Briefly: in our opinion, full speculative long positions (150% of the regular position size) in silver is justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. As we promised you previously, in our flagship Alerts, we will be providing you with bigger, more complex analyses (approximately once per week) and it will usually take place on Monday.

The most important analogies and long-term trends didn't change during the previous week and most of our previous extensive comments remain up-to-date. Of course, in today's analysis, we will update whatever needs to be updated or added. The parts that we didn't change (or changed only insignificantly) since last week will be put in italics.

Let's start today's analysis with a gold-focused update on the coronavirus.

Coronavirus, China's Economy and Gold Prices

The number of cases of coronavirus reported by the WHO have increased from 45,171 cases and 1,115 deaths by February 12 to 51,867 cases and 1,669 deaths by February 16, 2020. However, the number of new cases is slowing down, which suggests that the epidemic could reach a turning point within weeks. This is of key importance not only for the global health but also for the global economy, as the sooner the epidemic is over, the quicker China's economy will recover. As a reminder, the quarantines of the whole cities like Wuhan and other compulsory measures disrupted the supply chains and hampered the Chinese economy.

However, gold bulls should not count on the coronavirus to dramatically hit the long-term economic potential of China. The epidemic will cause only a short-term slowdown, but it should not decrease the long-term economic growth. Investors should remember that the epidemic will be contained eventually and that geopolitical events and external shocks have only temporary impact the gold prices.

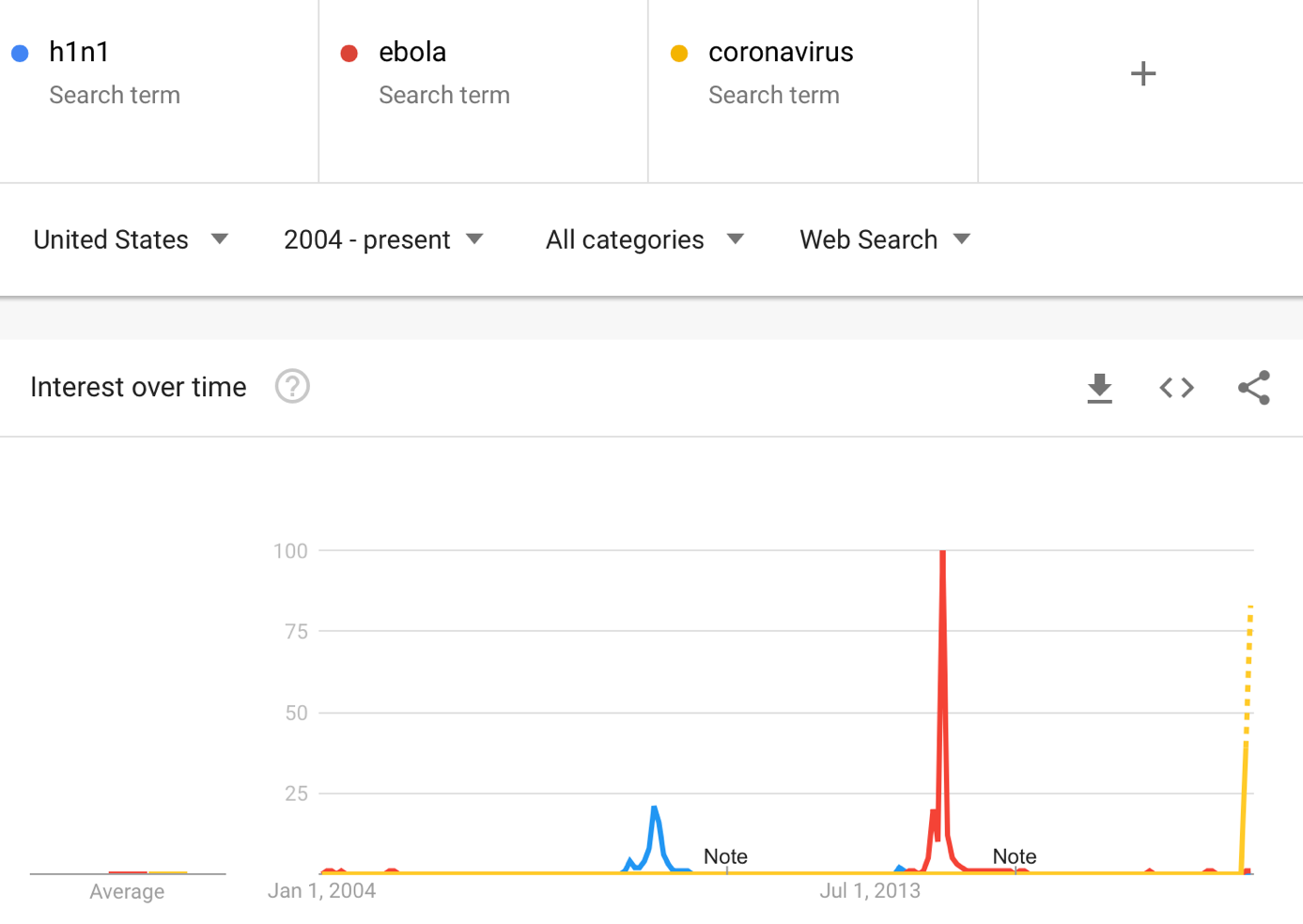

In our previous analyses, we also analyzed the interest in the Google searches for "coronavirus" which we used as a proxy for fear thereof. Last week we featured the chart below (courtesy of Google Trends) and we described it in the following way:

(...) at the 2014 peak, people were searching for ebola more than they are searching for coronavirus right now. It seems that people were more scared of ebola in 2014 than they are scared of the coronavirus right now.

Or - which is more likely true - the fear has not yet peaked this time.

Why would this be more likely? Because we should also take into account the increased usage of Internet worldwide as well as increased use of social media in general. It's becoming increasingly easier to share content, reactions, and emotions online. That's quite likely why the spike interest in ebola of 2014 is so much bigger than the spike in interest in h1n1 that we saw in 2008. Consequently, we can expect the coronavirus interest to peak at levels greater than those at which the ebola interest peaked in 2014.

And what's happening right now?

The projected search numbers for February are now much bigger than the ebola searches of 2014, just as we had indicated. This might be the peak, or we might still be ahead of it.

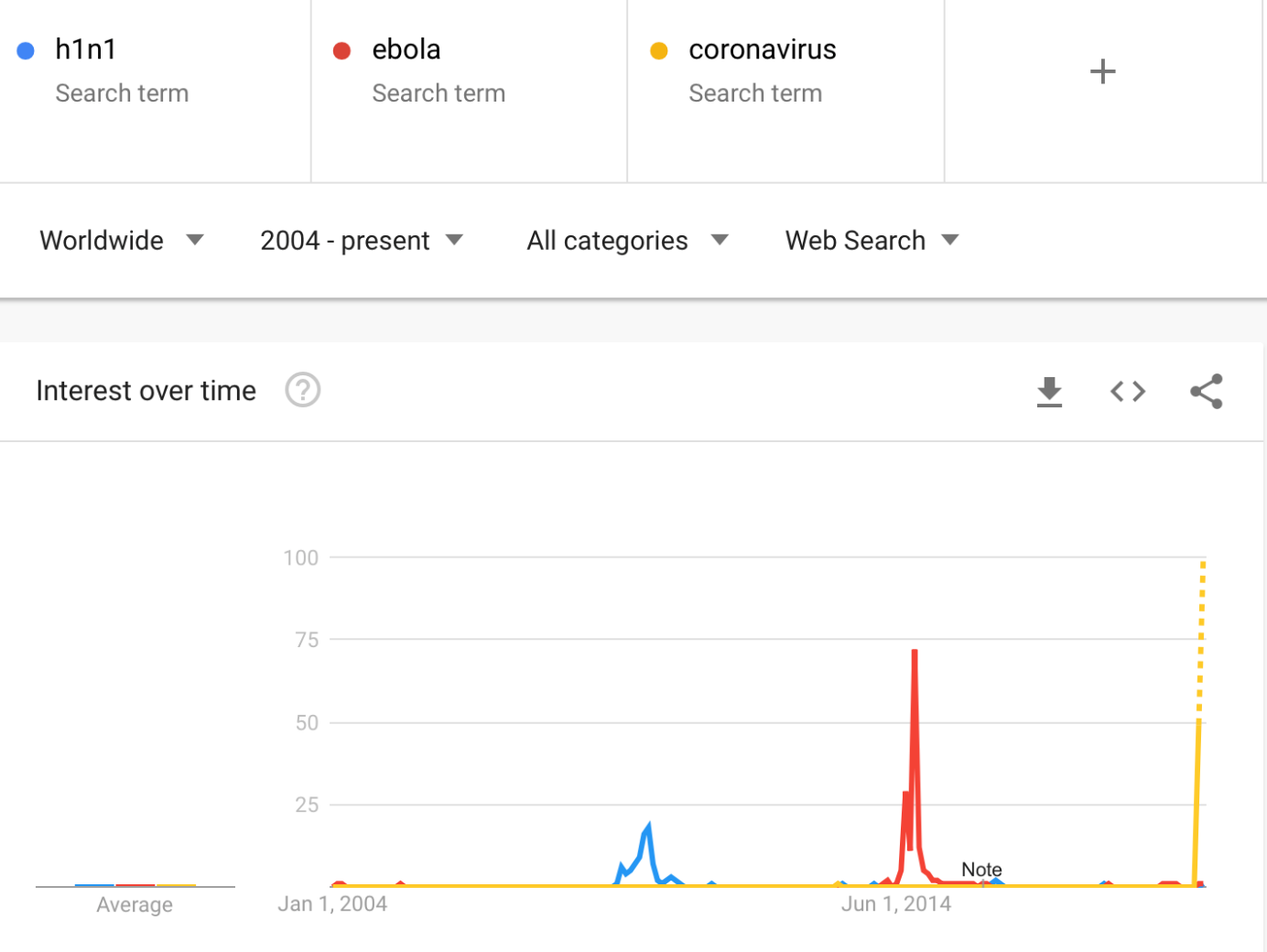

While the viruses are different, the fear of viruses is similar and the way people react to it, is also relatively similar - at least in case of capital markets. So, we can estimate how people might react right now, based on how they reacted to the ebola scare of 2014.

And how did gold react when the ebola scare was getting more serious, and what happened once the fear subsided? What did stocks and the USD Index do?

Gold price actually declined throughout most of the scare and only rallied during the final part of the scare - when the search interest for ebola peaked. There was also one small corrective upswing at the beginning of August.

The USD Index did the opposite - it was rallying for most of the time and only corrected in the final part of the scare.

The stock market, however, was very sensitive to the changes in ebola interest. Stock declined visibly, reacting clearly and strongly to both increases in ebola interest. During the peak interest, stocks declined about 10% from their previous 2014 high. So far, stocks have declined only about 3.3% from their recent high. And they rallied to new highs after the initial downswing.

Gold moved higher by about 6% in the final corrective upswing and it took about 2 weeks.

Fast forward to the current situation. Gold moved up, but not very significantly so, the stock market and USD Index are both up.

Consequently, based on the way how scared people got in 2014 and how the markets have reacted, it seems that the peak-interest and peak-concern was not yet reached. This quite likely means that the final peak for gold and the bottom for the stock market and the USD Index is not yet in.

The most likely scenario in our view is that while people get even more scared of the coronavirus, the USD Index and the U.S. stock market are going to decline in the short term (in particular, the former), while gold moves temporarily higher as stocks and the USD Index move temporarily down. The key word is "temporarily".

Of course, all the above makes sense only if the coronavirus is contained and doesn't translate into a full-blown world crisis. This is a very likely outcome in our view - practically all other similarly scary threats were contained without real market impact in the past decades. The damages (in monetary terms) done by hurricanes, floods and similar natural disasters have been much greater historically and they didn't cause changes in long-term market trends. That's unlikely to happen this time.

There are also other fundamental news that we would like to discuss.

Industrial Production, Inflation, and Gold

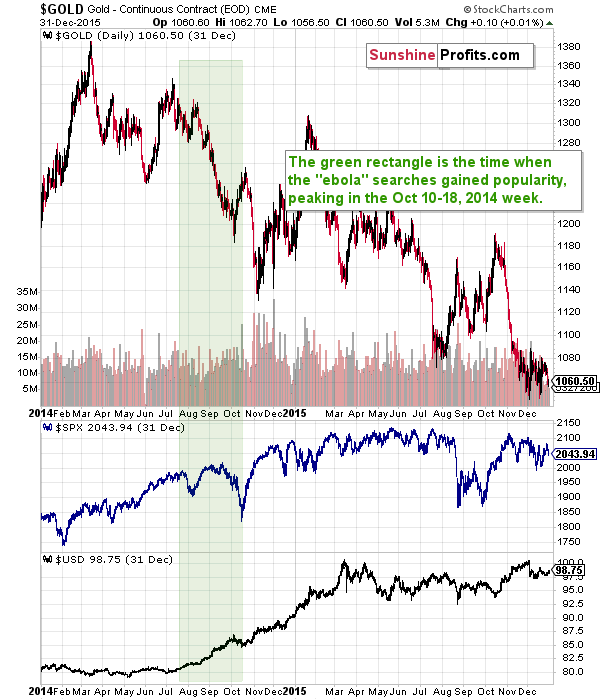

First, the CPI rose 0.1 percent in January, after increasing 0.2 percent in December, marking the smallest rise in four months. The analysts expected a stronger move. However, the annual inflation rate moved from 2.3 percent in December 2019 to 2.5 percent, the highest level since October 2018. The core CPI, which excludes food and energy prices, rose 0.2 percent on a monthly basis and 2.3 percent on an annual basis, the same increase as reported in the previous 3 months, as the chart below shows.

Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to January 2020.

Although inflation edged up in January, it remains subdued. It means that the Fed is unlikely to raise the federal funds rate in the nearest future, especially now, when the economic damage caused by the coronavirus is yet unknown. Low inflation decreases the gold's appeal as inflation hedge, but it also implies that the Fed is likely to remain dovish, which is positive for the gold prices.

Second, on Friday, the Federal Reserve reported that industrial production decreased 0.3 percent in January, marking the fourth decline in the past five months. It means that the industrial sector remains in the recessionary zone. However, the decrease mainly reflected unseasonably warm weather that held down the output of utilities and a significant slowdown in civilian aircraft production, as Boeing suspended completely the 737 MAX production after two deadly crashes in 2019. So, while the total manufacturing index declined 0.1 percent, it rose 0.3 percent, when excluding civilian aircraft. Moreover, the Manufacturing ISM index registered 50.9 percent in January, returning to expansion territory for the first time since July 2019. It offers some hope that the industrial sector will revive later this year. Of course, it would be better for gold if the industrial recession not only remained with us but also spread to other sectors of the economy.

Trump's Acquittal and Gold

In February, the Republican-led Senate acquitted the President of abuse of power and obstruction of Congress, ending the impeachment saga.

What's next? Well, some analysts fear that Trump's victory could embolden him to further expand executive power while avoiding accountability. President has already fired a few officials who testified against him in the impeachment inquiry.

Trump's acquittal should also strengthen the President. Indeed, after the historic vote, Trump had had the highest approval rating of his presidency - 49 percent in a Gallup tracking poll, which increases his chances to win the election in November. As Trump implies the status quo, his reelection should not impact the gold prices significantly. For the yellow metal, Sanders or Warren, with their radically progressive proposals, should be much better.

Moving on to the technical part of today's analysis, let's take a look at rhodium. Practically, everything we wrote on it last week remains up-to-date, but it's worth keeping it in mind as rhodium is still testing its 2007 high and the very round number of 10,000.

Many people never heard of it and it's hardly a surprise. You know that palladium and platinum markets are tiny compared to silver, which in turn, is small compared to gold's market. Well, rhodium's market is about a tenth of the size of palladium or platinum. Rhodium isn't traded on exchanges and the market for coins and bars is very, very small. Rhodium is mined as a byproduct of platinum and nickel and its mainly used in autocatalysts. There are other applications as well (Swarovski jewelry is often rhodium-plated for instance).

The most interesting thing about rhodium is how much it rallied recently.

This month, without a major shift in its supply or demand, rhodium soared to its new all-time high above $10,000, greatly outperforming other precious metals and almost every other asset. It's not very far above its July 2008 high, so rhodium prices are very vulnerable to a sudden selloff. The situation will become bearish only after the breakout to new highs is invalidated, but given the parabolic nature of rhodium's rally, the move higher looks very unsustainable.

The drop that followed the 2008 top was extremely sharp so everyone invested in rhodium right now might want to consider moving their capital somewhere else.

The demand coming from Asia is big, but this doesn't justify the near-vertical price rally. This demand wasn't absent just a year ago and yet rhodium was not skyrocketing as it is right now. Rhodium seems to be in a price bubble that's likely to pop.

There are very interesting implications for the precious metals market in general as well. You see, the tiny and most volatile parts of a given market tend to behave very specifically. Juniors, for instance, tend to outperform senior mining stocks in the final parts of upswings. Rhodium, being the tiny part of the PM market, could be showing us that what we see in the precious metals marker right now, is a medium-term top.

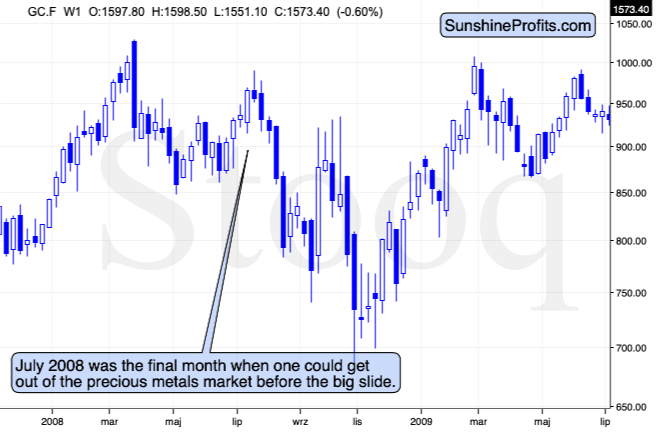

That's the theory, but did this theory work in 2008, when rhodium topped?

You bet it did.

Rhodium topped in July, 2008 and that was when gold formed the final high before one of the sharpest and biggest plunges of the past decades. In case of silver and mining stocks, it was the beginning of THE sharpest decline of the recent decades.

There are very few analogies that could be more bearish than the one that rhodium is now featuring.

Actually, given the fact that volume on which the 2008 top formed and volume on which gold topped recently are relatively similar (gold volume spiked in both cases), the above analogy is confirmed. Additional confirmation comes from the fact that in both: 2008 and 2020, gold tried to rally to the previous highs, and failed to reach them. In 2008, rhodium soared during this second attempt, and this is exactly the case right now. The analogy is clear and extremely bearish.

Before moving to technical price charts, we would like to remind you that this year is the final year of the U.S. Presidential cycle and that's the weakest year for silver and mining stocks. This doesn't change anything regarding the short-term price moves, but it is something that will likely have an impact throughout the year.

Assets' Returns and Presidential Cycle

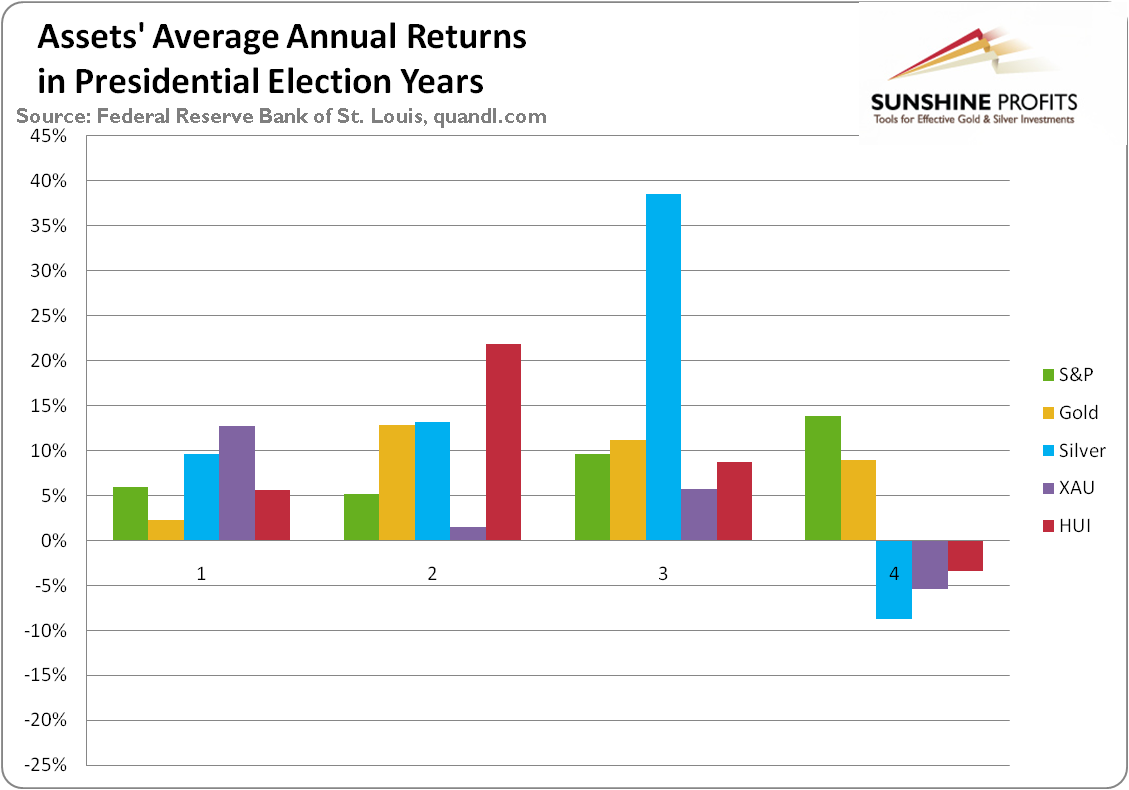

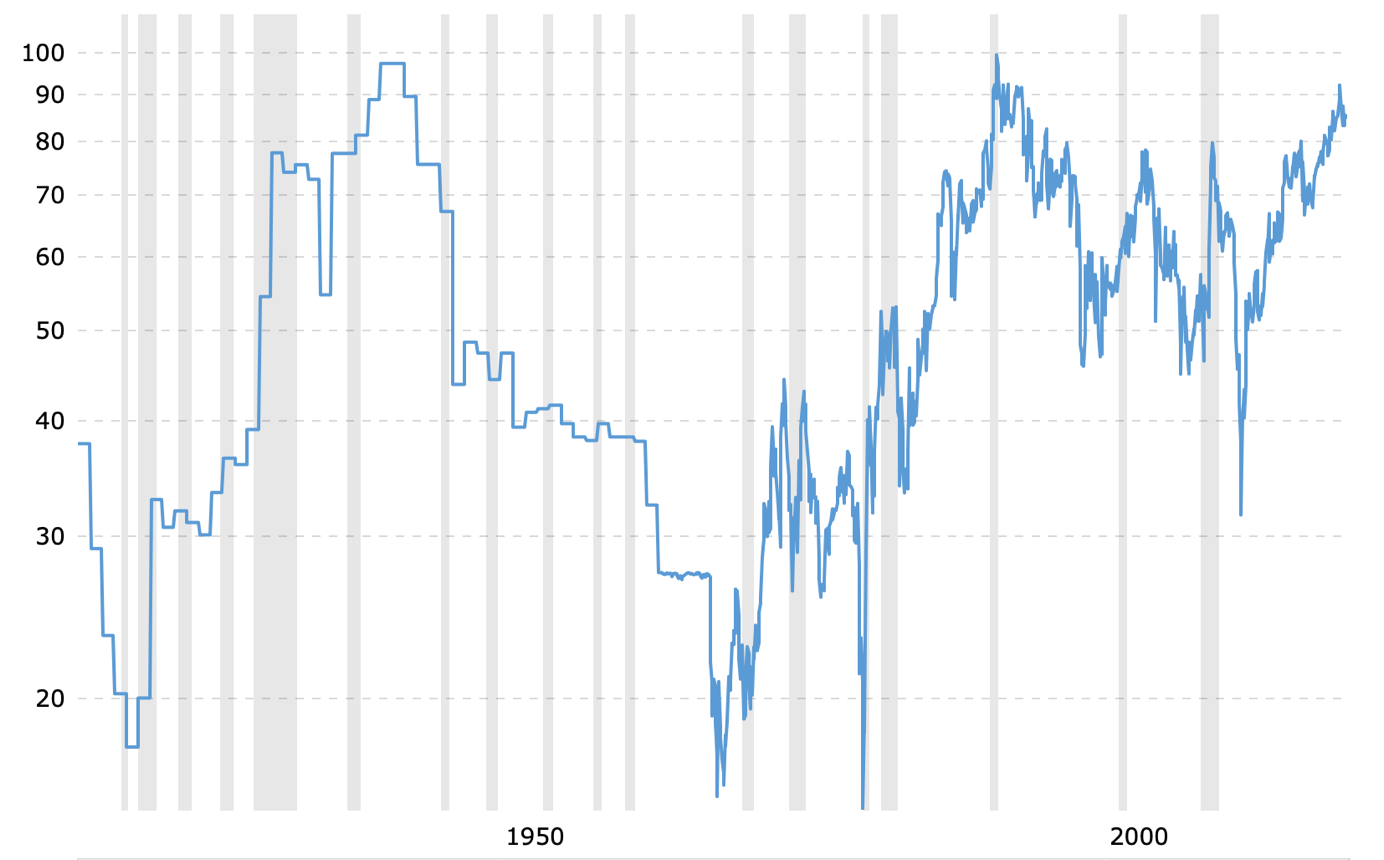

Average annual return of S&P (1948-2015, green line), gold (London P.M. Fix, 1972-2015, yellow line), silver (London Fix, 1972-2015, blue line), XAU Index (1984-2015, purple line) and HUI Index (1997-2015, red line) in presidential election cycles.

Gold's performance is more or less average in the election year, but in case of silver and mining stocks we see something very different. Namely, the election year is the only year when - on average - they all decline.

So, does it mean that gold won't be affected by this specific cyclicality, but silver and miners will be? Not really. It seems that the above chart shows that silver and miners - on average - lead gold lower. They perform worst in the election year and the yellow metal is the worst choice in the following year - the first year of presidency.

Silver and miners have already been performing very poorly relative to gold if we look at the long-term charts. Did silver or miners exceed their 2016 highs? They are not even close, especially silver. So, it seems that the pattern that we should be seeing at this time of the U.S. Presidential cycle, is already here and it started a bit earlier.

This means two things: even more weakness in silver and miners that we saw, and gold catching up with the decline.

The fundamental background is one thing, but the technical details are another. They provide details and insights that are impossible to get by just analyzing the news. Let's see how much the recent strength in gold changed the technical picture, and what's going on in the most important - long-term - charts featuring gold and the related markets.

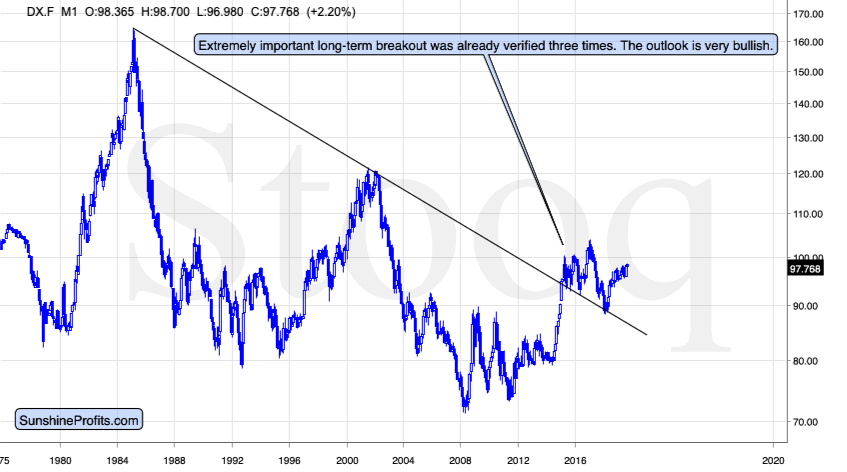

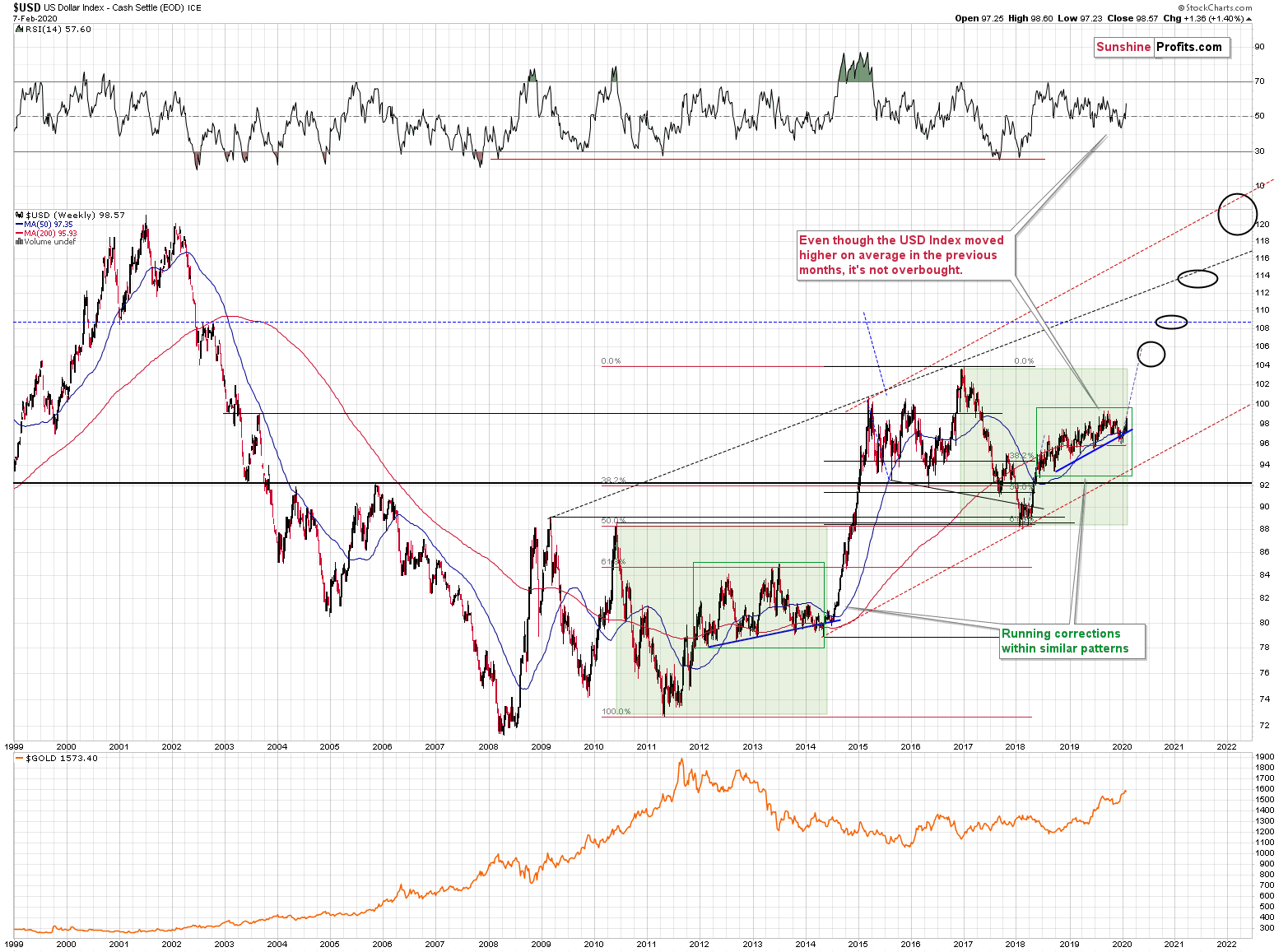

The most important point that remains intact (and unaffected by what happened in the past week) is that the USD Index is after a massive breakout that was already verified more than once. The connection with the gold market remains intact as well.

The Big Picture View of the USD Index

(please click on the charts to enlarge them)

The 2014-2015 rally caused the USD Index to break above the declining very-long-term resistance line, which was verified as support three times. This is a textbook example of a breakout and we can't stress enough how important it is.

The most notable verification was the final one that we saw in 2018. Since the 2018 bottom, the USD Index is moving higher and the consolidation that it's been in for about a year now is just a pause after the very initial part of the likely massive rally that's coming.

If even the Fed and the U.S. President can't make the USD Index decline for long, just imagine how powerful the bulls really are here. The rally is likely to be huge and the short-term (here: several-month long) consolidation may already be over.

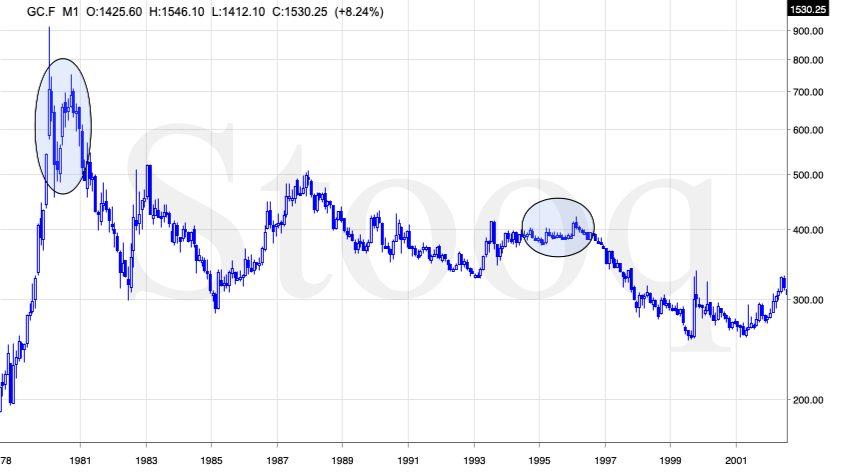

There are two cases on the above chart when the USD Index was just starting its massive rallies: in the early 1980s and in mid-90s. What happened in gold at that time?

Gold Performance When the USD Index Soars

These were the starting points of gold's most important declines of the past decades. The second example is much more in tune with the current situation as that's when gold was after years of prolonged consolidation. The early 1980s better compare to what happened after the 2011 top.

Please note that just as what we saw earlier this year, gold initially showed some strength - in February 1996 - by rallying a bit above the previous highs. The USD Index bottomed in April 1995, so there was almost a yearly delay in gold's reaction. But in the end, the USD - gold relationship worked as expected anyway.

The USD's most recent long-term bottom formed in February 2018 and gold seems to have topped right now. This time, it's a bit more than a year of delay, but it's unreasonable to expect just one situation to be repeated to the letter given different economic and geopolitical environments. The situations are not likely to be identical, but they are likely to be similar - and they indeed are.

What happened after the February 1995 top? Gold declined and kept on declining until reaching the final bottom. Only after this bottom was reached, a new powerful bull market started.

Please note that the pace at which gold declined initially after the top - in the first few months - was nothing to call home about. However, after the initial few months, gold's decline visibly accelerated.

Let's compare the sizes of the rallies in the USDX and declines in gold. In the early 80s, the USDX has almost doubled in value, while gold's value was divided by the factor of 3. In the mid-90s, the USDX rallied by about 50% from its lows, while gold's value was divided by almost 1.7. Gold magnified what happened in the USD Index in both cases, if we take into account the starting and ending points of the price moves.

However, one can't forget that the price moves in USD and in gold started at different times - especially in the mid-90s! The USDX bottomed sooner, which means that when gold was topping, the USDX was already after a part of its rally. Consequently, when gold actually declined, it declined based on only part of the slide in the USDX.

So, in order to estimate the real leverage, it would be more appropriate to calculate it in the following way:

- Gold's weekly close at the first week of February 1996: $417.70

- USDX's weekly close at the first week of February 1996: 86.97

- Gold's weekly close at the third week of July 1999: $254.50

- USDX's weekly close at the third week of July 1999: 103.88

The USD Index gained 19.44%

Gold lost 39.07% (which means that it would need to gain 64.13% to get back to the $417.70).

Depending on how one looks at it, gold actually multiplied USD's moves 2-3 times during the mid-90 decline.

And in the early 1980s?

- Gold's weekly close at the third week of January 1980: $845

- USDX's weekly close at the third week of January 1980: 85.45

- Gold's weekly close at the third week of June 1982: $308.50

- USDX's weekly close at the third week of June 1982: 119.01

The USD Index gained 39.27%

Gold lost 63.49% (which means that it would need to gain 173.91% to get back to $845).

Depending on how one looks at it, gold actually multiplied USD's moves by 1.6 - 4.4 times during the early-80 decline.

This means that just because one is not using U.S. dollars as their primary currency, it doesn't result in being safe from gold's declines that are accompanied by USD's big upswings.

In other words, the USD Index is likely to soar, but - during its decline - gold is likely to drop even more than the USD is going to rally, thus falling in terms of many currencies, not just the U.S. dollar.

Please note that there were wars, conflicts and tensions between 1980 and 2000. And the key rule still applied. Huge rallies in the USD Index mean huge declines in gold. If not immediately, then eventually.

Having covered the most important factor for the USD Index and gold, let's take a look at the other - also important - factors influencing both of these markets.

More on the USD Index and Gold

The USD Index is moving up in a rising trend channel (all medium-term highs are higher than the preceding ones) that formed after the index ended a very sharp rally. This means that the price movement within the rising trend channel is actually a running correction, which is the most bullish type of correction out there. If a market declines a lot after rallying, it means that the bears are strong. If it declines a little, it means that bears are only moderately strong. If the price moves sideways instead of declining, it means that the bears are weak. And the USD Index didn't even manage to move sideways. The bears are so weak, and the bulls are so strong that the only thing that the USD Index managed to do despite Fed's very dovish turn and Trump's calls for lower USD, is to still rally, but at a slower pace.

The temporary breakdown below the rising blue support line was invalidated. That's a technical sign that a medium-term bottom is already in.

Interestingly, that's not the only medium-term running correction that we saw. What's particularly interesting is that this pattern took place between 2012 and 2014 and it was preceded by the same kind of decline and initial rebound as the current running correction.

The 2010 - 2011 slide was very big and sharp, and it included one big corrective upswing - the same was the case with the 2017 - 2018 decline. They also both took about a year. The initial rebound (late 2011 and mid-2018) was sharp in both cases and then the USD Index started to move back and forth with higher short-term highs and higher short-term lows. In other words, it entered a running correction.

The blue support lines are based on short-term lows and since these lows were formed at higher levels, the lines are ascending. We recently saw a small breakdown below this line that was just invalidated. And the same thing happened in early 2014. The small breakdown below the rising support line was invalidated.

Since there were so many similarities between these two cases, the odds are that the follow-up action will also be similar. And back in 2014, we saw the biggest short-term rally of the past 20+ years. Yes, it was bigger even than the 2008 rally. The USD Index soared by about 21 index points from the fakedown low.

The USDX formed the recent fakedown low at about 96. If it repeated its 2014 performance, it would rally to about 117 in less than a year. Before shrugging it off as impossible, please note that this is based on a real analogy - it already happened in the past.

Based on what we wrote previously in today's analysis, you already know that big rallies in the USD Index are likely to correspond to big declines in gold. The implications are, therefore, extremely bearish for the precious metals market in the following months.

On a short-term basis, the USD Index is likely to correct as no market can move in a straight line indefinitely.

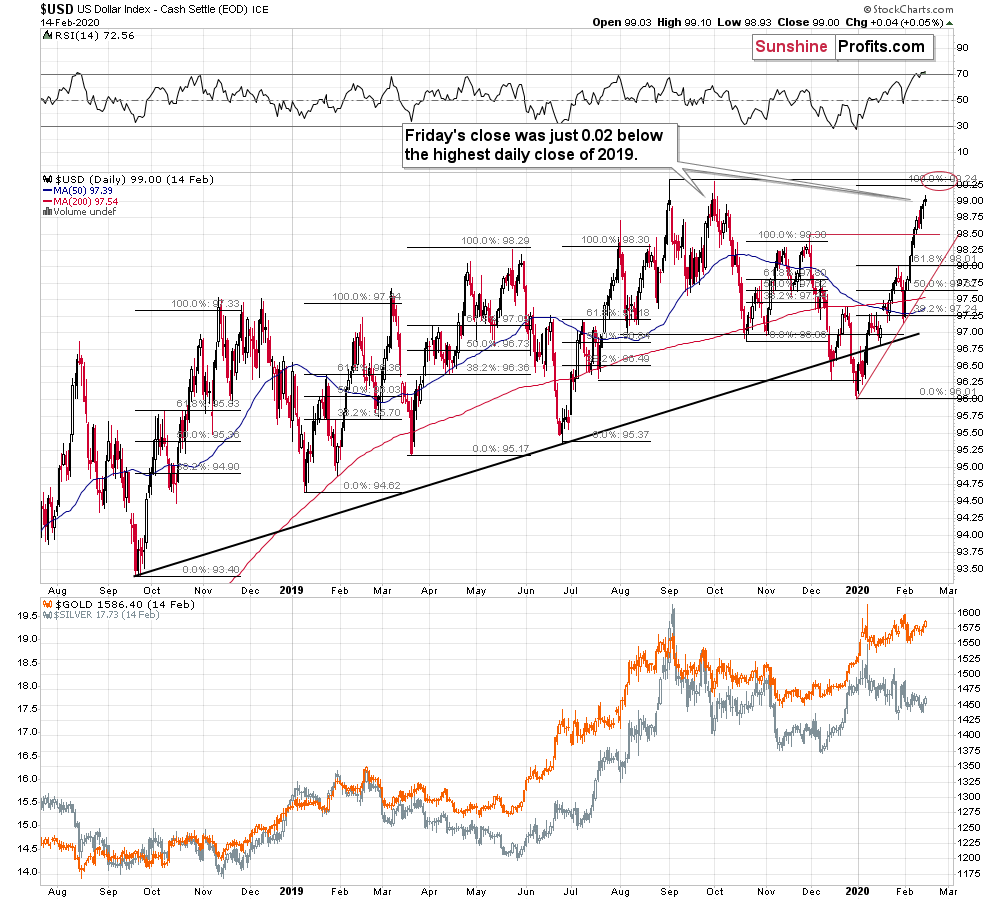

Last week, we annotated on the above chart that unless the breakout above the November high is invalidated shortly, the USD Index is likely to rally to the 2019 high and that's what happened.

The USD Index closed last week at exactly 99 - just 0.02 below the highest daily close of 2019. While the USDX has not moved to last year's intraday highs, it moved to its highs in terms of the closing prices. At the moment of writing these words, the USDX is slightly higher. Its upside in the short term is very limited as the strong resistance created by the previous intraday highs, the declining resistance line based on these highs and the target level based on the Fibonacci extension of the January 2020 rally, is only about 0.2 higher. And since the USDX moved to the 2019 high in terms of the closing prices, we might not get anything more than an intraday attempt to move higher that's followed by a sizable short-term decline.

The downside target for the USD Index is the 98 level as that's where we have the January high and the rising support line will be there in a few days.

This means that gold, silver, and mining stocks are likely to rally based on the full index point decline in the USDX, but neither of these moves is likely to be anything more than a short-term development.

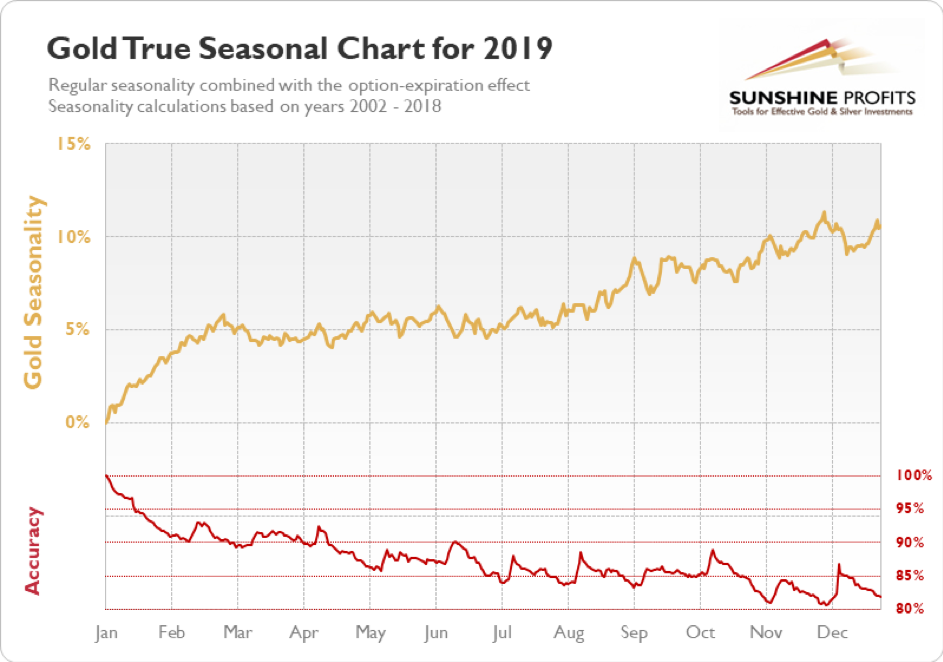

Gold Seasonality Lessons

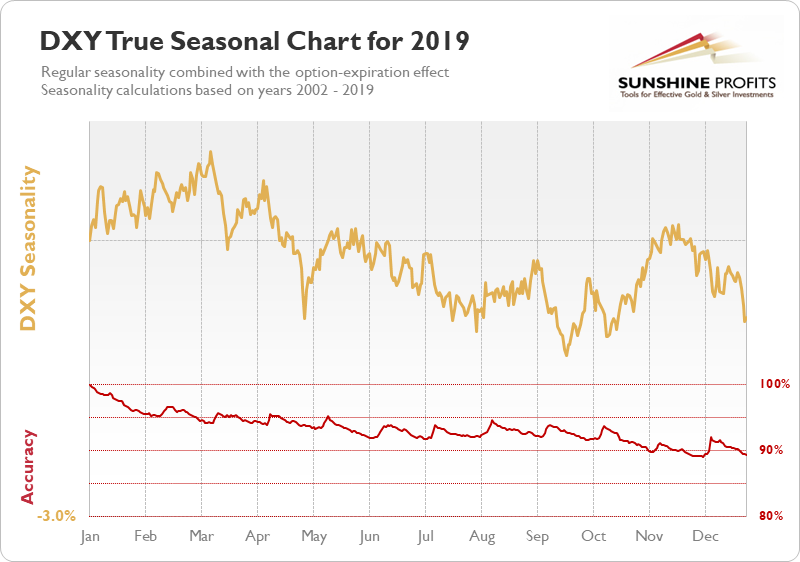

Having said that, let's take a look at the current seasonality in gold. In short, it's positive at face value, and it's neutral once one considers the likelihood of USD Index's upswing.

As a reminder, our True Seasonal gold charts are an improved version of the regular seasonality, as they additionally estimate also the Accuracy and they are based not only on the plain seasonality, but also on the way gold price tends to move around the options expiration dates (they don't take place at exactly the same day each month, so the regular seasonality ignores this effect).

The option expiration effect is not huge in case of the yellow metal; it's more significant in case of silver. Also, this effect is not very visible in case of yearly charts, such as the one that we present below, but it becomes more useful in case of the quarterly charts that we also feature from time to time (and which you can access on your own over here). You can read more details about this effect in this report (note: the pdf file is quite heavy, so it may take a while to load).

At the beginning of the year, gold tends to rally while the USD's performance varies in January (while the USDX usually soars in early February).

The USDX has definitely soared in early February, but let's keep in mind that the corrective downswings are also volatile at this time of the year. While the USDX is not likely to give away the entire rally, it could erase half thereof or so, before moving up. At least based on how things are usually taking place in February. This is in tune with the 98 target that we mentioned earlier today. USD's decline is likely to correspond to a temporary upswing in gold, but let's keep in mind that the True Seasonality for gold will soon change from being bullish to bearish, and this will remain in place until mid-April.

Retracements, Reversals and Gold

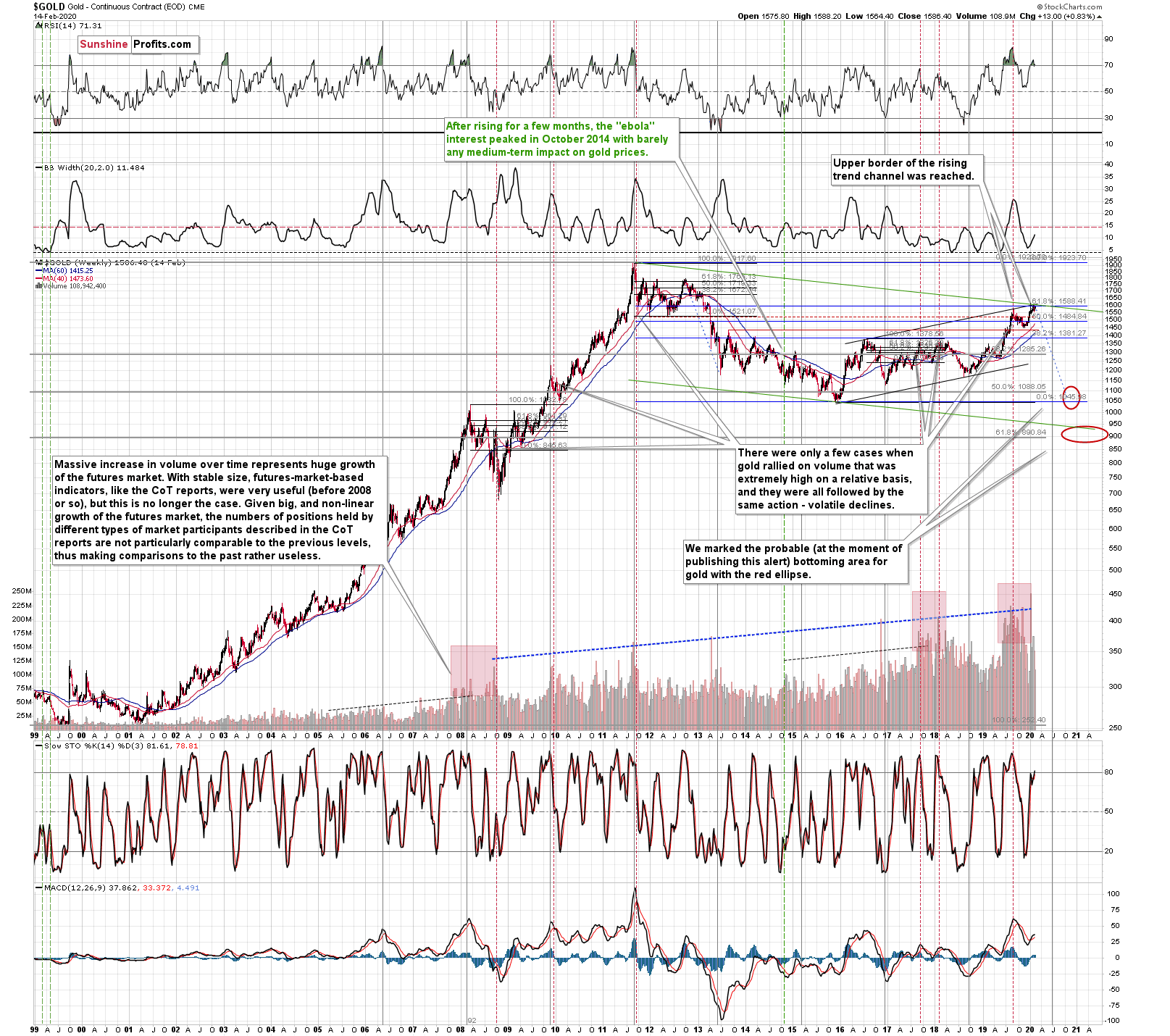

There are many other things that need to be taken into account while analyzing the market other than just the USD Index and gold's seasonality. For instance, the analogy in terms of the previous long-term retracements within big declines. In particular, the declines that we saw in 2008 (please keep the rhodium analogy in mind) and between 2011 and 2015.

The markets have fractal nature, meaning that the price patterns that we see in one timeframe, can also apply on a different scale, with proportionate implications. For instance, silver's tendency to outperform gold at the end of a bigger move higher - it takes place on a small scale in case of local rallies, and it's more visible in case of more medium-term moves.

In case of gold's long-term chart, the Fibonacci retracements are the thing that likely applies on a different scale right now. In today's second fundamental point, we explained why certain patterns repeat themselves despite taking place at entirely different times and under different circumstances. The Fibonacci retracements are one of the patterns that keeps on emerging in many markets, including gold. The 61.8% Fibonacci retracement is the most classic one.

In both previous cases (the 2011-2015 and 2008 declines), gold declined initially after the top (March 17, 2008, September 6, 2011) and then corrected a bit more than 61.8% of the decline before forming the final short-term top (July 15, 2008, October 5, 2012) from which the biggest declines started. The 2016 decline was also preceded by a sharp rally and it was also characterized by a temporary move back up - slightly above the 61.8% Fibonacci retracement - before the main part of the slide.

Now gold also moved to the 61.8% Fibonacci retracement level (precisely, it tried to move above it and managed to do so only very temporarily), but to one of much bigger meaning.

The 61.8% Fibonacci retracement that's based on the entire 2011 - 2015 decline is $1,588. That was the initial high in gold. It was the high that gold failed to break above.

Many people - especially those selling gold - will want to tell you that gold has been in a huge rally since late 2015. In reality, however, gold remains in a corrective mode after declining from 2011. And if you don't want to trust gold's classic retracement tool, maybe you'll trust silver or gold stocks.

Silver is mere $4 above its 2015 bottom. That's about $32 below the 2011 high. Big rally in the precious metals sector? What big rally? It's only gold that's been showing significant strength and taking a closer look reveals that it just corrected (!) 61.8% of the previous decline. It's relatively common for markets to retrace this amount before the previous trend resumes.

And gold miners? The HUI Index is about 400 index points below its 2011 high and only about 130 index points above the 2016 low.

That's a correction, not a new powerful rally. We will see one, but this is not the real deal just yet.

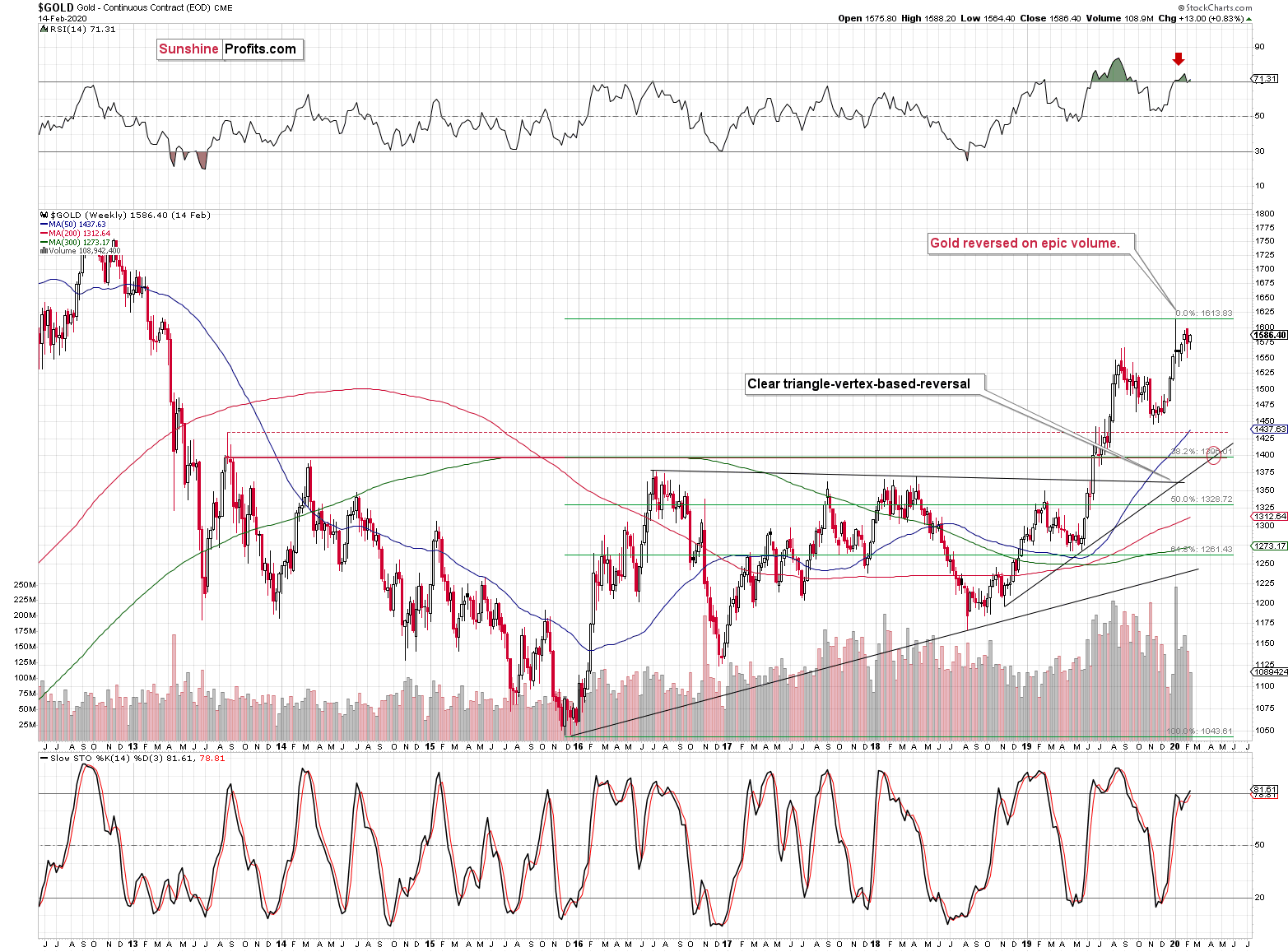

And speaking of major gold moves, please note how perfectly the long-term triangle-vertex-based reversals in gold worked.

Gold was very likely to reverse, and it did exactly that, just like we had written earlier.

Reversals should be confirmed by big volume, and the volume, on which gold reversed was truly epic, and that's a perfectly bearish confirmation. It was the biggest weekly gold volume EVER.

We already wrote a lot today about gold and we will write even more, also about silver and miners. We will cover multiple signs that point to lower precious metals prices in the following weeks and months (not days, though). But, the record-breaking-volume reversal is alone enough to make the outlook bearish. That's how significant this reversal-volume combination is.

In addition to the above, the above chart shows the next medium-term target for gold - at about $1,400 level. This target is based on the mid-2013 high in weekly closing prices, the 38.2% Fibonacci retracement based on the 2015 - 2019 upswing, and the rising medium-term support line. Of course, that's just the initial target, gold is likely to decline more after pausing close to $1,400.

Since the triangle-vertex-based reversal technique worked so well recently, let's check what else it can tell us. The below charts feature the reversal points based on the very long-term triangles.

Gold seems to have reversed (a short-term bottom) close to its reversal date and the next one is at the beginning of March.

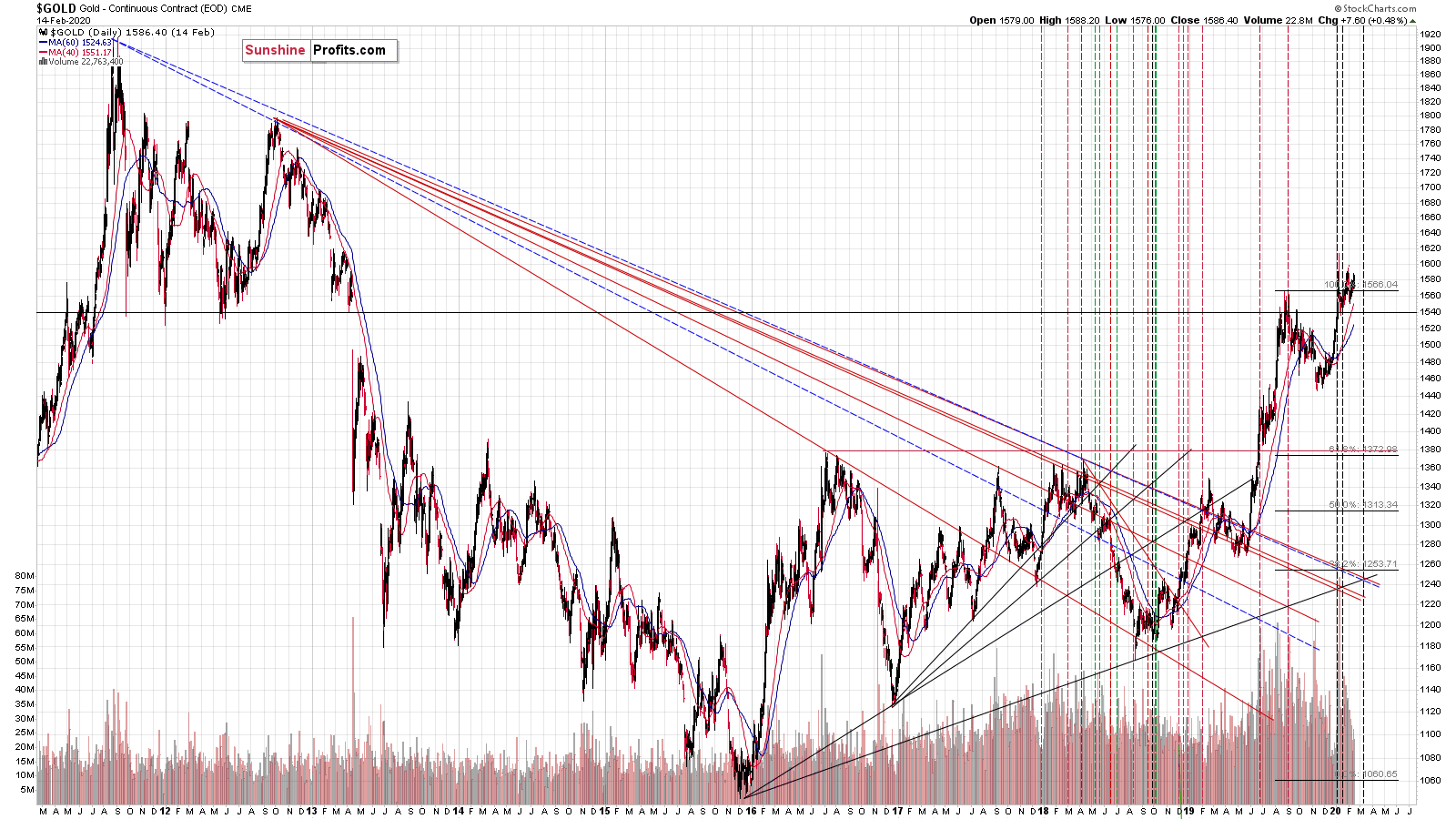

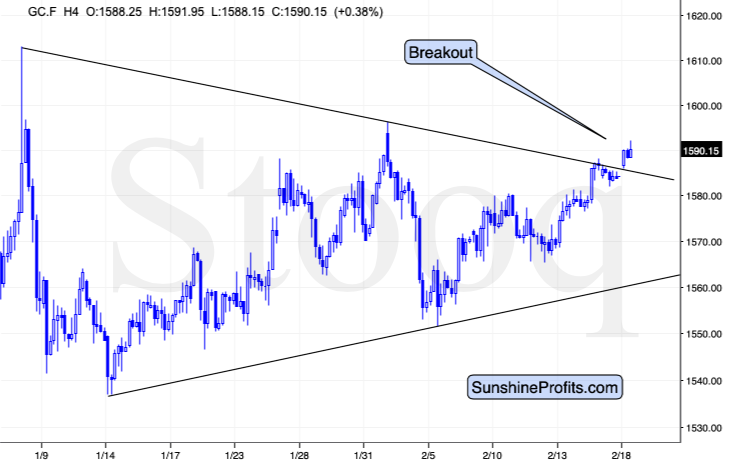

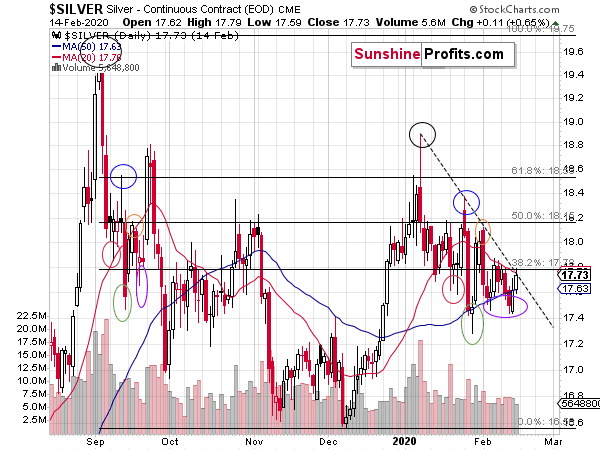

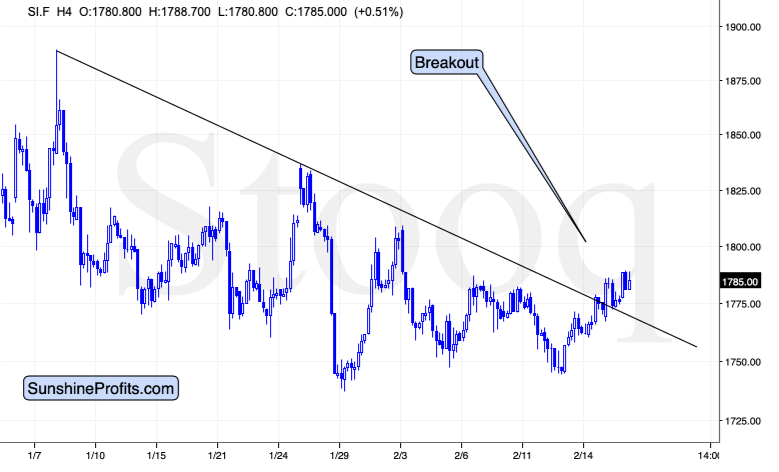

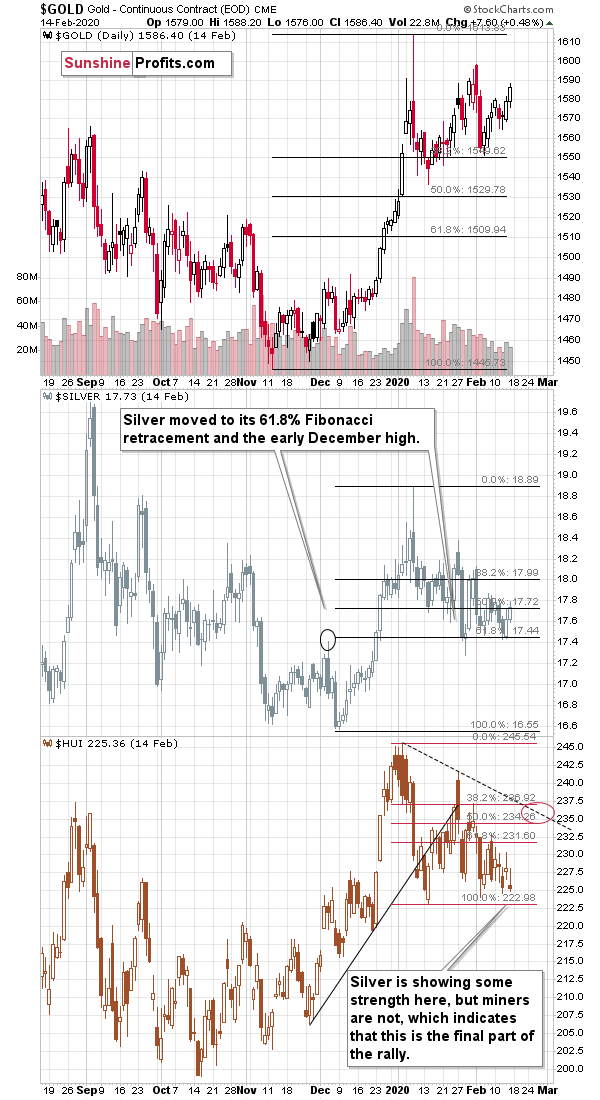

As far as the short term is concerned, gold is likely to rally not only based on the coronavirus scare, and the likelihood for the USD Index to correct. It also just managed to break above its short-term triangle pattern.

On the 4-hour chart, it's clear that gold just managed to rally above its declining resistance line and it managed to do so without USD's help. That's very bullish for the following days. If a given market shows strength even without the factors that should push it in a given direction, then it suggests that this market would likely magnify the arrival of such factors quite remarkably.

That's the current situation in gold. It couldn't wait for the USD Index to decline, so it started to rally even without this help. But once it gets this help, it's likely to be like adding fuel to fire. This golden flame is likely to be bright, but it's not likely to be burning for long. As the USD Index ends its corrective move, and the coronavirus-related fear peaks, gold is likely to top as well.

Gold failed to move to its January high at the beginning of the month, but once the USD Index corrects, it's likely to rally once again. The nearest resistance levels are the $1,600 level and $1,613, which is the intraday high of this year. Gold might also soar to $1,630 or so, if the fear of coronavirus reaches the panic level.

Given gold's breakout even without the USD's help, the yellow metal might really manage to touch or temporarily surpass its January high.

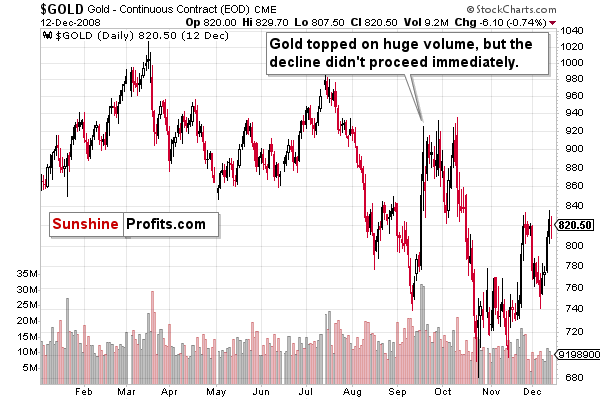

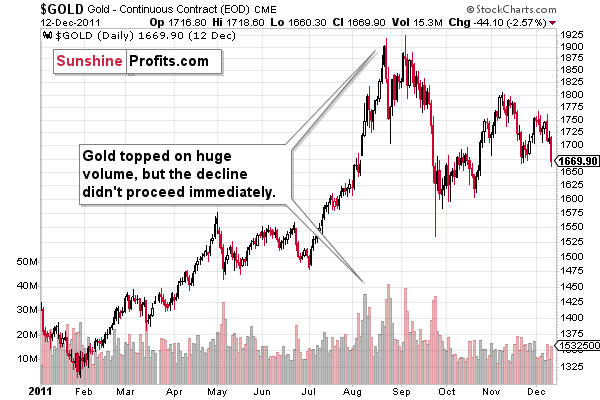

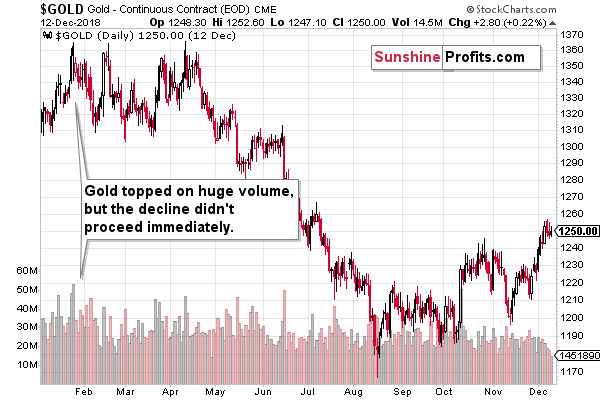

The rally to or close the previous yearly high would be in perfect tune with how gold behaved after previous tops that formed in huge volume.

The three very similar cases volume-wise and volatility-wise are the September 2008 top, the 2011 top, and the early 2018 top. How did gold perform immediately after the tops?

In all three cases, gold topped on huge volume, but the decline didn't proceed immediately. There was a delay in all cases and a re-test of the previous high. The delay took between several days and a few months.

Since a similar pattern followed the huge-volume tops, it seems that we might see a re-test of the recent high in the near future. Don't get us wrong - the true rally has most likely ended, but we might see a move close to the January high, a move to it, or even a move that takes gold very insignificantly above it. That's when people bought gold at the top in 2008, 2011, and 2018, and we don't want you to fall for this market trick. Knowing what happened then - huge declines in the price of gold - should prevent you from buying on hope for a breakout to new highs. Oh, and by huge declines, we mean the ones where gold declined by hundreds of dollars.

Based on the triangle-vertex-based reversals and cyclical turning point in gold, it seems that we won't have to wait as long as a few months - in fact the final top for this upswing might be formed as early as today.

Let's take a look at gold's sister metal - silver. There are no upcoming long-term reversals for silver based on the triangle-vertex technique for silver, but there are other points worth keeping on one's mind.

Silver Shares Its Two Cents

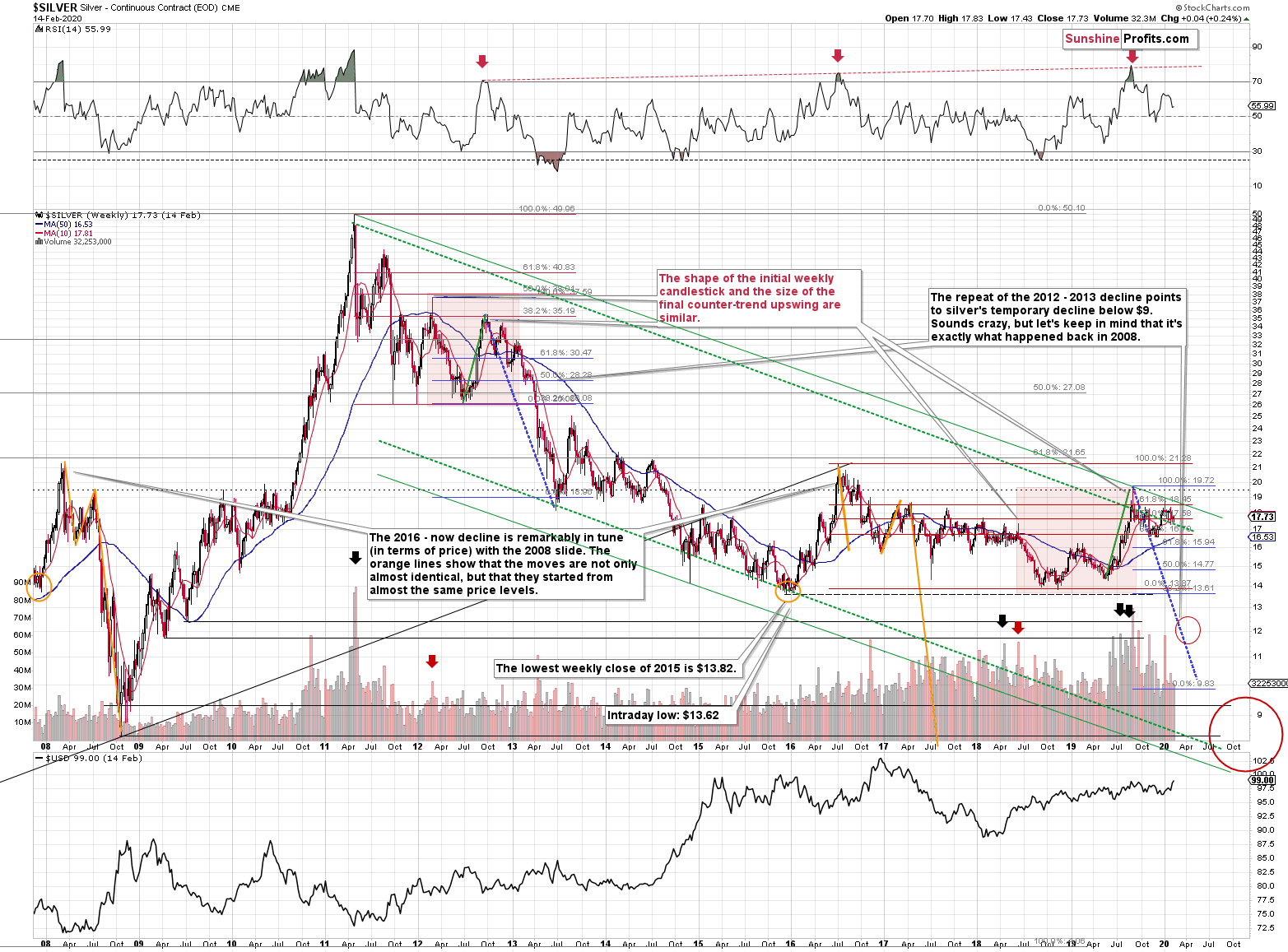

The key analogy in silver (in addition to the situation being similar to mid-90s) continues to be the one between 2008 and the 2016 - now periods.

There is no meaningful link in case of time, or shape of the price moves, but if we consider the starting and ending points of the price moves that we saw in both cases, the link becomes obvious and very important. And as we explained in the opening part of today's analysis, price patterns tend to repeat themselves to a considerable extent. Sometimes directly, and sometimes proportionately.

The rallies that led to the 2008 and 2016 tops started at about $14 and we marked them both with orange ellipses. Then both rallies ended at about $21. Then they both declined to about $16. Then they both rallied by about $3. The 2008 top was a bit higher as it started from a bit higher level. And it was from these tops (the mid-2008 top and the early 2017 top) that silver started its final decline.

In 2008, silver kept on declining until it moved below $9. Right now, silver's medium-term downtrend is still underway. If it's not clear that silver remains in a downtrend, please note that the bottoms that are analogous to bottoms that gold recently reached, are the ones from late 2011 - at about $27. Silver topped close to $20.

The white metal hasn't completed the decline below $9 yet, and at the same time it didn't move above $19 - $21, which would invalidate the analogy. This means that the decline below $10, perhaps even below $9 is still underway.

Naturally, the implications for the following months are bearish.

Let's consider one more similarity in the case of silver. The 2012 and the 2018 - today performance are relatively similar, and we marked them with red rectangles. They both started with a clear reversal and a steady decline. Then silver bottomed in a multi-bottom fashion, and rallied. This time, silver moved above its initial high, but the size of the rally that took it to the local top (green line) was practically identical as the one that we saw in the second half of 2012.

The decline that silver started in late 2012 was the biggest decline in many years, but in its early part it was not clear that it's a decline at all. Similarly to what we see now, silver moved back and forth with lower highs and lower lows, but people were quite optimistic overall, especially that they had previously seen silver at much higher prices (at about $50 and at about $20, respectively).

The 2012 corrective upswings were actually the final chances to exit long positions and enter short ones. It wasn't easy to do it back then just as it's not easy to do so right now. But the size of the decline that followed speaks for itself. In investing and trading, what's pleasant and what's profitable is rarely the same thing.

Silver's huge early-January reversal confirms gold's reversal. Silver's volume didn't set a new record, but it was truly big nonetheless. Definitely more than enough to make silver's reversal important and reliable. It's very bearish on its own and extremely bearish when examined together with gold's reversal.

Silver has been very volatile recently, but the overall tendency for silver to outperform gold and mining stocks in the final part of a given rally remains intact. This means that if the precious metals sector is to rally for the next week or so, silver is likely to rally visibly.

There is something interesting on its chart that we would like to share with you. Namely, silver's performance so far this year resembles the way silver behaved after the early-September 2019 top.

We marked the analogous price extremes with ellipses of the same color. The tops are in black, the initial lows are in red, the first corrective highs are in blue, then the lowest short-term lows are in green, then the next corrective highs are in orange, and then the final short-term lows are in purple.

If the similarity is to persist, silver is likely to rally particularly well this week.

This is especially the case, given silver's pre-market breakout above the declining dashed resistance line that you can see on the above chart.

Just as gold broke above its resistance line, silver did the same thing above a different line. The implications are very bullish for the short term. The market just confirmed our decision of moving the profit-take levels in silver to higher levels.

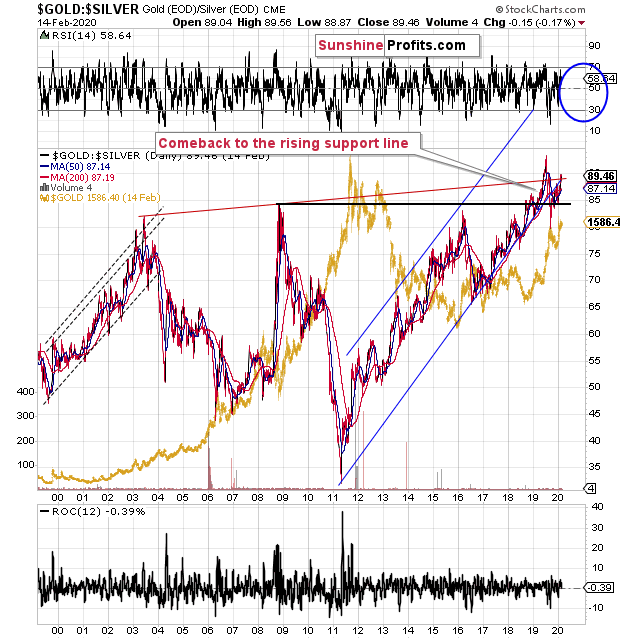

Meanwhile, silver's relationship with gold continues to support medium-term downtrend in the precious metals sector.

In early July 2019, the gold to silver ratio topped after breaking above the previous highs and now it's after the verification of this breakout. Despite the sharp pullback, the ratio moved back below the 2008 high only very briefly. It stabilized above the 2008 high shortly thereafter and now it's moving slowly up once again. Well, slowly if you take the day-to-day price movement into account. In case of the long-term point of view, the strong uptrend simply resumed after a quick breather.

Anything after a breakout is vulnerable to a quick correction to the previously broken levels. On the other hand, anything after a breakout that was already confirmed, is ready to move higher and the risk of another corrective decline is much lower.

The most important thing about the gold and silver ratio chart to keep in mind is that it's after a breakout above the 2008 high and this breakout was already verified. This means that the ratio is likely to rally further. It's not likely to decline based on being "high" relative to its historical average. That's not how breakouts work.

Besides, the true, long-term resistance in the gold to silver ratio is at about 100 level. This level was not yet reached, which means that as long as the trend remains intact (and it does remain intact), the 100 level will continue to be the likely target.

Before moving to mining stocks, let's take a look at the little metals (the market sizes are really tiny) that made many headlines recently - platinum and palladium.

A Few Words on Palladium and Platinum

Previously, we provided you with extended analysis of palladium and platinum, and while we don't want to repeat our fundamental analysis of these markets each week, we will provide you with a technical update.

Let's look more into palladium's and platinum's technical situation.

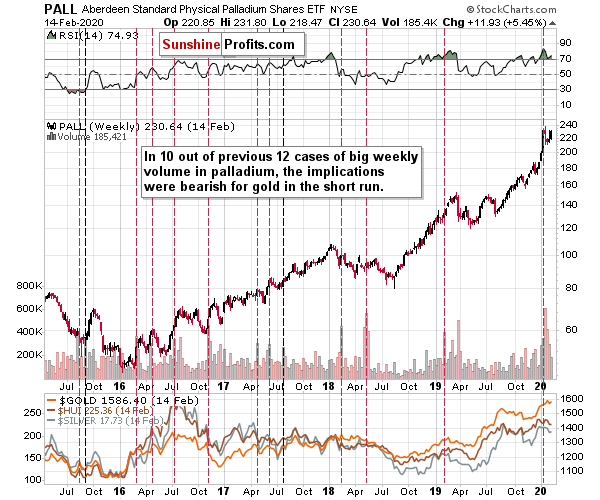

Palladium soared recently and the weekly volume that accompanied these moves was exceptional. While the price move itself might or might not indicate anything special for the major parts of the precious metals market: gold, silver, and mining stocks, the volume reading does.

In 10 out of 12 previous cases when palladium rallied on a weekly basis and it happened on big volume, the implications were bearish for gold in the short run (not necessarily in the immediate term).

Given the pace at which palladium has been moving higher, RSI well above 70 and the big volume, the current situation is similar to what we saw in early 2019. Gold, silver, and mining stocks declined after the huge-volume week in palladium. After the daily volume spike in palladium, gold moved higher on the next day and then it started a short-term decline.

The problem here is that the volume was really "once again" huge. The problem stems from the sharpness of the recent rally and its parabolic nature. In these movements, it's easy to tell that the situation is extreme, but it's hard to tell when the move is really ending. The valuations are already ridiculous from the very short-term point of view and the volume was already extreme. However, how can one know that the valuations won't get more extreme in the next few days, or the volume doesn't become even bigger?

So, while palladium seems to be topping here, it's unclear if it has indeed topped or that it will soar some more before finally sliding. The top is very likely close in terms of time, but it's not that clear in terms of price.

(Please note that since we first wrote the above palladium declined significantly, but then moved up once again - just like we warned.)

The implications here are bearish for the next week or two, but they are rather neutral for today and tomorrow.

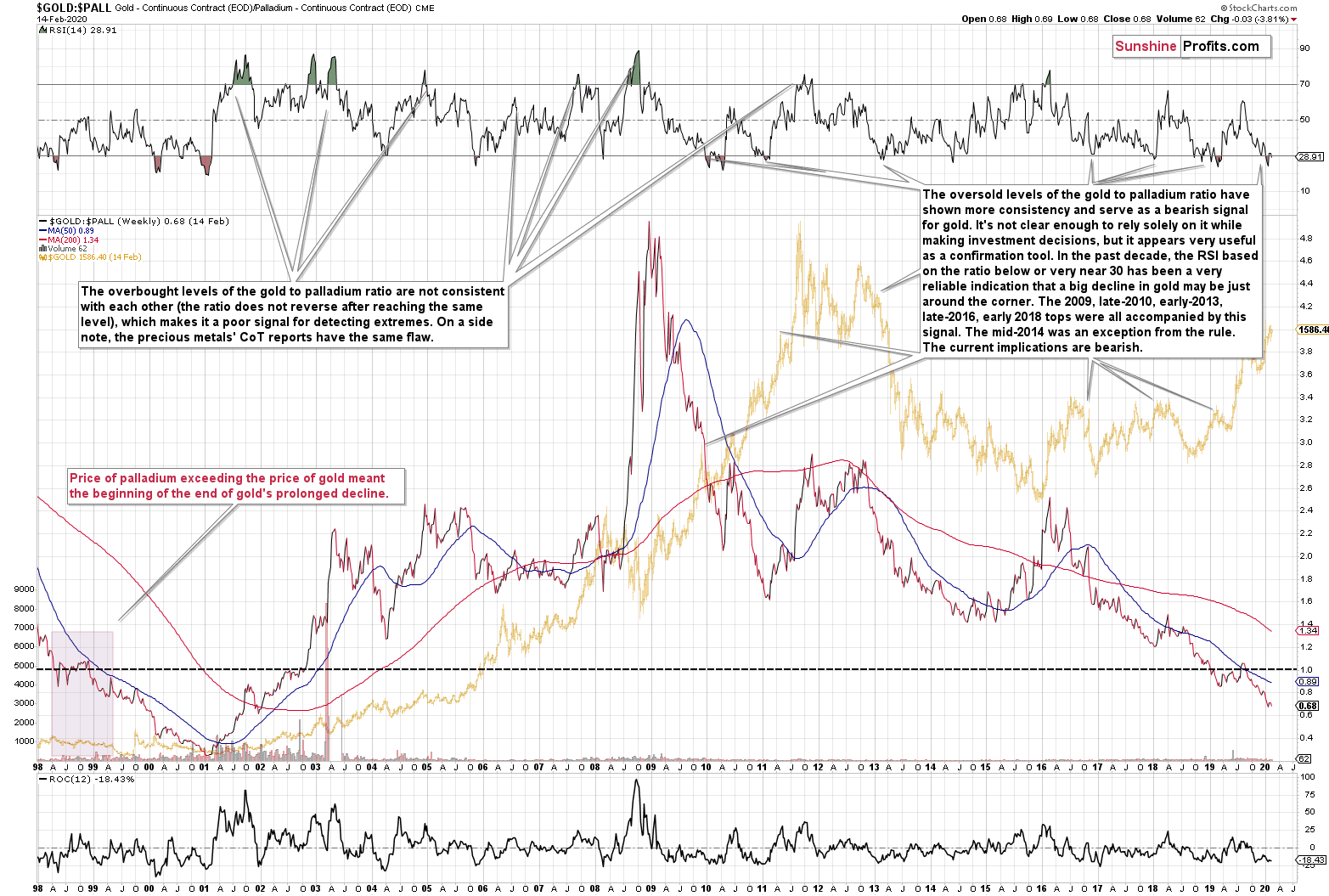

And what can palladium's performance tell us if we compare it to the one of gold?

There was only one situation when palladium became more expensive than gold and the gold to palladium ratio fell below 1. Once that happened, the ratio then corrected for a few months and then declined to new lows. The same thing happened in the past months. The previous time when we saw that was... early 1999.

The oversold status of the ratio - with RSI below 30 - suggests weakness in gold in the medium term. We marked similar cases on the above chart. And yes - the late-2012 top was also confirmed by this indication.

Having said that, let's move to platinum.

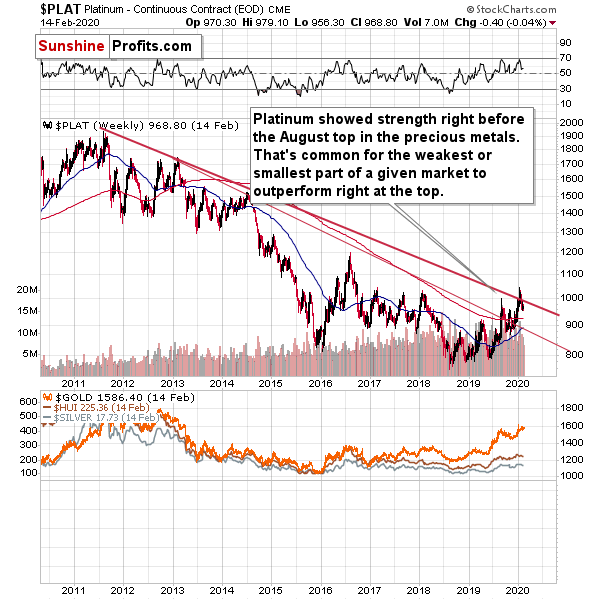

Platinum invalidated the breakout above its short-term declining resistance line, which is a bearish sign for the short term.

This also tells us that the medium-term top in gold is quite likely in, or that it will not be breached significantly. The reason is that platinum often outperforms close to the tops. No wonder, its market is not as small as the one of rhodium, but it's still very small compared to gold's market. The invalidation of previous breakout suggests that the outperformance - and the rally in the precious metals sector - are over.

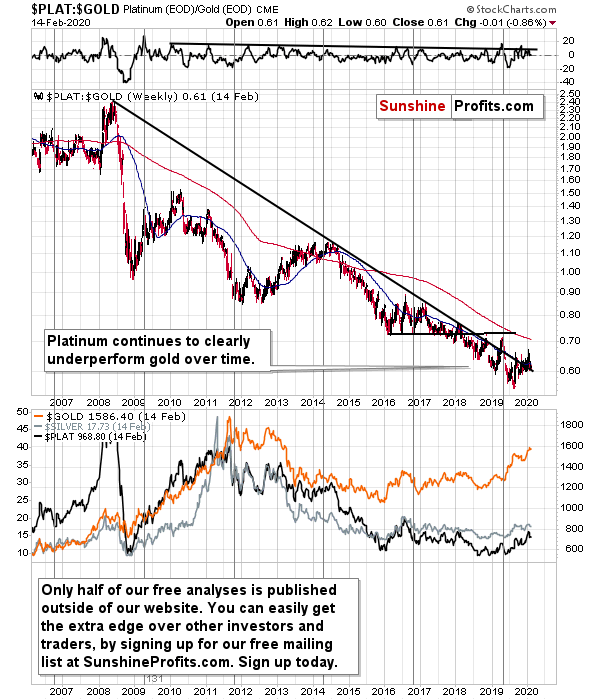

Speaking of platinum's relative strength, let's see how the platinum to gold ratio is performing.

There have been a few unsuccessful attempts to break above the long-term downtrend, and since they all failed, it doesn't seem that this year's attempt would be any different. This is especially the case given the parabolic nature of palladium's rally. Once the parabola burns itself out, both palladium and platinum are likely to decline. As of this day, the ratio is almost back below the trendline.

Having said that, let's take a look at the situation in the mining stocks, starting with miners' flagship analogy.

Turning to Gold Miners

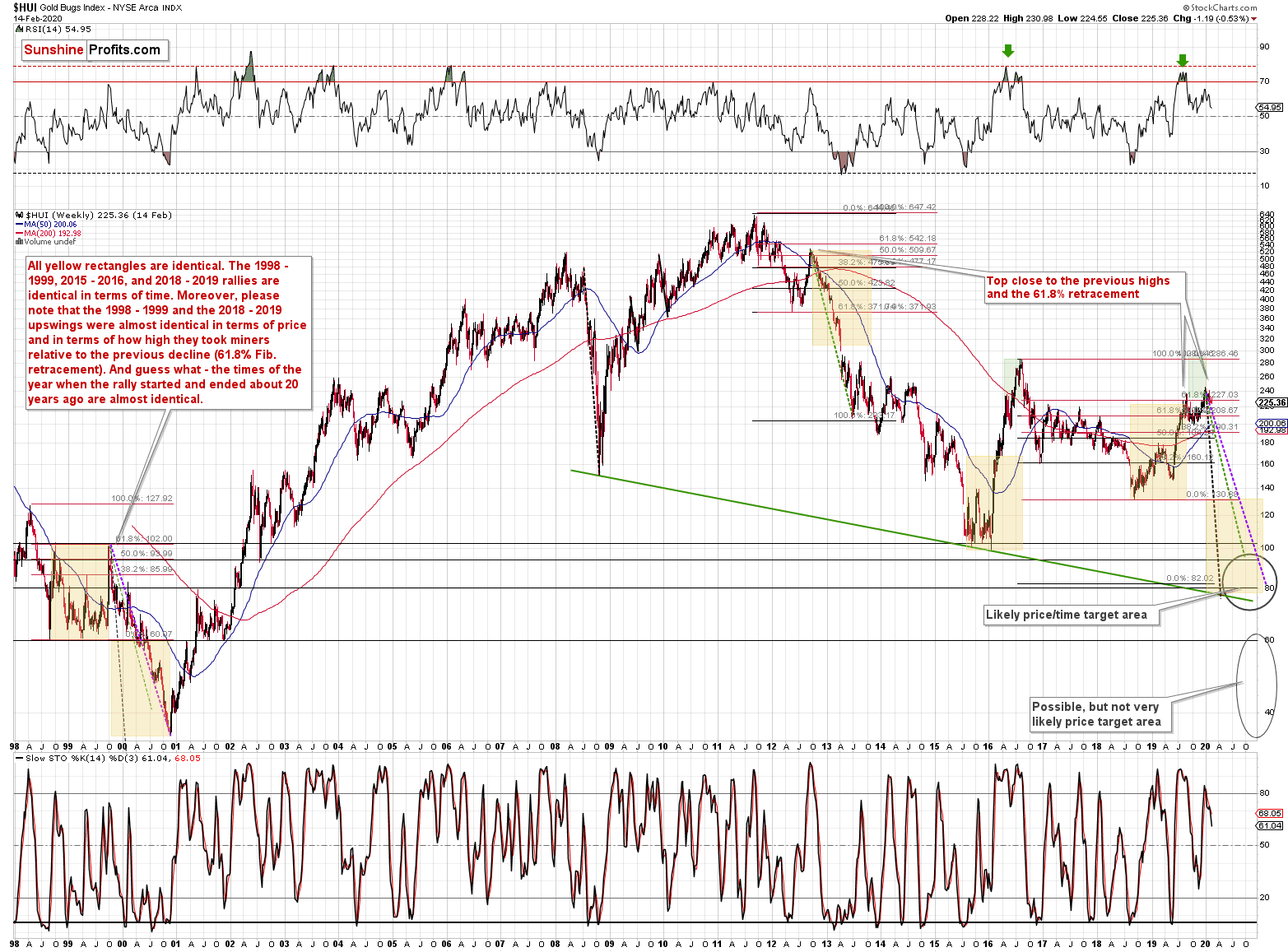

In case of gold stocks, we see that history is repeating with an almost exact 20-year delay. This might sound crazy... Until you see the chart revealing how precise it is, and how well it fits to what happened now and in 2012 as well.

(as a reminder, clicking on the chart will expand it)

Let's start with something relatively more familiar - the Fibonacci retracements. Back in 2012, the HUI Index retraced almost 61.8% of the preceding rally before the decline continued. That was one of the reasons that we thought that the 2019 rally won't get much above this retracement, if at all. Indeed, the August breakout above this retracement was very short-lived. The current move higher took the HUI just a little above the August high and this move was already invalidated as gold miners declined this year. Right now miners are trying to stay above the 61.8% Fibonacci retracement once again, but given that silver is already outperforming, the odds are that the PM rally is ending. This means that miners are likely to decline below their 61.8% Fibonacci retracement relatively soon.

(Based on the last week's and the previous week's closes that already happened, the medium-term implications are already very bearish.)

The important thing is that this is not the only time when this retracement stopped a sizable, yet counter-trend rally before a big decline.

The 1999 top formed almost exactly at the 61.8% Fibonacci retracement. That's one similarity between what happened recently and in 2012.

The second similarity is what's so exciting about this discovery. The length of the rally. All yellow rectangles on the above chart are identical. The 1998 - 1999, 2015 - 2016, and 2018 - 2019 rallies are identical in terms of time. Most importantly, the 1998 - 1999 and the 2018 - August 2019 upswings were almost identical in terms of both: time and price. And that's in addition to both rallies ending at the same Fibonacci retracement.

Let's re-state it again. Both rallies took practically the same amount of time, and the rallies were almost alike in terms of size - percentagewise.

The current move up is just a little above the August high and the breakout is not confirmed, which is why we don't yet view the current prices as the end of the rally. It's more of a double-top at this time. The rally seems to have ended in August and the only thing we see right now is a re-test of the same Fibonacci retracement.

The times of the year when the rally started and ended about 20 years ago are almost identical as well. The 1998 rally started right after the middle of the year and the same thing happened in 2018. The rally ended in the second part of 1999 and the same was / is the case right now. The month is not the same, but it's close nonetheless.

Based on the way in which the previous bear market in gold stocks ended, it seems that we have about a year of lower prices ahead of us and the HUI Index will decline at or a bit below the 80 level. That's in perfect tune with the upper one of the price target areas that we've been featuring on the above chart for some time now. The key of the additional trading techniques pointing to the 80 level or its proximity as the downside target are the early 1999, and 2011 tops as well as the early 2002 bottom, and the long-term declining support line based on the 2008 and 2016 lows.

The implications extend beyond just the final target - the analogy can tell us something important about the likely corrective upswings that we'll see along the way. Some of them will be relatively small, but there will also be those that are visible even from the long-term point of view, such as the one that we saw in early 2000.

How to detect them? Let's get back to the basics. When does a price rally, even though it remains in a downtrend? When it gets too low, too soon - at least in many cases. The key follow-up question is "too low compared to what?". And that's where the analogy to the 1999 - 2000 decline comes into play.

The purple line is the line that connects the start and the end of the 1999 - 2000 decline. The green line marks the start and the end of the 2012 - 2013 decline and the black one is based on the 2008 decline. There are two rules that we can detect based on these analogies.

First, the time after which we saw corrections during longer declines is similar to the times when the quicker decline ended. The end of the black line (early 2000) is also when we - approximately - saw the first big corrective upswing during the decline. Applying the same technique to the current top (of course, assuming that the top is being formed right now) provides us with early April 2020 as the likely bottoming target date. Naturally, it's likely to be just a short-term bottom that would be followed by a corrective upswing and then even lower prices.

Second, the chance of a corrective upswing and the chance that such upswing would be significant increases dramatically when price moves visibly below the dashed line. There are 3 dashed lines to choose from - each based on a different decline - so the question is which one should be used. It seems that the middle one is appropriate as it was most useful in 2000. The 2012-2013 decline took place mostly above the dashed line that connected its starting and ending point and it didn't have profound corrective upswings until it ended. What we saw 20 years ago, however, was very different. The price declined sharply initially, but then corrected a few times and the more price moved below the declining green dashed line, the bigger the corrective upswing was.

So, if the HUI moves visibly below the declining green dashed line, it will suggest that the miners got too low too fast and are likely to bounce back up sooner rather than later.

As far as the short term is concerned, we see that the HUI Index continues to move higher, but it does so below the rising support line that it had broken earlier this month.

Gold is getting very close to its previous 2020 highs, silver is getting closer to the middle of its 2020 trading range (taking into account also today's pre-market upswing), while mining stocks... Are testing the yearly lows.

Silver is showing some strength here, but miners are very weak, which indicates that this is the final part of the rally. Of course, given gold's and silver's breakouts, the miners are likely to rally as well, but while gold might move to new highs, and silver is likely to soar particularly visibly at the end of the upswing, we expect mining stocks to remain weak relative to the metals.

That's simply how they perform in the final parts of the upswings. There might be a session at the very end of the rally when they pretend to be strong, but nothing more is likely. The upside target for the HUI Index is based on the declining resistance line and the 61.8% Fibonacci retracement based on the 2020 decline. It's at about 235 - 237.

Once miners lag and silver laps gold in a clear way, we'll get the clear sell-and-short sign. For now, it seems that the next move in the very short term is going to be up.

Silver Stocks in Focus

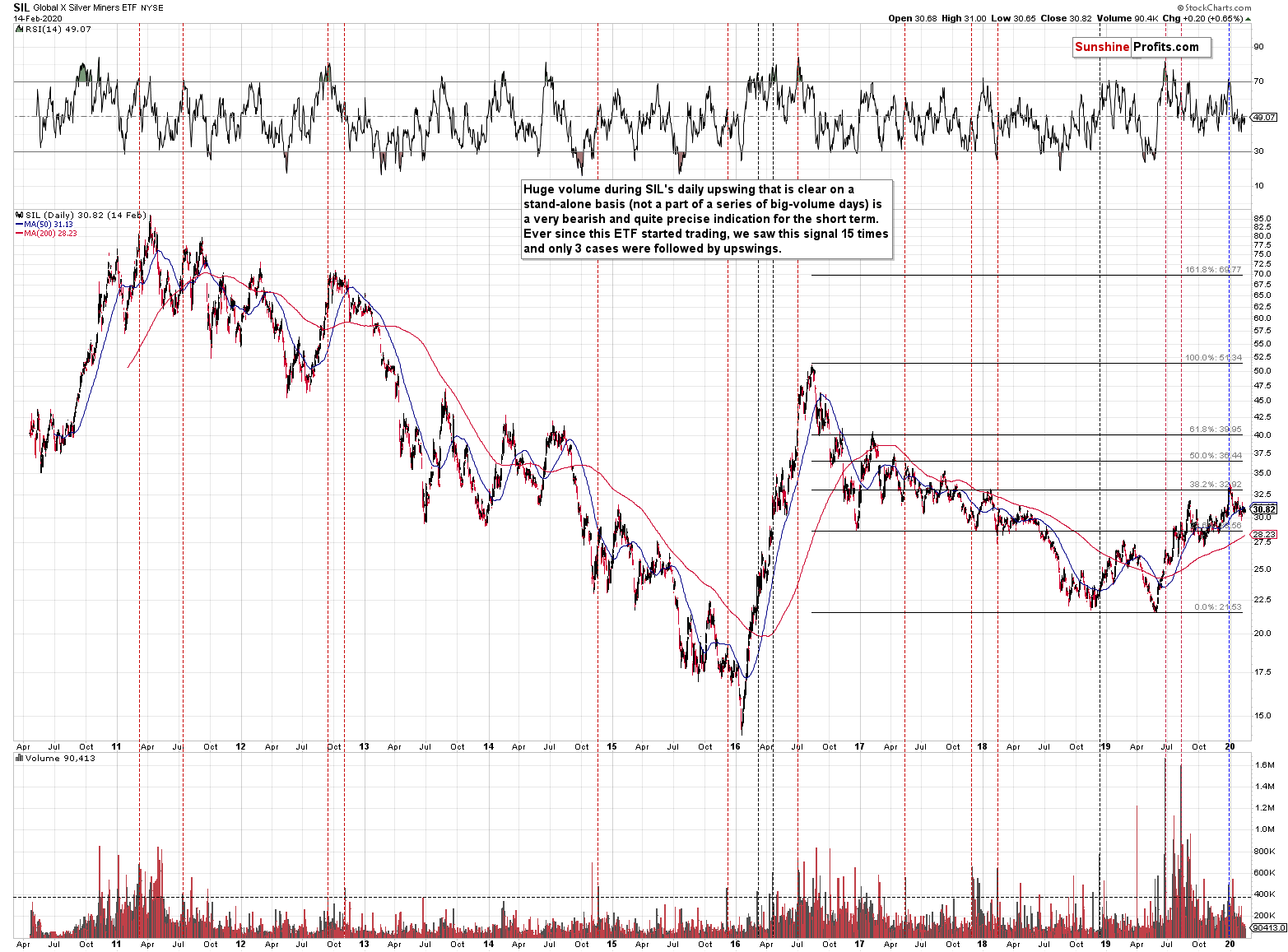

"Silver stocks reached their new yearly high on relatively strong volume" sounded very bullish, didn't it?

The problem was - as we had explained in the previous Alerts - that reaching the new yearly high meant that silver miners were barely able to correct 38.2% of the decline from the 2016 high. And that's compared to the decline alone. Comparing the recent rally to the one that we saw in 2016, we see that this year's upswing is barely one fifth of the previous upswing (about 50% vs about 250%). That's very weak performance - silver miners don't really want to move higher, they are forced to move higher as gold and silver are increasing, but the size of the move emphasizes that it's not the "true" direction in which the market is really moving.

The volume is also not as bullish as it seems to be at the first sight. Conversely, huge volume during SIL's (ETF for silver stocks) daily upswing that is clear on a stand-alone basis (not a part of a series of big-volume days) is a very bearish and quite precise indication for the short term. Ever since this ETF started trading, we saw this signal 15 times and only 3 cases were followed by upswings.

Yes, the silver stocks moved sharply higher on a very short-term basis, but please note that they had moved sharply lower on a very short-term basis in early 2016. The opposite of the recent price action was what preceded the biggest and most volatile rally of the recent years. If we see a reversal and invalidation of the breakout to new 2019 highs, we'll have almost exactly the opposite situation and the implications will be even more bearish.

While silver stocks don't provide any meaningful indications with regard to the short term, they point to a very bearish outlook for the following months.

Summary

Summing up, it seems that the precious metals market is about to rally in the next several days and form the final medium-term top, before starting another major move lower. The short-term decline in the USD Index (to about 98 or so) is likely to be one of the triggers for this short-term upswing in the PMs. The second trigger has already taken place as gold and silver broke above their declining short-term resistance lines.

In our opinion, once silver hits $18.19, your profits from the long position should be automatically taken off the table. We will let you know manually once we want to open short positions in gold, silver, or mining stocks.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long position (150% of the full position) in silver is justified from the risk/reward perspective with the following stop-loss orders and binding exit profit-take price levels:

- Silver futures: profit-take exit price: $18.19; stop-loss: $17.24; initial target price for the USLV ETN: $94.97; stop-loss for the USLV ETN: $82.95

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager