $94.87; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,512.

Gold futures upside profit-take exit price: $1,512.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief