Inflation accelerated again in September, and gold prices (finally!) reacted positively. Bad news: the rally was short-lived.

Unfortunately, I was right. One month ago, when commenting on the CPI readings for August, I wrote that inflation “doesn’t have to go away anytime soon” and that the economic developments suggest that “inflation isn’t disappearing just yet.” And here we are, one month later, with inflation accelerating again.

Indeed, the latest BLS report on inflation shows that the CPI rose 0.4% in September after increasing 0.3% in August. The core CPI, which excludes food and energy prices, also accelerated to 0.2% in September from 0.1% in the preceding month.

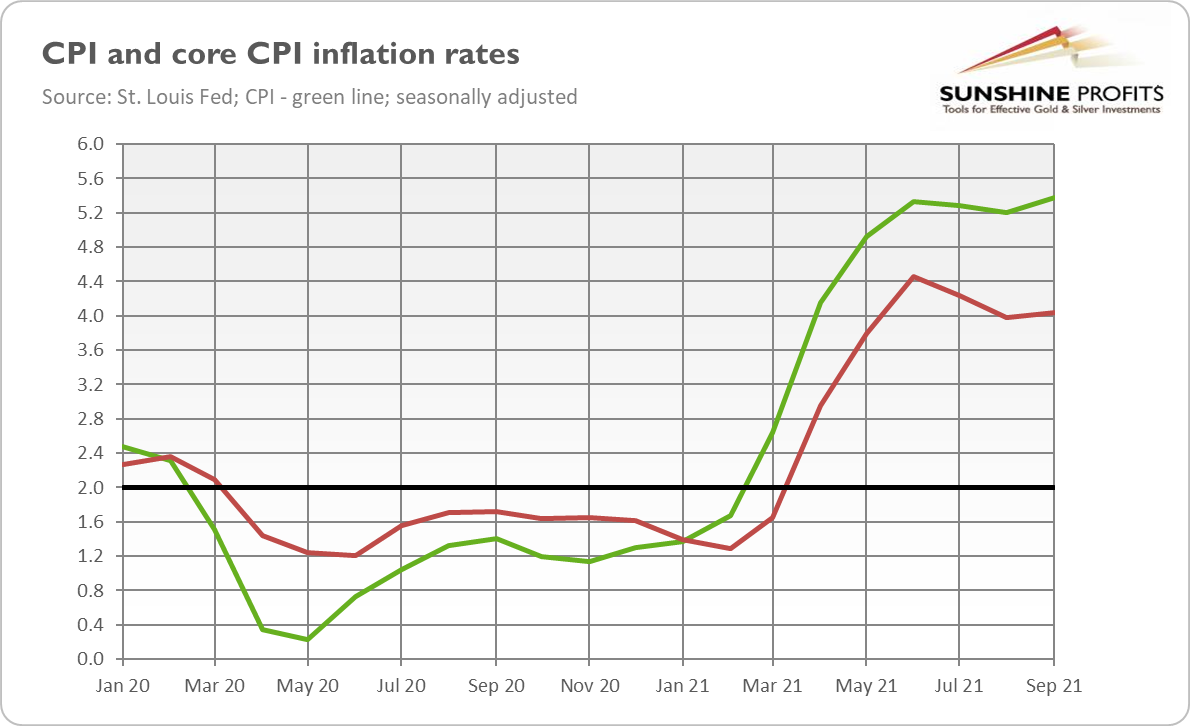

On an annual basis, inflation has also accelerated a bit, as the chart below shows. The overall index soared 5.4% in September, following 5.2% in the previous month (numbers seasonally adjusted). It was the biggest surge since July 2008 – and that was in the midst of the Great Recession. Meanwhile, the core CPI edged up from 3.98% to 4.04%.

So, inflation is not transitory. On the contrary, the chart above shows that the June overall CPI reading functioned as a peak only temporarily. The fact that inflation rebounded to a new high is a final blow to the ‘transitory inflation’ narrative. Therefore, my warnings that inflation doesn’t have to go away anytime soon remain valid.

Actually, my arguments have been strengthened by the recent data. Why? Well, inflation intensified despite the fact that several subindexes declined in September. As we can read in the BLS report:

The index for airline fares continued to fall sharply, decreasing 6.4 percent over the month after falling 9.1 percent in August. The apparel index also decreased in September, declining 1.1 percent over the month after rising 0.4 percent in the previous month. The index for used cars and trucks fell 0.7 percent this month, continuing to decline after it decreased 1.5 percent in August.

So, why didn’t inflation decrease? After all, the mainstream narrative was that inflation was caused by a few categories strongly linked to the pandemic and the reopening that followed. Well, here we are; these categories fell, but inflation rose. The answer to this puzzle is: the Fed officials and the pundits were wrong. Inflation is not limited to just a few categories because of the supply-chain disruptions, it’s a broad-based phenomenon caused by the increase in the broad money supply and in the monetary demand.

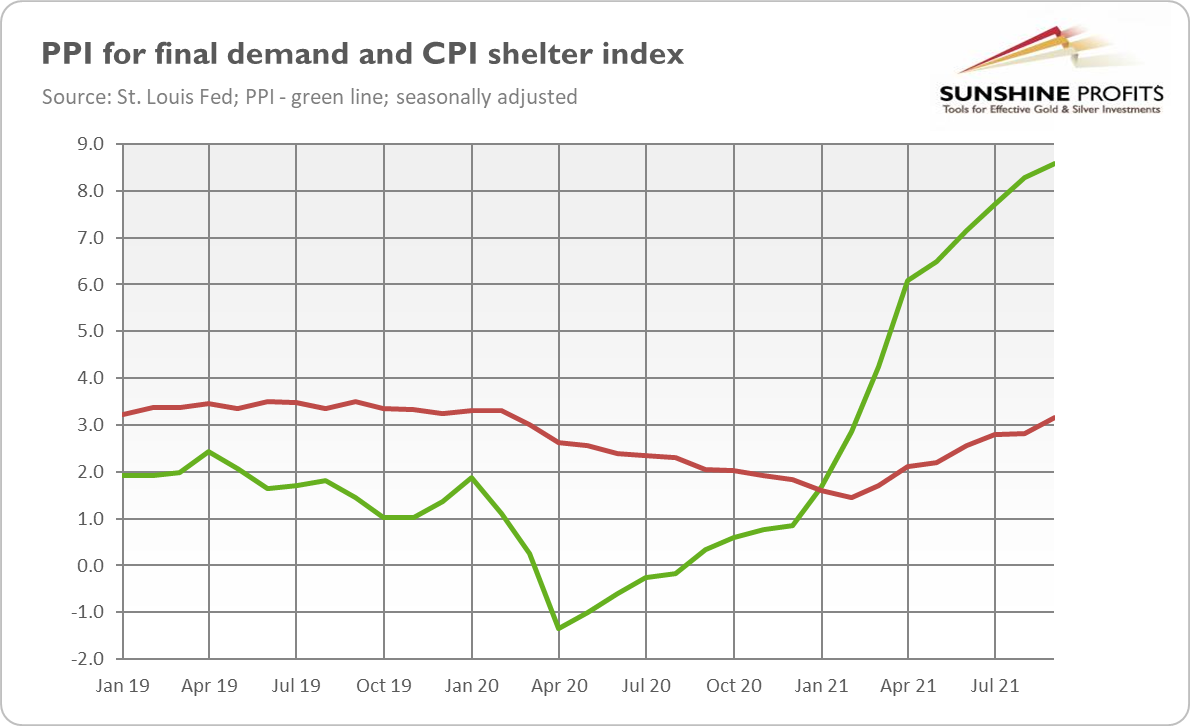

More specifically, the declines in some subindexes were counterweighted by increases in others, in particular by the significant acceleration in the shelter index. As one can see in the chart below, the shelter index jumped 3.2% in September, much faster than the 2.8% observed in August.

This acceleration is perfectly in line with my analyses. In September, I wrote:

Secondly, the index for shelter – the biggest component of the CPI – has been rising gradually since February 2021, and it accelerated from 2.79% in July to 2.82% in August (…) As a reminder, home prices – which are not covered by the CPI – have been surging recently, which should translate into further increases in the index for shelter.

Oh boy, I hate to be right! However, I’m afraid that consumer inflation could increase even further in the near future. Careful examination of the money supply growth implies that the real peak in inflation might occur in Q1 2022. Given the upward trend in home prices, the shelter index could continue its upward march. Last but not least, the surging Producer Price Index (see the chart above) might also add to the inflationary pressure.

Implications for Gold

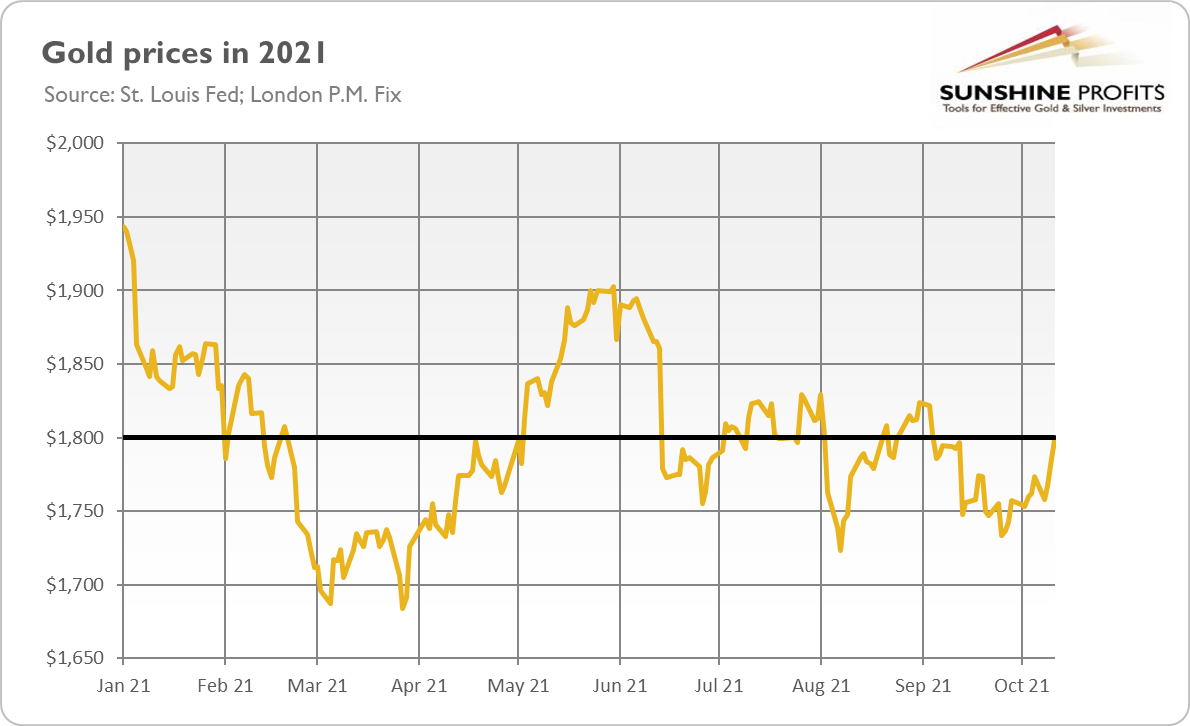

What does the September report on CPI imply for the gold market? Well, the theory remains the same: high inflation should be positive for gold, as it is considered an inflation hedge. Higher inflation also means lower real interest rates and a weaker greenback, which should support gold prices. However, elevated inflation wasn’t supportive for the yellow metal so far, as it strengthened the expectations of the Fed’s tightening cycle, creating downward pressure on gold prices.

All in all, the September report (which showed continuously rising inflationary pressure) made investors rethink the Fed’s transitory argument. These worries pushed gold prices to their resistance level of $1,800 on Thursday, as the chart below shows.

Unfortunately for the gold bulls, any hopes of a more prolonged rally were quickly quenched, as the price of gold declined on Friday. So, it seems that until the Fed tapers its quantitative easing, gold will remain under downward pressure. Nonetheless, when it finally happens, better times may come for gold.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.