Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Welcome to this week's flagship Gold & Silver Trading Alert. As we promised you previously, in our flagship Alerts, we will be providing you with bigger, more complex analyses (approximately once per week) and it will usually take place on Monday.

The outlook that we featured last week didn't change based on last week's price moves as prices generally moved in tune with our expectations. Consequently, there are parts of the previous analysis that didn't change in the previous days - we will put them in italics.

Before discussing the technical picture, we'd like to write a few words on the recent fundamental developments. The most recent news was the publication of the minutes from the FOMC meeting in July that triggered gold's decline. To be clear, it was the direct trigger, but why gold moved significantly and not just mildly and briefly, was likely based on the technical build-up that we commented on previously.

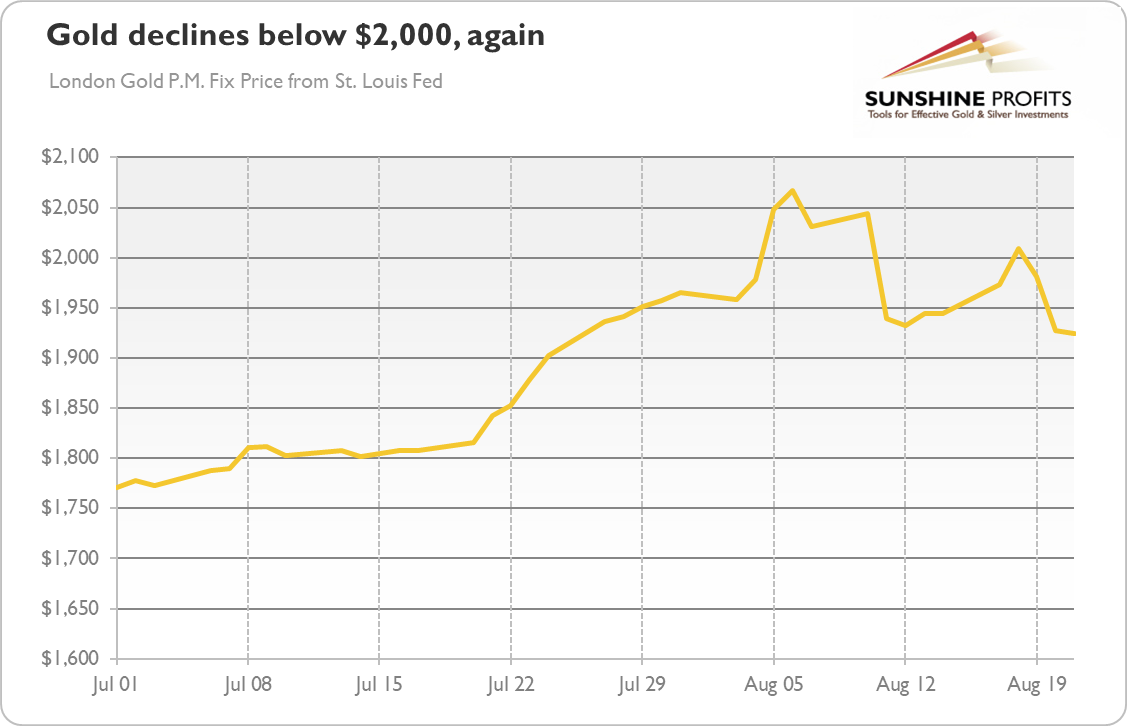

After the minutes were released, the U.S. dollar jumped, while the price of gold dropped, as the chart below shows. Why? Well, the Fed officials disappointed investors who expected some clues about upgrading the U.S. central bank's forward guidance in September. In other words, the Fed failed to provide any new guidance on interest rate expectations.

And, perhaps even more importantly, the discussion among the FOMC members shows that they do not want to introduce the yield curve control, at least not now, as costs outweigh benefits:

Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee's forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low. Many of these participants also pointed to potential costs associated with yield caps and targets. Among these costs, participants noted the possibility of an excessively rapid expansion of the balance sheet and difficulties in the design and communication of the conditions under which such a policy would be terminated, especially in conjunction with forward guidance regarding the policy rate. In light of these concerns, many participants judged that yield caps and targets were not warranted in the current environment but should remain an option that the Committee could reassess in the future if circumstances changed markedly.

Hence, the minutes were interpreted as less dovish than expected, so investors sold gold and bought the greenback. The hawkish FOMC minutes coincided with some positive economic reports from the U.S. that also supported the dollar. In particular, the flash U.S. Composite PMI Index jumped from 50.3 in July to 54.7 in August, the highest level since February 2019. Importantly, the service sector recorded the first rise since the start of the year. Meanwhile, the comparable indices for the eurozone came in worse than expected, which helped the U.S. dollar against the euro.

Moreover, housing market has improved. In July, the housing starts rose 22.6 percent compared to June, while the existing home sales soared 24.7 percent, marking two consecutive months of significant sales gains.

What does it all mean for the gold market? Well, the expressed aversion to the yield curve control is indeed negative for gold prices. Without fresh dovish declarations from the Fed, the market interest rates may increase, creating downward pressure on the gold prices.

However, with or without the yield curve measures, the Fed is even not thinking about thinking about hiking the federal funds rate. So, the fundamentals remain bullish for gold. What we are observing right now, is a much needed consolidation phase. After all, the real interest rates will remain in the low to negative territory for years. The public debt is soaring. The pandemic continues to wreak havoc within the economy. And the FOMC is aware of this. The minutes acknowledges that

the projected rate of recovery in real GDP, and the pace of declines in the unemployment rate, over the second half of this year were expected to be somewhat less robust than in the previous forecast.

and that

through June, only about one-third of the roughly 22 million loss in jobs that occurred over March and April had been offset by subsequent gains

Yup, only about one-third! So, the economy is still far from being normal, and the uncertainty surrounding the economic outlook is elevated. The upcoming presidential election and tensions between the U.S. and China contribute as well.

So, don't believe that the Fed has become hawkish suddenly and that gold's long-term potential is gone. On the contrary, we could see new dovish moves by the U.S. central bank in the future:

Noting the increase in uncertainty about the economic outlook over the intermeeting period, several participants suggested that additional accommodation could be required to promote economic recovery and return inflation to the Committee's 2 percent objective.

This week is crucial, as the annual Jackson Hole symposium is taking place and Fed Chair Jerome Powell is scheduled to speak on Thursday. If we see a hawkish turn, then, of course, gold may suffer. However, the Fed is likely to remain dovish, and it may even strengthen its dovish stance, which would support gold prices.

All in all, there are multiple fundamental reasons due to which gold is likely to soar in the upcoming years, however, even the most profound bull markets can't move up in a straight line and some corrections will take place. After big rallies, we're likely to see big corrections, and one is long-overdue in case of the precious metals market.

Just as it was in March, it seems that the visible worsening in the economic situation might trigger a sell-off.

At this point we would like to quote what we wrote about the aspects of the virus scare and how the market reacts to them. In short, gold (and other markets) reacted when people started to strongly consider the economic implications and this topic was ubiquitous in the media.

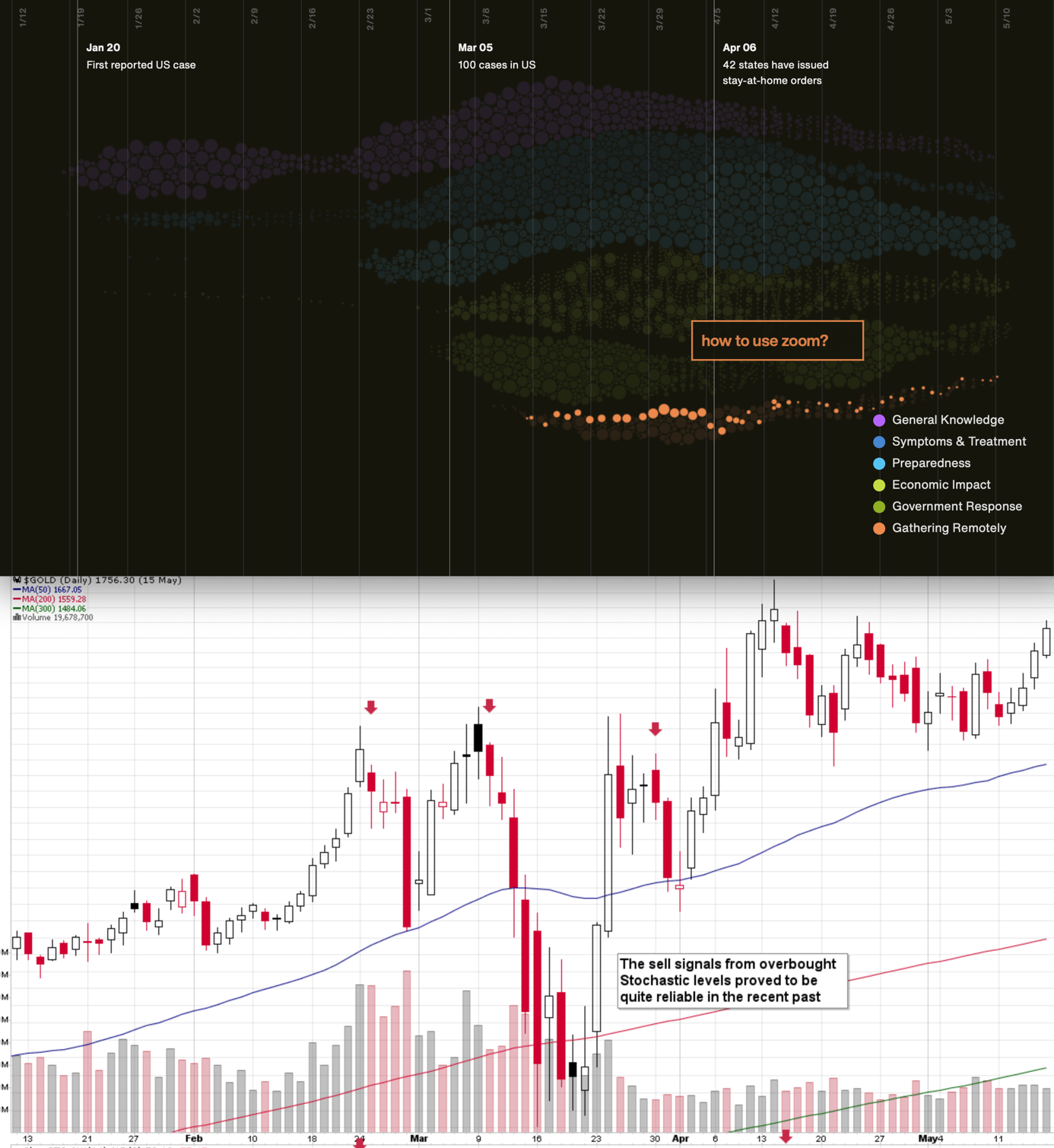

The particularly important factor for gold will likely be the economic implications of the second Covid-19 wave. How do we know that? Because we compared what people were searching for (online) with how gold prices shaped. There's a lot more data available on https://searchingcovid19.com/ but we'll focus on the chart that shows when people were getting interested in what aspects of the pandemic and we'll compare them to gold.

We aligned both charts with regard to time. The chart on the bottom is from Stockcharts.com and it features gold's continuous futures contract. The gold price (and the USD Index value) really started to move once people got particularly interested in the economic impact of the pandemic and in the government's response.

In the recent days (and weeks) the news is dominated by other issues. Once people start considering the economic implications of the second wave of this coronavirus, the prices would be likely to move.

The news coming from the Fed is positive for gold in the long run, but in the short term, they continue to indicate risk for the economy. This risk is likely to translate into lower stock values and initially gold is likely to slide given the above - just like it did in March.

All in all, gold is likely to rally far in the long run, but in the short run it's vulnerable to a sizable decline, when the economic implications of the pandemic's continuation become obvious to investors.

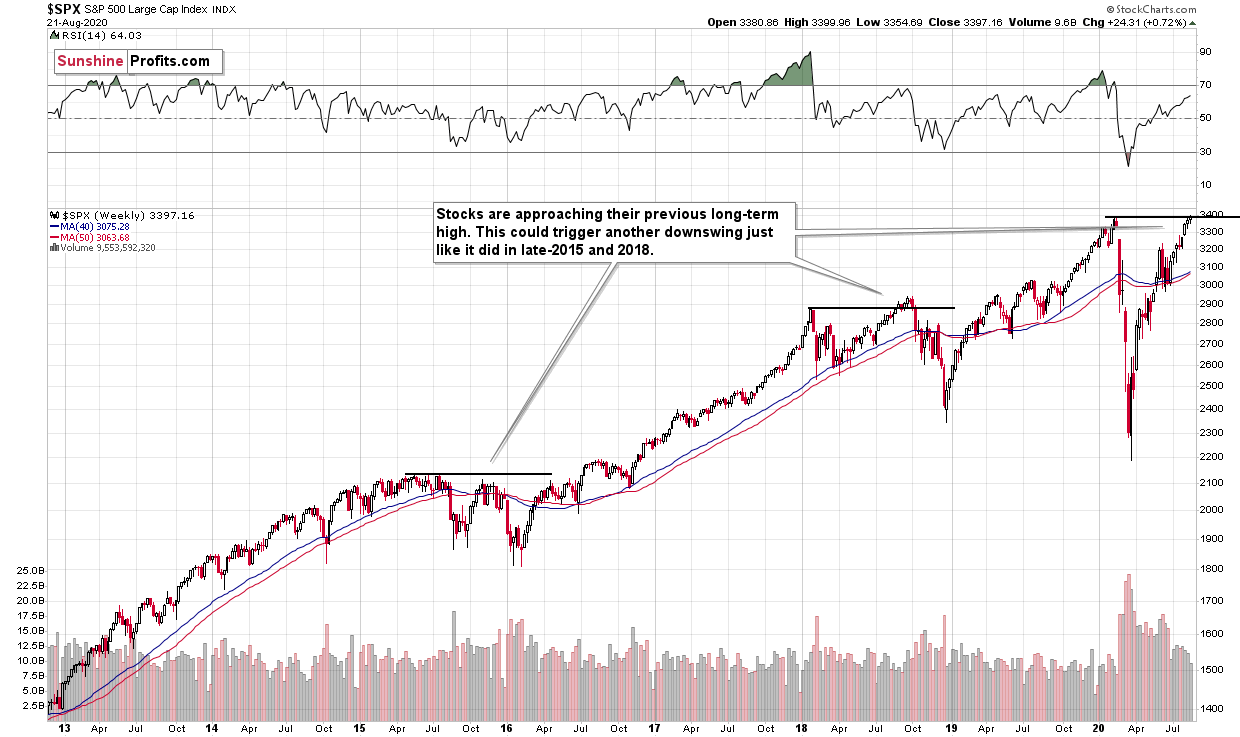

The S&P 500 has just moved slightly above previous 2020 high.

Given the economic background, I find this performance unfounded. But the markets can stick to a certain emotional trend for longer than many investors can remain logical, which would fit the above picture.

Back in 2015 stocks topped below their previous highs, and in 2018 they topped a bit above them, so the proximity to the previous is far from being a precise sell signal. It does indicate, that the stock market is likely vulnerable to sell signals coming from other markets and that this emotional rally could end sooner rather than later.

Do you remember what happened in February when the S&P 500 lost its upward momentum? They plunged, and that was when tops in mining stocks and silver formed. Gold made another attempt to move higher but ultimately declined profoundly in the following days.

It appears that on one hand, everything that could have gone well for gold on the fundamental front, has already gone well [maybe the tone of the just-released minutes, which were dovish, but less dovish than expected], and it already rallied, and on the other hand, we have many signals pointing to the situation being excessive. This means that as some of the bullish factors ease (perhaps temporarily) and investors get scared about economy's ability to really recover, gold is likely to correct significantly, before continuing its upward march.

One quick side note regarding the stock market. While it is rarely the case that we comment on our other services, it seems that the situation in stocks warrants these details. And the details are that while the S&P 500 is more or less at the levels at which it was trading when we re-started our Stock Trading Alerts, with Monica Kingsley as the author back in February, the service was able to generate over 20% profit in unleveraged S&P 500 trades while the index went nowhere during those months.

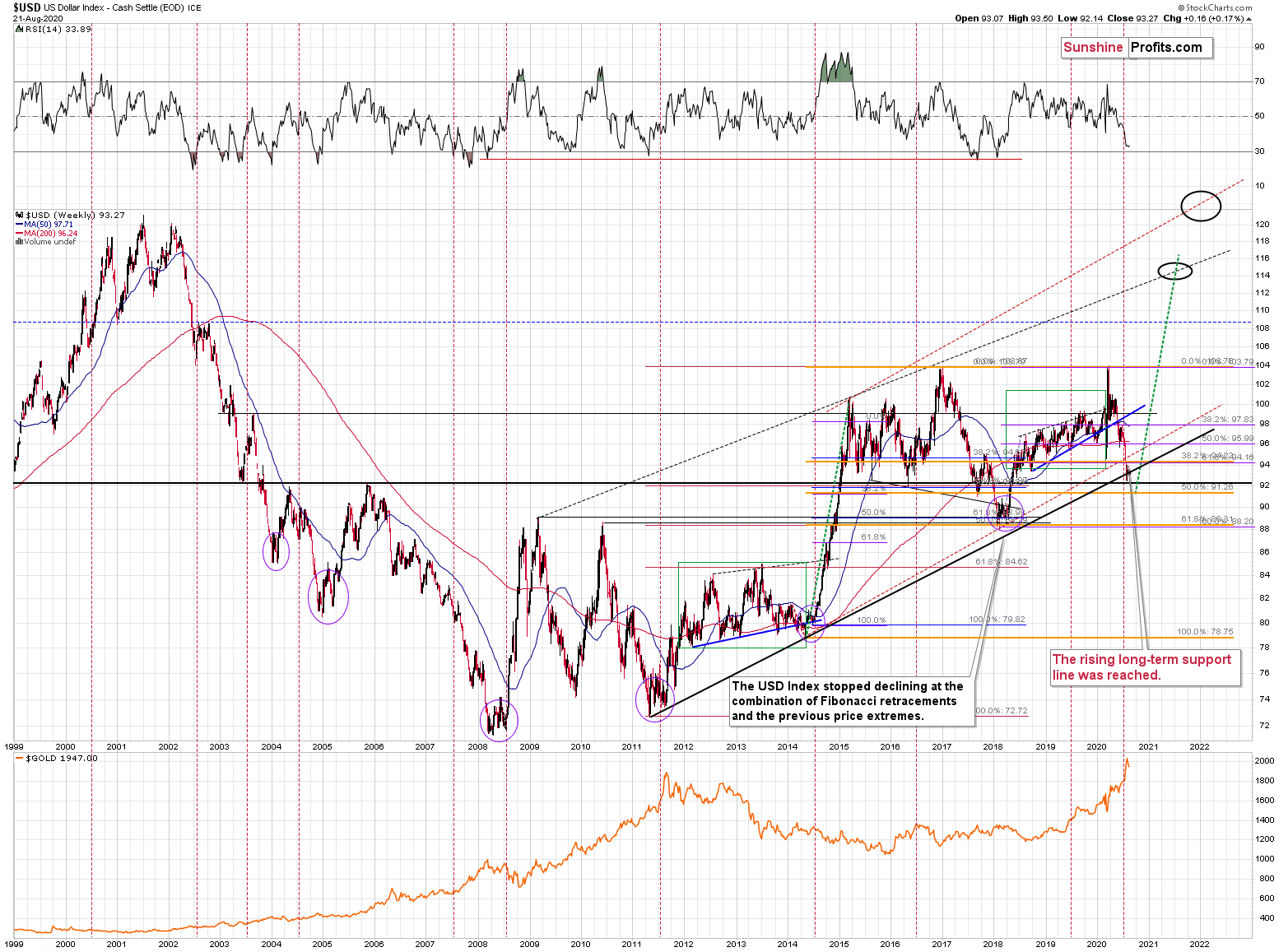

Moving back to the indications pointing to the situation being excessive, let's take a look at the USD Index.

Remember when in early 2018 we wrote that the USD Index was bottoming due to a very powerful combination of support levels? Practically nobody wanted to read that as everyone "knew" that the USD Index is going to fall below 80. We were notified that people were hating on us in some blog comments for disclosing our opinion - that the USD Index was bottoming, and gold was topping. People were very unhappy with us writing that day after day, even though the USD Index refused to soar, and gold was not declining.

Well, it's the same right now.

The USD Index is at a powerful combination of support levels. One of them is the rising, long-term, black support line that's based on the 2011 and 2014 bottoms.

The other major, long-term factor is the proximity to the 92 level - that's when gold topped in 2004, 2005, and where it - approximately - bottomed in 2015, and 2016.

The USDX just moved to these profound support levels, and it's very oversold on a short-term basis. It all happened in the middle of the year, which is when the USDX formed major bottoms on many occasions. This makes a short-term rally here very likely.

While it might not be visible at the first sight (you can click on the chart to enlarge it), the USD Index moved briefly below the long-term, black support line and then it invalidated this breakdown before the end of the week. This is a very bullish indication for the next few weeks.

We even saw a confirmation from USD's short-term chart.

The U.S. currency is moving higher after invalidating the breakdown below the previous lows. It then tried moving lower once again, but bounced off the late-July and early-August lows. This is a positive sign. The current very short-term decline is nothing to be concerned with as it didn't even take the USD Index below the rising red support line based on two most recent lows.

Given the long-term chart featured previously and the short-term invalidation, it seems that the outlook for the USDX is very bullish. Still, until the index breaks above the declining black resistance line and the August highs, it won't be clear to most traders. Consequently, we expect to see the biggest rally in the USDX - and the biggest decline in gold - once we see the above-mentioned breakout.

Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market. It's generally a good gold trading tip to monitor the USD Index's performance.

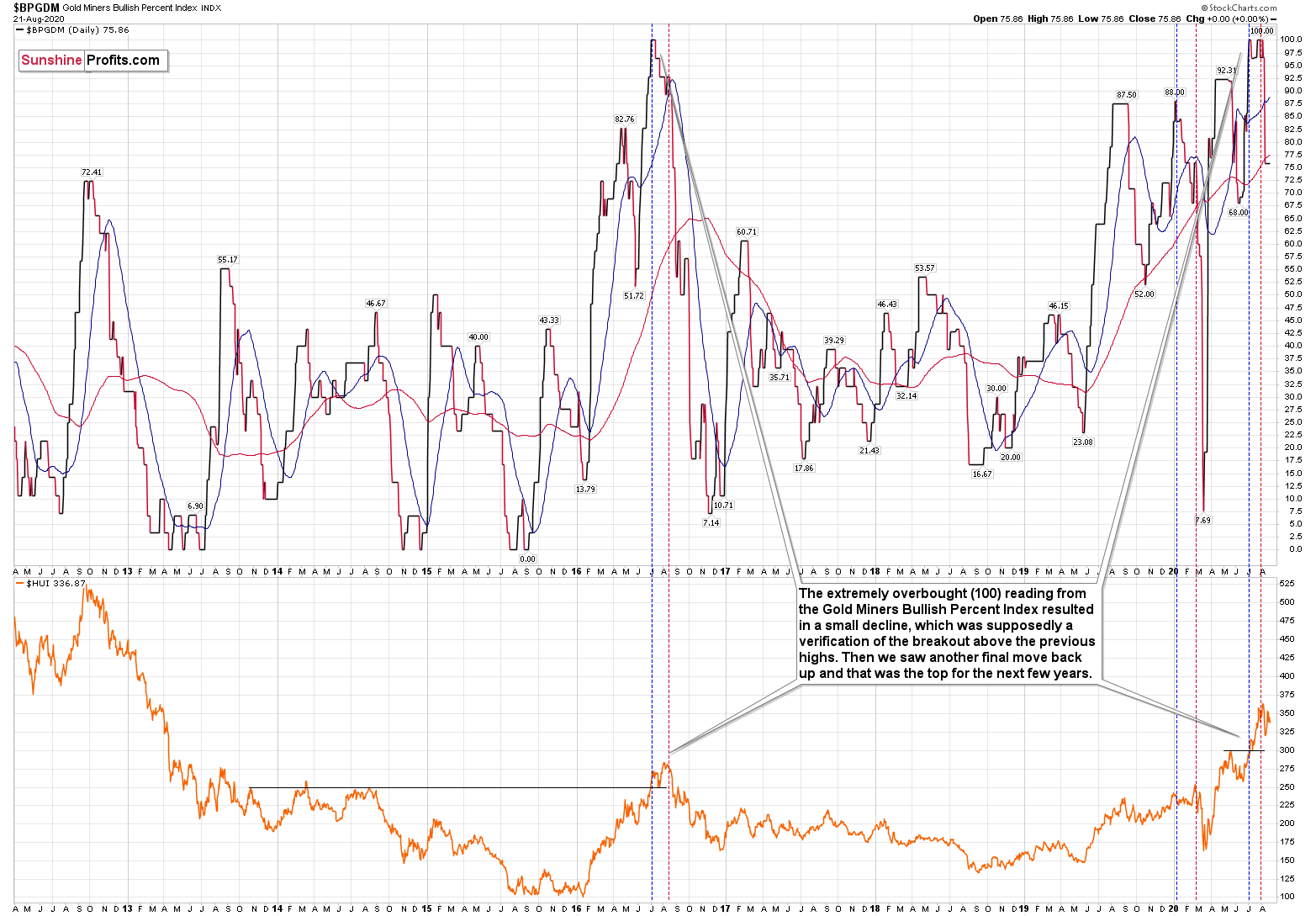

Consequently, based on this analogy, the implications for the near term are bearish for the PMs. Especially, when we consider the fact that Gold Miners Bullish Percent Index showed the highest possible overbought reading recently.

The excessive bullishness was present at the 2016 top as well and it didn't cause the situation to be any less bearish in reality. All markets periodically get ahead of themselves regardless of how bullish the long-term outlook really is. Then, they correct. If the upswing was significant, the correction is also quite often significant.

Please note that back in 2016, there was an additional quick upswing before the slide and this additional upswing has caused the Gold Miners Bullish Percent Index to move up once again for a few days. It then declined once again. We saw something similar also this time. In this case, this move up took the index once again to the 100 level, while in 2016 this wasn't the case. But still, the similarity remains present.

Back in 2016, when we saw this phenomenon, it was already after the top, and right before the big decline. Given the situation in the USD Index, it seems that we're seeing the same thing also this time.

Please note that back in 2016, after the top, the buying opportunity didn't present itself until the Gold Miners Bullish Percent Index was below 10. It's currently above 70, so it seems that miners have a long way to go before they bottom.

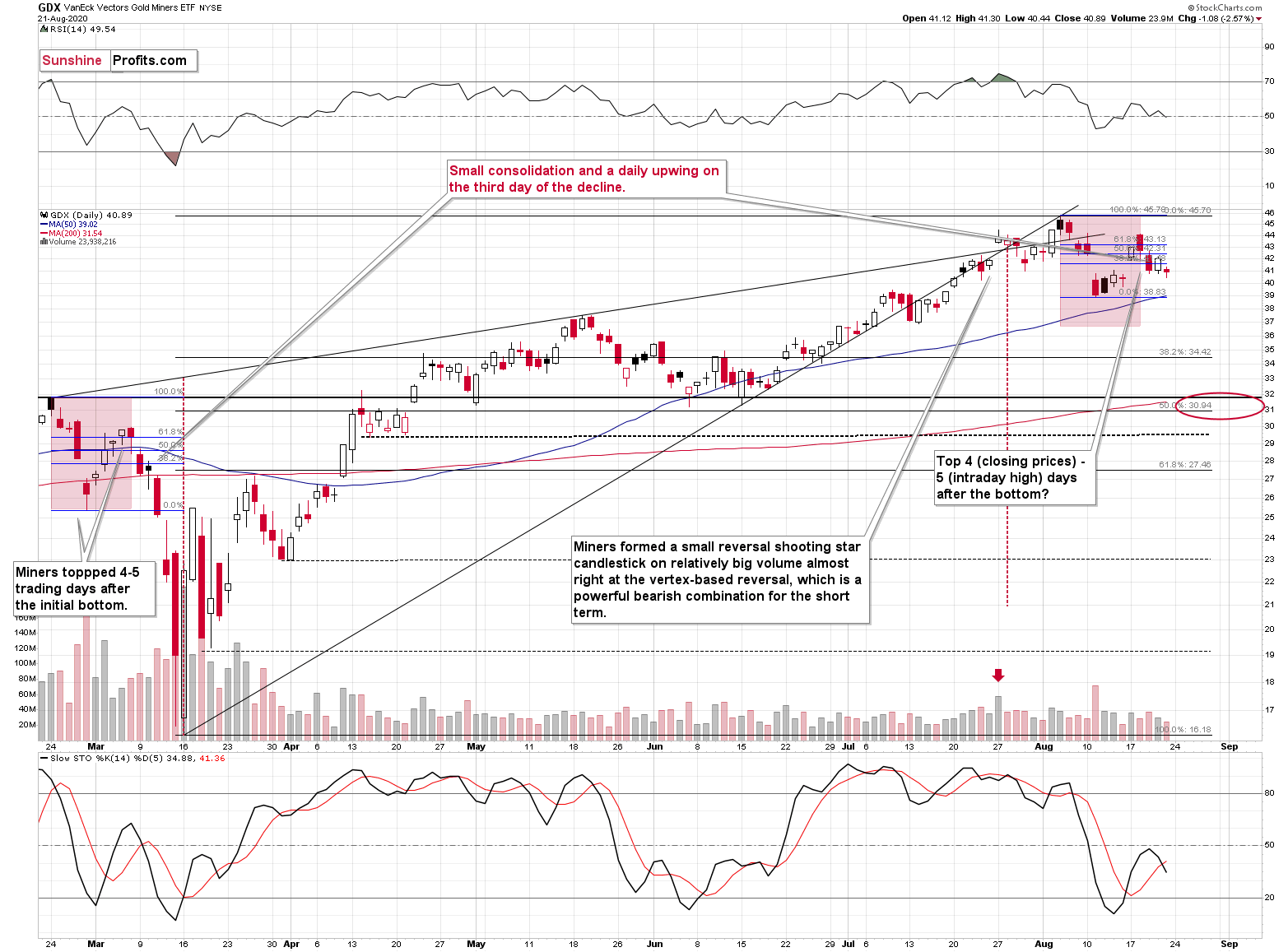

Last week, gold stocks rallied initially, but erased almost all of their gains before the week was over. Most interestingly, that's very much in tune with what happened in March.

Back then, on the third day of the decline - on March 10th - we saw a small daily upswing, which was just a daily pause right before the biggest part of the move.

We saw the same thing on Thursday. The GDX ETF moved a bit higher and it was the third day of the decline.

Just as we saw on March 10th, GDX moved higher on volume that was slightly lower than what we saw on the previous trading day.

On Friday - the fourth day of the decline - miners declined, more than erasing the previous day's gains. This is exactly what happened on March 11th - the fourth day of the previous decline.

The self-similarity remains intact and the implications remain very bearish.

Now, since the general stock market moved above the previous highs and continues to rally, we might or might not see a sizable decline early this week. Back in March, the slide in miners corresponded to the decline in the general stock market, and this could be repeated, or we could see some sideways trading after the slide resumes, once stocks finally decline.

Still, at this time, the implications of the above chart are very bearish.

Let's turn to metals themselves.

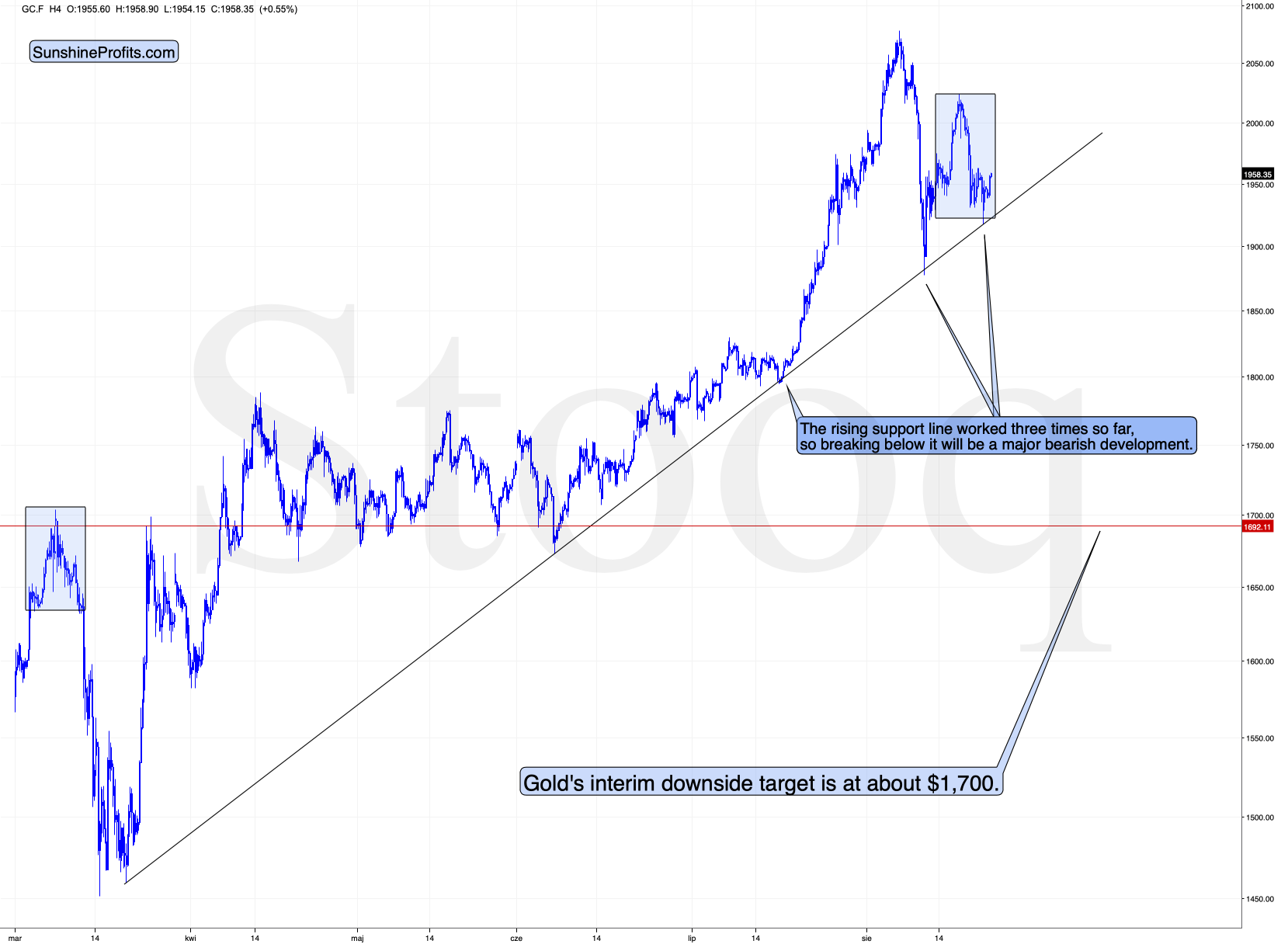

Gold's performance continues to be very similar to what happened in early March and the 4-hour candlestick chart shows the details.

The short-term gold chart confirms the self-similarity that miners indicate. The areas marked with blue rectangles are similarly shaped and they happened at similar times, if we consider what the USD Index had been doing in both cases.

Unlike what we saw in March, this time, gold didn't move back to its previous high, but this doesn't invalidate the entire analogy.

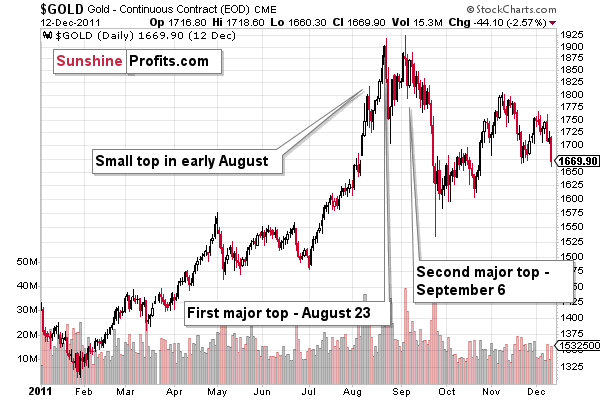

To be clear, we could still see a move back to the previous high, but it seems more likely that since we already saw two distinct tops, there would be no third top. In this way, the double-top pattern would be similar to what happened in March and in 2011, but we wouldn't have the similarity in terms of the price levels that were reached.

As a reminder, here's what happened in 2011.

The additional similarity between now, March 2020, and the 2011 top, is that gold's pace of decline diminished after the second top.

The next support is at $1,700, which is where - approximately - gold topped and bottomed multiple times earlier this year.

The $1,700 level is additionally confirmed by the 61.8% Fibonacci retracement based on the entire 2015 - 2020 rally.

There's also possibility that gold would decline to the $1,500 - $1,600 area or so (50% Fibonacci retracement and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

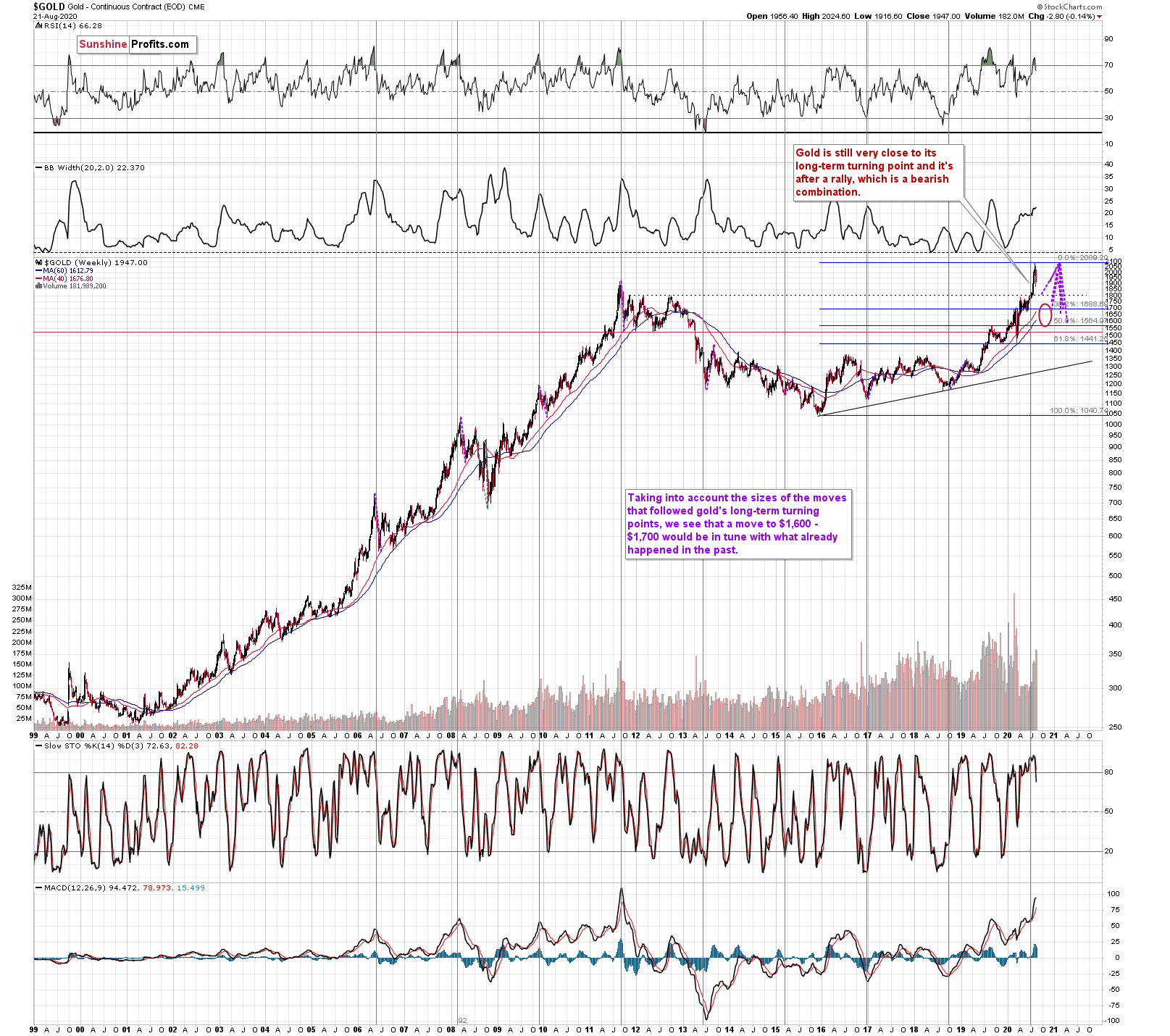

Gold's very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold's big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom close to the $1,700 level. That's very much in tune with how much gold moved after the previous long-term turning points.

Also, while we're discussing the long-term charts, please note the most important detail that you can see on the gold, silver, and mining stock charts, is hidden in plain sight. Please note how much silver and miners rallied.

The analogy to the price moves after the previous turning points didn't change, but since the starting point is much higher, the downside target is also higher.

Speaking of upside targets, two weeks ago, we wrote the following:

Based on gold's Fibonacci extensions and the previous major highs and lows (the 2018 high and late-2019 low along with the 2020 low), we get a nearby upside target of $2085. At the moment of writing these words, gold is trading at $2044. Given this week's volatility, it could even be a matter of hours before gold reaches the above-mentioned target and reverses. Taking closing prices into account, gold is up by $35, so if it reverses significantly, we would be likely to see a powerful weekly reversal candlestick and one that causes gold to decline in the following weeks.

That's more or less what happened. Gold topped at $2,089.20. It then declined quite visibly and closed last week at about $1,950.

And what about silver?

While gold moved to new highs, silver - despite its powerful short-term upswing - didn't manage to correct more than half of its 2011 - 2020 decline.

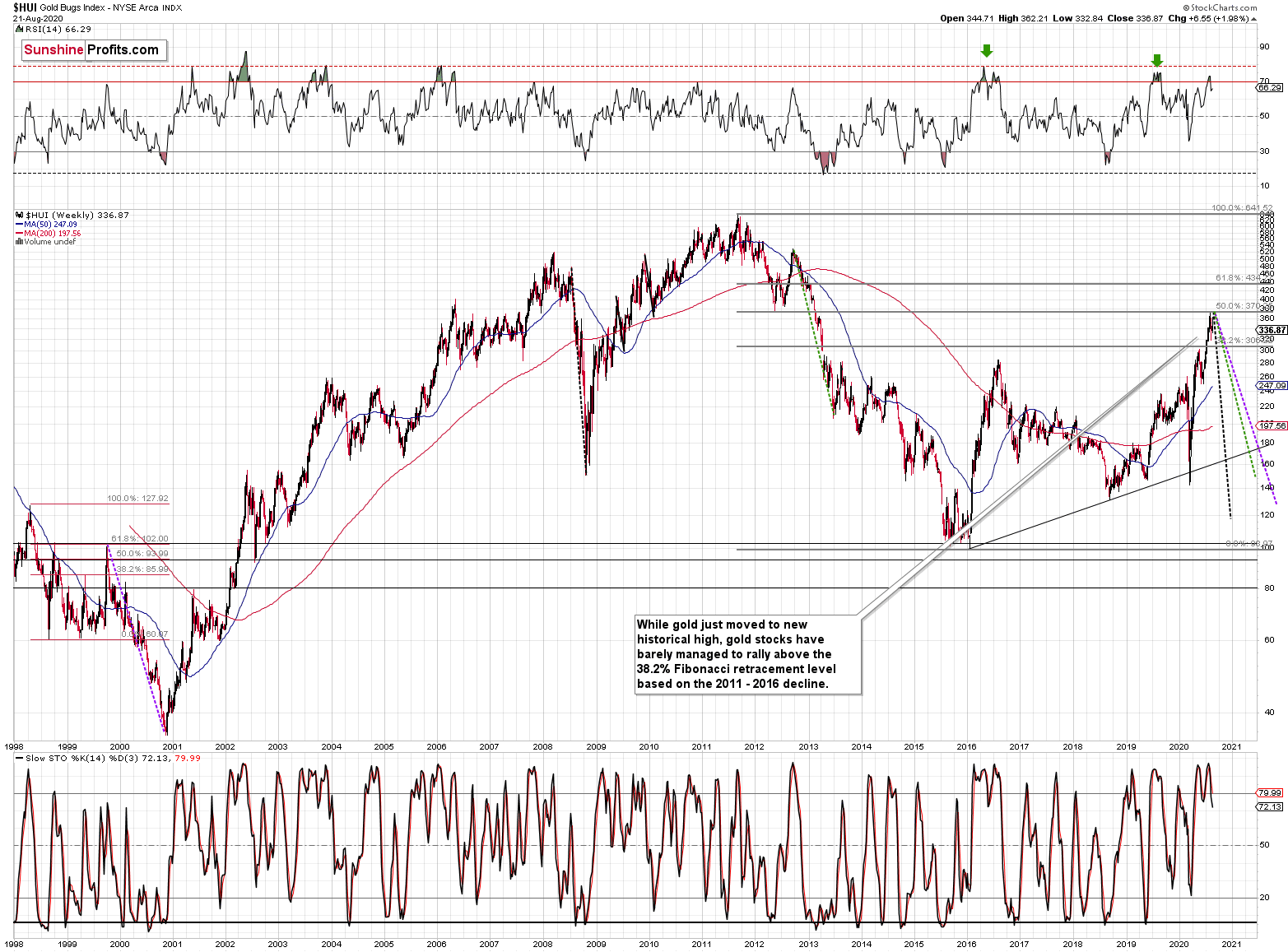

We see something similar in the HUI Index. The latter corrected half of its 2011 - 2016 decline and nothing more, while gold moved well above its 2011 high.

All in all, it's mostly gold that is making the major gains - not the entire precious metals sector.

Moving back to silver's forecast, it's good to note that the time the current rally is taking, is still very similar to the time that the final part of the 2016 run-up took. The current move is bigger, but in terms of time, they are still very alike. This adds to the bearish implications of the situation in the USD Index and gold miners' extremely overbought condition that we saw recently.

Overview of the Upcoming Decline

As far as the current overview of the upcoming decline is concerned, I think that it has already begun, at least in case of the mining stocks. It's still relatively unclear if gold makes another attempt to move to new highs before plunging below $1,800, but it now appears more likely that it won't.

During the final part of the slide, we expect silver to decline more than miners. That would be in tune with how the markets initially reacted to the Covid-19 threat.

The impact of all the new rounds of money printing in the U.S. and Europe on the precious metals prices is very positive in the long run, but it doesn't make the short-term decline unlikely. In the very near term, markets can and do get ahead of themselves and then need to decline - sometimes very profoundly - before continuing their upward march.

Summary

Summing up, it seems that after reversing $4 above our upside target, gold has finally topped, and that it formed the second top from the double-top pattern last week. The opposite appears likely in case of the USD Index, which just invalidated its breakdown below the previous lows. This creates a very bearish environment for the precious metals market, especially for the mining stocks. The decline in the latter is likely to accelerate once the general stock market finally declines.

Naturally, everyone's trading is their responsibility, but in our opinion, if there ever was a time to either enter a short position in the miners or to increase its size if it wasn't already sizable, it's now. We made money on the March decline and on the March rebound, and it seems that another massive slide is about to start. When everyone is on one side of the boat, it's a good idea to be on the other side, and the Gold Miners Bullish Percent Index literally indicates that this is the case with mining stocks.

After the sell-off (that takes gold to about $1,700 or lower), we expect the precious metals to rally significantly. The final decline might take as little as 1-6 weeks, so it's important to stay alert to any changes.

Most importantly - stay healthy and safe. We made a lot of money on the March decline and the subsequent rebound (its initial part) price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $32.02; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $28.73; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $42.72; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $21.22; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,703.

Gold futures downside profit-take exit price: $1,703

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager