Briefly: in our opinion, full (250% of the regular size of the position) speculative short position in gold, silver, and mining stocks is justified from the risk/reward perspective at the moment of publishing this Alert.

Gold soared on the possible escalation of trade wars. We have more than 2 weeks before the announced tariffs would come into effect, but since the markets are forward looking, they already discounted this in price. The general stock market fell, while gold and gold miners rallied sharply. Gold even managed to rally back above the neck level of the previously completed head-and-shoulders pattern. Moreover, gold moved above the declining resistance line based on the 2019 tops at the same time. The volume on which it all happened was huge - the biggest daily volume on which gold rallied so far this year. How bullish has the situation really become for the short run?

Barely. Yes, it might seem weird that such a combination of factors didn't change much, but this is really the case. First of all, the only changes were of short-term nature. All the long- and medium-term factors continue to favor lower PMs prices in the following months. For instance, the gold to silver ratio rallied above 88 yesterday.

Second, the technical changes are not as simple as stated above and we'll get into the details in just a minute.

Third, it was a geopolitical event that triggered the moves and the effects of these moves tend to be temporary. It was not a purely technical move that would show market participants' true attitude. Investors got scared and fled to the traditional hedge - gold. Gold was practically forced to rally regardless of what it's about to do anyway. This means that yesterday's rally should be viewed with skepticism. The no-news-based breakdown in the mining stocks that we saw on Friday was many times more important as it showed where the market really wants to go.

Think about it this way - you hear jet engines and you look into the sky to check in which direction they are flying. If it's very cloudy on that day and they are above the clouds, then you won't be able to clearly determine it. You might hear something, but you won't be sure, especially that the sound is delayed and there would be many airplanes in the air at the same time.

Gold was forced to rally yesterday, so its true intentions were obscured. We had some insights from the pre-market silver slide, but that's it. Based on what we saw in the precious metals sector in the preceding days (based on what was on the horizon line before it got cloudy), we know that the overall outlook should be bearish. But still, it's important to check how things developed on the charts, because just knowing the above is not enough to determine if gold and the rest of the PM sector is going to rally or decline in the next few weeks. Declines continue to be extremely likely in the next few months, but perhaps it's a good time to exit the position and wait for a better moment to re-enter the market?

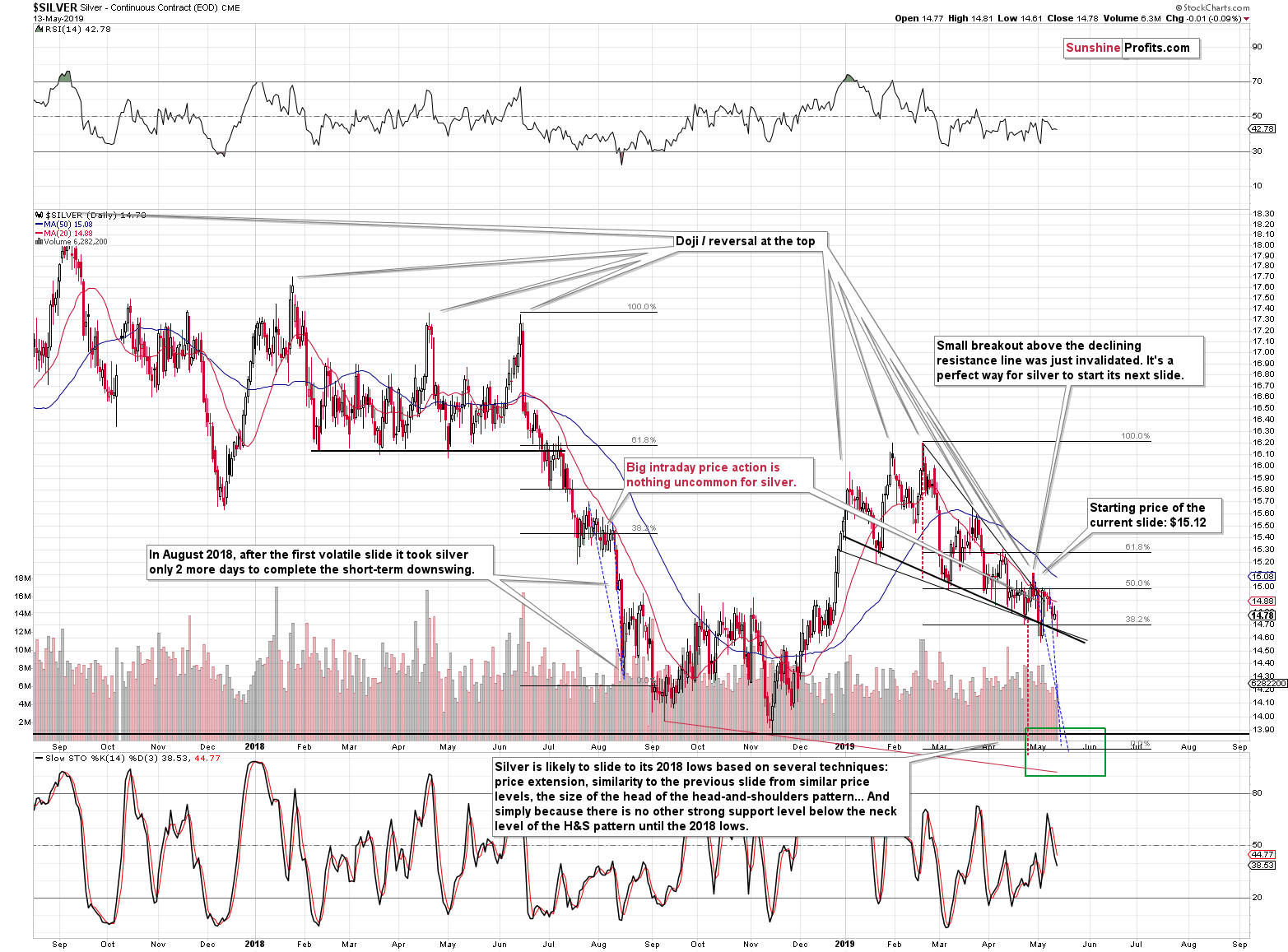

Let's start with the chart where the situation is simple: the silver chart.

Dissecting Silver's "Reversal"

Silver closed yesterday's session 1 cent lower, which means that the only effect that yesterday's rally had, was triggering the intraday reversal and interrupting silver in its decline. We already discussed the temporary nature of geopolitically-driven rallies, so let's stick to the technicals.

Silver's back and forth movement with lower highs makes the current moment very similar to what we saw in early August 2018. We wrote about it previously, but that was before a large part of the recent back-and-forth trading. The situation was similar previously, and it continues to be similar, but in a bit different way.

We have previously used the highest and final tops of the consolidation in order to measure the size of the following decline (blue dashed lines). We then applied these declines to the analogous recent tops. Now, because we saw more back-and-forth trading, we have new - and more appropriate - tops to "attach" those previous price moves to. By doing so, we get a more coherent target for the upcoming price slide than we have had before.

Previously, both declines pointed to the bottom between $13.90 and $14. Now, they suggest a move to about $13.75. As a reminder, our take-profit level for this trade is set at $13.81 based also on other factors, so the above is great news as it increases the chance that our target will be reached shortly before the next important turnaround.

So, while it may be surprising, we have slightly more bearish and visibly more precise outlook for silver for the rest of the month.

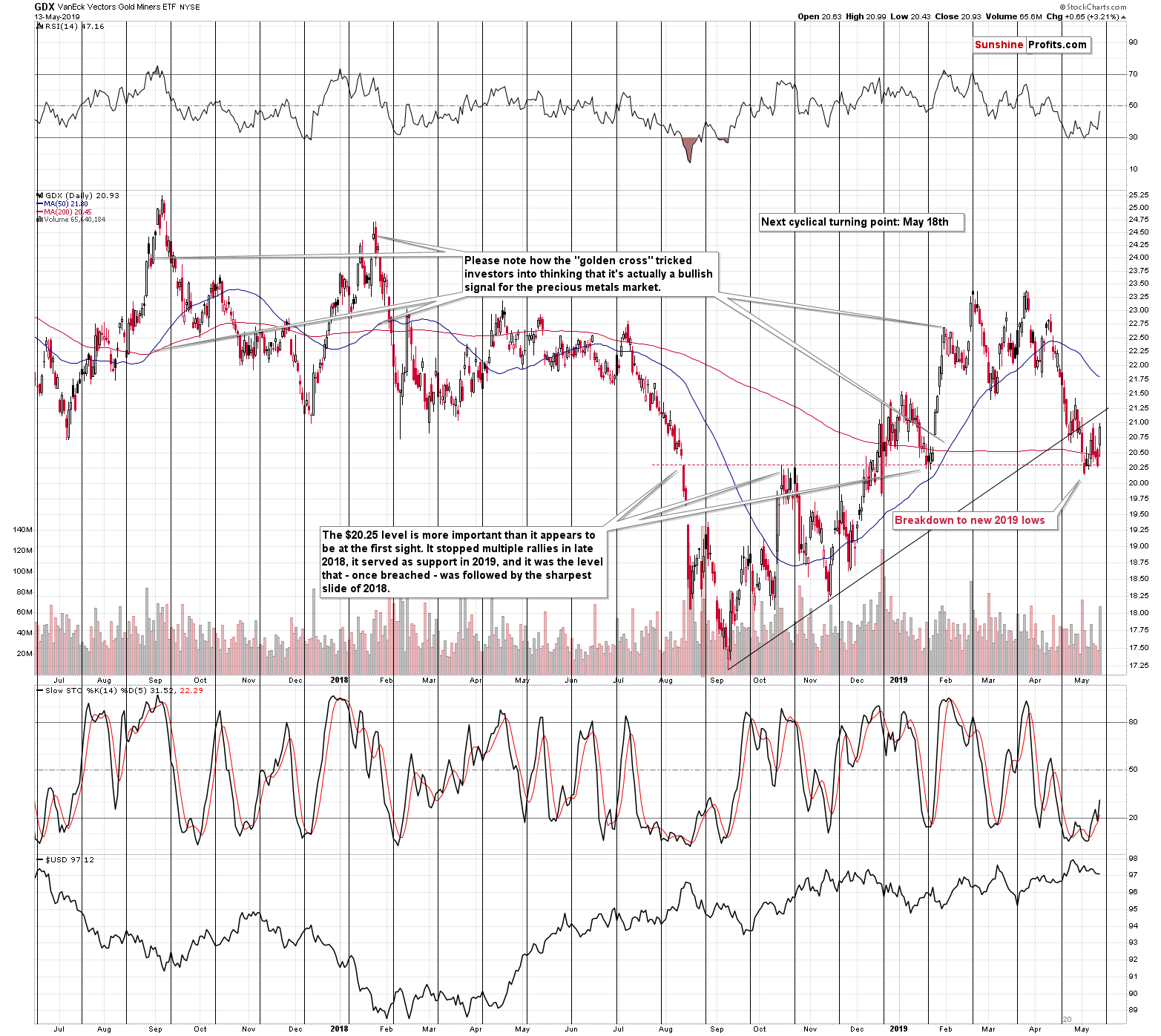

Let's move to mining stocks.

Mining Stocks´ Turn

There is something very interesting on the GDX ETF chart. Namely, we saw a big-volume rally just ahead of the cyclical turning point. Does it look familiar? It should, because that's exactly what we saw in the second half of February, earlier this year. That was the day before the final top of the year. So, is a big-volume rally necessarily a bullish thing here? No.

In our May 8 Gold & Silver Trading Alert, we wrote that if the miners strength wasn't just a bluff, then the possible upside target (that would not change anything from the broader point of view) for the HUI Index was 162.5. To be clear, we wrote the following:

Gold stocks (at the very bottom on the above chart) might move to the late-April highs, the 38.2% Fibonacci retracement, or the early January highs, which would make the current upswing symmetrical to the early-January decline. As far as the latter is concerned, it might be likely (assuming that miners would move higher from here at all) as the miners have already proved to form such symmetrical patterns in the past. For instance, the early-November 2018 rally and top, was symmetrical to the early-October action. All the above points to approximately 162.5 as the possible upside target. "Possible" doesn't mean "likely", though.

There is one more thing that needs to be considered - the previously broken rising resistance line. It´s currently at about $21.25. Consequently, the analogous target for the GDX ETF, based on the above-mentioned symmetry, and the late-April high and the resistance line is the $21.25 - $21.50 area.

This is how high mining stocks might realistically go in the next few days before they turn south and decline with vengeance.

Please note that regardless of whether miners decline right away, or after another small move to the upside, the December - now price pattern will most likely become a one big bearish head-and-shoulders pattern. Based on the size of the head (the highest point is the February top of $23.70), the downside target will be about $17.40. This would be a perfect confirmation of the target that we had already established for this downswing.

All in all, the situation in the mining stocks didn't really improve. Yes, there might be some short-term strength here, but the enormous downside remains intact. The possible move higher seems too small to justify adjusting the trading position for the sake of it.

Let's turn to gold.

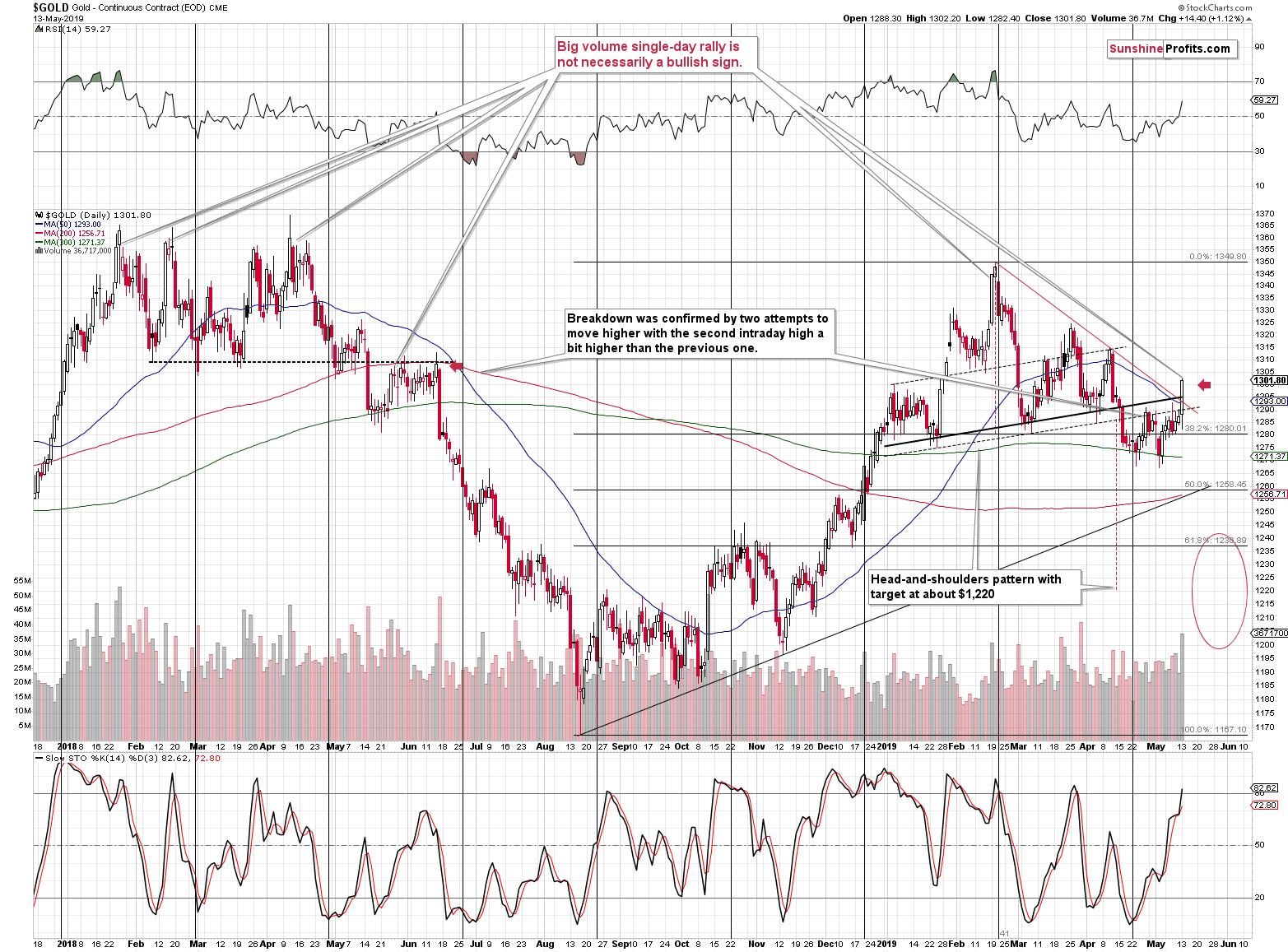

Finally, Gold

The yellow metal moved higher and closed the day above the $1,300 level, but at the moment of writing these words, gold's continuous futures (that's what the above chart represents) is trading at $1,299, so this milestone was invalidated. However, in order to for the above chart to become fully bearish once again, gold should decline not only below $1,295 (the neck level of the head-and-shoulders pattern), but also below $1,293, which is the declining red resistance line that was broken yesterday. Price moves are usually confirmed within the next 2 days after the breakout or breakdown, so today's and tomorrow's closing prices will be important. Will gold invalidate yesterday's rally by that time?

It seems quite likely and even if it doesn't manage to do that by that time, it's likely to head south within a week anyway. That's particularly likely given the following two factors:

- The big-volume daily rallies were quite often seen at the final part of the rally and right before the turnaround. In fact, all major tops of 2018 and 2019 formed in this way. At times, there was one or two more (smaller) daily rally / rallies thereafter and at times, the slide followed right away but the overall tendency remained intact. Big-volume rallies in gold that we see after a calmer rally is not something very bullish as the technical-analysis-101 books would have one believe. Gold market reacts in its own way and what was saw yesterday looks like an indication of a top.

- We have a short-term triangle-vertex-based reversal just around the corner. The declining red resistance line crosses the neck level of the H&S pattern (black, dashed line) tomorrow.

Moreover, the last 2 times the Stochastic moved above the 80 level, we saw a local top shortly. One of them was the final top of the 2018-2019 upswing.

Let's keep in mind that these are only the short-term factors pointing to lower prices. There are also multiple medium-term bearish confirmations that we are not discussing today, but that we have discussed in the previous days and weeks.

Summary

Summing up, at first sight, it may seem a lot has changed based on yesterday's rally in gold and mining stocks, but that's not the case. The breakout in gold is not confirmed and is similar to rallies that took place right before the most important tops of 2018 and 2019. The triangle-vertex-based reversal in gold is just around the corner, and the same goes for the cyclical turning point in the mining stocks. Plus, options expire on Friday. It doesn't seem that this news-driven rally will be able to do much more than delay the big decline by just a few more days. We might see the decline resume right away, but we might also see it resume on Friday or early next week. The much more important thing is the likelihood that the big decline is coming anyway than whether it starts now or in a few days. The potential profits on the slide are huge and definitely worth waiting a few extra days. Consequently, we think that keeping the short positions intact is justified from the risk to reward point of view.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short position (250% of the full position) in gold, silver, and mining stocks is justified from the risk/reward perspective with the following stop-loss orders and exit profit-take price levels:

- Gold: profit-take exit price: $1,241; stop-loss: $1,357; initial target price for the DGLD ETN: $51.87; stop-loss for the DGLD ETN $39.87

- Silver: profit-take exit price: $13.81; stop-loss: $15.72; initial target price for the DSLV ETN: $39.38; stop-loss for the DSLV ETN $26.97

- Mining stocks (price levels for the GDX ETF): profit-take exit price: $17.61; stop-loss: $24.17; initial target price for the DUST ETF: $34.28; stop-loss for the DUST ETF $15.47

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so - we think senior mining stocks are more predictable in the case of short-term trades - if one wants to do it anyway, we provide the details), here are the stop-loss details and target prices:

- GDXJ ETF: profit-take exit price: $24.71; stop-loss: $35.67

- JDST ETF: profit-take exit price: $78.21 stop-loss: $30.97

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Chair Powell claims that subdued inflation is caused by transitory factors. Does the recent data confirms his views? And just how transitory is the new tariff rate on $200bn Chinese imports? Will we see a creep higher in inflation about to lift the gold prices?

Will the Transitory Inflation Turn into a Tailwind for Gold?

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager