Free Guest Analysis: Gold, Silver, Crude Oil, Stocks & Forex

Below you will find guest articles on investing and trading. Please note that the opinions included below don't represent the opinions of our company or any of its employees - they are only opinions of the respective authors. If you'd like to check out our premium analyses, please take a few seconds to sign up for our free 7-day trial today.

-

Gold Scores Gains as Draghi and Powell Grow Concerned

June 20, 2019, 6:33 AM -

Is Gold Reversing, or Pushing to New Highs?

June 19, 2019, 8:00 AM

Gold and mining stocks just closed at a new yearly high. Silver is not even close to reaching such levels, and gold is already back below where it was trading 24 hours ago. Can these breakouts be trusted? Do they have a lasting power? To answer that, we better remember something important first. This changes the overall picture regarding gold and mining stocks entirely.

-

Let's Gain Even More on the Sliding Euro and Pound

June 18, 2019, 8:22 AM

Yesterday, we've heard the ECB President speak and tomorrow, it's the Fed's turn. What about the time in between? Well, the markets still move and it's our job to be positioned accordingly so as to profit from whatever is unfolding. And what kind of opportunities we've managed to catch! Good news, the ride is far from over. Let's take a look at the way things are shaping up. We'll then sharpen our battle plans accordingly. We even have a new candidate for opening a long position to tell you about!

-

Gold Awaits the FOMC as Economic Data Send Mixed Signals

June 18, 2019, 7:38 AM

Who wouldn't know the Spaghetti Western The Good, the Bad and the Ugly? In today's analysis, we have important pieces of economic data starring in the first two roles. Retail sales and industrial production rebounded in May, while the Empire State Index plummeted in June. How will these reports affect tomorrow's FOMC decision and the gold market?

-

Precious Metals' Reversals - Everywhere You Look

June 17, 2019, 8:21 AM

What a remarkable day Friday has been! Going into the U.S. session open, we have seen gold challenging its early-June highs. The barrage of geopolitical news has been deafening and gold had literally nowhere to go but up. But something "unexpected" yet totally predictable happened to those who have jumped on the gold bandwagon. Friday's U.S. session has sent gold lower. On huge volume. And not only gold, that is. Those looking at the charts' bigger picture, those familiar with our analyses, hadn't been surprised. Now that the dust is settled and gold pushes lower, let's examine the aftermath. And draw lessons for the days ahead.

-

S&P 500 Stuck at 2,900, Still No Clear Direction

June 17, 2019, 7:27 AM -

Crude Oil Going Nowhere Despite the Rising Tensions and Supply Cuts?

June 14, 2019, 8:15 AM

Crude oil bulls proved weaker and the strength they attempted to project yesterday, evaporated to a considerable degree. Neither today, they appear any stronger. Given the rising geopolitical tensions in the Middle East, one could expect a stronger performance. Additionally, OPEC and Russia appear to be close to agreement on their oil supply coordination. Turning to the question on everyone's mind - is the hope for higher oil prices lost?

-

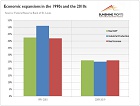

Will the US Economy Fall into Recession? Or Will It Accelerate? Lessons from the 1990s Expansion for the Economy and the Gold Market

June 14, 2019, 7:35 AM

The current economic expansion has just equaled with the longest boom in the US history. Is that not suspicious? We invite you to read our today’s article, which provide you with the valuable lessons from the 1990s expansion for the gold market and find out whether the US economy will die of old age.

-

Profiting on the Increasing Momentum in the Currencies

June 13, 2019, 10:59 AM

It looks like the calm in the currencies is drawing to a close and volatility is about to pick up. So far, so good. We're at a crossroads these days: after a recent string of declines, the USD appears to be catching a bid. This is not without repercussions and a move either way will be profoundly felt across the markets. But which way that move will be? Read on to find out - and also get positioned accordingly.

-

Soft Inflation Data and Concerned Draghi. How Will Gold Like It?

June 13, 2019, 7:49 AM -

Stocks Poised to Bounce Back?

June 13, 2019, 7:27 AM

Wednesday's trading session was slightly bearish, as investors took more short-term profits off the table following the recent advances. However, the daily trading range was very narrow. The S&P 500 index reached the new local high on Tuesday and then it came back below the 2,900 mark. So was it a downward reversal or just correction before another leg up?

-

Betting on Rising Gold? Look at the USD First!

June 12, 2019, 9:13 AM -

Oil Bulls Fight to Recover Lost Ground after Yesterday's Reversal

June 11, 2019, 9:33 AM

Yesterday's bullish attempt has met a swift response and the oil price powerfully reversed lower. Earlier today, the bulls are pushing higher again, though less vigorously than yesterday or the day before. Do they have any aces up their sleeves? The risk appetite is creeping back into the market and OPEC joined by Russia may support them...

-

May Payrolls Disappoint. Fed to the Rescue? And Gold?

June 11, 2019, 5:06 AM

On Friday, it was announced that the U.S. added merely 75,000 jobs in May. Needless to say, a severe disappointment on the downside. The talk of an oncoming recession, and the interest rate cut speculations - were boosted. Is it justified? How close are we actually to the end of the business cycle? Should we buy gold now?

-

1990s vs. 2010s. Which Expansion Will be Better for Gold?

June 7, 2019, 6:15 AM

Ladies and Gentlemen, we have a tie! The current expansion already lasts as long as the economic boom that started in March 1991 and ended in March 2001. We invite you to read our today’s article, which compares both expansions and find out whether the current boom will be better for gold than the 1990s.

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts