The great day of the Fed interest rates decision and forward guidance has arrived. There hasn't been much pre-positioning volatility in the precious markets so far. With the exception of gold perhaps, you might say. Let's dive in and assess whether a technically important gold move has happened yesterday, or not. Examination of the other markets will show us whether it's the real deal, or not.

In yesterday's Alert, we warned you about the upcoming volatility preceding the Fed interest rate decision and the following press conference. So far, we seen relatively little volatility, but it was already notable. More could follow and it's now particularly important to stay focused on what really matters - the trends and technical signals that we saw before the forthcoming news-driven dust settles.

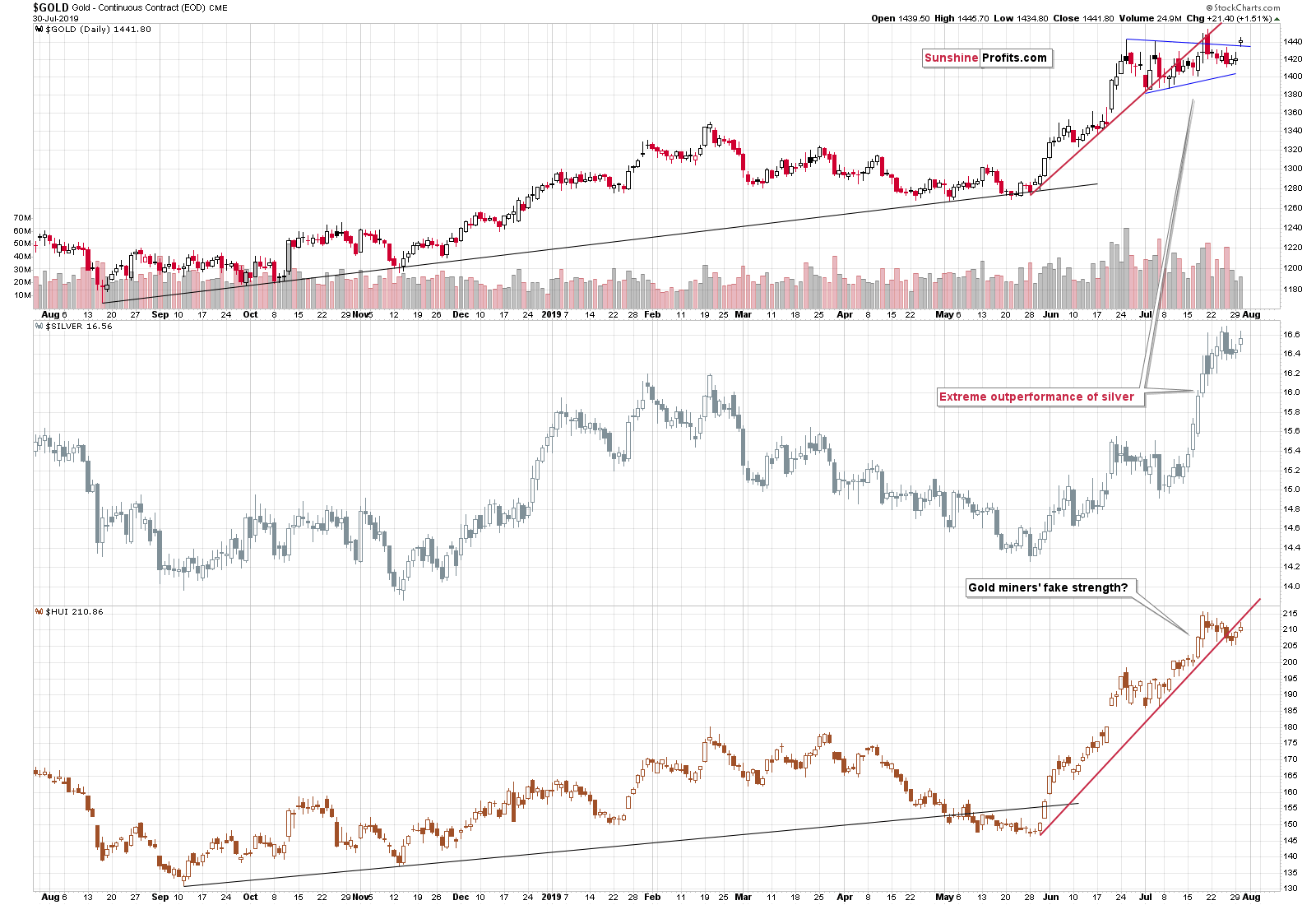

In gold, we saw an invalidation of the breakout above the pennant pattern. In silver, we saw exceptional strength in the short term. Gold miners broke below their rising support line and just verified the breakdown below it. This is a bearish combination, even if we don't take into account the multiple similarities between now and the late 2012 top in the entire precious metals sector, especially the ones in silver (the same retracement) and the ones in the gold stocks to gold ratio that we explained yesterday.

Checking Yesterday's PMs Action

While gold miners certainly closed below their rising support line and there was no new breakout in silver, it seems that gold once again broke above the pennant pattern. But...

It's not really the case.

Looking at gold futures based on a more detailed chart from a different chart provider, we get a different picture - there was no breakout. The outlook certainly could become bullish in the following days and weeks, but it's unlikely and it hasn't happened yet.

Silver's move may appear to be making the silver forecast bullish, but please note that the white metal already gave up yesterday's gains entirely at the moment of writing these words.

To be honest, there's not much that we can add in today's short-term analysis to what we wrote yesterday, but since the month is almost over and the key comments from the Fed are to be released today, we would like to speculate a bit about where the month could end and what it might imply.

The Gold Chart Scenarios

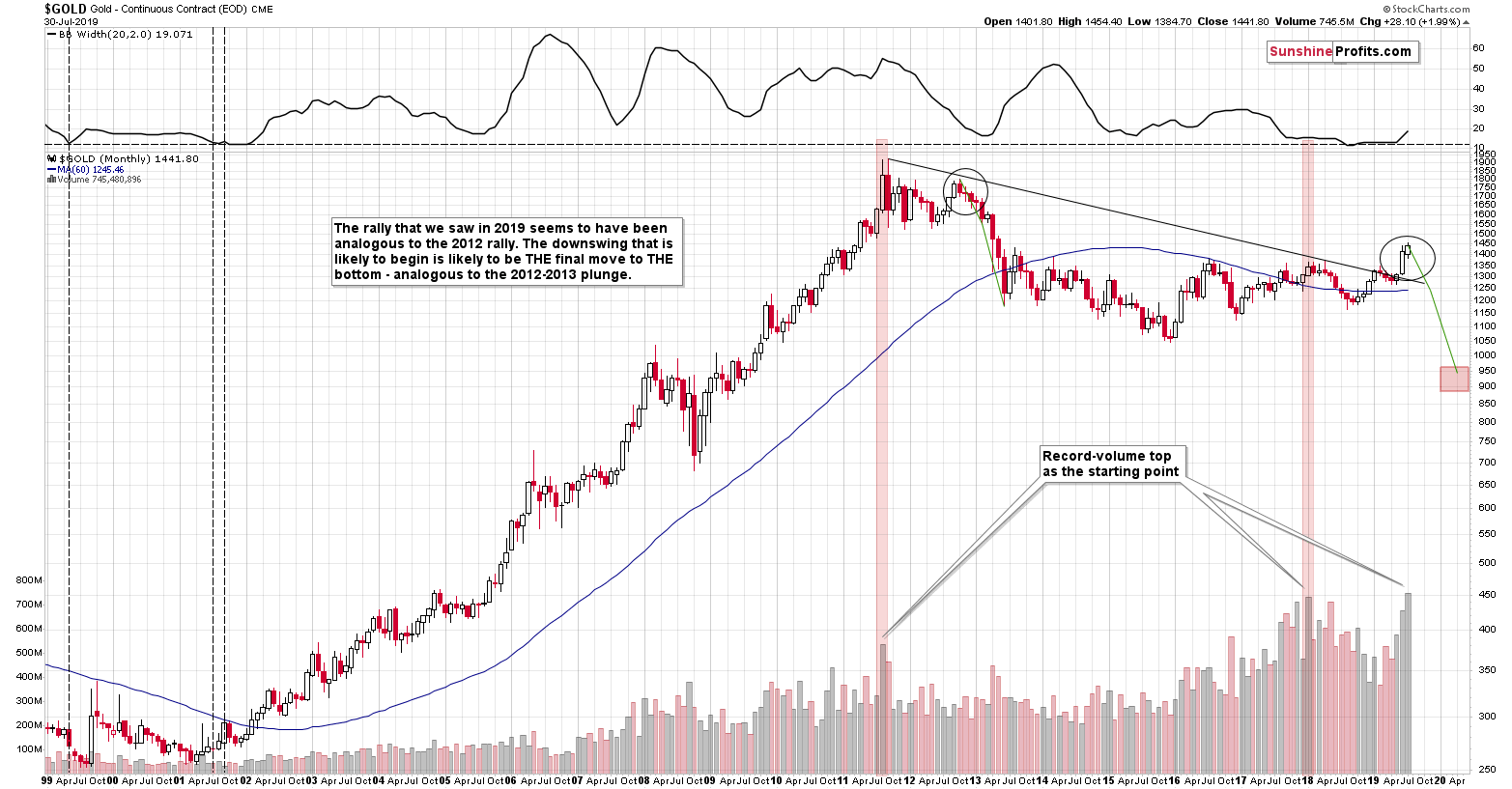

Even though the month is not yet over, we can already see that the volume that accompanied the July price change was huge. Actually, it's an understatement. It is the biggest monthly volume ever. The other two major monthly volume levels were recorded right at the 2011 top and at the 2018 top (in terms of the monthly closing prices). This alone is something that should make you question the logic behind buying gold now as opposed to buying it after a sizable price decline takes place.

But there's actually more to the big volume than the above. We mentioned this gold trading tip numerous times, but it's worth repeating once again. The reversals, for instance the shooting star candlesticks, need to be confirmed by sizable volume in order to be reliable. The volume is already extreme.

Wait, we don't have any reversal candlestick just yet.

That's true, but today is the final day of the month, and it's the day when the Fed provides critical clues and that means that gold could change its course quite rapidly. It's certainly possible that gold rallies based on the - likely - interest rate cut, but let's keep in mind that gold might actually decline even though the Fed is likely to lower the interest rates. Why? Because practically everyone expects the rates to be lowered, while some investors expect them to be lowered by 50 basis points, not just 25. They are likely to be disappointed (the Fed is unlikely to shoot a bazooka as a warning, insurance shot), which means that the interest rate decision - even though it is likely to be a rate cut - might be actually viewed as something hawkish. Again - not because it is such per se, but because it is hawkish compared to the average expectations.

Quite a lot will depend on what the Fed says during the press conference, so the final part of today's session will likely be quite volatile. And the implications of the entire monthly price changes will depend on it. The volume is already huge, so it will confirm what happens in terms of price. If gold rallies, we will have a conflict between bearish implications of huge volume per se, and bullish implications of a rally on big volume. But, when gold reverses this month, the extreme volume will make the gold reversal very, very, very profound.

There's one more thing that we would like to discuss about the Trump - Fed conflict regarding interest rates. Trump wants lower dollar in order to boost U.S. exports, economic numbers, and stock prices - the last two are the statistics that will be used to measure the success of his presidency. And he definitely wants it to look as good as possible - that's why he's been pressing so hard for lower interest rates instead of higher ones.

Let's see what happened after the Fed changed its course and bowed to the pressure.

The expectations regarding interest rates are already much lower. But is the U.S. dollar lower?

Framing the USD Index

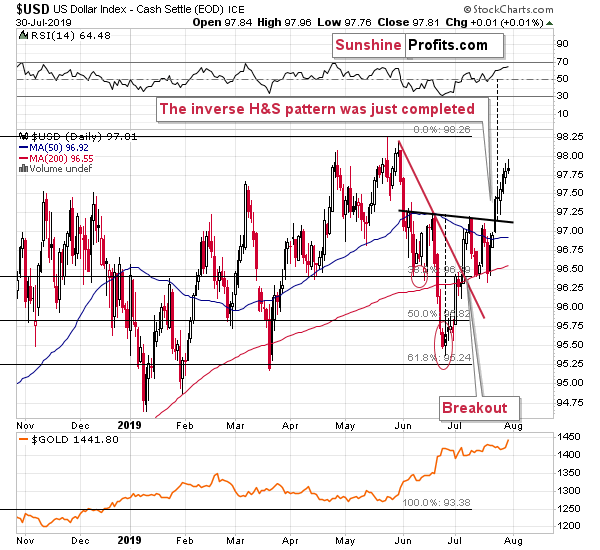

It's not. Of course, the U.S. currency reacted just as it was supposed to - initially. It declined based on dovish comments. But, once it was all said and done (mostly said), the USD soared back up. It's now very close to its yearly high, even though the expectations regarding interest rates are entirely different.

The Fed sees that lowering rates didn't work and - most importantly - so does Trump. It either already became obvious to him or it will become obvious that the market forces are too strong to keep the U.S. currency at low levels. What then?

Replying to this question is difficult when we think about the economic environment, geopolitics, and financial markets. But it's easy when we get back to the likely core of the decision to keep the dollar lower in the first place.

Trump wants to look good and wants his presidency to be viewed as successful and that's why he wants the lower U.S. dollar. What if we can't get it no matter what he does (which appears to be the case)? Then there's only one thing left to do. Find something or someone else to blame, while allowing the inevitable (rallying USD) to happen. The Fed lowered interest rates? Maybe it didn't lower them soon or significantly enough. Trade war with China? Europe? Or maybe Mexico or the war drums beating on Iran? There will definitely be someone to blame for declining stock market and soaring USD. Trump said so many times that he wants lower USD that if anything unpleasant (plunging stock prices?) happens, it's very easy to blame it on too high USD, which is fault of everyone except him (right?).

The bottom line is that USD's rally is definitely possible despite the current political setups and so is gold's decline.

Summary

Summing up, the breakdown in the gold stocks, the multiple signals coming from the silver market and strong bearish indications from the gold stocks to gold ratio clearly confirm that the rally in the precious metals sector has most likely already ran its course. Moreover, let's keep in mind that gold has recently invalidated its breakout above the previous highs, the late-2013 highs, and the upper border of the pennant pattern, which is also a very strong bearish sign. The situation in the currency market confirms the bearish outlook for the PMs. In those circumstances, we simply cannot forecast gold at higher levels in the medium term. There will most likely be times when gold is trading well above the 2011 highs, but they are unlikely to be seen without being preceded by a sharp drop first.

Today's sessions could be volatile due to the interest rate decision and the follow-up press conference, but once it's all said and done, the main trend is likely to resume. And the main trend is down.

Today's article is a small sample of what our subscribers enjoy on a daily basis. Check more of our free articles on our website, including this one - just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. On top, you'll also get 7 days of instant email notifications the moment a new Signal is posted, bringing our Day Trading Signals at your fingertips. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care