Briefly: in our opinion, full (100% of the regular position size) speculative long positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Gold rallied, gold miners soared to new March highs and the USD Index finally moved lower; and most likely, these price moves are not yet over.

The precious metals market finally moved yesterday after providing us with bullish indications for quite a few days. Let’s jump right into charts and examine the details, starting with the part of the precious metals market that showed particular strength – mining stocks.

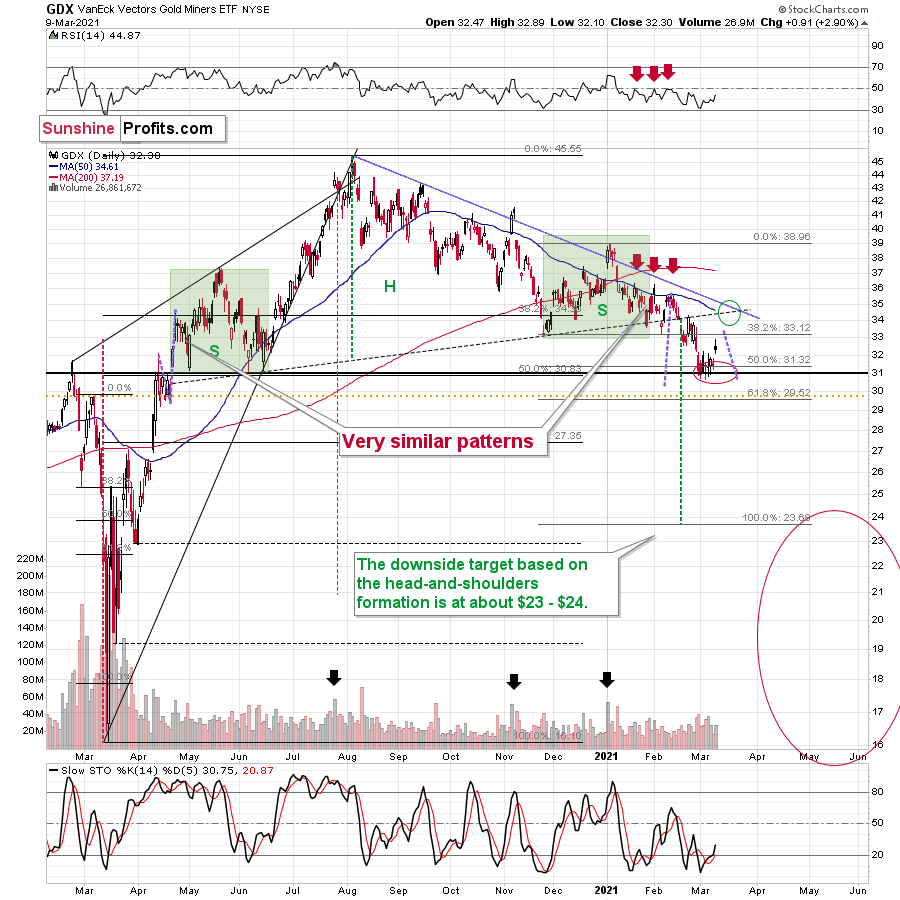

Figure 1 - VanEck Vectors Gold Miners ETF (GDX)

Even though gold moved lower in early March, gold miners stopped declining after reaching my target area based several techniques – most importantly the 50% Fibonacci retracement based on the entire 2020 rally, and the previous lows and highs. Just as miners’ relative weakness had previously heralded declines for the entire precious metals sector, their strength meant that a rally was about to start. And that’s just what we saw yesterday (Mar. 9).

Ultimately, it seems that the above corrections will result in the GDX ETF moving to about $34 or so.

The resistance levels in the $34 - $35 area are provided by:

- The late-February 2020 high

- The rising neck level of the previously completed head and shoulders pattern

- The analogy to how big miners’ correction was in April (assuming that the mirror similarity continues)

- The declining blue resistance line

- The 50-day moving average

Additionally, please note that the last few local tops were accompanied by RSI at about 50. The latter is currently below 45, suggesting that this rally has more potential, but that it’s not particularly extreme.

The confirmation that the top is indeed in might come from the volume. Please note that the last three times when we saw really important tops, the GDX rallied on particularly strong volume. If we see something like that within the next 5 trading days or so (quite likely on Monday or close to it), we’ll have an even bigger chance of catching the reversal.

Consequently, the GDX is likely to form a top in the above-described area, and my previous comments on the likely follow-up remain up-to-date:

After breaking below the head-and-shoulders pattern, gold miners would then be likely to verify this breakdown by moving back up to the neck level of the pattern. Then, we would likely see another powerful slide – perhaps to at least $24.

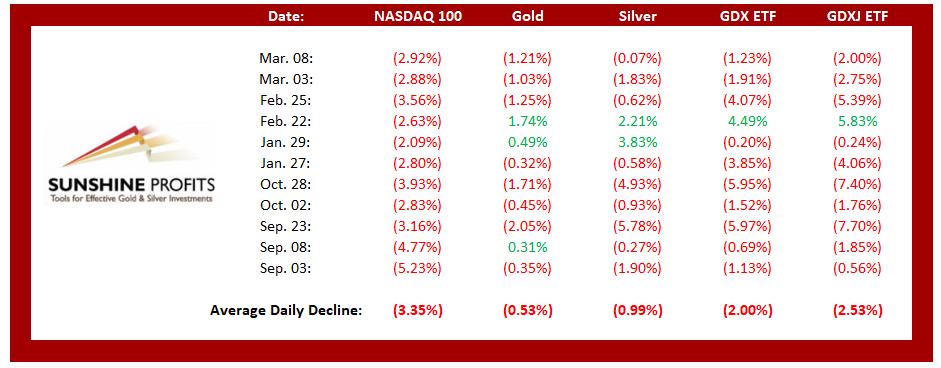

This is especially the case, since silver and mining stocks tend to decline particularly strongly if the stock market is declining as well. And while the exact timing of the market’s slide is not 100% clear, the day of reckoning for stocks is coming, and it might be very, very close.

As I explained previously, based on the similarities to the 1929 and 2008 declines, it could be the case that the precious metals sector declines for about three months after the general stock market tops. And it seems that we won’t have to wait long for the latter. In fact, the next big move lower in stocks might already be underway, as the mid-Feb. 2021 top could have been the final medium-term top.

Let’s consider what the GDX and GLD did on an intraday basis yesterday.

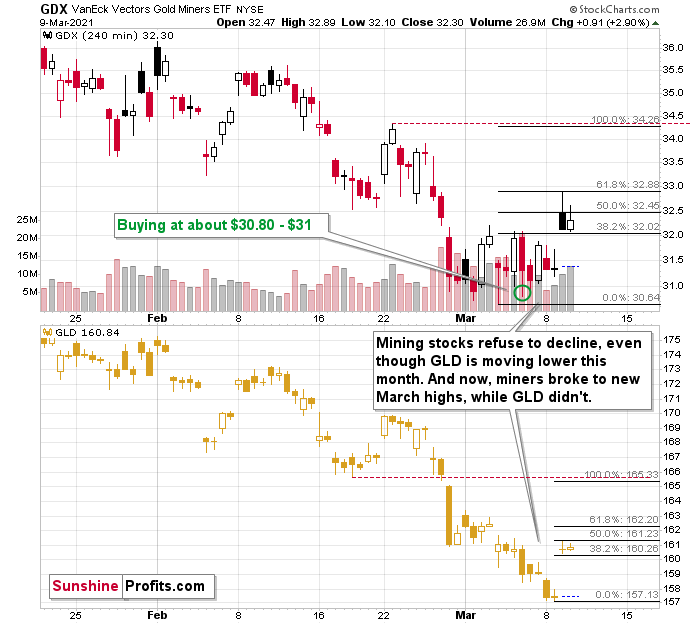

Figure 2 - VanEck Vectors Gold Miners ETF (GDX) and Gold ETF (GLD) Comparison

As I already wrote, mining stocks rallied to new monthly highs, and the above 4-hour chart (each candlestick represents 4 hours of trading) makes it crystal-clear that the late-February bottom was the moment after which miners stopped declining and started to trade sideways. Gold (here: the GLD ETF, which I’m using to have an apples-to-apples comparison – both ETFs trade on the same exchange) continued to decline in March. Well, to be precise, miners did form new yearly lows in March, and we went long almost right at one of those intraday lows, but the moves were not significant enough to really change anything.

So, since miners no longer wanted to decline, and there were only two other things left for them to do: either nothing or rally.

They had been doing nothing for several days, due to the lack of bullish leadership in gold. They just got this leadership yesterday, and they soared.

Now, let’s keep in mind what I wrote in yesterday’s intraday Alert – namely, that mining stocks tend to rally particularly well in the initial part of the upswing, and then they underperform during the final part of the rally. So, when gold is above $1,750 or so, miners might already be rallying to a limited degree. Consequently, miners might rally above $34.27, but that is far from being certain. They might actually rally slightly less – perhaps to exactly $34 or so.

I applied the Fibonacci retracement levels to the above chart, but I actually used them as Fibonacci extensions. My current upside target for gold is at about $1,770 (which corresponds to about $166 in the GLD ETF) and it’s at about $34 for mining stocks (GDX ETF). The Fibonacci extensions emphasize that if both targets were to be reached, then it means that gold so far rallied (intraday) about half of its entire rally, while mining stocks rallied (intraday) about 61.8% of their entire rally. This perfectly fits miners’ tendency to outperform in the initial part of a given move, which makes both price targets more reliable.

Having said that, let’s move to gold.

Figure 3 - COMEX Gold Futures

Gold rallied strongly after bottoming right in the middle of my target area and after moving almost right to its June 2020 bottom, and after almost doubling its initial January decline. Yesterday’s rally also meant invalidation of the brief breakdown below the 61.8% Fibonacci retracement level based on the entire 2020 rally. Thus, the very short-term trend is up.

Please keep in mind that the upswing might be relatively short-lived – perhaps lasting only one week or so. There’s a triangle-vertex-based reversal point on Monday, so it wouldn’t be surprising to see an interim top at that time, especially considering that:

- The triangle-vertex-based turning points have been working particularly well in the recent past – they marked the January and February tops.

- The corrective upswings during this medium-term decline (especially in mining stocks) often took about a week to complete – at least the easy part of the upswing took a week.

The USD Index has been rallying relentlessly – just like in 2018 – in the last couple of days, but a quick pullback would not be surprising. In fact, it seems that one is already underway.

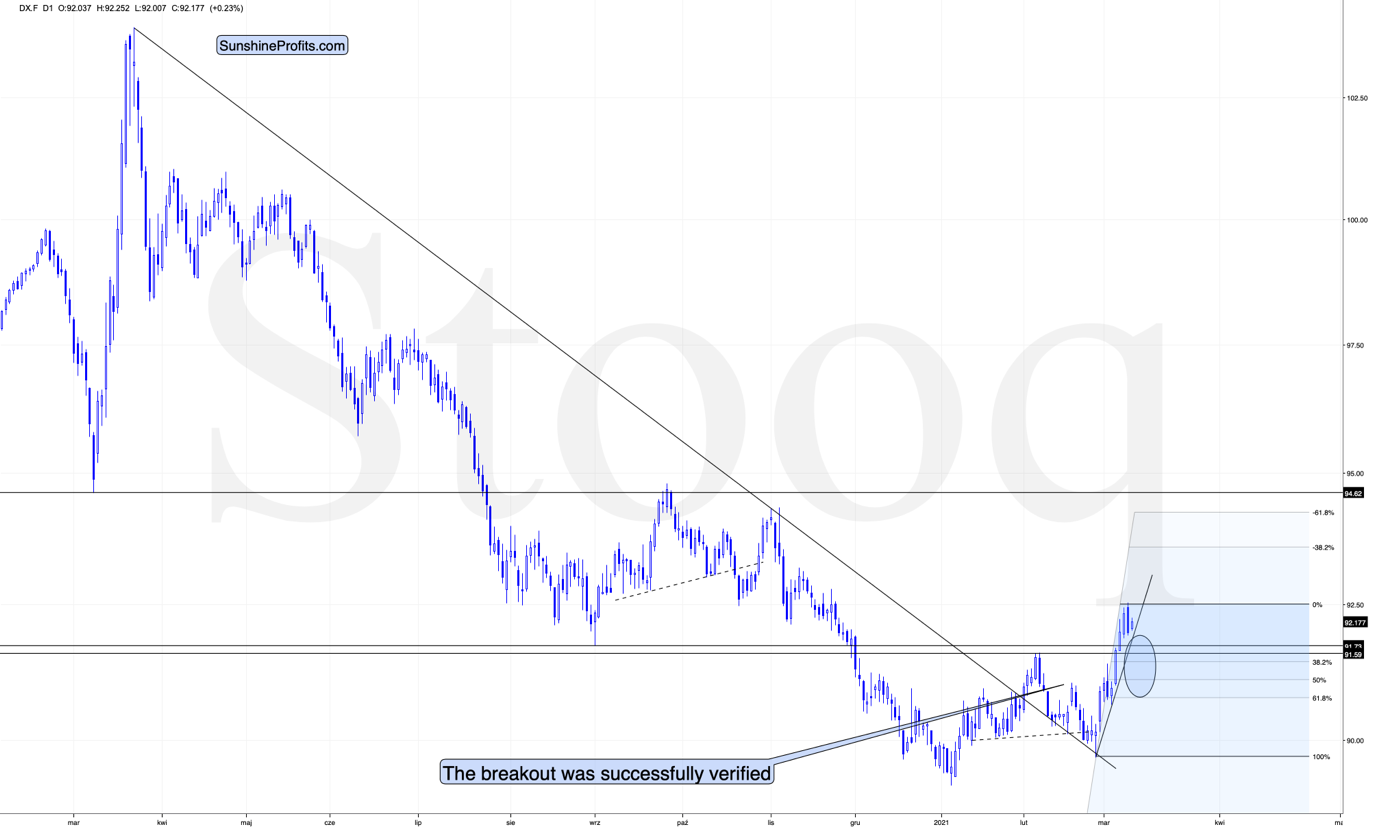

Figure 4 - USD Index (DX.F)

On March 8, the USD Index had closed above its lowest daily closing price of August 2020 (92.13), but yesterday, it closed back below this resistance. This means that we just saw an invalidation of the breakout – which is a bearish sign for the short term.

How low could the USD Index move during this pullback? Not particularly low, as the similarity to 2018 implies a rather unbroken rally. The February 2021 high of 91.6 seems to be a quite likely target, but we might see the USDX move a bit lower as well – perhaps to one of the classic Fibonacci retracements based on the recent upswing – lowest of them (the 61.8% one) being at about 90.8.

This pullback might trigger a question about the validity of the analogy to the 2018 rally, which seems to have taken place without any interruptions.

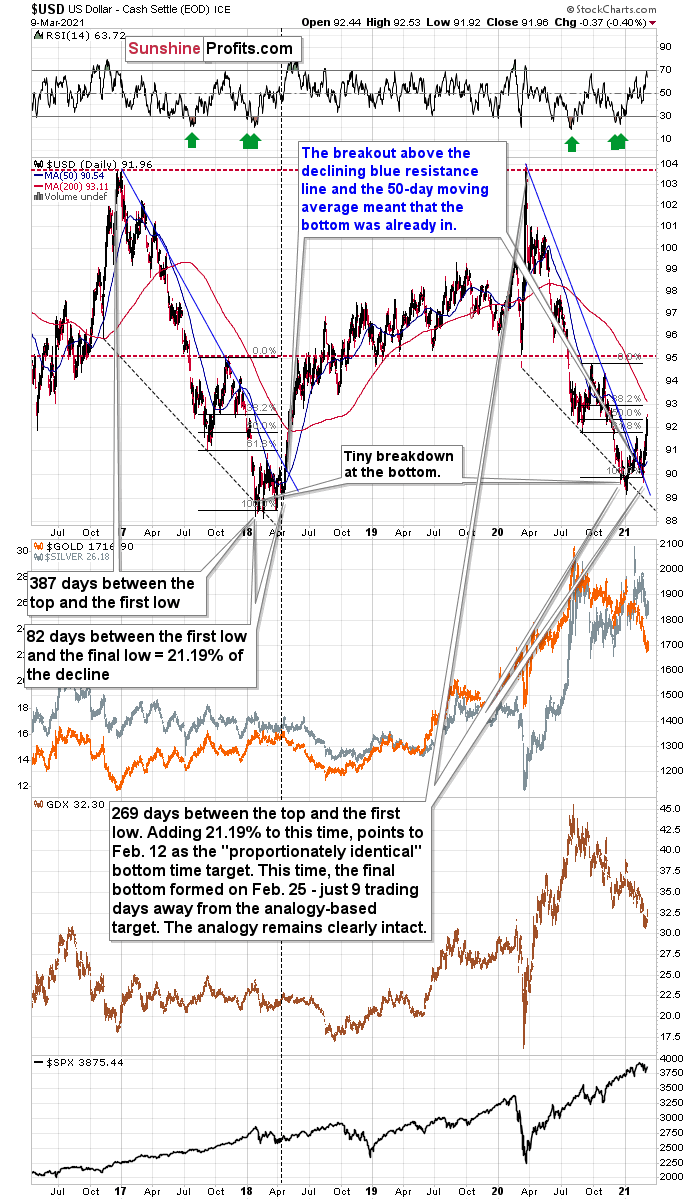

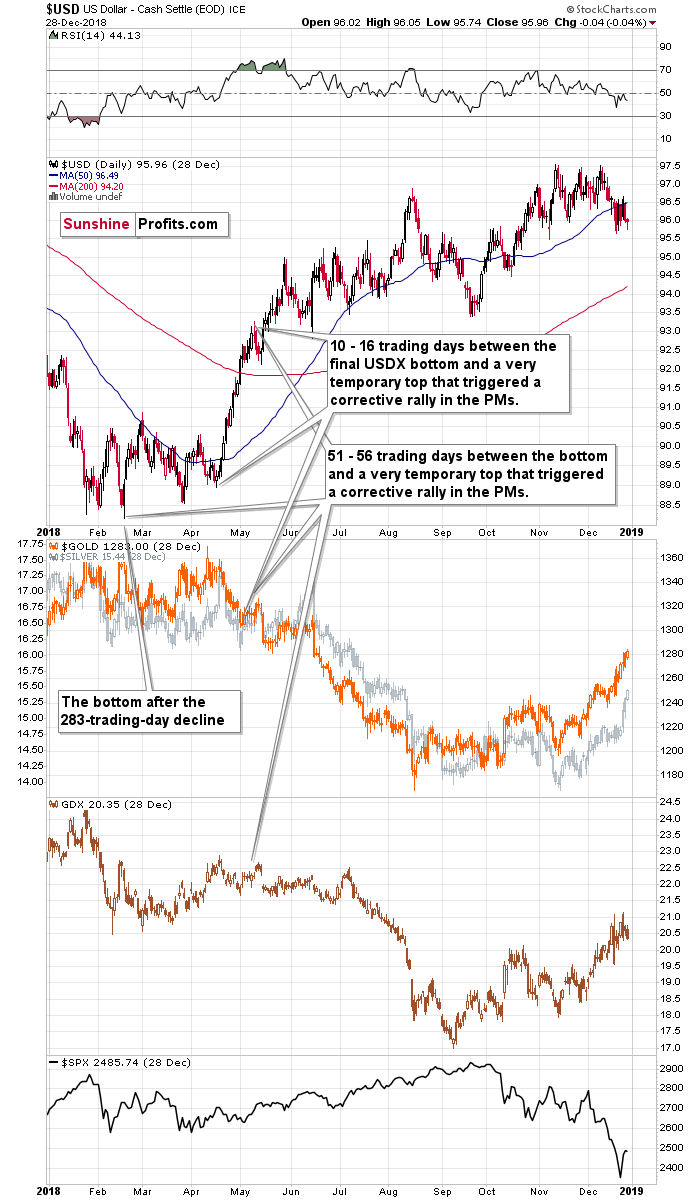

Figure 5

The analogy seems to remain intact when looking at it from the long-term point of view. Let’s keep in mind the recent decline was a bit sharper and it took less time to complete.

The 2017 – 2018 decline took 387 day (between the top and the first low) and then there were 82 days between the initial and the final low (21.19% of the decline).

This time, there were 269 days between the top and the first low. Adding 21.19% to this time, points to Feb. 12 as the "proportionately identical" bottom time target. The final bottom formed on Feb. 25 - just 9 trading days away from the analogy-based target. The analogy remains clearly intact.

“So, doesn’t it imply that there shouldn’t be any pullbacks until the USD Index rallies above 94?”

No. And this becomes obvious once we zoom in.

Figure 6

You see, it’s not true that there were no pullbacks during the 2018 rally. There were, but they were simply too small to be visible from the long-term point of view.

The first notable pullback took place in early May 2018, and it contributed to a corrective upswing in the precious metals market. To be precise, the USD Index declined after rallying for 56 trading days, but gold rallied earlier – 51 trading days after the USD Index’s final bottom. The USDX’s immediate-top formed 16 trading days after its final bottom, and gold’s bottom formed 10 trading days after the USD’s final bottom.

Comparing this to the size of the previous decline in terms of the trading days, it was:

- 51 – 56 trading days / 283 trading days = 18.02% - 19.79%

- 10 – 16 trading days / 283 trading days = 3.53% - 5.65%

Now, let’s examine the current situation.

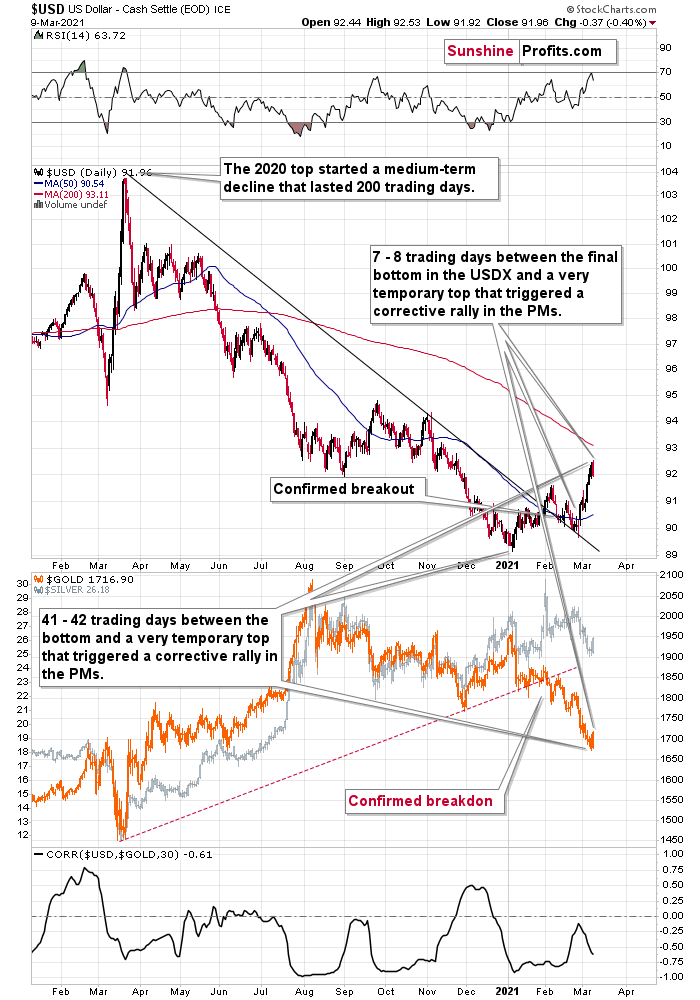

Figure 7

The preceding decline lasted for 200 trading days and there were 41 – 42 trading days between the final USDX bottom and the short-term reversals in gold and USDX. Comparing this to the final USDX bottom, we get 7 – 8 trading days.

Applying the previous percentages to the length of the most recent medium-term decline in the USD Index provides us with the following:

- 18.02% - 19.79% x 200 trading days = ~36 - ~40 trading days

- 3.53% - 5.65% x 200 trading days = ~7 - ~11 trading days

The above estimation of about 36 – 40 trading days almost perfectly fits the current 41 – 42-day delay, and the estimation of about 7 – 11 trading days almost perfectly fits the current delay of 7 – 8 trading days.

In other words, the analogy to the 2018 performance does not only remain intact – it actually perfectly confirms the validity of the current corrective upswing. Once again, it’s very likely just a pullback, not a big trend reversal.

Also, please note that back in 2018, the USD Index corrected after moving back above its mid-2017 lows and now we see the analogy to that – the USDX corrects after moving back above its mid-2020 lows. Back in 2017, the USD Index corrected to approximately its previous short-term high (the January 2018 high). Now, the February high is providing strong support at about 91.6 – that’s where this brief correction might end – on an approximate basis.

The above perfectly fits the scenario in which the precious metals market rallies on a very short-term basis (likely to about $1,770 in gold and about $34 in GDX), and then resumes its medium-term decline.

Having said that, let’s take a look at the market from the more fundamental angle.

Mining for Profits

For weeks, I’ve warned that the GDX ETF was headed to $31. And after closing only $0.10 below my initial downside target on Mar. 1,

On Mar. 8, I added:

Gold, silver and the miners’ 10-day correlations have begun to normalize. With the PMs exhibiting a positive relationship with the S&P 500 and a negative relationship with the U.S. dollar, their behavior is akin to what we see over a 250-day period (a reliable length of time). Thus, equity strength should remain supportive this week.

But while champagne (or Goldwasser) always tastes better after a tangible achievement, it’s important to remember that countertrend rallies in mining stocks often last one week – at least their “easy” parts. And because the GDX ETF will likely top in the $34/$35 range, it’s prudent not to overstay our welcome.

Why so?

Because with the USD Index verifying its medium-term breakout and U.S. Treasury yields still untethered, their breathers on Mar. 9 are likely the calm before the medium-term storm.

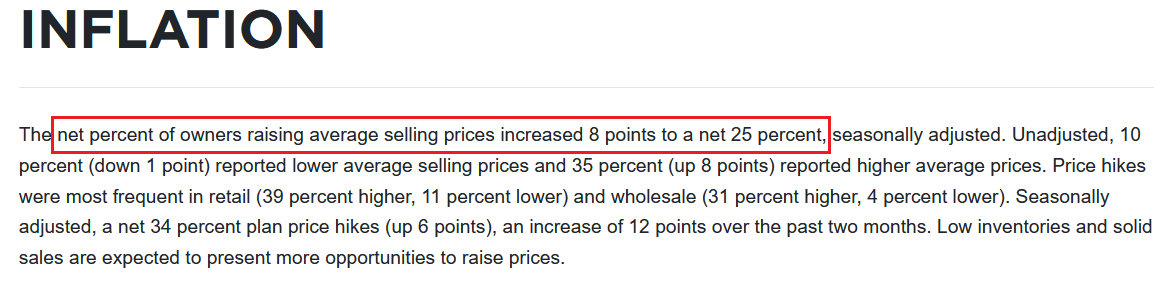

Case in point: On Mar. 9, the National Federation of Independent Business (NFIB) released its February Small Business Report. And because the devil is in the details, a net-8% of respondents increased their average selling prices over the last month, with a total reading of net-25% setting a new all-time high.

Please see below:

Figure 8 - Source: NFIB

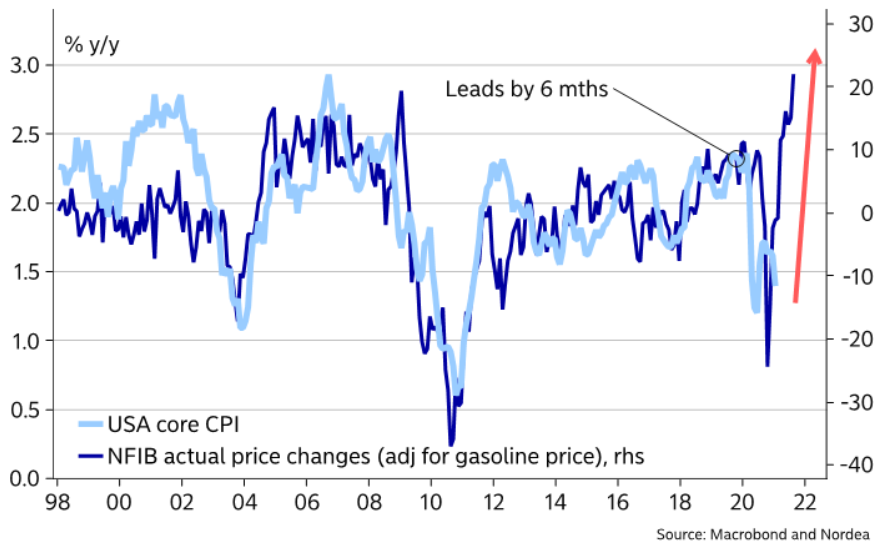

More importantly though, while Jerome Powell, Chairman of the U.S. Federal Reserve (FED), can’t seem to spot any “unwelcome inflation,” he could be in for a rude awakening. If you analyze the chart below, you can see that changes in small businesses’ average selling prices are a precursor to U.S. core CPI.

Figure 9

To explain, the dark blue line above tracks the changes in small businesses’ average selling prices, while the light blue line above tracks the changes in U.S. core CPI. If you analyze the right side of the chart, you can see the material divergence. However, changes in small businesses’ average selling prices leads U.S. core CPI by six months.

But is this merely an estimate or a foregone conclusion?

Well, you be the judge: on Feb. 4, the FED released its annual Small Business Credit Survey. At the beginning of the report, it read:

“The SBCS is an annual survey of firms with fewer than 500 employees. These types of firms represent 99.7% of all employer establishments in the United States.”

Remember, it’s not Amazon, Walmart or other large corporations that employ the majority of Americans. And because small business is the lifeblood of the U.S. economy, the pricing behavior of small business owners has a direct correlation with U.S. inflation.

But you may be thinking: shouldn’t rising inflation be a fundamental boon for the PMs?

Well, over the long-term, yes. Over the medium-term, however, rising inflation leads to erratic behavior in the bond market. More specifically, it causes U.S. Treasury yields to surge.

For context, I wrote on Jan. 15:

The U.S. government has essentially painted itself into a corner:

- If they let yields rise, the cost of borrowing rises, the cost of equity rises, and the U.S. dollar is supported (all leading to shifts in the bond and stock markets and destroying the halcyon environment they worked so hard to create).

- To stop yields from rising, the U.S. Federal Reserve (FED) has to increase its asset purchases (and buy more bonds in the open market). However, the added liquidity should have the same net-effect because it increases inflation expectations, which is a precursor to higher interest rates.

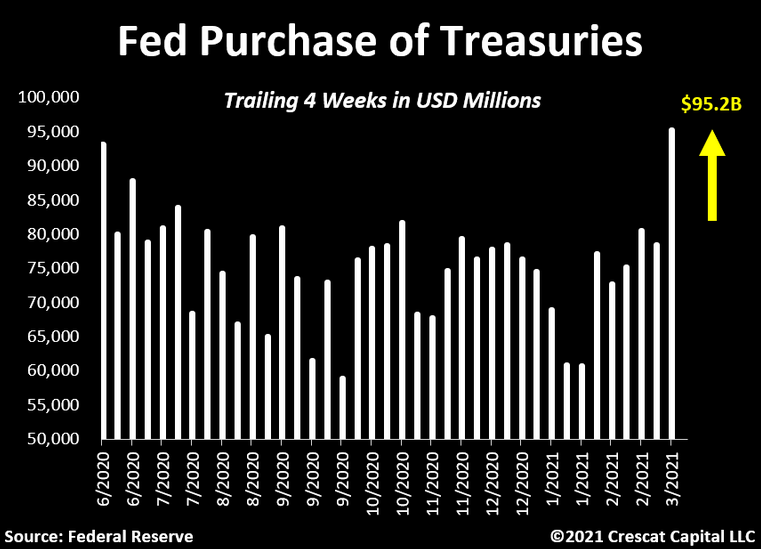

And proving quite prescient, the recent yield surge has caused the FED to do just that. If you analyze the right side of the chart below, you can see that FED purchases of U.S. Treasures have spiked over the last four weeks.

Figure 10

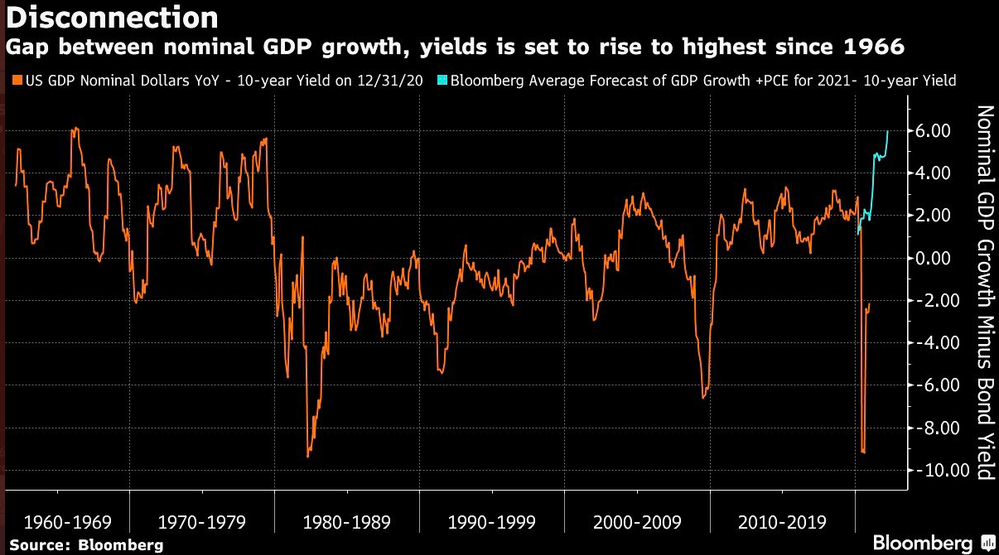

What’s more, with the combination of FED intervention and Joe Biden’s $1.90 trillion stimulus package increasing economists’ 2021 GDP growth estimates, the spread between the expected percentage change in U.S. GDP growth and the U.S. 10-Year Treasury yield is now at its highest level since 1966.

Please see below:

Figure 11

To explain, the orange line above plots the percentage change in U.S. nominal GDP relative to the U.S 10-Year Treasury yield. For context, medium-to-long-term bond yields often equal or remain closely tied to GDP growth expectations. Case in point: up until 2019, the average spread between the two had always been less than 2.00%. Today, however, the average spread has ballooned to more than 7.00%. Thus, either the U.S. 10-Year Treasury yield is poised to move materially higher or U.S. GDP growth expectations are poised to move materially lower.

As a respected opinion, Jeffrey Gundlach – coined ‘The Bond King’ – believes that the U.S. 10-Year Treasury yield should be comparable to the average of U.S. nominal GDP growth and the German 10-year Government Bond yield (a proxy for Eurozone yields). Even so, if we apply this measure, the U.S. 10-Year Treasury yield should be trading north of 3.00%.

But why is the U.S. 10-Year Treasury yield so important?

Because, as I’ve reiterated on several occasions, gold topped (on Aug. 7), exactly one day after the U.S. 10-Year Treasury yield bottomed (Aug. 6). Moreover, they’ve continued their divergence ever since.

Please see below:

Figure 12

Adding another layer of anxiety, on Mar. 8, the U.S. 10-Year Treasury yield actually rose above the average investment grade (IG) corporate bond yield.

Please see below:

Figure 13

To explain the significance, notice how the average IG corporate bond yield tends to track the U.S. 10-Year Treasury yield? Because the government can tax its citizens and use the proceeds to repay its debt, the U.S. 10-Year Treasury yield is considered the medium-to-long-term ‘risk-free rate.’ Conversely, because corporations have unpredictable revenue streams, their higher default risk requires a ‘corporate spread’ (additional interest).

For context, I wrote on Mar. 5:

Because corporate bonds are riskier than government bonds, lenders charge a ‘spread’ (additional rates of interest) to compensate for the excess risk. In a nutshell: the narrower (lower) the spread, the easier and cheaper it is for corporations to borrower money.

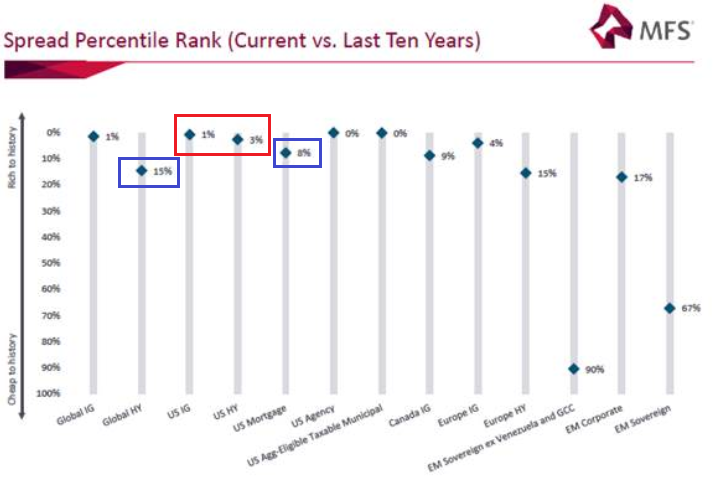

Figure 14

However, if you analyze the visual above, you can see that corporate spreads have begun to widen (increase). To explain, the blue diamonds above depict the percentile rank of current corporate spreads relative to their 10-year history. And despite U.S. investment grade (IG) and U.S. high yield (HY) spreads still being extremely low (the red box above), global HY spreads have risen to the 15th percentile, while U.S. mortgage spreads have risen to the 8th percentile (the blue boxes above).

The key takeaway?

With the U.S. 10-Year Treasury yield rising above the IG corporate bond yield, the theory of risk-adjusted returns is now completely out of whack. However, with global HY spreads already reacting to the uptick in government bond yields, follow-through by U.S. HY and global IG could cause an even-deeper sell-off of the NASDAQ 100, which in turn, could inflict even more pain on the PMs.

Figure 15

In conclusion, while the PMs continue to dance the night away, their forthcoming hangover will likely leave them bedridden for several months. But because Chuck Prince, former CEO of Citigroup, famously said “that we have to dance until the music stops,” with the PMs’ band on stage, it’s still too early to leave the party. However, with a final performance likely to coincide with $34/$35 on the GDX ETF, keep an eye on the exit. Why so? Because no matter how lively the festivities, they eventually come to an end.

Overview of the Upcoming Part of the Decline

- It seems to me that the initial bottom has either just formed or is about to form with gold falling to roughly $1,670 - $1,680, likely this week.

- I expect the rebound to take place during the next 1-3 weeks (in my view the top is most likely to form close to Monday, March 15).

- After the rebound (perhaps to ~$34 in the GDX), I plan to get back in with the short position in the mining stocks.

- Then, after miners slide once again in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver (this could take another 1-4 weeks to materialize). I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,450 - $1,500 and the entire decline (from above $1,700 to about $1,475) would be likely to take place within 1-10 weeks and I would expect silver to fall hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments in my view. This might happen with gold close to $1,475, but it’s too early to say with certainty at this time.

- Consequently, the entire decline could take between 3 and 17 weeks.

- If gold declines even below $1,500 (say, to ~$1350 or so), then it could take another 10 weeks or so for it to bottom, but this is not what I view as a very likely outcome.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops . If the mid-February 2020 top was the final medium-term top, then it seems that we might expect the precious metals sector to bottom in mid-May or close to May’s end.

- The above is based on the information available today and it might change in the following days/weeks.

Letters to the Editor

Q: Dear Mr. Radomski,

I am currently long Silver. Can you please indicate the target price for silver or should I just exit when gold touches $1750?

Warm regards

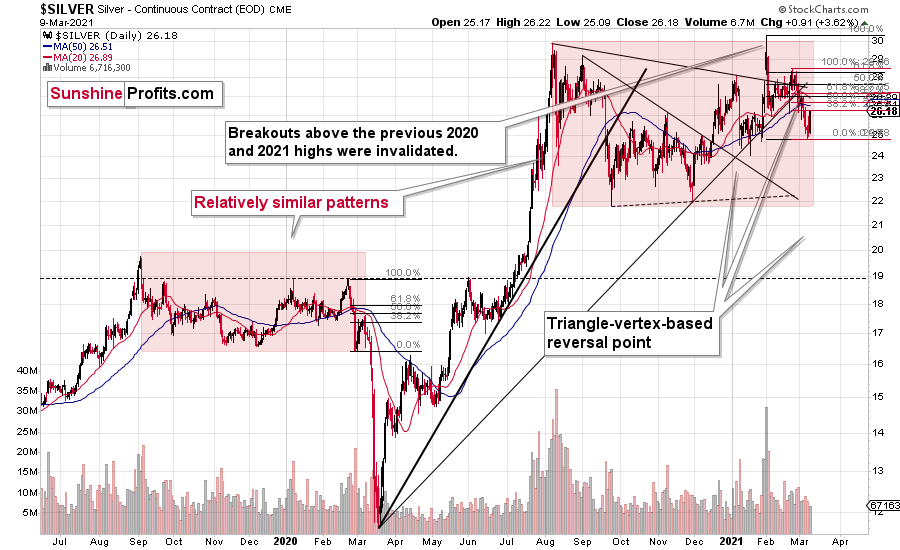

A: Silver is the least predictable of the classic precious metals trio (gold, silver, and mining stocks) – at least at this time. The biggest problem with silver’s upside targets is that silver tends to overshoot resistance levels and create “fakeouts” (instead of breakouts) right before plunging. This means that using the tool that is so useful in case of other markets (resistance lines and levels) is often misleading in case of the white metal.

Still, I’ll attempt to provide a useful upside target for it.

Figure 16

The recent silver price pattern is somewhat similar to what we saw between mid-2019 and early 2020. I marked them both with red rectangles. If this similarity continues to some extent, then we can expect silver move higher in the very near term. Back in March 2020, silver corrected about half of the recent upswing and it topped close to both: it’s 20-day moving average (marked with red) and the previous lows.

Silver’s 20-day moving average is currently at $26.89, and the mid-February lows are between $26.75 and $27.33 (I’m not counting the February 19 low, which seems relatively accidental). The 50% retracements are at $27.60 (if we take the 2021 high as the start of the decline) and $26.64 (if we use late-February top as the start of the decline).

Based on the above levels, it seems that silver’s next short-term top is likely to form in the $26.60 - $26.85 range.

But, if I had a long position in silver, would I wait until the above area is reached? No, I would focus on gold and exit the long position in silver, when gold moves to $1,758 ($12 below its upside target of $1,770). Gold seems more predictable at this time, so I’d use the above silver target area only as additional information. If silver is there when gold is at about $1,758, it would further validate this target.

Also, please note that the above is my opinion on the silver and gold market in general – it’s not investment advice / information directed to you only (I can’t tell you, specifically, what you should do, as that depends on more factors than just the outlook for the markets).

Q: Thank you for providing a valuable service with a genuine and considerate tone toward your clients.

It amazes me that PR is brilliant with analyses and yet takes the time to share his insights for others. It must take hours to compile the facts that confer a risk to reward short to medium term strategy, and then to write a comprehensive report at a level anyone can grasp. A lesser mortal – a selfish person – would keep the knowledge close to the chest and profit with less effort.

Please pass on my sincere respect and appreciation.

A: Thank you very much for your kind words – I’m very happy to see that you appreciate the results of my (and the entire Sunshine Profits Team’s) work. The fact that I can contribute to people’s investment successes and the realization of their plans and dreams is very satisfying and motivating. As well, longer reports are actually usually quicker and easier to write than the short ones, because when I notice something that’s particularly interesting to me (like the analogy in the USD Index to 2018 that I described today), I’m typing the analyses quickly naturally. It’s more difficult when the situation is boring from my point of view and there’s little worth commenting on (again from my point of view), but at the same time I realize that many subscribers will still want to read about the market on a given day – so I’m preparing the analyses on those days, anyway. Fortunately, it seems that the boring days for the precious metals investors are over.

Q: Hi PR. Regarding the typo on Mar. 8 – thank you for the correction. But I read your report word for word and then backwards. I knew what you meant – it’s all good. By the way, thank you. Its takes a great deal of trust to part with your hard earned dough on somebody else’s advice ( for me that's the case anyway ). I've been watching gold go down like a rock falling in water, and it was difficult this time to go long. But I did and spread my coin amongst three Aussie Gold miners for the counter trend rally. Catalyst Metals asx Cyl, Perseus PRU and Ramelius resources RMS. I am learning from you and your team. Thanks a million.

A: Thank you. I’m very happy to read that you’re benefitting from my analyses. It might be more difficult to profit from the brief price moves in the non-US exchanges as the currency price moves could be a relatively important factor with regard to the total rate of return. Still, it seems to me that these three stocks would be likely to rally along with the GDX in the next several days.

Q: Hi PR / Team

Thanks for the update, I'm out of this countertrend rally as soon as Gold reaches $1750 assuming it’s in Australian time. I can only trade between 10 am and 4 pm.

A: If your broker allows this, it might be a good idea to enter a limit sell order that could be realized also outside of the regular trading hours (in the pre-market / after-market trading) – this applies also to other exchanges, including the U.S. exchanges. That’s the kind of order that I have placed on my account.

Why? Because this might increase the chance of the trade being realized. Gold might move above $1,770, but it might do that when the U.S. markets are closed. Putting the profit-take price below this level is one of the ways in which I’m aiming to increase the chance of the trade being realized, but extending the time during which the trade could take place is another tool that would be useful in my view.

As always, the above is just my general opinion, not an investment advice or recommendation directed at anyone specifically.

Q: Phenomenal email - and exactly what I'd expect from a top-rate alert service.

Warmest Regards

A: Thank you! That’s our promise – to keep our subscribers updated, and that’s what we’re doing through not only the regular (and flagship) Gold & Silver Trading Alerts, but also through the intraday Alerts, if the situation seems to warrant it.

Summary

To summarize, the PMs’ medium-term decline is well underway, as miners broke below the neck level of their almost-yearly head-and-shoulders formation and then continued the decline. However, it now seems that we’re going to see a counter-trend bounce with the GDX ETF moving to about $34 or so, which is why I wrote about opening long positions in the mining stocks.

If your broker allows this, it might be a good idea to have a limit sell order (as a profit-take order) that could be realized also outside of the regular trading hours (in the pre-market / after-market trading). That’s the kind of order that I have placed on my account.

In addition, because we’re likely entering the “winter” part of the Kondratiev cycle (just like in 1929 and then the 1930s), the outlook for the precious metals’ sector remains particularly bearish during the very first part of the cycle, when cash is king.

The confirmed breakout in the USD Index is yet another confirmation of the bearish outlook for the precious metals market.

After the sell-off (that takes gold to about $1,450 - $1,500), we expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and it seems that we’re about to make much more on this March decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we are opening a possibility to extend one's subscription for a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now, while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (100% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDX ETF): binding profit-take exit price: $33.92; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the NUGT (2x leveraged) and GDXU (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the NUGT: $60.92; stop-loss for the NUGT: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXU: $18.92; stop-loss for the GDXU: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,758.

Gold futures upside profit-take exit price: $1,758.

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief