Donald and Xi have confirmed their true and everlasting friendship now. Trade wars are over, it's all rainbows and unicorns - and investors do not need safe havens anymore. Right? The celebratory mood feels great but let's find out what the trade truce really means for the gold market.

Ufff, They Announce Trade Truce

The G20 meeting in Osaka, Japan, is behind us. Did I write "G20"? It should be "G2", as the world's focus was on the meeting between Donald Trump and Xi Jinping.

Both sides agreed to not escalate the conflict and not to impose new tariffs (however, the U.S. tariffs on $250 billion in Chinese goods and China's retaliatory measures remain in place). In particular, the much feared 25 percent tariff on an additional $300bn in Chinese imports has been put on hold. Trump also lifted some restrictions on Huawei (although not all of them), which signals true willingness to make a deal with China. In return, China agreed to buy more US agricultural goods. And both countries pledged to restart trade negotiations.

Moreover, Trump made a surprise visit to North Korea over the weekend and met with Kim Jong Un. They said they would resume talks on North Korea's nuclear program, which could also ease geopolitical worries and please the fickle Mr. Market.

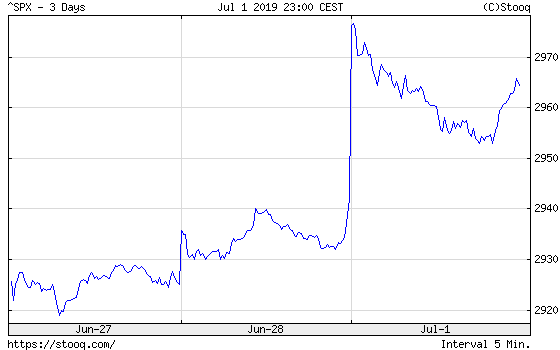

Investors definitely liked the outcome of the U.S. - China talks. Risk-sentiment came back to the markets and global stocks soared yesterday. As one can see in the chart below, the S&P 500 Index jumped above 2970 points immediately upon opening on Monday morning.

Chart 1: S&P 500 Index from June 27 to July 1, 2019.

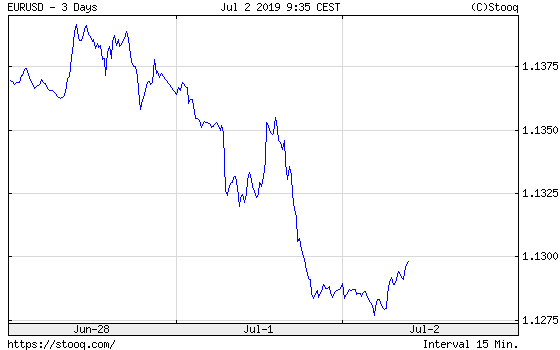

Bond yields rose, and the greenback advanced against major peers. In particular, the euro declined against the U.S. dollar from almost 1.1375 to below 1.1300 on Monday, as the chart below shows.

Chart 2: EUR/USD exchange rate from June 28 to July 2, 2019.

Hence it's not surprising that given the rally in the stock market and the U.S. dollar, as soon as gold started trading Sunday night, it corrected sharply (see the chart below for the vigor). The global trade wars reprieve and the return on risk-sentiment is bearish for safe-haven assets such as gold.

Chart 3: Gold prices from June 30 to July 2, 2019.

Implications for Gold

On Thursday's edition of the Gold News Monitor, we wrote:

If the trade wars de-escalate, uncertainty about the trade policy will vanish, while positive sentiment will return to the financial markets. The Fed would lose then an excuse to cut interest rates. Keep that in mind, while investing in the precious metals market!

And that is exactly what traders witnessed with the U.S. and China announcing a truce in their trade war. The risk sentiment returned to the markets, boosting the global stock markets and sinking the yellow metal.

But what's next for the gold market? On the one hand, the trade truce removed the risk of further escalation from the global economy. This should improve market sentiment. And it should make it tougher for the U.S. central bank to cut interest rates this month (moreover, the oil prices jumped as OPEC agreed to curb production, which should translate into higher inflation). A 50 basis points cut is definitely excluded, although the markets still see more than 20 percent chance of such a move. So, the expectations for the Fed cuts could weaken somewhat or shift to September or later this year. All this seems to be a headwind for the gold prices.

On the other hand, geopolitical developments generally result only in temporary moves in the gold market. And the trade detente is just a ceasefire, not the end of the trade war. The ultimate resolution is still elusive and the restart of negotiations does not guarantee a deal any time soon (however, given the upcoming elections and Trump's need to sign a deal, we bet that the two superpowers will eventually reach an agreement this year).

The bottom line is that investors should not read too much into the trade truce. There is still a long way to reach a true and lasting trade deal. However, some tensions were eased, and some uncertainty was removed. On the margin, it's bad news for the gold bulls.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you're not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits' Gold News Monitor and Market Overview Editor