Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's flagship Gold & Silver Trading Alert. Predicated on last week’s price moves, our most recently featured outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days, which will be written in italics.

The key thing that we saw this week is the continuation of the medium-term decline after the sharp corrective upswing. Things appear to be getting back to normal. A profitable normal.

Let’s start today’s analysis with a recap of what recently happened on the fundamental front.

The Weekly Fundamental Roundup

With depressed sentiment helping to uplift the S&P 500, this week was all about whether or not the bear market rally had legs. However, with higher interest rates spoiling the party on Oct. 19, hawkish realities helped suppress the upward momentum.

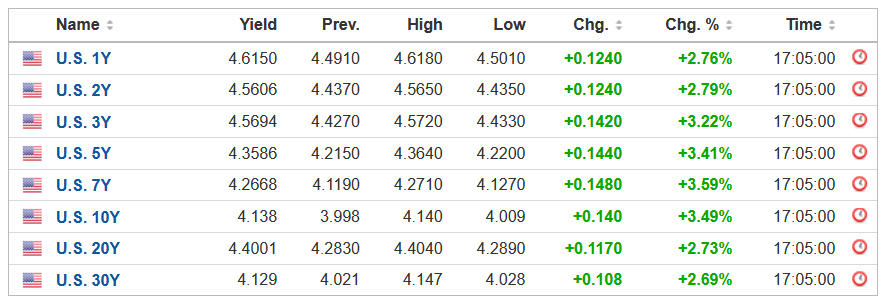

Please see below:

To explain, yields rallied across the curve, and the U.S. 10-Year Treasury yield closed at 4.14%, its highest level since 2008. More importantly, the U.S. 10-Year real yield hit a new 2022 high of 1.74%. As a result, the ascent combined with the material rise in the USD Index was profoundly bearish for gold, silver, mining stocks and the S&P 500.

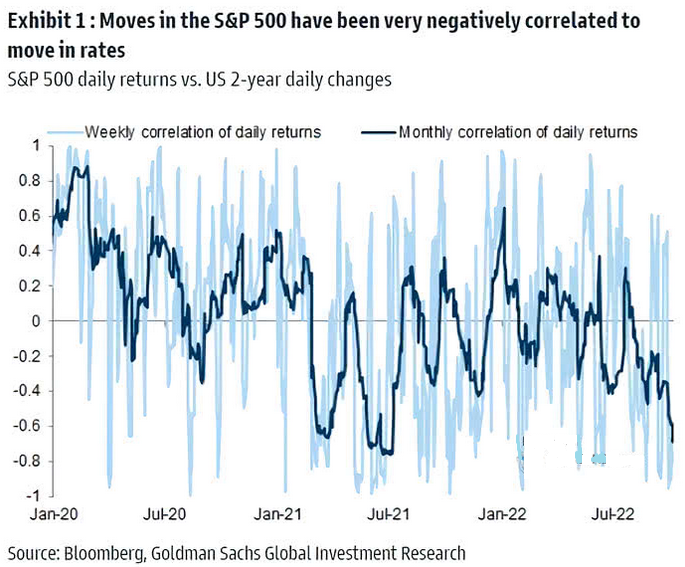

Please see below:

Likewise, with the U.S. 2-Year Treasury yield also hitting a new 2022 high, its rapid rise continues to disrupt the S&P 500.

Please see below:

To explain, the light blue bars and the dark blue line above track the weekly and monthly correlation of daily returns between the U.S. 2-Year Treasury yield and the S&P 500. If you analyze the right side of the chart, you can see that the relationship has gotten more negative as higher interest rates inflict pain on U.S. equities.

As further evidence, the S&P 500 has largely moved in the opposite direction of the U.S. 10-Year Treasury yield since late 2021.

Please see below:

To explain, the red line above tracks the daily movement of the S&P 500, while the green line above tracks the inverted (down means up) daily movement of the U.S. 10-Year Treasury yield. If you analyze the relationship, you can see how higher interest rates have weighed on the general stock market. As such, risk assets suffered on Oct. 19, and the GDXJ ETF was a material underperformer.

Conversely, with different forces pulling the S&P 500 in competing directions, I noted on Oct. 19 that while the index could push higher in the short term, the optimism should be short-lived. I wrote:

Positioning, sentiment and seasonality support a higher S&P 500, while the medium-term technicals and fundamentals are profoundly bearish. Thus, we consider any strength a bear market rally and expect the index to hit lower lows in the months ahead. However, since asset prices don't move in a straight line, the setup is tactically bullish.

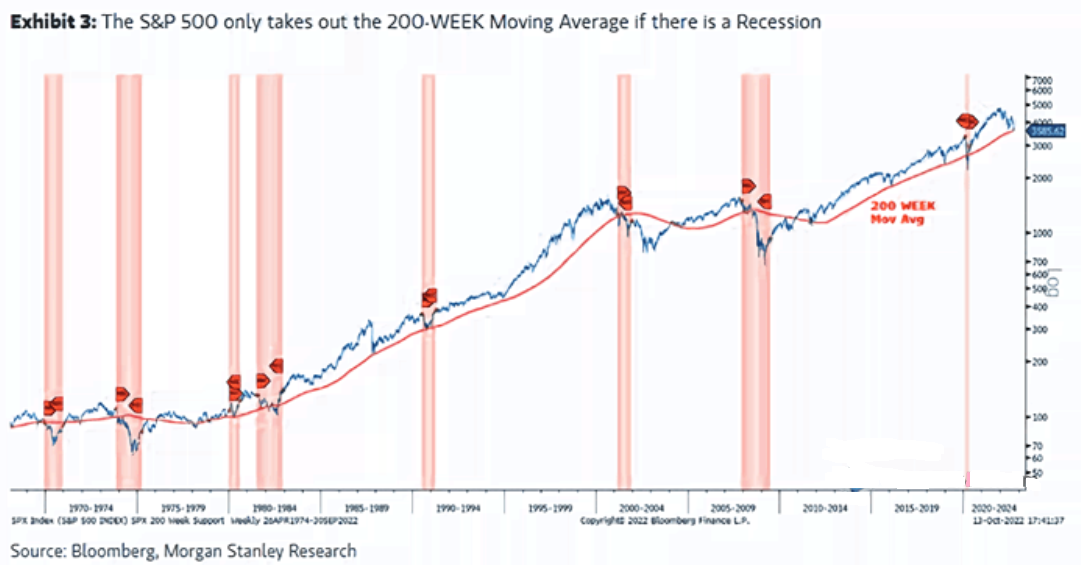

Furthermore, while Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson has been a vocal bear in 2022, he admitted that the 200-week moving average “is hard to take out without a fight.”

Please see below:

To explain, the blue line above tracks the S&P 500, while the red line above tracks the 200-week MA. Wilson found that the S&P 500 often holds the level unless a recession occurs. Therefore, with the MA present near 3,606, support may materialize unless a climatic event unfolds.

In contrast, with higher real yields and a stronger USD Index, which is highly bearish for gold, silver, and mining stocks, the Fed’s inflation fight should continue to cause problems. So while the S&P 500 may find a short-term floor, the PMs can still move lower.

Fanning the Hawkish Flames

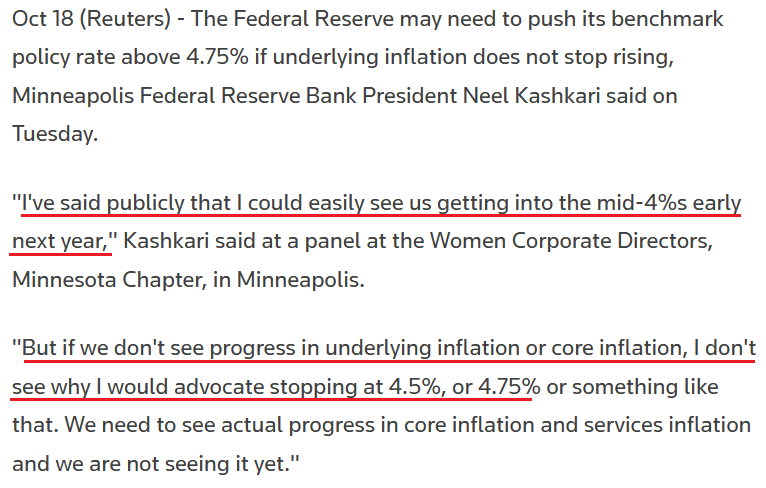

With Fed officials continuing their hawkish crusade, Minneapolis Fed President Neel Kashkari said on Oct. 18 that his U.S. federal funds rate (FFR) target is "predicated on a flattening out of underlying inflation." However, if the pricing pressures prove persistent, "then I don't see how we can stop."

As such, Kashkari warned that the FFR may need to rise above the 4.5% to 4.75% he expects in early 2023.

Please see below:

Thus, while I stressed throughout 2021 and 2022 that the FFR needed to go much higher than investors expected, our 2023 estimate of 4.5% to 5.5% remains much more likely than not.

Similarly, St. Louis Fed President James Bullard said on Oct. 19 that ‘’front-loading” interest rate hikes is necessary to achieve a “meaningfully restrictive level.”

“In 2023, I think we’ll be closer to the point where we can run what I would call ordinary monetary policy,” he said. “Now you’re at the right level of the policy rate, you’re putting downward pressure on inflation, but you can adjust as the data come in in 2023.”

So while Fed officials remain data-dependent, as they have throughout this entire cycle, the reality is that inflation remains problematic, and a resilient U.S. labor market should push the FFR higher.

For example, the Fed released its latest Beige Book on Oct. 19. The report revealed:

“Price growth remained elevated, though some easing was noted across several Districts. Significant input price increases were reported in a variety of industries, though some declines in commodity, fuel, and freight costs were noted. Growth in selling prices was mixed, with stronger increases reported by some Districts and a moderation seen in others”

“Some contacts noted solid pricing power over the past six weeks, while others said cost passthrough was becoming more difficult as customers push back. Looking ahead, expectations were for price increases to generally moderate.”

Therefore, while the pricing picture was somewhat mixed, employment and wage inflation remained uplifted.

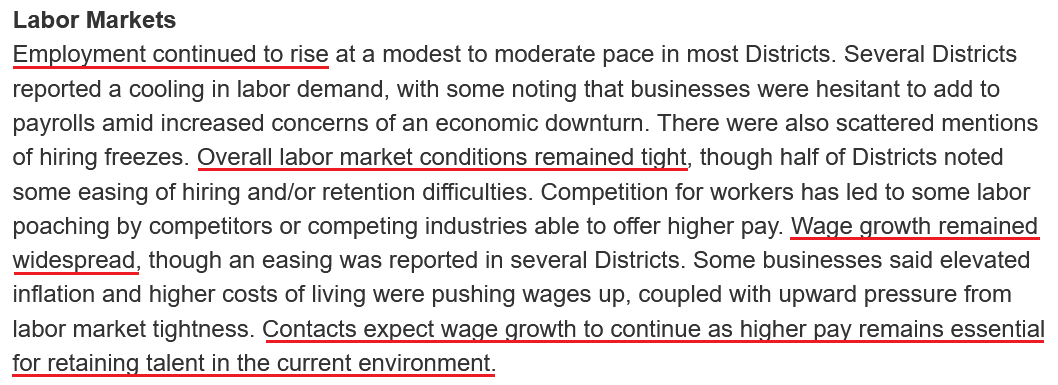

Please see below:

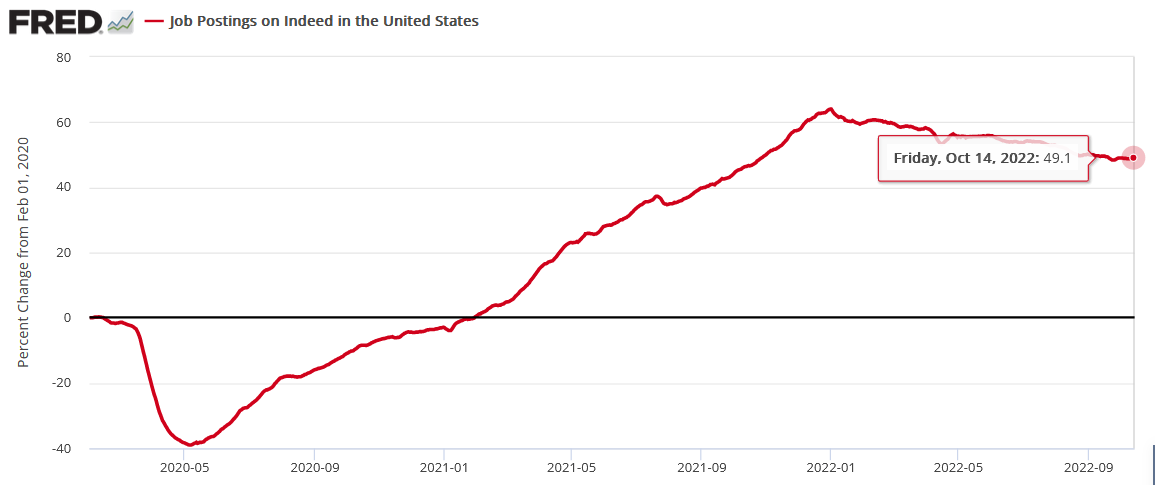

Also noteworthy, Indeed updated its job postings data on Oct. 19. As of the week ended Oct. 14, there are still 49.1% more jobs listed than pre-pandemic; and even though the metric has declined from its January high, it’s far from falling off a cliff. As a result, the demand destruction necessary to curb inflation has not materialized.

Please see below:

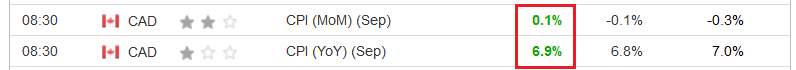

Finally, I’ve noted how the Bank of Canada (BoC) and the Fed often move in lockstep. Remember, due to the geographical proximity and the fact that 75% or more of Canadian exports are sent to the U.S., the two regions often have similar economic and monetary policy outcomes; and with the Canadian Consumer Price Index (CPI) outperforming expectations on Oct. 19, the implications are bearish for gold, silver, and mining stocks.

Please see below:

The official report read:

“In September, prices for food purchased from stores (+11.4%) grew at the fastest pace year-over-year (YoY) since August 1981 (+11.9%).”

In addition:

“Excluding food and energy, prices rose 5.4% year over year in September, following a gain of 5.3% in August. Prices for durable goods, such as furniture and passenger vehicles, grew at a faster pace in September compared with August.”

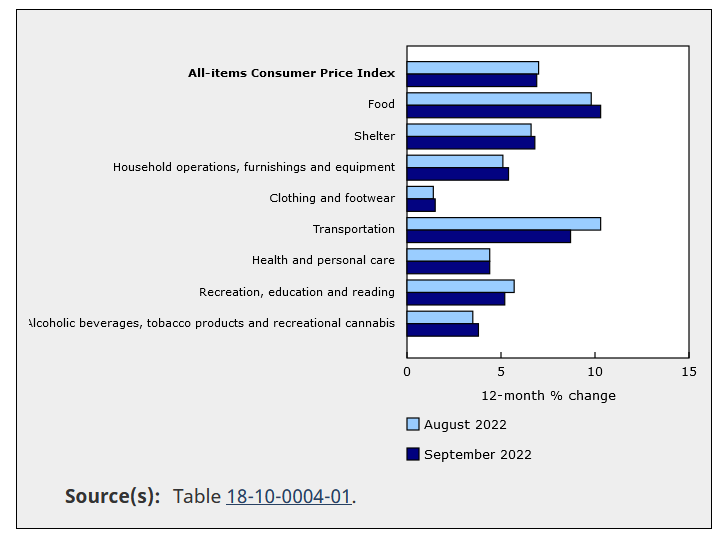

Please see below:

To explain, the dark blue bars above show how food, shelter, household goods, apparel, and alcohol/smoking products were all higher YoY in September versus August. Thus, several categories accelerated, and the data is hawkish for North American central bank policy.

To that point, with U.S. and Canadian bonds often joined at the hip, the inflationary plight of both regions supports higher interest rates and lower precious metals prices.

Please see below:

To explain, the red line above tracks the iShares 20+ Year Treasury Bond (TLT) ETF, while the green line above tracks the BMO Long Federal Bond Index (ZFL) ETF. For context, the former holds long-term American bonds, while the latter holds long-term Canadian bonds.

As you can see, the pair often follow in each other’s footsteps, and both have suffered mightily amid inflation’s reign. As a result, the Fed and the BoC should continue their hawkish connection over the medium term.

The Bottom Line

While the S&P 500 is more of a wild card at this point, the Oct. 19 drawdown showed how the index's weakness has a material impact on the GDXJ ETF. However, history shows that the PMs can still fall even if the S&P 500 rallies, so the bearish thesis remains intact regardless of equities' short-term movement.

In conclusion, the PMs declined on Oct. 19, as higher interest rates hurt risk assets. Moreover, with the USD Index and the U.S. 10-Year real yield poised to continue their ascents in the months ahead, it's an ominous medium-term backdrop. As such, even if the S&P 500 rises in the short term, lower lows should materialize before this bear market ends.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Oct. 24: S&P Global U.S. Composite PMI

The nationwide survey provides key insights into growth, employment and inflation. Therefore, it’s a leading indicator of future government data.

- Oct. 25: Richmond Fed manufacturing index

The regional survey only covers the outlook in Virginia, but it’s still an important piece of the economic puzzle.

- Oct. 27: Q3 GDP, KC Fed manufacturing index

Similar to the regional results from the Richmond Fed, the KC Fed’s data will shed light on the growth, employment and inflation progress in Missouri. In addition, it will be interesting to see if the Atlanta Fed’s 2.9% Q3 real GDP growth estimate (updated on Oct. 19) comes to fruition.

- Oct. 28: Personal Consumption Expenditures (PCE) Index

While it gets less attention than the CPI, the PCE Index is the Fed’s preferred inflation gauge. So it’s an important variable to monitor.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

Technically Speaking

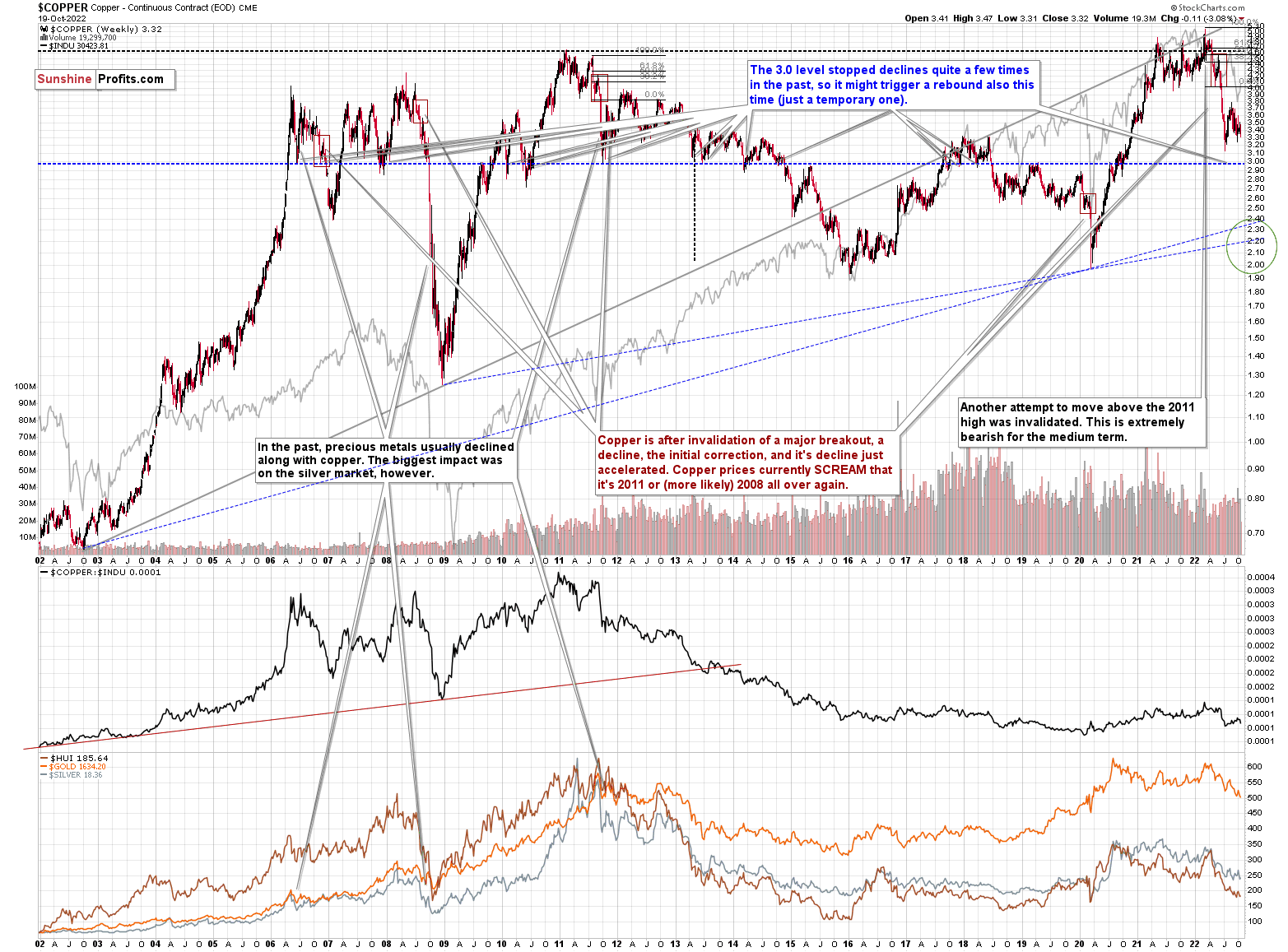

Let’s start today’s technical discussion with a quick check on copper prices.

Practically, everything that I wrote about it last week (and in the previous weeks/months) remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

It seems to me that there might be some kind of smaller corrective upswing or a pause when copper moves to about $3.0, but that it would then decline profoundly once again, only to bottom in the $2.0-2.4 area. That’s where we have rising, long-term support lines and also the previous – 2016 and 2020 – lows.

Interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged.

Again, copper is after invalidation of a major breakout, a decline, the initial correction, and its decline just accelerated. Copper prices currently SCREAM that it’s 2011 or (more likely) 2008 all over again. This is extremely bearish for mining stocks (especially juniors) and silver.

No market moves in a straight line, up or down, but since we just saw a corrective upswing, the downtrend might now resume.

Based on the recent short-term move lower, it seems that the downtrend has already resumed.

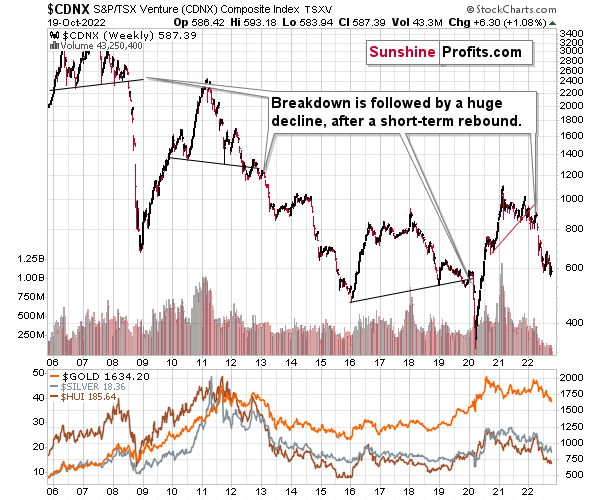

Having said that, let’s check junior miners’ really big picture.

I previously commented on the above chart in the following way:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

Having said that, let’s turn to gold.

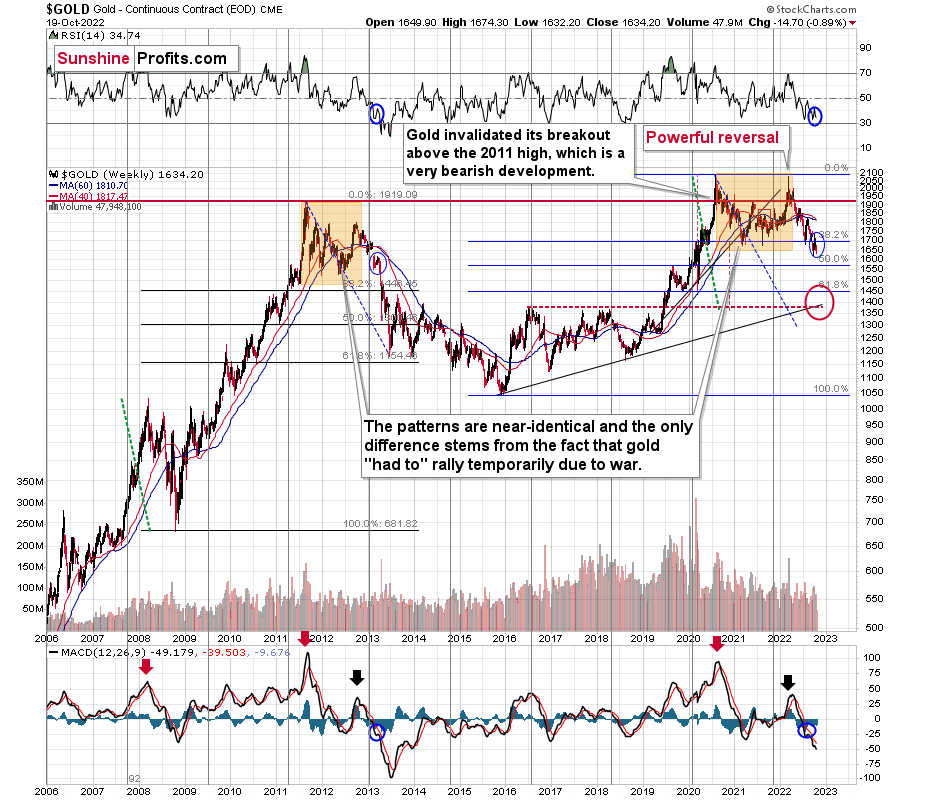

Let’s start with context:

Between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet, gold failed to rally to new highs.

In fact, it’s trading very close to its 2011 high, which tells you something about the strength of this market. It’s almost absent.

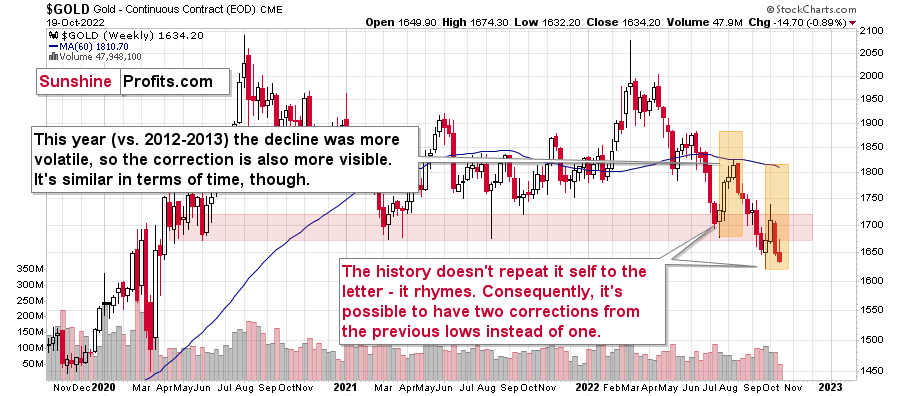

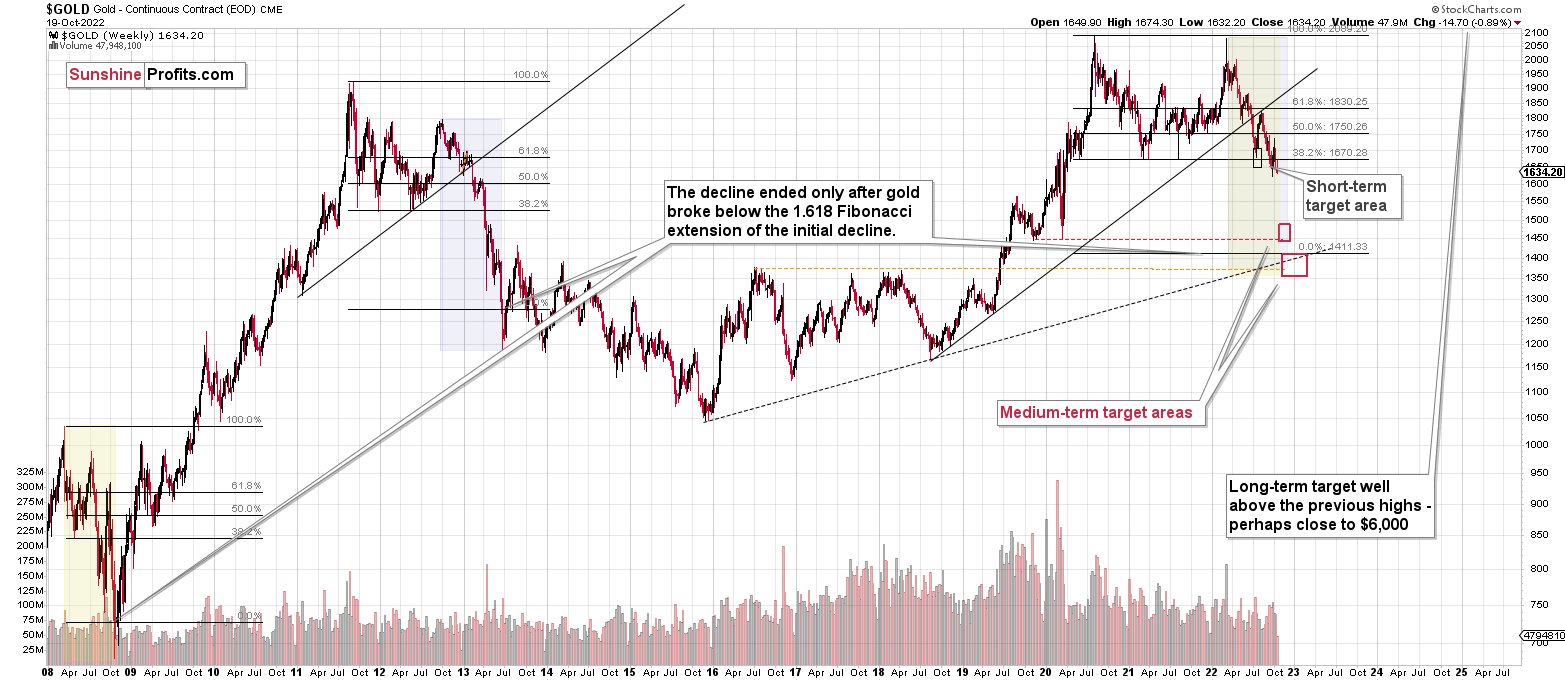

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. The long-term gold price chart below provides details.

Basically, the key thing about gold’s long-term chart is that it doesn’t show any important changes. The downtrend continues in tune with the 2013 price action, and the very recent rally is barely visible.

To clarify, it is visible, but what’s visible is still in tune with the final attempt for gold to rally in April 2013, right before the biggest part of the slide.

Gold is sometimes forced to react to some geo-political events as the safe-haven buying kicks in, but these moves are usually short-term lived. Looking at long-term charts helps to keep things in proper perspective.

Consequently, my previous comments remain up-to-date:

Based on the above chart, it’s quite clear that the situation that is now being repeated. The patterns marked with orange rectangles and blue ellipses are almost identical (also in the MACD indicator, and to a lesser extent in the RSI indicator).

Sure, the situations are not identical, as this time we had a Russian invasion of Ukraine that pushed gold temporarily higher. Other than that, the situations are extremely similar.

Based on the stage of the self-similarity and the confirmed breakdown below the $1,700 level, gold is now likely to slide.

Based on the analogy to 2013, it’s not only likely to slide, it’s likely to slide profoundly in a sharp manner. These may be the last days or hours before the slide fully begins.

How low is gold likely to go during this upcoming decline? Perhaps as low as its 2020 low – to the $1,450-1,500 area.

I realize this is far from the current price, but nonetheless, this target area appears justified in my opinion. There are two important Fibonacci retracements based on the 2015-2020 rally that gold can bounce from (it recently bounced from the 38.2% retracement). These are 50% and 61.8% retracements.

The support provided by the 61.8% retracement is strengthened by the 2020 low and the support provided by the 50% retracement is strengthened by the 2019 high.

However, based on gold’s self-similarity to 2013, it seems that we’re about to see a slide that’s bigger than what we’ve been seeing so far this year. This time – based on the similarity – gold is likely to decline profoundly, but no longer in the back-and-forth mode. If gold formed its next local low at the 50% retracement (so at about $1,560), then it might do so still within the declining, short-term trend channel (sometime in September).

However, if gold is to stick to the link to 2013, then it should decline more rapidly. In this case, the technique that can help us estimate the short-term target is the one that says that after a breakdown from a trend channel, price is likely to move approximately by as much as the height of the previous trend channel. In this case, gold could break below the trend channel soon and then decline even more. Based on the height of the trend channel, the above means that a move to the 61.8% retracement as the next downside target is more likely than a move to the 50% retracement.

I previously wrote that the above-mentioned decline in gold would likely be linked to a breakdown in the EUR/USD below 1, and we already saw both: decline in gold, and a breakdown in the EUR/USD below 1. The implications remain bearish.

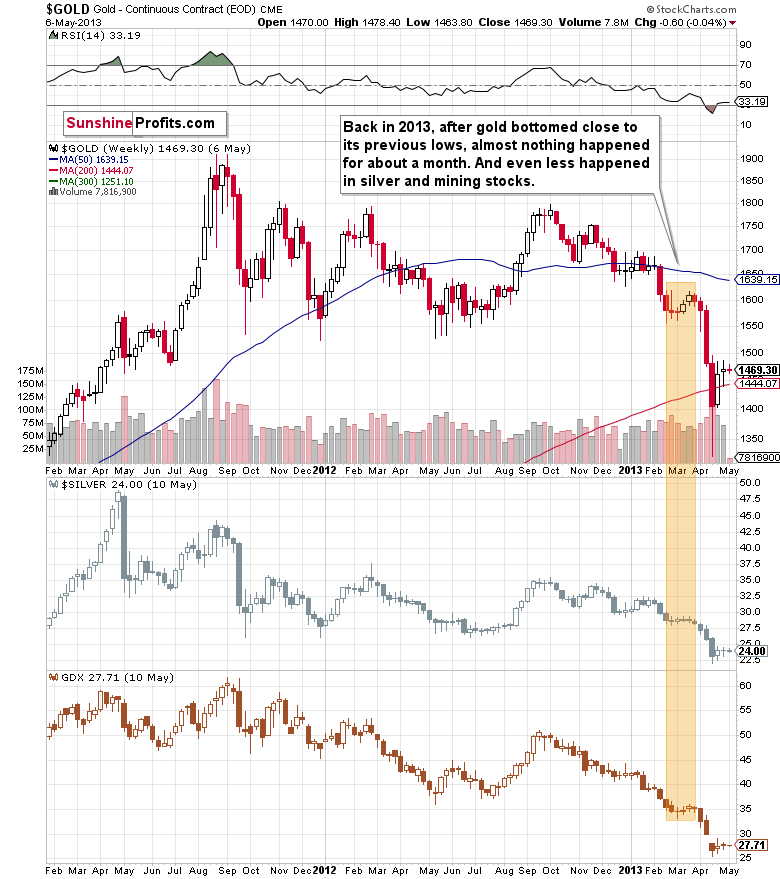

Let’s zoom in on what happened in 2013 after the analogous rebound.

Well, gold consolidated for a few weeks and plunged only after that consolidation.

That’s what we saw recently as well. Of course, we haven’t seen the big plunge yet, but the other parts of the recent price patterns are very, very similar to what we saw in 2013.

Still, let’s keep in mind that history doesn’t necessarily repeat itself to the letter – it rhymes. Consequently, it’s quite possible to have two corrections from the previous lows instead of just one.

Especially if the temporary (!) effect of geopolitical events practically forces gold to move up due to safe-haven demand.

In other words, on a more-or-less basis, gold is doing exactly what it’s been doing in April 2013, right before the biggest part of the slide.

In fact, gold is down this week, and unless it soars today or tomorrow, it’s going to form the lowest weekly low in more than two years.

This means that right now is probably one of the worst moments to be exiting the short position in the precious metals sector, and perhaps one of the best ones to be entering the short position if one doesn’t already have it at their desired size.

The above is what I wrote right after gold rallied recently, and indeed, since it declined profoundly, so far it seems that it was a very bad moment to be exiting short positions.

Also, please note that the most recent short-term upswing took two weeks – just like the one that we saw in 2013 right before the biggest part of the slide.

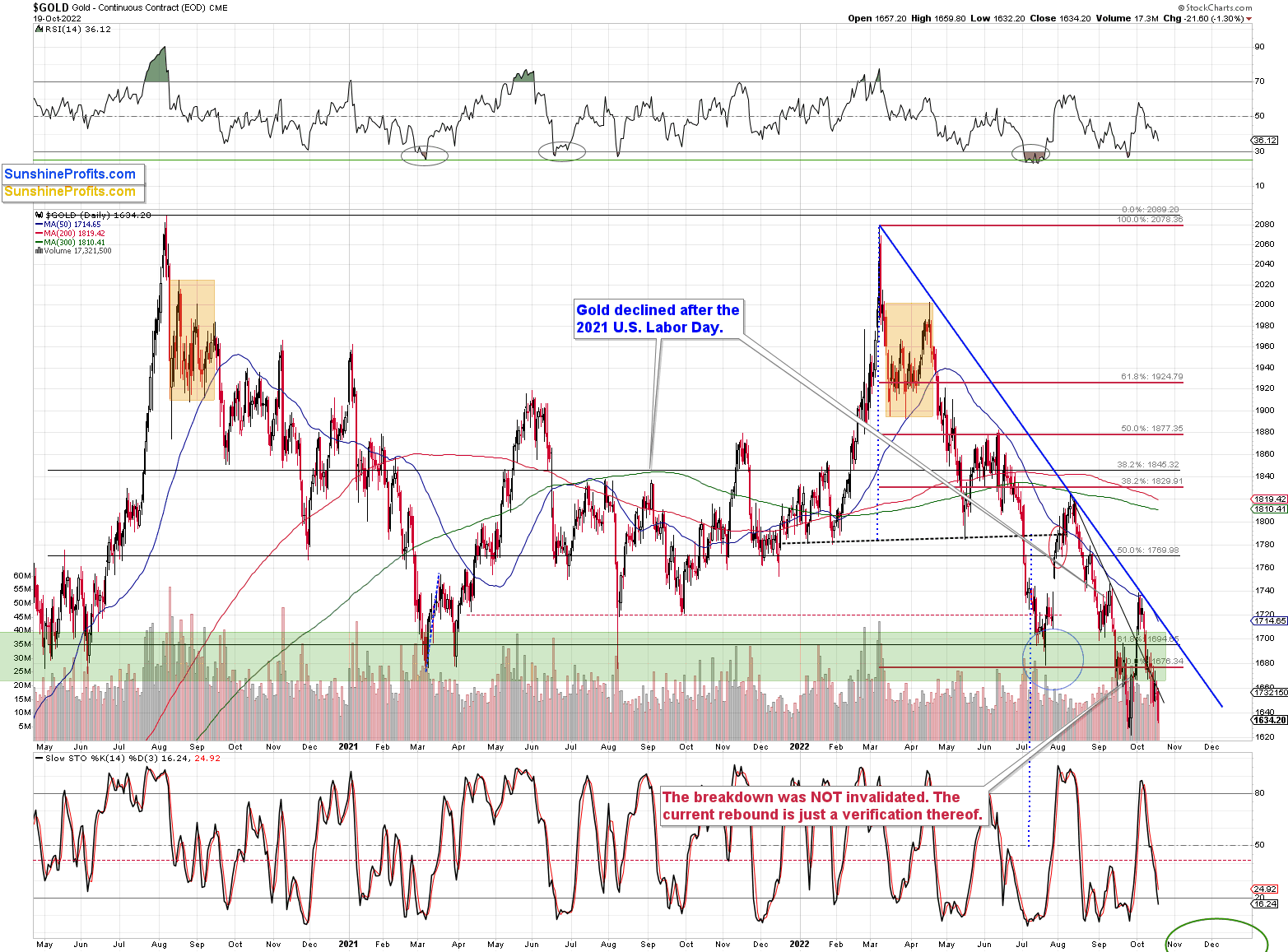

Having said that, let’s zoom in to see gold’s short-term price moves.

Two weeks ago, I commented on the above chart in the following way:

Gold moved sharply higher very recently, and… It didn’t change that much.

It managed to get back above the green support/resistance zone, but it only happened after the breakdown was already verified, and it happened based on quite a few geopolitical events that happened close to each other.

Gold was still stopped by its declining medium-term resistance line and its 50-day moving average.

So, gold got a boost from almost everywhere (I even received quite a few questions about how gold would move in the event of WW3, so the level of concern regarding geopolitical stability is high), and all it managed to do was to rally a bit above $1,720 – it’s not that much.

The reasons for which gold rallied are likely either unfounded (Fed’s supposed U-turn) or temporary and likely exaggerated (geopolitical events, WW3). Consequently, gold’s rally seems to be a temporary phenomenon, and as the dust settles and the “world doesn’t end”, the bigger trends are likely to be resumed.

No wonder that gold erased the previous rally so quickly.

Yesterday’s close was less than one dollar above the lowest daily close of September, so one could say that the rally is gone.

What I would like to emphasize here is that the fact that the rally happened and then it was reversed makes the situation more bearish now than about a month ago, when gold was trading at similar price levels. The RSI indicator confirms that. Back in September, it moved below 30, and now we don’t see anything like that.

Gold is now even more ripe for a powerful slide lower – the 2013-style.

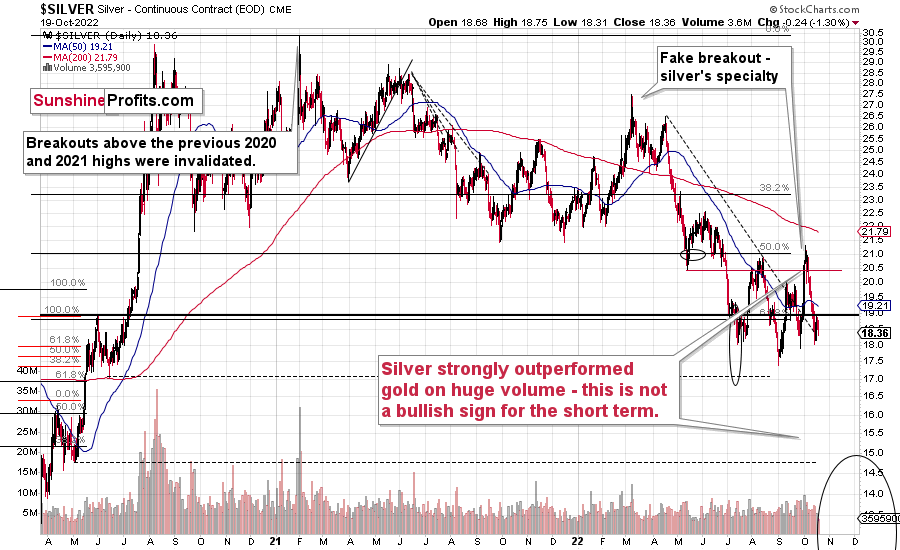

Having said that, let’s take a look at the silver market.

Last week, I commented on the above silver chart in the following way:

Just like gold, silver reversed, and just like it’s the case with gold, I’m not buying the supposedly bullish narrative here. I don’t think anything more than a brief rebound is likely and it’s quite possible that there will actually be no additional rally – silver is down by almost 1% so far in today’s pre-market trading.

Silver’s slide from above $21 to below $19 has been very sharp, so it’s natural to see some sort of breather. It doesn’t necessarily have to be bullish.

When in doubt, take a step back and think about what really changed. And, well, nothing changed. Real rates are still going to move higher. The situation, being as bad as it is on many levels, is still better than the situation (in monetary / fiscal terms that is) in the Eurozone and Japan. Consequently, the USD Index has good reasons to strengthen.

Since real rates and the USDX are the main fundamental drivers for gold, and the technicals for gold continue to support the medium-term downtrend’s continuation, the big surprises for the precious metals sector are likely to be to the downside. The pace at which silver has declined recently appears to confirm that.

Indeed, silver declined profoundly. It moved much lower, practically erasing its recent rally. No wonder – the rally was based on an unfounded expectation of Fed’s dovish U-turn, which is unlikely to happen anytime soon.

What’s next?

Well, the July-now period can be viewed as one big flag pattern, and those “continuation patterns” tend to be followed by moves that are similar to the ones that preceded them.

In this case, the move that preceded the flag was a decline from about $28. This means that another move lower in silver is likely to be huge.

Once silver breaks below its 2022 lows, it has little support all the way until its 2020 low. There’s support just below $15, but it’s not very strong, so it might not trigger anything more than a brief correction.

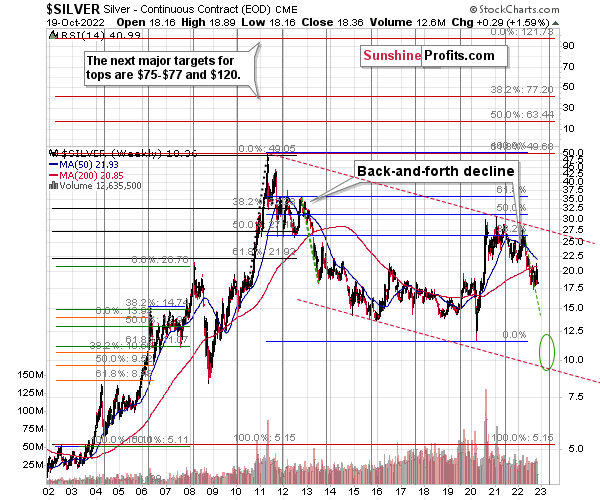

Let’s keep in mind that while gold is repeating its 2013 performance, so is silver.

As you can see on the above chart, silver corrected about 50% of the previous downswing, and this correction ended at about $30, a long time ago. Ever since, silver has been declining, and even the outbreak of war in Europe didn’t make silver rally above that level.

On the above chart, you can see how silver first topped in 2011, then declined and formed another top at the cyclical turning point. Next, it declined once again – to the previous lows. After that, silver rallied (in 2012 and 2022), and it topped between its 50-week moving average (marked in blue) and the previous top. Now silver is declining in a back-and-forth manner (you can see it more clearly on the previous short-term silver chart).

Back in 2012, these were just the early days of a gargantuan decline, and the same appears likely to be the case this time. Interest rates are going up after all, and the Fed is determined to quench inflation.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Besides, please note that silver didn’t even manage to rally as much as copper (which tried to move to new highs recently) or most other commodities, thus being rather weak.

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in mining stocks.

History tends to repeat itself. Not to the letter, but in general. The reason is that while economic circumstances change and technology advances, the decisions to buy and sell are still mostly based on two key emotions: fear and greed. They don’t change, and once similar things happen, people’s emotions emerge in similar ways, thus making specific historical events repeat themselves to a certain extent.

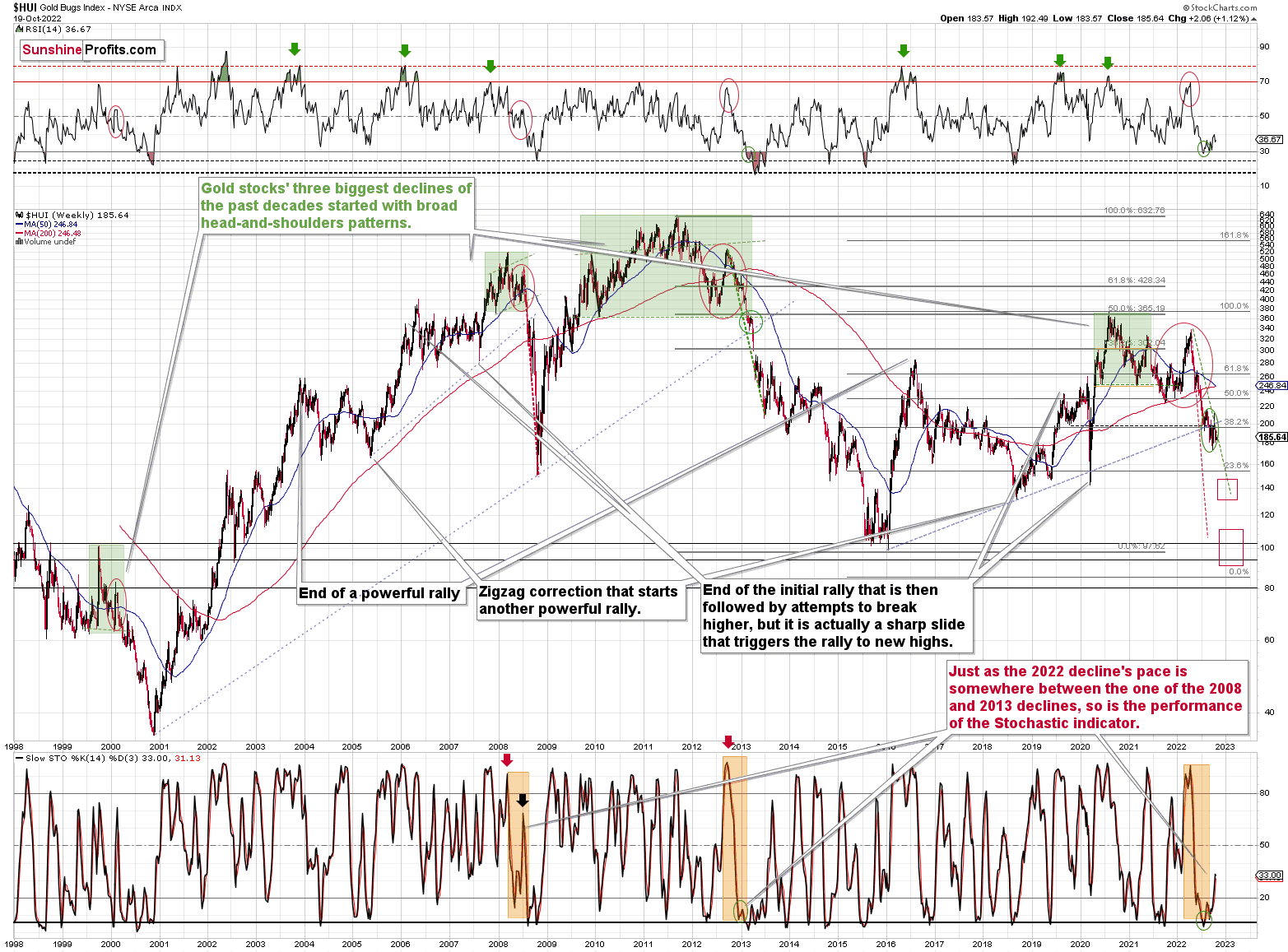

For example, right now, gold stocks are declining similarly to how they did in 2008 and in 2012-2013.

As gold was practically forced to rally recently based on geo-political events (UK’s QE, tactical nuclear warfare scare, Iranian protests), so were gold stocks.

Did it change anything technically?

Only briefly. This and last week’s decline and invalidation of the temporary move back above the rising medium-term support/resistance line confirm that this move was forced and rather artificial.

The above provides the perspective needed to properly assess the situation in the precious metals market. Gold stocks often lead the rest of the sector, and right now they are after a major breakdown and its confirmation. This is extremely bearish.

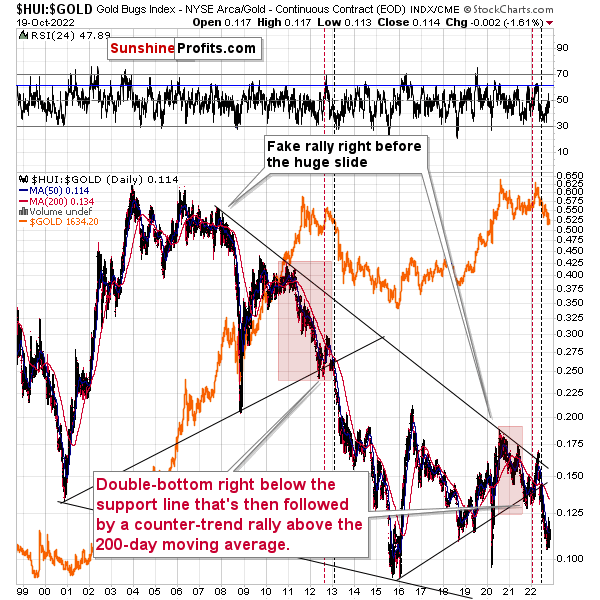

Since the analogies to 2013 and 2008 were not invalidated because of this upswing, my previous comments on the above chart remain up-to-date:

The key analogies in the case of the HUI Index (I’m using this chart as it has the most long-term scope) are to 2008 and 2013.

In 2008, there was a move higher in the stochastic that accompanied a sharp – but temporary – upswing that was then followed by a much bigger decline.

In 2013, there was a series of tiny upswings that didn’t really change anything.

Right now, we see something in between the above.

On multiple occasions, I wrote that the situation right now is somewhat similar to what we saw in 2013 (mostly), but it also has a 2008 vibe to it.

Even so, the pace at which gold stocks are declining is between both declines: the 2008 and 2013 ones. I marked this with dashed lines.

Please note the green, dashed line that starts at the late-2012 top and the one that starts at the 2022 top. Those lines are identical. You can see that back in 2012 and 2013, the HUI Index traded above this line. This time, it’s trading below it – gold stocks are declining faster.

Faster declines imply sharper corrections – as emotions get hotter.

So, does Stochastic’s performance indicate an even bigger rally here? Not necessarily.

Was the current rally very likely based on stochastic? Possible – yes, but very likely – no. The link to 2013 is still more visible and more important.

How low can the HUI Index fall during the next big downswing?

As it’s the case with gold and silver, a move back to the 2020 lows is definitely in the cards. Please note that this level is also strengthened (as support) by other major lows: the 2019, 2014, and 2008 ones.

However, I wouldn’t rule out a move even lower on a temporary basis. If gold were to decline to about $1,450-1,500, it would mean that it would double its current 2022 decline. If the HUI Index does that, it will move below 150.

So, all in all, 120-150 is my current target area for the upcoming slide in the HUI Index.

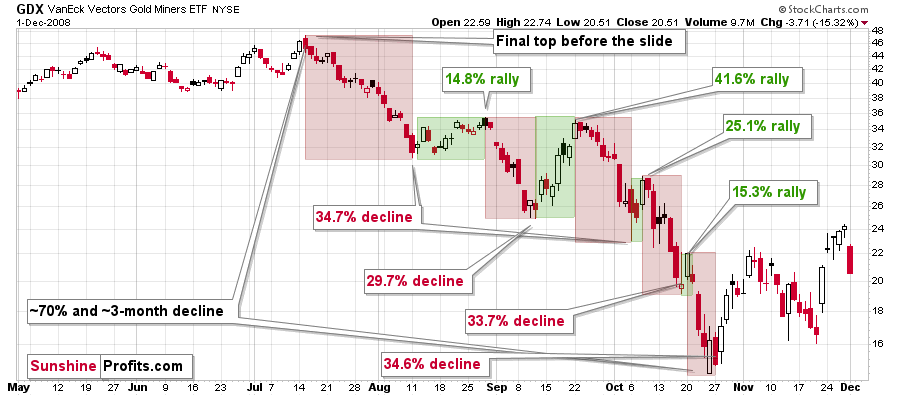

All right, let’s zoom in and see how mining stocks declined in 2008.

Back then, the GDXJ ETF was not yet trading, so I’m using the GDX ETF as a short-term proxy here.

The decline took about 3 months, and it erased about 70% of the miners’ value. The biggest part of the decline happened in the final month, though.

However, the really interesting thing about that decline – that might also be very useful this time – is that there were five very short-term declines that took the GDX about 30% lower.

I marked those declines with red rectangles. After that, a corrective upswing started. During those corrective upswings, the GDX rallied by 14.8-41.6%. The biggest corrective upswing (where GDX rallied by 41.6%) was triggered by a huge rally in gold, and since I don’t expect to see anything similar this year, it could be the case that this correction size is an outlier. Not paying attention to the outlier, we get corrections of between 14.8% and 25.1%.

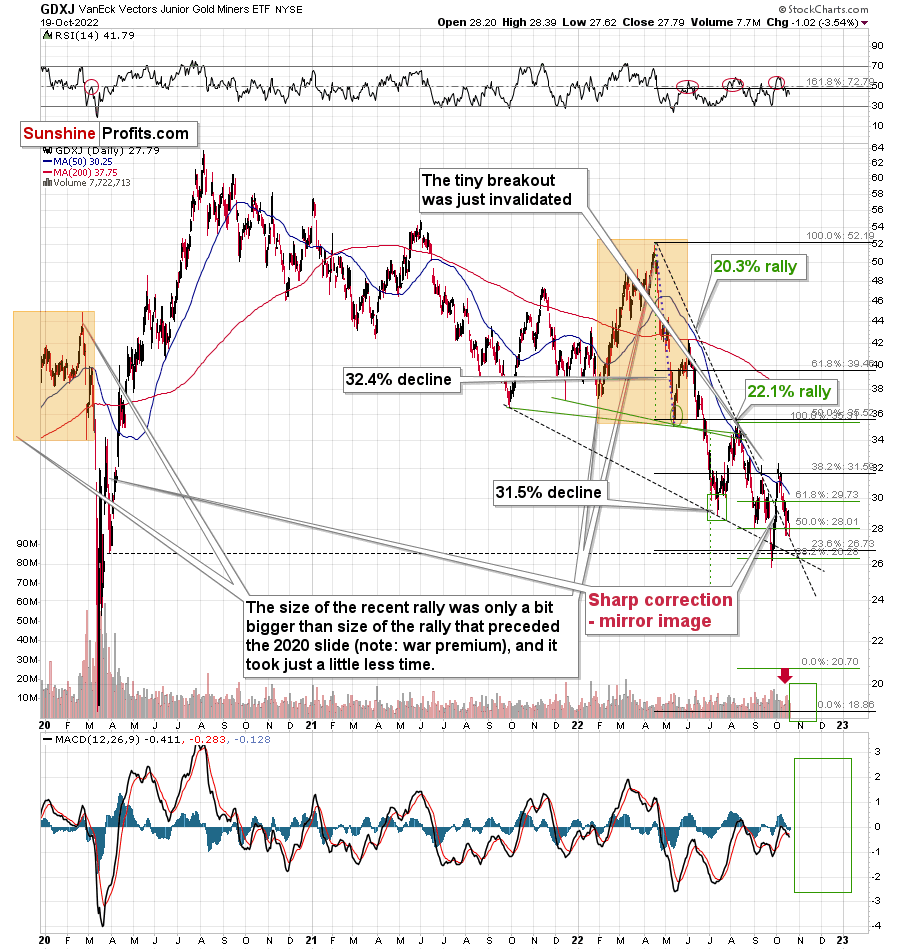

Fast forward to the current situation. Let’s take a look at the GDXJ ETF.

Just like the rest of the precious metals sector, the GDXJ ETF moved higher recently. And, just like gold and silver, the junior mining stocks declined sharply after the corrective upswing.

In other words, my previous expectations based on the above chart were realized:

That’s the fourth attempt of the GDXJ to break above its 50-day moving average (marked in blue). All previous cases failed, and in all previous cases the rally taking prices to this MA were sharp.

Is this time different? That’s unlikely, as the fundamentals (as explained earlier today) haven’t changed.

Additionally, please note that the RSI just jumped above 50, and ever since the April 2022 top, these levels in the RSI meant that local tops were in. I marked that with red ellipses in the upper part of the chart.

There’s also one additional factor explaining why this counter-trend bounce might be so volatile – that’s because the mirror image of this decline – the 2020 rally – also features a sharp correction around those price levels.

This time, the correction doesn’t have to be as big as the move that led to it was not as sharp.

Now, as you may recall, I previously had a downside target of about $26, but I ended up resigning from it. I continue to think that this decision was justified from the risk to reward point of view (given the data that we had available at that time), as there were previously corrective upswings, and it was not a no-brainer that we’re going to see a rebound also one more time.

However, as geopolitics came into play this time, the counter-trend rally has indeed materialized. Since it doesn’t make much sense to try to predict those near-term geopolitical events – the world is too unpredictable, it’s better to focus on the part of the picture where we can actually gain an extra edge over other market participants. That is recognizing trends and tendencies. Once the very short-term dust settles, the markets are likely to get back to their previous trends and surprise those who assume that short-term geopolitical events have a lasting impact on the markets. They don’t. If that was the case, gold would be above $2,000 at this time, as that’ where it soared based on the Russian invasion. Well, the war didn’t end, and yet gold is at about $1,700.

Indeed, the RSI appears to have topped in the area that I marked, just like it did twice earlier this year. It seems that the decline can now continue, regardless of the immediate-term performance.

At this point, you might be wondering why junior miners are not trading at their previous 2022 lows, just like gold is, and what does this “strength” mean.

In short, it’s most likely due to the stock markets’ performance. It rallied recently, and some of the bullishness spilt over to mining stocks. What does it imply?

Well, as the stocks are likely to slide, the small bullish impact is likely to turn into a huge bearish impact. And if stocks don’t slide, but rally instead, then juniors are still likely to decline more than gold and silver in percentage terms, but their decline would not be as dramatic in this case.

In my view, a decline in stocks is still the most likely outcome – and I think that junior miners will be affected to a great extent. And yes, this means that I expect (no promises, of course) that our profits on the short positions in junior mining stocks are going to soar in the coming weeks.

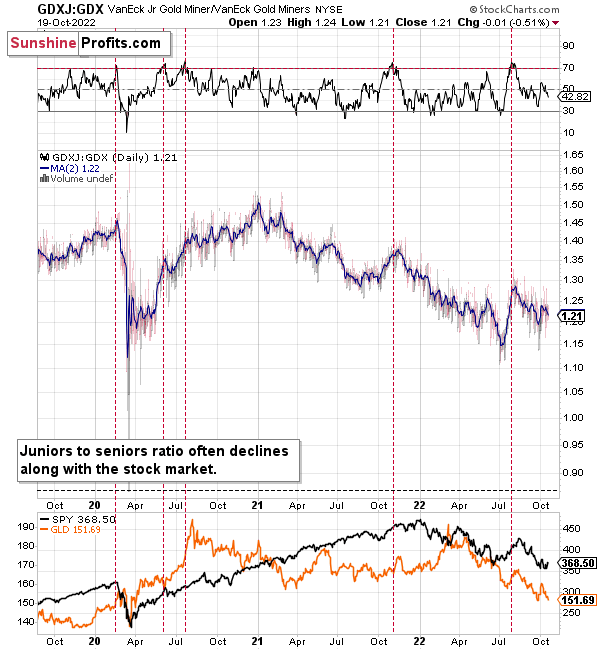

Meanwhile, the relative performance of junior miners compared to senior miners continues to deteriorate in a medium-term trend.

During this quick upswing, juniors rallied relative to seniors, but this is just a very short-term move that’s within a short-, and medium-term downtrends.

This implies bigger declines in the GDXJ in the future.

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw at the 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI to gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

Recently, we saw a quick upswing in the ratio, but that’s not a game-changer – even the biggest declines had quick corrections in the past.

If history is to rhyme, we’re about to see a profound decline. In fact, we’re likely already past its beginning.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices of gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… just stocks) and that’s exactly what’s likely to happen.

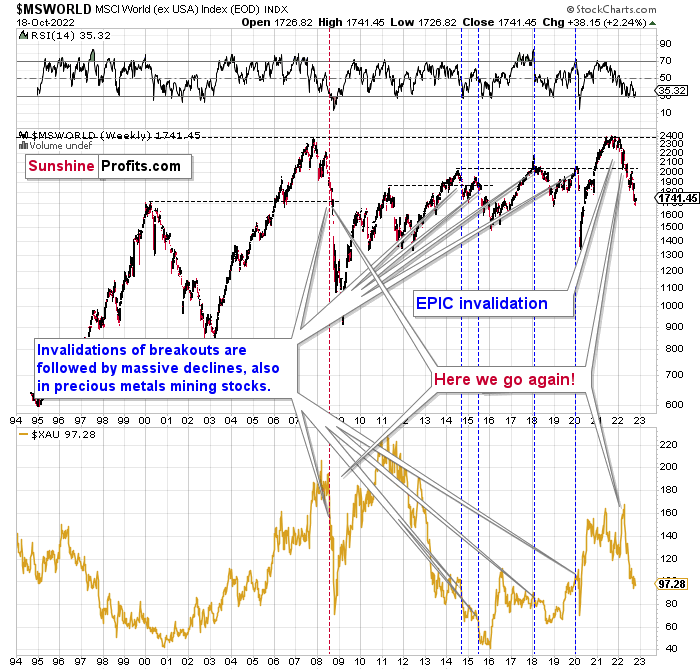

The technical picture in the case of world stocks remains extremely bearish, and my previous comments on it were just confirmed.

After a brief pause, the freefall continues, just like in 2008. This has profoundly bearish implications for the mining stocks that declined severely back then.

Here’s what I’ve been writing about the above chart for quite a few weeks now:

World stocks have already begun their decline, and based on the analogy to the previous invalidations, the decline is not likely to be small. In fact, it’s likely to be huge.

For context, I explained the ominous implications on Nov. 30. I wrote:

Something truly epic is happening in this chart. Namely, world stocks tried to soar above their 2007 high, they managed to do so, and… failed to hold the ground. Despite a few attempts, the breakout was invalidated. Given that there were a few attempts and that the previous high was the all-time high (so it doesn’t get more important than that), the invalidation is a truly critical development.

It's a strong sell signal for the medium - and quite possibly for the long term.

From our – precious metals investors’ and traders’ – point of view, this is also of critical importance. All previous important invalidations of breakouts in world stocks were followed by massive declines in mining stocks (represented by the XAU Index).

Two of the four similar cases are the 2008 and 2020 declines. In all cases, the declines were huge, and the only reason why they appear “moderate” in the lower part of the above chart is that it has a “linear” and not a “logarithmic” scale. You probably still remember how significant and painful (if you were long, that is) the decline at the beginning of 2020 was.

All those invalidations triggered big declines in the mining stocks, and we have “the mother of all stock market invalidations” at the moment, so the implications are not only bearish, but extremely bearish.

World stocks have declined below their recent highs, and when something similar happened in 2008, it meant that both stocks and gold and silver mining stocks (lower part of the chart) were about to slide much further.

The medium-term implications for mining stocks are extremely bearish.

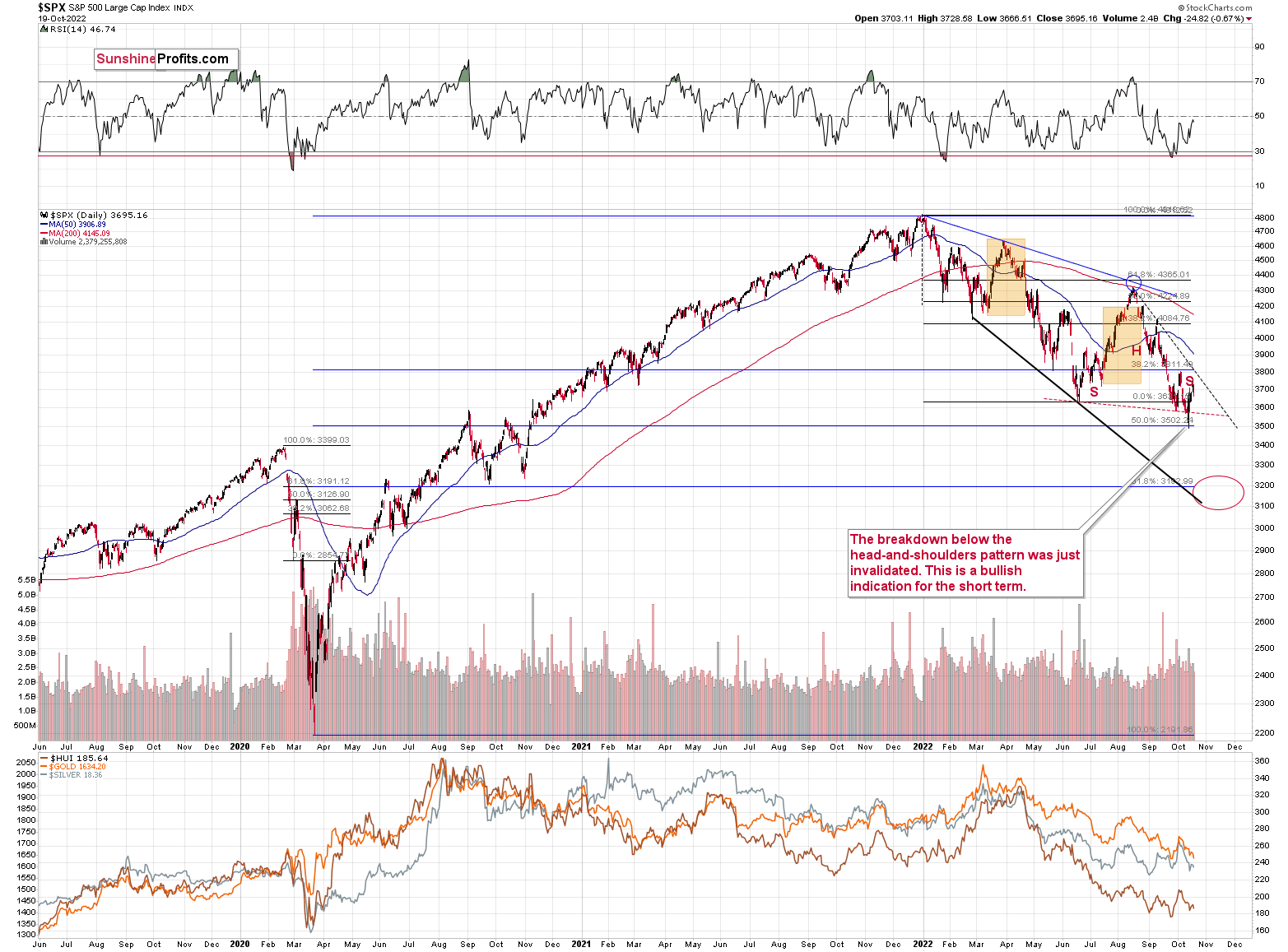

However, let’s get back to the short- and medium-term points of view.

Remember the rather big head-and-shoulders pattern that was recently invalidated?

Well, it wasn’t completed nor invalidated in closing price terms. This formation could therefore still be completed and followed by a profound decline – at least to 3,250.

Ideally, this formation should be symmetrical, and please note that the left shoulder was created by two local tops (June and July 2022). Consequently, the fact that we just saw two local tops (October 2022) makes the formation quite reliable – if it’s going to be completed.

Stocks declined yesterday, and the S&P 500 futures are down in today’s pre-market trading, so it could be the case that the next big move lower is already underway. In this case, S&P 500 would first complete the right shoulder of the formation, break below it, perhaps correct a bit to verify the breakdown, and then slide much lower.

What does it all mean?

In my opinion, it means that the short-term outlook for stocks is unclear with a bearish bias, the medium-term outlook for stocks remains bearish, and the short- and medium-term outlooks for junior mining stocks remain bearish. Even if we see some immediate-term strength in the latter, I think it will be very temporary.

As interest rates are likely to go up, the stock market is likely to go down – perhaps as low as 3,200 on a short-term basis – and then – after a correction – even lower.

Most interestingly, though, such a decline would likely have a devastating effect on the prices of mining stocks (especially junior mining stocks) and silver. There might be some impact on gold, too.

The above would also be in tune with an extra rally in the USD Index. After all, less competitive exports are not that favorable for the U.S. economy.

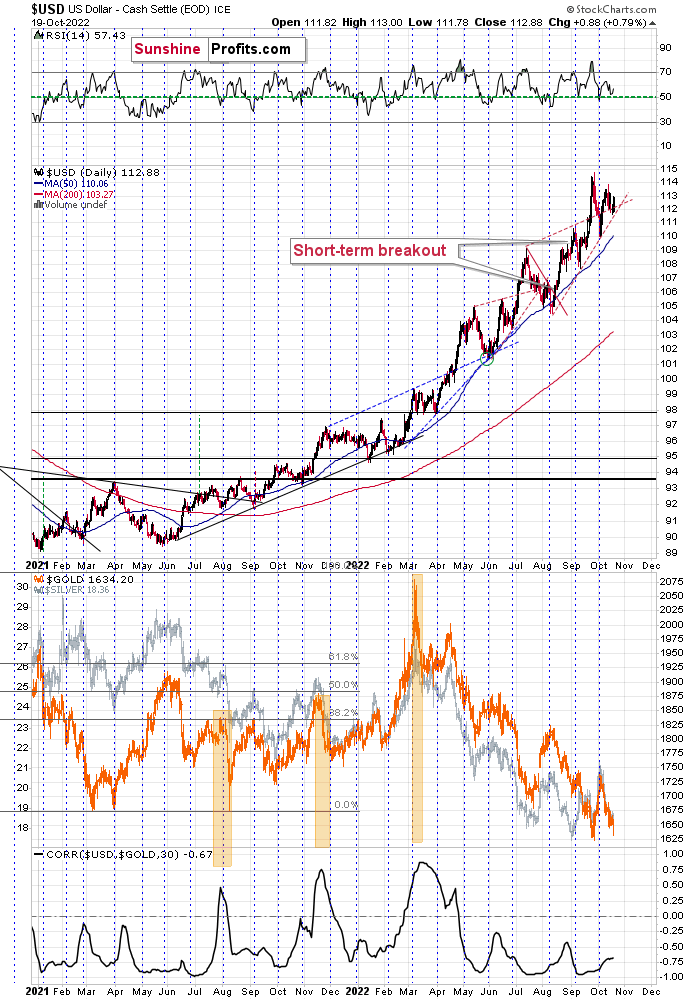

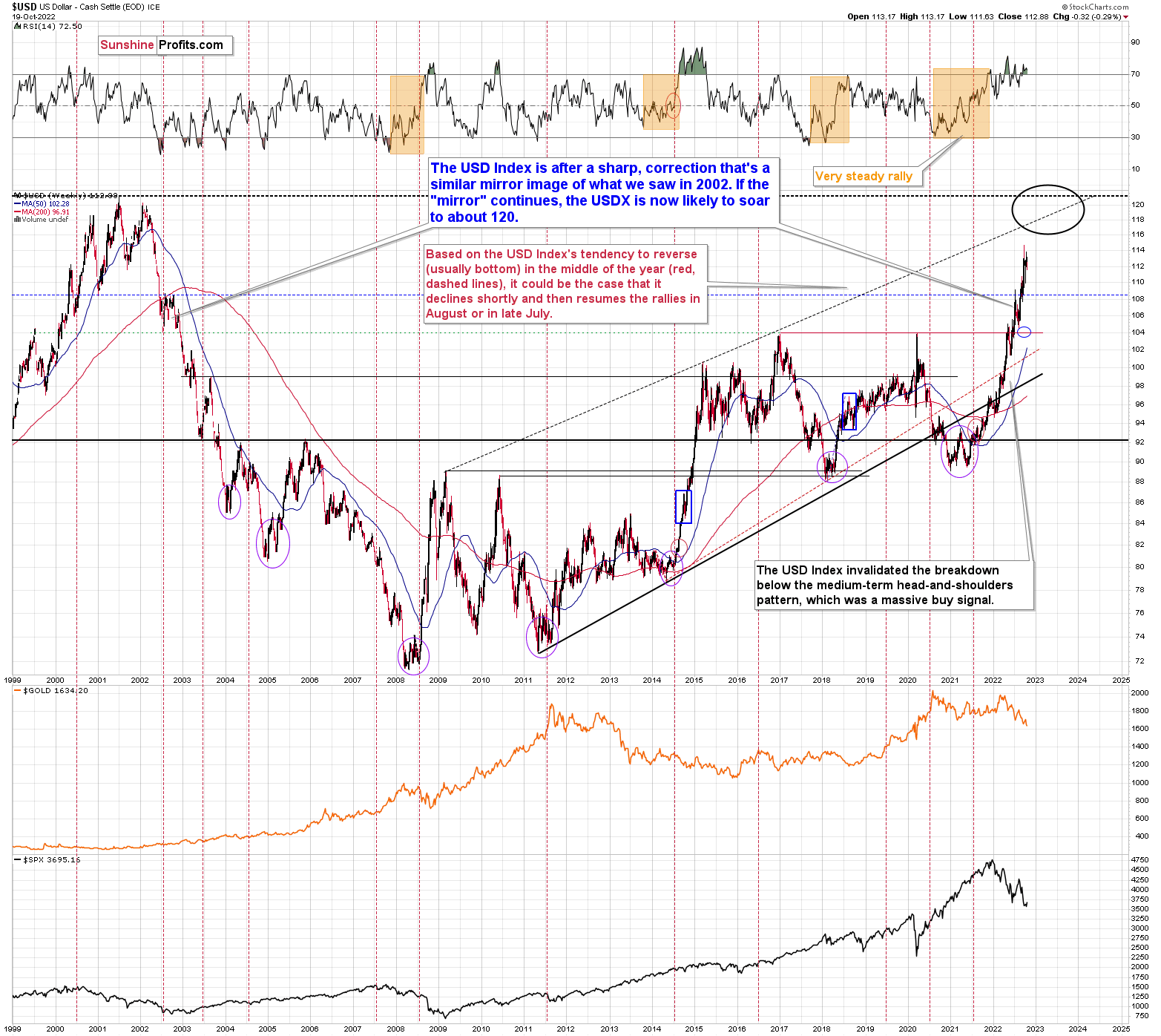

From the short-term point of view, the USD Index’s rally simply continues. Yes, it got ahead of itself, and it corrected close to the turn of the month – and then it bottomed. This is rather normal, and it doesn’t change the uptrend. The implications for the USD Index are bullish, and they are bearish for the precious metals sector due to the traditionally low correlation between them.

Let’s zoom in a bit for extra details.

It turns out that what we’ve seen in recent weeks is similar to what we had just seen days before. This time it’s happening on a bigger scale, but since markets tend to be self-similar (proportionate moves can be similar, not necessarily identical ones), the implications are bullish nonetheless.

Just as the late-September rally was bigger than the mid-September decline, the following rally could be bigger than the September-October correction.

In other words, the USD Index could rally any day or hour now, and the opposite is likely for the precious metals sector.

So, overall, it seems that history rhymed, and the USD Index bottomed close to the turn of the month once again.

From the long-term point of view, the USD Index is currently rallying in approximately the mirror image of how it declined in 2002. Based on this, it seems that one shouldn’t be surprised by a rather quick move from the current levels to about 120 – USD Index’s long-term highs. Of course, the implications for the precious metals market are profoundly bearish.

This doesn’t rule out quick corrections along the way – those don’t interrupt the big, weekly/monthly moves at all, and they don’t break the analogy. This includes the recent downswing – it didn’t invalidate the bullish medium-term uptrend.

This is extremely bearish for gold and the rest of the precious metals sector.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is over, and that the next big move lower is already underway.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Summary

Summing up, it seems that the biggest part of the 2013-like decline is taking place right now, and – while I can’t make any promises regarding performance - it seems likely to me that our big profits are about to become huge, and then ridiculously big in the relatively near future.

As I have written before, the recent upswing didn’t change anything. While the mining stocks appeared “strong” recently, it seems to me that it’s just a reflection of the temporary (in my view) strength in the general stock market. And as stocks decline, mining stocks – and especially junior mining stocks – are likely to truly slide.

Things might happen very fast in the coming days, and if I plan to make any adjustments, I’ll keep you informed. Still, if the targets that I’m mentioning in the “Trading” part of the summary are reached, I think that profits should be taken off the table without an additional confirmation from me. I will probably get on the long side of the market at that time, but I’ll send a confirmation if I decide to do so.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Friday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief