Quick Update

As a quick update to kick off today’s newsletter, I would like to summarize my correct calls and what I profited on since beginning to publish these Driver & Diver updates. While nobody can predict the future, here are the major calls I am most proud of since producing these letters: 1) hedging or selling the U.S. Dollar; 2) selling energy; 3) switching my short-term call on small-caps from HOLD to SELL.

Ever since beginning these Driver & Diver updates on December 9th, I have made SELL calls for the U.S. Dollar and energy. My call on the U.S. dollar was based on the Fed’s policies, the effect of interest rates this low for this long, government stimulus, strengthening of emerging markets, and inflation. I also said that any minor rally the dollar would experience would be fool’s good. Since the dollar briefly pierced the 91-level on December 9th, it has fallen over 1%. Despite the dollar experiencing another mini-rally and nearly piercing the 91-level again on December 22, I remained steadfast in my bearish outlook of the dollar. Since the open on December 23rd, the U.S. Dollar has declined another 0.75%. I believed the dollar could drop back below 90 before the new year, and now here we are.

Since the first Driver & Diver, I also said that energy is unpredictable and volatile, and has consistently pulled back in 2020 after experiencing a hot streak. Since December 10th, the Energy Select Sector SPDR Fund (XLE) has declined over 9.5%.

I also switched my call on small-caps, specifically the Russell 2000, to a short-term SELL from a HOLD on December 16th. Although the iShares Russell 2000 ETF (IWM) is largely flat since I switched my call, by any measurement, the index has overheated. In this week alone, the IWM has underperformed ETFs tracking the larger indices and has declined by nearly 3%. While I am still bullish on small-caps in the long run and maintain my STRONG BUY call on the Russell for the long-term, it is contingent on a pullback. I believe that pullback may have begun.

Stocks fell on Tuesday (Dec. 29) after the major indices all hit record highs on Monday (Dec. 28). Investors monitored the Senate’s talks on higher stimulus checks.

News Recap

- The Dow Jones snapped a 3-day winning streak and declined 68.30 points lower, or 0.2%, to close at 30,335.67. At its session high, the Dow was up more than 100 points. The S&P 500 also snapped a 3-day winning streak and declined 0.2%, and the Nasdaq fell 0.4%. The small-cap Russell 2000 index continued its decline this week and fell 1.92%.

- The Democrat-led House voted late Monday to increase stimulus payments to $2,000 from $600. Although Senate Majority Leader Mitch McConnell blocked fast-tracking unanimous Senate approval on Tuesday (Dec. 29), many GOP Senators have expressed support for the stimulus increase. Time will tell what happens.

- Apple (AAPL) and Home Depot (HD) fell more than 1% each to lead the Dow lower.

- Intel (INTC) shares rose nearly 5% due to news of exploring “strategic alternatives.” Intel shares have lost nearly 18% this year, and the chipmaker has lost significant market share to many other semiconductor competitors.

- Amidst fears of a COVID-19 “surge on top of a surge” after the Christmas holiday, more than 2.1 million people in the U.S. have now been vaccinated. However, the U.S. is likely to fall far short of its goal to vaccinate 20 million people by the end of the year. Meanwhile, the U.S. has averaged at least 184,000 new infections per day.

- The U.K. became the first country to approve a COVID-19 vaccine by AstraZeneca and Oxford. This is the third emergency-use approval vaccine, but is not yet approved in the U.S.

Investors on Monday (Dec. 28) cheered President Trump’s signing of the stimulus bill. However, some of those gains were lost on Tuesday (Dec. 29) as eyes turned to the Senate’s decision on raising direct stimulus payments from $600 to $2,000.

While some of these declines can be attributed to the end of the year consolidation, profit-taking, and rebalancing, a lot of this can also be chalked up to an overheating market.

Some of these declines can also be due to a pandemic that is still not under control. The market has surged since March 23rd and has largely ignored the reality on the ground. But in the near term, a tug of war between good news and bad news is inevitable. Although vaccine distribution has officially begun, it has been a slower and choppier roll-out process than anticipated. The level of infection and death has also reached unprecedented levels.

“The viral resurgence has induced lockdown measures throughout the country, stunting economic reopening efforts. If the viral spread is not brought under control by year’s end, it will likely be a key initiative to do so in early 2021, before a vaccine has become widely distributed,” Jason Pride, CIO of private wealth at Glenmede said.

Despite the declines on Tuesday (Dec. 29), the general focus of both investors and analysts has appeared to be the long-term potential of 2021.

As Tom Essaye, founder of The Sevens Report said:

“The five pillars of the rally (Federal stimulus, FOMC stimulus, vaccine rollout, divided government and no double dip-recession) remain largely in place, and until that changes, the medium and longer-term outlook for stocks will be positive.”

While I still believe that this tug of war between good news and bad news will lead into the beginning of the new year, I am now convinced that these moves are manic and based on sentiment. There has not been a sharp pullback to end the year as I anticipated, however, I do believe that markets have overheated and that between now and the end of Q1 2020, a correction could happen.

There is optimistic potential, but the road towards normalcy will hit inevitable speed bumps.

I do believe, though, that a correction is healthy and could be a good thing. Corrections happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one since there has not been one since the lows of March. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

The mid-term and long-term optimism are very real, despite the near-term risks. The passage of the stimulus package only solidifies the robust vaccine-induced tailwinds entering 2021.

The consensus is that 2021 could be a strong year for stocks, despite short-term headwinds. According to a new CNBC survey which polled more than 100 chief investment officers and portfolio managers, two-thirds of respondents said the Dow Jones will most likely finish 2021 at 35,000- a roughly 16% gain from last Thursday’s (Dec. 24) close of 30,199.87. Five percent also said that the index could climb to 40,000 by the end of 2021.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, please do me a favor and let me know what you think of this segment! I’m always happy to hear from you.

Driving

Materials (XLB)

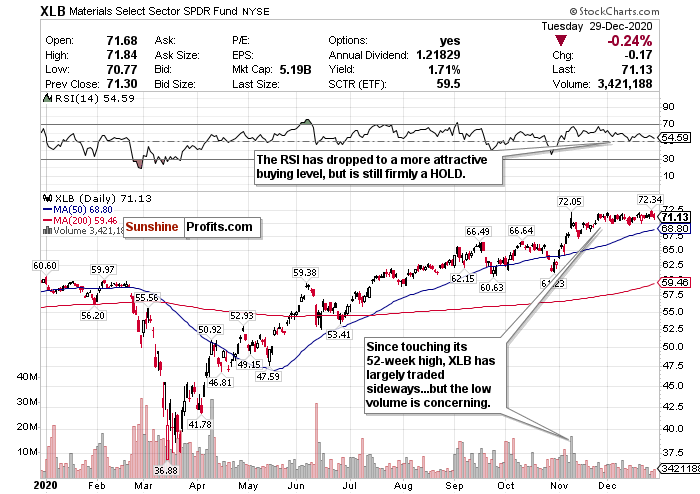

Figure 1 - Materials Select Sector SPDR Fund (XLB)

The materials sector, as represented by the XLB ETF, has largely traded sideways since hitting its 2020 high in November. But several macro-level tailwinds could benefit materials in the mid-term and long-term.

Materials companies could be some of the biggest beneficiaries of vaccines getting us back to normal. With this new stimulus package and a weakened U.S. dollar, the bullish drums are certainly beating. Historically, dovish economic policies and a weak U.S. dollar have benefitted materials.

Because of materials largely benefitting from a weak dollar, emerging markets and materials performances are also historically closely linked. I am very bullish on emerging markets for 2021 and believe these markets are primed to build on what has been a strong 2020.

Yet ever since the XLB peaked at $72.41 a share, the ETF’s volume has plummeted, and largely stayed low.

I believe that this sector could pull back further in the early parts of 2021. It did not have the bounce that I expected after the stimulus deal passed, and there are very real short-term headwinds at the macro level. I do not foresee a consistent rally happening until the end of Q1 2020, but I do foresee the XLB ETF eventually exceeding its 52-week high and going on a nice run. I just don’t believe it will happen within the next few months.

For the time being though, there is too much uncertainty to make a conviction call. Therefore, this is a HOLD for the short-term. But I would BUY on a pullback.

Energy (XLE)

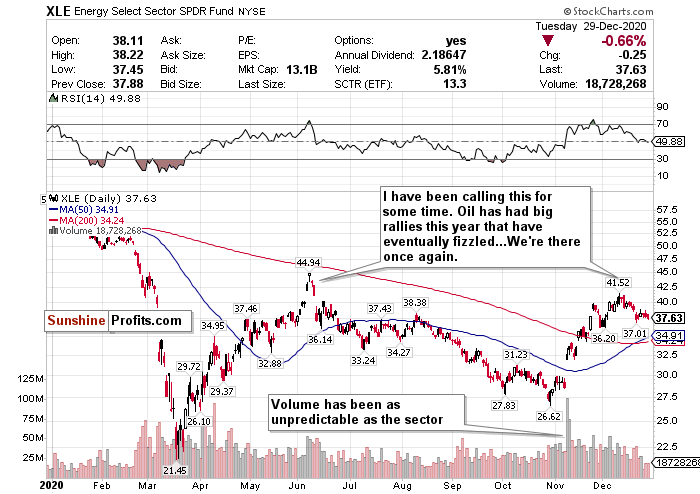

Figure 2 - Energy Select Sector SPDR Fund (XLE)

Avoiding energy has been one of my biggest conviction calls for weeks. Energy is a sector largely dependent on sentiment. Right now, there are numerous question marks. The sector can lead and lag the market every other day for weeks at a time. One thing that I do know about the energy sector though, is that in 2020, the sector has had big rallies that have eventually fizzled. We're there once again.

On one hand, if you are bullish, all of this vaccine news bodes well for a full economic reopening by the second half of 2021. That means travel, and therefore fuel demand, could surge back to pre-pandemic levels. Energy is still largely undervalued and optimism about stimulus in addition to the vaccines could bode well for the sector. The U.S. also witnessed its biggest travel volume in nine months over the Christmas holiday.

But I believe that all of these tailwinds have already been baked in. Stricter shutdowns and travel restrictions are being imposed with fresh concerns over global fuel demand. In fact, according to Ned Davis Research, U.S. crude demand is still over 1.0 million barrels a day below pre-virus levels. I believe this will continue into Q1 2021.

I had called this pullback a very real possibility. Since December 10th, the Energy Select Sector SPDR Fund (XLE) has declined over 9.5%.

In the long-term, 2021 could also witness further movements away from fossil fuels towards clean and sustainable energy. Pension funds worldwide have been divesting from oil in droves, for example.

I have a hard time thinking bullish thoughts on this sector. Therefore:

While there is vaccine optimism now that there wasn’t before, conditions are largely the same on the ground concerning COVID-19 and travel demand. Therefore, my call is to take profits and SELL.

Financials (XLF)

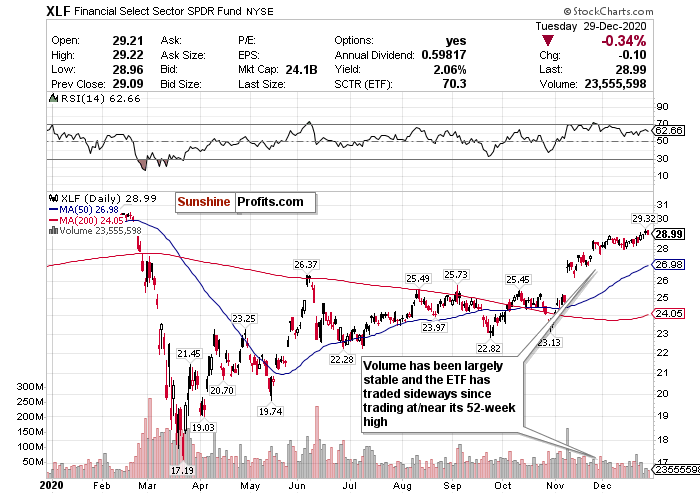

Figure 3 - Financial Select Sector SPDR Fund (XLF)

The financial sector has traded largely sideways since hitting its 52-week high. While the Fed once again allowing banks to buy back shares, has done well for the sector, I have some serious concerns. I do not believe this sector will benefit from a dovish Fed in the long run.

Interest rates - a huge driver of banking revenue - are truly muddling my bullishness. While this sector has performed better than the U.S. dollar, rates this low that will not rise until possibly 2022-2023, will not be good for this sector. The Fed has not been shy about keeping these rates low either and will let the GDP heat up. Until rates start rising again, profit margins will continue to narrow.

Although higher-quality loan applications and an influx of new investors have helped certain banking stocks, I don’t believe it will be enough for mid-term and long-term strength.

I foresee a rise in COVID-related defaults coming in 2021 as well. With potential defaults on the horizon, and without raising interest rates, it’s hard to truly justify the gains.

The theme of mixed sentiment continues for this sector. Because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for the foreseeable future, I have this at a SELL. Take the profits while you can!

Diving

Communication Services (XLC)

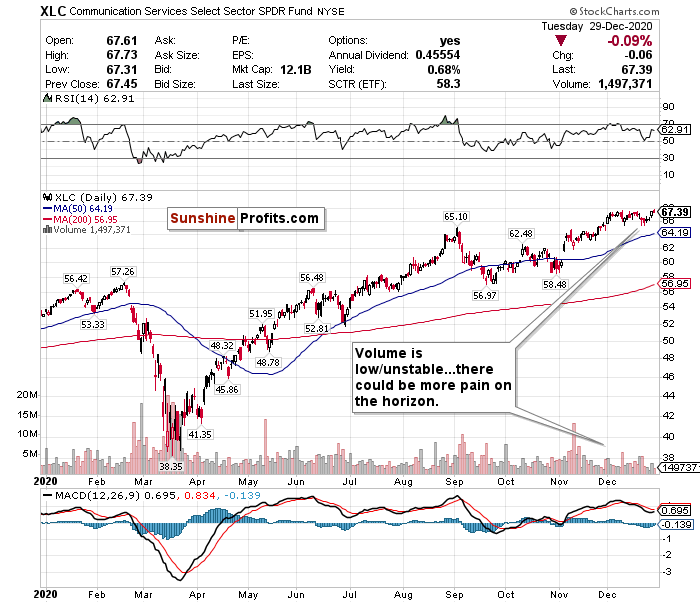

Figure 4 - Communication Services Select Sector SPDR Fund (XLC)

The XLC Communication Services ETF is trading near its 52-week high of 67.81 and has largely been more stable than other ETFs as of late. But communications stocks do not excite me at all. Even when markets outperform, communications stocks seem to underperform.

While traditionally this is a good sector to find value in, right now I just don’t see it. I see downside risk without the same type of upside potential as certain other sectors that may benefit more from a successful vaccine roll-out and economic reopening, like small-caps and materials.

The ETF’s volume is already low and has been unstable too. This screams volatility to me.

I just can’t see how you would benefit from buying into this sector. It is hard to foresee how this sector will truly benefit from a vaccine and 2021 reopening relative to other sectors. Therefore, I give it a SELL call.

Health Care (XLV)

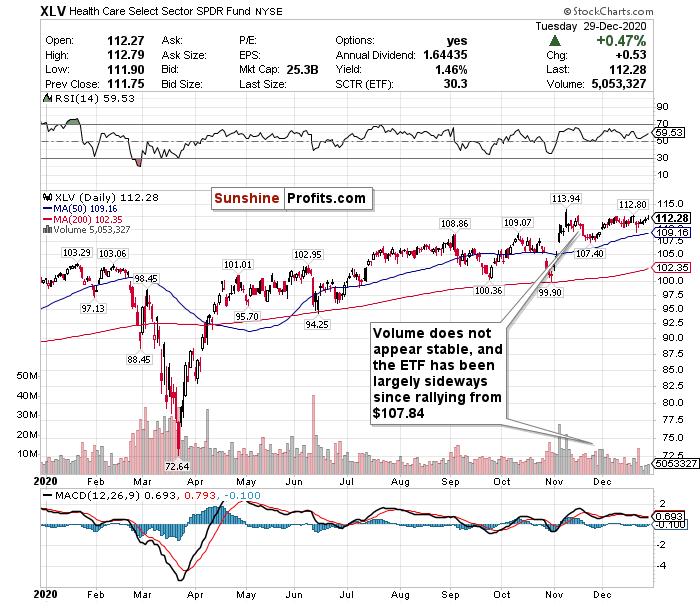

Figure 5 - Healthcare Select Sector SPDR Fund (XLV)

Healthcare has outperformed lately and been one of the best performing sectors over the last week. But I am not one of those who believes that healthcare as a sector will benefit from the vaccines.

Good vaccine news will cause short-term surges in companies that are directly involved in vaccine production and distribution such as Pfizer (PFE) and Moderna (MRNA). But in my view, vaccine-induced returns for these companies were already baked in.

Vaccines will not be a long-term profit driver for these companies. Just take Pfizer’s and Moderna’s stocks for example. These are vaccine stocks that surged on news that their vaccines worked. Despite both Pfizer and Moderna rolling out their vaccines this month, since peaking December 10th, Pfizer’s stock is down 11.21% while Moderna’s is down 26.53%.

Meanwhile, the pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon. Hospitals generate a lot of their revenue from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures. ICU capacity across the U.S. is seemingly declining by the second as well.

Outside of some blue-chip companies to invest in for the long-term, it’s hard to see the upside in healthcare right now. According to Ned Davis Research, only 84.4% of issues are trading above their 50-day moving averages- the fourth-lowest among all sectors.

If you’re feeling aggressive, maybe taking a gamble on a vaccine stock and crossing your fingers for a short-term pop could be a fun strategy. AstraZeneca (AZN), Johnson & Johnson (JNJ), and underdog biotech firms such as Novavax (NVAX) still haven’t released their vaccine candidates yet. But it’s a risk.

The XLV ETF has shown fewer signs of volatility than other sector-specific ETFs and can outperform on any given day. But I would prefer it pullback before initiating a position. Therefore, I give this ETF a HOLD call.

Utilities (XLU)

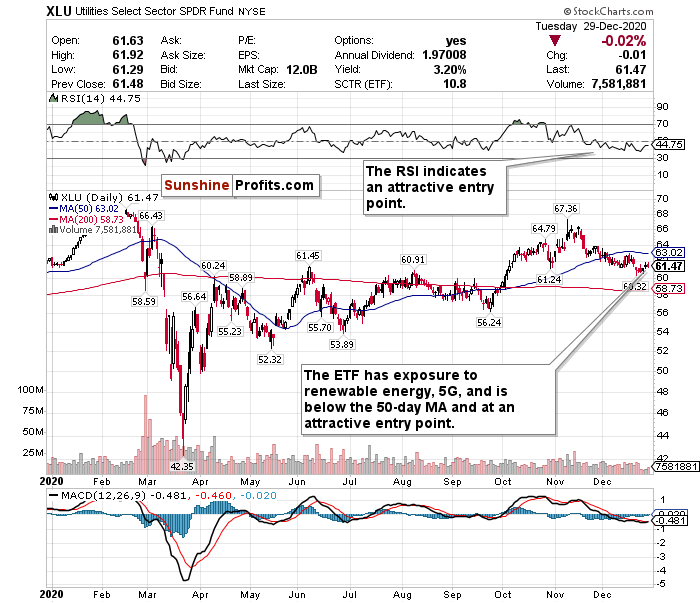

Figure 6 - Utilities Select Sector SPDR Fund (XLU)

Utilities stocks are not exciting to invest in during bull runs. After outperforming in September and October, this sector has been a laggard since November. Utilities though are dependable stocks and may offer the best opportunity to find value in a market this overinflated, manic, and unpredictable.

Utilities are considered to be defensive investments, and as a result, have underperformed the market. However, on days where investors are either taking profits or running for the hills, it’s a good sector to own.

This is a boring sector not focused on growth or gains. But during uncertain times, this is a solid sector to find value in. Utilities are cheap, they do not swing much upwards or downwards, they generally pay solid dividends, and are usually a safe place to park your money.

In the short-term and long-term, this sector may also be a good hedge against volatility and bad news and may also be a good way to gain exposure to renewable energy and 5G.

Utilities do not pose the same type of overheating risks as other sectors such as small-caps. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is lower than other sectors and the ETF is trading below its 50-day moving average.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

While the worsening spread of COVID-19 and an overheating market may drive some short-term concerns, the stimulus deal and the vaccines pose significant optimism for 2021 and beyond. But we could be in for a challenging start to the new year. Until COVID-19 is eradicated, there will inevitably be a tug of war between optimism and pessimism.

Please keep in mind though that markets are forward-looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, use this as a time to find buying opportunities for the second half of 2021. Do not get caught up in fear if there is a correction.

I do not believe a crash like the one we saw in March is on the horizon, but a pullback is inevitable. If this happens, do not be scared. Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 97.4%. Nasdaq (QQQ) up 84.52%. S&P 500 (SPY) up 68.73%. Dow Jones (DIA) up 65.18%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, I have a BUY call for:

- Small-Caps (IWM) - but ONLY on a pullback for the long-term

- Materials (XLB)- but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- Materials (XLB)

- Health Care (XLV)

And I have SELL calls for:

- Small-Caps (IWM) - in the short-term. But do not fully exit positions.

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist