Briefly: gold and the rest of the precious metals market are likely to decline in the next several weeks/months and then start another powerful rally. Gold’s strong bullish reversal/rally despite the USD Index’s continuous strength will likely be the signal confirming that the bottom is in.

Welcome to this week's Gold Investment Update.

Predicated on last week’s price moves, our most recently featured medium-term outlook remains the same as the price moves align with our expectations. On that account, there are parts of the previous analysis that didn’t change at all in the earlier days and are written in italics.

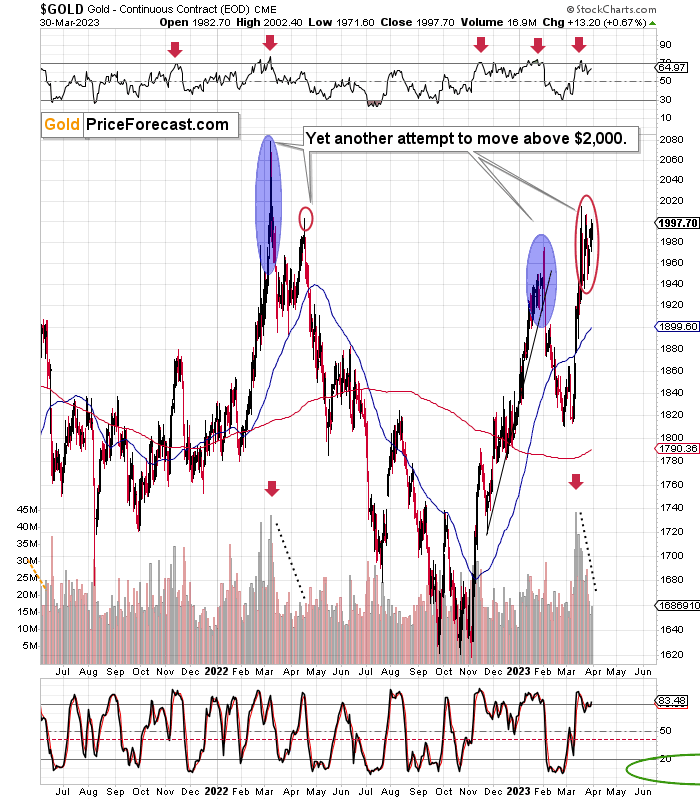

The key indication that we saw this week and this month comes from the volume levels in gold. Increased volume levels along with increased tensions confirm the increased activity of investment public on the market. The same emotional wave likely triggered all of the above, as well as the decent performance of junior mining stocks, which are currently the weakest part of the precious metals sector. The important detail is that the same volume levels accompanied previous attempts when gold tried to move above the $2,000 level. And all those attempts failed! What would make the situation really different? Nothing, really. Especially since there are so many similarities to 2008 that explain why gold "had to" rally so much (sadly, only in retrospect) before moving sideways and falling particularly sharply (which is still in the near future).

Also, I’ll keep the previous “Technical Look at the Fundamentals” section intact because it remains to have the key background impact on the entire landscape for all markets, including the precious metals market. After all, one of the two primary fundamental drivers of gold prices (the other being the USD Index) is real interest rates. In fact, that’s what I’m going to start with. (This section is just as it was previously, so if you have already read it, please feel free to scroll down to the next section.)

Technical Look at Fundamentals

Let me start by quoting one of the things that we already wrote above:

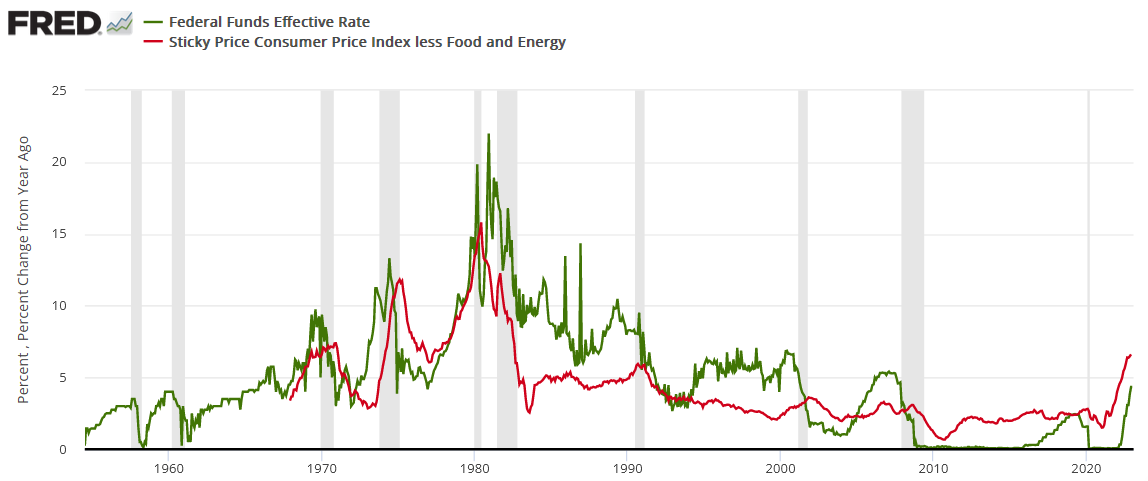

However, we’ve warned on numerous occasions that the Fed has always pushed the U.S. federal funds rate (FFR) above the peak year-over-year (YoY) percentage change in the core Consumer Price Index (CPI) and that nine of the last 10 bouts of rising inflation have ended with recessions.

The latter – likelihood of a recession – means that the stock market (along with silver, mining stocks, and – in particular – junior mining stocks) is likely to fall. Given how far it rose on the various stimulus-based programs, it can also fall substantially. This is not to be taken lightly.

The former implies that either higher or lower interest rates, or both, are possible. Or at least a faster increase in rates than inflation (or a slower decline in rates than inflation).

In fact, let’s see the long-term chart once again.

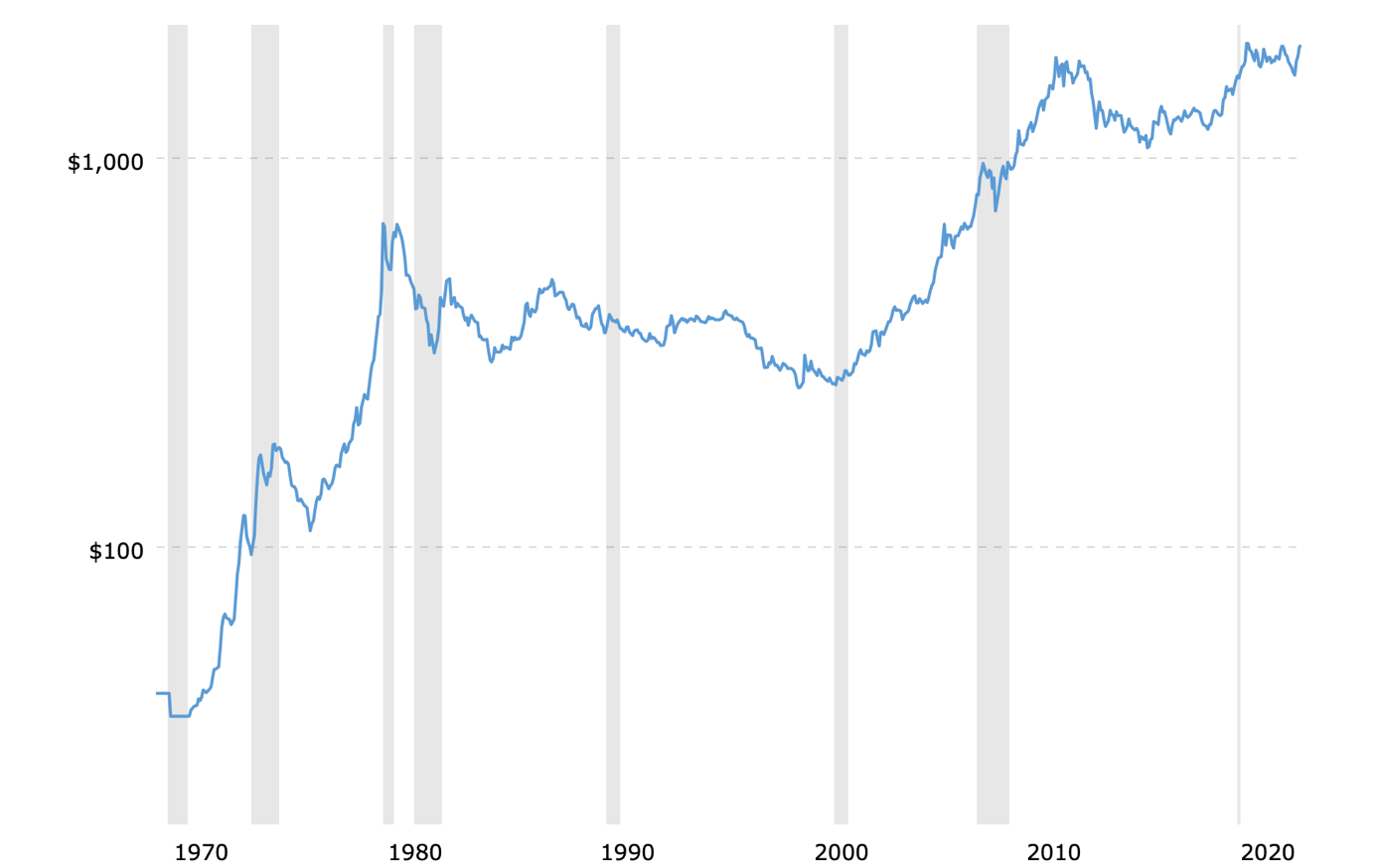

Here’s what gold did in the long run.

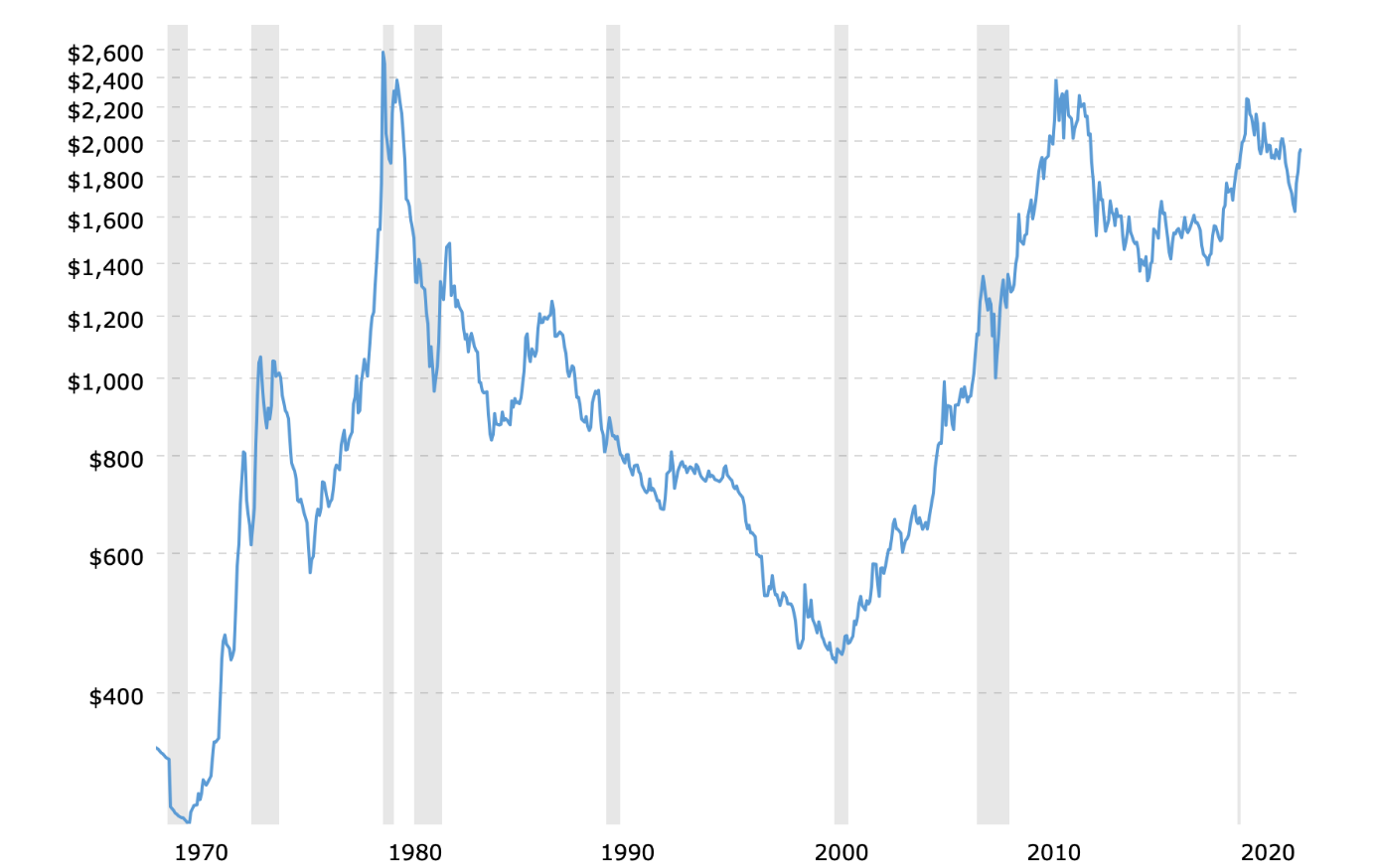

The above chart features gold’s price in nominal terms, and the below chart shows the price of gold in real terms (adjusted for inflation based on the official inflation statistics).

Source: Macrotrends.net

The thing that I want to emphasize here is gold’s performance in the 70s and 80s. There were two major declines in gold – one in the mid-70s and one in 1980. Let’s zoom in a bit on the former, as it might not be clear based on the above charts.

Source: chartsrus.com

What happened on the rates vs. CPI chart at those times? There were some major shifts in their relative values.

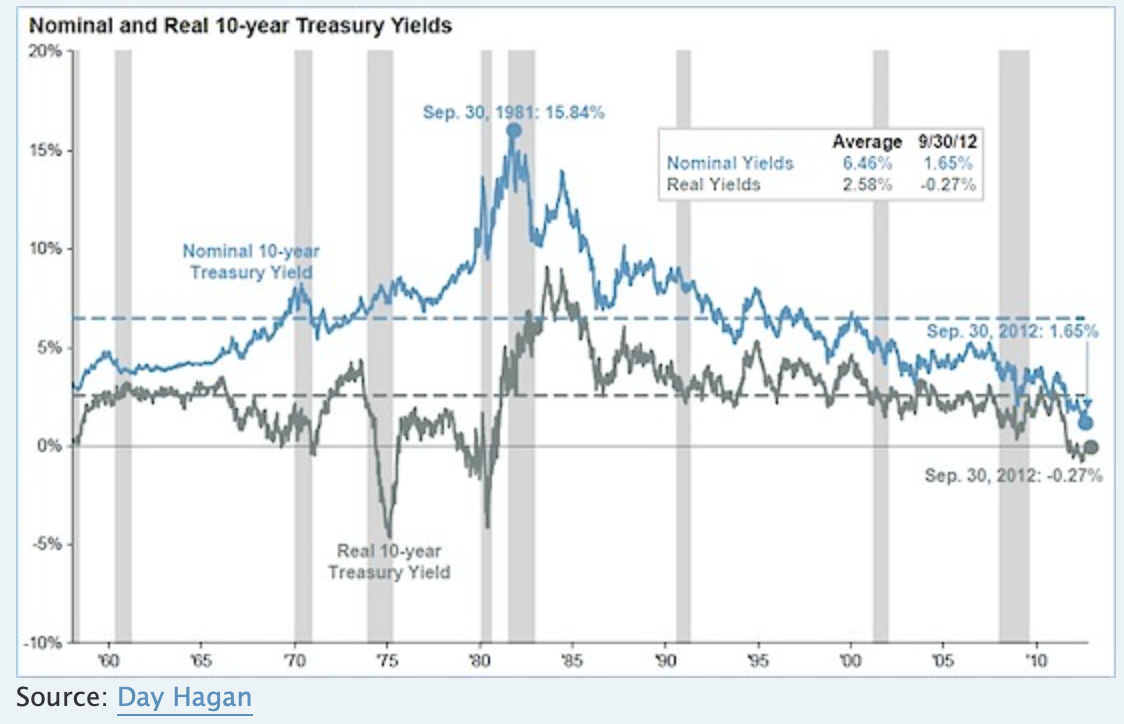

To make it easier to see what was going on, let’s take a look at yet another chart – the one featuring both nominal and real Treasury yields. Of course, the yields are closely linked to the interest rates, so it’s pretty much the same chart.

The real yield is what is of the greatest importance here.

Why? Because that is what one effectively gets by postponing consumption, saving the capital, and investing (technically, lending) it at very low risk.

If the real yield moves below 0%, it means that one is effectively losing money while just earning interest on Treasuries. That is when gold becomes extremely valuable.. Gold pays no interest, but it’s been currency throughout history, so it’s viewed as something safe and stable in the long run. Therefore, it seems better to just hold gold, which at least won’t (theoretically) lose value, while fiat money does. In other words, gold is then used as an inflation hedge.

When the real yields rally, however, the situation turns upside down.

Since gold doesn’t provide interest, and rising real yields mean that it makes more and more sense to have capital in the form of money that pays this increasing interest (like Treasuries), the appeal for gold ownership declines.

That’s why real yields and real interest rates are one of the two key fundamental drivers of gold prices. The other is the USD Index.

Indeed, the lows in real yields (mid-70s and 1980) corresponded to tops in the gold price.

So, again, to clarify:

- Rising real interest rates / yields are extremely likely to trigger declines in the gold price.

- Declining real interest rates / yields are extremely likely to trigger rallies in the gold price.

The above might not work in the short term, but it’s likely to work over the medium- and long term. After all, the markets can be particularly emotional in the short run and move on just about anything, regardless of whether it makes sense or not.

All right, to clarify even more, what exactly are those real interest rates? How to calculate them?

Here’s the definition from Google / Wikipedia.

Nominal interest rate minus the (expected) inflation rate. This approximation will suffice.

Where are the nominal interest rates going now? Higher. They may be rising at a slower rate than previously, but they are rising, and, as history has shown, they will continue to rise until the federal funds rate rises above the year-over-year CPI reading.

The latest year-over-year CPI reading in the U.S. (from Jan. 12, 2023) was 6.5%.

The FFR is about 2% below that.

The above and the historical tendencies imply that either the CPI has to move lower by at least 2% or the FFR has to move higher by 2% while the CPI is unchanged – or some combination of the above (which is most likely).

Either way, this means that the real interest rate is likely to rally by at least 2% from current levels.

Let me quote what I already stated above:

Rising real interest rates / yields are extremely likely to trigger declines in the gold price.

This means that we are extremely likely to see big declines in the gold price.

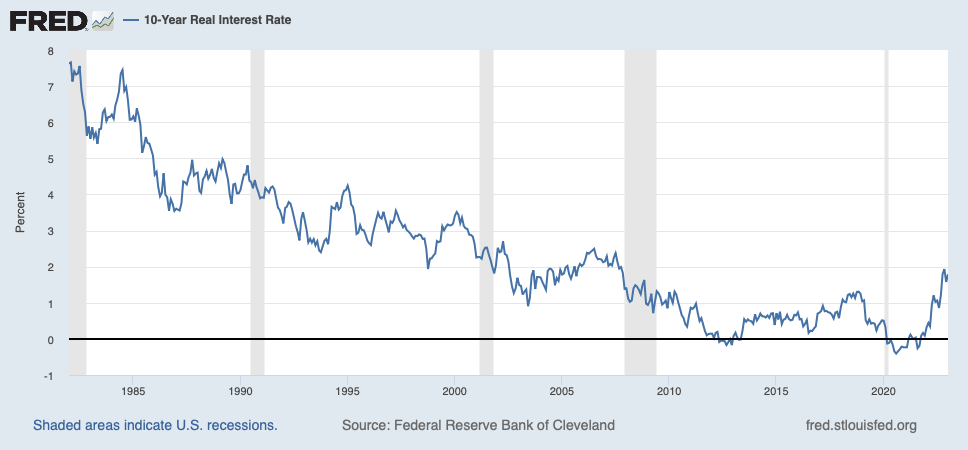

What are the real rates doing now?

Well, they are soaring, of course. However, as I wrote earlier, the link between real rates and the gold price doesn’t have to work in the short term, as the markets can focus on all sorts of things due to technical/emotional reasons.

I won’t say that the current rally in real rates is unprecedented, but we haven’t seen this kind of upswing in a long time. The last time we saw something of at least similar magnitude was right before the year 2000. What happened to the gold price back then?

Gold was after the “Brown Bottom”, but it declined, nonetheless.

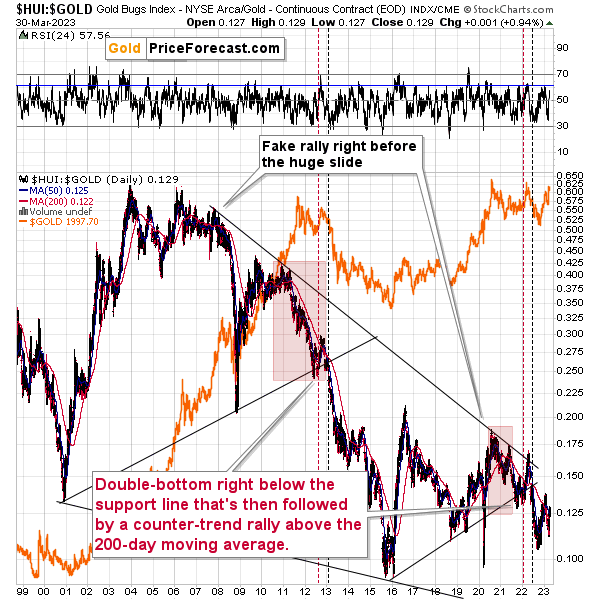

In the case of the HUI Index – a proxy for gold stocks – it was right before the final part of the slide.

Yes, this is as extremely bearish as it looks.

These are some of the reasons why this short-term rally is a counter-trend rally. The things that I’m covering in my day-to-day analyses are important too, but they are not as important as the above indications. I’m simply not commenting on the things that don’t change that often, and the day-to-day price swings do change often, but I’m commenting on them because they often make people concerned about the outlook.

Speaking of a more short-term situation, let’s take a look at what happened and what changed (and what didn’t change) more recently.

Technically Speaking

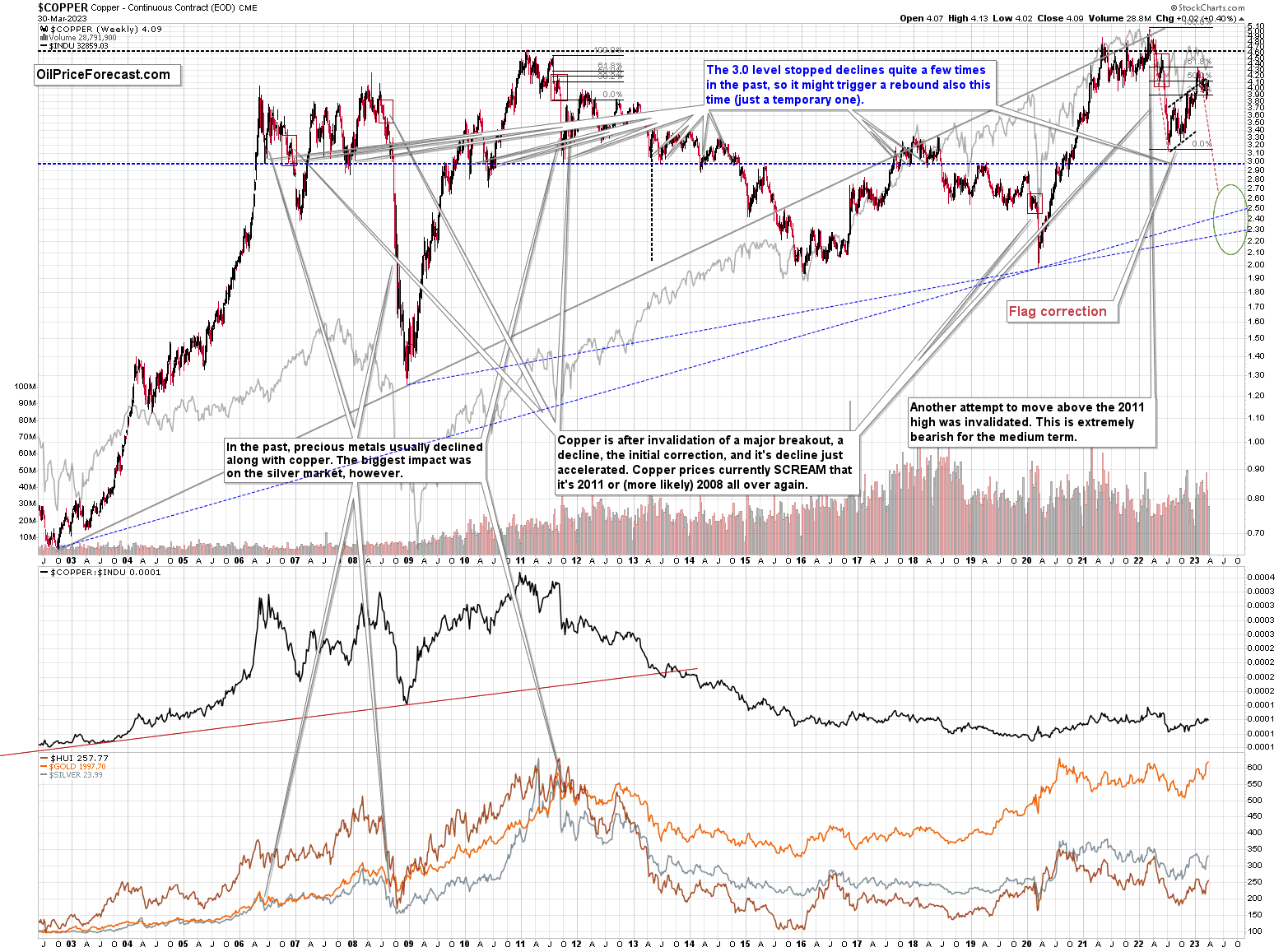

Let’s start today’s technical discussion with a quick check of copper prices.

Copper rallied recently, but it stopped at its 61.8% Fibonacci retracement level and then moved back down. Consequently, the recent move – while impressive from the day-to-day point of view – remains to be a short-term correction only.

Consequently, what I wrote about it previously remains up-to-date:

Copper recently CLEARLY invalidated another attempt to move above its 2011 high. This is a very strong technical sign that copper (one of the most popular commodities) is heading lower in the medium term.

No market moves up or down in a straight line (well, the 2008 slide appears to have been an exception), and a short-term correction doesn’t necessarily invalidate the bigger trend. For the last couple of months, copper has been trading sideways, but it didn’t change much regarding the outlook.

In fact, it made my previous target area even more likely. You see, the consolidation patterns are often followed by a move that’s similar to the move that preceded them. In this case, the previous 2022 decline was quite significant, and if it is repeated, one can expect copper to decline well below 3.

Actually, copper could decline profoundly and bottom in the $2.0-2.7 area. That’s where we have rising, long-term support lines and also the previous – 2016 and 2020 – lows.

Flag patterns (which we just saw in copper) tend to be followed by price moves that are similar to ones that preceded them. I marked this on the above chart with red, dashed lines. This method supports a copper price’s move to around $2.7.

Given the size of the previous decline (and its pace), it seems quite likely that it could take another 2-7 months for copper to move to about $2.4. May seems to be the most likely time target given the current data.

Interest rates are going up, just like they did before the 2008 slide. What did copper do before the 2008 slide? It failed to break above the previous (2006) high, and it was the failure of the second attempt to break higher that triggered the powerful decline. What happened then? Gold declined, but silver and mining stocks truly plunged.

Again, copper is after invalidation of a major breakout, a decline, and a correction. Copper prices currently SCREAM that it’s a variation of 2008 all over again. This is extremely bearish for mining stocks (especially juniors) and silver.

Before moving further, I’d like to extend the copper analysis into the analysis of the situation in one of the major copper companies – FCX. That’s where there’s the “extra trading opportunity” that I described several days ago.

And it became profitable almost instantly.

What you find below is a quote from this analysis as it remains up-to-date (I’m updating the charts though). One thing that I’d like to add is that on FCX’s medium-term chart, you can see a breakdown below the rising support line, which makes the outlook even more bearish.

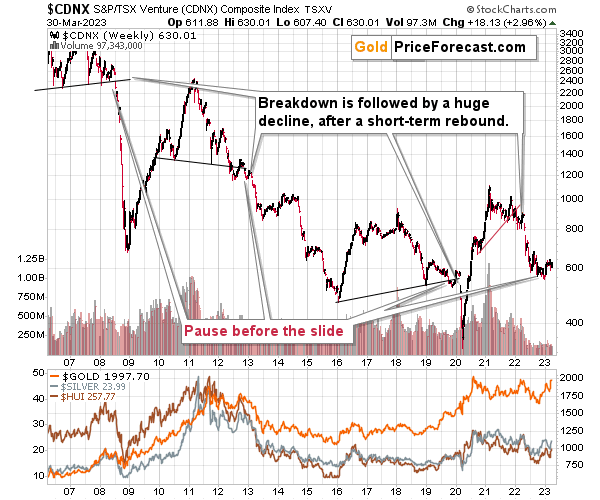

Having said that, let’s check the junior miners’ really big picture.

In short, we saw a tiny correction in the TSX Venture index, and this should be a major red flag for anyone thinking that the recent rally was a game- or trend-changer. This is a blip on the radar screen, similar to what we saw in the second half of 2021, before another big move lower.

The really important thing here is that we saw the first crack in the dam. The index declined visibly and it might mean that the final part of the 2008-style slide has just begun.

Consequently, my previous comments on the above chart remain up-to-date:

The Toronto Stock Exchange Venture Index includes multiple junior mining stocks. It also includes other companies, but juniors are a large part of it, and they truly plunged in 2008.

In fact, they plunged in a major way after breaking below their medium-term support lines and after an initial corrective upswing. Guess what – this index is after a major medium-term breakdown and a short-term corrective upswing. It’s likely ready to fall – and to fall hard.

So, what’s likely to happen? We’re about to see a huge slide, even if we don’t see it within the next few days.

Just like it was the case in 2008, the move higher that we saw before the final (biggest) slide in gold, silver, and gold stocks (lower part of the chart), didn’t translate into a visible rally in the TSX Venture Index. Just as the index paused back then, it pauses right now.

Currently, it’s trading at about 600, and back then, it consolidated at about 2500. The price levels are different, but the overall shape of the price moves (lack thereof) is similar. This serves as a signal that the recent upswing in the PMs is not to be trusted.

The above chart is one of the weakest (from a technical point of view) that is seen across the board right now. There is a strong long-term downtrend visible in the TSX Venture Index, and if stocks slide similarly as they did in 2008, the TSXV could truly plunge – perhaps even to the 300 level or lower.

The important short-term detail is that the TSXV just broke to new yearly lows. This is a major (yet barely noticed by most) indication that the next big move lower is about to start.

Having said that, let’s turn to gold.

Let’s start with context:

Between 2020 and now, quite a lot happened, quite a lot of money was printed, and we saw a war breaking out in Europe. Yet gold failed to rally to new highs.

In fact, gold was just trading well below its 2011 high, which tells you a lot about the strength of this market. It’s almost absent.

There’s a war in Europe, and billions of dollars were printed, and gold was below its 2011 highs – in nominal terms! Adjusted for inflation, it’s much lower. And silver and gold stocks’ performance compared to their 2011 highs? Come on…

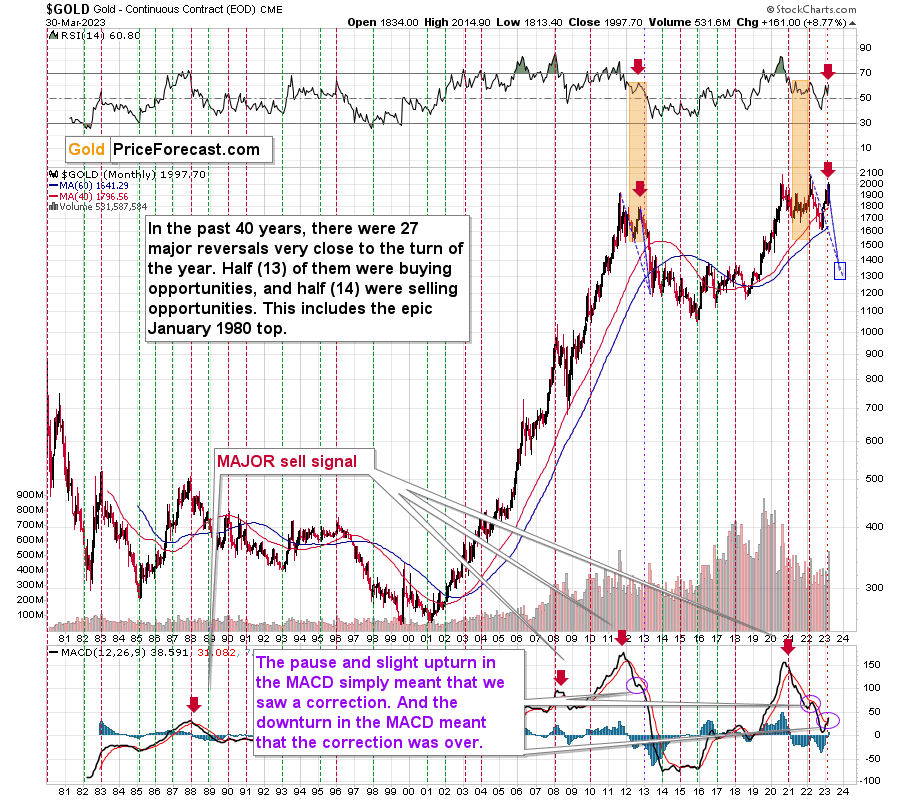

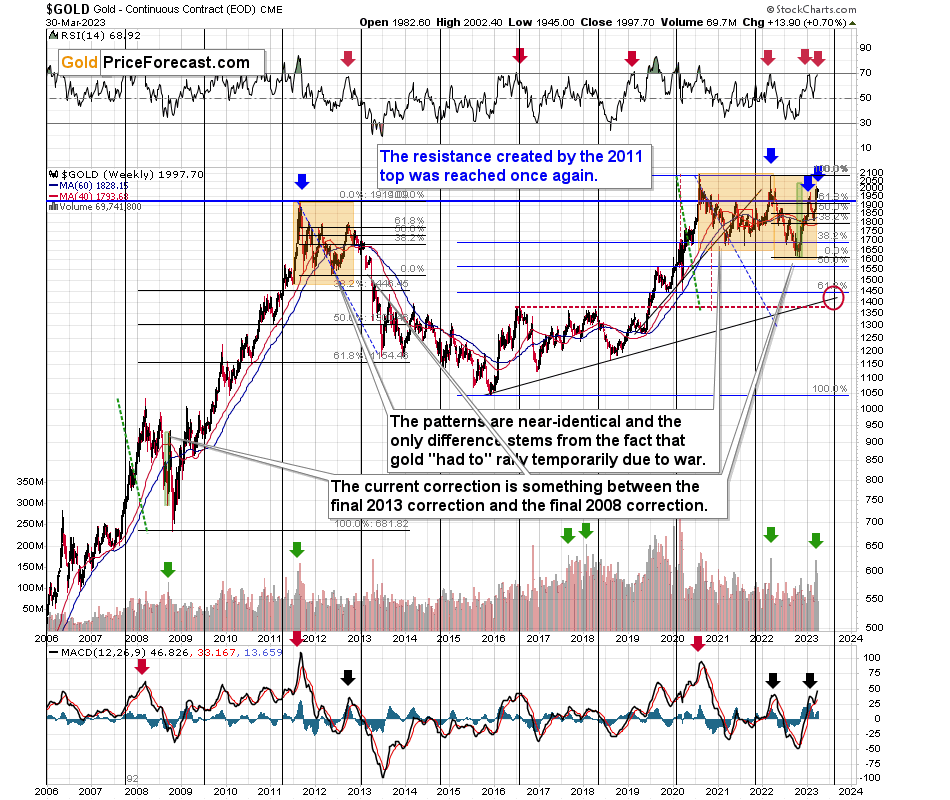

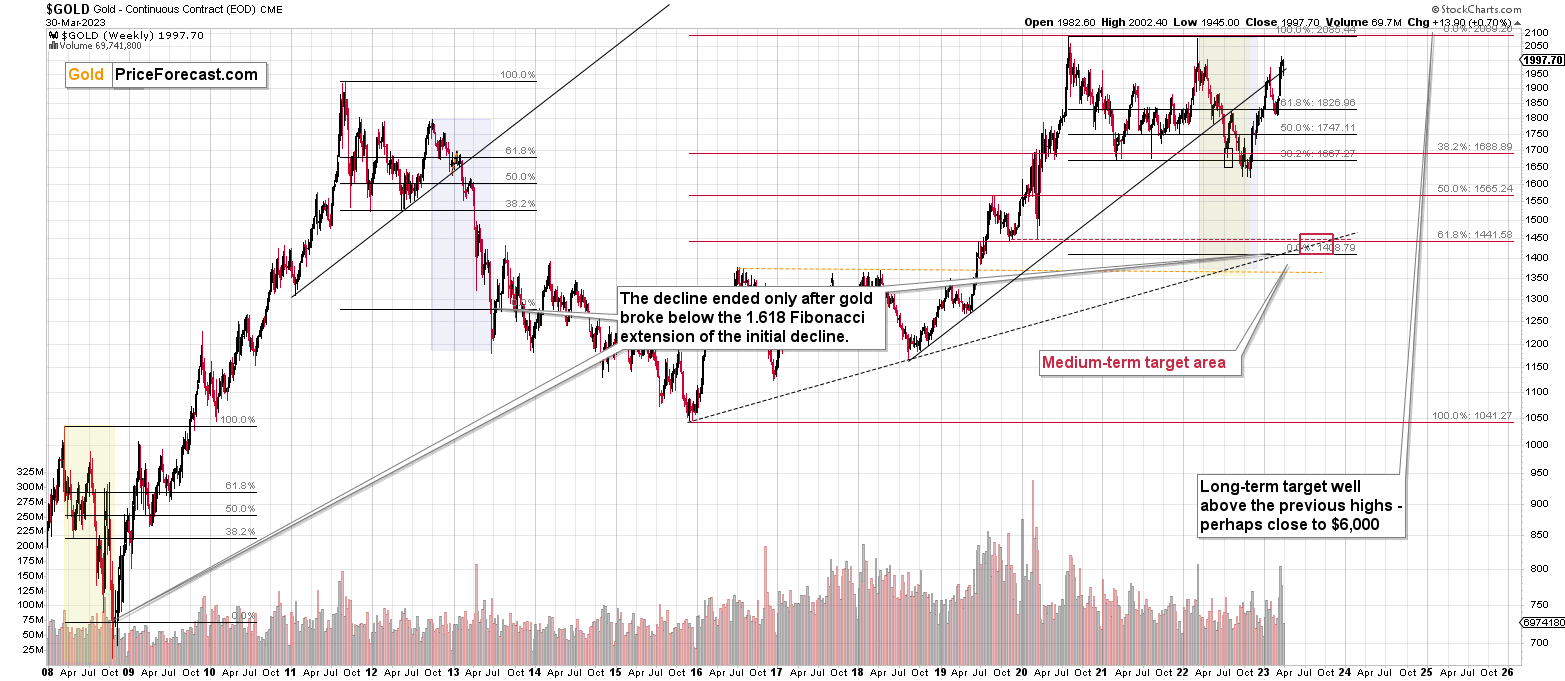

Truth be told, what we see in gold is quite in tune with what we saw after the 2011 top, and in particular, shortly after the 2012 top. We can also spot similarities between now and 2008. The long-term gold price chart below provides details.

I marked the big increases in weekly volume levels during gold’s upswings with green arrows.

The most recent case is from 2022, when gold topped.

The same happened in early 2018.

That’s how gold topped in 2011.

And – most importantly – that’s exactly what we saw at the final pre-slide top in 2008.

Please note that the rapid rally that we saw in 2008 before the slide was very much in tune with what we saw recently (note: green rectangles). Consequently, it’s not a bullish game-changer.

Now, some of the high-volume weeks were accompanied by RSI at about 70, and I marked those cases with red arrows. That was the case in early 2022, and during many other major tops.

What’s most interesting is that all of gold’s previous attempts to move above $2,000 were accompanied by the RSI at or above 70. And they all failed! The history tends to rhyme, so the implications here are profoundly bearish – not just from the point of view of volume but also from the point of view of the RSI indicator.

And, of course, given the link to 2008.

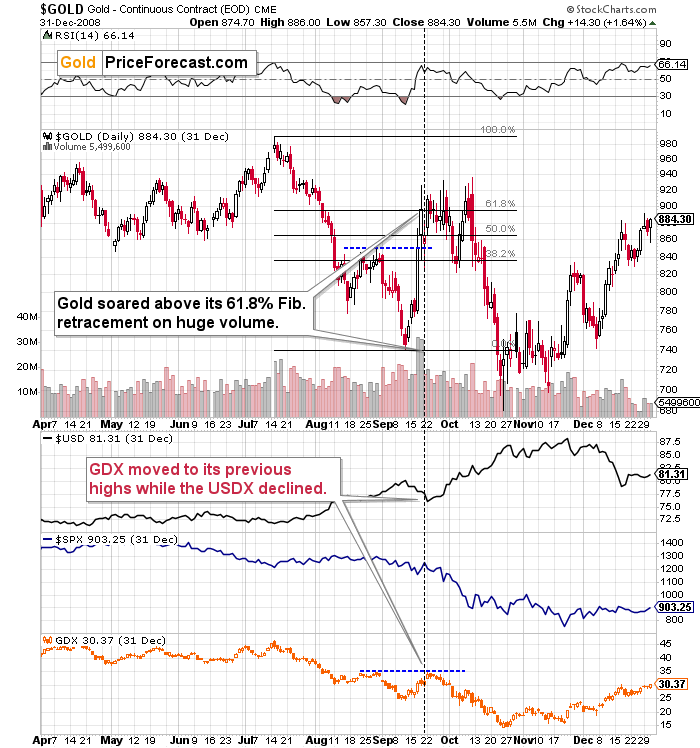

Let’s take a look at how the situation developed on the technical front back in 2008.

Gold’s final pre-slide corrective upswing was based on turmoil, uncertainty, and safe-haven buying. It was volatile, it was large, and it was accompanied by huge volume.

The RSI indicator moved a bit below the 70 level.

Sounds familiar?

Back in September and October, 2008, gold even rallied above its 61.8% Fibonacci retracement level.

During that time, the USD Index declined in a relatively sharp manner, and the GDX ETF pretty much followed the stock market.

It’s exactly the same thing right now. Back then, stocks declined over time, and this time they are moving somewhat higher, but the mining-stocks link is just as it was in 2008.

Also, let’s keep in mind the situation in real interest rates. It might not be as sexy as bank collapses, but that remains one of the key reasons for gold’s decline in the following weeks/months.

Gold has a lot of catching up to do with its decline to “normalize” its link with real rates.

Technically speaking, the key thing is that gold once again tried to move above its 2011 highs, and it once again failed to do so. It invalidated this breakout in one of the most bearish ways imaginable – with a weekly reversal.

This is an extremely important sell signal. The combination of fundamental and technical factors alone is a reason to prevent one from having a long position in gold right now (except for the insurance capital, that is).

That’s one thing. Another thing is that, given the major fundamental event that I already mentioned above (the war outbreak), it’s possible for the technical patterns to be prolonged and perhaps even repeated before the key consequence materialized. Similarly to the head-and-shoulders pattern that can have more than one right head before the breakdown and slide happen.

In gold’s case, this could mean that due to the post-invasion top, the entire 2011-2013-like pattern got two major highs instead of one. And thus, the initial decline and the subsequent correction are pretty much a repeat of what we saw in 2020 and early 2021, as well as what we saw in 2011 and 2012.

The particularly interesting fact (!) about the correction that we saw after the 2011-2012 decline (the one that was followed by the huge 2012-2013 decline) is that during it, gold corrected slightly more than 61.8% of the preceding medium-term decline. Consequently, the current situation is just like what happened back then.

And if all the above wasn’t bearish enough, please take a look at the reading of the RSI indicator based on the weekly price changes. It’s now just below 70, and guess where it was at the final top before the 2012-2013 slide? Yes, it was exactly there, too.

That’s also approximately, where the RSI was at last year’s top.

The orange rectangles on the above chart represent the corrective upswings from approximately the previous local lows. There are two of them, and back in 2013, there was just one corrective upswing, before gold truly plunged.

However, please remember that history doesn’t repeat itself to the letter – it rhymes. This means that two corrections instead of one are still within the scope of the similarity, especially since the first correction wasn’t as big as the 2008 one.

The current situation is truly special, as the rate hikes are something that we haven’t seen in a long time. The same goes for the level of concern about the inflation that’s “out there.” The latter implies that when faced with a decision about whether to fight inflation or help the economy, the Fed is likely to lean toward the former. And that’s bearish for assets like gold.

Gold’s medium-term outlook is one thing, and it is likely linked to real rates. However, is there anything bullish about gold’s short-term picture?

There are some who think that rallies are bullish, but rallies are a thing of the past (the price needs to move higher before someone describes the move as a rally), whereas an outlook is something that is about the future. And just because a given move just happened, it doesn’t mean that we are likely to see the same kind of event next.

I already wrote about the huge weekly volume and its bearish implications going forward. However, there’s more than that - we see the same thing from a daily point of view.

In early March, gold moved higher on volume that was slightly higher than what we saw in March 2022 (and yes, markets like anniversaries). And when did we see it? At the yearly top.

What happened next in 2022? Gold moved lower and then back up. However, the volume declined during this period and ultimately, the gold price plunged, erasing more than the entire preceding rally.

What is happening right now? After the huge-volume top, gold moved lower and then back up, but the volume at which it happened was much lower. This is very bearish.

Why is gold moving closer to previous highs this time? Because gold is behaving similarly not only to what happened in 2022, but also to what happened in 2008.

The implications are very bearish.

Having said that, let’s take a closer look at the silver market.

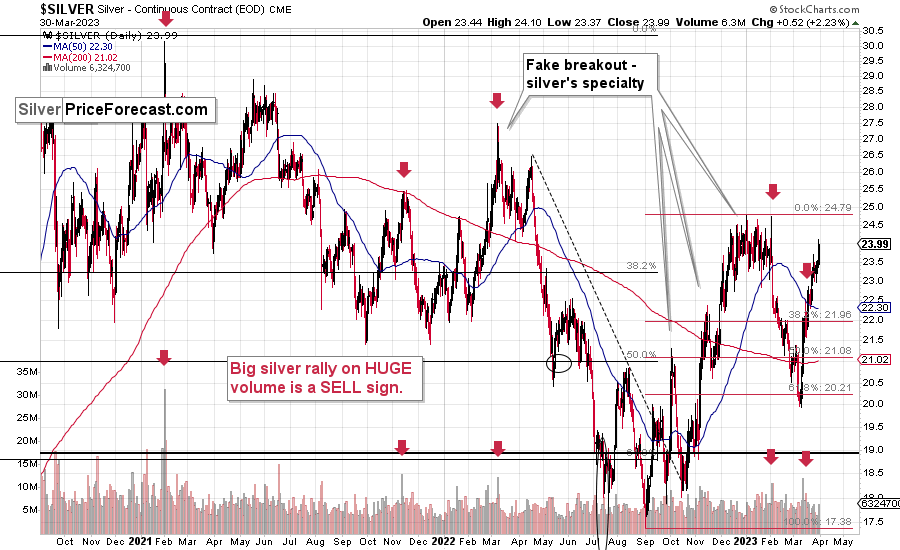

Silver soared recently, and it might seem bullish at first glance.

However, it would probably seem bullish only to those, who are new to the silver market, and they haven’t noticed how silver performs – especially relative to gold – before big declines.

Yes, it tends to outperform gold at those times. And, well, we’re seeing this once again now.

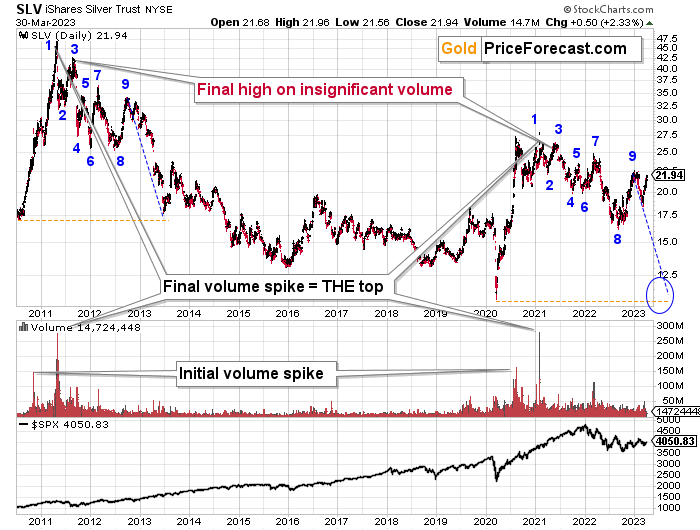

Also, while it’s not visible on the above silver chart, the white metal is currently repeating its previous post-top performance. It’s crystal-clear on the below SLV ETF chart.

However, before we move on to the SLV ETF, let’s take a moment to recall the time when everyone and their brother were bullish on silver – in early 2021.

The silver price even tried to move above the $30 level, and it succeeded in doing so… For a brief moment.

Silver was “supposed to” take off. Shot up to the moon. Based on the physical market’s tightness, silver’s availability, a short squeeze, etc. Truth be told, it’s difficult not to write this with sarcasm (and I’m not), because I remember exactly the same reasons being used to justify silver forecasts above $100 back in the early 2000s. I’ve been there and I’ve been buying silver below $5, so I know a thing or three about what kind of analyses, discussions, and rumors were “out there” at those times.

Two decades later, the silver price rallied in a rather regular manner, along with gold, and then declined – also along with gold. To be precise – I’m not ruling out any of the above – short squeeze, shortages in general, etc. However, I am saying that just because something MIGHT EVENTUALLY happen, that doesn’t mean that it IS going to happen NOW or ANYTIME SOON.

For those exceptional situations, it’s great to have some physical silver (and gold, too). However, on a day-to-day basis, the investment and trading parts of one’s capital should be governed while putting great weight on things that are actually likely to happen in regular situations.

One way to thrive while trading silver is not to take silver’s strength at face value. Just as I warned that even if silver was about to soar (and I really DO expect silver to soar above $100 in the following years), then it was very unlikely to do so again in 2021 as the bigger trend was not supporting this outcome.

Anyway, when silver was trying to break above $30, I warned you about the real bearishness of the situation. (By the way, this link also proves that I’ve been expecting the interest rates to rise before that materialized.)

Many months later, we see that what formed in early 2021 was a major top that started a major medium-term decline.

Those of you who have been following my analyses for a long time might recall this chart.

I featured it originally many months ago, and the emphasis was on the analogy in price movement and in the spikes in SLV ETF’s volume.

Indeed – the situations proved to be analogous, and the silver price declined.

What’s remarkable is how similar the declines were.

What I added today are the counters (no, it’s not an Elliott Wave count), and I added the S&P 500 at the bottom of the chart.

The counters help to see which parts of the silver price movement are analogous. They are not identical, but they are much more similar than it seems that they “should be.” Even the “8” bottom was rather broad in both cases.

Based on this similarity, silver is now starting the main part of the slide. Its recent weakness relative to gold definitely confirms that.

Silver’s decline (and PMs decline in general) took a rather measured shape in its initial months (late 2012 – early 2013), so should we expect the same thing to happen now?

No.

The reason for this lies in the link to the stock market. Back in 2013, there was no visible decline in stocks, let alone a substantial one.

This time, we are likely to see one. And you know when we also saw some sharp declines in stocks? In 2008 and in 2020, and you can see the latter on the above chart. Silver plunged in a sharp (not measured!) manner in both cases.

Given rising interest rates and the investment public’s realization that the rates are not “about to move lower,” that is something that is likely to lead to the stock market’s sell-off. But I’ve been writing about that already.

The thing is that it has implications for the above-mentioned analogy in silver. And that is: the upcoming part of the decline in silver is likely to be sharper than what we saw in 2013. The same goes for the implications for mining stocks (and probably gold). This slide is likely already underway.

Let’s take a look at the situation from a broader point of view.

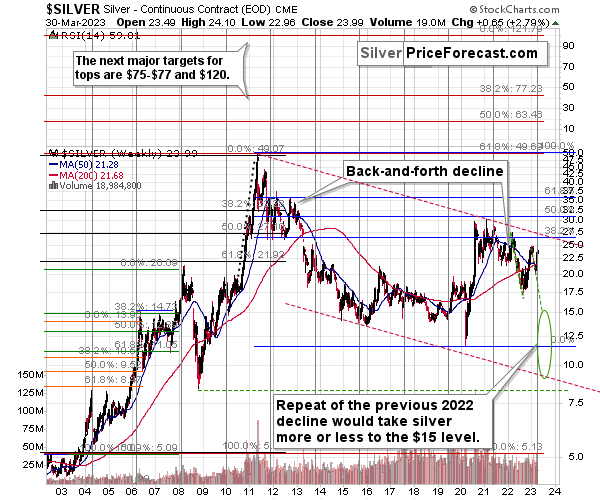

When looking at silver from a long-term point of view, it’s still obvious that the recent move higher was most likely just a corrective upswing.

What happens after corrections are over (as indicated by, i.e., silver’s outperformance)? The previous trend resumes. The previous trend was down, so that’s where silver is likely headed next.

Besides, the long-term turning point for silver is due in several months, and if silver repeats its previous 2022 decline, then it will bottom close to the turning point and also close to the $15 level– in the first half of 2023.

It’s likely to repeat its previous 2022 pattern, because that’s what tends to happen after flag patterns, and what you see on silver’s short-term chart between September and yesterday appears to be a flag pattern.

However, will silver only repeat its previous 2022 performance and not decline more than it already has?

Based on the analogies to 2008 and 2013, the latter is more likely. The 2013 slide was bigger than the initial decline that we saw in 2012. And the final 2008 slide was WAY bigger than what we saw before it.

Due to its industrial uses, silver is known to move more than gold, in particular when the stock market is moving in the same way as gold does. Since I think that gold and stocks are both likely to slide, silver is indeed likely to decline in a truly profound manner. Quite likely lower than just $15.

Consequently, my prediction for silver prices remains bearish, as does the outlook for the rest of the precious metals sector.

Let’s not forget that rising interest rates are likely to negatively impact not just commodities, but practically all industries. This will likely cause silver’s price to decline profoundly, as silver’s industrial demand could be negatively impacted by lower economic growth (or a decline in economic activity).

Consequently, it seems that silver will need to decline profoundly before it rallies (to new all-time highs) once again.

Having said that, let’s take a look at what happened in mining stocks.

History tends to repeat itself. Not to the letter, but in general. The reason is that while economic circumstances change and technology advances, the decisions to buy and sell are still mostly based on two key emotions: fear and greed. They don’t change, and once similar things happen, people’s emotions emerge in similar ways, thus making specific historical events repeat themselves to a certain extent.

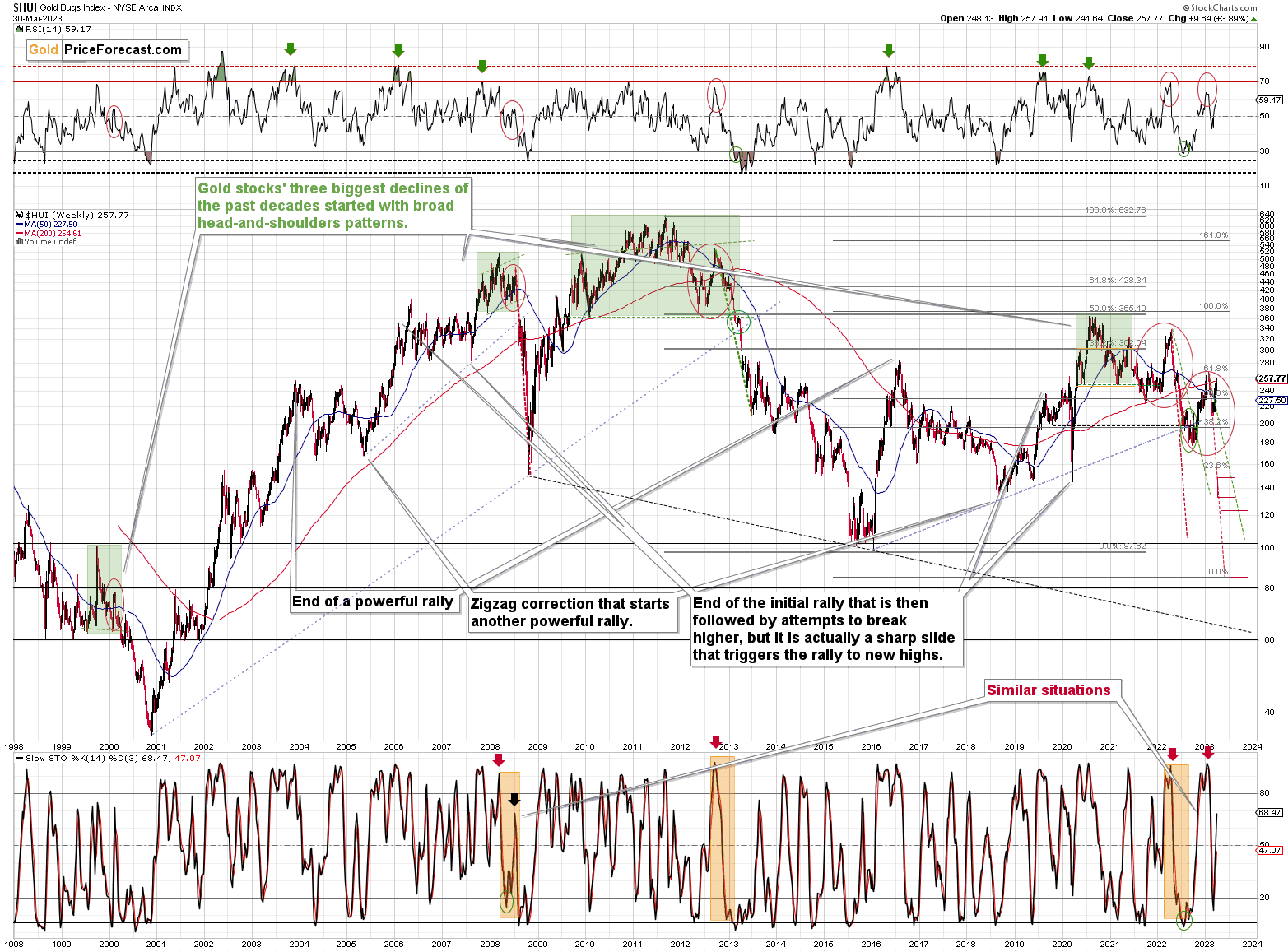

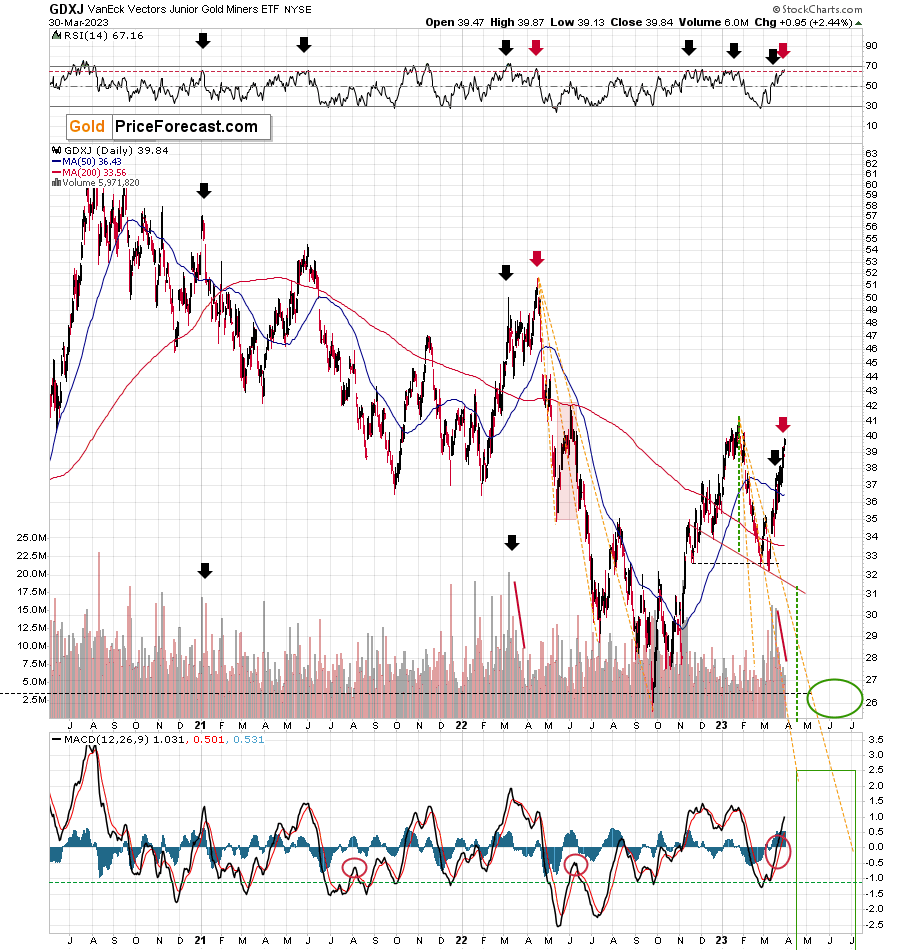

For example, right now, gold stocks are declining similarly to how they did in 2008 and in 2012-2013.

Moreover, the Stochastic indicator (lower part of the above chart) is currently performing just like it did at the 2022 top – so, the bearish similarity between those periods is not just in gold.

Please note that back then, there was a slight correction when stochastic moved to the 20 level, which is about to happen provided that gold stocks decline a bit more.

And, well, we have just profited from its part. :)

What I would like you to focus on here is that the “double correction” theory that I described below gold’s long-term chart is clearly visible also here. We already saw the 2012 rally being repeated, and now we see it all over again. I marked them with red ellipses.

What are the implications? Well, obviously, they are bearish, as it was this correction in 2012 that started one of the most powerful declines of the previous decades. The RSI indicator based on the weekly prices is in a similar position to where it was at the late-2012 and 2022 tops. The consequences are clearly bearish for the following months.

My previous comments on the above chart, therefore, remain up-to-date:

The situation being what it is on the gold market (as discussed above) and the stock market (as I’ll discuss below), it seems to be only a matter of time before gold stocks slide.

For many months, I’ve been writing that the situation in the HUI Index is analogous to what we saw in 2008 and in 2013. Those declines were somewhat similar, yet different, and what we see now is indeed somewhere in between of those declines – in terms of the shape of the decline.

At first, the HUI Index declined just like it did in 2013, and the early 2022 rally appears to be similar to the late-2012 rally. However, the correction that we saw recently is also similar to the late-2012 rally.

Since history doesn’t repeat itself to the letter, but rhymes, is it really that odd that we now saw two corrective upswings instead of one? Not necessarily.

This is especially the case given that the 2008 decline had one sizable correction during the big decline. It’s not clearly visible on the above chart due to the pace of the 2008 slide, but it’s definitely there. You can see it more clearly in one of the below charts.

So, no, the recent rally is not an invalidation of the analogies to the previous patterns, it continues to rhyme with them in its own way. And the extremely bearish implications for the following months remain intact.

How low can the HUI Index fall during the next big downswing?

As is the case with gold and silver, a move back to the 2020 lows is definitely in the cards. Please note that this level is also strengthened (as support) by other major lows: the 2019, 2014, and 2008 ones.

However, I wouldn’t rule out a move even lower on a temporary basis. If gold were to decline to about $1,450-1,500, it would mean that it would double its current 2022 decline. If the HUI Index does that, it will move below 150.

So, all in all, 80-120 is my current target area for the upcoming slide in the HUI Index.

What about the short run?

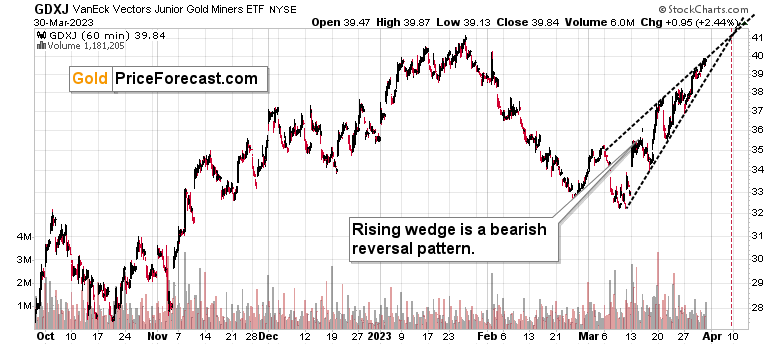

Well, the GDXJ ETF moved higher recently as the investment public likely pushed stock prices higher.

The GDXJ moved higher in the rising wedge pattern, which is a bearish pattern. The size of rallies and declines has been decreasing, and the odds are that we’ll see a breakdown any day (or hour) now.

The lines creating the pattern cross in slightly more than a week from today, so perhaps that’s when the next immediate-term bottom is likely to form.

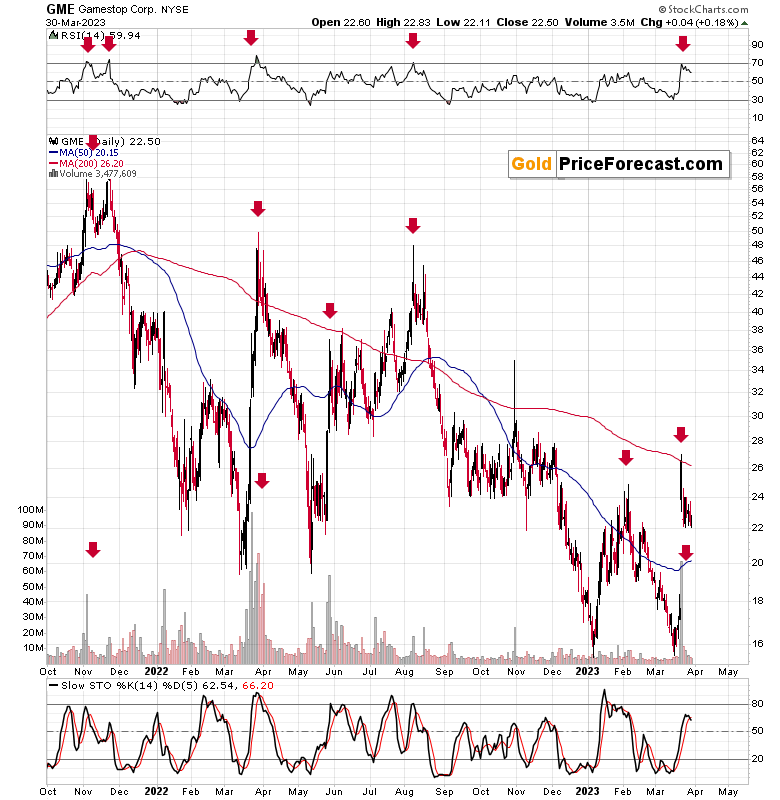

Anyway, why would this be the investment the public is buying that has pushed prices higher recently? High volume in gold is only one indication. Another comes from the recent performance of the GME (Gamestop) stock price. I wrote about it last week:

Having said all the above, it’s time to move on to the one “extra” chart that I mentioned in the opening paragraph.

It’s GME – the GameStop stock symbol.

Why GME? Because it’s one of the recently (or not so recently) popular “meme stock” that got the spotlight in 2021. The fundamentals of the company are not favorable in my view, and it’s been slowly declining from its 2021 “pumped” peak.

The thing is that since it doesn’t have a favorable fundamental situation but was popular with the investment public, it’s now a useful barometer of sentiment.

It’s likely getting cheaper for a reason, and yet, every now and then, we see sharp rallies and peaks in its price. Why would that be the case? It is most likely the phenomenon that I described previously – the worst performers get a boost at the end of the rally as the investment public enters the market.

Why is this relevant to us?

Well, please take a look at the moments that I marked with red arrows:

- November 2021

- Late March 2022

- Late May 2022

- Early August 2022

- Early February 2023

- and now.

What happened in the GDXJ at those times?

Let’s check:

- November 2021 – major top

- Late March 2022 – very close to the final top; before a huge slide

- Late May 2022 – major top

- Early August 2022 – major top

- Early February 2023 – major top

- and now.

The first two of those cases (I put them in bold) were accompanied by a big volume. The declines in the GDXJ in the following weeks were particularly big in those cases.

So, the situation in the GME makes it very likely that it was the general investment public’s buying that recently pushed GDXJ higher. This means that this rally should not be taken at face value.

Instead – and the analysis of GME shows that – this should be treated as a very bearish indication of medium-term importance.

Since this comes on top of the link to 2008, the extremely bearish situation in world stocks, bearish confirmations in the S&P 500, and the bullish (medium-term importance, not just short-term) set-up in the USD Index, the outlook for the precious metals sector – in particular for the junior mining stocks – is currently very, very bearish. The profit potential for our short positions remains enormous.

Please note that the tops in GME and GDXJ didn’t necessarily form on exactly the same days – but they were still very close to each other. The implications here are very bearish for both GME and GDXJ.

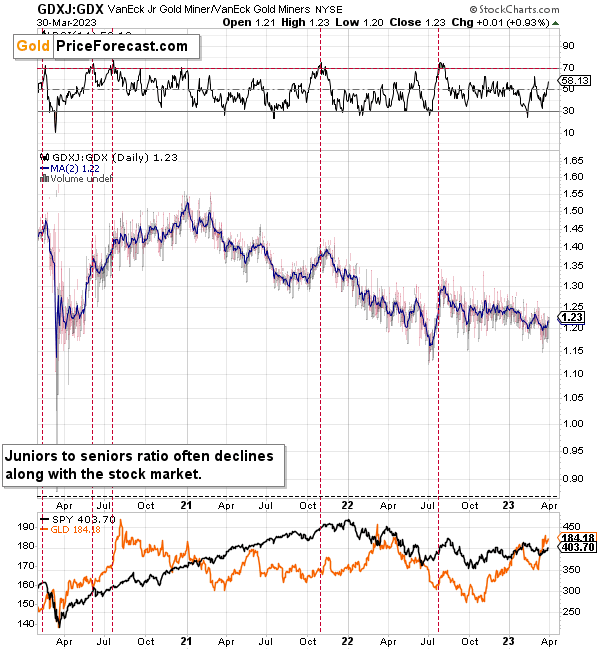

Meanwhile, the relative performance of junior miners compared to senior miners continues to deteriorate in a medium-term trend.

During this quick upswing, juniors rallied relative to seniors, but this is just a very short-term move that’s within a short- and medium-term downtrend.

This implies bigger declines in the GDXJ in the future.

Also, let’s not forget about the forest while looking at individual trees. By that, I mean looking at how gold stocks perform relative to gold. That’s one of the major indications that the current situation is just like what we saw in 2012 top.

The situation in the gold stock to gold ratio is similar to what we saw in late 2012 and early 2013. The HUI-to-gold ratio invalidated its first attempt to break lower (marked with red, dashed lines), but after a corrective upswing, it then broke lower more decisively. That’s what I marked using black, dashed lines.

Recently, we saw a quick upswing in the ratio, but that’s not a game-changer – even the biggest declines had corrections in the past. In fact, the correction appears to be over, as the ratio declined sharply. This is yet another indication that the huge, medium-term downswing is already underway.

If history is to rhyme, we’re about to see a profound decline. In fact, we’re likely already past its beginning.

Also, please note that the pattern that we currently see, which started in early 2016, is somewhat similar to what happened between 2003 and 2008.

Back in 2008, the breakdown from the consolidation resulted in sharply lower ratio values and much lower prices for gold stocks.

So, if the situation is analogous to 2012-2013, we’re likely to see a big decline in the following weeks/months, and if it’s analogous to 2008, we’re likely to see an enormous decline in the following weeks/months.

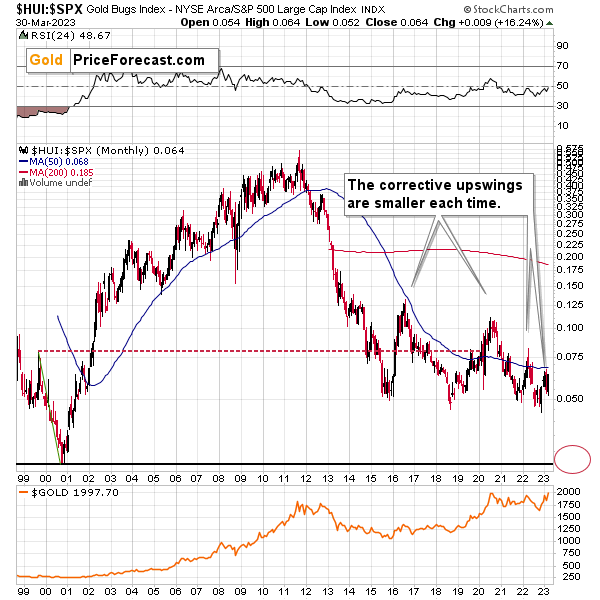

Interestingly, the situation in the gold stocks to other stocks ratio (HUI Index vs. S&P 500 Index) provides the same implications but from a different angle.

The corrective upswings that we’ve been seeing since 2015 are getting smaller and smaller. The current one is visibly smaller than what we saw last year.

Just like it was the case with the gold stocks to gold ratio, the gold stocks to other stocks ratio has declined sharply recently, and it serves as a bearish confirmation.

Consequently, it seems that the ratio is ripe for a breakdown below the 0.05 level. The next support is provided by the all-time low of 0.026. And yes, with the ratio at 0.065 right now, this implies a decline by about of 60%. If the HUI Index were to decline by 60% right now, it would have to move to about 100. If the stock market declined as well, it would imply the HUI was even lower.

Declining stock prices would only add fuel to the bearish fire (after all, gold stocks are… just stocks), and that’s exactly what’s likely to happen.

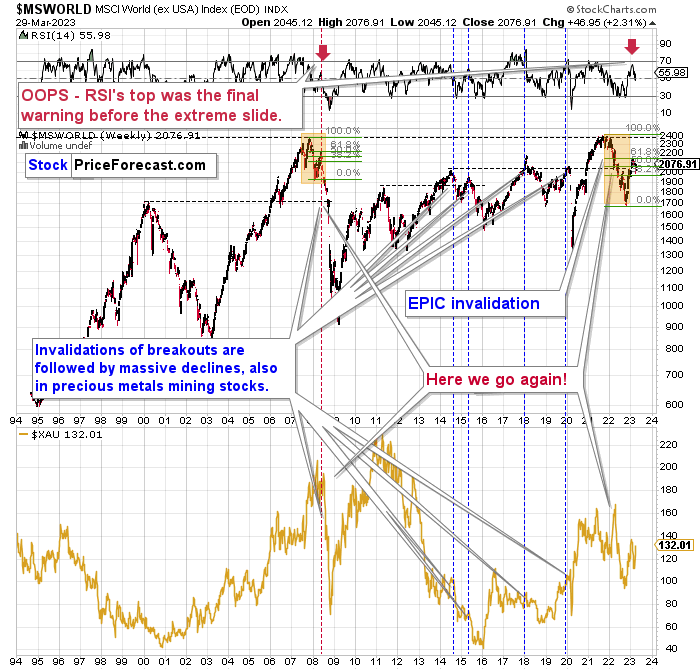

Just like what we saw in the case of copper and gold, world stocks corrected about 61.8% of their preceding decline. And that’s extremely bearish given the self-similarity to 2008.

Please note that the initial decline is now bigger than what we saw in 2008. Back then, stocks corrected about 61.8% of their initial decline before tumbling. And exactly the same thing happened recently!

Also, the RSI just turned south and back in 2008; that was the final confirmation before the waterfall selling.

Just as the 2008 rally wasn’t bullish, the most recent corrective upswing wasn’t bullish at all.

Real interest rates are rising, which is bad news for businesses! People appear to live on “hopium,” expecting the Fed to turn dovish and throw money on the market, but the data doesn’t support this outcome at all.

Given the analogy to 2008 and the fact that the initial slide was bigger this time, the following slide could be even bigger than what we saw in 2008. Naturally, this would be profoundly bearish for junior mining stocks.

This means that nothing really changed, and the situation remains extremely bearish based, i.e., on the analogy to what we saw after previous invalidations of long-term breakouts.

As a reminder, in early 2022, I wrote that the situation was very bearish as invalidations of previous breakouts were usually followed by massive declines – not just in stocks but also in precious metals.

When stocks invalidated their 2006 breakout in 2008, their prices truly crumbled.

We also saw that on a smaller scale in 2014, 2015, and early 2018.

We’re seeing it right now.

To clarify, we’re actually seeing the aftermath of the invalidation. The huge decline is already taking place.

The difference between now and 2008 is that back then the slide was more volatile, and we didn’t really see a visible correction during the plunge. This time, the decline is more measured, and we saw a correction to one of the most classic retracements imaginable – the 38.2% one. This correction doesn’t change the trend, which remains down.

Based on what happened in 2008, it seems that stocks are about to move much lower in the following months.

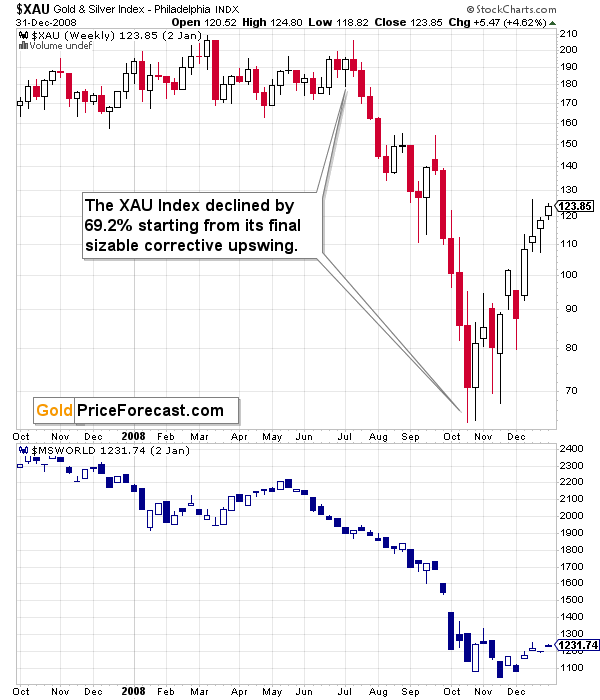

The lower part of the chart features the XAU Index, a proxy for both gold stocks and silver stocks.

First of all, this comparison of mining stocks and other stocks could appear shocking, and rightfully so.

The XAU Index is well below its… 1995 highs (yes, miners are really so weak), while world stocks are much higher.

The second shocker is how far and how fast miners declined in 2008. Starting with the final corrective upswing, the mining stocks index declined by a breathtaking 69.2%!

Less than a third of the starting value.

It took just a few months for this decline to materialize.

So far this year, the XAU Index has declined by 18.7%, counting from the yearly high to yesterday’s intraday low.

And so far this year, the GDXJ ETF has declined by 19.3%, using the same measurements.

As a result, the performance of both may be roughly comparable, or — more likely — junior miners may decline more due to their closer link to the general stock market. This means that based on the above-mentioned analogy to 2008, we can’t rule out a decline by about 70% (or more!) in the GDXJ starting at the recent short-term high ($41.16).

Shaving off 70% of that value leaves us with $12.35 as the possible downside target for the GDXJ ETF.

Impossible? It has already happened! (In the XAU, as the GDXJ wasn’t trading at that time yet).

So, yes, the outlook for mining stocks is truly extremely bearish for the following months.

Let’s take a look at the markets from a more short-term point of view and from the U.S. perspective.

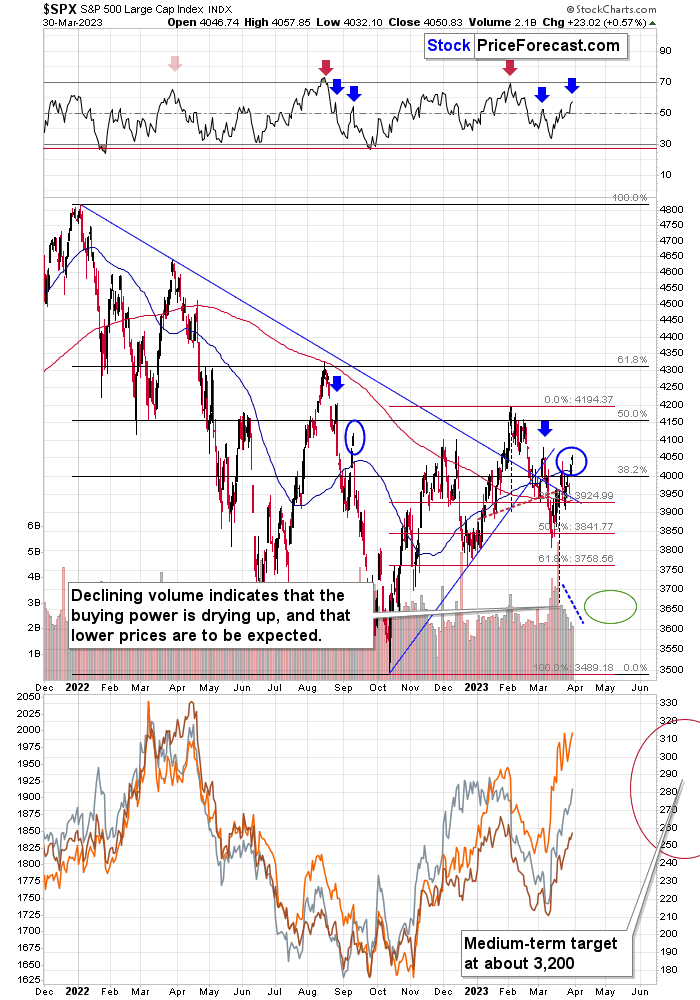

The S&P 500 is making another attempt to rally above the 4,000 level. However, given the decisively declining volume, it’s very unlikely that it will be able to hold on to those gains, so I expect to see another invalidation shortly.

Also, the RSI is in a position that makes the current situation similar to what we saw in September 2022. That was when stocks moved sharply higher, above their 50-day moving average (blue line), and… They topped there. This corrective upswing was followed by a substantial decline to new yearly lows.

And since mining stocks are currently moving more or less in tune with the stock market, the implications are very bearish.

Why is this important for gold and silver investors and traders? Because the last two big moves took place more or less in line with each other – in stocks and in precious metals (and miners). The slide in stocks could also trigger something similar in the case of commodities like crude oil. The same thing is likely to happen again this time, especially given what’s happening in the USD Index.

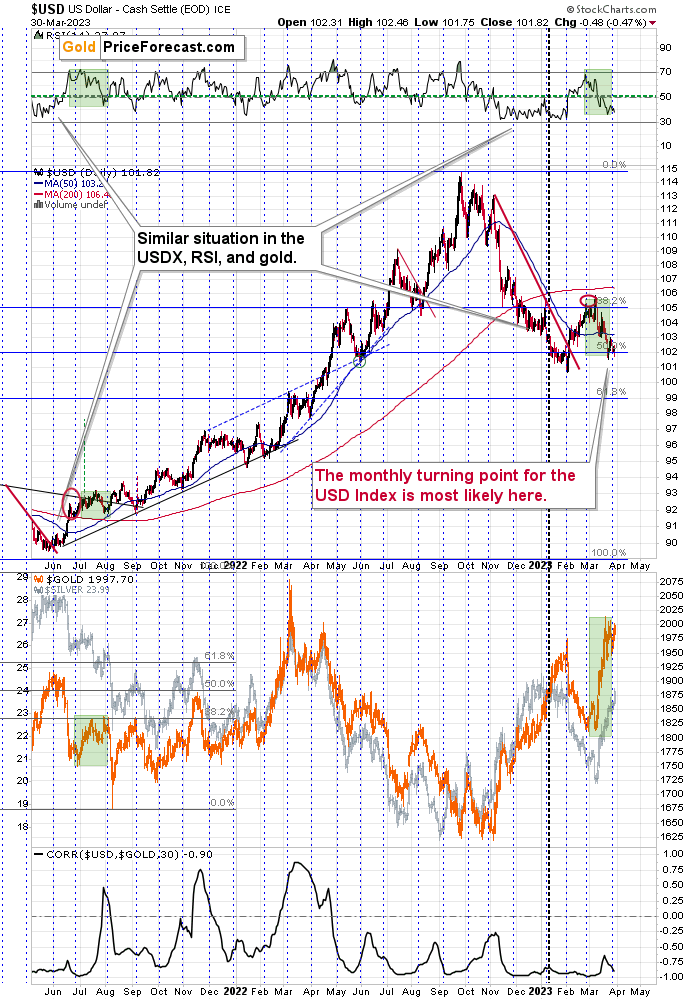

The USD Index is after a sharp corrective downswing that is very similar to what happened in the USDX during the 2008 corrective rally in gold.

On a short-term basis, we see a similarity in the RSI to what happened in mid-2021 (marked with green rectangles). In fact, the similarity is present also in price – it moved to the 50-day moving average and then rallied once again. The RSI moved below this moving average, and gold moved higher, but let’s keep in mind that this is what makes the current situation more similar to 2008.

Finally, please keep in mind that the USD Index tends to reverse close to the end of the month. I marked the previous such reversals with vertical dashed lines. This tendency is surprisingly (given its simplicity) useful.

And, well, today is the last day of March, and the last short-term price move was to the downside.

This suggests that the USDX is ready to rally further.

Let’s zoom out.

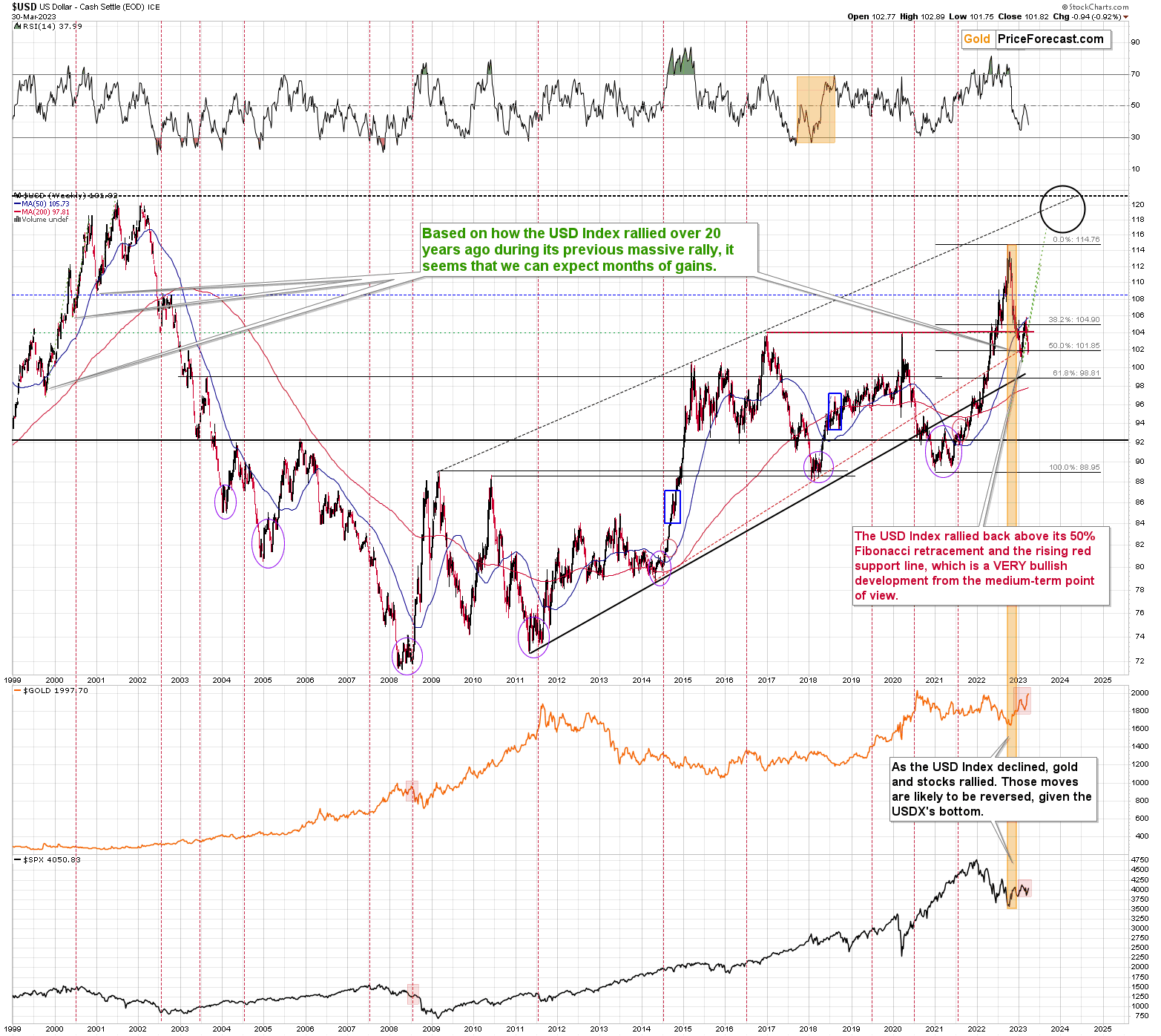

The key thing to keep in mind is that what we see right now – along with the most recent very short-term decline – is something that we also saw in mid-2008, right before the USD Index’s sharpest rally in decades.

The preceding bottom was not a single V-shaped low, but rather a bottom that consisted of a few separate bottoms. The final short-term decline started with RSI at about 50. And guess what – the current short-term decline also started with the RSI close to 50.

Consequently, given all the other links to 2008, it seems that a big rally in the USD Index is just around the corner.

The implications are very bearish for the precious metals sector.

And given the situation on the stock market – especially in world stocks – the situation is particularly bearish for junior mining stocks.

Just as the night is darkest before the dawn, it “seems most bullish” right before the biggest slides.

Stay strong.

===

On a side note, while commenting on analyses, please keep the Pillars of the Community in mind. It’s great to provide points that help others be more objective. However, it’s important to focus on the facts and discuss them in a dignified manner. There is not much of the latter in personal attacks. As more and more people join our community, it is important to keep it friendly. Being yourself, even to the point of swearing, is great, but the point is not to belittle other people or put them in a position of “shame” (whether it works or not). Everyone can make mistakes, and everyone does, in fact, make mistakes. We all here have the same goal: to have a greater understanding of the markets and pick better risk-to-reward situations for our trades. We are on the same side.

Overview of the Upcoming Part of the Decline

- It seems that we’re seeing another – and probably final – corrective upswing in gold, which is likely to be less visible in the case of silver and mining stocks.

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place and if we get this kind of opportunity at all – perhaps with gold prices close to $1,500 - $1,550.

- I plan to switch from the short positions in junior mining stocks or silver (whichever I’ll have at that moment) to long positions in junior mining stocks when gold / mining stocks move to their 2020 lows (approximately). While I’m probably not going to write about it at this stage yet, this is when some investors might consider getting back in with their long-term investing capital (or perhaps 1/3 or 1/2 thereof).

- I plan to return to short positions in junior mining stocks after a rebound – and the rebound could take gold from about $1,450 to about $1,550, and it could take the GDXJ from about $20 to about $24. In other words, I’m currently planning to go long when GDXJ is close to $20 (which might take place when gold is close to $1,450), and I’m planning to exit this long position and re-enter the short position once we see a corrective rally to $24 in the GDXJ (which might take place when gold is close to $1,550).

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold prices close to $1,400 and GDXJ close to $15 . This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,400, but at the moment it’s too early to say with certainty.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding nor clear enough for me to think that they should be used for purchasing options, warrants, or similar instruments.

Letters to the Editor

Please post your questions in the comments feed below the articles, if they are about issues raised within the article (or in the recent issues). If they are about other, more universal matters, I encourage you to use the Ask the Community space (I’m also part of the community), so that more people can contribute to the reply and enjoy the answers. Of course, let’s keep the target-related discussions in the premium space (where you’re reading this).

Summary

To summarize, we recently took profits from the additional FCX trade (right before the trend reversed!) and the current short position in junior mining stocks is – in my view – poised to become very profitable in the following weeks, and perhaps days.

Things might appear chaotic in the precious metals market right now, but based on the analogy to the previous crises (2020 and 2008), it’s clear that gold, miners, and other markets are pretty much doing the same thing all over again.

The implications of this “all over” are extremely bearish for junior mining stocks. Back in 2008, at a similar juncture, GDXJ’s price was about to be cut in half in about a week! In my opinion, while the decline might not be as sharp this time, it’s likely to be enormous anyway and very, very, very profitable.

===

As a reminder, we still have a “promotion” that allows you to extend your subscription for up to three (!) years at the current prices… with a 20% discount! And it would apply to all those years, so the savings could be substantial. Given inflation this high, it’s practically certain that we will be raising our prices, and the above would not only protect you from it (at least on our end), but it would also be a perfect way to re-invest some of the profits that you just made.

The savings can be even bigger if you apply it to our All-inclusive Package (Stock- and Oil- Trading Alerts are also included). Actually, in this case, a 25% discount (even up to three years!) applies, so the savings are huge!

If you’d like to extend your subscription (and perhaps also upgrade your plan while doing so), please contact us – our support staff will be happy to help and make sure that your subscription is set up perfectly. If anything about the above is unclear, but you’d like to proceed – please contact us anyway :).

As always, we'll keep you – our subscribers – informed.

To summarize:

Short-term outlook for the precious metals sector (our opinion on the next 1-6 weeks): Bearish

Medium-term outlook for the precious metals sector (our opinion for the period between 1.5 and 6 months): Bearish initially, then possibly Bullish

Long-term outlook for the precious metals sector (our opinion for the period between 6 and 24 months from now): Bullish

Very long-term outlook for the precious metals sector (our opinion for the period starting 2 years from now): Bullish

As a reminder, Gold Investment Updates are posted approximately once per week. We are usually posting them on Friday, but we can’t promise that it will be the case each week.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

Moreover, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don’t promise doing that each day). If there’s anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief