-

Crude Oil: Rising on Election Day

November 3, 2020, 12:25 PMCrude oil declined yesterday in the first part of the session, but before it was over, it rallied back up, forming a quite significant reversal as a result. That’s bullish, and it was followed by a pre-market upswing – at least so far today.

So, did this nullify the previously bearish comments? Well, only some of them, which means that overall, the outlook remains bullish in any case.

You see, given the pre-election tensions, it’s no wonder that markets are correcting their preceding moves. We can witness similar developments in the USD Index, U.S. stock market, and even in the case of the precious metals sector.

In particular, the corrective nature of the current move lower in the USD Index is clear.

In yesterday’s Gold & Silver Trading Alert, I wrote that I wouldn’t be surprised to see a corrective move lower that would trigger a brief move higher in the precious metals and mining stocks. I also wrote that such a move would only be temporary, and that it probably won’t last more than several days.

That’s what we see – it’s not a game-changer, but a relatively normal uncertainty-based phenomenon.

Therefore, even though yesterday’s action might seem to be a short-term game-changer, in the pre-election environment, it doesn’t seem that reliable. Consequently, my yesterday’s comments remain up-to-date:

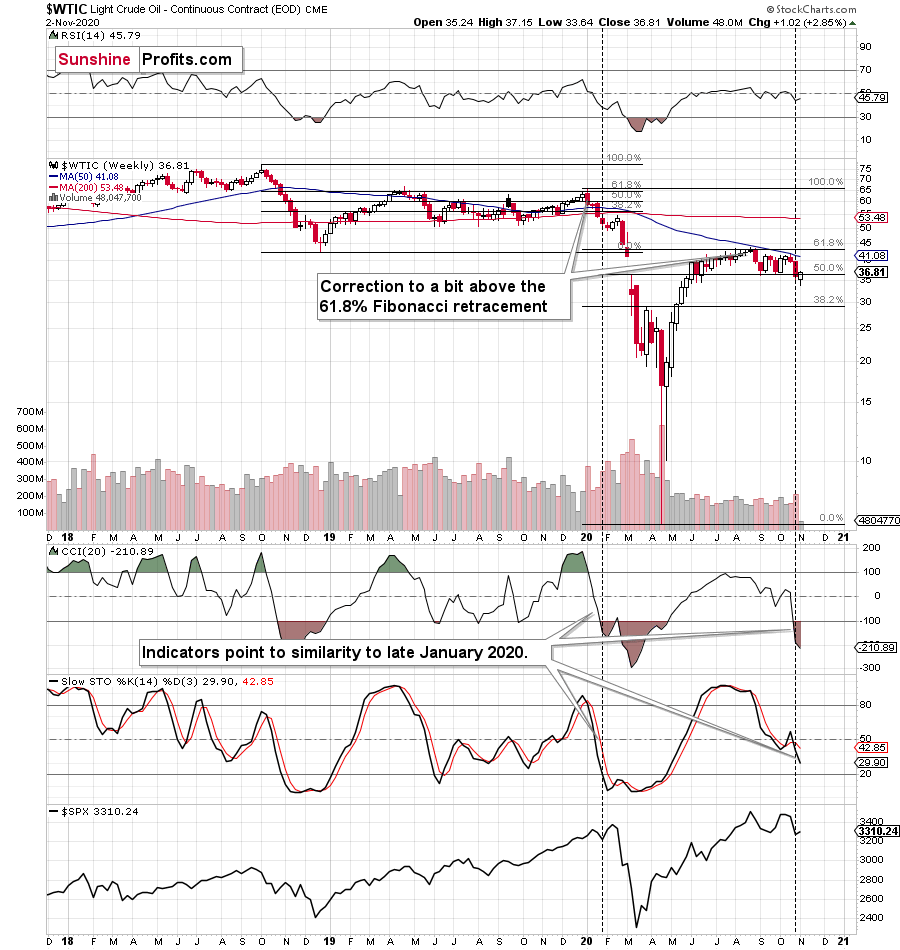

First of all, crude oil stopped rallying after correcting approximately 61.8% of the previous 2020 decline, which means that it was quite likely a real top instead of a fake one that will be broken shortly.

Second, the initial decline was followed by a zigzag, which is a classic corrective pattern. Since the preceding move lower was to the downside, the end of the correction insinuates another decline.

Third, the Stochastic indicator is on a sell signal.

Finally, it’s all similar to what we’ve witnessed in Q1 2020, not just the breakdown in crude oil, but the fact that it had first corrected slightly above the 61.8% of the preceding decline and that stocks were forming a double-top pattern.

Of course, we’ll be aware of the final point (stock’s double top) only after they decline further. However, the shape of the price moves (lower part of the above chart) is already similar.

Furthermore, the Covid-19 cases are soaring once again as well. Even though the fear of the unknown is not present this time, the scale of the phenomenon is much greater, and thus, the emotional reaction is also getting more serious. The charts above reflect that perfectly. Just as it was the case in January and February, crude oil is the first to show weakness, but it’s definitely not the last to do so.

The USD Index has already confirmed its breakout and is rallying almost daily, so things do really look like they did in the first quarter of the year.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish (not necessarily for the several hours – few days).

Today's premium Oil Trading Alert includes details of our profitable trading position, which became such as soon as we entered it. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief -

Determining the Next Big Move

November 2, 2020, 7:58 AMCrude oil started this week with a bearish price gap and a breakdown below the September and October lows. This is an extremely valuable indication. The black gold seems to have finally decided what the next big move is going to be, and by breaking lower, it effectively “agreed” with our expectations.

On its own, the breakdown is very bearish. However, what preceded is equally important, as it shows that this move has much more potential than just a few-dollar drop.

First of all, crude oil stopped rallying after correcting approximately 61.8% of the previous 2020 decline, which means that it was quite likely a real top instead of a fake one that will be broken shortly.

Second, the initial decline was followed by a zigzag, which is a classic corrective pattern. Since the preceding move lower was to the downside, the end of the correction insinuates another decline.

Third, the Stochastic indicator is on a sell signal.

Finally, it’s all similar to what we’ve witnessed in Q1 2020, not just the breakdown in crude oil, but the fact that it had first corrected slightly above the 61.8% of the preceding decline and that stocks were forming a double-top pattern.

Of course, we’ll be aware of the final point (stock’s double top) only after they decline further. However, the shape of the price moves (lower part of the above chart) is already similar.

Furthermore, the Covid-19 cases are soaring once again as well. Even though the fear of the unknown is not present this time, the scale of the phenomenon is much greater, and thus, the emotional reaction is also getting more serious. The charts above reflect that perfectly. Just as it was the case in January and February, crude oil is the first to show weakness, but it’s definitely not the last to do so.

The USD Index has already confirmed its breakout and is rallying almost daily, so things do really look like they did in the first quarter of the year.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish.

Today's premium Oil Trading Alert includes details of our profitable trading position, which became such as soon as we entered it. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief -

Progressively Bearish with Each Passing Day

October 30, 2020, 1:52 PMAvailable to premium subscribers only.

-

Declining Further in Spite of Rather Stable S&P 500

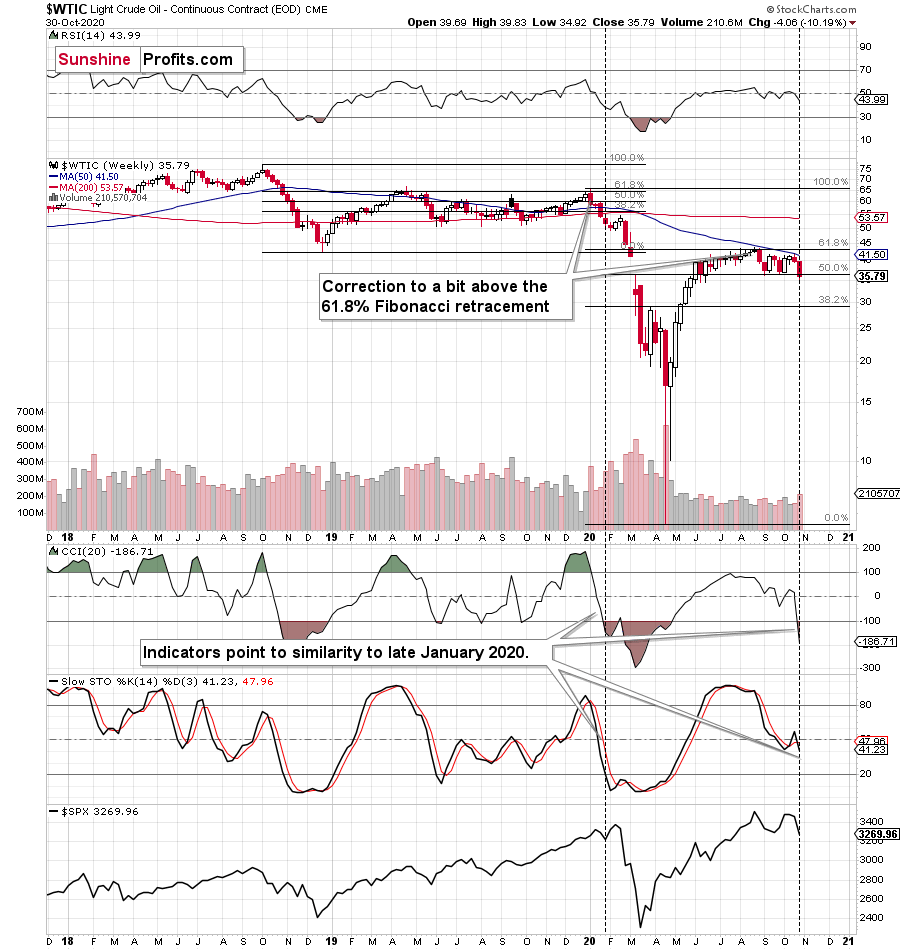

October 29, 2020, 12:59 PMUnder our current and previous expectations, and entirely in accord with our existing trading position, crude oil is declining. In today’s pre-market trading, the big news is that the black gold price moved below the previous September and October lows.

The crude oil price topped on October 20th and it’s been declining ever since. The move below $36 makes our trading positions more profitable, but what is interesting about this breakdown is that it indicates the beginning of a more significant lower move.

In the preceding days, crude oil declined along with the U.S. stock market, but oil is down again in today’s pre-market trading, even though S&P 500 futures are relatively flat. This underperformance of oil is extremely bearish, especially since it makes the current situation similar to what we’ve witnessed in March. Back then, crude oil also showed exceptional weakness.

To summarize, for the upcoming weeks, the outlook for crude oil stays bearish, and the most recent upswing did not change that at all. Moreover, based on the completion of the zigzag pattern, the odds are that the correction in crude oil is already over.

Today's premium Oil Trading Alert includes details of our profitable trading position, which became such as soon as we entered it. Interested in more exclusive updates? Join our premium Oil Trading Alerts newsletter and read all the details today.

Thank you.

Nadia Simmons

Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Free Gold & Oil Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts

+ Mining Stock Rankings

Gold Alerts

More-

Status

New 2024 Lows in Miners, New Highs in The USD Index

January 17, 2024, 12:19 PM -

Status

Soaring USD is SO Unsurprising – And SO Full of Implications

January 16, 2024, 8:40 AM -

Status

Rare Opportunity in Rare Earth Minerals?

January 15, 2024, 2:06 PM