-

Stock Investment Update - The S&P 500 Ride Ahead - Rocky or Not So Rocky?

July 6, 2020, 8:52 AMWelcome to this week's Stock Investment Update.

Supported by another strong ADP non-farm payrolls, the S&P 500 extended its premarket rally on Friday, but it quickly ran out of steam. How concerning is seeing most of its intraday gains gone? That's actually not the only sign of short-term non-confirmation. Should the bulls be getting concerned here?

There are still more factors going for this rally than against it. In today's analysis, I will present these together with the non-confirmation signs.

Credit markets are still on the upturn, stocks are undaunted by the rising U.S. Covid-19 cases and hits to reopening plans across many states.

This dynamic is still at play, and I think the bullish bias to the S&P 500 outlook will deal with the above-mentioned signs of caution in a relatively short order.

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

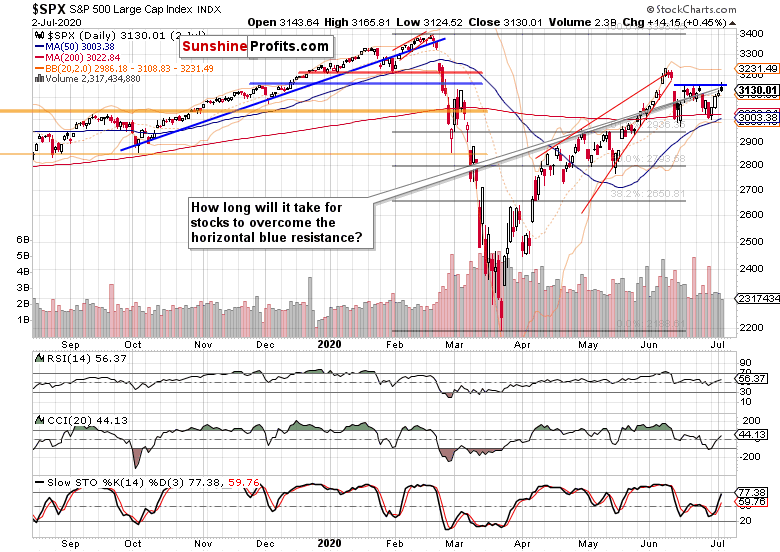

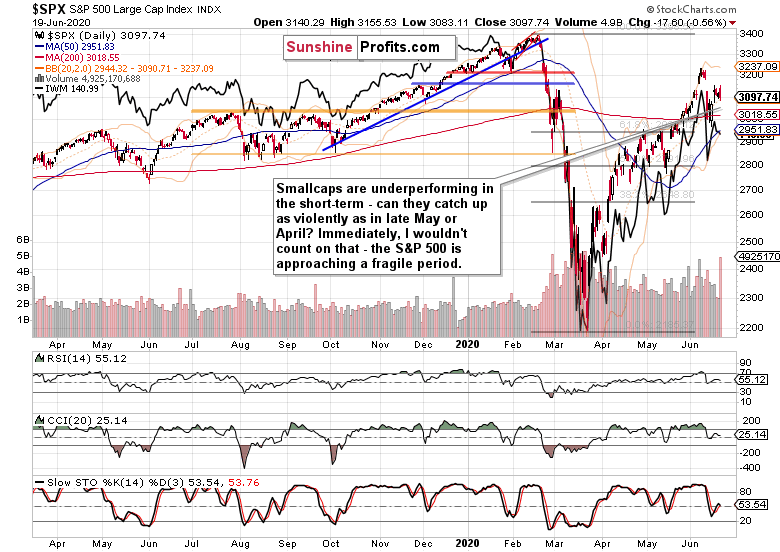

Last week, the S&P 500 rebounded off the 50-week moving average, and closed not too far from the weekly highs. Yet, Friday's attempt to overcome previous two weeks' intraday tops, was rejected. So far rejected.

While the weekly indicators appear tired, that wouldn't be a concern for the stock upswing to continue. The volume doesn't raise red flags either - had Friday not been a bank holiday, the weekly volume would be more than adequate with its average daily addition. But it must be said that the weekly chart is bullish-to-neutral in its implications.

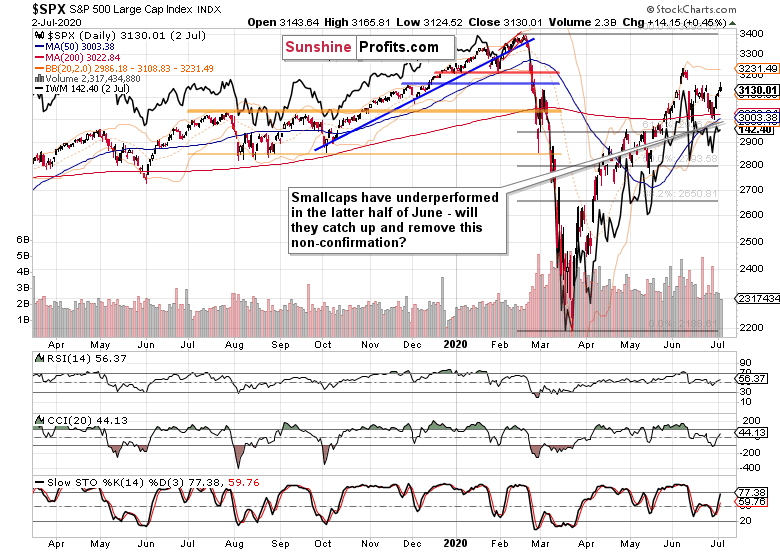

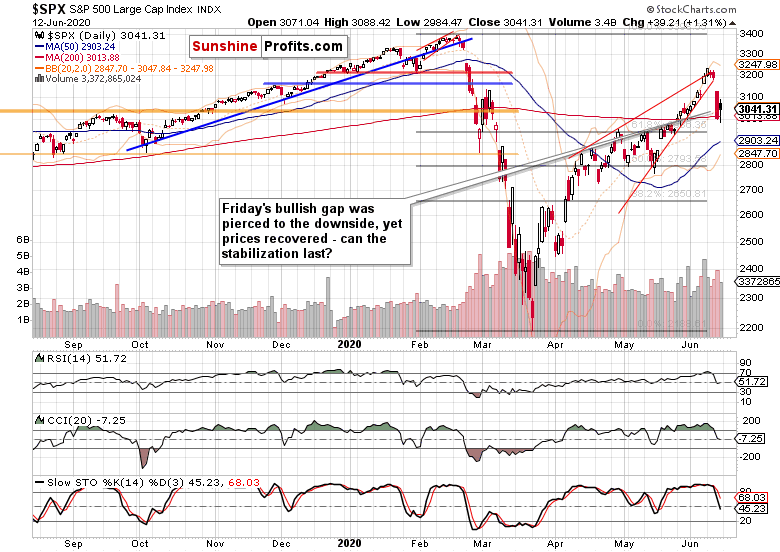

The daily chart shows that the bulls were again rejected on Friday at the blue horizontal resistance line. Still, I would not consider the latest candle as one characterizing a reversal - and not only because of the lower volume. The daily indicators favor the upswing to continue, short-term breather to come or not.

Let's move to the credit markets next.

The Credit Markets' Point of View

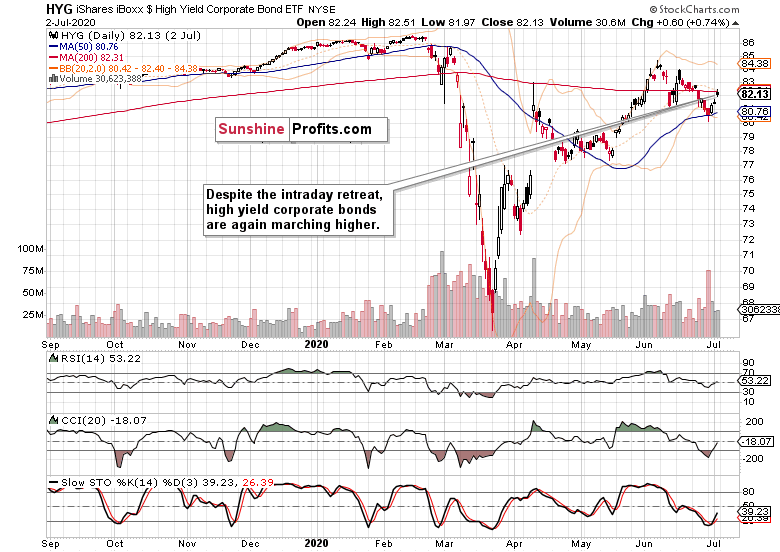

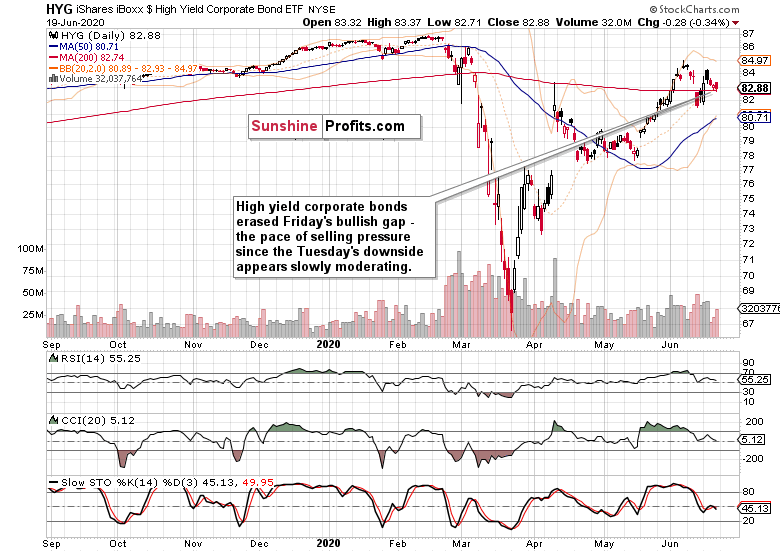

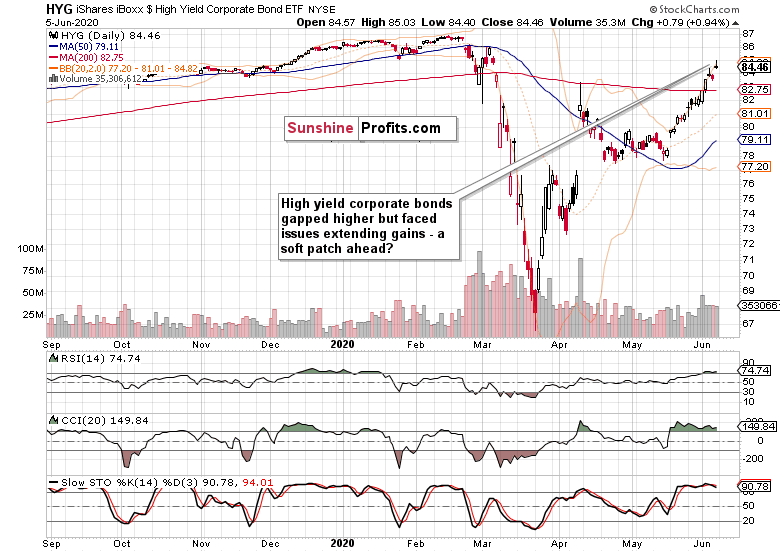

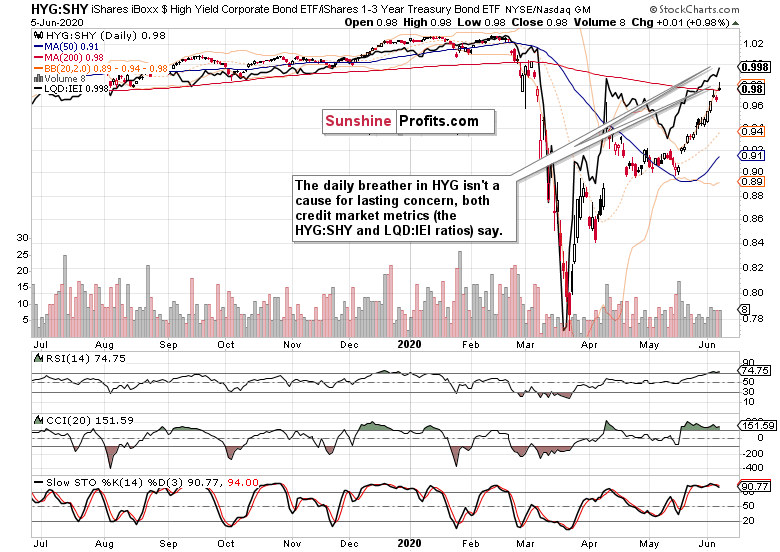

Friday's candle in high yield corporate bonds (HYG ETF) mirrored the S&P 500 one, and hints at a daily consolidation - yes, more gains will come down the road, and power stocks higher.

Risk is coming back into the market place - slowly but surely. And it's not just about the PHB:$DJCB (high yield corporate bonds to all bonds) ratio's fledgling uptick from the late June local bottom.

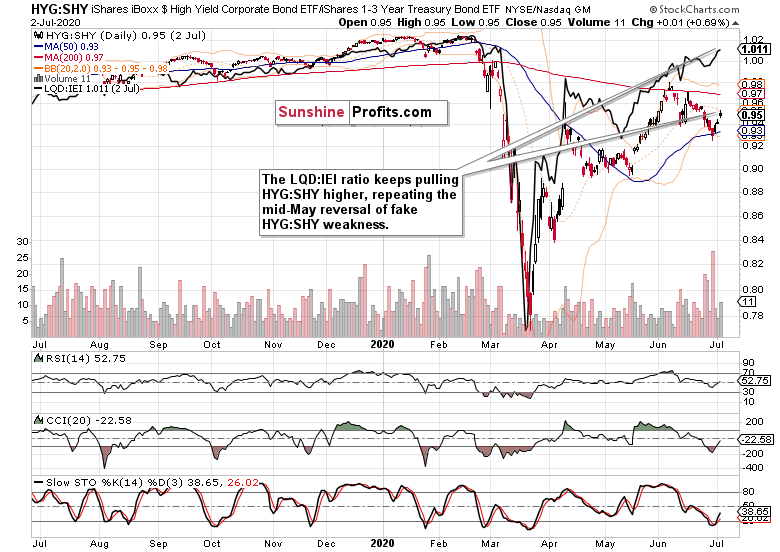

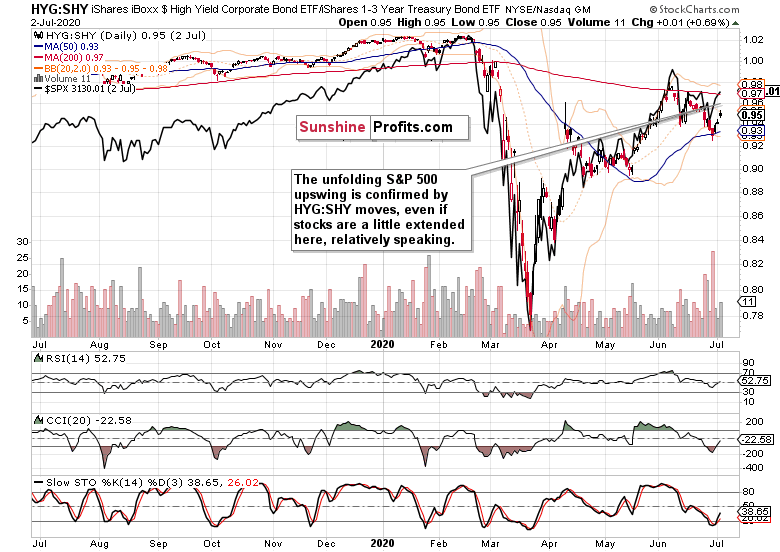

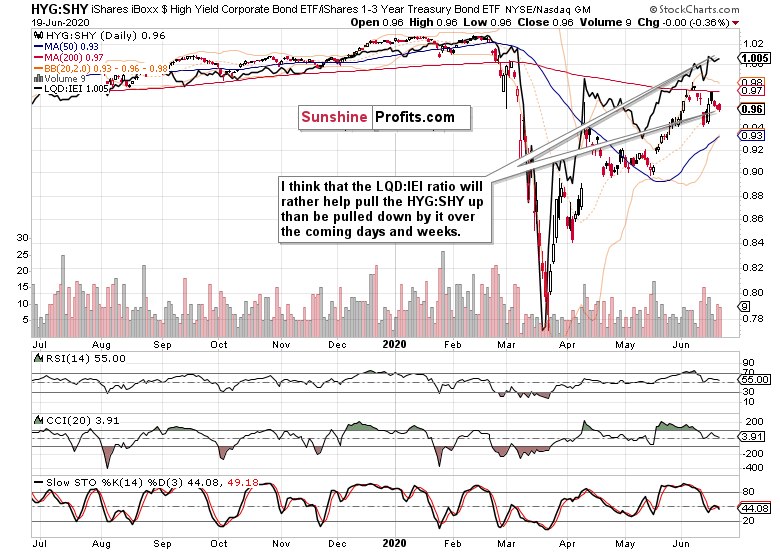

As the above chart shows, investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) are helping the high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio to move higher, and much more still appears to come for both metrics.

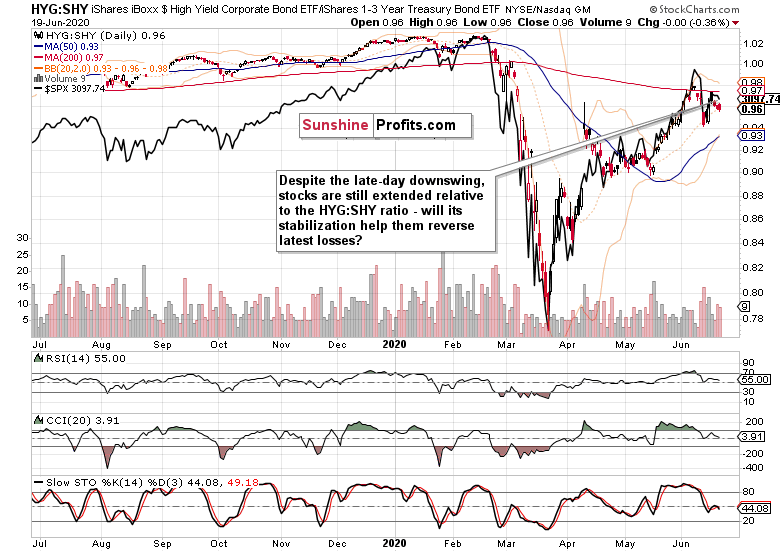

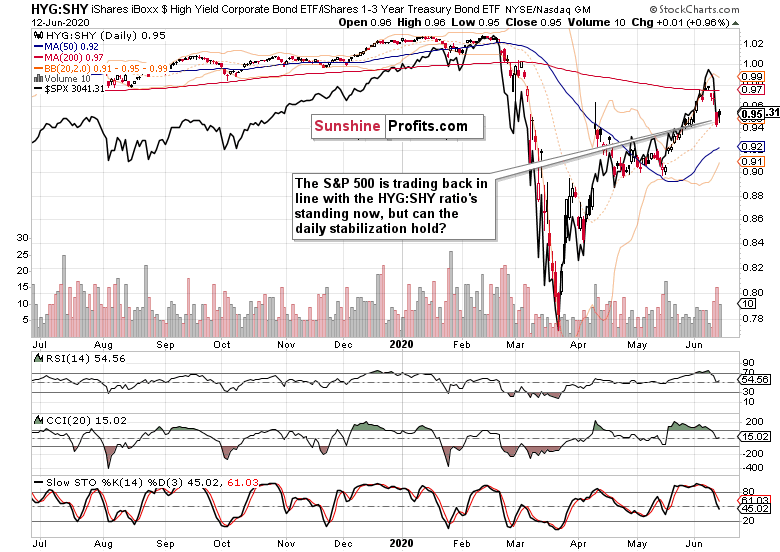

The HYG:SHY ratio supports the stock upswing, but with the S&P 500 at late June highs while the ratio isn't there yet, stocks are a bit extended here. While the charts don't favor a reversal, a sideways consolidation for a few days wouldn't be all too surprising - especially should the credit markets stall.

S&P 500 Market Breadth, Volatility and Other Clues in Focus

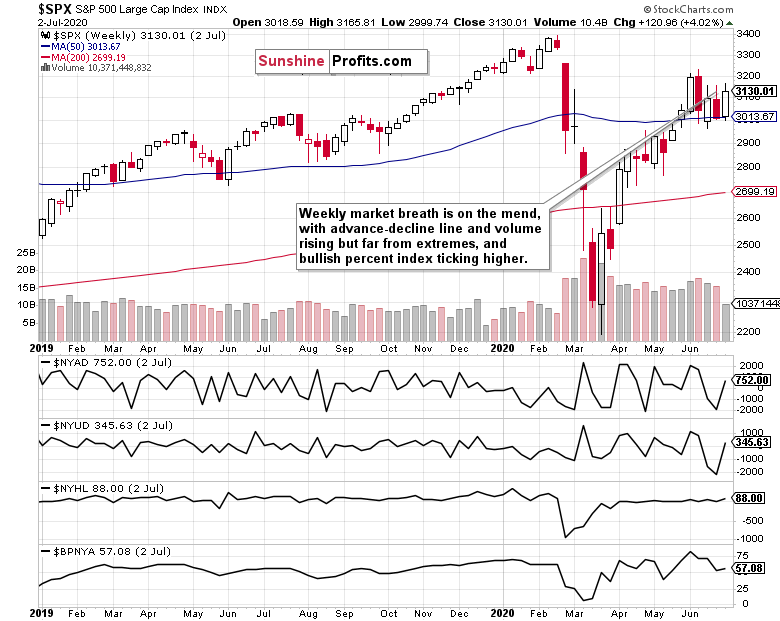

Both the advance-decline line and the advance-decline volume are moving increasingly positively for the bulls - and they have ample scope for moving higher. Bullish percent index has remained in bullish territory, and is curling higher again. In short, market breadth indicators are improving with a solid potential for more constructive action.

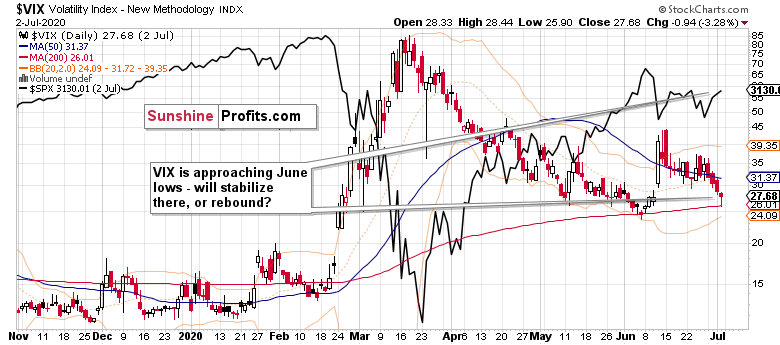

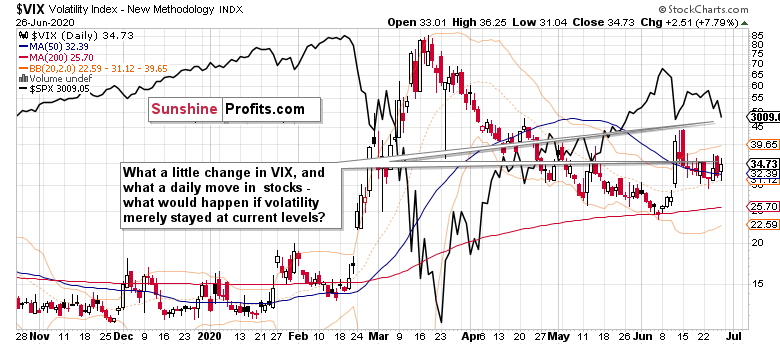

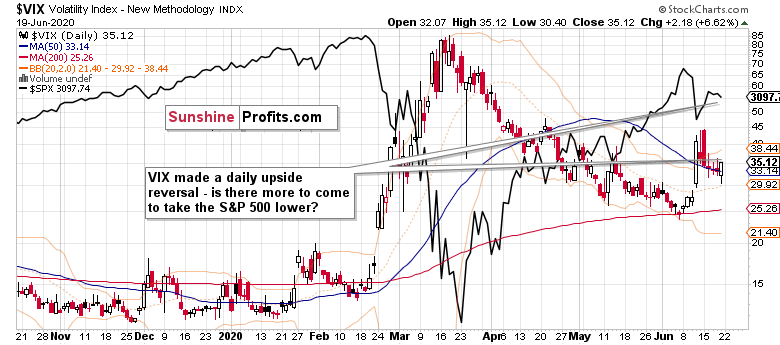

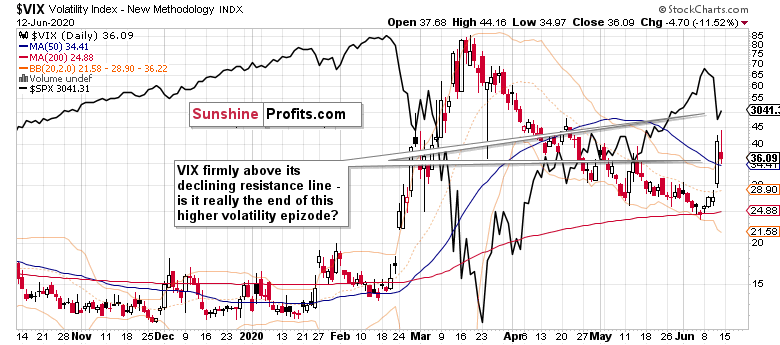

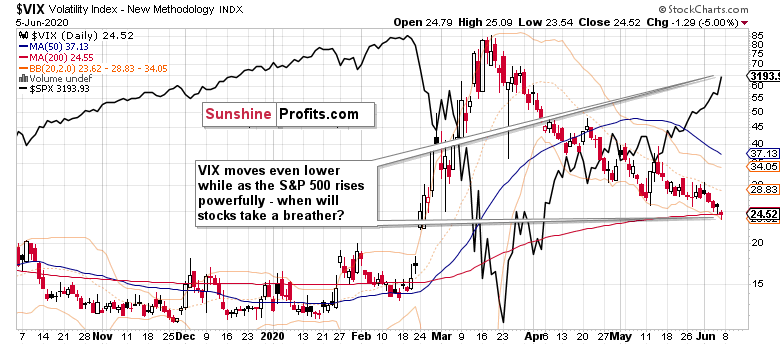

The favorite volatility metric, the VIX, erased much of its Friday's decline. Is it stabilizing around the June lows, or preparing for a rebound? The stabilization scenario appears more probable.

Smallcaps have suffered two daily setbacks, and continue lagging behind the S&P 500. That's especially visible in the latter half of June, right after their failed breakout above their 200-day moving average. While the S&P 500 is trading comfortably above it (i.e. support held and thus upswing continuation is more likely), the Russell 2000 (IWM ETF) isn't yet. Positive resolution to this non-confirmation would certainly lift the outlook - and I think it's a question of time merely.

The USD Index also paints a rather bullish picture for the coming week(s), and the caption says it all. The greenback won't be standing in the way of a more risk-on environment.

On Thursday, I added these thoughts on the dollar:

(...) Wouldn't you expect a more veracious move on new U.S. daily corona cases highs? Yeah, cases... That's it.

Key S&P 500 Sectors and Ratios in Focus

Technology (XLK ETF) is again moving to new highs, and that's positive for the whole index. Yet, the following semiconductors chart shows that there's something amiss with the strength here (just like with the Russell 2000 message).

Semiconductors (XSD ETF) are lagging behind, also revealing that we're not in a raging risk-on environment yet. That's also the takeaway from the junk corporate bonds to all corporate bonds (PHB:$DJCB) ratio.

The consumer dicretionaries to consumer staples (XLY:XLP) ratio shows that the cyclicals (such as discretionaries or materials) are doing fine. Baltic Dry Index ($BDI) is also rising while the defensive sectors (utilities and staples) aren't at their strongest. That's a subtle hint that the bullish environment for stocks is intact.

Summary

Summing up, given Friday's non-farm payrolls, the S&P 5000 gains could have been bigger, but the index is still taking time to overcome its late June local tops. Signs are though mostly arrayed behind the bulls, and the credit markets support the unfolding stock upswing. The non-confirmation in Russell 2000 or semiconductors underperforming technology will likely get resolved over the coming days or weeks as we see more rotation into cyclical and riskier plays.

The greenback isn't likely to get in the way of further stock gains, and I expect it to rather weaken as the recovery narrative gains more traction - and if you look at emerging market stocks, they've done better over the June consolidation than their U.S. counterparts. Encouragingly, their Friday's upswing has already overcome its early June highs - their outperformance means more gains for the U.S. stock indices as they explode higher again.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Investment Update - The Darkening Clouds on the S&P 500 Horizon

June 29, 2020, 7:40 AMWelcome to this week's Stock Investment Update.

Friday's overnight gains evaporated faster than you could say Jack Robinson, and not much bottom fishing came later that day. Is the tide in stocks turning - or has it turned already? With Thursday's financial news-driven gains reversed in a flash, it's tempting to say so - especially when coupled with the other signs I see in the charts.

In short, more downside appears likely, confirming what I said in Friday's analysis. A quick quote: "Despite the generally positive S&P 500 performance during the runups to Independence Day, the new Fed rules might not have saved the day yet. Trading remains choppy, corona cases just made a new U.S. daily high, and the elections are getting closer."

Will the market agree?

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

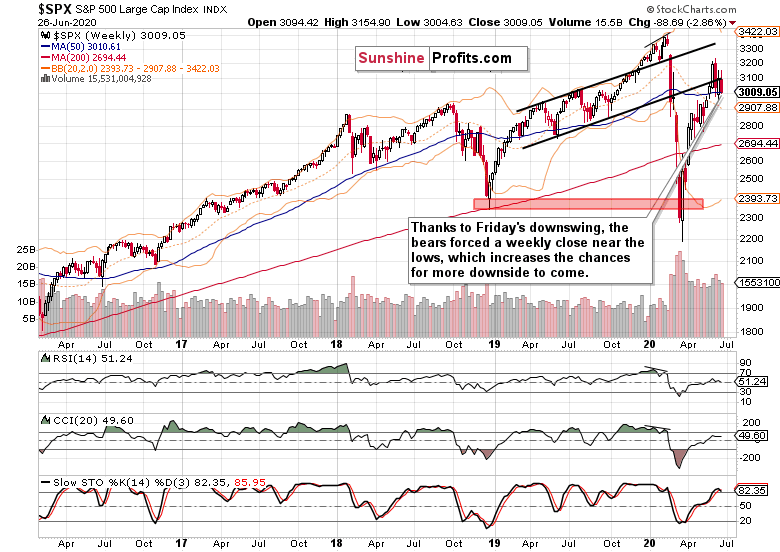

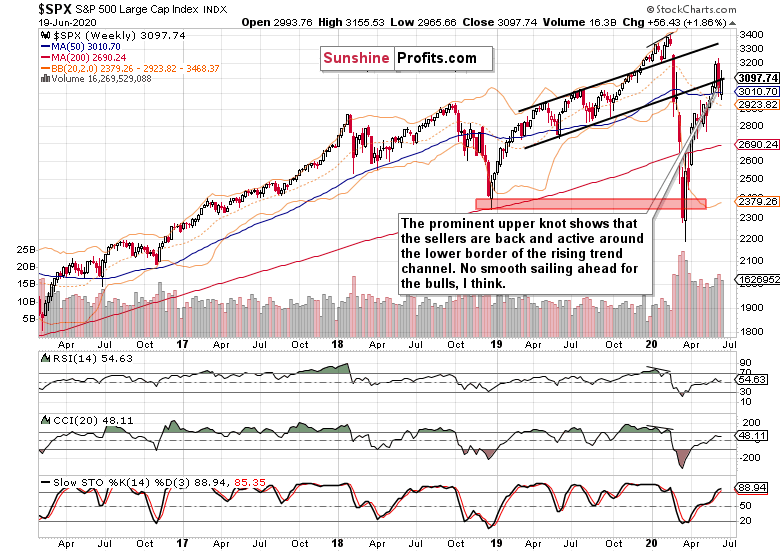

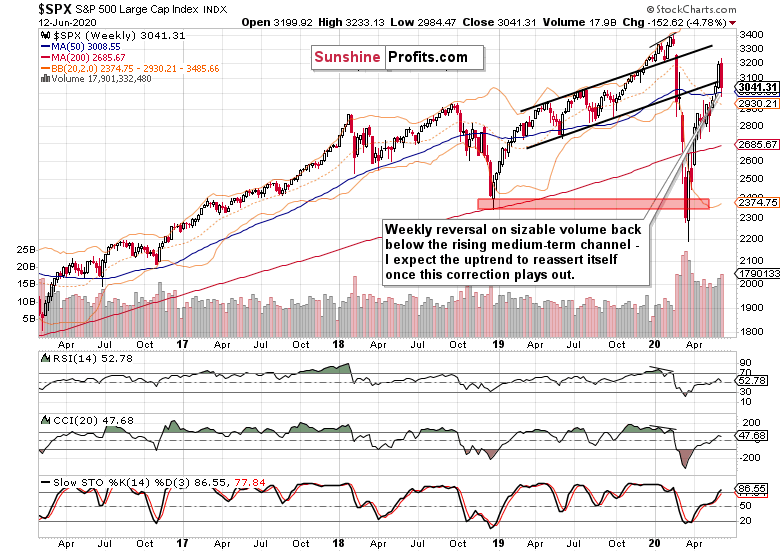

The weekly candle's opening and closing prices were practically the same going into Friday's session - but that day changed a lot as you can see. Within Friday's analysis, I mentioned the tellingly long upper knots in the two prior weeks, pointing out that a daily downswing would increase the chances of seeing a reversal.

That's what is happening, and I carried on with these observations still on Friday:

(...) Just as the March volume examination showed heavy accumulation, and stock bears unable to reassert themselves right next, last weeks' trading smacks of distribution, of selling into strength. Yes, that's the result of the bulls being unable to stage a comeback this week (so far - we'll soon learn, but the odds favor a downside move).

The thorn in the bears' side is that prices are still trading above the 50-week moving average (roughly corresponding to the 200-day moving average on the daily chart, at 3010 and 3020). Breaking below this support would likely lead to accelerated selling, but we're having none of this so far.

What about the bullish side of the argument? It's about moving prices back into the rising black trend channel - again, we aren't seeing any of this.

The weekly indicators are looking fairly extended, which wouldn't be an issue - but the weakening uptrend in CCI or the RSI continuously unable to overcome its neutral readings, is.

So, these are the reasons why I think yesterday's financial sector news isn't a real game changer, and why I see persisting risks to the downside. True, they might not materialize in the very short run, but the reward potential is higher for the bears here, the longer the above issues persist.

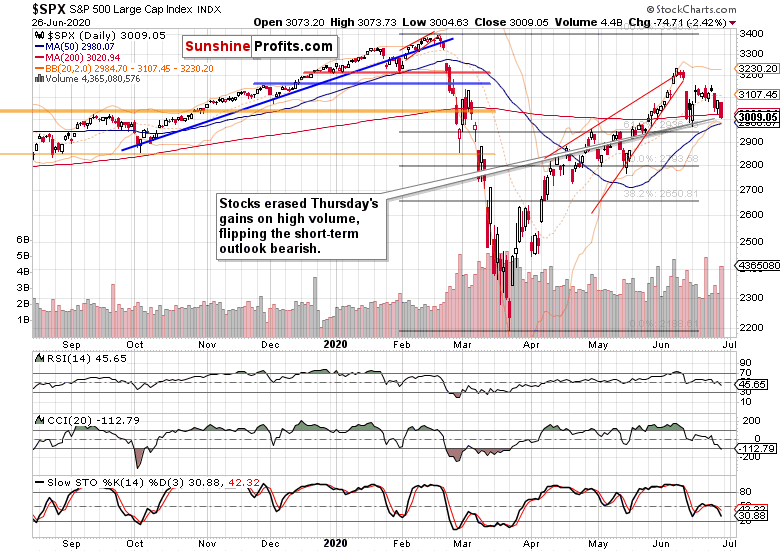

We have seen the daily downswing indeed materialize, and it brought the S&P 500 right to the 50-week moving average (and a tad below the 200-day moving average on the daily chart). These levels were pierced.

The support withstood Friday's selling pressure, but remains in a precarious position - I am unconvinced by the little intraday bounces as the bulls really could have stepped up to the plate some more. This can't be even called a dead cat bounce (or a toned-down base-building), raising questions about the bulls' strength in the now.

Thursday's gains turned history, prices closed below that day's intraday lows, and it happened on really high volume. The Wednesday-discussed fleeting stabilization of daily indicators in the end proved temporary indeed, and the bear raid I discussed, wildly succeeded. The daily close so near the intraday lows makes follow through selling on Monday likely.

On one hand, we have these bearish factors and strengthening corona fears (risks of renewed lockdowns or disruptions to economic activity in general), on the other the uncertain effects of Q2 window dressing and generally rather positive seasonality going into Independence Day.

Given the prominence of each of the above factors, I see the bearish side as the one favored by the odds - do the credit markets agree?

The Credit Markets' Point of View

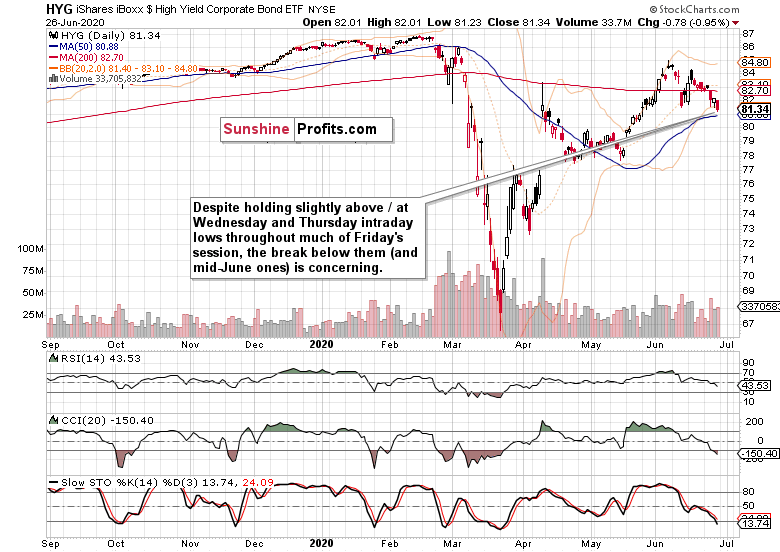

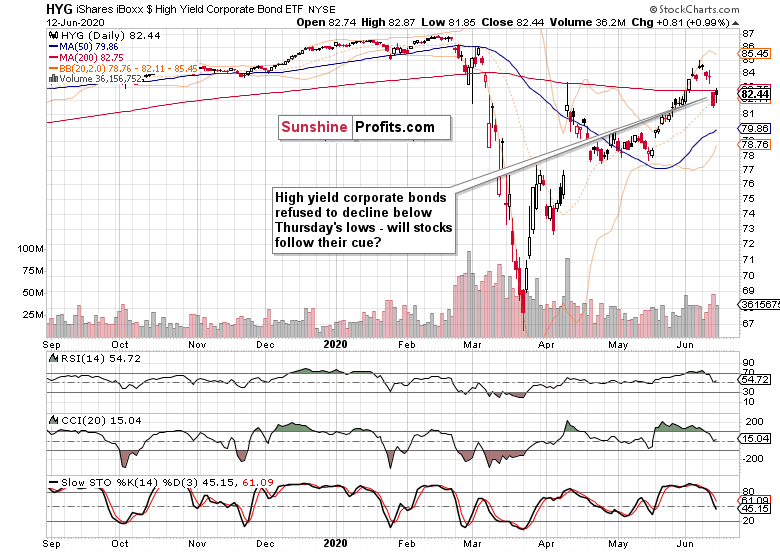

High yield corporate bonds (HYG ETF) broke below the Wednesday and Thursday intraday lows in the end, and the daily indicators don't rule out more deterioration. Not good for the stock bulls.

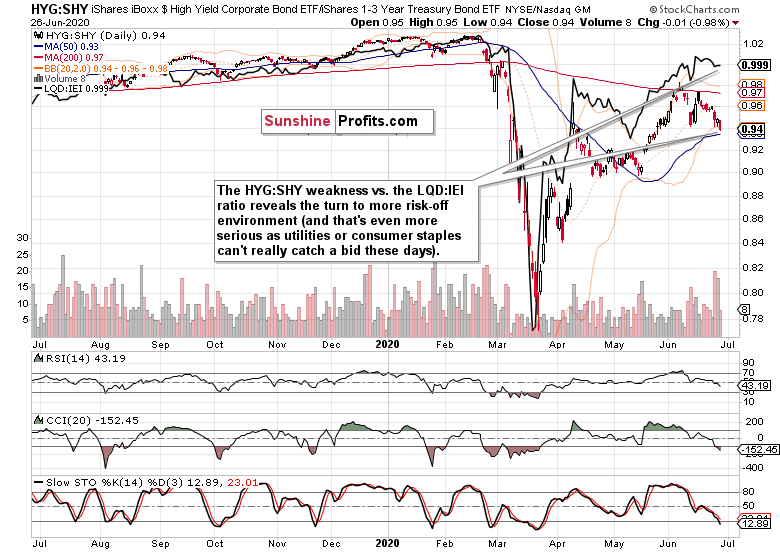

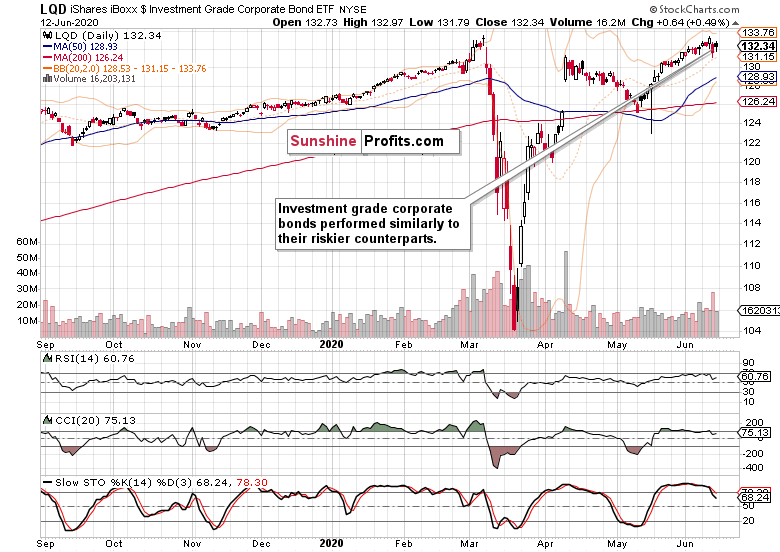

But the investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) ratio is holding up better than the high yield corporate bonds to short-term Treasuries one (HYG:SHY). But do two days qualify as a turnaround?

I don't think so, and the below chart tells you why.

High yield corporate bonds to corporate bonds (PHB:$DJCB) ratio has been doing badly recently, and challenges the rising support line made by the recent local lows. The appetite for more risk in the corporate bonds arena seems disappearing, which doesn't bode well for the stock bulls.

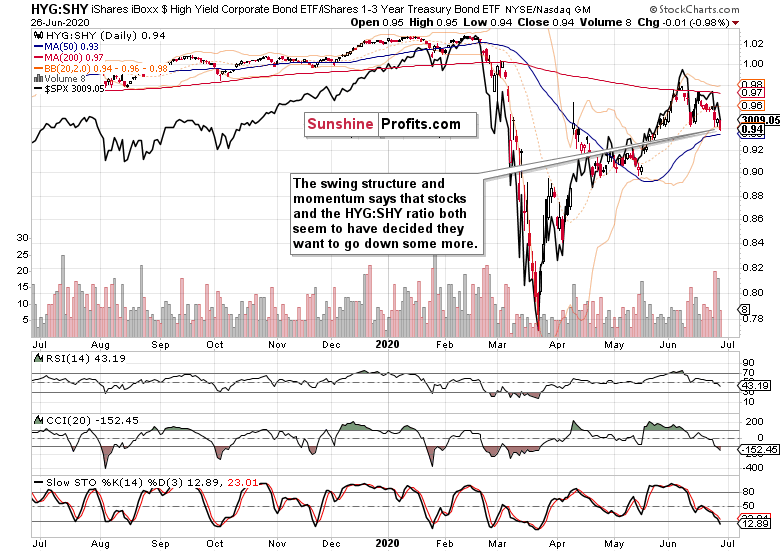

Just take a look at how the Q1 strength in the S&P 500 vs. the weakness in the ratio turned out over the coming weeks. We might be at the doorstep of a challenge to the bull market assessment. The key supports to hold are the 200-day moving average (3020, and if you take the 50-week moving average, then 3010), the 61.8% Fibonacci retracement (2940) and the 50% Fibonacci retracement (2790) on the daily chart.

The caption says it all. It's about direction, and both metrics appear ready to go down some more.

Let's quote these Friday's thoughts:

(...) I still stand by the call for rougher trading over the summer. Look, elections are drawing nearer, the polls are showing... whatever - what would happen once the markets start discounting the prospects of Biden presidency more? Markets hate uncertainty, and the Trump years brought us many pro-business policies. Will they continue? What new ones would take their place?

As summer progresses, that could influence stocks more than corona / lockdown fears. The markets would tell us as we go. As I showed you on the weekly chart, the risks are skewed more to the downside in the short- and medium-term.

Volatility appears not really willing to decline from current levels much, which supports the notion of rougher waters ahead. I don't think it would stay this low in July or August.

The market breadth indicators highlight the shifting sands. The advance-decline line hasn't surpassed its mid-June highs - and on a weekly basis, it's challenging its late-April bottom. The bullish percent index also reveals the mounting troubles for the bulls.

Let's move next to the sectoral analysis.

Key S&P 500 Sectors in Focus

Technology (XLK ETF) has stalled recently, and I wouldn't take Friday's downswing on high volume as a sign of accumulation just yet. What concerns me, is that this has been the start performer of the move higher off the March lows - which implies that much of the rest has been lagging behind.

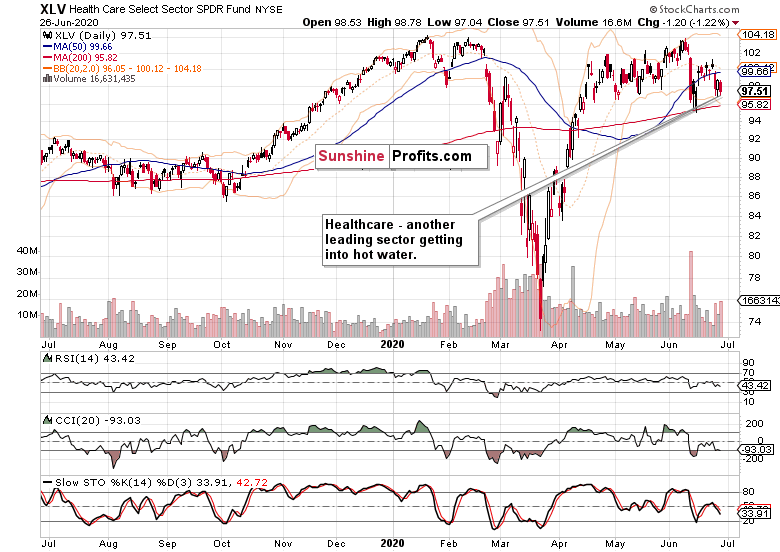

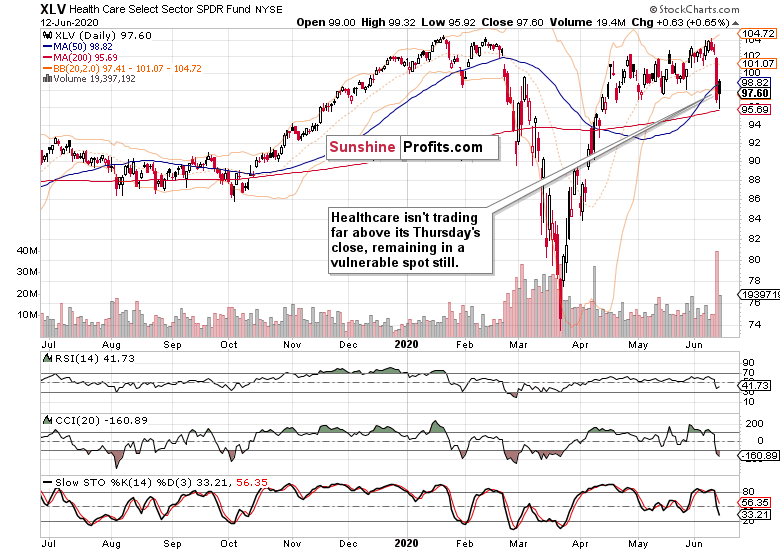

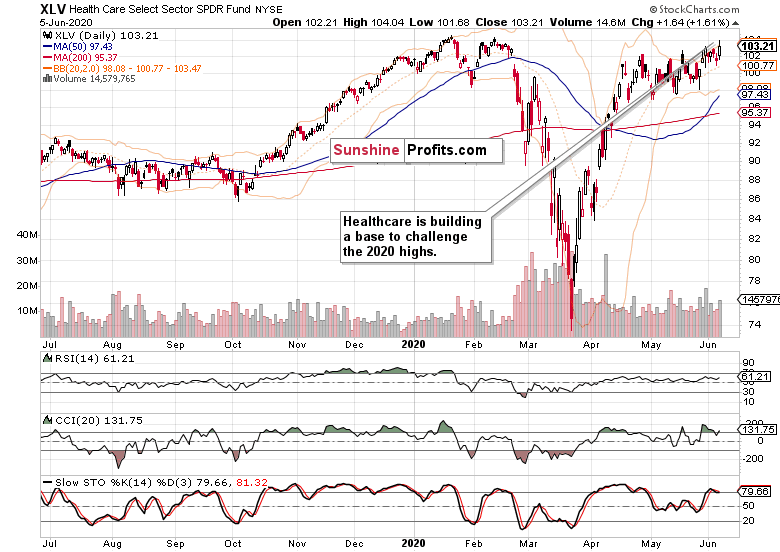

Healthcare (XLV ETF) was the second sectoral heavyweight engine of growth, and it has already made a lower high (unlike the tech, which made a higher high). That's concerning for the stock bulls, because whenever the generals are among the last to hold ground while the rest shows weakness, it's time to put one's guard up.

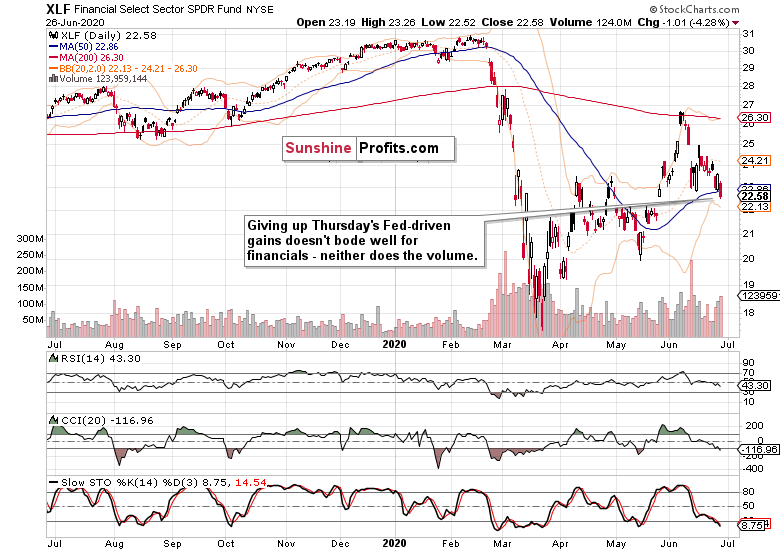

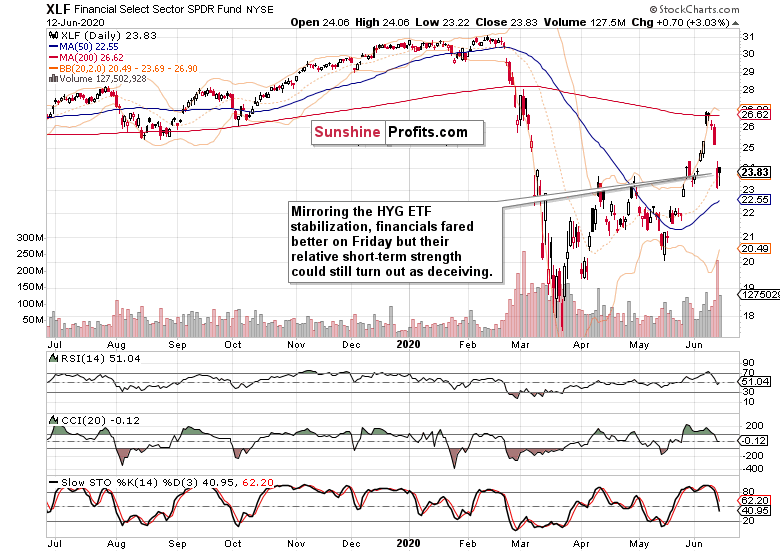

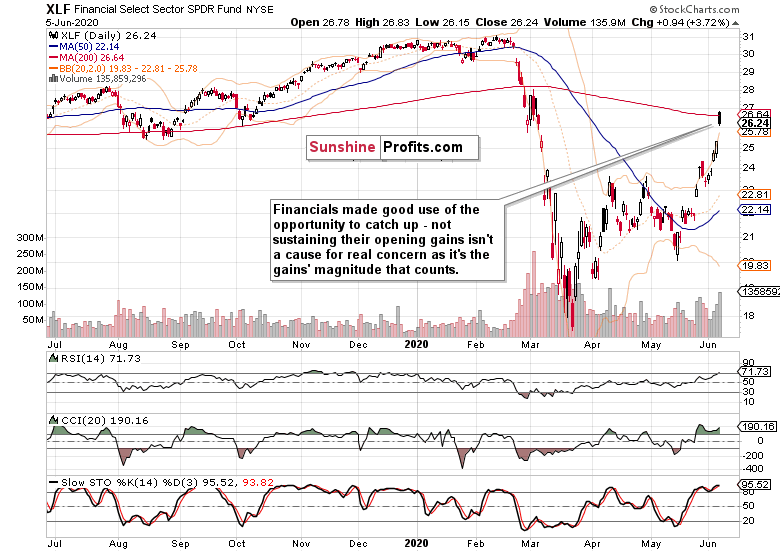

The veracity in erasing Thursday's news-driven gains in the financials (XLF ETF), is concerning.

Consumer discretionaries (XLY ETF) approximate the healthcare performance, but how resilient will the sector be once lockdown fears rear their truly ugly head?

Among the defensive sectors, both utilities (XLU ETF) and consumer staples (XLP ETF) took it on the chin, and are approaching their mid-May lows. While that makes both leading ratios (XLF:XLU and XLY:XLP) look relatively healthy, don't be taken in - all of these sectors are sinking currently. The only bullish interpretation possible is that the growth sectors are holding up better than the defensive ones, which would point to rotation into growth plays.

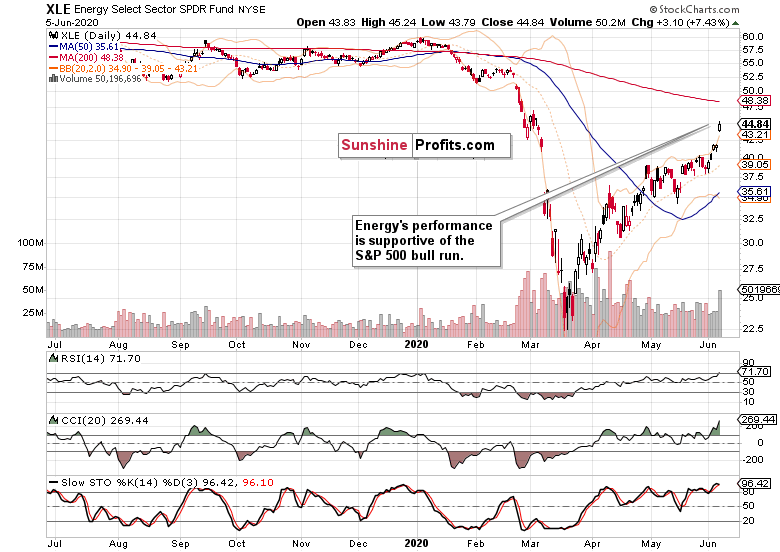

Within the stealth bull market trio, let's start with energy (XLE ETF). Given the relative stability of oil prices in recent weeks (that's an understatement as they've been slowly marching higher actually), one would expect a stronger sectoral performance - but remember that the US shale companies are under serious pressure as both Saudi Arabia and Russia price war moves have inflicted pain upon the sector.

In April, the nearest futures contract prices went even negative as so much demand has come offline. But I stand by my call for higher oil prices in Q3 and Q4 especially - just take a look at the June 22 From the Readers' Mailbag section - I talk gold there as well.

Okay, it's the materials' (XLB ETF) turn now. They're holding up relatively better, which reflects the rising inflation expectations (I cover these in the course of answering the gold question in the June 22 Stock Trading Alert).

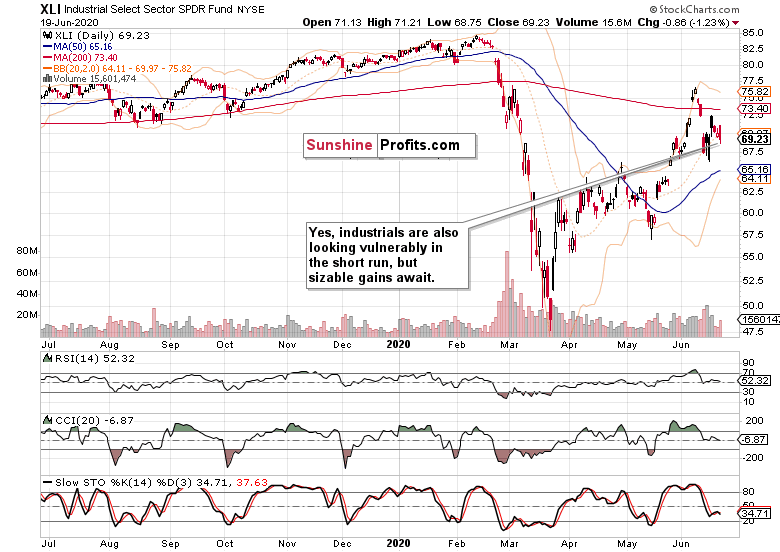

Despite the encouraging manufacturing activity data, industrials (XLI ETF) are weaker than the materials. Taken together with energy and materials, the stealth bull market trio isn't really helping the S&P 500 move higher, which serves as a red flag.

From the Readers' Mailbag

Q: I read an article on seeking alpha predicting upward movement of Russell 2000 in the 3rd quarter, suggesting buying the IWM and staying long. What's your take on this Monica?

A: Let's start with the situation in the now.

The Russell 2000 (IWM ETF) is still acting weak, with the caption again saying it all. The prospects for it to catch up over Q2 are limited in my opinion. Once we have the election uncertainty removed, the prospects for smallcaps get better. But we might be facing corona and flu panic in autumn as well, which wouldn't really help the sector.

So, I ask - is it really a good time to buy now?

Summary

Summing up, Friday's session raised the specter of more selling over the coming weeks, and justifiably so. Credit market metrics have weakened, market breadth deteriorated, and volatility is far from tamed. The weekly chart is sending ominous signals while the Russell 2000 continues to underperform. Among the sectors, technology can't save the day.

Significant short-term risks persist amid the choppy trading (now with a downside bias) characterizing last two weeks. The medium-term examination favors the bears now. Should the market get spooked by corona even more down the road, that would be a cherry on the cake for the bears.

As the saying goes, you're on the right track with stock bulls - but stay there long enough, and you get run over - and the S&P 500 setup these days is precarious.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Investment Update - The S&P 500 Wall of Worry Got Steeper on Friday

June 22, 2020, 7:21 AMWelcome to this week's Stock Investment Update.

Friday's session added a new wrinkle to the bulls, and especially its close is a fly in the ointment for Thursday's encouraging signs. I anticipated the sideways-to-down period to arrive in July - but aren't we at its doorstep already? The narratives haven't changed one bit - there are the corona second wave fears coupled with the Fed's cautious tone against the data pointing that the recovery is on and new stimulus is underway.

The bulls' interpretations have been winning earlier in the week before the bears took initiative. How serious is this crack in the dam, enough to derail the stock bull market? I don't think it will succeed in doing that, but rougher times for stock bulls might very well be knocking on the door already. In what I think will turn out to be summer doldrums in stocks, I stand by my call that we're going to see quite higher S&P 500 prices in December than is the case now.

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

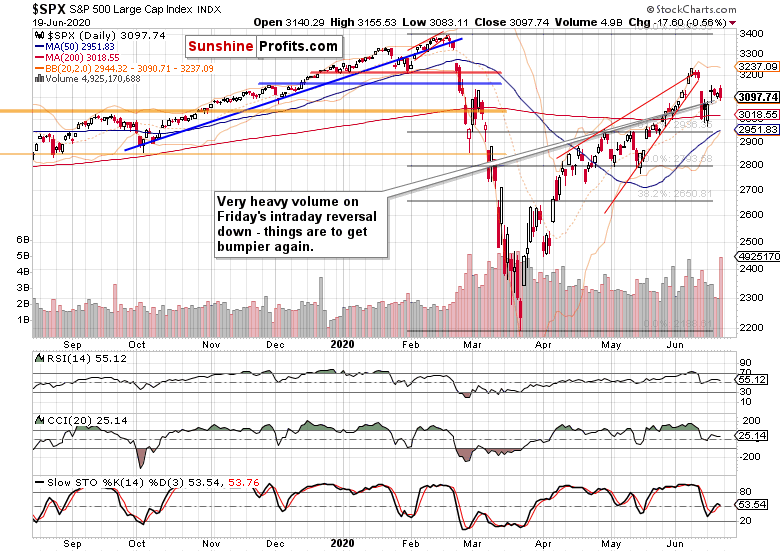

The weekly chart shows last week's battle precisely. After reversing prior week's selloff on Monday and Tuesday, stocks stalled on Wednesday and Thursday. Friday's session opened encouragingly, and it appeared the bulls will close the week decently. Yet despite two intraday rebounds, the sellers proved to be in the driving seat.

This week's candle got a bearish flavor as a result. The lower volume isn't as concerning as the upper shadow is. The extended weekly indicators are whispering caution here as well, regardless of being still fit to power one or a few weeks of more upside before consolidating.

Either way, the last three weeks have shown that volatility is rising again, giving us sizable swings both ways. The steep recovery of the March 23 lows that came with its own fits and starts in April and May, appears to be entering a similar period now, and as the days and weeks go by, it might very well turn out that the risks would get skewed rather to the downside than to the upside.

The week just over is a first one of its kind in another way too - not only the Fed's balance sheet increases have been moderating prior, but we just got a first week of balance sheet contraction since the corona crisis hit. This is a piece of the puzzle that no stock bull can ignore - it's less new money to help drive stocks (and whatever else is viewed as an anti-dollar play at that moment) higher, and helping the greenback recover.

On one hand, the Fed stands ready to support the real economy's recovery, on the other hand, the toying around with yield curve control doesn't do much good to financial stocks. We all know that the recovery will be a long and thorny event spanning not merely quarters, and I suspect it could easily be years in some aspects. By some, I mean e.g. airlines, cruise ship operators, leisure and hospitality, your usual suspects.

But these are anecdotal, because I view the corona hit as having a potential for creative destruction. The emphasis goes on creative and creativity. I mean that corona is an accelerator of trends, a trigger for an overdue clean-up - for example in retail. Also, many companies are getting used to operating long-term with remote workforce, which hits the commercial real estate.

Globalization and supply chains are being reassessed. Mergers and acquisitions are marching on, and the consolidations are moving us closer to oligopolistic structures, which means less competition and better margins for companies. What we see as an extended P/E ratio now, might not be as extended more than a few quarters down the road.

That's bringing me back to the Fed, and especially the source of upcoming stock market gains. While the central bank's engine is sputtering in the short run (remember those implied calls that the fiscal policy has to step up to the plate? What chances does Trump's $1T infrastructure bill stand vs. the Democrat's $3T wish list?) and election uncertainties will creep in increasingly more, it's the real economy's actual performance that will be driving further stock gains. Along with the earnings recovery (also note that so many stocks are trading below their book value currently), whose not only source I hinted at above.

It will be a bumpy ride. On one hand, latest non-farm payrolls coming in above expectations is an understatement, and strong retail sales or Philly Fed manufacturing with building permits support that. On the other hand, continuing claims are sticky - little wonder with their disincentive to work through overly generous benefits at times.

Meanwhile corona is surging in the Sun Belt states, raising fears of another series of lockdowns and disruptions to economic activity. Little wonder if you look at what's going on in Beijing. And the Red States would find it hard to reconcile with that after reopening - not that it were easier in Michigan. The virus is still here, and a reasonable coexistence must be achieved in the now - stocks seem to me more worried about the actual recovery, monetary and fiscal policy steps than another corona headache nationwide.

That's why I think that Friday's intraday reversal was more driven by the Fed's guarded tone, Apple store closures (indicative for the rest of the crowd) and simply less fresh money available.

But can the Fed be tightening here? After the hockey stick since March? I see it rather as a trial balloon - will anything start to disintegrate? It's not in their (and their mandate's) interest to try to do that too hard. When exactly did Powell say "We are not even thinking about raising rates"? Once this event of sticking it to freeloading Europe (EUR/USD rising, which is helping the eurozone sell its balance sheet expansion plans) while keeping the US as afloat as can be, is over, I fully expect the balance sheet to keep on expanding throughout this year - given the fundamental circumstances we're in, it can't really be any other way.

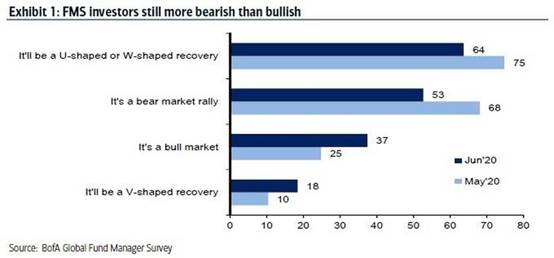

The new money taking place of the deflationary corona black hole, is bound to lift all boats, stocks including. Yet, it's not yet etched into the fund managers' consciousness. Take a look at the following graph (tough to make an attribution, so let's name them all: Bank of America, Zero Hedge and Wealth Research Group):

I've been in the minority since calling this S&P 500 a new bull markets so many weeks ago, and while I have reservations about a V-shaped recovery, it's nonetheless encouraging to see both hypotheses becoming ever more broadly accepted during the last 30 days.

These sentiment figures just show you that there's plenty of doubters and money on the sidelines to deploy. This doesn't take away from the short- and medium-term signs of deterioration I'll tell you about next, but illustrates that a lot of fire powder is still dry.

While stocks can take a hit, the sentiment is still too bearish to take us back into a bear market. Remember, bull markets end when there's no one left to buy - and I see quite a few potential buyers here.

Does the daily chart really paint such a cautious tone that I am striking for the coming weeks?

It does, and not only because of the extraordinary Friday's volume. Going into the open with a solid bullish gap and extending gains, was what I had been looking for based on Thursday's action. But the selling pressure throughout the day was gradually picking up steam, and the above mentioned headlines (Powell, Clarida, Quarles and Apple) served as useful catalysts.

It's the market that decides to either ignore or place a certain weight on an event, story or soundbite. And the Fed didn't say anything really unknown and out of the blue, which is why the reaction (selling pressure) is making me worried. It might be that regardless of corona not disrupting the reopening on a large scale yet (that's why I earlier wrote that it's too early to sweat this one in mid-June), the sands are shifting a few weeks earlier than I thought they would. In other words, the market's sensitivities are on the move already.

Even the daily chart as such warrants caution here. Will follow through selling strike well before we wake up to the regular session on Monday? I don't rule out this possibility entirely but don't view it yet as highly probable. The daily indicators are in no-man's land.

If it comes that far, will the 61.8% Fibonacci retracement hold again, or can we carve out a local bottom way about this key support? Or is this just an isolated tremor in the protracted base building after Monday's Fed move?

I wrote on Friday that with a pinch of salt, we've seen two daily inside candles. And Friday's trading also remained within the confines of Tuesday's wild swings. Are we building a bullish flag (poking fun here, can any buyer come up with a more bullish look at things)?

Let's turn to the credit markets, because they take away quite some froth from the bullish explanations.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) came under pressure, and lost the opening bullish gap. Again, the positive signs from their Thursday's performance are short-term gone, and the bulls will have to reassert themselves after Friday's downside reversal.

Since their similar performance on Tuesday (another bullish gap coming under attack), the pace of decline has slightly moderated, but it's nothing the bulls could call home about - the best proof of an uptrend are rising prices, which we don't have currently (we have merely a solid potential for them).

Investment grade corporate bonds to the longer-term Treasuries (LQD:IEI) ratio offers a positive hint. This is the less risk-on ratio than the high yield corporate bonds to short-term Treasuries (HYG:SHY), and it peeked higher on Friday in what could turn out to be a temporary weakness for its more risk-on counterpart.

It's important to note that none of these ratios is breaking down - only once they do that, the stocks can enter a period of true weakness. I made these fundamental outlook observations on Thursday, and they're still valid today:

(...) In short, the bond markets aren't questioning the recovery storyline, and are still more sensitive to the money spigots than hair-raising corona stories. I'm not arguing for a V-shaped recovery here, I just think that less bad is the new good as stocks are bought amid the prevailing real economy uncertainties (just when and how much will it rebound with some veracity?) and stimulus efforts as far as eye can see.

The money spigots are in a slowdown mode on a weekly basis, but I think that the Fed is just making a point that it's not the world's central bank ready to bail out everyone (right now). Will the markets try to test that, and will that show up in stock prices? To answer, I'll just say that it's been less than a week since the Fed has shown that it's willing and ready to support the U.S. economy. And just this Friday, Fed Vice Chair Clarida said that the central bank can and will do more to support the U.S. economy.

The HYG:SHY ratio with overlaid S&P 500 prices shows that the current price action and closeness of mutual relationship of these two metrics, isn't out of the ordinary. Right now, stocks are no longer trading that extended relative to the HYG:SHY ratio.

What we're seeing currently, could very well turn out to be a consolidation on par with the April-May one. My Thursday's observations still ring true today (we're not in a period where the markets decided to take on the Fed):

(...) Take a look instead at the sizable early April gap and the trading action that followed next. There were some downside moves, yet amid generally rising stocks. And what about the mid-May non-confirmation as the HYG ETF moved lower while stocks more than held ground? While we're not at such an advanced stage of Monday's Fed move digestion, it pays to remember that lesson already.

If one credit market ratio spells caution, it's this one - high yield corporate bonds against corporate bonds (PHB:$DJCB). As the junk corporate bonds aren't compared to Treasuries, but instead to the corporate bond universe, this metric reveals the willingness to take on more risk within corporate bonds - and the short-term picture isn't all that pretty.

It's true that in mid-May, stocks also traded elevated compared to the ratio testing its rising support line made by the April intraday lows. Right now, the ratio isn't that far off that line (reinforced by the mid-May test too) either.

The bearish takeaway from the ratio's daily indicators is more pronounced than in HYG:SHY, indicating more risk aversion within the corporate bond space. And that can have negative consequences for the stock bulls. I mean in the short run, because the ratio isn't breaking down and pulling stocks along right now.

Rising volatility ($VIX) is another short-term sign of caution. Its consolidation with a downside bias just couldn't carry on anymore on Friday. Is it ready to march higher again relentlessly? Not necessarily, but it isn't likely to immediately budge down either. In short, we appear to be on the doorstep of the bumpier ride ahead for stocks.

Smallcaps are still lagging behind, and the picture isn't improving in the very short-term either. Barring an uptake in risk-on sentiment, I don't see them likely to catch up in the short run. This also goes to highlight the risks the S&P 500 faces right now.

But the S&P 500 market breadth shows that we're quite far into the current weakness - the advance-decline volume is at its recent extremes already. But that's the result of Friday's extraordinary volume - the advance-decline line still has some room before it reaches its own extreme zone, meaning that we might very well be meeting lower stock prices before long.

From the Readers' Mailbag

Q: what is your opinion about gold and what do you think about Brent crude making impact on markets ?

A: I don't follow gold on a daily basis, but it's common knowledge that gold loves money printing. It has also been rather steadily rising since the Fed made its U-turn and went off its tightening plans many quarters ago. While the yellow metal hasn't risen as strongly during the repo crisis (autumn 2019), it had been consolidating similarly to spring 2019.

Corona brought us a deflationary episode in March, and gold went sharply down. If you compare that to the pre-Lehman times, it had been weakening since mid-July 2008. The Lehman collapse (mid-September 2008) helped put a short-term floor below it, and gold rallied. But what was the Fed-Treasury response back then, was it convincing enough for the markets to turn around? No, both gold and the S&P 500 went on to make new lows (the king of metals did so in October 2008 while stocks only in March 2009).

Fast forward to today - we're seeing the events play out much faster than back then. The quantitative easing announcement (let alone its volume) came much earlier this time (end of November 2008 was when QE1 was launched), and the market didn't really question the authorities since. Now, the Fed's balance sheet is over $7T, and the expansion has been the fastest ever.

Obviously, this is driving inflation expectations higher, but we are not yet seeing inflation on the ground meaningfully spiking. Yet, gold is reacting as if it were the case already. Right now, gold is not signaling another true deflationary event on the horizon or the Fed truly changing its rhetoric and behavior. But this doesn't mean it's safe from a short-term downside, especially if inflation keeps coming in weak. The yellow metal has a great future ahead and I expect higher prices in the quarters and years to come.

The oil part of your question ties in to gold as well, in what I think will turn out two great surprises for the markets later on. The first will be inflation rearing its head, and the other one would be higher oil prices. I say so despite the oil demand destruction that will take much patience to recover. Both of these factors will become very apparent well before the end of 2020 in my opinion, and stocks will like that.

Q: What's your prediction for Russell 2000 in 3 months? I read small businesses usually boom after a recession more than big ones.

A: You're asking about a time point that could very well mean the peak uncertainty about the election results. Take a look what happened in 2016 - smallcaps were not willing to rise much and were taking a dive since October 2016. Something similar could play out this time as well, but we're not seeing smallcaps outperforming in the runup from the panic lows. That's a watchout against being too bullish on the smallcaps right now.

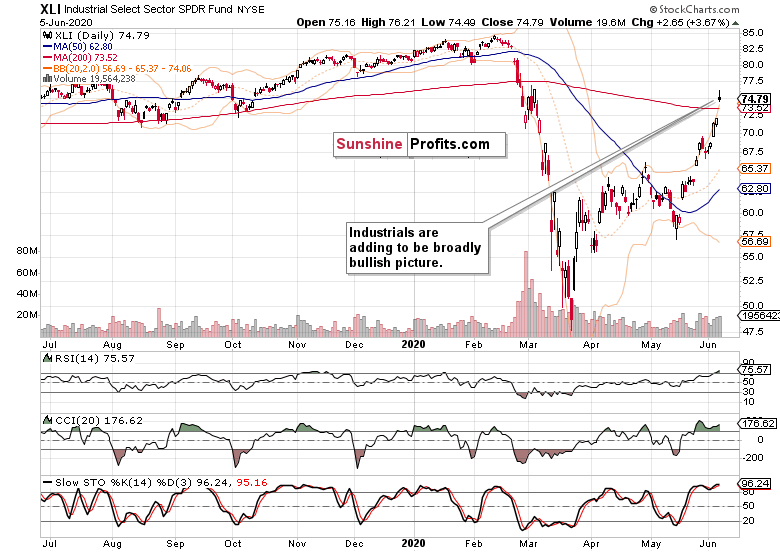

Q: I've recently bought industrials (XLI ETF) and want to profit on the stock upswing. How do you view the chances for the sector to appreciate?

A: I think industrials are a great choice within the bull markets' early recovery stage - they're leading the way higher, similarly to materials (XLB ETF).

Have we seen their top? I don't think so - there is ample room for appreciation as the recovery gets increasingly recognized as being on track. The incoming manufacturing data help to paint a bright picture too. If your investment horizon is long enough (end of 2020 as a minimum), you're set in for really nice gains in my opinion.

Q: I am curious about your thoughts on bank stress reports coming out on Thursday and the Fed not wanting banks to respond till after the markets close.

A: While this could in theory turn out a catalyst for a sizable stock move, I think it wouldn't be a great surprise to the markets - unless accompanied by a shift in the Fed's narrative, which I don't expect. Yes, they're taking the punch bowl away on a very short-term basis, but will it last long? I don't think so. Similarly, I think that the banks' comments won't push markets down in the aftermarket session. Of course, should I feel about that differently after Wednesday's closing prices, I'll highlight that.

Q: I'm interested in your short- and very short-term view on the AEX and DAX indices. Would appreciate your comment/analysis on this one.

A: I deal primarily with U.S. stock indices but a little international perspective certainly won't hurt as different national stock markets aren't moving totally independently of each other.

The S&P 500 has been more resilient that the DAX (or other eurozone indices) since the corona crisis hit, and I think the relative valuation is at an interesting point currently. I look rather at the U.S. to outperform than underperform next (we're at the 200-day moving average support here), and the U.S. outperformance will get into a true limelight once the election uncertainty is removed. Before that, it's a tough call, but I still slightly favor the U.S.

Fundamentally, much depends upon how the U.S. - China trade deal and globalization sentiment (supply chains reset) goes - should these tensions go into overdrive, export-dependent Germany with its stock market would suffer.

Summary

Summing up, the risk-on sentiment took it on the chin with Friday's reversal, and while no key supports were broken, the short-term outlook has deteriorated. The credit markets' performance is sturdier than is the case with stocks, and will set the tone for the S&P 500 amid the mixed short-term picture the index is sending. The summer doldrums for stocks that I anticipated in July, might be making an appearance already - time to buckle up, continuously assess whether stocks are or aren't getting ahead of themselves relatively speaking, and expect more risk-off environment in the weeks ahead.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Investment Update - Is the Waterfall in S&P 500 Over Now?

June 15, 2020, 6:48 AMWelcome to this week's Stock Investment Update.

After Thursday's blood bath, Friday's recovery fizzled out, new weekly lows were made and as well rejected - where next in this correction? Given the preceding momentum, I would look for some more down-to-sideways action before the upswing reasserts itself. Despite the late-Friday's encouraging signs, I wouldn't call the correction finished yet. But first things first - what's the outlook and my game plan?

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

A profound bearish weekly candlestick on solid volume - but is this really a reversal of the stock market fortunes? Look how far prices declined, yet how relatively little moved are the weekly indicators - this goes to show the downswing would likely turn out as a temporary setback in a firmly established stock bull run.

How much follow-through selling could we get and will the support at 50-week moving average (which roughly corresponds to the 200-day moving average on the below daily chart) keep holding?

Let's see the daily chart for more details.

The first impression is that the resolution of the bearish wedge breakout invalidation and island top reversal likely has longer to play out before it's over. Sure, the downswings during this young bull run have been no protracted events, but comparing the sharpness of Thursday's move with preceding occasions makes it reasonable to look for this one to run a tad longer.

The above-mentioned 200-day moving average withstood the selling pressure also on Friday, but if it is broken, the next in line is the 61.8% Fibonacci retracement at roughly 2940, followed by the 50-day moving average just above 2900 and finally the 50% Fibonacci retracement at around 2790.

I say finally because given the technical and fundamental circumstances, I don't expect the correction to reach farther, let alone this low. In terms of the price decline, we might very well be more than halfway through already - that's the scenario I consider most likely, and the reason why I grabbed the almost 50-point profit off the open short position off the table earlier today.

What if Friday's sizable lower knot shows that the buy-the-dip mentality market has decided, enough of the downside? While the daily volume has been respectable, absent a clear bullish gap on Monday, it might not have been enough in staving off further downside, which I look for to go on some more, in terms of time as a minimum.

But the following argument can be made in favor of the correction drawing near its end - I'll expand upon these arriving comments:

(...) I watched HYG today but it did not follow SPX down below yesterday's low. It looked like it wanted to go up instead and finally SPX gave in and followed HYG up. Also many beaten down stocks did not follow SPX down. They held their position pretty firmly indicating buyers are busy picking up beaten down stocks with good breadth. Based on these movements, I agree with your view that markets rather grind up than go down. Going up slowly is probably healthier than going up fast. Parabolic rise always end up with a hiccup.

I've been watching this credit market metric and its ratios as well, and at the intraday stock market low just above 2980, the HYG ETF has been lagging behind (i.e. not trading below its daily low). The question became who would lead each other - after all, one or the other can move first though it's the bond guys who are mostly proven right in the end. In other words, would corporate bonds catch up on the downside, or stocks stop declining as a minimum?

The session's close showed that the debt markets were right on that day, and the following chart shows the daily stabilization vividly:

When I look at the market breadth indicators, the daily stabilization thanks to the runup to the closing bell in stocks, is apparent:

The advance-decline line isn't really far off its daily highs, and importantly, even on a weekly basis, it hasn't declined much from the highs reached during the breakout above the bearish wedge on surprisingly strong non-farm payrolls data.

Coupled with the bullish percent index being solidly in the bullish territory, it shows that there might not be all that much to go in this correction in terms of prices, as a deeper slump would likely attract more buying power than has been the case so far. As well, market players probably expect the correction to be a more drawn-out event rather than a single day out of the ordinary, before the selling exhausts itself.

One more point, it would be better for the stock bull market health if the correction took a little longer to play out. The sentiment has been turning very bullish (and it could be felt reading my articles as well), and the gradually quickening pace of staircase-higher values proved the assessment right.

The daily volatility measure shows that a new phase started two days ago as the VIX has broken above its declining resistance line formed by the April and May tops. Another way to look at it would be to say that it had broken above its falling wedge (which is a bullish) pattern.

Similarly steep upswings have taken more time to play out, making it reasonable to expect some more volatility before things die down again. That's why I think that Friday's S&P 500 session will turn out a temporary lull and not the end of the correction at all.

Working out the excessive bullishness that accompanies local tops, would serve to build a base for the next upleg, and making a higher low would go a long way towards that. That's another reason why I'm not really looking for stocks to break below the 50% Fibonacci retracement as that would send kind of a different signal.

Having addressed the comment and gone into ratios, let's cover the credit market basics.

The Credit Markets' Point of View

High yield corporate bonds (HYG ETF) didn't move below Thursday's lows, but their daily downswings attracted fresh waves of selling in stocks nonetheless. The question still remains whether bonds are showing temporary strength or a local bottom in stocks being made - for the above reasons though, I think there's some more consolidation ahead in this asset class as well for the time being.

But the corporate grade corporate bonds (LQD ETF) hint that we better not expect too much of a downside move to happen still. Solidly trending higher, they're more resilient than their junk counterparts.

Key S&P 500 Sectors in Focus

Technology (XLK ETF) also broke to new local lows on Friday, and finished retracing a similar portion off Thursday's closing prices as the S&P 500 did. This can be taken as a sign that this leading sector isn't yet taking the index out of its slump, and that the correction is still likely to carry on.

Tech's sizable volume though shows solid buying interest, indicating that the scope for further downside is probably limited.

Healthcare (XLV ETF) doesn't paint as bullish a short-term picture. Having closed not too far above its Thursday's prices and on not-so-equivalent volume, shows that the sector is in rougher waters, relatively speaking.

Financials (XLF ETF) volume examination is similar to that of healthcare, but the price action is more bullish in a likewise short-term comparison.

Coupled with the broadly similar Friday performance in energy (XLE ETF), materials (XLB ETF) and industrials (XLI ETF), paints signs of short-term index stabilization, and gives neither the odds of a coiled S&P 500 spring ready to just jump higher, nor of another slump the next day.

The sectoral analysis implications are rather neutral, and I would rely more on the volatility, market breadth and especially credit markets here - I read their message as one favoring the consolidation still to go on before another upleg.

Summary

Summing up, the jury is still out on whether Friday's session brought us a local low or not, but the signs of short-term stabilization are apparent already. Still, the volatility examination shows that all the downside action might not be over just yet, despite the daily positive signals from the credit markets, smallcaps (IWM ETF) or market breadth. As a minimum in time, this correction has further to go before the selling pressure of Thursday's caliber and momentum can be deemed exhausted, and the S&P 500 ready for another run higher.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits. -

Stock Investment Update - Peek Under the Hood of the Great Bull Run

June 8, 2020, 7:39 AMWelcome to this week's Stock Investment Update.

Stocks shaking off whatever comes there way was the essence of my call - and with surprisingly strong non-farm payrolls, the fuse was lit. Rising relentlessly, they broke out of the bearish wedge to the upside. In today's article, I'll examine the bull run underway, and present you with a view of quite a few important markets. The growing realization that all the post-corona money printing, stimulus bills, will be hugely inflationary provides us profit opportunities as in the early stages of inflation, many benefit and few pay. Let's welcome them the with open arms.

S&P 500 in the Medium- and Short-Run

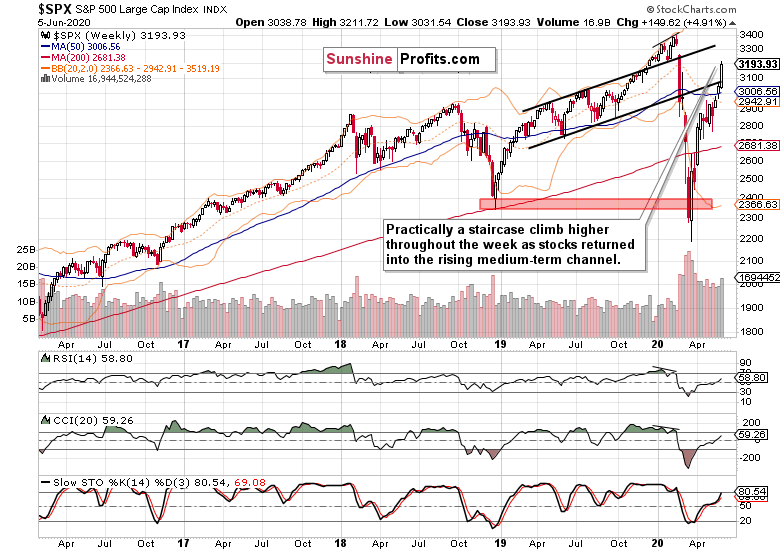

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

The bullish price action is impossible to miss. Respectful volume and a close near the weekly highs - what else can the stock bulls wish for? As prices reached the midpoint of the rising black channel, the weekly indicators still have room to grow before flashing amber.

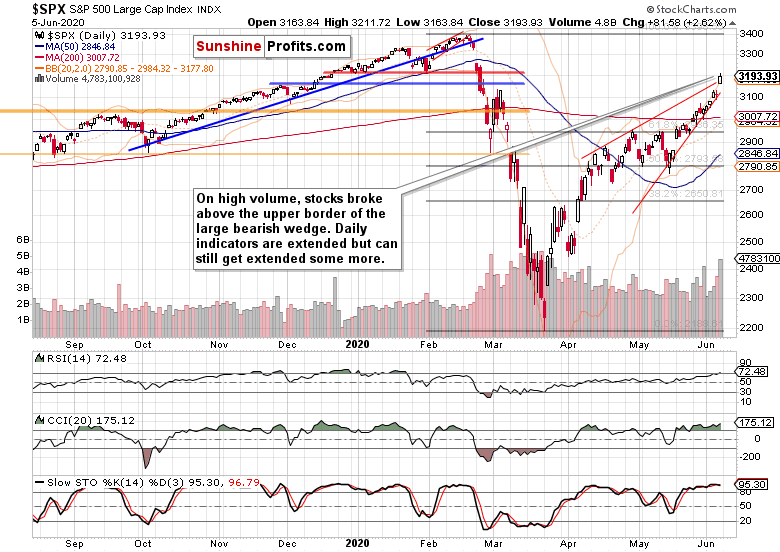

Friday's key development was the breakout above the upper border of the bearish wedge (thin red lines connecting April tops at its upper border, and May bottoms at is lower border). The move happened on the highest volume since the start of April, and on fundamentally positive news for the real economy. Is the party just getting started, or the fat lady is about to sing any moment now?

Let's recap the fundamentals. Friday's non-farm payrolls turning positive instead of merely decelerating as was the case with manufacturing and others recently, is a strong kick in the teeth for bears, because it shows that the worst of the corona crisis is likely behind the us. I wouldn't count on bad data over the summer as the US economy will go on filling the vacuum and repairing the damage sustained. Yes, it will take time, and stocks have been smelling that for quite a while - less bad will be the new good.

As the real economy goes on the mend, what has the power to derail it? A real flashpoint of contention between the US and China that the leaders don't back off from while denying each other the opportunity to save face. This doesn't seem likely to become a burning issue any time soon - the elections are far off, there's plenty of time still to play the China card.

The most likely candidate for turmoil generation is the next round of stimulus. The Fed will find it easier to expand its programs, but all the Treasuries to buy must come from somewhere. And if partisanship makes it difficult to pass the several trillion bill the market is looking for, then we have a problem. A short-term one but still.

How large, tailored and timely the fiscal stimulus would be, is a key risk factor for the coming weeks. Think the CARES Act extension et cetera - a misstep here, and we might be facing another unemployment surge (U3, U6 and I'm not even going into the participation rate) later in summer. Not throwing enough new money at the problems is precisely the risk Powell implicitly mentioned when the S&P 500 last declined to the 50% Fibonacci retracement.

So far though, the market is happy and getting more complacent. Some might even say salivating.

However, the key volatility measure, the VIX, is still above its late-February gap. It clearly has some more room to decline before even the bulls would get uncomfortable. As for now, stocks are well-positioned to overcome whatever short-term bump in VIX we see - and regardless of all the riots around, I think the setbacks wouldn't derail the bull. In other words, whatever choppy trading we get over summer (and we will get it), won't end the bull run.

The Credit Markets' Point of View

Despite renewed upswing, high yield corporate bonds (HYG ETF) aren't enjoying a totally smooth sailing. Wednesday's upper knot foretold Thursday's modest decline - and so could Friday's bearish candle. As the volume doesn't fit the reversal description, corporate bonds can take a breather, which would translate into a pullback for stocks. How worrying would that be?

Friday's bearish HYG candle is mirrored in its ratio to shorter-dated Treasuries. But neither this (HYG:SHY) or the other credit market health metric (investment grade corporate bonds to longer-dated Treasuries, LQD:IEI), seem willing to give up much of the latest sizable gains. Both look likely to recover fast, being primed for still more gains.

My key point regarding Treasuries on Friday, was that they're telling us that another push higher in stocks is likely. It indeed happened - take a look how both shorter- and longer-term Treasuries did that day.

The short-term ones kept not too far from their intraday lows, while the longer-dated ones staged an intraday reversal. I wouldn't read too much into it being a sign of lasting stabilization though.

These were my Friday's remarks about the rising yields in Treasuries as they relate to corporate bonds:

(...) I think that this marks the rush into riskier assets, a rotation underway, with the Fed remaining as an ever larger buyer in the Treasuries market, relatively speaking. Treasury yields will thus remain lower than they would have been absent the interventions, and the fiscal deficits will remain serviceable. Unless the bond vigilantes show up one day.

That's what financial repression looks like - everyone is happy, and only the pension funds and people living off fixed income can't get returns that would keep up with inflation. Sure, the outlook for TIPS is better than for other Treasuries, but I guess it's clear.

And it's the prospect of inflation that is working its way through the system, that drives the stock bull run as well. That's why the stock bull market has much higher to run - just think about all the money sitting on the sidelines in bond funds waiting to be deployed, still looking for the other shoe to drop and none is arriving...

Another subtle sign of the run into equities is that corporate bonds aren't likewise crashing or leading to the downside. Conversely, even the safest investment grade ones are holding value much better than Treasuries. And I've already covered the stronger showings of high yield corporate bonds over their safer counterparts.

Let's check the implications of the USD moves.

Given Friday's surprise, the bounce is disappointing. Sure, Thursday's declaration of the ECB's moves drove the common currency higher - and as the EUR/USD has the greatest weight in the USDX, it's felt.

But the key point is not any bigger or better ECB policy step. The greenback has been in a precarious position since the deflationary corona effects gave way to the stronger and stronger reflationary efforts. Reflecting that, I continue to think that the dollar will rather muddle through with a sideways-to-down bias over the coming months.

But this is not about the USDX as such, but about its influence on stocks. The key takeaway is that it won't be an obstacle to rising stocks regardless of the path it takes - down, sideways, or even a bit higher. This means that unless the dollar goes on the offensive, stocks won't come under significant selling pressure.

Inflation is coming, that's what the many asset classes are telling us. These were my parting thoughts on Thursday:

(...) Given the Fed's and fiscal measures taken (they're joined at the hip, because where would all the new Treasuries to buy come from if not from deficits?), the odds favor the Fed to keep at winning this reflationary game right now.

Good for stocks for they don't love many things more than money printing.

Key S&P 500 Sectors in Focus

Technology (XLK ETF) is taking on its February highs, and the only question appears to be how much of a resistance will these levels provide.

The pressure in healthcare (XLV ETF) is building up, and I think a move higher is merely a question of time.

Despite Friday's retracement of almost half of the sizable bullish gap, financials (XLF ETF) have more catching up to do, relatively speaking. As they work on the 200-day moving average, they'll overcome it regardless of the ominously looking latest daily candle on high volume.

Energy (XLE ETF) gapped higher, and extended gains. This is very bullish for the stock market advance.

The action in materials (XLB ETF) is looking even better for the bulls.

Despite the daily reversal, industrials (XLI ETF) defended practically all of their opening gains.

Nevermind that I said as little as about this stealth bull market trio (energy, materials, industrials) as I did. They're moving in symphony higher, no signs of making a top, which means that this bull market has much further to run.

Summary

Summing up, the bearish wedge in the S&P 500 was resolved with a sharp upswing. The weekly and daily charts highlight the bullish outlook, and credit markets including Treasuries support the rotation into stocks, and more buying power to come in from the sidelines. The sectoral performance remains conducive, and the strong showing of the early bull market trio (energy, materials and industrials) underscores that. Without the dollar under pressure and unlikely to stage more than a reflexive short-term bounce, stocks aren't likely to face a new deflationary headwind any time soon. But it's the debt markets' performance that is the cornerstone of my bullish outlook.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, I encourage you to sign up for my Stock Trading Alerts to also benefit from the trading action described - the moment it happens. The full analysis includes more details about current positions and levels to watch before deciding to open any new ones or where to close existing ones.

Thank you.

Monica Kingsley

Stock Trading StrategistSunshine Profits: Analysis. Care. Profits.

Free Gold & Stock Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM