In our opinion, the following forex trading positions are justified - summary:

- EUR/USD: long (a stop-loss order at 1.1015; the initial upside target at 1.1157)

- GBP/USD: long (a stop-loss order at 1.2720; the initial upside target at 1.2976)

- USD/JPY: short (a stop-loss order at 109.66; the initial downside target at 107.14)

- USD/CAD: long (a stop-loss order at 1.3070; the initial upside target at 1.3300)

- USD/CHF: none

- AUD/USD: none

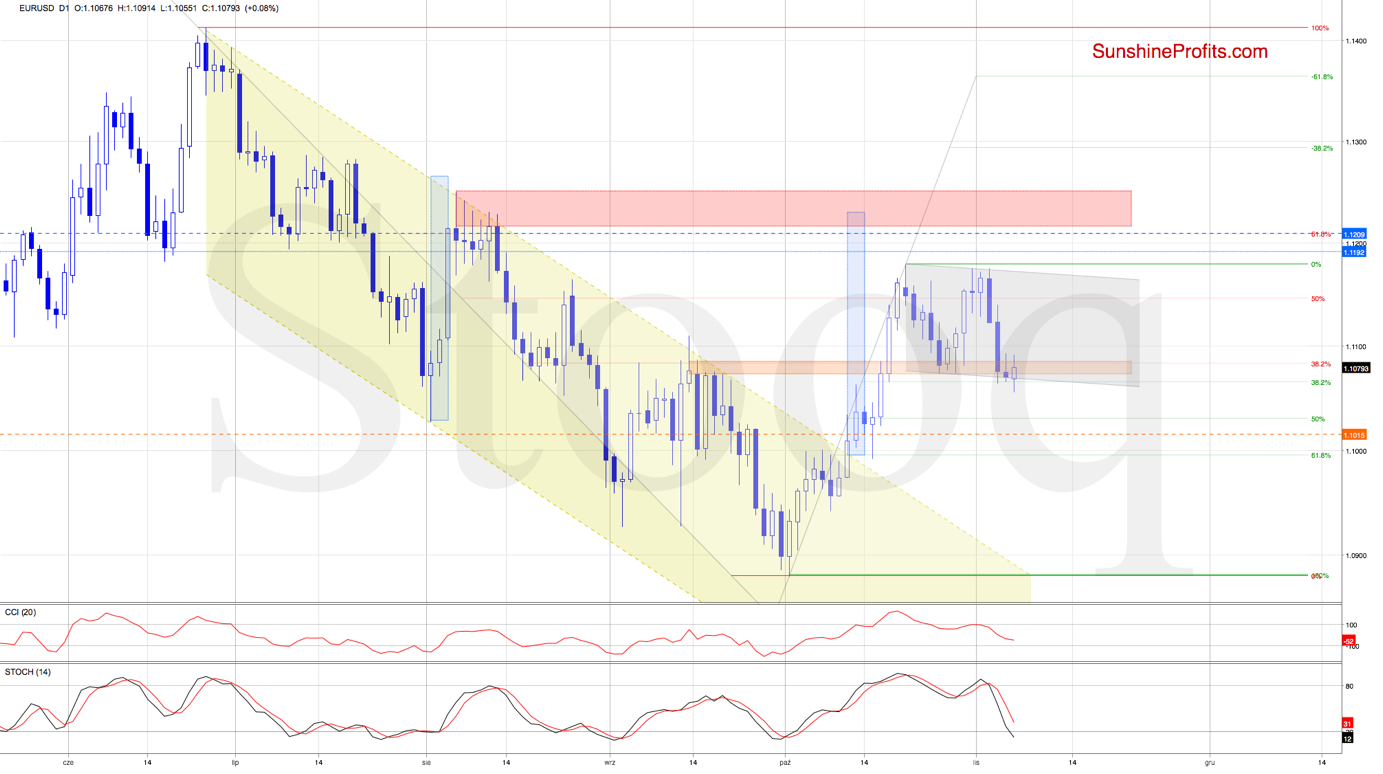

EUR/USD

EUR/USD declined a bit yesterday, retesting the 38.2% Fibonacci retracement. This support withstood the selling pressure, and the pair rebounded earlier today.

This means invalidation of the earlier tiny breakdown below the lower border of the declining grey trend channel, which raises hopes for further improvement. However, this scenario will be more likely and reliable only if the pair closes today's session (or one of the following) above the orange zone.

Should we see such price action, the first upside target for the buyers would be the resistance area created by the recent peaks.

Trading position (short-term; our opinion): long positions with a stop-loss order at 1.1015 and the initial upside target at 1.1157 are justified from the risk/reward perspective.

USD/JPY

Today's trading brought the exchange rate back to the orange resistance zone, but it has been strong enough to stop the buyers two days ago and quite a few times in the past already.

The pair also keeps trading below the upper border of the rising green wedge that serves as another resistance. Connecting the dots, as long as there is no breakout above these resistances, another reversal remains likely.

Trading position (short-term; our opinion): Short positions with a stop-loss order at 109.66 and the initial downside target at 107.14 are justified from the risk/reward perspective.

USD/CHF

Since October, USD/CHF has been mostly trading within the declining red trend channel. No breakdown or breakout attempt has made it far. The pair is now bumping into the upper border of the said trend channel. Time for a breakout, or is downside action more likely?

Let's dive right into the chart below (chart courtesy of www.stooq.com ).

Recently, USD/CHF bounced off the green support zone once again, and came back to the upper border of the declining red trend channel on Tuesday.

While this is a bullish development, the bulls couldn't break above this resistance in any of the following days, similarly to the end of October.

We saw another attempt to move higher earlier today, but the 50% Fibonacci retracement stopped the buyers for the second time in a row. It suggests that another reversal in the very near future should not surprise us.

Therefore, should we see another daily close inside the trend channel, we'll consider opening short positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist