Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

Let’s start with a quick review of the key fundamental news that hit the market last week.

The ECB and the Phantom Taper

The ECB tapered its asset purchases. Only that it didn’t taper at all. Are you confused? Gold isn’t – it simply doesn’t care.

Tapering has begun. For now, in the Eurozone. This is at least what headlines suggest, as last week, the Governing Council of the European Central Bank held its monetary policy meeting. The European central bankers decided to slowdown the pace of their asset purchases:

Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters.

The financial markets were only slightly moved by the ECB’s action. The price of gold was also barely changed, as the chart below shows. One reason is that such step was widely expected. Another is that this “tapering” is actually “pseudo-tapering”, or not tapering at all. Why?

The answer is that the ECB will continue to conduct net asset purchases under the Pandemic Emergency Purchase Programme with an unchanged total envelope of €1,850 billion. So, the total amount of assets bought under this program won’t necessarily change, as the ECB could still spend all of the envelope. The pace will only slow down, but please remember that it was boosted earlier this year. Hence, even Christine Lagarde admitted during her press conference that the ECB’s move was rather a “re-calibration of PEPP for next three months” than tapering.

What’s more, the net purchases under the Asset Purchase Programme, the original quantitative easing program, will continue at an unchanged pace of €20 billion per month. Last but not least, the ECB leaved its interest rates unchanged. And it reiterated that it was not going to normalize interest rates anytime soon, even in face of strong price pressure. In other words, the ECB signaled once again that it would tolerate higher inflation:

In support of its symmetric two per cent inflation target and in line with its monetary policy strategy, the Governing Council expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two per cent over the medium term. This may also imply a transitory period in which inflation is moderately above target.

What does the ECB’s last meeting imply for gold? Well, although Lagarde and her colleagues didn’t signal any further reduction of monetary accommodation, the slowdown in asset purchases under PEPP is a small step toward normalizing the monetary policy after pandemic. Additionally, please note that the ECB’s September economic projections boosted both the expected pace of GDP growth and inflation in coming years, which should provide the bank more room for more hawkish actions. In this context, the ECB’s could be seen as a shy harbinger of unwinding the emergency measures introduced during epidemic. This is probably why the euro has strengthened slightly after the ECB meeting.

However, the ECB remained in fact very dovish. It will just reduce the pace of asset purchases under PEPP that was boosted earlier this year. And the European central bankers didn’t provide any timeline, nor just clues, about the possible end of its quantitative easing programs. The Fed will also likely maintain its very accommodative stance, especially given the spread of the Delta variant of coronavirus and disappointing August nonfarm payrolls.

Having said that, the recent comments from the Fed official suggest that they are determined to start, or at least announce, tapering by the end of the year. For instance, the St. Louis Fed President James Bullard said in an interview that “The big picture is that the taper will get going this year and will end sometime by the first half of next year”.

Hence, the big picture for gold remains rather negative for the next several months, as the prospects of the Fed’s tightening cycle could still exert downward pressure on gold. However, the actual beginning of the process, especially if accompanied by more dovish signals from the Fed than expected, could provide some relief for the yellow metal, in line with “sell the rumor, buy the fact”. My intuition is that 2022 may be actually better for gold that this year, but a lot will depend on the future economic developments, as well as the US central banks’ actions and communication. This week we will get the fresh CPI data, while the FOMC will gather next week. Stay tuned!

Medium-Term Implications for Gold

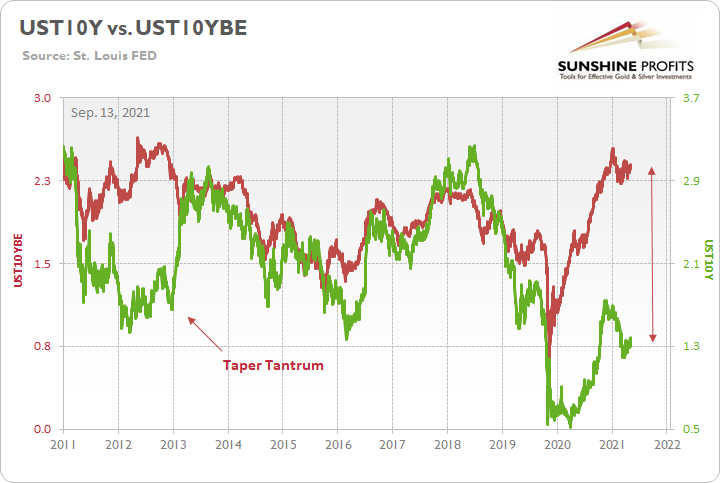

With the U.S. 10-Year Treasury yield inching higher recently, the Treasury benchmark has moved incrementally closer to investors’ 10-year inflation expectations. However, with the former still demonstrating a wide divergence from the latter, a reversal of the imbalance could have a profound impact on the PMs.

For example, if (once) the two lines reconnect, the development will likely send shockwaves across the precious metals market.

To explain, I wrote on May 11:

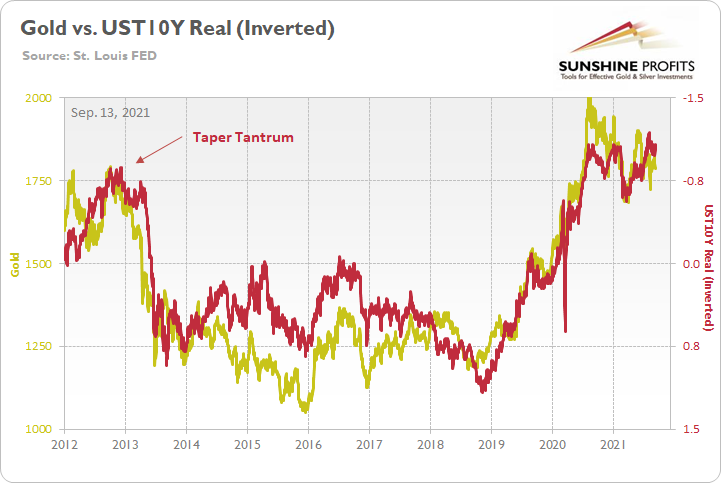

The gold line above tracks the London Bullion Market Association (LBMA) Gold Price, while the red line above tracks the inverted U.S. 10-Year real yield. For context, inverted means that the latter’s scale is flipped upside down and that a rising red line represents a falling U.S. 10-Year real yield, while a falling red line represents a rising U.S. 10-Year real yield.

If you analyze the left side of the chart, you can see that when the U.S. 10-Year Treasury yield began its move to reconnect with the U.S. 10-Year breakeven inflation rate in 2013 (taper tantrum), the U.S. 10-Year real yield surged (depicted by the red line moving sharply lower). More importantly, though, amidst the chaos, gold plunged by more than $500 in less than six months.

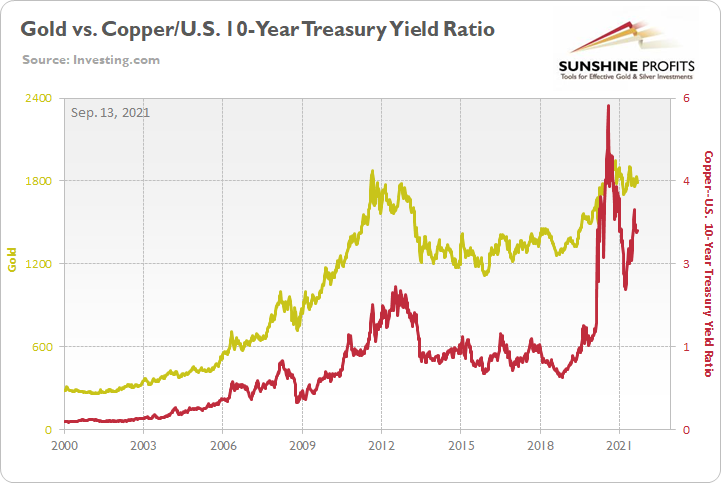

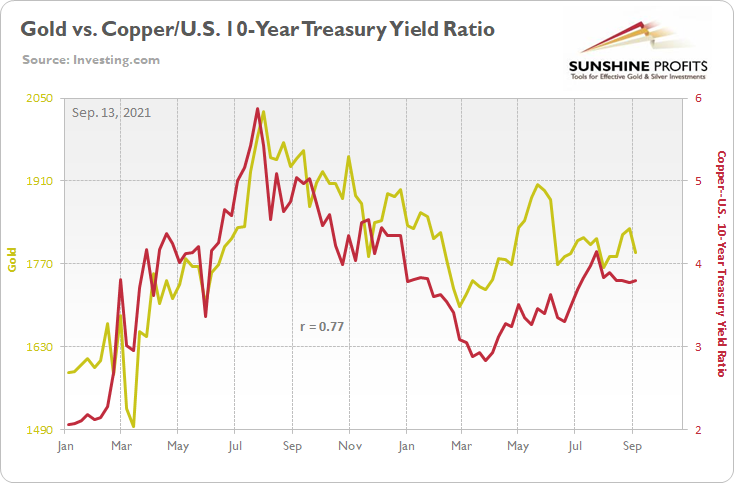

Over the medium-to-long term, the copper/U.S. 10-Year Treasury yield ratio is yet another leading indicator of gold’s future behavior.

I wrote previously:

When the copper/U.S. 10-Year Treasury yield ratio is rising (meaning that copper prices are rising at a faster pace than the U.S. 10-Year Treasury yield), it usually results in higher gold prices. Conversely, when the copper/U.S. 10-Year Treasury yield ratio is falling (meaning that the U.S. 10-Year Treasury yield is rising at a faster pace than copper prices), it usually results in lower gold prices.

If you analyze the chart below, you can see the close connection:

Moreover, with gold attempting (again) and failing (again) to run away from the copper/U.S. 10-Year Treasury yield ratio, the yellow metal suffered another sharp drawdown last week. And while the ratio still implies a gold price of roughly $1,740, many other indicators signal an even larger decline over the medium term.

Please see below:

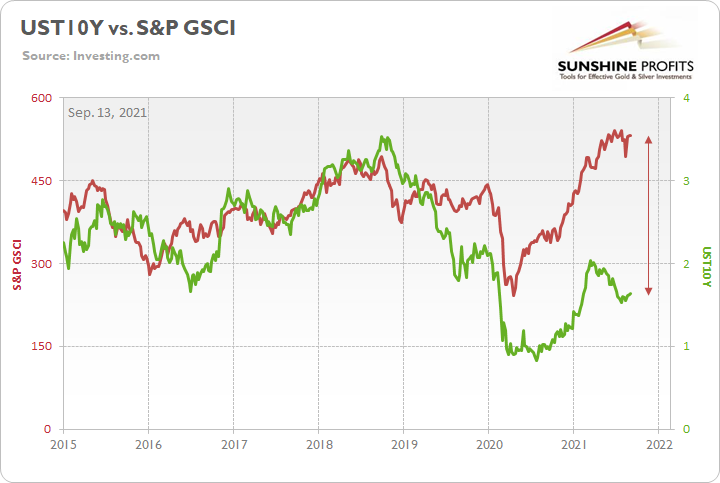

Finally, the S&P GSCI (the commodity index) has decoupled from the U.S. 10-Year Treasury yield. And with the former moving in near lockstep with the latter since 2015, a reversal of the imbalance could increase the PMs’ troubles over the medium term.

On the flip side, if we extend our time horizon, there are plenty of fundamental reasons why gold is likely to soar in the coming years. However, even the most profound bull markets don’t move up in a straight line, and corrections are inevitable.

As it relates to the precious metals, a significant correction (medium-term downtrend) is already underway. However, the pain is not over, and a severe climax likely awaits.

For context, potential triggers are not always noticeable, and the PMs may collapse on their own or as a result of some random trigger that normally wouldn’t cause any major action. However, a trigger will speed things up, and that’s where the S&P 500 comes in:

Stock Market Signals

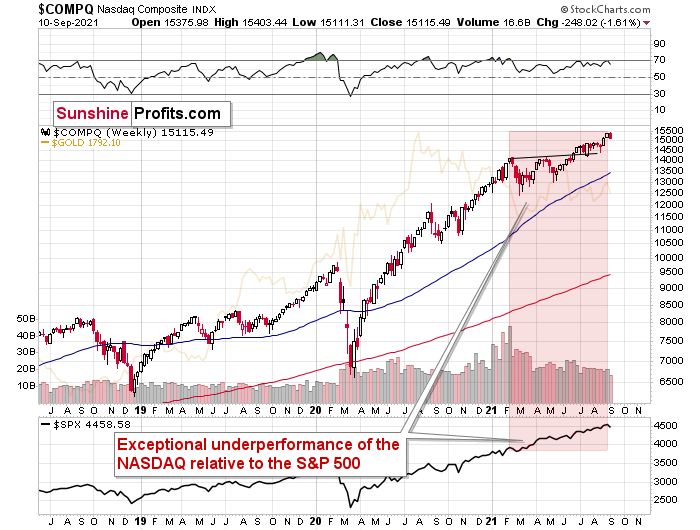

With regional Fed Presidents’ trading activities drawing immense criticism and U.S. GDP growth wobbling amid the spread of the Delta variant, risk sentiment soured across Wall Street. And with record-high leverage present alongside record-high valuations, it only takes one spark to light a bearish fire. And providing the match, the NASDAQ Composite is still underperforming the S&P 500 and with both indices’ RSIs (Relative Strength Index) signaling overbought conditions (near 70), a reversion to the mean could result in at least a profound correction in the coming months.

Please see below:

What’s more, the PMs are ominously intermingled with the performance of Big Tech. For example, when the NASDAQ Composite fell off a cliff in 2000, the XAU Index plunged by more than 50%. And with today’s warning signs strikingly similar to its predecessors, another Minsky Moment could wreak havoc on the PMs.

To explain, I wrote previously:

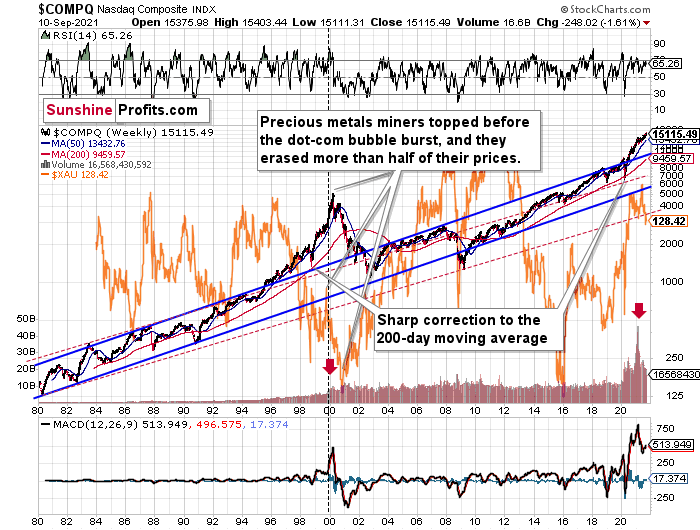

With the MACD indicator recording an epic sell signal, the extreme reading can only be rivaled by the peak of the dot-com bubble.

While history might not repeat itself, though it does rhyme, those who insist on ignoring it are doomed to repeat it. And there’s practically only one situation from more than the past four decades that is similar to what we see right now.

It’s the early 2000s when the tech stock bubble burst. It’s practically the only time when the tech stocks were after a similarly huge rally. It’s also the only time when the weekly MACD soared to so high levels (we already saw the critical sell signal from it). It’s also the only comparable case with regard to the breakout above the rising blue trend channel. The previous move above it was immediately followed by a pullback to the 200-week moving average, and then the final – most volatile – part of the rally started. It ended on significant volume when the MACD flashed the sell signal. Again, we’re already after this point.

The recent attempt to break to new highs that failed seems to have been the final cherry on the bearish cake.

Why should I – the precious metals investor – care?

Because of what happened in the XAU Index (a proxy for gold stocks and silver stocks) shortly after the tech stock bubble burst last time.

What happened was that the mining stocks declined for about three months after the NASDAQ topped, and then they formed their final bottom that started the truly epic rally. And just like it was the case over 20 years ago, mining stocks topped several months before the tech stocks.

Mistaking the current situation for the true bottom is something that is likely to make a huge difference in one’s bottom line. After all, the ability to buy something about twice as cheap is practically equal to selling the same thing at twice the price. Or it’s like making money on the same epic upswing twice instead of “just” once.

And why am I writing about “half” and “twice”? Because… I’m being slightly conservative, and I assume that the history is about to rhyme once again as it very often does (despite seemingly different circumstances in the world). The XAU Index declined from its 1999 high of 92.72 to 41.61 – it erased 55.12% of its price.

The most recent medium-term high in the GDX ETF (another proxy for mining stocks) was at about $45. Half of that is $22.5, so a move to this level would be quite in tune with what we saw recently.

And the thing is that based on this week’s slide in the NASDAQ that followed the weekly reversal and the invalidation, it seems that this slide lower has already begun.

“Wait, you said something about three months?”

Yes, that’s approximately how long we had to wait for the final buying opportunity in the mining stocks to present itself based on the stock market top.

The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. Consequently, we might see the next major bottom – and the epic buying opportunity in the mining stocks – about three months after the general stock market tops. The NASDAQ might have already topped, so we’re waiting for the S&P 500 to confirm the change in the trend.

The bottom line?

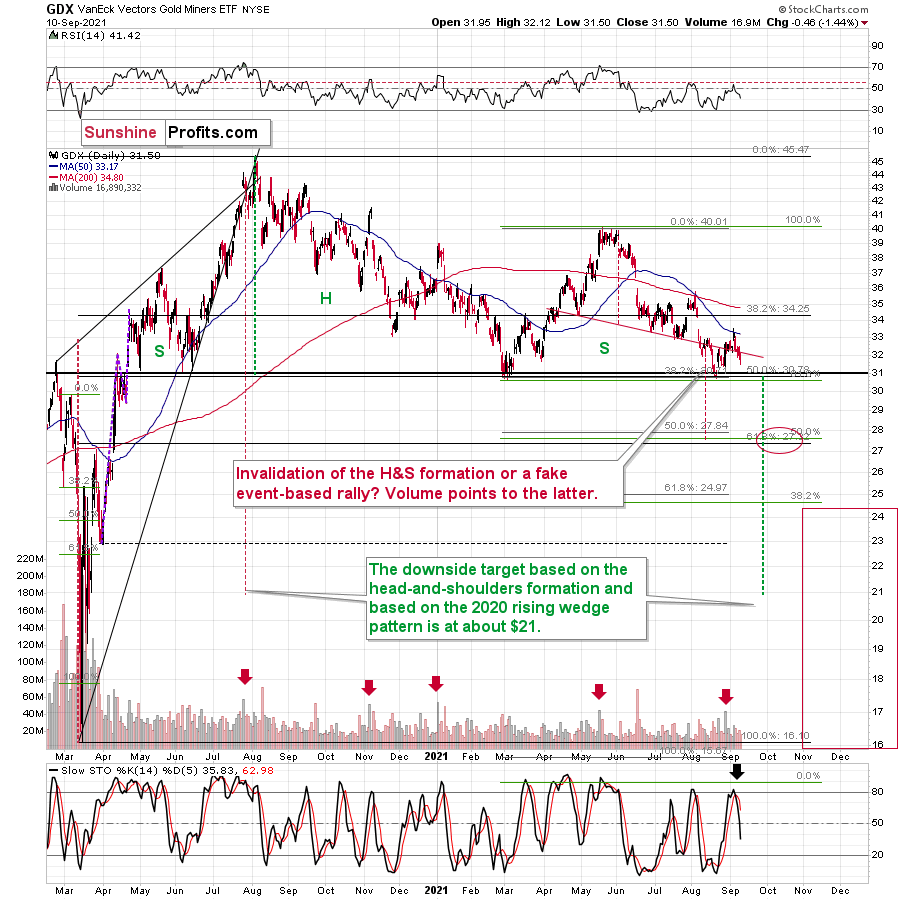

New lows are likely to complete the GDX ETF’s bearish H&S pattern and set the stage for an even larger medium-term decline. And if the projection proves prescient, medium-term support (or perhaps even the long-term one) will likely emerge at roughly $21.

But why ~$21?

- The target aligns perfectly with the signals from the GDX ETF’s 2020 rising wedge pattern. You can see it in the left part of the above chart. The size of the move that follows a breakout or breakdown from the pattern (breakdown in this case) is likely to be equal (or greater than) the height of the wedge. That’s what the red dashed line marks.

- The broad head-and-shoulders pattern with the horizontal neckline at about $31 points to the $21 level as the likely target.

Confronting a similar calamity, the S&P 500 is also quite vulnerable. And with that, it’s important to remember that while the U.S. equity benchmark hugs its rising support line (and its 50-day moving average), it only takes one gust of wind to blow down the entire house of cards. Thus, while the timing remains uncertain, 2020 proved that risk can happen fast and that months of gains can be wiped out in a single week.

In the meantime, though, while last week’s breakdown in the S&P 500 was quite visible, back-and-forth trading may ensure before the climax unfolds. However, once the S&P 500 finally meets its maker, the PMs will likely follow suit, with the gold miners and silver suffering the brunt of the blow.

To explain, I wrote previously:

With its RSI mirroring the bearish behavior that we witnessed in 2019/2020 – though five moves are present this time, while two moves were present back then – the S&P 500 remains on a collision course lower. For context, similar behavior led to explosive drawdowns in early 2020 and in the second half of 2018. Moreover, with the Fed turning a bit more hawkish in recent weeks, volatility will likely erupt once the central bank’s taper timeline is finally revealed.

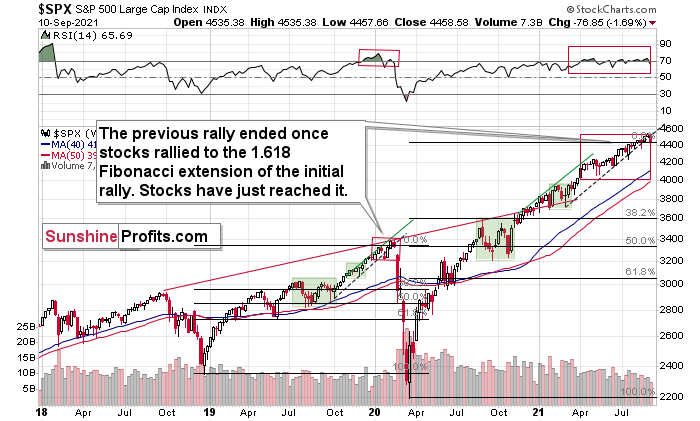

On top of that, the shape, the movement, and the drawdowns that occurred along the way during the S&P 500’s 2018-2020 rally all mirror today’s price action. To explain, the self-similar pattern from 2018-2020 saw the S&P 500 peak once the index rose slightly above the 1.618 Fibonacci extension level based on the size of the initial rally. On the above chart, you can see this as a move to the highest retracement in April 2019 – the full size of the rally compared to the 61.8% retracement is actually 1.618 of the initial rally, because 1 / 0.618 = ~1.618 (the Phi number).

And with the S&P 500 slightly exceeding this extension-based target on Aug. 13, we may have already witnessed the top. Back in 2020, the S&P 500 closed slightly above this level prior to the crash, and with an identical development playing out today, another drawdown could be right around the corner.

Keep in mind though: the PMs’ forthcoming slide is independent (and has been) of the performance of the general stock market – at least with regard to the existence of the PMs’ slide. However, due to the cross-asset implications and the interconnectedness of the financial markets, a severe correction of U.S. equities will likely supercharge the pace of the PMs’ implied decline (especially silver and mining stocks). If stocks continue to rally, PMs will likely still decline, but at a regular pace. As an example, we witnessed that behavior on Aug. 6. Even though the S&P 500 ended the day in the green, the PMs declined significantly.

For context, the precious metals used to bottom about 3 – 3.5 months after the top in the general stock market in some of the similar cases, for instance, in 1929. And with both major indices remaining resilient, the timeframe of the PMs’ final trough is still up in the air.

If – based on the analogy to 2013 that I’ll discuss later today – a bottom for the PMs materializes in December 2021 and (reverse engineering the forecast) the stock market peaks 3 – 3.5 months in advance, the top may be in (if the 1929 analogy holds — it could also be about a month away). As a result, if the general stock market continues its slide, it will further validate the thesis that the PMs will likely bottom in December.

For more context:

Why should we – precious metals investors and traders – be concerned with the performance of stocks? Because when stocks finally top and start to decline, it will likely make the decline in the precious metals market much more severe. For one, identical developments occurred in 2008, 2020 and 1929. Second, the precious metals often bottom about 3 – 3.5 months after the top in the general stock market. Third, the S&P 500’s 2020 analogue is becoming even more valid by the day.

(…)

The markets are self-similar (which is another way of saying that they have a fractal nature), which generally means that while the history tends to rhyme, it also tends to rhyme in similar shapes of alike or various sizes.

For example, the rally from 2018–2020 seems very similar to the rally from 2020 to the present. Both rallies started after a sharp decline, and the first notable correction took the form of back-and-forth trading around the previous high. I marked those situations with big rectangles.

Then the rally continued with relatively small week-to-week volatility. I created rising support lines based on the final low of the broad short-term consolidation and the first notable short-term bottom.

This line was broken, and some back-and-forth trading followed, but it was only about half of the previous correction in terms of price and time.

Then, we saw a sharp rally that then leveled off. And that was the top. The thing that confirmed the top was the visible breakdown below the rising support line right after stocks invalidated a tiny breakout to new highs. That’s what happened in February 2020, and that’s what seems to be taking place right now.

Back in 2020, the rally ended when the weekly RSI moved above 70 once again and when the S&P moved slightly to its new highs. While the history doesn’t have to repeat itself to the letter, if we see another small move higher – to new highs – that also takes the RSI above 70, please keep in mind that it’s not really a bullish development, but actually history forming its final rhyme. And the implications appear bearish for the precious metals sector, as it’s likely to be hit by the first wave of stock market declines – just like it was the case in 2008, 2020, and… 1929.

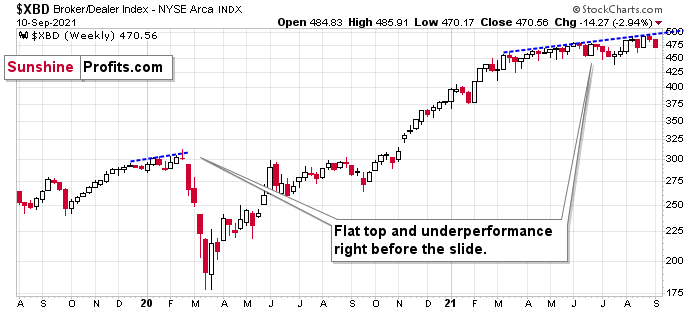

Furthermore, after the broker-dealer index (XBD) suffered another sharp decline last week, the index is still underperforming the S&P 500. As a result, the bearish implications remain intact.

Please see below:

For context, I wrote previously:

One of the canaries in the coal mine is the financial sector. It indicated the 2020 slide by forming a relatively flat top and underperforming other stocks. That preceded the 2008 slide as well. Well, we’re seeing the financials underperforming once again. While the S&P 500 moved to new highs last week, the financial sector is more or less where it was in early March, below its June highs.

The bottom line?

It seems that history is indeed forming its final rhyme. However, can we start the 3-3.5-month countdown now? Well, while timing remains uncertain, the main drivers of the stock market’s success are beginning to sputter. With inflation running hot and employment likely to surge in the coming months (once enhanced unemployment benefits expire), all of the boxes should be checked for the FED to taper its asset purchases. And with investors largely averse to a reduction in liquidity, the outcome could have a profound impact on both the general stock market and the PMs.

Keep in mind though: a decline in stocks is not required for the PMs to decline. But a break in the former could easily trigger a sell-off in the latter, and if history decides to rhyme again, silver and the miners will be the hardest hit.

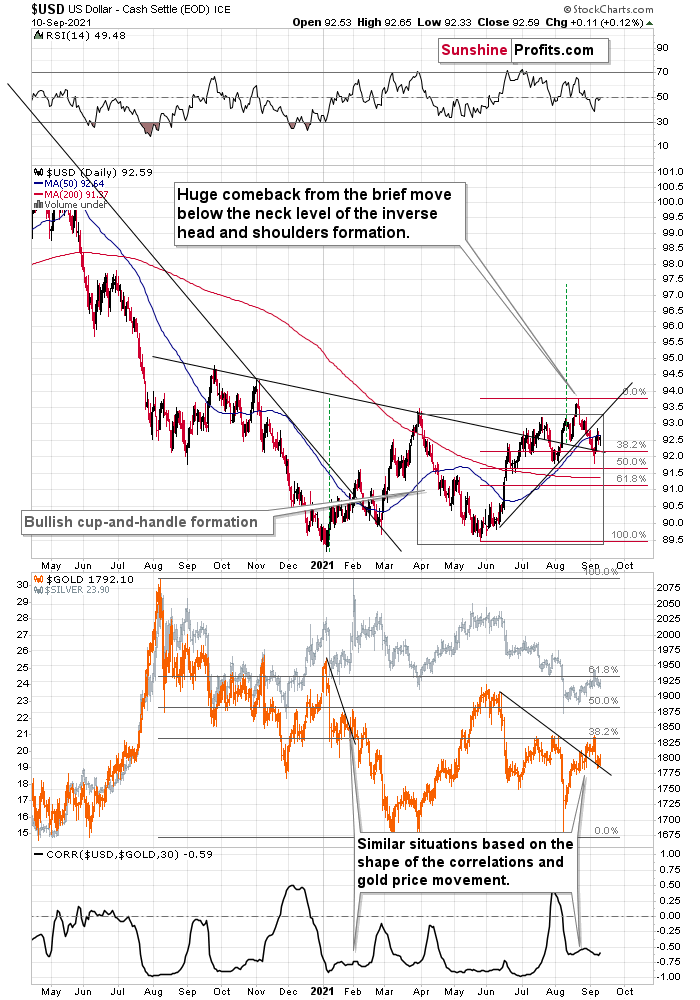

The USD Index (USDX)

While the USD Index was under fundamental fire in recent weeks, buyers eagerly hit the bid near the 38.2% Fibonacci retracement level. And after positive sentiment lifted the greenback back above the neckline of its inverse (bullish) head & shoulders pattern last week, the USDX’s medium-term outlook remains profoundly bullish.

Please see below:

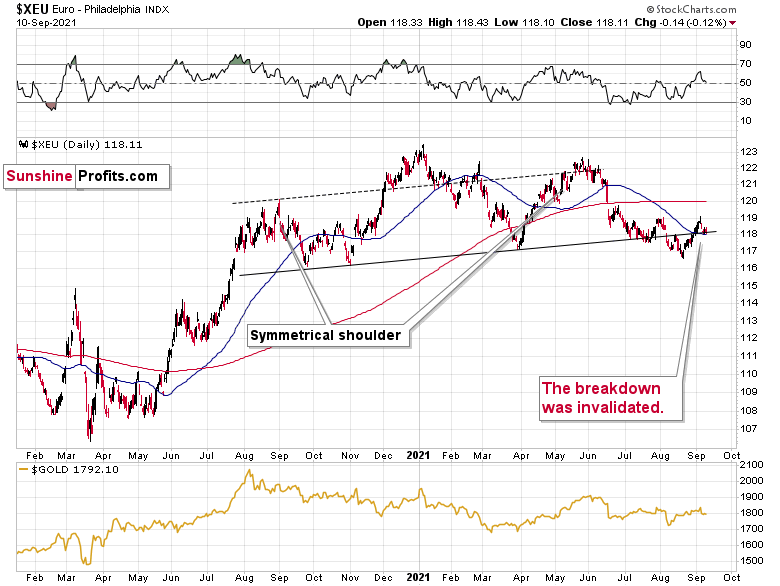

Likewise, with the USD Index’s technical strength also uplifting the Euro Index, the latter nearly retraced the entire surge above the neckline of its bearish H&S pattern. And while I have less conviction in the Euro Index’s next move relative to the USD Index, more likely than not, the Euro Index should break down once again and the bearish momentum should resume over the medium term.

Please see below:

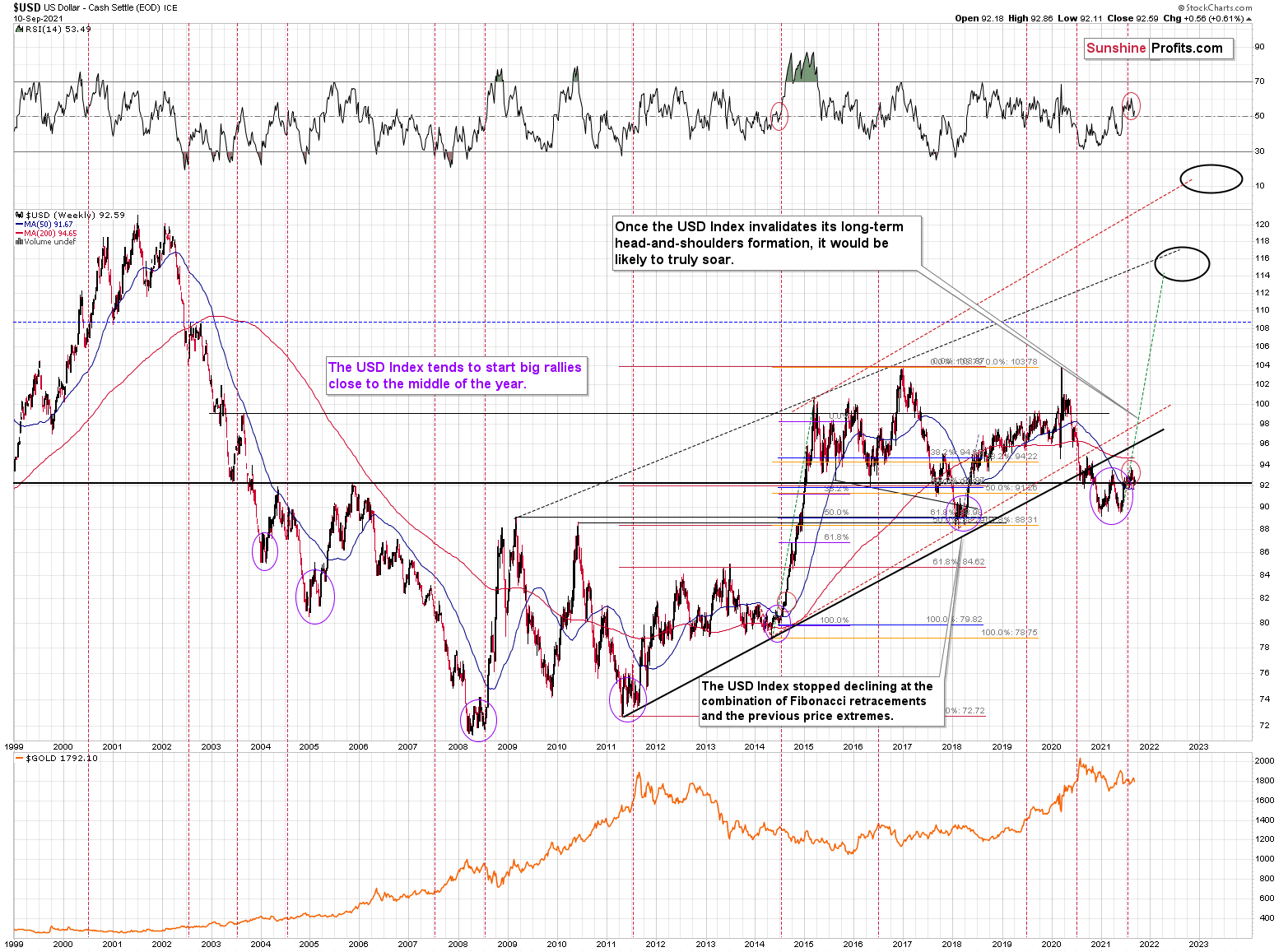

Adding to our confidence, the USD Index often sizzles in the summer sun and major USDX rallies often start during the middle of the year. Summertime spikes have been mainstays on the USD Index’s historical record and in 2004, 2005, 2008, 2011, 2014 and 2018 a retest of the lows (or close to them) occurred before the USD Index began its upward flights (which is exactly what’s happened this time around).

Furthermore, profound rallies (marked by the red vertical dashed lines below) followed in 2008, 2011 and 2014. With the current situation mirroring the latter, a small consolidation on the long-term chart is exactly what occurred before the USD Index surged in 2014. Likewise, the USD Index recently bottomed near its 50-week moving average; an identical development occurred in 2014. More importantly, though, with bottoms in the precious metals market often occurring when gold trades in unison with the USD Index (after ceasing to respond to the USD’s rallies with declines), we’re still far away from that milestone in terms of both price and duration.

Moreover, as the journey unfolds, the bullish signals from 2014 have resurfaced once again. For example, the USD Index’s RSI is hovering near a similar level (marked with red ellipses), and back then, a corrective downswing also occurred at the previous highs. More importantly, though, the short-term weakness was followed by a profound rally in 2014, and many technical and fundamental indicators signal that another reenactment could be forthcoming.

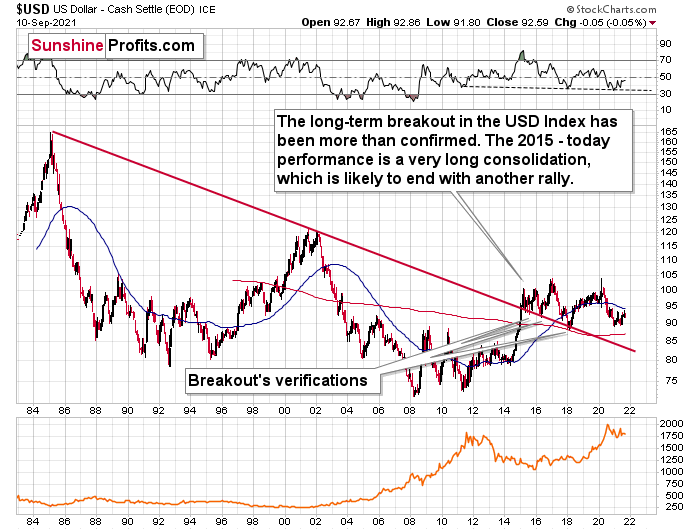

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or the ones of silver)here is likely not a good idea.

Continuing the theme, the eye in the sky doesn’t lie. And with the USDX’s long-term breakout clearly visible, the wind still remains at the greenback’s back.

Please see below:

The bottom line?

Once the momentum unfolds, ~94.5 is likely the USD Index’s first stop, ~98 is likely the next stop, and the USDX will likely exceed 100 at some point over the medium or long term. Keep in mind though: we’re not bullish on the greenback because of the U.S.’ absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone, the EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

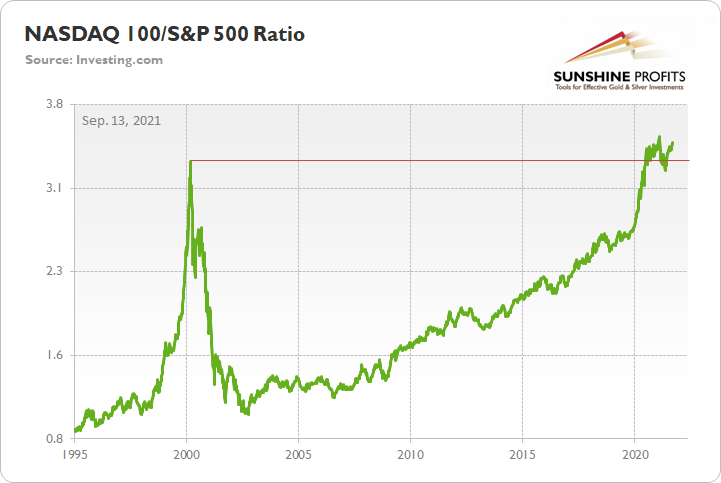

The NASDAQ 100

As a secondary catalyst, a material drawdown of the NASDAQ 100 could eventually rattle U.S. equities.

Please see below:

To that point, given the USDX’s strong negative correlation with the NASDAQ 100, a material reset could propel the greenback back to its March highs. Moreover, following a short-term consolidation, the USDX could even exceed those previous highs.

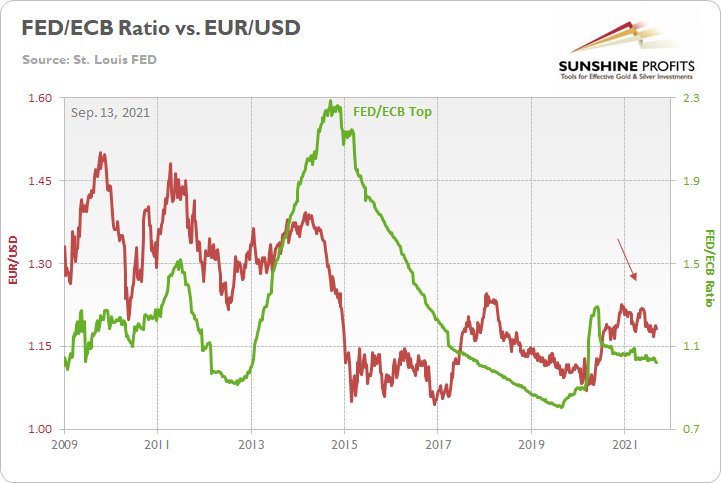

Furthermore, relative outprinting by the European Central Bank (ECB) remains of critical importance. Last week, the FED/ECB ratio decreased by 0.10%, while the EUR/USD decreased by 0.53%. And given that the ratio has declined by more than 20% since May 2020, the EUR/USD still has some catching up to do.

Please see below:

The key takeaway?

With the ECB injecting more liquidity to support an underperforming Eurozone economy, the FED/ECB ratio, as well as EUR/USD, should move lower over the medium term. More importantly, though, because the EUR/USD accounts for nearly 58% of the movement of the USD Index, EUR/USD pain will be the USDX’s gain.

In addition, the top in the FED/ECB total assets ratio preceded the slide in the EUR/USD less than a decade ago, and it seems to be preceding the next slide as well. If the USD Index was to repeat its 2014-2015 rally from the recent lows, it would rally to 114. This level is much more realistic than most market participants would agree on.

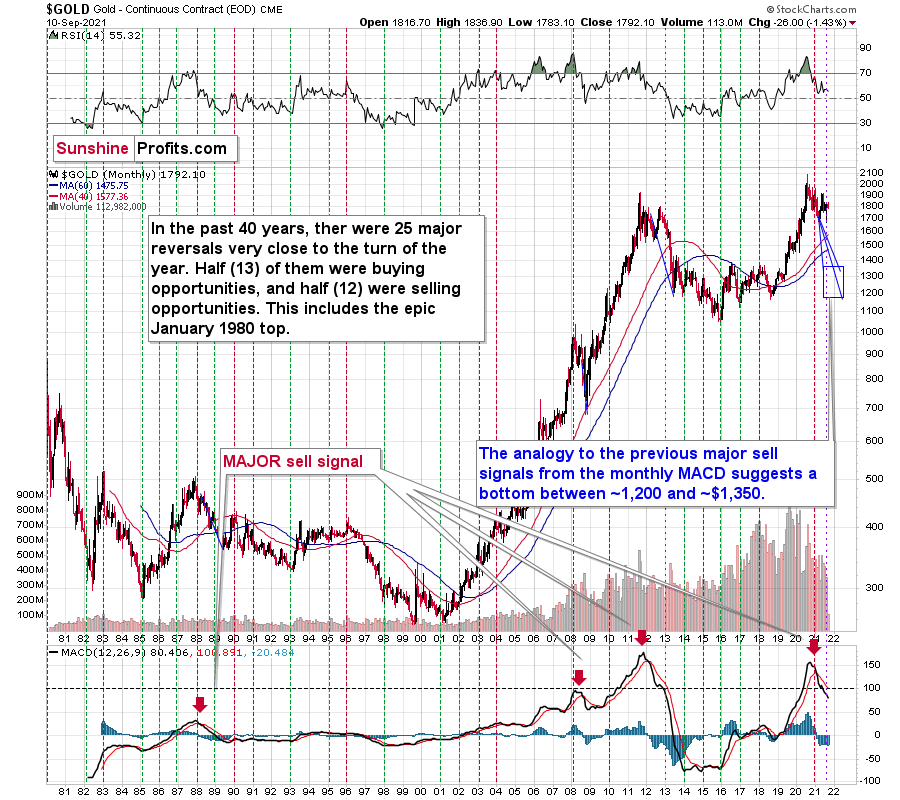

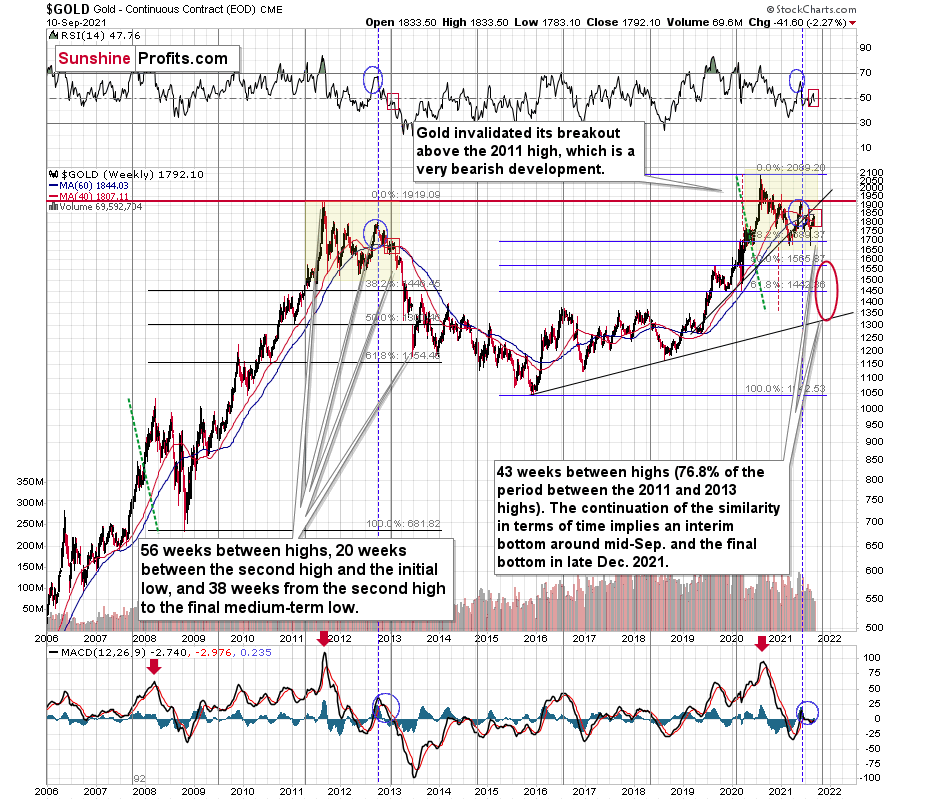

Very Long-Term Indications for Gold

With another month on the books and gold’s back-and-forth behavior whipsawing investors’ emotions, it’s important to remember that the long-term thesis remains intact: the MACD indicator still elicits a strong sell signal and gold’s monthly close has not changed the calculus. As a result, the PMs’ outlook still remains very bearish over the next few months.

To explain, I wrote previously:

With the month of June now on the books, the MACD indicator is still flashing red. And despite gold’s recent strength and all of the attention that has come with it, the MACD indicator has barely flinched. Furthermore, while a slight pause in the MACD indicator’s downtrend is clearly visible, an identical development also occurred in mid-2012. And what happened then? Well, if you analyze the chart below, you can see that gold’s joy quickly turned into sadness, and the yellow metal suffered a profound decline.

Even eerier, the MACD indicator’s recent pause has occurred at a level that also mirrors the analogue from 2012. And what happened back then? The yellow metal plunged by more than $600 before the bottom was finally reached. Likewise, the current position of the MACD indicator is also symmetrical to the 2008 top. And back then – during the Global Financial Crisis (GFC) – the yellow metal plunged by more than $334 from peak to trough (over 30%).

While short-term price movements often garner the most attention, it’s important to remember that gold’s long-term downtrend is also reminiscent of the second half of 2012. If you analyze the middle-right area of the chart below, you can see that the MACD indicator sounded the alarm in 2012. And while investors ignored the warning and gold moved higher, a profound plunge followed in 2013. Moreover, while the MACD indicator’s sell-signal was visible throughout gold’s entire journey – despite several ebbs and flows in the price action – the narrowing distance between the black and red lines actually preceded gold’s plunge. Thus, with gold’s swan song beginning to play at nearly the same level in 2013, the yellow metal’s recent strength is likely only the intermission.

The above-mentioned narrowing distance between the MACD lines can be seen clearly seen through the blue bars hovering around the 0 level on the indicator part of the chart. We now see the current blue bar move toward 0. We saw the same thing in the second half of 2012, which is when gold rallied for the last time before the huge slide.

Remember the huge gap between the U.S. 10-Year Treasury yield and the U.S. 10-Year breakeven inflation rate? The situation in the very long-term MACD indicator is yet another confirmation that what we saw recently is similar to what we saw before the huge 2012 – 2013 slide. We get the same confirmation from the gold to bonds ratio, and I’ll move to that a bit later.

Moreover, with the situation unfolding as it did in 2012, the recent pause in the MACD indicator has been followed by a continued move lower. And while we’re still in the early innings of the PMs’ likely slide, the analogue is, unsurprisingly, playing out as expected. To that point, despite last week’s rally, gold’s long-term MACD indicator hasn’t flinched. And with that, the yellow metal’s recent strength is largely immaterial from a long-term perspective.

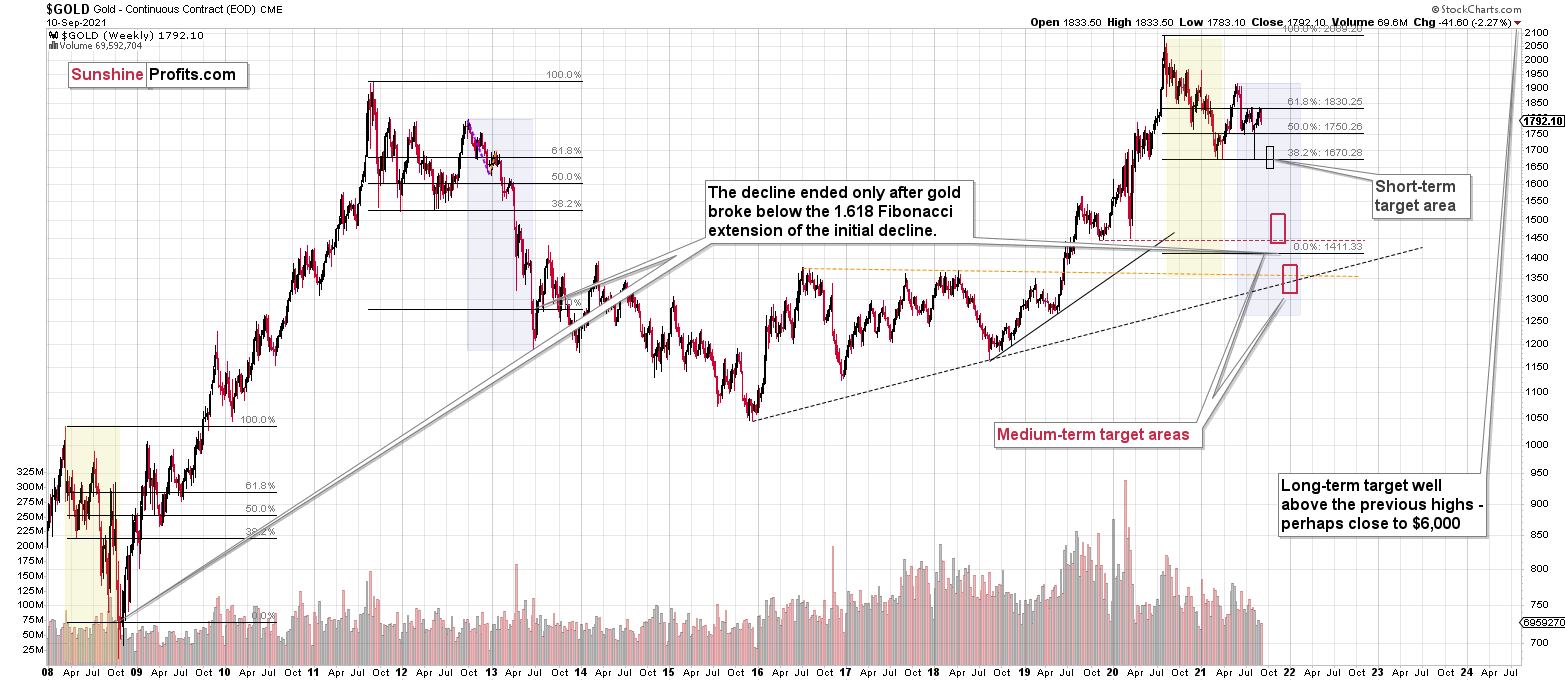

Based on gold’s previous performance after the major sell signals from the MACD indicator, one could now expect gold to bottom in the ~$1,200 to ~1,350 range. Given the price moves that we witnessed in 1988, 2008 and 2011, historical precedent implies gold forming a bottom in this range. However, due to the competing impact of several different variables, it’s possible that the yellow metal could receive the key support at a higher level.

Considering the reliability of the MACD indicator as a sell signal for major declines, the reading also implies that gold’s downtrend could last longer and be more severe than originally thought. As a result, $1,500 remains the most likely outcome, with $1,350 still in the cards.

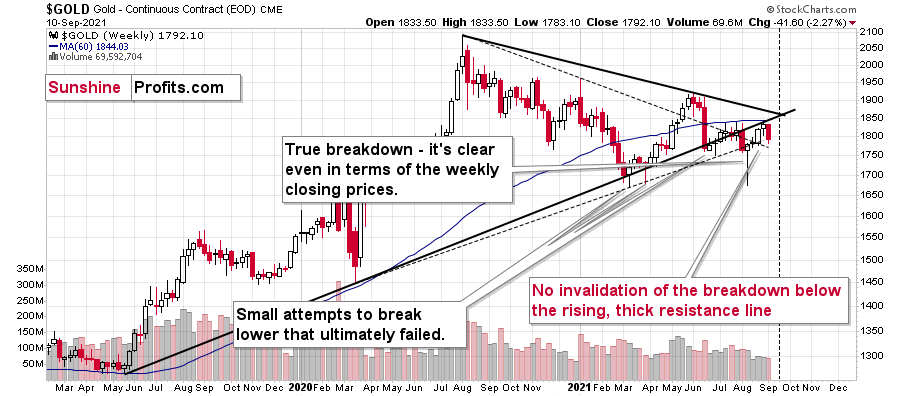

As further evidence, gold’s weekly chart highlights the ominous price action, and the yellow metal plunged by more than $40 last week after confronting its rising resistance line (the thick black line below). However, with another triangle-vertex-based reversal point scheduled within the next two weeks, we may witness a decline shortly, and then a short-term corrective upswing during the back half of September. However, the medium-term implications remain intact and lower lows should still materialize in the months ahead.

Please see below:

Likewise, gold’s weekly chart depicts the validity of the 2012 analogue. Whether it’s the RSI indicator (as visible on the chart below), the MACD indicator or the overall price action, the readings are profoundly similar, and the bearish implications remain intact.

To explain further, gold’s behavior is mirroring what we witnessed near the end of 2012. For example, following gold’s short-term corrective upswing nearly a decade ago, the yellow metal proceeded to fall off a cliff. And with the shape, the RSI, and the MACD indicators sending the same bearish signals that we witnessed back then (marked with the purple vertical lines and blue ellipses below), if it looks like a duck, swims like a duck and quacks like a duck, then it’s probably a duck.

Furthermore, the recent breakdown also aligns with gold’s self-similar pattern from 2011 to 2013. For example, since we’re right after the point marked with the vertical purple line below, gold should now decline to its previous lows, correct, and then continue its medium-term slide. Likewise, with the duration of the analogue aligning as well, it took 56 weeks for gold to make an initial high and then form a final high from 2011-2013. And since we’re in the midst of a 43-week (76.8% of the 2011-2013 duration) top-to-top pattern, an interim bottom should (assuming that the 76.8% proportion in terms of time remains in place) form in mid-September (which also aligns with gold’s triangle-vertex-based reversal point that was mentioned above) and the final bottom should present itself in mid or late December.

What’s more, gold’s RSI and its MACD indicator are behaving exactly as they did in early 2013. If you analyze the chart below, you can see that gold’s RSI hovered at 50, while the MACD indicator kept moving lower. Moreover, a similar cocktail is present today. On top of that, the yellow metal is currently sandwiched between its 40-week and 60-week moving averages, and the consolidation in 2013 (prior to the plunge) occurred in between these two key levels. As a result, further weakness likely lies ahead.

Please see below:

If you analyze the long-term chart above, you can see that gold has invalidated the breakout above its 2011 high. More importantly, though, with its rising support line (on the right side of the chart) also coinciding with the 61.8% Fibonacci retracement level and the 2019 and 2020 lows, ~$1,450 to $1,500 is the most prudent medium-term price target.

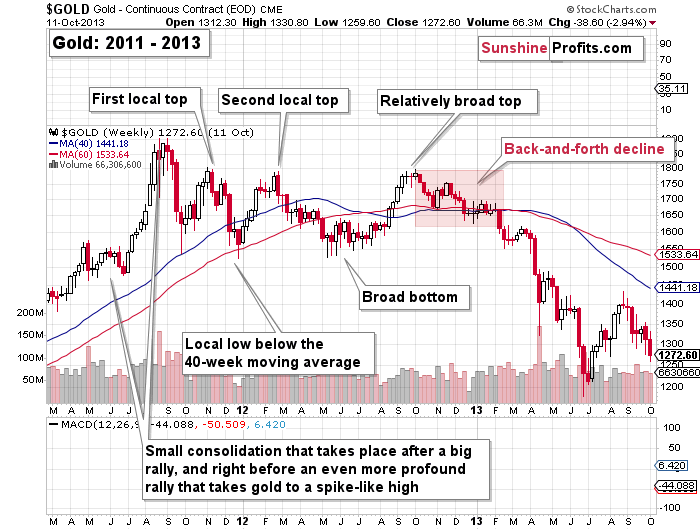

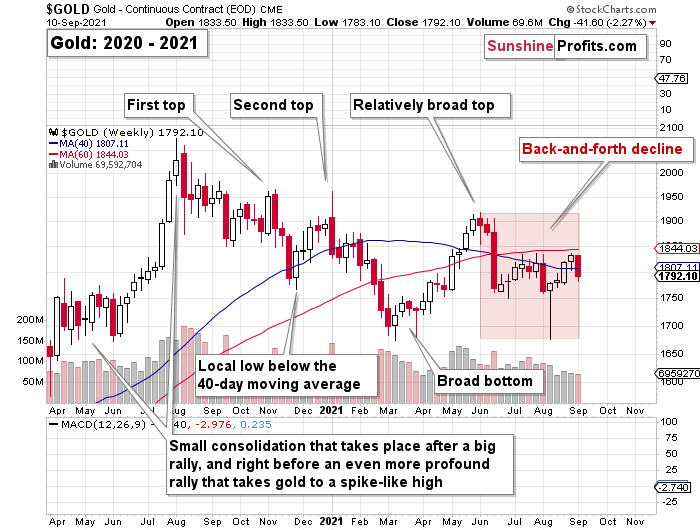

For an in-depth explanation of the self-similarity pattern, I wrote on Sep. 10:

The history repeats itself to a considerable degree, and you will soon see that the fact that gold was unable to hold its breakout above its 2011 highs was not accidental. It’s not a coincidence that gold is now about $300 lower than it was when it reached its August 2020 high, even though the USD Index is trading approximately at the same levels as it was trading in August 2020.

Even without zooming in on the chart above, you can clearly see that both areas marked in yellow are similar (please note that you can click on the chart to enlarge it).

Before discussing gold’s price moves, please note that the positions of the indicators (the RSI in the upper part of the chart, and the MACD in the lower part of the chart) are almost identical now and during the 2012-2013 decline. The areas marked with red and blue correspond to each other.

To make the analogy clearer, I’ll zoom in on them separately, using two charts below.

Both yellow areas start with a small consolidation that takes place after a big rally and right before an even more profound rally, which takes gold to a spike-like high.

Then gold declines. After the first drop and a quick rebound (in both cases), we get the first local top, where gold shows that it’s unable to reach the previous high, let alone break above it. We saw that in November 2011 and in early November 2020.

Then we see another decline in gold’s price. This time, it takes gold below its 40-week moving average (marked with red). Both bottoms form quickly, and the comeback is swift. That happened in December 2011 and in late November 2020.

Then we see another move higher – right to the most recent local high. That happened in February 2012 and in early January 2021.

And then we see another slide lower. In this case, gold bottoms close to the small consolidation that preceded the final (2011, 2020) top. The bottoms were broad and took place between May 2012 and July 2012, as well as between March and April 2021.

Then we get yet another rally that takes gold relatively close to the previous local tops (October 2012 and May 2021). In both cases, the shape of the top is broader than it was in the case of the previous two tops.

After that top, a huge decline in the price of gold begins, but it’s not clear at first, and many people still think it’s just a consolidation that will be followed by more rallies.

During this time (October 2012 – early 2013, and May 2021 – now) gold moves back and forth with lower lows and lower highs. Gold stocks underperform gold in a clear manner in both periods.

So far, the moves have been extremely similar, and if the history simply continues to be similar, we can estimate what’s ahead by extrapolating what we already saw in 2013. Based on this analogy, it seems that we’re about to see one final correction when gold once again moves to its previous (2021) lows, but this correction won’t be significant. It will be the final good-bye to the current trading range before gold truly slides – just as it did between April and June 2013.

Now, this is what the situation looks like right now, and the above outlook is based on much more than just the above (extraordinary, but still) single analogy. The remarkable self-similarity is present also in the HUI Index, and what’s likely to take place in the case of gold’s arch-nemesis – the USD Index – fully corresponds to the above-featured scenario. Silver’s performance confirms it as well. (By the way, have you noticed the fact that even though gold temporarily moved above its 2011 high, neither gold stocks nor silver managed to do the same thing? They were not even close. This should make even the most bullish precious metals investors concerned.)

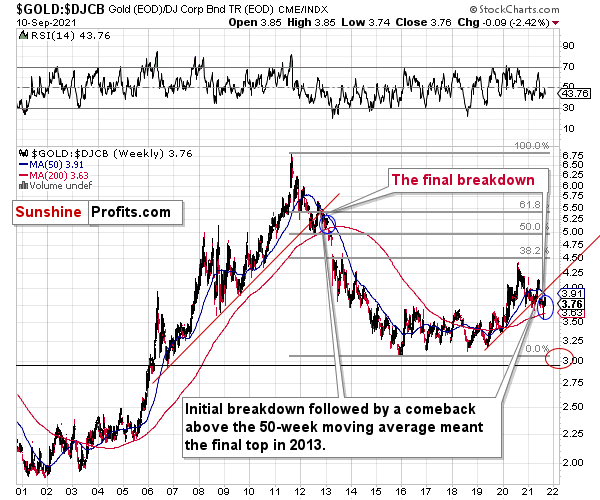

If that wasn’t enough, the gold/ Dow Jones Corporate Bond Index (Total Return) ratio has fallen below its rising support line. And when this occurred in 2012, the most violent part of gold’s decline was already underway.

Please see below:

To explain, if you analyze the middle of the chart above, you can see that the ratio recorded a countered rally, jumped back above its rising support line and 50-week moving average and then… collapsed. And with a similar pattern forming on the right side of the chart, the ratio is looking more and more like a widow-maker. Furthermore, when factoring in mining stocks’ bearish H&S patterns, the fundamental headwinds confronting gold and the strong likelihood of a medium-term swoon in the stock market, you can already hear the yellow metal’s death knell tolling in the distance.

Gold’s Short-and-Medium-Term Outlook

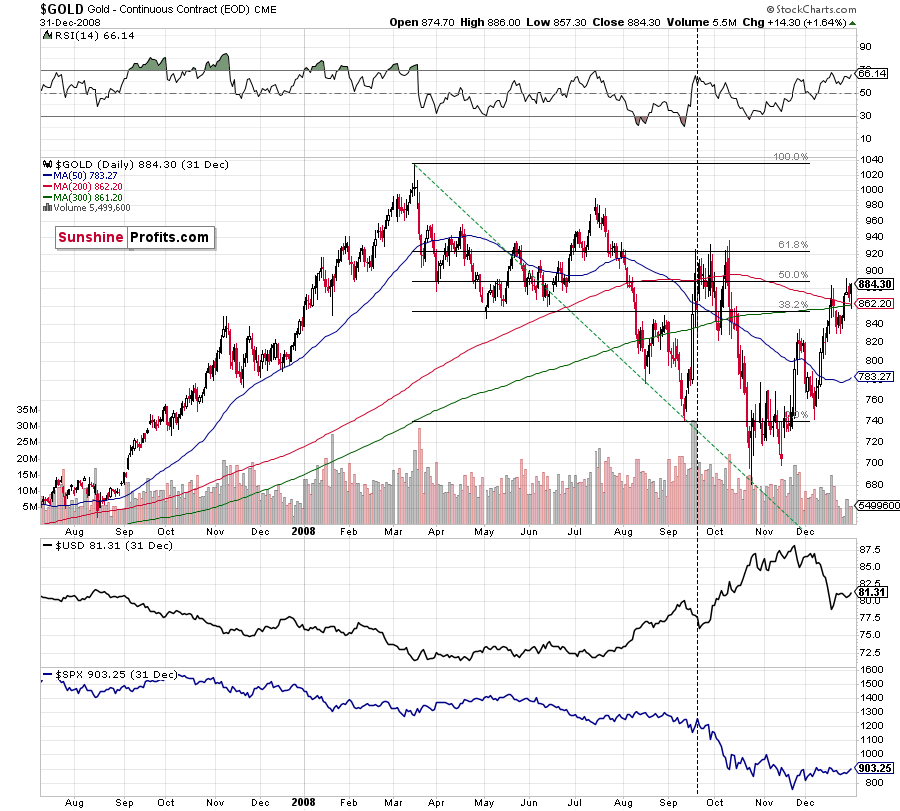

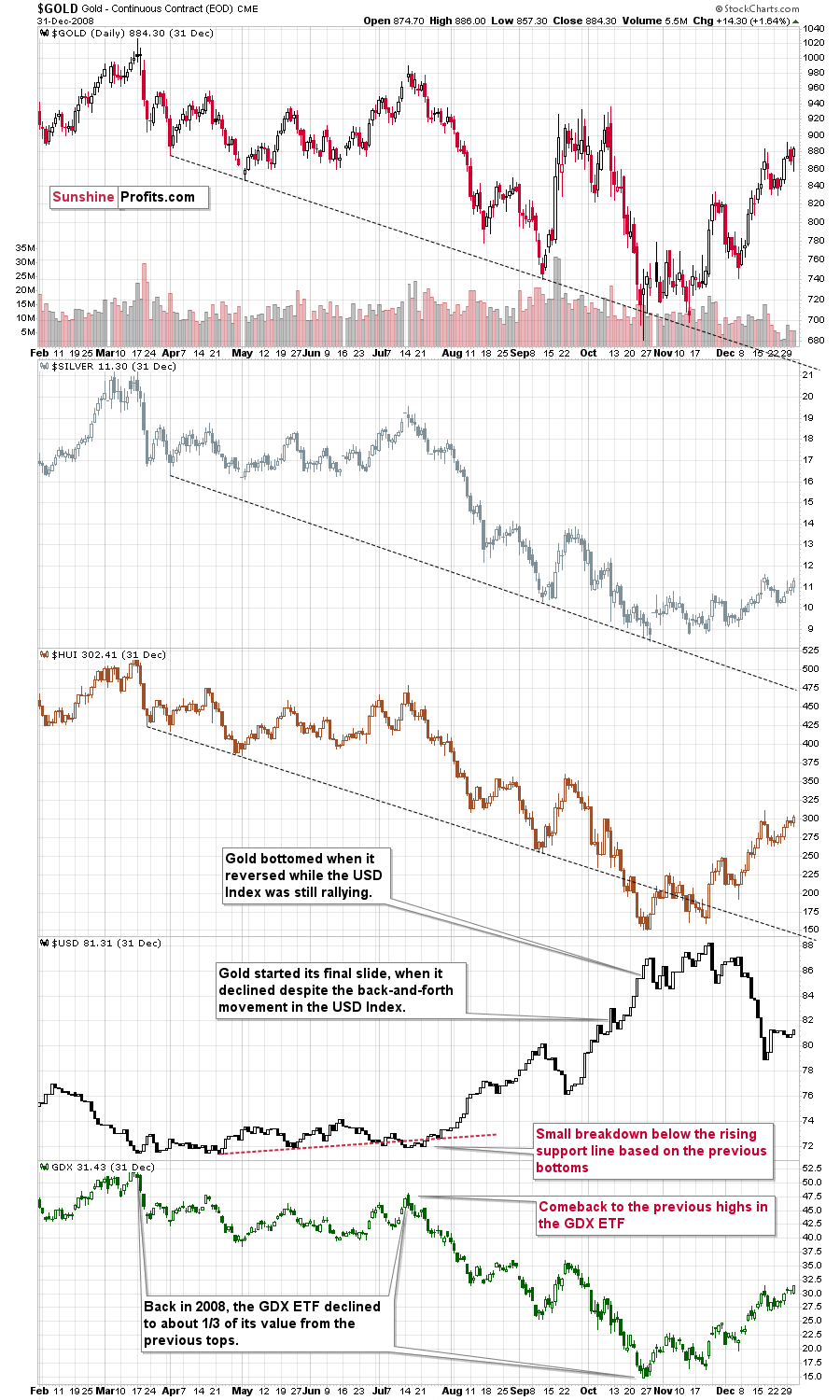

While 2013 provides us with the clearest roadmap of gold’s next move, the yellow metal is also following (to a lesser extent) its 2008 playbook. And why is this relevant? Well, with a profound drawdown of the S&P 500 present during the latter and not the former, if (once) the general stock market plunges, the pace of gold’s forthcoming decline could be expedited.

To explain, I wrote previously:

Back in 2008, gold corrected to 61.8% Fibonacci retracement, but it stopped rallying approximately when the USD Index started to rally, and the general stock market accelerated its decline.

Taking into consideration that the general stock market has probably just topped, and the USD Index is about to rally, then gold is likely to slide for the final time in the following weeks/months. Both above-mentioned markets support this bearish scenario and so do the self-similar patterns in terms of gold price itself.

What’s more, there are many other layers to the analogue from 2008 that are extremely important.

Please see below:

Please note (in the lower part of the above chart) that back then, the final huge slide in the mining stocks started when the GDX ETF moved back to its previous highs, while the USD Index moved a bit below its rising support line based on the previous tops. That’s exactly what happened recently as well. The final bottom in the GDX ETF formed about 3 months later at about 1/3 of its starting price.

The recent high was $40.13 and 1/3 thereof would be $13.38. While I don’t want to say that we will definitely see the GDX ETF as low as that, it’s not something that would be out of the ordinary, given the analogy to 2008. Now you see why the large bottoming target on the GDX ETF chart with the lower border in the $15s might actually be conservative… As always, I’ll keep you – my subscribers – updated.

“Ok, but what price level would be likely to trigger a bigger rebound during the next big slide?”

Well, the 76.4% Fibonacci retracement level (it’s visible as the 23.6% Fibonacci retracement level on the above chart as inverting the scale is used as a workaround) also coincides with gold’s April 2020 low. Taken together, an interim bottom could form in the ~$1,575 to $1,600 range.

For context, back in early March, the yellow metal continued to decline after reaching the 61.8% Fibonacci retracement (visible as 38.2% Fibonacci retracement) level, while, in contrast, the miners began to consolidate. Gold finally bottomed slightly below the retracement – at its previous lows. This time around, we might witness a similar event. And while the story plays out, the miners’ relative strength should signal the end of the slide (perhaps with gold close to 1,600), while gold will likely garner support sometime thereafter (at $1,575 – $1,580 or so).

Remember though: this is only an interim target. Over the medium term, the yellow metal will likely form a lasting bottom in the ~$1,350 to $1,500 range.

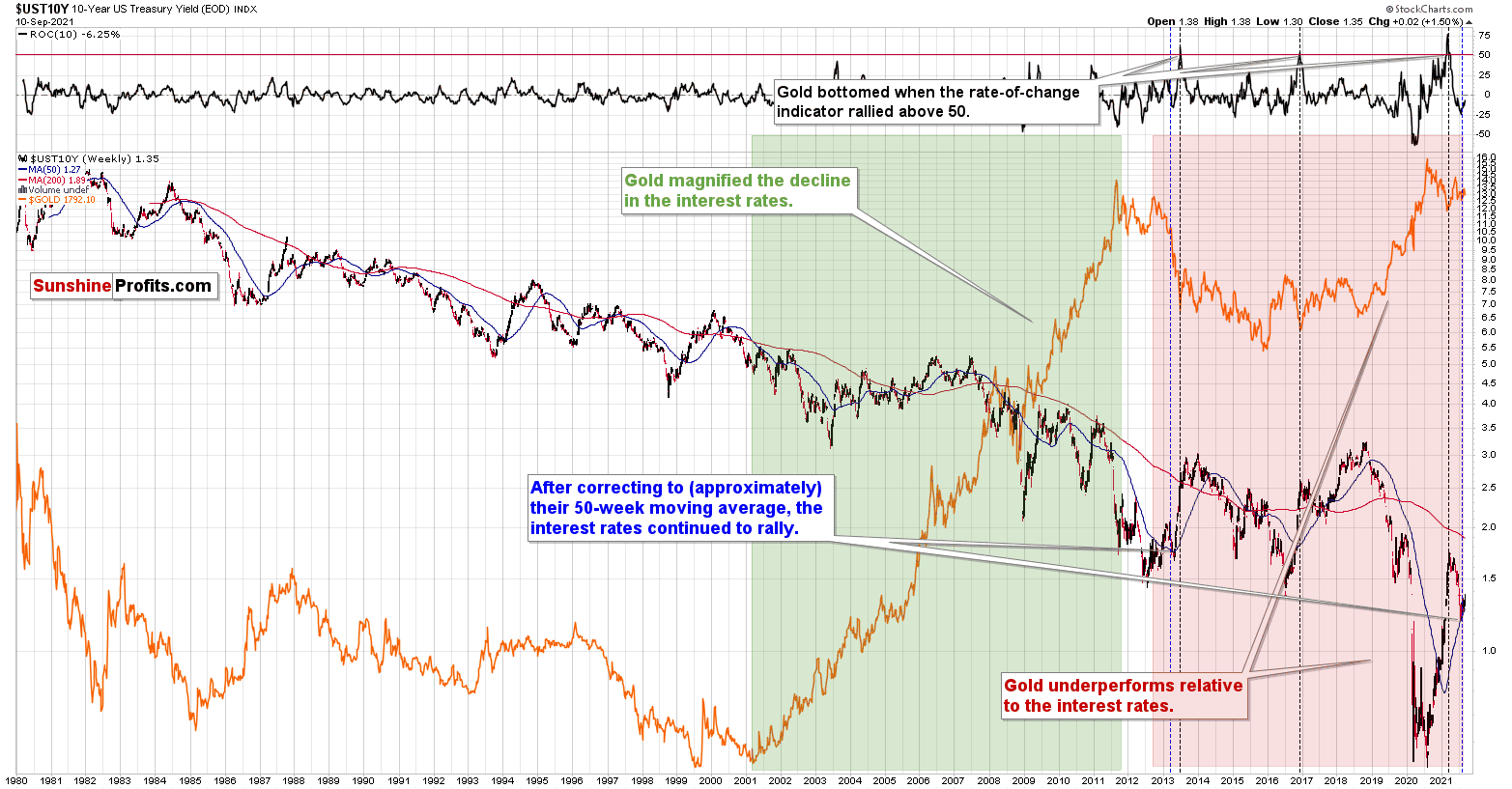

Finally, adding credibility to the analogy from 2013, long-term interest rates helped push gold off the cliff. And with the U.S. 10-Year Treasury yield bouncing off of its 50-week moving average, a similar development in 2013 (the red shaded area on the right side of the chart below) preceded the most violent part of gold’s medium-term decline. As a result, whether the S&P 500 leads the move lower (like in 2008) or further momentum persists in long-term Treasury yields (like in 2013), gold confronts a challenging environment over the next few months.

The Gold Miners

With Fed Chairman Jerome Powell sticking to his dovish guns and U.S. nonfarm payrolls elongating the central bank’s perceived taper timeline, gold, silver, and mining stocks were extremely happy campers. However, with event-driven rallies much more semblance than substance, I warned on Sep. 7 that the rollercoaster of emotions would likely end in tears.

I wrote:

With the 2013 analogue leading the gold miners down an ominous path, the HUI Index and the GDX ETF have rallied by roughly 8% off their recent lows. However, identical developments occurred in 2013, and neither bout of optimism invalided their bearish medium-term outlooks.

And after the GDX ETF and the GDXJ ETF (our profitable short position) plunged by 5.35% and 6.98% respectively last week, summertime sadness confronted the precious metals. Likewise, with more melancholy moves likely to materialize over the medium term, gold, silver, and mining stocks should hit lower lows during the autumn months.

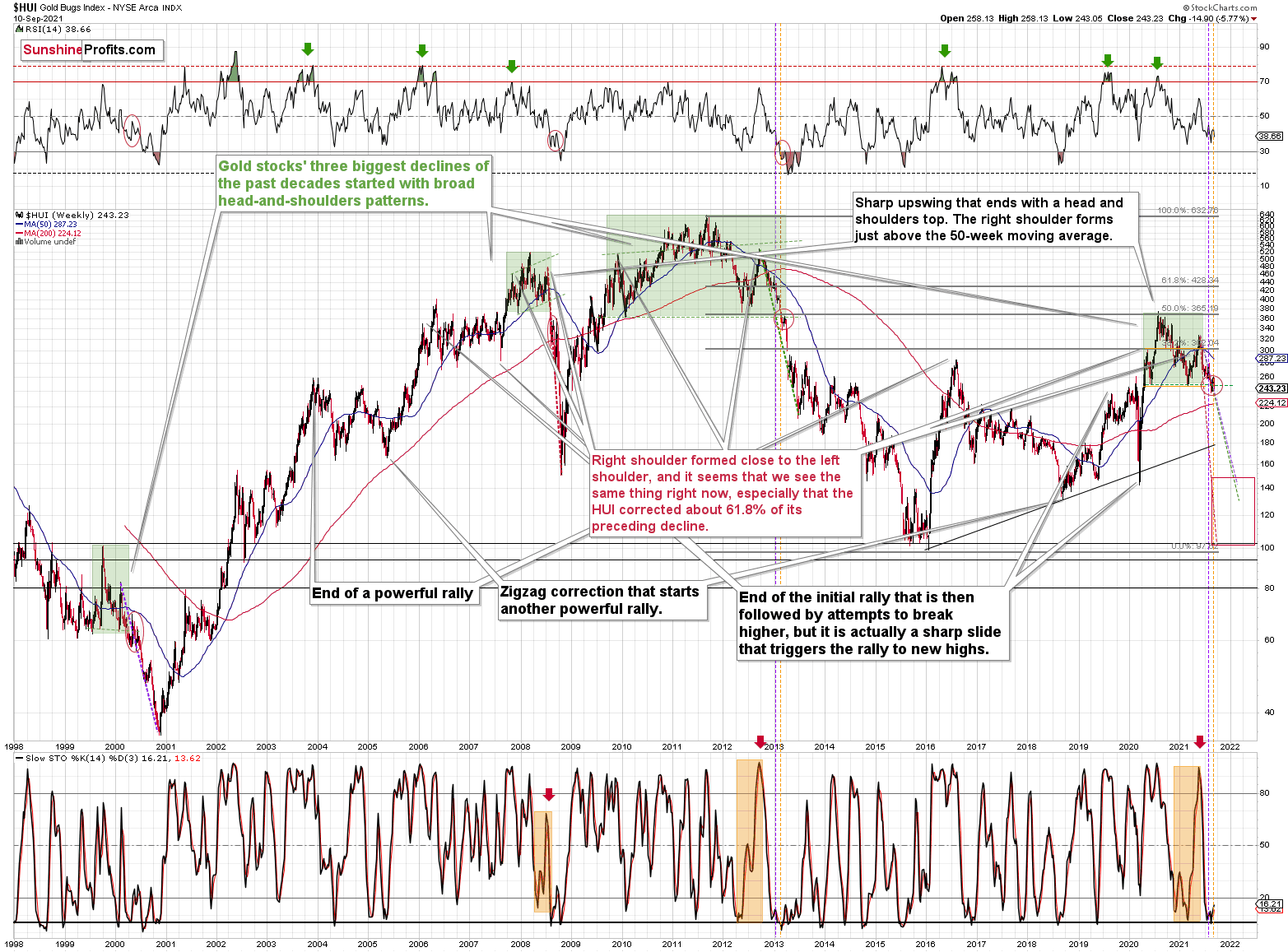

To explain, the HUI Index also plunged by nearly 6% last week, and the reversal of the previous corrective upswing mirrors its behavior from 2013. In addition, with its stochastic oscillator and its RSI (Relative Strength Index) also a spitting image, an ominous re-enactment of 2013 implies significantly lower prices over the medium term.

Please see below:

What’s more, the vertical, dashed lines above demonstrate how the HUI Index is following its 2012-2013 playbook. For example, after a slight buy signal from the stochastic indicator in 2012, the short-term pause was followed by another sharp drawdown. For context, after the HUI Index recorded a short-term buy signal in late 2012 – when the index’s stochastic indicator was already below the 20 level (around 10) and the index was in the process of forming the right shoulder of a huge, medium-term head-and-shoulders pattern – the index moved slightly higher, consolidated, and then fell off a cliff. Thus, the HUI Index is quite likely to decline to its 200-week moving average (or so) before pausing and recording a corrective upswing. That’s close to the 220 level. Thereafter, the index will likely continue its bearish journey and record a final medium-term low some time in December.

Furthermore, I warned previously that the miners’ drastic underperformance of gold was an extremely bearish sign. There were several weeks when gold rallied visibly and the HUI Index actually declined modestly. And now, gold stocks are trading close to their previous 2021 lows, while gold is almost right in the middle between its yearly high and its yearly low.

And why is this so important? Well, because the bearish implications of gold stocks’ extreme underperformance still remain intact.

Let’s keep in mind that the drastic underperformance of the HUI Index also preceded the bloodbath in 2008 as well as in 2012 and 2013. To explain, right before the huge slide in late September and early October 2008, gold was still moving to new intraday highs; the HUI Index was ignoring that, and then it declined despite gold’s rally. However, it was also the case that the general stock market suffered materially. If stocks didn’t decline so profoundly back then, gold stocks’ underperformance relative to gold would have likely been present but more moderate.

Nonetheless, broad head & shoulders patterns have often been precursors to monumental collapses. For example, when the HUI Index retraced a bit more than 61.8% of its downswing in 2008 and in between 50% and 61.8% of its downswing in 2012 before eventually rolling over, in both (2008 and 2012) cases, the final top – the right shoulder – formed close to the price where the left shoulder topped. And in early 2020, the left shoulder topped at 303.02. Thus, three of the biggest declines in the gold mining stocks (I’m using the HUI Index as a proxy here) all started with broad, multi-month head-and-shoulders patterns. And in all three cases, the size of the declines exceeded the size of the head of the pattern. As a reminder, the HUI Index recently completed the same formation.

Yes, the HUI Index moved back below the previous lows and the neck level of the formation, which – at face value – means that the formation was invalidated, but we saw a similar “invalidation” in 2000 and in 2013. And then, the decline followed anyway. Consequently, I don’t think that taking the recent move higher at its face value is appropriate. It seems to me that the analogies to the very similar situation from the past are more important.

As a result, we’re confronted with two bearish scenarios:

- If things develop as they did in 2000 and 2012-2013, gold stocks are likely to bottom close to their early-2020 low.

- If things develop like in 2008 (which might be the case, given the extremely high participation of the investment public in the stock market and other markets), gold stocks could re-test (or break slightly below) their 2016 low.

In both cases, the forecast for silver, gold, and mining stocks is extremely bearish for the next several months.

For even more confirmation, let’s compare the behavior of the GDX ETF and the GDXJ ETF. Regarding the former, investors rejected the senior miners (GDX) attempt to recapture their 50-day moving average and the failure was perfectly in tune with what I wrote on Sep. 7:

Large spikes in daily volume are often bearish, not bullish. To explain, three of the last four volume outliers preceded an immediate top (or near) for the GDX ETF, while the one that preceded the late July rally was soon followed by the GDX ETF’s 2020 peak. Thus, when investors go ‘all in,’ material declines often follow. And with that, spike-high volume during the GDX ETF’s upswings often presents us with great shorting opportunities.

Please see below:

Even more bearish, not only did last week’s plunge usher the GDX ETF back below the neckline of its bearish head & shoulders pattern (the horizontal red line on the right side of the chart above), but the sell signal from the stochastic oscillator remains firmly intact. As a result, ominous clouds continue to form.

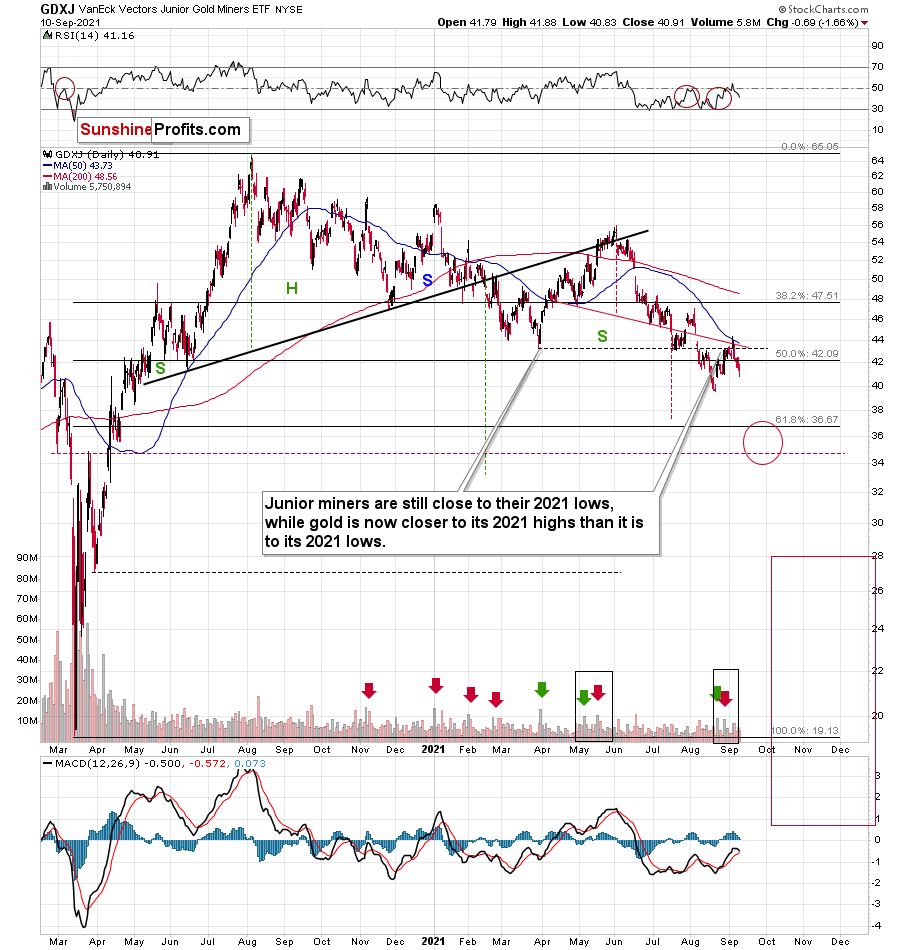

And with the GDXJ ETF stuck in a similar rut, I wrote on Sep. 7 that overzealous investors would likely end the week disappointed:

With the current move quite similar to the corrective upswing recorded in mid-May, the springtime bounce was also followed by a sharp drawdown. As a result, the GDXJ ETF could be near its precipice, as its 50-day moving average is right ahead. And with the key level now acting as resistance, investors’ rejection on Sep. 3 could indicate that the top is already here.

Moreover, while the junior miners followed the roadmap to perfection, the GDXJ ETF still remains ripe for lower lows over the medium term.

Please see below:

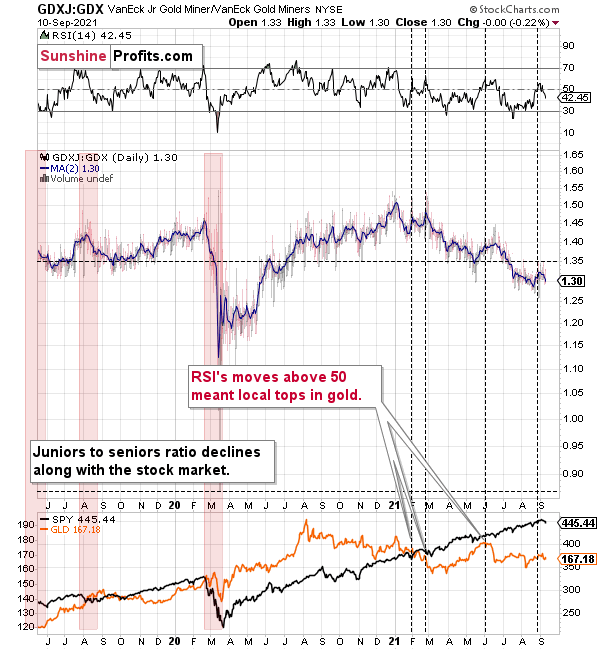

Finally, while I’ve been warning for months that the GDXJ/GDX ratio was destined for devaluation, after another sharp move lower last week, the downtrend remains intact. For example, when the ratio’s RSI jumped above 50 three times in 2021, it coincided with short-term peaks in gold. Second, the trend in the ratio this year has been clearly down, and there’s no sign of a reversal, especially when you consider that the ratio broke below its 2019 support (which served as resistance in mid-2020). When the same thing happened in 2020, the ratio then spiked even below 1.

More importantly, though, with the relative weakness likely to persist, the profits from our short position in the GDXJ ETF should accelerate during the autumn months.

The bottom line?

If the ratio is likely to continue its decline, then on a short-term basis we can expect it to decline to 1.27 or so. If the general stock market plunges, the ratio could move even lower, but let’s assume that stocks decline moderately (just as they did in the last couple of days) or that they do nothing or rally slightly. They’ve done all the above recently, so it’s natural to expect that this will be the case. Consequently, the trend in the GDXJ to GDX ratio would also be likely to continue, and thus expecting a move to about 1.26 - 1.27 seems rational.

If the GDX is about to decline to approximately $28 before correcting, then we might expect the GDXJ to decline to about $28 x 1.27 = $35.56 or $28 x 1.26 = $35.28. In other words, $28 in the GDX is likely to correspond to about $35 in the GDXJ.

Is there any technical support around $35 that would be likely to stop the decline? Yes. It’s provided by the late-Feb. 2020 low ($34.70) and the late-March high ($34.84). There’s also the late-April low at $35.63. Conservatively, I’m going to place the profit-take level just above the latter.

Consequently, it seems that expecting the GDXJ to decline to about $35 is justified from the technical point of view as well.

In conclusion, gold, silver, and mining stocks went from delighted to despondent, as the technical downpour continues to rain on their parade. And while a major buying opportunity may present itself in December, the next few months will likely elicit more tears than cheers. As a result, while we eagerly await the opportunity to go long the precious metals and participate in their secular uptrends, bearish breakdowns, stock market struggles, and the Fed’s taper timeline will likely dampen their moods over the medium term.

For more context on the GDXJ/GDX ratio, I wrote previously:

The GDXJ ETF remains a significant underperformer of the GDX ETF. Despite sanguine sentiment and a strong stock market creating the perfect backdrop for the junior miners, the GDXJ ETF hasn’t lived up to the hype. To that point, it’s important to remember that small fakeouts in the juniors to seniors ratio often occur right before medium-term tops. Why? Because juniors tend to catch up with seniors, somewhat similarly to silver.

In addition, once one realizes that GDXJ is more correlated with the general stock market than GDX is, GDXJ should be showing strength here, and it isn’t. If stocks don’t decline, GDXJ is likely to underperform by just a bit, but when (not if) stocks slide, GDXJ is likely to plunge visibly more than GDX.

Expanding on that point, the GDXJ/GDX ratio has been declining since the beginning of the year, which is remarkable because the general stock market hasn’t plunged yet. However, if the S&P 500 proceeds to decline, the junior miners will likely underperform the senior miners. As a result, the GDXJ ETF has a lot more room to fall than the GDX ETF.

Why haven’t the juniors been soaring relative to senior mining stocks? What makes them so special (and weak) right now? In my opinion, it’s the fact that we now – unlike at any other time in the past – have an asset class that seems similarly appealing to the investment public. Not to everyone, but to some. And this “some” is enough for juniors to underperform.

Instead of speculating on an individual junior miner making a killing after striking gold or silver in some extremely rich deposit, it’s now easier than ever to get the same kind of thrill by buying… an altcoin (like Dogecoin or something else). In fact, people themselves can engage in “mining” these coins. And just like bitcoin seems similar to gold to many (especially the younger generation) investors, altcoins might serve as the “junior mining stocks” of the electronic future. At least they might be perceived as such by some.

Consequently, a part of the demand for juniors was not based on the “sympathy” toward the precious metals market, but rather on the emotional thrill (striking gold) combined with the anti-establishment tendencies (gold and silver are the anti- metals, but cryptocurrencies are anti-establishment in their own way). And since everyone and their brother seem to be talking about how much this or that altcoin has gained recently, it’s easy to see why some people jumped on that bandwagon instead of investing in junior miners.

This tendency is not likely to go away in the near term, so it seems that we have yet another reason to think that the GDXJ ETF is going to move much lower in the following months – declining more than the GDX ETF. The above + gold’s decline + stocks’ decline is truly an extremely bearish combination, in my view.

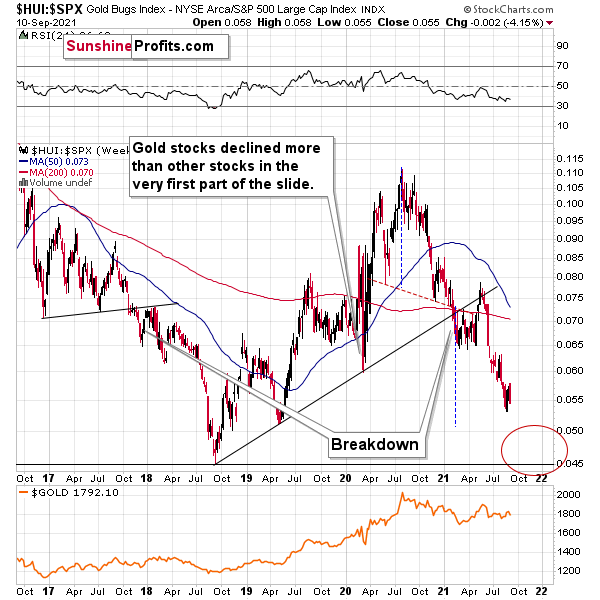

In addition, I warned on Jun. 1 that the HUI Index/S&P 500 ratio invalidation of the breakdown below its rising support line (which became resistance) would be short-lived.

I wrote:

[The invalidation] doesn’t outweigh the myriad of other indicators – both technical and fundamental – that signal further weakness. In other words, the ratio should move back below its rising support/resistance line shortly.

And going from “maybe” to “likely” to “happened” once again, the HUI Index/S&P 500 ratio is now back in the bearish zone. Thus, the medium-term implications remain extremely bearish.

Please see below:

On top of that, the countertrend upswing actually mirrored the behavior that we witnessed in 2018. If you analyze the left side of the chart, you can see that the ratio flirted with its rising support line before eventually rolling over. And with the current price action looking eerily similar, the ratio’s final act could be just as painful.

For more context:

When the ratio presented on the above chart above is rising, it means that the HUI Index is outperforming the S&P 500. When the line above is falling, it means that the S&P 500 is outperforming the HUI Index.

The target for the ratio based on this formation is at about 0.05 (slightly above it). Consequently, if the S&P 500 doesn’t decline, the ratio at 0.05 would imply the HUI Index at about 196. However, if the S&P 500 declined to about 3,200 or so (its late-2020 lows) and the ratio moved to about 0.05, it would imply the HUI Index at about 160 – very close to its 2020 lows.

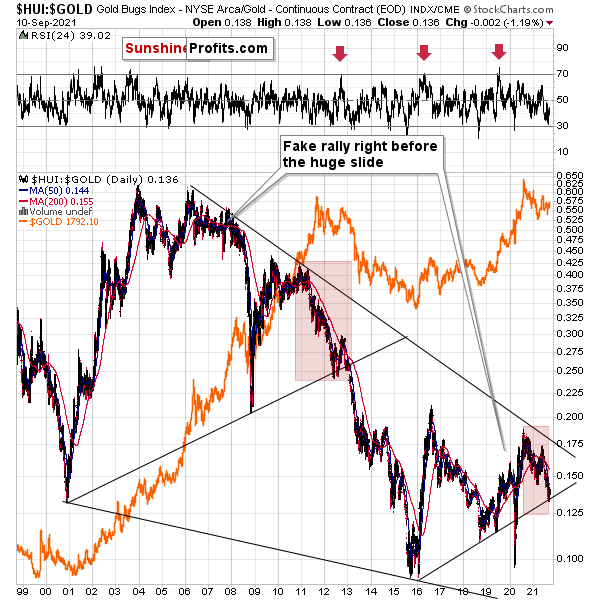

Let’s take a look at another important ratio – the one featuring gold stocks performance relative to gold.

The ratio moved to its rising long-term support line and it’s currently trading right at it. That’s exactly what we saw also in early 2013, right before the ratio plunged, taking both: gold, and gold stocks with it. That’s yet another similarly to what happened in early 2013 that further confirms it. It truly seems that we are on the verge of another powerful slide in the precious metals sector.

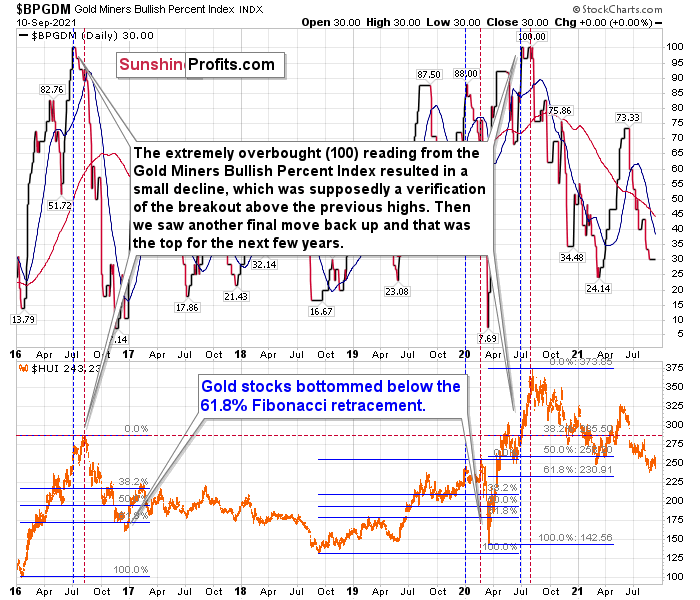

As another reliable indicator (in addition to the myriads of signals coming not only from mining stocks, but from gold, silver, USD Index, stocks, their ratios, and many fundamental observations) the Gold Miners Bullish Percent Index ($BPGDM) isn’t at levels that trigger a major reversal. The Index is now at 30. However, far from a medium-term bottom, the latest reading is still more than 20 points above the 2016 and 2020 lows.

Back in 2016 (after the top), and in March 2020, the buying opportunity didn’t present itself until the $BPGDM was below 10.

Thus, with the sentiment still relatively elevated, it will take more negativity for the index to find the true bottom.

The excessive bullishness was present at the 2016 top as well, and it didn’t cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide, and this additional upswing had caused the $BPGDM to move up once again for a few days. It then declined once again. We saw something similar also in the middle of 2020. In this case, the move up took the index once again to the 100 level, while in 2016 this wasn’t the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top and right before the big decline. Based on the decline from above 350 to below 280, we know that a significant decline is definitely taking place.

But has it already run its course?

Well, in 2016 and early 2020, the HUI Index continued to move lower until it declined below the 61.8% Fibonacci retracement level. The emphasis goes on “below” as this retracement might not trigger the final bottom. Case in point: back in 2020, the HUI Index undershot the 61.8% Fibonacci retracement level and gave back nearly all of its prior rally. And using the 2016 and 2020 analogues as anchors, this time around, the HUI Index is likely to decline below 231. In addition, if the current decline is more similar to the 2020 one, the HUI Index could move to 150 or so, especially if it coincides with a significant drawdown of U.S. equities.

With all of that said: how will we know when a medium-term buying opportunity presents itself?

I view price target levels as guidelines and the same goes for the Gold Miners Bullish Percent Index (below 10), but the final confirmation will likely be gold’s strength against the ongoing USDX rally. At many vital bottoms in gold, that’s exactly what happened, including the March bottom.

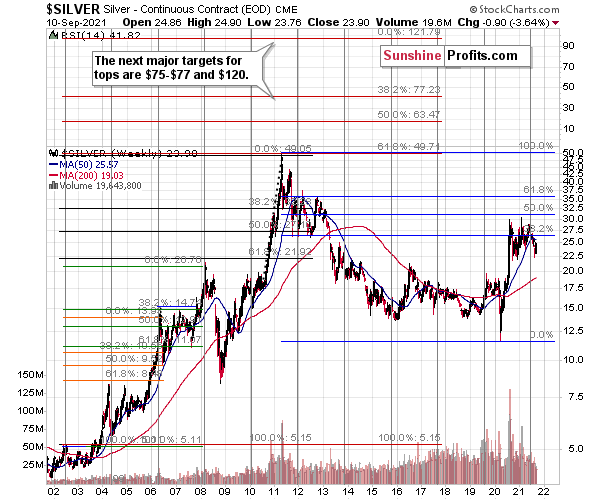

Silver

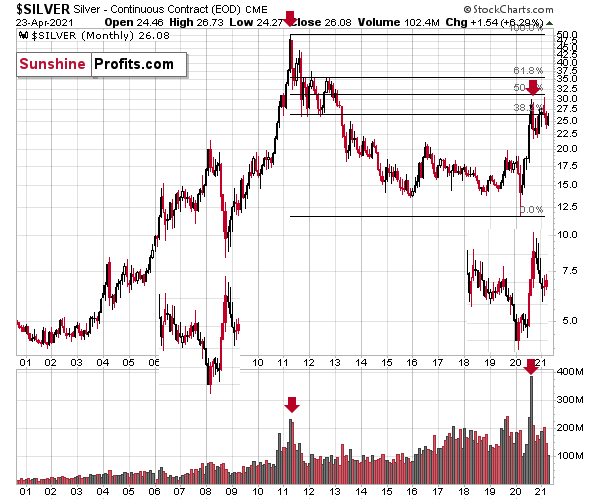

With silver’s long-term cycle implying a surge above $75 (and even $100) over the next several years, the white metal’s secular uptrend remains intact. However, with an epic collapse likely to precede the forthcoming Renaissance, volatility presents us with ample opportunities.

Case in point: silver cycles last roughly two years and the turning points culminate with extreme volatility in both directions. Sometimes ferocious rallies follow, and other times the white metal falls off a cliff. In the here and now, with silver approaching the end of its current cycle, a supreme climax could be around the corner. Moreover, when we combine the myriad of technical and fundamental indicators signaling the same outcome, the white metal could get cut in half over the next few months.

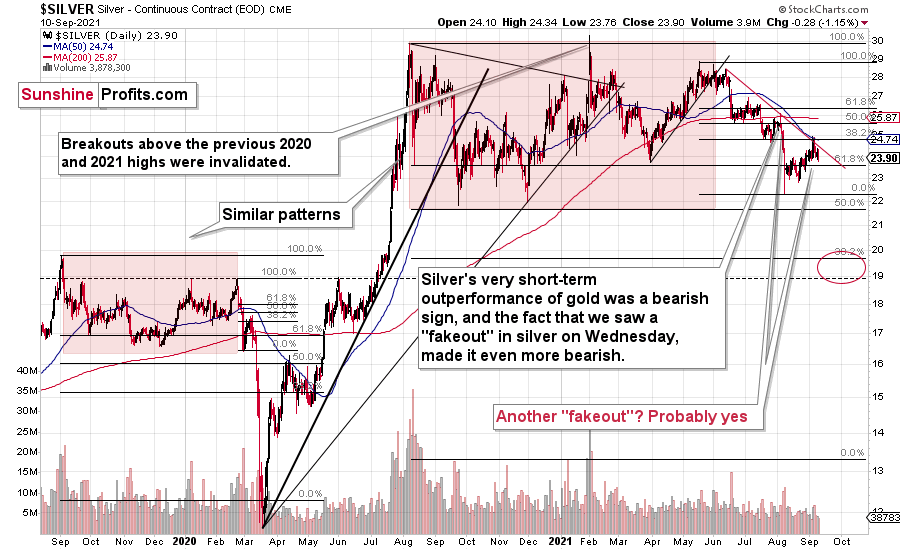

Please see below:

As for the short term, analyzing silver’s historical fakeouts has proven quite valuable. For example, while many investors chase the white metal’s upward momentum only to find little light at the end of the tunnel, I’ve warned on several occasions that falling for the seduction is an extremely costly mistake.

Moreover, while I warned on Sep. 7 that silver now faces resistance from a double top, its declining resistance line (the red line below) and the 38.2% Fibonacci retracement level, it didn’t take long for the white metal to fulfill the bearish prophecy. And with that, last week’s sharp reversal once again demonstrates the fallibility of sliver’s famous fakeouts.

Please see below:

To that point, silver should challenge the $19 to $20 range in the coming months before a corrective upswing ensues. For context, the range coincides with the 61.8% Fibonacci retracement level and the September 2019 highs. To clarify: in my view, silver is very likely to soar in the following years, but timing matters, and ignoring cycles, trends, and technical patterns is what could make people lose a lot of capital.

Also, please note that gold is the canary in the coal mine, and the yellow metal’s behavior will likely signal the shift in silver’s sentiment.

Now, this is extremely important because if the GDXJ ETF plunges and silver doesn’t, we may shift our short position to the white metal. However, if the opportunity presents itself, we will keep you, our subscribers, updated.

For more context on silver’s self-similarity patterns, I wrote previously:

If you analyze the left side of the chart above, you can see that silver moved back and forth before breaking toward its September highs. However, after failing to complete the milestone, the white metal eventually collapsed. As a result, with the pattern on the right side of the chart eerily similar, investors’ optimism has occurred at what’s likely the worst possible time.

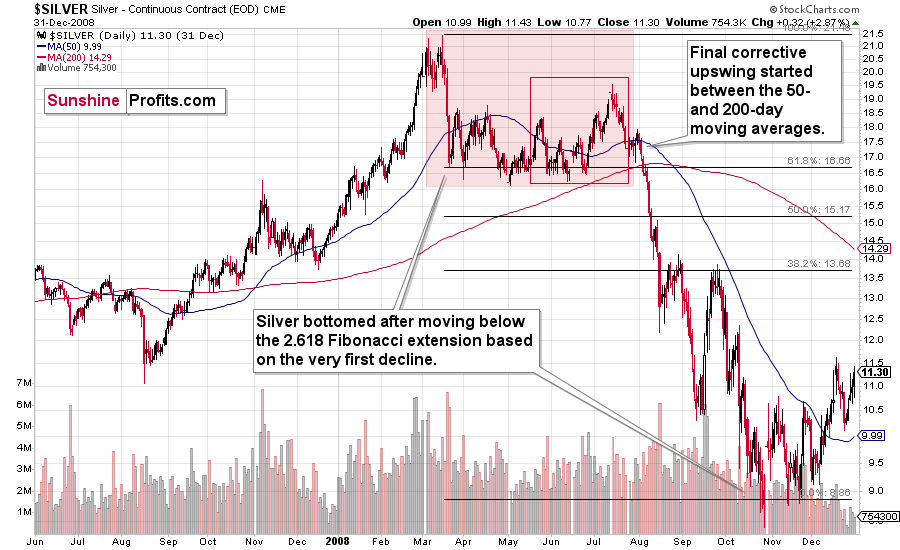

To that point, with its current behavior also mirroring 2008 – where silver fell below and then rallied back above its 50-day MA before plunging – the white metal remains on a journey of self-destruction.

If we zoom in on the white metal’s price action in 2008, you can see that an immaterial bounce also occurred right before silver fell off a cliff.

The final corrective upswing of early 2020 took place in very late February and early March, while the two – normal – tops that created the red-line rectangle formed more or less at the turn of the year and in late February. This year, it’s all taking place at almost exactly the same time of the year.

Let’s be realistic - so far, the analogy (to what happened in 2019 and 2020) might seem too unclear to be viewed as a reliable base for making a silver forecast.

But what if… What if there was a very similar pattern in the past that also preceded a massive decline? This would greatly increase the reliability of the above self-similarity.

There was indeed such a pattern!

That’s what silver did in 2008 before it declined.

The August 2007 – March 2008 rally (please note the interim top in November 2007 that was followed by a zigzag decline, more or less in the middle of the rally) is similar to the March 2020 – August 2021 rally (please note the interim top in June 2020 that was followed by a zigzag pattern, more or less in the middle of the rally).

Afterwards, we saw a double top in both cases that was followed by a sizable slide. Then silver formed a specific U-shaped broad top, where the final top was below the initial one (exception: in this case the forum-based rally took silver slightly above the previous high, but due to the specific / random nature of the move, it “doesn’t count” as something that invalidates the analogy).

After the top, silver declined, and the final corrective upswing took place approximately between the 50- and 200-day moving averages.

Please note that in both previous (2008 and 2020) cases silver then truly plunged, and it kept on declining until it moved below the 2.618 Fibonacci extension based on the initial downswing. The above charts illustrate that by showing the first decline at the 38.2% retracement (1 / 0.382 = approximately 2.618). Applying the same to the current situation (the initial decline took silver from below $30 to below $24) provides us with the minimum decline target at about $13.50. Will silver really decline as low? In my view, it’s imperative to watch other markets for indications as they might have more reliable targets (for instance gold), but I wouldn’t say that this target (or lower price levels) is out of the question. Of course, that’s just on a temporary basis – silver will likely soar in the following months and years (after this decline).

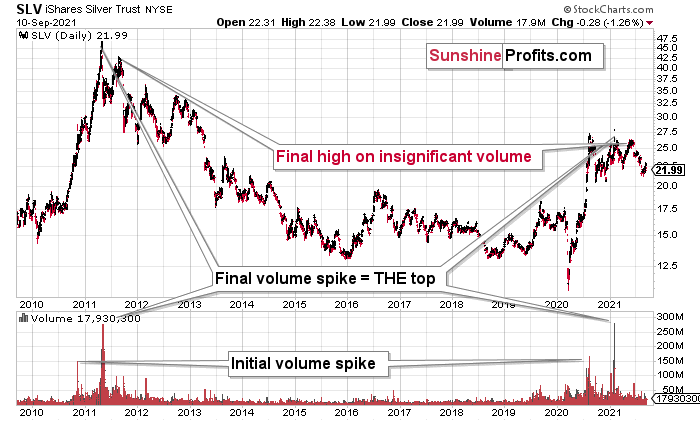

Highlighting the effect of WallStreetBets’ #SilverSqueeze, the SLV ETF’s volume spikes in 2020/2021 were nearly identical to the surges that we witnessed ~10 years ago. If you analyze the chart below, you can see that the massive inflows at the end of 2012 were not the beginning of a medium-term upswing. In fact, they coincided with silver’s final bounce before the white metal suffered a major decline.

Please see below:

If you analyze the volume spikes at the bottom of the chart, 2021 and 2011 are a splitting image. To explain, in 2011, an initial abnormal spike in volume was followed by a second parabolic surge. However, not long after, silver’s bear market began.

SLV-volume-wise, there's only one similar situation from the past - the 2011 top. This is a very bearish analogy as higher prices of the white metal were not seen since that time, but the analogy gets even more bearish. The reason is the "initial warning" volume spike in this ETF. It took place a few months before SLV formed its final top, and we saw the same thing also a few months ago, when silver formed its initial 2020 top.

In addition, the SLV ETF is also following the 2011 playbook. Back then, the SLV ETF recorded an initial spike in price and volume and followed that up with a parabolic spike in both that marked THE top. This was then followed by one last spike in price on relatively average volume. To that point, if you focus your attention on the right side of the chart above, you can see that an identical formation is present. After an initial spike in price and volume, the big one occurred in early 2021. And with silver’s latest rally occurring on relatively average volume, the price action looks a lot like the calm before the 2011 storm.

That third average-volume top in 2011 was the final chance to sell silver above $40 and perhaps to short it. It could be the same right now, but with regard to the $25 price level. Of course, silver is likely to soar well above $50 and $100 in the following years, but currently, the analogy points to lower prices in the medium term.

The history may not repeat itself to the letter, but it tends to be quite similar. And the more two situations are alike, the more likely it is for the follow-up action to be similar as well. And in this case, the implications for the silver price forecast are clearly bearish.

Based on the above chart, it seems that silver is likely to move well above its 2011 highs, but it’s unlikely to do it without another sizable downswing first.

Similarly, silver’s inverse price action also has bearish implications. Nearly identical to the inverted formation that emerged from 2006 to 2009, today’s chart looks eerily similar to its predecessor.

While it’s more of a wild card, the above pattern shows that silver’s 2020 top plots are nearly identical to the inverse of the 2006-2009 performance. I copied the 2006 – 2009 performance right below the regular price movement and inverted it. I also copied this inverted pattern to the last few years.

The similarity is quite significant. And whenever a given pattern has been repeated, the odds are that it could also repeat in the not-too-distant future. Of course, there is no guarantee for that, but once the same market has reacted in a certain way to a specific greed/fear combination, it can just as well do it again. And these similarity-based techniques work quite often. So, while it’s not strong enough to be viewed as a price-path-discovery technique on its own, it should make one consider some scenarios more closely. In particular, this means that the declines in the prices of silver, gold, and mining stocks could be bigger and take longer than it seems based on other charts and techniques.

The above is also in tune with the implications of the sell signal from the MACD indicator on the monthly gold chart.

The only thing that comes to my mind which could – realistically – trigger such a prolonged decline would be a major drop in the general stock market. Given what I wrote above, the latter is quite possible, so I’ll be on the lookout for confirmations and invalidations of this scenario.

If history rhymes, silver could be in for a profound decline over the next few months (beyond my initial target). Moreover, the development would increase the duration of the precious metals’ bear market (also beyond my initial forecast).

After all, gold did invalidate its long-term breakout above the 2011 highs, and the way gold reacted to a small upswing in the USD Index was truly profound…

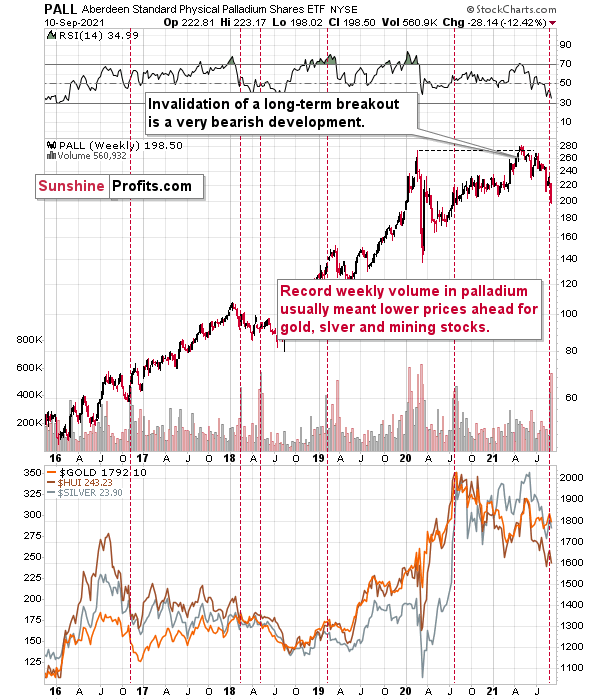

Finally, I warned on Sep. 7 that palladium signaled tough times ahead for the PMs.

I wrote:

Adding credibility to the conclusions drawn from the volume spikes in the GDX ETF and the GDXJ ETF, last week, the Aberdeen Standard Physical Palladium Shares (PALL) ETF recorded a new 2021 high for weekly volume.

And whenever we see one on a given market, it’s useful to check what happened when we saw it previously. At times, you can notice some regularities – a pattern. And such a pattern could have important trading implications. That’s the case with palladium volume spikes, which – while rather inconsequential for palladium itself – were practically always followed by lower gold, silver, and mining stock prices. The implications for the said markets for the following weeks are thus bearish.

Moreover, after the forecast became fact and the PMs responded as expected, I continue to anticipate further weakness over the medium term.

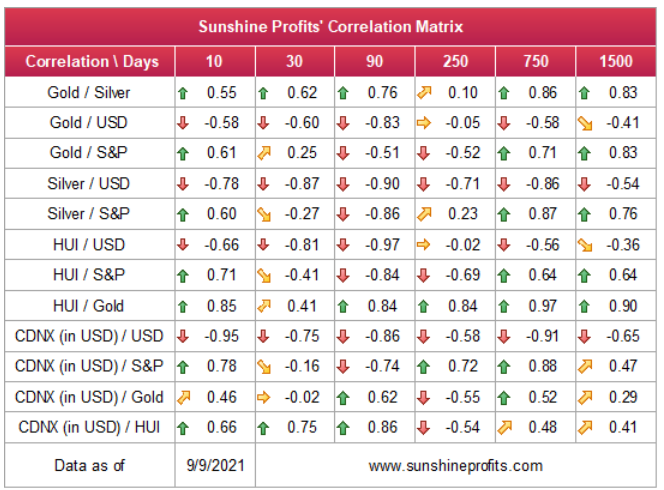

Turning to cross-asset correlations, gold, silver, and the HUI Index’s 10, 30 and 90-day correlations are performing as expected. The PMs still exhibit strong negative relationships with the U.S. dollar, and that’s what we should expect over the medium term. And with the U.S. dollar in season once again, an uprising could send the PMs running in the opposite direction.

For more context, I wrote previously:

Since gold, silver, and mining stocks have been strongly negatively correlated with the USD Index in the medium term, it seems likely that they will be negatively affected by the upcoming sizable USDX upswing.

…Until we see the day where gold reverses or soars despite the U.S. currency’s rally.

If that happens with gold at about $1,350 - $1,500, we’ll have a very good chance that this was the final bottom. If it doesn’t happen at that time, or gold continues to slide despite USD’s pause or decline, we’ll know that gold has further to fall.

Naturally, we’ll keep you – our subscribers – informed.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing in gold is over or close to being over, and the big decline seems to be already underway.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the previous strength in the precious metals sector was reversed, just like it was likely to, and the most bearish thing about it is that it happened practically without a good fundamental trigger. This means that the precious metals sector simply can’t wait to decline to much lower levels.

It seems that our profits from the short positions are going to become truly epic in the following weeks.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

Now hear this… !

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief