Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading positions

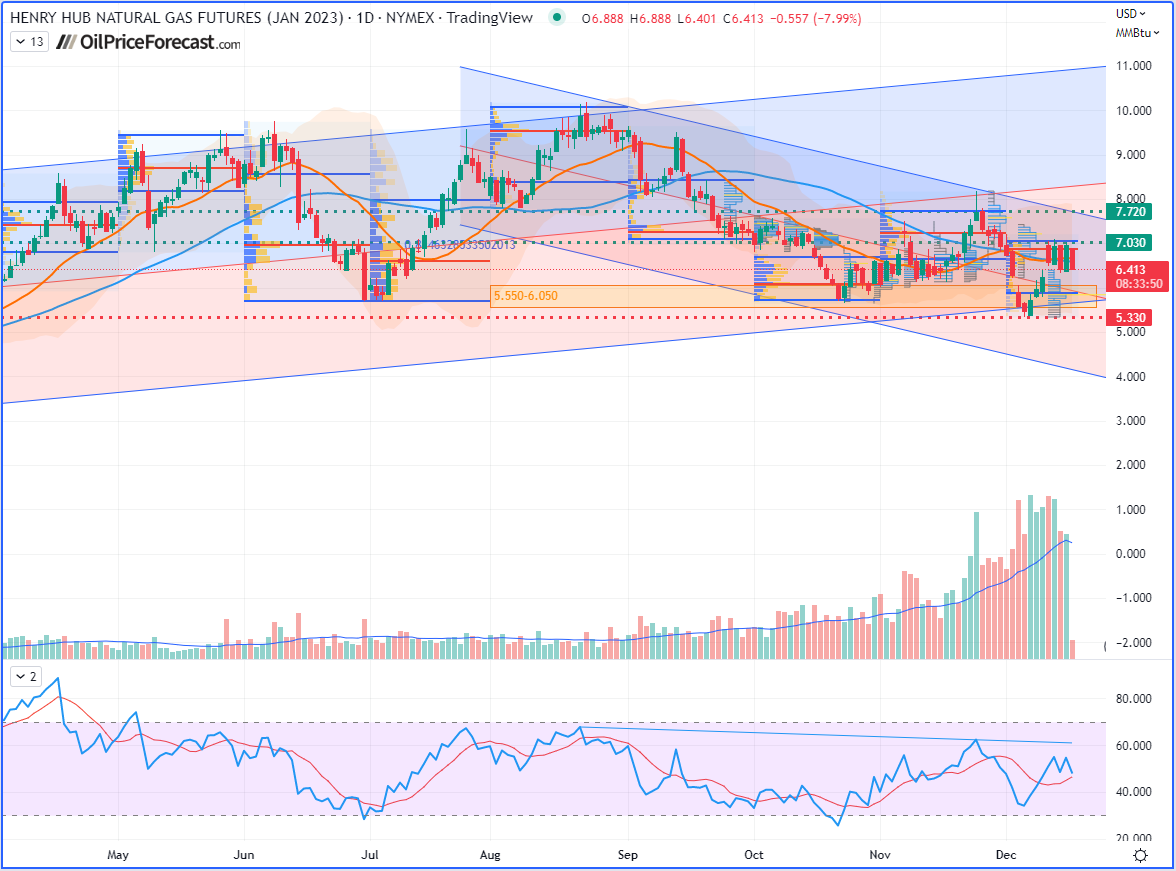

- Henry Hub Natural Gas Long Jan’23 contract (NGF23) around the 5.55-6.05 support zone (highlighted by the yellow band) with stop at 5.33 and targets at 7.03 & 7.72.

- RBOB Gasoline No new position justified from a risk/reward point of view.

- WTI Crude Oil No new position justified from a risk/reward point of view.

- Brent Crude Oil No new position justified from a risk/reward point of view.

Regarding risk management, it is always best to define your strategy according to your own risk profile. For some guidance on trade management, read one of my articles on that topic.

Technical Charts

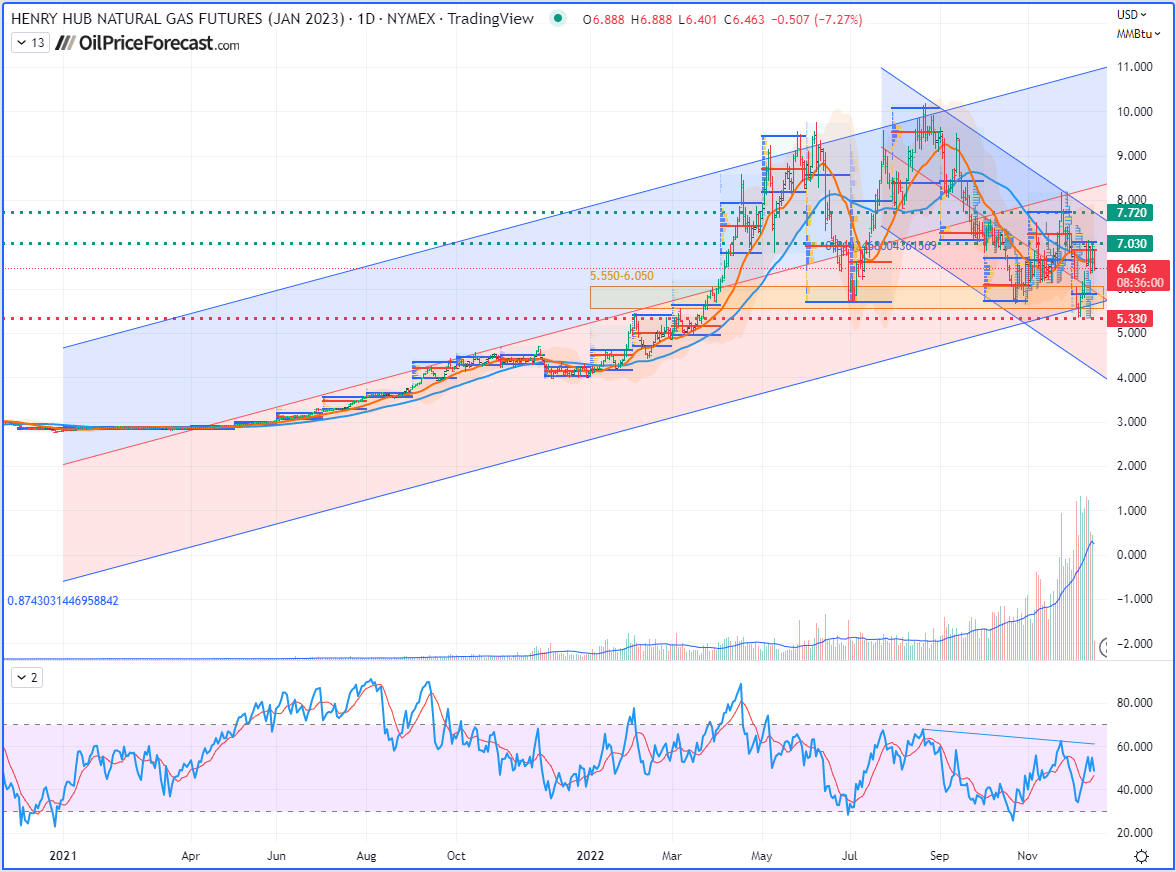

We currently have a market configuration that turned bearish in the last quarter. With fundamentals turning rather bullish in the past week, I would expect this volatile market to turn up as negative temperatures have further hit inventories.

The market has reached the lower side of its 2022 regression channel (which I will define as a long-term trend) the medium-term channel that formed within the latter could rebound up to the long-term regression line (or median of the long-term regression channel) located around the $8 mark.

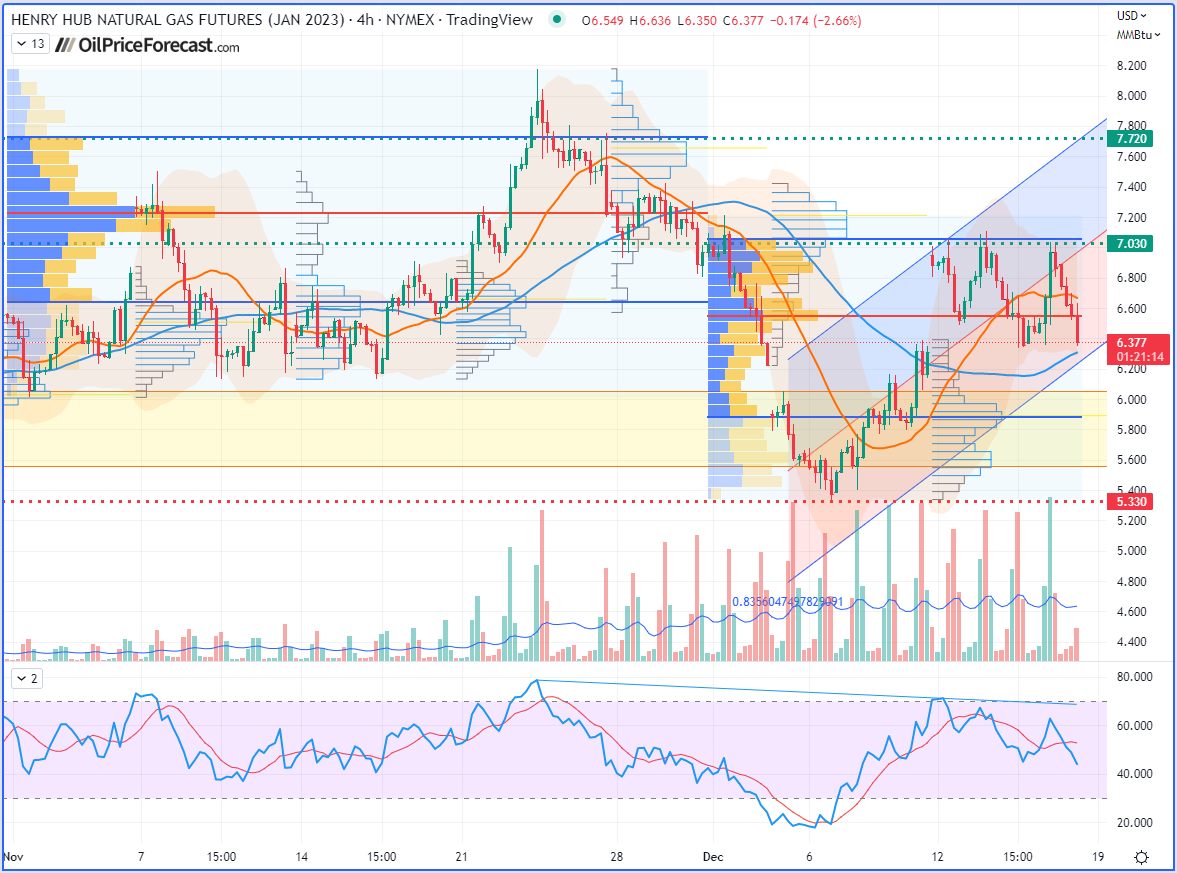

To obtain an optimal risk-to-reward ratio, I look at those channels with a pinch of salt – especially the short-term ones – as I would put more weight in my decision making on higher volume nodes rather than the extremities of those channels (which can be extended by the market price moves). Therefore, my entry is located around the higher volume nodes below a volume gap on the December monthly volume profile (as shown by the 4H chart) and also around the Volume Point of Control (VPoC) on the volume profile for the month of October (seen on the second daily chart). That is where most activity should normally take place. I prefer to keep a relatively tight stop – just below the December swing low – as if it gets hit, this would trigger an extension to the downside, with bears taking back control.

Henry Hub Natural Gas (NGF23) Futures (January contract, daily chart) – Zoom Out (Overall View w/ Long & Medium-Term Regression Channels)

Henry Hub Natural Gas (NGF23) Futures (January contract, daily chart) – Zoom Out (Overall View w/ Long & Medium-Term Regression Channels)

Henry Hub Natural Gas (NGF23) Futures (January contract, daily chart) – Zoom In (Current Price Action w/ Long & Medium-Term Regression Channels)

Henry Hub Natural Gas (NGF23) Futures (January contract, daily chart) – Zoom In (Current Price Action w/ Long & Medium-Term Regression Channels)

Henry Hub Natural Gas (NGF23) Futures (January contract, 4H chart) – Short-Term Regression Channel

Henry Hub Natural Gas (NGF23) Futures (January contract, 4H chart) – Short-Term Regression Channel

It’s been a little while since we took a closer look at natural gas, as the US market has been more difficult to read in the past quarter.

A Cold Winter Is Fueling Gas Demand

As I mentioned in Tuesday’s article, an element capable of restoring momentum to the energy market is the degraded weather conditions in the northern hemisphere – also likely to affect fuel demand. This is particularly true for Heating Oil, but also for Natural Gas:

“Firstly, in Europe, a mass of cold air from the Arctic brought temperatures down several degrees below seasonal averages. Secondly, in the United States, a cold front will sweep through much of the East, with negative temperatures forecast in Chicago, Cleveland, and Indianapolis.” – Oil Trading Alert (16/12/2022)

In Europe, and more specifically in Germany, relatively intense cold temperatures may have an impact on the natural gas stockpiles, even though France is helping its German neighbor match its current domestic energy demand, which is why this has to be closely monitored.

Have a nice weekend!

As always, we’ll keep you, our subscribers well informed.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist