tools spotlight

-

The Fed Races Against the Clock. Will It Avert Hyperinflation?

June 30, 2022, 8:29 AMWhile I’ve warned for months that unanchored inflation would force the Fed’s hand, hawkish rhetoric and policies are now obvious to investors. Moreover, with the hyper-inflationist ‘death of the dollar’ crowd increasingly anxious, their mettle has come under immense pressure. To explain, I wrote on Nov. 18, 2021:

The hyper-inflationists are missing the forest through the trees. In their argument, they assume that high U.S. debt levels make raising interest rates impossible. As a result, the U.S. government will allow inflation to run rampant and the U.S. dollar will crash in the process. However, while it’s an interesting story, it’s unrealistic. And why is that?

Well, for one, not raising interest rates will likely do more harm to the U.S. economy than tightening monetary policy. The reasons are outlined above: if prices keep rising and consumer confidence keeps falling, eventually demand destruction unfolds. As a result, if policymakers don’t solve their inflationary conundrum, failure to do so will likely push the U.S. economy into recession.

Second, the political component shouldn’t be ignored. Biden’s approval ratings keep hitting new lows along with consumer confidence. Thus, is it in his best interest to maintain the status quo? Of course not. That’s why he’s been so forceful on inflation over the last few weeks. Essentially, if he (and/or the Fed) does nothing, he’ll likely lose the next presidential election and the Democrats will likely lose control of Congress. However, if he tames inflation, then he’s a hero. And left with those two options, which one do you think he’ll choose?

The Lesser of Two Evils

To that point, with six rate hikes realized in 2022 (25 basis point increments) and Fed officials amplifying their hawkish threats, commodity investors have run for cover.

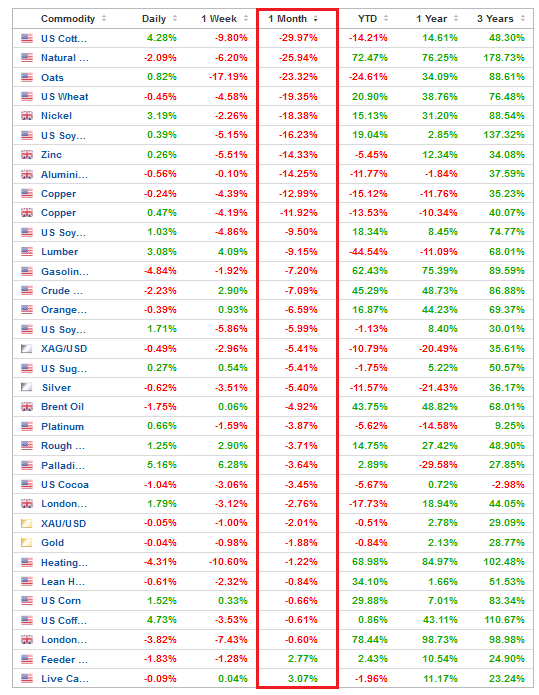

Please see below:

To explain, the table above tracks the performance of commodities over various timeframes. If you analyze the vertical red rectangle, you can see that most commodities have been crushed over the last month. Moreover, with the GDXJ ETF also suffering mightily, lower prices were always necessary for the Fed to achieve its inflation goal. Therefore, the fundamental thesis continues to unfold as expected.

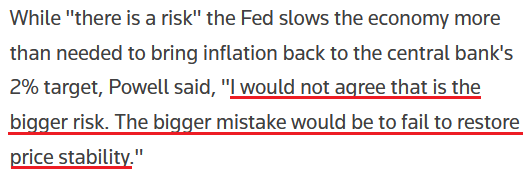

Furthermore, Fed Chairman Jerome Powell reiterated his conviction in fighting inflation on Jun. 29. Likewise, while letting inflation rage was never a realistic outcome, he understands that a recession that kills inflation is much better than a hyper-inflationary collapse.

He said that while the U.S. economy is "in pretty strong shape," the path to a "soft landing" becomes "significantly more challenging" the longer inflation persists.

As a result:

"The clock is kind of running on how long will you remain in a low-inflation regime (...). The risk is that because of the multiplicity of shocks you start to transition into a higher inflation regime, and our job is to literally prevent that from happening and we will prevent that from happening."

Therefore, while I've long warned that inflation was the most important fundamental variable, the hyper-inflationists realize that Powell has a similar belief.

Please see below:

Supporting the claim, Cleveland Fed President Loretta Mester said on Jun. 29 that “Job one for us now is to get inflation rates under control, and I think right now that’s coloring how consumers are feeling about the economy and where it’s going.”

“If conditions were exactly the way they were today going into that meeting – if the meeting were today – I would be advocating for 75 [basis points] because I haven’t seen the kind of numbers on the inflation side that I need to see in order to think that we can go back to a 50 increase.”

Thus, she expects 12 to 14 rate hikes in 2022:

“I think getting interest rates up to that 3-3.5%; it’s really important that we do that, and do it expeditiously and do it consistently as we go forward, so it’s after that point where I think there is more uncertainty about how far we’ll need to go in order to rein in inflation,”

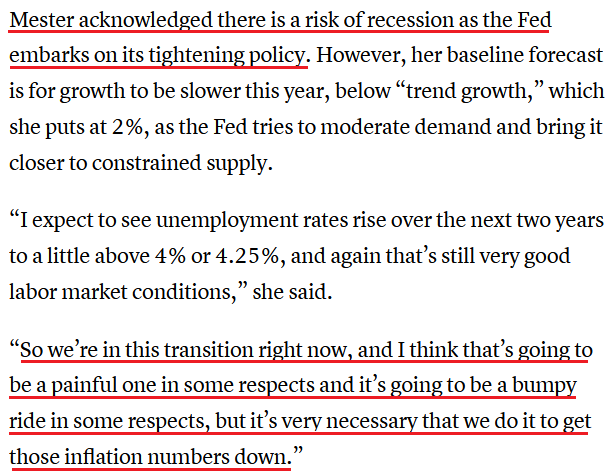

Furthermore, she essentially recited my points from Nov. 18:

Please see below:

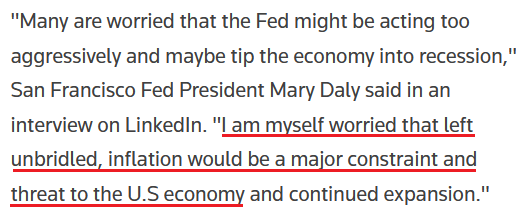

Making three of a kind, San Francisco Fed President Mary Daly said on Jun. 28 that the Fed is "tapping the brakes" to cool demand. "We are working towards that as quickly as we possibly can, and hopefully Americans everywhere will start to see some relief in their pocketbooks."

In addition, she also cited my argument:

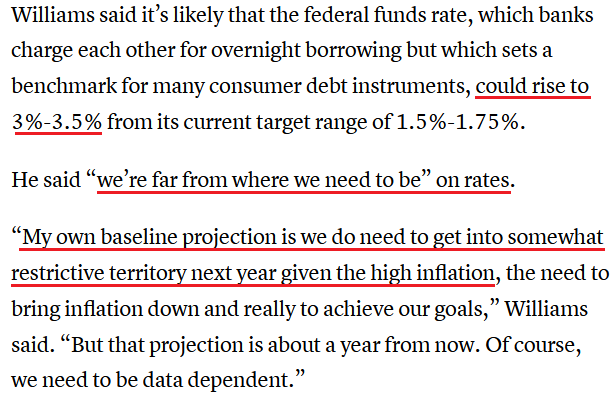

Continuing the theme, New York Fed President John Williams (a reformed dove) said on Jun. 28: “a slowdown [is what] we need to see in the economy to really reduce the inflationary pressures that we have and bring inflation down.”

He added:

"We need to move expeditiously. In terms of our next meeting I think 50 [basis points] or 75 is clearly going to be the debate."

As a result, anxiety in the stock and commodities markets should intensify in the months ahead.

Thus, while I've noted on many occasions that unanchored inflation left unchecked is worse than a recession induced by interest rate hikes, Fed officials understand that the latter is the lesser of two evils. As a result, my comments from Apr. 6 continue to bear fruit. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. If that occurs, investors should suffer a severe crisis of confidence.

To Be, or Not to Be

While recession fears have spread across Wall Street, a realization, or lack thereof, could have major implications on the performances of the S&P 500 and the GDXJ ETF. However, an economic malaise is much more likely than not. To explain, I wrote on Jun. 1:

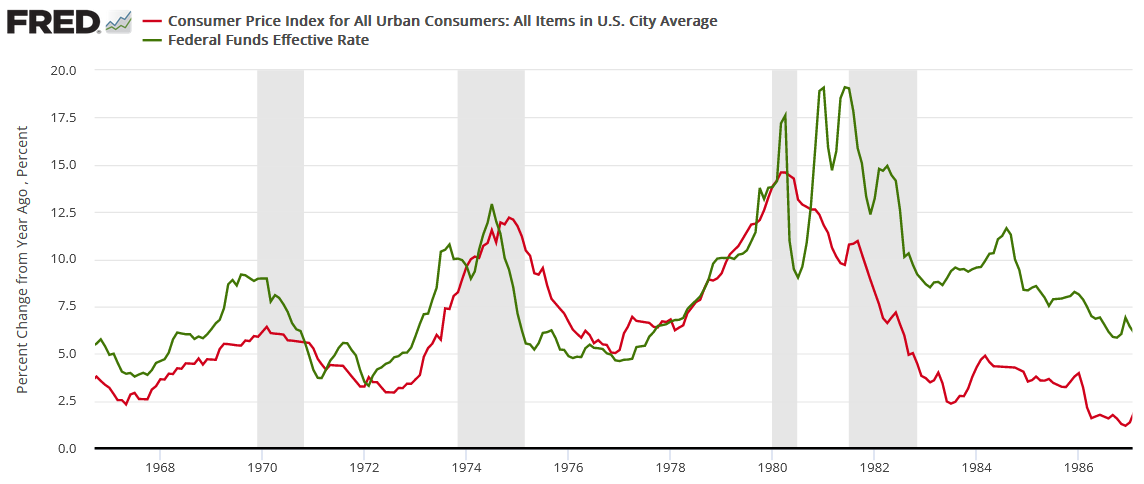

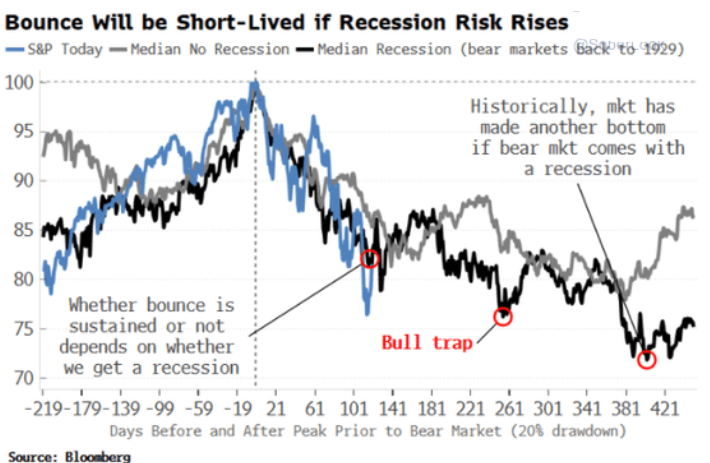

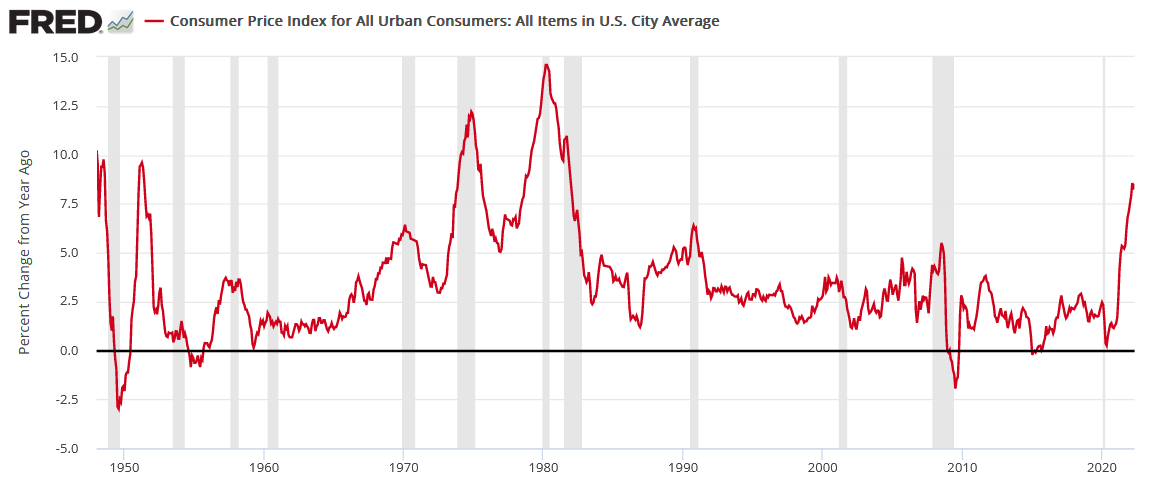

While the consensus either doesn't care or doesn't know history, unanchored inflation in the 1970s/1980s pushed the U.S. into recession four times over ~12 years (the vertical gray bars below). For context, if we exclude the COVID-19 pandemic, the U.S. has only entered a recession once in the last 20 years. Thus, putting a Band-Aid on a gunshot wound won't do much good.

Please see below:

Likewise, modern history sings a similar tune. For example, the Fed has never curbed inflation without the U.S. federal funds rate eclipsing the YoY CPI rate at some point. Therefore, if the Fed pauses at 1.83% and inflation falls to its 2% target, Powell and his crew would accomplish something that’s never been done.

To that point, notice how every inflation spike leads to a higher U.S. federal funds rate and then a recession. As such, do you really think this time is different?

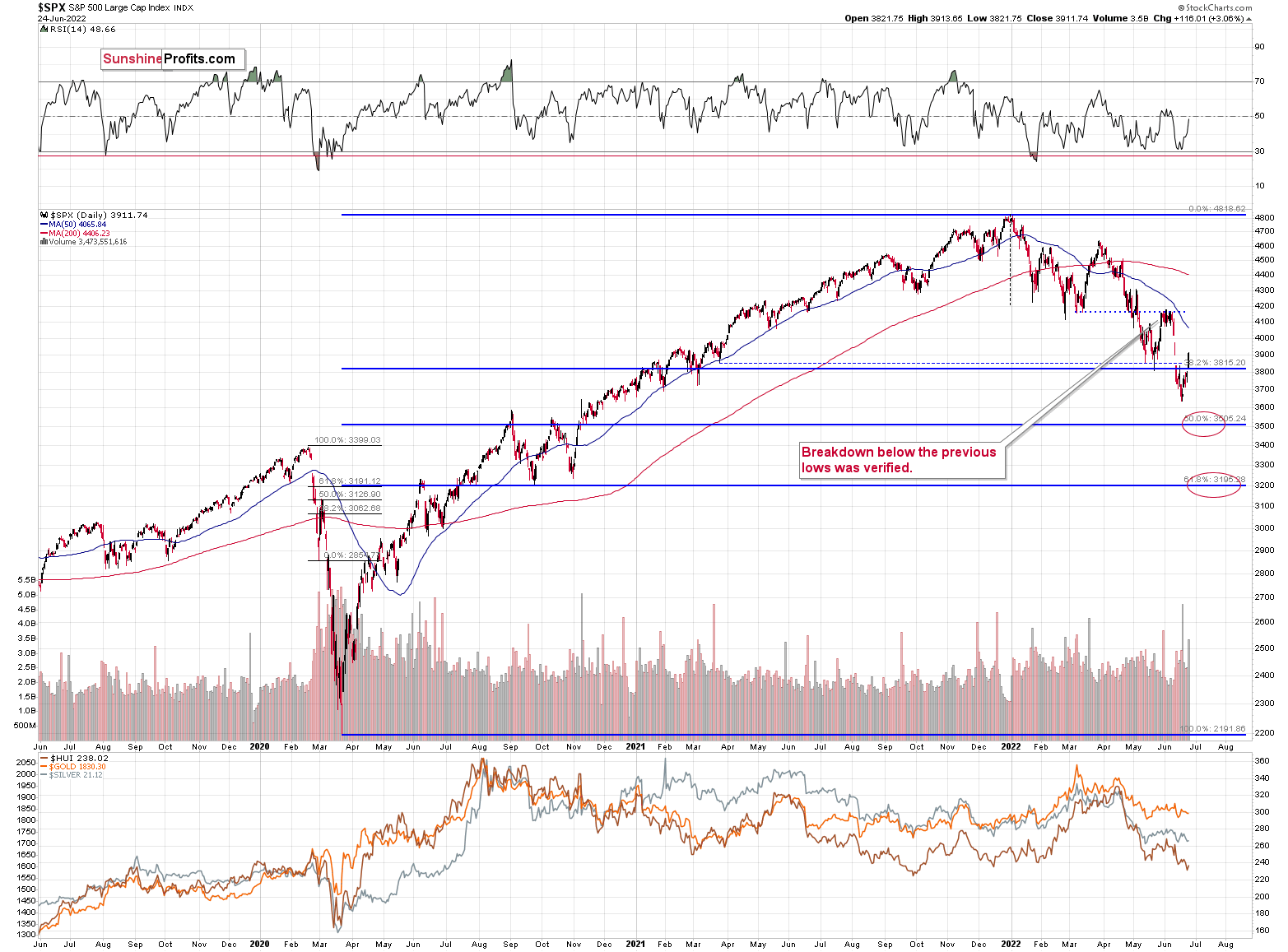

Therefore, if (when) a recession materializes, the S&P 500 and the GDXJ ETF should hit new lows.

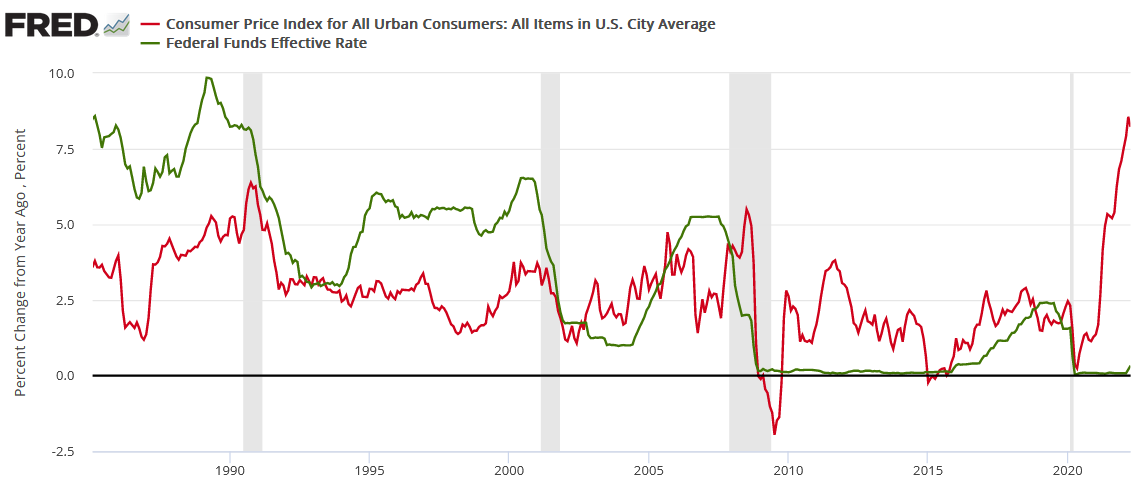

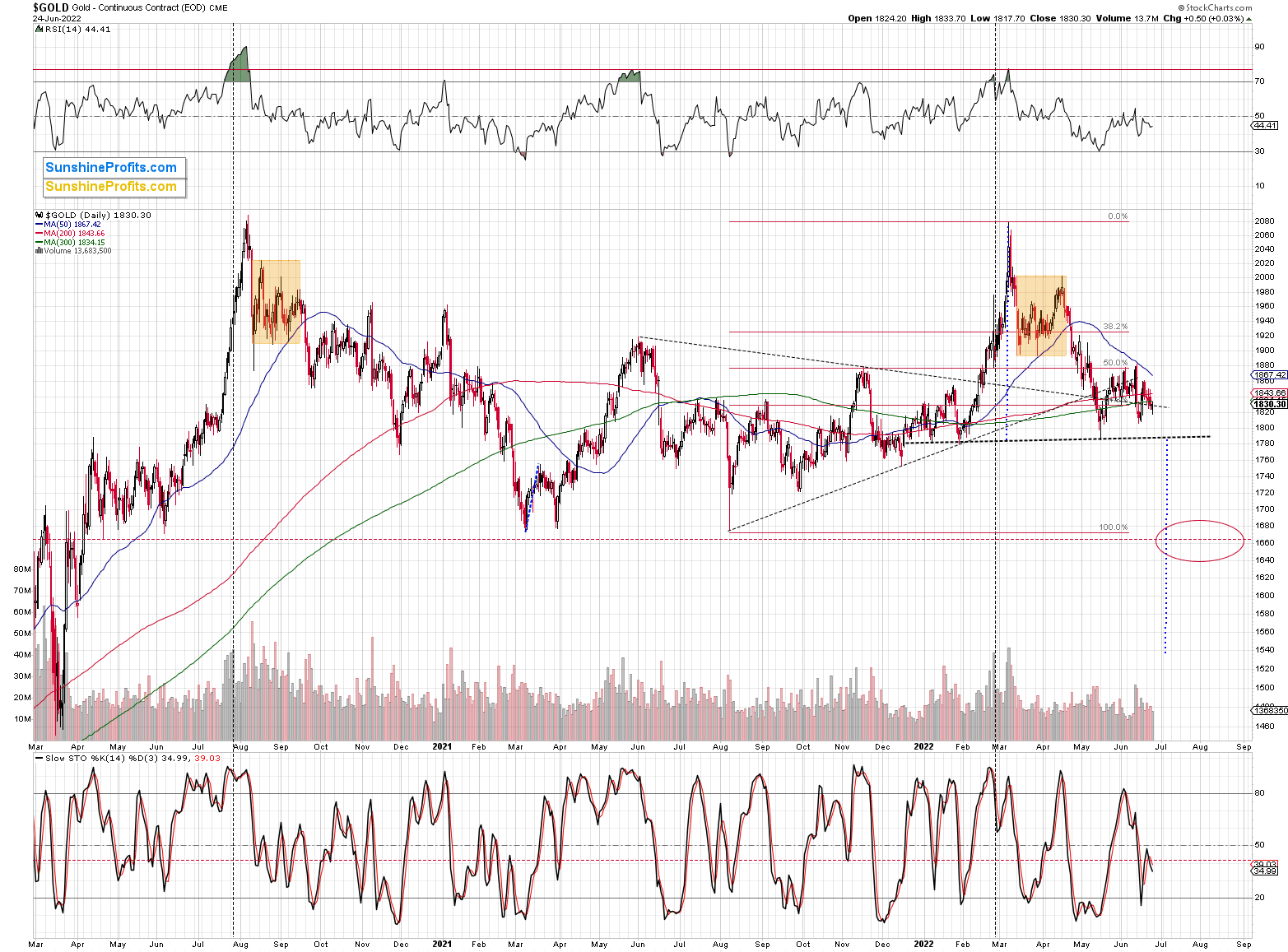

Please see below:

To explain, the blue line above tracks the S&P 500’s current path, while the gray line above tracks the index’s median movement during no-recession bear markets (20% declines) since 1929. As you can see, the S&P 500 often doesn’t hit a new low after an initial sharp drawdown.

Conversely, the black line above tracks the S&P 500’s median path when a recession occurs. If you analyze the performance, you can see that sharp drawdowns often elicit failed relief rallies that culminate in new lows. Moreover, it’s not uncommon for a second new low to materialize. Thus, with a recession likely on the horizon, the S&P 500 and the GDXJ ETF are likely far from medium-term bottoms.

In addition, while inflation is higher now than in 2008, the monetary backdrop is eerily similar.

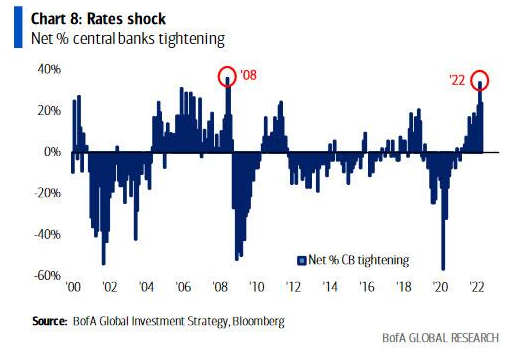

Please see below:

To explain, the blue bars above track the net percentage of global central banks tightening monetary policy. If you analyze the annotations, you can see that 2022 rivals 2008. As a result, the immense liquidity drain should have drastic consequences in the months ahead.

A Real Reminder

Reality has returned to the bond market, and the realization is profoundly bearish for the PMs. To explain, I wrote on Apr. 20:

The next leg higher for the U.S. 10-Year real yield may occur for the opposite reasons. For example, I noted above that we don’t need nominal yields to rise for real yields to rise. Moreover, while the U.S. 10-Year Treasury yield was undervalued in 2021 and was poised to move higher, the U.S. 10-Year breakeven inflation rate is overvalued in 2022 and is poised to move lower.

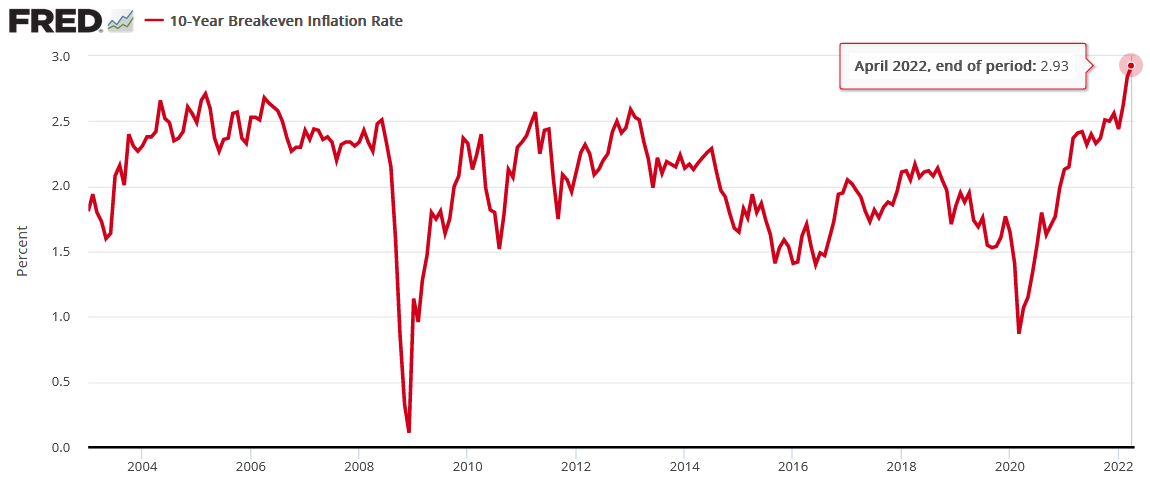

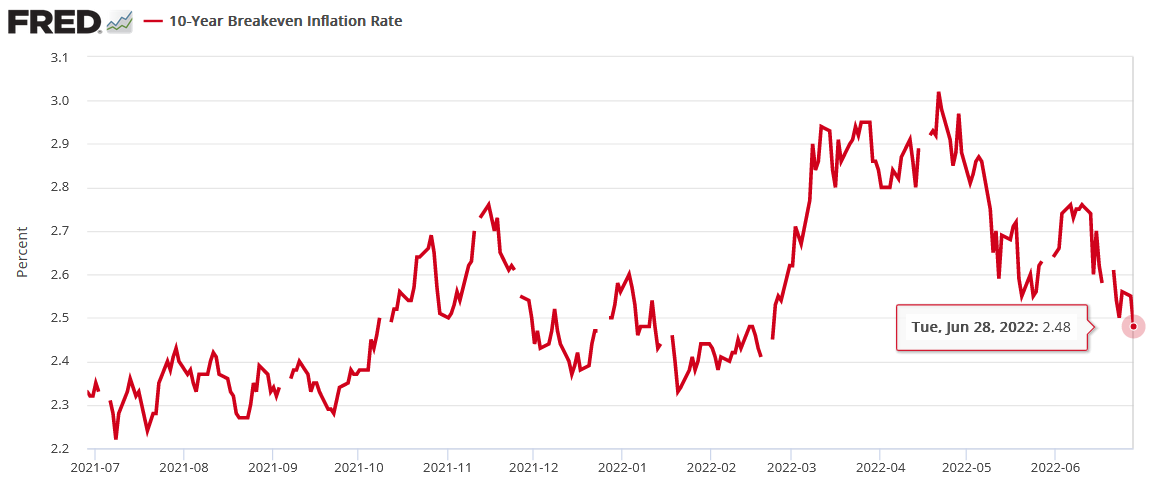

Please see below:

To explain, the U.S. 10-Year breakeven inflation rate ended the Apr. 19 session at 2.93%, only slightly below the all-time high of 2.95% set in March. However, like the PMs, investors’ long-term inflation expectations remain in la-la land.

To that point, with the U.S. 10-Year breakeven inflation rate ending the Jun. 29 session at 2.36%, the Fed doubters and their assets are in free fall.

Likewise, notice the similarity between the above chart and the GDXJ ETF’s 12-month chart?

The Bottom Line

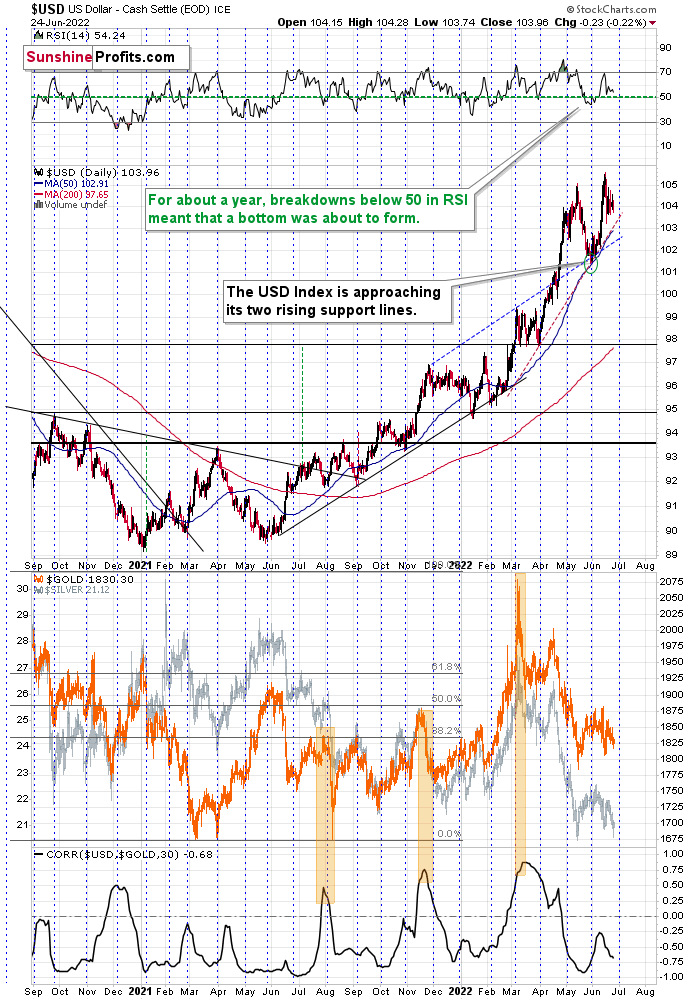

The fundamental thesis continues to unfold as expected: the Fed is hawked up, and their policies have helped uplift the USD Index and the U.S. 10-Year real yield. Moreover, since these metrics are the PMs' main fundamental adversaries, the GDXJ ETF has gone in the opposite direction.

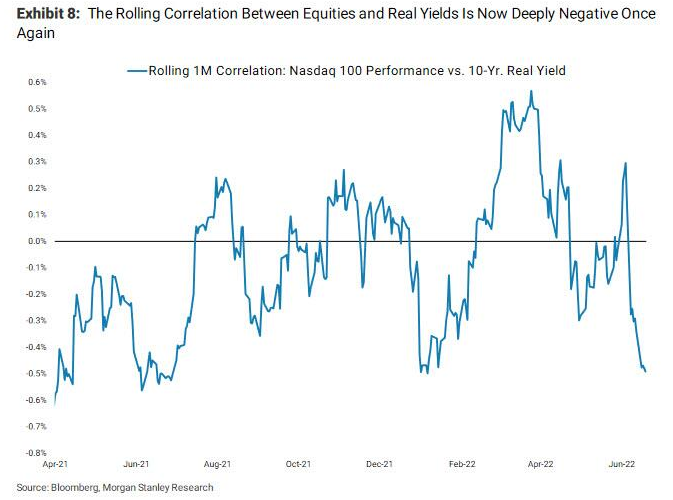

Furthermore, with the NASDAQ Composite highly allergic to higher real yields, the developments also hurt the S&P 500. Therefore, with the junior miners more correlated with the general stock market, the medium-term fundamental outlook remains bright for our short position.

In conclusion, the PMs declined on Jun. 29, as many commodities have lost their luster. Furthermore, with more rate hikes poised to uplift the USD Index and the U.S. 10-Year real yield in the months ahead, gold, silver, and mining stocks are stuck in no-man's land.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Asset Prices Erupted Prior to Independence Day

June 29, 2022, 8:32 AMFireworks Came Early

While it seemed logical that a sense of calm would dominate the financial markets until after the Jul. 4 holiday, asset prices erupted on Jun. 28. Moreover, with the abnormal bouts of volatility highlighting investors’ anxiety, their short-term psyches can’t seem to shake the medium-term fundamentals.

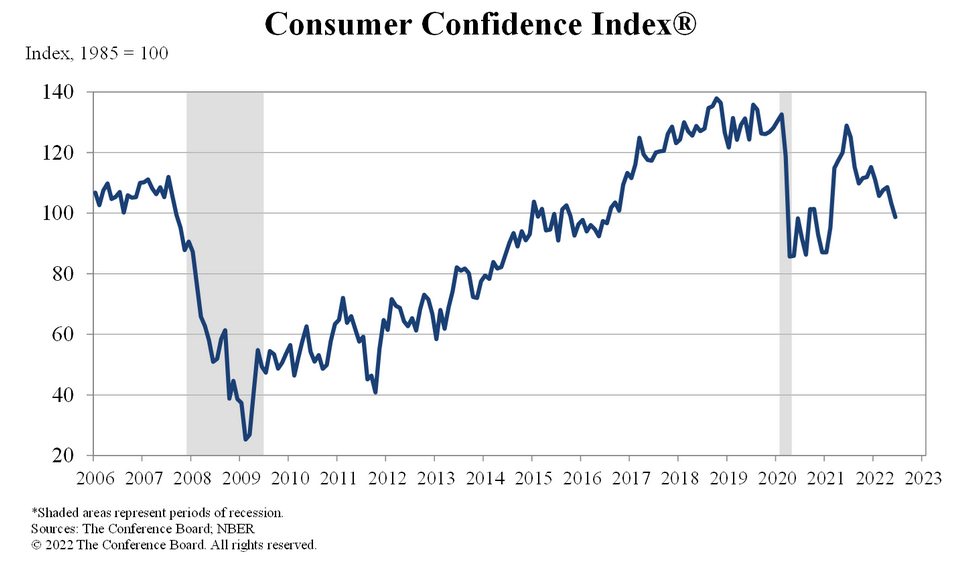

For example, The Conference Board released its Consumer Confidence Index on Jun. 28. The index declined from 103.2 in May to 98.7 in June, reaching its lowest level since February 2021. However, the report was profoundly hawkish for Fed policy. An excerpt read:

“51.3% of consumers said jobs were ‘plentiful,’ down from 51.9%. Conversely, 11.6% of consumers said jobs were ‘hard to get,’ down from 12.4%.”

Therefore, with Americans’ employment prospects holding up much better than their overall sentiment, the data adds fuel to the hawkish fire.

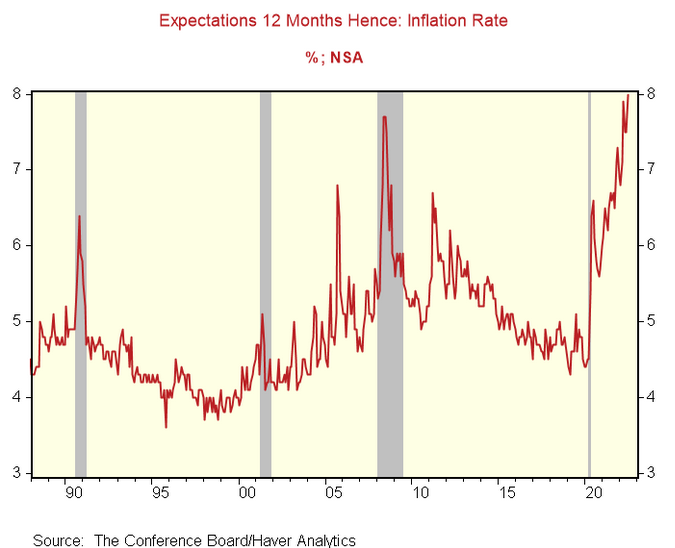

Please see below:

To that point, the report also showed Americans’12-month expected inflation rate hit an all-time high of 8%.

Please see below:

To explain, the red line above tracks The Conference Board’s inflation survey results. If you analyze the right side of the chart, you can see that the metric hit a new record high. As a result, Americans’ inflation expectations fall materially outside of the Fed’s expected range.

Furthermore, I’ve noted on numerous occasions that unanchored inflation is the perfect ingredient for U.S. recessions, and the data from The Conference Board was another stark reminder. For example, Lynn Franco, Senior Director of Economic Indicators at The Conference Board, said:

“While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory – falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as a growing risk of recession by year-end.”

Please see below:

To explain, the blue line above subtracts The Confidence Board’s Present Situation Index from its Expectations Index. In a nutshell: when the blue line is falling, Americans expect the future to be worse than the present.

If you analyze the right side of the chart, you can see that the blue line has fallen off a cliff. Moreover, the vertical red bars highlight how sharp declines in the spread often occur before U.S. recessions. As a result, with inflation preventing the Fed from easing to support the U.S. economy, it’s likely only a matter of time before a recession is confirmed.

Likewise, since the pricing pressures are unlikely to abate without more rate hikes, it may be an extended wait before the Fed turns dovish.

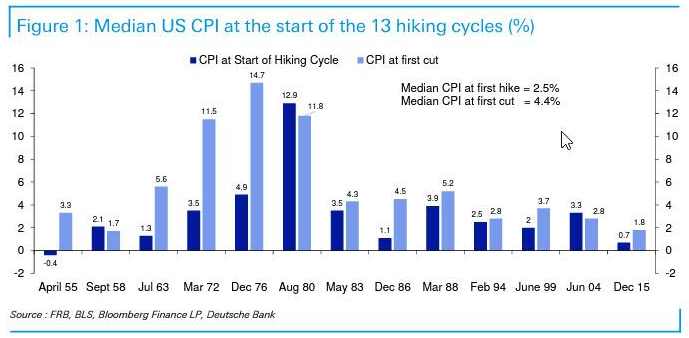

Please see below:

To explain, the dark blue bars above depict the year-over-year (YoY) percentage changes in the headline Consumer Price Index (CPI) when the Fed began its historical rate hike cycles, while the light blue bars above depict the CPI levels when the Fed finally cut rates.

The data shows that the median rate hike occurred with the headline CPI at 2.5% YoY. Therefore, the Fed normally tightens before inflation gets out of control. However, while I warned throughout 2021 that the Fed was materially behind the inflation curve, that ship has already sailed.

More importantly, history shows that the median rate cut occurred with the headline CPI at 4.4% YoY. Furthermore, anything higher than 5% is a material outlier. Therefore, with the headline CPI currently at 8.5% YoY, we’re far from levels where the Fed can run to the rescue. As a result, my comments from Apr. 6 still hold. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

Take Shelter

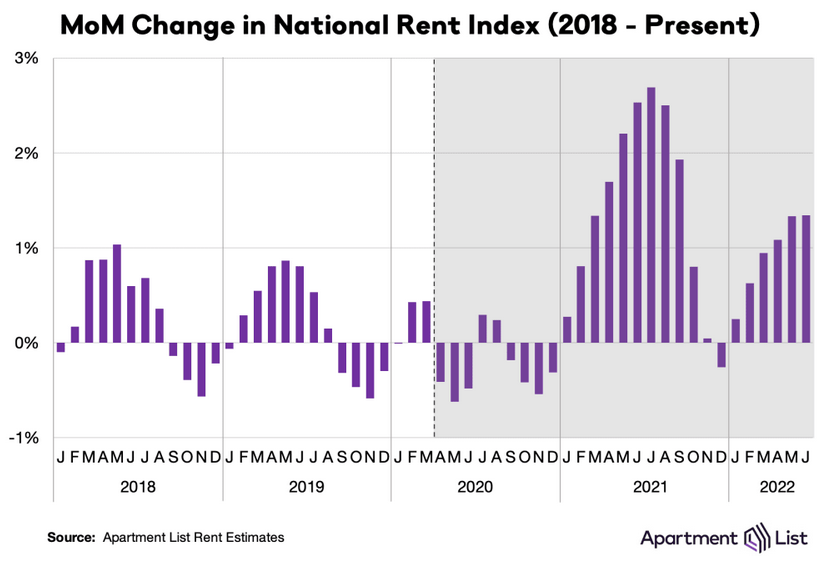

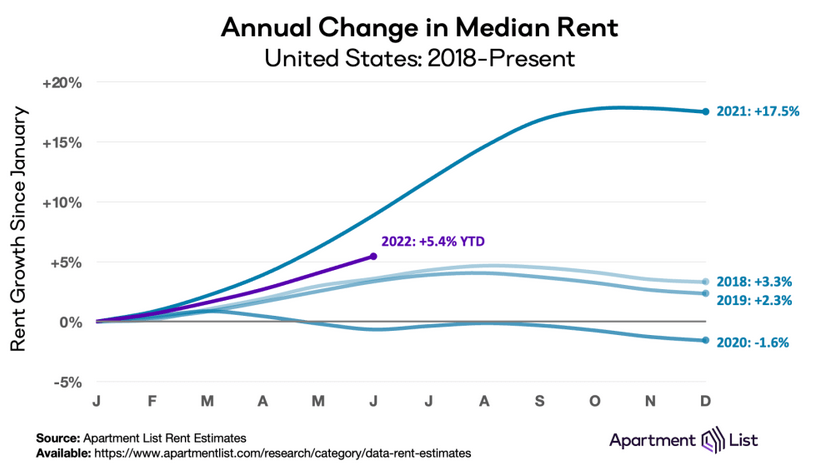

While investors focus much of their attention on food and energy prices, rent inflation is material. For example, the Shelter CPI accounts for more than 30% of the headline CPI’s movement. Moreover, Apartment List released its National Rent Report on Jun. 28. An excerpt read:

“Our national rent index increased by 1.3 percent month-over-month in June, consistent with last month’s increase. In June 2021, our national rent index jumped by 2.5 percent month-over-month, nearly doubling this month’s increase. In contrast, from 2017 to 2019, month-over-month growth in June averaged 0.7 percent, just over half of this month’s increase.”

Please see below:

In addition:

“In the first half of this year, our national rent index has increased by 5.4 percent, well below last year’s 8.8 percent increase over the same months. However, this year’s pace is also still notably faster than that of the years prior to 2021. For comparison, rent growth from January to June totalled 3.1 percent in 2017, 3.6 percent in 2018, 3.4 percent in 2019, and -0.7 percent in 2020.”

Please see below:

Thus, while 2022 rent inflation lags 2021, the important point is that the six-month percentage change has already eclipsed the annual figures from 2018 and 2019. As a result, more hawkish policy should dominate the headlines in the coming months, and a realization is profoundly bearish for the S&P 500 and the PMs.

A Real Conundrum

I’ve long warned about the impact of U.S. real yields on the PMs. However, plenty of liquidity beneficiaries suffer when the Fed tightens monetary policy. To explain, I wrote on Jan. 12:

[Like] hyper-growth NASDAQ stocks and speculative assets like cryptocurrencies, the PMs, suffer from a similar fundamental affliction. For context, the PMs are less volatile than speculative assets. However, it's important to remember that gold, silver, and mining stocks peaked amid the liquidity-fueled surge in the summer of 2020. Likewise, their uprisings coincided with real interest rates that were at all-time lows at the time.

Conversely, with the Fed's liquidity drain already unfolding and real interest rates poised to rise in the coming months, the PMs should suffer from the likely re-pricings.

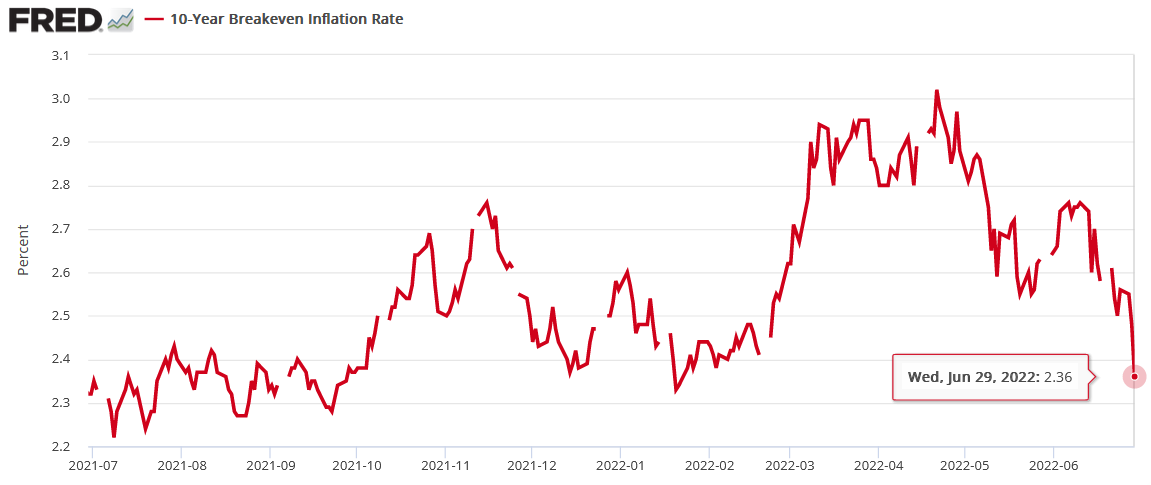

Thus, while gold has remained relatively uplifted, silver and the GDXJ ETF have lost material ground in 2022. Likewise, while Americans’ inflation expectations have become unanchored, bond investors understand the implications of the Fed’s rate hike cycle. As a result, the U.S. 10-Year breakeven inflation rate has performed as expected. For context, I wrote on Apr. 20:

The next leg higher for the U.S. 10-Year real yield may occur for the opposite reasons. For example, I noted above that we don’t need nominal yields to rise for real yields to rise. Moreover, while the U.S. 10-Year Treasury yield was undervalued in 2021 and was poised to move higher, the U.S. 10-Year breakeven inflation rate is overvalued in 2022 and is poised to move lower.

Please see below:

To explain, the U.S. 10-Year breakeven inflation rate ended the Apr. 19 session at 2.93%, only slightly below the all-time high of 2.95% set in March. However, like the PMs, investors’ long-term inflation expectations remain in la-la land.

With the Fed on a hawkish crusade to stifle demand and reduce inflation, the central bank can achieve this goal. The only question is how much economic pain officials are willing to tolerate to get the job done.

Furthermore, with the metric declining on cue, the U.S. 10-Year breakeven inflation rate ended the Jun. 28 session at 2.48%.

Therefore, with the U.S. 10-Year Treasury yield ending the day at 3.20%, the U.S. 10-Year real yield remains elevated at 0.72%. However, the Fed needs to push the metric higher to curb inflation, and a realization should profoundly impact the NASDAQ 100, the S&P 500, and the GDXJ ETF.

Please see below:

To explain, the blue line above tracks the rolling one-month correlation between the NASDAQ 100 and the U.S. 10-Year real yield. If you analyze the right side of the chart, you can see that the blue line has fallen sharply, indicating that a higher U.S. 10-Year real yield has sent the NASDAQ 100 running in the opposite direction. Likewise, with the GDXJ ETF a liquidity beneficiary that’s more correlated with the general stock market, a continuation of the theme should result in lower lows over the medium term.

The Bottom Line

Stocks sold off on Jun. 28, as asset prices continued to whipsaw violently in both directions. However, the GDXJ ETF has fallen more on down days and risen less on up days than the S&P 500. As a result, the underperformance is profoundly bearish, and the dynamic should continue in the months ahead.

In conclusion, the PMs declined on Jun. 28, as pessimism reigned. Moreover, with the USD Index rallying, the PMs’ medium-term fundamentals continue to worsen. Therefore, a final flush should occur before long-term buying opportunities emerge.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Pressuring Growth Is the Lesser Evil for the US Economy

June 28, 2022, 8:50 AMPMI Problems

With investors in wait-and-see mode for the next fundamental catalyst to propel financial assets in either direction, the prospect of pension fund rebalancing has market participants relatively upbeat. Moreover, with Independence Day on Jul. 4, we may have to wait until after the holiday for the next bout of volatility.

However, while short-term sentiment may have found a floor, the medium-term fundamentals continue to deteriorate. For example, the Dallas Fed released its Texas Manufacturing Outlook Survey on Jun. 27. The headline index declined from -7.3 to -17.7, as the figure “reached lows last seen in May 2020.” In addition, “the outlook uncertainty index shot up to 43.7, a 17-point jump from May.”

More importantly:

“Labor market measures continued to indicate robust employment growth and longer workweeks. The employment index moved down six points to 15.2 but remained well above its series average of 7.7. Twenty-four percent of firms noted net hiring, while 9 percent noted net layoffs. The hours worked index pushed up further, from 7.4 to 11.8.”

In addition:

“Prices and wages continued to increase strongly. The raw materials prices index edged down to 57.5, a reading still more than twice its average of 28.0. The finished goods prices index also moved down, from 41.8 to 33.8, but remained highly elevated. The wages and benefits index came in at 49.9, unchanged from May and markedly higher than its 20.4 average.”

As a result, hawkish implications for the Fed’s dual mandate – maximum employment and price stability – remain alive and well in Texas. Moreover, while output has suffered amid higher interest rates, the pricing pressures remain problematic. For example, with manufacturers increasing their inflation expectations in June, the Fed’s catch-22 is on full display.

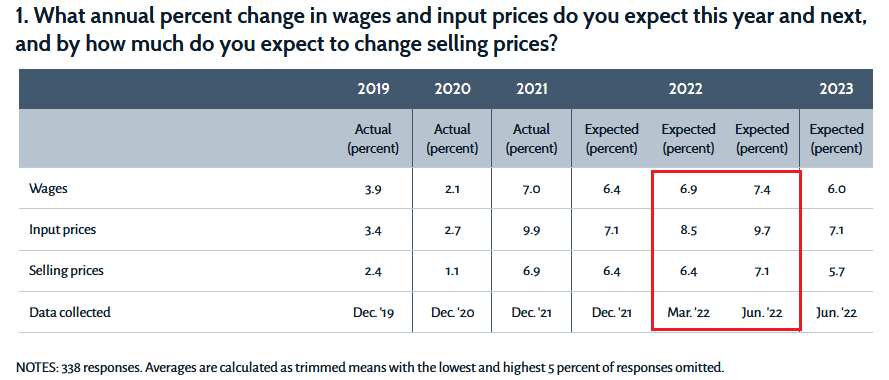

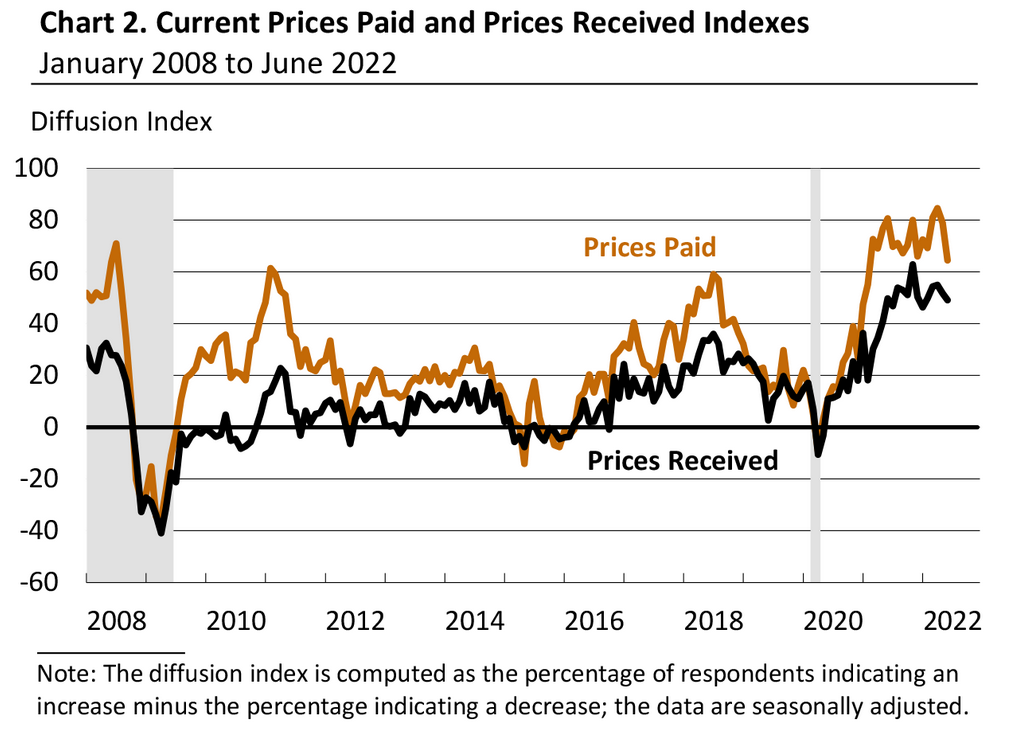

Please see below:

To explain, survey respondents are periodically asked about their wage, input, and output price expectations. If you analyze the red box, you can see that all three increased from March to June. Therefore, while investors hope that a few rate hikes will suppress inflation’s reign, manufacturing firms in Texas expect more inflation now than they did in March. As a result, six rate hikes (25 basis point increments) have done little to curb realized or expected inflation.

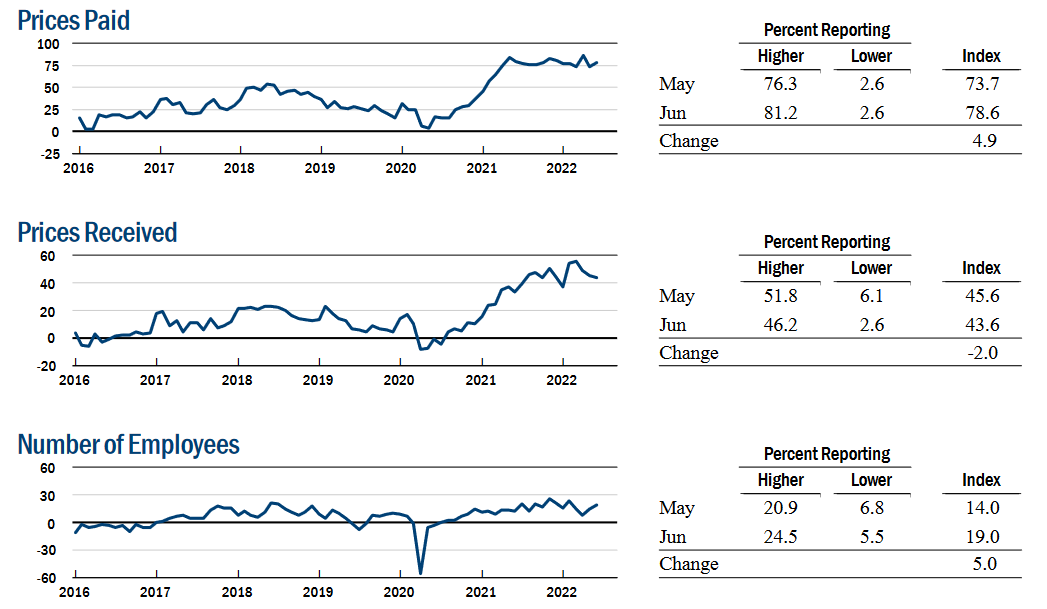

Likewise, the New York Fed released its Empire Manufacturing Survey on Jun. 15. Moreover, while the headline index increased month-over-month (MoM), so did inflation. The report revealed:

“The index for the number of employees increased five points to 19.0, pointing to a solid increase in employment, and the average workweek index came in at 6.4, indicating a small increase in hours worked.”

In addition:

“The prices paid index rose five points to 78.6, several points below its recent record high, and the prices received index edged down to a still elevated 43.6, signaling ongoing substantial increases in both input prices and selling prices.”

Please see below:

Singing a similar tune, the Philadelphia Fed released its Manufacturing Business Outlook Survey on Jun. 16. The headline index declined six points to -3.3. However:

“Firms continued to report increases in employment, and the employment index moved up from 25.5 to 28.1. More than 31 percent of the firms reported increases in employment, compared with 3 percent that reported decreases; 66 percent reported no change. The average workweek index decreased 4 points, to 11.8.”

Likewise:

“The indicators for prices paid and prices received continue to indicate widespread price increases but decreased this month.”

Therefore, while inflation was less fierce in Philadelphia, both prices paid and received indexes remain stubbornly high.

Please see below:

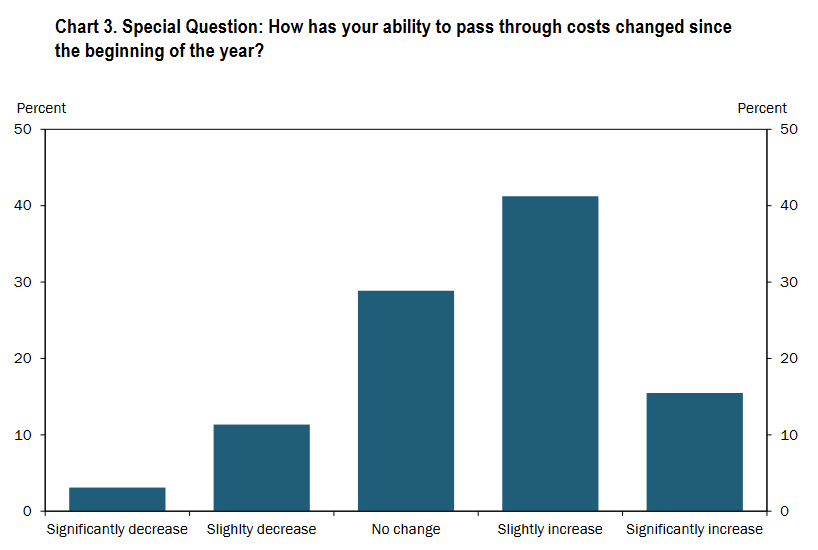

Finally, the Kansas City Fed released its Tenth District Manufacturing Activity survey on Jun. 23. The headline index also declined, falling from 23 in May to 12 in June. Moreover, while the employment index also declined, the prices received index increased from 42 in May to 51 in June.

Furthermore, the majority of respondents claim it’s easier to raise prices now than in January.

Please see below:

If you analyze the blue bars furthest to the right, you can see that roughly 55% of respondents said their ability to pass through higher input costs has either “slightly” or “significantly” increased since the start of the year.

As a result, inflation dynamics are not heading in the Fed’s desired direction. Therefore, the central bank will have to choose between supporting growth and stoking inflation or pressuring growth and defeating inflation. However, I’ve long warned that the former approach pushed the U.S. into recession four times over ~12 years in the 1970s/1980s.

Thus, a half-hearted approach to calming the pricing pressures results in more long-term damage than simply raising rates and inducing a recession. Furthermore, I noted on Jun. 23 that Fed Chairman Jerome Powell understands the precarious pitfalls and realizes that a dovish pivot would be a disaster. I wrote:

I warned on numerous occasions that letting inflation rage would be the worst long-term outcome for the U.S. economy. In a nutshell: turning dovish would hurt the U.S. dollar and embolden commodity traders to bid up prices even more.

As a result, Powell must follow through with his hawkish threats or the progress will reverse and he’ll be back to square one. However, he sounds like a man who realizes that fighting inflation is the only plausible path forward. Moreover, a rising unemployment rate won’t be enough to deter future rate hikes.

Please see below:

Melancholy in Michigan

The University of Michigan released its Consumer Sentiment Index on Jun. 24. Moreover, with the index hitting a new all-time low, I’ve highlighted how inflation is both a financial and political problem. The report revealed:

“The final June reading confirmed the early-June decline in consumer sentiment, settling 0.2 Index points below the preliminary reading and 14.4% below May for the lowest reading on record. Consumers across income, age, education, geographic region, political affiliation, stockholding, and homeownership status all posted large declines.”

“About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009. Inflation continued to be of paramount concern to consumers; 47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession.”

Likewise:

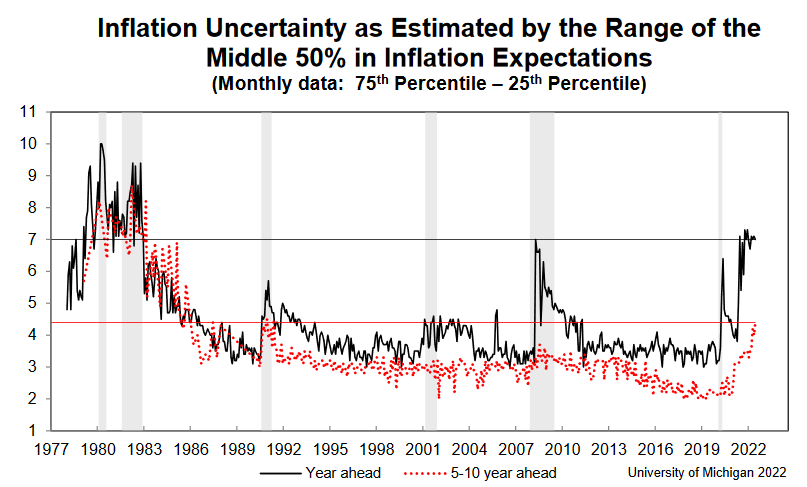

“Consumers also expressed the highest level of uncertainty over long-run inflation since 1991, continuing a sharp increase that began in 2021.”

Please see below:

To explain, the black and red dotted lines above track respondents’ median one-year and 5-10-year inflation uncertainty. If you analyze the right side of the chart, you can see that the black line is on par with the global financial crisis (GFC) highs. However, the red dotted line has eclipsed its GFC highs, as long-term inflation has become embedded in Americans’ psyches.

Again, the gray bars on the left show how high inflation is the perfect predictor of U.S. recessions. Therefore, the Fed must address the problem to avoid a decade of economic fits and starts.

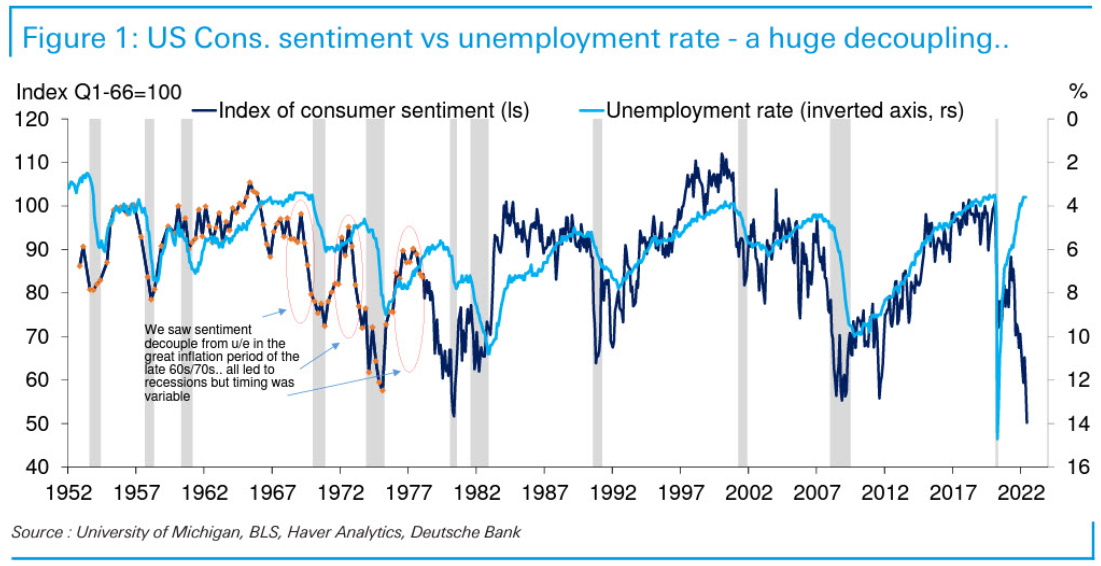

To that point, the 1970s-like sentiment-unemployment rate divergence has likely sowed the seeds of an economic malaise.

Please see below:

To explain, the dark blue line above tracks the University of Michigan’s Consumer Sentiment Index, while the light blue line above tracks the inverted U.S. unemployment rate. For context, inverted means the latter’s scale is flipped upside down, and a rising light blue line represents a falling U.S. unemployment rate.

Moreover, if you analyze the left side of the chart, the vertical gray bars and annotations show how unanchored inflation often decouples sentiment from the unemployment rate and results in a recession. Likewise, the epic divergence on the right side of the chart is even worse.

In a nutshell: failing to curb the pricing pressures eventually leads to demand destruction, a rising unemployment rate and a recession. Therefore, if Fed officials fail to act, history shows that inflation will inflict pain. As such, directly dealing with the issue is the lesser of two evils.

The Bottom Line

While investors assume that weakening growth will provoke a dovish pivot, a patient Powell won’t cure the U.S.’s economic ills. In contrast, turning dovish would worsen the situation and elicit a re-enactment of the 1950s to 1980s. As evidence, notice how the gray bars (recessions) on the left side of the chart above are more clustered together than on the right? Well, it’s no coincidence that these periods culminated with unanchored inflation. Moreover, the chart below highlights the ominous dynamic.

As such, if Powell wants the U.S. to enjoy a post-1983 economic environment, he needs to get inflation under control.

In conclusion, the PMs were mixed on Jun. 27, as silver ended the day in the green. However, with investors awaiting the next fundamental catalyst, the short-term price action may be subdued. Despite that, the medium-term outlook is unchanged: hawkish Fed policy is necessary to curb inflation, and that realization should uplift the USD Index and U.S. real yields. As a result, the PMs should head in the opposite direction over the medium term.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

Junior Miners: A Bearish Push Is Coming to Move Them Lower

June 27, 2022, 9:39 AMLet's not be confused by the temporary USDX weakness. Junior miners are faint and we can expect them to decline again soon.

April and May Replay?

Although history doesn’t repeat itself to the letter, it rhymes. At least that’s what tends to happen in the financial markets.

In today’s analysis, I’ll explain why I think we’re about to see another example of the above in the case of junior mining stocks. There’s a technique that suggests one thing, but there’s also another that suggests that a 1-to-1 analogy wouldn’t be as good a fit, as a slight deviation from it.

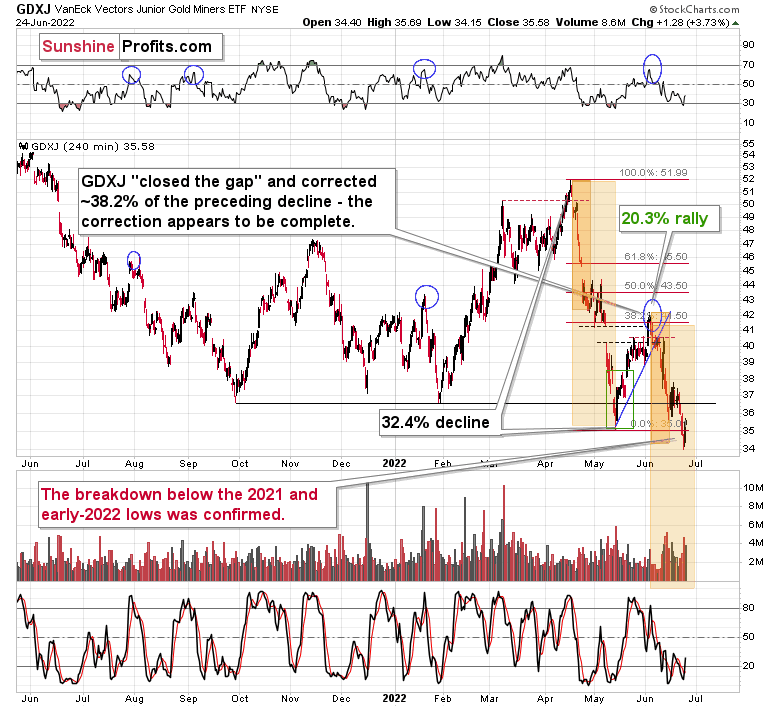

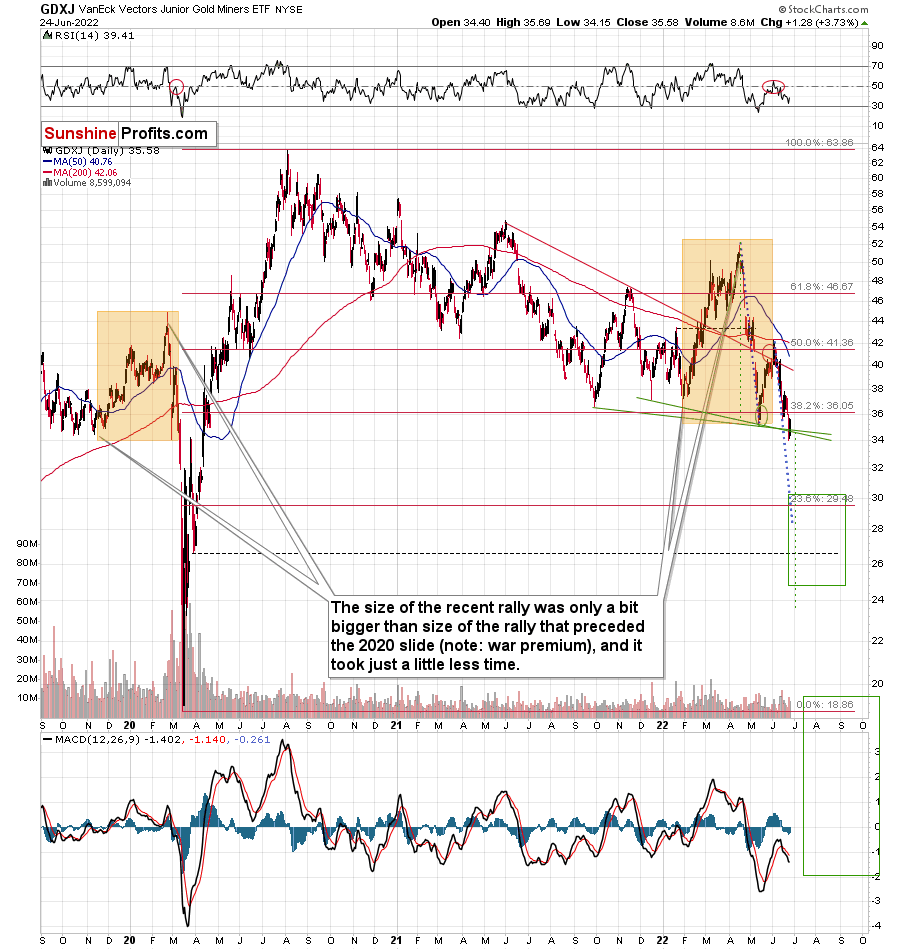

So far, the situation in the GDXJ – a proxy for junior mining stocks – has been similar to what happened in the second half of April and early May.

I even marked those similar periods with orange rectangles. We saw a small consolidation right after the end of the smaller rectangle, so history had already proved to be repeating itself.

However, let’s see what happened differently. This time, the initial decline (so the smaller rectangle) was not as steep as it was in April, and the following consolidation was shorter and narrower, too.

What does it tell us? No, I don’t mean the obvious “well, it’s not identical” here. The price moves are smaller either because the entire current short-term downswing is smaller (so, a smaller initial part and then a smaller final part would together create a smaller version of what we saw in April and May), or because this time, the structure of the price move is going to be a bit different.

If the latter is the case, it means that the decline can actually be bigger than what we saw in April-May, not smaller.

Looking at the charts featuring gold and the general stock market, we can tell that the latter of the above scenarios is more likely being realized.

Why? Because junior miners are weak relative to both: gold and the stock market.

Did gold move to new 2022 lows recently? Or below its 2021 lows?

Nope, it’s not even particularly close to those levels. In fact, gold didn’t even move below its recent lows on Friday.

What about the general stock market – did it slide profoundly recently? If it did, it might have explained juniors’ weakness, as both juniors and the general stock market are relatively highly correlated (compared to how correlated is the general stock market is with other parts of the precious metals sector).

Actually, the general stock market rallied last week, and it invalidated its previous breakdown below the recent and 2021 lows. In fact, the S&P 500 Index was up by over 6% last week!

Was GDXJ up by over 6% too? No. It was down by over 3%, and profits on our short positions in juniors have increased once again.

The juniors are weak. Period.

This tells us that it’s more likely that the deviation from the history that is not repeating itself to the letter will be toward something more bearish than the 1:1 analogy would be.

Does it complicate the outlook or analysis right now? Actually, it’s the opposite, because the above perfectly fits what was visible on broader charts all along!

I previously explained that the next target for the GDXJ is likely around the $26-27 area.

That’s below the 1:1 analogy-based target that would be at “just” $28 as the blue, dotted lines would indicate.

Additionally, please note that the GDXJ is likely about to complete a head-and-shoulders pattern. Actually, it doesn’t matter if we use the late-2021 rally as the left shoulder or the late-2021 – early-2022 one, as the early-2022 rally is still the head, and the target based on the formation is the same in both cases. I marked the neck levels with green, solid lines, and I marked the downside target based on the potential formation with green, dashed lines – it’s slightly below $24.

The formation is only “potential” at this time, as we would need to see a confirmed breakdown below the neck level to say that the formation is complete. This would mean a breakdown below ~$34.

Given the kind of weakness that we saw in junior miners recently, it seems that we won’t have to wait too long for the above to take place.

Speaking of time, the month is ending, and this might ring some bells…

The USDX Tendency

The USD Index tends to turn around at the turn of the month, usually bottoming out at that time. For example, that happened about a month ago and three months ago.

The month ends this Thursday. This tendency works on a near-to basis, so the exact bottom might or might not form on Thursday, but it doesn’t seem that we’ll need to wait for this bottom for long.

Based on junior’s weakness, we see that they just “can’t wait” to move lower, and the above USD Index chart tells us that they are likely about to get a bearish push.

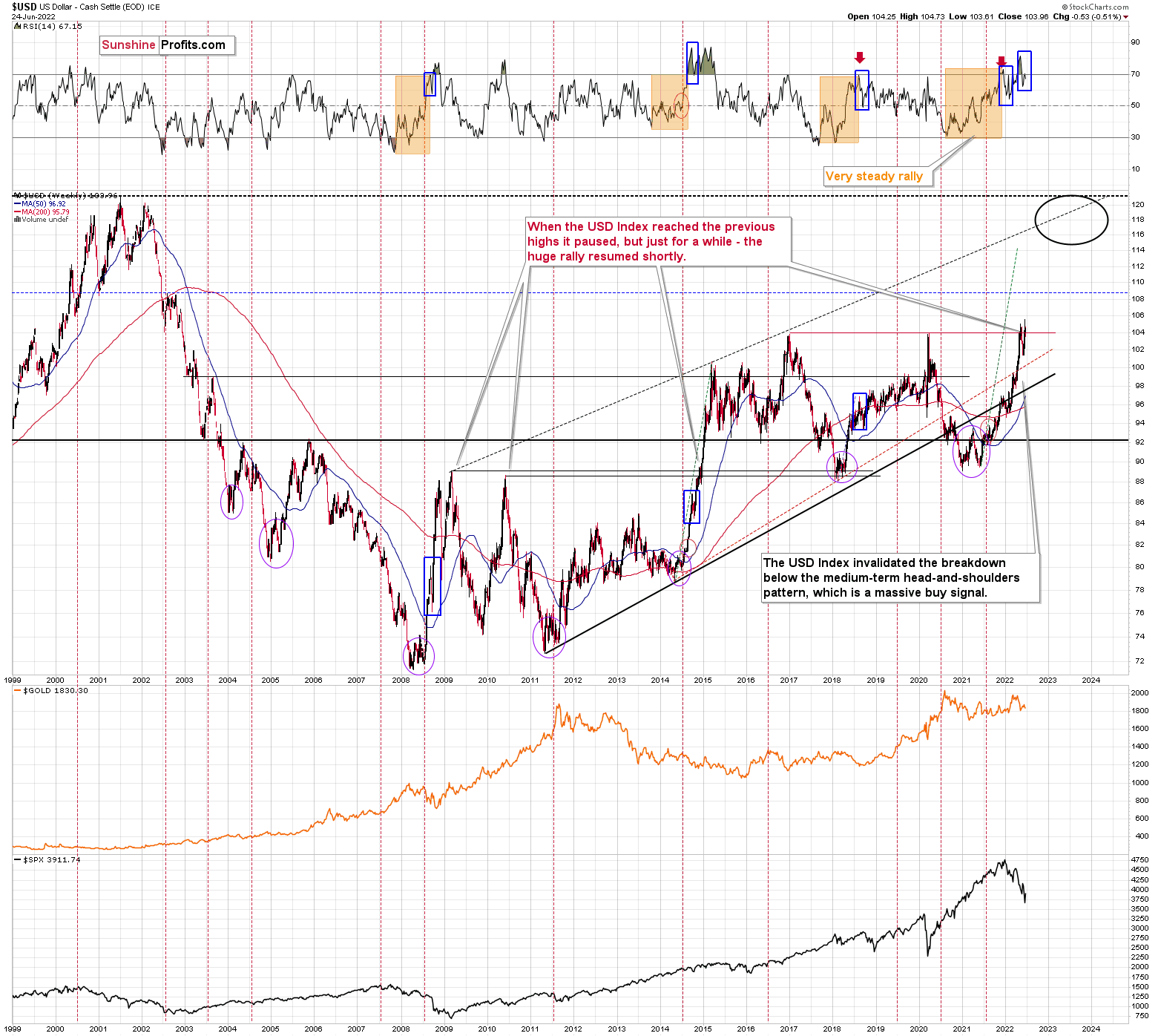

Let’s not forget about the forest while looking at trees. The recent brief decline in the USD Index is likely just a handle of a cup-and-handle pattern that – when completed – is likely to take the USD Index much higher.

Most importantly, the entire cup-and-handle pattern (so basically the May-now performance) is a big handle of a much bigger cup-and-handle pattern that you can see on the long-term USD Index chart.

This means that once the USD Index breaks and confirms the breakout above the previous highs (and it’s likely to do so in the near future), it’s likely to soar.

This is bearish for the precious metals market – extremely so. Gold’s back-and-forth movement is likely about to end, just like junior miners are indicating. Gold’s next important stop (not the final end of the entire medium-term decline, though) is likely to be at its 2021 lows or close to them.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief -

The Fed Just Cannot Rest in Raising Interest Rates

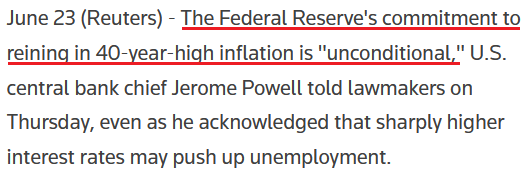

June 24, 2022, 9:38 AMWith Fed Chairman Jerome Powell capping off his two-day Congressional hearing on Jun. 23, he reiterated his pledge to combat inflation. He said:

“We really need to restore price stability... because without that we're not going to be able to have a sustained period of maximum employment where the benefits are spread very widely. It's something that we need to do, we must do."

As a result, Powell realizes that persistent periods of unanchored inflation are much worse than an impending recession.

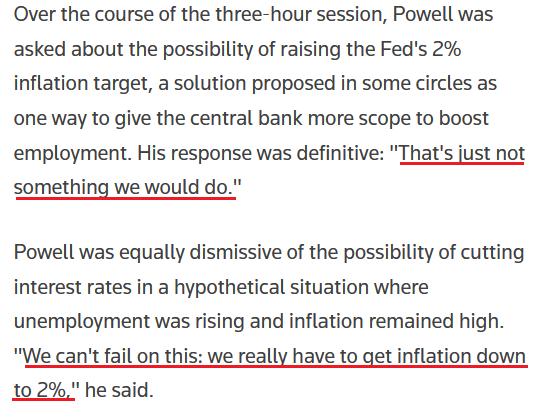

Please see below:

In addition, he added:

"We don't have precision tools, so there is a risk that unemployment would move up, from what is historically a low level though. A labor market with 4.1% or 4.3% unemployment is still a very strong labor market."

Powell on the Prowl

Thus, Powel is laser-focused on curbing inflation. Remember, I warned on numerous occasions that letting inflation rage would be the worst long-term outcome for the U.S. economy. In a nutshell: turning dovish would hurt the U.S. dollar and embolden commodity traders to bid up prices even more.

As a result, Powell must follow through with his hawkish threats or the progress will reverse and he’ll be back to square one. However, he sounds like a man who realizes that fighting inflation is the only plausible path forward. Moreover, a rising unemployment rate won’t be enough to deter future rate hikes.

Please see below:

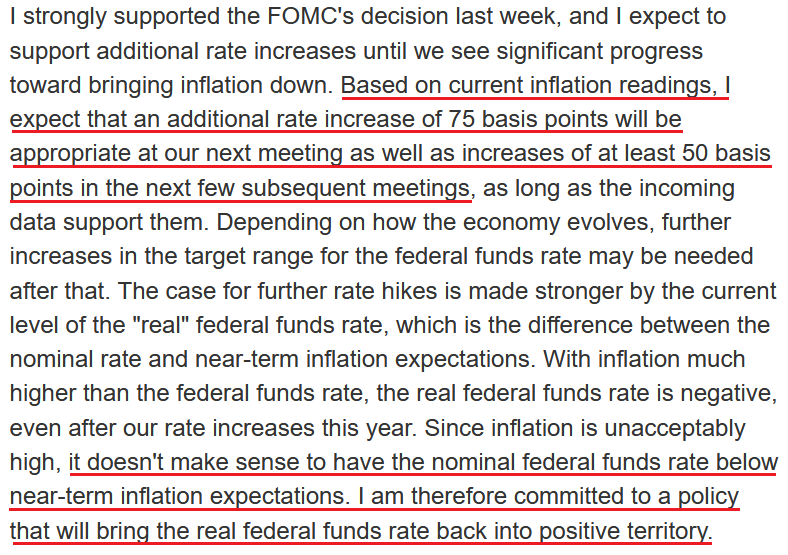

Supporting the argument, Fed Governor Michelle Bowman said on Jun. 23:

“The inflation data show that, after moderating slightly for a short time, price increases for motor vehicles have picked up again, energy prices rose sharply in May, and prices for food have risen more than 10 percent from a year ago.”

She added:

“One important factor that we often point to in driving today's spending decisions and inflation outlook are expectations of future inflation (…). If expectations move significantly above our 2 percent goal, it would make it more difficult to change people's perceptions about the duration of high inflation and potentially more difficult to get inflation under control.

“As we see surveys like the Michigan survey report higher longer-term inflation expectations, we need to pay close attention and continue to use our tools to address inflation before these indicators rise further or expectations of higher inflation become entrenched.”

As a result, Bowman expects rate hikes of “at least” 75 and 50 basis points at the next “few” FOMC meetings.

Please see below:

As it relates to her second point, remember what I wrote on Jun. 16 following the FOMC meeting?

The most important quote of the press conference occurred when Powell was asked: does 3.8%-4% [federal funds rate] get the job done and break the back of inflation?

He responded:

“I think we’ll know when we get there. You would have positive real rates and inflation coming down. I think you would have positive real rates across the curve.”

Thus, Powell confirmed what I’ve been warning about for months: the Fed needs higher real yields to curb inflation.

The fundamentals of the day were clear:

- The FOMC increased its median rate hike projection to ~14 in 2022.

- Powell wants higher real interest rates.

- Letting inflation rage is “not an option.”

- The FOMC “widely” wants “a modestly restrictive” policy by the end of 2022.

Therefore, while I’ve stated this many times throughout 2021 and 2022, the PMs’ medium-term fundamental outlooks continue to worsen.

Thus, while Powell and Bowman delivered another dose of reality to the financial markets on Jun. 23, it was commodities’ turn to suffer. In contrast, the general stock market rallied and short-term interest rates declined.

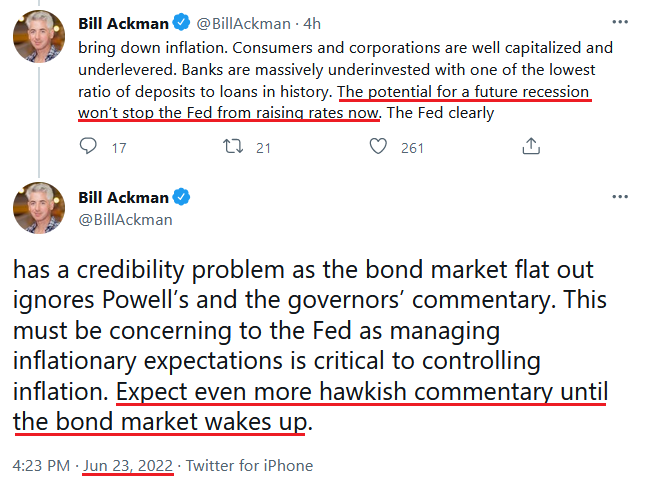

However, billionaire hedge fund manager Bill Ackman – who has sounded the alarm on inflation for months – wrote on Jun. 23:

“Despite [Fed officials’] coordinated commentary, the bond market has ignored these statements leading to a massive decline in short-term rates since the Fed meeting. A prediction: the Fed is serious. Powell and the governors care about the American people, our economy and their legacy.”

“Powell does not want to be known as a worse chair than Arthur Burns. The Fed will raise rates 75 bps or more in July and 50 bps or more in subsequent meetings and won’t pause until it is clear and convincing that inflation is headed back to 2%. [Federal funds rate] FF of 5% or more next year is in the cards.”

As a result, Ackman shares our view that a dovish pivot would be extremely harmful to the U.S. economy. Sure, it may provide the financial markets with a short-term sugar high. However, the long-term consequences of unaffordable food, housing, gasoline, and other basic necessities would lead to social unrest. Therefore, investors don’t realize they’re not the most important variables in this equation.

Please see below:

Take Stock

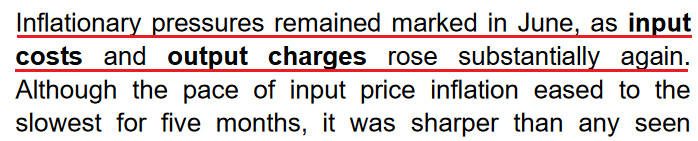

With the ‘bad news is good news’ crew out in full force on Jun. 23, the general stock market rallied. Moreover, the NASDAQ Composite outperformed, as weaker economic prospects crushed commodities and increased the appeal of high-multiple growth stocks. Moreover, the positioning shift was spurred by a weak PMI print.

For example, S&P Global released its U.S. Composite PMI on Jun. 23. The headline index declined from 53.6 in May to 51.2 in June. Moreover, while output is still expanding, the report stated:

“The decline in the index reading signalled further easing in the rate of expansion in business activity to a pace notably slower than March’s recent peak. Although service providers continued to indicate a rise in output, it was the weakest increase for five months.”

Moreover:

“Weaker demand conditions, often linked to the rising cost of living and falling confidence, led to the first contraction in new orders since July 2020.”

However, while the prospect of more rate hikes has rattled U.S. businesses, inflation remains extremely problematic. As a result, the Fed’s catch-22 is on full display, and Powell has rightfully determined that actively reducing inflation is the lesser of two evils.

Please see below:

To that point, while old habits die hard, I warned on May 25 that the post-GFC crowd doesn’t realize this time is different. I wrote:

A decade of dovish pivots has left a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

The bottom line? We’ve officially entered the monetary version of The Boy Who Cried Wolf. With Fed officials running to the rescue each time the financial markets show signs of stress, investors are programmed to ignore their hawkish threats. However, while these post-GFC pivots occurred with inflation perched near 2%, investors are so steadfast in their belief that they ignore the climactic consequences of unanchored inflation.

Furthermore, little has changed. Despite six rate hikes (25 basis point increments) and more on the way, the consensus continues to await a dovish pivot. Therefore, the Cboe Volatility Index (VIX) still hasn’t cracked 40, and the S&P 500’s 20%+ drawdown has been relatively orderly. However, while oversold conditions made a case for a short-term rally, the medium-term outlook is much more ominous.

For example, Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson told clients on Jun. 21: “With our view for lower multiples and earnings now more consensus, the markets are more fairly priced. However, it does not price the risk of a recession, in our view, which is 15-20% lower, or roughly 3,000 [for the S&P 500]. The bear market will not be over until recession arrives or the risk of one is extinguished.”

As such, with Wilson reducing his medium-term target from 3,400 to 3,000, he again cited investors’ complacency.

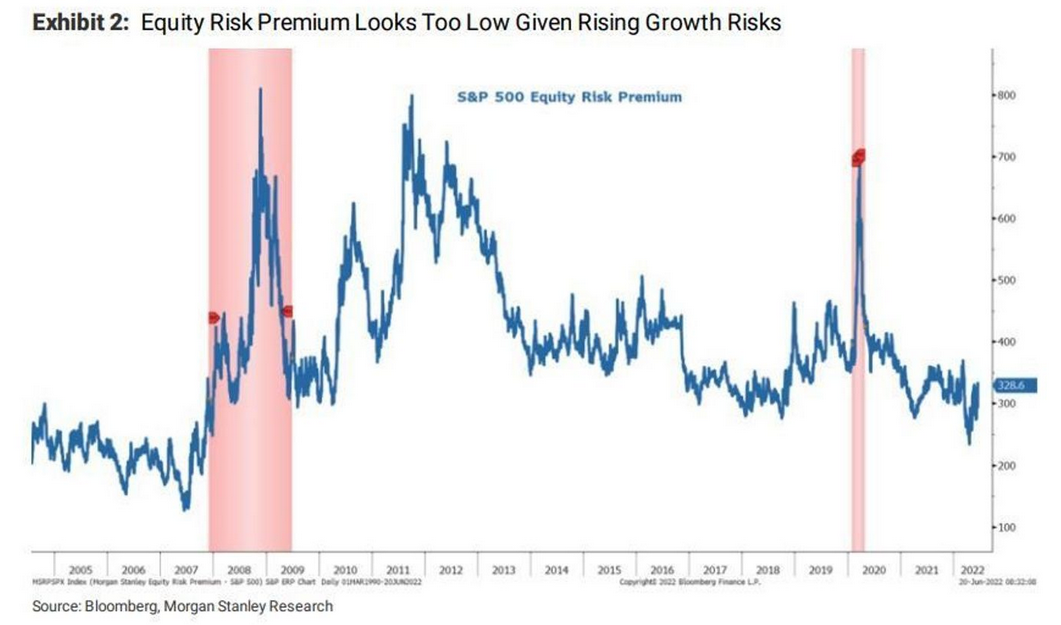

Please see below:

To explain, the blue line above tracks the S&P 500’s equity risk premium (ERP). In a nutshell: a higher ERP and lower stock prices should coincide with periods of high uncertainty to compensate investors for the increased risks. However, if you analyze the right side of the chart, you can see that the ERP remains relatively low.

In contrast, the pink vertical bars highlight the material spikes that occurred in 2008 and 2020 during their respective crises. As a result, with no real fear in the market, the true panic should materialize as the Fed’s rate hike cycle continues.

The Bottom Line

The Fed has to choose between supporting Americans and curbing inflation or supporting the financial markets and uplifting asset prices. Moreover, while investors are used to the latter, Powell made it clear that a higher unemployment rate won’t derail his quest to harness inflation. Unfortunately, it’s his only option, as short-term economic pain is preferable to long-term devastation.

Therefore, while investors hope that weakening data points will change his tune, turning dovish will only push stock and commodity prices higher and re-ignite inflation’s flames. As such, Powell’s acceptance of reality should push the S&P 500 and the PMs to lower lows in the coming months.

In conclusion, the PMs declined on Jun. 23, as economically-sensitive commodities felt the Fed’s wrath. Moreover, while the U.S. 10-Year Treasury yield has fallen recently, so has the U.S. 10-Year breakeven inflation rate. As a result, the U.S. 10-Year real yield ended the Jun. 23 session at 0.59%. Moreover, with Powell and Bowman telling us they want higher real yields, this realization is profoundly bearish for the PMs.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of the full analyses that our subscribers enjoy on a regular basis. They include multiple premium details such as the interim targets for gold and mining stocks that could be reached in the next few weeks. We invite you to subscribe now and read today’s issue right away.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold Investment News

Delivered To Your Inbox

Free Of Charge

Bonus: A week of free access to Gold & Silver StockPickers.

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM