Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's Gold Investment Update. Predicated on last week’s price moves,

our most recently featured outlook remains the same as the price moves align with our

expectations. On that account, there are parts of the previous analysis that didn’t change at all

in the earlier days, which will be written in italics.

The key thing is that the current lack of major action is in perfect tune with what happened in 2013, right before the biggest slide, so it can be viewed as the calm before the storm.

Let’s start today’s analysis with a recap of what recently happened on the fundamental front.

The Weekly Fundamental Roundup

With last week’s bullish march built on hope and an uninformed understanding of fundamental realities, calls for bottoms have shifted from whispers to shouts. Moreover, with the consensus expecting the S&P 500 to continue its ascent, a realization would also be bullish for gold, silver, and mining stocks.

However, the narrative is much more semblance than substance. Since financial markets are all about the rate of change (less bad is good), “peak inflation” is seen as a green light to buy risky assets and position for a dovish pivot. In contrast, I’ve warned on numerous occasions that reducing the pace of inflation is easy, but normalizing inflation to 2% is extremely difficult. Therefore, while the consensus expects smooth sailing ahead, treacherous waters should capsize investors’ optimism over the medium term.

To explain, I warned on Aug. 9 that a material recession should plague the U.S. economy regardless of the Fed’s response to the current inflation fight. I wrote:

A “stop-go approach” means the Fed cuts interest rates and then has to raise them once again. However, the mistakes of the past highlight how the Fed’s inflation gambit ends the same either way.

Please see below:

Thus, doesn’t that sound familiar?

- We have politicians redefining the definition of a recession while investors clamor for a dovish pivot.

- The slightest drop in commodity prices, inflation expectations or the Consumer Price Index (CPI) is heralded as “peak inflation,” and therefore, the Fed can ease.

As such, Fed Chairman Jerome Powell can follow Volcker's path and raise the U.S. federal funds rate (FFR) to capsize inflation. Or, he can follow Burns' path and implement a "stop-go approach." However, history shows that both paths end with a much higher FFR (…).

The common denominator is that inflation didn't (and doesn't) magically disappear. In reality, economic pain is needed to reduce the pricing pressures. Thus, while I've stated it several times, if Powell chooses the Burns' path, the culminating recession will be much worse than if he chooses the Volcker path.

To that point, Richmond Fed President Thomas Barkin said on Aug. 12: “I’d like to see a period of sustained inflation under control. Until we do that, I think we are going to just have to continue to move rates into restrictive territory.”

He added:

“I want to see real rates across the curve sustained in positive territory. I think we are on the brink of moving real rates into positive territory across the curve. We need to sustain it there. And we need to follow through on some of the expectations that are out there in terms of the rate path in order to keep it there.”

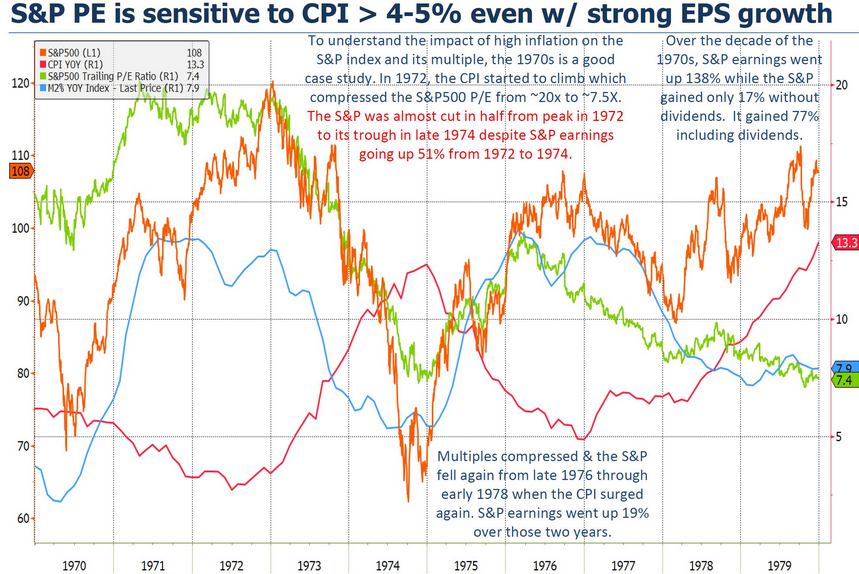

Therefore, while I’ve long warned that the Fed needs higher real interest rates to curb inflation, a realization is profoundly bearish for the PMs and the S&P 500. Furthermore, Barkin highlighted the importance of avoiding the 1974 debacle.

Please see below:

Thus, Barkin understands the pitfalls of the "stop-go approach." However, it's currently priced into the financial markets. Fed funds futures have the central bank cutting interest rates in July 2023. In contrast, note what Barkin said:

"If you can get to our target for a number of months, that's what we would like to see."

As a result, inflation will have to decline to 2% and stay there for "a number of months" for Barkin to consider it appropriate to ease. Yet, investors expect the Fed to ease in ~10 months. Moreover, with inflation likely to prove much longer-lasting than the Fed and investors expect, the latter's expectations are extremely out of touch with reality.

As further evidence, San Francisco Fed President Mary Daly said on Aug. 11:

“We don't want financial conditions to relax. I really do want those to remain tight and tightening as we go (…). I still think 50 basis points is the case [in September], but I am open to 75 should the data evolve differently.”

In addition, she also pushed back on the notion that the Fed will ease anytime soon.

Please see below:

Therefore, while asset prices have re-rated higher recently, investors' misunderstanding of inflation and the economic suffering required to tame the beast have fueled the recent rallies. However, I noted on Aug. 9 that since history shows that both paths end with a much higher FFR, prophecies of a new bull market are extremely misguided.

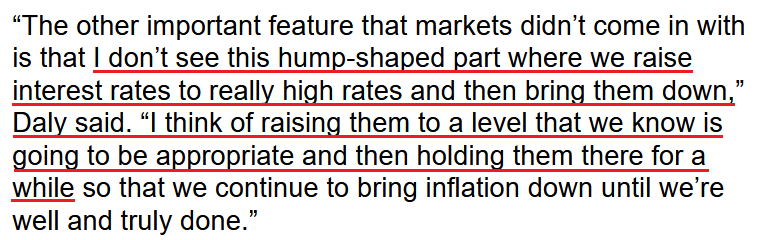

For example, after the FFR peaked in July 1973, the Fed cut interest rates to help support a weakening U.S. economy. However, with inflation still unanchored, the policy mistake led to an even higher FFR during the depths of the recession (the gray area).

Please see below:

Likewise, the S&P 500 initially celebrated the dovish pivot. With uninformed investors assuming that cutting interest rates was the appropriate response, a sharp rally occurred in July 1973, followed by a sharp pullback and then another rally to a higher high. As a result, don’t you think the crowd was calling for a new bull market from July through October 1973?

However, unanchored inflation forced the Fed to reverse course and the S&P 500 fell off a cliff. Therefore, while I’ve warned repeatedly that a dovish pivot (a “stop-go approach”) is the worst-case scenario for the U.S. economy and financial assets, investors are cheering on this outcome with glee. As such, their expectations are in la-la land, and the return of reality should elicit sharp drawdowns of the S&P 500 and the PMs.

For context, with Fed officials anxious about repeating past mistakes, they should forge ahead with rate hikes rather than risk a re-enactment of 1973-1974.

Hear but Don’t Listen

With the bulls extremely confident and the bears extremely rattled, the S&P 500’s recent run has eroded the latter’s confidence. However, with the fundamentals still crystal clear, the bulls have let the price action cloud their judgment. For example, I’ve noted how tighter financial conditions are needed to curb inflation. Yet, with investors ignoring Fed officials’ hawkish warnings, they continue to make the central bank’s job more difficult.

Please see below:

To explain, the green line above tracks the FFR, while the red line above tracks the Goldman Sachs Financial Conditions Index (FCI). If you analyze the relationship, you can see that the FCI was tracking the FFR higher. In a nutshell: when the Fed raises interest rates, financial conditions should tighten.

However, the gap on the right side of the chart shows how the FCI has decelerated since the Fed hiked interest rates in July. As a result, the red line is helping to spur inflation, not reduce it. Thus, the Fed needs to reverse the trend to achieve its inflation goals, and such a realization is bullish for real yields and the USD Index.

Second, while the bond market has been attentive to Fed officials’ hawkish warnings, the S&P 500’s forward price-to-earnings (P/E) ratio has diverged from the U.S. 10-Year real yield.

Please see below:

To explain, the black line above tracks the S&P 500’s forward P/E, while the red line above tracks the inverted (down means up) U.S. 10-Year real yield. Outside of the panic in March 2021, the pair have maintained their inverse relationship.

Likewise, if you analyze the right side of the chart, you can see that the U.S. 10-Year real yield has rallied off its recent lows (red line falling), while the S&P 500’s forward P/E has done the same (black line rising). However, with higher real yields necessary to reduce inflation, the red line should continue to fall and the black line should follow suit.

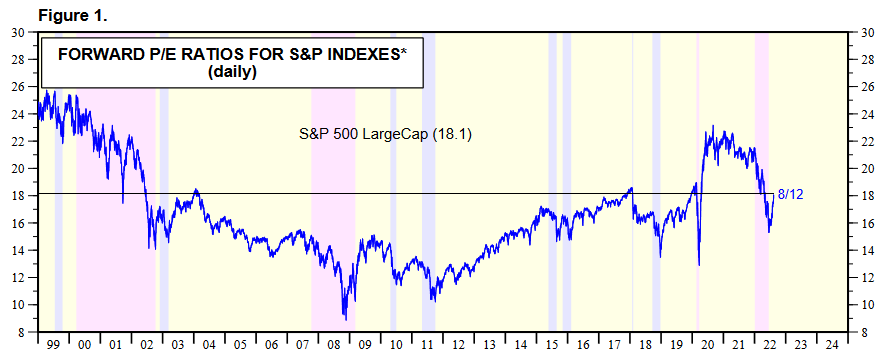

In addition, it’s important to remember that a forward P/E above 18x is nowhere near the levels seen during recent bottoms.

Please see below:

Furthermore, that’s only recent history. The inflationary malaise of the 1970s shows that the S&P 500’s trailing P/E (the green line below) fell below 8x in 1974 and 1979.

The Bottom Line

While the bulls want you to believe that all is well on Wall Street, the reality is that none of the fundamental issues have been resolved: inflation remains problematic, and the FFR is destined for higher ground whether the Fed employs a destructive “stop-go approach” or not. Moreover, with history unkind to the proponents of the policy, uninformed investors are giddy about an act that proved to be their downfall in 1973/1974. As such, while sentiment is clearly bullish, the medium-term fundamental outlook is profoundly bearish.

In conclusion, the PMs rallied on Aug. 12, as optimism is contagious. However, with investors severely miscalculating what lies ahead, they’re pricing in outcomes that have never materialized. Therefore, harsh lessons should be learned in the months ahead.

What to Watch for This Week

With more U.S. economic data releases next week, the most important are as follows:

- Aug. 15: New York Fed Empire Manufacturing Survey

The latest manufacturing data from the New York Fed will provide insight into how growth, employment, and inflation are unfolding in New York State.

- Aug. 17: U.S. retail sales, Fed minutes

With consumers still flush with cash, it will be interesting to see how their spending habits have evolved in recent weeks. Moreover, continued strength would only put more pressure on the Fed. In contrast, the Fed minutes are unlikely to have a meaningful effect, as the comments were made before the recent CPI release. As a result, the bulls will likely ignore the findings, despite the hawkish threats.

- Aug. 18: Philadelphia Fed manufacturing index

Similar to the Empire State survey, the Philadelphia Fed’s data will highlight the growth, employment and inflation dynamics in Pennsylvania.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Technically Speaking

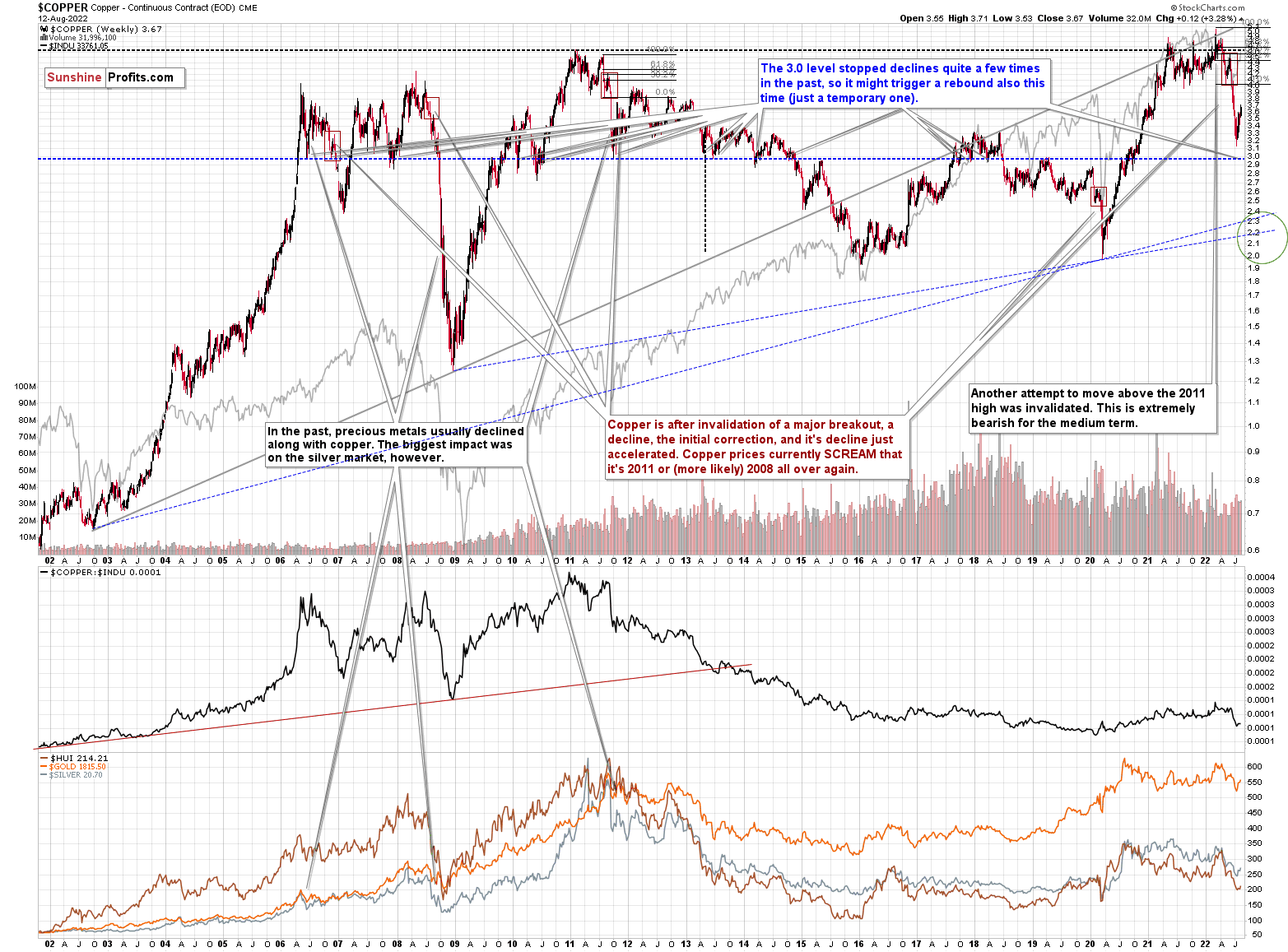

Let’s start today’s technical discussion with a quick check on copper prices.

Practically, everything that I wrote about it last week (and in the previous weeks/months) remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

It seems to me that there might be some kind of smaller corrective upswing or a pause when copper moves to about $3.0, but that it would then decline profoundly once again, only to bottom in the $2.0-2.4 area. That’s where we have rising, long-term support lines and also the previous – 2016 and 2020 – lows.

Interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged.

Again, copper is after invalidation of a major breakout, a decline, the initial correction, and its decline just accelerated. Copper prices currently SCREAM that it’s 2011 or (more likely) 2008 all over again. This is extremely bearish for mining stocks (especially juniors) and silver.

No market moves in a straight line, up or down, but since we just saw a corrective upswing, the downtrend might now resume (or it might resume after an additional very short-term upswing).

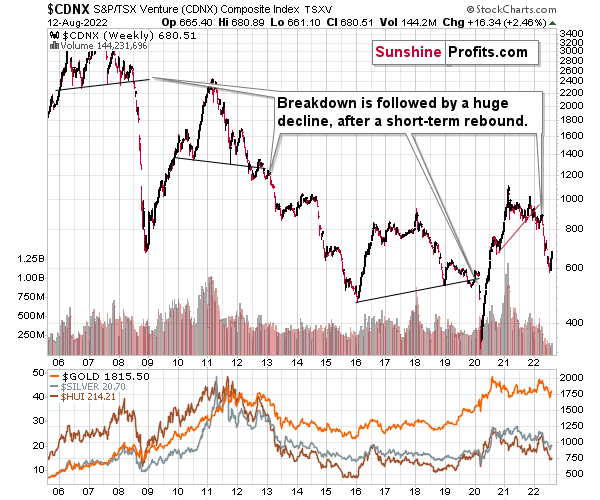

Having said that, let’s check junior miners’ really big picture.

I previously commented on the above chart in the following way:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

Having said that, let’s turn to gold.

Let’s start with context:

Between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet, gold failed to rally to new highs.

In fact, it’s trading very close to its 2011 high, which tells you something about the strength of this market. It’s almost absent.

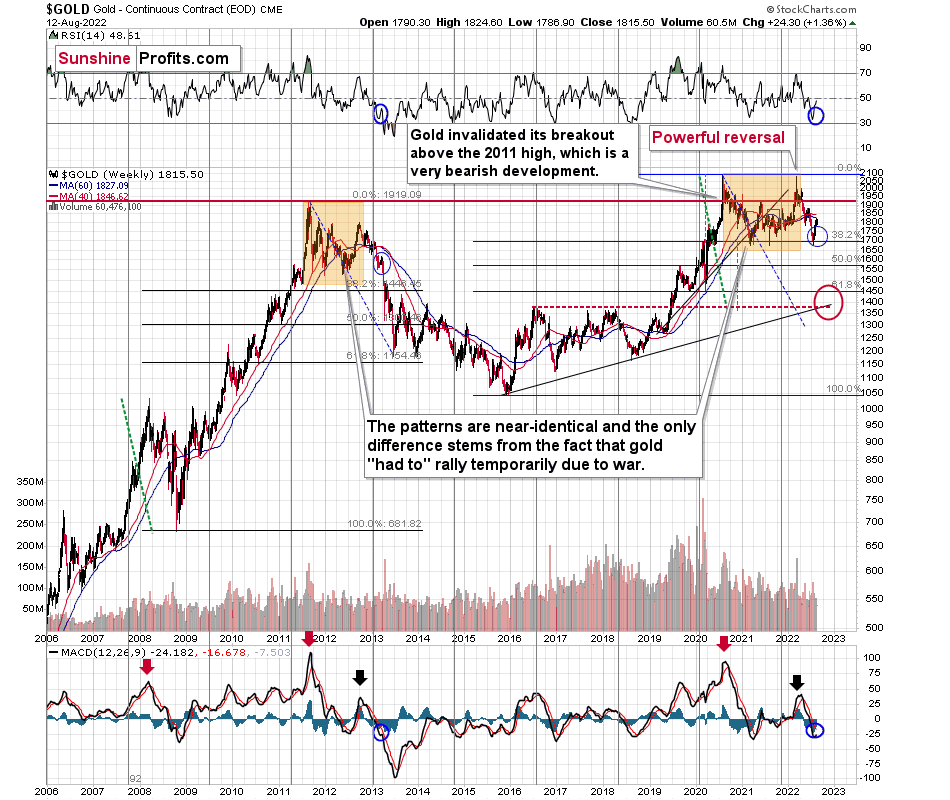

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. The long-term gold price chart below provides details.

Please note that the 38.2% Fibonacci retracement based on the entire 2015-2020 rally is very close to $1,700, which made the above-mentioned support area even stronger. Indeed, that’s when gold bottomed recently.

It seems that if it weren’t for the war in Europe, gold wouldn’t have been able to move above $2,000 and instead it would have topped close to its previous highs, which provided strong resistance.

The extraordinary thing about that is that that’s exactly what happened in 2012. Gold moved higher but only until it reached its previous highs, which happened in the second half of 2012.

This time the RSI was a bit higher, but it was close to 70, just like in 2012.

Yes, this time gold moved back to the previous high, but:

- This happened as a result of a geopolitical event (the war in Europe), and geopolitically-driven rallies are generally unsustainable;

- When gold reached its previous highs, it also formed a profound weekly reversal, which formed on huge volume, and that’s very bearish.

So, the current medium-term outlook for gold is very bearish.

There are also very interesting short-term takeaways from the above chart.

If the 2012-2013 is currently being replayed (at least to a significant extent), then let’s not forget that this decline initially took the shape of a back-and-forth decline with lower lows and lower highs (but there were notable short-term rallies within the decline).

The final of the corrections that still took place within the back-and-forth decline started in early 2013 - when gold moved close to its previous medium-term lows, when RSI was a bit above 30, and when the MACD was close to -20, which was also slightly below its previous medium-term low.

We can see all three above-mentioned similarities on the above chart. I marked them with blue ellipses. They are not “somewhat similar” – they are remarkably similar in both cases!

Indeed – gold rallied recently just like it had rallied in 2013, right before the most volatile part of the slide.

What does it imply going forward?

Please note that, based on the above-mentioned similarity, the corrective upswing in gold has probably already been completed or is about to be completed. Even at first sight, the rallies within blue ellipses appear practically identical. The RSI moved similarly higher as well.

The rally is bigger this time, but the geopolitical factors also contributed (China/Taiwan), but as we know, geopolitical factors tend to have only a temporary effect on prices.

Moreover, please note that this time, due to the Russian invasion on Ukraine, the price from which gold started its big decline, was higher. As a result, gold declined in a more volatile manner, and thus it’s quite normal for it to correct in a more visible manner. Just like a ball that’s dropped from higher altitude – it will bounce higher.

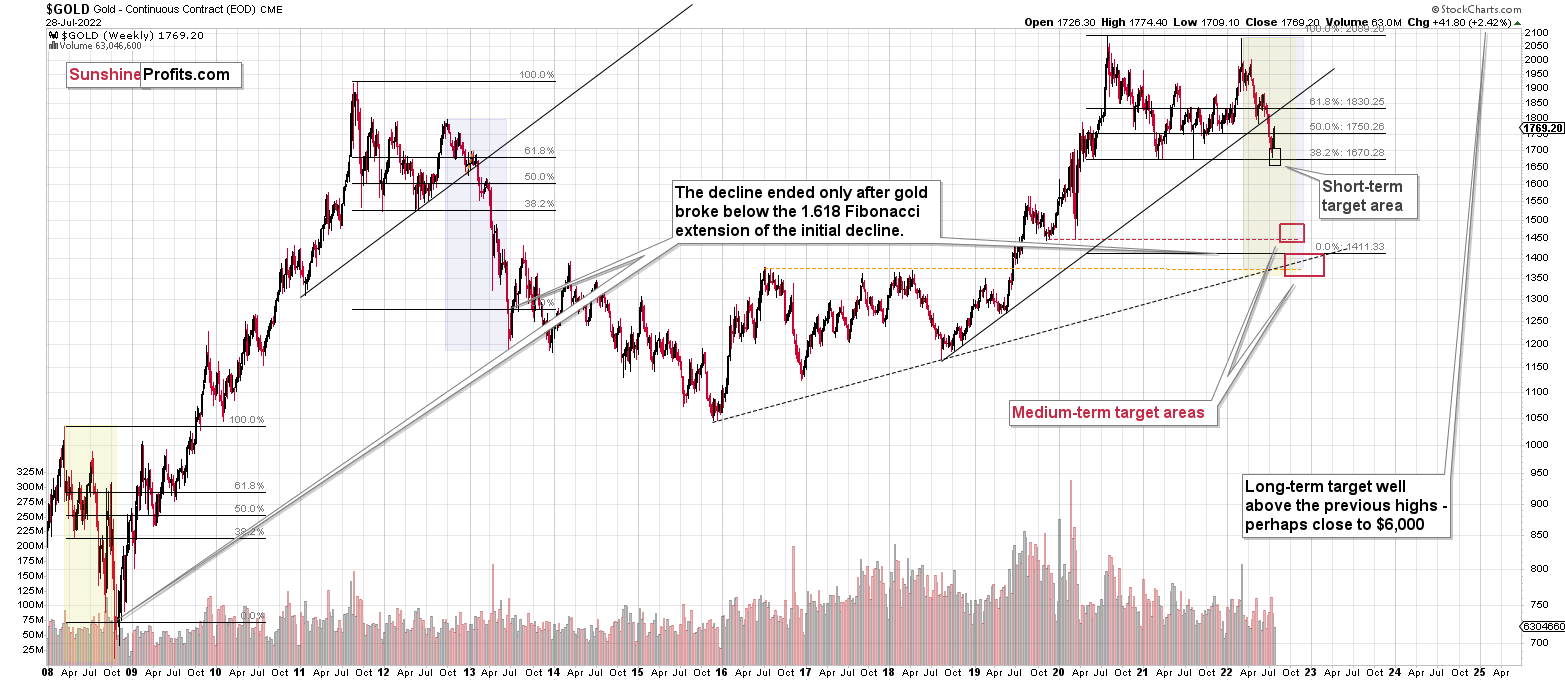

How low is gold likely to go during this upcoming decline? Perhaps as low as its 2020 low – to the $1,450-1,500 area.

I realize this is far from the current price, but nonetheless, this target area appears justified in my opinion. There are two important Fibonacci retracements based on the 2015-2020 rally that gold can bounce from (it recently bounced from the 38.2% retracement). These are: 50% and 61.8% retracements.

The support provided by the 61.8% retracement is strengthened by the 2020 low and the support provided by the 50% retracement is strengthened by the 2019 high.

However, based on gold’s self-similarity to 2013, it seems that we’re about to see a slide that’s bigger than what we’ve been seeing so far this year. This time – based on the similarity – gold is likely to decline profoundly, but no longer in the back-and-forth mode. If gold formed its next local low at the 50% retracement (so at about $1,560), then it might do so still within the declining, short-term trend channel (sometime in September).

However, if gold is to stick to the link to 2013, then it should decline more rapidly. In this case, the technique that can help us estimate the short-term target is the one that says that after a breakdown from a trend channel, price is likely to move approximately by as much as the height of the previous trend channel. In this case, gold could break below the trend channel soon and then decline even more. Based on the height of the trend channel, the above means that a move to the 61.8% retracement as the next downside target is more likely than a move to the 50% retracement.

Besides, the decline in gold would likely be linked to a breakdown in the EUR/USD below 1, which – if confirmed – would likely trigger significant selling.

On the fundamental news front, this fits the current situation as well. The likelihood of real interest rates moving higher in the future didn’t decrease at all, but at the same time, the market focused on something insignificant – Powell’s speech. Yes, it was insignificant because of all the times Powell’s suggestions didn’t result in actual action. Also, wasn’t it Powell who spoke many times about the benefits of higher interest rates, but then cut them (probably as he was pressured to do so by Trump)?

This time, the pressure is different – people are most concerned with inflation, and the latter has become political. So, while it remains clear that real interest rates are going up, the market’s perception triggered this artificial short-term rally, which means that now the gold price has more room to fall.

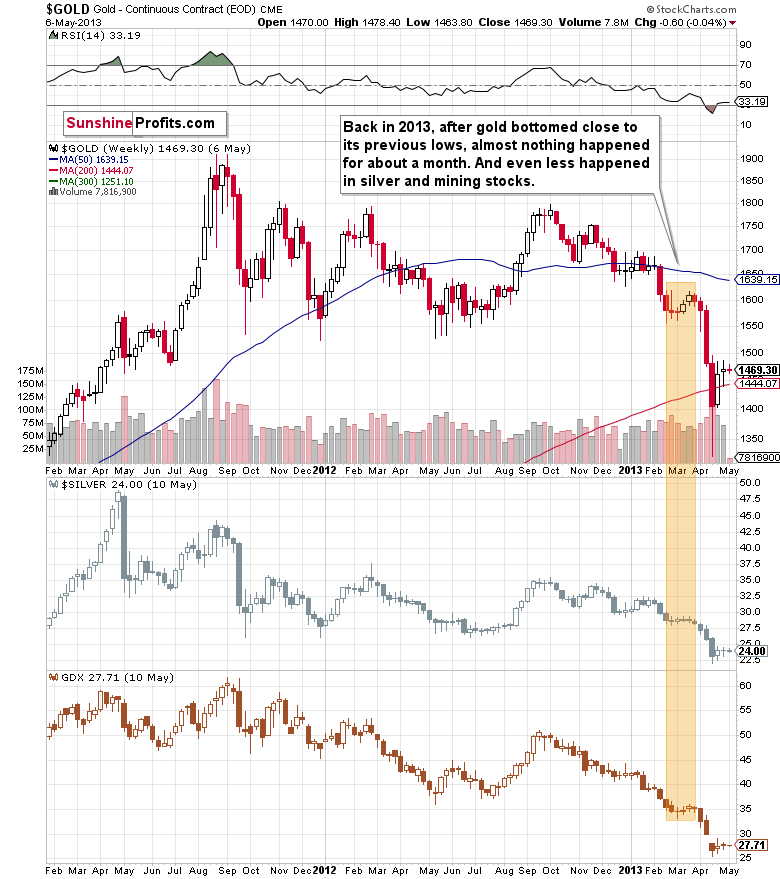

However – just because something is likely to happen, doesn’t mean that it’s likely to happen right away. So, let’s zoom in on what happened in 2013 after the analogous rebound.

Well, gold consolidated for a few weeks and plunged only after that consolidation.

While it doesn’t guarantee that we’ll see a pause that’s as long as the one that we saw before the April 2013 slide, it’s a good indication that the huge decline might not start immediately, but rather we might see some “preparatory” action.

For now, investors and traders might view the current prices as temporary, and they might expect gold to soar back up. In fact, I saw multiple analyses indicating exactly that. This means that a week or a few weeks of back and forth trading close to the current price levels or between the current price levels and the recent lows would help to convince them that this move lower was not accidental.

This would make them much more likely to sell (and panic) once gold breaks below its recent lows.

Also, while the above chart doesn’t show it, because it’s based on weekly and not daily prices, gold topped in March 2013 when its daily RSI was trading just a little above 50 and close to its previous highs – just like what we see right now.

Getting back to the possible back-and-forth movement that we might see now, please note that the price “action” was even more boring in the case of silver and mining stocks (middle and lower parts of the above chart). They did very little during the consolidation, but when they finally moved lower, they truly plunged.

Oh, and don’t let the sizes of the moves fool you – the scale is linear in the case of silver and GDX, while it’s logarithmic in the case of gold. In reality, the mining stocks still declined the most, and silver’s decline was still bigger than the one seen in gold.

So, like I wrote in the opening paragraphs of today’s analysis, the fact that the precious metals sector is doing pretty much nothing right now is perfectly normal, and the bearish outlook for the following weeks/months remains fully intact.

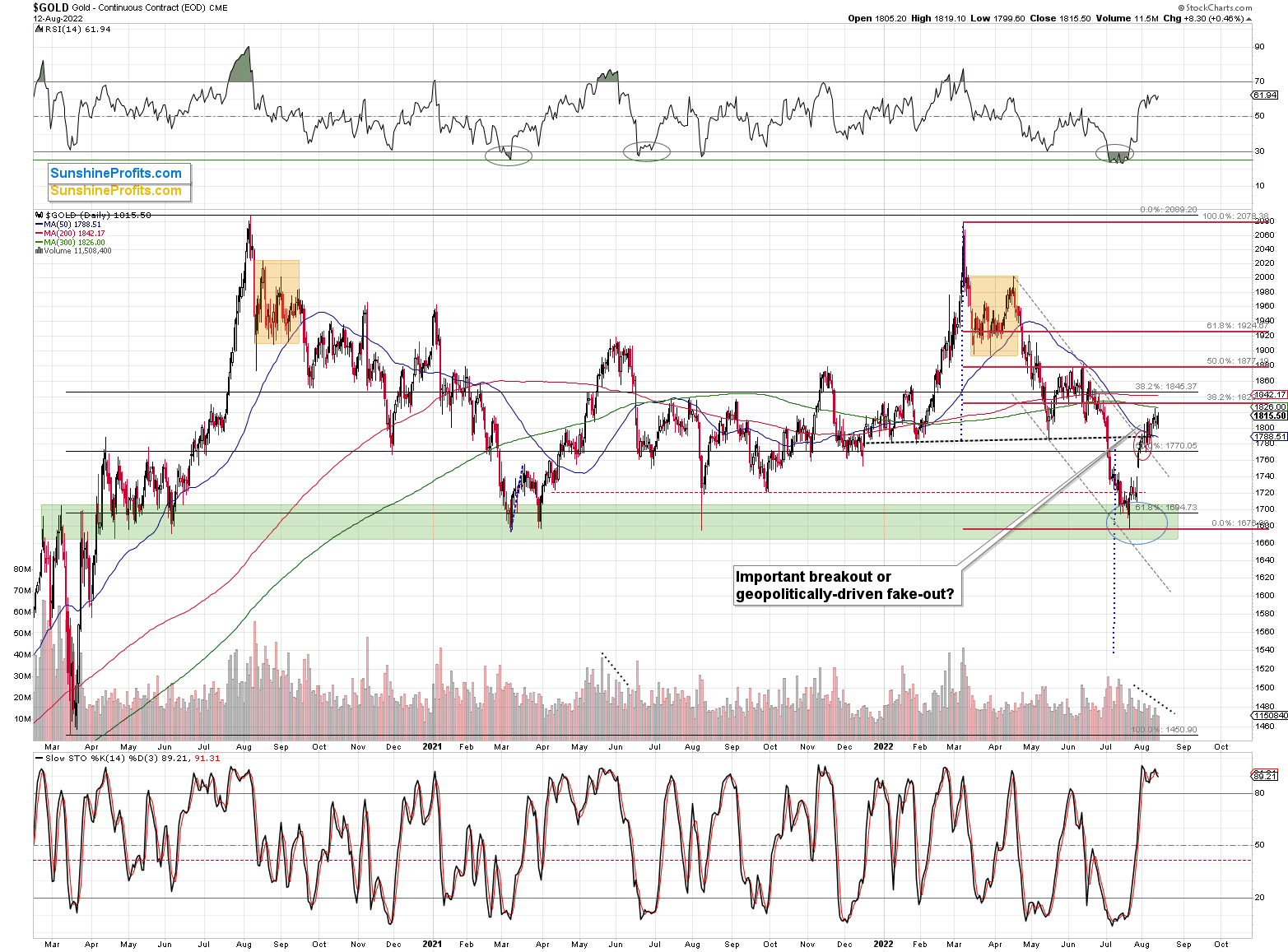

Gold moved a bit higher recently, and it almost touched its 38.2% Fibonacci retracement level. Even if it does touch it, it will still remain in the “corrective mode” in Fibonacci terms.

As I wrote earlier today, the correction and then the back-and-forth movement are perfectly normal given the analogy to 2013. It’s most likely not the start of another powerful rally, but rather something in tune with what happened during the previous huge, medium-term decline.

Is the rally already over? This could be the case. The yellow metal practically touched its 300-day moving average (green line) and then moved back down. Gold is moving lower in today’s pre-market trading as well.

At the moment of writing these words, gold is trading at about $1,792, which means that it’s already back below its early-August high. In today’s London trading, the GDXJ is also back below its early-August high.

Consequently, what I wrote previously remains perfectly up-to-date – the precious metals sector is currently likely to do pretty much nothing, and then it’s likely to slide in an epic manner. So far, we’re still in the calm-before-the-storm mode.

Silver and mining stocks are likely to be affected even more than gold, though.

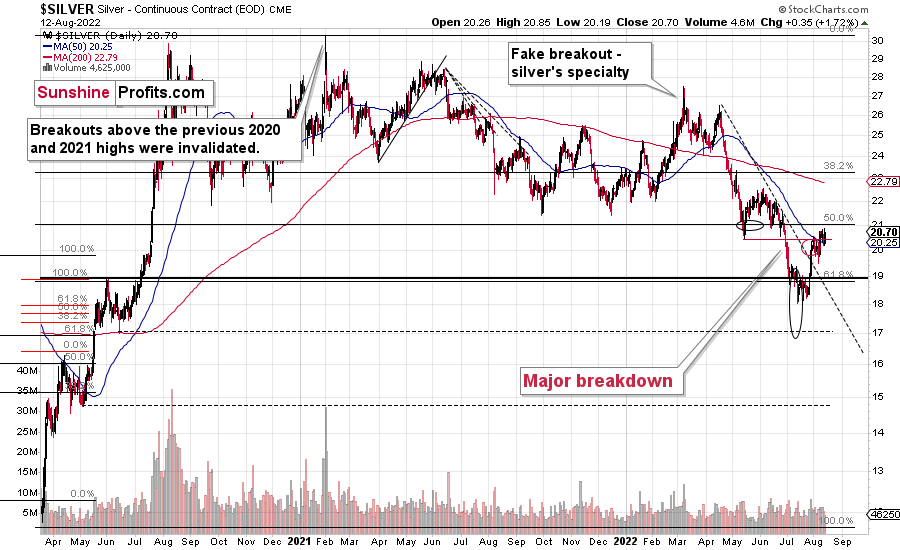

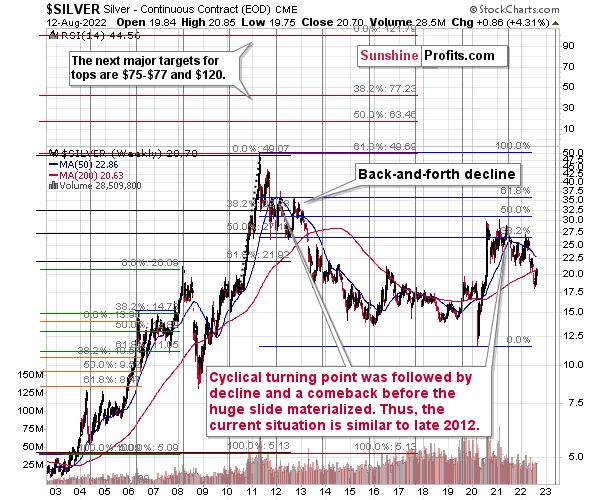

Let’s take a look at the silver market.

Like gold, silver just hit my previous target area. It touched its 50-day moving average and its May bottom. Since that time, silver tried to move higher, but it wasn’t able to do so. At the moment of writing these words, silver futures are trading at 20.28, which means that they, too (like gold and GDXJ), moved below their early-August high.

Silver is moving back and forth just like gold is, and it’s perfectly normal given the analogy to 2013. The outlook for the following weeks and months remains very berish.

Furthermore, during its recent upswing, silver outperformed gold on high volume, which we frequently see as confirmation of a short-term top being in or near. How low will silver now move? This is rather unclear, because things can now get very volatile (like in 2008, 2013 or 2020), and it seems to be a better idea to be looking at gold than at silver when determining the exit moment for the white metal.

However, to provide you with some numbers, I’d say that silver is likely to decline at least to $15 before the next important correction. I wouldn’t be surprised to see it fall all the way down to its 2020 low of $12 before moving up in a more visible way.

As you see, the silver outlook is not as precise as it is for gold, as the support levels and targets based on multiple techniques don’t necessarily align. In the case of gold, they do.

Let’s not forget that gold is not the only precious metal that is repeating its 2012 performance right now, and you can see more details on silver’s long-term chart.

As you can see on the above chart, silver corrected about 50% of the previous downswing, and this correction ended at about $30, a long time ago. Ever since, silver has been declining, and even the outbreak of war in Europe didn’t make silver rally above that level.

On the above chart, you can see how silver first topped in 2011, then declined and formed another top at the cyclical turning point. Next, it declined once again – to the previous lows. After that, silver rallied (in 2012 and 2022), and it topped between its 50-week moving average (marked in blue) and the previous top. Now silver is declining in a back-and-forth manner (you can see it more clearly on the previous short-term silver chart).

Back in 2012, these were just the early days of a gargantuan decline, and the same appears likely to be the case this time. Interest rates are going up after all, and the Fed is determined to quench inflation.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Besides, please note that silver didn’t even manage to rally as much as copper (which tried to move to new highs recently) or most other commodities, thus being rather weak.

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in mining stocks.

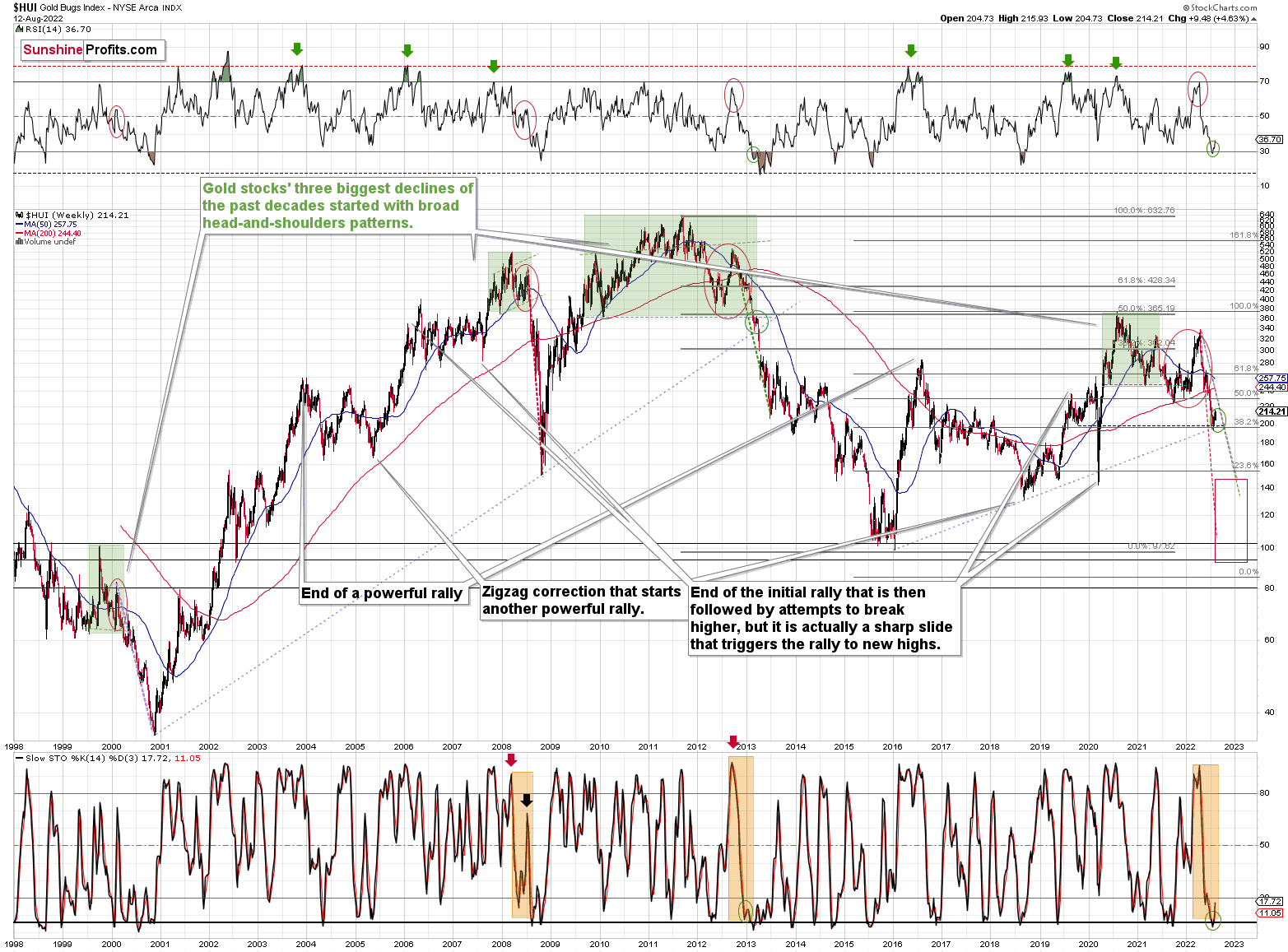

History tends to repeat itself. Not to the letter, but in general. The reason is that while economic circumstances change and technology advances, the decisions to buy and sell are still mostly based on two key emotions: fear and greed. They don’t change, and once similar things happen, people’s emotions emerge in similar ways, thus making specific historical events repeat themselves to a certain extent.

For example, right now, gold stocks are declining similarly to how they did in 2008 and in 2012-2013.

The Russian invasion triggered a rally, which was already more than erased, and if it wasn’t for it, the self-similarity would be very clear (note the head-and-shoulders patterns marked with green). Since the latter happened, it’s not as clear, but it seems that it’s still present. At least that’s what the pace of the current decline suggests.

I used a red dashed line to represent the 2008 decline, and I copied it to the current situation. They are very similar. We even saw a corrective upswing from more or less the 200-week moving average (red line), just like what happened in 2008.

We saw a breakdown to new short-term lows, which means that the volatile part of the slide is likely already underway.

Moreover, four weeks ago, I commented on the above chart in the following way:

On a short-term basis, we see a short-term (only) downside target of around 200. That’s about 10% below yesterday’s (Thursday’s) closing price. There are several reasons for it:

- It’s a round number, and those tend to be more important psychologically than other numbers.

- That’s where we have the rising medium-term support line based on the 2016 and 2018 lows. The temporary move below this line triggered a massive rally in 2020.

- That’s where we have the 61.8% Fibonacci retracement level based on the entire 2016-2020 rally.

The 200 target was then reached and briefly breached, and it was followed by a rally.

Analogy-wise, it’s what we previously saw in 2013. It might not be obvious which part of the chart to look at, as the upswings are not that visible from the long-term point of view, so I marked them with green ellipses (also in RSI and Stochastic).

How low can the HUI Index fall during the next big downswing?

As it’s the case with gold and silver, a move back to the 2020 lows is definitely in the cards. Please note that this level is also strengthened (as support) by other major lows: the 2019, 2014, and 2008 ones.

However, I wouldn’t rule out a move even lower on a temporary basis. If gold were to decline to about $1,450-1,500, it would mean that it would double its current 2022 decline. If the HUI Index does that, it will move below 150.

So, all in all, 120-150 is my current target area for the upcoming slide in the HUI Index.

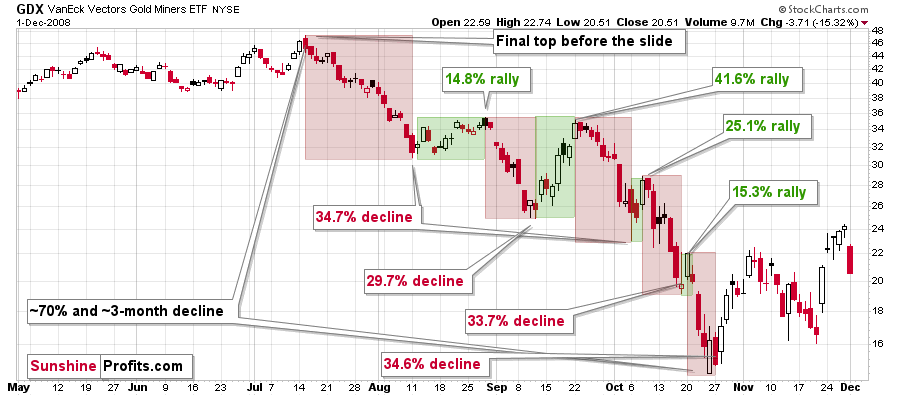

All right, let’s zoom in and see how mining stocks declined in 2008.

Back then, the GDXJ ETF was not yet trading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and it erased about 70% of the miners’ value. The biggest part of the decline happened in the final month, though.

However, the really interesting thing about that decline – that might also be very useful this time – is that there were five very short-term declines that took the GDX about 30% lower.

I marked those declines with red rectangles. After that, a corrective upswing started. During those corrective upswings, the GDX rallied by 14.8-41.6%. The biggest corrective upswing (where GDX rallied by 41.6%) was triggered by a huge rally in gold, and since I don’t expect to see anything similar this year, it could be the case that this correction size is an outlier. Not paying attention to the outlier, we get corrections of between 14.8% and 25.1%.

The interesting thing was that each corrective upswing was shorter (faster) than the preceding one.

The first one took 12 trading days. The second one took seven trading days. The third one took 2 trading days, and the fourth and final one took just 1 trading day.

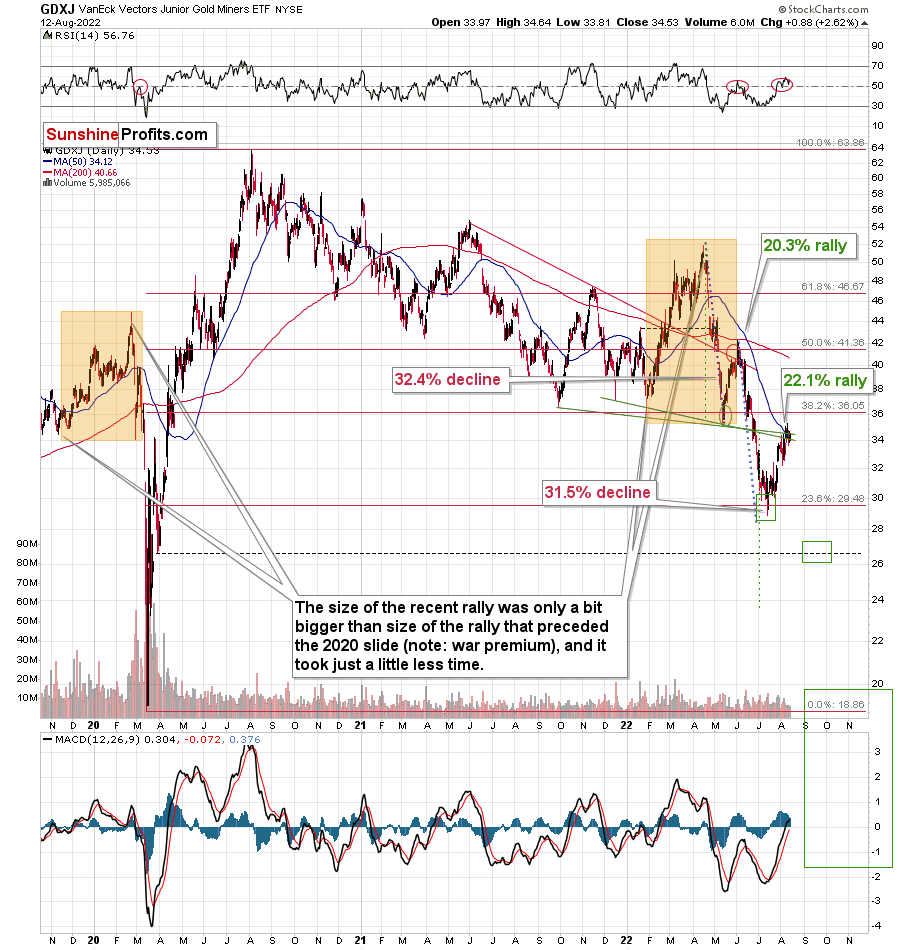

Fast forward to the current situation. Let’s take a look at the GDXJ ETF.

The GDXJ ETF declined by 32.4% and then corrected – it rallied by about 20.3%.

It had declined by about 31.5% and then rallied by about 22.1%.

The second decline and the second corrective upswing are bigger, just like it was the case in 2008.

Back then, gold rallied profoundly, which triggered a bigger corrective rally than the one that we just saw, but other than that, the situations seem similar.

Technically, junior miners moved to their May lows, and they verified them as resistance. The next wave lower can - and is likely to - now begin.

I previously wrote the following:

What does it tell us? It indicates that history can be rhymed, and while it will not be identical, we should pay attention to the indicators that worked in 2008. The next corrective upswing (a notable one, that is) might start when the GDXJ ETF declines by about 29-35% from its recent top. To clarify, I don’t claim that the above technique would be able to detect all corrective upswings, or that I aim to trade all of them. For instance, in my view, it was a good idea to enter a long position on May 12 and switch to a short position on May 26, but I wasn’t aiming to catch the intraday moves.

Based on how long the corrective upswings took in 2008 and how long the recent one took, the upcoming corrective upswing is likely to take between 5 and 10 trading days. If the bottom formed yesterday, which seems likely as the GDXJ ETF is already up by over 1% in today’s London trading, then we can expect the next local top to form within 1-2 weeks. In other words, it seems that the corrective upswing is likely to end in the next part of July – probably in its final week.

Back in 2008, the counter-trend rallies varied greatly in their magnitude, but please keep in mind that back then, the decline was very much news-based – Lehman Brothers’ collapse, etc. This time, the decline is more measured, so declines and corrections are more measured as well.

While back in 2008, during the first correction, the GDX gained only 14.8% and during the second one it gained a sizable 41.6%, this time the first rally provided a measured 20.3% increase. If the upcoming correction is also measured, then the GDXJ might also rally by about 20%.

It appears that it’s exactly what we saw. The medium-term downtrend can now continue (or if it hasn’t started yet, it might start soon).

How low can the GDXJ ETF move during the (this?) next big move lower? A move to its 2020 lows (~$20) seems quite likely.

Yes, it is possible that the GDXJ ETF will fall below its 2020 lows, but it might need to correct first.

Please note that a move to the 2020 lows (~$20) is something that fits what I wrote about gold and the HUI Index - that they could repeat their so-far 2022 decline (approximately).

I previously added an extra short-term downside target of about $26.5. If GDXJ gets there while gold re-tests its previous lows once again, then we might get one tiny rebound just before the slide. But it seems too small to be worth trading, as the risk associated with missing the much bigger move lower might not justify the potential quick gain.

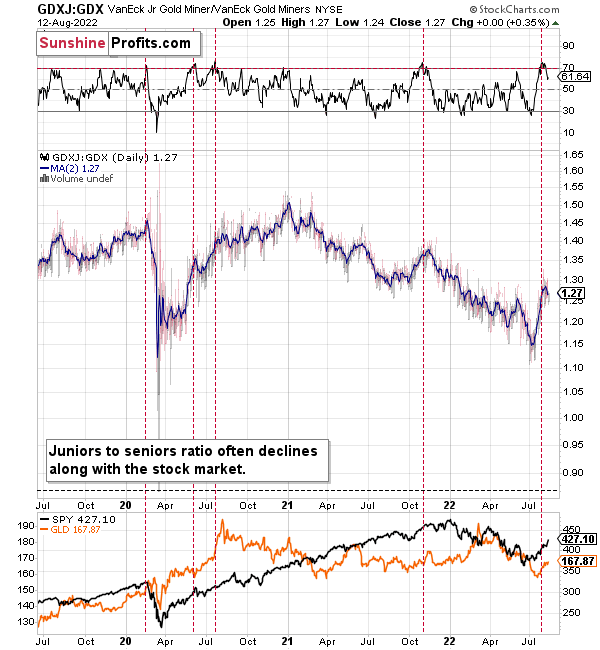

Moreover, please note that due to their recent outperformance, juniors can now reverse their trend and decline more than senior miners – this would fit a situation in which the general stock market declines.

During their previous upswing, juniors rallied relative to seniors, and the situation is now excessive from the short-term point of view. At least the RSI indicator suggests that juniors are now likely to decline relative to seniors.

In fact, it seems that the GDXJ to GDX ratio has already topped, and that it’s now declining once again. This implies bigger declines in the GDXJ in the future.

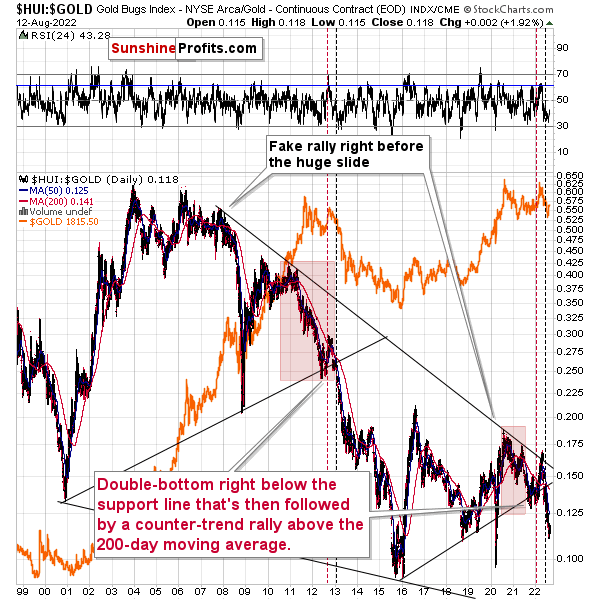

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI to gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

If history is to rhyme, we’re about to see a profound decline. In fact, we’re likely already past its beginning.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices of gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… just stocks) and that’s exactly what’s likely to happen.

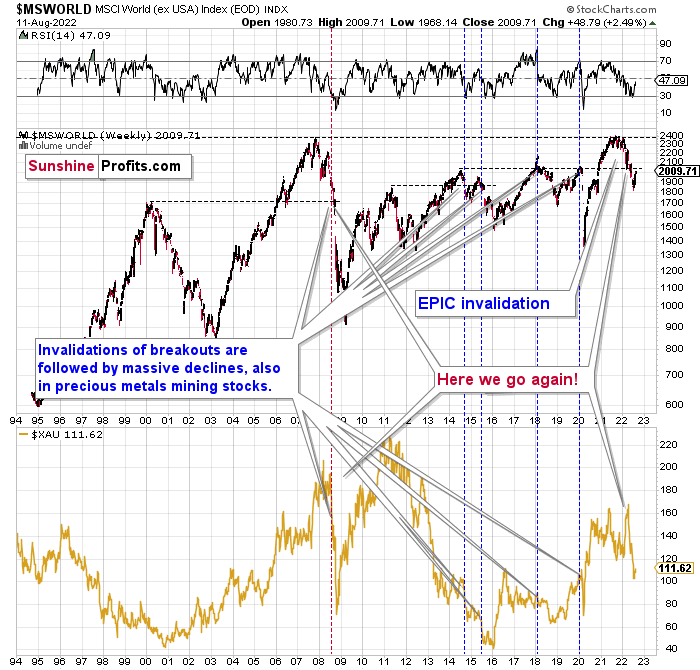

The technical picture in the case of world stocks remains extremely bearish, and my previous comments on it were just confirmed. Here’s what I’ve been writing about the above chart for quite a few weeks now:

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so, and… failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium - and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not a “logarithmic” scale. You probably still remember how significant and painful (if you were long, that is) the decline at the beginning of 2020 was.

All those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

World stocks have declined below their recent highs, and when something similar happened in 2008, it meant that both stocks and gold and silver mining stocks (lower part of the chart) were about to slide much further.

The medium-term implications for mining stocks are extremely bearish.

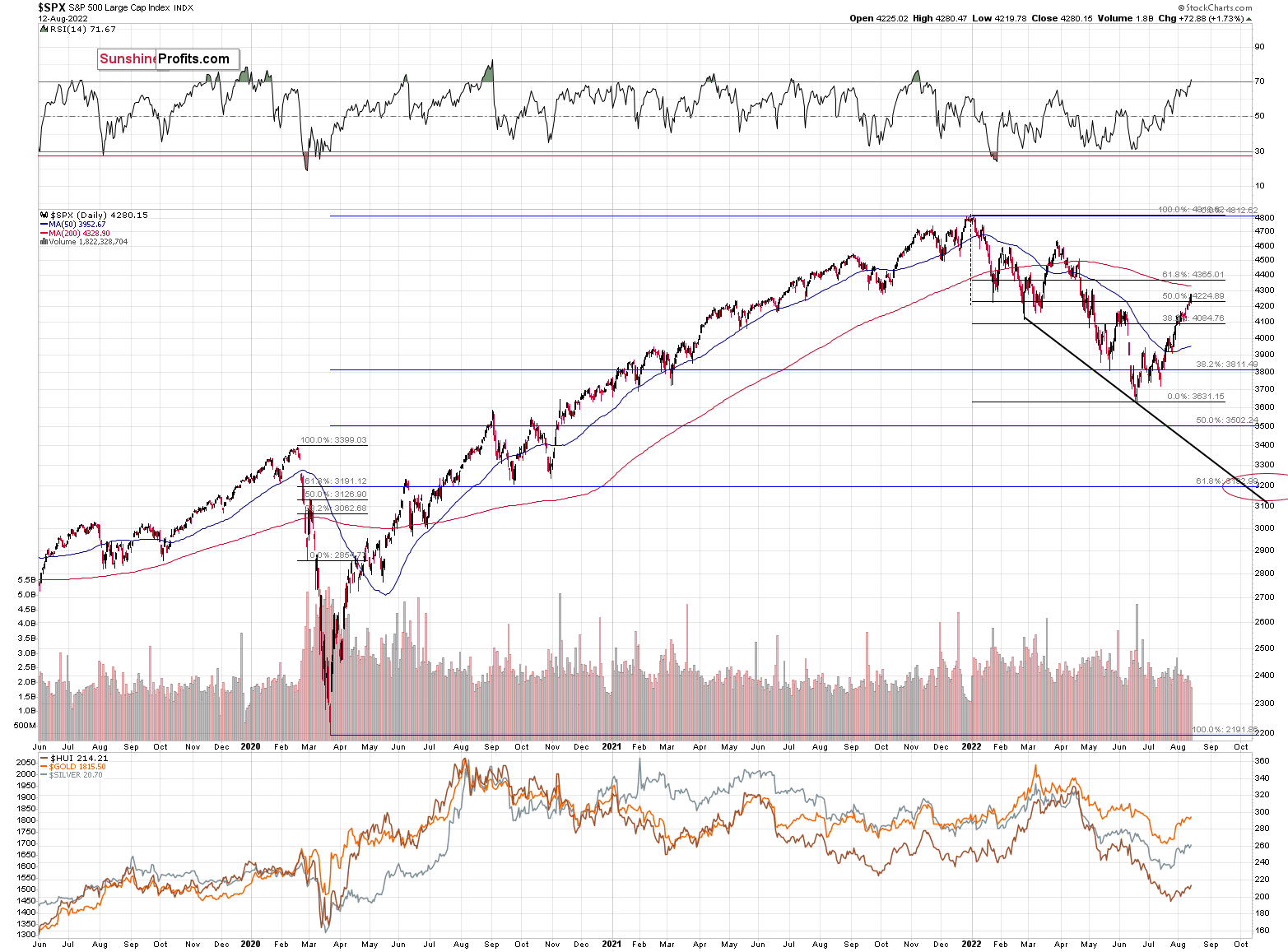

However, let’s get back to the short- and medium-term point of view.

Stocks rallied recently, but since they corrected approximately to their previous June highs and March lows, the rally might be over, or very close to being over.

Especially since the RSI just moved above 70, and based on this indicator, stocks are now more overbought than any other time this year.

As I had indicated previously, interest rates are likely going up, which is a bearish factor for the stock market, and the recent rally was likely due to the market’s misinterpretation of the importance of Powell’s speech. The S&P 500 wanted to correct (based on emotional = technical reasons) and it used Powell’s seemingly dovish comments as an excuse to do so. However, what materially changed? Nothing. Interest rates are likely to be raised, as inflation remains the key political issue right now, and the markets are likely to respond by declining.

Most interestingly, though, such a decline would likely have a devastating effect on the prices of mining stocks (especially junior mining stocks) and silver. There might be some impact on gold, too.

The above would also be in tune with an extra rally in the USD Index. After all, less competitive exports are not that favorable for the U.S. economy.

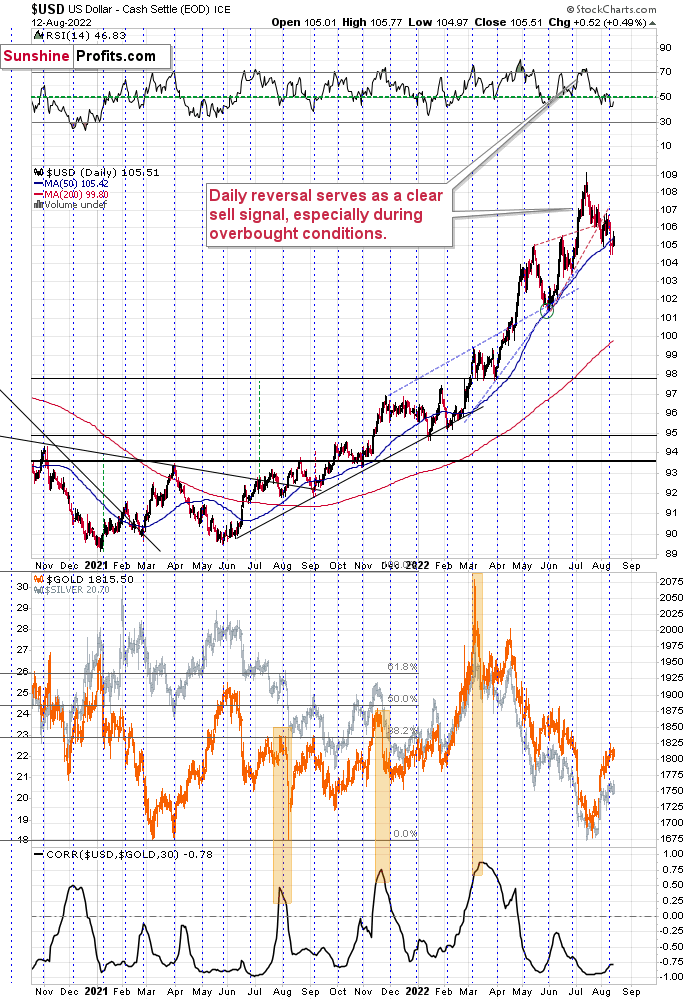

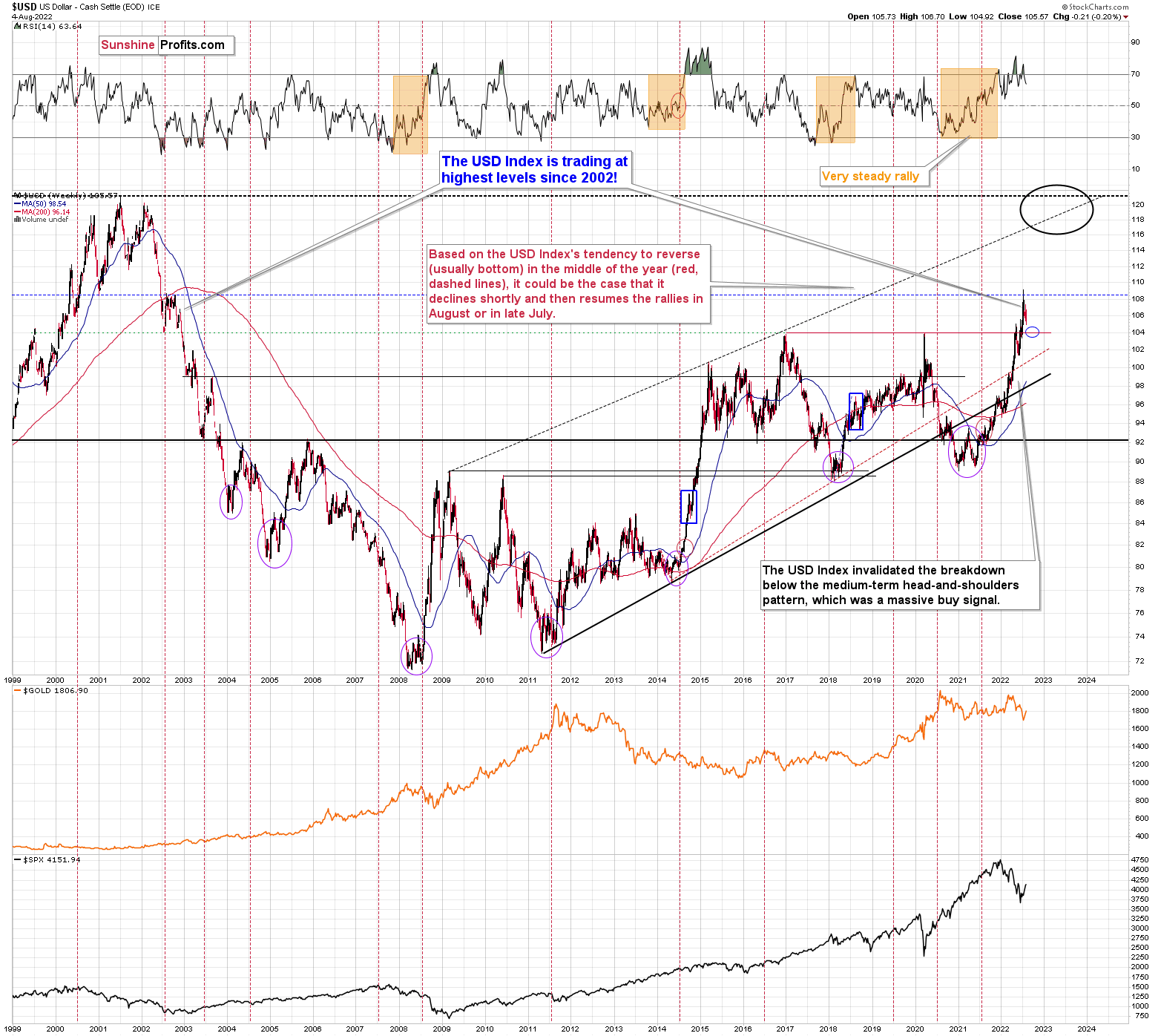

The USD Index recently moved slightly below its 50-day moving average, and then it moved back above it.

This move is in tune with what we saw at previous local bottoms. The RSI moved slightly below 50, which used to accompany bottoms in the previous months.

So, the scenario in which the USD Index has already bottomed seems quite likely.

I previously wrote the following about USD Index’s long-term chart:

There’s also the possibility that the USD Index keeps declining until it reaches the very strong support at about the 104 level – the previous long-term highs. Right now, it’s at about 105.5, which means that it could decline by another 1.5 index points or so. It doesn’t necessarily mean that gold, silver, and mining stocks would need to rally substantially if the above materialized. Conversely, since gold might now be reluctant to react to the USD’s lead and miners might be reluctant to react to gold’s lead, it seems that the possible upside for junior miners is very limited.

In other words, even if the big decline really picks up in a few weeks, I think that the risk-to-reward ratio already favors being on the short side of the precious metals sector. In particular, on the short side of junior mining stocks.

Last week, the USD Index bottomed at about 104.5, which was very close to the above-mentioned 104 level. If traders had expected the USD Index to bottom at this level, then some of them might have bought at higher levels in order to maximize their odds of catching the bottom, thus actually creating the bottom at higher levels.

Since the USD Index is already (at the moment of writing these words) back above the 106 level, it could be the case that the short-term bottom is already in.

This, in turn, likely means that the peak for the precious metals is already in.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is either over or about to be over, and that the next big move lower is about to start.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems that the corrective upswing is over (or close to being over), which means that the powerful medium-term downtrend can now resume.

Two weeks ago, we closed yet another profitable trade in a row. This year’s profits are already enormous, but it seems likely to me that they will grow even more in the following weeks and months. In particular, I expect the profits on the current short positions to be really profound.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Friday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief