Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's Gold Investment Update.

Predicated on last week’s price moves, our most recently featured medium-term outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days and are written in italics.

The two key things that are most important from our point of view that happened this week are the continuation of the declines in the precious metals sector along with the rally in the USD Index.

Quite many things happened on the fundamental front as well, so I’ll take this opportunity to update you on those changes first, and I’ll move to the technicals next.

The Weekly Fundamental Roundup

The hawkish choir continues to sing, as resilient economic data has interest rates resetting higher.

Moreover, while we warned for months that the recession bulls would have to wait until Treasury yields were sufficiently restrictive, they’re still not high enough to suppress demand and curb inflation.

As a result, the Fed’s hawkish crusade should continue, which makes the medium-term outlooks for gold, silver, and mining stocks highly bearish.

Interest Rates Rattle Gold

While the crowd assumed that a dovish pivot would help gold escape its bear market, we warned on Apr. 14 that the optimism would turn to pessimism. We wrote:

Market participants are pricing in ~60 basis points of rate cuts. If those cuts get priced out, the market impact is similar to the Fed raising the U.S. federal funds rate (FFR). No matter how you slice it, no cuts means the FFR stays higher for longer, and a realization should have a profound impact on the PMs…..

Mining stocks are particularly vulnerable. The rate-cut optimism contrasts the realities on the ground, and market participants are overconfident because the Fed has been wrong more than it’s been right. However, we believe the QE bulls will suffer disappointment in the months ahead.

To that point, with another week culminating with another new low for the FFR futures contract, rate-cut expectations have erased all of their bank-run gains. Consequently, our technical and fundamental thesis continues to unfold as expected.

Please see below:

To explain, the candlesticks above track the weekly movement of the December 2023 expected FFR. If the metric ends the week where it ended the Jun. 29 session, it will mark a new closing low for the cycle. In other words, the expected peak FFR continues to rise, and the hawkish re-pricing is bearish for the PMs.

Economic Bulls

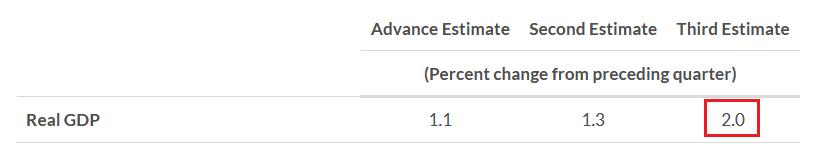

Q1 U.S. real GDP was revised higher on Jun. 29, with the metric coming in at 2% versus a previously expected 1.3%. The official report stated:

“The increase in first-quarter real GDP was revised up 0.7 percentage point from the second estimate, reflecting upward revisions to exports, consumer spending, state and local government spending, and residential fixed investment that were partly offset by downward revisions to nonresidential fixed investment, federal government spending, and private inventory investment.”

As such, U.S. economic growth continues to outperform its pre-pandemic trend, and the development is bearish for assets like silver and mining stocks.

Please see below:

Furthermore, economic resiliency has resulted in a surge in Citigroup’s Economic Surprise Index. For context, a ‘surprise’ occurs when a data point outperforms economists’ consensus estimate.

Please see below:

To explain, the ascent on the right side of the chart shows how U.S. economic data has surprised to the upside in recent weeks. Moreover, we warned this would occur, as interest rates are too low to sufficiently suppress demand. Therefore, the Fed needs to continue its hawkish march, and a realization should help uplift the USD Index.

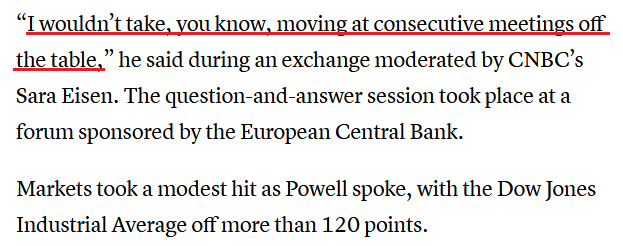

Speaking of which, Fed Chairman Jerome Powell said on Jun. 28:

“We believe there’s more restriction coming. What’s really driving it... is a very strong labor market.”

He added:

“Inflation has proven to be more persistent than we expected and not less. Of course, if that day comes when that turns around, that’ll be great. But we don’t expect that.”

Remember, we warned on Apr. 6 that the recession narrative would prove profitless. We wrote:

While the USD Index has suffered and the PMs have benefitted, the developments have only loosened financial conditions and made inflation more problematic. To win the war, long-term interest rates need to rise to suppress borrowing and consumption, and a realization supports higher real yields and a stronger USD Index. So, while the crowd believes QE is only a few months away, another disappointment should confront the pivot bulls in the months ahead.

And with Powell hinting at “consecutive” rate hikes at the following two FOMC meetings, the PMs should suffer even more if (when) the S&P 500 endures a material drawdown.

Overall, lower oil prices and base effects have been the primary drivers of the recent disinflation. But, the progress has been slow, and core inflation remains well above the Fed’s 2% target. Likewise, with the U.S. housing market reaccelerating recently, it’s another indicator that interest rates must rise to slay inflation. Consequently, the liquidity drain should continue, and gold, silver, and mining stocks should suffer along the way.

Why has the U.S. economy been so resilient?

Will Silver’s 200-Day MA Break?

Although fears of a banking crisis helped propel silver north of $26, we warned the good times would not last. We wrote on Apr. 6:

While silver has been a major beneficiary of the ‘bank crisis means rate cuts’ narrative, this is 2021/2022 all over again. When the crowd attempts to front-run a recession, it negates the recession due to the stimulative effect of lower long-term interest rates. That’s why sentiment surrounding silver has gone from euphoric to catastrophic several times over the last two years, and we believe another shift should occur over the next several months.

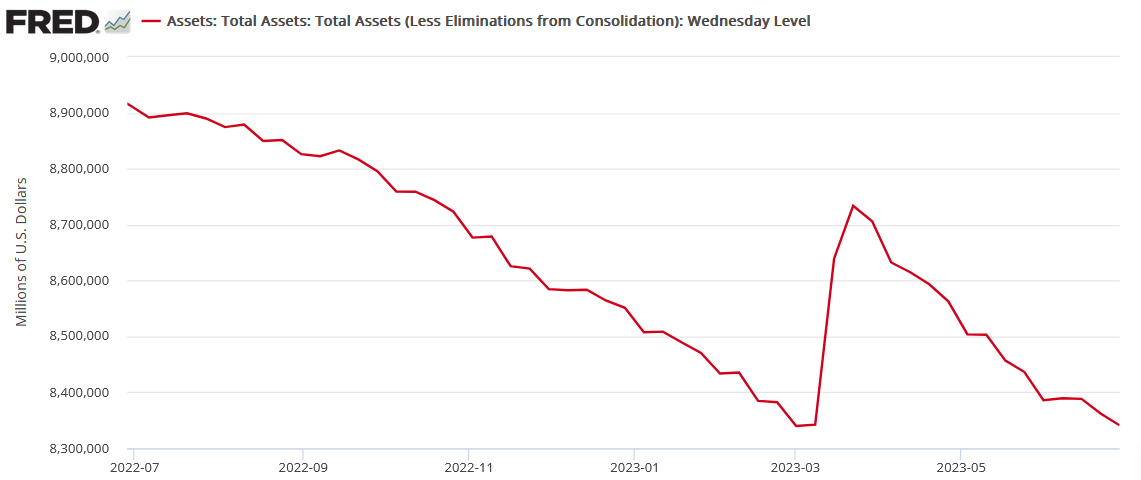

To that point, not only have rate-hike expectations increased dramatically, but the Fed’s balance sheet is ~$1 billion away from hitting a new cycle low.

Please see below:

To explain, the metric has declined significantly from its bank-run peak, and the Jun. 29 update shows how investors’ QE dreams have become a nightmare. As such, while we warned that disappointment would confront gold, silver, and mining stocks, our medium-term thesis continues to unfold as expected.

Labor Lessons

Despite prophecies of a crashing U.S. labor market, employment growth has defied expectations for over 12 months. And with The Conference Board’s Consumer Confidence Index increasing from 102.5 to 109.7 on Jun. 27, the data does not support a dovish pivot anytime soon. The report stated:

“23.7% of consumers said business conditions were ‘good,’ up from 19.7% last month. 16.3% said business conditions were ‘bad,’ down from 16.7%.”

In addition:

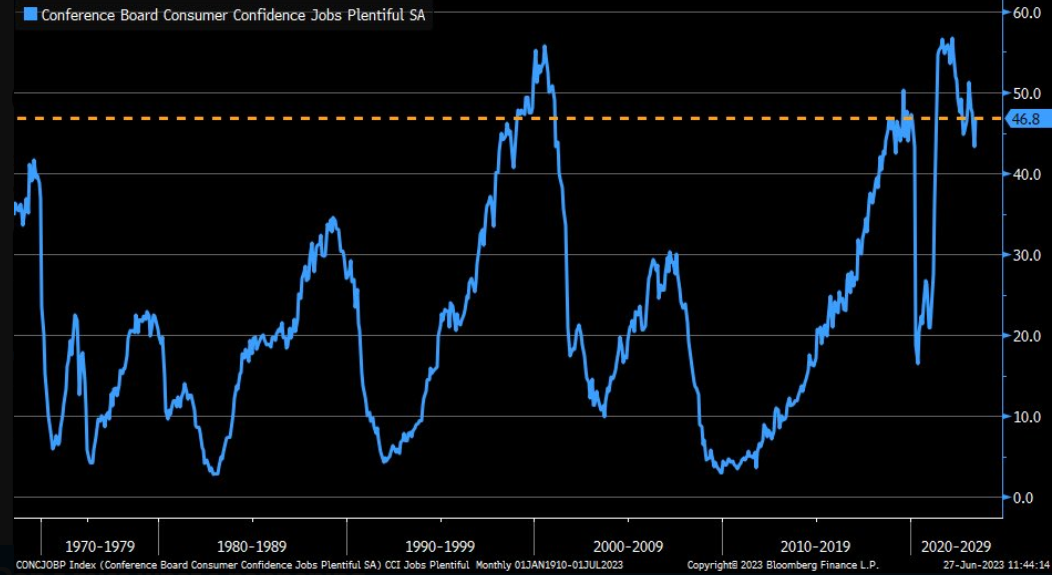

“46.8% of consumers said jobs were ‘plentiful,’ up from 43.3%. 12.4% of consumers said jobs were ‘hard to get,’ slightly lower than 12.6% last month.”

Consequently, The Conference Board’s labor differential remains highly elevated, and continued resilience is bullish for the U.S. dollar and real interest rates.

Please see below:

To explain, the blue line above tracks The Conference Board’s jobs are “plentiful” metric. If you analyze the right side of the chart, you can see that the latest reading is still well above its historical norm. As a result, abundant employment opportunities are bullish for wage and output inflation, and interest rates need to rise to rebalance supply and demand.

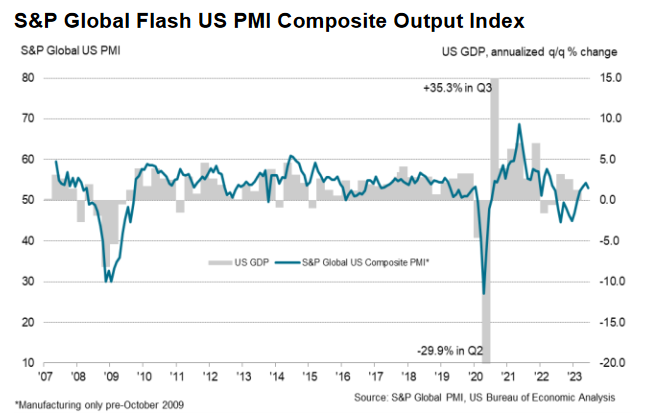

As further evidence, S&P Global released its U.S. Composite PMI on Jun. 23. The headline index declined from 54.3 in May to 53 in June but remains in expansion.

Please see below:

Regarding services, the report stated:

“Services firms continued to hire amid greater new orders. That said, the rate of job creation eased to the weakest since January amid challenges replacing voluntary leavers. In response to problems hiring sufficient new staff, the level of outstanding business at service providers increased in June.

Regarding manufacturing:

“Greater success in finding suitable candidates allowed firms to expand their workforce numbers in June, despite concerns surrounding future demand conditions. The rate of job creation slowed slightly but remained among the fastest in a year.”

So, with “voluntary leavers” the primary problem for service providers and manufacturing firms increasing their headcount “among the fastest in a year,” the U.S. labor market is nowhere near the crisis levels that would support rate cuts and QE.

Furthermore, the report added:

“Following a loss of momentum in May, price pressures gained intensity in June. The rate of cost inflation across goods and services picked up to a robust pace. The reigniting of cost inflationary pressures was driven by the service sector amid increased wage bills.”

Thus, while output inflation did not follow suit, the latter often lags input inflation. In other words, if U.S. businesses continue to confront higher cost inflation, they will inevitably raise their selling prices, as they did in 2021 and 2022. As a result, the Fed needs tighter financial conditions to curb this behavior, which means lower stock prices, higher interest rates and a stronger U.S. dollar

Speaking of which, while the S&P 500 ignores the significant liquidity drain, sentiment should shift in the months ahead.

Please see below:

To explain, the gold line above tracks the S&P 500, while the blue line above tracks the combined liquidity generated from the Fed’s balance sheet, the Treasury General Account, and the reverse repo facility. If you analyze the connection, you can see that the S&P 500 is highly sensitive to liquidity injections and withdrawals.

More importantly, the blue line’s descent on the right side of the chart shows how the current liquidity drain has been ignored by the S&P 500. Yet, with the tightening of financial conditions poised to persist, the blue line should continue its decline, and it’s likely only a matter of time before the S&P 500 follows suit.

Overall, commodities prices have been hammered, and assets like copper and oil have suffered mightily. Consequently, a stock market wake-up call could be the next catalyst to upend the PMs and help increase the gains from our GDXJ ETF short position. All in all, their medium-term outlooks remain profoundly bearish.

Do you think the liquidity drain will continue and eventually hurt the S&P 500?

The Bottom Line

Reality has returned to the financial markets, as rate-hike expectations are near their cycle peaks. However, long-term interest rates remain relatively depressed and are still well below their 2022 highs. Thus, with QT and the replenishment of the TGA poised to increase bond supply, the bulls need a Black Swan event to justify these levels. In the absence, the Fed should continue to hammer the financial markets, as long-term rates need to rise to suppress economic activity and normalize inflation.

In conclusion, the PMs were mixed on Jun. 29, as mining stocks outperformed. In contrast, the GDXJ ETF has been a major underperformer over the last three months, and the oversold bounce should give way to new lows in July.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Jul. 3: S&P Global and ISM Manufacturing PMIs

The nationwide surveys are always must-reads, as they paint the best portraits of the economic developments unfolding in the U.S.

- Jul. 6: S&P Global and ISM Services PMIs, JOLTS job openings, Challenger job cuts

The services PMIs will augment the findings from the manufacturing PMIs, while the JOLTS and Challenger job cuts data will provide more color on the strength of the U.S. labor market.

- Jul. 7: U.S. nonfarm payrolls, unemployment rate, labor force participation rate, average hourly earnings

The four metrics move markets and the wage inflation results should hint at whether the employment backdrop aligns with the Fed’s expectations.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Technically Speaking

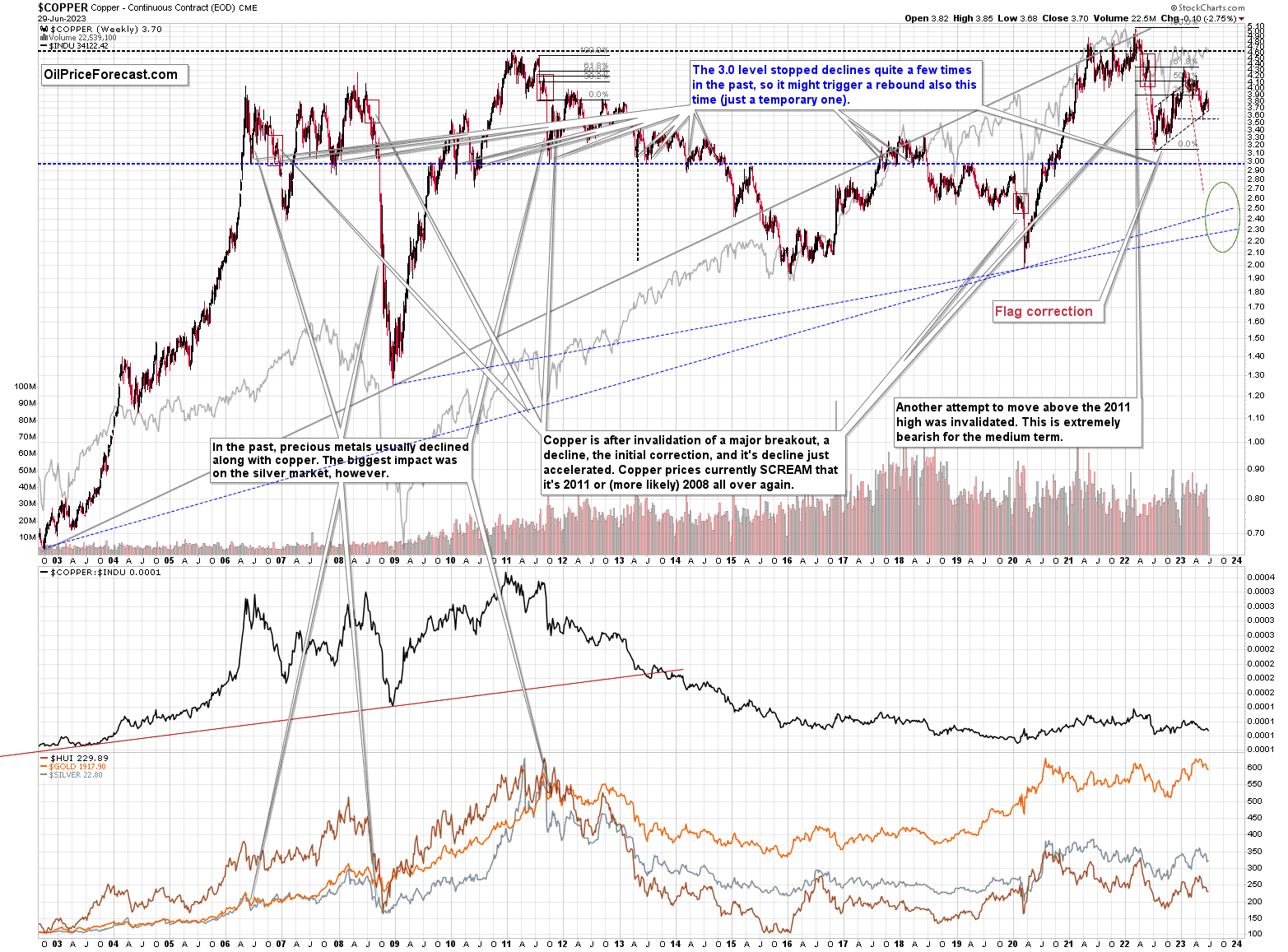

Let’s start today’s technical discussion with a quick check of copper prices.

Copper rallied recently, but it stopped at its 61.8% Fibonacci retracement level and then moved back down. Consequently, the recent move – while impressive from the day-to-day point of view – remains to be a short-term correction only.

Consequently, what I wrote about it previously remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

No market moves up or down in a straight line (well, the 2008 slide appears to have been an exception), and a short-term correction doesn’t necessarily invalidate the bigger trend. For the last couple of months, copper has been trading sideways, but it didn’t change much regarding the outlook.

In fact, it made my previous target area even more likely. You see, the consolidation patterns are often followed by a move that’s similar to the move that preceded them. In this case, the previous 2022 decline was quite significant, and if it is repeated, one can expect copper to decline well below 3.

Actually, copper could decline profoundly and bottom in the $2.0-2.7 area. That’s where we have rising, long-term support lines and also the previous – 2016 and 2020 – lows.

Flag patterns (which we just saw in copper) tend to be followed by price moves that are similar to ones that preceded them. I marked this on the above chart with red, dashed lines. This method supports a copper price’s move to around $2.7.

Given the size of the previous decline (and its pace), it seems quite likely that it could take another 2-7 months for copper to move to about $2.4. May seems to be the most likely time target given the current data.

Interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged.

Again, copper is after invalidation of a major breakout, a decline, and a correction. Copper prices currently SCREAM that it’s a variation of 2008 all over again. This is extremely bearish for mining stocks (especially juniors) and silver.

On a very short-term basis, though, please note that copper encountered two support levels and I marked both with black, dashed lines. One is a rising support line based on two previous bottoms, and the other one is the previous low. Five weeks ago, I warned that this could trigger a corrective rally, and that’s exactly what happened. However, I also wrote that this is most likely going to be just a short-term phenomenon, after which copper’s downtrend is likely to be resumed. And this remains up-to-date.

In fact, it seems that the downtrend just resumed.

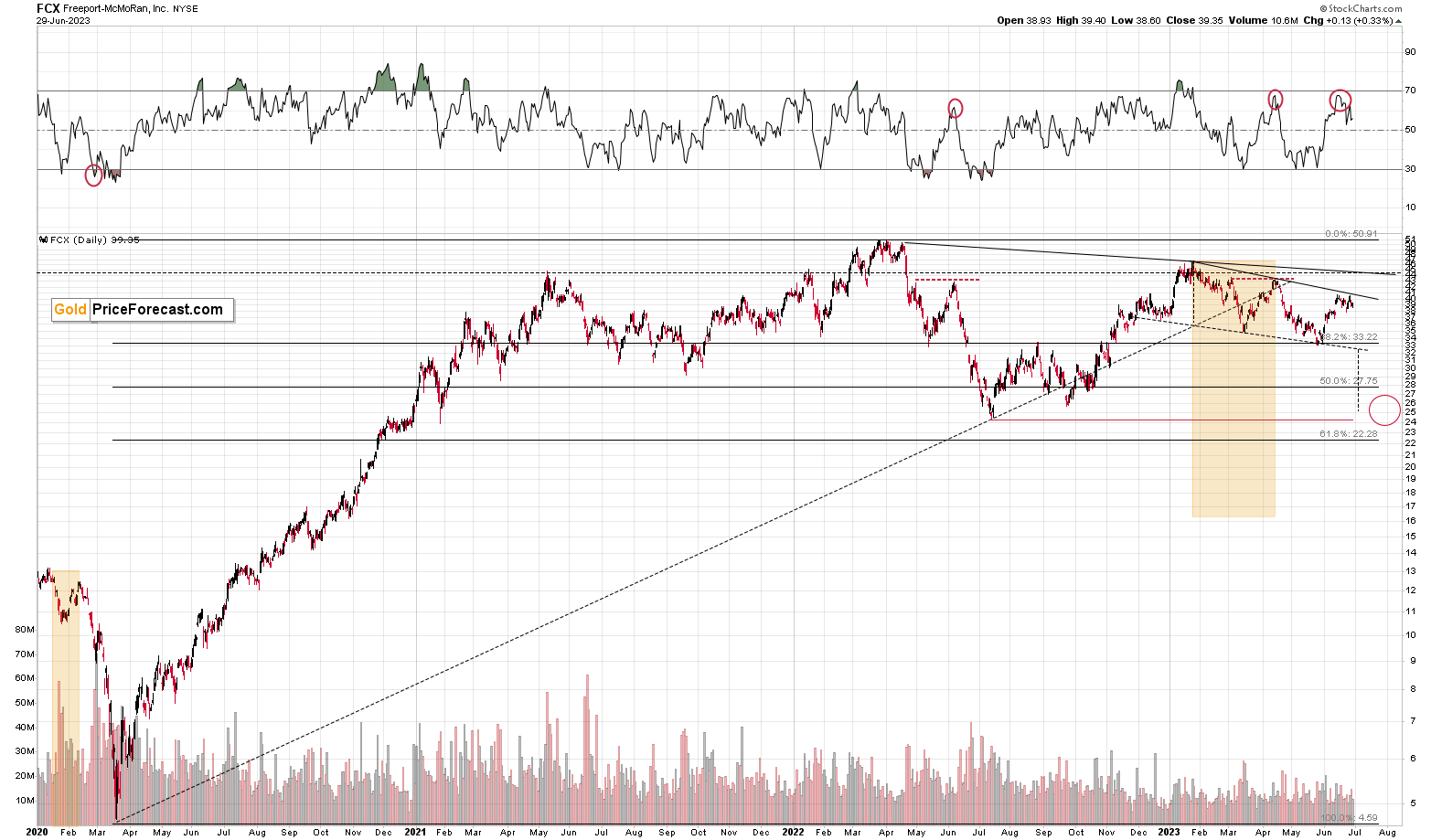

Before moving further, I’d like to extend the copper analysis into the analysis of the situation in one of the major copper companies – FCX.

We recently profitably closed a short position in it (and we have a new short position, which we re-opened at higher prices), but I’m featuring this chart to show you that the bearish potential that this asset has is still there.

The FCX moved higher recently, which is not surprising given the upswing in the S&P 500, and the small move higher in copper that I already wrote about above.

Still, it seems to me that this move is very temporary. Why? Because FCX was one of the very poor performers this year, and in the final part of a given upswing in stocks, the worst performers tend to rally.

This is the second corrective upswing within the decline that started in early 2023, but that is a part of a broader downswing that started in 2022.

Interestingly, the entire 2022-now performance could be viewed as the right should of a head and shoulders formation, so something symmetrical to the left shoulder that was created by the 2021 upswing and correction. The recent move higher doesn’t invalidate the symmetry of the pattern, so it has a very good chance of forming.

Now, on a very short-term basis, FCX might have topped here, or it might move to its next Fibonacci retracement, which coincides with the declining resistance line. If this level is reached (a bit below $42), it will very likely mark the top. This might be a good moment for one to add to their short positions in the FCX.

And just as the stock market is likely headed much lower – not just the U.S. stock market, but in particular world stocks, the demand for copper and the value of shares of its producers (like FCX) is likely to decline.

The investment public simply buys whatever is cheap, without considering that some shares might be cheap for a reason. It was likely the same with the GDXJ, too.

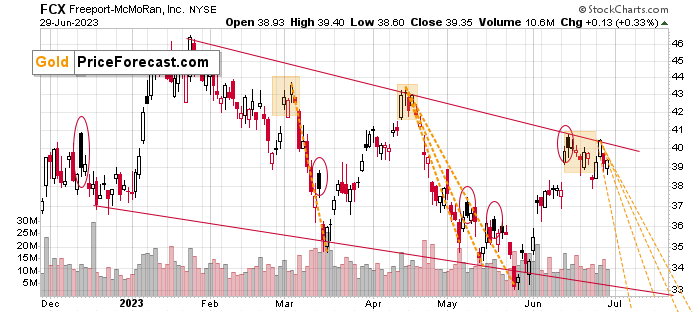

We’ll move to the rally in stocks in the following part of the analysis. For now, let’s zoom in.

The declining resistance line – based on the daily closing prices – was just reached. This means that the top is most likely in, and lower prices are about to be seen.

And – as I wrote above – if I didn’t have a short position in the FCX, I would open it now. Some might consider adding to that position at this time.

Having said that, let’s check the junior miners’ really big picture.

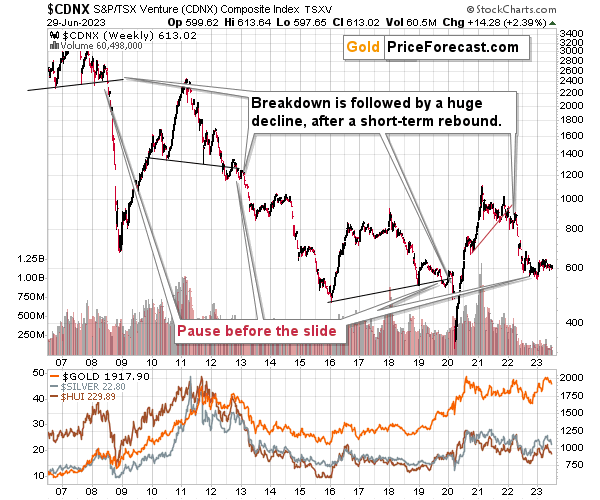

In short, we saw a tiny correction in the TSX Venture index, and this should be a major red flag for anyone thinking that the recent rally was a game- or trend-changer. This is a blip on the radar screen, similar to what we saw in the second half of 2021, before another big move lower.

The really important thing here is that we saw the first crack in the dam. The index declined visibly, and it might mean that the final part of the 2008-style slide has just begun.

Consequently, my previous comments on the above chart remain up-to-date:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

Just like it was the case in 2008, the move higher that we saw before the final (biggest) slide in gold, silver, and gold stocks (lower part of the chart), didn’t translate into a visible rally in the TSX Venture Index. Just as the index paused back then, it pauses right now.

Currently, it’s trading at about 600, and back then, it consolidated at about 2500. The price levels are different, but the overall shape of the price moves (lack thereof) is similar. This serves as a signal that the recent upswing in the PMs is not to be trusted.

The above chart is one of the weakest (from a technical point of view) that is seen across the board right now. There is a strong long-term downtrend visible in the TSX Venture Index, and if stocks slide similarly as they did in 2008, the TSXV could truly plunge – perhaps even to the 300 level or lower.

The important short-term detail is that the TSXV just broke to new yearly lows. This is a major (yet barely noticed by most) indication that the next big move lower is about to start.

Having said that, let’s turn to gold.

Let’s start with context:

Between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet gold failed to rally to new highs.

In fact, gold was just trading well below its 2011 high, which tells you a lot about the strength of this market. It’s almost absent.

There’s a war in Europe, and billions of dollars were printed, and gold was below its 2011 highs – in nominal terms! Adjusted for inflation, it’s much lower. And silver and gold stocks’ performance compared to their 2011 highs? Come on…

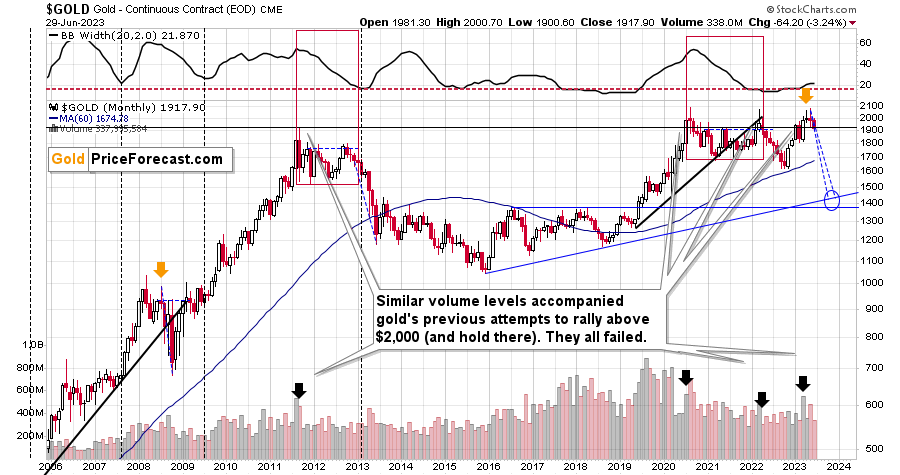

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. We can also spot similarities between now and 2008. The long-term gold price chart below provides details.

Based on the most recent rally in gold, the price now seems quite similar to what we saw in 2008. This time, we see a triple-top pattern where the tops are far apart, whereas in 2008, they were relatively close to each other.

The link to 2011-2013 is still present, although in this case, the price moves to the upside are more visible.

To be more precise, I should say that those moves higher “were” visible, because – despite the intramonth run-up – gold was down in May; and it’s down by over $70 this month (including today’s pre-market decline).

The RSI above 70 shows how extremely overbought gold just was and how likely it is to slide in the following weeks and months. I marked also other similar cases with red arrows, and as you can see, they were indeed followed by declines.

Please note that gold’s attempt to move to new all-time highs and the failure thereof are strongly pointing to lower prices ahead. The emotionality that I described in my recent Gold Trading Alerts had probably burnt itself out as gold approached the previous highs. And now, it’s time for logic and cold calculations to take its place. The reality is that real interest rates are going higher, and that’s very bearish for gold prices.

Finally, I marked the big increases in weekly volume levels during gold’s upswings with green arrows.

The most recent case is from 2022, when gold topped.

The same happened in early 2018.

That’s how gold topped in 2011.

And – most importantly – that’s exactly what we saw at the final pre-slide top in 2008.

Please note that the rapid rally that we saw in 2008 before the slide was very much in tune with what we saw recently (note: green rectangles). Consequently, it’s not a bullish game-changer.

Gold recently moved above $2,000, and just as all previous attempts to move above this level failed, we’re likely to see it fail once again.

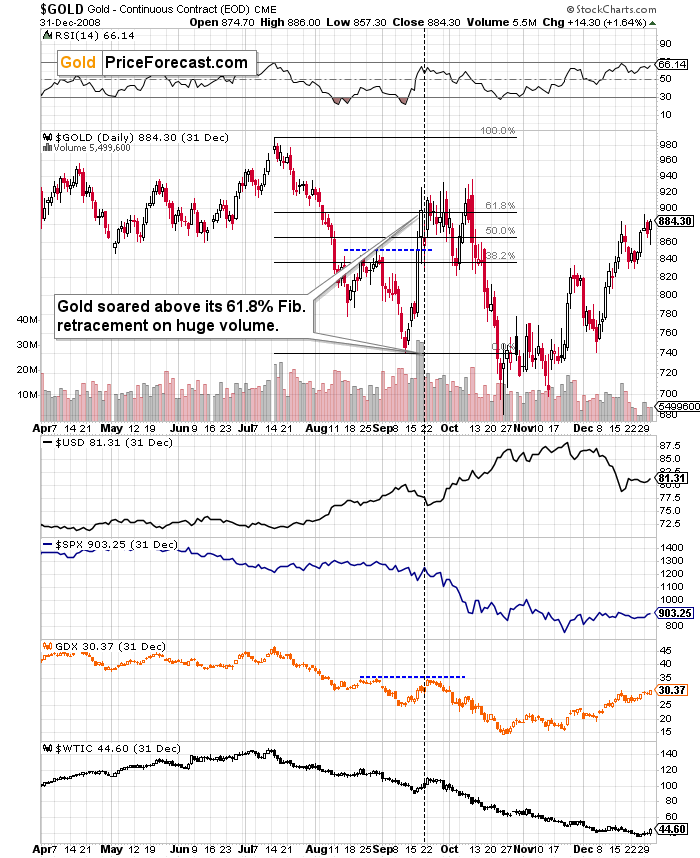

Let’s take a look at how the situation developed on the technical front back in 2008.

Gold’s final pre-slide corrective upswing was based on turmoil, uncertainty, and safe-haven buying. It was volatile, it was large, and it was accompanied by huge volume.

The RSI indicator moved a bit below the 70 level.

Sounds familiar?

Back in September and October, 2008, gold even rallied above its 61.8% Fibonacci retracement level.

During that time, the USD Index declined in a relatively sharp manner, and the GDX ETF pretty much followed the stock market.

It’s exactly the same thing right now (except for the fact that gold moved even higher right now). Back then, stocks declined over time, and this time they are moving somewhat higher, but the mining-stocks link is just as it was in 2008.

Also, let’s keep in mind the situation in real interest rates. It might not be as sexy as bank collapses, but that remains one of the key reasons for gold’s decline in the following weeks/months.

Gold has a lot of catching up to do with its decline to “normalize” its link with real rates.

Another thing is that, given the major fundamental event that I already mentioned above (the war outbreak), it’s possible for the technical patterns to be prolonged and perhaps even repeated before the key consequence materialized. Similarly to the head-and-shoulders pattern that can have more than one right head before the breakdown and slide happen.

In gold’s case, this could mean that due to the post-invasion top, the entire 2011-2013-like pattern got two major highs instead of one. And thus, the initial decline and the subsequent correction are pretty much a repeat of what we saw in 2020 and early 2021, as well as what we saw in 2011 and 2012.

The current situation is truly special, as the rate hikes are something that we haven’t seen in a long time. The same goes for the level of concern about the inflation that’s “out there.” The latter implies that when faced with a decision about whether to fight inflation or help the economy, the Fed is likely to lean toward the former. And that’s bearish for assets like gold.

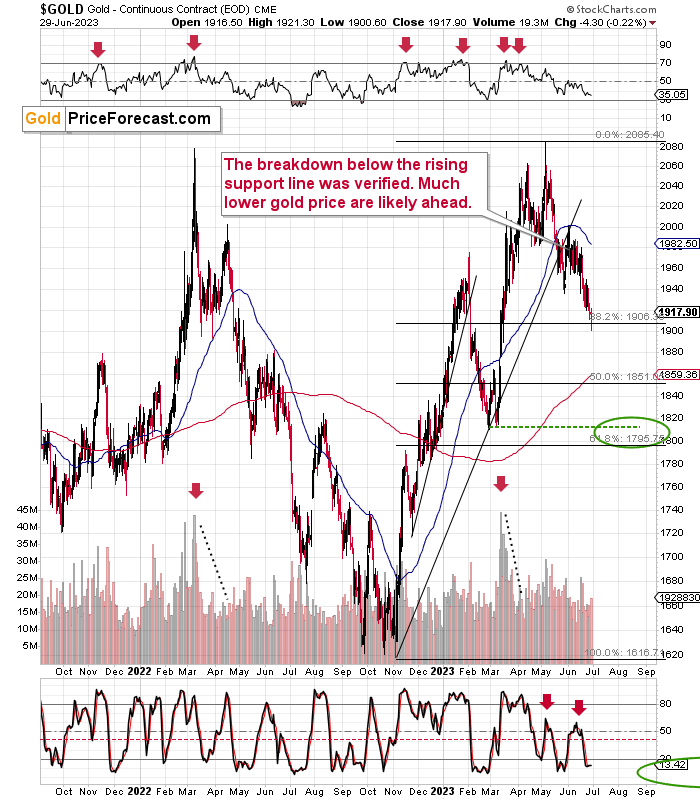

We’ll find more details on gold’s short-term chart. The first thing that “pops up” out of this chart is how far gold rallied and then how far it declined recently.

In my yesterday’s analysis, I commented on the above chart in the following way:

- “But PR, gold just reversed close to the 38.2% Fibonacci retracement level – wasn’t that a reversal?”

Those two factors are indeed bullish. However:

- I wrote about other bearish factors earlier today and in the previous days, which still overweight the importance of the above.

- The supposed “reversal” took place on low volume in gold futures, and huge volume should confirm reversals if they are to be viewed as such.

- The 38.2% Fibonacci resistance is usually important, but this time gold is just after a quite long consolidation, and it declined just a little below it. The decline is so far not even nearly as big as the decline that preceded the consolidation.

Just like I stated in the title – the bullish reversal in gold is coming – it’s most likely not here just yet, though.

During yesterday’s session, we pretty much saw a repeat of the above – gold once again moved lower, and then it moved back up once again. That was after the gold price reached the $1,900 level. That’s a psychologically important (round) number, so it’s quite normal that gold hesitated.

Still, it doesn’t mean that the decline is completely over now.

The volume was a bit bigger, but it was still below average, taking the recent months into account. And the post-consolidation decline still isn’t as big as the decline that preceded the consolidation, which means that the gold price most likely hasn’t declined enough.

Consequently, the above remains up-to-date – it seems that a meaningful reversal is coming, but we haven’t seen it just yet.

Now, the question is, how low can gold move before we see the next rebound.

The 50% Fibonacci retracement is the next candidate, and while it might provide support, it’s not very likely that it would. It’s not strengthened by anything more than the 200-day moving average, which – as you can see on the above chart – proved to be a poor support/resistance in the recent past.

The support provided by the 61.8% Fibonacci retracement is stronger as it’s close to the May lows as well as the psychologically important $1,800 level (it’s important as it’s round, which attracts attention). If gold goes to this level in a fast manner, it will be very likely to rebound in a meaningful manner.

It’s not as likely for the higher support levels.

The upcoming decline will likely create a great opportunity to take profits from the current short position in mining stocks and perhaps to switch to a long position in the GDXJ. This could happen as early as next week. There are no certainties in any market, but the above does seems quite likely. Whether we do indeed see this great opportunity, will depend on the way miners get to their downside target. As always, we’ll keep our Gold Trading Alert subscribers informed.

Having said that, let’s take a closer look at the silver market.

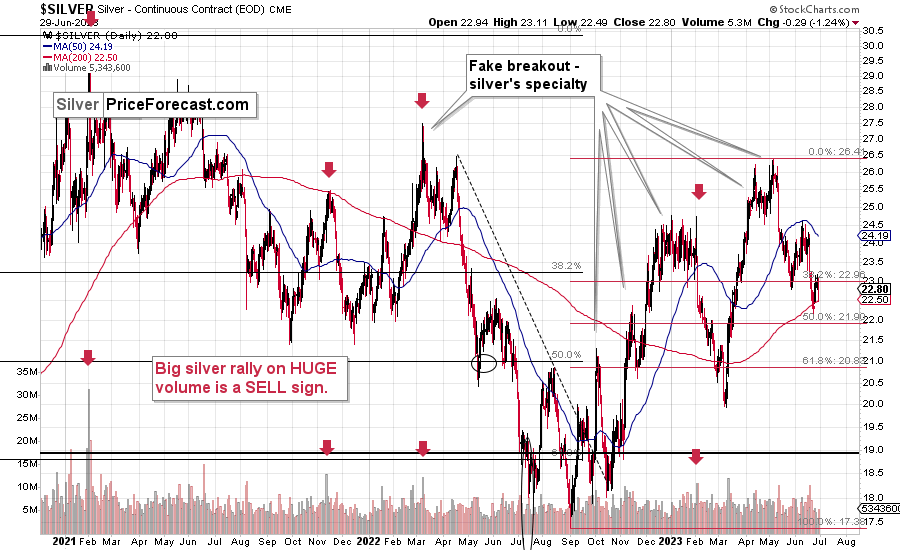

I’ve been putting “fake breakout – silver’s specialty” annotation on the below chart for quite some time now, and this month’s performance shows you precisely why I’ve been doing it.

While gold didn’t move to new monthly highs recently, silver did, which means that it just outperformed gold on a very short-term basis. This is a typical behavior that we tend to see before bigger declines.

Thanks to this rally, silver verified the breakdown below its 50-day moving average (marked with blue). We saw the same kind of even two years ago – in mid-2021 – and just as it preceded bigger declines back then, it’s likely that bigger declines will follow also this time.

Indeed, the price of silver declined, rebounded from approximately its 50% Fibonacci retracement, moved back to approximately its May low, and now it’s declining once again.

Since the breakdown below the May low was verified, another big move appears to be to the downside.

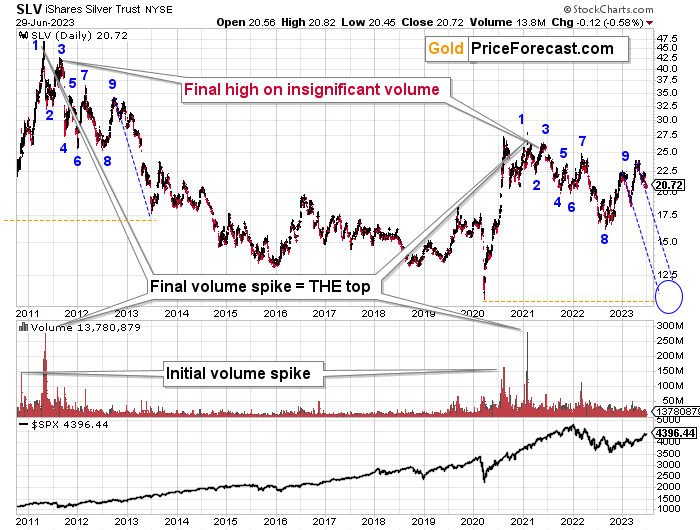

Also, while it’s not visible on the above silver chart, the white metal is currently repeating its previous post-top performance. It’s crystal-clear on the below SLV ETF chart.

However, before we move on to the SLV ETF, let’s take a moment to recall the time when everyone and their brother were bullish on silver – in early 2021.

The silver price even tried to move above the $30 level, and it succeeded in doing so… For a brief moment.

Silver was “supposed to” take off. Shot up to the moon. Based on the physical market’s tightness, silver’s availability, a short squeeze, etc. Truth be told, it’s difficult not to write this with sarcasm (and I’m not), because I remember exactly the same reasons being used to justify silver forecasts above $100 back in the early 2000s. I’ve been there and I’ve been buying silver below $5, so I know a thing or three about what kind of analyses, discussions, and rumors were “out there” at those times.

Two decades later, the silver price rallied in a rather regular manner, along with gold, and then declined – also along with gold. To be precise – I’m not ruling out any of the above – short squeeze, shortages in general, etc. However, I am saying that just because something MIGHT EVENTUALLY happen, that doesn’t mean that it IS going to happen NOW or ANYTIME SOON.

For those exceptional situations, it’s great to have some physical silver (and gold, too). However, on a day-to-day basis, the investment and trading parts of one’s capital should be governed while putting great weight on things that are actually likely to happen in regular situations.

One way to thrive while trading silver is not to take silver’s strength at face value. Just as I warned that even if silver was about to soar (and I really DO expect silver to soar above $100 in the following years), then it was very unlikely to do so again in 2021 as the bigger trend was not supporting this outcome.

Anyway, when silver was trying to break above $30, I warned you about the real bearishness of the situation. (By the way, this link also proves that I’ve been expecting the interest rates to rise before that materialized.)

Many months later, we see that what formed in early 2021 was a major top that started a major medium-term decline.

Those of you who have been following my analyses for a long time might recall this chart.

I featured it originally many months ago, and the emphasis was on the analogy in price movement and in the spikes in SLV ETF’s volume.

Indeed – the situations proved to be analogous, and the silver price declined.

What’s remarkable is how similar the declines were.

What I added today are the counters (no, it’s not an Elliott Wave count), and I added the S&P 500 at the bottom of the chart.

The counters help to see which parts of the silver price movement are analogous. They are not identical, but they are much more similar than it seems that they “should be.” Even the “8” bottom was rather broad in both cases.

This time the “9” top is a bit different, but it sems that what we see now is analogous to what in late 2012 was the first counter-trend rally. Only this time, the top is above the initial top.

Based on this similarity, silver is now starting the main part of the slide. Its recent weakness relative to gold definitely confirms that.

Silver’s decline (and PMs decline in general) took a rather measured shape in its initial months (late 2012 – early 2013), so should we expect the same thing to happen now?

No.

The reason for this lies in the link to the stock market. Back in 2013, there was no visible decline in stocks, let alone a substantial one.

This time, we are likely to see one. And you know when we also saw some sharp declines in stocks? In 2008 and in 2020, and you can see the latter on the above chart. Silver plunged in a sharp (not measured!) manner in both cases.

Given rising interest rates and the investment public’s realization that the rates are not “about to move lower,” that is something that is likely to lead to the stock market’s sell-off. But I’ve been writing about that already.

The thing is that it has implications for the above-mentioned analogy in silver. And that is: the upcoming part of the decline in silver is likely to be sharper than what we saw in 2013. The same goes for the implications for mining stocks (and probably gold). This slide is likely already underway.

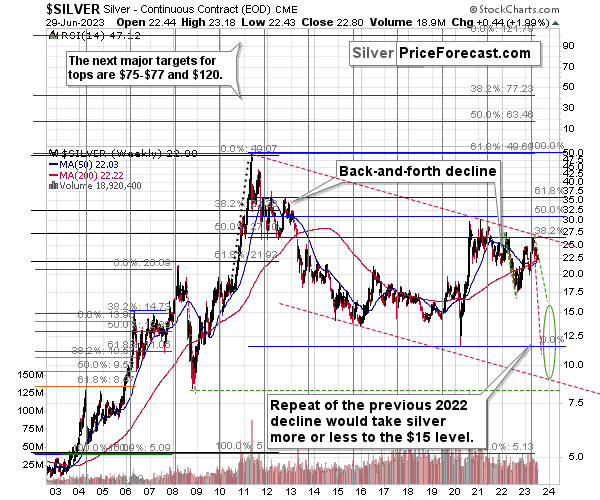

Let’s take a look at the situation from a broader point of view.

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

What happens after corrections are over (as indicated by, i.e., silver’s fakeout)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Please note that silver just approached it 38.2% Fibonacci retracement based on its 2011-2020 decline and the declining long-term red resistance line based on the 2011 and 2021 highs. This resistance is likely to cause silver to move lower.

Let me emphasize silver’s long-term weakness here – gold just tried to move to all-time highs, and silver barely moved to the 38.2% retracement based on the decline from its high.

That’s not how major bull markets are born, especially that mining stock confirm silver’s weakness, not gold’s strength.

Moreover, it appears that silver’s long-term turning point marked the very recent medium-term top. Consequently, the price of silver and now decline in a profound manner. Please note that it was this kind of turning point that also accompanied the 2021 tops (approximately).

If silver declines by as much it declined in 2022, it will move to about $15, and I marked it with green, dashed lines.

However, if silver declines similarly to how it declined in 2008, it will reach its 2020 low and the slide will take a very sharp form.

We could also see something in between of those scenarios, but the overall implications are very bearish for the following weeks and months, anyway.

Due to its industrial uses, silver is known to move more than gold, in particular when the stock market is moving in the same way as gold does. Since I think that gold and stocks are both likely to slide, silver is indeed likely to decline in a truly profound manner. Quite likely lower than just $15.

Consequently, my prediction for silver prices remains bearish, as does the outlook for the rest of the precious metals sector.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in mining stocks.

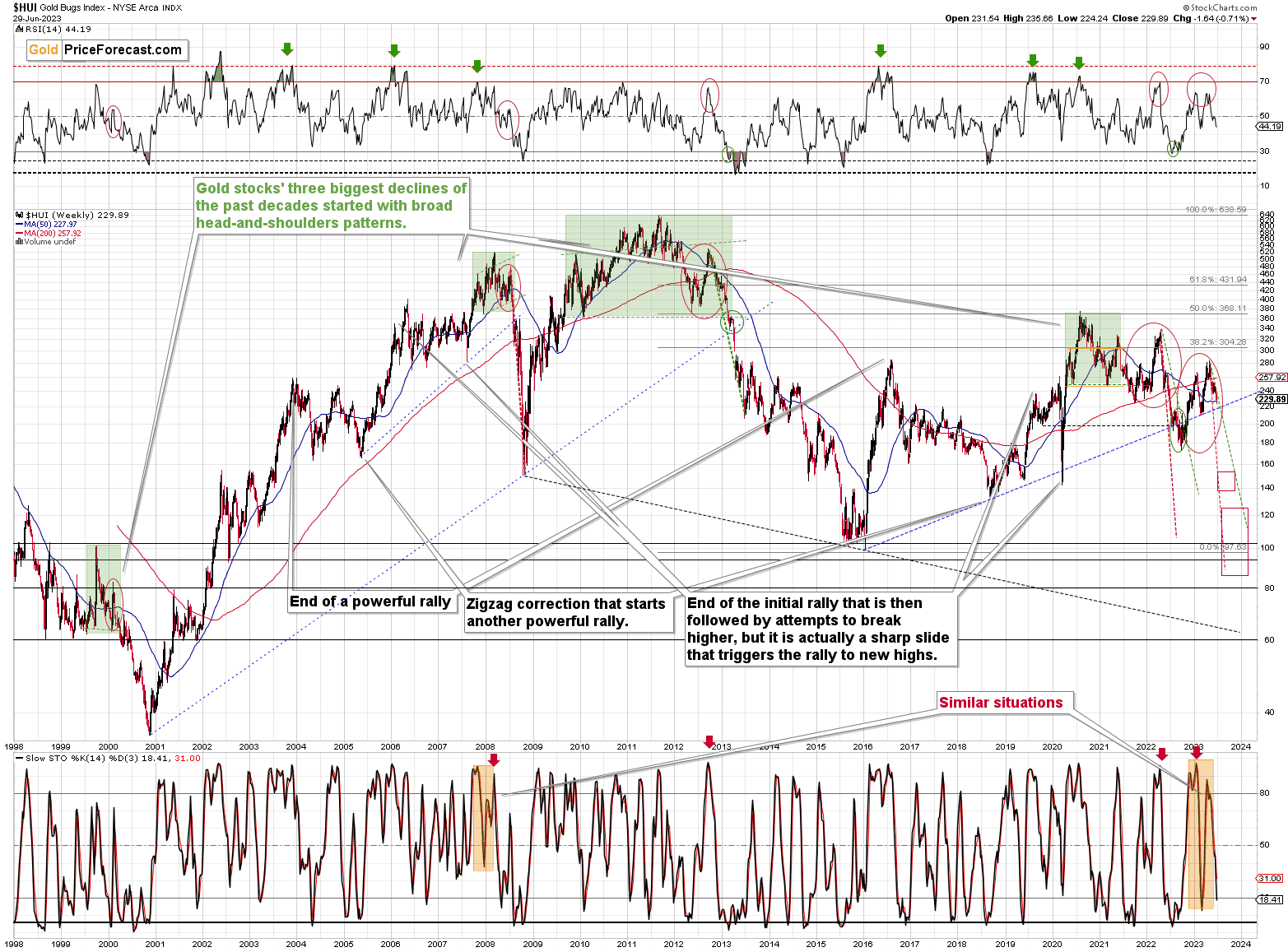

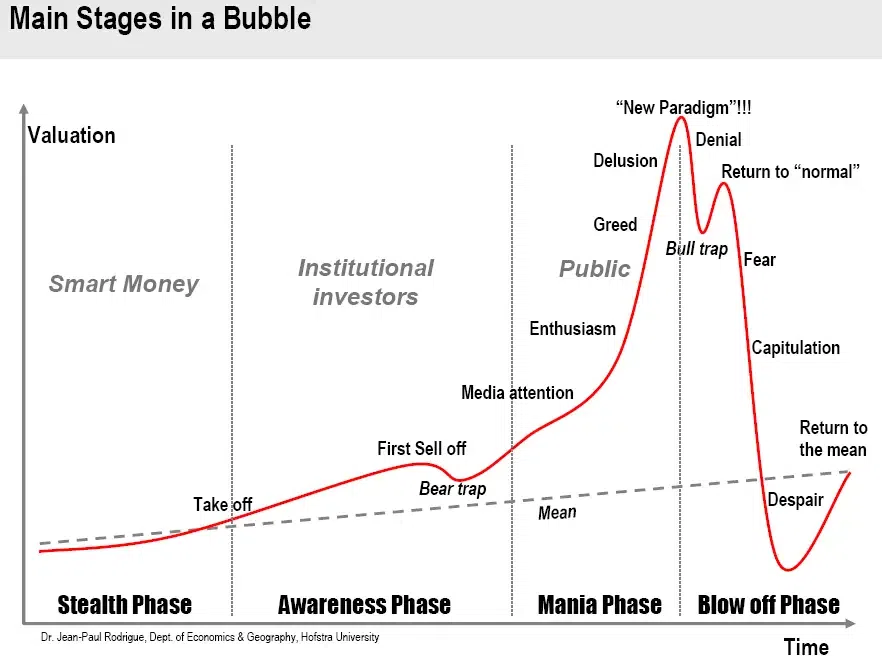

History tends to repeat itself. Not to the letter, but in general. The reason is that while economic circumstances change and technology advances, the decisions to buy and sell are still mostly based on two key emotions: fear and greed. They don’t change, and once similar things happen, people’s emotions emerge in similar ways, thus making specific historical events repeat themselves to a certain extent.

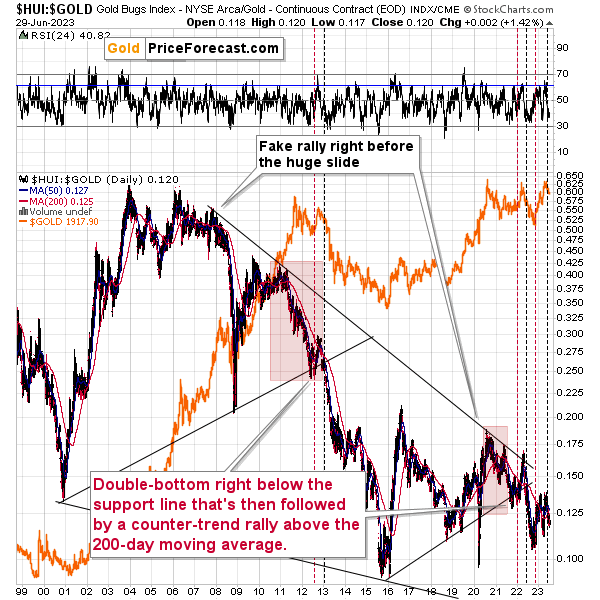

For example, right now, gold stocks are declining – and correcting – similarly to how they did in 2008 and in 2012-2013.

The HUI Index is decline along the green, dashed line, which is copied from the pace of 2012-2013 decline – so both declines are in tune. That’s not bullish at all, given what followed in 2013…

Moreover, the Stochastic indicator (lower part of the above chart) is currently performing just like it did at the 2008 top – so, the bearish similarity between those periods is not just in gold. In fact, given the rise above the 80 level, the situation is similar to both: 2008 and 2013 – to the top right before the final decline.

In mid-2008, the HUI Index – proxy for gold stocks – was moving higher. Quite visibly so. However, it’s important to note what accompanied this final pre-slide upswing in the HUI Index in case of the indicators.

The sentiment was just ridiculously positive, and it was just as positive back in 2008. Pretty much nobody was expecting what arrived next – the carnage.

This time, the volatility is even bigger (which is not that odd given that more money is floating around this time), but we can see that the indicator is behaving very similarly.

What I would like you to additionally focus on here is that the “double correction” theory that I described below gold’s long-term chart is clearly visible also here. We already saw the 2012 rally being repeated, and now we see it all over again. I marked them with red ellipses.

What are the implications? Well, obviously, they are bearish, as it was this correction in 2012 that started one of the most powerful declines of the previous decades. The RSI indicator based on the weekly prices is in a similar position to where it was at the late-2012 and 2022 tops. The consequences are clearly bearish for the following months.

My previous comments on the above chart, therefore, remain up-to-date:

The situation being what it is on the gold market (as discussed above) and the stock market (as I’ll discuss below), it seems to be only a matter of time before gold stocks slide.

For many months, I’ve been writing that the situation in the HUI Index is analogous to what we saw in 2008 and in 2013. Those declines were somewhat similar, yet different, and what we see now is indeed somewhere in between of those declines – in terms of the shape of the decline.

At first, the HUI Index declined just like it did in 2013, and the early 2022 rally appears to be similar to the late-2012 rally. However, the correction that we saw recently is also similar to the late-2012 rally.

Since history doesn’t repeat itself to the letter, but rhymes, is it really that odd that we now saw two corrective upswings instead of one? Not necessarily.

This is especially the case given that the 2008 decline had one sizable correction during the big decline. It’s not clearly visible on the above chart due to the pace of the 2008 slide, but it’s definitely there. You can see it more clearly in one of the below charts.

So, no, the recent rally is not an invalidation of the analogies to the previous patterns, it continues to rhyme with them in its own way. And the extremely bearish implications for the following months remain intact.

Also, I would like to take this opportunity to quote what I wrote recently regarding the sentiment that was present on the precious metals market right below the slide.

Today, I’m inviting you to join me on a journey to 2008.

You see, when we’re looking at the 2008 performance, or when we’re just thinking about it, we’re seeing the huge slide, and that’s pretty much all there is to it. Everything else gets tuned out as it’s not even comparably visible.

However, before the decline materialized, it was… well, not present at all. Nobody knew that it was just around the corner. Nobody “felt” the despair or the urgent need to sell mining stocks before they declined. And practically everyone felt this “need” after the prices were already low and it was time to buy (the irony…).

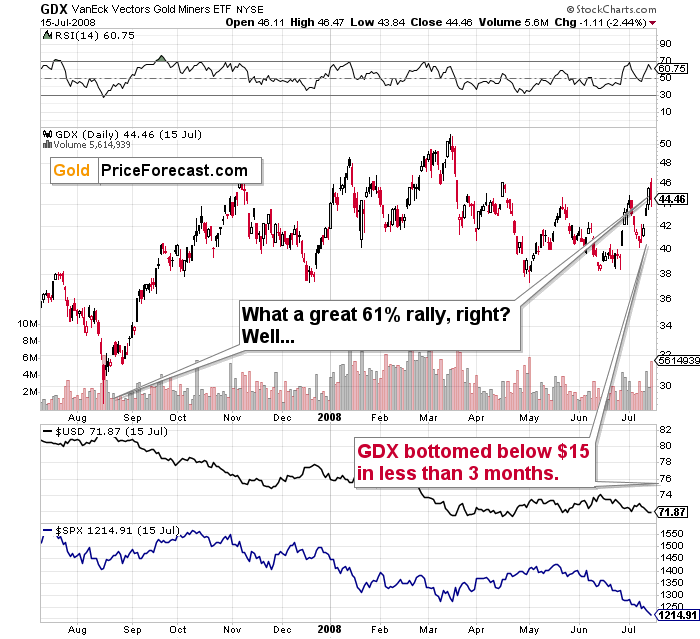

Today’s journey to 2008 is about looking at what everyone saw in July. Please imagine what everyone felt at that time.

The GDX ETF was after a several-month-long rally, and it just reversed, but it didn’t seem like a big deal at all. The short-term uptrend seemed strong.

The bulls were happy and confident at that time. The financial system had problems, as did the real estate market (nothing big, though - or so it seemed). Gold and gold stocks seemed like a solid bet – they are hedges against uncertainty, after all. Right?

The sentiment was very positive.

Math aligns with all the above: the GDX ETF was after a nice 60%+ run-up starting from its recent bottom.

The RSI was at about 70, but… Surely, miners were about to rally even more. Right?

Wrong.

Oh, so wrong.

What you see on the above chart was the final immediate-term high that preceded the unthinkable.

The GDX ETF plunged below $15, and it took less than 3 months for this decline to unwind. That’s about one-third of the most recent high, and about half of the low from which this “big 60%+” corrective rally started.

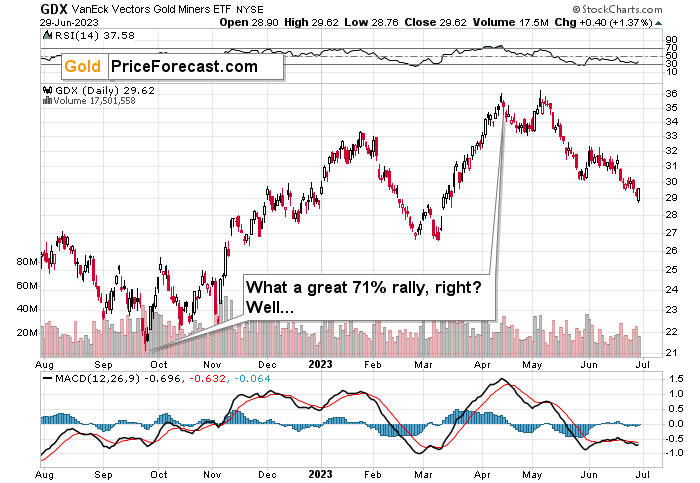

Fast-forward to the current situation.

The GDX ETF is after a nice, 71% run-up from its recent low.

The sentiment was very positive.

After all, gold and gold stocks are going to rally during uncertain times in the banking sector. Right?

It doesn’t matter that the RSI is above 70 and many other indications (even crude oil’s behavior) resemble what happened in 2008, right?

And it doesn’t matter that GDX just formed a daily shooting star reversal candlestick on huge volume, which is a classic sell signal, right?

So, it’s a great idea to be bullish at this moment. Right?

Wrong.

I know it “felt right” to be bullish at that time, but it was exactly the same thing before the slide started in 2008. This is what makes it so difficult to make money in the long run – to stay focused on what’s likely to happen and not follow the general sentiment.

GDX’s move back below its early-2023 high confirms the very bearish outlook.

How low can the HUI Index fall during the next big downswing?

As is the case with gold and silver, a move back to the 2020 lows is definitely in the cards. Please note that this level is also strengthened (as support) by other major lows: the 2019, 2014, and 2008 ones.

However, I wouldn’t rule out a move even lower on a temporary basis. If gold were to decline to about $1,450-1,500, it would mean that it would double its current 2022 decline. If the HUI Index does that, it will move below 150.

So, all in all, 80-120 is my current target area for the upcoming slide in the HUI Index.

What about the short run?

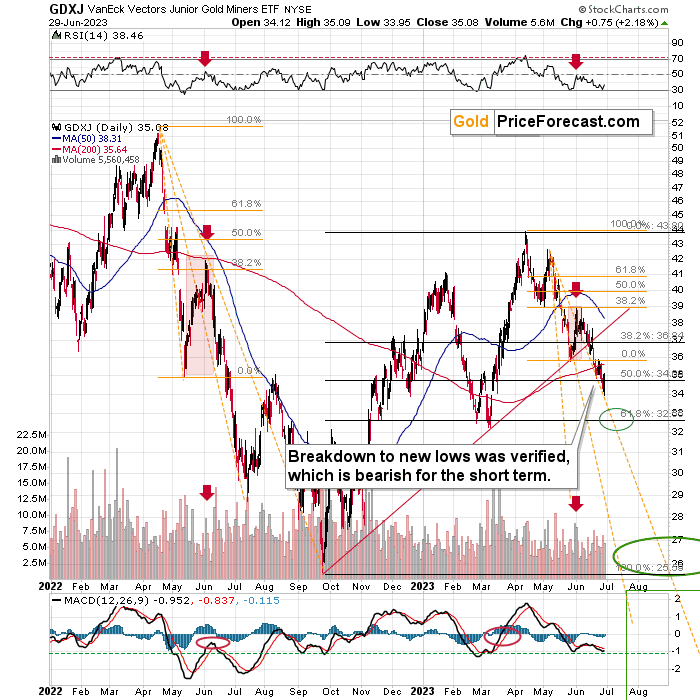

Back in April, the RSI was just pointing to GDXJ being most overbought IN YEARS. Literally.

That was the top – probably the yearly top and the start of an enormous decline.

What happened last month and what we see so far in June clearly confirms the above scenario.

Three weeks ago, I wrote the following about the above chart:

“The GDXJ just touched its rising red support line that’s based on two important bottoms, and at the same time, the GDXJ-based RSI (based on daily prices) just moved slightly below 30. Both are good reasons to expect a near-term rebound in this ETF.”

So, a rebound appeared to be in the cards. However, I wrote that this rebound might not be something significant.

And it wasn’t. It was quick and then junior miners declined quickly as well.

The GDXJ managed to finally break below the above-mentioned support line and this breakdown was more than confirmed. We can say the same thing about the breakdown below the recent post-breakdown consolidation.

The next short-term stop is most likely at about $33, close to the yearly lows and the 61.8% Fibonacci retracement based on the 2022 – 2023 decline. A quick move to this area might be a great opportunity to switch the position and go long. We’ll know more when we see the way in which junior move lower. A steady, measured decline might not create this opportunity, but a sharp drop likely would.

The decline’s current pace suggests we might indeed see this “switching opportunity” if we get to $33 (or below) shortly.

Also, please note that the RSI is close to the 30 level but not yet at it. This is very similar to what we saw a year ago, in July. The GDXJ formed a fake bottom but then declined once again before forming the true bottom. This might be taking place right now as well.

Of course, I’ll keep my Gold Trading Alert subscribers informed.

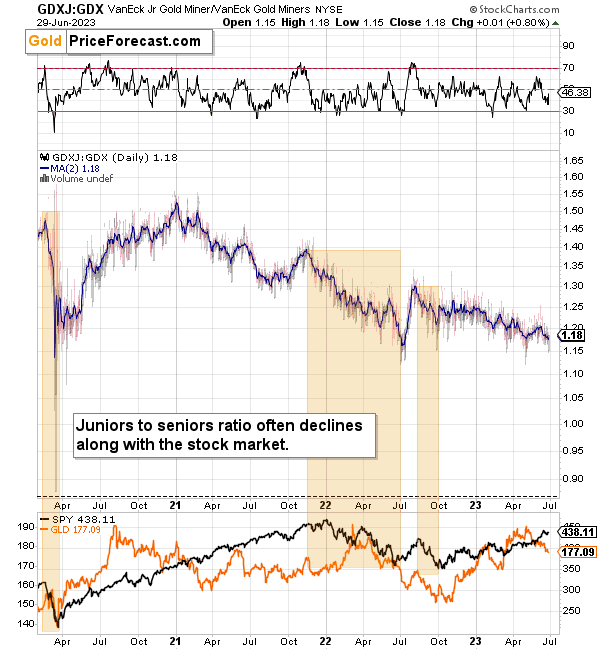

Meanwhile, the relative performance of junior miners compared to senior miners continues to deteriorate in a medium-term trend.

You can see a tiny uptick in it in the very recent past.

However, you can also see that it’s part of a big downtrend, which the very recent uptick didn’t change at all.

This means that junior miners are still likely to decline more (probably much more, but I’ll move to that in just a second) in the not-too-distant future.

And here’s where things get really interesting for junior mining stocks because the additional thing that you can see on the above chart is that the declines in stocks particularly negatively impact the GDXJ to GDX ratio. In other words, when stocks fall, junior mining stocks fall more than senior mining stocks.

I marked all three bigger declines in stocks since 2020 with orange rectangles, and they were all accompanied by declines in the ratio. The 2020 decline was particularly brutal.

Please note that the line that you can see in the main part of the chart is a moving average based on two sessions, and I’m using it to make the ratio’s movement more visible. You can see the ratio itself in the background, and the truth is that it’s quite volatile at times. In 2020, for example, the ratio very briefly moved below 1!

Sometimes, the GDXJ to GDX ratio declined on its own, without the stock market’s help, but the important thing is that in each case, when we saw a major decline in stocks, the ratio declined in a significant way.

And since stocks are likely to slide profoundly in the following weeks/months, the implications for the ratio – and junior mining stocks are extremely bearish.

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw in 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI-to-gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

Recently, we saw a quick upswing in the ratio, but that’s not a game-changer – even the biggest declines had corrections in the past. In fact, the correction appears to be over, as the ratio declined sharply. This is yet another indication that the huge, medium-term downswing is already underway.

If history is to rhyme, we’re about to see a profound decline. In fact, we’re likely already past its beginning.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices for gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

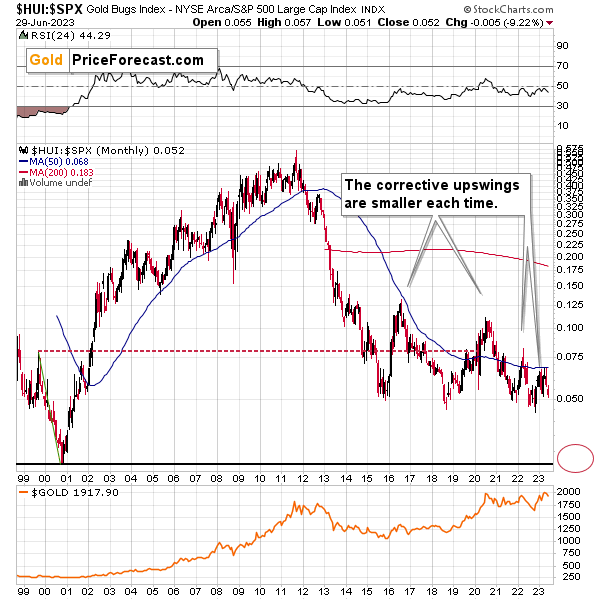

Interestingly, the situation in the gold stocks to other stocks ratio (HUI Index vs. S&P 500 Index) provides the same implications but from a different angle.

The corrective upswings that we’ve been seeing since 2015 are getting smaller and smaller. The current one is visibly smaller than what we saw last year.

Consequently, it seems that the ratio is ripe for a breakdown below the 0.05 level. The next support is provided by the all-time low of 0.026. And yes, with the ratio at 0.065 right now, this implies a decline by about of 60%. If the HUI Index were to decline by 60% right now, it would have to move to about 100. If the stock market declined as well, it would imply the HUI was even lower.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… just stocks), and that’s exactly what’s likely to happen.

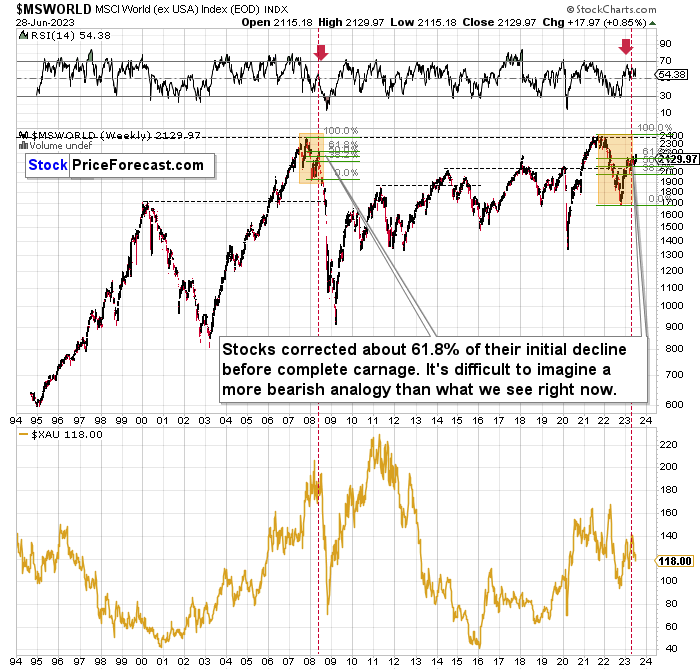

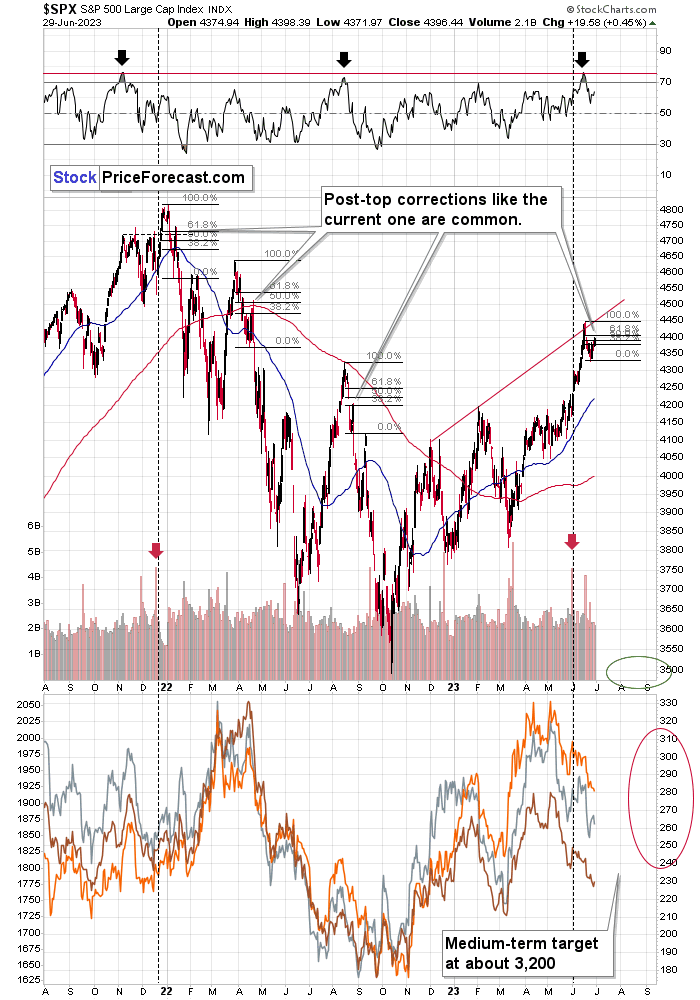

Just like what we saw in the case of copper and gold, world stocks corrected about 61.8% of their preceding decline. And that’s extremely bearish given the self-similarity to 2008.

Please note that the initial decline is now bigger than what we saw in 2008. Back then, stocks corrected about 61.8% of their initial decline before tumbling. And exactly the same thing happened recently! To be precise, this time, stocks moved slightly above this retracement, but the move above it is too small to really change anything.

Also, the RSI just turned south and back in 2008; that was the final confirmation before the waterfall selling.

Just as the 2008 rally wasn’t bullish, the most recent corrective upswing wasn’t bullish at all.

Real interest rates are rising, which is bad news for businesses! People appear to live on “hopium,” expecting the Fed to turn dovish and throw money on the market, but the data doesn’t support this outcome at all.

Given the analogy to 2008 and the fact that the initial slide was bigger this time, the following slide could be even bigger than what we saw in 2008. Naturally, this would be profoundly bearish for junior mining stocks.

This means that nothing really changed, and the situation remains extremely bearish based, i.e., on the analogy to what we saw after previous invalidations of long-term breakouts.

As a reminder, in early 2022, I wrote that the situation was very bearish as invalidations of previous breakouts were usually followed by massive declines – not just in stocks but also in precious metals.

When stocks invalidated their 2006 breakout in 2008, their prices truly crumbled.

We also saw that on a smaller scale in 2014, 2015, and early 2018.

We’re seeing it right now.

To clarify, we’re actually seeing the aftermath of the invalidation. The huge decline is already taking place.

The difference between now and 2008 is that back then the slide was more volatile, and we didn’t really see a visible correction during the plunge. This time, the decline is more measured, and we saw a correction to one of the most classic retracements imaginable – the 38.2% one. This correction doesn’t change the trend, which remains down.

Based on what happened in 2008, it seems that stocks are about to move much lower in the following months.

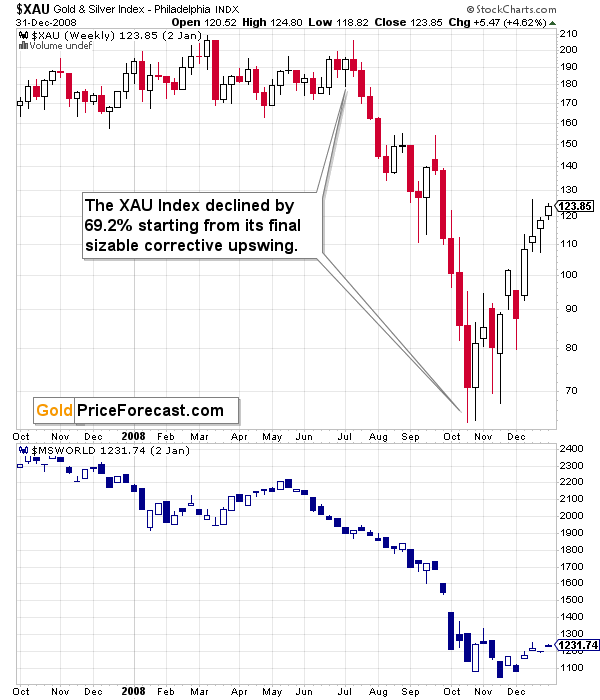

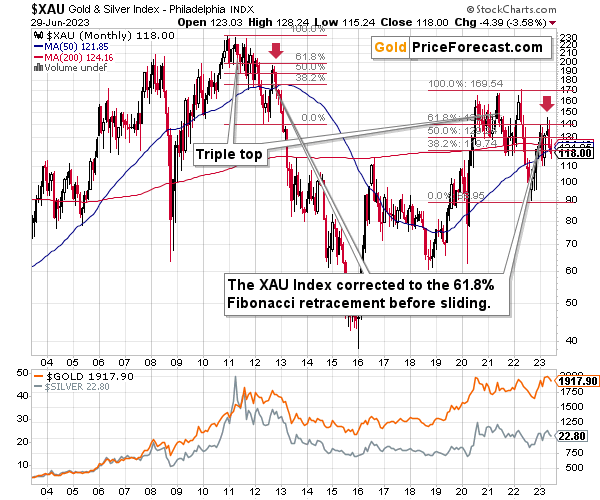

The lower part of the chart features the XAU Index, a proxy for both gold stocks and silver stocks.

First of all, this comparison of mining stocks and other stocks could appear shocking, and rightfully so.

The XAU Index is well below its… 1995 highs (yes, miners are really so weak), while world stocks are much higher.

The second shocker is how far and how fast miners declined in 2008. Starting with the final corrective upswing, the mining stocks index declined by a breathtaking 69.2%!

Less than a third of the starting value.

It took just a few months for this decline to materialize.

Based on this year’s performance, it’s clear that GDXJ’s price movement is slightly bigger and moves are more volatile (especially to the downside) than those in case of the XAU index.

As a result, the performance of both may be roughly comparable, or — more likely — junior miners may decline more due to their closer link to the general stock market. This means that based on the above-mentioned analogy to 2008, we can’t rule out a decline by about 70% (or more!) in the GDXJ starting at the recent short-term high ($43.89).

Shaving off 70% of that value leaves us with $13.17 as the possible downside target for the GDXJ ETF.

Impossible? It has already happened! (In the XAU, as the GDXJ wasn’t trading at that time yet).

So, yes, the outlook for mining stocks is truly extremely bearish for the following months.

Also, speaking of the XAU Index, let’s take a look at its chart.

After all, that’s where I see one of the key developments that happened recently…

How high did the XAU Index correct in a sharp manner back in 2021 before sliding from above 200 to below 40 (eventually, and below 90 in several months)?

It corrected to more or less its 61.8% Fibonacci retracement level. And the initial slide happened after a triple-top pattern.

Interestingly, we see exactly the same thing right now. Ok, the XAU moved slightly above this level, but it was quick to decline back below it.

The XAU Index first declined sharply after a triple-top pattern and now it just corrected approximately to its 61.8% Fibonacci retracement.

This is screaming long-term sell signal.

Also… Please note the obvious. The XAU Index is not only below its 2011 high. It’s not only below its 2008 high. It’s even below its 2006 high. Yes, the situation is as ridiculously bearish.

Let’s take a look at the markets from a more short-term point of view and from the U.S. perspective.

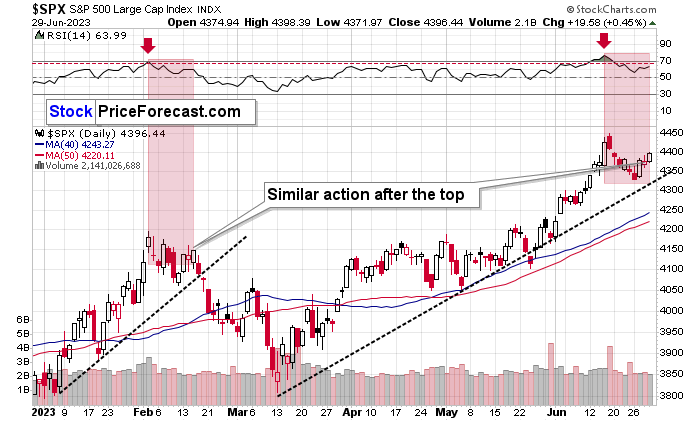

From the more short-term (still medium-term) view, the S&P 500 Index moved to its rising red resistance line. It’s yet another resistance line that was reached recently, and since the previous resistance levels were broken, you might be wondering what’s so special about this resistance that it would be likely to hold.

In reality, it’s not stronger than the previous ones, and the reason why it’s likely to hold doesn’t stem from this line’s strength.

It comes from the fact that stocks have rallied too far, too quick, and the RSI indicator shows that the situation shows that they situation is as extreme as it was at the November 2022 top. It was almost the final top of the rally, but since the history rhymes, it might be the top this time.

But even if it isn’t, and we would get a second top a bit later, the odds are that the current rally is unsustainable, even on an emotional level – that’s what the RSI shows.

Please note that stocks are now behaving just like they behaved after the previous tops. They declined and then corrected a part of the decline. In the previous cases, major tops were followed by 38.2% - 61.8% Fibonacci corrections, and we saw one recently as well. This is normal, not bullish.

Zooming in shows that the S&P 500 is repeating its early-2023 performance. The correction in stocks and the RSI levels are very similar. Even the daily reversal that is then followed by another daily rally was similar.

Of course, the analogy doesn’t have to repeat itself to the letter, but if we see a sizable decline today or on Monday, it would be in perfect – bearish – tune with what we saw previously.

Also, I’m mentioning the emotional level here, because on the fundamental level, rising interest rates or expectations of higher interest rates are fundamentally bearish for stocks – higher debt costs are likely to be a bigger and bigger burden for the worldwide companies.

The earnings season is just around the corner, and the reality will kick in sooner or later. Based on the RSI – sooner is the most likely scenario.

As I wrote in the previous days, it seems that investors are right now in the “return to normal” stage from the short-term and long-term points of view given the above and the above-discussed situation in world stocks.

And this market juncture makes it very difficult to stay calm and objective (which would explain the small rally and the previous tiny breakout to new highs in the S&P 500).

The “return to normalcy” stage is when the vast majority of market participants expect the previously unsustainable rally to be continued, even though much has changed and it’s already a different stage of the market. It’s no longer a bull market.

I’m writing about the stock market here, but the emotionality spreads to other markets as well. That’s most likely why people are not reacting to the massive increases in real interest rates as much as they “should”.

Where are we now in general? And by general, I mean, globally.

You already saw that earlier, on the world stocks chart. We are in the repeat-of-the-2008 mode.

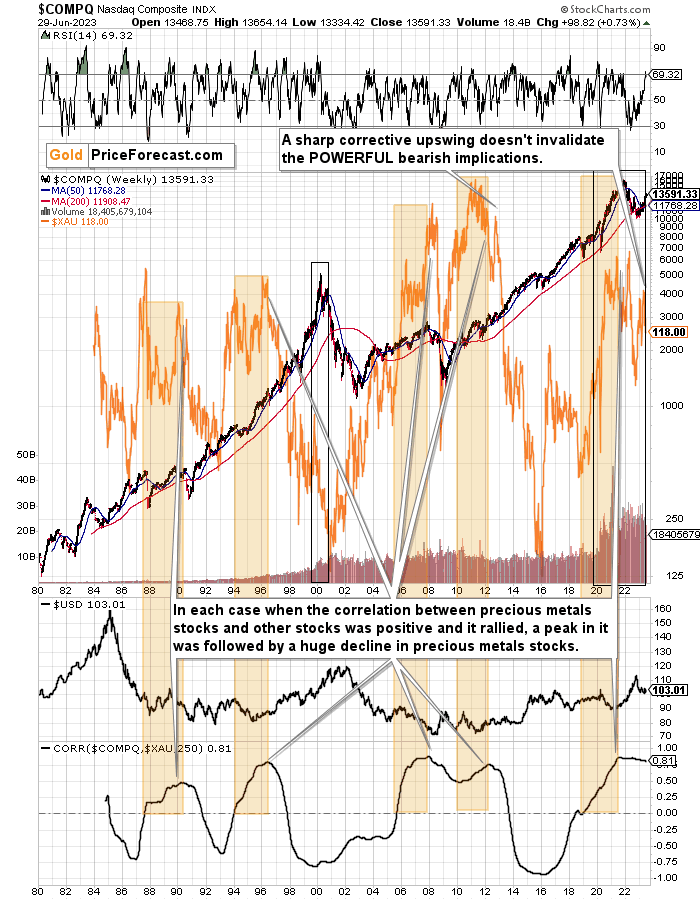

…And if all that wasn’t enough, the tech stocks appear to be ready to slide in a dot-com crash fashion (or similarly).

Just look at the NASDAQ chart and take just a second or two to compare the 90s rally with what we saw recently.

They’re very similar, and it’s clear at the first sight.

This time the volatility wasn’t as big, so it’s no wonder that the final top, initial decline and then the correction took more time. I marked both periods with black rectangles.

The rectangle covers volume and that’s not accidental. The action in it confirms that the situations are indeed analogous. The final tops formed on volume that increased rapidly, then it declined along with prices, and it stayed stable during the final pre-slide correction. That had been the case in 1999 / 2000, and it was the case in the recent months, weeks, and days.

Back in 2000, tech stocks declined and mining stocks (XAU Index is a proxy for gold and silver mining stocks and it’s marked with orange on the above chart) moved higher, but that was when those two markets had been negatively correlated in the long run (based on the 250-session correlation coefficient that you can see at the bottom of the above chart).

The correlation has been positive for a long time now, which means that when tech stocks slide now, they are likely to take mining stocks with them.

And are tech stocks likely to tumble soon?

Yes! That’s what the analogy to the Dot-com bubble and all above-mentioned signs point to.

Moreover, please note that the 50-week moving average (marked with blue) has almost always been on the rise. In the recent decades there were only three times when this moving average turned down in a noticeable way.

- One was at the 2000 top.

- Second warned about the 2008 slide.

- The third time was earlier this year.

Is this time different?

No, it isn’t. Tech stocks are about to slide, and mining stocks are likely to slide along with them.

But wait, there’s more!

The orange rectangles on the above chart mark times between the moment when the long-term mining-stocks-other-stocks correlation turned positive right to its top.

The particularly interesting thing is that when the correlation topped, it was only a matter of time before huge declines in the XAU Index followed.

That worked in four out of all four cases that we saw in the previous decades. And, in fact, ever, because the XAU Index didn’t exist before mid-80s.

And we saw this indication also in the previous months. Since that time, we saw a sizable decline and a corrective upswing that’s similar to the one that we saw in 2012. Since the 2012 rally wasn’t able to reverse the massive bearish indication, the recent one most likely wasn’t able to achieve that, either.

What followed the 2012 corrective upswing? A powerful slide. One that was in tune with the previous huge declines that we saw after the long-term correlation peaks.

The history is likely to rhyme, and as the German philosopher Georg Hegel pointed it out – people don’t learn from history.

At least most of them. And this “most” is the same “most” that is not making money in the long run.

Don’t be among this “most”.

What does it all mean in the short run?

Truth be told, it doesn’t have any very short-term implications, as it tells us how enormous the decline in mining stocks is likely to be in the following months, but as far as the day-to-day performance is concerned, more short-term charts are needed to estimate what’s the likely course of action.

Why is this all this important for gold and silver investors and traders? Because the last two big moves took place more or less in line with each other – in stocks and in precious metals (and miners). The slide in stocks could also trigger something similar in the case of commodities like crude oil. The same thing is likely to happen again this time, especially given what’s happening in the USD Index.

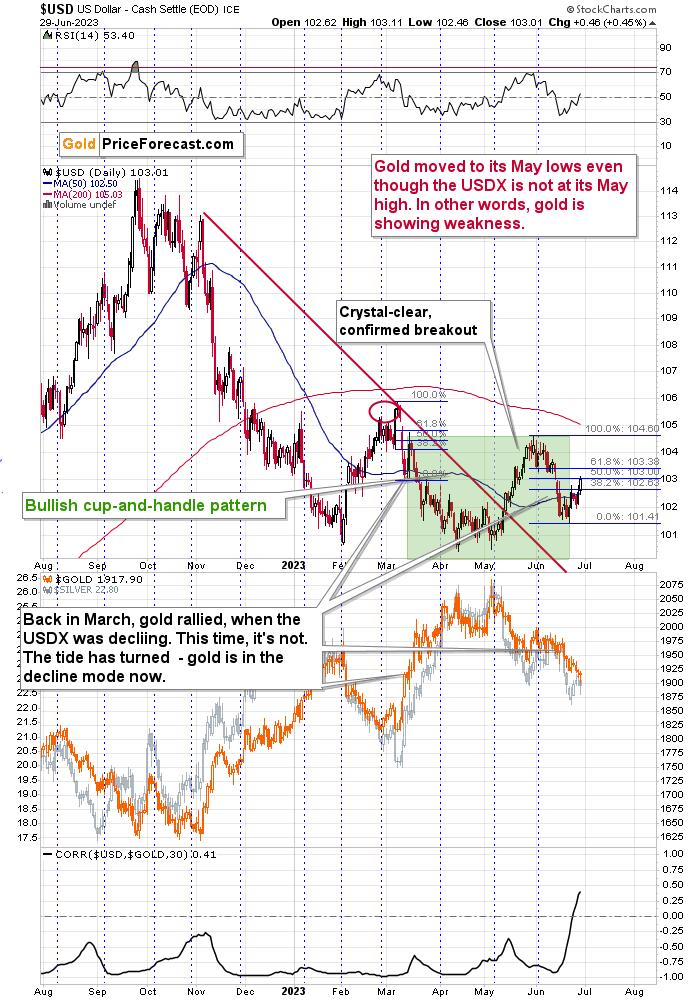

The USD Index is after a breakout above the declining red resistance line, and this breakout was more than confirmed.

The recent move lower seems to be nothing more than just post-breakout correction.

Now, at this point, you might be thinking that we already saw something similar to the most recent rally in March, and it was just a corrective upswing, after which the decline resumed. However, this time, the rally takes a much more measured pace, which means that it’s much more sustainable.

Moreover, if you compare gold’s action back then and now, it becomes clear that those two cases are different, like night and day.

Gold is currently magnifying USD’s rallies by declining much more, so the implications for the former are very bearish.

Of course, the current support provided by the $1,900 level in gold is something that generates a brief exception from this bearish link between the two, but that’s rather normal.

Moreover, please note that the mid-March – today performance in the USD Index can be described as a bullish cup-and-handle formation. This is yet another reason to expect further rallies in the USD Index in the following weeks.

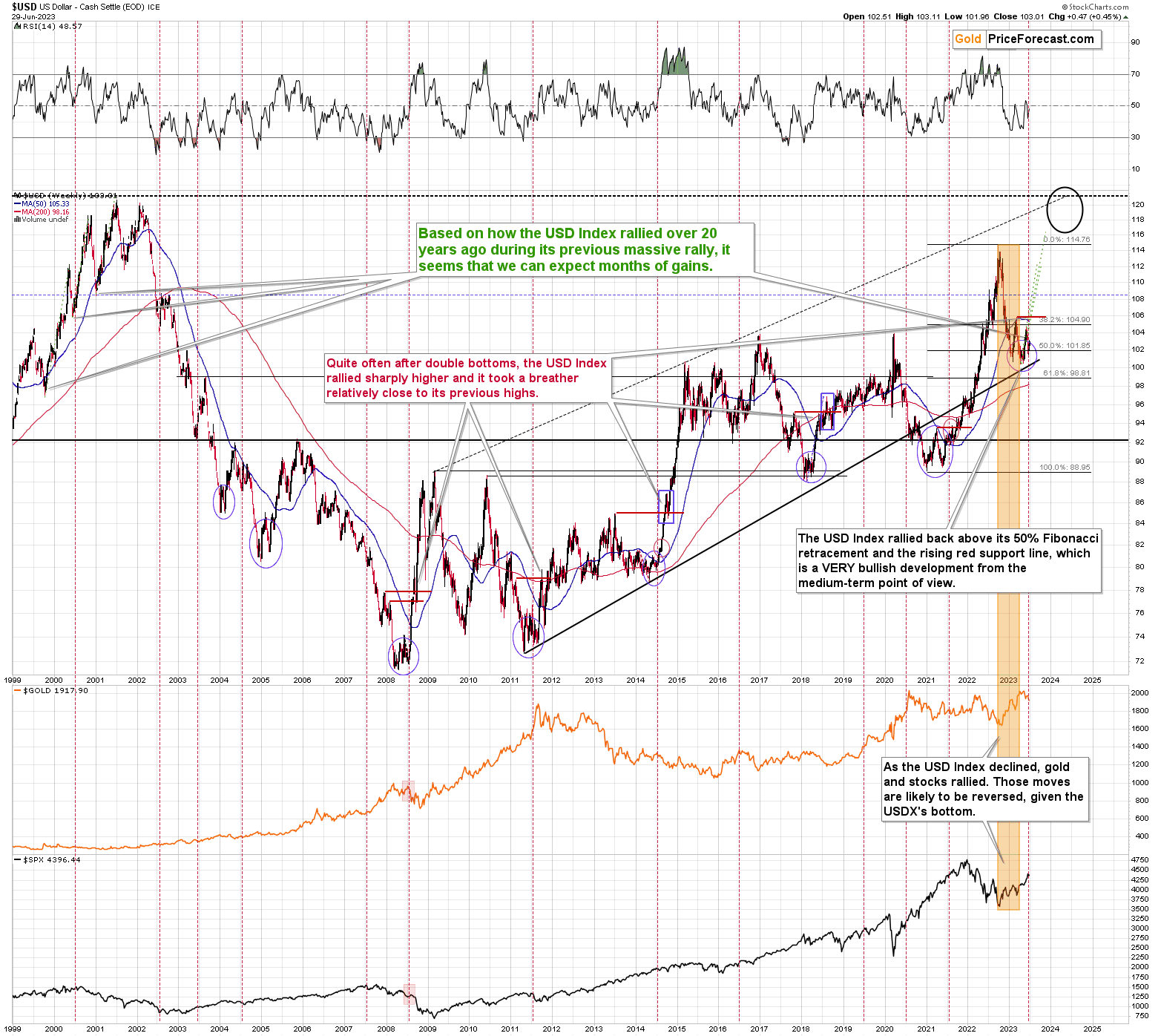

Most important details are present on the long-term chart, though.

Let’s zoom out.

Zooming out allows us to see that the really big rallies were usually preceded by a multi-bottom, and/or by a volatile correction in the early part of the rally.

Please take a look at the 2008 and 2011 bottoms in the USD Index. They were broad, multi-bottom patterns – the same with the 2020-2021 bottom. Is it any wonder that we’re seeing this kind of performance here?

These were also the times after which gold declined. And most importantly – it’s yet another factor confirming the analogy between now and 2008.

Consequently, given all the other links to 2008, it seems that a big rally in the USD Index is just around the corner.

Moreover, please note that there were many times when the USD Index formed major bottoms in the middle of the year. I marked those cases with vertical, red, and dashed lines. This is where we are once again, which has very bullish implications for the following weeks and months.

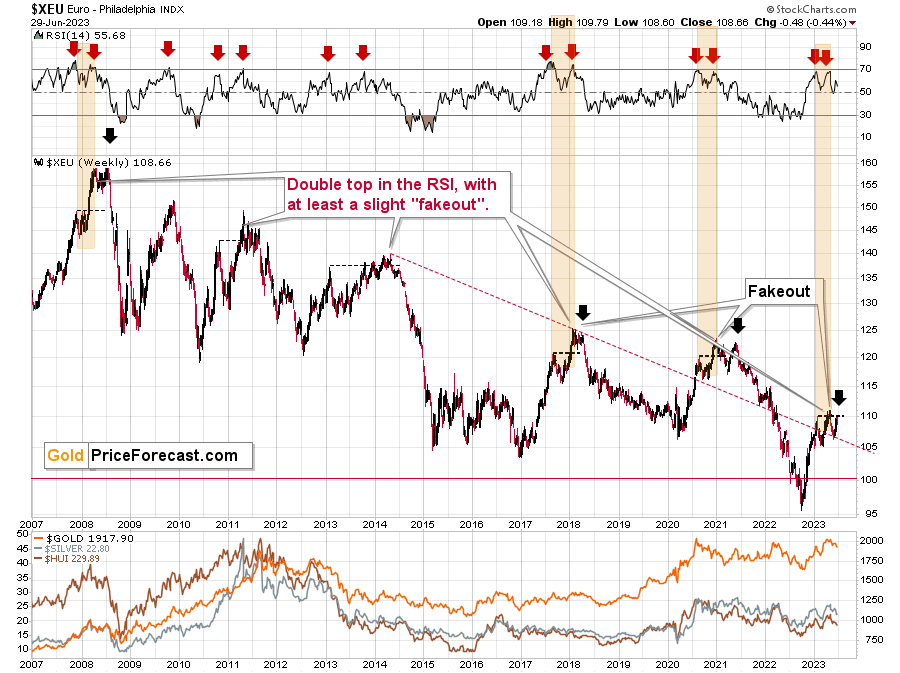

The situation in the biggest component of the USD Index: the EUR/USD exchange rate confirms the above outlook.

The RSI based on the Euro Index was just practically right at the 70 level, thus flashing a sell signal. These signals were very reliable in the past, especially when the Index was right after a short-term breakout.

Those breakouts were then invalidated, and bigger declines followed.

This small breakout was already invalidated.

Despite several attempts, the euro was not able to hold above its previous 2023 high.

Its bearish on its own as it’s a sign of weakness, but what really stands out is that those comebacks and (failed!) attempts to move to new highs are typical for the European currency. Tiny fakeouts were what preceded declines – massive ones – many times in the past. Even the situation in the RSI indicator (upper part of the above chart) points to the situation right now being similar to what happened previously.

And as the euro declines, the USD Index rises. And gold declines as well.

As gold declines, mining stocks are very likely to decline more (as they’ve done in the previous months and years).

The thing that I would like to add today is that in all three previous cases, there was a final small rally before the slide. I marked them with black arrows. Given this kind of pattern, seeing a small rally here is a normal part of a bearish pattern, not a bullish sign.

Therefore, the situation on the forex market continues to support lower precious metals values in the following weeks and months.

The huge profits that we recently reaped in the FCX recently are likely to be joined by massive profits from the current short positions in the junior mining stocks and in the FCX.

Overview of the Upcoming Part of the Decline

- It seems that the recent – and probably final – corrective upswing in the precious metals sector is over.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

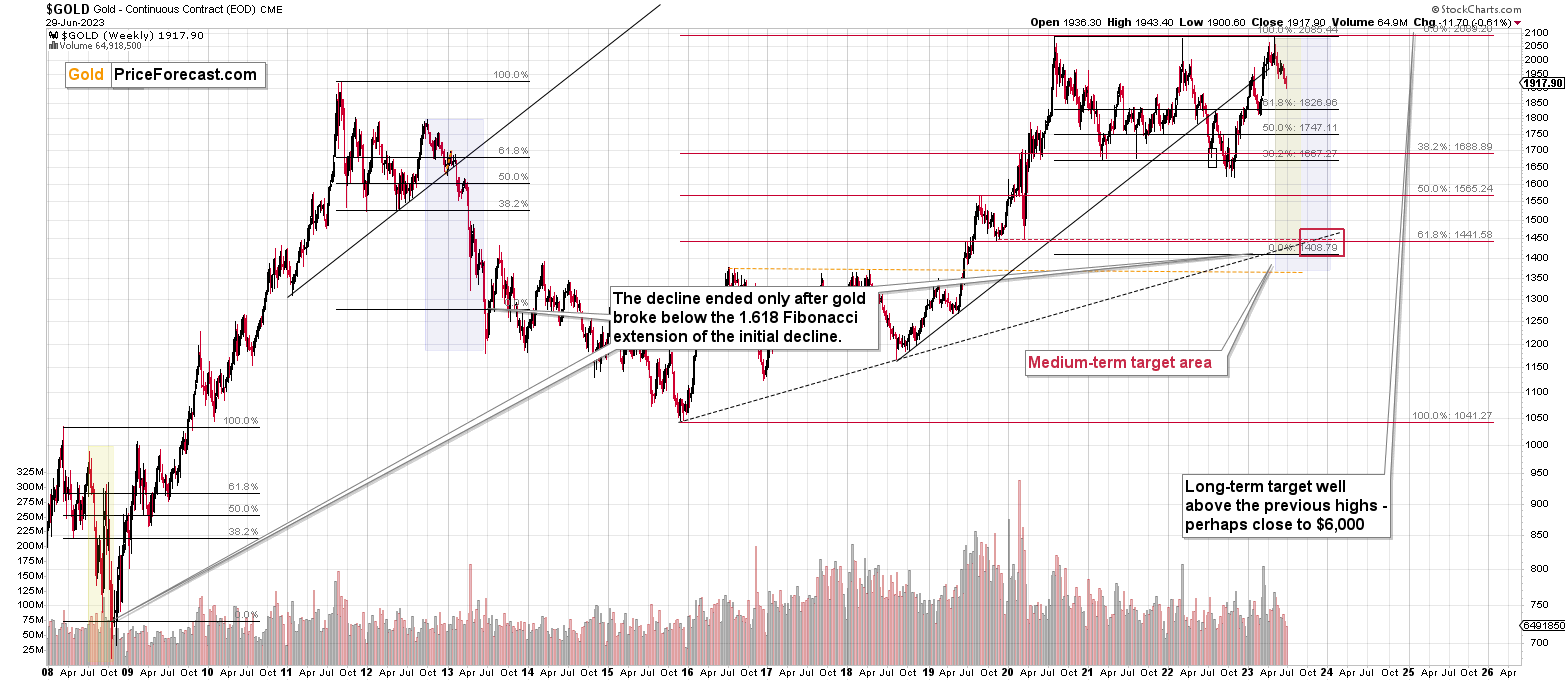

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, the medium-term outlook for the precious metals sector (and for the FCX) remains to be extremely bearish and the profit potential for short positions in junior miners and FCX remains enormous.

While I can’t promise any kind of return (nobody can), in my opinion, the recent profitable position in the FCX will soon be joined by even more profits, and the winning streak of trades that started in early 2022, will continue.

If I didn’t have a short position in junior mining stocks, I would be entering it now.

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Monday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief