Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

In yesterday’s gold analysis, I emphasized that there was very little to say about gold’s movement, and the same is up-to-date also today. Consequently, the full version of today’s analysis focuses on fundamental issues and only a small technical note is added at the beginning.

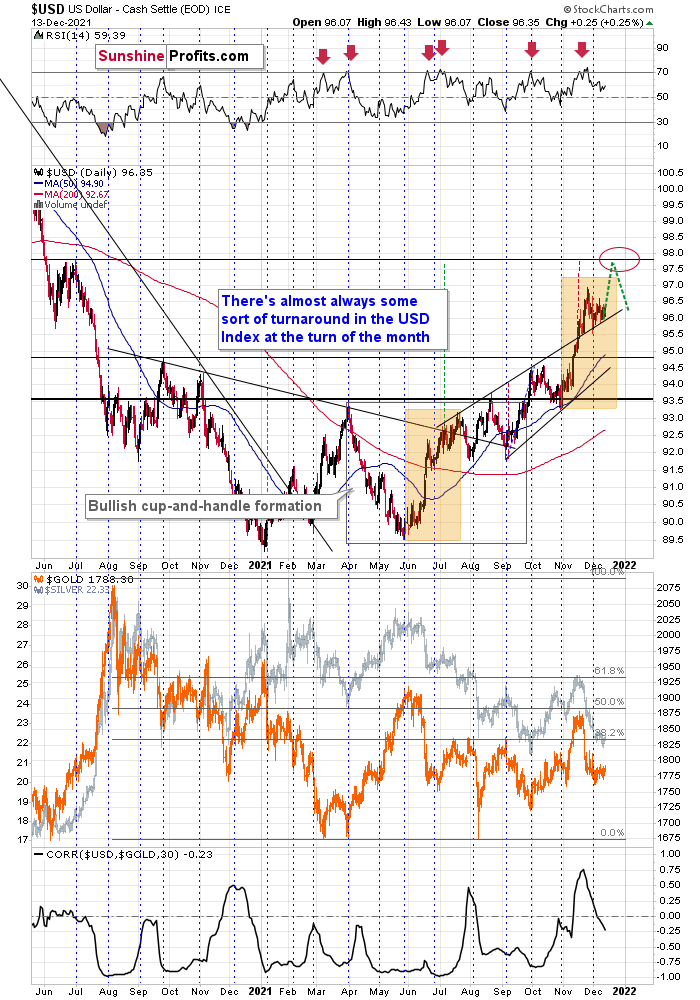

In short, the USD Index has been consolidating in one of the most classic ways possible. Namely, it formed a triangle. Triangles are generally “continuation patterns,” which suggests that the USDX is likely to break to the upside and rally.

Taking a closer look at the triangle, we see that earlier today, the USD Index tried to move above it, but so far it was not successful. The move higher was really small, so I don’t view it as a major invalidation.

Still, I wouldn’t be surprised to see the USD Index continue its back-and-forth trading within the triangle until we get some news from the Fed. In other words, we’re likely to see some major price action tomorrow.

The above, plus the fact that gold has been consolidating below its rising support line, suggests that the next move in the USDX is going to be to the upside, while gold is going to decline.

Still, let’s keep in mind that it’s also possible that we see a fake move lower (USDX) and higher in gold right before or right after the FOMC. That kind of volatility around important news announcements is relatively normal. Whatever happens initially, please don’t take it at its face value. It might or might not be the market’s true reaction, especially if silver rallies much more than gold.

The trends support higher USDX values in the near and medium-term, and lower gold prices in the near and medium-term.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Mauling Continues

With the bears taking another bite out of investor sentiment, the stock market’s freak-out continued on Dec. 13. With the bubble basket getting decimated, hyper-growth technology companies are under heavy pressure.

Please see below:

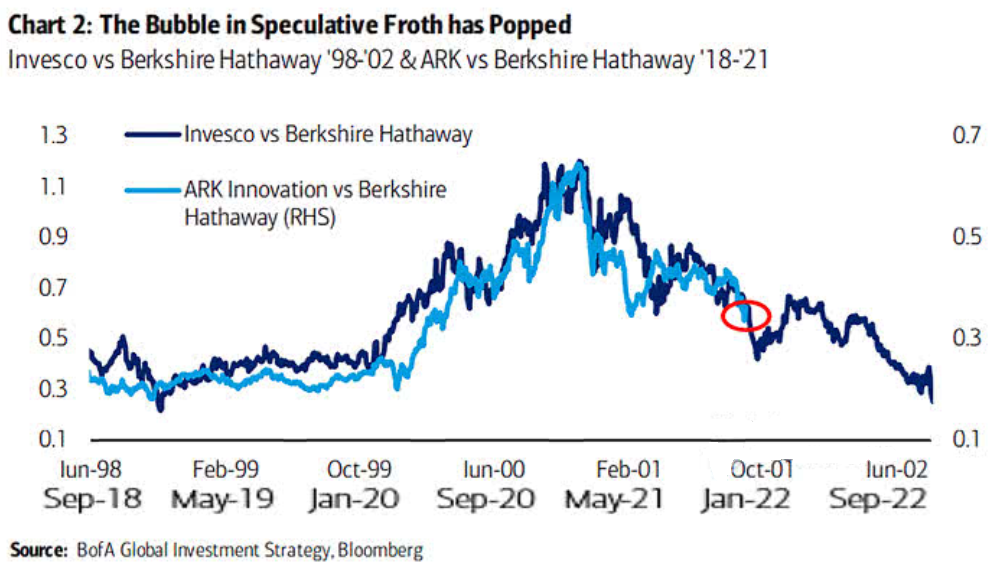

To that point, with the ARK Innovation ETF – which is home to some of the bubbliest stocks on Wall Street – continuing its free fall, Bank of America uncovered a pattern that mirrors the dot-com bubble.

Please see below:

To explain, the dark blue line above tracks the Invesco/Berkshire Hathaway ratio from 1998 to 2002. For context, Berkshire Hathaway is the conglomerate run by Warren Buffett. If you analyze the relationship, you can see that the ratio surged in 1999 and then plunged when the tech bubble popped.

More importantly, though, if you turn your attention to the light blue line, ARK’s mauling is already underway. For example, the light blue line tracks the ARK Innovation ETF/ Berkshire Hathaway ratio from 2018 until now. When you analyze the nearly identical pattern, you can see that the material outperformance has given way to material underperformance. If history is any indication, more pain should confront speculators over the medium term.

To that point, with the Fed’s narrative doing a complete 180 over the last two months, the hawks are feasting on the most vulnerable stocks on Wall Street.

For context, this was a Bloomberg headline on Oct. 19:

And this was a Bloomberg headline on Dec. 13:

Thus, it’s no surprise that volatility has afflicted Wall Street.

More importantly, though, while the PMs were relative outperformers on Dec. 13, their fundamental outlooks should die with QE. To explain, not only do rising interest rates help increase the fundamental value of the U.S. dollar – which often moves inversely to the PMs – but hawkish Fed policy frequently curbs inflation. As a result, nominal interest rates increase, inflation expectations decrease, and rising real interest rates take a bite out of gold, silver, and mining stocks.

Moreover, while investors have gotten used to the Fed bailing them out, this time is different. To explain, I’ve mentioned on several occasions that political survival trumps the performance of the financial markets. With U.S. President Joe Biden confronting an electorate that’s had it with inflation, it’s no coincidence that Fed Chairman Jerome Powell is ditching his dovish rhetoric.

For context, I wrote on Nov. 18:

If prices keep rising and consumer confidence keeps falling, eventually demand destruction unfolds. As a result, if policymakers don’t solve their inflationary conundrum, failure to do so will likely push the U.S. economy into recession.

Second, the political component shouldn’t be ignored. Biden’s approval ratings keep hitting new lows along with consumer confidence. Thus, is it in his best interest to maintain the status quo? Of course not. That’s why he’s been so forceful on inflation over the last few weeks. Essentially, if he (and/or the Fed) does nothing, he’ll likely lose the next presidential election and the Democrats will likely lose control of Congress. However, if he tames inflation, then he’s a hero. And left with those two options, which one do you think he’ll choose?

To that point, the latest ABC/Ipsos poll was released on Dec. 12. An excerpt read:

“More than two-thirds of Americans (69%) disapprove of how Biden is handling inflation (only 28% approve) while more than half (57%) disapprove of his handling of the economic recovery. Partisan splits for inflation show expected negativity in Republican views (94% disapproving), but the survey also reveals weaknesses from Biden's own party with only a slim majority of Democrats (54%) approving. Biden's orbit is also hemorrhaging independent voters, with 71% disapproving of his handling of inflation.”

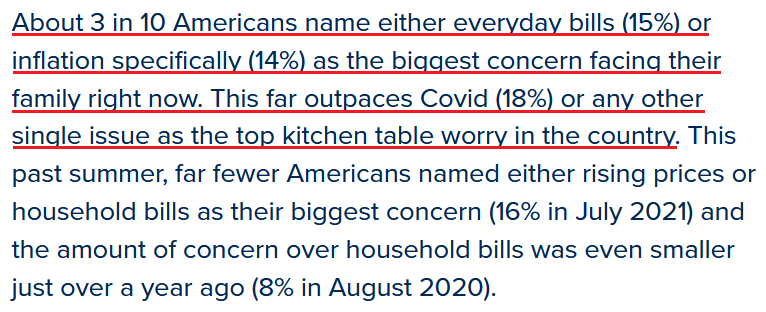

In addition, Monmouth University released its latest poll on Dec. 8. With the report revealing that “paying everyday household bills, and inflation specifically, top the list of concerns American families say they currently face,” Biden’s top priority is not the performance of the stock market or the PMs.

Please see below:

For context, Patrick Murray, director of the independent Monmouth University Polling Institute, painted a troubling portrait for the U.S. President:

“Concerns about inflation have taken center stage in discussions around America’s kitchen tables. And, as one would expect, many are placing the blame squarely on Washington.”

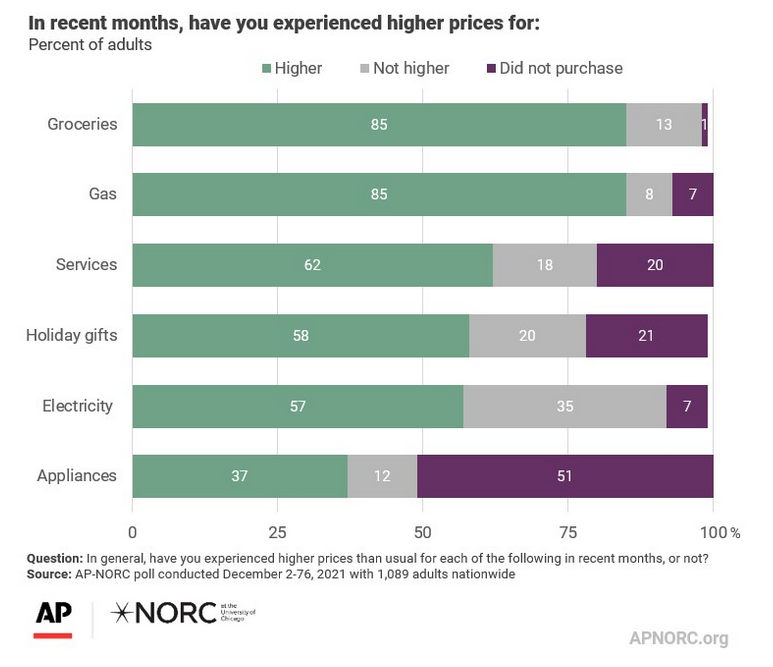

If that wasn’t enough, AP-NORC released its latest poll on Dec. 9. As more of the same, the report revealed:

“Views of the national economy have soured over the year while Americans’ evaluation of their own personal finances have not changed. Still, many Americans report financial challenges. Most are facing growing household expenses while fewer say their income has increased. Recent increases in the prices of goods and services are having an impact on most Americans with many changing spending and saving practices.”

Please see below:

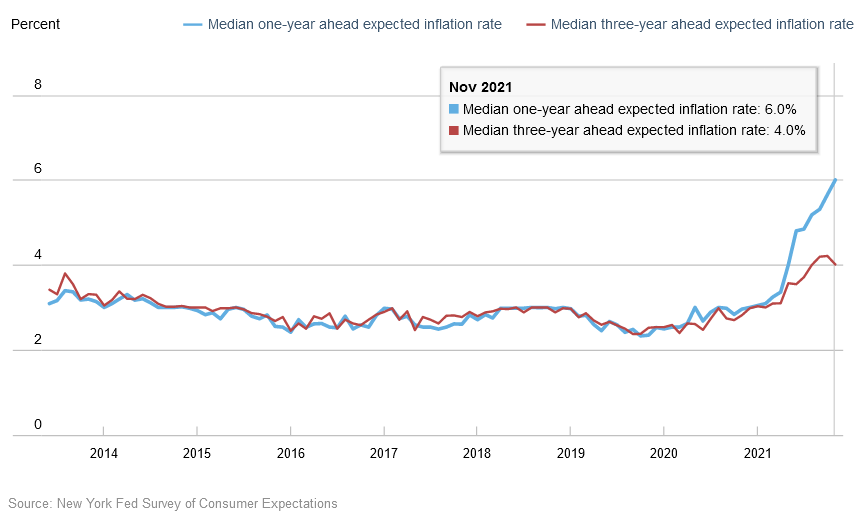

Also noteworthy, the New York Fed released its latest Survey of Consumer Expectations on Dec. 13. While the report revealed that Americans’ median three-year inflation expectations declined from 4.2% in October to 4.0% in November, Americans’ median one-year inflation expectations increased from 5.7% in October to 6.0% in November.

Please see below:

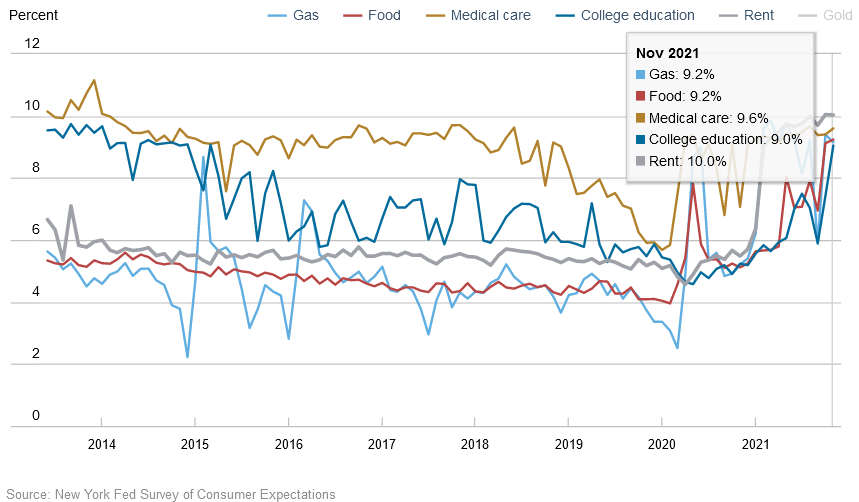

What’s more, Americans expect the prices of gasoline, food, medical care, tuition, and rent to rise by 9% or more over the next 12 months.

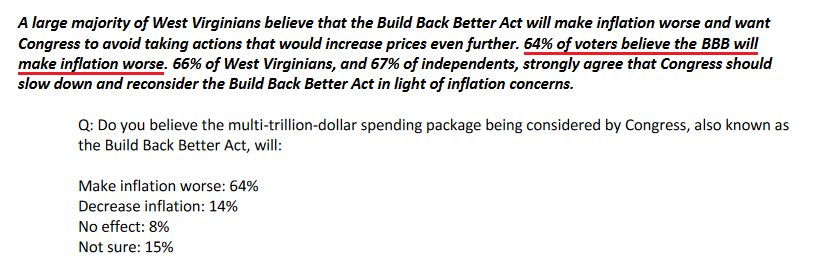

Finally, it’s important to remember that Biden still wants to pass his ~$1.7 trillion Build Back Better (BBB) stimulus package. And he needs Joe Manchin – a Democratic Senator from West Virginia – to vote in favor of the bill. However, Manchin said on Dec. 13:

“Inflation is real. It's not transitory. It's alarming. It's going up, not down. And I think that should be something we're concerned about.”

To that point, a poll conducted by Remington Research Group found that “64% of voters [in West Virginia] believe the BBB will make inflation worse.” As a result, if Biden doesn’t solve his inflation problem, Manchin could derail his BBB agenda. If this happens, it could derail Biden’s presidency.

Source: Remington Research Group

Source: Remington Research Group

The bottom line? With inflation surging and Biden’s political future hanging in the balance, he likely realizes that the days of passive policy are over. With Powell poised to echo that message in the coming days, weeks, and months, a new era should confront investors in 2022. Moreover, with this fundamental backdrop supportive of a stronger U.S. dollar and higher real interest rates, the PMs will likely lament Biden and Powell’s hawkish crusade.

Likewise, with stock market investors also rattled, volatility often benefits the U.S. dollar and hurts the PMs (especially silver and mining stocks). As a result, the precious metals should confront a tumultuous future.

In conclusion, the PMs were mixed on Dec. 13, as the GDXJ ETF ended the day in the red. While they remained upbeat relative to the S&P 500, their fundamental outlooks continue to deteriorate. With the Fed hawked up, Biden anxious, and the general stock market on the edge of a profound correction, it’s likely only a matter of time before the PMs suffer another profound drawdown. As a result, caution is warranted, and lower lows should materialize over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the current corrective upswing in gold is about to be over soon, and the next short-term move lower is about to begin. Since it appears to be another short-term move more than a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty. I expect the final bottom to take place near the end of the year, perhaps in mid-December. It is not set in stone that PMs have to bottom at that time. If not then, then early 2022 would become a likely time target.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops. The additional confirmation will come from the tapering schedule, as markets are likely to move on the rumor and reverse on the fact as they tend to do in general.

- The above is based on the information available today, and it might change in the following days/weeks.

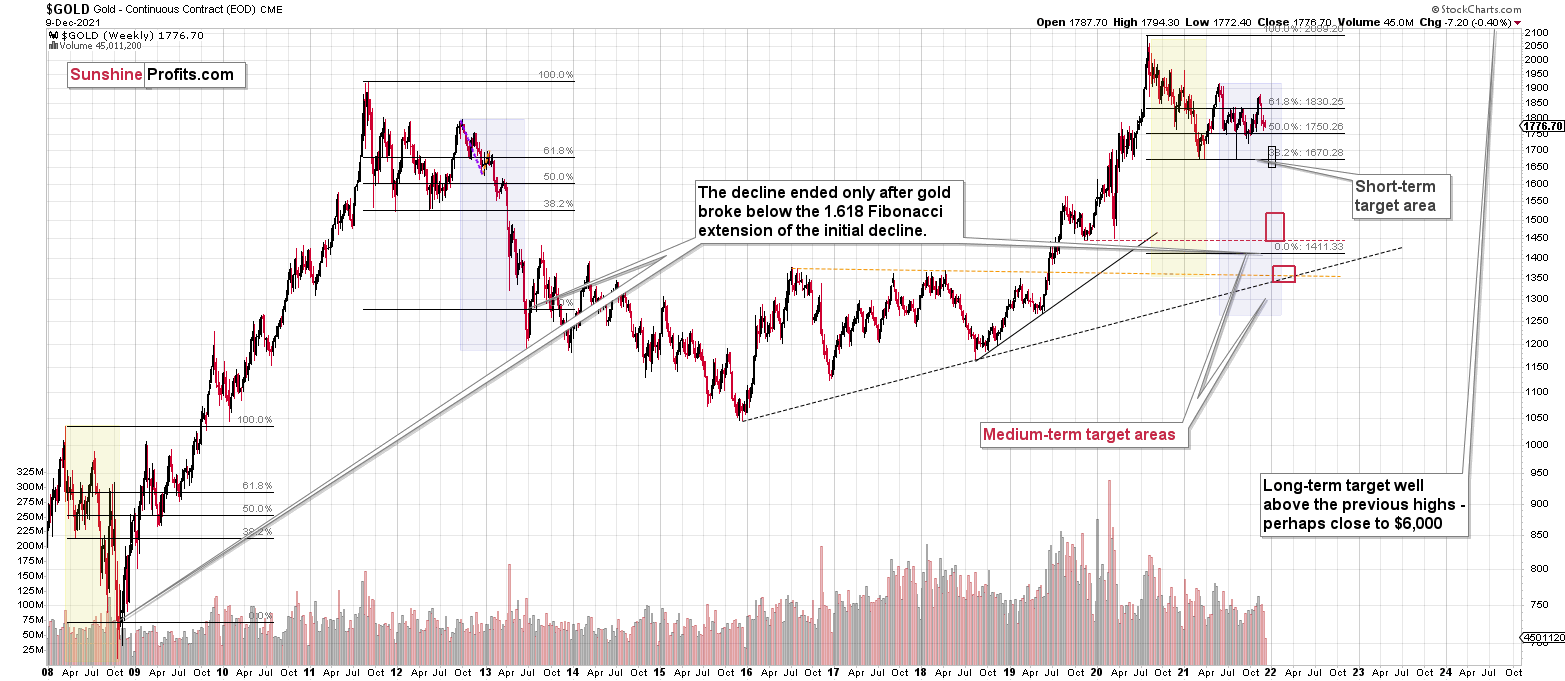

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Greetings, PR! Well done and a great call on gold’s most recent short-term decline. My question is: will all this war talk in the news in recent days – i.e., whether or not Russia will go into Ukraine – change your medium-term outlook for gold? Also, what about China talking about taking Taiwan as well? Any thoughts? Keep up the FANTASTIC analyses!

A: Thank you for the positive feedback, I greatly appreciate it.

If Russia invades Ukraine, I expect gold to rally in the short term and then to move back down in the medium term. Based on rumors, not facts, I would expect the majority of the upswing to happen before the actual invasion. I don’t think that the above is likely to happen, though.

If there are already “talks” about Russia going into Ukraine and China taking over Taiwan, and gold is not soaring despite those talks, the implications for gold are actually bearish, as it “should be” moving higher on those rumors in indications. Instead, gold has been trading back and forth below its rising support/resistance line. This shows that the precious metals market is currently weak, not strong.

Q: Thanks for the great analysis. I would appreciate it if you could mention invalidation area to manage the risk. For instance, gold shorts – it could be closing prices above a certain level, say 1920. In such a case, the bearish case could be scrapped. It will help us manage the risk.

A: I don’t have an invalidation area or stop-loss for the current trade. I understand the benefits of providing such levels in many trades, but I’m primarily looking at the dynamics of price moves relative to each other (gold vs. silver vs. USDX vs. miners). For the gold price itself (without any other detail) to invalidate the bearish outlook, it would need to move so significantly high (say to $2,151) that having a stop-loss level there would be useless. Of course, I would be likely to close the trade well before gold reached $2,151 if it rallied at all, that is. However, that would likely be based on mining stocks outperforming gold, while gold itself would be reacting strongly to the USD’s weakness. Right now, we have the opposite, by the way.

Q: What is the probability there will be a relief rally at the Dec 14/15 Fed meeting? Today, on the economic inflation data, gold rallied pretty significantly from the early premarket value and declined, then reversed some and still finished up. I expected gold to decline with high inflation numbers, the equity markets advancing, and the S&P setting a new high. Is gold already starting to move on the inflation number? The market has already priced in accelerated tapering. 10yrTB yield seems too careless and the USD basically did nothing and even declined again.

A: If gold declines right before the Fed meeting (before the results are announced), then a relief rally would be quite likely (say 60%-70%), but if gold does nothing beforehand, and just continues to trade sideways below the rising resistance line, it would be more likely to decline on any piece of news than to rally on it. In this case, I would see the chances of a relief rally at about 30% or less.

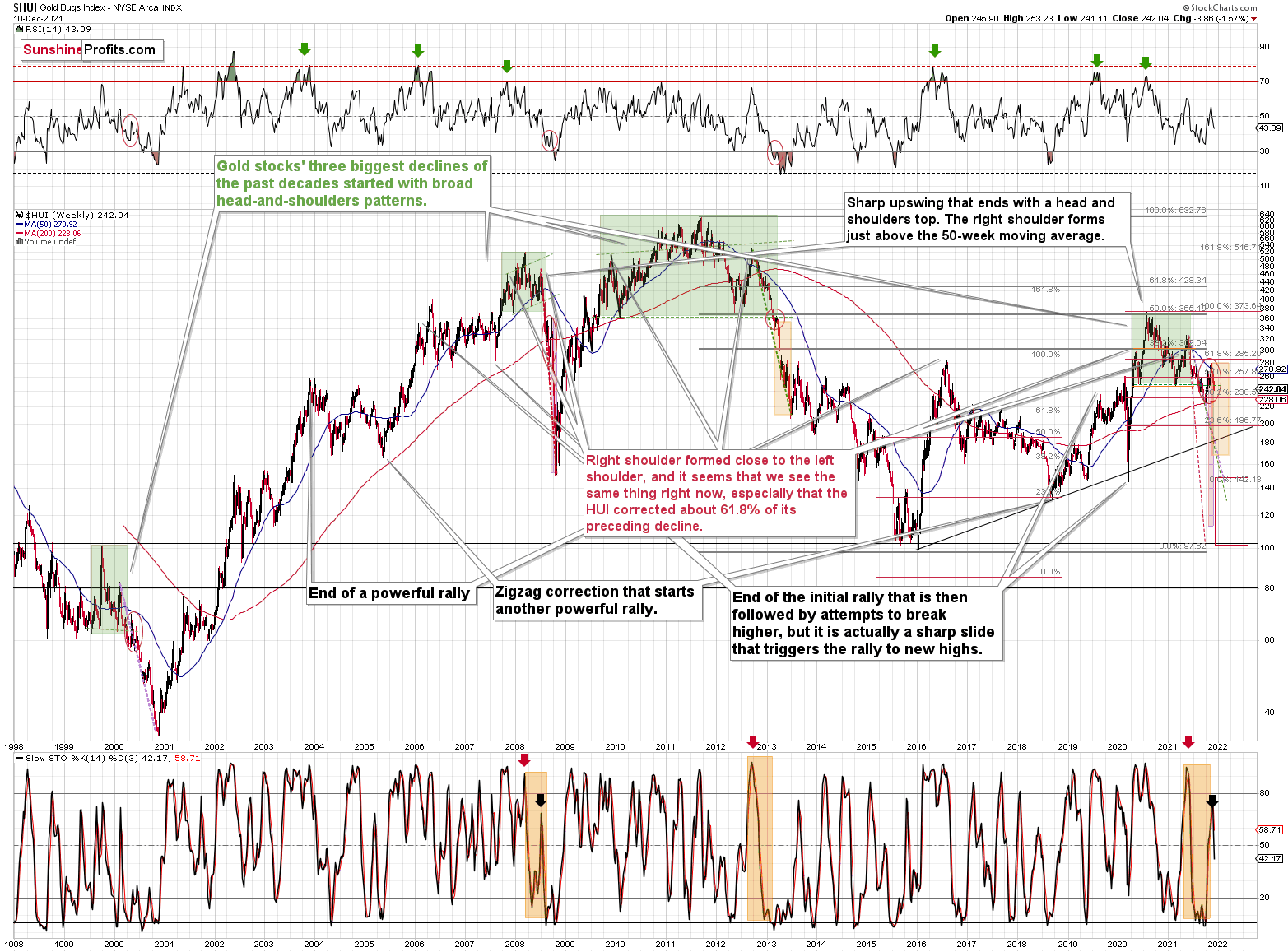

Q: Could you explain how, using HUI, the 2016 slide, the Fib retracements and use that to show and map the degree in which the HUI could potentially sink… this time?

Very best.

A: Sure.

After the 2016 top, the HUI Index kept declining until it corrected the 76.4% Fibonacci retracement (it’s visible on the chart as 23.6% as Stockcharts doesn’t provide a symmetrical price level to the above, but 100% - 23.6% = 76.4%). It’s one of the less famous Fib levels, but sometimes it also stops price moves. That’s what happened in 2018 and the HUI Index rallied.

If the HUI Index declined to its 23.6% Fibonacci retracement based on its recent sharp upswing (the 2020 one), then it would move slightly below the 200 level.

While this might be one of the targets that stops the decline, it doesn’t seem to me that this would be the final bottom for the current decline.

Please note that after the 2016 top, there was no major decline in the prices of the major stock indices, and we might see one in the not-too-distant future. Also, back then, the USD Index didn’t soar throughout the HUI’s bottoming process in 2016-2018. Consequently, to me, the current situation seems more similar to what happened in 2020, 2013, and 2008. Therefore, it seems to me that the HUI Index might bottom lower than at the above-mentioned 200 level.

Summary

Summing up, gold declined in tune with my long-term-based indications, and the medium-term downtrend appears to have resumed. Based on the analogy to 2013 and other factors, a bigger decline in gold appears to be just around the corner (regardless of what happens in the very near term).

If the new Covid-19 variant makes the vaccine rather useless, we might be in for very wild price moves in most markets. In the case of the precious metals sector, the initial move should be to the downside, but at the same time, it makes the long-term outlook even more bullish.

It seems that we might see a short-term bottom close to the middle of December, and perhaps that’s when gold will move to its previous 2021 lows. However, I don’t think that it would be the final bottom. Conversely, it seems that the final bottom would form lower after a short-term correction (from the above-mentioned December lows).

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief