Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Wednesday, the commodity lost 3.72% after bearish EIA weekly report, which showed a bigger-than-expected increase in domestic crude oil inventories. Thanks to these circumstances, light crude moved sharply lower and slipped under the barrier of $40 for the first time since Aug. Is it enough to trigger further declines?

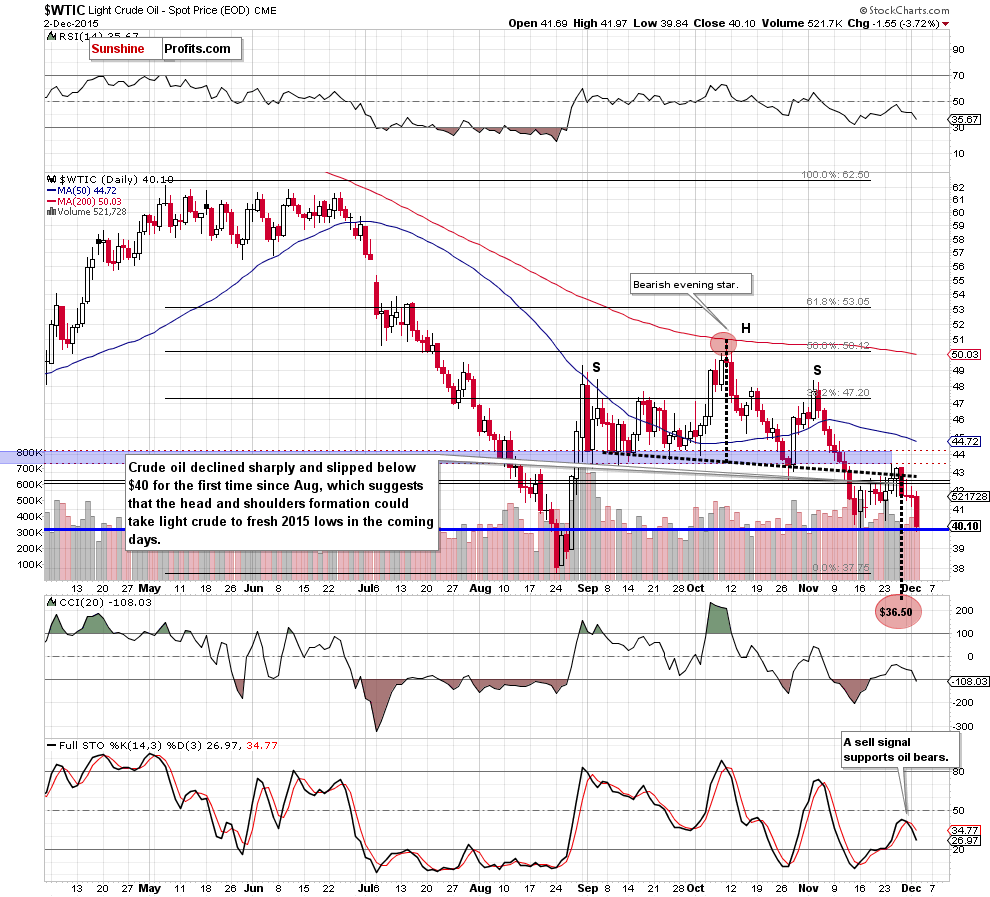

Yesterday, the U.S. Energy Information Administration reported that crude oil inventories increased by 1.177million barrels in the week ending on Nov. 27. Additionally, gasoline inventories rose by 0.135 million barrels, while distillate inventories jumped by 3.051 million barrels. Thanks to these bearish numbers, light crude oved sharply lower and slipped uner $40 for the first time since Aug. Is it enough to trigger further declines? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Quoting our Monday’s alert:

(…) the commodity invalidated a small breakout above the black dashed resistance line and erased all Wednesday’s gains, which is a strong negative signal that suggests further deterioration in the coming week (even if oil bulls will try to re-test the key resistance area once again). If this is the case, and light crude declines from here, we’ll see another test of the barrier of $40 in near future.

From today’s point of view we see that the situation developed in line with the above scenario and crude oil reached our initial downside target. At this point, it is also worth mentioning that the commodity slipped to an intraday low of $39.84, which was the first drop under the barrier of $40 since late Aug. In our opinion, this is a bearish signal, which suggests that further declines are just around the corner – especially when we factor in sell signals generated by the daily and weekly Stochastic Oscillator. On top of that, the size of volume that accompanied yesterday’s drop was huge, which confirms oil bears’ strength, indicating lower values of the commodity.

Finishing today’s alert we would like to draw your attention to a potential head and shoulders formation. As you see on the chart, last week’s upward move took light crude to slightly above the black dashed resistance line. Despite this improvement, oil bulls didn’t manage to push crude oil higher, which showed their weakness and resulted in an invalidation of the small breakout. As a result, light crude extended losses and slipped under $40 yesterday, which suggests that the bearish formation is underway. Therefore, in our opinion, if the commodity declines from here, we may see not only a test of the Aug low of $37.75, but also a fresh 2015 low (around $36.50, where the size of the downward move will correspond to the height of the formation).

Nevertheless, such price action will be more likely and reliable, if crude oil closes a day under the level of $40. Until this time, another rebound from current levels can’t be ruled out (similarly to what we saw in mid-Now).

Summing up, the most important event of yesterday’s session was a drop under the barrier of $40. Although the commodity reversed and closed the day above it, such price action suggests that oil bears are getting stronger (especially when we factor in the size of volume that accompanied yesterday’s decline) and lower values of the commodity are just around the corner (even if we see a rebound from here in the coming days). Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts