Briefly: in our opinion, full speculative long positions (150% of the regular position size) in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. In our view, no positions in gold or silver are currently justified from the risk to reward point of view. We expect to change our position soon (very likely this week).

In this week's flagship Gold & Silver Trading Alerts, we explained why the medium-term outlook for the precious metals market remained very bearish, but at the same time that it was bullish in the short term. We made multiple points that confirmed this scenario. Indeed, the precious metals market moved higher this week.

The rally was huge, especially in gold, which regained much of its previous declines. Silver rallied as well, while miners also moved higher, but this time, they didn't magnify gold's gains. Why didn't they? Most likely, because miners' performance was very closely linked with the performance of the general stock market, and the latter just started to rally yesterday.

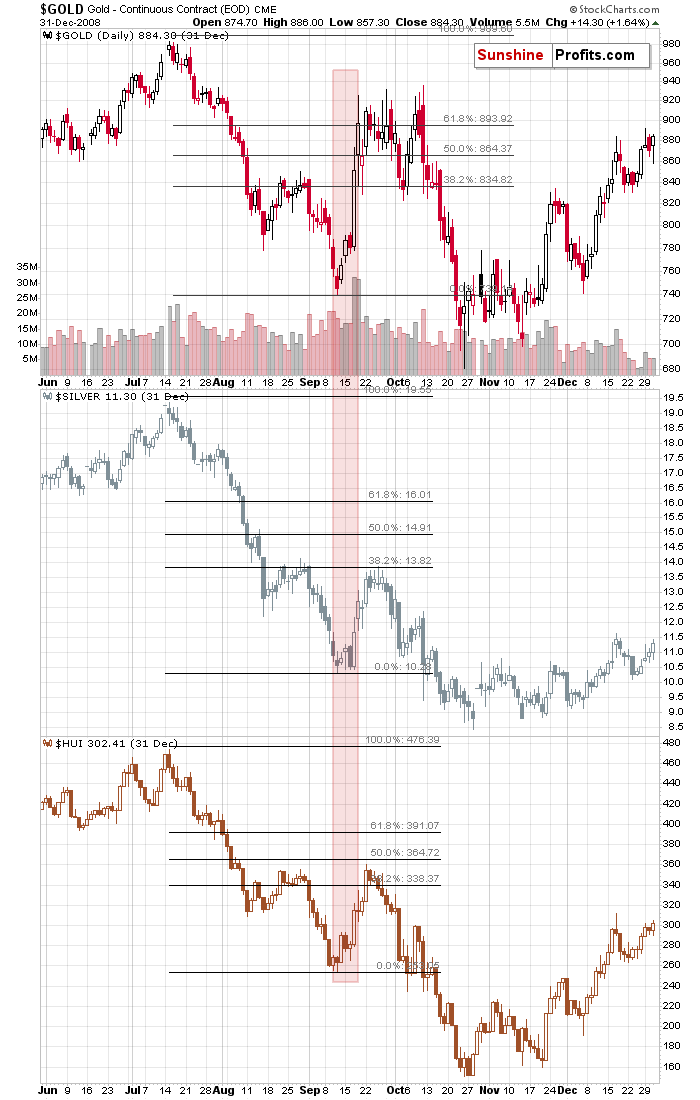

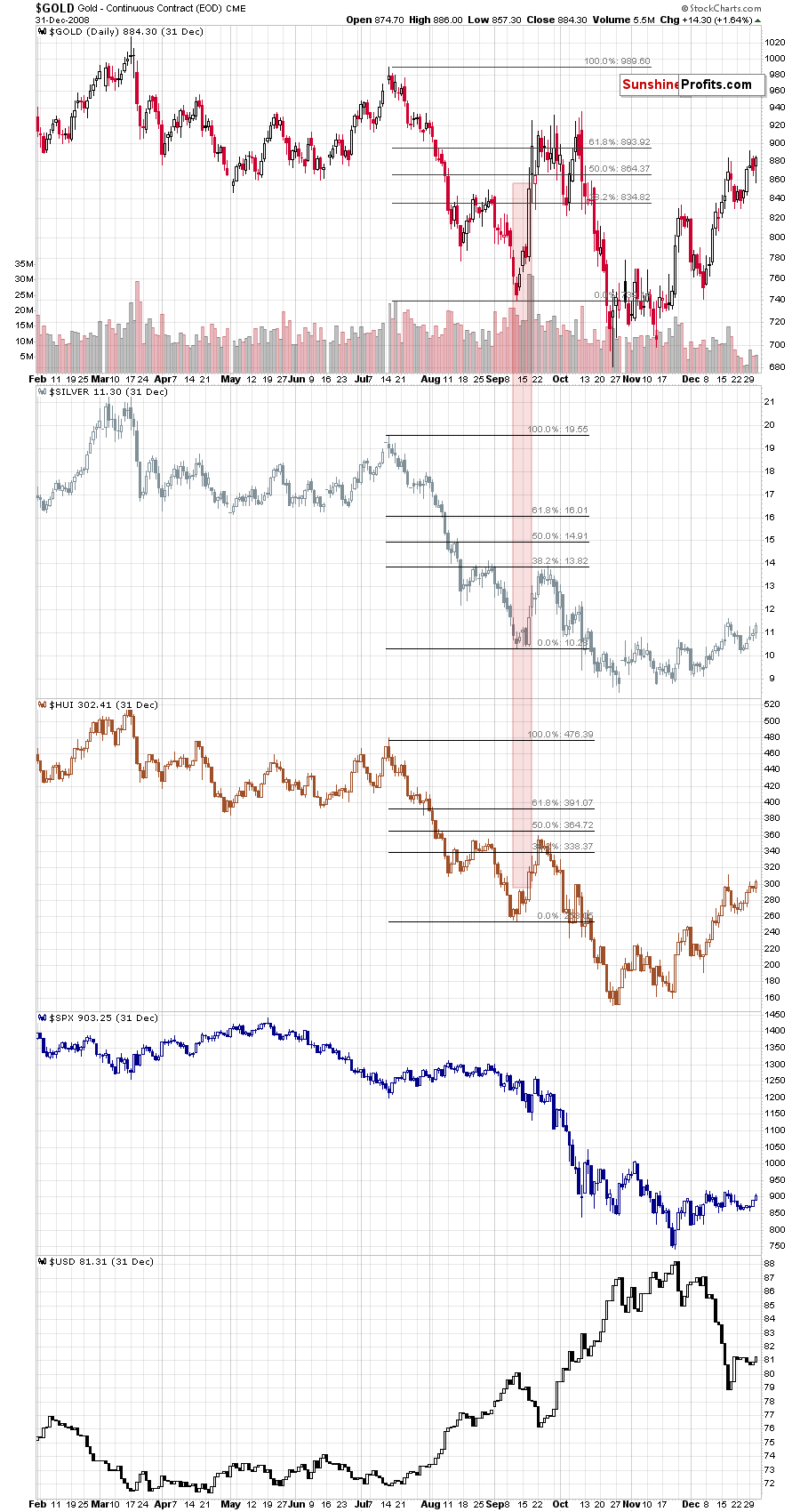

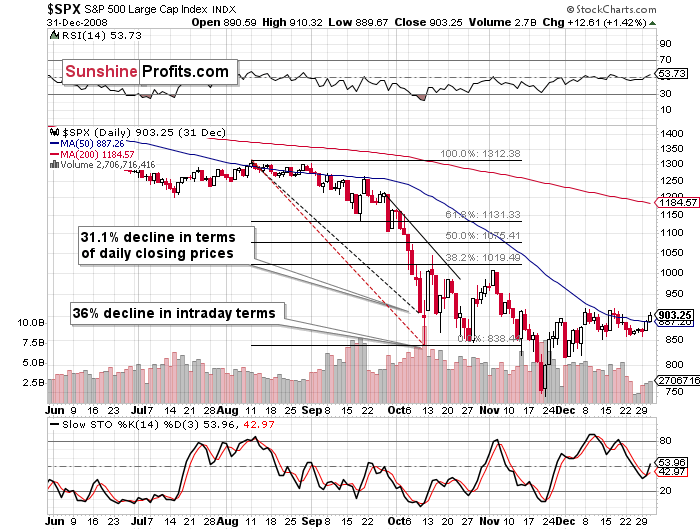

What's next? The situation is very similar to 2008 in terms of price moves and in terms of the underlying situation (significant stimulus that is unlikely to succeed anytime soon), so the history is likely to repeat itself to a considerable degree.

We wrote about this year being 2008 on steroids and this certainly remains to be the case based on new developments. The price moves are just as big, similarly big, or bigger, and they are even faster.

We know that much more is just around the corner, and it's going to become obvious quite fast. This means that the current rebound is also likely to be very fast.

Let's compare the 2008 and 2020 performance of gold once again, this time focusing on the aspect of time.

The 2008 and 2020 Comparisons

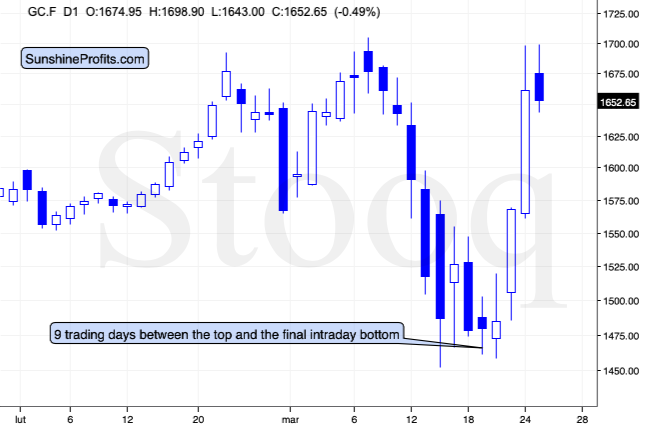

It took 9 trading days for gold to decline from its top to the final intraday bottom, before starting the powerful comeback.

In 2008, it took 41 days. It seems that things are developing about 4.5 times faster now, than they were developing in 2008. More precisely: 41/9 = 4.56 times.

Please note that the decline that preceded the sharp upswing in gold, is also somewhat similar to what we saw recently. There was an initial slide in gold that ended in mid-August 2008, then we saw a correction and then another slide and a bottom in early September. This year, we saw an initial bottom in mid-March, and the final one a few days ago.

Back in 2008, it took 23 trading days for gold to reach its initial bottom and it then took another 18 days for the final short-term bottom to form. 56.1% of the downswing was to the initial bottom, and the 43.9% of the downswing was between the initial and final bottom.

And now? It took 5 out of 9 trading days for gold to reach the initial bottom, and the remaining 4 days were the time between the bottoms. That's 55.6% and 44.4% respectively.

This is very important, because it shows that the shape of the move is indeed very similar now.

This means that we can most likely draw meaningful conclusions for the current situation based on how the situation developed back in 2008.

Back then, gold moved back and forth close to the initial top. That's what gold has been doing so far today - which serves as another confirmation for the analogy.

Back in 2008, gold topped over the period of 16 trading days. Dividing this by 4.56 provides us with 3.5 days as the target for the end of the topping pattern since its start. The pattern started yesterday, which suggests that gold could top tomorrow or on Friday.

The situation gets more interesting as we dig in more thoroughly...

There are 24 hours in a day. Dividing this by the factor of 4.56 provides us with 5.26. This means that if we could create a chart with 5.26 hour candlesticks, the price moves in gold should be analogous (in terms of how we see them on the chart) to their daily performance from 2008. The closest that we have available are the 4-hour candlesticks.

Let's check how gold performed recently from this perspective, and compare it to its daily performance from 2008.

The price moves are remarkably similar.

Even the March 17, 2020 upswing took gold to analogous price level! Gold temporarily topped very close to the previous (Feb 28) low. That's in perfect analogy to how high gold corrected in late August 2008 - it moved up to the early May 2008 high.

The link to 2008 truly is the key right now.

Ok, so when are silver and miners likely to top?

Sooner than gold.

Please note that both: silver and mining stocks topped more or less in the middle of gold's topping formation... Which suggests that they should be topping today.

And for the final confirmation - please take a look at what the stock market and the USD Index have been doing at that time. The USD Index was within a pullback while the stock market formed a very short-term upswing. Silver and miners topped along with the stock market.

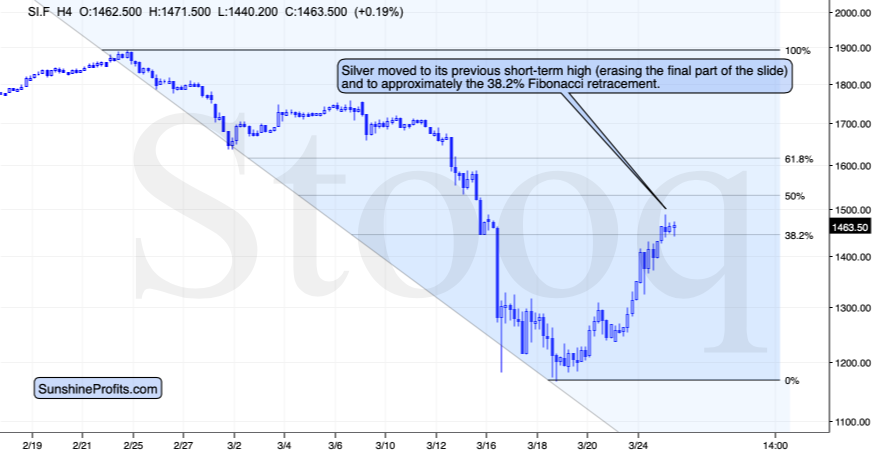

Silver just moved to its previous short-term high (a small high, but the one that preceded the final part of the decline) and it's approximately at its 38.2% Fibonacci retracement.

That's exactly where silver topped in 2008. Back then the analogous high was the late-August high, and it also topped close to its 38.2% Fibonacci retracement.

We are probably looking at a top in silver right now.

This means that miners are likely to top today as well.

Talking of miners, they moved higher yesterday, but not as high (in relative terms) as gold. We already explained why this was most likely the case yesterday, but it seems worth quoting this explanation (along with yesterday's charts) as it remains important also today:

Gold is already up in a big way and the only thing preventing gold miners from soaring was the declining stock market. The stock market is likely to rally not only based on yesterday's Fed bazooka, but also based on the new stimulus money that are likely to be approved shortly - quite likely today.

In fact, it's already moving higher in today's pre-market trading (S&P 500 futures).

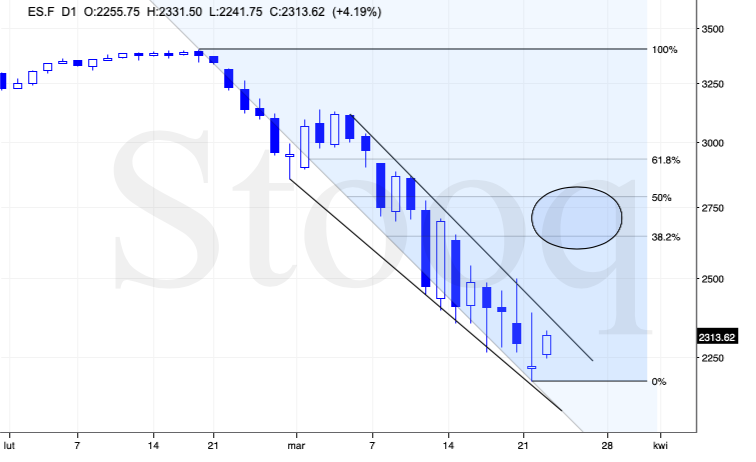

The Lessons from the Stock Market

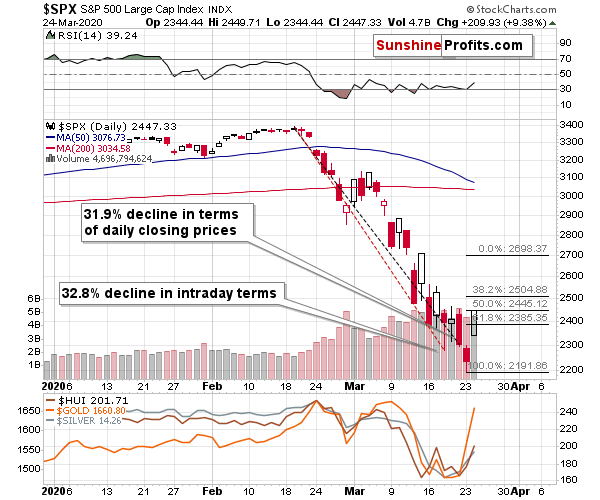

The minimum upside target for stocks is the 38.2% Fibonacci retracement level, which is about 400 index points higher. That will be the easy part of the upswing. During the 2008 slide stocks didn't correct much more than that, so we might to see a bigger upswing this time. Then again, the stimulus is bigger this time, so perhaps the quick rally will also be bigger. In our view, it's most justified from the risk to reward perspective to assume that stocks will move to the 38.2% Fibonacci retracement. This level is at about 2650.

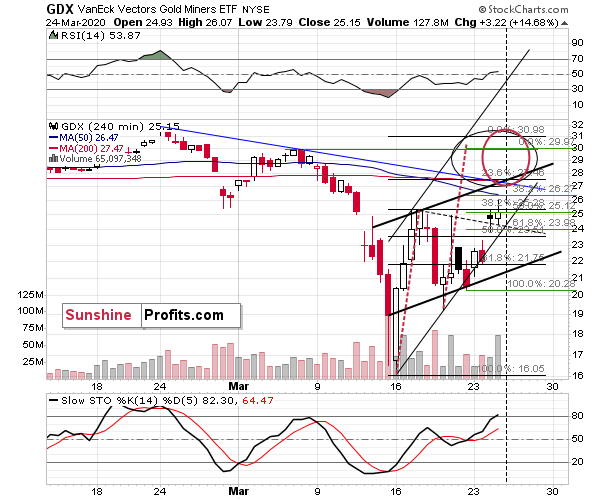

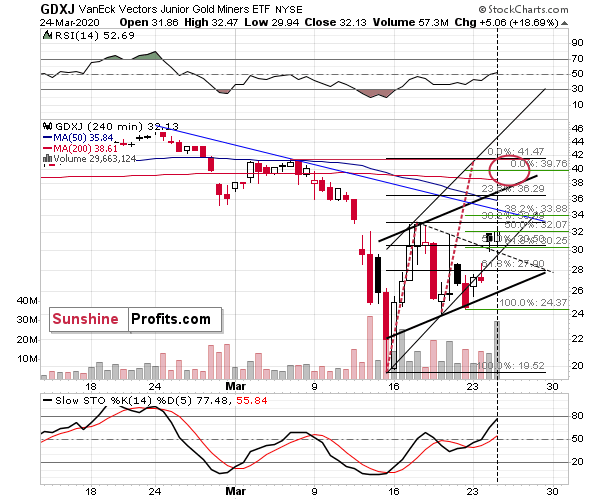

Now, what does this imply for the GDX and GDXJ?

It implies big gains.

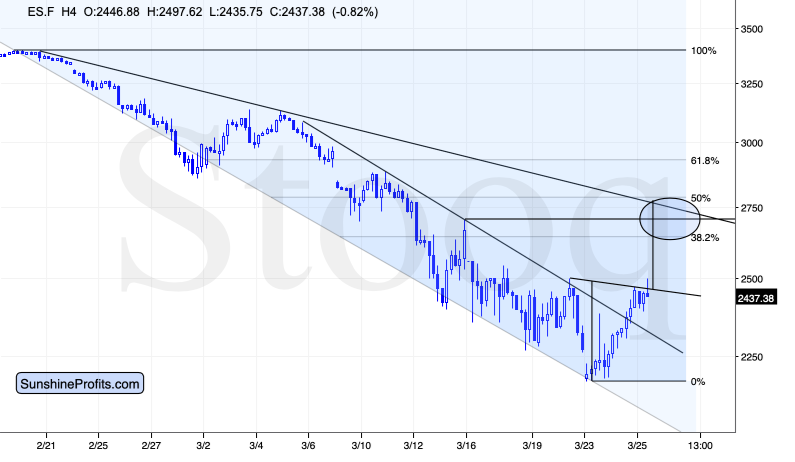

Now, the S&P 500 futures are already after a breakout above the declining resistance line and a quick consolidation. Naturally, this is bullish for the very short term.

This consolidation along with the most recent moves down and up appear to have created a bullish cup-and-handle formation. The size of the cup is what is likely to be repeated after the breakout. In case of the next several hour - few days, this implies a move to the declining resistance line and the 50% Fibonacci retracement.

This is definitely how high the stock market could rally before topping, but the easiest part of the upswing (easiest to trade - most likely to take place) is before the 38.2% Fibonacci retracement. It seems that the S&P 500 will top between approximately 2650 and 2800.

What could be the trigger for such a rally right now? Well, we already saw the trigger - it was the breakout above the declining trendline. However, on the news front, the market just got a major boost because the $2T stimulus package was just approved.

Ultimately, it will not prevent people from dying from Covid-19 and the markets are still likely to plunge in the following weeks, but the short-term focus is likely to be on the above stimulus.

Which brings us to yet another 2008 analogy. In stocks.

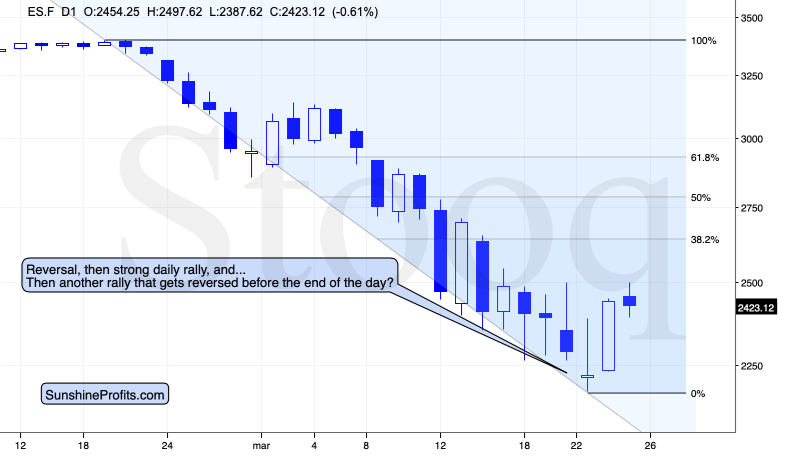

In 2008, the sharpest short-term decline that's similar to what we saw recently, ended with a sizable reversal - and we saw the same thing right now.

The S&P 500 futures reversed on Monday, and they rallied significantly on Tuesday. If the analogy continues, today would be the day on which stocks rally to or a bit above the 38.2% Fibonacci retracement and reverse the course before the end of the day. And... That could be it as far as the rally on the stock market is concerned.

Stocks already formed a reversal, but they did so without reaching the 38.2% retracement, so it seems that the rally is not over yet.

All this means, is that something profound is likely to happen today - we are quite likely to see a local top. Perhaps in stocks, but much more likely in silver and mining stocks, as the above is confirmed also by their individual analogy that we described earlier today.

In yesterday's analysis, we wrote that miners (GDX and GDXJ) would be likely to rally up to their March highs before topping, and this remains up-to-date also today. If stocks double their most recent rally (in terms of the closing prices), they will rally to about 2700, which seems quite realistic given what we already wrote today.

Let's check what happens if GDX and GDXJ double their most recent upswings. We're marking this with green Fibonacci lines.

In case of the GDX ETF, this technique provides us with exactly the March high as the target. In case of the GDXJ ETF, this technique provides us with a target slightly below the March high. Still, in case of the GDXJ, the Fibonacci extension based on the very first part of the upswing points to the March high as the target. This is also the target based on the repeat of the initial upswing in percentage terms. Consequently, we think that both ETFs are likely to rally up to their March highs before topping.

Our binding profit-take orders are strategically placed a bit below these levels to greatly increase the odds of exiting the trade. We will confirm entering the short positions manually, but it's quite likely that we will be entering them later today.

The big profits on this trade are most likely going to become enormous. And the total 2020 profits so far - unbelievable.

Before summarizing, we would like to reply to two questions that we received recently:

The first question is about the tightness of the silver market. The silver futures price is low, but the silver coins and bullion bars trade at much higher prices and the dealers' inventory is often sold out.

In short, it's a matter if availability of a particular investment product.

There's a lot of silver produced as a by-product in copper miners and also in other mining, which means that the supply will be there even if silver price declines.

On the other hand, there are very few silver bullion coins / bars available as they were sold out. This makes the premiums on these investment products very high right now. Just because silver is produced, it doesn't mean it can be instantly available in the form of coins or bars.

It was practically the same thing when silver declined in 2013. Then, after some time, the bullion prices moved lower. The current tightness of the physical market does not indicate that the declines in the silver price are over.

The question could be if the physical market manages to catch up with lower silver prices before the decline is over, and that would be a question to which we wouldn't have a good answer. It's not clear how the dynamics will work, but our best guess is that the bullion prices will decline, but they won't match the ones in silver futures within the next several weeks. The premiums will likely decline somewhat (perhaps by half or third), but they will still be relatively high.

This means that using physical bullion as an investment vehicle right now (while being much safer) to go long also means missing out on a quite visible chunk of the possible profitability. After all, an investment's success is not only about selling high, but also about buying low. The premiums will still be there when silver is trading much higher, but it's more important how much of the final price depends on the premium.

Let's say that silver futures price is at about $10 and the premium is $5. And after a few years, silver is at $100, and the premium is still at $5. Those buying investment vehicles with low or negligible premium would profit by 900% (100 / 10 - 1), while those who invested in the product with a premium would profit by 600% (105 / 15 - 1). The profits would be 1.5 bigger just because there was no premium in a given investment vehicle.

Of course, this does not mean that one shouldn't own any gold or silver as insurance in the physical form. One should. In fact, we've been writing about that in practically all our Gold & Silver Trading Alerts (yes, there's an "Insurance" capital below "Trading" and "Long-term Investment" below the summary). It means, however, that as far as other types of capital are concerned, it makes sense to consider also other forms of investment.

The second question was about spot prices. We get data in terms of futures, not spot prices, so that's what our analyses provide. Spot gold price is currently about $40 below the futures price and spot silver price is currently about $0.20 below the futures price. It might change, though. While our analyses and target prices focus on futures prices, please note that both the futures and the spot prices are likely to top and bottom at the same time (at least in case of major and average moves), so the timing of entry and exit moments will be analogous in almost all cases. This means that our analyses are also useful for anyone operating in terms of spot prices.

Summary

Summing up, the rally in the corrective upswing in the precious metals market is well underway, and as we warned, it is indeed sharp. It seems that we will see the next local top in the mining stocks shortly - likely within the next several hours. We might have already seen the tops in gold and silver. Gold might not start its decline until tomorrow or Friday, but both silver and miners could slide sooner, especially if the stock market declines after topping - perhaps even today.

Our binding profit-take orders are strategically placed a bit below the March highs to greatly increase the odds of profitably exiting the trade. We will confirm entering the short positions manually, but it's quite likely that we will be entering them later today.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time. Please contact us, if you'd like to take advantage of this offer.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative long positions (150% of the full position) in mining stocks (but not in gold nor silver) are justified from the risk/reward perspective with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $28.68; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the NUGT ETF: $11.98; stop-loss for the NUGT ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $39.47; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JNUG ETF: $9.48; stop-loss for the JNUG ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager