Briefly: in our opinion, full (250% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

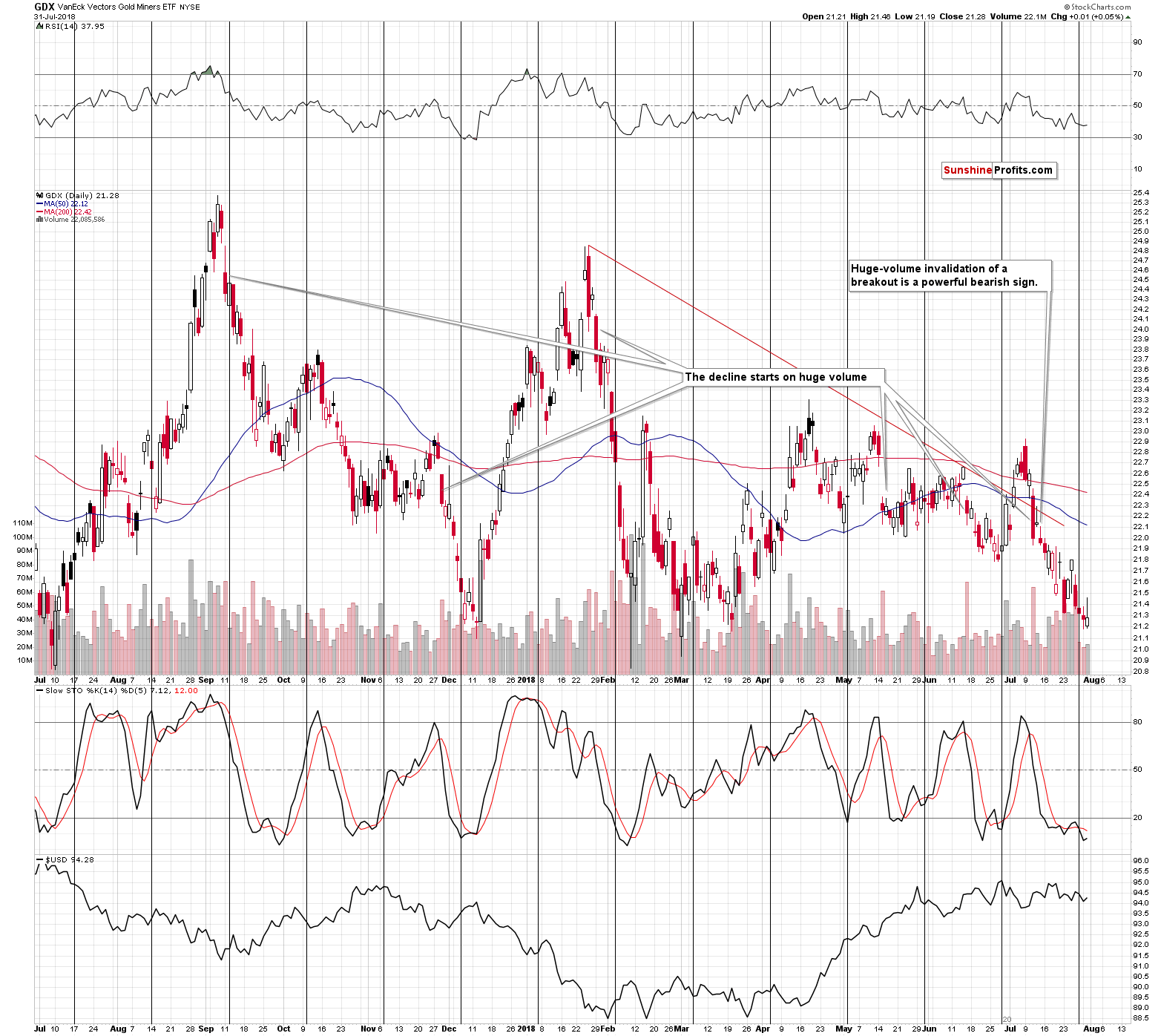

Today’s Alert is going to be rather short as nothing really happened in the precious metals market yesterday and not much is going on today as well. In fact, we’ll just feature one chart, the one with mining stocks, as their early strength yesterday seemed to be a very bullish sign. After all, we often stated that a situation in which silver outperforms and miners disappoint is a bearish sign, so since we saw the opposite – good performance of miners – it might be viewed as something bullish. Let’s take a closer look at the GDX ETF chart (charts courtesy of http://stockcharts.com).

Miners initially rallied, erasing the two previous daily declines and then some more, giving the impression of a starting rally. Even though it was just a few-hour-long move, we already received questions if the market is turning around. And it did turn around, but to the downside, not to the upside. All the bullishness disappeared and the price dropped back to where it had been at the beginning of the session. Well, not entirely, as the GDX ETF ended the session $0.01 higher, but this 1-cent move is the very definition of the phrase “next to nothing”.

All of that happened on weak volume. It was a bit higher than what we saw in the past two trading days, but when compared to the big volume of the past few weeks, it was still low. This means that the intraday move was also not accompanied by anything spectacular and that it was just a fake move. It was not a strong rally – it was a form of a pause.

Consequently, it didn’t cause any changes whatsoever and the outlook for mining stocks remains just as bearish as it was previously (extremely) and the same goes for the rest of the precious metals sector.

Uncertainty Regarding Fundamental Factors

We’re right before two important news announcements. The Fed interest rate decision is today and this week will also feature the latest employment numbers. This means that the highest uncertainty is right now and precious metals should be rallying or at least be at some temporarily high price level. We haven’t seen any rally recently except for the very weak consolidation. Even a lower USD was unable to generate an upswing in the PMs and miners. This is a very valuable information that we have before (!) the news is released. PMs are not reacting as they should, which is a bearish sign.

Now, if the markets are surprised in a big way positive for PMs, then we may see a temporary upswing… And nothing more than that is likely anyway. In other words, at this time, the worst-case scenario (for those aiming to profit on declining gold and silver prices) is that we’ll see a brief correction in profits after which they are likely to move to new highs anyway, as the medium-term decline continues. This is a rather unlikely outcome, though.

It’s more likely that the markets will either not be surprised, or that they will be surprised in a way that’s negative for the PMs. In the first case, the uncertainty will decline, which is likely to lead to lower PM prices (we wrote about this nothing-turns-into-a-decline phenomenon in early April in greater detail). In the latter case, the PMs are likely to truly plunge (perhaps $50 in a day in gold, or even more).

Some may prefer to stay out of the market in light of the above uncertainty, but we are not pursuing this strategy. The reason is that it simply seems to be the worse option when compared to keeping the positions intact. Keeping the positions intact, we are keeping the ability to profit on a big move that’s very likely to happen eventually and we are also positioned to take advantage of a huge profitable move to the downside. At the same time, we are risking the additional wait before the downtrend resumes.

By picking the option in which we stay out of the market for a few days, we would be risking missing out on the big slide and the only benefit would be the possibility of boosting the profits by a rather small amount. And, realistically, it might not be possible to profit on the potential upswing at all because it might be too quick.

Naturally the above two outcomes heavily depend on the factors that we’ve been analyzing and discussing in the past days and weeks and for those who are not aware of all these signals, a rally from here seems just as likely as a decline and there is no asymmetry in the risks and rewards. But when we include all the signals into the final decision, it turns out that keeping the short positions intact is the preferred option.

To be clear, this doesn’t make any outcome guaranteed – it’s what seems to be the best way to deal with the uncertain outcomes given all the details that we have right now.

Current Exit Prices

Since we updated our trading strategy, we have received quite a few e-mails regarding it, so we thought that it would be a good idea to explain it a bit more. We’ll quote our previous explanation and add more details below.

In our July 30th Gold & Silver Trading Alert, we wrote the following:

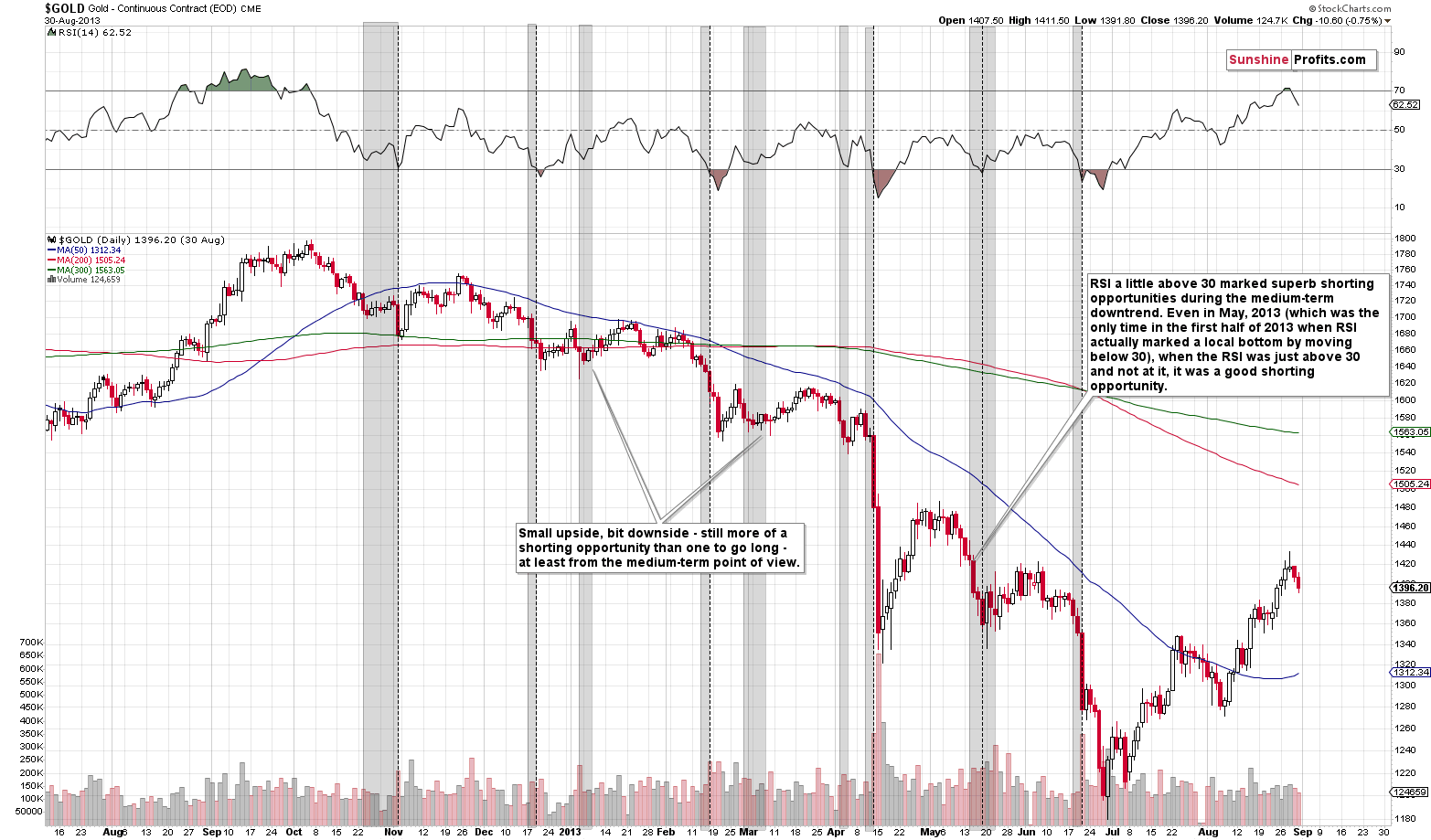

Back in 2013, gold declined from about $1,560 to about $1,320 (intraday) or $1,350 (closing prices). That was a $210 - $240 decline that took just a few days. Given the combination of multiple bearish factors that we have here and the long-term breakdowns that we discussed in the previous Alerts, we should take into account that something similar could take place. It doesn’t have to be as volatile, or as deep, but the key thing is that it’s quite possible. After all, the current decline is quite similar to what happened in 2013.

If gold declined by $210 - $240 back in 2013, then the decline from the current price levels should be smaller, because gold starts from a lower price. After all, it will be percentage moves that have a similar impact on investors, not moves in absolute terms (by the way, that’s the reason why we’re using a logarithmic scale for precious metals charts). So, in 2013 gold declined by 13.46% - 15.38%. Applying this to the current price (approximately $1,220), we get the following prices as targets: $1,032 - $1,056. The area is not precise, but we have a major support level in this range – the 2015 bottom.

To be more precise: we have a target price level that is likely to stop a huge volatile intraday or overnight decline. There are other support levels above this price and each of them might stop this move, but none of them is so likely to do so as the 2015 bottom.

If we see bullish signs close to other support levels, we will likely limit, close or reverse the current short position. But, if we do see a big price plunge, like the one in 2013, we may not have time to react, let alone conduct analysis. Therefore, in order to maximize the chance of making the most of the above analysis, we should have a trading order that is waiting to be realized, while still paying attention to what happens in the market and react if there are reliable reversals signs. And that’s what we do.

Consequently, while it’s not inevitable, it’s certainly possible that gold would decline to its 2015 lows very quickly and it might be difficult to react in a fast manner when that happens (it could take place during overnight trading). The 2013 decline took investors by surprise. We don’t want you to be surprised – we want you to be prepared and profitable. That’s why we are moving our target prices for the current decline to the 2015 / 2016 bottoms for gold and mining stock prices and we are turning them into exit orders. This means that if the price touches them, this order should be executed automatically by the trading platform (being effectively a profit-take order). As far as silver is concerned, we are moving the targets even below the 2015 bottom, because of the rising trend in the gold to silver ratio.

Before making the above adjustment to our trade, we didn’t have exit prices, we only had “initial target prices”, which means that it was more or less where the metals and miners were likely to move and once they did, we would decide what to do next. It was just an early heads-up of what we think seems likely.

The previous target price levels may very well be reached and if we see bullish signs at that time, we are still likely to adjust our positions – nothing changed in our approach here. In other words, we didn’t “give up” on trading in the meantime. We didn’t “lose” anything from the trade or from the approach. We only gained something – protection against missing out on a huge move that’s not extremely likely to take place but for which one should be prepared, because it’s likely enough for one to include such a possibility in their trading plan.

If we’re wrong about the above, nothing really changes – we’re on the lookout for bullish signs regardless of the above possibility and we can exit the current short position or switch to a long one at prices that are much higher than the 2015 bottoms (perhaps with gold close to $1,130 – the December 2016 bottom). But, thanks to having the distant profit-take orders in place, we’ll be ready to take advantage of huge overnight / intraday action that might take place in the following weeks (or days).

In other words, we simply gained a way to profit on the sudden decline, while retaining the ability to stay flexible in case it doesn’t happen.

Summary

Summing up, the outlook for the precious metals sector is extremely bearish even though we may see some short-term volatility this week, it seems that sticking to the short positions is still justified from the risk to reward point of view.

On an administrative note, the Gold & Silver Trading Alerts that we post tomorrow and on Friday may be shorter than usual due to your Editor’s travel schedule, but you will be kept updated on any major changes in the market anyway.

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (250% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,062; stop-loss: $1,272; initial target price for the DGLD ETN: $82.96; stop-loss for the DGLD ETN $46.38

- Silver: profit-take exit price: $12.72; stop-loss: $16.46; initial target price for the DSLV ETN: $46.97; stop-loss for the DSLV ETN $24.07

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $13.12; stop-loss: $23.64; initial target price for the DUST ETF: $80.97; stop-loss for the DUST ETF $20.87

In case one wants to bet on junior mining stocks’ prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: profit-take exit price: $17.52; stop-loss: $34.82

- JDST ETF: initial target price: $154.97 stop-loss: $42.78

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Last week, the ECB reaffirmed that it would end quantitative easing this year. What does it mean for the gold market?

ECB Ends QE in 2018. What Does It Imply for Gold?

=====

Hand-picked precious-metals-related links:

Traders are carefully watching for gold's next move

Gold ends higher, but logs a fourth straight monthly loss

=====

In other news:

Manafort hid Ukraine income in foreign accounts, US prosecutor says

As Trump's tariffs start to bite, China pledges it'll keep its economy stable

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts