Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Thursday, crude oil bounced off the barrier of $40 as a weaker U.S. dollar supported the price. In this environment, light crude erased around 50% of Wednesday’s decline and closed the day above $41. But did this increase change anything in the short-term picture of the commodity?

Yesterday, the European Central Bank cut its deposit rate to -0.3% from -0.20%. Despite this move, the bank left the main refinancing rate unchanged, which together pushed the euro sharply higher against the greenback. As a result, the USD Index invalidated earlier breakout above the barrier of 100 and lost almost 3 points, making crude oil more attractive for buyers holding other currencies. Thanks to these circumstances, light crude erased around 50% of Wednesday’s decline and closed the day above $41. But did this increase change anything in the short-term picture of the commodity? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Yesterday, we wrote the following:

(…) we may see not only a test of the Aug low of $37.75, but also a fresh 2015 low (…). Nevertheless, such price action will be more likely and reliable, if crude oil closes a day under the level of $40. Until this time, another rebound from current levels can’t be ruled out (similarly to what we saw in mid-Now).

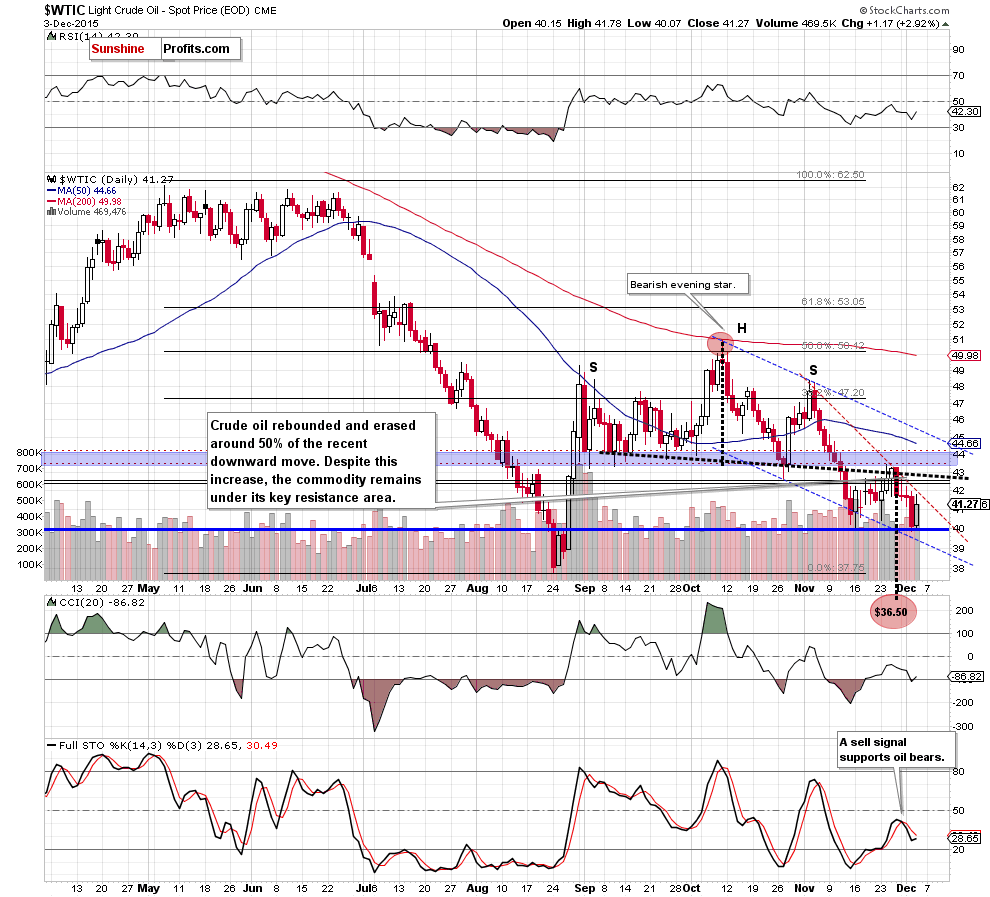

On the daily chart, we see that the history repeated itself (as we has expected) as crude oil reversed and bounced off the barrier of $40. With this upswing, light crude invalidated earlier small breakdown under the previous low and erased 53% of the recent downward move, approaching the Wednesday’s high and the red dashed declining line (based on the Nov 3 and Nov 27 highs). Despite this one-day rally, the commodity remains under its key resistance zone and sell signals generated by the weekly and daily Stochastic Oscillator remain in place, which suggests another attempt to move lower.

Having said that, let’s examine the weekly chart.

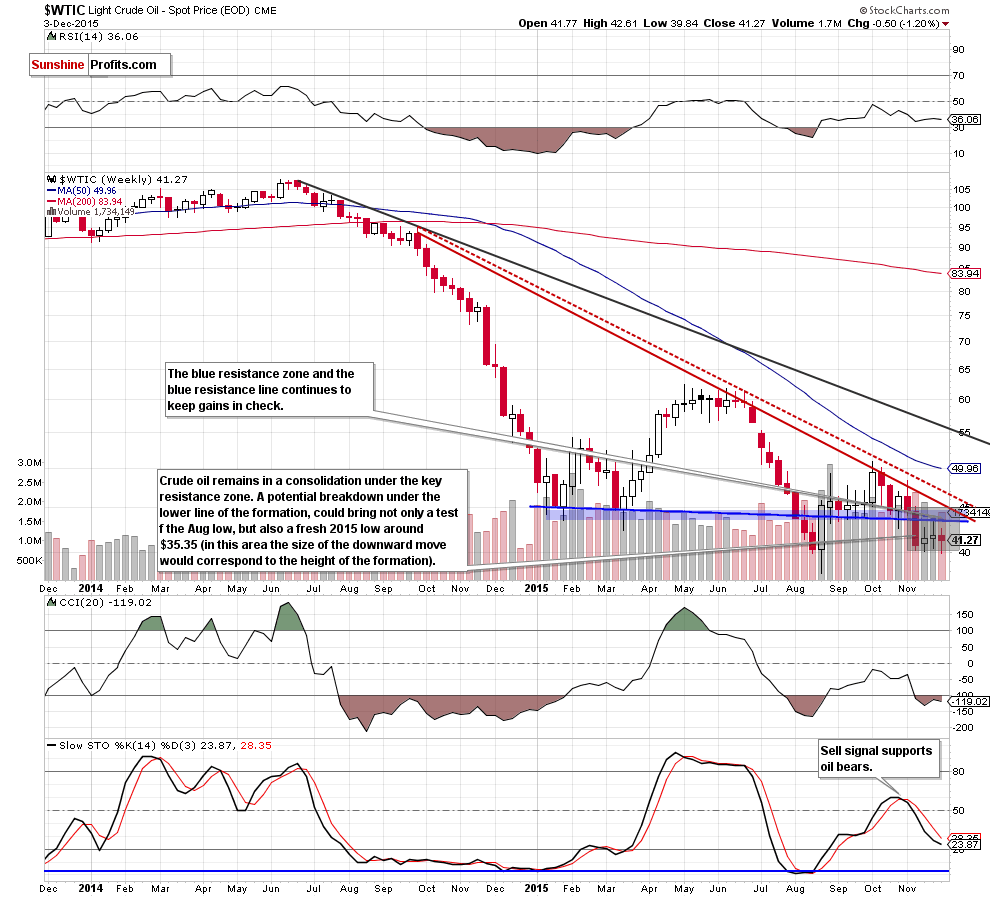

From this perspecive we see that crude oil remains in a consolidation (marked wih grey) under the key resistance zone. A potential breakdown under the lower line of the formation could bring not only a test of the Aug low, but also a fresh 2015 low around $35.35 (in this area the size of the downward move would correspond to the height of the formation).

Nevertheless, we should keep in mind that although oil bears have more technical factors on their side, today’s OPEC meeting in Vienna could bring surprising decisions. Although OPEC is largely expected to leave their production quota unchanged, there are rumors that Venezuela (the sixth-largest producer in the cartel) will propose a 5% reduction in overall output. Any production cuts could tighten a wide supply-demand gulf and push the price of the commodity higher. Therefore, taking into account the uncertainty around today’s meeting high volatility later in the day is very likely.

Summing up, crude oil invalidated a small breakdown under the barrier of $40, which triggered a sharp rebound in the following hours. Despite this increase, the commodity remains under its key resistance zone, which suggests that lower values of the commodity are still in play. Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts