And here we go again. Gold slipped below $1,400 per ounce. This is where it fell after stronger-than-expected June Employment Report. How does that key piece of economic data play into the market's rate cuts expectations? And how does it all impact gold?

June Payrolls Surpass Expectations

The U.S. created 224,000 jobs in June, following a disappointing increase of 72,000 in May (after a downward revision). The number surprised positively, as the economists polled by the MarketWatch forecasted 170,000 created jobs. The gains in hiring last month were widespread, but with a leading role of education and health services (+61,000) and professional and business services (+51,000). Only retail trade and mining cut jobs.

However, the strong headline number was accompanied by downward revisions in May and April. Counting these, employment gains in these two months combined were 11,000 lower than previously reported. Consequently, job gains have averaged 171,000 per month over the last three months, which is lower than not so long ago (in 2018, the average gain was 223,000 per month).

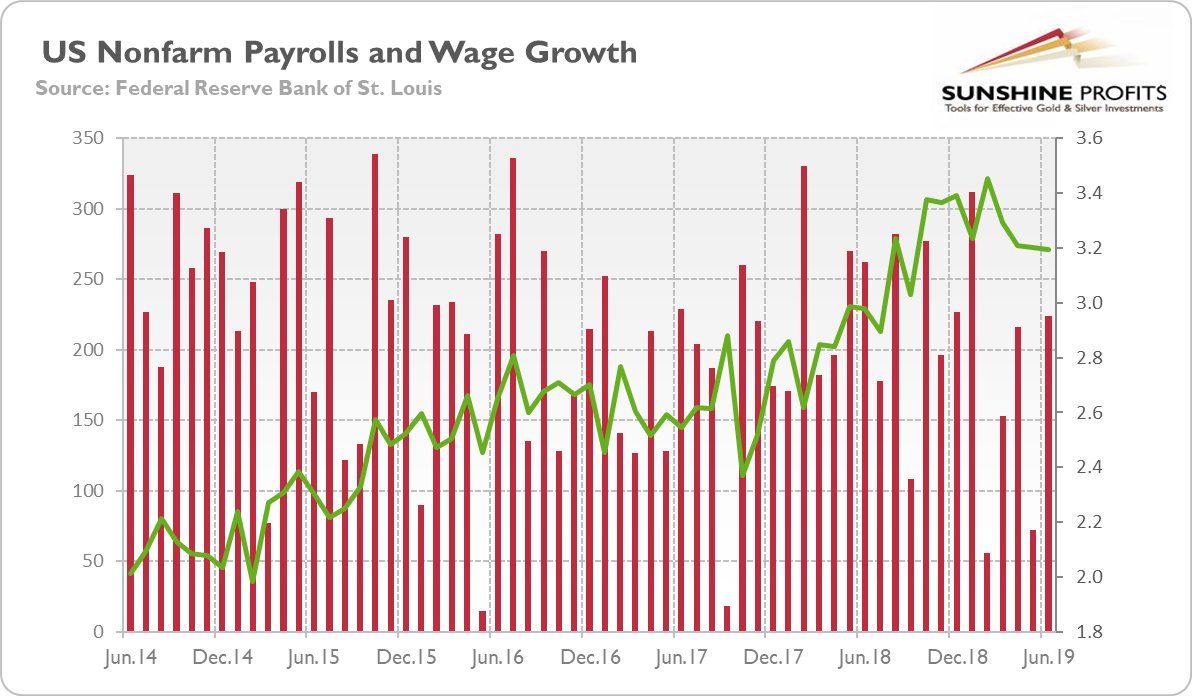

So, the pace of hiring has slowed, as the chart below shows. But the economy is still creating jobs at a reasonable pace. The U.S. labor market is likely to further contribute to the longest expansion on record. What is crucial here, is that the nonfarm payrolls rebounded in June from May, calming worries about the health of an economy. Gold bulls surely aren't cheering that.

Chart 1: U.S. nonfarm payrolls (red bars, left axis, change in thousands of persons) and the annual growth in average earnings in the private sector (green line, right axis, %) from June 2014 to June 2019.

Wage Growth Flat, while Unemployment Rate Rises

What about the other indicators? The average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $27.90, which means a 3.1 percent increase over the last twelve months. The rate of wage inflation was unchanged from May, although slower than at the beginning of the year, as the chart above shows.

Importantly, the unemployment rate edged up from 3.6 to 3.7 percent, as one can see in the chart below. Should we be worried? On the one hand, the unemployment rate is a powerful recession indicator, so its rise might be worrisome.

Chart 2: The unemployment rate U3 from June 2014 to June 2019

On the other hand, the indicator is still near a 50-year low. And it increased amid more people looking for a job. More than 300,000 people entered the labor force in search of work in June, lifting the participation rate from 62.8 to 62.9 percent. Hence, we believe although the development of the unemployment rate requires attention, the recent rise is not a point of concern yet. It is still below the natural unemployment rate, and the Sahm's indicator we analyzed in detail in this month's edition of the Market Overview, does not flash alarm. Gold bulls better be patient.

Implications for Gold

What does it all mean for the gold market? The June Employment Report was stronger than expected. The unemployment rate edged up, but it was caused by more people entering the labor force, so it should not be a point of concern yet. The nonfarm payrolls surpassed expectations, easing concerns about the state of economy that emerged after the weak May report.

Consequently, investors scaled back bets of an aggressive interest rate cuts. This is exactly what we predicted on June 2, writing in the Gold News Monitor:

A 50 basis points cut is definitely excluded, although the markets still see more than 20 percent chance of such a move. So, the expectations for the Fed cuts could weaken somewhat or shift to September or later this year. All this seems to be negative for the gold prices.

Indeed, the markets still expect one 25-basis points interest rate cut in July, but now the odds of a 50-basis points reductions amount only to 6 percent, compared to 25 percent one week ago. As investors adjusted finally their overly dovish expectations, the bond yields jumped, while the price of gold dived again below $1,400.

Now, what next? We believe that even 25-basis points cut is not justified by the economic outlook. And the precious metals investors should not downplay the possibility that the Fed would end up delaying the cut and pushing back its dovish perception, in part to show its political independence from the White House. However, because of the Wall Street's addiction to loose monetary policy, the FOMC could be forced to cut the federal funds rate at its next meeting. The Powell's testimony in Congress this week should provide us with more clues about the current Fed's stance. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits' Gold News Monitor and Gold Market Overview Editor