Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Monday, crude oil lost 6.25% after OPEC didn’t agree to lower production on its Friday’s meeting. Additionally, a stronger greenback pushed the price of the commodity lower. In these circumstances, light crude broke below the barrier of $40 and declined sharply, hitting a fresh 2015 low of $37.50. Will we see further deterioration in the coming days?

Yesterday, crude oil declined sharply as OPEC decision to maintain current production levels at around 31.5 million barrels per day continued to weigh on investors’ sentiment. Additionally, Friday’s bullish job report (which showed that the U.S. economy added 211,000 jobs in the previous month, beating analysts’ forecasts) increased expectations that the Fed will hike interest rates at its upcoming meeting, which pushed the USD Index above 98, making crude oil more expensive for buyers holding other currencies. In this environment, light crude broke below the barrier of $40 and declined sharply, hitting a fresh 2015 low of $37.50. Will we see further deterioration in the coming days? Let’s examine charts and find out what can we infer from them (charts courtesy of http://stockcharts.com).

Quoting our Oil Trading Alert posted on Thursday:

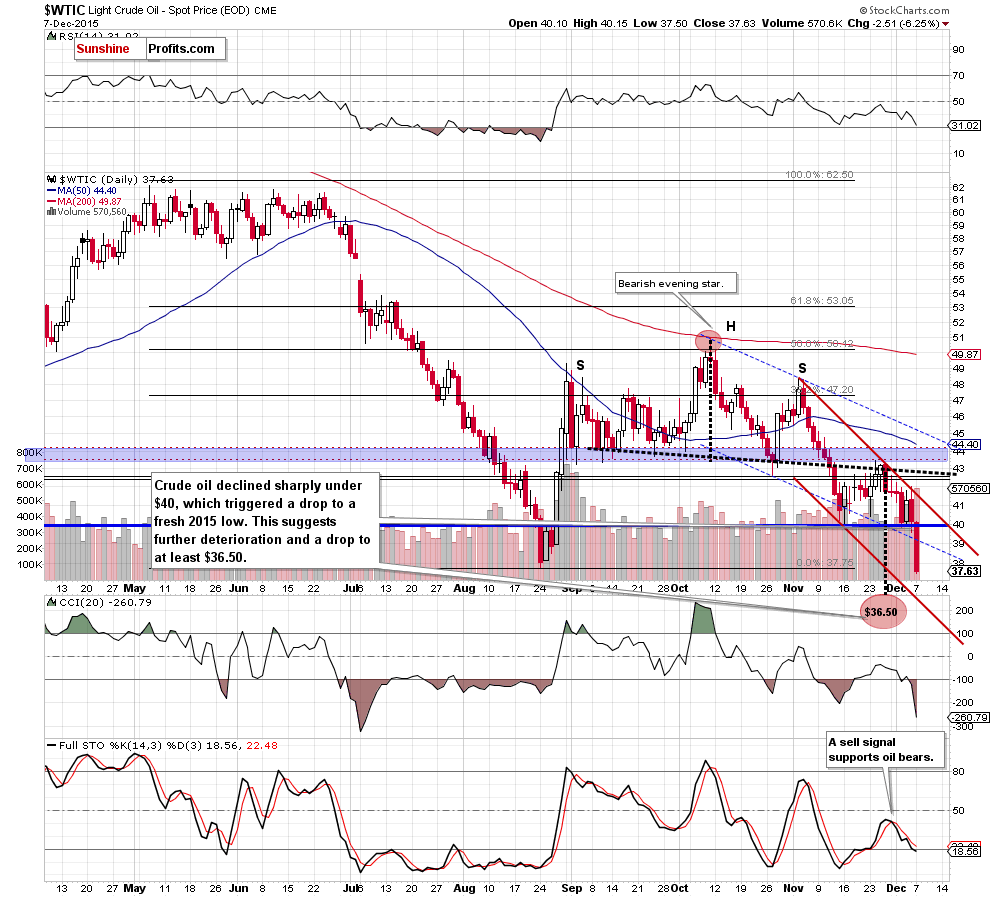

(…) we would like to draw your attention to a potential head and shoulders formation. As you see on the chart, last week’s upward move took light crude to slightly above the black dashed resistance line. Despite this improvement, oil bulls didn’t manage to push crude oil higher, which showed their weakness and resulted in an invalidation of the small breakout. As a result, light crude extended losses and slipped under $40 yesterday, which suggests that the bearish formation is underway. Therefore, in our opinion, if the commodity declines from here, we may see not only a test of the Aug low of $37.75, but also a fresh 2015 low (around $36.50, where the size of the downward move will correspond to the height of the formation).

Looking at the above chart, we see that oil bears pushed the commodity lower (as we had expected), which resulted in a breakdown under the barrier of $40. This negative event triggered a sharp decline, which took light crude below the Aug low. This is a bearish signal, which suggests that our next downside target (around $36.50, where the size of the downward move will correspond to the height of the head and shoulders formation) would be in play in the coming day(s).

Nevertheless, we should also keep in mind what we wrote on Friday, analyzing the weekly chart:

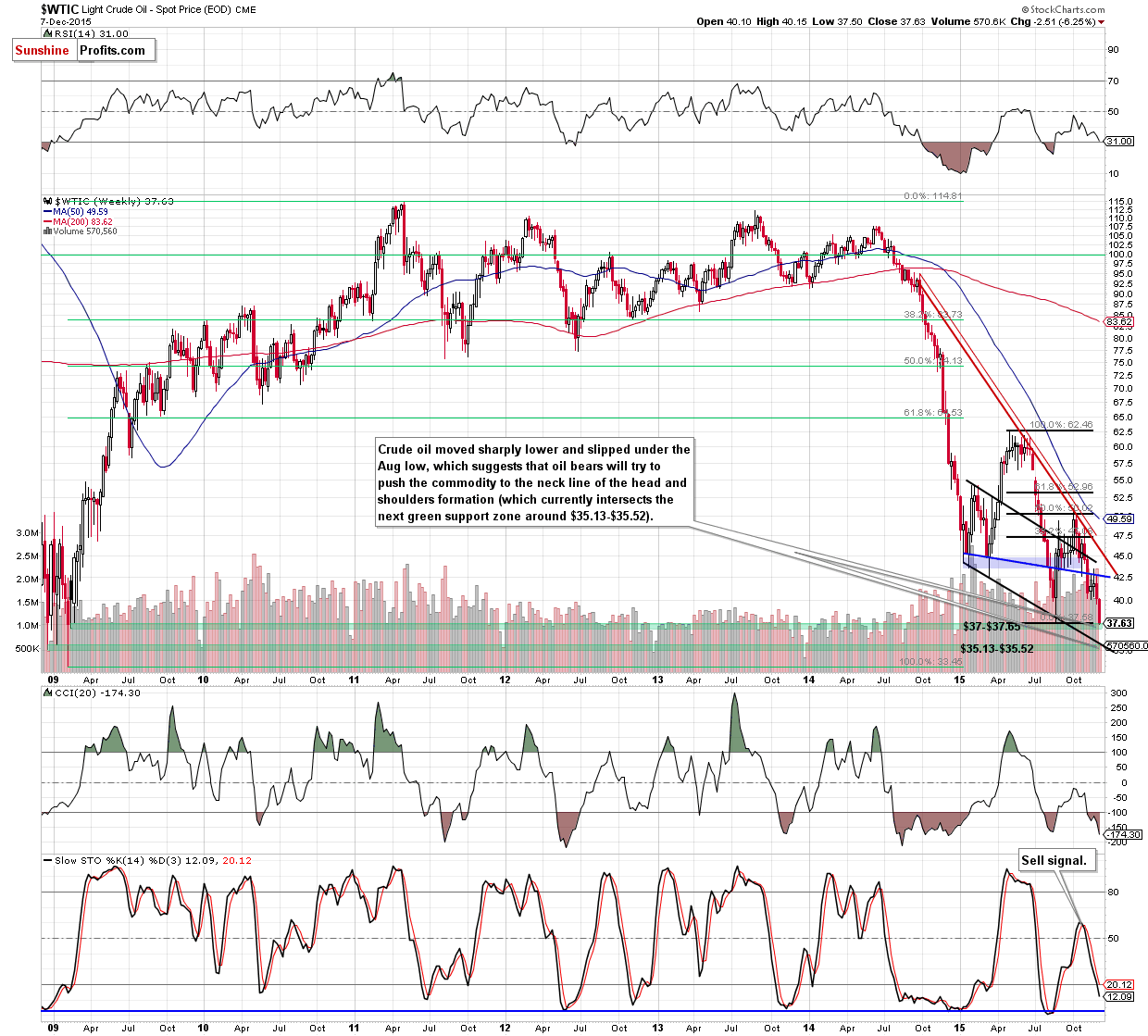

(…) crude oil remains in a consolidation (marked wih grey) under the key resistance zone. A potential breakdown under the lower line of the formation could bring not only a test of the Aug low, but also a fresh 2015 low around $35.35 (in this area the size of the downward move would correspond to the height of the formation).

Yesterday, we added:

(…) crude oil not only broke under the lower border of the consolidation, but also closed the previous week below it. This is a bearish signal, which suggests that our downside target from the previous alert would be in play in the coming week(s).

As you see on the weekly chart, Friday’s breakdown under the lower border of the consolidation triggered a sharp decline, which approached the commodity to the upper green support zone marked on the above chart. If it is broken, we’ll see further deterioration and a drop to the lower green zone around $35.13-$35.52. At this point, it is worth noting that in this area is also the neck line of the head and shoulders formation (marked with black), which could encourage oil bulls to act and pause the downward move.

Summing up, crude oil declined sharply and hit a fresh 2015 low, which suggests that further deterioration is more likely than not. Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts