Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Introduction

Welcome to the Gold Investment Update. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

This week might have appeared bullish at first (at least if one focuses on day-to-day price swings only), but based on what happened in the final part thereof, we see that the bearish implications for the medium term remain intact, and it could be the case that the short-term rally is over, too.

Let’s start today’s analysis with a recap of what happened last week on the fundamental front.

The Weekly Fundamental Roundup

While the PMs remain elevated and optimism echoes, momentum investors have little use for medium-term technicals or fundamentals. However, with the Fed's hawkish agenda poised to collide with investors' over-positioning, the PMs should suffer mightily when the next bout of volatility erupts.

To explain, this week was filled with Fed officials urging investors to slow their roll. Whether it's Kashkari, Barkin, Waller, Bullard, Bostic, Daly or Powell, they all warned about substantial interest rate increases over the next several months.

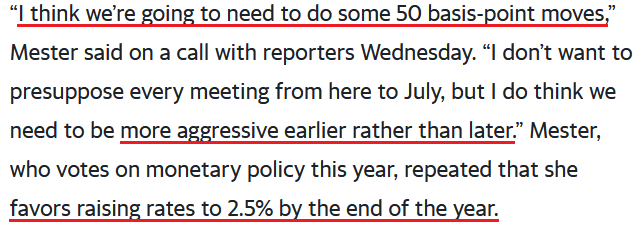

Furthermore, with the chorus expanding later in the week, Cleveland Fed President Loretta Mester said on Mar. 23 that investors should prepare for several rate hikes and quantitative tightening (QT) in the coming months.

“We have told the markets that we would let them know what the balance sheet process would look like,” said Mester. “I think given the situation we’re in and the communications that Chair Powell has already made about the balance-sheet process, I don’t have concerns that that would be destabilizing.”

Moreover, Mester expects 10 rate hikes by the end of 2022 (2.5% = 10 hikes of 0.25%).

Please see below:

Singing a similar tune, Chicago Fed President Charles Evans said on Mar. 24: “We want to be careful, we want to be humble and nimble, and get to neutral before too long – maybe 50 helps, I’m open to that.”

Either way, he added: “I would be comfortable with each meeting increasing by a quarter point,” which implies six more rate hikes (seven in total) by the end of 2022.

Please see below:

As a result, we’ve had nine Fed officials tell investors this week that seven to 12 rate hikes are coming over the next nine months. While the financial markets have taken the hawkish rhetoric in stride, history implies that the fundamental implications contrast with the sanguine sentiment. To explain, I wrote on Mar. 23:

When Fed officials dial up the hawkish rhetoric, their “messaging” is supposed to shift investors’ expectations. As such, the threat of raising interest rates is often as impactful as actually doing it. However, when investors don’t listen, the Fed has to turn the hawkish dial up even more. If history is any indication, a calamity eventually unfolds.

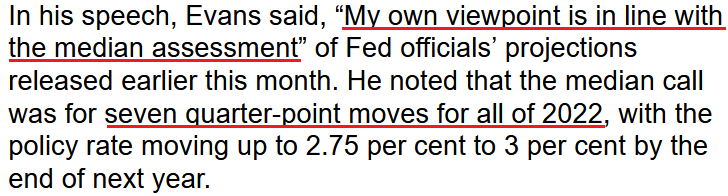

Please see below:

To explain, the blue line above tracks the U.S. federal funds rate, while the various circles and notations above track the global crises that erupted during the Fed’s rate hike cycles. As a result, standard tightening periods often result in immense volatility.

However, with investors refusing to let asset prices fall, they’re forcing the Fed to accelerate its rate hikes to achieve its desired outcome (calm inflation). As such, the next several months could be a rate hike cycle on steroids.

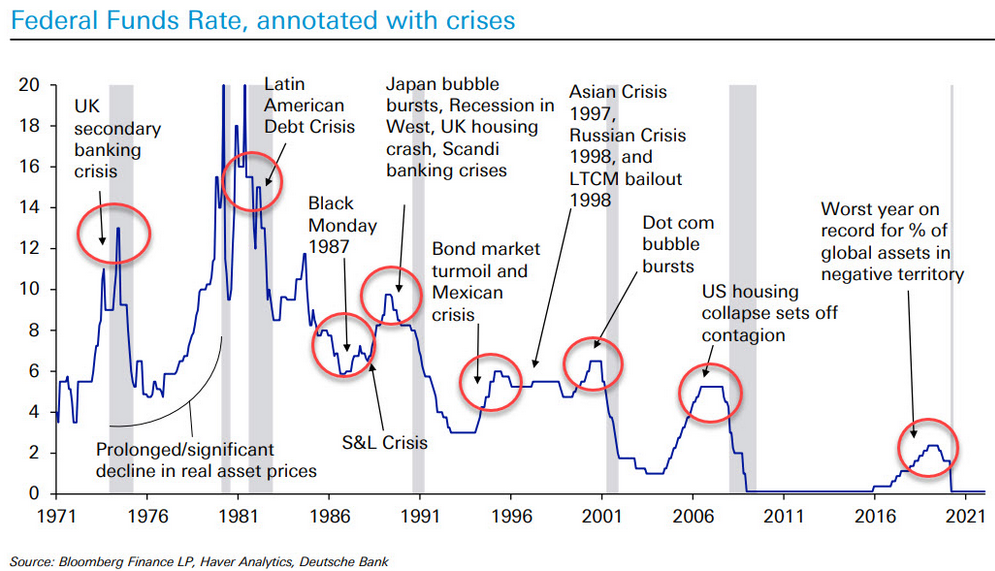

To that point, investors may take solace in the belief that the Fed won’t follow through on its hawkish promises. As such, why not buy the PMs and front-run the Fed’s dovish pivot? However, I’ve warned for months that the U.S. economy remains in solid health. As a result, the probability of a dovish 180 continues to dwindle. For context, new U.S. home sales dipped on Mar. 23, as higher interest rates reduced demand.

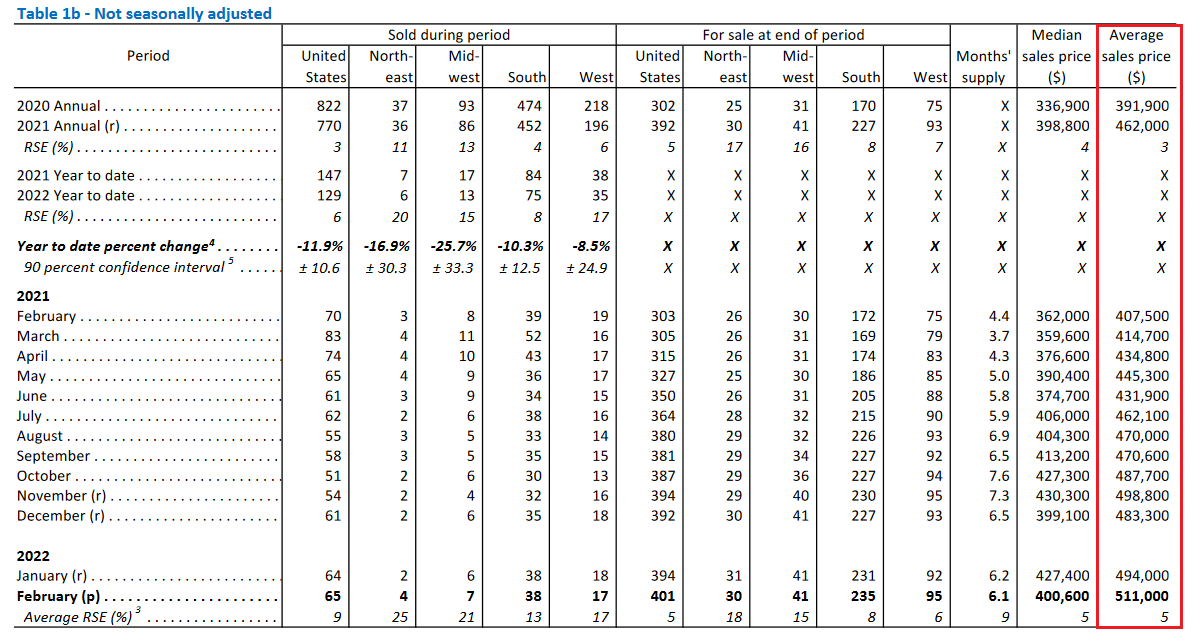

Please see below:

However, the average selling price of a U.S. home increased to an all-time high of $511,000 in February. As a result, shelter has never been more unfordable in the U.S., and lower-for-longer interest rates have been the primary driver of housing inflation.

Please see below:

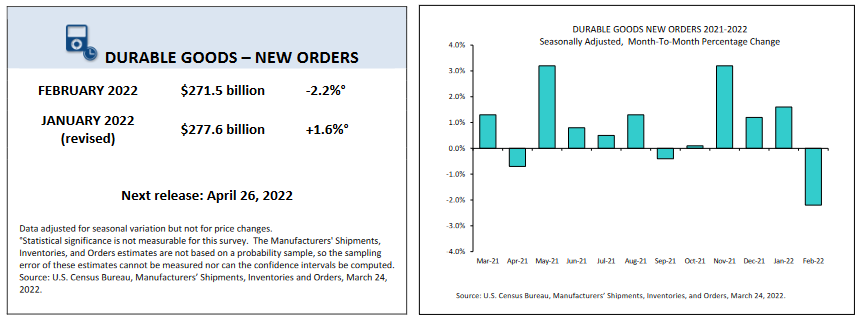

Likewise, U.S. durable goods orders also slipped on Mar. 24. However, the decline followed four-consecutive months of gains.

Please see below:

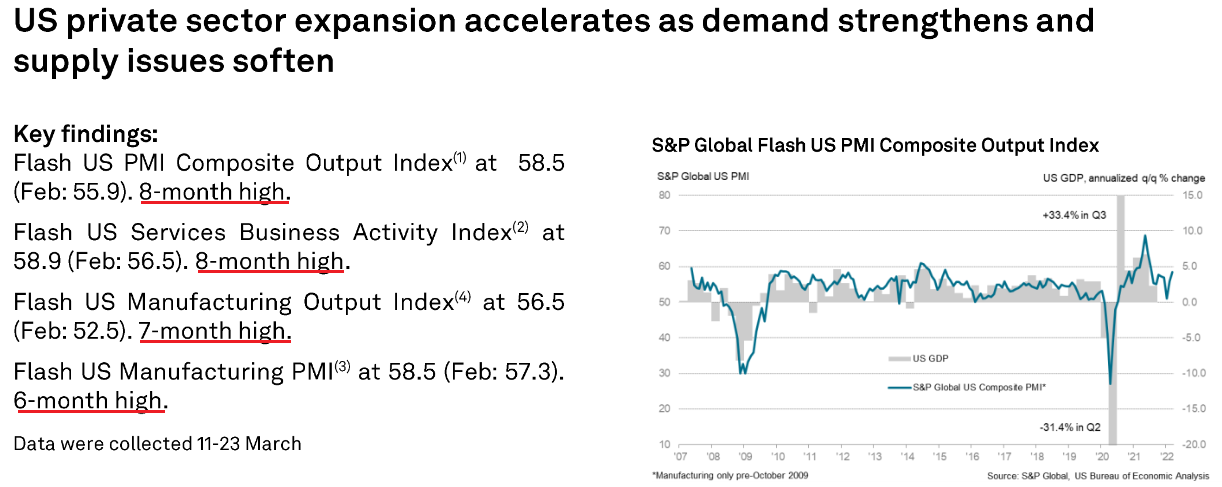

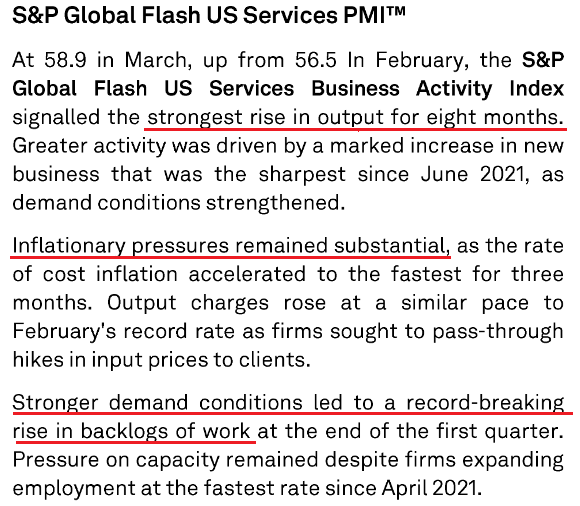

More importantly, though, IHS Markit’s U.S. Composite PMI was the data point we waited for all week. For context, IHS Markit completed its merger with S&P Global, so the data goes by the latter’s name now. However, with the data acting as a leading indicator of U.S. economic activity, the results often predict the direction of future U.S. government data.

What was the verdict? Well, aligning with what I’ve been warning about for many months, S&P Global’s U.S. Composite PMI increased from 55.9 in February to 58.5 in March, as “manufacturers and service providers registered stronger upturns in activity, largely supported by pent-up demand and the easing of COVID-19 restrictions.”

Please see below:

On top of that, the report revealed:

"March data showed a marked rise in new orders at businesses, as an upturn in client demand strengthened for the second month running to reach a nine-month high…. Alongside more favorable domestic demand conditions, new export orders rose at a quicker pace at the end of the first quarter."

In addition:

"The rate of overall job creation was the sharpest since April 2021, as manufacturers and service providers alike recorded steeper upturns in employment."

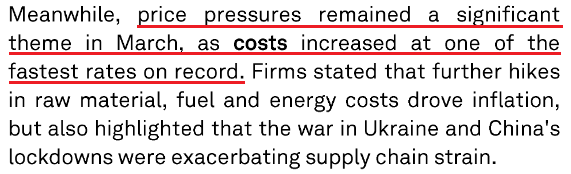

Moreover, with resilient demand colliding with rising commodity prices, the inflationary results still contrast with the Fed's goals.

Please see below:

In addition, while the U.S. service sector has lagged manufacturing due to the restrictions imposed during the spread of the Delta and Omicron variants, many U.S. states have abandoned their COVID-19 policies. As a result, services are gaining momentum and have grabbed the inflationary baton.

Please see below:

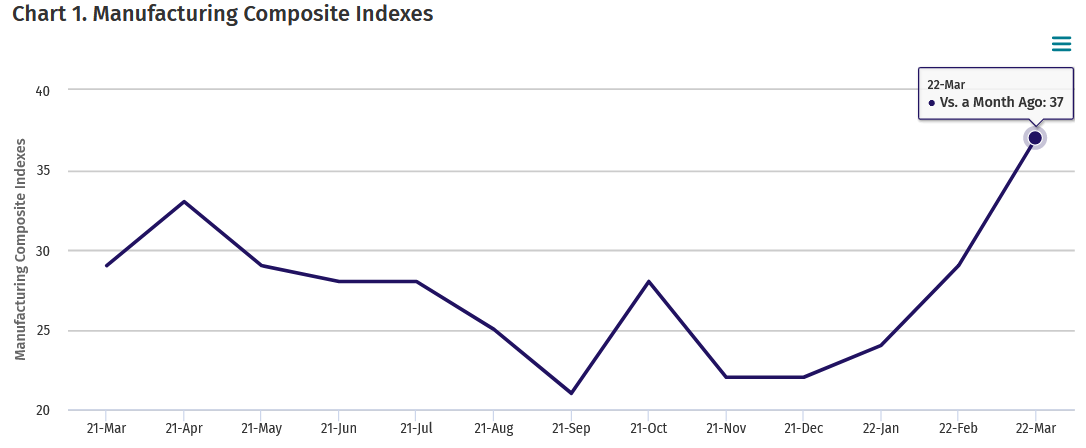

As a result, does this seem like an economic environment where the Fed will refrain from raising interest rates? As further evidence, the Kanas City Fed released its Tenth District Manufacturing Activity Survey on Mar. 24., and with the headline index increasing from 29 in February to 37 in March, the report revealed that “Tenth District manufacturing activity reported record high growth and expectations for future activity remained solid.”

Please see below:

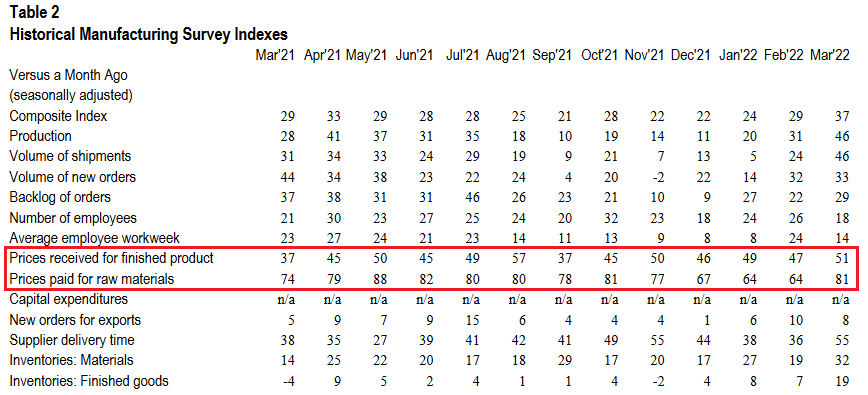

Moreover, the KC Fed’s prices paid index increased from 64 in February to 81 in March, while its prices received index increased from 47 to 51. As a result, inflation trends are not moving in the Fed’s desired direction.

Please see below:

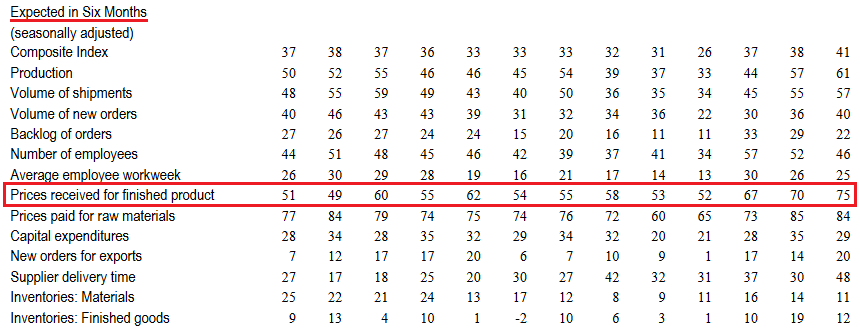

On top of that, not only did current inflationary pressures increase month-over-month (MoM) in March, but the KC Fed’s index of manufacturers’ six-month expectations for prices received increased to an all-time high of 75.

Please see below:

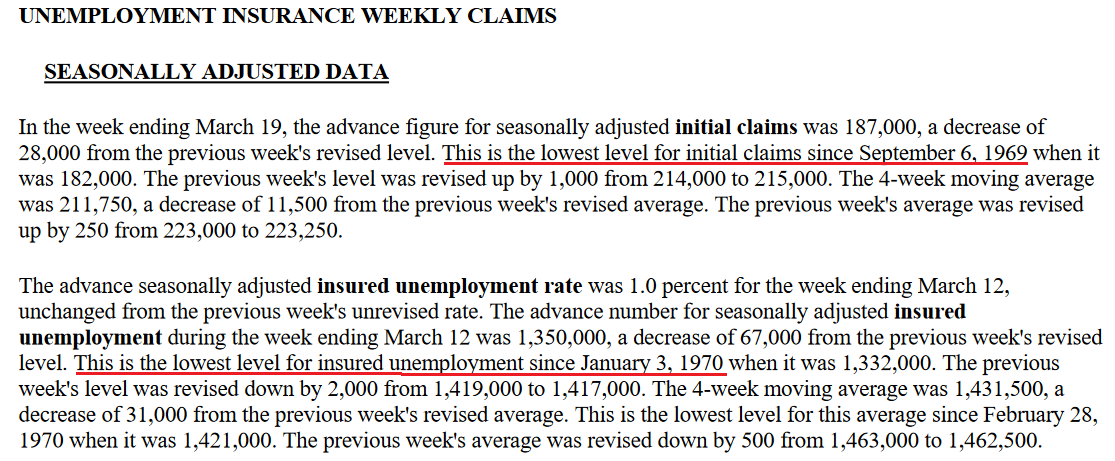

Finally, the U.S. Department of Labor (DOL) released its weekly unemployment data on Mar. 24. With initial unemployment claims hitting a new post-pandemic low of 187,000, the U.S. labor market also meets the Fed’s threshold to raise interest rates.

The bottom line? While some investors think that the Fed is all bark and no bite, the data suggests otherwise. With demand resilient, inflation abundant, unemployment falling, and Fed officials warning of coming rate hikes, the next several months should elicit plenty of hawkish fireworks.

Likewise, the data we received this week shows that inflation is still increasing MoM. Moreover, the PMI report from S&P Global shows that U.S. economic activity has also strengthened MoM. Furthermore, with the warm weather approaching, the summer months should increase consumer mobility and foster stronger economic growth relative to the winter periods. As such, the good news should continue to flow, and that’s bullish for hawkish Fed policy, the USD Index, and U.S. Treasury yields, and bearish for the PMs.

What to Watch for Next Week

With another full slate of U.S. economic data releases next week, the most important ones are as follows:

- Mar. 28: Dallas Fed manufacturing index

Like the data covered above, the Dallas Fed manufacturing index will let us know how output, employment, and inflation are behaving in Texas.

- Mar. 29: The Confidence Board consumer confidence, JOLT job openings, Dallas Fed services index

With interest rates on the rise and inflation still raging, it will be interesting to see how the dynamics have affected consumers' psyches as well as businesses' hiring expectations. Likewise, the data from the Dallas Fed will provide a window into the service sector recovery in Texas.

- Mar. 30: ADP employment, Q4 GDP

While ADP's data is often a poor predictor of U.S. nonfarm payrolls, it still provides valuable insights into private employers' hiring activity. In addition, Q4 GDP is a lagging indicator, and investors are forward-looking. As a result, the data isn't as impactful as the monthly surveys. However, it's still important to monitor.

- Mar. 31: PCE Index, Challenger job cuts, Chicago PMI

The PCE Index is the Fed's primary inflation gauge, so more hot prints will only increase officials' hawkish dispositions. Likewise, Challenger job cuts will let us know how many U.S. citizens have lost their jobs, while the Chicago PMI will let us know how output, employment, and inflation are behaving in Illinois.

- Apr. 1: U.S. nonfarm payrolls, ISM manufacturing PMI

Like the PCE Index, continued outperformance of U.S. nonfarm payrolls will only increase Fed officials' hawkish estimates. In addition, it will be interesting to see if ISM's manufacturing PMI confirms or contrasts with S&P Global's data outlined above.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

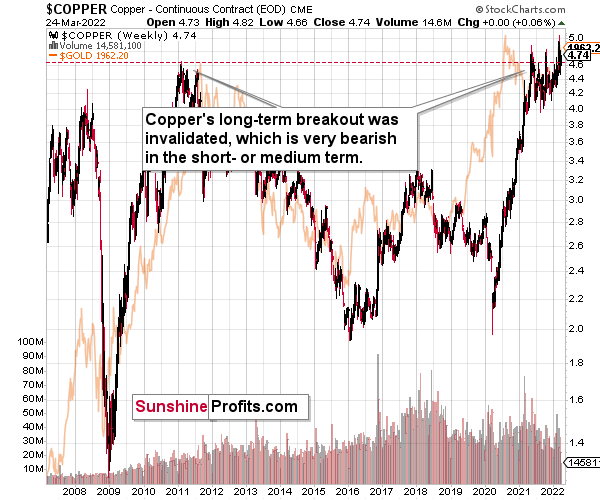

Let’s start today’s technical discussion with a quick check on copper prices.

Copper recently invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

Yes, it might be difficult to visualize this kind of move given the recent powerful upswing, but please note that it’s in perfect tune with the previous patterns.

The interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged. The GDXJ was not trading at the time, so we’ll have to use a different proxy to see what this part of the mining stock sector did.

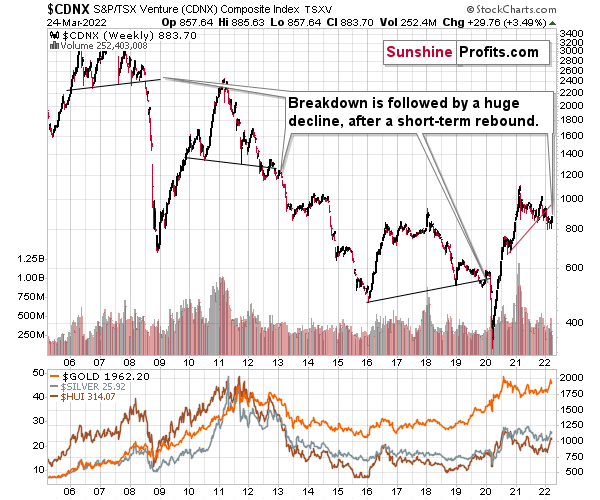

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

In fact, the outlook for the next few days is rather unclear, as different groups of investors can interpret yesterday’s developments differently. However, once the dust settles, the precious metals sector is likely to go down significantly.

What happened during yesterday’s session?

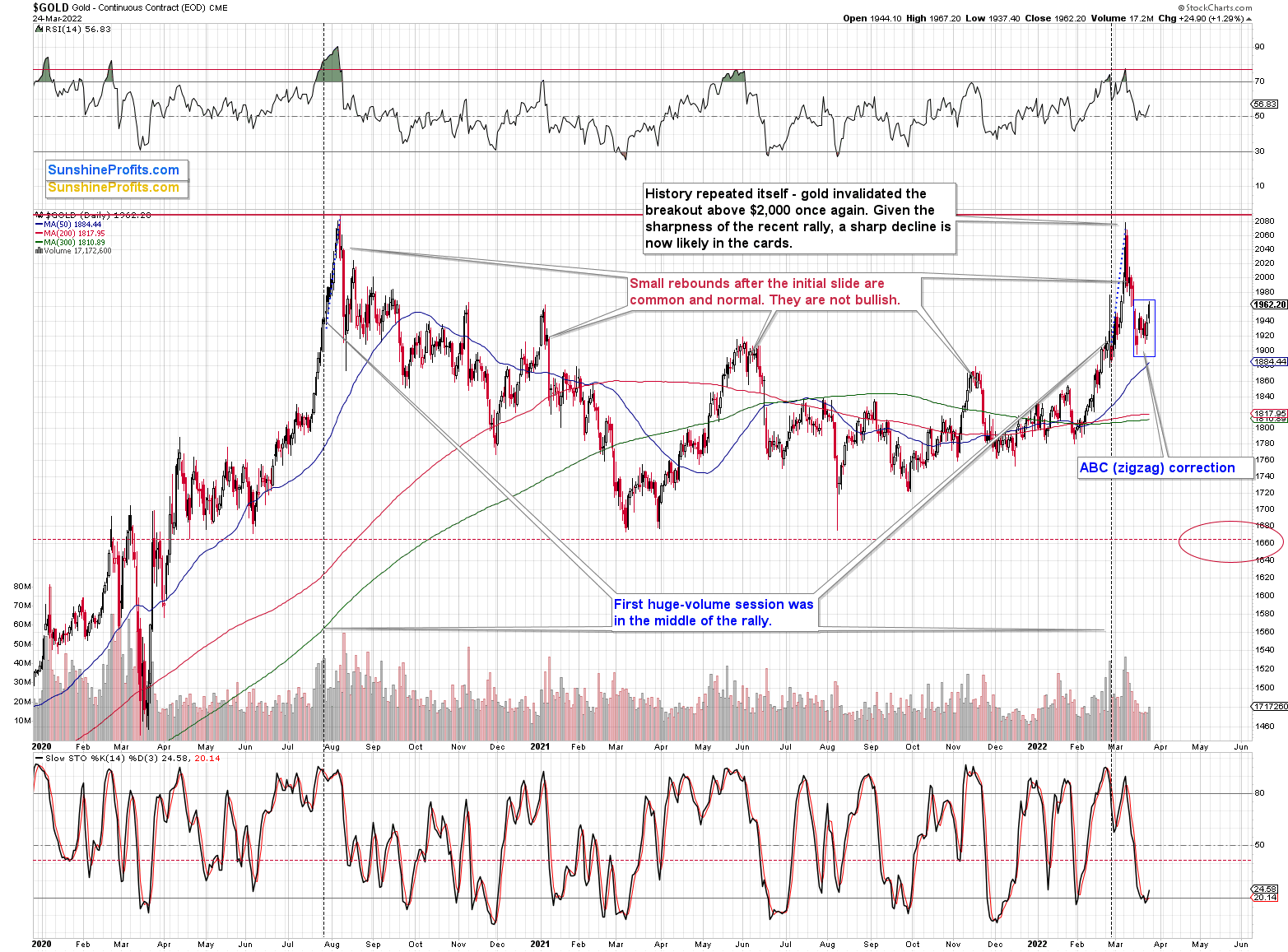

The gold price moved higher, but that was well within what one might consider normal during corrections. In fact, gold appears to have formed a classic ABC (zigzag) pattern. This – along with yesterday’s outperformance of silver and underperformance of mining stocks – is an indication that the big decline is about to continue.

Please note that gold is currently behaving similarly to what it did when it previously invalidated a breakout above $2,000 in 2020. It paused after the first sizable decline, then declined much more, and then corrected more visibly. The corrective upswing was not that visible in the case of the RSI indicator – and we see the same thing right now.

Moreover, please note that while yesterday’s $24.90 rally in gold might have appeared significant, it was not confirmed by significant volume. The latter was relatively low, even though it was slightly higher than we had seen in the previous few days. This indicates that the most recent move higher was just a correction.

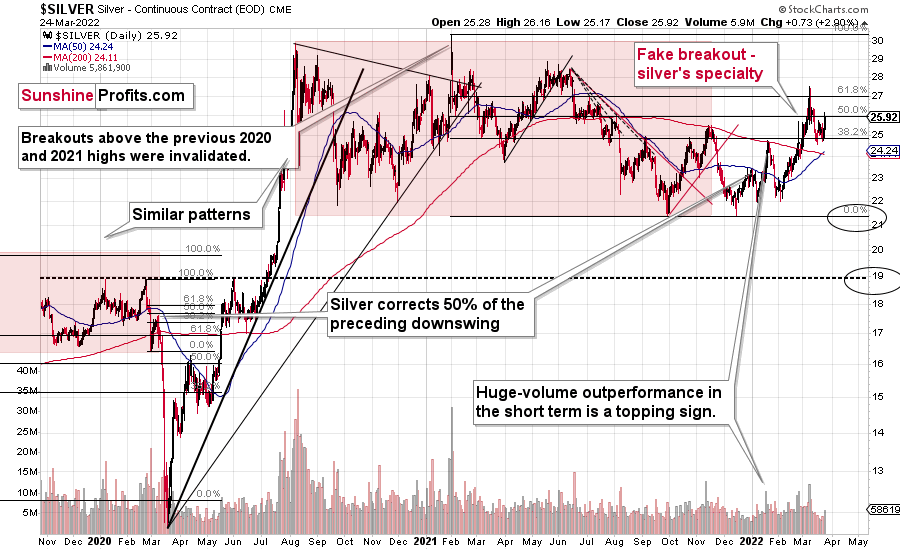

Besides, silver’s yesterday’s outperformance and miners’ underperformance confirm that the top is already in. Let’s take a look at the former.

Silver was up by almost 3% yesterday, while gold was up by only 1.29%. Silver clearly outperformed.

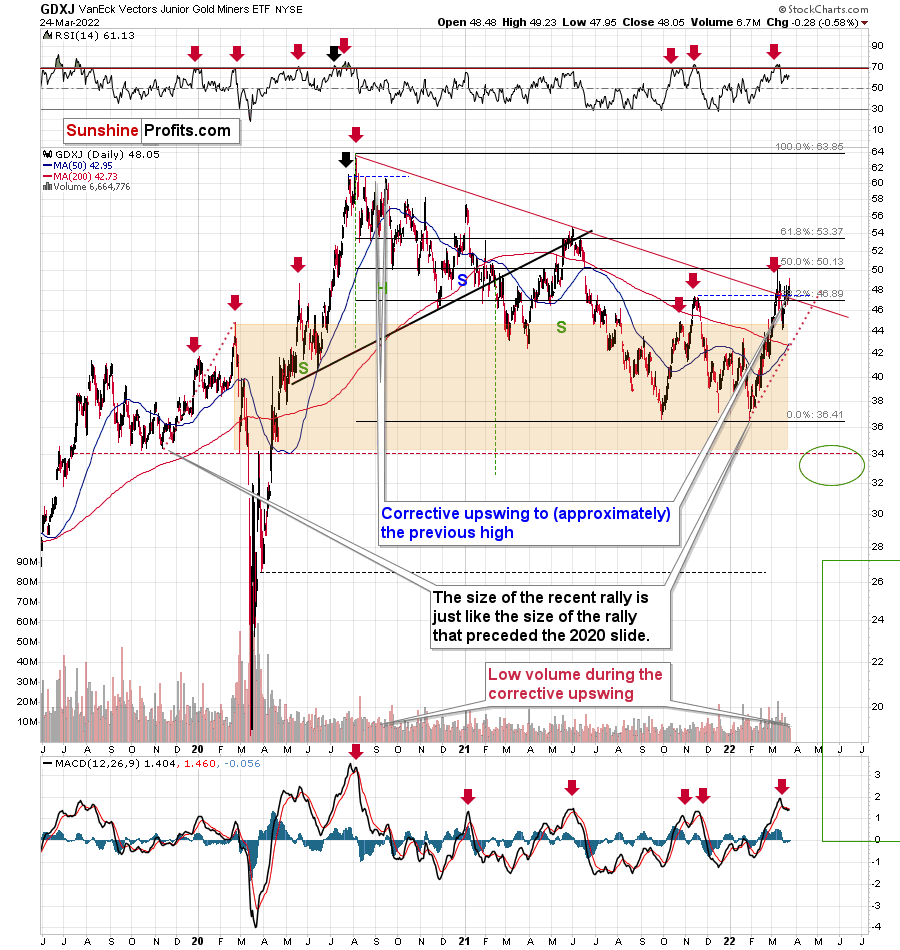

Conversely, mining stocks were very weak.

The GDXJ ETF actually declined yesterday (by 0.58%) despite gold’s gains. This weakness – along with silver’s immediate-term strength – is what one tends to see at the tops in the precious metals sector. Consequently, it seems that we have just seen the short-term top.

The sell signal from the MACD indicator clearly confirms that. These signals were highly effective at detecting major short-term tops, and the fact that we just saw one makes the outlook for mining stocks even more bearish.

Based on the above, the small breakout above the declining red resistance line is likely to be invalidated, and much lower GDXJ prices are likely to follow.

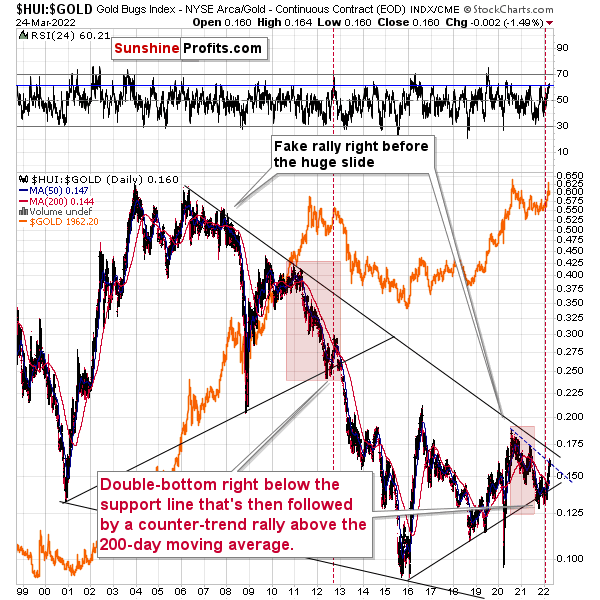

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top. In other words, my yesterday’s comments on the chart below remain up-to-date.

Gold stocks (GDX, GDXJ, and HUI Index) have recently been quite strong relative to gold. OK, but is this necessarily bullish? It might be, until one considers the fact that we saw the same thing at the 2012 top! This changes everything, and it does so, because the links between now and that top are almost everywhere: in gold, in silver, in gold stocks, and even in their ratios.

It is the gold stocks to gold ratio that I would like to start with today. That’s the flagship proxy for the relationship between these two markets.

As it turns out, gold stocks to gold ratio is behaving almost identically as it was behaving at the 2012 top in the precious metals sector.

In both cases, the ratio moved below the rising medium-term support line, then formed a double-bottom below the line, and invalidated the breakdown, which resulted in a counter-trend rally. The rally ended shortly after the ratio moved above its 200-day moving average (marked in red). That’s what happened recently. What happened next in 2012? The decline not only continued – it accelerated!

Consequently, the recent action in the ratio is not really bullish. In other words, the fact that gold stocks were recently (in the short run only) strong relative to gold doesn’t make the medium-term outlook for the precious metals sector bullish. However, it remains bearish.

Interestingly, the ratio itself moved to its declining resistance line, indicating that the corrective upswing might already be over or almost over. We get the same indication from the RSI indicator. It’s not above 70, but in the case of most local tops, the RSI didn’t have to move above 70. It just moved to more or less the same levels – I marked it with a horizontal blue line.

The above is actually a confirmation of the analogy that is visible directly in all three key components of the precious metals sector: gold, silver, and mining stocks.

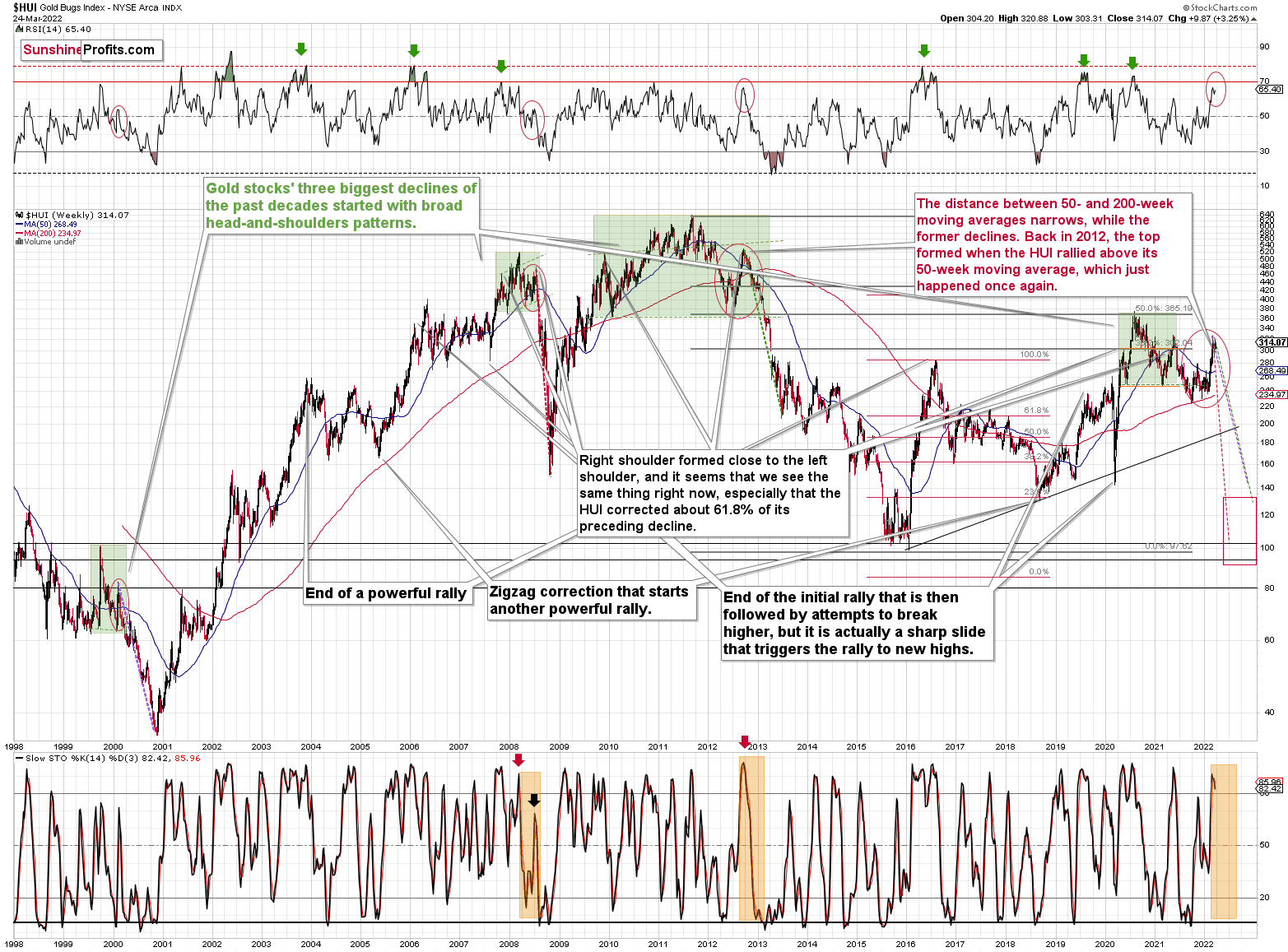

Starting with the latter, the situation remains in tune with how I described it last week:

If you look at the areas marked with red circles (especially now, 2012/2013, and 2008), you’ll notice that they are very similar. These are the sizable short-term rallies that we saw after / in the final parts of the broad head-and-shoulders patterns.

The moves were quite sizable – the 2012 rally was even bigger than the current one, even though there was no war in Europe at that time.

Based on how broad the pattern is and the self-similarity present in gold, it seems that the analogy to what happened in 2012 is most important right now.

Looking at the moving averages, we see that the 50-week moving average (blue) and 200-week moving average (red) performed quite specifically in late 2012, and we see the same thing this year.

The distance between 50- and 200-week moving averages is currently narrowing, while the former is declining. Back in 2012, the top formed when the HUI rallied above its 50-week moving average, which just happened once again.

The RSI indicator (above the price chart), based on the HUI Index’s weekly chart, provides us with another confirmation of the analogy, and the same goes for the stochastic indicator (below the price chart). The former is just below the 70 level – exactly what we saw at the 2012 top, and the latter is above 90 – again, something that we saw at the 2012 top.

As history tends to rhyme, gold stocks are likely to slide, similarly to how they declined in 2012 and 2013.

Still, if the general stock market slides, and that appears likely for the following weeks and months, then we might have a decline that’s actually similar to what happened in 2008. Back then, gold stocks declined profoundly, and they have done so very quickly.

The dashed lines that start from the recent prices are copy-paste versions of the previous declines that started from the final medium-term tops. If the decline is as sharp and as big as what we saw in 2008, gold stocks would be likely to decline sharply, approximately to their 2016 low. If the decline is more moderate, then they could decline “only” to 120-150 or so. Either way, the implications are very, very, very bearish for the following weeks.

Also, based on last and this week’s performance, we saw a fresh sell signal from the weekly stochastic indicator, which (unlike its 4-hour version) is quite efficient. This is a very bearish development for the medium term. After all, the last two times we saw this signal, were at the 2021 and 2020 tops.

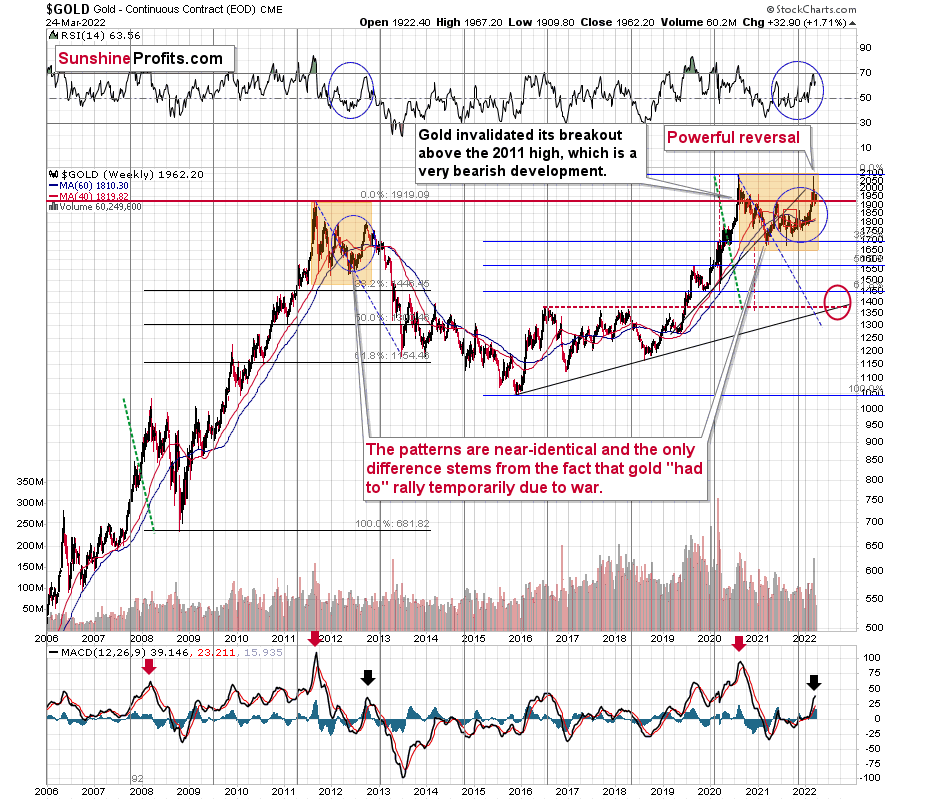

Having said that, let’s take a look at the analogy present in gold.

In short, the analogy between 2012 and 2022 remains up-to-date, with one important difference. This time, gold was practically forced to rally due to the safe-haven demand that war triggered. However, as it’s often the case with geopolitical events, their impact is likely to be temporary.

The RSI based on gold’s weekly chart is now above its 2021 high and very close to the 70 level, which is in tune with what we saw in 2012 (at the top) and it’s a major sell signal on its own.

The move higher in the MACD indicator (bottom of the above chart) is also noticeable, which is in tune with what we saw at the 2012 top.

This week is not over yet, but the nature of this week’s trading already seems clear. Namely, we’re likely to see a powerful weekly shooting star reversal candlestick. This is a very bearish indication for the following weeks and months.

Even the moving averages (40- and 60-week ones) are trading close to each other, just like what we saw in late 2012. Back then, they marked the target for the very initial decline from the top.

If this part of history were to be repeated, we could see some sort of short-term rebound (nothing major, though) after gold declines to about $1,800. This would be in tune with the analogy to 2003, when gold gave back all the war-based premium.

This would likely have a devastating impact on the prices of mining stocks. The latter would also likely suffer when the general stock market slides, and it seems that we won’t have to wait too long for that either.

Before moving to silver, please note that the very bearish implications of the recent huge-volume reversal of epic size remain up-to-date.

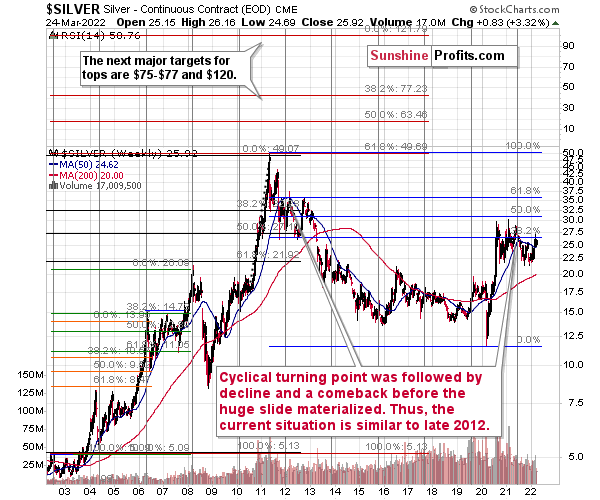

Silver’s 2012-2022 analogy looks like this:

At the turn of the year in 2011/2012, there was a cyclical turning point in silver, and we saw a sizable decline in silver shortly thereafter. The same happened in 2021, after silver’s cyclical turning point.

Back in 2012, silver declined more or less to its previous lows and then rallied back up, but it didn’t reach its previous top. It more or less rallied to its 50-week moving average and then by about the same amount before topping.

Recently, we saw exactly the same thing. After the initial decline, silver bottomed close to its previous lows, and most recently it rallied to its 50-week moving average and then by about the same amount before topping below the previous high.

Thus, the situation is just like what it was during the 2012 top in all three key components of the precious metals sector: gold, silver, and mining stocks.

We have a situation in the general stock market that points to an even quicker slide than what we saw in 2012-2013. If stocks slide sharply and significantly just like in 2008, then the same fate may await the precious metals sector – just like in 2008. In this case, silver and mining stocks (in particular, junior mining stocks) would be likely to fall in a spectacular manner.

All the above was confirmed by silver’s invalidation of its breakout above the late-2021 high. Not only has the medium-term outlook been bearish, but now the short-term outlook for silver is bearish too.

So, the link between the current situation and the two most bearish periods in precious metals’ recent history remains up-to-date (with 2012-2013 and 2008). The link with the latter is primarily based on the likelihood of interest rate hikes, how overvalued the general stock market has become from the medium-term point of view, and the technical signs from the latter.

Let’s take a brief look at the stock market indices.

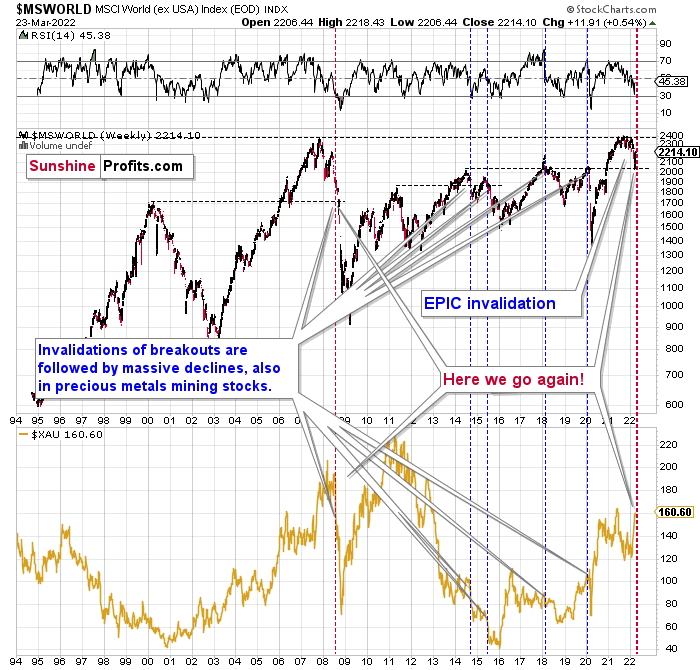

The technical picture in the case of world stocks remains extremely bearish, and my previous comments on it remain up-to-date:

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so and… they failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium- and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not a “logarithmic” scale. You probably still remember how significant and painful (if you were long that is) the decline at the beginning of 2020 was.

Now, all those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

What does it mean? It means that it is time to get out of the short position in mining stocks to get a few extra dollars from immediate-term trades that might be risky. The possibility that the omicron variant of COVID makes vaccination ineffective is too great to be ignored as well. If that happens, we might see 2020 all over again – to some extent. In this environment, it looks like the situation is “pennies to the upside and dollars to the downside” for mining stocks. Perhaps tens of dollars to the downside… You have been warned.

World stocks have declined to their previous highs, and when something similar happened in 2008, it meant that both stocks and gold and silver mining stocks (lower part of the chart) were about to slide much further. In particular, that’s when the corrective upswing in the miners ended and the huge slide started. The implications for mining stocks are extremely bearish.

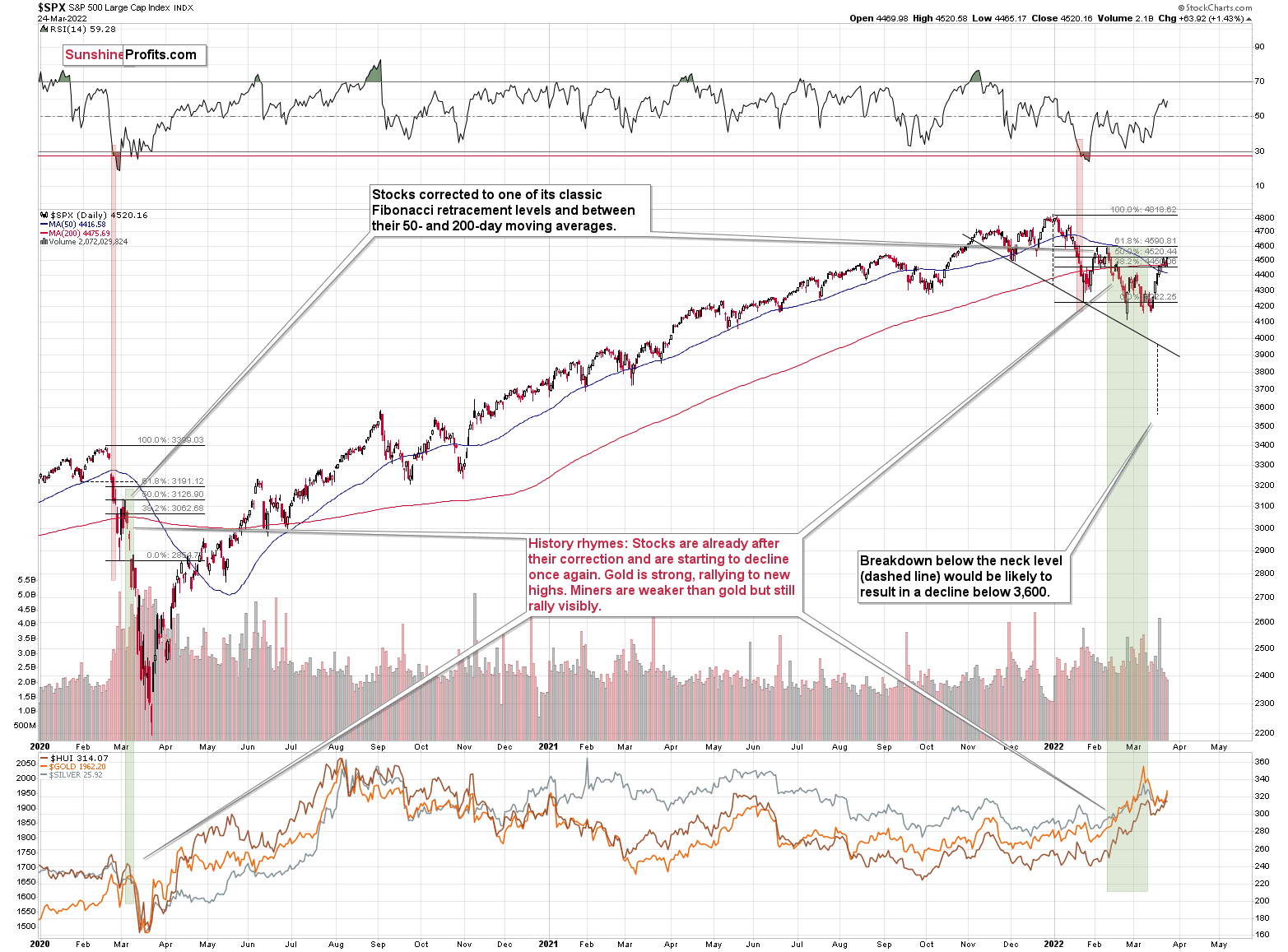

Here's how the situation currently looks from the U.S. point of view. The chart below features the S&P 500 futures.

The key thing about the above chart is that what we’ve seen this year is the biggest decline since 2020 (I’m not counting the last several days), and the size of the recent slide is comparable to what we saw as the initial wave down in 2020. If these moves are analogous, the recent rebound and sideways trend are normal – there was one in early 2020 too (the correction that is). This also means that a much bigger decline is likely in the cards in the coming weeks.

Stocks have not yet declined significantly below the previous lows, but it seems that they are on the verge of doing so (the rates are rising and they are about to rise much more based on the fact that inflation has gotten very political). If 2020 could teach us anything, it would be that the following slide could be huge and sharp.

The volatility won’t necessarily match the 2020 one, but the decline is likely to be significant, anyway.

Let’s keep in mind that interest rates are likely to go higher, and that sanctions on Russia could impact global trade in multiple ways, thus negatively affecting the stock market.

This would be likely to have a very negative impact on the precious metals market, in particular on junior mining stocks (initially) and silver (a bit later).

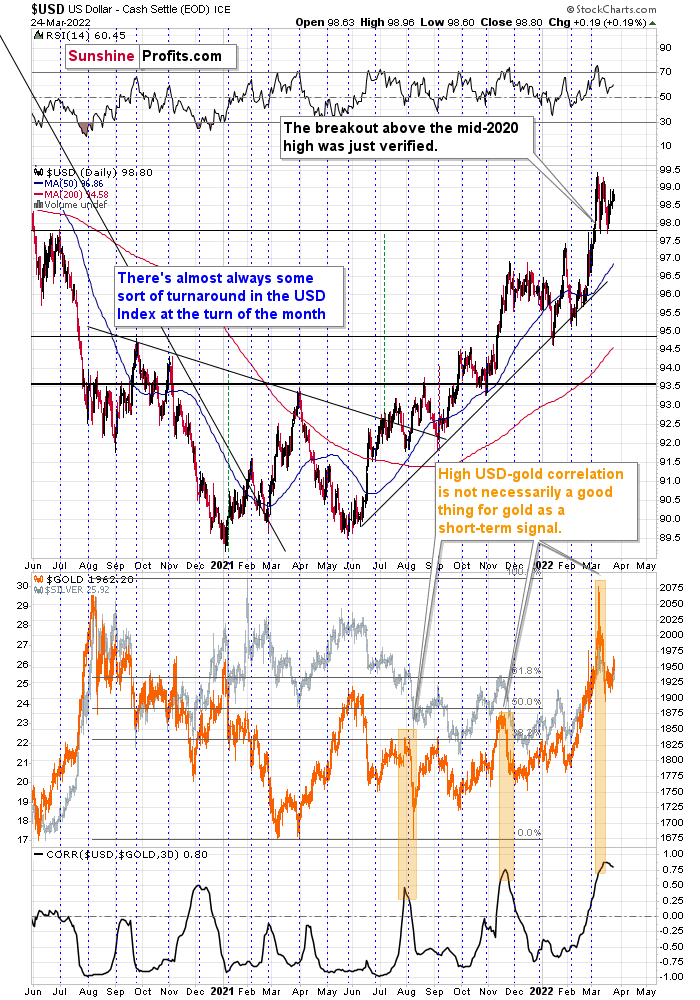

The USD Index is after a breakout above its mid-2020 high and two verifications of this breakout. This means that it appears ready to soar once again, likely moving into three digits within the next few weeks.

As the war-based premiums on gold and the USD appear to be waning, a high-interest-rate-driven rally in the USD is likely to trigger declines in gold. The correlation between these two assets started to decline, and when that happened during the last two cases (marked with orange), gold declined profoundly shortly thereafter.

All in all, technicals favor a decline in the precious metals sector sooner rather than later.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

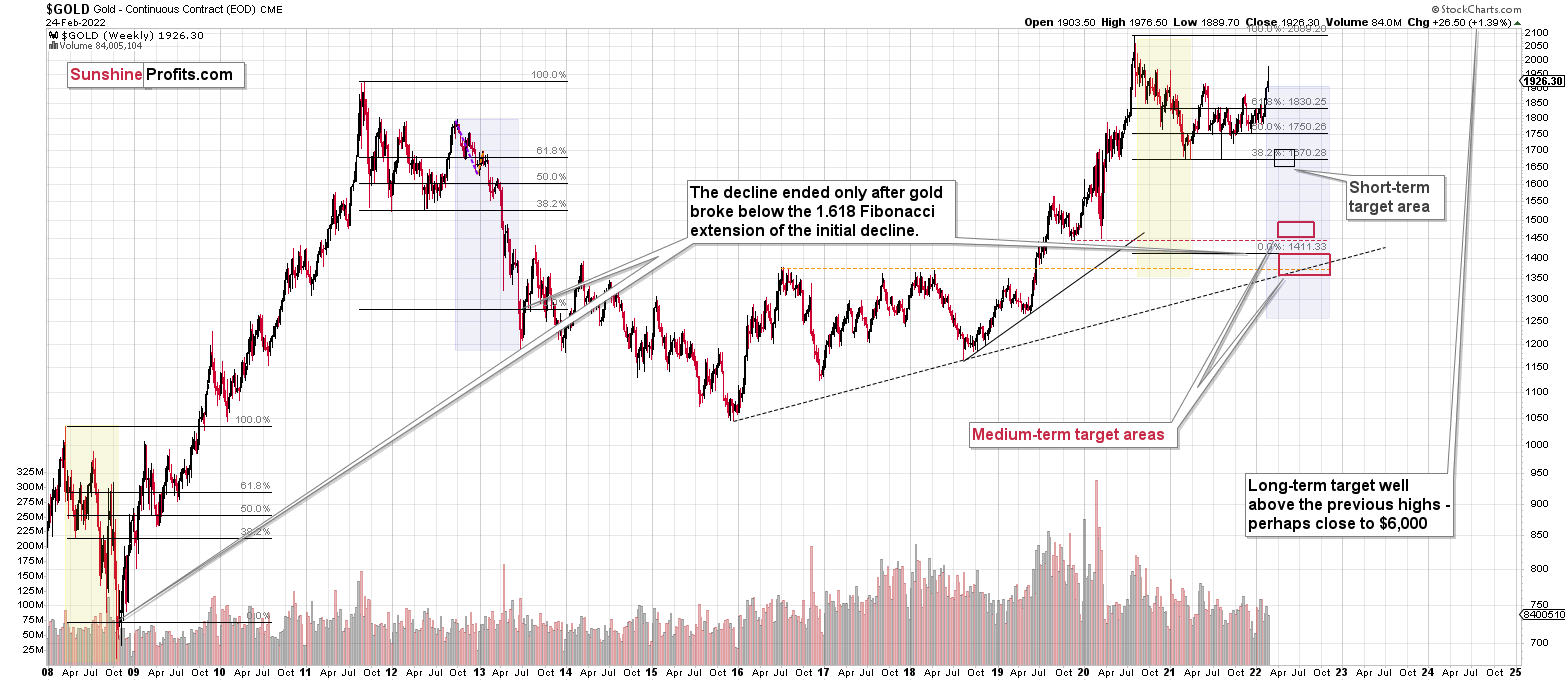

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, despite the recent rally in gold, the outlook for junior mining stocks remains exactly as I described previously.

Crude oil’s extreme outperformance, the stock market’s weakness, and critical medium-term resistance levels reached by gold (all-time high!) and junior mining stocks, all indicate that the tops are at hand or have just formed. The huge-volume reversals in gold and (especially) mining stocks, along with silver’s short-term outperformance, all point to lower precious metals prices in the following days/weeks. It seems that the top is in.

Investing and trading are difficult. If it was easy, most people would be making money – and they’re not. Right now, it’s most difficult to ignore the urge to “run for cover” if you physically don’t have to. The markets move on “buy the rumor and sell the fact.” This repeats over and over again in many (all?) markets, and we have direct analogies to similar situations in gold itself. Junior miners are likely to decline the most, also based on the massive declines that are likely to take place (in fact, they have already started) in the stock markets.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more in the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief