Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

What a signal-rich week that was! At least if you’re interested in forecasting gold and predicting silver prices.

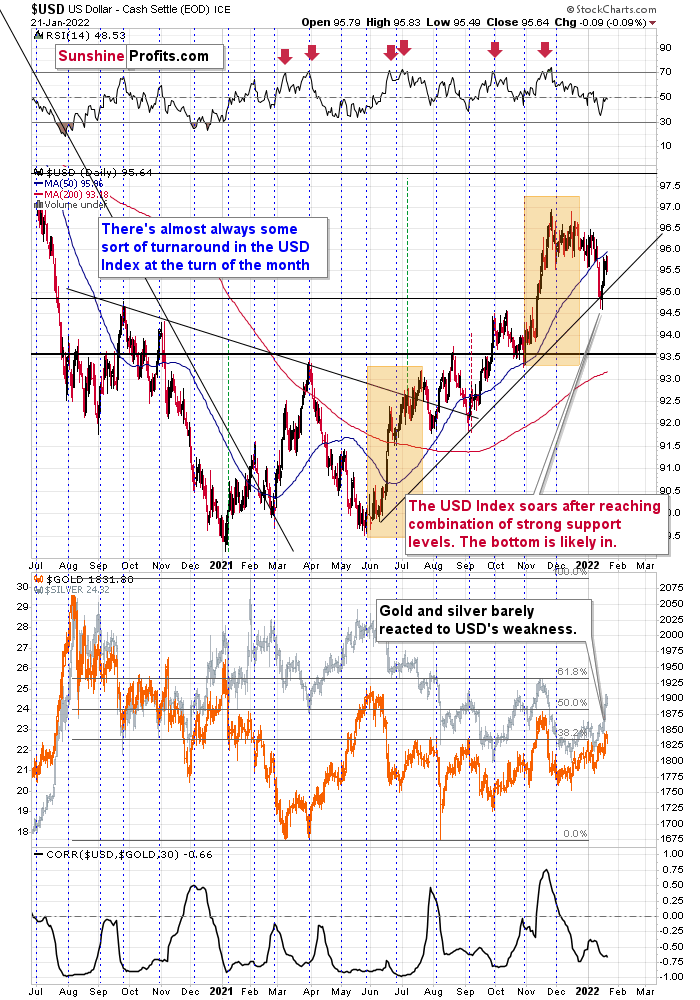

The USD Index rallied, but that was the least interesting of the important developments, as it had already reversed during the preceding week. So, the fact that the USD Index continued its medium-term uptrend last week is not that noteworthy.

It needs to be said, though, as that continues to be an important factor for the future of the precious metals market. To be clear – the implications for the PM sector are bearish.

What about gold, the key precious metal?

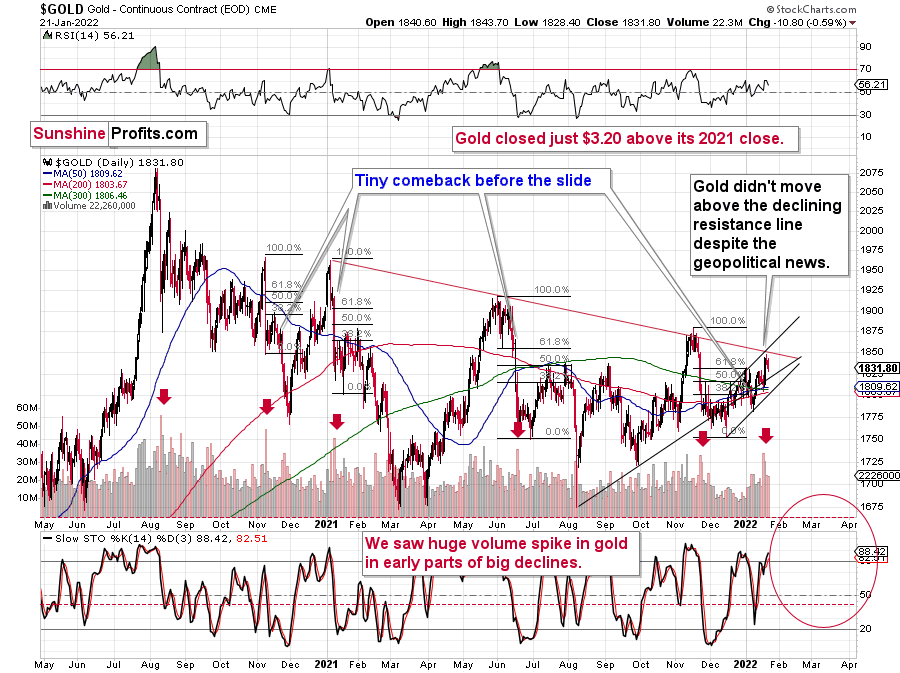

Gold is so far almost unchanged this year, despite the initial decline and the subsequent rally. Overall, gold is up by $3.20 so far in 2022, which is next to nothing.

Gold rallied on a supposedly dangerous situation regarding Ukraine, but it failed to rally above the combination of resistance lines and very little changed technically.

On a side note, I would like to remind you that, based on our own reliable source in Ukraine (one of our Team members is located there), the risk of military conflict (in particular, a severe one) is low, and it seems that the market’s reaction was greatly exaggerated.

Anyway, moving back to technicals, let’s keep this $3.20-up-this-year statistic in mind while we take a look at what’s going on in silver and mining stocks.

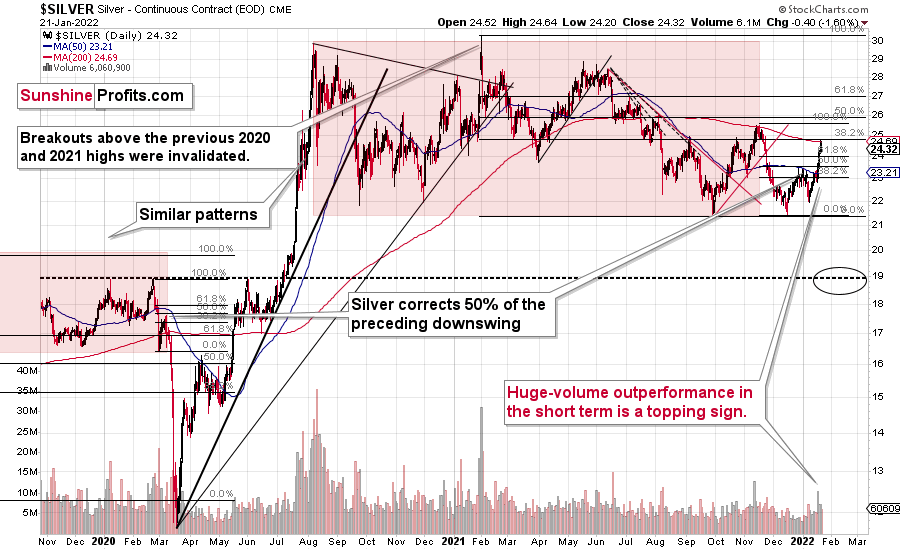

Silver declined on Friday, but it’s still up by $0.97 so far in 2022. This means that on a short-term basis, silver greatly outperformed gold.

What’s up with mining stocks?

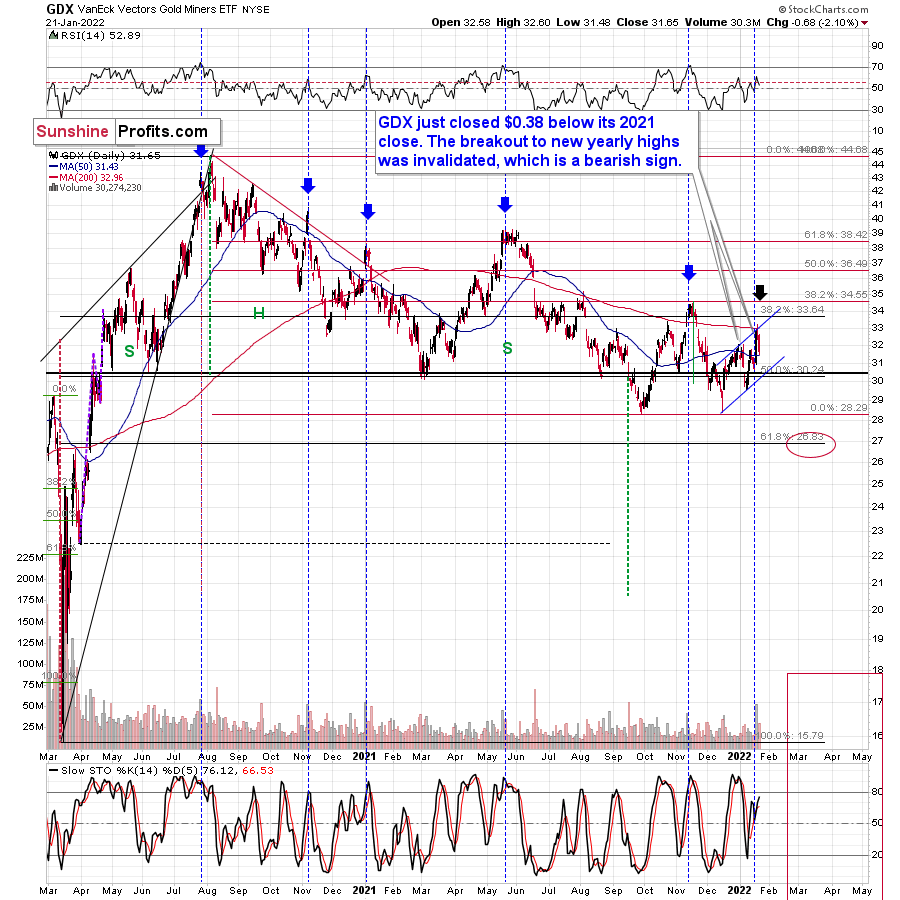

The GDX ETF – a proxy for generally senior mining stocks – is down this year by $0.38, which is 1.19%.

At the same time, the GDXJ ETF is down by $0.87, which is 2.07%.

In other words:

- While silver is outperforming gold on a short-term basis, gold mining stocks are underperforming it.

- Junior mining stocks (our short position) are declining more than senior miners, and in fact, they are declining the most of the entire precious metals sector.

Silver’s outperformance, accompanied by gold miners weakness, is a powerful bearish combination in the case of the entire precious metals sector.

If the general stock market is going to slide, silver and mining stocks (in particular, junior mining stocks) are likely to decline in a rather extreme manner.

The thing is…

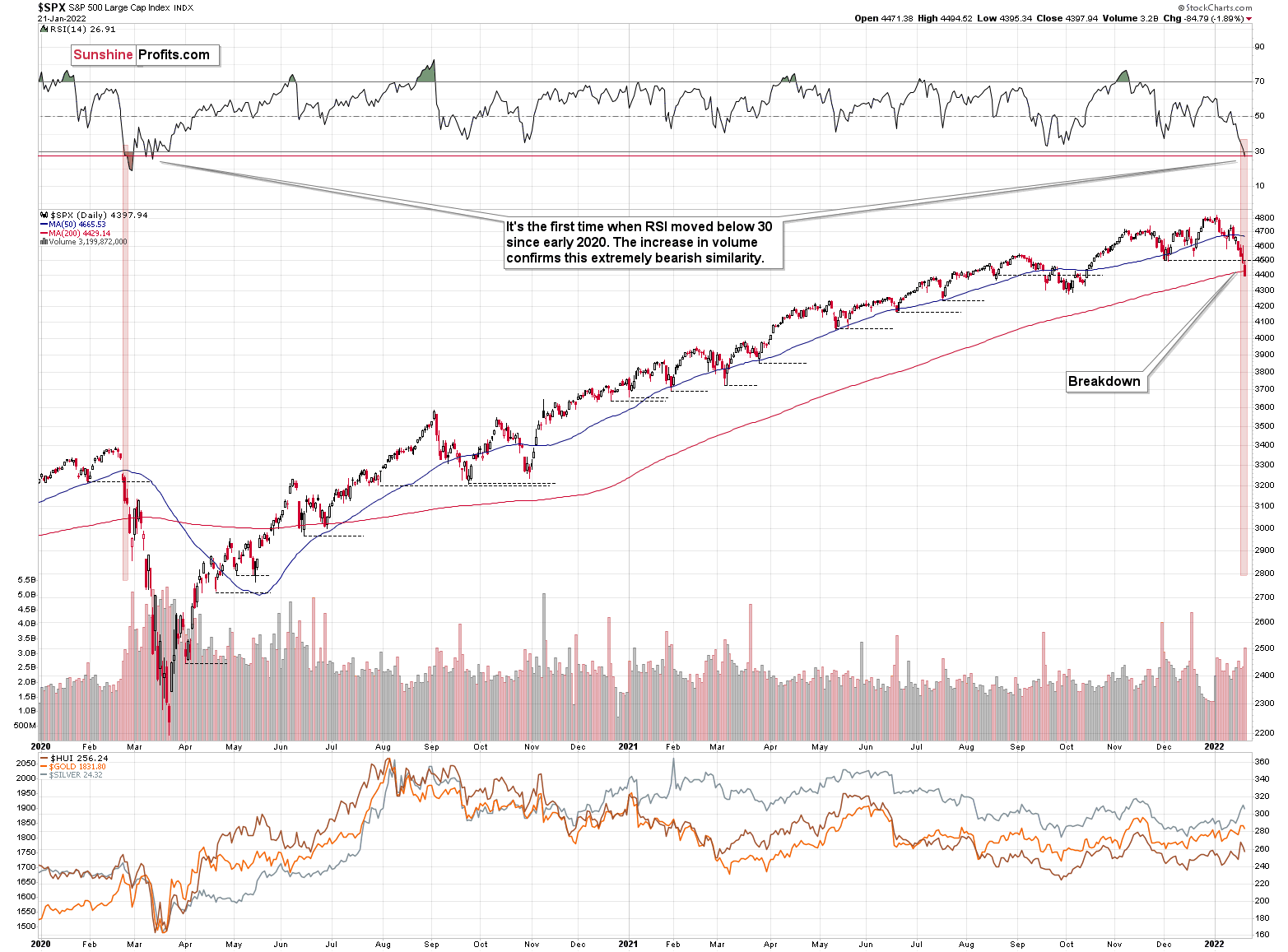

We just saw something in the general stock market that we haven’t seen since early 2020 – right before the massive decline that triggered the huge declines in the precious metals sector.

The RSI Index just moved below 30 for the first time since pre-slide moments. Just like what we saw back then, the S&P 500 is now declining on increasing volume.

Yes, RSI below 30 is generally considered oversold territory, but the direct analogies take precedence over the “usual” way in which things work in markets in general. In this case, the situation could get from oversold to extremely oversold. Let’s keep in mind that stocks declined very sharply in 2020.

One could say that times were different, but were they really? The key difference is that the monetary authorities are now already after the bullish money-printing cycle and are handling inflation by aiming to increase interest rates, while they had been preparing to cut them in 2020.

The situation regarding the pandemic is not that different either. Sure, back in 2020, it was all new, we had massive lockdowns and there was great uncertainty regarding… pretty much everything. Now, the situation is not entirely unexpected, but given the explosive nature of new COVID-19 cases (likely due to the Omicron variant), it’s still quite new and uncertain.

The uncertainty is not as great as it was back in 2020, but then again, now we’re facing monetary tightening, not dramatic dovish actions. Thus, I wouldn’t exclude a situation in which we really see a repeat of the early-2020 performance, where the declines are sharp and huge. The technicals in the precious metals market have been pointing to that outcome for months, anyway, especially the long-term HUI Index chart that I’ve been discussing previously.

Having said that, let’s take a look at the situation from the fundamental point of view.

Biden’s Blessing

While I’ve been warning for months that inflation has become a political issue, the implications stretch far beyond Wall Street. With consumers increasingly anxious, U.S. President Joe Biden’s approval rating plunging, and the Fed stuck in the middle, the developments are fundamentally bearish for the PMs.

For context, I wrote on Jan. 18:

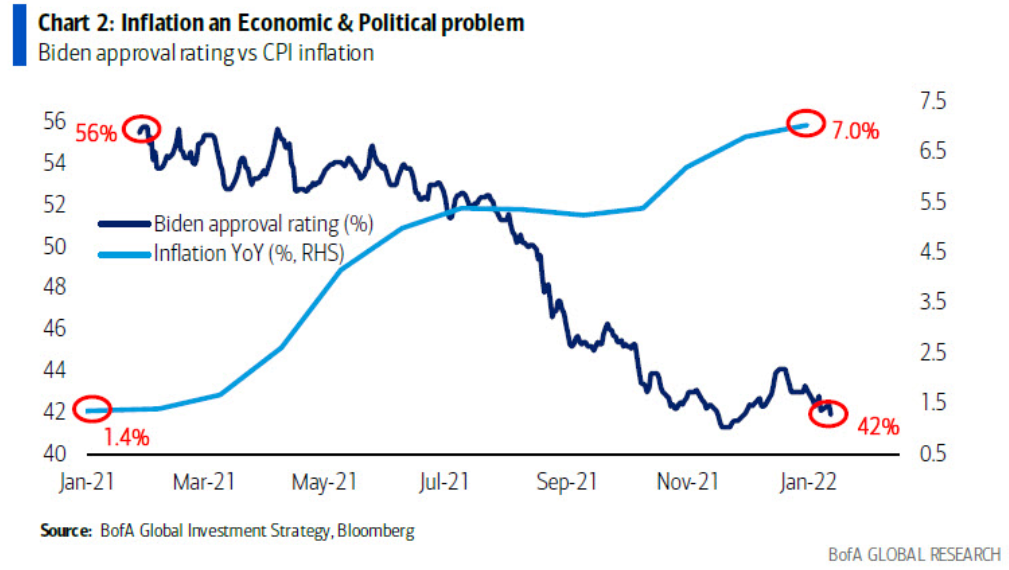

The inverse relationship between inflation and U.S. President Joe Biden’s approval rating is extremely detrimental to his re-election hopes.

Please see below:

To explain, the dark blue line above tracks Biden’s approval rating, while the light blue line above tracks the year-over-year (YoY) percentage change in the headline Consumer Price Index (CPI). As you can see, surging inflation isn’t doing the president any favors. And with his political survival on the line, doing nothing is the easiest way to lose the next election. As a result, the Fed isn’t bluffing and Biden is likely Powell’s strongest supporter.

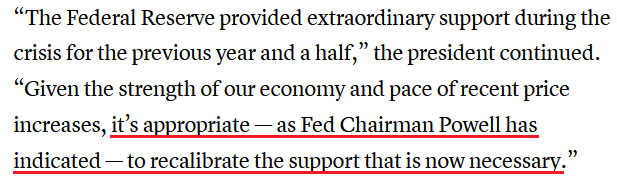

To that point, with Biden telling reporters on Jan. 19 that “people see [inflation] at the gas pump, the groceries stores, and elsewhere,” he made it clear that Powell has the hawkish green light. He said:

Thus, while I warned that Powell’s hawkish pivot was no accident, Biden finally admitted what we already knew. Likewise, the more the president hemorrhages political capital, the less likely the Fed performs a dovish 180. To explain, the U.S. midterm elections are held on Nov. 8, 2022. With plenty of seats up for grabs, the Democrats could get slaughtered if they don’t get inflation under control.

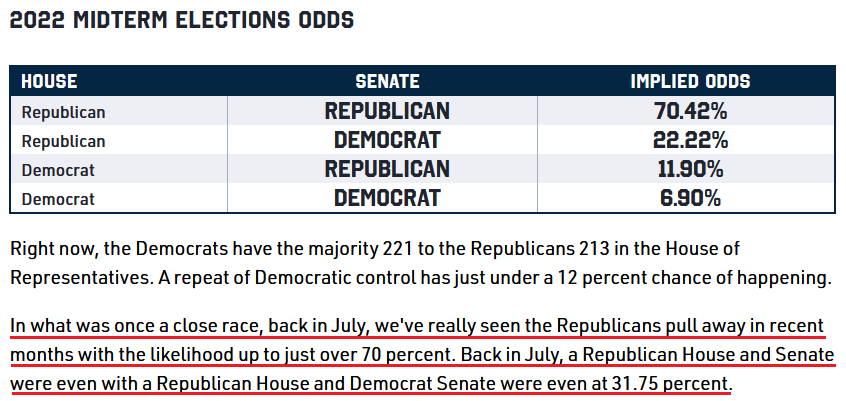

For example, the probability of the Republicans holding a majority in the House and Senate was only 31.75% in July. Now, the probability of the Republicans achieving the milestone has risen to 70.42%.

Please see below:

On top of that, NBC News released its latest national poll on Jan. 23. With more trouble for the party in power, Democratic pollster Jeff Horwitt said: “downhill, divided, doubting democracy, falling behind, and tuning out – this is how Americans are feeling as they're heading into 2022.”

To that point, 72% of Americans surveyed said that the country is headed in the wrong direction, up from the 71% recorded in October. Moreover, it’s only the sixth time on record when responses met or exceeded 70%. And as an ominous warning for Democrats:

“In the three instances when this sustained dark outlook coincided with an election year, it foreshadowed bad news for the party in power – 1992, 2008 and 2016,” said Horwitt.

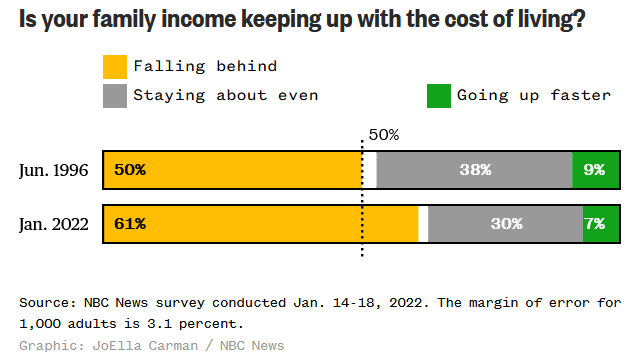

What’s more, 61% of respondents said that their family incomes are underperforming inflation. For context, 30% had a neutral response, and only 7% said that their family incomes are outperforming inflation.

Please see below:

Saving the best for last, the report also revealed:

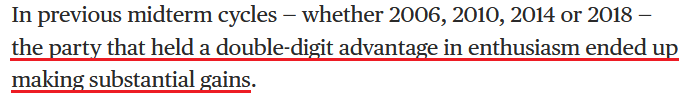

“Republicans enjoy a double-digit advance on enthusiasm ahead of November’s elections, with 61 percent of Republicans saying they are very interested in the upcoming midterms – registering their interest either as a 9 or 10 on a 10-point scale – compared with 47 percent of Democrats who say the same.”

Why is this so important?

Thus, Biden is like a boxer on the ropes. With inflation sizzling and each CPI print akin to another haymaker, he needs to shift the momentum before it’s too late. With less than 300 days until the November midterm elections, it’s clear that Powell and Biden are aligned on a common goal.

As a result, with inflation now public enemy no. 1, interest rate hikes should materialize in the coming months. For context, the Fed’s next monetary policy meeting is on Jan. 25/26. While Powell could use the stage to signal his intentions, he’s unlikely to announce a major policy change this week. However, from a medium-term perspective, with Democrats’ survival hinging on their ability to tame inflation, their success will likely come at the expense of the PMs.

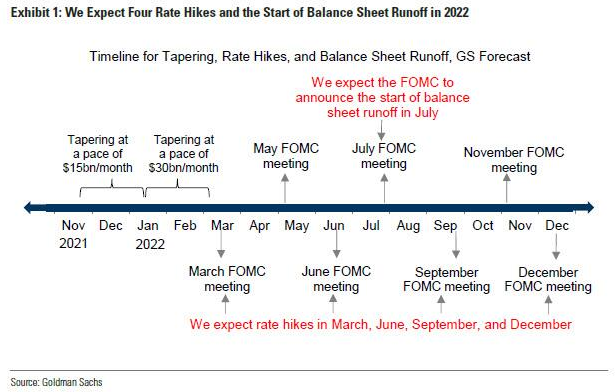

For example, Goldman Sachs team of economists led by Jan Hatzius told clients over the weekend that elevated inflation should elicit hawkish Fed policy in the coming months. They wrote:

"The FOMC is likely to be looking at a hot inflation dashboard at its next few meetings, with well above-target year-on-year core PCE and especially core CPI inflation and pressure beneath the surface too. Supply-side problems including labor shortages and supply chain disruptions are likely to last a while longer. And more importantly, wage growth, rent growth, and short-run inflation expectations are all likely to remain too high for the FOMC’s comfort."

As a result, Goldman Sachs concludes: “the FOMC will want to take some tightening action at every meeting,” and this “raises the possibility of an additional hike or an earlier balance sheet announcement in May, and of more than four hikes this year.”

Please see below:

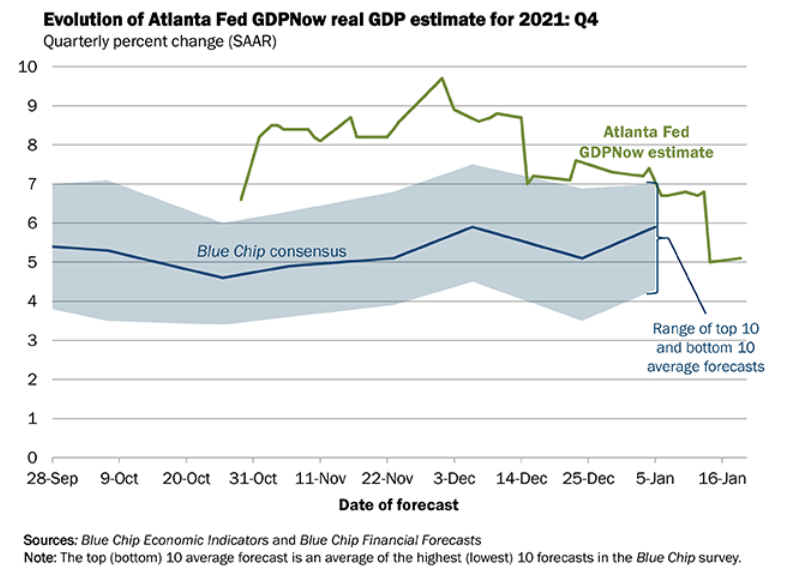

Finally, while the Omicron variant has disrupted U.S. economic activity, the negativity has spread across the financial markets. While the Blue Chip Consensus (major investment banks) remains resilient, the Atlanta Fed’s Q4 GDP growth estimate (the green line below) has suffered amid the spread.

Please see below:

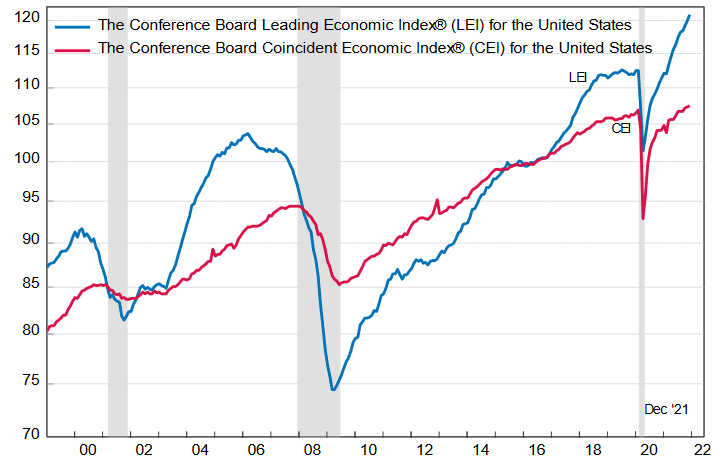

However, The Confidence Board released its Leading Economic Index (LEI) on Jan. 21. With the index increasing by 0.8% in December – versus 0.7% increases in both November and October – Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board, said:

“The U.S. LEI ended 2021 on a rising trajectory, suggesting the economy will continue to expand well into the spring. For the first quarter, headwinds from the Omicron variant, labor shortages, and inflationary pressures – as well as the Federal Reserve’s expected interest rate hikes – may moderate economic growth. The Conference Board forecasts GDP growth for Q1 2022 to slow to a relatively healthy 2.2 percent (annualized). Still, for all of 2022, we forecast the US economy will expand by a robust 3.5 percent – well above the pre-pandemic trend growth.”

The bottom line? With inflation raging and the Democratic Party on pace to suffer a monumental defeat, political forces should encourage Powell to raise interest rates in the coming months. Moreover, while the Omicron variant has depressed sentiment, the U.S. economy remains resilient. As a result, the Fed has little reason to perform a dovish 180. Furthermore, with a realization poised to push real interest rates even higher in the coming months, the PMs will likely crack sooner rather than later.

In conclusion, the PMs declined on Jan. 21, and the GDXJ ETF was a noticeable underperformer. While the general stock market resumed its freak out, the U.S. 10-Year Treasury yield performed relatively well. Moreover, with the USD Index also poised for an upward re-rating, the PMs’ fundamental outlooks remain profoundly bearish. As a result, the trio’s 2021 downtrends should have more room to run.

Overview of the Upcoming Part of the Decline

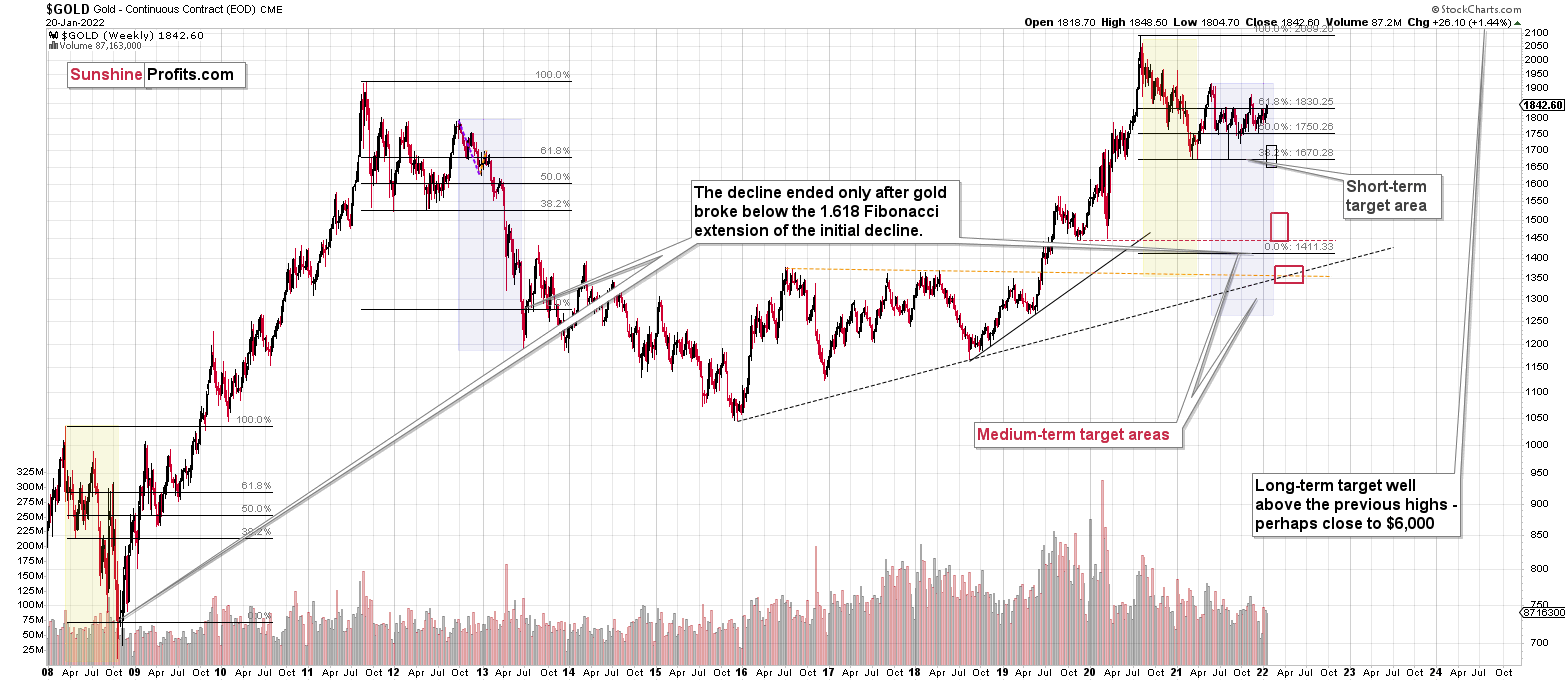

- It seems to me that the corrective upswing is over or close to being over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the corrective upswing is over or very close to being over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline (note: silver might continue to outperform and rally for a few more days – it’s practically impossible to tell how high it can go in the very near term, but either way, it’s likely that this decline will be reversed rather quickly).

Please note that if last week’s rally was indeed based on supposedly increased tensions regarding Ukraine, then it’s likely that this rally is not going to be significant, and it might already be over. The “supposedly shocking” news already hit the market, and without any real follow-up (material) action, like Russian troops marching across the border with Ukraine, it seems that there’s nothing additional that markets could rally on. The market already “knows” that the tensions are very high and the chance for military conflict is high, regardless of whether that’s true or not. There’s not much more that can be said to increase that even further – only real action is likely to do it – and seeing such action is very unlikely in my view.

I continue to think that junior mining stocks are currently likely to decline the most out of all parts of the precious metals sector.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief