Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

For the very first time in weeks, we can write with clear conscience that yesterday's session was relatively boring. Gold, silver, and - in particular - mining stocks haven't done much - almost nothing.

Don't get used to it as it seems that it was the calm before the storm. And no, it's not just wishful thinking - we have confirmations on the charts. Let's start with the general stock market.

S&P 500 Lessons for the PMs

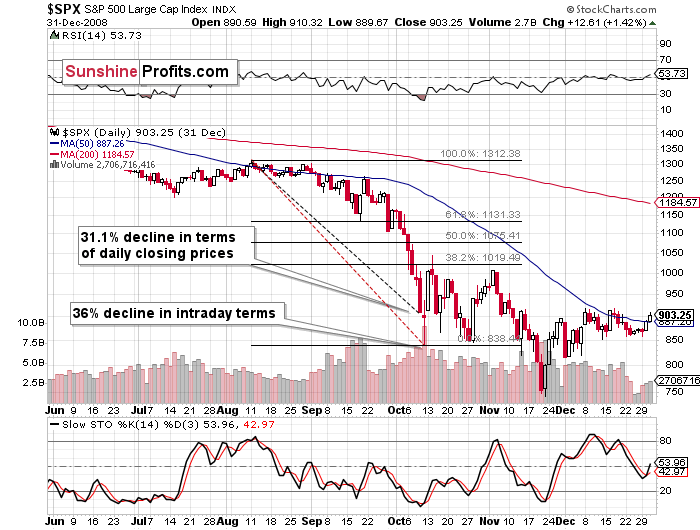

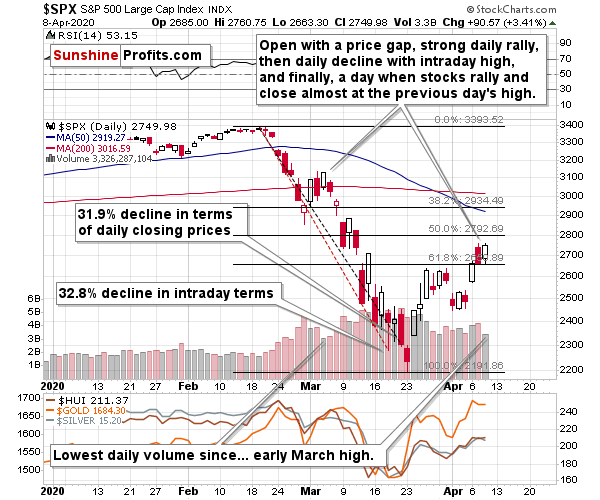

First of all, let's keep in mind that back in 2008, after the most volatile short-term decline - and the one most similar to what we saw in February and March - stocks corrected between 38.2% and 50% of their previous downswing before moving back down.

Stocks moved to the same resistance zone this week. Of course, that's not the only topping sign, we have three more:

- Stocks moved to their previous price gap, which stopped practically all previous rallies since late February. The early March rally ended once stocks moved to the Feb 26 price gap (upper border). The March 10 correction ended when stocks tried to move above the previous day's price gap. The same with the March 13 correction. Right now, stocks moved to the upper border of the price gap created after the March 11th close. Based on the closing prices, the gap was closed yesterday, but the same thing happened on March 4th, right before the biggest slide, which brings us to the second point...

- The last three trading days are almost exactly as the first three sessions of March. The daily rally that starts with a bullish price gap, then a daily decline with some sort of intraday reversal, and finally a daily rally that ends the day very close to previous day's intraday high. Based on this similarity, the next huge downswing is about to start.

- The volume that we saw yesterday was the lowest since... March 4th. This is yet another confirmation of the bearish analogy from point 2, but also a bearish factor on its own. Stocks moved higher on volume that was low on a relative basis and that's a bearish sign by itself.

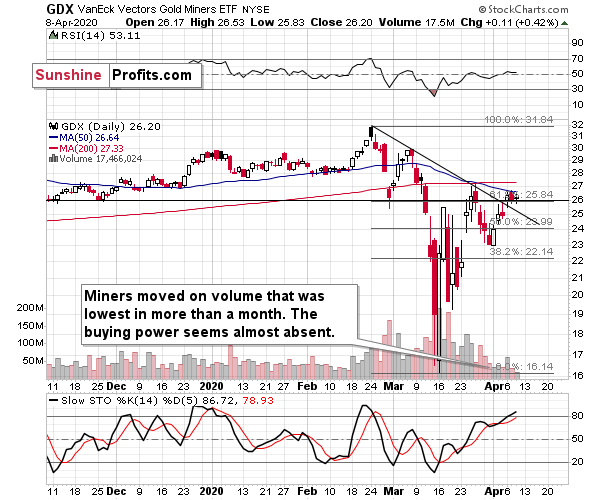

Speaking of low volume, it was also very low in case of the mining stocks.

The volume in the GDX ETF was the lowest since... May 24, 2019! It was the lowest volume in almost a year! If this doesn't scream that the buying power has practically dried up, I don't know what does.

Back in May, 2019, GDX was preparing for a big move higher. Now, it seems that the tables have turned.

The miners broke above the inverse head and shoulders pattern and confirmed this breakout by three consecutive closes, so the implications of this breakout should be bullish. However, we don't trust this breakout, just as we didn't trust the early-March comeback above the early-February lows.

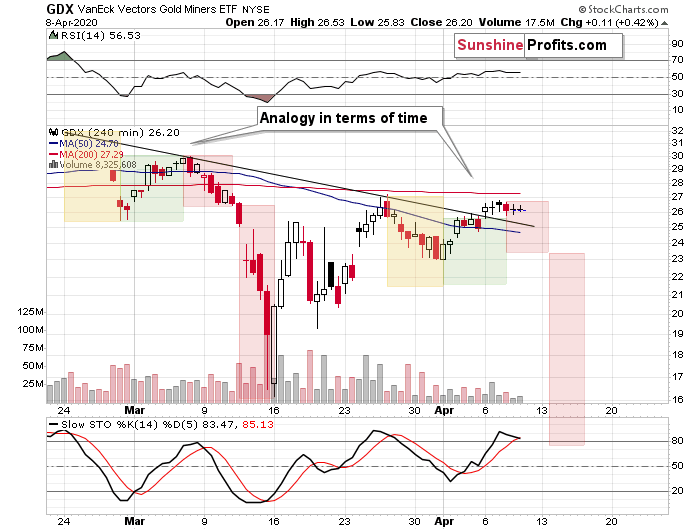

Please note that as far as the 4-hour candlesticks are concerned, we just saw a sell signal. The indicator (black line) moved below its signal line (red line) and in all recent cases, when it happened near the 80 level, it meant sizable declines were just ahead.

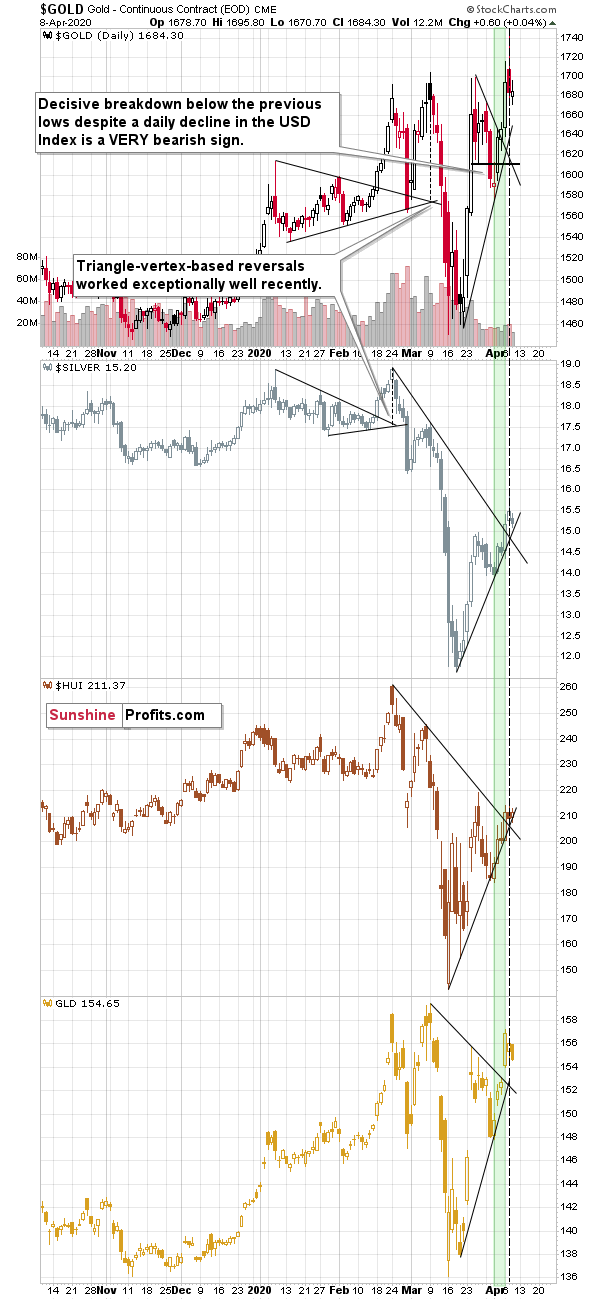

Despite an intraday rally, miners made no new high, so it's now even clearer that the precious metals market has already reversed this week, just as the triangle-vertex based reversals have indicated.

Moreover, please note that gold tried to rally back above its previous 2020 highs and close above them in terms of the 4-hour candlesticks, but it failed to do so. The implications are bearish.

From the Readers' Mailbag

Q1: In Lieu of the recent projections that the death toll due to Corona Virus are projected to be much less and may not be as initially projected-100,000-240,000. Secondly treatments such as the combination of Hydrochloroquine/Azithromycin/Zinc are looking somewhat promising, though not validated, imply that Panic due to death toll may not happen. Assuming this to be the case are you still looking at a big drop in Precious Metals before they start rallying, or this is the new rally without further major corrections??

Q2: I am reading on CNN that projections for U.S. Covid deaths will be better than expected, going from 82,000 to 60,415. Won't this soften the decline in markets and precious metals?

A: In short, it doesn't change our price projections for the precious metals market.

In yesterday's Alert, I made calculations that are based on the assumption that the above-mentioned treatment does help and... It didn't change that much, because the problem is with the ICU availability.

That's not the most important thing as far as the precious metals market is concerned, though. It would be important if we were trying to pinpoint the exact bottom for the stock market, which is likely to bottom along with peak panic.

In case of the precious metals market, we expect the bottom to be reached sooner - while the panic is still growing - just as what we saw in 2008. This means that whether one of the treatments limits the Covid-19 death toll or not and hundreds of thousands die instead of millions, or not, gold will likely bottom sooner than this effect comes into play (as far as the stock market is concerned). The PMs might already be after their bottom once the new treatment is started being applied at a bigger scale.

The precious metals market has very good fundamentals right now. Excellent, actually. And yet, it's likely to slide as people flock to the dollar for safety. This is likely to change, just as it changed in 2008.

Summary

Summing up, it seems that the precious metals sector just topped (possibly along with the general stock market) just as we had indicated previously. It also seems that we were able to close our previous long position in gold and increase the size of the short position in miners very close to the final highs.

This might be the beginning of a decline that takes the PMs to their final lows. The time target for the final lows in the precious metals sector is the second half of April.

This rally might have made one feel bullish - after all, the prices of miners seem to have recovered to a large extent. Please be sure to keep in mind that what we saw, was the first big wave down of a much bigger move lower, also in the stock market. The coronavirus stock-market decline has likely just begun and once it continues - and as the rally in the USD Index resumes - the precious metals market is likely to suffer. Silver and miners are likely to be hit particularly hard.

The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. It might peak when the death toll is in hundreds of thousands per day. We hate to be right on this prediction, but we expect the number of the total confirmed cases in the US to be multiple times greater than the analogous number in China. At the moment of writing these words, the number of total confirmed cases in the US is about 432k. The US death toll is about 15k today (increased by about 2k since yesterday,).

It's 2008 on steroids.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks is justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $11.47; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $14.87; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58

Gold futures downside profit-take exit price: $1,312 (the target for gold is least clear; it might drop to even $1,170 or so)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager