Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Another day, another new yearly high for the USD Index. The U.S. currency soars just like it has since the beginning of the year, in tune with what I said at that time, (and against what almost everyone else said about its outlook). The rally accelerated recently, with the USD Index soaring by 0.78 this week – and it’s only Wednesday today.

So, surely that’s bullish for the USD Index? - one might ask.

No.

“Bullish” or “bearish” relates to the future, not to the past. In fact, the rally in the USD Index might need a breather as all markets – no matter how bullish or bearish the situation is in them – can’t rally or decline in a straight line, without periodic corrections. The USD Index, gold, silver, mining stocks, and practically all the other markets are no exception from this rule. Even the real estate prices don’t increase over the long run without periodic downturns.

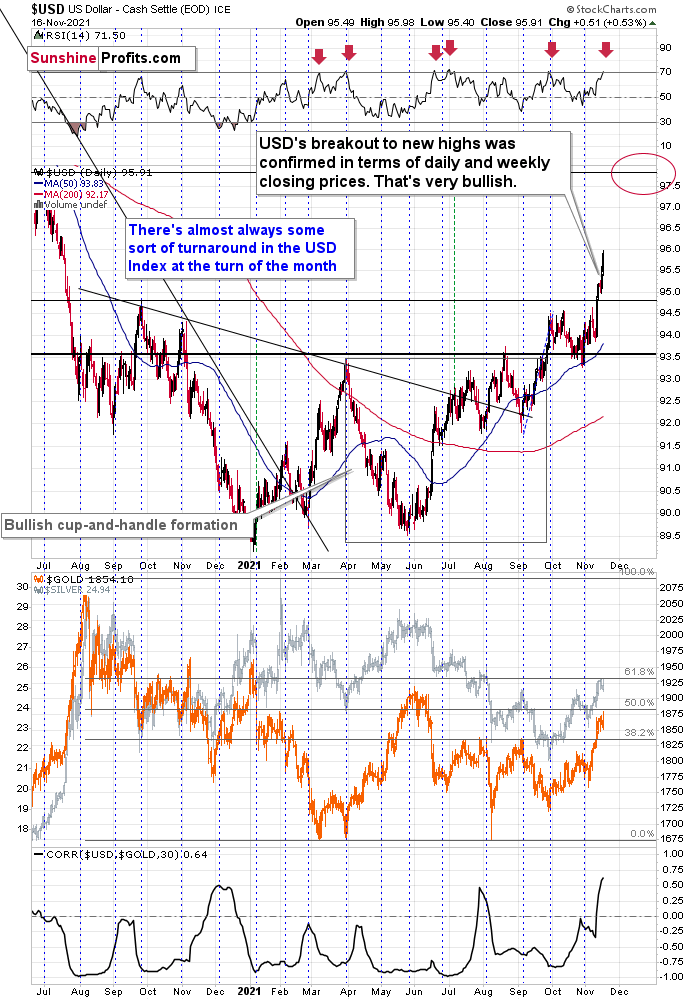

As you can see on the above chart, the U.S currency index soared to almost 96 yesterday and it’s after an almost straight-up rally. This rally caused the RSI indicator to move above 70, and this has been a quite precise short-term sell signal this year. In fact, in all cases when we saw it, some kind of short-term correction followed.

Based on the size of the current rally, it seems that the current situation is most similar to what we saw in early March and in late June. That’s when we saw short-term declines that took the USDX approximately a full index point lower. In the current case, it could mean a decline back to 95. This would be a perfectly natural think for the USD Index to do right now, given that the previous resistance (which now serves as support) is located slightly below 95. The support is provided by the late-2020 high and the March 2020 low (not visible on the above chart).

So, surely this corrective downswing in the USD Index would cause an even bigger rally in the precious metals sector, right?

That’s where things get complicated.

You see, the biggest (over 50%) part of the USD Index (which is a weighted average) is the EUR/USD currency pair. Let’s take a look at it.

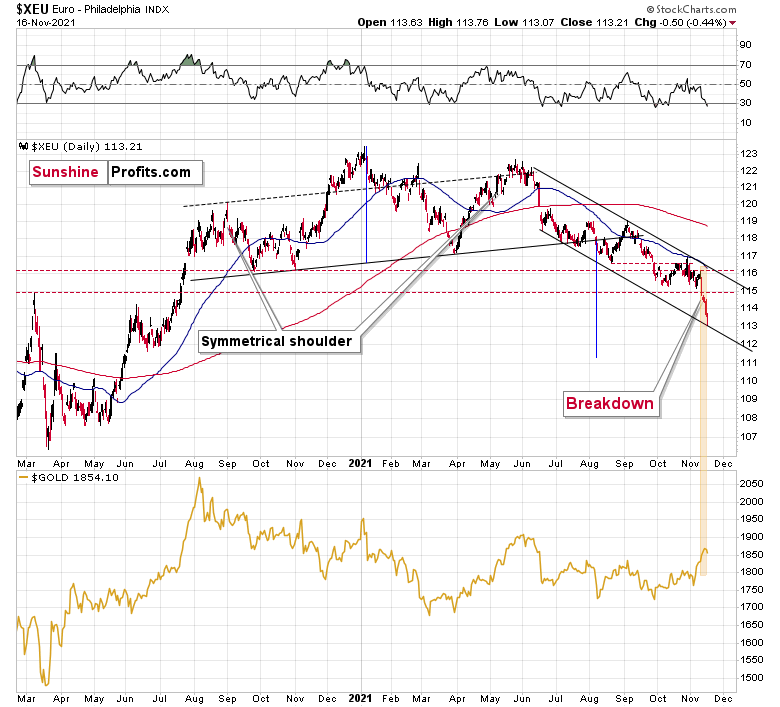

The Euro Index moved sharply lower last week and just like the RSI based on the USD Index flashed a sell signal, the RSI based on the Euro Index flashed a buy signal.

Also, the Euro Index just moved to the lower border of its declining trade channel, which is likely to indicate some kind of rebound.

Why am I discussing the euro here? Because that’s what’s complicated about the current USD-gold link.

The euro recently declined and the prices of silver and gold recently rallied shortly after dovish comments from the eurozone. Namely, while the expansionary nature of fiscal and monetary decisions in the U.S. might be after its peak (with the infrastructure bill signed even despite high inflation numbers), the eurozone is far from limiting its expansionary (i.e., inflationary) policies, and it was just made clear recently.

That was bearish for the euro and bullish for the gold price – as more money (euros in this case) would be chasing the same amount of physical gold bars.

The point here is that it might have been the decline in the value of the European currency that caused gold to rally, and it had little to do with what happened in the USD Index.

Don’t get me wrong, most of the time, the gold-USD link is stable and negative. In some cases, gold shows strength or weakness by refusing to move in tune (and precisely: again) with the U.S. dollar’s movement. But in this case, it seems that it’s not about the U.S. dollar at all (or mostly), but rather about what happened in the Eurozone and euro recently.

I marked the recent decline in the euro and the rally in gold with a golden rectangle.

The usual link between gold-USD would have one assume that lower USD Index values (due to higher EUR/USD values) would trigger a rally in gold. However, given how things worked and the fact that we saw/heard the news coming from the Eurozone, it seems like this “temporary” and “bearish for the PMs” interpretation would actually prevail. It could also be the case that we see some kind of mixed reply from the precious metals sector when the USD Index and the Euro Index correct. The PMs could for example fall only after the situation regarding the gold-USD link gets back to normal – that is perhaps after both currencies correct.

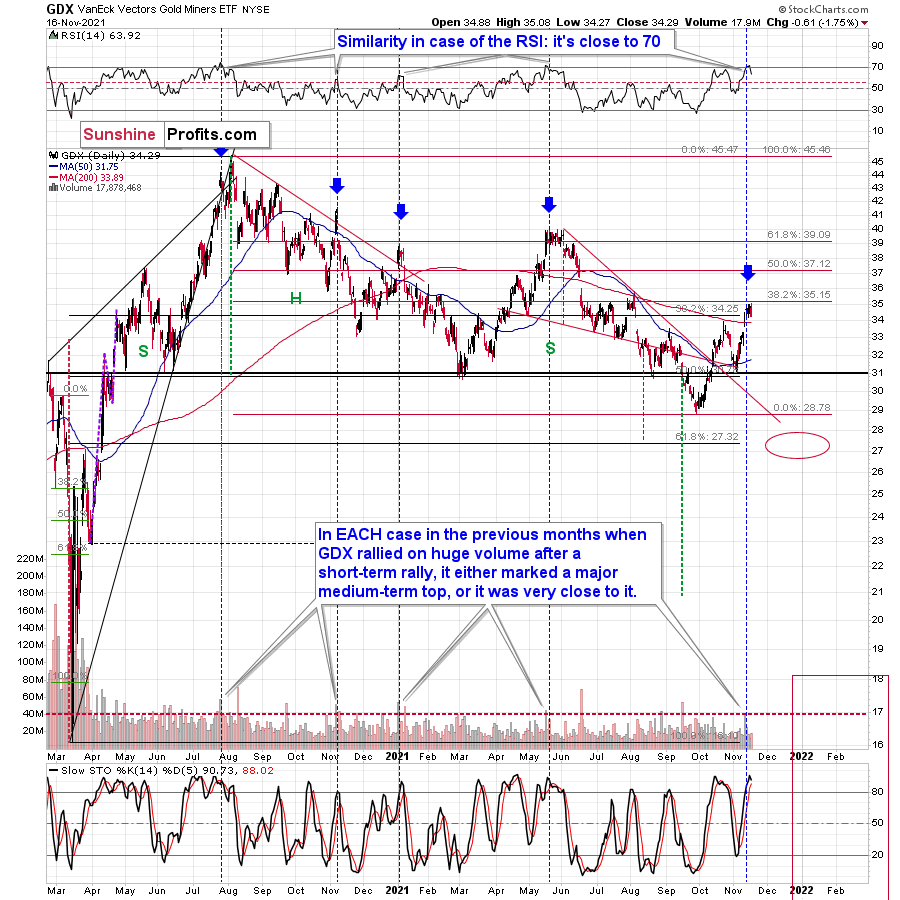

Meanwhile, the situation in the GDX ETF remains just as I described it previously. Given the reversal nature of yesterday’s session, perhaps that was the final top – and perhaps not, based on today’s pre-market rally in gold. Either way, the GDX might top soon and it would be in perfect tune with the analogies to the recent high-volume session that preceded other tops.

To explain, the GDX ETF rallied on huge volume on Nov. 11 and there were only 4 cases in the recent past when we saw something like that after a visible short-term rally.

In EACH of those 4 cases, GDX was after a sharp daily rally.

In EACH of those 4 cases, GDX-based RSI indicator (upper part of the chart above) was trading close to 70.

The rallies that immediately preceded these 4 cases:

- The July 27, 2020 session was immediately preceded by a 29-trading-day rally that took the GDX about 42% higher. It was 7 trading days before the final top (about 24% of time).

- The November 5, 2020 session was immediately preceded by a 5-trading-day rally that took the GDX about 14%-15% higher (the high-volume day / the top). It was 1 trading day before the final top (20% of time).

- The January 4, 2021 session was immediately preceded by a 26-trading-day rally that took the GDX about 17%-18% higher (the high-volume day / the top). It was 1 trading day before the final top (about 4% of time).

- The May 17, 2021 session was immediately preceded by a 52-trading-day rally that took the GDX about 30% higher. It was 7 trading days before the final top (about 13% of time).

So, as you can see these sessions have even more in common than it seemed at the first sight. The sessions formed soon before the final tops (4% - 24% of time of the preceding rally before the final top), but the prices didn’t move much higher compared to how much they had already rallied before the high-volume sessions.

Consequently, since history tends to rhyme, we can expect the GDX ETF to move a bit higher here (but not significantly so) and we can expect this extra move higher to take between additional 0 to 7 trading days (based on the Nov. 12 session, so as of Nov. 16, it’s between 0 and 4 trading days). That is, if the final top didn’t form yesterday, on Nov. 16.

Why 0 – 4 trading days (as of today – Nov. 16)? Because with the 4% timeline now in the rearview, the latter represents the updated 24% timeframe based on the preceding rally (that took 30 trading days).

Since it’s unlikely to take the mining stocks much higher, and the reversal could take place as soon as today, I don’t think that making adjustments to the current short positions in the mining stocks is justified from the risk to reward point of view.

Is there a meaningful resistance level that would be likely to trigger a decline in mining stocks? Yes! The GDX ETF is just below its 38.2% Fibonacci retracement level based on the August 2020 – September 2021 decline. The resistance is slightly above $35, so that’s when the final top could form.

As a result, those historical readings provided us with great shorting opportunities. And while I’m not increasing my short position, if I didn’t already have one in place, I would consider the current setup as offering a great risk-reward proposition.

Having said that, let’s take a look at the markets from a more fundamental point of view.

Snap Back to Reality

With the EUR/USD extending its free fall, the USD Index nearly hit 96 on Nov. 16. And with the currency pair accounting for nearly 58% of the movement of the USD Index, its destruction should help cement the dollar basket’s resurrection. Not necessarily in the immediate term though, but I already wrote about that earlier today.

Feeling the whiplash, the PMs were under pressure on Nov.16. And with harsh fundamental and technical realities manifesting themselves throughout the PMs’ recent rallies, sharp re-ratings could occur at any moment.

To explain, U.S. inflation is still raging. And while the U.S. dollar is our disinflationary canary in the coal mine (a stronger U.S. dollar is profoundly disinflationary), the seeds are being sown for a material rise in U.S. real yields.

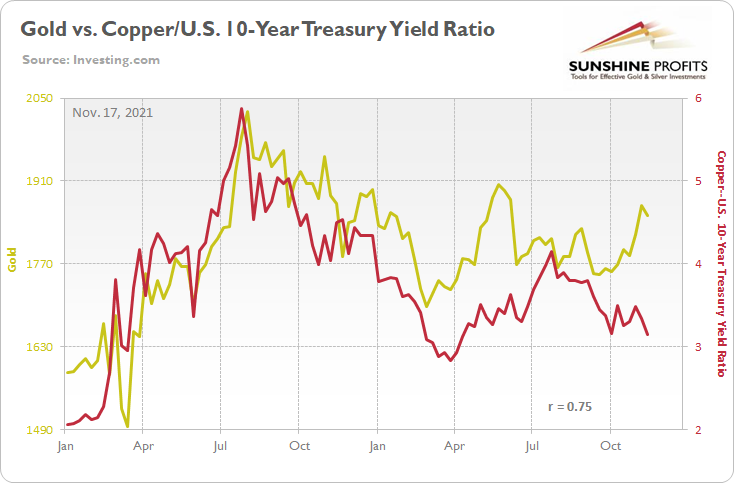

For example, I’ve highlighted on several occasions how a stronger U.S. dollar often collapses commodities’ uptrends. And with copper – which is considered an indicator of global growth – on pace for its fourth weekly decline in the last five weeks, the copper/U.S. 10-Year Treasury yield ratio sunk to its lowest level since early April on Nov. 16.

Please see below:

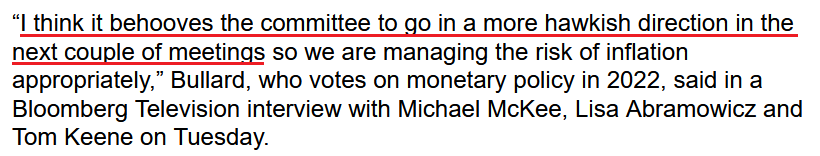

Likewise, while the U.S. dollar has been on fire in recent weeks, the greenback’s fundamental foundation continues to strengthen. Case in point: St. Louis Fed President James Bullard said on Nov. 16 that the FOMC should up the hawkish ante in the coming months.

Please see below:

What’s more, with surging inflation reducing the University of Michigan’s Consumer Sentiment Index to a “level that you might associate with a recession,” Richmond Fed President Thomas Barkin added on Nov. 16 that “I think that’s very much because of the impact that prices have on people.”

Also referencing consumers’ agony, Atlanta Fed President Raphael Bostic said on Nov. 16 that inflation needs to be controlled. For context, when prices rise in perpetuity, demand destruction eventually occurs. Essentially, the cost of goods rise to a point where consumers can’t afford them anymore. And with the dynamic extremely detrimental to a sound U.S. economic recovery, Bostic said:

“I think you’ve heard from all of us concerns about the higher levels of inflation that we’ve seen recently and the need to get that back under control.”

Thus, with the U.S. dollar’s surge helping the Fed to fight inflation, the relationship is now mutually beneficial: if the Fed preaches patience on inflation, the U.S. dollar will likely decline. However, the decline will likely uplift commodities, and therefore, accelerate the Fed’s inflationary conundrum.

That’s why I wrote on Sep. 30:

Powell’s only hope to curb inflation is to strengthen the U.S. dollar and weaken commodity prices. For context, major futures contracts are priced in U.S. dollars. And when the dollar rallies, it’s more expensive for foreign buyers (in their currency) to purchase the underlying commodities. As a result, a stronger U.S. dollar often stifles demand. And with the current supply/demand dynamics favoring higher commodity prices, Powell will have to work his magic, strengthen the dollar and reduce commodities demand if he wants his inflation problem to subside.

As a result, contrasting what we witnessed during the spring and summer of 2021, the Fed’s days of talking down the U.S. dollar are likely over. And with technicals, fundamentals, Fed policy, and now investor sentiment supporting the greenback’s comeback, the uprising should continue over the medium term.

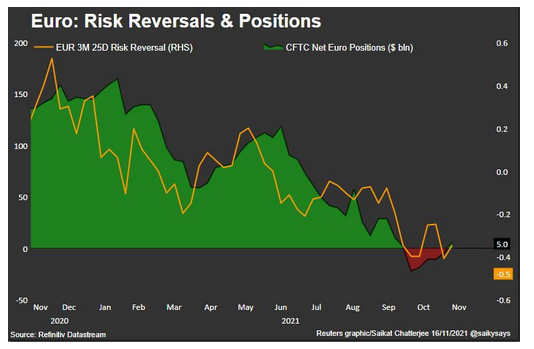

As I mentioned above, the EUR/USD remains the head of the dollar basket’s snake. And with the currency pair collapsing under its own fundamental weight, oversold conditions may result in a short-term consolidation. However, the EUR/USD’s medium-term downtrend remains intact.

For starters, the option spread for three-month euro risk reversals are now at their lowest level since May 2020. In a nutshell: the cost of euro put options (which profit when the euro falls) have increased materially relative to the cost of euro call options (which profit when the euro rises). As a result, the cost of hedging euro downside his risen to reflect its dismal outlook.

Please see below:

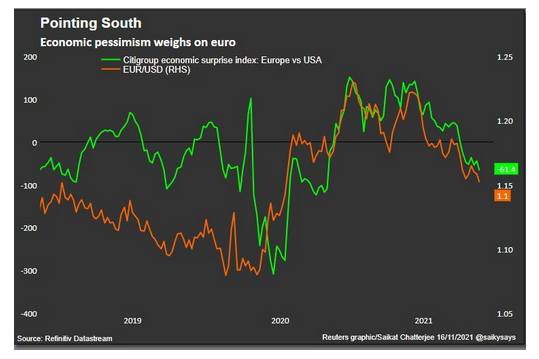

Second, since sentiment in the options market can shift, the euro’s fundamental weakness is our main concern. For example, Citigroup’s Eurozone Economic Surprise Index has materially underperformed its U.S. counterpart. And with the Eurozone-U.S. economic surprise spread hitting a new 2021 low on Nov. 16 (the green line below), it’s no surprise that the EUR/USD has followed suit (the orange line below). For context, an economic ‘surprise’ occurs when a realized data point outperforms economists’ consensus estimate.

Please see below:

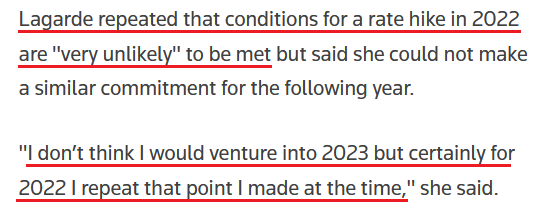

Third, ECB President Christine Lagarde reiterated her dovish position on Nov. 15. Pushing back against a potential rate hike in 2022, she said that “if we were to take any tightening measures now, it could cause far more harm than it would do any good.”

As a result:

Thus, with the Fed turning hawkish and the ECB running in the opposite direction, the Eurozone-U.S. spread of potential 2022 rate hikes has fallen off a cliff. For context, when the orange line below is falling, it means that the futures market expects more 2022 rate hikes by the Fed than the ECB.

Please see below:

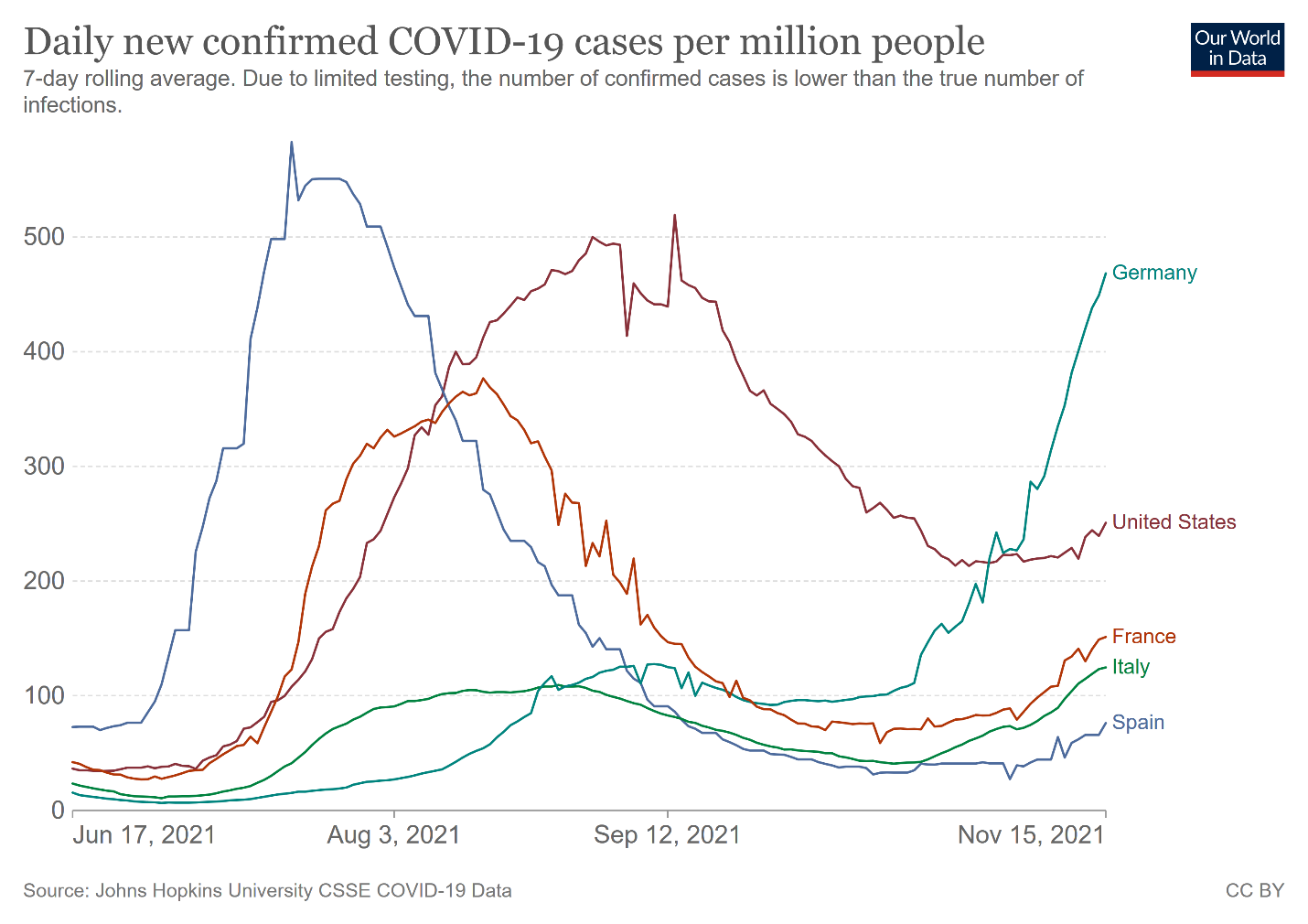

Also noteworthy, COVID-19 cases are on the rise in Germany, France, Italy, and Spain – Europe’s four-largest economies – and the potential economic upheaval could widen the Eurozone-U.S. economic surprise spread even more. For context, Germany’s daily new confirmed cases per million people has risen sharply over the last few weeks.

Please see below:

And due to the potential economic disruptions, Invesco’s dollar bear has thrown in the towel:

For context, Alessio de Longis, senior portfolio manager at Invesco Investment Solutions, has moved to overweight the dollar versus the euro, the pound and the yen (which combine to account for more than 83% of the USD Index’s movement). He said:

“We find that a powerful driver of the dollar is how economic data surprises are printing, especially outside the U.S…. In both developed markets outside the U.S. and emerging markets, the return of COVID concerns, the fourth wave in Europe, and the delay of the full reopening of the economy are now affecting growth data.”

The bottom line? With the USD Index’s fundamental foundation growing stronger by the day, the PMs are confronting a two-headed monster. On one side, the PMs’ strong negative correlations with the U.S. dollar should rear their ugly heads over the medium term. On the other side, a strong U.S. dollar is often kryptonite to inflation. And if the U.S. dollar’s intense rally continues, fears of ‘hyperinflation’ could come crashing down. Alongside, the PM’s bullish narrative could come crashing down as well.

In conclusion, the PMs declined on Nov. 16, as reality re-emerged once again. And with the U.S. dollar rallying, U.S. Treasury yields rallying and copper signaling that something is amiss, the PMs should confront more negativity over the medium term. Moreover, with precious metals’ sentiment known to shift at the snap of a finger, investors shouldn’t be surprised if another sharp daily drop ‘comes out of nowhere.’

Overview of the Upcoming Part of the Decline

- It seems to me that the current corrective upswing in gold is about to be over soon, and the next short-term move lower is about to begin. Since it seems to be another short-term move more than it seems to be a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

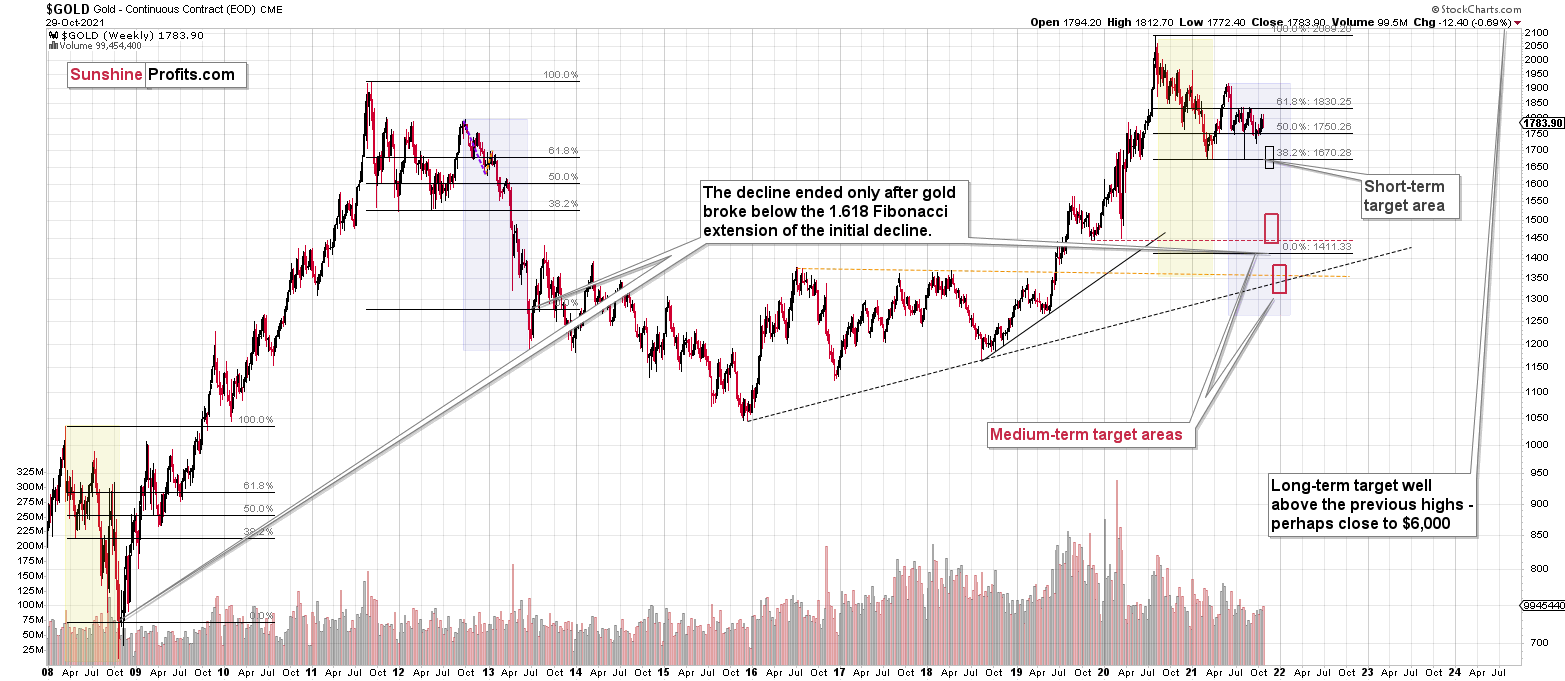

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December. It is not set in stone that PMs have to bottom at that time. If not then, then early 2022 would become a likely time target.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops. The additional confirmation will come from the tapering schedule, as markets are likely to move on the rumor and reverse on the fact as they tend to do in general.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

The PMs rallied last week, and their momentum has teetered on euphoria. However, when prices diverge from fundamentals, sharp selloffs often occur when sentiment shifts. As a result, caution is warranted, and the PMs’ recent bout of optimism will likely end in disappointment. This disappointment could start within the next few days, based on analogies to very similar cases in mining stocks. The decline in the GDX could start right away or once it moves to or slightly above $35, quite likely in 0 – 4 trading days. That is, if the top didn’t form yesterday (Nov. 16).

Since it seems that the PMs are likely about to start another short-term move lower more, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years, or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $30.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief