Briefly: short-term outlook is bullish for the next 1-2 days, then bearish (for the next two weeks or so), then relatively unclear for the following two weeks, and then bullish going forward.

Welcome to this week's Gold Investment Update.

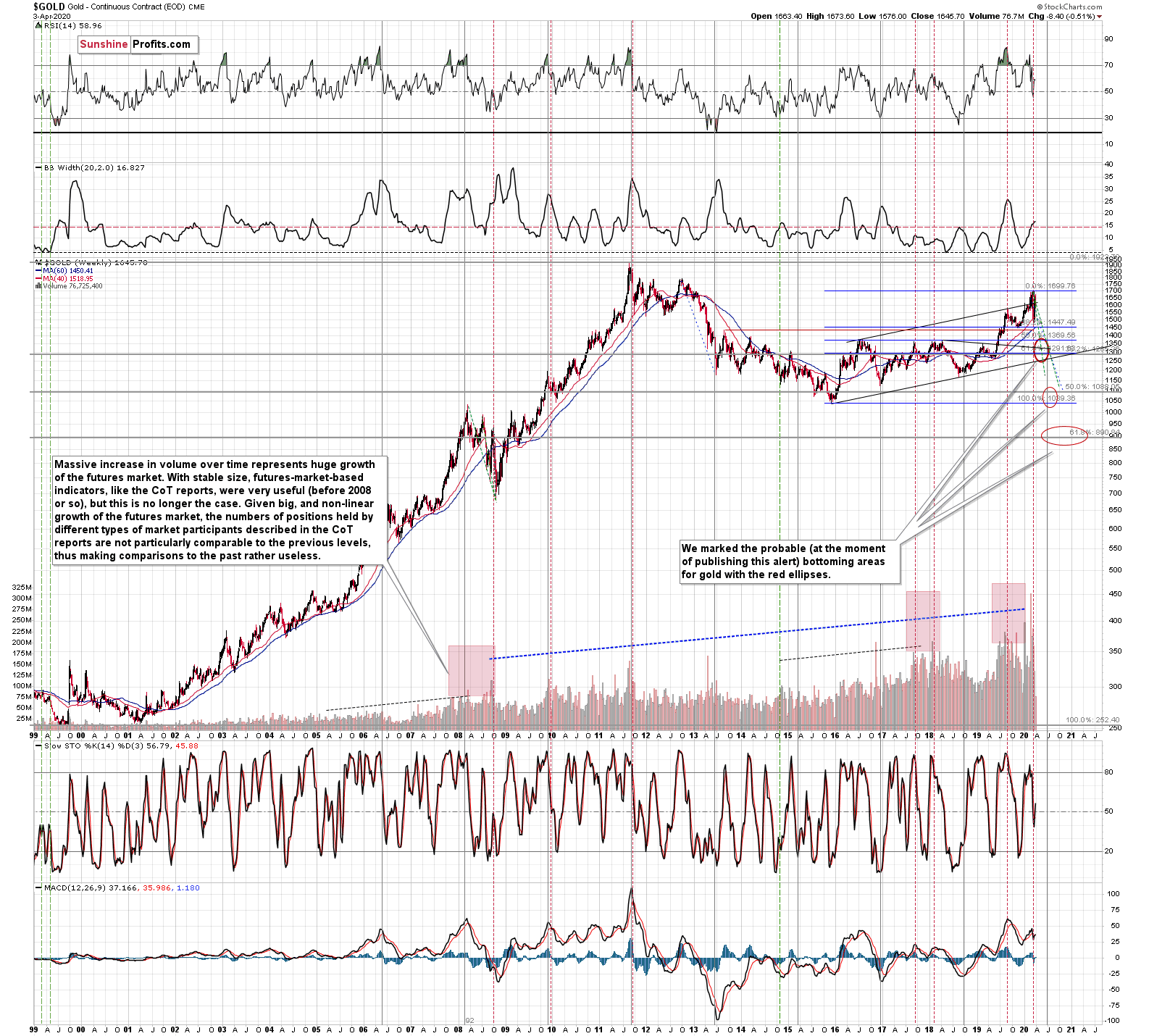

Practically, the most important analogies and long-term trends didn't change during the previous week and most of our previous extensive comments still remains up-to-date in general. However, as far as the details of the 2008 - 2020 price link are concerned with regard to the next several days, they require an update. While it seems that we haven't seen the final top in gold just yet (perhaps later today or - most likely - tomorrow, we can already see some new details.

As it is the case usually, we will quote last week's comments while updating everything that needs to be updated or changed. In the end, the entire analysis that you'll read below is up-to-date at the moment of publishing. The parts that we didn't change (or changed only insignificantly) since last week, will be put in italics.

Let's start with the general commentary on the possibility that we'll see the final bottom in gold later this month.

While we once again (just as we did in the previous week) made tremendous amounts of profits last week, we have to admit that we will probably have to adjust our long-term forecast for gold. Perhaps admitting is not the best word here, as it implies that something was done incorrectly.

For many months we've been writing that gold, silver, and mining stocks have not bottomed in 2015/2016. Almost all of our colleagues have been writing that gold, silver, and mining stocks have bottomed in 2015/2016.

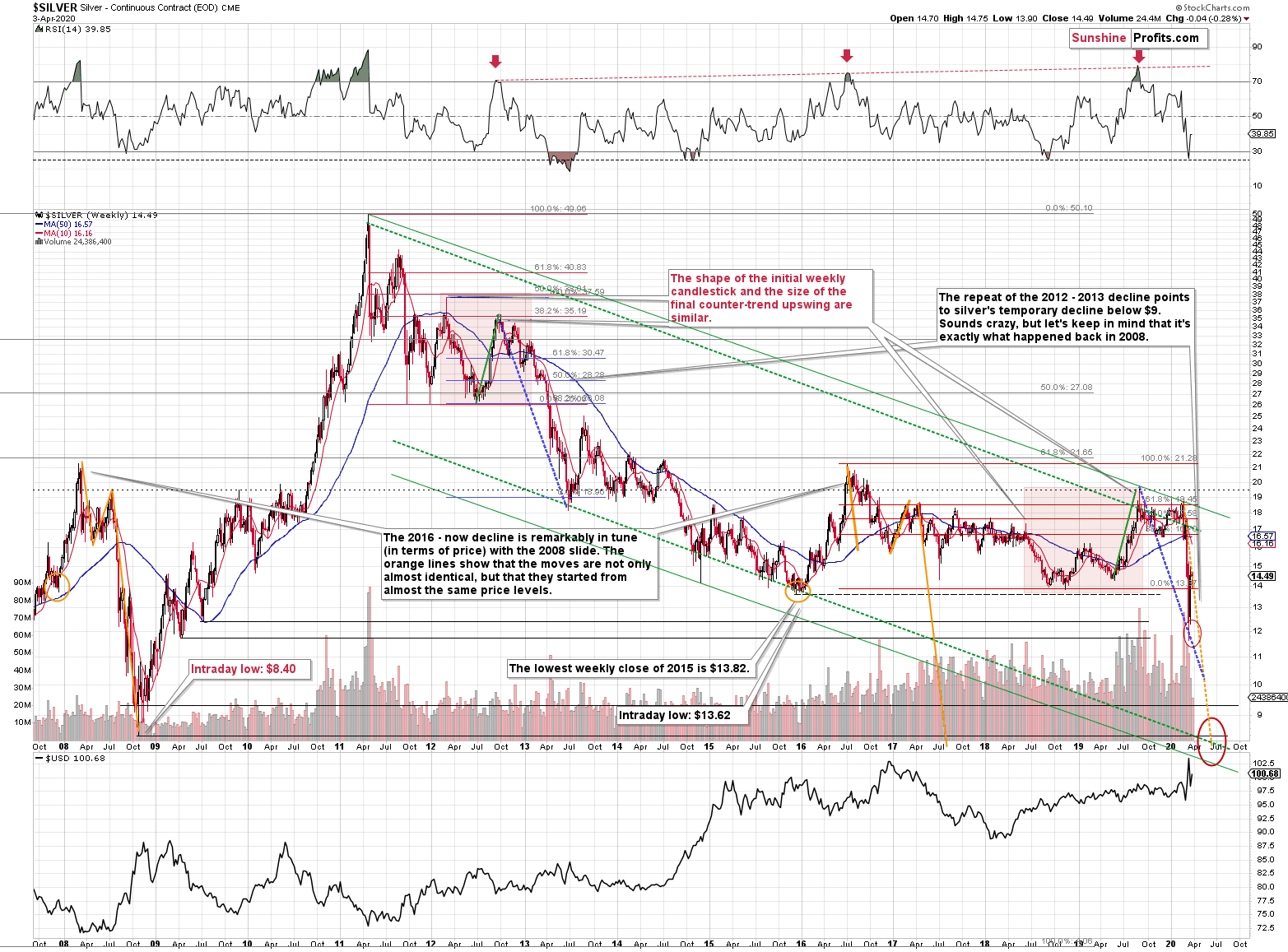

Silver already proved us right in case of this part of the precious metals market - it declined dollars below its 2015 bottom. We were certainly right on this one.

Gold didn't decline profoundly, despite the above, and - more precisely - it did, but it came back up with vengeance. It's still likely to slide in a rather extreme manner, but it seems that it's not likely to slide below its 2015 bottom. The odds are (based on the information that we have available right now) that our prediction from months ago regarding gold will not turn out to be correct after all. Point for our colleagues. But is it really? If the fundamental outlook hadn't changed, gold would have probably declined in a less volatile manner, but likely more significantly, quite likely breaking below its 2015 low after all.

Mining stocks didn't decline below their 2016 lows, but given how weak they were on Thursday relative to gold and the general stock market, how difficult the current times are for the mining stock companies (fundamentally), and due to many other technical factors that we outlined on Friday, it seems that miners will move below their 2016 highs soon. Perhaps very, very soon. While the jury is still out in case of the miners, we expect to be proven correct shortly.

It's too early to summarize, so we won't, but if miners do indeed decline to new lows, it will turn out that our long-term predictions for the precious metals market - while not being perfect - were still better than almost everyone else's. And since in this business it's impossible to get everything right at all times, isn't the above actually the best that one could hope for? Again, it's too early to summarize, and you be the judge. But please judge only once we're clear on this trade in the mining stocks.

"Wait. What? You just changed your mind on gold?! After all those years?"

Yes, the time that a given forecast remains in place is relevant only from the psychological point of view. That's not something that the "ego" wants to hear, but it's exactly what the size of one's investment account loves. Our procedure is to always look at the market fresh, as if we didn't have any position in it, and then decide whether we would open a position "right now". If the answer suggests a position different than we already have - we change it. Simple as that. And as difficult as that for non-professional investors (actually, it's challenging for professionals as well), due to the above-mentioned "ego" factor, "cognitive dissonance", and "myopic loss aversion".

Gold doesn't care about our past views, so neither should we. What we should care about is the multitude of factors that are likely to contribute to gold's movement in the future.

And these are: gold's technical picture, and gold's fundamental picture.

We will elaborate on gold, silver's, miners' and related markets' and ratios' technical picture below.

What we will not elaborate today (well, we will somewhat, but not to the full extent) is the fundamental picture for gold. Why would we change our mind right now? Because of the extreme shift in the fundamental situation due to the Covid-19 outbreak. The post-Covid-19 world is very likely to be a very stagflationary place. Gold loves stagflationary places.

It's 2008 on steroids.

Also fundamentally.

And while the general stock market continued to slide well into 2009 (bottoming in March 2009), that's not what happened in gold, silver, and mining stocks. They all bottomed sooner. By the time the S&P 500 bottomed in March 2009, gold miners were already after a 100%+ gain from their final lows. That's not when we'd prefer to enter the market, and we guess that you'd prefer to enter it much closer to the bottom as well.

Consequently, while it seems that the S&P 500 Index might slide all the way down to its 2008 lows, gold, silver, and mining stocks would be likely to bottom well before that takes place.

For details regarding the fundamental picture and all the stagflationary details that change the golden landscape, we strongly encourage you to read the April Gold Market Overview report by Arkadiusz Sieron, PhD. In my - PR - view, it's one of the best, if not the best issue that we ever published. And it's definitely the most timely one.

After the lengthy (hopefully, you found it informative) introduction, let's move to the main part of today's analysis. We'll start today's issue with quoting what we wrote about the Covid-19 previously, as that continues to be the key issue driving the markets right now.

COVID-19 Revisited

Our previous prediction regarding the number of confirmed cases in the US was already realized - we expected to see between 300k and 1M confirmed cases in the US and at the moment of writing these words, we have 338k confirmed cases. By the moment you read these words, it might be closer to 400k. The death toll is about 10k. And yes, this is still just the beginning.

This will make it even clearer just how serious the situation in the US is going to become. Last week, we wrote that technically, the markets looked ripe for a corrective upswing, but it was very likely that this upswing wouldn't last long. It seems that this corrective upswing is already over.

People know that this is serious, but they don't fully grasp the extent yet. Once they do, the real panic will kick in, and we'll see price moves bigger and more profound than we saw in 2008. At least that's how we see it.

Why? Generally, our take on the situation didn't change since last week, so quoting our previous analysis, seems appropriate.

The situation in the world is unlike anything we've seen in the last few decades. In terms of the total death count it's still not much more of a deal than regular flu, but the problem is that what we see right now it's just the very tip of the iceberg. An iceberg that is not only under water, but also almost entirely beyond horizon.

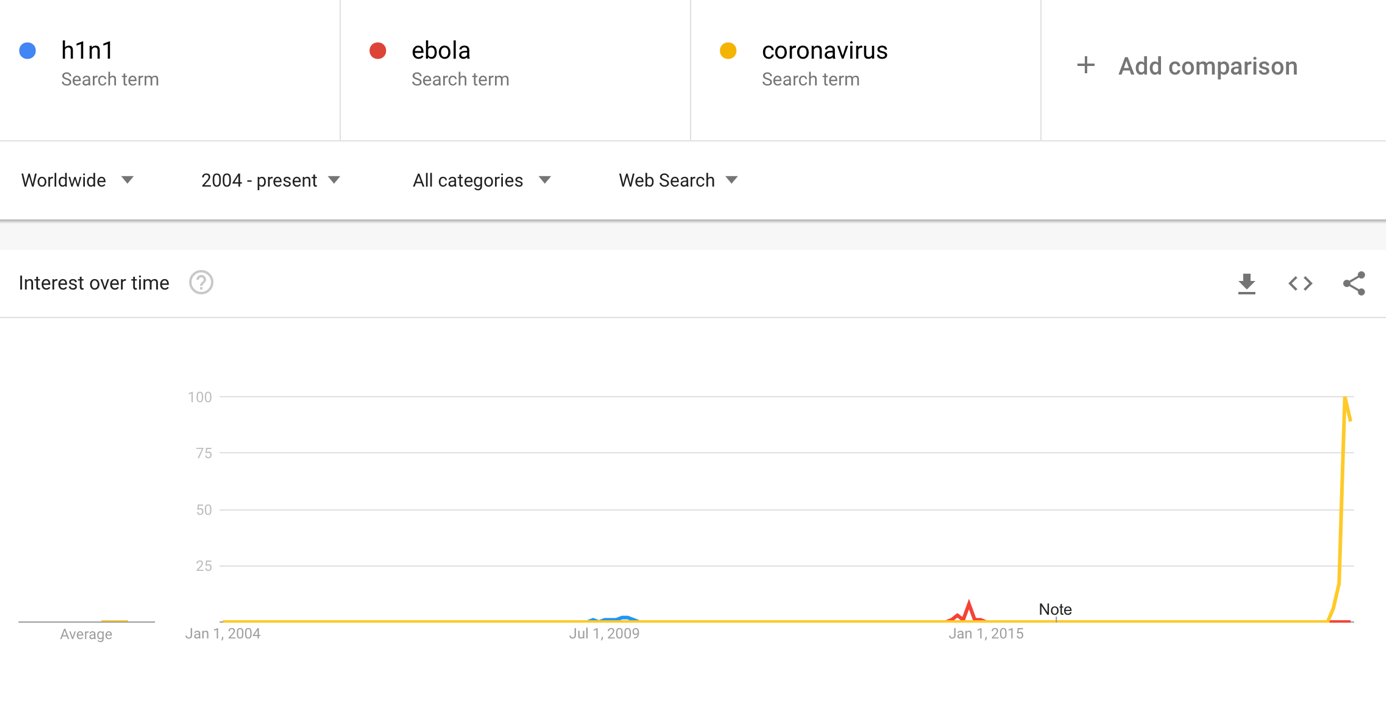

The fear of the virus (chart courtesy of Google Trends) went through the roof and is headed to the moon.

This implies a couple of things, and the most important one is that the analysis of what's likely to happen is increasingly more important compared to technical signals. Why? Because technical analysis is all about checking how things worked previously and assuming that most of the time history repeats itself to a considerable degree.

Sometimes, technicals alone trigger reversals and trends that then proceed based on technical rules.

Sometimes, fundamentals alone trigger reversal and trends that then proceed based on technical rules.

And sometimes, they both interact with each other in a yin-yang fashion creating a cocktail of triggers and psychological/technical mechanisms.

Right now, we are in the third, most complex situation, with news being a very important trigger for the markets.

This means that the market analysis right now cannot focus only on technicals (except for day trading, of course, where it's perfectly justified), but has to deal with how the situation develops also in the real world.

The most similar situation to what we have right now from the medium-term point of view, is the 2008 decline, so it's our main point of reference.

Before discussing the analogies and similarities, let's consider how the situation is evolving and - most importantly - how the situation is likely to evolve going forward.

Note: we don't want to discuss whether severe lockdown measures should be implemented or not (or if they should be implemented partially, only in case of the oldest people where the risk appears to be the highest). Our focus is on estimating what is the likely course of action, and how the markets are likely to respond. And to be ahead of them.

This is the election year, and Trump really doesn't want to be the person who locked the entire country up and sent troops out on the streets to ensure that the lockdown is indeed enforced. He also refuses to take the responsibility for downplaying the virus threat for so long, and this sentence might be the key observation from this report. This is the case because a lot will depend on how Trump deals with the situation in the following days and weeks, and the above gives us a hint.

The hint is that there will be a lot of finger-pointing, some people will get fired, and there will be speeches about how the US is doing great overall, and that the virus is not really a big threat compared to other threats. Decisions will be made, but they will be made only after it is clear that the general (and voting) public wants those decisions [This entire paragraph is a quote from the previous issues, but we see that this is indeed taking place]. And they won't be dramatic. And the decisions will aim to ensure that it looks like the President is doing a great job (which might or might not be the case - the point is not to criticize the decisions that were not even made yet, the point is to see that the outside appearance of a given decision is and will be an important factor). These techniques to influence people and this approach overall tends to work under normal circumstances. But these are not normal circumstances.

All the money being pumped into the system is a good example of the above - it is a lot of money, and it's visible (!) that the President and other officials are definitely doing something. But still...

Viruses care about very few things. They care about replication. They don't care about borders, politics, politicians, and egos. And they are not negotiating.

If you have some time now, we encourage you to read this article on coronavirus - I find it to be the most informative piece on that topic that I've read so far (not in financial terms, but in general). If you don't have time right now, I strongly encourage you to get back to this article later today. Long story short, things are very far from ok in the US and unless some really dramatic measures are taken (some ideas are quite extreme), the virus will spread throughout the country. And we don't think that these measures will be taken in the US shortly, which is only likely to make things worse several days or weeks later.

Note: there is a follow-up to the above-mentioned article on coronavirus - it's also highly informative. If you decide to read it (it might really be worth your time), please compare the efficiency of "mitigation" (which pumping money more or less is) and "doing nothing".

Regardless of the way the situation is handled, it'll quite probably trigger further weakness in the US stock market.

Based on last week's developments, it seems that people might prefer the US dollar as a safe haven of choice - initially. After all, gold won't be used as money during the Covid-19 outbreak - electronic payments don't transmit viruses in general, while physical objects, like gold bars or coins - do. Consequently, the USD Index seems likely to soar in the following weeks after all.

As that happens gold is likely to slide.

But.

Once the focus on liquidity and raising cash (getting out of everything) subsides, people will realize that "it's the 70s all over again". Not because of oil shocks, but because of the stagflationary results. Some will anticipate what's likely to happen and they will buy gold. Some others will probably buy silver. And some will buy gold and silver miners that will have been hammered very hard. In one way it's like the 70s, but in another way - more technically - it's like 2008. Just like back then, gold is likely to rise back up like a phoenix reborn and rising from the ashes.

The key thing from the articles to which we linked above is that there is a significant delay between when a person gets infected with Covid-19, to the moment when they finally get tested. Plus, most people, who are infected don't have any visible symptoms, but are already spreading the virus. This means that the situation is currently exponentially more severe than its being reported. And it will get much more severe in the following days and weeks unless it is contained in a really decisive way.

It's unlikely that this decisiveness will come soon in the US. It will probably arrive when it's already too late, or it won't arrive at all as the problem was downplayed at the official level for too long. The relatively easy measures will be taken (that's already happening) - such as pumping money into the system, and so on. But that won't stop the virus. Really decisive actions would be required for that. The actions that are relatively unlikely to be seen in the US - at least not at the national level.

The mortality rate is between 0.5% and several percent, depending on how well prepared the health system is in a given country. Let's say that the mortality rate in the US will be 0.5%, which seems to be a conservative assumption. Given the delay in implementing decisive actions, a lot of people already are infected, and much more will become infected in the following days and weeks. Ultimately it could spread to, say 20% of the US population. And we're being conservative here - there are statistical models that point to about 50%-70% infection rate in the end.

With the US population at 327 million, this means that 327,000,000 * 20% * 0.5% = 327,000 Americans are likely to die from the Covid-19.

And what if the numbers were not that conservative? 1.5% mortality rate and 40% infection rate?

327,000,000 * 40% * 1.5% = 1.962 million Americans

Things could get even worse than that. The mortality rate calculation is based on how well the healthcare system is prepared and how gradual can the outbreak of Covid-19 be. 5% of those infected, require intensive care. If 40% of Americans get infected and 5% of them require intensive care, this means that 327,000,000 * 40% * 5% = over 6.5 million Americans will need intensive care. If people, who need intensive care, don't get it, their mortality rate is about 90%.

But the US healthcare system is prepared, right?

It is estimated that there are about 45,000 intensive care unit (ICU) beds in the US. [EDIT: Other sources report about 100,000 ICU beds, but this doesn't change much in the grand scheme of things]

Perhaps over 6,500,000 Americans will need intensive care, and there are only 45,000 ICU beds. About 90% of those, who don't get intensive care and need it due to Covid-19 infection, are likely to die.

Of course, the above assumes that everyone would need the ICU beds at the same time, which won't be the case. The more the Covid-19 outbreak is spread over time, the more people could be cured per one ICU bed. But still, it will likely be far too little to help even a third of those who might need it.

This means that a few millions of Americans would be likely to die due to Covid-19 this year. For comparison, the flu kills between 12k and 61k Americans yearly. A few millions vs. about 35k (average)... Since the Covid-19 could be responsible for about 100x more deaths than the average flu season, we can say that it's definitely "not just a flu". And what we've seen so far is not just a quick market pullback that is already over.

It's true that so far, we haven't seen more deaths than in case of the regular flu. The key words are "so far". The comparative death toll at the end of the month will look completely different.

We really want to be wrong on this one, because it would be an unspeakable tragedy.

On the analytical front - if we're at least somewhat close to the final numbers, there will be a real carnage on the markets. The markets have already declined severely and the total death count in the US was below 500 at that time. This might be less than 0.1% of the final number. Right now, the Covid-19 US death toll is about 10k.

It's not the point to predict the exact death toll figure. The point is to show you how serious things are likely to get before this is all over.

And the death toll is going to increase exponentially until a major lockdown (or any other critical measure is taken), which might never arrive. The death toll will not be counted in tens or hundreds. And not even thousands. And not tens of thousands. The best-case scenario that we see is that the death toll would be below 100,000 in the US.

Now, the markets are forward-looking, so they should be discounting all the above right now. But they are not, as it's not intuitive for people to make such complicated calculations, especially since that they are being reassured that everything is or will soon be under control. Ultimately people will act on emotions just as they did recently.

Recently, the death toll in the US was "just" below 500 and the stock market was already down over 20%, and there were signs of real estate market prices moving lower as people were unwilling to even watch new homes right now.

If people got scared out of their stock positions based on fewer than 500 deaths in the US and about 15000 deaths worldwide, then how bad can things go, when the death count is going to up in tens or hundreds (worldwide) of thousands daily?

Extremely bad.

We expect things to get worse than they were in 2008. Of course, the question is how one defines "worse". Imagine what would happen if stocks dropped similarly as in 2008 but more and faster - and that's the likely scenario.

The problem with the 2008 slide was that it was relatively unpredictable, especially in case of gold. The corrective upswings were very fast, and they didn't last for long. Overall, this kind of movement is also likely this time. The two parts of the precious metals market that were hit particularly strongly, were silver and mining stocks.

Three weeks ago, miners declined more during the week, then they ever had previously - at least as long as the XAU Index exists. And silver broke below the 2015 lows, finally confirming what we've been writing for years - the precious metals bear market didn't end in 2015 or 2016.

It's 2008 all over again, but supercharged.

It might even be the case that the 1929 slide is a better analogy [And it's getting increasingly more likely]... But it's too early to say so.

Of course, even if the market is going to slide, it doesn't mean that it will slide without periodic corrections.

In fact, it seems that one of the corrective upswings has just ended several days ago.

Let's get back to the big picture and think about the future. In several weeks, the situation in the US will probably be much worse than it is right now, a lot of people will die, and the stock market will already be trading much lower, likely taking precious metals sector with it. Gold is likely to be an exception, but not initially.

What then? Then the realization will come with regard to what really happened.

More or less (very rough approximate) as many people will die from the Covid-19 as they die from heart disease each year. People die due to many reasons and Covid-19 will increase the total death toll this year (say by 10% - 30% or so), but not multiply it in general. Those who die will be mostly retired seniors, and those who already had other diseases. As brutal and as harsh as it sounds (and we apologize for writing this, but still, it's our job to analyze the situation and report to you as we see it), this will be a huge personal loss, but not a huge economic loss for companies traded on the US exchanges. Almost everyone (in global terms) will still be around and companies will be able to operate as they had previously (for instance in 2019). The life will go on.

The buildings, the factories, the machinery - it will all still be there and there will be people, who are already immune to the Covid-19 disease that will be eager to get back to work full time (or overtime) and the central banks around the world will likely be providing support and cheap credit to get things up and running soon.

And people will realize that in the previous weeks - focused on deaths and their emotional aspect - they priced everything - stocks, commodities, real estate way too low. And new bull markets will start.

We have to get through many more individual tragedies, and through much more pain and panic in general before we get there. This means many more declines, especially for silver and mining stocks on the horizon.

The US Presidential cycle is not as important as the above, but it's worth keeping it in mind, anyway.

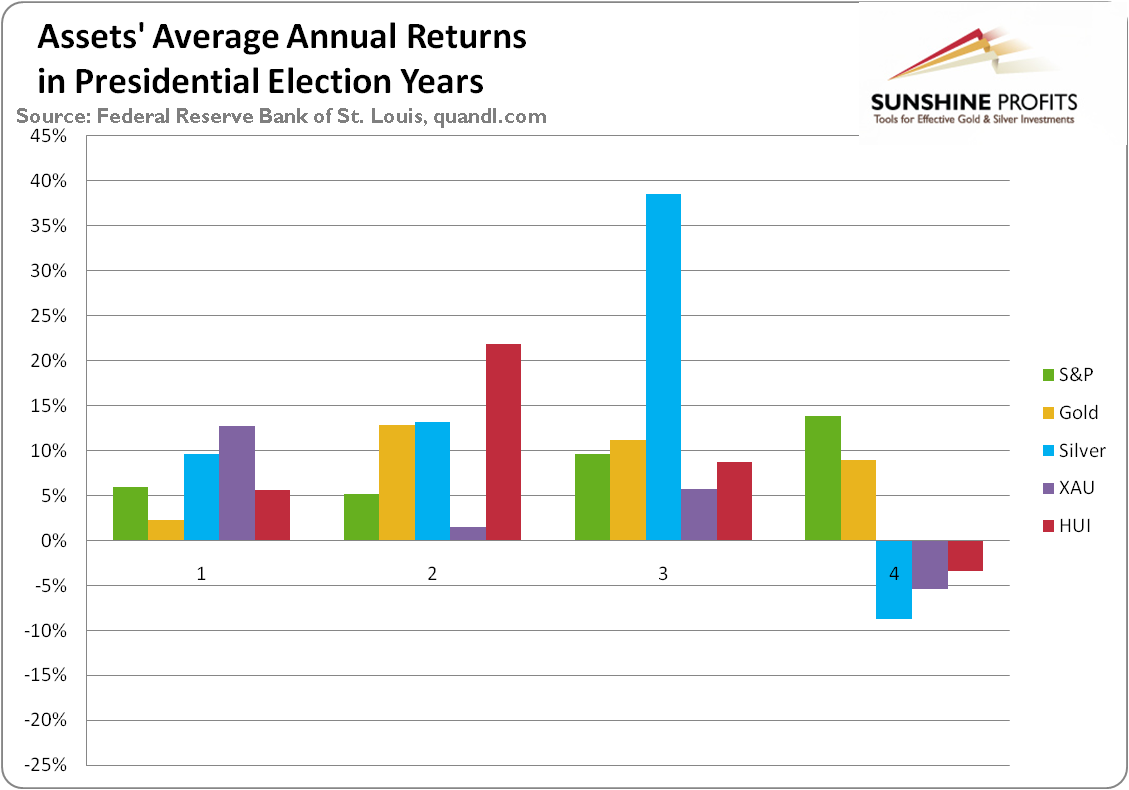

Assets' Returns and Presidential Cycle

Average annual return of S&P (1948-2015, green line), gold (London P.M. Fix, 1972-2015, yellow line), silver (London Fix, 1972-2015, blue line), XAU Index (1984-2015, purple line) and HUI Index (1997-2015, red line) in presidential election cycles.

Gold's performance is more or less average in the election year, but in case of silver and mining stocks, we see something very different. Namely, the election year is the only year when - on average - they all decline.

So, does it mean that gold won't be affected by this specific cyclicality, but silver and miners will be? Not really. It seems that the above chart shows that silver and miners - on average - lead gold lower. They perform worst in the election year and the yellow metal is the worst choice in the following year - the first year of presidency.

Silver is already at new multi-year lows and miners just declined the most during the previous week...Ever. The above-mentioned analogy seems to have worked quite well.

We previously supplemented the above with the discussion of interest rates and QE4. We argued that the lower rates are not likely to help in a sustainable manner and neither will QE4. But we could see a temporary rally based on this factor.

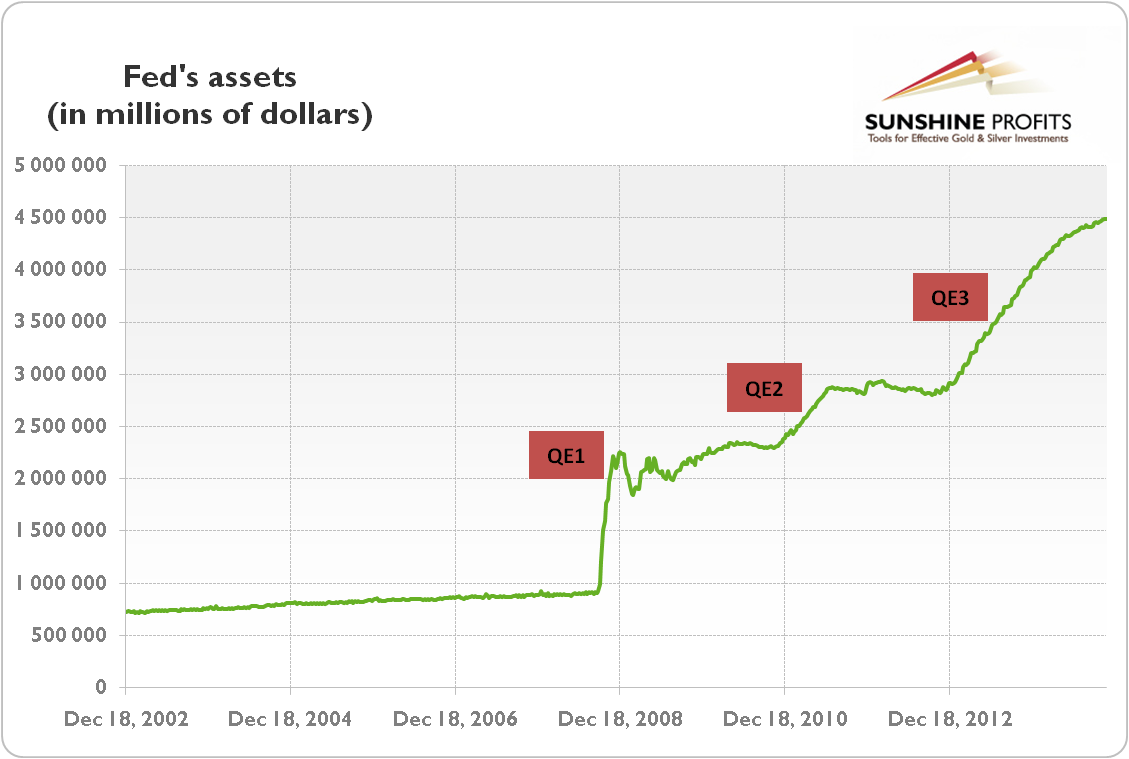

Well, let's see what the previous quantitative easing programs did.

Quoting from our explanation of the link between QE and gold:

"The effects of quantitative easing on the gold market depended on how it was perceived by investors. Initially, after the financial crisis of 2008, quantitative easing was positive for the price of gold. It was a new and unprecedented program, which undermined the investors' confidence and caused a fear of inflation or even hyperinflation. However, the U.S. economy recovered after some time and there was no inflation on the horizon. In consequence, the price of gold entered a decline in September 2011, just two months after the end of the QE2. As the confidence in the Fed and the U.S. economy was restored, the third round of the quantitative easing was welcomed by the investors. The increased confidence reduced risk premia and the bidding for tail risk insurance. Consequently, the stock market rose, while the price of gold declined."

QE1 was very bullish for the precious metals sector - the market was surprised, and the precious metals market was already after a huge decline.

QE2 was still bullish for the PMs and miners, but not as much as the first round.

QE3 started in the final part of 2012 and as it continued, PMs and miners declined profoundly. QE3 didn't prevent the decline.

Each round of the QE program was less bullish than the previous one. This trend doesn't suggest placing a lot of bullish faith in QE4 with regard to the precious metals market.

The most bullish QE was the one that was launched after gold had already declined severely for months. This is definitely not the case right now. What is the case right now is that gold just declined tens of dollars despite the dovish change in investors' expectations toward interest rates. This suggest than neither rate cuts, nor QE4 may be able to stop the decline that just started - at least not on their own and not until gold drops much further.

One more thing regarding the elections. Trump is the anti-establishment President. Perhaps the "establishment" actually wants the stock market to tumble this year, to make sure that the next U.S. President will be pro-establishment. Consequently, perhaps the stock market won't be saved until it drops much lower, and until the U.S. dollar is soaring much higher, proving that pro-lower-dollar-Trump was unable to get what he aimed for.

Rhodium Update

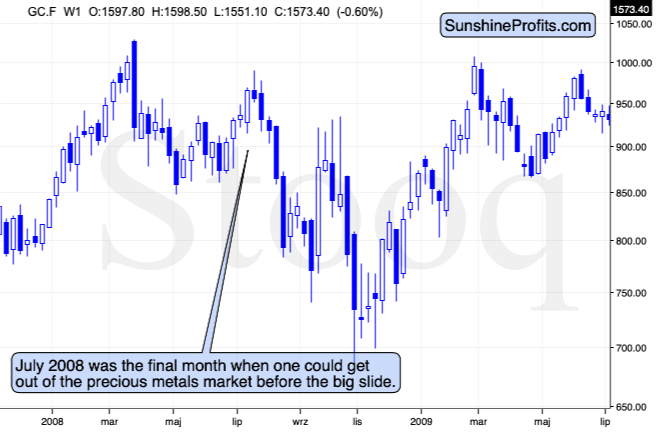

We previously discussed the rhodium market in detail, and we argued that a sudden explosion in rhodium's price was an indication that things were very similar to 2008 right now. We also wrote that the rally in rhodium was unsustainable. Indeed, its price collapsed from above $10,000 to about $2,000. It has then bounced along with other parts of the precious metals sector, but it didn't move back to its previous highs. Why are we mentioning it today? To further emphasize the analogy between 2008 and 2020, and to show you that the previous top in gold was analogous to the July 2008 top. It is not only gold's price shape that confirms it.

Rhodium topped in July, 2008 and that was when gold formed the final high before one of the sharpest and biggest plunges of the past decades. In case of silver and mining stocks, it was the beginning of THE sharpest decline of the recent decades.

There are very few analogies that could be more bearish than the one that rhodium is now featuring.

Actually, given the fact that volume on which the 2008 top formed and volume on which gold topped recently are relatively similar (gold volume spiked in both cases), the above analogy is confirmed. Additional confirmation comes from the fact that in both: 2008 and 2020, gold tried to rally to the previous highs, and failed to reach them. In 2008, rhodium soared during this second attempt, and this is exactly the case right now. The analogy is clear and extremely bearish.

Let's dig deeper.

The 2008 - Now Link

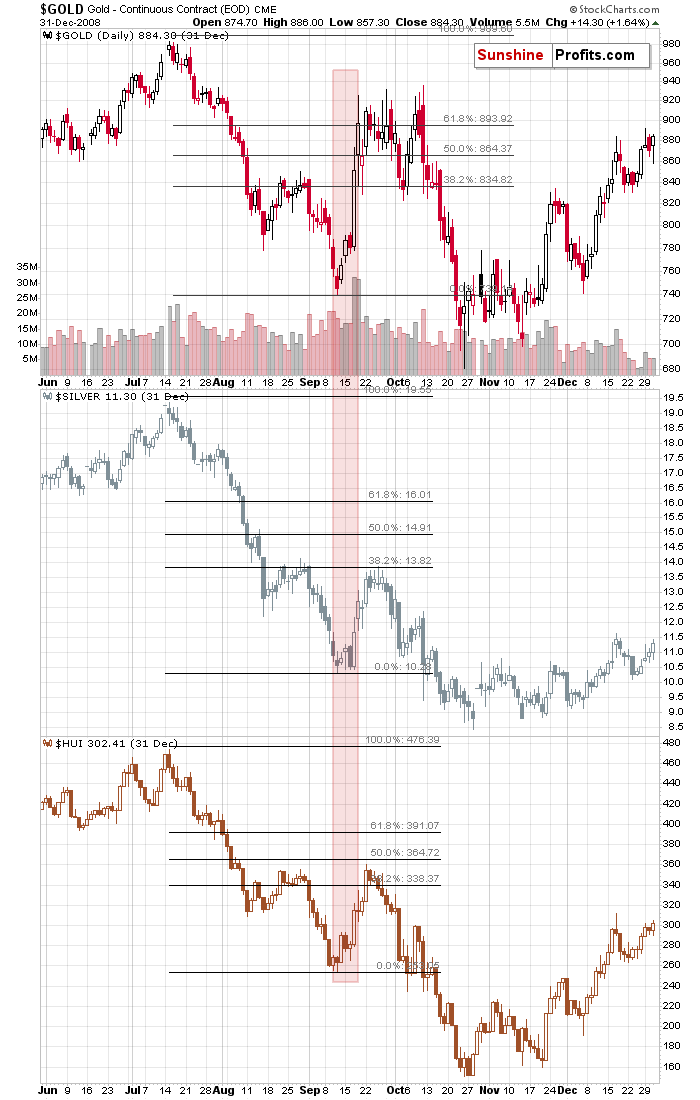

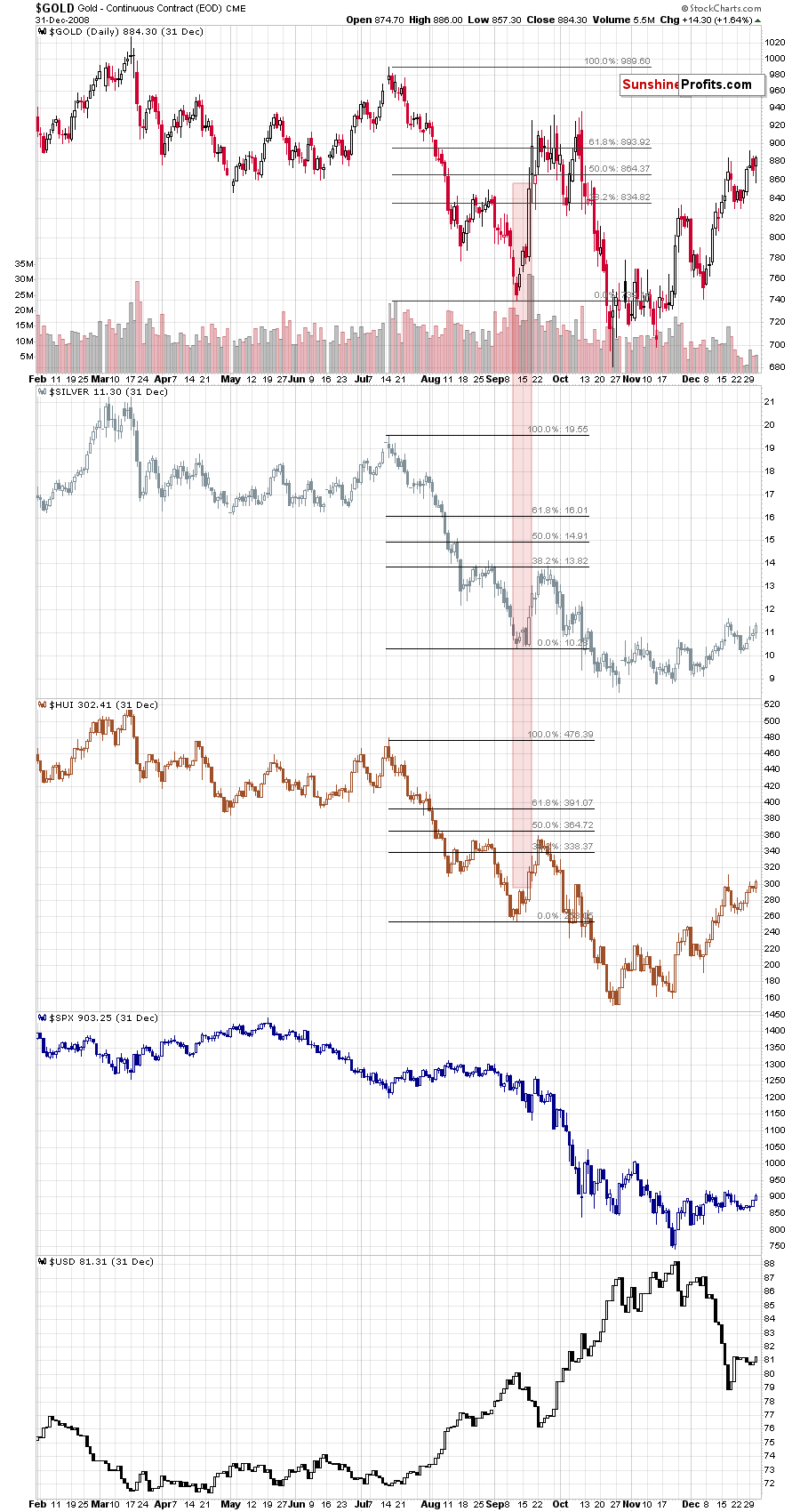

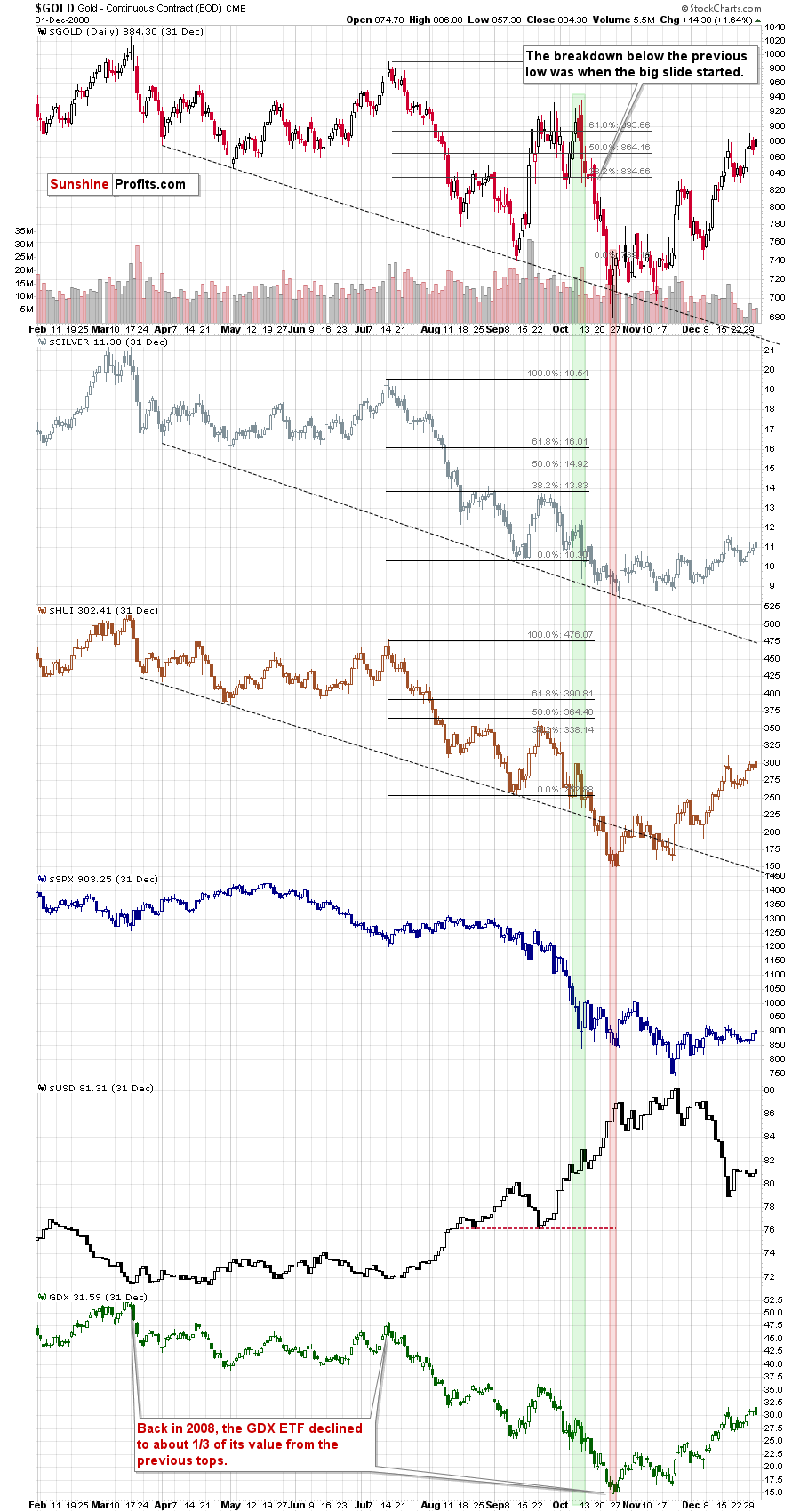

We already had gold reversing on huge volume, and we saw it decline very strongly in the first week after the top. We already had another attempt to break above that high and we saw it fail. We also saw rhodium at about $10,000. We already saw silver and miners plunging much more severely than gold did. In fact, silver just plunged almost exactly as it did in 2008 during the analogous part of the slide.

All these factors make the current situation similar to how it was in 2008, at the beginning of one of the biggest declines in the precious metals sector of the past decades.

But the very specific confirmation came from the link between gold and the stock market. Stocks plunged along with gold, silver, and mining stocks. That's exactly what was taking place in 2008. The drop in 2008 was very sharp, and silver and miners were hit particularly hard. We expect this to be the case this time as well.

In 2008, the temporary rallies were particularly visible in case of gold, not that much in case of silver, mining stocks, or the general stock market. Gold declined particularly hard only after the USD Index started its powerful rally.

The 2008 decline in the PMs ended only after a substantial (about 20%) rally in the USD Index.

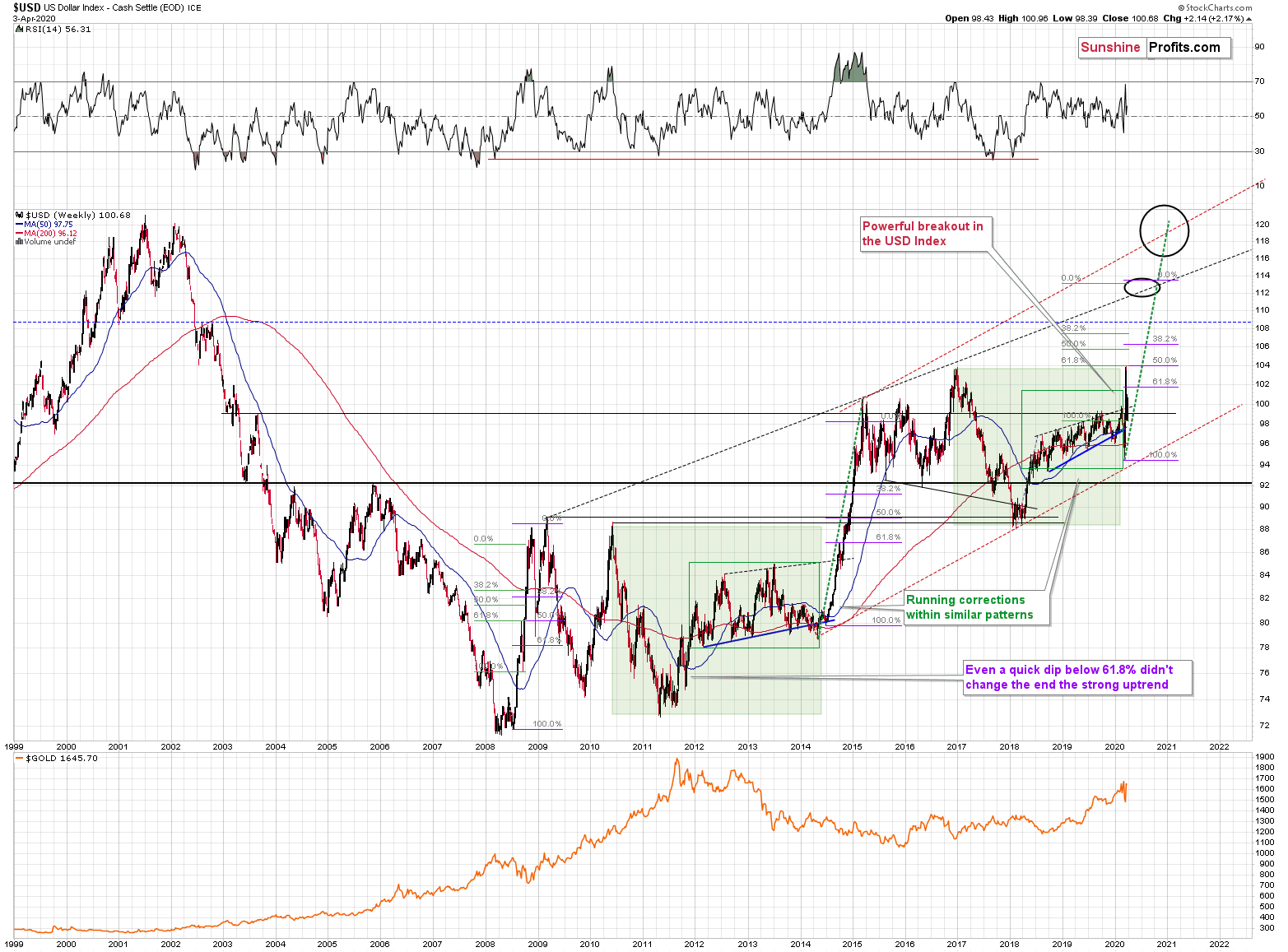

The USDX has just corrected almost 61.8% of its previous decline, and it could be the case that it's now ready to soar much higher. Last week, we wrote that the USD Index could correct based on the 2T stimulus and other monetary, and fiscal steps taken by the US officials.

That's exactly what happened. Yet, it's not likely that these steps will prevent people from raising cash when their fear reaches extreme levels. And - based on the rally in the USD Index, it seems that this process has already started.

As the situation is more severe, the USD Index might rally even more than 20% and the 120 level in the USD Index (comeback to the 2001 high) has become a quite likely scenario.

Let's keep in mind that it was not only the 2008 drop that was sharp - it was also the case with the post-bottom rebound, so if there ever was a time, when one needed to stay alert and updated on how things are developing in the precious metals market - it's right now.

Last week we supplemented the above with description of the 2008 analogy in terms of the shape of the price moves. Last Wednesday, we supplemented it with a more detailed time analysis. It's very important today (and for the rest of the week), so we're quoting our Wednesday's comments:

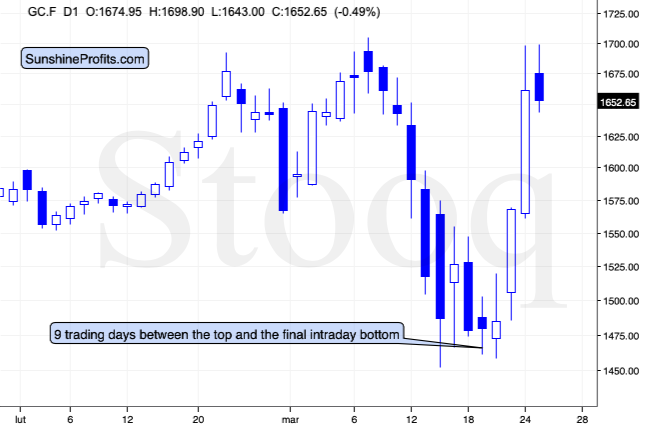

It took 9 trading days for gold to decline from its top to the final intraday bottom, before starting the powerful comeback.

In 2008, it took 41 days. It seems that things are developing about 4.5 times faster now, than they were developing in 2008. More precisely: 41/9 = 4.56 times.

Please note that the decline that preceded the sharp upswing in gold, is also somewhat similar to what we saw recently. There was an initial slide in gold that ended in mid-August 2008, then we saw a correction and then another slide and a bottom in early September. This year, we saw an initial bottom in mid-March, and the final one a few days ago.

Back in 2008, it took 23 trading days for gold to reach its initial bottom and it then took another 18 days for the final short-term bottom to form. 56.1% of the downswing was to the initial bottom, and the 43.9% of the downswing was between the initial and final bottom.

And now? It took 5 out of 9 trading days for gold to reach the initial bottom, and the remaining 4 days were the time between the bottoms. That's 55.6% and 44.4% respectively.

This is very important, because it shows that the shape of the move is indeed very similar now.

This means that we can most likely draw meaningful conclusions for the current situation based on how the situation developed back in 2008.

Back then, gold moved back and forth close to the initial top. That's what gold has been doing so far today - which serves as another confirmation for the analogy.

Back in 2008, gold topped over the period of 16 trading days. Dividing this by 4.56 provides us with 3.5 days as the target for the end of the topping pattern since its start. The pattern started yesterday, which suggests that gold could top tomorrow [Thursday, March 26th] or on Friday.

EDIT: That's exactly what happened - in terms of the daily closing prices, gold has indeed topped on Thursday.

The situation gets more interesting as we dig in more thoroughly...

There are 24 hours in a day. Dividing this by the factor of 4.56 provides us with 5.26. This means that if we could create a chart with 5.26 hour candlesticks, the price moves in gold should be analogous (in terms of how we see them on the chart) to their daily performance from 2008. The closest that we have available are the 4-hour candlesticks.

Let's check how gold performed recently from this perspective, and compare it to its daily performance from 2008.

The price moves are remarkably similar.

Even the March 17, 2020 upswing took gold to analogous price level! Gold temporarily topped very close to the previous (Feb 28) low. That's in perfect analogy to how high gold corrected in late August 2008 - it moved up to the early May 2008 high.

The link to 2008 truly is the key right now.

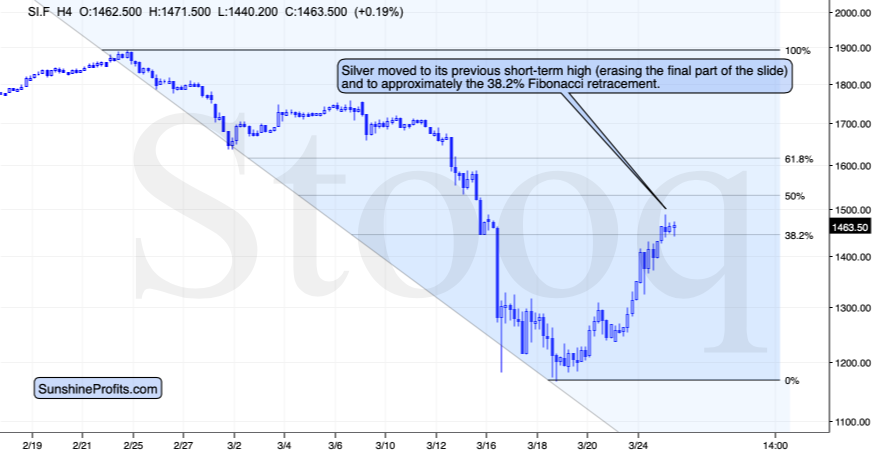

Ok, so when are silver and miners likely to top?

Sooner than gold.

Please note that both: silver and mining stocks topped more or less in the middle of gold's topping formation... Which suggests that they should be topping today.

And for the final confirmation - please take a look at what the stock market and the USD Index have been doing at that time. The USD Index was within a pullback while the stock market formed a very short-term upswing. Silver and miners topped along with the stock market.

Silver just moved to its previous short-term high (a small high, but the one that preceded the final part of the decline) and it's approximately at its 38.2% Fibonacci retracement.

That's exactly where silver topped in 2008. Back then the analogous high was the late-August high, and it also topped close to its 38.2% Fibonacci retracement.

We are probably looking at a top in silver right now.

This means that miners are likely to top today as well.

EDIT: That's exactly what happened in terms of the daily closing prices. Both: silver and GDX formed the highest daily closing prices on Wednesday - the same day we had published the above.

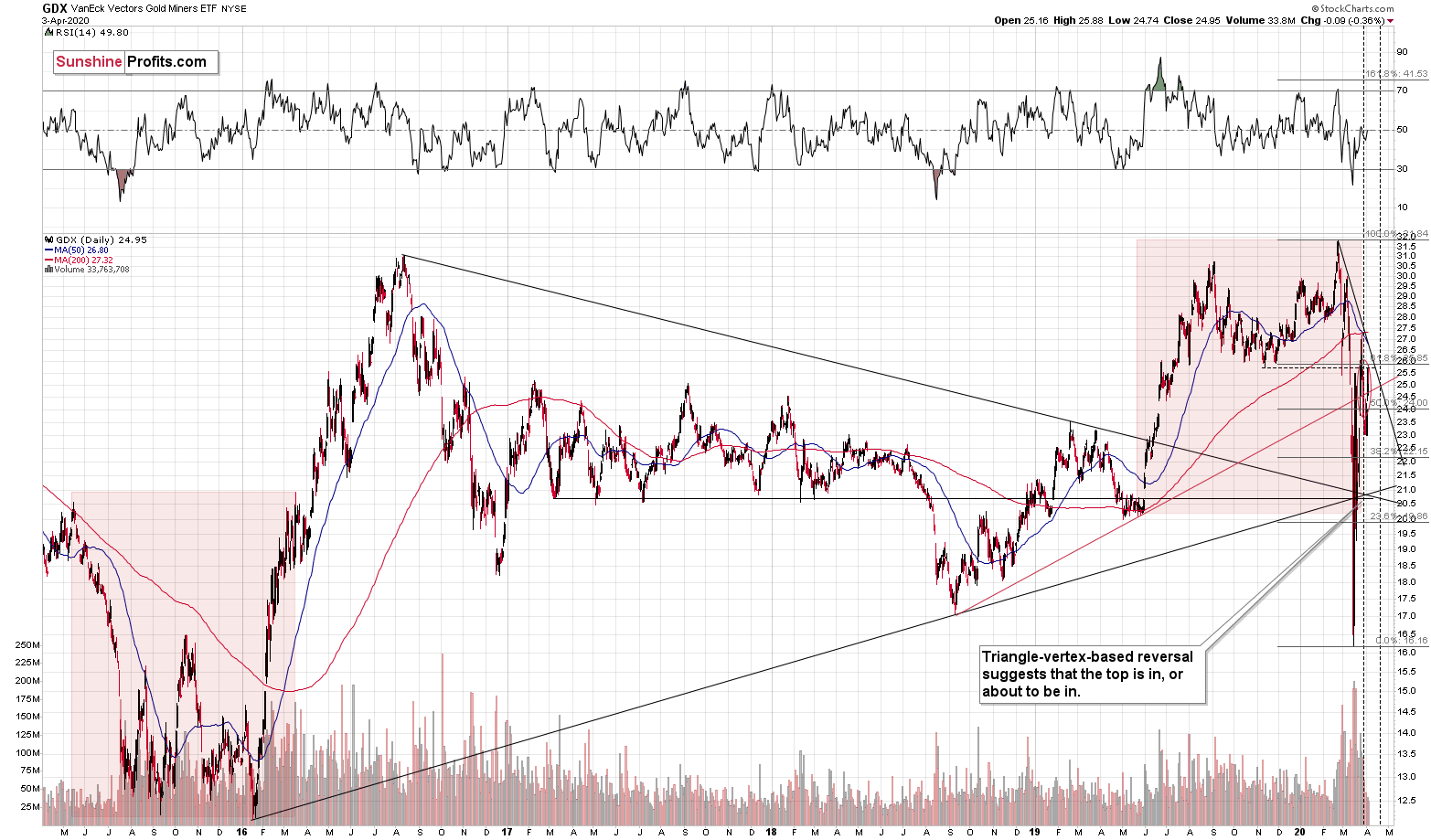

Please keep in mind that after the 2008 bottom in stocks, it took only two days before they formed an intraday top. Given that this time, the price moves are more volatile, it seems that we could (far from certain) see a powerful reversal (top) asearly as tomorrow. This estimate is in perfect tune with the triangle-vertex-based reversal that we see on the GDX and GDXJ charts.

EDIT: Again, that's exactly what happened. The GDX index formed the intraday high on Thursday, one day after we wrote the above. The GDXJ formed the intraday high on Wednesday.

How much clearer could it get that the precious metals market is re-creating its 2008 slide?

Ok, so what does it tell us going forward?

It tells us that the precious metals market is likely going to slide very profoundly, and very quickly. And it might happen as early as this, or next week.

Before Thursday's upswing, it seemed likely that we were in the part of the analogy when gold was already after the breakdown below the lower border of the broad top. But it seems that it was not the case, because gold invalidated this breakdown. That's not something that happened during the final slide, but something that happened right before the final top in gold.

Consequently, that was likely not the true breakdown. And since it was likely not the true breakdown, the adjustment in terms of time that we made previously this week, are no longer up-to-date. We will update them once gold breaks below the recent lows as that's when we'll get the true breakdown. However, we can already do that right now given that we know when the final fakedown low was formed.

Back in 2008, it took 16 trading days for gold to reach the fakedown low (Oct 3, 2008) from its final intraday bottom (Sep 11, 2008) bottom.

In 2020, it took 8 trading days for gold to reach the fakedown low of (Apr 1, 2020) from its final intraday bottom (March 20, 2020) bottom.

Consequently, it might the case that the situation is now indeed developing faster than it was developing in 2008, but not 4.56 times faster. Instead, it could be developing about 2x faster.

This has important implications regarding the timing of the future turning points.

Back in 2008, gold's final decline (starting from the final interim high) took precisely 10 trading days - 2 weeks. Given the 2x multiplier, it seems that gold could move to its final low within a week after forming the final interim high.

It might also be the case that it takes a bit longer. After all, the initial (over 4x) multiplier just declined to about 2x. Perhaps it will decline once again as we move forward, but this doesn't change that much. It still seems that gold, silver, and mining stocks would decline profoundly and likely form THE bottom this month.

The million-dollar question is, how low could gold go during this decline, and what's the most likely price level at which the buying opportunity will present itself with an excellent risk to reward ratio.

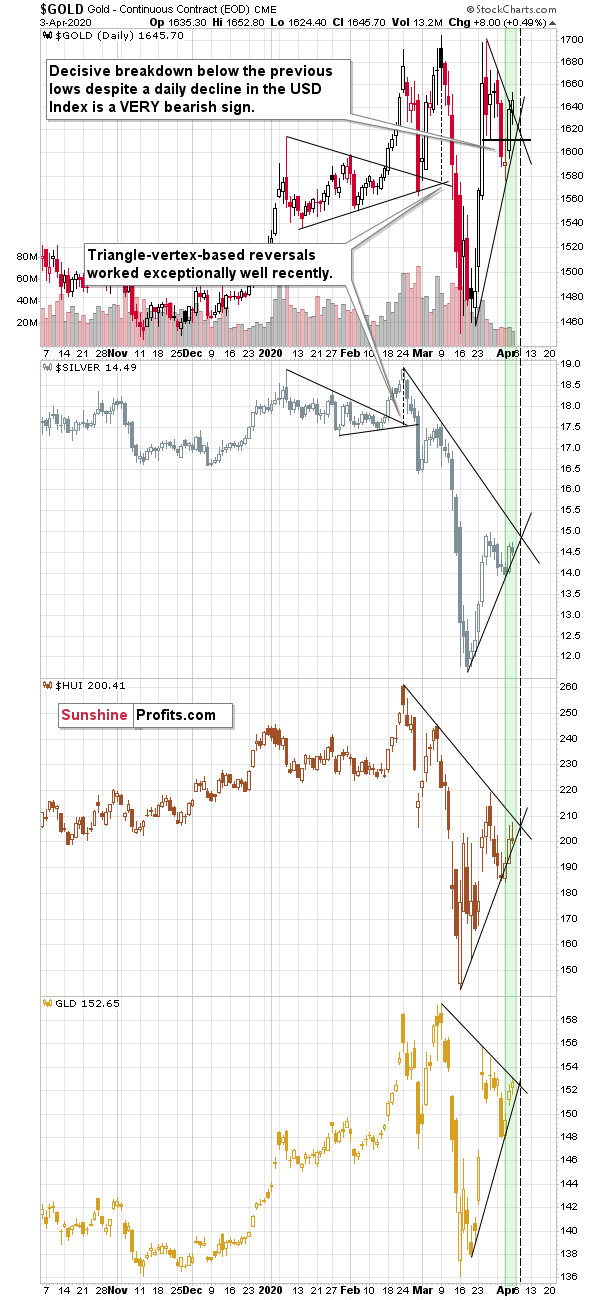

The above chart provides us with some hints and one big detail.

The big detail is that during the final part of the broad topping pattern, gold moved slightly above the previous interim highs, and it managed to do so despite the rising USD Index. Consequently, if gold moves to or above its recent highs (or even breaks a bit above the previous 2020 highs), and it does so alongside the rising USD Index, it will not be anything groundbreaking, or unexpected. In fact, we do expect this to happen.

Besides the above, there are five key take-aways from it.

- Gold is likely to decline in a volatile manner, until it breaks below the declining support line that is based on the most recent two lows.

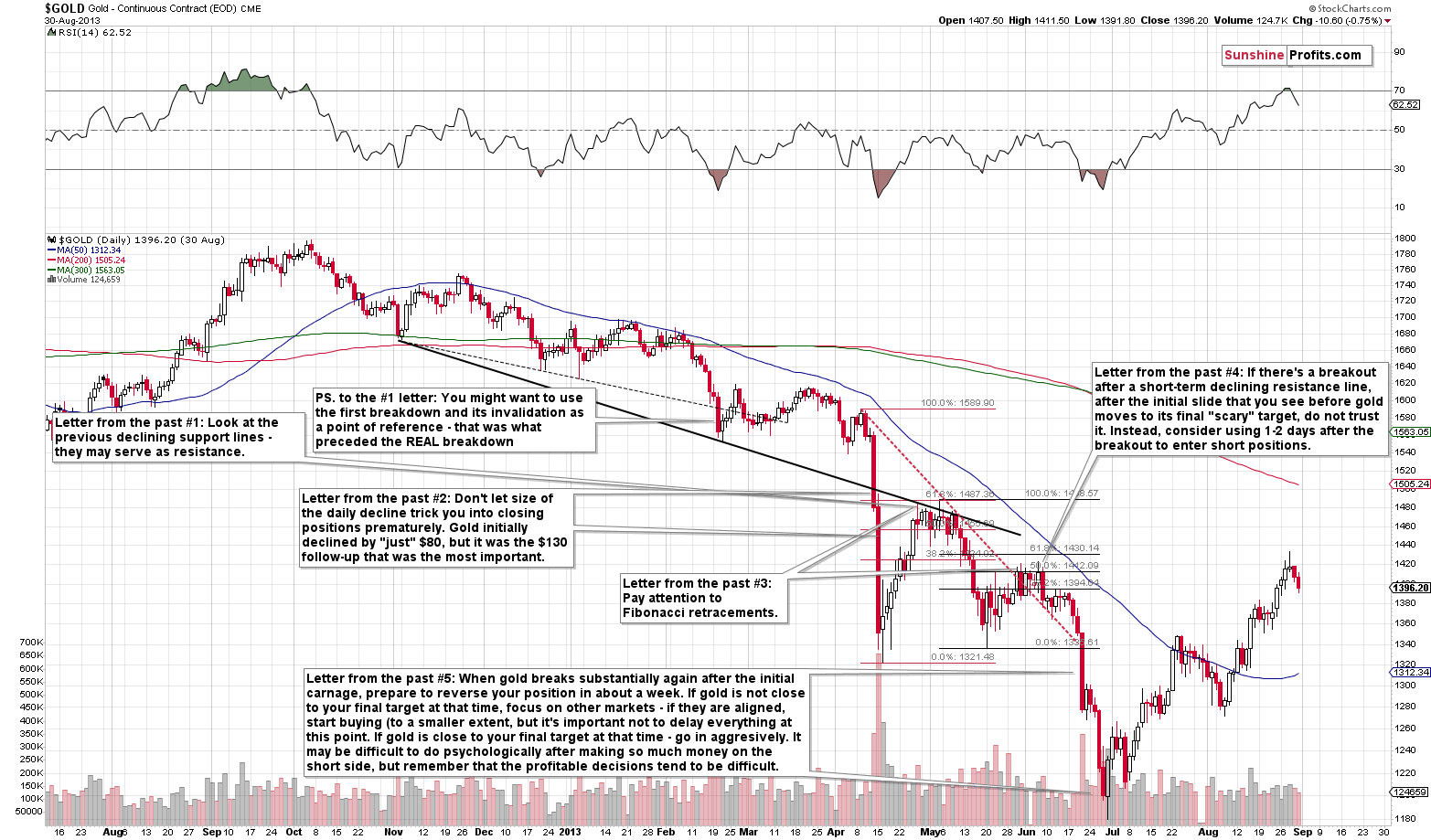

The very important confirmation of the usefulness of this trading technique comes from the 2012-2013 slide.

Over a year ago, we created a chart based on the possible similarity of the final slide in the PMs to the 2012-2013 slide. We wrote comments on it and we called them "Letters" to the future investors. While the situation is not as similar to the 2012-2013 slide, as it is to the 2008 one, this chart seems useful anyway.

The key thing visible above is the slide well below the declining support line that was based on the previous local lows. It's not that important how much gold broke below this line, but that it provided a great temporary buying opportunity just a day after the breakdown.

This is very similar to what we see on the 2008 gold chart.

Now, the 2008 decline was faster (overall) than the 2013 decline, and the current slide is even faster, so it seems that it would not take two trading days to form the bottom after the breakdown, but that it would rather take place on the intraday basis.

- The area marked with red rectangle - the bottom in gold - was characterized by a clear show of strength in gold. Gold reversed and closed the day higher despite a move higher in the USD Index. We will be on a lookout for this kind of confirmation as it might prove extremely important also this time.

- The precious metals market formed its final bottom, when stocks formed their local bottom at their previous local low. This might be a useful clue, but it doesn't have to be. It's not as important as the previous point.

- The precious metals market bottomed after the USD Index was already after a sizable rally, but it didn't wait for the USD Index to form its top. The relative strength was the critical sign - waiting for the USDX to reach its target or critical resistance level was not that important. Consequently, the first two points seem most important.

- Silver and mining stocks bottomed along with gold and silver bottomed practically right at is declining support line while miners - just like gold - broke temporarily below it. In case of the miners, the breakdown was not immediately invalidated, though.

The first point are what we are going to apply to the current technical picture and we're going to use the remaining ones as confirmations.

Connecting the previous two lows in gold, provides us with very quickly descending support lines (based on both: intraday lows and the daily closing prices) that are going to point to between $1,200 and $1,340 next week.

The interpretation is simple. Once gold breaks below these lines, it likely creates a buying opportunity. It's not clear which line we should focus on. Theoretically, based on the 1-to-1 link to 2008, we should take into account the steeper line based on the intraday lows, however, it might be too unrealistic given gold's very favorable stagflationary potential.

However, just in case gold drops heavily below this line (as it did in 2013), it will be best to wait for some kind of confirmation before saying that the bottom is definitely in (or at least most likely in). This could come in the form of silver or miners reaching their target levels, or it could be based on gold's strength relative to the USD Index. Please note that since the price moves are likely to be quicker, we might need to consider intraday strength or weakness of gold relative to the USDX, instead of the one based on the daily price changes.

If gold is to slide below the support line, then the odds are that the rebound would be triggered by some other support. Let's see what kind of strong support levels gold has just below the $1,300 - $1,350 area.

There are three support levels that fulfill the above-mentioned requirement but that are still relatively close to the sharply declining support line:

- The 61.8% Fibonacci retracement based on the 2015 - 2020 rally (at about $1,290)

- The rising medium-term support line based on the 2015 and 2018 lows (currently at about $1,250)

- The 2019 bottom of about $1,270

There's also the support provided by the 2018 lows at about $1,170, which we view as maximum size of the next short-term decline. As you can see, taking also the $1,170 the discrepancy between the highest and lowest support levels is quite high - that's why bullish confirmations will be so important.

What about silver and it's confirmations?

If the white metal bottoms at its declining support line shortly, it's likely to bottom below $9, likely closer to $8, or even $7. Sounds familiar? It should, because that's in perfect tune with the analogy to 2008 in terms of medium-term price moves in silver that we've been describing for months.

Silver just plunged to our initial target level and reversed shortly after doing so. It was for many months that we've been featuring the above silver chart along with the analogy to the 2008 slide. People were laughing at us when we told them that silver was likely to slide below $10.

Well, the recent low of $11.64 proves that we were not out of our minds after all. Our initial target was reached, and as we had explained earlier today, the entire panic-driven plunge has only begun.

Those who were laughing the loudest will prefer not to notice that silver reversed its course at a very similar price level at which it had reversed initially in 2008. It was $12.40 back then, but silver started the decline from about 50 cent higher level, so these moves are very similar.

This means that the key analogy in silver (in addition to the situation being similar to mid-90s) remains intact.

It also means that silver is very likely to decline AT LEAST to $9. At this point we can't rule out a scenario in which silver drops even to its all-time lows around $4-$5.

Crazy, right? Well, silver was trading at about $19 less than a month ago. These are crazy times, and crazy prices might be quite realistic after all. The worst is yet to come.

Let's quote what the 2008-now analogy is all about in case of silver.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

Also, if you didn't profit on the recent decline in silver, don't despair - this decline seems to be far from over and there will be plenty of room for profits, especially that silver seems to be starting a corrective upswing now. Just like it did in the 2008. Back then, it corrected to about $14 before moving lower and this might be a realistic target also this time. This would serve as a verification of the breakdown below the 2015 low, and it would open the way for even lower silver prices.

Silver moved above its 2015 bottom, but it didn't change much in terms of the above-mentioned analogy. It move a bit higher than it did in 2008, nothing more. It moved up, just like gold and the general stock market did, but it didn't really magnify their gains in a way that would indicate true strength.

In 2008, silver bottomed at $8.40, but... It started the entire decline from higher levels, so if the price moves are to remain similar in terms of their sizes, we should expect silver below $8.40 at its final bottom. The fact that the most recent bottom formed a bit below its counterpart - the interim 2008 low confirms the above.

Back in 2008, the final top from which silver declined below $9 was $19.55. This year, it was $18.92. As the starting point was $0.63 lower this time, perhaps the bottom would also be $0.63 lower.

This would provide us with $7.77 as the final downside target for the white metal. And this level is almost right in the middle of our target area on silver's short-term chart, at the sharply declining support line.

If we were shorting silver right now, we would place our binding profit-take level at $8.58, just in case the white metal reverses sooner. We would also consider buying heavily once silver falls below $8. Please note that the only reason we are not shorting silver right now is that we think that the shorting opportunity is even greater in case of mining stocks.

Before moving to the mining stocks, we'll examine the situation in the USD Index, as it's one of the factors that makes it very likely that gold is going to decline heavily in the following 1-4 weeks (perhaps not without a quick rally beforehand, though).

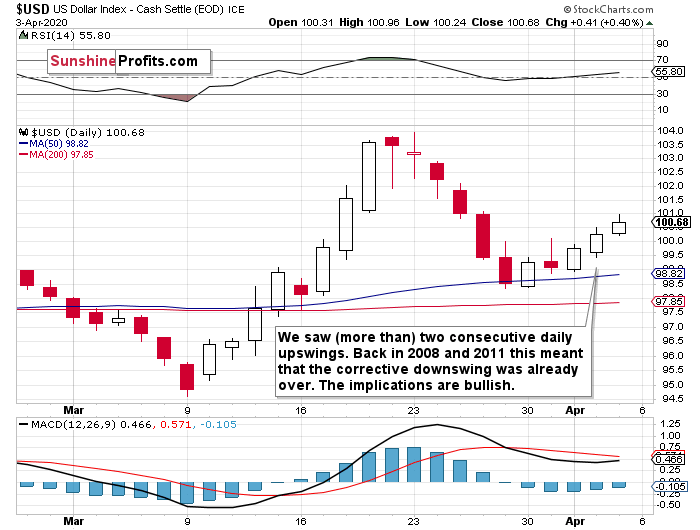

The key point with regard to the US currency is that it appears to have already ended its pullback and is now ready to soar well above its previous 2020 high.

How do we know that the pullback is most likely over?

Because the USD Index already rallied for (actually more than) two consecutive trading days.

USDX on the Rise

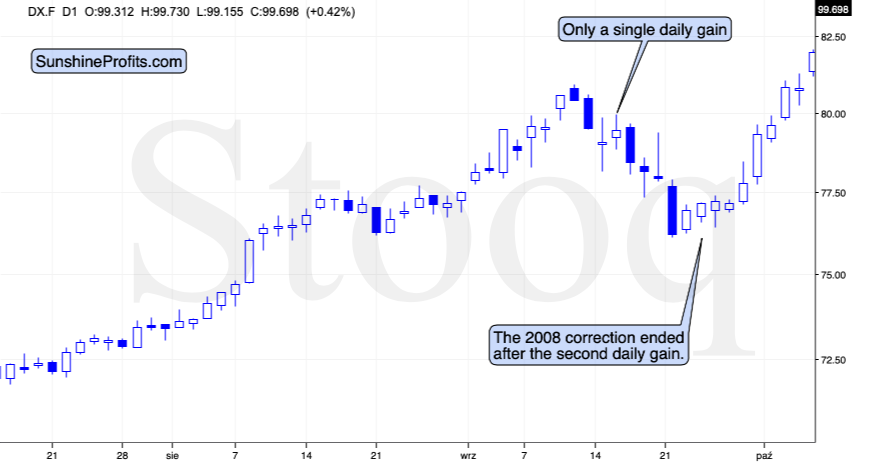

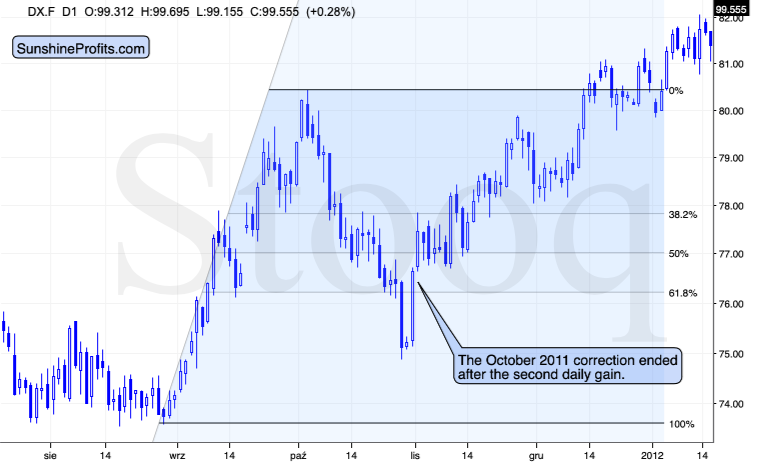

The USD Index just posted a daily rally and it was the third daily rally in a row. This may not seem significant at first sight, but it is significant, because that was what confirmed that the downward correction was already over in case of both similar price moves: the 2008 and 2011 one.

We compared the corrections in similar times and here's what we found.

Based on the above chart, we see that there were two similar cases to what we see today - one in 2008 and the other in 2011. These years are also similar due to the fact that in both cases we saw major tops in gold.

Given the size of the most recent rally, the 2014-2015 rally might appear similar, but the correction that we saw back then, was not big enough and the preceding rally was not sharp enough to be really comparable. That's why we're focusing on 2008 and 2011.

In 2008, the USDX corrected a bit below its 50% retracement, but not to its 61.8% retracement - just like it did recently. There were moves both up and down during the corrective downswing, and the thing that confirmed its end, was the second daily gain.

And in 2011?

Exactly the same thing was the case. The shape of the decline was different, and the decline was deeper (it moved below the 61.8% retracement but the USDX stayed there for just 2 trading days), but once we saw two daily gains in a row, it served as a confirmation that the decline was over.

We already got this bullish confirmation, so the USD Index's rally is now likely to continue.

The good news is that since we know that the correction is most likely over, we can use Fibonacci extension tools based on the previous rally and the correction to estimate how high the USD Index is likely to move before this significant, yet short-term rally is over. Once the short-term rally is over, it would probably be followed by a more meaningful correction and then another wave up, but that's not the key information from the precious metals investor's and trader's point of view, because PMs and miners are likely to bottom even before the USD Index tops.

So, how high would the USD Index be likely to rally in the near term?

Back in 2008, the USD Index topped after it slightly exceeded the level that one would get by doubling the size of the initial sharp upswing. The first, initial top formed slightly above the level that one would get by multiplying the size of the initial sharp correction by 2.618.

Based on these techniques and the analogy to 2008, the USD Index is likely to soar to about 113 before correcting in a more meaningful manner. This level is just above the rising, long-term resistance line that's based on the 2009 and 2015 highs, which is at about 112, so conservatively we will view 112 as our upside target.

The USD Index is at about 100 at the moment of writing these words, so the upside potential is substantial.

And as we wrote in many previous extensive analyses, big moves higher in the USD Index almost always translate into big declines in gold. Consequently, given a high-quality prediction for the USD Index, one is quite likely to make a good gold price forecast as well.

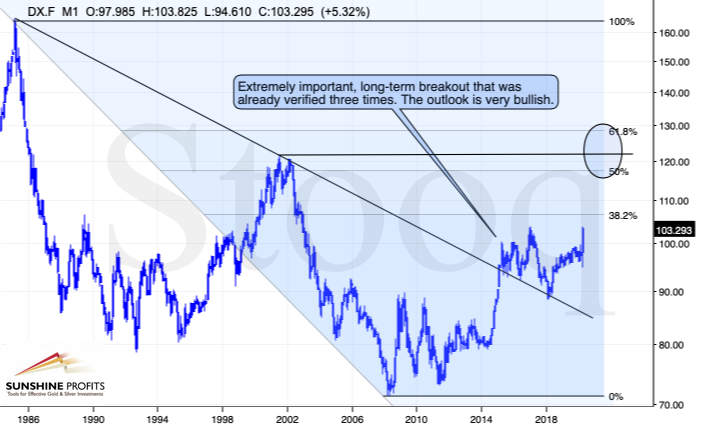

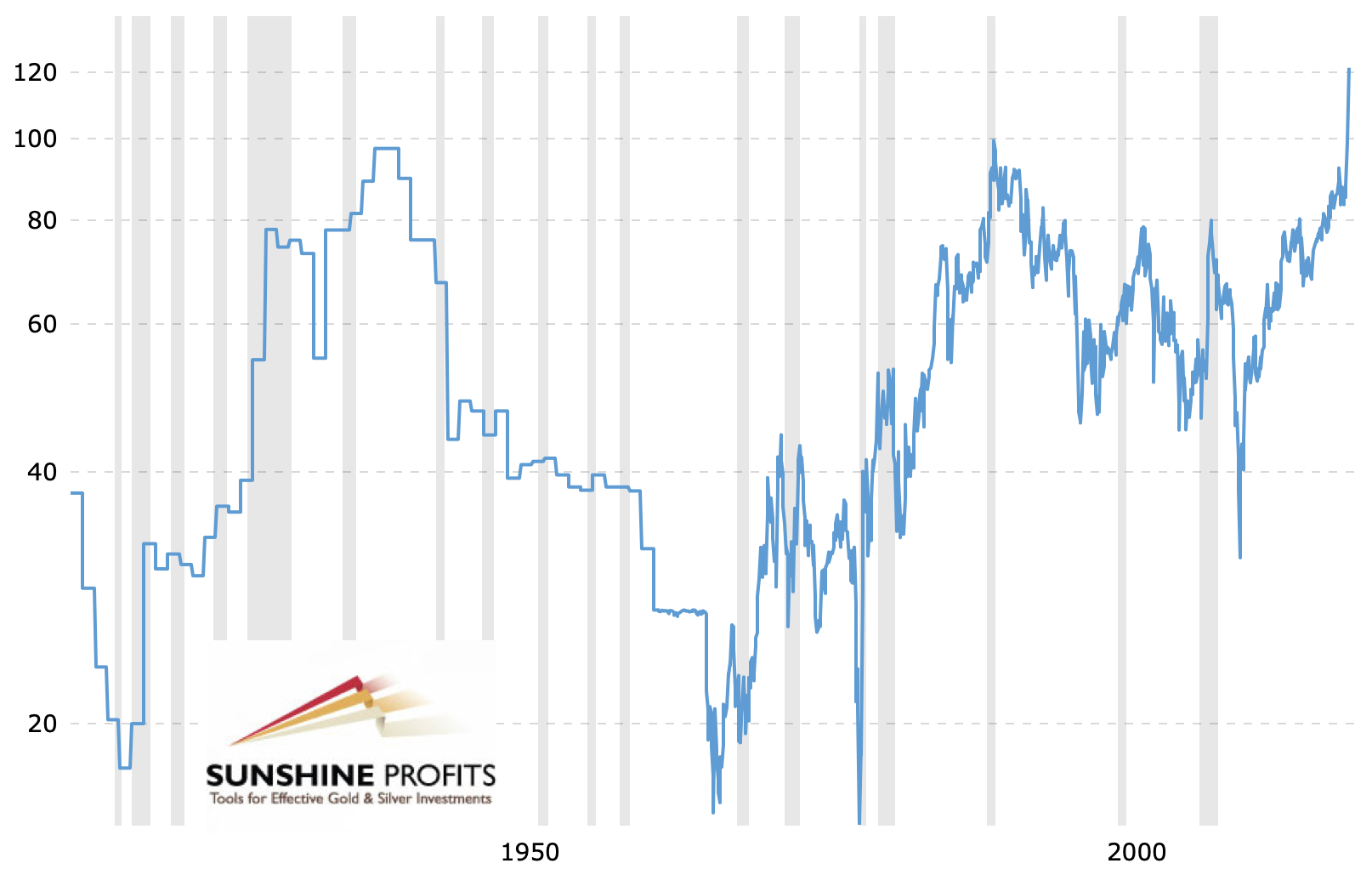

The Big Picture View of the USD Index and Gold

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

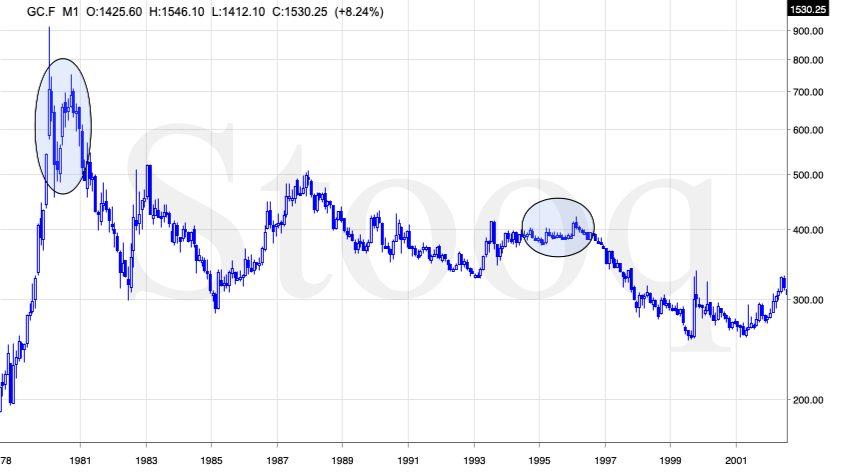

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

Consequently, it seems most likely that while the USDX rallies, gold would first rally to or slightly above its 2020 highs (topping today or tomorrow), and decline in a volatile manner shortly thereafter.

For now, it seems most likely that we'll get the final bottom in gold close to the middle of the month or in its second half. Perhaps on Easter Monday, when trading is more difficult in many parts of the world (as the markets are closed there) - that's exactly when silver topped in 2011.

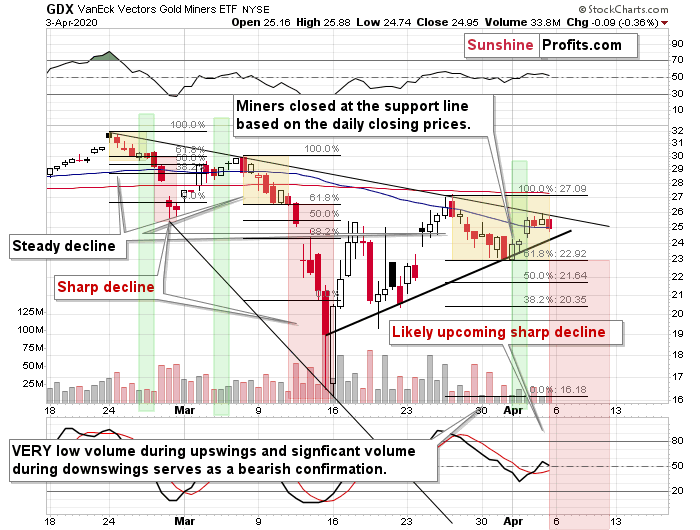

Also, let's keep in mind that we have a medium-term triangle-vertex-based reversal in the middle of the month in the GDX ETF.

What happened in other markets once gold rallied for the final time in 2008? Silver and mining stocks moved higher, but not as significantly as gold. Neither silver, nor mining stocks moved above their previous highs. The general stock market moved back and forth, mostly doing nothing, and the USD Index rallied.

What's happening right now in the stocks and the USD Index? The stocks are moving back and forth, while the USD Index is moving higher and it just rallied for two consecutive days.

Silver moved higher, but not above its recent high, and miners corrected about half of their most recent downswing. It seems that the two periods in 2008 and 2020 (both marked with green) are indeed very similar.

Note: silver might exceed its recent high temporarily as the market might focus on the industrial demand due to the upcoming infrastructure projects. That's unlikely to be anything more than a temporary development.

As you can see, there are there are triangle-vertex-based reversals early this week in all key parts of the precious metals sector: in gold, in silver, and the mining stocks. We also get the same indication based on the GLD ETF.

This means that - based on this trading technique - it's very likely that we'll see some kind of reversal today or tomorrow. Based on the analogy to 2008, it's likely to be a local top, even despite the rally in the USD Index.

Checking the Miners Again

The upswings that we see in case of the GDX ETF on a 4-hour basis are accompanied by very low volume. The declines, however, are accompanied by volume that is significantly higher (at least on a relative basis). This is exactly what a pre-slide pause looks like.

On Friday, miners moved lower even though gold moved higher (and both of our trading positions: long in gold, and short in miners) gained. However, as gold rallies to its previous high (or slightly above it), it seems that miners will gain as well. It could even be the case today that miners move above their declining resistance line and the early April high. This rally would likely be only temporary.

This is the reason due to which one might consider limiting or even briefly exiting their speculative short position in the mining stocks. We are exiting it with the goal to re-enter it later today or tomorrow, but this is definitely not action that seems to be a good idea for many (in fact, most) individual investors / traders, which is why we are only limiting it in case of our overall opinion on the market in the "summary" and "briefly" parts of the analysis.

And what about the target for the final decline in the miners? Our previous comments remain up-to-date.

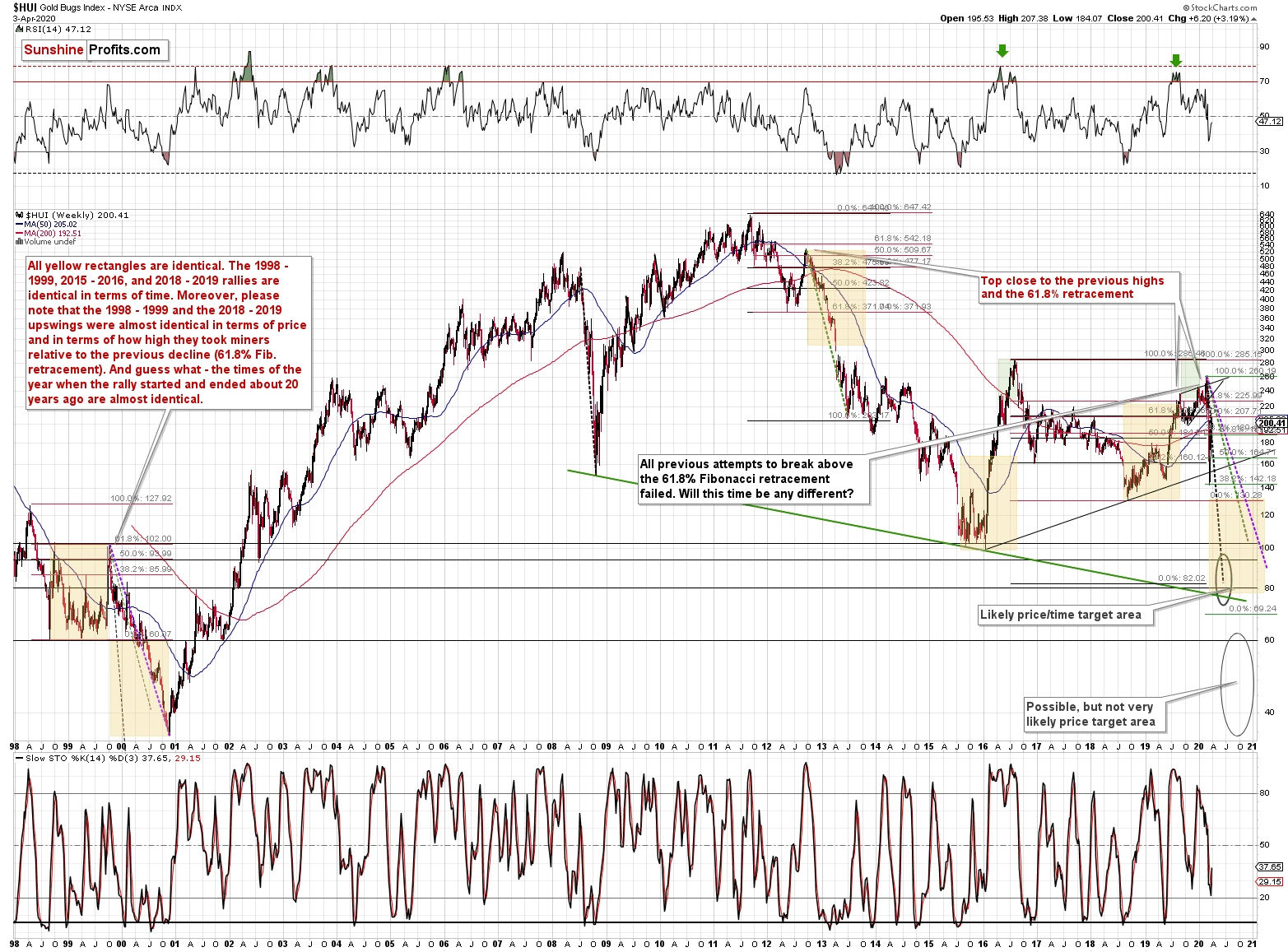

The long-term HUI Index chart shows that there's the 2018 low that could stop the decline, but... It was already broken in case of the GDX, and GDXJ. Consequently, miners are likely to drop more than to just these levels. The next support is provided by the 2015 / 2016 lows, and there's also the long-term declining support line that's currently at about 80 in case of the HUI Index.

What about the GDX?

Based on three types of Fibonacci extensions, we created a target area that's approximately between $10 and $12.50. Yes, this is really our expectation for this slide. We expect the slide to be enormous and it might appear unbelievable. But the early-March decline was also unbelievable, right? And yet, it happened.

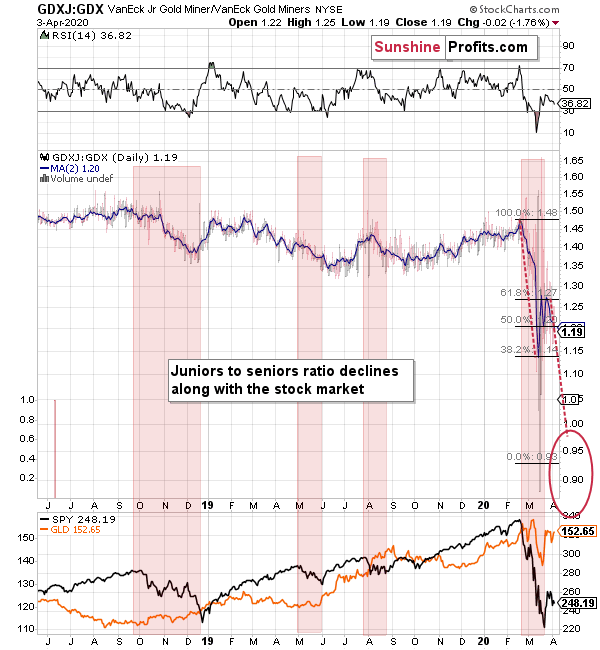

If GDX could bottom at about $10 - $12.50, then how low could the GDXJ drop? As surprising as it may seem... We expect GDXJ to decline below GDX in absolute terms. Here's why.

The ratio between GDXJ and GDX is moving relatively in tune with the general stock market. We've been describing that for many years (not very frequently, though) that juniors are more dependent on the general stock market than any other part of the precious metals sector. The areas that we marked with red prove it.

Here's another proof.

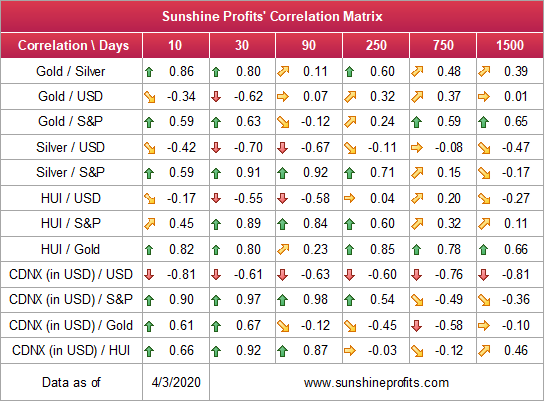

Please focus on the third row from the bottom. It shows the correlation between the TSE Venture Index (another proxy for the junior mining stocks) and the S&P 500 Index. The two highest values of correlation from the entire table are the ones between juniors and the general stock market. It's 0.98 and 0.97. The closer a given number is to 1, the stronger the link becomes. 0.98 is an extremely strong correlation (it's even stronger than the link between gold and silver, and the one between gold and gold miners!) and that's how correlated juniors really are with stocks, when taking into account the past 30 and 90 trading days. These are exactly the periods that we're interested in, given the likely short-term nature of the following decline.

So, since the general stock market is likely to slide further, the junior mining stocks are likely to slide really low, also relative to senior mining stocks.

This means a visible drop in the GDXJ to GDX ratio. Based on the technical principles, we applied to the ratio, it seems that it would decline at least below 1. Based on the ratio alone, the move to 0.93 appears more probable, and based on how far the general stock market could slide, it might not even be the final low.

With $10 - $12.50 as the target for GDX, and the target for the ratio at 0.93 - 1, the target area for the GDXJ is $9.30 - $12.50.

What we already wrote about gold and silver suggests that the above target area for the GDX ETF might be correct or it might be even too high. After all, it's based on the declining support line, and back in 2008, miners first declined below this line, and then kept on moving lower. In 2008, miners bottomed only once gold moved below its own declining support line.

Still, this time, the initial slide in the miners was huge, and sharp, which suggests that perhaps this time the mining stocks won't move below the declining support line, but rather bottom at it, or even above it, at one of the above-described Fibonacci extension targets.

This is where the analysis of the key mining-stock ratio might be particularly valuable.

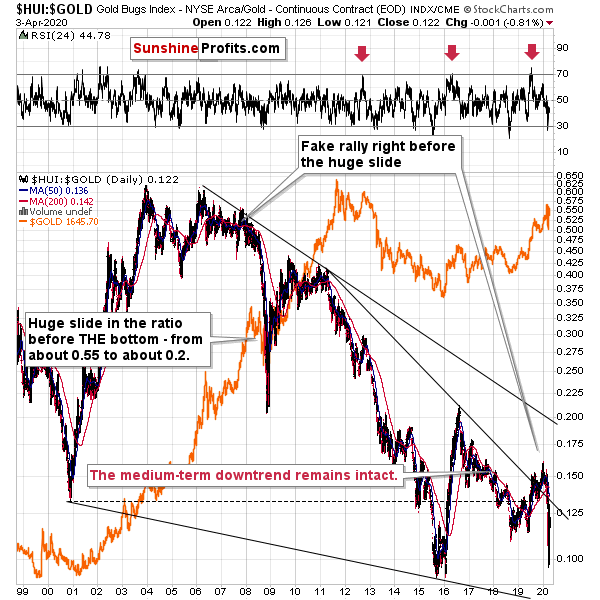

The gold stocks to gold ratio declined substantially recently, and it did so after invalidating the breakout above the declining resistance line, just like what we described as the likely outcome months ago.

While being quite big, this decline is still relatively small compared to how huge it was in 2008. Since it's 2008 on steroids, the decline that we see this time, could be even bigger, but let's assume that it will be "just" similar.

Back then the ratio declined from about 0.55 to about 0.2. This means that its value declined by about 63.6%. Applying the same size of the decline to the most recent high (at about 0.16) provides us with 0.058 at the next target.

With gold at $1,170 - $1,300, the above ratio would translate into 68 - 75 target area for the HUI Index. In other words, the HUI Index would be likely to slide to the declining green support line that's based on the 2008 and 2015 lows. This means that the value of the HUI Index would be more than cut in half. Approximately, 61% - 65% lower.

The GDX ETF just closed at $24.37. By decreasing this price by 61% - 65%, we would get $8.53 - $9.50 as the next target area. This more or less fits the previous estimations.

Speaking of GDX's relative valuations, let's also consider something else.

(it's the same chart that you've seen above, but seems more convenient to copy it also here)

Back in 2008, the GDX ETF formed the very first top a bit above $50, and the second top, a bit below $50. It then bottomed at about $15 - a bit less than a third of the average of these highs.

The most recent two highs for the GDX ETF were $31.84 (Feb 24) and $29.96. Rounding it conservatively, we get $30 as the starting point. The third of this value is $10, and to repeat its 2008 performance, GDX would have to slide a bit below it.

This perfectly fits the previous techniques, and provides us with $10 as the next target for the GDX ETF. This means that $9.2 for the GDXJ ETF might very well be in the cards.

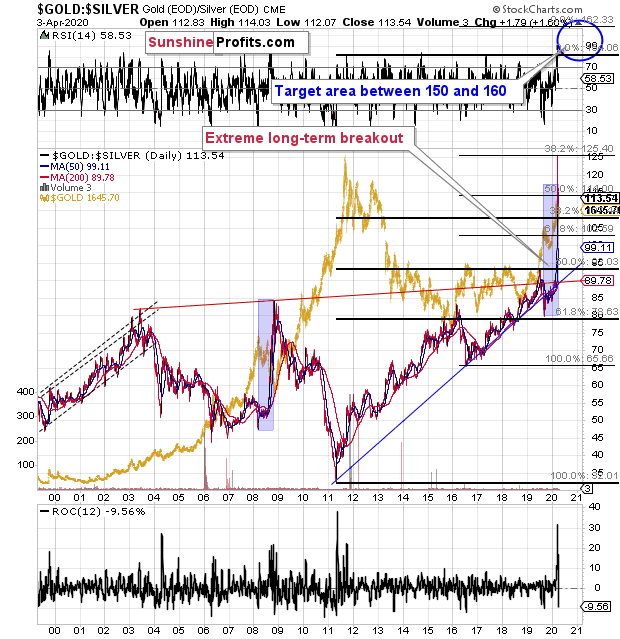

Before summarizing, let's take a look at the gold to silver ratio.

Remember the time, when the gold to silver ratio moved to 80 and practically everyone (well, we didn't) told you to buy silver? We told you that the real long-term resistance was at the 100 level, and that should the gold to silver ratio break above the previous highs, it was likely to shoot up. That's exactly what happened.

A month ago we wrote about the move to the 100 level in the following way:

We've been writing the above for weeks, despite numerous calls for a lower gold to silver ratio. And our target of 100 was just hit today. It was only hit on an intraday basis, not in terms of the daily closing prices, but it's still notable.

We had been expecting the gold to silver ratio to hit this extreme close or at the very bottom and the end of the medium-term decline in the precious metals sector - similarly to what happened in 2008. Obviously, that's not what happened.

Instead, the ratio moved to 100 in the situation where gold rallied, likely based on its safe-haven status, and silver plunged based on its industrial uses.

Despite numerous similarities to 2008, the ratio didn't rally as much as it did back then. If the decline in the PMs is just starting - and that does appear to be the case - then the very strong long-term resistance of 100 might not be able to trigger a rebound.

It might also be the case that for some time gold declines faster than silver, which would make the ratio move back down from the 100 level. The 100 level could then be re-tested at the final bottom.

Or... which seems more realistic, silver and mining stocks could slide to the level that we originally expected them to while gold ultimately bottoms higher than at $890. Perhaps even higher than $1,000. With gold at $1,100 or so, and silver at about $9, the gold to silver ratio would be a bit over 120.

If the rally in the gold to silver ratio is similar to the one that we saw in 2008, the 118 level or so could really be in the cards. This means that the combination of the above-mentioned price levels would not be out of the question.

At this time it's too early to say what combination of price levels will be seen at the final bottom, but we can say that the way gold reacted recently and how it relates to everything else in the world, makes gold likely to decline in the following months. Silver is likely to fall as well and its unlikely that a local top in the gold to silver ratio will prevent further declines.

Breakout above the resistance level as extremely important, is very likely to be followed by at least a pullback. At the moment of writing these words, the ratio is trading at about 113, which means that it did correct some of the previous rally, but it was not even close to invalidating the previous breakout. The latter is confirmed.

As far as the medium-term upside target for the ratio is concerned, we view the 150 - 160 level as likely. Yes, crazy, we know. Remember these are crazy times, though.

We created this target area based on the Fibonacci extension technique that we applied to the previous upswings. It's based on doubling the 2011 - 2019 upswing, and by multiplying the 2016 - 2020 (so far - taking the recent high into account) by a factor of 1.618.

Please note that with gold at $890 and silver at $5 - $6, the ratio would be between 148 and 178. Yes, we know, it sounds crazy...

Gold at $1,300 and silver at $9 would imply the gold to silver ratio at 144 - very close to the above-mentioned target area.

Gold at $1,280 and silver at $7.77 would imply the gold to silver ratio at about 165. Still fits the above target area.

The reason we featured the gold and silver ratio today is to show you two things:

- The breakout in the ratio was not invalidated, so the previous trends (lower in the PMs) are likely to continue

- Our extreme target prices are not so crazy after all (assuming that confirmation of another crazy target in crazy times is a valuable tool... But it likely is).

Finally, before summarizing, we would like to reply to questions that we received recently.

From the Readers' Mailbag

Q: I think funds must be re-allocating because its the beginning of the quarter and they appear to be buying metals as a hedge in this environment. Hopefully theyll be done soon. Do you agree?

A: This could very well be taking place, and it would explain the pause in the big moves in the past few days. Whether this is the reason behind the current pause, or not, it seems that it will be over very soon, likely this week.

Q: Sunshine Profits Team,

Love your work - wish I had found you 6 weeks ago! Incidentally, it was your gold-silver ratio article that appeared in Kitco that brought me to see the light.

Question for you regarding the imminent drop in precious metals. Do you see the 2008/2020 correlation persisting after the drop? That is, should the recovery bear out in a similar way this time around? Your timeline targets are very helpful!

A: Thank you, glad to have you aboard! In short, we do think that the 2008 - 2020 similarity would persist for some time after the bottom. This means that we expect the post-bottom rally to be sharp.

Well, to be honest, the typical shapes of the post-bottom rally that takes place after a volatile drop is relatively similar in most markets. The 2008 performance was just one of the examples. The rebound is initially just as sharp as the decline, then the volatility decreases and it's not as sharp as the decline, then the market enters some sort of consolidation and then - depending on whether the market is done declining or not - we see another wave down, or the continuation of the uptrend at a more moderate pace.

In the second half of March, we saw the former type of reaction, and after the 2008 bottom, we saw the latter type of reaction.

So, while the initial rebound is likely to be very similar to what we saw in 2008, the rally could then continue in a bit different way. It's too early to say what would be different and what would be similar. We will monitor the market for signs that the similarity is breaking (at some point it will), but until that takes place, it seems that looking at 2008 in order to determine what's likely ahead, will prove very useful.

The thing that we'll probably see is the outperformance of mining stocks at the beginning of the rally, which would then fade away, and at some point (perhaps a few weeks - a few months after the bottom) silver would take the baton of leadership... Until the next sizable pullback. After the pullback, miners would be likely to lead initially once again.

Q: I notice that JNUG is at historic lows, I don't know why that would be unless they recently changed their portfolio or investment targets? I went back 10 years, it's never been lower.

I'm wondering aloud to you, whether some sort of "buy" price for that should be enacted on this trip down with the junior miners via JDST? I'm sure it'll be going lower, that isn't the point. At some price point, it'll be cheap insurance against some sort of outlier event that triggers what we all believe will be a substantial bull market for the miners.

So I guess I'm asking about whether you feel it prudent to devise an investment strategy to capture any substantial moves that are unanticipated as we experience what your research indicates should be a hard move to the downside with these miners? Kind of like a "straddle" in options parlance. Just a thought I wanted to plant with you in the event you hadn't been thinking along these lines or have, but discarded that strategy?

A: It seems that we just implemented "kind of like a straddle" strategy in case of gold and mining stocks. Interestingly, both legs of this trade gained on Friday - gold moved higher while miners (especially juniors) moved lower.

With regard to JNUG - just because it's price is at an all-time low, doesn't mean much from the technical point of view. Normally (in case of regular, unleveraged instruments such as stocks), this might indicate a great buying opportunity, provided that a given asset is fundamentally sound.

However, the leveraged instruments such as JNUG should not be viewed as "normal". Their price moves are not based just on the fundamentals or even technicals of the mining stock sector. They are instrument created specifically for multiplying (right now 2x) DAILY price moves in the miners. It's very important that it's about DAILY price moves.

Why? Because through simple math, you can see that as the underlying asset (juniors) is volatile, the value of the leveraged instrument based on it will decline over time. And the more volatile it is, the more it will decline. Naturally, positive moves will not make it decline, but the point is that negative moves will be exponentially more damaging than a similar positive move.

For instance, say the underlying asset: GDXJ, moves from $30 to $20, then from $20 to $30, then from $30 to $20 and then back to $30 once again. Back and forth movement without any implication for someone holding GDXJ. Now, let's see what would likely happen to JNUG.

Let's assume that JNUG has a starting price of $100.

Day 1: GDXJ moves from $30 to $20. This means that it declines by 33.33%. Being 2x leveraged in case of DAILY price moves, JNUG declines by 66.66%. This means that it's now at $33.33.

Day 2: GDXJ moves from $20 to $30. This means that it rallies by 50%. Being 2x leveraged in case of DAILY price moves, JNUG rallies by 100%. This means that it's now at $66.66 (it gained 100% over it's price from the previous day, which was $33.33).

Day 3: GDXJ moves from $30 to $20 once again. This means that it once again declines by 33.33%. This means that JNUG declines once again by 66.66%. $66.66 x (1-0.6666) = about $22.22

Day 4: GDXJ moves from $20 to $30 once again. This means that it once again rallies by 50%. This means that JNUG rallies by 100%, doubling its value. $22.22 * 2 = $44.44

In the end, the GDXJ is back at its original value, and people who just held onto JNUG during this volatile period lost most of their capital.

This means that just because JNUG is at its all-time lows, it doesn't tell us anything about the potential or lack thereof of the mining stock sector or the JNUG per se. Instead it confirms that the mining stocks were recently particularly volatile during the decline. But we already knew that, so it doesn't really tell us anything new.

As you know, the target for JDST change relatively frequently as a lot depends on even a slight change in the outlook. If on one day it seems that the decline would take 5 trading days, and on the other 7 trading days, the price target for JDST will need to be adjusted. And exactly the same goes for JNUG. Based on the volatility it's almost impossible to provide a reasonable entry target at this time. Besides, it's even possible that JNUG's value will drop below $1 which would likely result in a reverse-split and the nominal price would increase without real implications for investors.

The current plan here is to enter long positions in the mining stocks right after (perhaps immediately) closing the short positions in them (this doesn't apply to today's situation - I mean the bottom that we see after the upcoming sharp slide). This is based on the likelihood of seeing an extreme slide in the miners' prices - just like what we saw in mid-March. If instead of that we get a steadier decline, the exit of the short positions and entry of the long positions might not take place on the same day. Perhaps not even the same week. For now, the first scenario seems most likely, though.

Q: Direxion Fund ETF Discrepancies and their effect on gold stocks" article. I would appreciate your assessment and comment' as I would think all your subscribers would, especially as your article appeared on the same day on Kitco .com.

A: While we don't want to comment on all points made in this article, we would like to point out that it doesn't take into account the fact that the Direction leveraged funds are focused on the daily price moves and magnify those. This effectively means that they will have a downward drift over time - please see the example from the previous reply for details. Our take is that Direxion probably got hundreds or thousands of phone calls from very unhappy investors that weren't aware of the above price mechanism and lost a lot of their money by staying long (NUGT and JNUG) hoping for a rebound - and when it finally came, they learned the hard way that it doesn't mean that they will get their profits (and capital) back. While they wanted to do something to mitigate the situation going forward and at the same time keep the funds at least somewhat leveraged (otherwise, there would be very little reason to buy them instead of the underlying ETFs or individual miners), they did something in between - they decreased the leverage, which means that the above-mentioned price effects will not be as extreme as they were previously.

Q: Is it the nature of this market that senior mining stocks are outperforming junior mining stocks, and do you expect that to continue? How will that affect any shorting opportunities?