Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

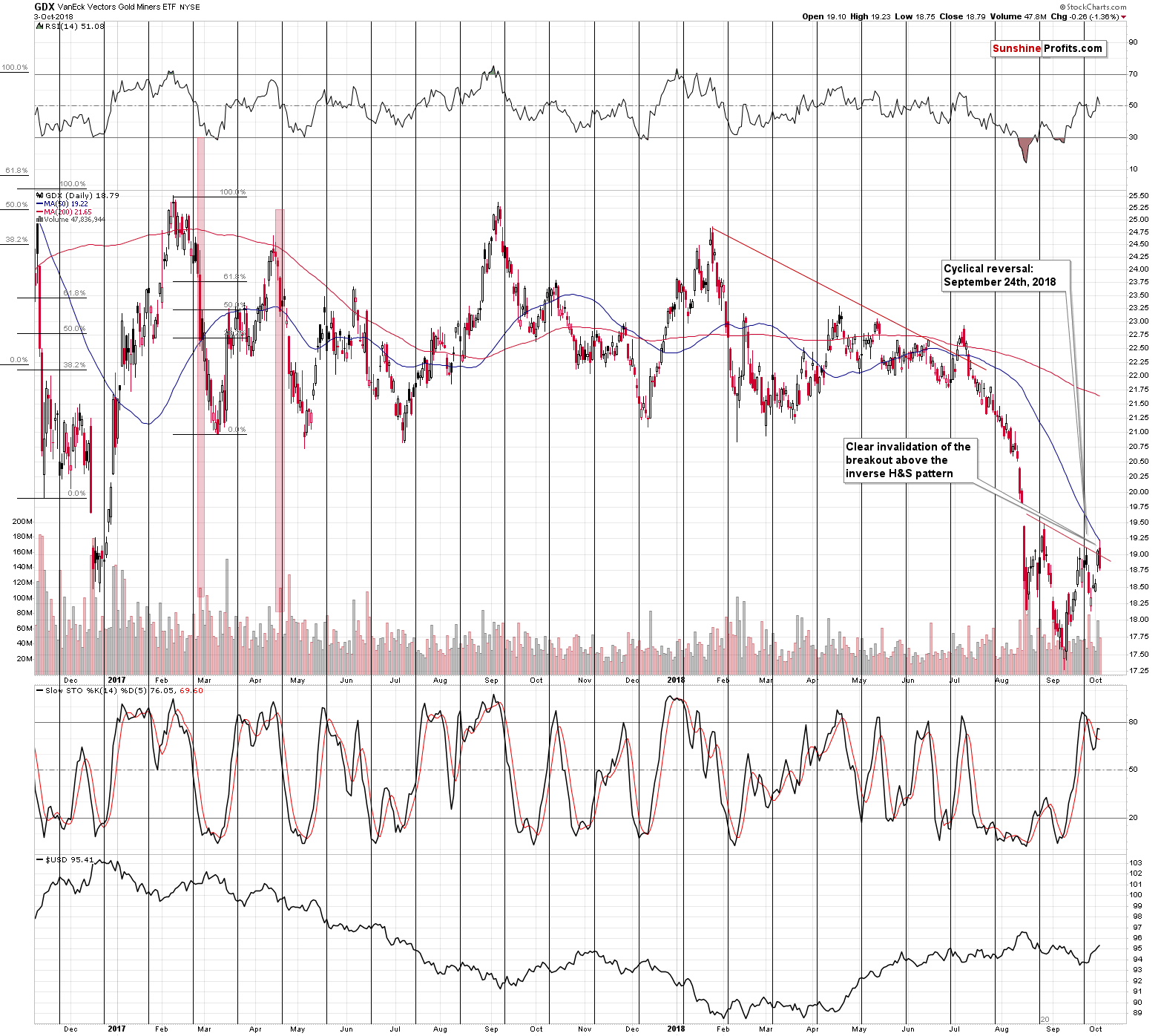

In yesterday’s analysis we wrote a lot about the possible inverse head-and-shoulders being formed in the mining stocks. We emphasized that the breakout above the neck level of the formation in the GDX ETF was too small to be considered meaningful without a confirmation, especially that other proxies for the mining stock sector didn’t provide analogous signals. We didn’t have to wait for long for the market to agree with us – GDX invalidated its breakout shortly and clearly. What’s next?

The decline is likely to resume shortly based on the above, on the signals coming from the silver market (its outperformance) and on multiple other bearish signals that we described in the previous days and weeks.

Let’s take a closer look at the GDX ETF from short- and long-term points of view (charts courtesy of http://stockcharts.com).

On the short-term chart, we see that the small move above the neck level was invalidated. Initially, however, miners rallied to the 50-day moving average and declined shortly thereafter. The bulls were overwhelmed by the selling pressure and finally the GDX closed even below Tuesday’s opening price.

Both above-mentioned invalidations are bearish on their own, but the shape of yesterday’s session has bearish implications based also on something else. Namely, yesterday’s session is extremely similar to what we saw in late August and in early July exactly as the starting session of the big declines. This analogy has profound bearish implications.

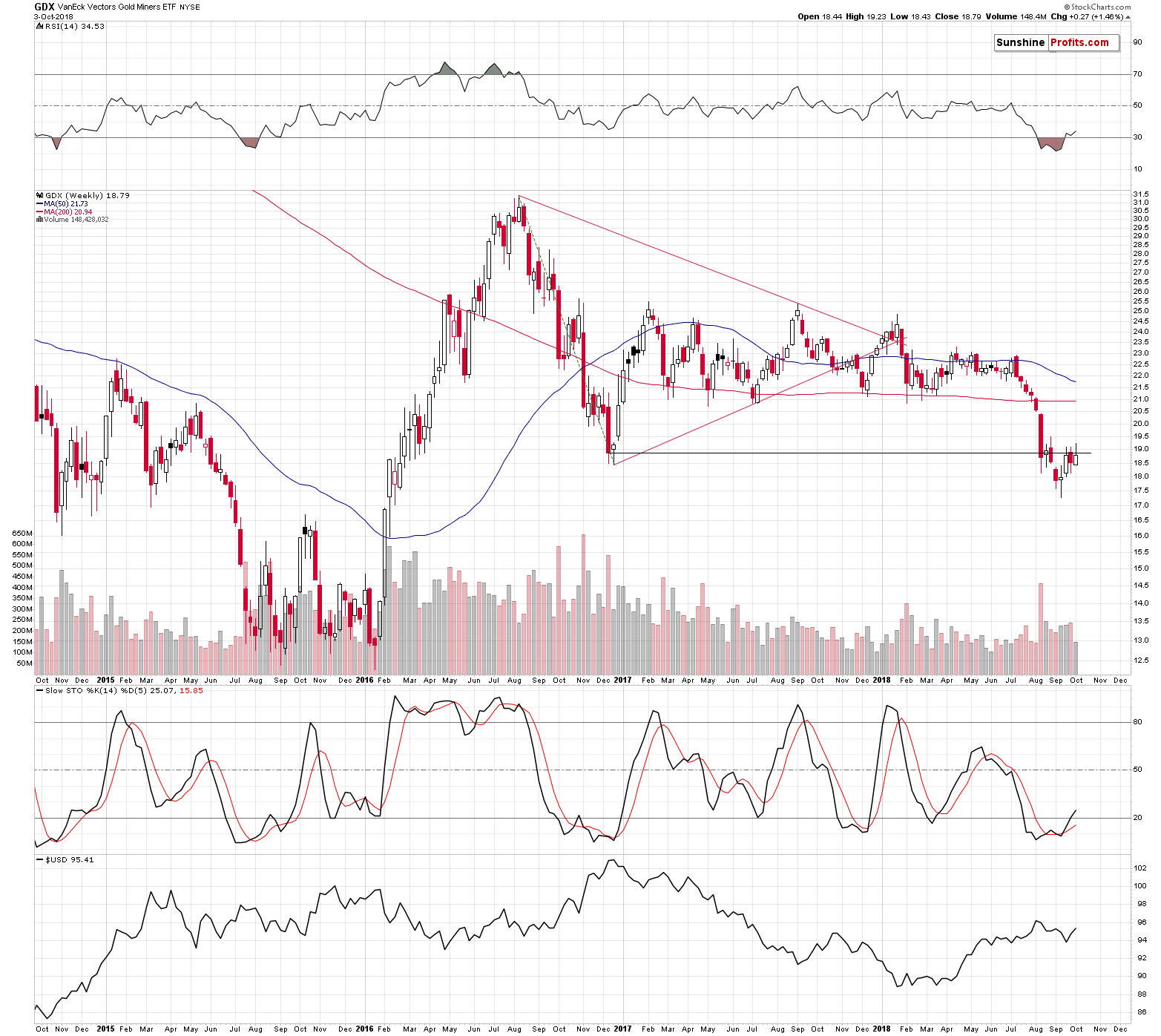

Zooming out confirms the above.

It may seem that the miners moved visibly higher in the past few weeks, but taking into account the weekly closing prices all that we saw were attempts to move back above the 2016 bottom. And they all failed.

The breakdown below the 2016 lows is more than confirmed and the implications are very bearish.

This completes the regular analysis as there were no or little changes in the other important PM-related charts (EDIT: 1 hour after today’s session’s opening, silver is practically right where it was 24 hours ago while gold is only a few dollars higher, so there really is nothing new, especially that GDX is showing weakness so far), but before summarizing, we would like to answer a question that we received recently.

Changing One's Mind - Why, When, and How

The questions was when does one change their mind regarding the outlook:

I remember I started reading years ago to Jim Sinclair ... eternal bull ... accurate when gold went from 300 to 1900 ... but for many years (8 ???), all is diving and he keeps singing that gold is going up to 5000 ... maybe it will ... but how many years "lost" (and maybe $ as well?)

My curiosity is to know when does ones minds switches and accepts that yes, the trend changed, so I can be a bull but from today on ... then, till nobody knows when I am a bear going with the trend ... and vice-versa?

There is a good reply to this question, but before presenting it, we’d like to emphasize that this issue is not limited to long-term bull or bear markets. It also extends to short-term trades. Investors often say that they can’t close a given position, because that would mean that they would be taking a loss. They say it like it was a normal and understandable thing to do. But is it really the case?

Let’s take a look at the hypothetical example. Meet Clark and Bruce. For simplicity, we’ll assume that they invested their entire savings in one mining company. They are investors in the Superb Extra Turbo Gold Junior, Ltd. (SETGJ). The company's management has an excellent track record, great properties, enough cash for a few years of production and all the permissions that it might need. Also, even though the company is still qualified as a junior, it’s liquid enough to attract significant investments. It’s simply a great company from when looking at its fundamentals.

Clark bought 5000 SETGJ shares at $10. Bruce also bought 5000 SETGJ shares, but he bought it years ago, when the stock was trading at $2.

The SETGJ is currently trading at $6, so Clark’s trade is in the red, while Bruce’s trade is in the green.

They have both conducted through macroeconomic analysis, checked the cycles, applied multiple technical tools and discussed SETGJ’s outlook with their investment advisor. They are both convinced that despite the good fundamental situation, the price is likely to decline to about $3 - $5 simply because of the current stage of the market cycle. They are not sure, but they have exactly the same doubts.

Bruce is thinking: “Awesome, I can now cash in my gains and get back in when the market bottoms. I may even consider betting on this decline through a trading vehicle.”

Clark is thinking: “No problem, I’ll just wait it out, the company has good fundamental outlook, so I should be fine.”

Consequently, based on exactly the same outlook (likelihood of $1 - $3 decline in the value of the SETGJ share price). Bruce and Clark make different investment decisions: Bruce is selling ($6 * 5000 = $30,000), while Clark is keeping his SETGJ shares.

Sounds like both decisions are justified? Let’s see.

The SETGJ goes to $3.50 and Bruce buys back his ($30,000 / $3.50) 8,571 shares. He finally decided not to short the market during the decline, but if he did, he’d have $40,000 to purchase SETGJ, and he’d buy ($40,000 / $3.50) 11,428. At the same time Clark still has his original 5,000 shares.

Just before the final part of the upswing during which they both planned to sell, the grim news hits them. Their wives are diagnosed with rare disease and require urgent and expensive ($150,000) treatment. They both sell their SETGJ positions immediately.

In the meantime, the SETGJ price soared to $24 so they both sell at a profit. Clark ends up with ($24 x 5,000) $120,000, while Bruce ends up with ($24 x 8,571) $205,704. He recalls the time, when he didn’t short the market and for a minute, he wonders how much he would have now if he did. It would be ($24 x 11428) $274,272.

Bruce pays for his wife’s treatment immediately and she is cured within a month. They are both happy and the only thing that they argue about is whether go to Tuscany, Italy in the spring when everything’s green, or in the summer, when everything’s yellow, but the weather is warmer, water in the Mediterranean Sea in particular. Bruce is happy knowing that it’s great that they can afford such vacation at least once a year, and while he wishes they could go on vacation like that a few times per year, he’s happy with how the things are.

Clark, on the other hand, is struggling to find the missing $30,000 and after many sleepless nights he finally finds a way to borrow the missing $30,000 (on very unfavorable terms, but still) and pay for the treatment. The treatment is successful, but they both have to get second jobs in order to repay their new debt. They have no time, nor money for vacation.

Both: Clark and Bruce started with the same amount of shares, and yet, their lives were very different after the years. Clark has no idea that this was the case, but it was his loss aversion that made all the difference.

Nobody likes losses, but most people pay way too much attention to them, because they want what’s best for their portfolio and for the ones around them that the portfolio will benefit in the future. And it’s hard to say that it’s bad. The motives are excellent, but focusing on avoiding losses is not the most efficient way to grow capital and at times it can be very costly. For a non-market-professional it’s an intuitive thing to do, but it’s not effective in the long run.

You saw how much it costed Clark in the above example. And what did he gain in exchange? For a moment (he would forget about it in a few days – weeks), he felt like a winner as he had no losing trades. So what? Did it pay for his wife’s treatment, when it was necessary? Did it positively impact their future? Was the several-day long feeling of “staying strong and undefeated” really worth it?

Investing is about growing one’s capital. Can that be done by taking losses? (What kind of stupid question is that, right?) Yes, it can! If the price is about to decline, then getting out and realizing the loss and getting back at lower prices is exactly what grows the capital (naturally, assuming that the very long-term outlook is positive). Taking the loss might be unpleasant for anyone who is not a professional market participant, and to some of the pros as well. But that’s a natural part of the process.

The outlook changes and one cannot control it. But one can react to it and be positioned accordingly. Every now and then, the initial decision will cease to be what’s justified given the up-to-date information. And with the changing outlook, the decision regarding capital should generally change as well. If at that time the price of the investment is profitable, it will mean taking profits, and if it’s not profitable, it will mean taking a loss. But both are justified in exactly the same way and by the same thing – by the change in the outlook. The market doesn’t care what your, ours, or anybody else’s position was and how profitable or how unprofitable it is. The market will usually do what it’s likely to do based on objective factors and the price moves will be the same for everyone.

The decline of $2.50 in the value of SETGJ impacted Clark’s holdings exactly as it would have impacted Bruce’s holdings, if he had chosen to keep them. It made absolutely no difference if their position was a losing one (Clark) or a profitable one (Bruce). If Clark had sold his holdings like Bruce, and then bought back at $3.50, he would have exactly the same number of shares and he would have ended with over $200k instead of $120k. The decision to hold onto the position that he knew was likely to decline didn’t cost a few dollars – it actually costed over $80k.

Yes, it’s difficult to close a trade while it’s in the red, because one feels that they are doing something wrong, or admitting to making a mistake. It’s not like that. Investing and trading is not deterministic – probability plays a huge role in the outcome. So, you might have done good research and your position ended in the red. It’s not a reason to forget about checking at the outlook and dismiss the ideas of adjusting the position so that it fits the current (! – not the previous) outlook. Clark’s original decision to purchase SETGJ may or may have not been a good idea – we don’t have enough data to say that. But the decision to keep the investment intact even when he knew that the stock is going south only served his ego – it didn’t serve his portfolio or his family. His initial reason for investing was good, but the way he executed it turned against him.

Again, Clark thought the following:

“No problem, I’ll just wait it out, the company has good fundamental outlook, so I should be fine.”

Whereas, what he could have thought this:

“All right, this trade is not going well, but since it’s likely to go even worse, I’ll temporarily close the position, which will allow me to ultimately gain even more.”

This little change in thinking would have changed so much in Clark’s future.

The takeaway is this: whether a trade is a losing or winning one is actually of little value. The outlook is many times more important, and when the outlook changes significantly, the position should change as well. At times, one’s ego will not like that, but one’s portfolio and one’s future self will be thankful and that’s much more important.

The simple truths that help to keep the above perspective in mind are:

- You cannot control the market, so you are not responsible for what it does. But, you are responsible for how you react to these changes.

- Investment is a long-term process – it’s not one live-or-die transaction and losses are natural and inherent part thereof.

- You are a human being, and as such you have the right to make mistakes. A losing trade doesn’t make you a bad person. Or a bad investor. But ignoring your own analysis and keeping positions intact in opposition to what you think is going to happen may make you an unprofitable investor in the long run, even if you get a few trades right.

- The outlook determines what the market is likely to do. Your position, its status, and your ego don’t.

And now, finally, after this very long introduction, we’d like to get back to the original question – when does ones minds switches and accepts that yes, the trend changed.

Staying Calm and Focused on What Matters

We wrote that there is a good reply to this question and that’s the truth. The good strategy is to never think of oneself as a bull or bear for any market and to always start the analysis without the prior bias. In this way, you effectively never have to switch your mind from one approach to the other, because it was never “fixed” on any particular view in the first place. This takes some time each day (in your Editor’s case) or each week / month (if that’s how often you want to conduct the analysis) as you have to go through everything from the start, while “forgetting” what you thought about a given chart yesterday. But it pays off.

The charts are updated each day, so each day you have new information that could change the outlook. Each time you start from the scratch, which doesn’t mean erasing all the charts and annotations. It means looking at each single chart and objectively determining what the chart implies, and noting the observations. Then the same thing repeats for the next chart, and so on and so forth. This applies to non-chart factors as well. Once it’s all done, you look at all the factors that you noted and you determine the final outlook. Important: what you thought yesterday, a week before, a year before etc. are not factors that you take into account. When you arrive at your final outlook, your analytical work is done and you translate it into the positions and their sizes. Again, the positions that you had yesterday, a week before, a year before etc. are not factors that you take into account.

If the outlook that you determined on a given day is different than the one that you had determined on the previous day, it means that the outlook will change. Simple as that.

If the positions that you found to be justified on a given day differ from those that you had determined as justified on the previous day, it means that they will be adjusted. Perhaps they will be increased, perhaps decreased, perhaps closed, or perhaps reversed. Whatever the change may be, it’s not important if it means cashing profits or cutting losses – it’s just as justified to make this change and over the long run it’s the right thing to do.

This approach is likely to lead to both: peace of mind, and long-term growth of capital (assuming that the analysis is done with appropriate diligence and care). There are other ways to manage one’s views and positions, and some may say that they are optimal, but during our entire market career we haven’t found anything better than what we presented above.

Important Analyses

Before summarizing, we would like to emphasize that we have recently posted several analyses that are very important and that one should keep in mind, especially in the next several weeks. If you haven’t had the chance of reading them previously, we encourage you to do so today:

- Dear Gold Investor - Letters from 2013 - Analogy to 2013, which should make it easier to trade the upcoming sizable upswing (if enough factors point to it, that is) and to enter the market close to the final bottom.

- Gold to Soar Above $6,000 - discussion of gold’s long-term upside target of $6,000.

- Preparing for THE Bottom in Gold: Part 6 – What to Buy - extremely important analysis of the portfolio structure for the next huge, multi-year rally in the precious metals.

- Preparing for THE Bottom in Gold: Part 7 – Buy-and-hold on Steroids - description of a strategy dedicated to significantly boosting one’s long-term investment returns while staying invested in the PM sector.

- Gold’s Downside Target, Upcoming Rebound, and Miners’ Buy Plan - details regarding the shape of the following price moves, a buying plan for mining stocks, and a brief discussion of the final price targets for the current decline.

- Gold: What Happened vs. What Changed - discussion of the latest extreme readings from gold’s CoT report

- Key Factors for Gold & Silver Investors - discussion of key, long-term factors that support the bearish outlook for PMs. We are often asked what makes us so bearish – this article is a reply to this question.

- The Upcoming Silver Surprise - two sets of price targets for gold, silver and mining stocks: the initial and the final one.

- Precious Metals Sector: It’s 2013 All Over Again - comparison between 2013 and 2018 throughout the precious metals sector, the general stock market and the USD Index. Multiple similarities point to the repeat of a 2013-style volatile decline in the PMs.

Summary

Summing up, the breakout above the neck level of the inverse head-and-shoulders formation in the GDX ETF was just invalidated and the implications are strongly bearish. The analogy to 2013 remains in place and the outlook remains strongly bearish. All in all, it seems that the huge profits on our short positions will soon become enormous.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,226; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $53.67

- Silver: profit-take exit price: $12.72; stop-loss: $15.16; initial target price for the DSLV ETN: $46.97; stop-loss for the DSLV ETN $31.37

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $19.61; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $33.37

Note: the above is a specific preparation for a possible sudden price drop, it does not reflect the most likely outcome. You will find a more detailed explanation in our August 1 Alert. In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $29.43

- JDST ETF: initial target price: $154.97 stop-loss: $64.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Wednesday's trading session passed with no significant changes, as stocks extended their short-term fluctuations following the recent advance. The S&P 500 index continues to trade relatively close to its late September record high. Is this a topping pattern or just a consolidation before another leg up?

Topping Pattern or Just Consolidation Before Another Leg Up?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts