Briefly: in our opinion, full (300% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

This week’s back-and-forth movement in gold, silver, and mining stocks is neither particularly exciting nor interesting. There is, however, some fundamental news that I would like to cover today. The technical part of today’s analysis will cover just one piece of news, as that’s actually the only thing that has changed since yesterday and Monday. This means that what I wrote on Monday – in this week’s flagship Gold & Silver Trading Alert – and in yesterday’s follow-up remains up-to-date.

The single notable thing that I’d like to cover today is today’s pre-market performance of gold vs. the performance of silver.

Here’s what gold did so far today:

It moved slightly higher in a relatively boring manner; it moved a bit higher after having moved a bit lower. Nothing to write home about.

And here’s what silver did so far today:

Silver moved higher as well, and while this move was relatively insignificant in nominal and percentage terms (+0.78%), it was much bigger than what we saw in gold (+0.22%); the difference is crystal-clear when we compare today’s pre-market moves to the most recent short-term highs in both precious metals.

Silver moved to its recent short-term high while gold is not even close to being halfway back up. This means that on a very short-term basis, silver is clearly outperforming gold.

This is also what tends to happen shortly before significant declines across the precious metals sector.

Now, the sizes of both moves were not that significant, so this performance could also be more or less random, and, if that was the case, the outperformance would be just accidental. Consequently, it’s not a game-changing signal in terms of its importance. It is something that’s on top of multiple other indications that we have, and the most important ones are not of a short-term nature at all. The long-term self-similarities in gold and the HUI Index (gold stocks) are the true key to understanding where the precious metals sector is likely to head next, and you already know about those, as I described them thoroughly on Monday.

Should We Fear Countertrends?

Having said that, let’s move to the less technical details and more fundamental ones. Before I proceed, though, I would like to reply to a question that I just received that will serve as a good segue from the world of the technicals into the world of the fundamentals. Here’s the question (the bold formatting was added by me):

You have made a compelling case and a very thorough one for the decline in the precious metals market, and yet the US treasury Bond yields decline and the USD-DXY continue to decline. The analysis needs to include the countertrend that exists and how this countertrend occurred. You refer to this in one-sentence statements which are not very clear. There have been many short-term moves in Gold that have been fairly substantial, and the current trend in the USD and US 10yrT yield is significant. Explaining how the countertrends could and would move within your analysis and projections would help everyone... The daily analyses are much appreciated and I would like to have better understanding of the countertrend moves within your analyses, as well as the US Fed and the ECB influence.

And here’s my reply.

As far as the USD Index (USD-DXY) is concerned, then I wouldn’t say that it “continues to decline”, as it’s been on the rise since the beginning of this year. But let’s say that we’re talking about the last 2 weeks or so. In this case, the USD Index is indeed declining. The highest recent closing price was 92.98 (July 20). Yesterday’s closing price for the USD Index was 92.09, so the USDX is down by 0.89 – almost a full index point.

What did the 10-year yield do between those dates? The $TNX (10-year US Treasury Index) declined from 12.09 to 11.76. But if we took July 13 as the starting date (the recent short-term high in the $TNX), we would see that it moved from 14.15 to 11.76 – a substantial decline.

Ok, what did gold do during these times? Almost nothing. Gold moved from $1,811.40 (July 20) to $1,814.10 (August 3). So, while the USD Index declined by almost a full index point, gold moved higher by a mere $2.70.

And in the case of the TNX, between July 13 and yesterday, gold moved from $1,809.90 to $1,814.10 (it moved higher by a mere $4.20).

Based on this comparison, the reply is already quite evident. What if these trends continue? If these trends continue, gold is likely to do… Nothing.

Based on how gold tends to perform (based on the 2008 and 2011-2013 analogies), it’s time for gold to fall, and to fall hard. If it was just gold that was performing just as it did in all those years, it might not have been as critical. But gold stocks (the HUI Index) are doing the same thing! They are also repeating what happened in all those years. And based on these analogies, the markets are about to slide.

Now, what does the market do if it wants to move in a given direction (here: down) and it gets bullish signals from other markets or the from news? It ignores them. This could take the form of reacting in a weak manner and then, after the dust settles, moving slowly back down. That’s exactly what gold has been doing.

The bullish indications from the USD Index (reminder: they are of a very short-term nature only; the USDX tends to rally after bottoming in the middle of the year) and bond yields are simply delaying the PMs’ slide. At the same time, gold, silver, and mining stocks act like a spring that’s being coiled with bigger force. It doesn’t move, but when something finally changes (yields and the USDX move higher), something big (here: decline in the PMs) is likely to happen.

Having said that, let’s move to the more fundamental part of the analysis. I will also discuss the situation in bond yields more thoroughly in the upcoming analyses.

Work in Progress

With the USD Index patiently waiting for the release of the U.S. nonfarm payrolls report on Aug. 6, the greenback has recorded a muted start to the month. However, if payrolls outperform and investors accelerate the U.S. Federal Reserve’s (FED) taper timeline, a U.S. dollar surge could happen sooner rather than later.

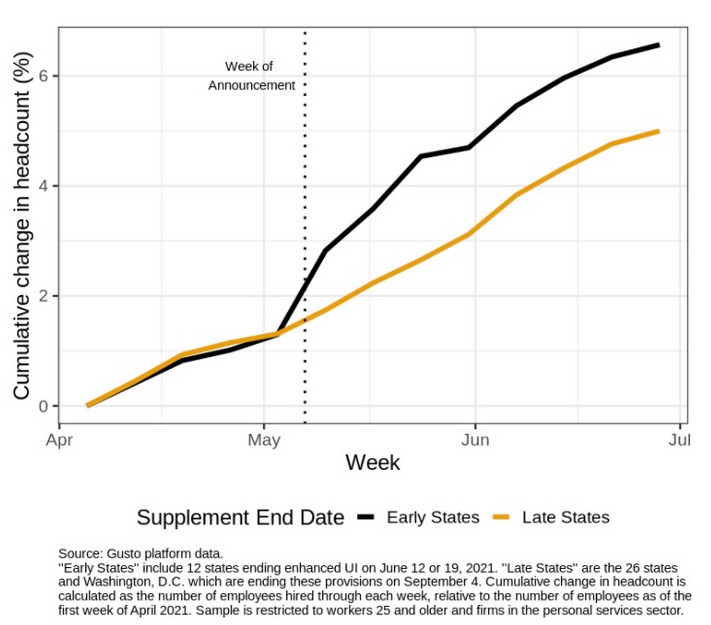

In the interim, though, the U.S. labor market is trending in the right direction. Case in point: while Gusto – a software company that provides cloud-based payroll, benefits and human resource management solutions for U.S. businesses – largely downplayed the end of enhanced unemployment benefits in many states, an excerpt from the Jul. 27 report read:

“Looking at employment trends by employee age, we observe that around the time of governors’ announcements in the first week of May, hiring rates for workers 25 and older rose in states ending these benefits early, which indicates that UI did play a role in the labor supply decisions of a group of adult workers.”

Please see below:

To explain, the black line above tracks the cumulative headcount of adults 25 and older in the states where enhanced unemployment benefits ended early, while the brown line above tracks the same cohort in states where enhanced unemployment benefits are still in play. If you analyze the acceleration of the black line, it’s clear that fiscal benefits have impacted U.S. citizens’ desire to find employment.

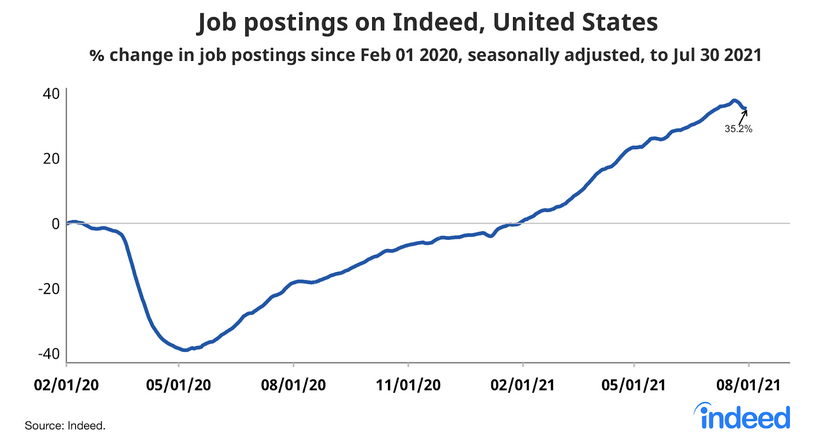

Also noteworthy, Indeed revealed on Aug. 3 that U.S. job openings fell by “two points from last week” and that “job postings increased in May, June, and July at a slower pace than in March and April.”

Please see below:

At first glance, the results may seem disappointing. However, it’s important to remember that if job postings are declining, businesses have likely filled the vacancies. Think about it: when a person is hired, the job posting is no longer necessary. And with the latter declining at a time when enhanced unemployment benefits have ended for roughly 30% of Americans, the ‘coincidence’ signals that a restocking of the U.S. labor force is already underway.

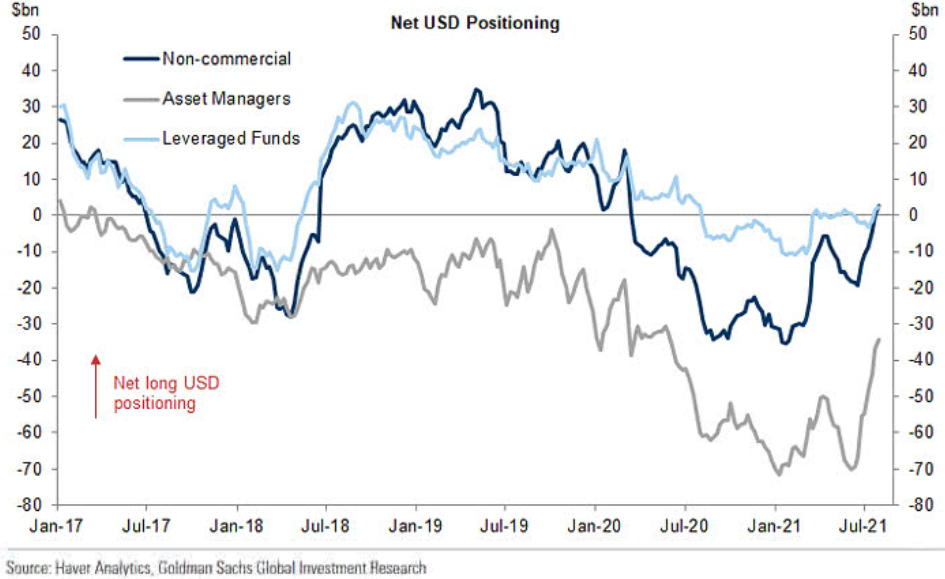

Allocation to the Dollar Rises

Circling back to the USD Index, as indicated in the CoT reports, the non-commercial (speculative) futures traders, asset managers and leveraged funds’ allocation to the U.S. dollar are now at 2021 highs.

Please see below:

To explain, the dark blue, gray and light blue lines above represent net-long positions of non-commercial (speculative) futures traders, asset managers and leveraged funds. When the lines are falling, it means that the trio have reduced their net-long positions and are expecting a weaker U.S. dollar. Conversely, when the lines are rising, it means that the trio have increased their net-long positions and are expecting a stronger U.S. dollar. And if you analyze the right side of the chart, you can see that the trio have upped their bullish bets in recent weeks (with leveraged funds moving notably higher last week).

On the flip side, euro sentiment is moving in the opposite direction. And because the EUR/USD accounts for nearly 58% of the movement of the USD Index, the performance of the currency pair is extremely important.

Please see below:

To explain, the dark blue, gray and light blue lines above track the trio’s allocation to the euro. If you analyze the right side of the chart, you can see that speculative euro bulls are throwing in the towel.

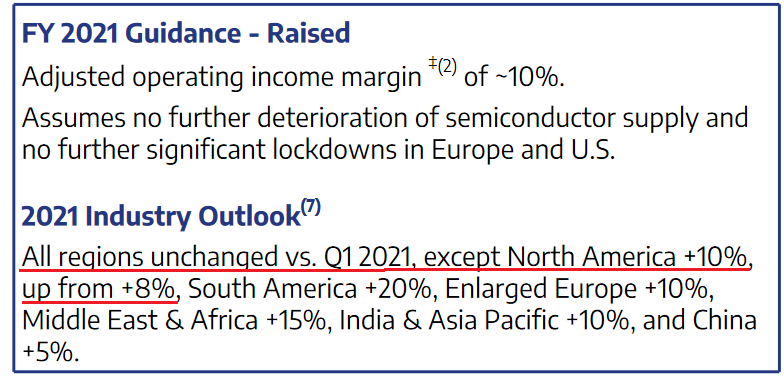

Furthermore, the relative fundamentals also favor the greenback. With U.S. GDP growth poised to outperform the Eurozone, growth differentials still signal a stronger U.S. dollar. For example, Stellantis NV – a European automaker that was created following the merger of PSA Group and Fiat Chrysler in 2021 – increased its full-year 2021 earnings guidance on Aug. 3. The main reason? Higher output in North America.

Please see below:

Households in the US Are… Wealthier?

On top of that, with U.S. fiscal benefits plumping consumers’ balance sheets, household savings in the U.S. far outweighs the Eurozone. For context, the construction of the European Union makes it difficult for the bloc to find common ground on fiscal policy. And while the lack of spending decreases the supply of euros relative to U.S. dollars, the growth outperformance should result in capital flowing into the U.S. and investors buying the U.S. dollar.

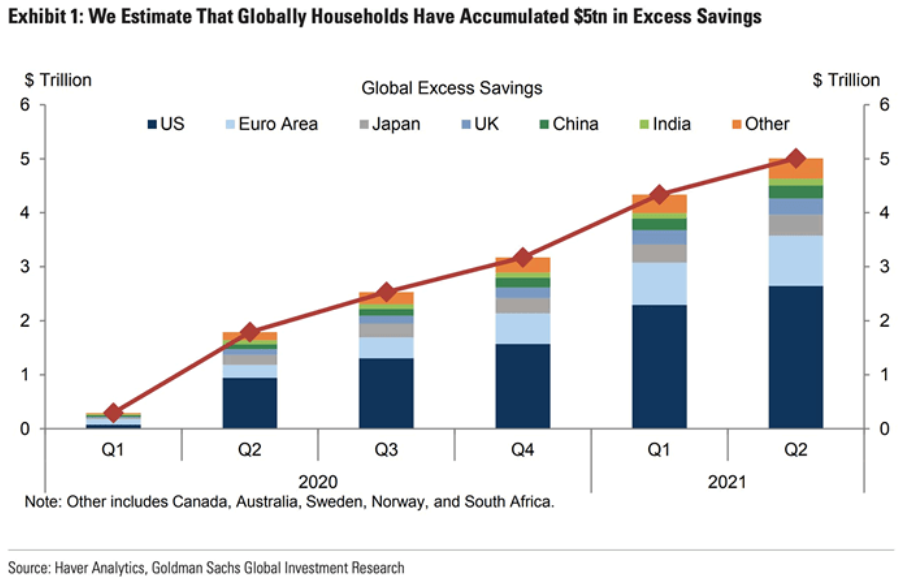

Please see below:

To explain, the stacked bars above depict various regions’ household savings over the last six quarters. If you analyze the column on the right side of the chart labeled “Q2,” you can see that the U.S. (the dark blue section) has much more household savings built up than the Eurozone (the light blue section). As a result, when U.S. citizens’ willingness to spend matches their ability to spend, the prospective economic outperformance is bullish for the greenback.

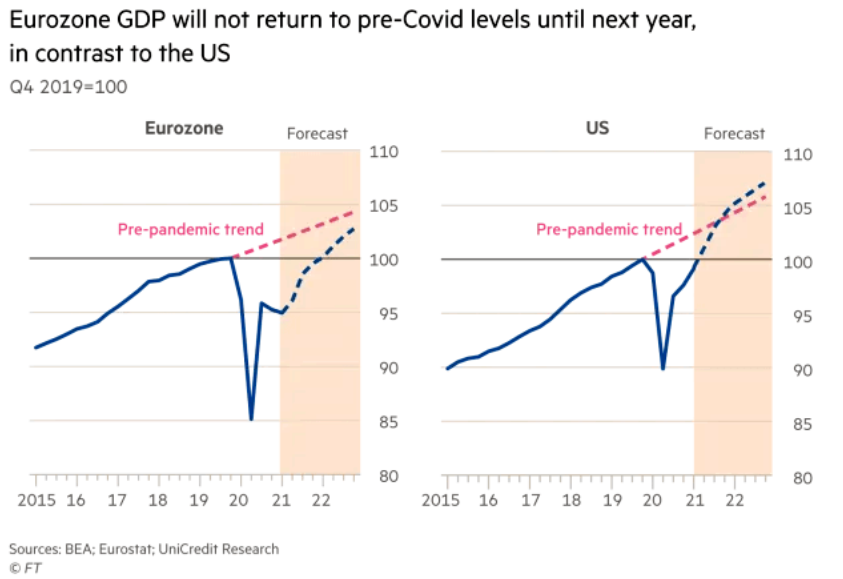

To that point, while the U.S. is about to recoup its pre-pandemic GDP growth trajectory, the Eurozone isn’t expected to reach the milestone until late 2022.

Please see below:

To explain, the chart on the left compares the Eurozone’s current growth trajectory (the blue line) with its pre-pandemic trend (the pink line). If you analyze the gap, you can see that the Eurozone is still a ways away from recapturing its past glory. Conversely, if you turn your attention to the chart on the right, you can see that the U.S. has already recouped its pre-pandemic GDP level (100) and the region is expected to exceed its pre-pandemic trend in the third or fourth quarter of 2021.

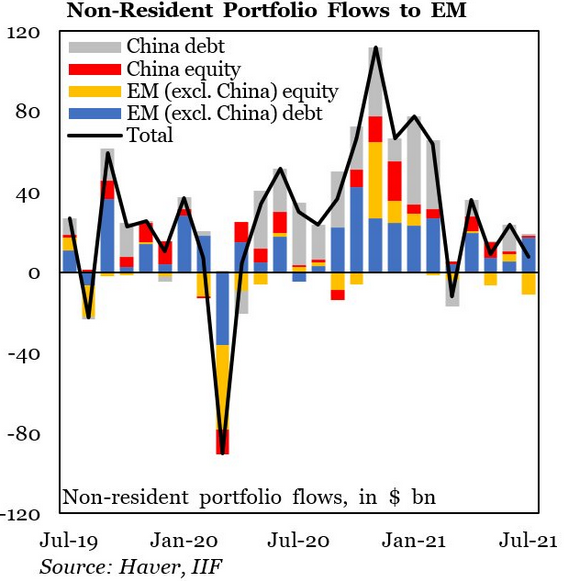

Finally, with the momentum shifting across emerging markets, foreign portfolio flows have stalled once again.

Please see below:

To explain, the stacked bars above categorize non-resident portfolio flows into emerging markets, while the black line above tracks the consolidated total. If you analyze the sharp fall in early 2020 and the sharp rise in late 2020, the former coincided with a sharp rise in the USD Index, while the latter coincided with a sharp fall in the USD Index. More importantly, though, if you focus your attention on the right side of the chart, you can see that non-resident portfolio flows into emerging markets continue to lose momentum. And if the dynamic persists, it will likely add even more fuel to the USD Index’s fire.

In conclusion, the precious metals’ performance was mixed on Aug. 3, as payrolls uncertainty has many assets stuck in consolidation mode. However, whether reality resurfaces on Aug. 6 or the PMs bask in what’s left of the summer sun, the bearish medium-term implications remain intact. With the U.S. labor market moving closer to the FED’s taper threshold, the PMs have become increasingly anxious. And after the U.S. 10-Year real yield hit another all-time low on Aug. 2, the metals’ inability to muster a relief rally is a sign of extreme weakness. The bottom line? While short-term bursts of strength are definitely possible and expected along the way, the PMs’ medium-term trend still remains down. And it seems that the current short-term corrective upswing in gold, silver, and mining stocks is over or about to be over.

Overview of the Upcoming Part of the Decline

- The biggest corrective upswing in gold might already be over, and it seems that we won’t have to wait long for the current small correction to end either.

- After miners slide in a meaningful and volatile way, but silver doesn’t (and it just declines moderately), I plan to switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this would take place – perhaps with gold close to $1,600. I plan to exit those short positions when gold shows substantial strength relative to the USD Index, while the latter is still rallying. This might take place with gold close to $1,350 - $1,500 and the entire decline (from above $1,900 to about $1,475) would be likely to take place within 6-20 weeks, and I would expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold – after gold has already declined substantially) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,475, but it’s too early to say with certainty at this time.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector would be likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, it seems that the bigger corrective upswing in gold might already be over and that we won’t have to wait for the current small correction to end, either. While the next few days may (!) bring temporarily higher prices, it’s unlikely that they will hold. In particular, just as mining stocks had local corrections that didn’t change the nature of the huge medium-term declines in 2008 and 2012-2013, it’s unlikely that the current local correction will change anything.

It seems that our profits on the short position in the junior mining stocks are going to grow substantially in the following weeks.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $37.12; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $15.96; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $37.02; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures upside profit-take exit price: unclear at this time - initially, it might be a good idea to exit, when gold moves to $1,683

Gold futures upside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.88

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief