The S&P 500 closed down for the third consecutive day (Dec. 22), despite Congress’s long-overdue approval of an economic stimulus package.

News Recap

- The Dow Jones declined 200.94 points, or 0.7%, to 30,015.51. The S&P 500 closed down for a third consecutive day and fell 0.2%. Reflecting a return to the “stay-at-home” tech trade, the Nasdaq gained 0.5% on the day (Dec. 22). The small-cap Russell 2000 index managed to outperform yet again, rising 1.01%.

- Congress finally voted on and approved a $900 billion stimulus package to aid struggling Americans. Attached to this bill was also a $1.4 trillion measure to fund the government through Sept. 30. President Trump is expected to sign the bill into law within the next few days.

- A mutant strain of COVID-19 discovered in the UK weighed on markets for a second consecutive day. While the vaccine(s) could still be effective on this strain, the strain appears to be more contagious than others. The discovery of this virus strain has caused stricter lockdown measures and travel restrictions worldwide.

- Travel stocks were the laggards of the day due to fears of the new strain of COVID-19. American Airlines (AAL) fell 3.9% and United (UAL) dropped 2.5%. Cruise lines all fell as well. Carnival (CCL) fell nearly 6%, Royal Caribbean (RCL) dropped nearly 3%, and Norwegian (NCL) plummeted 6.9%

- Apple (AAPL) led the Nasdaq higher as it jumped 2.9% due to investor excitement about their EV plans to challenge Tesla (TSLA) by 2024

- Mixed economic data came in on Tuesday (Dec. 22). The final reading on Q3’s GDP growth found that the US GDP grew 33.4% on an annualized basis, compared to the estimated 33.1%. On the other hand, US consumer confidence fell for the second month in a row and missed expectations - despite vaccine optimism.

- COVID-19 has now killed over 318,000 Americans (and counting). The CDC announced that this is now the deadliest year in American history as total deaths are expected to top 3 million for the first time. Deaths are also expected to jump 15% from the previous year. This would mark the largest single-year percentage leap since 1918, when WWI and fatalities from the Spanish Flu Pandemic caused deaths to rise an estimated 46%.

Markets have officially stumbled before Christmas and experienced a predictable tug-of-war between good news and bad news. While the general focus of both investors and analysts has appeared to be the long-term potential of 2021, there are some very concerning short-term headwinds.

Although there was some anticipation that a stimulus deal could send stocks higher in the near-term, investors may be simply taking profits before the year’s end and rebalancing for 2021. On the other hand, it is very possible that the stimulus package was “too little too late,” and is being overshadowed by a more contagious strain of COVID-19 discovered over the past weekend in the U.K.

While nobody predicted a renegade mutant virus weighing on market sentiment, short-term battles between optimism and pessimism were quite predictable.

According to a note released on Monday (Dec. 21) from Vital Knowledge’s Adam Crisafulli

“The market has been in a tug-of-war between the very grim near-term COVID backdrop and the increasingly hopeful medium/long-term outlook (driven by vaccines) – the latter set of forces are more powerful in aggregate, but on occasion, the market decides to focus on the former, and stocks suffer as a result.”

Meanwhile, the overwhelming majority of market strategists, including myself, are bullish on equities for 2021. It might just be a bit of a bumpy road getting there. I believe that a correction and some consolidation could be very likely in the short-term, on the way towards another strong rally in the second half of 2021. While it is hard to say with conviction WHEN we could see a correction, I believe that the market’s behavior as of late could be a potential preview of what’s to come between now and the end of Q1 2020. There is optimistic potential, but I believe a potential 5% pullback before the year’s end is possible, as well as a minimum 10% correction before the end of Q1 2020.

According to Jonathan Golub, Credit Suisse’s chief U.S. equity strategist, choppiness in the economy and markets in the coming months could be expected before a surge in consumer spending by mid-2021. Golub said, “I don’t think that there’s a smooth, easy straight-line story on this...I think for the next three or four months, the reopening process is going to be sloppy.”

I believe that the S&P’s three-day losing streak could be an ominous sign of what’s to come in the near-term. I do believe though that this is healthy and could be a good thing.

Before Monday’s (Dec. 21) session, I had warned that the market was flashing signs of over-optimism and euphoria. In its most recent survey, for example, the American Association of Individual Investors (AAII) found that 48.1% of investors identified as being bullish - well above the historical average of 38%.

A correction could be just what this market needs. Corrections also happen way more often than people realize. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017). I believe we are overdue for one because there has not been a correction since the lows of March. This is healthy market behavior and could be a very good buying opportunity for what I believe will be a great second half of the year.

The mid-term and long-term optimism are very real, despite the near-term risks. The passage of the stimulus package only solidifies the robust vaccine-induced tailwinds entering 2021, specifically for small-cap value stocks.

In the short-term, there will be some optimistic and pessimistic days. On some days, such as Tuesday (Dec. 22), the “pandemic” market trend will happen - cyclical and COVID-19 recovery stocks lagging, and tech and “stay-at-home” stocks leading. On other days, a broad sell-off based on virus fears may occur as well. Additionally, there will also be days where there will be a broad market rally due to optimism and 2021 related euphoria. And finally, there will be days (and in my opinion, this will be most trading days), that will see markets trading largely mixed, sideways, and reflecting uncertainty.

Therefore, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and Q1 2021 is very possible. But I do not believe, with conviction, that a correction above ~20% leading to a bear market will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, please do me a favor and let me know what you think of this segment! Always happy to hear from you.

Driving

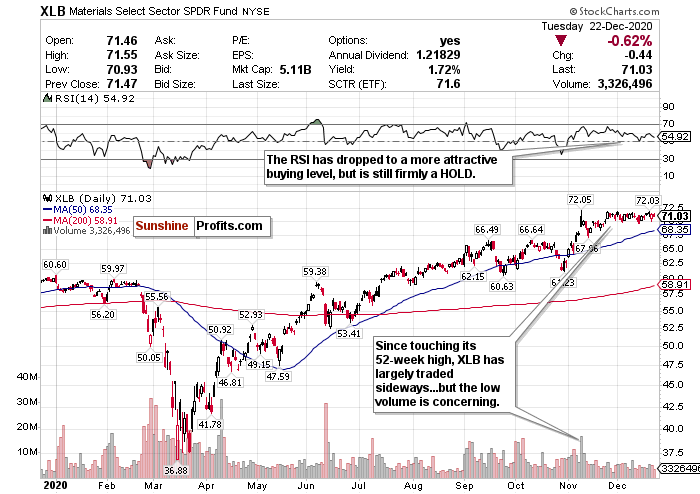

Materials (XLB)

The materials sector, as represented by the XLB ETF, has largely traded sideways since hitting its 2020 high in November. But several macro-level tailwinds could benefit materials in the mid-term and long-term.

Materials companies could be some of the biggest beneficiaries of vaccines getting us back to normal. With this new stimulus package and a US dollar plummeting with no end in sight, the bullish drums are certainly beating. Historically, dovish economic policies and a weak US dollar have benefitted materials.

Yet ever since the XLB peaked at $72.41 a share, the ETF’s volume has plummeted, and has largely stayed low.

I believe that this sector could pull back further. It did not have the bounce I expected after the stimulus deal passed, and there are very real short-term headwinds at the macro level. I do not foresee a consistent rally happening until the end of Q1 2020, but I do foresee the XLB ETF eventually exceeding its 52-week high and going on a nice run. I just don’t believe it will happen within the next few months.

For the time being though, there is too much uncertainty to make a conviction call. Therefore, this is a HOLD for the short-term, but I would BUY on a pullback.

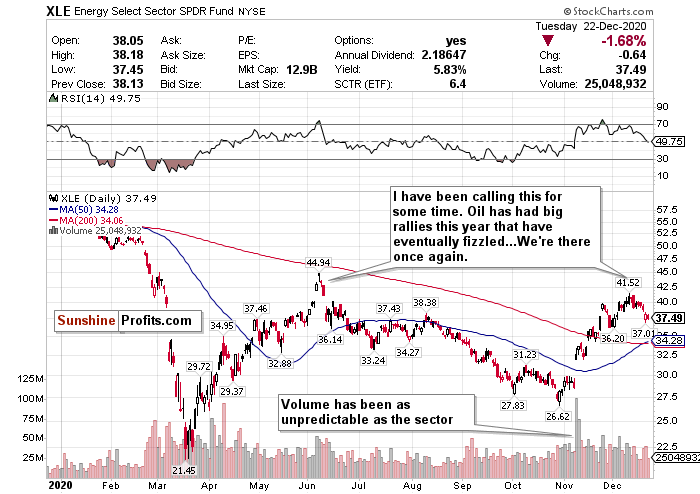

Energy (XLE)

The only thing predictable in this unpredictable market is this: energy is unpredictable! This is a sector largely dependent on sentiment, with several question marks. It can lead and lag the market every other day for weeks at a time.

But I believe that we have reached the eventual end of energy’s rally since November.

On one hand, if you are bullish, all of this vaccine news bodes well for a full economic reopening by the second half of 2021. That means travel, and therefore fuel demand could surge back to pre-pandemic levels. Energy is still largely undervalued and optimism about stimulus in addition to the vaccine(s) could bode well for the sector.

However, I believe that was already baked in. Stricter shutdowns and travel restrictions are being imposed thanks to the mutant virus strain. Fresh concerns over global fuel demand are certainly weighing on these stocks. I believe this will continue into Q1 2021. If there’s one thing that oil stocks have shown us in 2020, it’s that these rallies will always come to an end eventually.

I had called this happening as a very real possibility in the near-term future. Since December 10th, the XLE ETF has declined 8.67%.

Meanwhile, in the long-term, 2021 could witness further movements away from fossil fuels towards clean and sustainable energy. Pension funds worldwide have been divesting from oil in droves, for example.

I have a hard time thinking bullish thoughts on this sector. Therefore:

While there is vaccine optimism now that there wasn’t before, conditions are largely the same on the ground concerning COVID-19 and travel demand. Therefore, my call is to take profits and SELL.

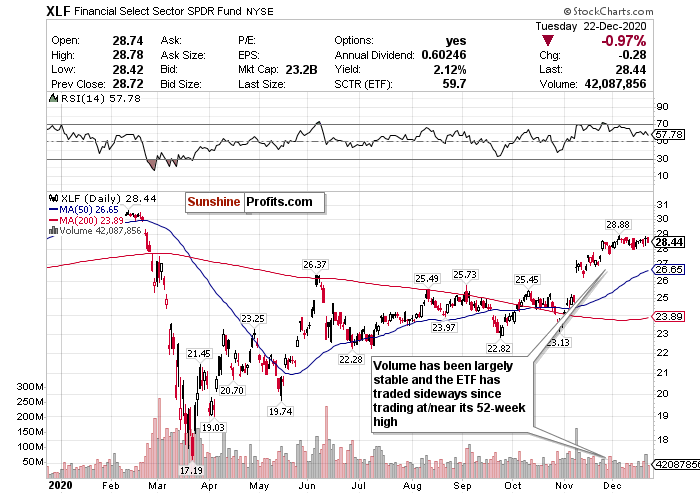

Financials (XLF)

The financial sector has traded largely sideways since hitting its 52-week high. While the banks surged on Monday (Dec. 21), thanks to the Fed once again allowing banks to buy back shares, I have some serious concerns and believe this sector will not benefit from a dovish Fed in the long-run.

Interest rates -a huge driver of banking revenue - are truly muddling my bullishness. While this sector has performed better than the US dollar, rates this low that will not rise until possibly 2022-2023 will not be good for this sector. The Fed has not been shy about keeping these rates low either and will let the GDP heat up. Until rates start rising again, profit margins will continue to narrow.

Although higher-quality loan applications and an influx of new investors have helped certain banking stocks, I don’t believe it will be enough for mid-term and long-term strength. Without rising interest rates, it’s hard to truly justify gains, despite some optimistic tailwinds.

The theme of mixed sentiment continues for this sector. Because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for the foreseeable future, I have this at a SELL. Take the profits while you can!

Diving

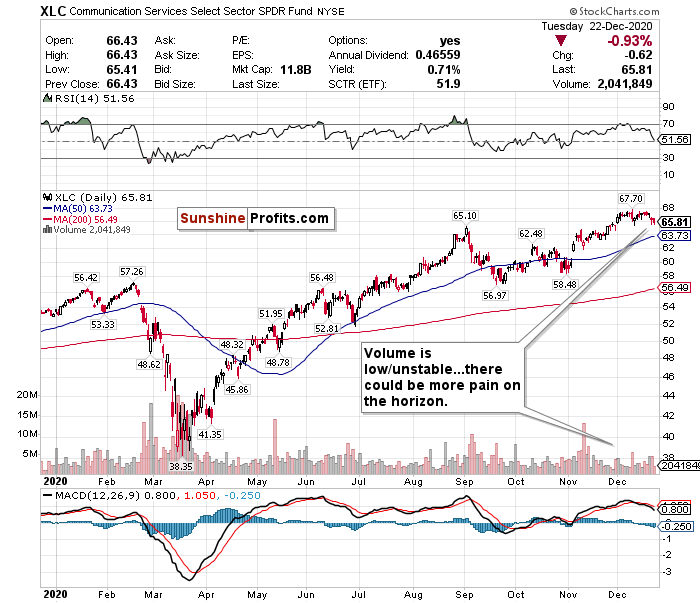

Communication Services (XLC)

Communications stocks do not excite me at all. Even when markets outperform, communications stocks seem to underperform. This appears to be a usual occurrence in the short-term and long-term.

Ever since the XLC Communication Services ETF touched an intraday 52-week high of 67.70 and closed at 67.20, it has declined by nearly 2.2%.

While traditionally this is a good sector to find value in, right now I just don’t see it. I see downside risk without the same type of upside potential as certain other sectors that may benefit more from a successful vaccine roll-out and economic reopening - like small-caps and materials.

The ETF’s volume is already low and has been unstable too. This screams volatility to me.

I just can’t see how you would benefit from buying into this sector. It is hard to foresee how this sector will truly benefit from a vaccine and 2021 reopening relative to other sectors. Therefore, I give it a SELL call.

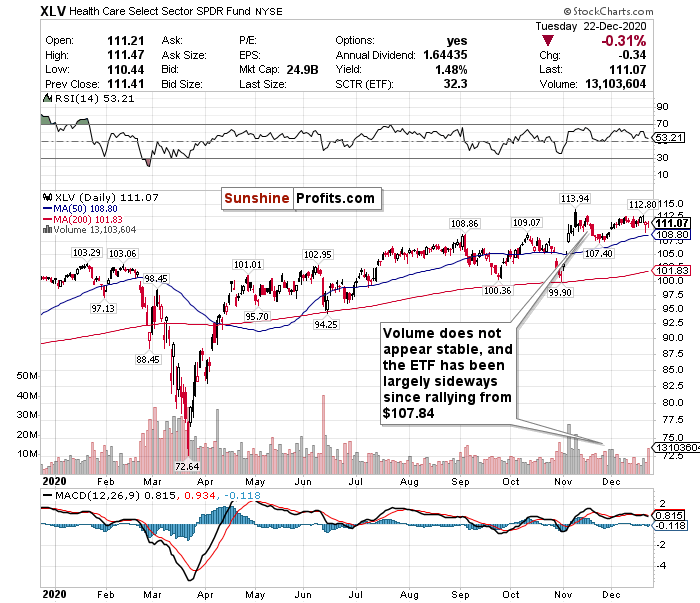

Health Care (XLV)

Healthcare outperformed many other sectors on Tuesday (Dec. 22) and did not have a major decline. But the idea of healthcare as a sector benefitting from the vaccine(s) is largely a myth. Good vaccine news will cause short-term surges in companies that are directly involved in vaccine production and distribution such as Pfizer (PFE) and Moderna (MRNA). But in my view, vaccine-induced returns for these companies were already baked in.

Vaccines will not be a long-term profit driver for these companies. Just take Pfizer’s and Moderna’s stocks for example. These are vaccine stocks that surged on news that their vaccines worked. Despite both Pfizer and Moderna rolling out their vaccines this month, since peaking December 10th, Pfizer’s stock is down nearly 14% while Moderna’s is down nearly 26%.

Meanwhile, the pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon. Hospitals generate a lot of their revenue from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures. ICU capacity across the US is seemingly declining by the second as well.

Outside of some blue-chip companies to invest in for the long-term, it’s hard to see the upside in healthcare right now. If you’re feeling aggressive, maybe taking a gamble on a vaccine stock and crossing your fingers for a short-term pop could be a fun strategy. AstraZeneca (AZN), Johnson & Johnson (JNJ), and underdog biotech firms such as Novavax (NVAX) still haven’t released their vaccine candidates yet. But it’s a risk.

While there will not be as much upside in this sector as others, there is still some potential. The XLV ETF has also shown fewer signs of volatility than other sector-specific ETFs and can outperform on any given day. Therefore, I give this ETF a HOLD call.

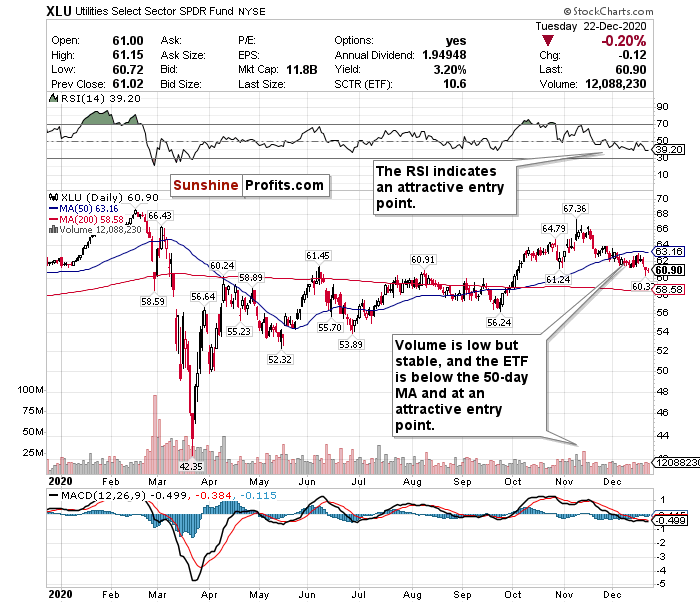

Utilities (XLU)

Utilities are like Subarus. They may be ugly, they may be boring, but they are dependable and get you from point A to point B.

Utilities stocks may offer the best opportunity to find value in a market this overinflated, manic, and unpredictable.

Utilities are considered to be defensive investments, and as a result, have underperformed the market. In the last week, the XLU ETF is down nearly 2.73% for example. However, on days where investors are either taking profits or running for the hills thanks to a mutant virus, it’s a good sector to own.

This is a boring sector not focused on growth or gains. But during uncertain times, this is a solid sector to find value in. Utilities are cheap, they do not swing much upwards or downwards, they generally pay solid dividends, and are usually a safe place to park your money.

In the short-term and long-term, this sector may also be a good hedge against volatility and bad news and may also be a good way to gain exposure to renewable energy and 5G.

Utilities do not pose the same type of overheating risks as other sectors such as small-caps. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is lower than other sectors and the ETF is trading below its 50-day moving average. The ETF’s volume, while low, has also been stable.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

While this new mutant strain of COVID-19, and an overheating market may drive some short-term concerns, the stimulus deal, and the vaccine(s) poses significant optimism for 2021 and beyond. This should be cheered by everyone despite what could be a challenging start to the new year.

Until COVID-19 is eradicated, there will inevitably be a tug of war between optimism and pessimism. The mania that has consumed the markets could possibly lead to a short-term correction to end off 2020 and start 2021 as well.

Please keep in mind though that markets are forward-looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, use this as a time to find buying opportunities for the second half of 2021. Do not get caught up in fear if there is a correction.

I do not believe a crash like the one we saw March is on the horizon, but a pullback is inevitable. If this happens, do not be scared. Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 100.48%. Nasdaq (QQQ) up 82.63%. S&P 500 (SPY) up 66.81%. Dow Jones (DIA) up 63.34%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

To sum up all our calls, I have a BUY call for:

- Small-Caps (IWM) - but ONLY on a pullback for the long-term

- Materials (XLB)- but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- Materials (XLB)

- Health Care (XLV)

And I have SELL calls for:

- Small-Caps (IWM) - in the short-term. But do not fully exit positions.

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist