Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one-third (1/3rd) and two-fifth (2/5th) in case of further dips and depending on the volatility of each chosen security.

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Either below the previous swing low (depending on your timeframe/time horizon);

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

MLPs |

|

EPD, 20.20-20.81 |

|

ET, 8.27-8.81 |

|

MMP, 43.23-44.89 |

|

MPLX, 21.36-23.15 |

|

PAA, 7.93-8.82 |

Also, have a look at the dynamic watchlist containing our energy stock-picks!

Let’s focus on another kind of securities to trade energies today: Master Limited Partnership (MLP). How do they work and how can they be profitable?

By the way, a big “thank you!” goes to Simon, one of our readers, who asked us about this last Friday. Feel free to send us your questions or any topics that you would like us to write about in the forthcoming editions, and we’ll try our best to answer them!

A good way to diversify the construction of your oil and gas investment portfolio is to use a variety of assets for balanced exposure to the energy sector and its industrial components.

What Is a Master Limited Partnership (MLP)?

To learn in detail what a MLP is, we invite you to read the following articles that already contain the necessary basic information you need to know before starting investing in them.

- Master Limited Partnership (MLP), Investopedia.com

- The Benefits of Master Limited Partnerships, Investopedia.com

Key Reason for Going Into Those Alternative Investments

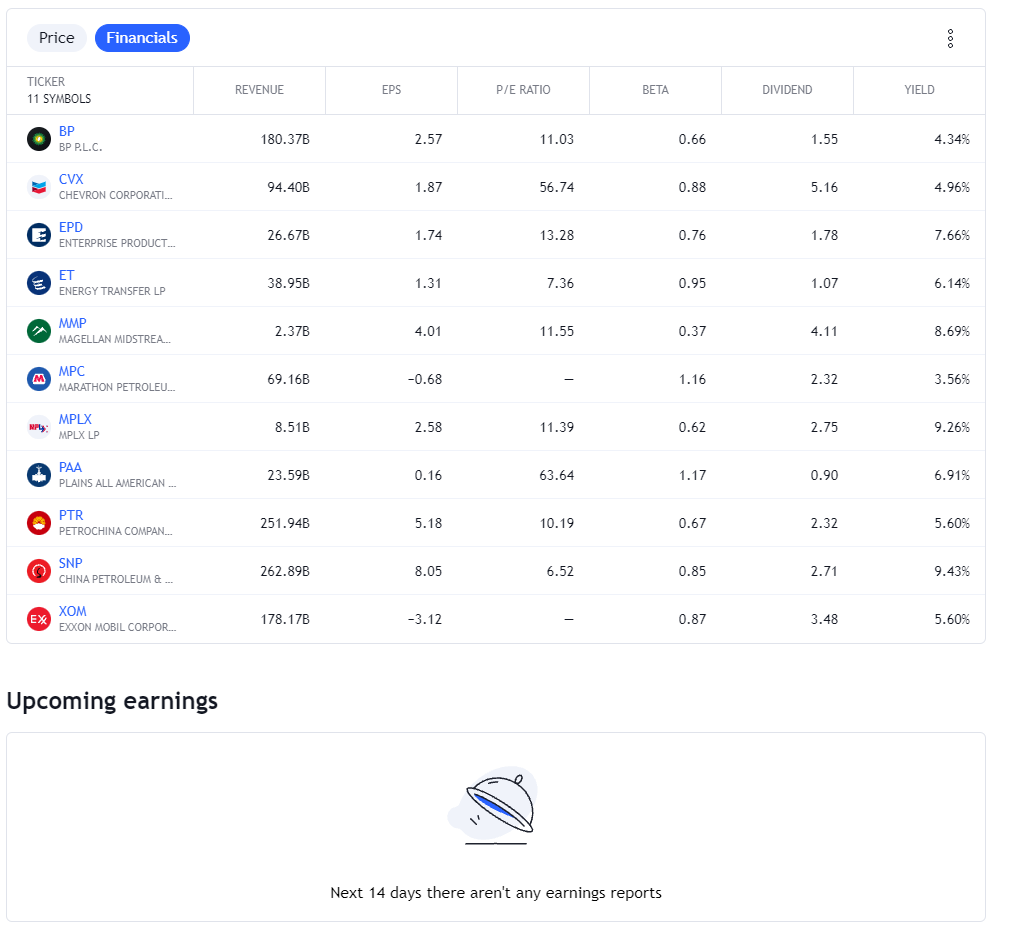

The most important advantage is the high-income potential. Indeed, Master Limited Partnerships (MLPs) typically pay high yields to investors, mainly due to the fact that they do not pay corporate income taxes.

Stock Watchlist (Continued)

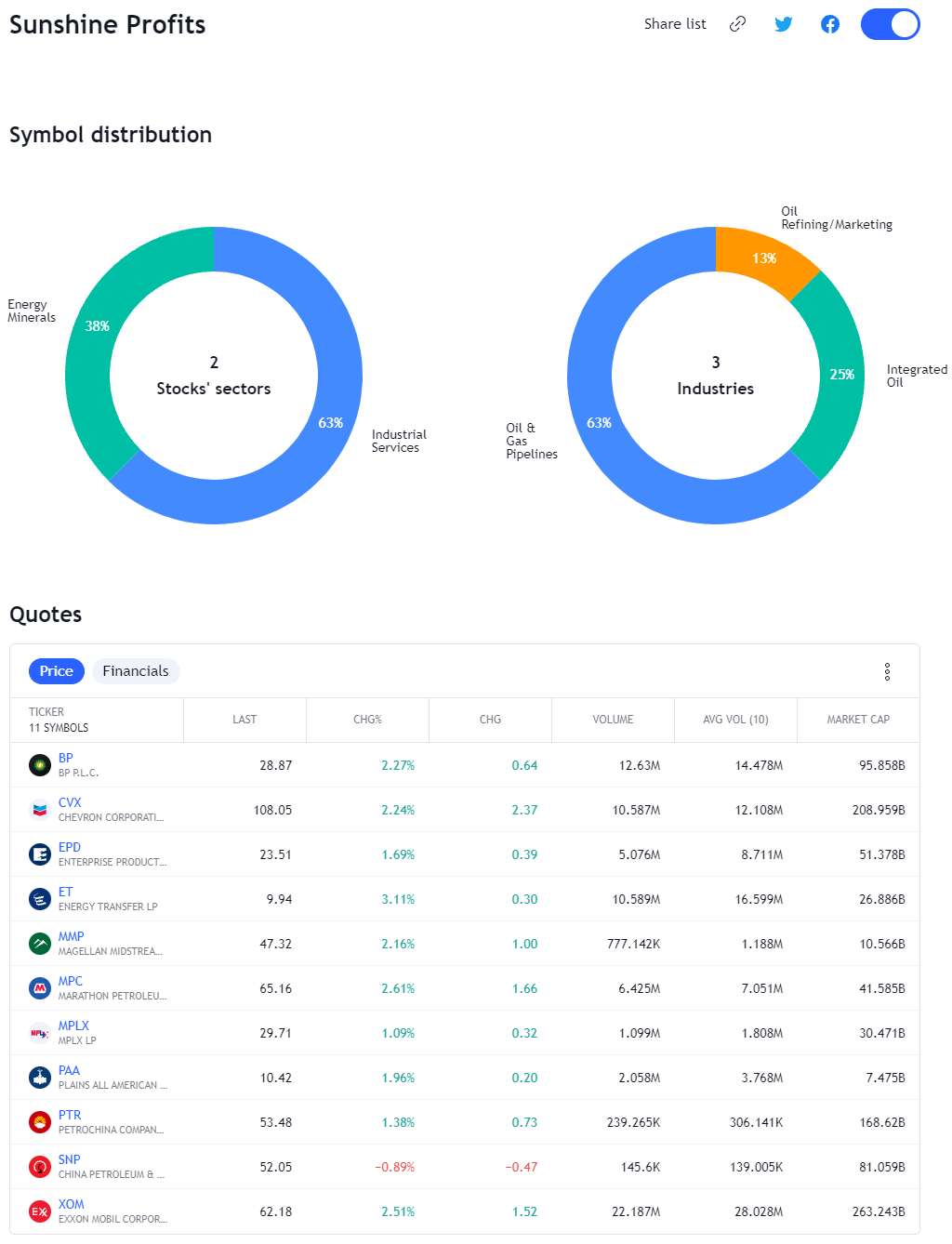

In the first article about alternative investments, we started a watchlist with some major energy stocks. Today, let’s update it!

As usual, our stock-picks will be shared through this link to our dynamic watchlist (which will be included in the position from now on). It will be updated from time to time as we progress through our portfolio construction process.

Take a look below at a few examples of some indicative metrics:

Today we picked five oil and gas Master Limited Partnership (MLP) companies that are quoted on the US exchange. Their revenues are as stated below:

Revenue (in billion US dollars):

- Enterprise Products Partners LP (EPD) $26.67B

- Energy Transfer LP (ET) $38.95B

- Magellan Midstream Partners LP (MMP) $2.37B

- MPLX LP (MPLX) $8.51B

- Plains All American Pipeline LP (PAA) $23.59B

MLP Charts

On the charts given below, I marked entry levels for the MLPs mentioned in the position. Trade wisely!

Figure 1 – Enterprise Products Partners LP (EPD) Stock (monthly chart, logarithmic scale)

Figure 2 – Energy Transfer LP (ET) Stock (monthly chart, logarithmic scale)

Figure 3 – Magellan Midstream Partners LP (MMP) Stock (monthly chart, logarithmic scale)

Figure 4 – MPLX LP (MPLX) Stock (monthly chart, logarithmic scale)

Figure 5 – Plains All American Pipeline LP (PAA) Stock (monthly chart, logarithmic scale)

In summary, those alternative investments may present stable benefits and diversify your energy portfolio… So, what MLPs do you guys trade?

As always, we’ll keep you, our subscribers, well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Risk Management: an idea here could be to enter on some potential dips (price getting back to support levels) by allocating one quarter (1/4th) of the position, then averaging down to lower supports with successively one-third (1/3rd) and two-fifth (2/5th) in case of further dips and depending on the volatility of each chosen security.

If you want to set a stop-loss, we suggest that you place it according to your risk appetite:

- Either below the previous swing low (depending on your timeframe/time horizon);

- Or just use some Average True Range (ATR) multiplicator.

Investing entries (medium to long-term; our opinion; support levels for stocks): Long.

|

MLPs |

|

EPD, 20.20-20.81 |

|

ET, 8.27-8.81 |

|

MMP, 43.23-44.89 |

|

MPLX, 21.36-23.15 |

|

PAA, 7.93-8.82 |

Also, have a look at the dynamic watchlist containing our energy stock-picks!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist