Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. We are adjusting the exit price levels for the current short position.

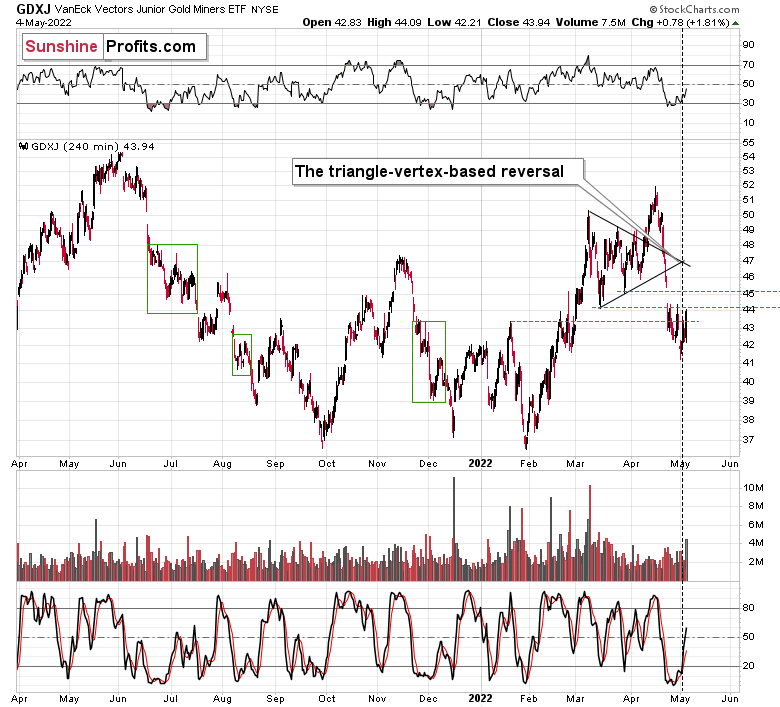

The precious metals sector moved higher yesterday, just as I had indicated on the grounds of the triangle-vertex-based technique. The “direct” trigger was provided by the Fed during the press conference. Powell cooled down some of the most hawkish expectations by stating that 0.75% rate hikes are not on the table.

Well, the reality is that the Fed’s comments are not that useful when estimating what’s going to happen. Remember when we heard so many times that inflation was under control and transitory? Exactly.

Still, regardless of whether 0.75% rate hikes will follow or not, the reality is that we saw a rally, and the key question is whether this rally is:

- the beginning of something much bigger,

- nothing special that will be followed by another wave lower soon,

- just a very brief pause within a decline to the previous target level (slightly above $37 in the GDXJ), and this target is going to be reached within the next few days.

Which one is most likely?

In my view, the first point is rather unlikely. The medium-term trend is down, just as the trends in the USD Index, and real interest rates are up.

You know what’s better than knowing the reply to a question about the future? (After all, it’s not possible to have a 100% certain answer to anything regarding the future.)

A strategy! A strategy is a plan for how to act in various future scenarios so that one knows what to under all circumstances.

If scenario number 3 is going to happen and the target level is reached shortly (today or tomorrow), then the original expectation for PMs to start a counter-trend rally is likely to be realized. In this case, it makes sense to simply keep the current exit orders intact.

If scenario number 2 is going to happen and we’re about to see a bigger decline soon (perhaps to the previous 2022 lows in the GDXJ), then it would be better to move our exit prices much lower – perhaps to the 2022 lows, or even lower.

Here’s where it gets interesting. While at this moment, it’s not clear which of the above scenarios will prevail, it will naturally clarify on its own as time passes.

If we get a sharp decline today or tomorrow, it will mean that scenario 3 is being realized, and therefore, we’ll get out of the short positions when the downside targets are reached, and we’ll enter long positions. However, if we don’t get a sharp decline today or tomorrow, it will likely mean that scenario 2 is being implemented and it will make sense to adjust our exit prices.

It's also possible that we will get a decline, but an indecisive one. In this case, I’ll elaborate further in the following analyses, as my preferred action will likely depend on what happens in other markets.

So far, gold is up today, but its initial overnight rally is being slowly erased as I’m writing these words. This kind of action supports scenarios #2 and #3, so it doesn’t help us determine which one is more likely.

The same is with silver – it’s up but not significantly so.

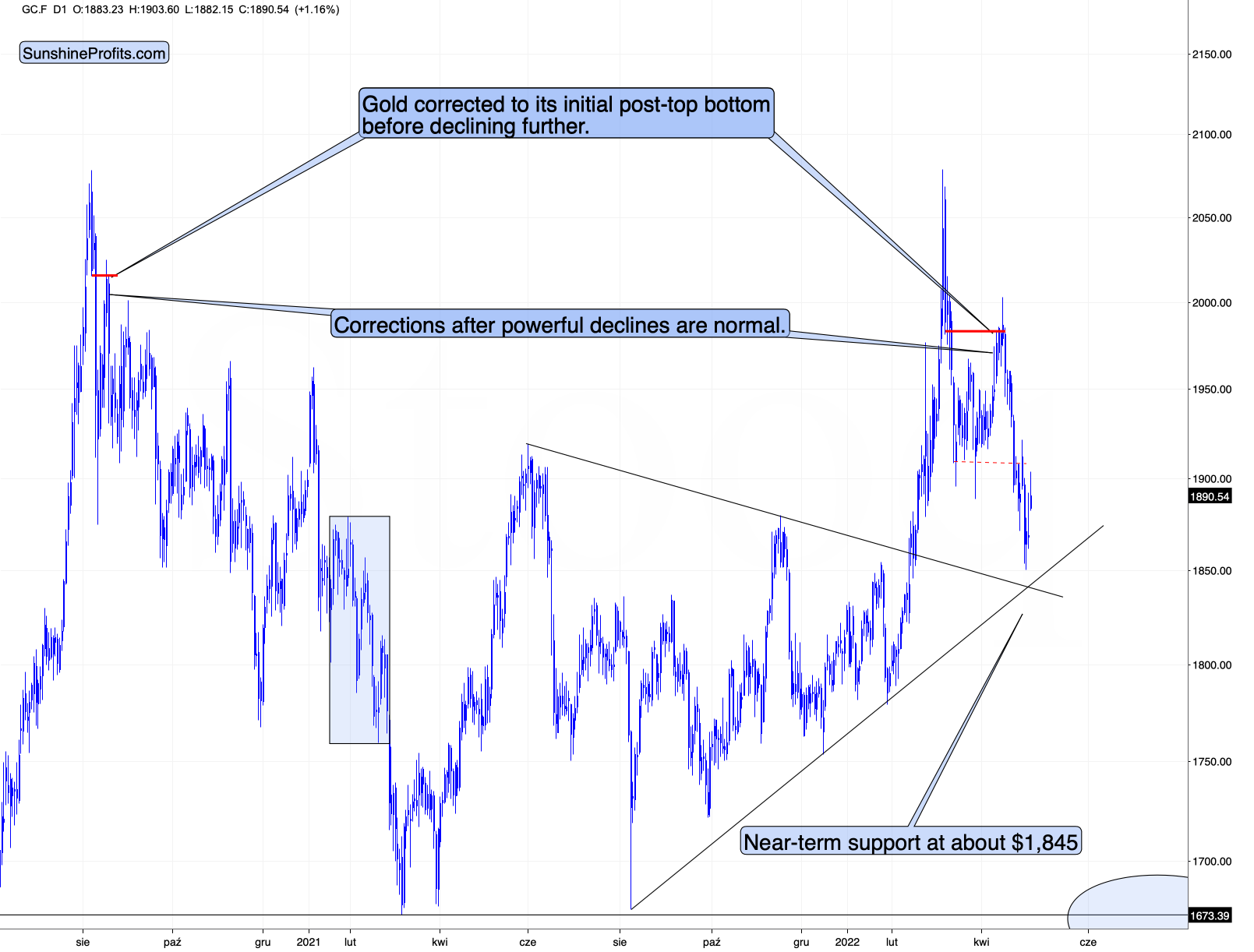

Please take a look at the areas that I marked on both the above charts with blue rectangles. They show situations when we saw local rallies, but ones that, overall, were very tricky to trade. We could be seeing something similar right now.

Remember when I emphasized that it was the sharpness of the decline and its excessiveness that would be the factors determining whether or not it was a good idea to switch to long positions? The small rallies that we see marked in blue are not the kinds of rallies that I would aim to trade in the above-mentioned way. However, something like the early-August 2021 decline is what I’d want to trade in the above-mentioned way. So far, what we saw is not yet the early-August 2021 decline, and what happens today and tomorrow will determine what kind of correction is likely (or perhaps if it’s already behind us).

The corrective upswing in the GDXJ was visible from a very short-term point of view, but it was small enough to still be a part of the pre-bottom trading. On the above chart, I marked instances when the GDXJ was trading like that with green rectangles.

Depending on the follow-up action today and tomorrow, different trading decisions will likely make sense (scenario #2 or #3).

Naturally, as always, I’ll keep you – my subscribers – informed.

Having said that, let’s take a look at the markets from a fundamental point of view.

Won’t Go Down Without a Fight

With investors hitching their wagons to the Fed’s horse on May 4, they still believe that Chairman Jerome Powell can accomplish the impossible. Therefore, it’s all about following the man who will lead you to prosperity. However, while market participants’ faith in the Fed is profoundly short-sighted, I noted on Apr. 27 that pledging allegiance is how investors operate. I wrote:

“The PMs were mixed on Apr. 26, as mining stocks continued their material underperformance. Moreover, while investors will likely remain in ‘buy the dip’ mode until the very end, lower highs and lower lows should confront the S&P 500 and gold over the next few months. As a result, the medium-term outlook for the GDXJ ETF is profoundly bearish.”

Thus, while hope is not a strategy, it was clearly a popular opinion on May 4.

Please see below:

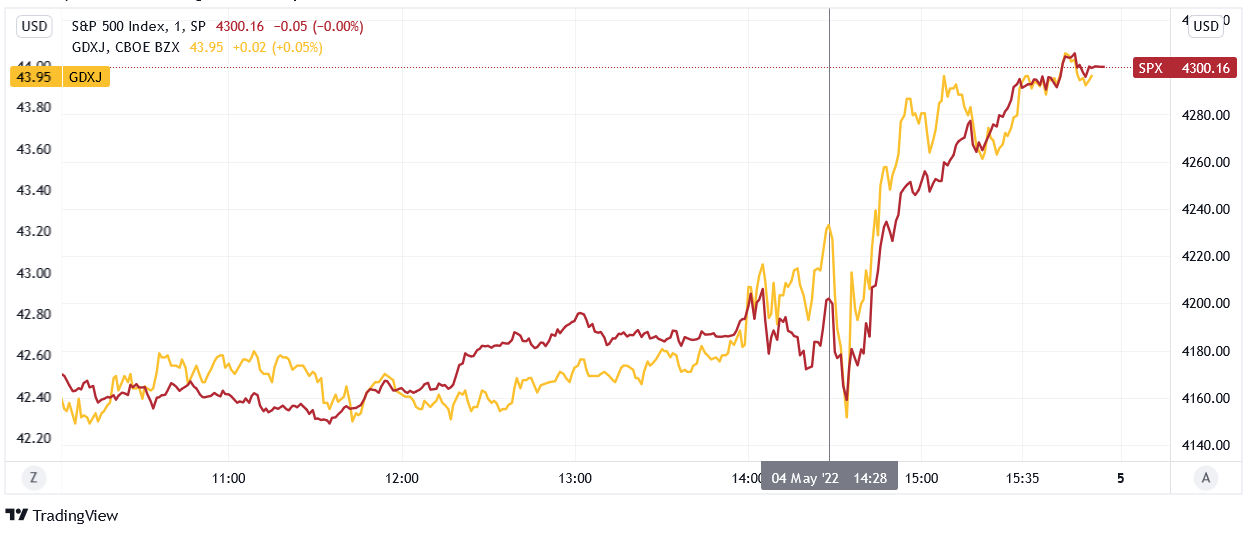

To explain, the red line above tracks the one-minute movement of the S&P 500, while the gold line above tracks the one-minute movement of the GDXJ ETF. If you analyze the relationship, you can see that both sank at the outset of Powell’s presser and then rallied into the close. As a result, a little bullish sentiment combined with some short-covering were the perfect ingredients for a sharp daily rally.

However, not only did the pair’s medium-term fundamentals not follow suit, they actually worsened. Therefore, while sentiment rules the day in the short term, their medium-term outlooks couldn’t be more treacherous.

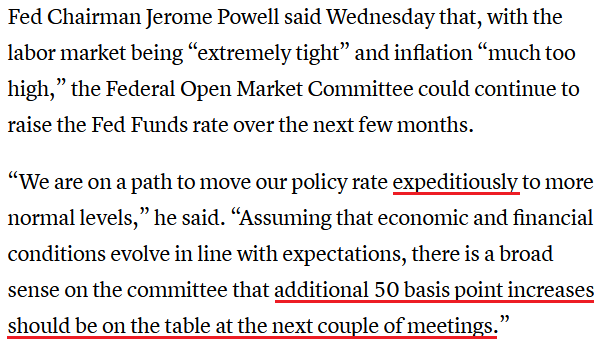

To explain, the FOMC hiked interest rates by 50 basis points on May 4. Moreover, like I have been warning throughout the technical sections of the daily Gold & Silver Trading Alerts, we witnessed a ‘sell the rumor, buy the fact’ event. However, with the Fed increasingly hawked up, investors’ misguided optimism should evaporate over the next few months. An excerpt from the FOMC statement read:

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong.”

“In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3/4 to 1 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee decided to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities on June 1.”

As a result, while investors hear what they want to hear, the reality is that hawkish fireworks should light up the financial markets this summer.

Please see below:

In addition, Powell said: “We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

What are these “tools” he speaks of?

Thus, with Powell admitting that “blunt tools” are the only mechanism to curb inflation, the Fed’s pathway to lower prices should result in plenty of collateral damage. As a result, while the price action on May 4 suggests that normalization will be easy, the sentiment shift should be profound when reality sets in. To that point, I wrote on Apr. 6:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. And as that occurs, investors should suffer a severe crisis of confidence.

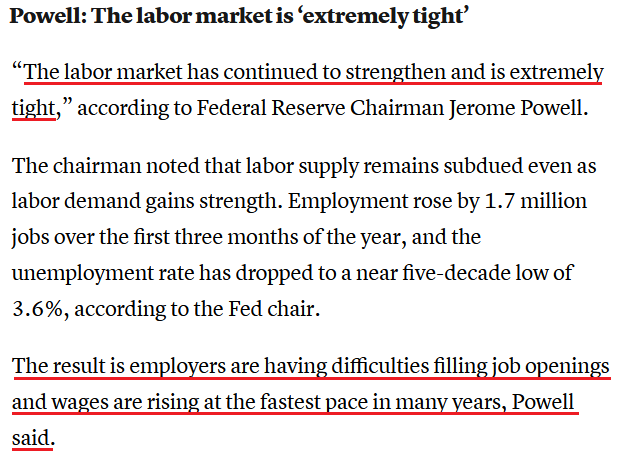

Furthermore, Powell made the point for me on May 4:

Also noteworthy, when asked about curbing inflation without impairing the U.S. economy, Powell responded: “I would say I think we have a good chance to have a soft or softish landing, or outcome if you will. It doesn’t seem to be anywhere close to a downturn. The economy is strong and is well-positioned to handle tighter monetary policy.”

For context, referencing a “softish landing” completely lacks confidence, but it’s Powell’s way of recognizing reality without spooking the financial markets. Moreover, as one of the most important quotes of the press conference, he added:

“I do expect that this will be very challenging; it’s not going to be easy; and it may well depend on events that are not in our control. But our job is to use our tools to try to achieve that outcome, and that’s what we’re going to do.”

As such, with Powell noting that a soft landing "may well depend on events that are not in [their] control," he's essentially telling you that the Fed is past the point of managing this outbreak. In reality, inflation is like cancer. Once it spreads, it reaches a point where too much damage has been done to save the patient.

Thus, this is where we are now. With the Fed's "blunt tools" poised to inflict serious damage on the U.S. economy, the undesirable trade-off of supporting growth versus curbing inflation has the Fed in a material bind. As a result, investors severely underestimate the challenges that will confront them over the next several months.

To that point, remember what I wrote on Apr. 26?

The Federal National Mortgage Association (Fannie Mae) – a U.S. government-sponsored enterprise – released its Economic and Housing Outlook report on Apr. 19. An excerpt read:

“Our updated forecast includes an expectation of a modest recession in the latter half of 2023 (…).”

“While a ‘soft landing’ for the economy is possible, which is where inflation subsides without economic contraction, historically such an outcome is an exception, not the norm. With the most recent inflation readings at levels not seen since the early 1980s and wage growth exceeding that which is consistent with a 2-percent inflation objective, we believe the odds of a soft landing are even lower.”

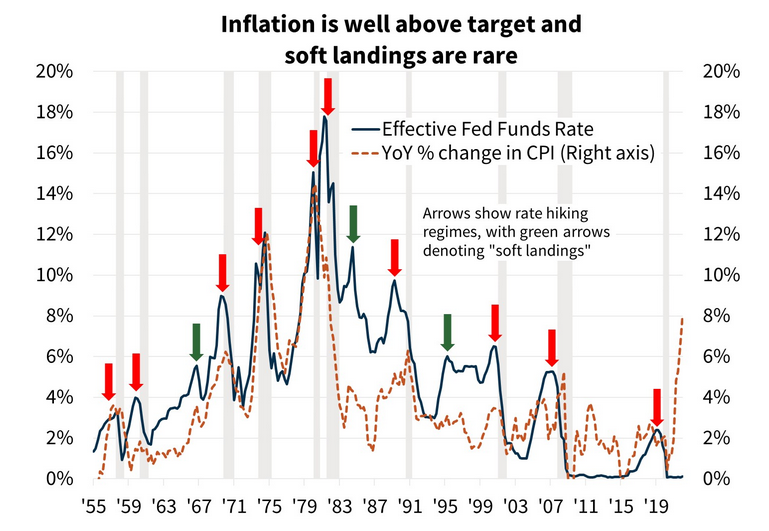

Please see below:

To explain, the green line above tracks the U.S. federal funds rate, while the dashed brown line above tracks the YoY percentage change in the headline Consumer Price Index (CPI). More importantly, the red arrows above depict hard landings, while the green arrows above depict soft landings. As such, the odds are not in the Fed’s favor.

Even more revealing, if you analyze the green arrows near 67, 83, and 95, you can see that the YoY inflation (the dotted brown line) was no more than ~4.5%. As a result, all of the soft landings occurred alongside manageable inflation, not a headline CPI at 8.6%.

Therefore, while history highlights the Fed’s ineptness at handling crises, history also highlights how investors follow the central bank off the cliff. Moreover, while Powell can convince the consensus that “a soft or softish landing” should materialize, please remember that “the fool wonders, the wise man asks.”

To explain, remember what I wrote on Nov. 4 following the FOMC meeting?

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

And now?

Likewise, remember what he said about the U.S. labor market and wage inflation? I wrote on Nov. 4:

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

For example, Powell said during his press conference that “the inflation that we’re seeing is really not due to a tight labor market. It’s due to bottlenecks and it’s due to shortages and it’s due to very strong demand meeting those (…). We don’t see troubling increases in wages, and we don’t expect those to emerge.”

And now?

As such, investors are either unaware of how wrong Powell has been, or they simply don't care. However, the comments in italics were made only six months ago. Either way, Fed officials' inability to see the forest through the trees should have drastic implications over the next several months. As evidence, when the "transitory" camp was brimming with confidence, I wrote on Apr. 30, 2021:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

Thus, the situation is unchanged. With Powell predicting that the impossible is achievable, his assertion of “a soft or softish landing” is laughable. Therefore, can you guess where this story is headed next?

Finally, it’s important to distinguish between where we are now and where we are likely headed. Regarding the latter, the “soft landing” crowd will likely be the 2023 version of the “transitory” crowd from 2021/2022. Regarding the former, the U.S. economy remains on solid footing RIGHT NOW. However, the dynamic only adds further fuel to the hawkish fire.

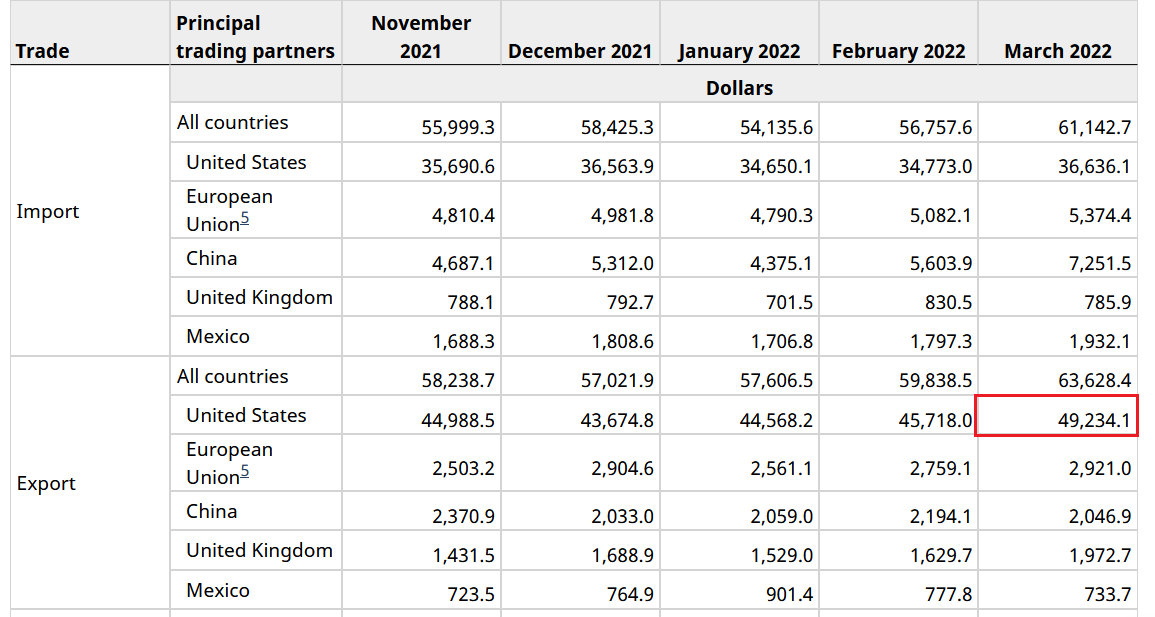

For example, Statistics Canada released its latest international merchandise trade update on May. 4. Now, the data is important because more than 77% of Canadian exports were sent to the U.S. in March. Therefore, the two economies are increasingly intertwined.

To that point, with exports to the U.S. hitting an all-time high of CA $49.234 billion, the data highlights how demand conditions in the U.S. remain resilient. As a result, the Fed’s “blunt tools” still have plenty of work to do.

The bottom line? It’s interesting how investors can repeat the same mistakes over and over again. Despite being burned by the Fed during the dot-com bubble and the global financial crisis (GFC), investors remain loyal followers. Moreover, even though the central bank’s inflation and labor market forecasts have been way off, investors’ confidence in Powell remains unwavering. As a result, while ‘fool me twice’ should have been enough, a third rendition will likely emerge over the medium term.

In conclusion, the PMs were mixed on May 4, as gold and silver didn’t participate in the bullish stampede. However, with investors severely underestimating the impact of seven to 12 rate hikes over nine months, the liquidity drain should materially depress the performances of the PMs and the S&P 500 as the drama unfolds.

Overview of the Upcoming Part of the Decline

- It seems to me that the post-decline consolidation is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

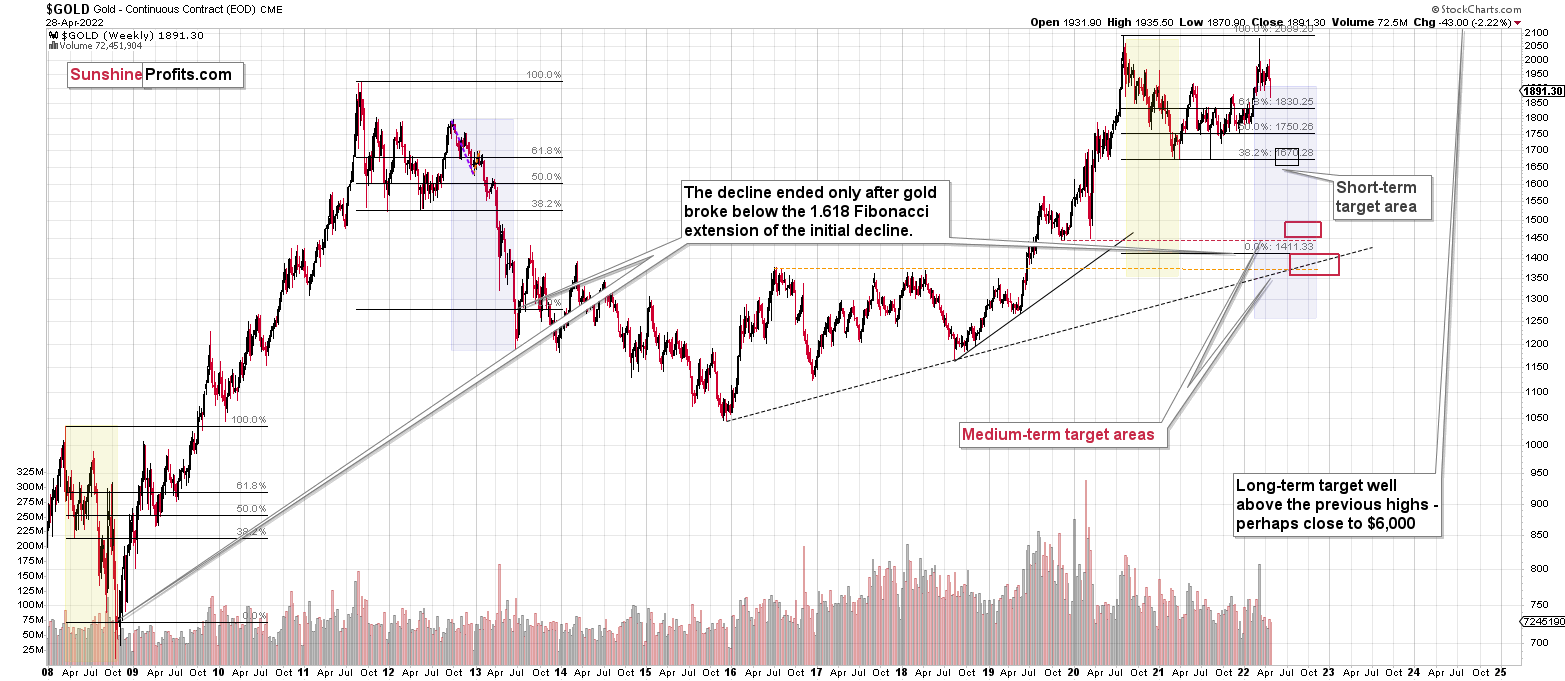

- It seems that the first ( bigger ) stop for gold will be close to its previous 2021 lows, slightly below $1,800 . Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems that we are about to see a short-term corrective upswing in the precious metals sector, even though the medium-term trend remains clearly down.

The medium-term downtrend is likely to continue shortly (perhaps after a weekly or a few-day long correction). As investors are starting to wake up to the reality, the precious metals sector (particularly junior mining stocks) is declining sharply. Here are the key aspects of the reality that market participants have ignored:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months.

For now, I’m adjusting the exit price levels. Please note that they are “binding exit prices”, which means that I think that exiting the short positions without an additional (manual) confirmation from me is a good idea. I think that once these short positions are closed, entering long ones (100% of the regular position size) is also a good idea. If one wants to use a leveraged ETF for this long trade, the JNUG might be worth considering. However, it seems that in most cases, simply using the GDXJ would be sufficient (I’m writing about 100% of the regular position size, not 200% or 300% as I am right now in the case of the short positions). Then again, it’s your capital, and you can do with it whatever you want and are comfortable with.

Of course, if you’re not comfortable with such short-term trading, you can ignore this quick trade and focus on the bigger downturn.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $40.62; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $9.83; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $12.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $21.63

SLV profit-take exit price: $20.14

ZSL profit-take exit price: $27.89

Gold futures downside profit-take exit price: $1,853

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $6.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $21.47

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief