Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Based on yesterday’s and today’s pre-market price action, I recorded two technical videos:

- Publicly available video featuring the analysis of silver:

- Premium video available to you (and other premium subscribers) only – it includes the analysis of gold, GDX, GDXJ, and the USD Index.

You will find the first (silver) video over here:

And you will find the second (premium) video over here:

Having said (literally) that, let’s move to the more fundamental side of things.

When in Doubt

With U.S. nonfarm payrolls coming in weaker than expected on Oct. 8, the Fed’s taper timeline was once again in the spotlight. However, with the U.S. unemployment rate falling to 4.8% (versus 5.1% expected) and the weakness mainly driven by a decline in government payrolls (private payrolls increased by 317,000), the lukewarm print should still meet Chairman Jerome Powell’s taper threshold.

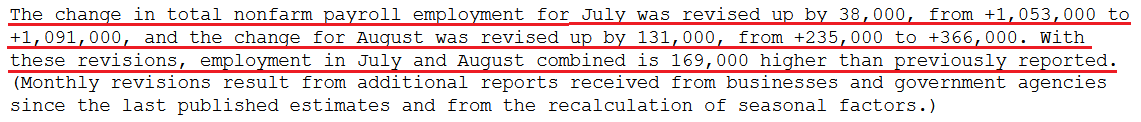

To explain, July’s data was revised upward by 38,000 (increased for the second time), while August’s data was revised upward by 131,000. As a result, 169,000 more jobs were added than previously reported.

Please see below:

Source: U.S. Bureau of Labor Statistics (BLS)

Source: U.S. Bureau of Labor Statistics (BLS)

What’s more, with inflation surging and the “transitory” narrative suffering a slow and painful death, the Fed is having its ‘come-to-Jesus’ moment. For context, I’ve been warning for months that the central bank remains materially behind the inflation curve.

I wrote on Apr. 30:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

To that point, Atlanta Fed President Raphael Bostic said on Oct. 12:

“I believe evidence is mounting that price pressures have broadened beyond the handful of items most directly connected to supply chain issues or the reopening of the services sector.... Up to now, indicators do not suggest that long-run inflation expectations are dangerously untethered. But the episodic pressures could grind on long enough to unanchor expectations.”

More importantly, though, he admitted:

“Transitory is a dirty word…. It is becoming increasingly clear that the feature of this episode that has animated price pressures – mainly the intense and widespread supply chain disruptions – will not be brief. By this definition, then, the forces are not transitory.”

And how does this impact his taper timeline?

Also making the rounds, Fed Vice Chairman Richard Clarida supported the hawkish rhetoric on Oct. 12. Speaking at the Institute of International Finance’s virtual annual meeting, he said that “the risks to inflation are to the upside.” And after conceding that “the big unknown right now is how long it will take for these bottleneck effects to work their way through,” he admitted:

For context, if the Fed concludes the taper by the “middle of next year,” the timeline is extremely hawkish. To explain why, I wrote on Sep. 23:

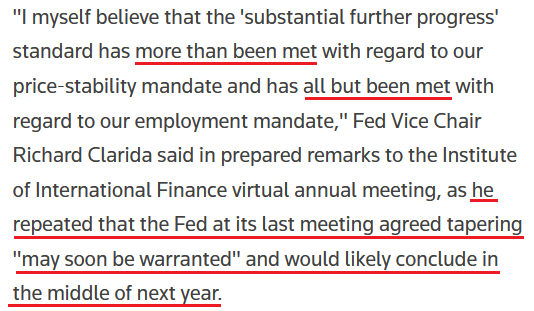

With ~$120 billion worth of bond purchases poised to hit zero in roughly nine months, the accelerated liquidity drain is extremely bullish for the USD Index.

Please see below:

To explain, the dark blue line above tracks the pace of the Fed’s taper following its announcement in December 2013, while the orange line above tracks the consensus estimate this time around. However, if you focus your attention on the light blue line, you can see that Powell’s taper timeline pushes QE to zero in advance of both the precedent set in 2014 and the current consensus estimate.

On top of that, while the Fed has finally opened its eyes to persistent inflation, the central bank is still operating in the rearview. To explain, while Fed officials seem to agree that tapering is necessary to calm inflation (which we also agree on), at the current rate, the hawkish shift isn’t nearly hawkish enough.

For example, while I’ve been sounding the alarm on the cost-push inflationary spiral for months, Brent and WTI prices are now trading north of $80 per barrel and Citigroup said that winter weather could uplift the former to $90 per barrel in the fourth quarter. For context, Citigroup, Goldman Sachs and Bank of America are all forecasting $90+ per barrel Brent this year. And while The White House called on OPEC (for the second time) to “do more” (increase supply to reduce oil prices), the cartel has ignored the pleas. As a result, if oil’s upward momentum persists, the Fed is materially underestimating the inflationary impact.

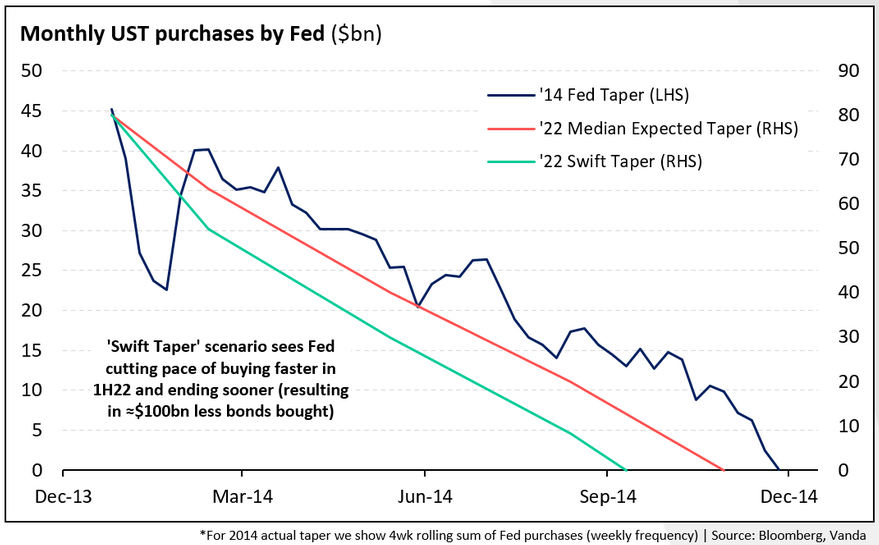

Second, while commodity prices remain the most important driver of inflation, even “transitory” factors have leaped to new highs. For context, I wrote on Apr. 16:

The Manheim Used Vehicle Index – compiled from a database of more than five million annual used vehicle transactions – increased by 5.87% month-over-month to a record high 179.2 in March. What’s more, the pace of the surge is unlike anything that we’ve ever witnessed before.

And after a brief pause – which even we conceded given that abnormally high used car prices should be “transitory” – Manheim revealed that wholesale used vehicle prices “increased 5.3% month-over-month in September” and “brought the Manheim Used Vehicle Index to [a record high] 204.8.”

Please see below:

In addition, Oshkosh Corporation – an American manufacturer of specialty trucks, military vehicles, truck bodies, airport fire apparatus and access equipment – reduced its full-year revenue and earnings guidance on Oct. 8. The company cited “significant supply chain and logistics disruptions as well as material and freight cost inflation similar to other companies that are beyond the company’s prior expectations.”

CEO John C. Pfeifer added:

“We implemented multiple price increases in our non-defense segments over the past six to nine months to combat unprecedented raw material inflation and freight cost escalation. Based on current conditions, we expect that our pricing actions will cover our higher input costs. However, due to our backlogs, we do not believe this price catch-up will occur until the end of the second quarter of Calendar 2022. If cost escalation persists, we will take additional pricing actions.”

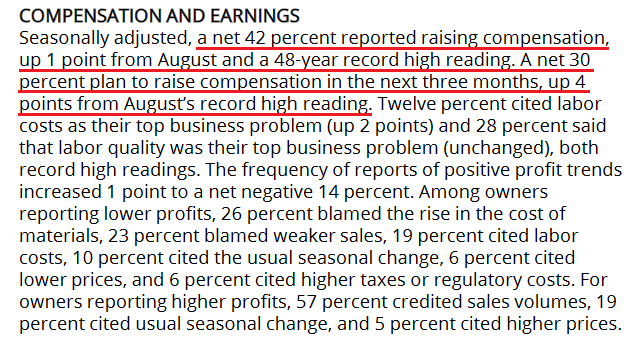

On the other side of the inflationary coin, the NFIB released its Small Business Optimism Index on Oct. 12. And while the headline index declined from 100.1 in August to 99.1 in September, wage inflation rose to levels unseen since the 1970s.

Please see below:

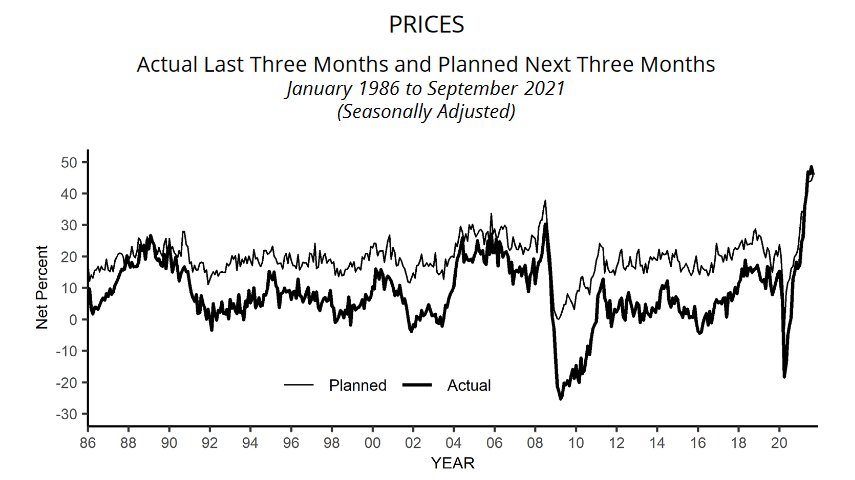

Furthermore, while “the net percent of owners raising average selling prices decreased 3 points to a net 46 percent,” output inflation still remains at a more than 30-year high.

Please see below:

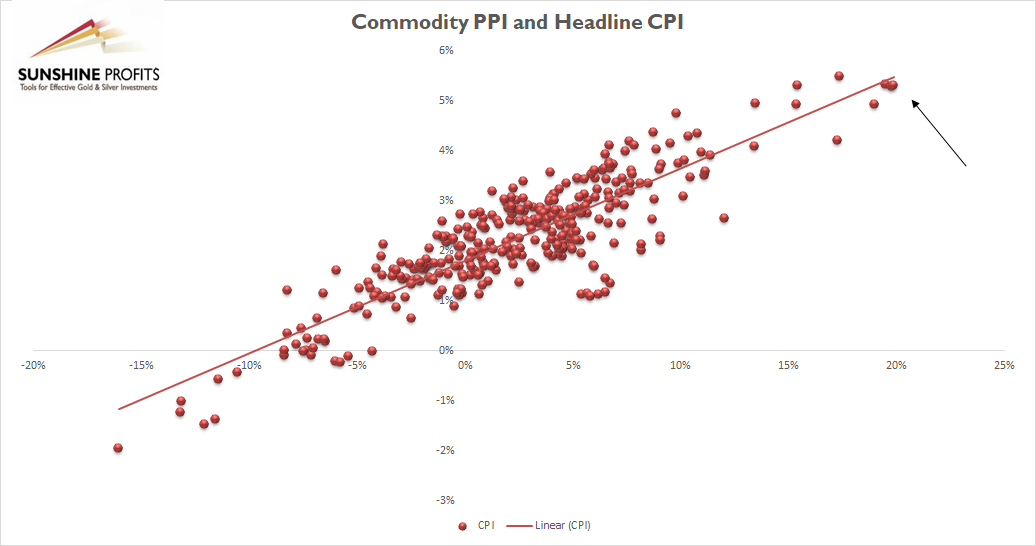

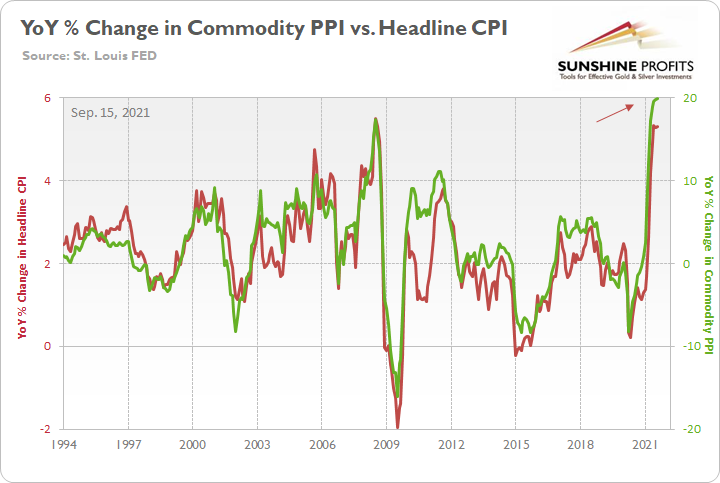

Finally, I’ve mentioned on several occasions that the commodity Producer Price Index (PPI) will likely determine when/if the inflationary momentum subsides. For context, its relationship with the headline Consumer Price Index (CPI) remains right on trend (follow the black arrow below):

And with the headline CPI the most important fundamental data point released today, I wrote on Sep. 15 that “another headline CPI print of roughly 5.25% to 5.75% should hit the wire when the data is released on Oct. 13.

Please see below:

To explain, the green line above tracks the YoY percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline CPI. If you analyze the relationship, you can see that the pair have a close connection.

The bottom line? While the headline CPI remains pinned in the 5%+ range (expected) for now, the metric is still well above the Fed’s 2% annual target. What’s more, with the S&P Goldman Sachs Commodity Index (S&P GSCI) making new highs alongside Brent and WTI, the future impact on the commodity PPI should be material. And if the Fed doesn’t accelerate the liquidity drain and calm commodities’ fervor, we may see a 6% headline CPI print before we see 4%. Conversely, if companies can’t pass through the higher input inflation, the impact on corporate profit margins could upend the general stock market and leave the Fed handcuffed.

As a result, whether the Fed accelerates its taper timeline or margin pressures lead to a stock market correction, both outcomes are profoundly bullish for the U.S. dollar. And with the PMs exhibiting strong negative correlations with the greenback, they could suffer materially as the events unfold.

In conclusion, the PMs were mixed on Oct. 12. However, with the EUR/USD hitting a new 2021 low and the USD Index hitting a new 2021 high, the dollar’s medium-term outlook remains quite bright. Moreover, with the Fed upping the hawkish ante and an accelerated liquidity drain poised to chip away at the PMs, new lows should materialize over the next few months.

Overview of the Upcoming Part of the Decline

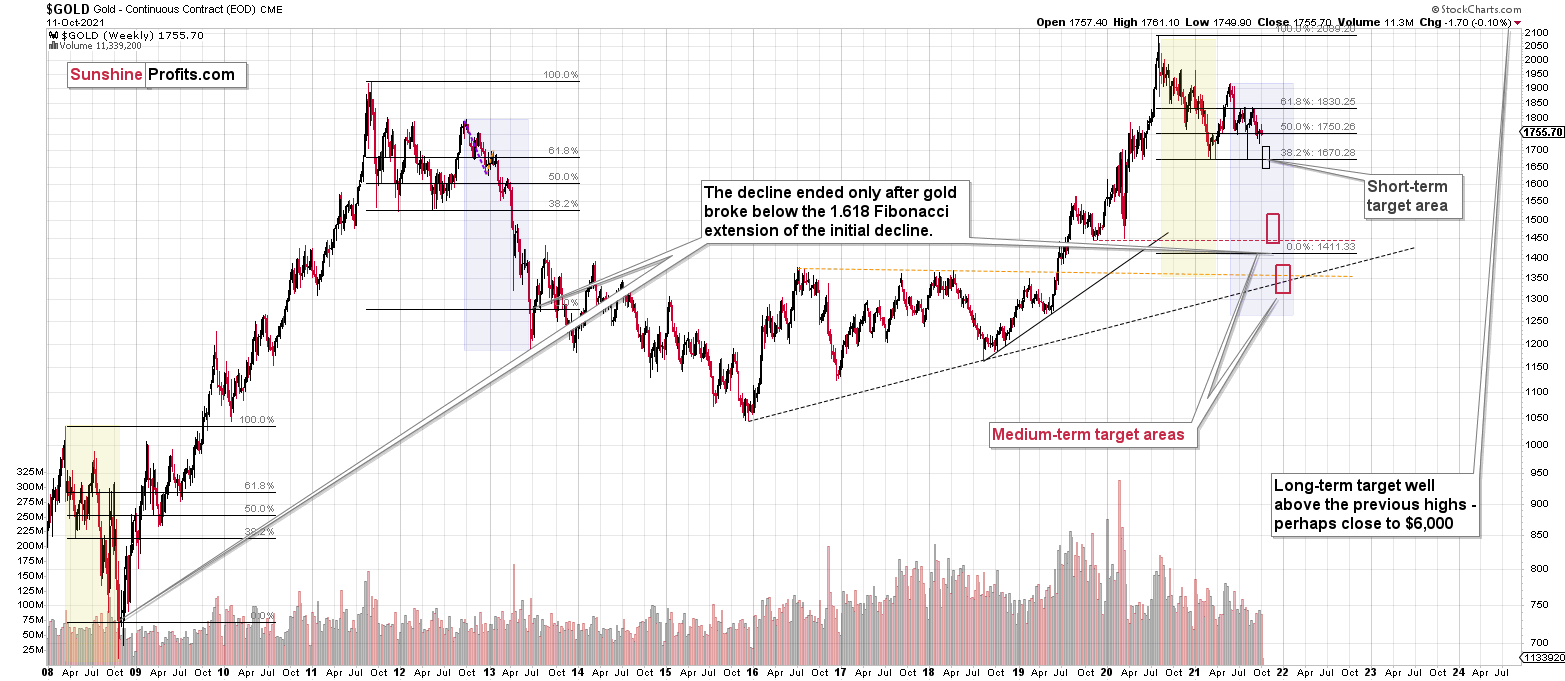

- It seems to me that the current corrective upswing in gold is over, and the next short-term move lower is about to begin. Since it seems to be another short-term move more than it seems to be a continuation of the bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time. Before the next big slide, I will likely prefer to get back to the short position in the junior mining stocks.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the outlook for the precious metals sector remains extremely bearish for the next few months. Since it seems that the PMs are starting another short-term move lower more than it seems that they are continuing their bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

Since juniors have rallied more than silver recently, the recent switch helped us get an extra percent on this trade. Of course, exiting the short position at the short-term bottom and re-entering it now would have been better in dollar terms, but given the enormous strength of the downtrend, exiting the short position completely would have been too risky, in my view. So, it seems that we actually made the most of this corrective upswing from the risk to reward point of view, as we never risked missing out on the big downswing if it had happened, and we saved some capital anyway. And now we can move back to the asset that rallied more and is likely to decline more in the short term.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $35.73; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $16.18; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $32.08; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $41.38

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $12.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief