Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Just Where Should We Cash Some Profits in the Currencies?

July 9, 2019, 9:53 AM -

Can Gold Recover from Friday's Strong Payrolls Hit?

July 9, 2019, 7:18 AM -

Record-Long Expansion and Gold

July 5, 2019, 5:35 AM

Ladies and Gentlemen, it has finally happened! The current expansion already goes on for 121 months, becoming the longest economic boom in the US history. Should we celebrate now? Or should we worry, as all good things come to an end, and whatever lasts long, ends up even faster? We invite you to read our today's article, which assesses the vitality of the current expansion, and find out whether the U.S. economy in a good shape or on the edge of collapse, and what all of this implies for the gold market.

-

Monetary Growth Slows. Will Gold Accelerate Now?

July 3, 2019, 7:30 AM -

Crude Oil's Reversal Sparks Our New Trading Decision

July 2, 2019, 11:01 AM

Yesterday's oil session was indeed heavy on action. The initial upswing gave way to a reversal lower, leaving black gold to close almost unchanged. Well, it finished a bit lower than it opened the day actually. Does this signify something important? That important that it would make us act? You bet - let's dive in to the juicy details.

-

Gold Plunges Below $1,400 On the News of Trade War Truce

July 2, 2019, 7:43 AM -

Once Upon a Time There Was a Goldilocks Economy. Will This Story End Well for Gold?

June 28, 2019, 4:52 AM -

Can the Oil Bulls Extend the Sputtering Rally?

June 27, 2019, 9:00 AM

The series of higher oil prices appears to be over as today, we might see the bulls' power tested. Where can the bears aim realistically and what is most likely to happen next? These are certainly valid questions as the oil price has reached an important resistance and appears hesitating today. Will some geopolitical news come to the rescue? High time to dive in...

-

S&P 500: Will Tuesday's Decline Resume?

June 27, 2019, 8:16 AM -

Gold Declines As the Fed Dampens Rate Cut Expectations

June 27, 2019, 7:41 AM -

Gold Clearly Reverses at Consolidation's Upper Border

June 26, 2019, 7:56 AM

Quite a few journalists wrote about gold's breakout in the previous days even though gold made an attempt to break above the key resistance - the mid-2013 high - only today (and it failed). At the same time, when the gold to silver ratio was breaking out in a clear way, many journalists ignored that and emphasized the importance of the resistance at hand. Either way, the focus was not on what was really going on, but on trying to make the reality fit the bullish case for gold. After all, "gold people" have to be bullish on gold all the time, right? Wrong - those, who want their clients to succeed need to stay focused on what is likely to happen based on objective, cold logic and facts, instead of chasing the emotions of the day. And what do the facts tell us?

-

Our Ducks Are in a Row as the Currencies Are Ready for Their Next Moves

June 25, 2019, 11:29 AM

By comparison to quite a few previous sessions, yesterday's one might seem uneventful. That was not the case however. The markets never sleep - they offer plenty of insights, hinting at their next moves. Evaluating these, and the directions they point to, brings strong rewards. We're ready for the powerful opportunities identified. Let's go!

-

Gold Jumps Above $1,400 after Dovish Fed

June 25, 2019, 7:37 AM

Last week was definitely hot. Both major central banks adopted a more dovish stance. Gold reacted positively, jumping above $1,400. What has changed, and what has not? How close are we to an actual rate cut, not only to the speculation of getting one for sure on the next Fed meeting? How will gold like it?

-

Gold Above $1,400 is Only the Tip of the Signal Iceberg

June 24, 2019, 11:02 AM

Gold broke above the $1,400 level last week and the volume that corresponded the move was exceptional. The story doesn't end there. The volume for silver was big and the volume for silver stocks was truly epic. Something very, very, very important is happening right now. You knew a part of the story for weeks now... And the last week seems to have written its conclusive verse.

-

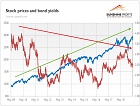

S&P 500 Pulling Back From New Record, Reversal?

June 24, 2019, 7:25 AM

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts