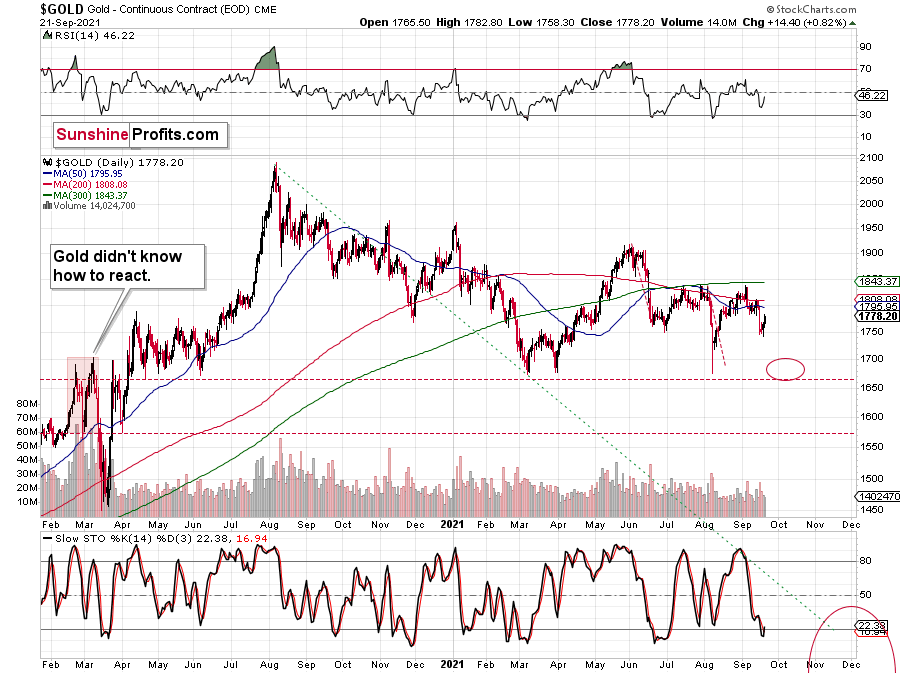

Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

PLEASE NOTE:

Next week’s Gold Investment Update comes to you a little early – this week. Due to my travel schedule there will be no update on September 27th, so I’m providing you with a broad overview via video.

Our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

As already stated, I’m providing the technical part of my analysis in the video format, but I’m also attaching the charts below the video, if you’d like to see them separately as well.

As I continue to experiment with the video format, I decided to talk a bit more than I did previously, as I found the latest combination of factors particularly interesting. I also replied to quite a few questions that I received recently (I’m reading and I’m grateful for all feedback messages – also those that I didn’t feature in the video). And “talk a bit more” is a light way of putting it, because today’s video ended up being over 1h long. Yes, I remember that some of you wrote about keeping the videos under 10 minutes, but it wasn’t possible to correctly describe even the technical part under 10 minutes.

While the sound volume was a bit too low previously, this time I set the volume too high, which impaired its quality – sorry for the inconvenience. I won’t be able to re-record the video in a timely manner with a new sound setting, so I’m publishing as it is, while changing the settings so that it won’t happen again.

As I say close to the end of the video, there are a few ways in which I plan to make the videos more digestible for people who prefer text:

- Adding chapters to the videos – will make browsing them later easier as well as skipping the parts that one is not interested in (like my book/podcast/fun-or-interesting-fact related comments)

- Adding all covered charts on the website (below).

- Keeping most timely Alerts (the intraday ones that change the positions) in text format.

The additional thing that you might want to do is to enable captions in the video – YT does a quite good job at detecting what I’m saying most of the time, so if you can’t enable sound but want to read the text, it might be useful. Please note that YT allows for auto-translating those captions too.

======

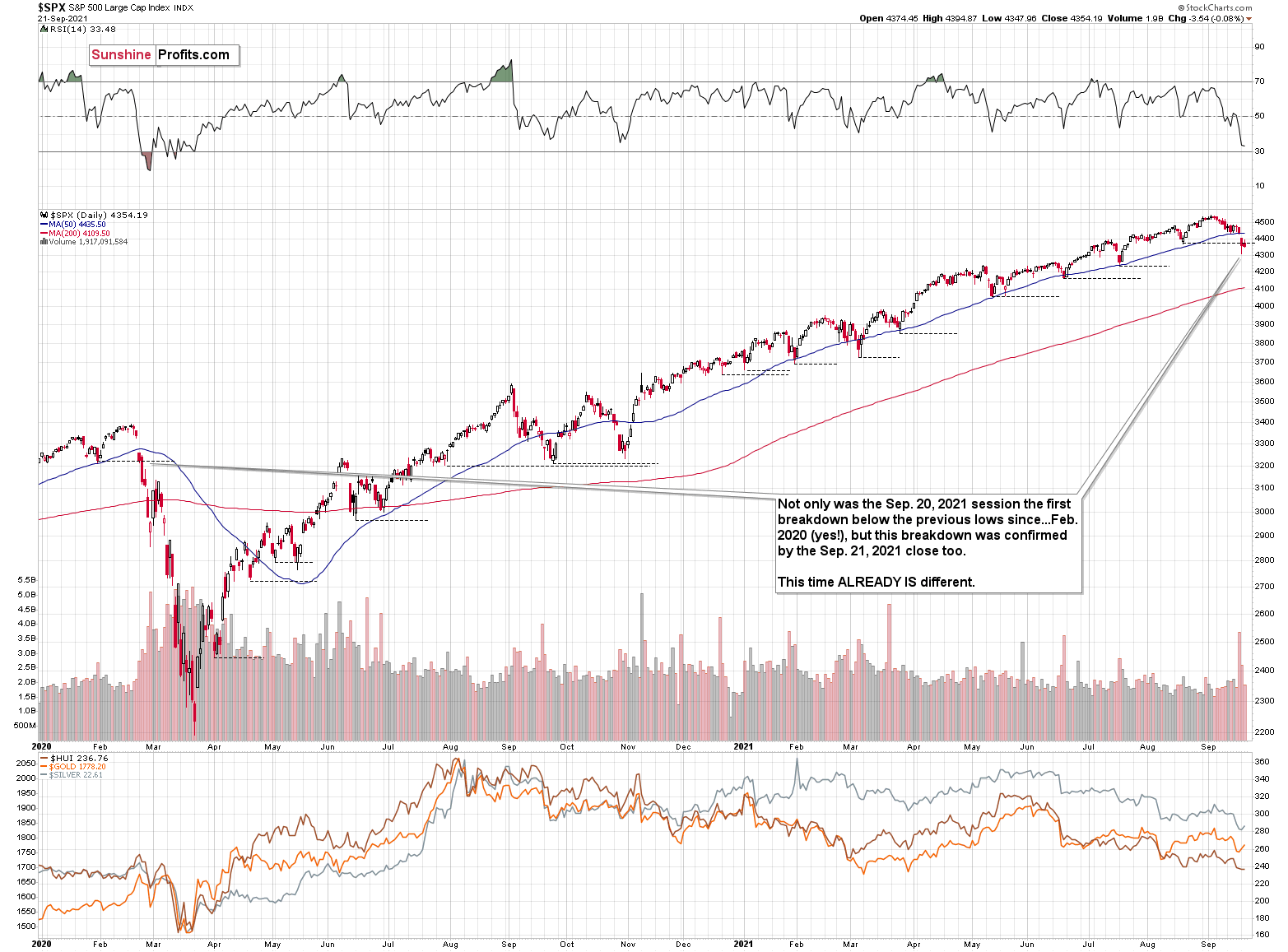

The long-story-short version is that the outlook remains very bearish and the recent price action in the stock market serves as a confirmation that we might see the final bottom in the PMs this December.

And now for the long video version:

You will find the latest charts below:

Having said that, let’s move to the fundamental part of today’s analysis.

Scenario Analysis

With the USD Index and U.S. Treasury yields the main fundamental drivers of the PMs’ performance, some confusion has arisen due to their parallel and divergent moves. For example, sometimes the USD Index rises while U.S. Treasury yields fall, or vice-versa, and sometimes the pair move higher/lower in unison. However, it’s important to remember that different economic environments have different impacts on the USD Index and U.S. Treasury yields.

To explain, the USD Index benefits from both the safe-haven bid (stock market volatility) and economic outperformance relative to its FX peers. Conversely, U.S. Treasury yields only benefit from the latter. Thus, when economic risks intensify (like what we witnessed with Evergrande on Sep. 20), the USD Index often rallies while U.S. Treasury yields often fall. Thus, the economic climate is often the fundamental determinant of the pairs’ future paths.

For context, I wrote on Apr.16:

The PMs suffer during three of four possible scenarios:

- When the bond market and the stock market price in risk, it’s bearish for the PMs

- When the bond market and the stock market don’t price in risk, it’s bearish for the PMs

- When the bond market doesn’t price in risk, but the stock market does, it’s bearish for the PMs

- When the bond market prices in risk and the stock market doesn’t, it’s bullish for the PMs

Regarding scenario #1, when the bond market and the stock market price in risk (economic stress), the USD Index often rallies and its strong negative correlation with the PMs upends their performance. Regarding scenario #2, when the bond market and the stock market don’t price in risk, U.S. economic strength supports a stronger U.S. dollar and rising U.S, Treasury yields reduce the fundamental attractiveness of gold. For context, the PMs are non-yielding assets, and when interest rates rise, bonds become more attractive relative to gold (for some investors). Regarding scenario #3, when the stock market suffers and U.S. Treasury yields are indifferent, the usual uptick in the USD Index is a bearish development for the PMs (for the same reasons outlined in scenario #1). Regarding scenario #4, when the bond market prices in risk (lower yields) and the stock market doesn’t, inflation-adjusted (real) interest rates often decline, and risk-on sentiment can hurt the USD Index. As a result, the cocktail often uplifts the PMs due to lower real interest rates and a weaker U.S. dollar.

The bottom line? The USD Index and U.S. Treasury yields can move in the same direction or forge different paths. However, while a stock market crash is likely the most bearish fundamental outcome that could confront the PMs, scenario #2 is next in line. While it may (or may not) seem counterintuitive, a strong U.S. economy is bearish for the PMs. When U.S. economic strength provides a fundamental thesis for both the USD Index and U.S. Treasury yields to rise (along with real interest rates), the double-edged sword often leaves gold and silver with deep lacerations.

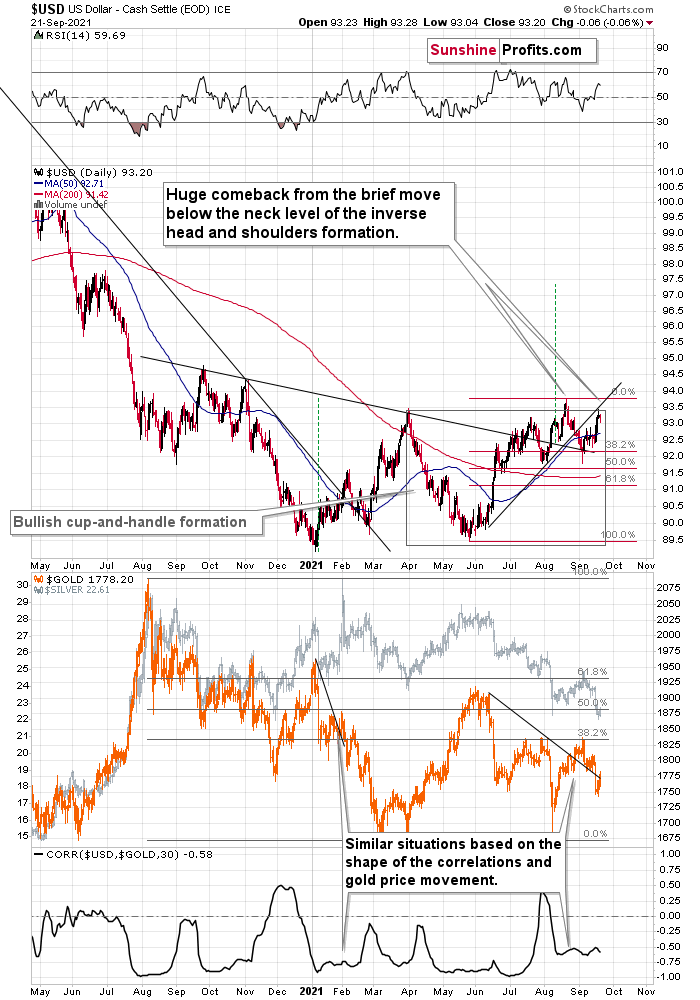

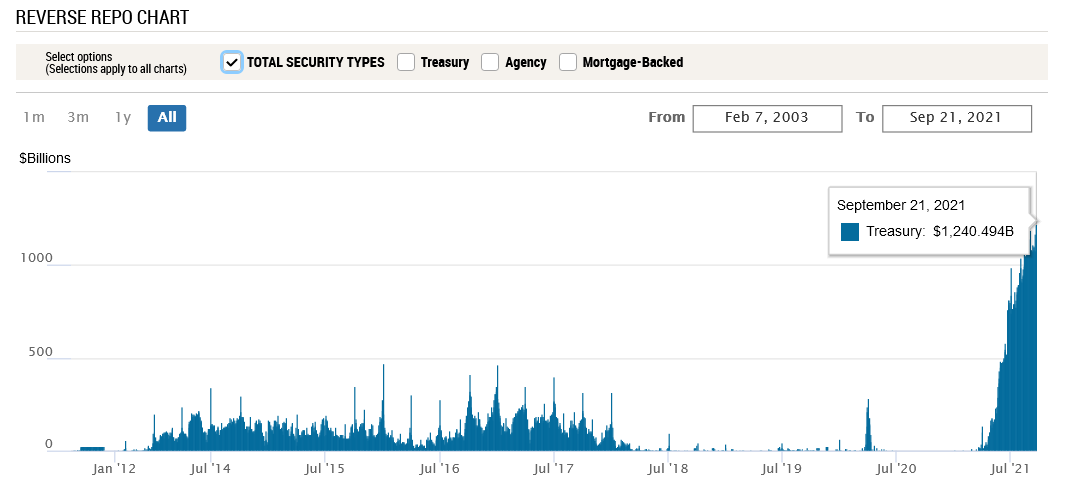

In the meantime, though, with investors eagerly awaiting the Fed’s monetary policy decision today, QE is already dying a slow death. Case in point: not only has the USD Index recaptured 93 and surged above the neckline of its inverse (bullish) head & shoulders pattern, but the greenback’s fundamentals remain robust. With 78 counterparties draining more than $1.240 trillion out of the U.S. financial system on Sep. 21, the Fed’s daily reverse repurchase agreements hit another all-time high.

Please see below:

To explain, a reverse repurchase agreement (repo) occurs when an institution offloads cash to the Fed in exchange for a Treasury security (on an overnight or short-term basis). And with U.S. financial institutions currently flooded with excess liquidity, they’re shipping cash to the Fed at an alarming rate. And while I’ve been warning for months that the activity is the fundamental equivalent of a taper – due to the lower supply of U.S. dollars (which is bullish for the USD Index) – the psychological effect is not the same. However, as we await a formal taper announcement from the Fed, the U.S. dollar’s fundamental foundation remains quite strong.

Furthermore, with the Wall Street Journal (WSJ) publishing a rather cryptic article on Sep. 10 titled “Fed Officials Prepare for November Reduction in Bond Buying,” messaging from the central bank’s unofficial mouthpiece implies that something is brewing. And while the Delta variant and Evergrande provide the Fed with an excuse to elongate its taper timeline, surging inflation has the Fed increasingly handcuffed.

As a result, Goldman Sachs Chief U.S. Economist David Mericle expects the Fed to provide “advance notice” today and set the stage for an official taper announcement in November. He wrote:

“While the start date now appears set, the pace of tapering is an open question. Our standing forecast is that the FOMC will taper at a pace of $15bn per meeting, split between $10bn in UST and $5bn in MBS, ending in September 2022. But a number of FOMC participants have called instead for a faster pace that would end by mid-2022, and we now see $15bn per meeting vs. $15bn per month as a close call.”

On top of that, with stagflation bubbling beneath the surface, another hawkish shift could materialize.

To explain, I wrote on Jun. 17:

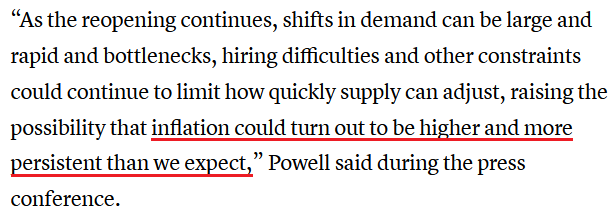

On Apr. 30, I warned that Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), was materially behind the inflation curve.

I wrote:

With Powell changing his tune from not seeing any “unwelcome” inflation on Jan. 14 to “we are likely to see upward pressure on prices, but [it] will be temporary” on Apr. 28, can you guess where this story is headed next?

And with the Fed Chair revealing on Jun. 16 what many of us already knew, he conceded:

Moreover, while Powell added that “our expectation is these high inflation readings now will abate,” he also conceded that “you can think of this meeting that we had as the ‘talking about talking about’ [tapering] meeting, if you’d like.”

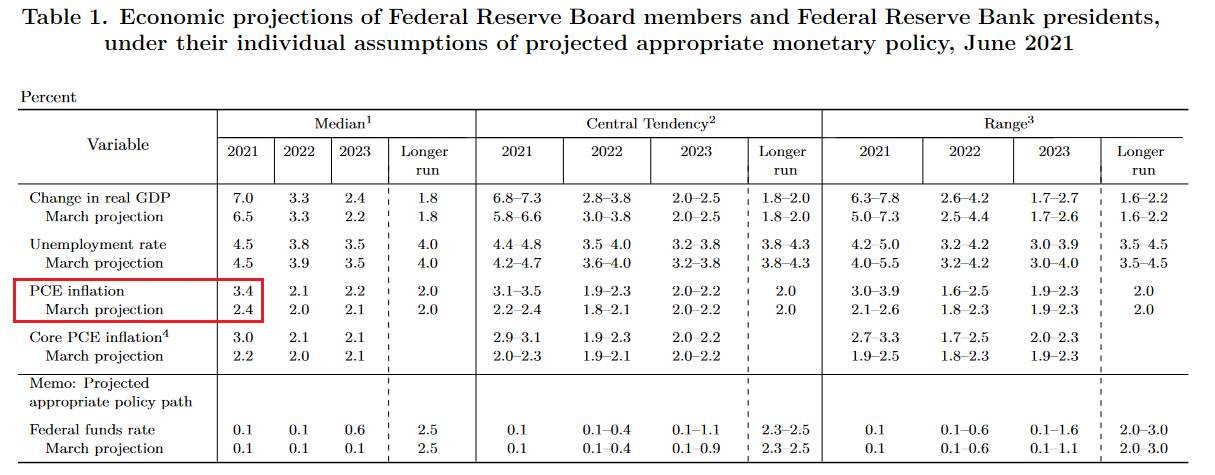

However, because actions speak louder than words, notice the monumental shift below?

To explain, if you analyze the red box, you can see that the Fed increased its 2021 Personal Consumption Expenditures (PCE) Index projection from a 2.4% year-over-year (YoY) rise to a 3.4% YoY rise. But even more revealing, the original projection was made only three months ago. Thus, the about face screams of inflationary anxiety.

What’s more, I highlighted on Aug. 5 that the hawkish upward revision increased investors’ fears of a faster rate-hike cycle and contributed to the rise in the USD Index and the fall in the GDXJ ETF (our short position).

Please see below:

And why is all of this so important? Well, with Mericle expecting the Fed to increase its 2021 PCE Index projection from 3.4% to 4.3% today (the red box below), if the Fed’s message shifts from we’re adamant that inflation is “transitory” to “suddenly, we’re not so sure,” a re-enactment of the June FOMC meeting could uplift the USD Index and upend the PMs once again. For context, the FOMC’s July meeting did not include a summary of its economic projections and today’s ‘dot plot’ will provide the most important clues.

Please see below:

Finally, with CNBC proclaiming on Sep. 21 that the Fed is “widely expected to indicate it is getting ready to announce it will start paring back its $120 billion in monthly purchases of Treasuries and mortgage-backed securities,” even the financial media expects some form of “advance notice.”

The bottom line? While the Delta variant and Evergrande have provided the Fed with dovish cover, neither addresses the underlying problem. With inflation surging and the Fed’s 2% annual target looking more and more like wishful thinking, reducing its bond-buying program, increasing the value of the U.S. dollar, and decreasing commodity prices is the only way to get inflation under control. In absence, the Producer Price Index (PPI) will likely continue its upward momentum and the cost-push inflationary spiral will likely continue as well.

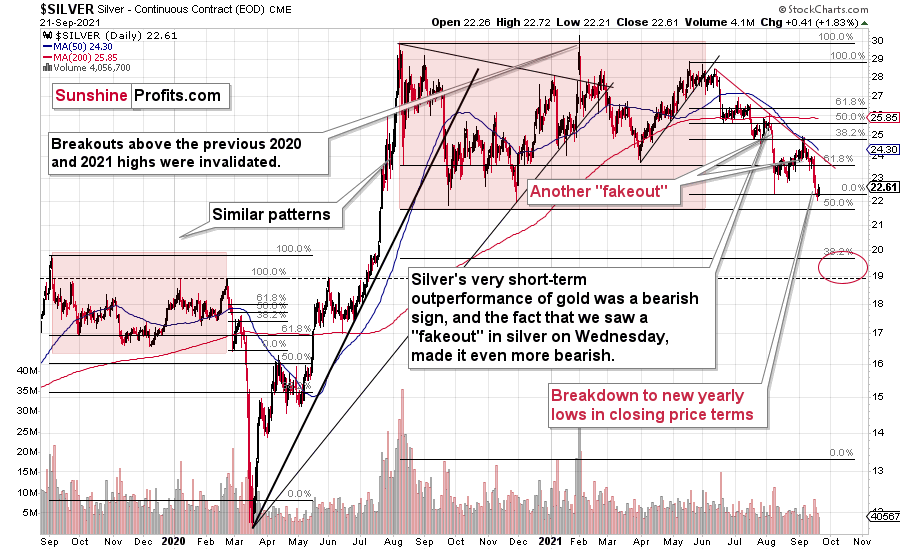

In conclusion, the gold miners underperformed gold once again on Sep. 21 and the relative weakness is profoundly bearish. Moreover, while the USD Index was roughly flat, Treasury yields rallied across the curve. And while Powell will do his best to thread the dovish needle today, he’s stuck between a rock and a hard place: if he talks down the U.S. dollar (like he normally does), commodity prices will likely rise, and inflation will likely remain elevated. If he acknowledges reality and prioritizes controlling inflation, the U.S. dollar will likely surge, and the general stock market should suffer. As a result, with the conundrum poised to come to a head over the next few months (maybe even today), the PMs are caught in the crossfire and lower lows will likely materialize over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing in gold is over, and the big decline seems to be already underway.

- It seems that the first stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

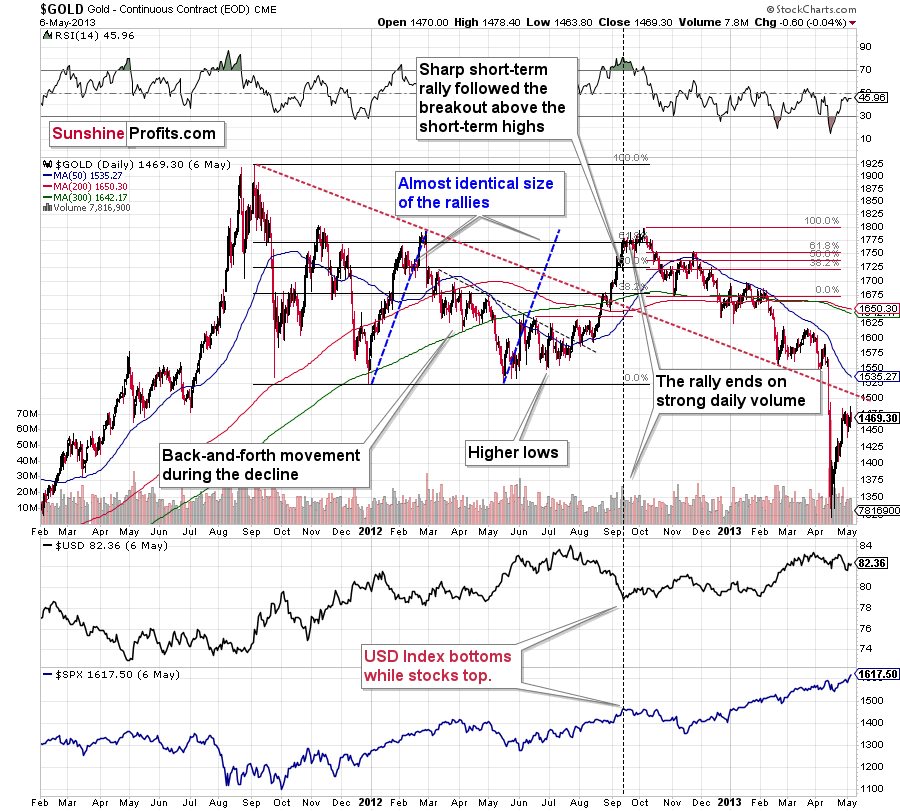

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

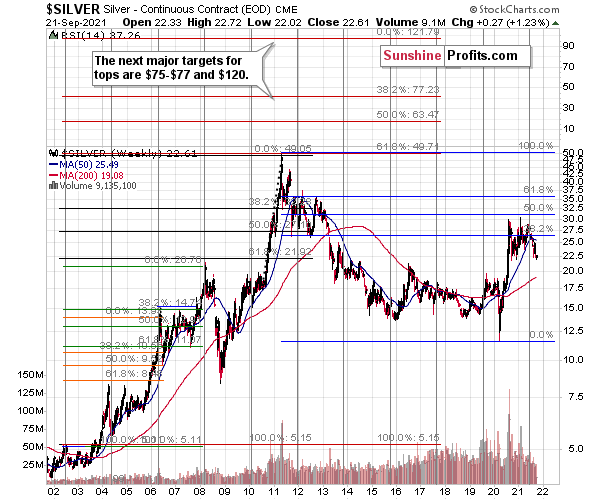

- I plan to exit all remaining short positions when gold shows substantial strength relative to the USD Index while the latter is still rallying. This might take place with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This might also happen with gold close to $1,375, but it’s too early to say with certainty at this time. I expect the final bottom to take place near the end of the year, perhaps in mid-December.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

To summarize, the outlook for the precious metals sector remains extremely bearish for the next few months.

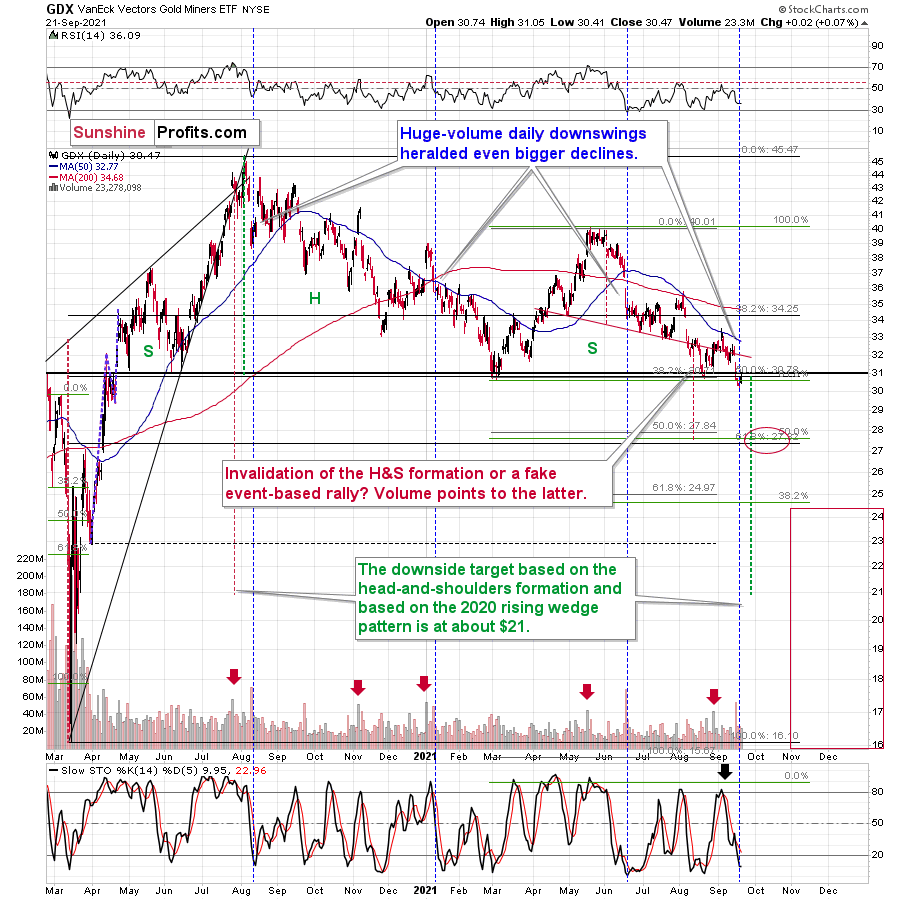

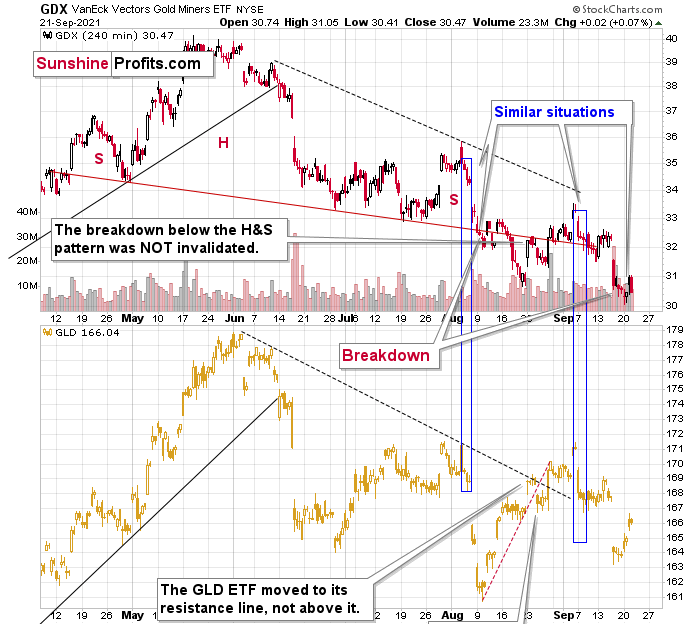

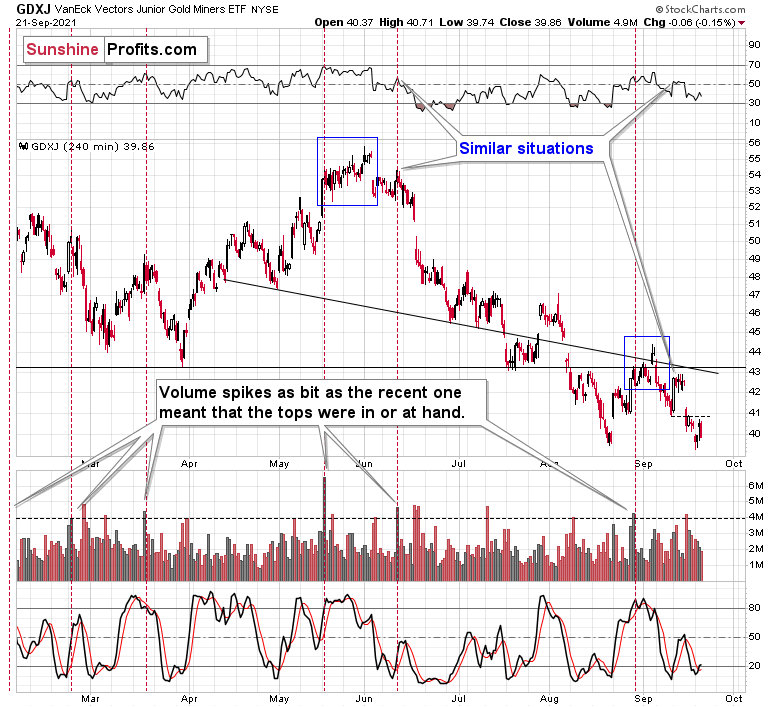

The decline to new lows in the GDX and silver as well as strength that we saw in the USD Index were important short-term confirmations for the bearish case, but the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the following weeks.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

By the way, we’re currently providing you with the possibility to extend your subscription by a year, two years or even three years with a special 20% discount. This discount can be applied right away, without the need to wait for your next renewal – if you choose to secure your premium access and complete the payment upfront. The boring time in the PMs is definitely over, and the time to pay close attention to the market is here. Naturally, it’s your capital, and the choice is up to you, but it seems that it might be a good idea to secure more premium access now while saving 20% at the same time. Our support team will be happy to assist you in the above-described upgrade at preferential terms – if you’d like to proceed, please contact us.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief