Stocks rose sharply on Tuesday (Dec. 15) as optimism grew that Congress could pass another economic stimulus package before year’s end.

News Recap

- The Dow Jones gained 337.76 points, or 1.1%, and closed at 30,199.31. The S&P 500 also gained 1.3% and snapped a four-day losing streak. The tech-heavy Nasdaq climbed 1.3% and reached a new record closing high of 12,595.06. However, the Russell 2000 small-cap index once again beat the other indices and gained 2.40%.

- In the strongest indication yet that we may be coming closer to a stimulus agreement, the top four congressional leaders-House Speaker Nancy Pelosi, Senate Majority Leader Mitch McConnell, Senate Minority Leader Chuck Schumer, and House Minority Leader Kevin McCarthy - all were set to meet after market close on Tuesday (Dec. 15).

- Democrats and Republicans still remain deeply divided on certain matters, but a two-part bipartisan stimulus plan proposed on Tuesday (Dec. 15) has a chance of passing.

- The stimulus package would provide around $908 billion in total aid. The first part would be a $748 billion stimulus package that includes an additional $300 per week in federal unemployment benefits and another $300 billion for more PPP loans. This segment would also include money for vaccine distribution, education, and rental assistance. The second segment would be a $160 billion aid package and cover the more partisan issues of business liability protections and financial aid to state and local governments.

- The first round of shots from the vaccine developed by Pfizer and BioNTech were given in the U.S. on Monday (Dec. 14) with further distributions occurring Tuesday (Dec. 15).

- FDA staff announced that they endorsed emergency usage of Moderna’s vaccine. The FDA’s vaccine advisory panel will meet Thursday (Dec. 16) to decide whether to recommend clearance for emergency use. Upon authorization, government officials plan to ship nearly 6 million doses of Moderna’s vaccine in addition to the 2.9 million Pfizer doses already in distribution.

- Apple led the Dow higher, jumping 5% after Nikkei reported that the company will increase iPhone production by about 30% in the first half of 2021.

- All 11 S&P 500 sectors gained on Tuesday (Dec. 15) and were led by energy and utilities.

- We are approaching the darkest days of the COVID-19 pandemic yet. 300,000 people across the country have now lost their lives to the disease. However, the worst may not be over yet. According to the CDC Director Robert Redfield, US COVID-19 deaths are likely to exceed the 9/11 death toll for the next 60 days.

The short-term may see some pain and/or mixed sentiment due to two major catalysts - the lack of stimulus and an out-of-control virus.

According to Art Hogan, chief market strategist at National Securities:

“There’s been a tug of war between the vaccine news and the virus news. The only tiebreaker that’s kept the averages on their way higher seems to be the potential for getting stimulus out of gridlock...It certainly feels like one of the proposals that’s on the table ... can go through.”

Additionally, Luke Tilley, chief economist at Wilmington Trust, said that another stimulus package was needed to keep the economic recovery from stalling before a mass distribution of a vaccine.

“With the continued rising cases and mass vaccinations still a ways out, we could see some further weakness in jobs and even a flattening where we’re not even adding jobs at all ... that’s absolutely a possibility for this next jobs report,” Tilley said. “And if we were to not get another stimulus package, you’re going to have 10 to 11 million people fall off the unemployment rolls right away, and that would hit spending as well.”

On the other hand, the mid-term and long-term optimism is very real. While there may be some semblance of a “Santa Claus Rally” occurring, the general consensus between market strategists is to look past the short-term pain, and focus on the longer-term gains.

According to Robert Dye, Comerica Bank Chief Economist:

“I am pretty bullish on the second half of next year, but the trouble is we have to get there...As we all know, we’re facing a lot of near-term risks. But I think when we get into the second half of next year, we get the vaccine behind us, we’ve got a lot of consumer optimism, business optimism coming up and a huge amount of pent-up demand to spend out with very low interest rates.”

In the short-term, there will be some optimistic and pessimistic days. On some days, like Monday (Dec. 14), the broader “pandemic” market trend will happen - cyclical and recovery stocks lagging, and tech and “stay-at-home” stocks leading. On other days, like Tuesday (Dec. 15), there will be a broad market rally due to optimism and 2021 related euphoria. On other days (and in my opinion this will be most trading days), markets will trade largely mixed, sideways, and reflect uncertainty.

However, if a stimulus deal passes before the end of the year, all bets are off. It could mean very good things for short-term market gains.

In the mid-term and long-term, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will stabilize, and optimism and relief will permeate the markets. Stocks especially dependent on a rapid recovery and reopening such as small-caps should thrive.

Due to this tug of war between sentiments though, it is truly a challenge to predict the future with certainty.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! Always happy to hear from you.

Driving

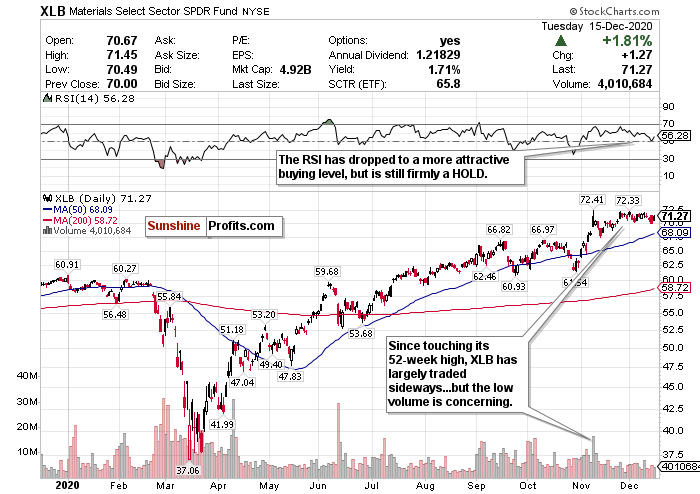

Materials (XLB)

The materials sector, as represented by the XLB ETF, has largely traded sideways since hitting its 2020 high in November.

Cyclical sectors such as materials are set to be some of the biggest beneficiaries from an economic reopening in 2021. However, ever since peaking at $72.41 a share, the ETF’s volume has plummeted - and largely stayed low.

I believe that this sector could pull back further or stay in a sideways pattern for the rest of the month. This is a sector that may surely be more exposed than others to short-term headwinds. Unless a stimulus passes, I simply don’t foresee a rally happening either. For the materials ETF to come back, exceed its 52-week high, and pierce that $72 resistance level, a stimulus package is necessary, and the vaccine(s) must be efficiently rolled out and scalable. If this happens and a near-term economic slowdown can be somewhat averted, then materials could benefit. But for now, my view is muddled.

For the time being, there is too much uncertainty to make a conviction call. Therefore, this is a HOLD for the short-term. However, I am considerably more bullish on materials in the long-term.

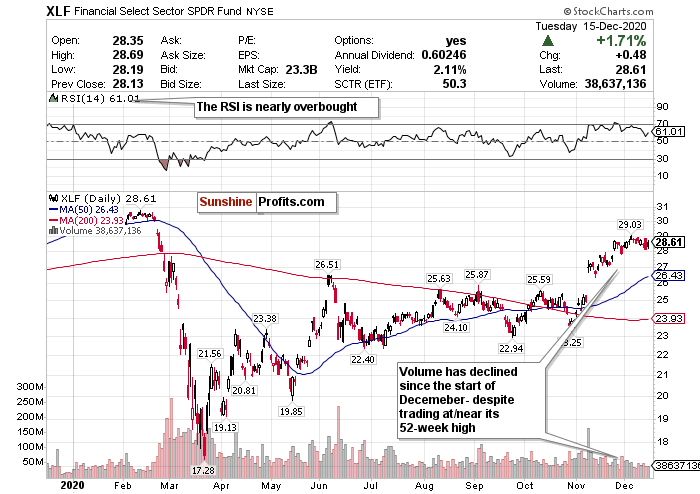

Financials (XLF)

The financial sector is another sector that will lead markets on optimistic days, such as Tuesday (Dec. 15). Overall, this is a sector that has continued its November surge with a strong first half of December. But compared to other sectors, I have some serious concerns.

What is muddling my bullishness are interest rates - a huge driver of banking revenue. Rates are still at unprecedented lows and will not change until possibly 2022-2023. The Fed has not been shy about keeping these rates low either, and will let the GDP heat up. I don’t expect the Fed to make any earth-shattering announcements during its statements on Thursday (Dec. 17) either – I believe the Fed will likely stay dovish. Until rates start rising again, profit margins will continue to narrow.

Although higher quality loan applications, and an influx of new investors have helped certain banking stocks, I worry about overheating in this sector. Judging from its RSI, the decline in volume, pricing position relative to its moving averages, and proximity to its 2020 high, the signs are obvious. Without rising interest rates, it’s hard to truly justify these gains- despite the optimistic tailwinds.

The theme of mixed sentiment continues for this sector. However, because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for at least the foreseeable future, I have this at a SELL. Take the profits while you can!

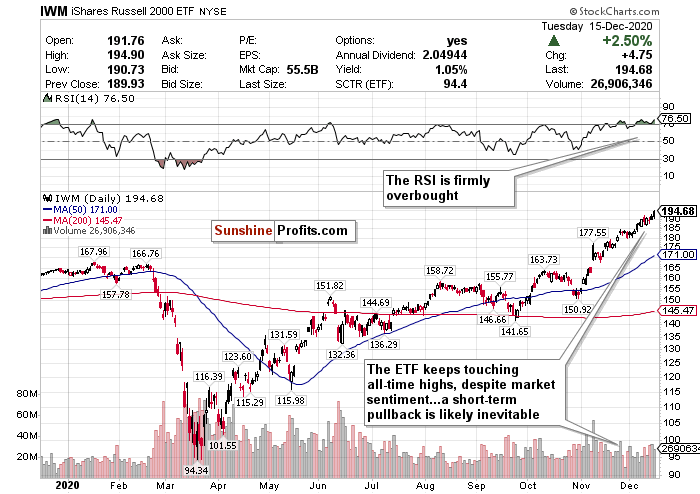

Small-Caps (IWM)

I love small-cap stocks in the long-term, but this short-term run has simply overheated. The small-cap Russell 2000 keeps outperforming the other indices - no matter what the market sentiment of the day is. For example, the week ended December 11th was an overall down week, however, the Russell 2000 STILL managed to outperform the larger indices and eek out another weekly gain of 1.02%. But I do not see how this is sustainable.

The performance of the Russell 2000 index since early November has been nothing short of staggering. Although the Russell index is composed mostly of small-cap value cyclical stocks dependent on the recovery of the broader economy, and may be more adversely affected on “sell-the-news” kind of days, its hot streak since November has not cooled off in the slightest.

Since the start of November, the Russell 2000 has skyrocketed and considerably outperformed the other major indices. The iShares Russell 2000 ETF (IWM), in comparison to the ETFs tracking the Dow (DIA), S&P (SPY), and Nasdaq (QQQ), has risen over 24%. This is at least 12% higher than all of the other major indices. Since the start of December, the Russell ETF has also outperformed the other ETFs between 4% to 5%.

This run by small caps is what makes the overall market rally since November different from the one in April/May. Instead of tech, which led the April/May rally, small-caps and cyclicals have led the way. This is a bullish sign for an economic recovery and shows that investors are optimistic that a vaccine will return life to relatively normalcy in 2021.

However, when looking at the chart for the Russell 2000 ETF (IWM), it becomes pretty evident that small-cap stocks have overheated in the short-term. These are stocks that will experience more short-term volatility. Stocks don’t always go up but the Russell’s trajectory since November has been basically vertical. The IWM ETF keeps hitting record highs while the RSI keeps overinflating way past overbought levels. I would SELL and take profits in the small-term- but do not fully exit these positions. BUY for the long-term recovery on a pullback.

Diving

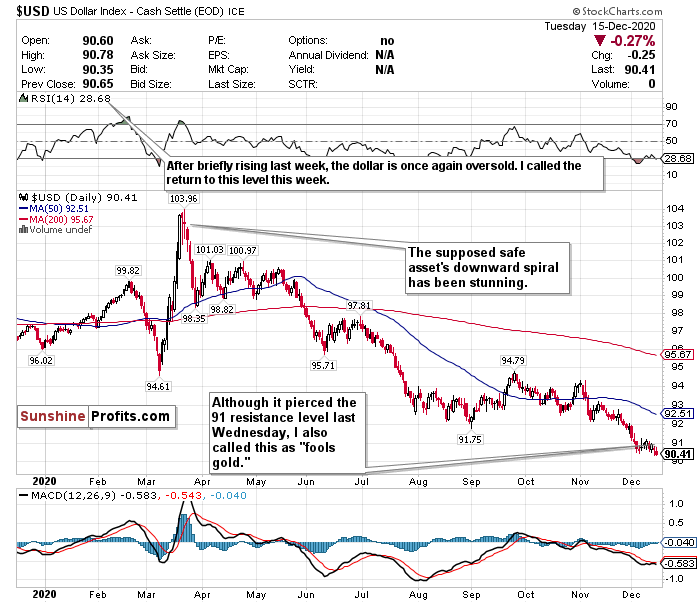

US Dollar ($USD)

The U.S. Dollar’s plunge continues. I called the return to oversold levels this week despite the currency piercing the 91-level last Wednesday. I knew it was “fool's gold” and I knew that it was not the sign of any sort of breakout. I have been calling the dollar’s weakness for weeks despite its low levels, and I expect the decline to continue.

The world’s reserve currency is still hovering around its lowest level since April 2018 and has plunged in excess of 12% since March. Meanwhile, other currencies, such as the euro, are strengthening. The euro hovered near a 2.5-year peak on Tuesday (Dec. 15), and has surged 4% since early November.

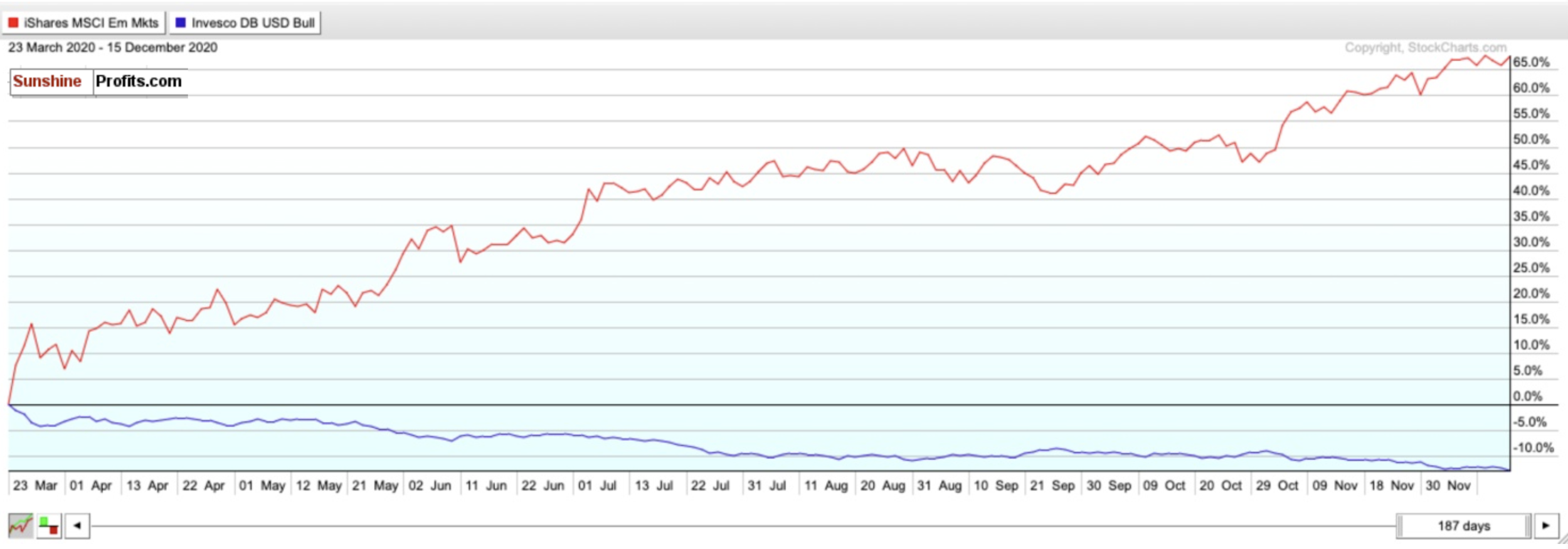

After briefly rising above an oversold RSI of 30 last week, the dollar’s RSI is back under 30. The dollar is also significantly trading below both its 50-day and 200-day moving averages, while emerging market indices and currencies continue to grossly outperform the perceived safe asset

Further illustrating the dollar’s decline has been its performance relative to emerging markets. Just compare the performance of the iShares MSCI Emerging Market ETF (EEM) relative to the Invesco DB USD IDX Bullish ETF (UUP) since March 23. The difference is shocking and continues to widen too.

Many believe that the dollar could fall further as well due to a multitude of headwinds.

If the world returns to relative normalcy within the next year, investors may be more “risk-on” and less “risk-off,” which means that the dollar’s value will decline further.

Additionally, because of all of the economic stimulus that has already been pumped in, combined with future stimulus seemingly imminent, and record low-interest rates, the dollar’s value has declined and could have more room to fall. Do not forget that the Fed plans on holding interest rates this low for at least another 2 years - at least. For the dollar’s value, rates remaining this low for 2 years is an eternity.

As the world’s reserve currency, this plunge in value is concerning both in the short-term and mid-term for the US economy. A declining dollar means the strengthening of other foreign currencies, and this may only be the beginning.

While the dollar may have more room to fall, this MAY be a good opportunity to buy the world’s reserve currency at a discount. The RSI reflects this. But I just have too many doubts on the effect of interest rates this low, government stimulus, strengthening of emerging markets, and inflation to be remotely bullish on the dollar’s prospects over the next 1-3 years.

For now, where possible, HEDGE OR SELL USD exposure.

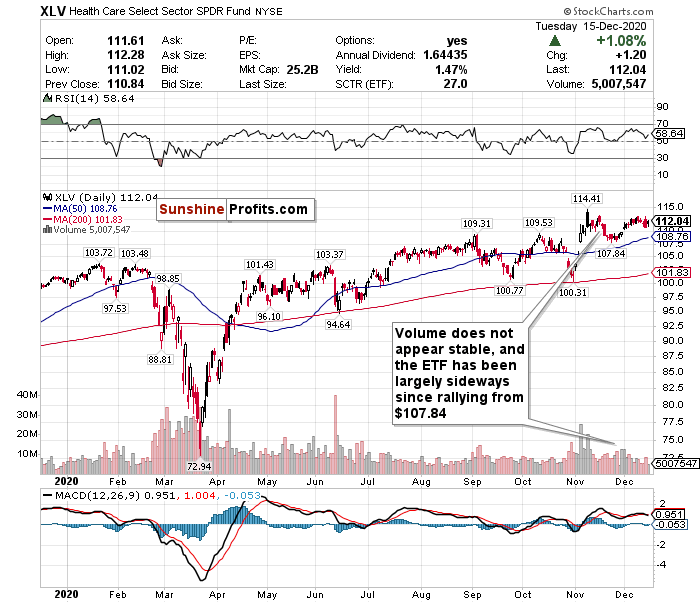

Health Care (XLV)

In theory, Healthcare is a sector that should benefit from a vaccine, however, it continues to be one of the market’s biggest underperformers, despite its rally on Tuesday (Dec. 15).

A vaccine will cause short-term surges in companies that are directly involved in vaccine production and distribution such as Pfizer (PFE) and Moderna (MRNA). However, it will not be a long-term profit driver for these companies. Just take Pfizer’s stock for example. Despite the vaccine receiving formal approval a week ago while the roll-out commenced this week, the stock is down over 9% in that same timeframe! The vaccine(s) will simply only benefit a few companies in the short-term while the rest of the sector lags. The pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon.

Keep this in mind as well. Hospitals make a lot of their money from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures.

Outside of a few companies, it’s simply hard to see the upside in healthcare now. However, volume-wise, the RSI is not as close to overbought as other sectors.

While there will not be as much upside in this sector as others, there will also not be as much volatility. Therefore, I give this a HOLD call (and if you own a vaccine stock, consider taking profits).

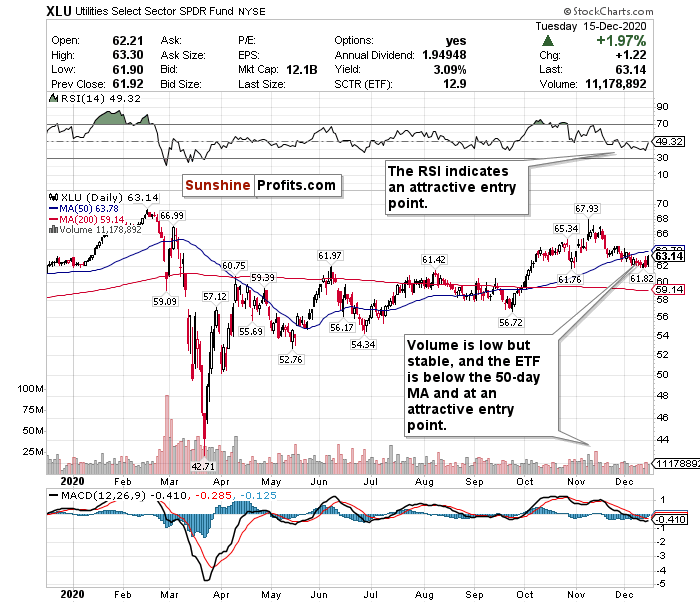

Utilities (XLU)

Utilities may offer the best opportunity to find value in a market this overinflated, manic, and unpredictable.

Utilities are considered to be defensive investments, and as a result, have underperformed the market. However, this was one of the best performing sectors on Tuesday (Dec. 15).

This is frankly a boring sector not focused on growth or gains. But during uncertain times, this is a solid sector to find value in because it is cheap, does not swing much upwards or downwards, and is generally a safe place to park your money. In the short-term and long-term, this sector may be a good hedge against volatility and bad news, and may also be a good way to gain exposure to renewable energy and 5G.

Utilities do not pose the same type of overheating risks as other sectors, such as small-caps. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is lower than other sectors and the ETF is trading below its 50-day moving average. The ETF’s volume, while low, has also been stable.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the vaccine/treatment front poses significant optimism for 2021 and beyond. The start of global vaccinations, and the likely FDA approval of another vaccine (Moderna) this week, should be cheered by everyone. Although sentiment seemingly changes day by day, the long-term outlook for equities could be very positive.

There is still some short-term tumult to close off this “interesting” year, but we can officially enter 2021 with some glimmer of hope. However, COVID-19 is still here and has not been eradicated. Until that happens, there will inevitably be a tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, remember how sharp and swift the rally was after the crashes in March.

I do not believe a crash like that is on the horizon, but if there is a short-term correction or downturn, keep your eyes on buying opportunities. Why? Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 97.65%. Nasdaq (QQQ) up 80.85%. S&P 500 (SPY) up 67.17%. Dow Jones (DIA) up 64.41%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

If everything goes well with distributing the vaccines, and the virus can be contained, the short-term volatility may be worth monitoring for opportunities.

To sum up all our calls, I have a BUY call for:

- Small-Caps (IWM) - but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- Materials (XLB)

- Health Care (XLV)

And I have SELL calls for:

- Small-Caps (IWM) - in the short-term. But do not fully exit positions.

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist