Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Please note:

On an administrative note, there will be no regular Gold & Silver Trading Alert due to your Editor’s travel schedule. However, if something really major happens, I’ll send out an intraday Alert, anyway. The bigger, flagship analysis that I’m usually posting on Friday’s, will be posted on Monday.

Practically nothing changed on the technical side of things in the precious metals market yesterday or in today’s pre-market trading, so everything that I wrote yesterday remains up-to-date.

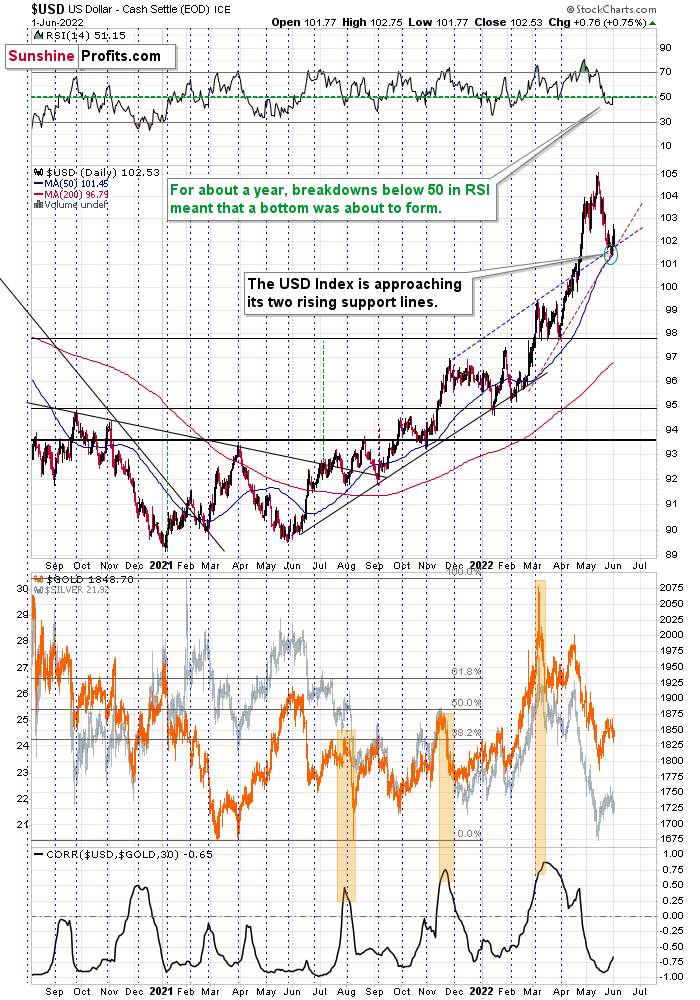

In particular, the USD Index rallied from my previous downside target area.

Gold, however, didn’t respond by declining. Why would that be the case? Does it mean that gold is showing strength here and thus we just got a bullish indication?

No. It’s not that simple.

You see, the USD Index is an… index.

It’s a weighted average of currency exchange rates, and the EUR/USD exchange rate has the biggest (57.6%) weight. The purpose of the USD Index is to isolate the strength of the U.S. currency so that it’s clear what’s going on in it. However, this is not a perfect way to measure it (there is no perfect way to do it, they all have their flaws).

The assumption here is that what happens in all those other monetary areas (Eurozone, Japan, etc.) will average itself out and we’ll be left with the USD’s “value changes”, which is what’s taking place most of the time.

However, not always, and yesterday was one of those “other” days.

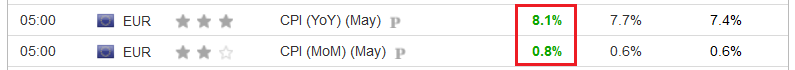

I’ll elaborate a bit later, but in short, the Eurozone inflation numbers came in and they were terrible. Inflation once again soared. Greater than expected inflation means that the euros are worth less than they used to be and that their value has declined more than was previously expected. In other words, the “value of the euro” declined.

If the value of the euro declined, what would happen to the EUR/USD exchange rate? Of course, it declines too. How does it impact the USD Index (because it’s definitely going to have an impact, since most of the index is about the EUR/USD)? Of course, the USD Index would be likely to rally based on the above.

So, did gold show strength by not declining yesterday, despite the USD Index’s strength? No, because it was not the U.S. dollar that was strong – it was the euro that was weak. As a consequence, what we saw yesterday was not a bullish sign for the precious metals market.

What does it mean for us and our short position in the junior mining stocks? In short, it means nothing. Yesterday’s session was an “exception” from the rule that usually remains intact, and we don’t have to worry about it.

The medium-term downtrend remains intact. The USD Index is likely to move higher and (most importantly), real interest rates are going higher. It’s likely to be a global phenomenon, but it seems that they are likely to rally faster in the U.S. than in the Eurozone. This is a profoundly bearish combination for the precious metals sector in the medium term.

All in all, it seems that we’re about to see another sizable decline in the prices of junior mining stocks, and while I can’t promise any performance, it seems likely to me that profits on our short positions will increase substantially.

Having said that, let’s take a look at the markets from a more fundamental point of view.

The Canary

With unanchored inflation still rattling the financial markets, prayers for peaks have gone unanswered in recent weeks. Moreover, with Eurozone inflation hitting another 2022 high on May 31, the timeline for normalization continues to lengthen. For context, the figures in the middle column were economists’ consensus estimates.

Please see below:

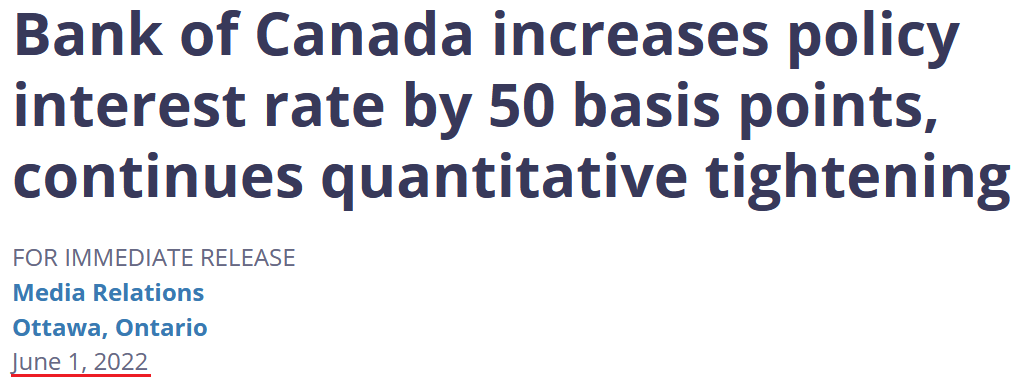

However, the more important development came from the Bank of Canada (BoC) on June 1. With 1970s/1980s-like inflation a global phenomenon, I warned on Apr. 14 that the BoC is the canary in the coal mine for future Fed policy. I wrote:

The Bank of Canada (BoC) announced a 50 basis point rate hike on Apr. 13. With the Fed likely to follow suit in May, the domestic fundamental environment confronting the PMs couldn’t be more bearish.

Please see below:

Moreover, BoC Governor Tiff Macklem (Canada's Jerome Powell) said that "We are committed to using our policy interest rate to return inflation to target and will do so forcefully if needed."

Furthermore, while he added that the BoC could "pause our tightening" if inflation subsides, he cautioned that "we may need to take rates modestly above neutral for a period to bring demand and supply back into balance and inflation back to target."

However, with the latter much more likely than the former, the BoC's decision is likely a preview of what the Fed should deliver in the months ahead.

To that point, the Fed hiked interest rates by 50 basis points in May, and the BoC increased its overnight lending rate by another 50 basis points on Jun. 1. As a result, the North American connection should hold firm.

Please see below:

In addition, the BoC release stated:

“With the economy in excess demand, and inflation persisting well above target and expected to move higher in the near term, the Governing Council continues to judge that interest rates will need to rise further. The policy interest rate remains the Bank’s primary monetary policy instrument, with quantitative tightening acting as a complementary tool.”

“The pace of further increases in the policy rate will be guided by the Bank’s ongoing assessment of the economy and inflation, and the Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target.”

Thus, with inflationary realities forcing hawkish central bank responses, more pain should confront the financial markets as the drama unfolds.

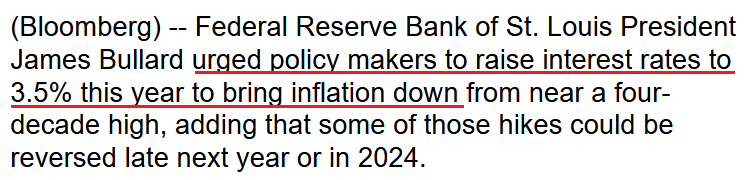

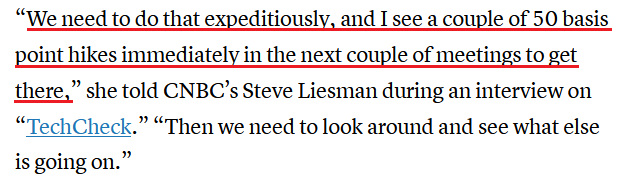

To that point, St. Louis Fed President James Bullard said on Jun. 1: "The current U.S. macroeconomic situation is straining the Fed's credibility with respect to its inflation target." As such, he reiterated his call for a 3.5% U.S. federal funds rate by the end of 2022.

Please see below:

Likewise, San Francisco Fed President Mary Daly said on Jun. 1 that there must be material progress on inflation before the central bank can slow its roll.

“We aren’t really there yet, so we need to see those data on a slowing economy bringing demand and supply back in balance, and I need to see some real progress on inflation,” she said.”

She added:

“I don’t meet anyone, contacts, consumers, anyone, who thinks the economy needs help from the Fed right now. I certainly am comfortable to do what it takes to get inflation trending down to the level we need it to be. I really think these inflation numbers have been going on too long, and consumers, businesses and everyday Americans are depending on us to get inflation back down and bridling it.”

As a result:

Thus, while the Fed remains focused on taming inflation, the reality is that more hawkish drama should unfold over the medium term. For example, the Fed released its latest Beige Book on Jun. 1. For context, the report consolidates the economic data from all of the regional Federal Reserve banks.

The growth outlook was decent:

“All twelve Federal Reserve Districts have reported continued economic growth since the prior Beige Book period, with a majority indicating slight or modest growth; four Districts indicated moderate growth. Four Districts explicitly noted that the pace of growth had slowed since the prior period.”

The labor market outlook was relatively better:

“Most Districts reported that employment rose modestly or moderately in a labor market that all Districts described as tight. One District explicitly reported that the pace of job growth had slowed, but some firms in most of the coastal Districts noted hiring freezes or other signs that market tightness had begun to ease. However, worker shortages continued to force many firms to operate below capacity.”

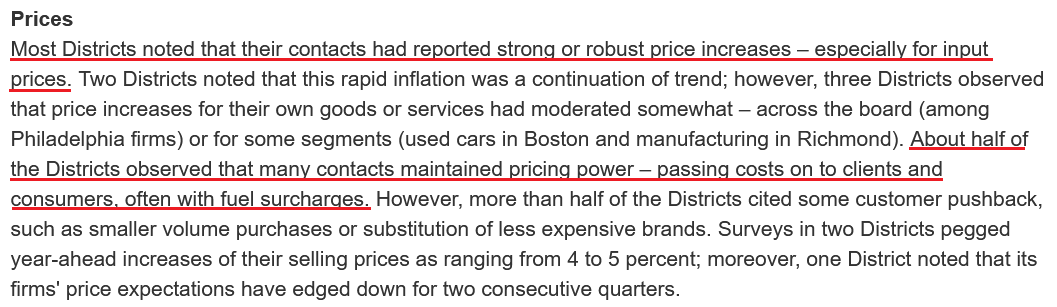

And pricing pressures remain “robust:”

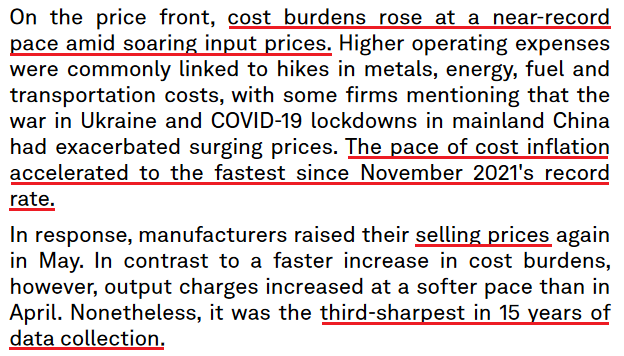

Likewise, S&P Global released its U.S. Manufacturing PMI on Jun. 1. The report revealed:

“New orders rose sharply in May, with higher new sales inflows often attributed to a sustained rise in customer demand and the acquisition of new clients. That said, the pace of growth softened further from March's recent peak and was the slowest seen since January.”

More importantly:

As a result, while some data points show record inflation and others show “robust price increases” with some moderation, the important point is that the Fed’s war with inflation will be one of attrition. To explain, I wrote on May 24:

It’s ironic how the permabears hope for a recession so that the stock market will crash and the permabulls hope for a recession so that the stock market will rally. Confused? Well, the reality is that collapsing inflation allows the Fed to perform a dovish 180 and follow the post-GFC script. Therefore, the ‘bad news is good news’ mantra will likely benefit the bulls.

Conversely, the longer inflation persists, the longer the Fed stays on the sidelines. Thus, simmering inflation and resilient consumer spending should keep the Fed on a hawkish warpath, which is bearish for the S&P 500 and the PMs.

Again, macroeconomic data declining from all-time highs represents normalization, not a crisis. Moreover, what did investors think would happen when the Fed started hiking interest rates? Of course, economic momentum would moderate. However, with a huge gap between 8%+ annualized inflation and the Fed’s 2% goal, more rate hikes are needed to alleviate the pricing pressures.

Therefore, the newest narrative is that a faltering U.S. labor market could provide dovish cover for the Fed. I added on May 24 that the permabull prayer looks like this:

Fundstrat founder Tom Lee said:

"Incoming data could show the labor market weakening... and thus [the] job market could be cooling at a pace faster than implied by tighter financial conditions." Moreover, “layoffs are accelerating, hitting 7,700 so far in May....We expect this to soon go parabolic, based upon anecdotal comments we have heard.”

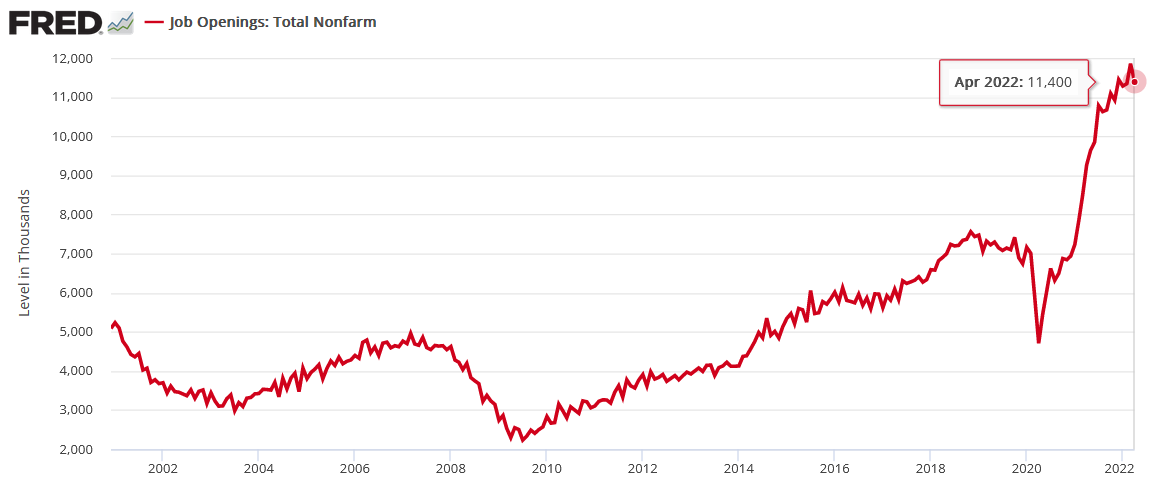

In contrast, the U.S. Bureau of Labor Statistics (BLS) released its JOLTS jobs report on Jun. 1. For the sake of objectivity, U.S. job openings declined from their all-time high of 11.855 million in March to 11.400 million in April. Also, the April data lags by two months, so it’s not real-time.

However, does it look like the U.S. labor market is moderating at a pace that will cool inflation anytime soon?

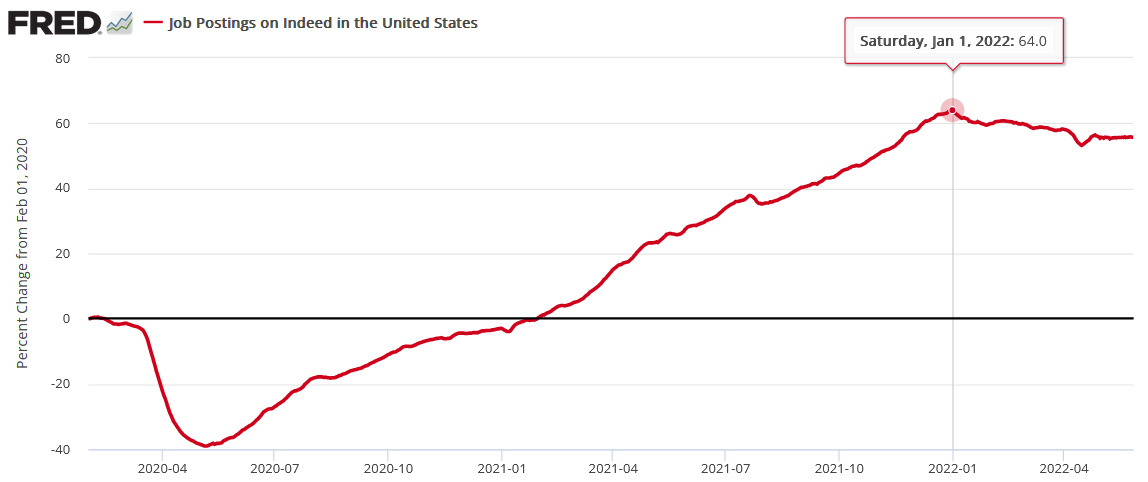

Second, Indeed releases its job openings data weekly, with the latest update on Jun. 1. Moreover, while postings have declined from their all-time high, they remain elevated and have held steady in recent weeks.

Please see below:

Third, the BLS’ JOLTS report stated:

“In April, the number of layoffs and discharges edged down to a series low of 1.2 million (-170,000). The rate was little changed, at 0.8 percent. Layoffs and discharges decreased in professional and business services (-133,000).”

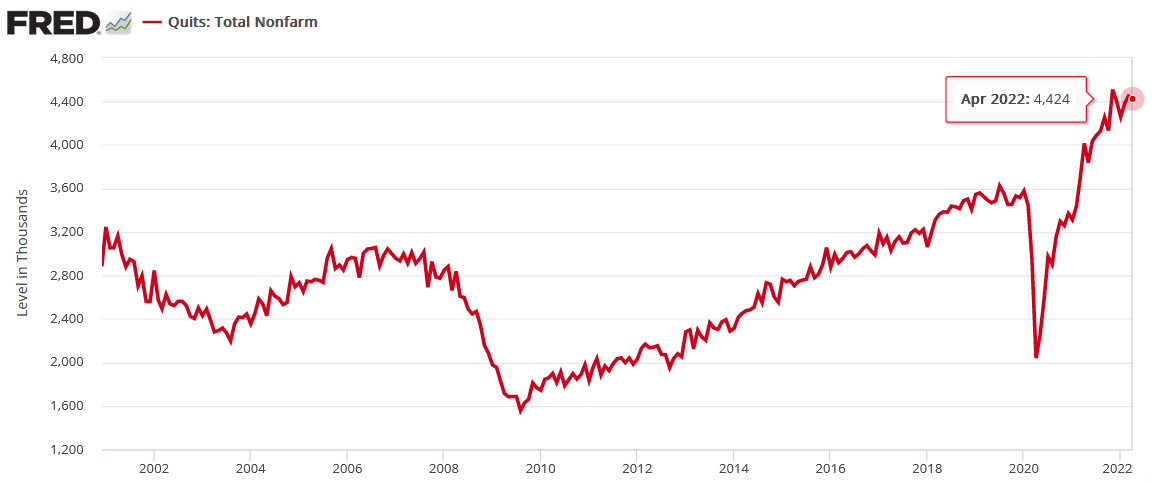

Likewise, Americans are still quitting their jobs at unprecedented rates. For context, the BLS states: “Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs.”

As a result, does it seem like Americans fear unemployment?

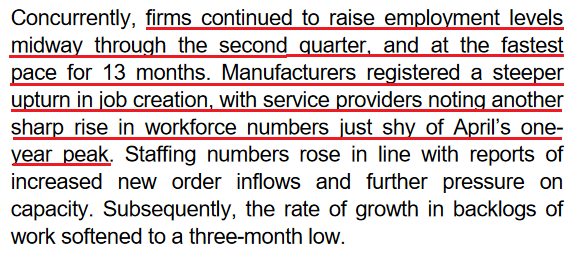

Fourth, and most importantly, S&P Global released its U.S. Composite PMI on May 24. For context, the data was collected from May 12-23 and includes responses from “around 800” manufacturing and service sector companies in the U.S. An excerpt stated that they added employees “at the fastest pace for 13 months.”

The bottom line? The Fed remains materially behind the inflation curve, and nearly 70 years of history shows that the U.S. federal funds rate needs to rise above the annualized inflation rate to curb price pressures. Therefore, curing 8%+ inflation with a couple of rate hikes is unrealistic, and investors should learn this lesson the hard way over the medium term. As a result, more downside should confront the S&P 500 and the PMs over the next few months.

In conclusion, the PMs rallied on Jun. 1, as they sidestepped Wall Street’s negativity. However, the thesis remains unchanged: the U.S. 10-year real yield is still at 0.26% and needs to rise to calm inflation. Moreover, a hawkish Fed is bullish for the USD Index, and U.S. Treasury yields are also rallying once again. Therefore, the PMs should feel the fundamental heat this summer.

Overview of the Upcoming Part of the Decline

- It seems to me that the short-term rally in the precious metals market is either over or very close to being over. It’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

- We’re likely to (if not immediately, then soon) see another big slide, perhaps close to the 2021 lows ($1,650 - $1,700).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

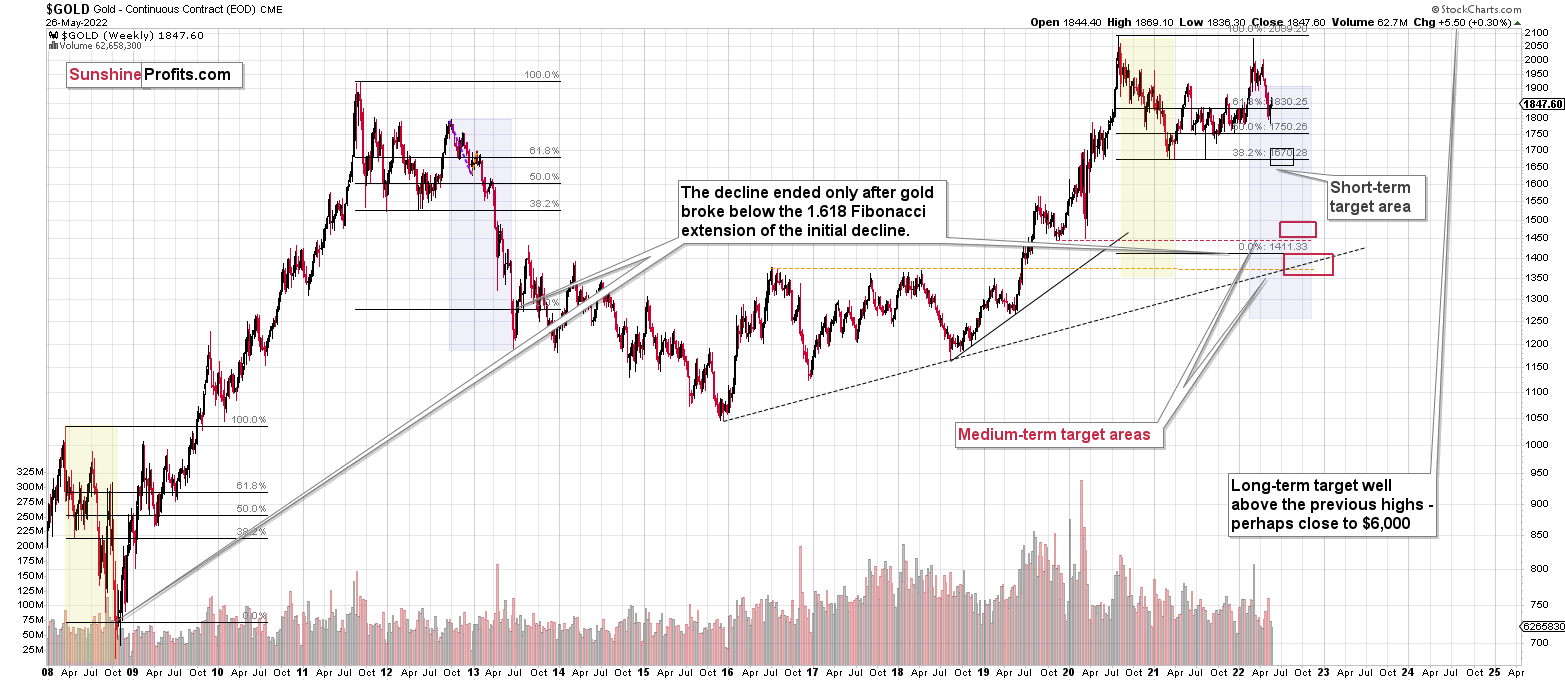

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Administrative Note

There will be no regular Gold & Silver Trading Alert tomorrow (Friday, June 3) due to your Editor’s travel schedule. However, if something really major happens, I’ll send out an intraday Alert. The bigger, flagship analysis that I usually post on Fridays will be posted on Monday.

Summary

Summing up, it seems to me that the short-term rally in the precious metals market is either over or close to being over. In fact, it’s so close to being over that I think it’s already a good idea to be shorting junior mining stocks.

I previously wrote that the profits from the previous long position (congratulations once again) were likely to further enhance the profits on this huge decline, and that’s exactly what happened. The profit potential with regard to the upcoming gargantuan decline remains huge.

As investors are starting to wake up to reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

On an administrative note, there will be no regular Gold & Silver Trading Alert tomorrow (Friday, June 3) due to your Editor’s travel schedule. However, if something really major happens, I’ll send out an intraday Alert. The bigger, flagship analysis that I usually post on Fridays, will be posted on Monday.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $27.32; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged). The binding profit-take level for the JDST: $19.87; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $17.22

SLV profit-take exit price: $16.22

ZSL profit-take exit price: $41.87

Gold futures downside profit-take exit price: $1,706

HGD.TO – alternative (Canadian) 2x inverse leveraged gold stocks ETF – the upside profit-take exit price: $11.87

HZD.TO – alternative (Canadian) 2x inverse leveraged silver ETF – the upside profit-take exit price: $31.87

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you’ve already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (as it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief