Briefly: In our opinion, full (150% of the regular full position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

Gold and silver showed strength yesterday, while the USD Index declined, but these moves have been more or less erased in today’s pre-market trading just as the lagging mining stocks had suggested. What’s next? In yesterday’s alert we elaborated on the likely scenario for gold, but as we all know, no market can move totally independent of the rest of the financial world, and gold is no exception from this rule. Consequently, in today’s alert we dig deeper into the near-term target for one of gold’s key drivers – the USD.

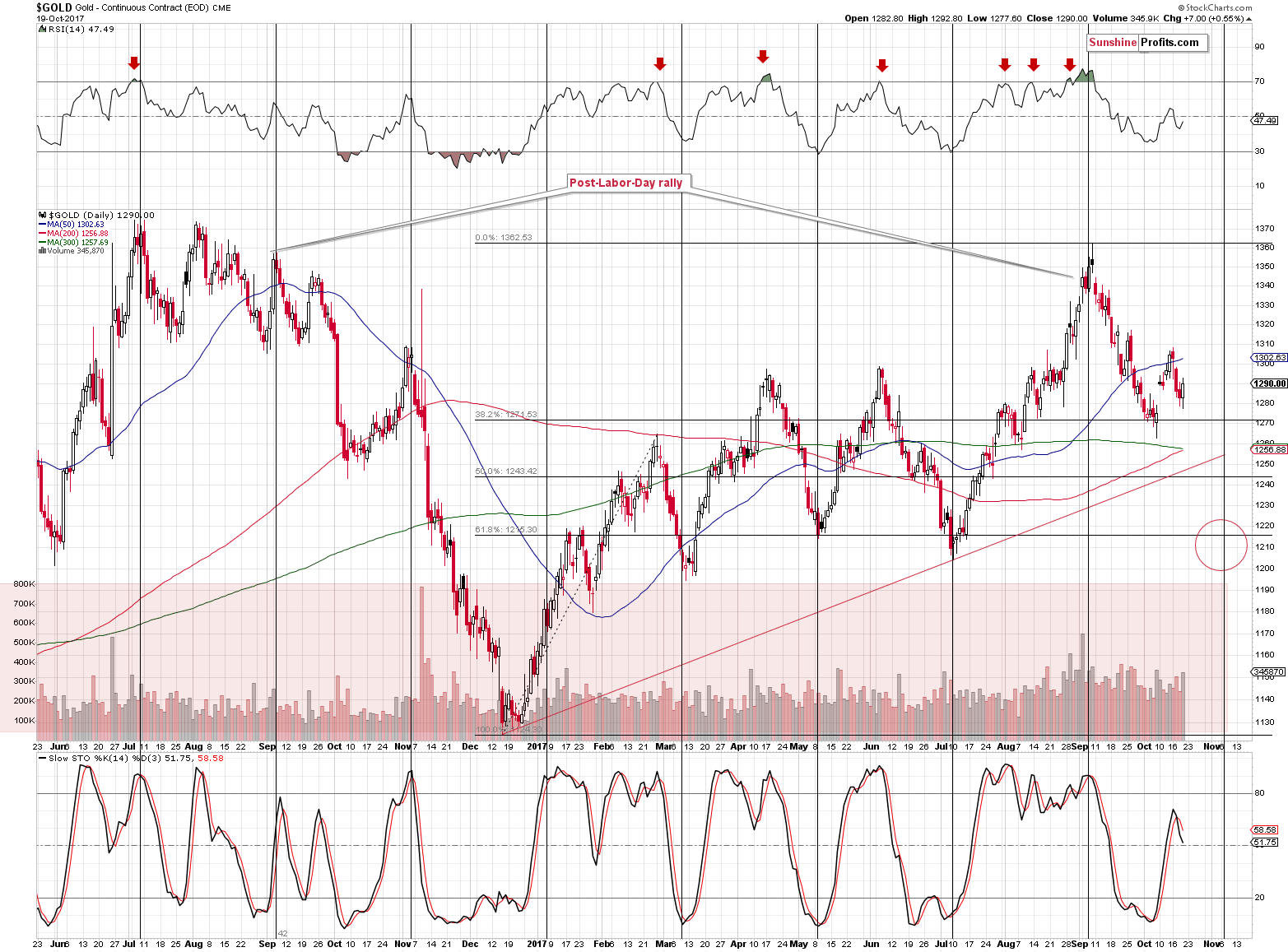

Before moving to the analysis of the USD Index, let’s take a look at what happened yesterday, starting with the metals (chart courtesy of http://stockcharts.com).

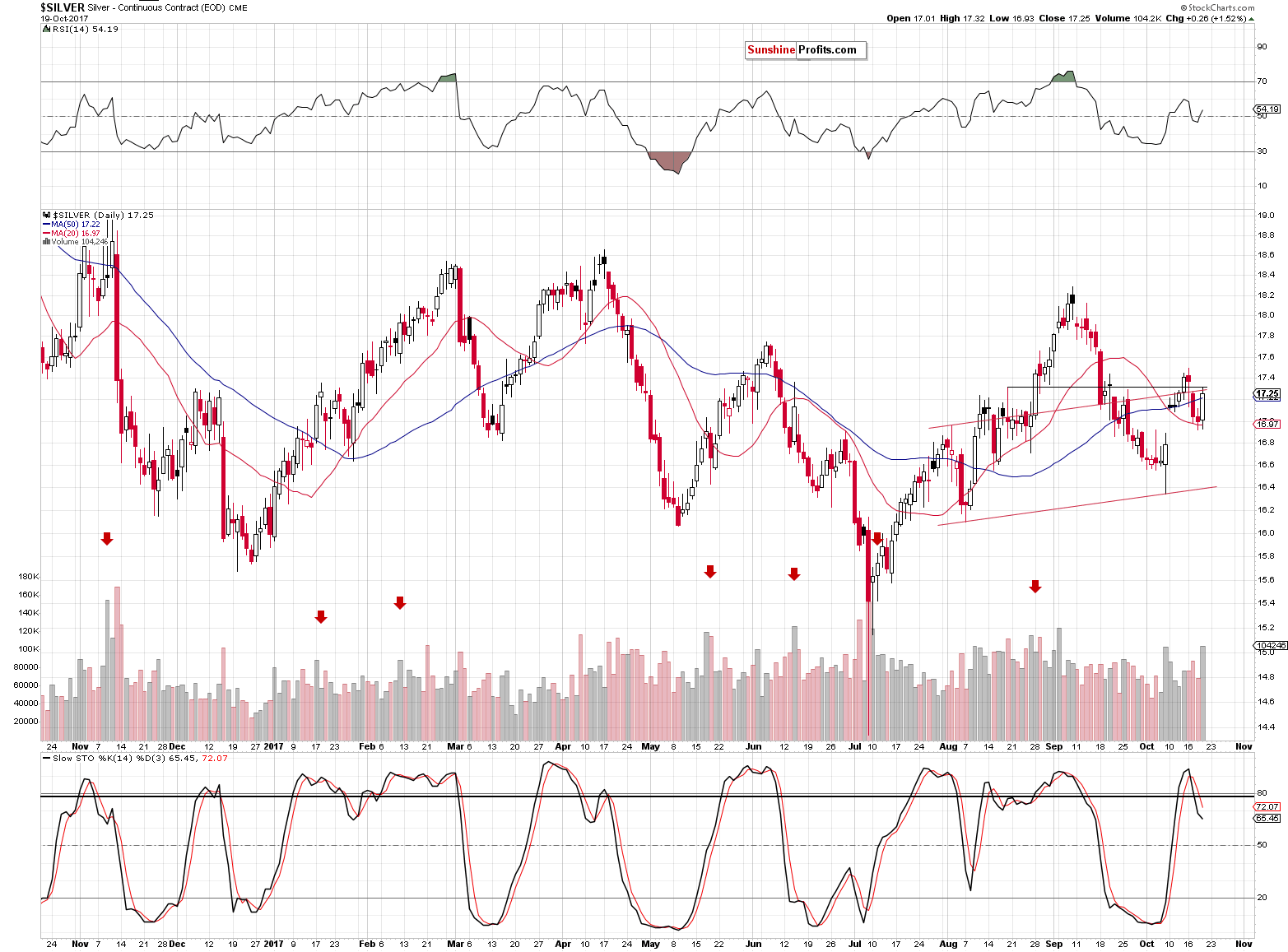

Gold rallied somewhat and silver rallied quite strongly, which – based on how silver tends to perform – is something that should raise one’s eyebrow. Today’s pre-market action already confirmed silver’s tendency to outperform right before declines as both moves were invalidated. Precisely, gold’s upswing was entirely invalidated, while silver’s upswing was invalidated “only” mostly.

Yesterday’s rallies seem to have been just a one-day anomaly and the trend seems to remain down – the Stochastic indicator didn’t even react to this one-day event.

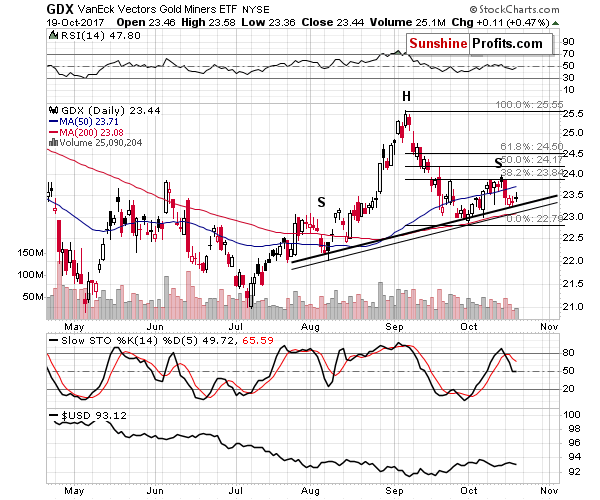

What’s most interesting, though, is that mining stocks were barely affected. The GDX ETF moved only 11 cents higher and the volume that accompanied it was low.

Lagging miners and outperforming silver – that’s the combination that we described many times in the recent past as a clear bearish sign, so you were prepared for the turnaround and today’s downswing. While other investors might have bought into this sizable move in silver, you knew that it was likely a fake one.

Based on how gold and silver declined in today’s pre-market trading, it seems that mining stocks are about to slide once again. Such a slide could complete the head-and-shoulders formation that might have been forming (we will know only after the formation’s completion) since late July. Once completed, the formation will provide us with a downside target at about the May and July lows – which is in perfect tune with what we wrote about the target for gold in the following weeks and also in tune with the target area that we featured earlier for the HUI Index.

All in all, the outlook for the precious metals remains bearish.

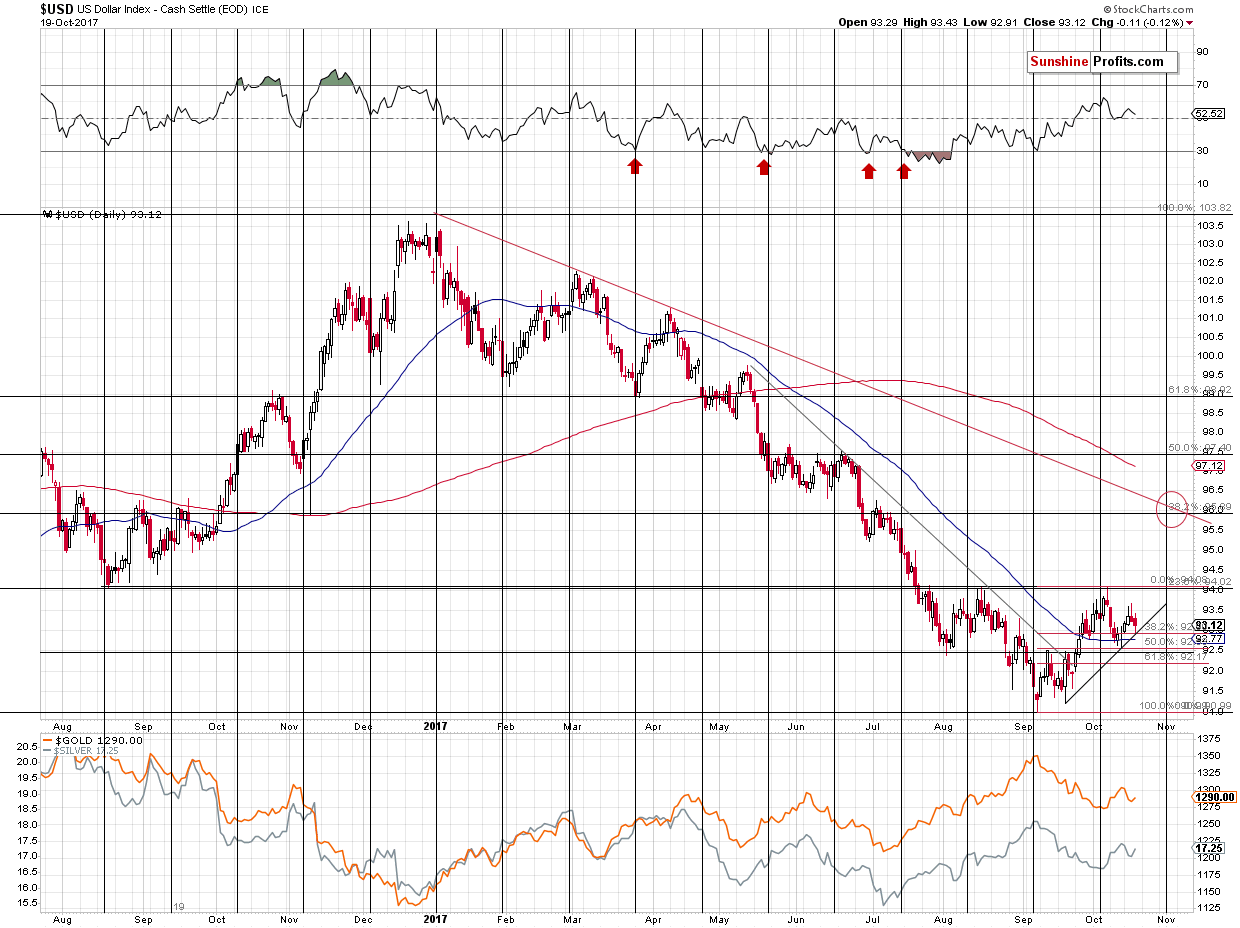

Having said that, let’s examine what’s in store for the U.S. currency.

In yesterday’s alert we explained why the $1,200 - $1,220 is likely the next step for gold and the reason was that several support levels coincide there and it is also strengthened by the turning point.

Applying the same methodology to the USD Index, we arrive at the 95.5 – 96.5 range with the 96 level being the most likely target. The above is in tune with the reverse-head-and-shoulders formation (if it is completed, that is), the 38.2% Fibonacci retracement level, the July high and the USD’s turning point.

Why is this important if one aims to trade the precious metals market and not currencies? Because if the USD Index reaches its target before gold does, it could indicate that a turnaround in both the USD and gold will take place anyway and thus it might be a good idea to limit the exposure to the precious metals market at that time. It could also work the other way, if gold reaches its target, but the USD Index doesn’t and we see no signs of a reversal in the gold market other than the target being reached, then perhaps gold will have further to fall before the reversal is seen. All in all, being aware of what’s going on in the USD Index helps in determining what’s next for gold and the rest of the precious metals sector.

Now, to be objective, there is also a possibility of seeing another temporary (!) decline in the USD Index, which would not invalidate the bigger trend. If the reverse-head-and-shoulders formation is to be completely symmetrical, then we might see another move low slightly below 92.5, because that would be in tune with what happened in early August. The rally in the USD that we saw in the first half of August took the form of a zigzag and thus the October decline could also take this form. If this happens, precious metals would probably move higher once again while miners would continue to lag. This move seems too small to adjust the position for it, but let’s keep the above possibility in mind – it’s not something that should come as a surprise. The outlook for the USD remains bullish nonetheless and the opposite is the case for gold.

Summing up, it seems that the top in gold, silver and mining stocks is already in. Multiple bearish signals (i.a. gold’s huge monthly volume, the analogy in the HUI Index, the analogy between the two most recent series of interest rate hikes, and a breakout in Nikkei) point to much lower gold prices in the following months and the short-term signals also confirm the bearish outlook.

As far as the following weeks are concerned, it seems that we could see another rebound during the decline, but not likely until gold moves to the $1,200 - $1,220 range, which is likely to take place in the first half of November. The analogous range for the USD Index is 95.5 – 96.5 with the 96 level being the most likely target.

Since we plan to temporarily exit the short positions when gold reaches the mentioned targets, we are updating our targets in the bullet-point list below. We are also changing the initial targets into exit prices, which means that reaching them should exit the position. If gold reaches the exit price level, we think the position should be closed (without an additional confirmation) and this would also mean closing the positions in silver and mining stocks. The same goes for silver and mining stocks – if silver or mining stocks exit levels are reached, the entire position in gold, silver and mining stocks should be closed. This does not extend to the junior mining stocks ETFs or to any leveraged ETNs (as it’s described in greater detail in the following paragraphs).

As always, we will keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Short positions (150% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels / profit-take orders:

- Gold: exit price: $1,218; stop-loss: $1,366; exit price for the DGLD ETN: $51.98; stop-loss for the DGLD ETN $38.74

- Silver: exit price: $15.82; stop-loss: $19.22; exit price for the DSLV ETN: $28.88; stop-loss for the DSLV ETN $17.93

- Mining stocks (price levels for the GDX ETF): exit price: $21.23; stop-loss: $26.34; exit price for the DUST ETF: $29.97; stop-loss for the DUST ETF $21.37

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – if one wants to do it anyway, we provide the details), here are the stop-loss details and exit prices:

- GDXJ ETF: exit price: $30.28; stop-loss: $45.31

- JDST ETF: exit price: $66.27; stop-loss: $43.12

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Spain’s central government said that it would suspend Catalonia’s autonomy on Saturday. What does it imply for the gold market?

Catalonia’s Suspended Autonomy and Gold

Investors are worried about the Chinese slowdown. Will the 19th National Congress of the Communist Party of China change the macroeconomic picture? We invite you to read our today’s article about the recent developments in the China’s economy and find out whether the condition of the Chinese economy is as bad as it is perceived by many analysts.

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold falls as hopes of U.S. tax reform boost riskier assets

Gold dips as dollar gains after U.S. Senate clears tax reform hurdle

Gold Prices Threatened By New EU Bank Rules: LBMA’s Crowell

=====

In other news:

Wall Street banks are starting to sound the alarm on a stock-market correction

The stock market is finally falling — and Apple is to blame (AAPL)

Senate passes budget blueprint key to Trump tax effort

Goldman Sachs CEO is trolling Britain over Brexit

Debt, old age, stagnation: Japan's economy faces huge challenges

Betrayed by Banks, 40,000 Businesses Are in Limbo

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts