Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one third (1/3rd) and two fifths (2/5th) in case of further dips and depending on the volatility of each chosen security…

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Below the previous swing low (depending on your timeframe/time horizon).

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

Biofuel-related stocks |

|

EPD, 20.20-20.81 |

|

AMTX, 17.06-17.78 |

|

DAR, 69.09-71.25 TANH, 0.74-0.79 |

Oil & Gas Trading positions

- WTI Crude Oil [CLF22] Long around $75.25-76.22 support (yellow band) with targets at $79.37 / $82.24 and stop just below $73.43 (previous swing low) – See my trading plan (Entry triggered!)

- Natural Gas [NGZ21] No position currently justified on a risk-to-reward point of view.

By the way, have you read my last article about commodity currencies? Let me know what you would like to learn more about regarding that hybrid (commodities/FX) topic, so I will do my best to emphasize some of your suggestions in my future posts!

How do you feel about adding a broader range of stocks to our energy investment portfolio watchlist? Let’s see what we can do!

By the way, feel free to send us your questions or topics that you would like us to write about in the forthcoming editions, so we’ll try our best to answer them!

Trading positions are available to our premium subscribers.

First, let’s quickly define what biofuels are:

A biofuel is a liquid or gaseous fuel derived from the transformation of non-fossil organic matter from biomass, for example, plant materials produced by agriculture (beets, wheat, corn, rapeseed, sunflowers, potatoes, etc.). So, it is considered a source of renewable energy. The combustion of biofuels produces only carbon dioxide (CO2) and steam (H2O) and little or no nitrogen and sulfur oxides. Therefore, biofuels – as being at the crossroads between energy and agricultural commodities – respond to economic drivers (crops/supply, demand, dollar strength, reserves, etc.) and geopolitics of both industrial sectors. Furthermore, they allow their producing countries to reduce their energy dependence on fossil fuels.

Key reasons to invest in these alternative energy sources:

Given the recent surge of oil and gas prices, biofuels have become somehow more attractive, and consequently one could witness a slight shift in demand from fossil to non-fossil fuels. This was also a central topic of talks during the recent United Nations Conference of the Parties (COP26), which recently took place in Glasgow (Scotland), and where world leaders finally agreed to preliminary rules for trading carbon emissions credits. In addition, as we all know, the combustion of fossil fuels contributes to greenhouse gas (GHG) emissions. Regarding biofuels - the carbon emitted to the atmosphere during their combustion has been previously fixed by plants during photosynthesis. Thus, the carbon footprint seems to be a priori neutral.

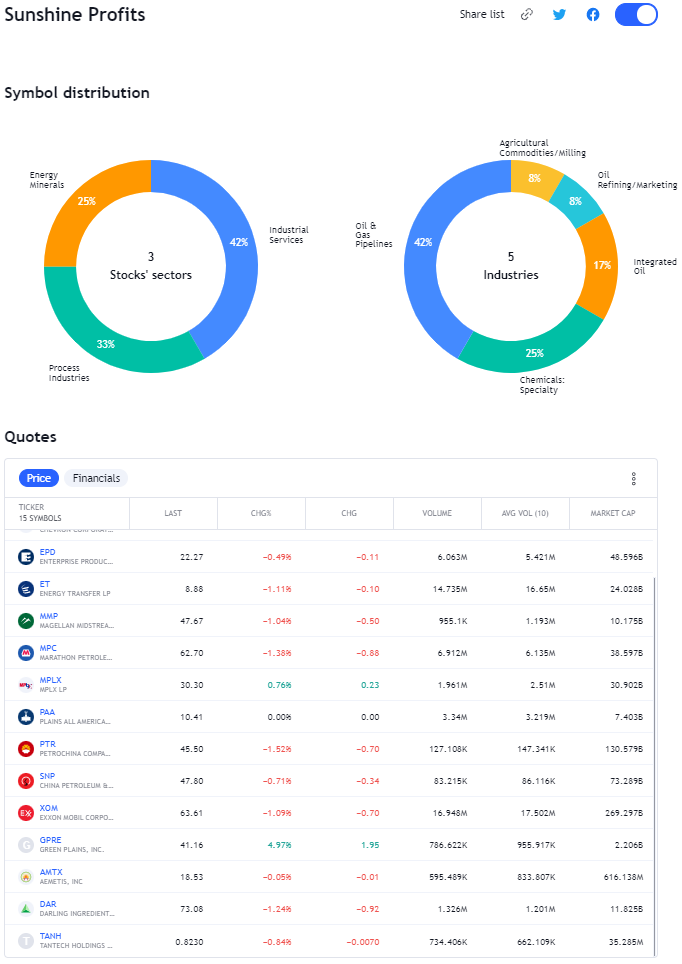

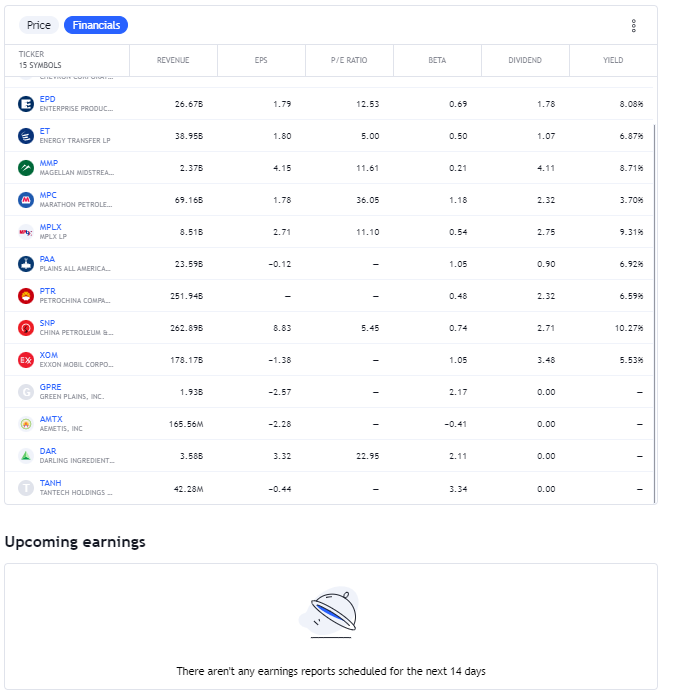

Stock Watchlist (Continued)

In the first article, we started a watchlist with some major energy stocks. In the second article, we added some more spicy assets (MLPs). Today, let’s update it with some biofuel-based stocks!

As usual, our stock picks will be shared through that link to our dynamic watchlist which will be updated from time to time, as we progress through this portfolio construction process...

Below is an example of some indicative metrics:

Daily Technical Charts

Figure 1 – Green Plains, Inc. (GPRE) Stock (daily chart)

Figure 2 – Aemetis, Inc. (AMTX) Stock (daily chart)

Figure 3 – Tantech Holdings Ltd. (TANH) Stock (daily chart)

Figure 4 – Darling Ingredients Inc. (DAR)

Stock (daily chart)

In summary, those biofuel-related stocks may present some benefits to diversifying your energy portfolio while covering some alternative fuels as well.

As always, we’ll keep you, our subscribers well informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one third (1/3rd) and two fifth (2/5th) in case of further dips and depending on the volatility of each chosen security…

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Below the previous swing low (depending on your timeframe/time horizon).

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

Biofuel-related stocks |

|

EPD, 20.20-20.81 |

|

AMTX, 17.06-17.78 |

|

DAR, 69.09-71.25 TANH, 0.74-0.79 |

Oil & Gas Trading positions

- WTI Crude Oil [CLF22] Long around $75.25-76.22 support (yellow band) with targets at $79.37 / $82.24 and stop just below $73.43 (previous swing low) – See my trading plan (Entry triggered!)

- Natural Gas [NGZ21] No position currently justified on a risk-to-reward point of view.

By the way, have you read my last article about commodity currencies? Let me know what you would like to learn more about regarding that hybrid (commodities/FX) topic, so I will do my best to emphasize some of your suggestions in my future posts!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist