Briefly: in our opinion, full (200% of the regular size of the position) speculative short positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert.

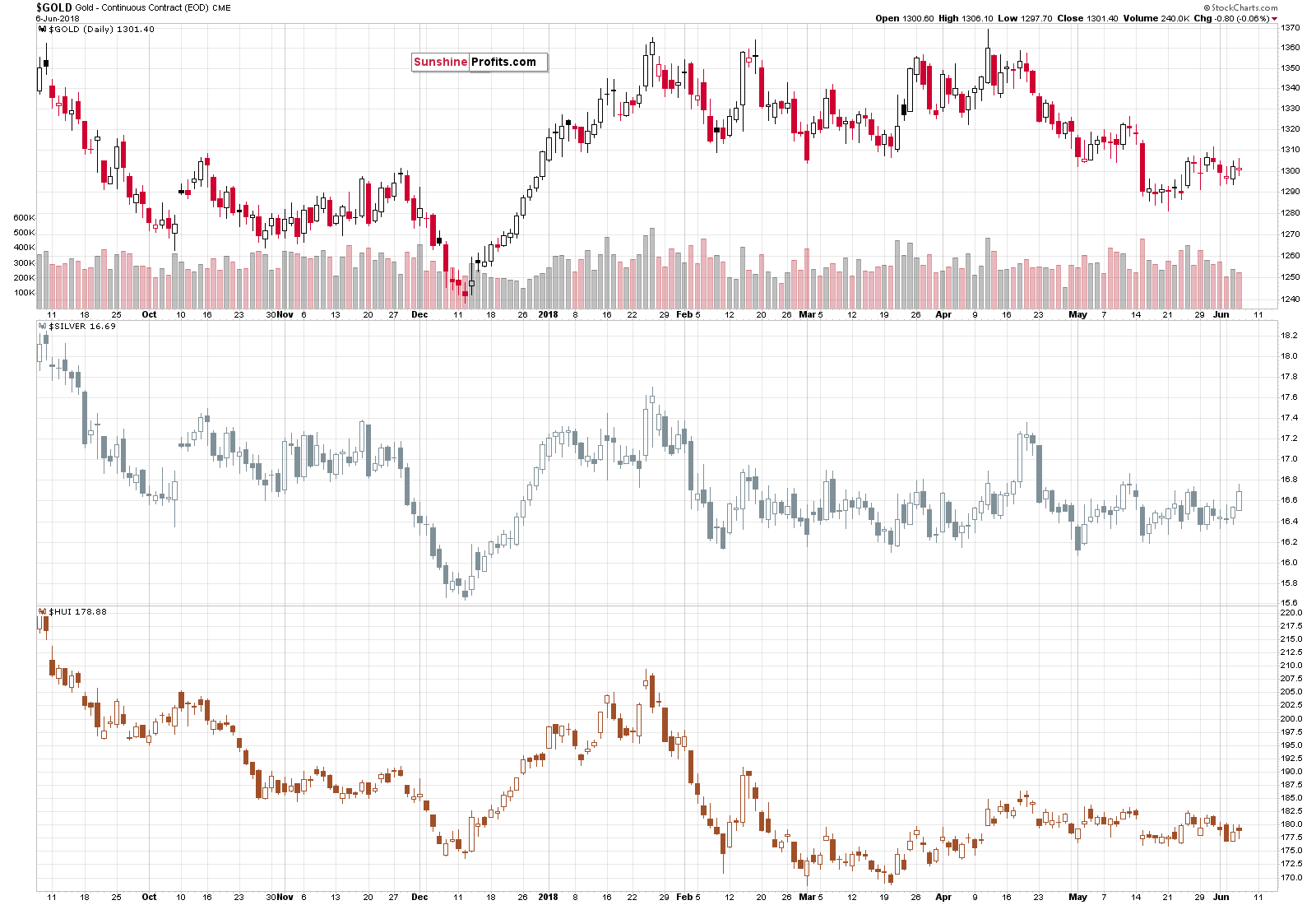

We just saw a specific divergence on the precious metals market. Part thereof – silver – visibly rallied, while the key proxy for gold stocks – another important part of the PM sector – HUI Index, was up by a mere 0.12%. Investors wanting to check what’s really going on are looking at gold for guidance. They aren’t getting any as gold didn’t really change (which seems bearish compared to silver’s rally), but at the same time, it’s above the declining trend channel, which may appear bullish. What should one make of all this?

In short, one should keep in mind what is usually happening after situations in which silver is strongly outperforming, while the rest of the precious metals sector is not doing much. These are usually the final calls to enter short positions as the slide is about to unfold.

Let’s take a closer look at the charts.

Another Day, Another Breakout in Gold

In yesterday’s alert, we wrote the following:

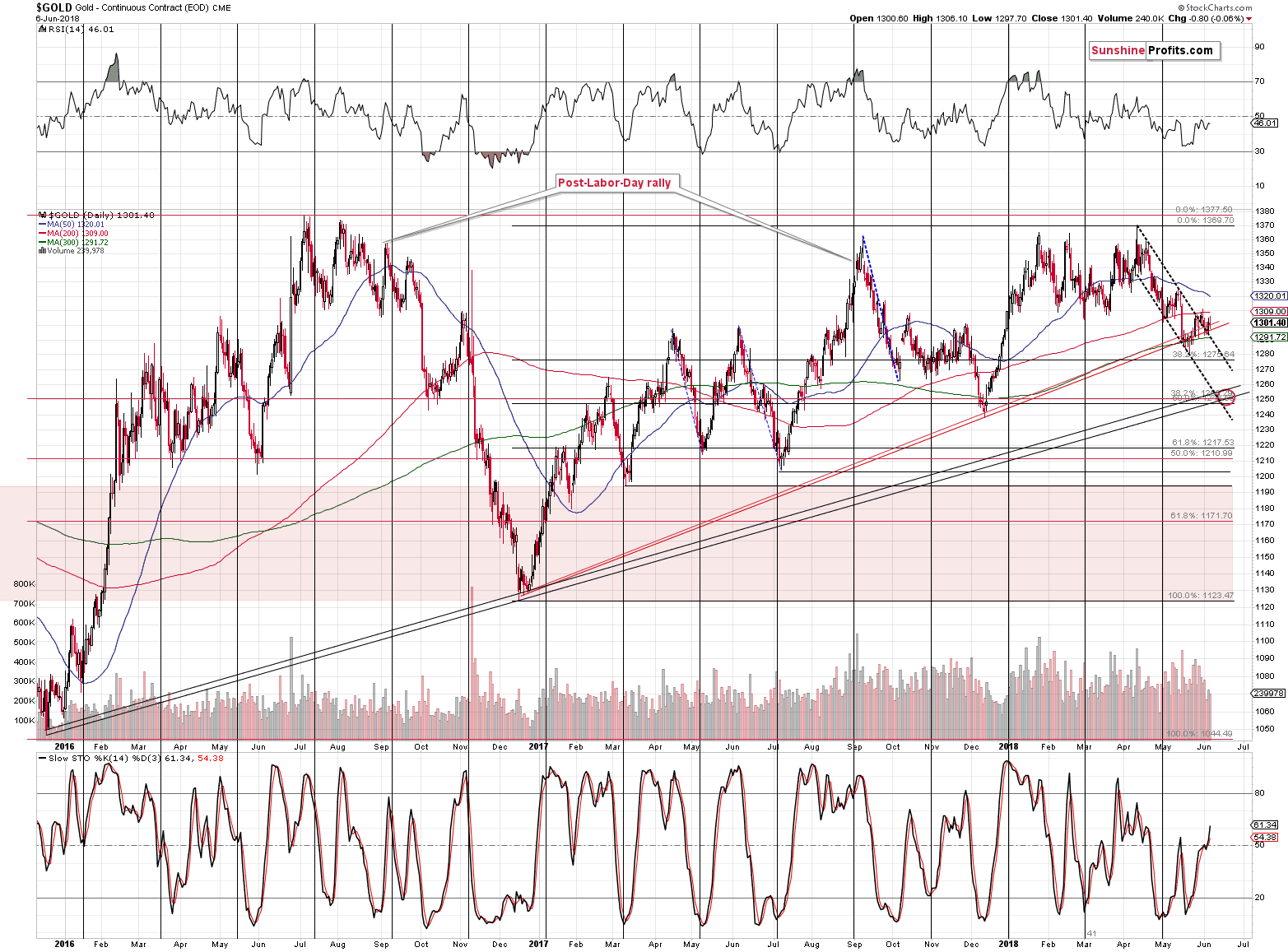

Yesterday’s upswing, as encouraging as it may have appeared, was nothing extraordinary. Yes, the price of gold moved above the upper border of the declining trend channel, but the same was the case just several days ago and the breakout was invalidated shortly as gold moved back below $1,290 shortly.

Breakouts need to be confirmed, before they can be viewed as important. If they are not, and are invalidated instead, they become bearish signs. We have just seen an example of this phenomenon in the gold market, and this should make us particularly suspicious to another attempt of gold to move above the declining resistance. This is especially the case since gold moved higher on low volume. Yesterday’s breakout did not represent a fierce battle between bears and bulls that was won by the latter. It was more of a pause during which both sides were hesitating. Consequently, there are no bullish implications of yesterday’s upswing in gold.

Since nothing really happened in gold yesterday, we can say that the above remains up-to-date. Gold is only a bit above the declining trend channel and it didn’t move much above it even when it had a good reason to. After all, the USD Index moved lower yesterday, so gold “should have” used this trigger to rally, if the outlook was really bullish. But it didn’t; and so the breakout is not confirmed so far.

Silver’s Not-so-subtle Outperformance

In yesterday’s alert, we wrote the following about the above and below charts:

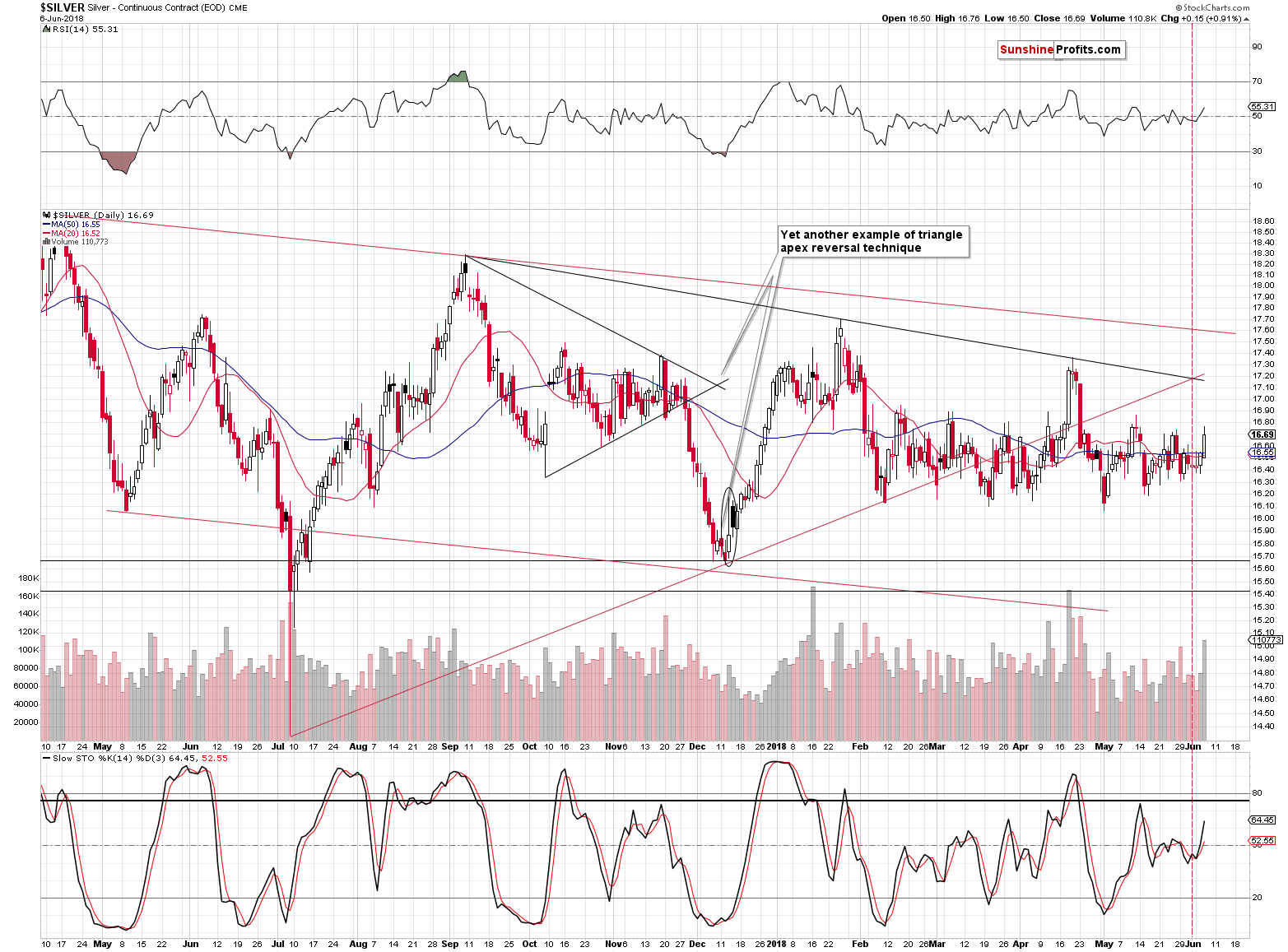

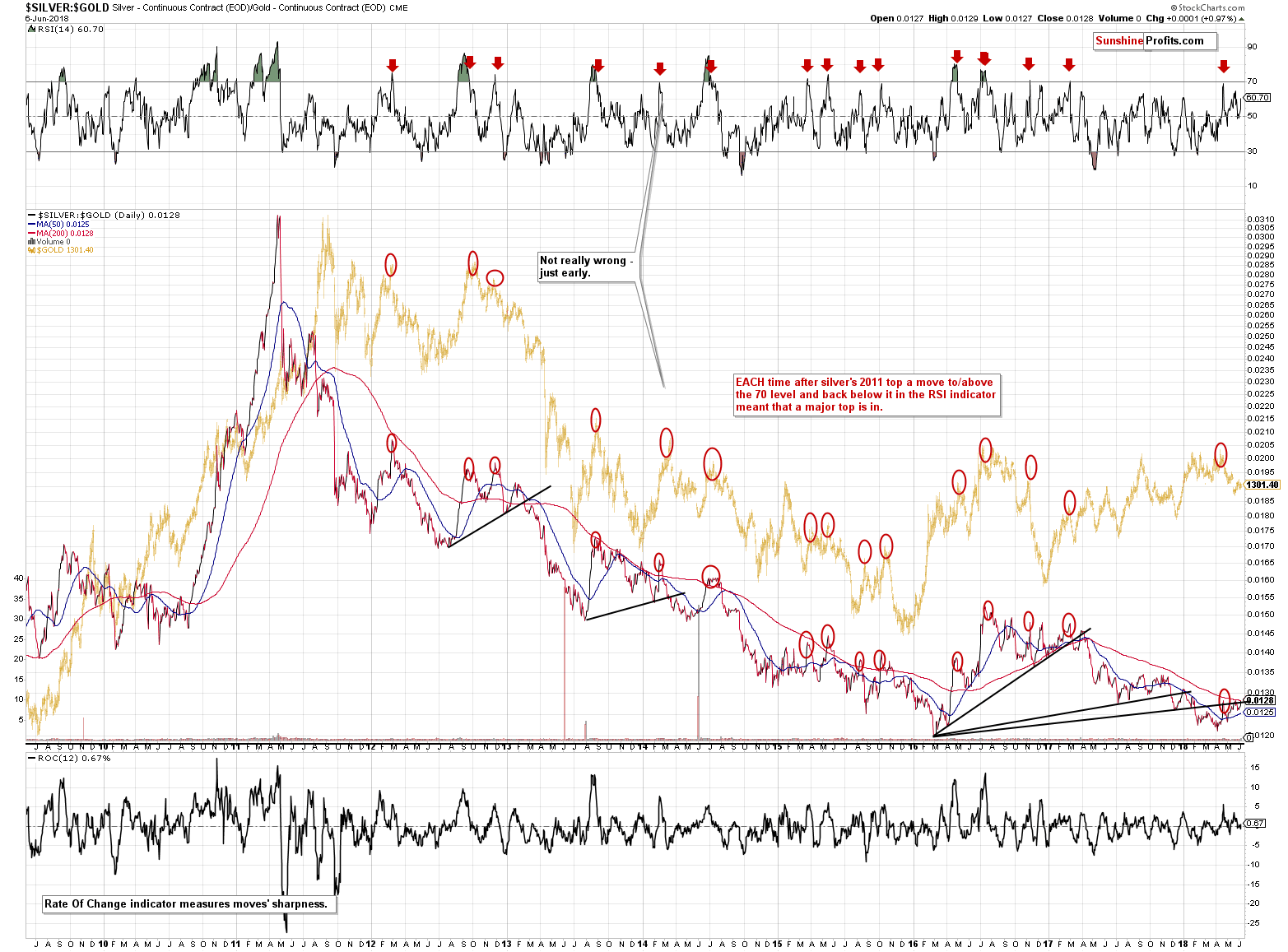

The size of the silver rally doesn’t seem significant at first sight, but the size of the volume in silver suggests that we may have seen something important. It’s not spectacular, but it is big if we compare it to the size of the volume in gold. The yellow metal moved higher on low volume, but what we see above is rather average. Could it be the case that the silver price action is somehow meaningful in relation to gold?

To answer this question, let’s take a look at the chart that features them both at the same time.

On a day-to-date basis, it may not appear significant, but if we consider the last 5 trading days, we’ll see that gold is lower than it was, gold stocks are lower than there were and that they underperformed gold, whereas silver is more or less where it was before.

This means that silver has indeed outperformed gold, while gold stocks underperformed. The signal is not as clear as if we had seen this kind of outperformance and underperformance on a single day, but it’s definitely meaningful.

As a reminder, silver’s outperformance and mining stocks’ underperformance is something that we usually see right before declines.

Interestingly, we just saw a daily confirmation of the 5-day pattern. It was as clear as it gets. Silver rallied, while gold and miners practically didn’t move. The implications are very bearish for the short term. In fact, as odd as it may sound, they are much more bearish than they were before silver’s rally.

As we’ve often stated, just because a price moved higher, it doesn’t mean that it’s likely to move higher again. This seems to be the most natural way of viewing the market by the beginning investors and traders, but the reality is much more complex. As simple fact that negates the above is that in order to make profits, one needs to buy low and sell high. The price is high after a rally, so based on the above approach alone, one would never be able to sell at or close to a top.

The opposite – viewing rallies as bearish – is only a little better but it’s still wrong overall. The key is to look at the context and only make a decision whether a move is bullish or bearish, once it’s been properly analyzed.

Moving back to silver, some may say that given the above tendency of the white metal to outperform, silver could rally for much longer and thus we should close the trading positions right away and re-enter them after silver already declines, proving that the top is already in.

This sounds good in theory, but in practice, the sharp upswings are very often followed by even sharper declines and it’s very difficult to get a better price during a decline so ultimately the above strategy is more likely to decrease profits instead of increasing them.

Plus, in case of the current situation, it appears that silver’s outperformance may already be over.

The silver to gold ratio recently moved back to the rising support / resistance line and then declined. Then it tested the previous support as resistance and declined again. Now, it moved to it for the third time. Technically, yesterday’s rally was simply a third verification of the breakdown.

The existence of this resistance is a factor that makes subsequent strength in the white metal relative to gold rather unlikely as that would imply a breakout. Since the breakdown was already verified twice, it’s more likely that it will not be broken. Consequently, we can expect silver to continue its underperformance of gold shortly.

GDX’s Rally vs. HUI’s Apathy

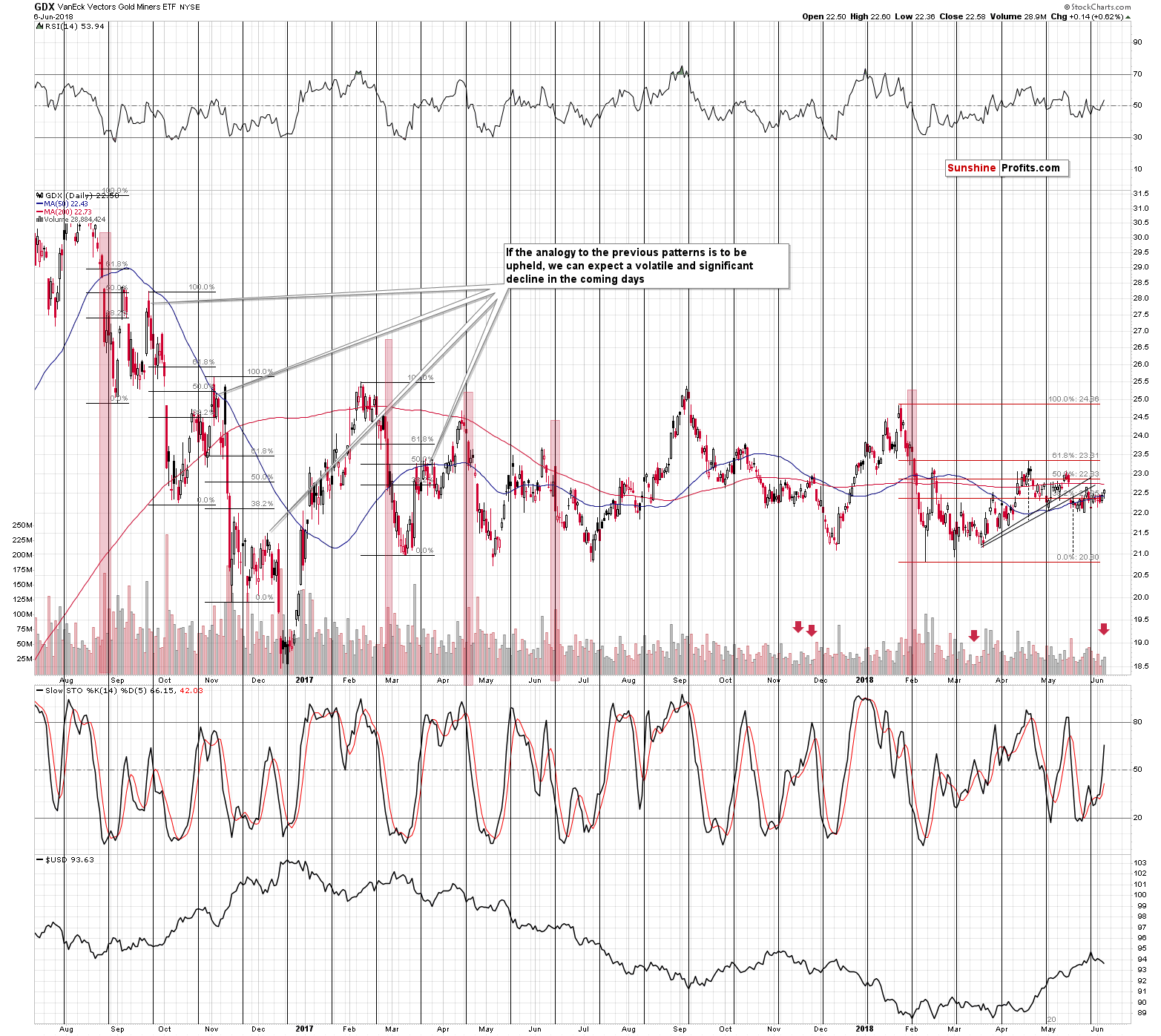

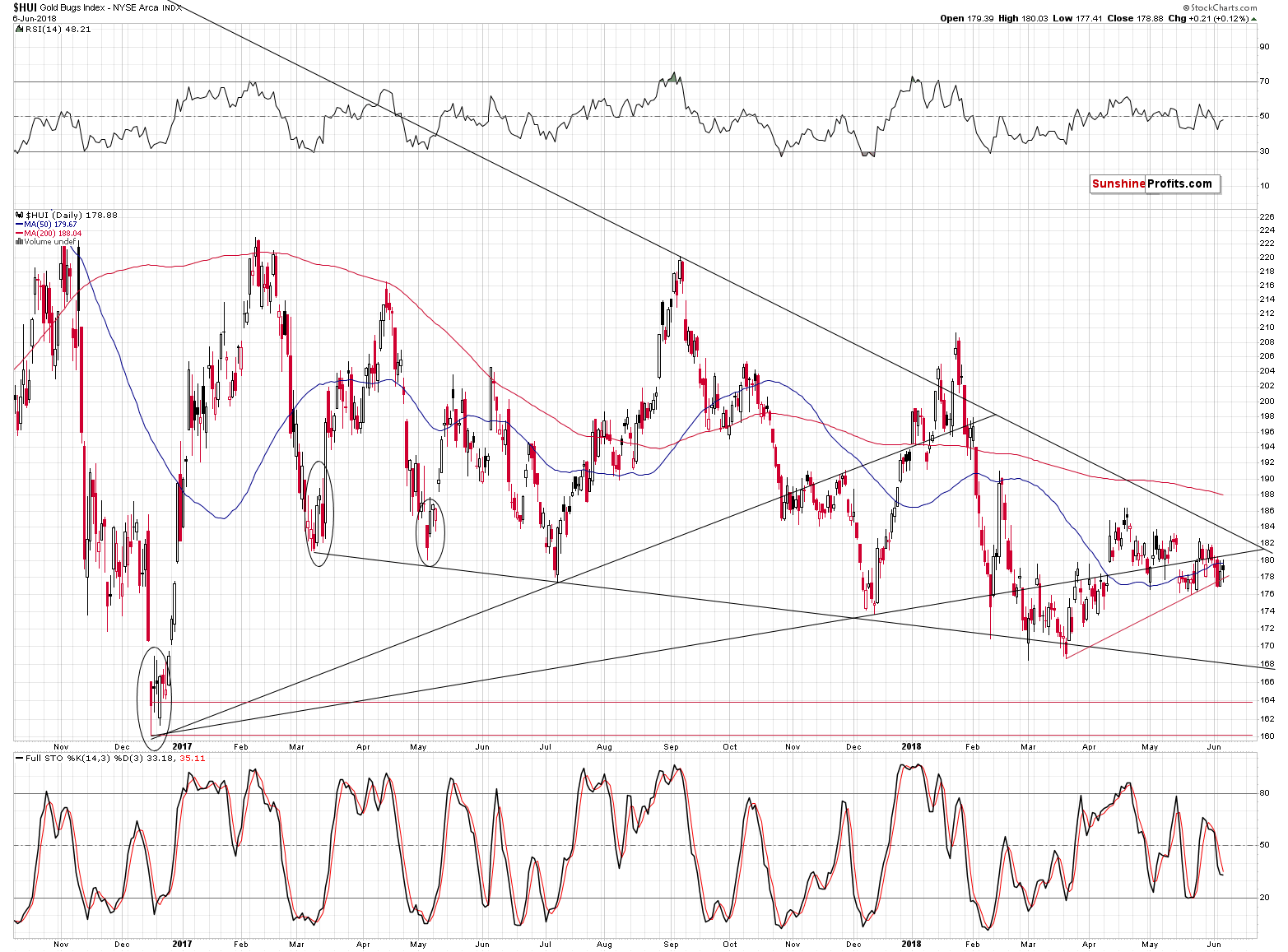

The GDX ETF moved higher yesterday, but only by 14 cents, which was nothing to call home about, but when we add it to Tuesday’s rally of 16 cents it becomes somewhat visible. But is the upswing big enough to have any implications? Not really. It’s still part of the pattern that we discussed previously:

After each short-term downswing that was particularly volatile, GDX moved back up a few times before the decline continued. The early 2018 decline was definitely very volatile, so we shouldn’t be surprised to see this kind of consolidation. It’s longer than the previous ones, but in terms of the prices that were reached, the 2016 price moves and the 2018 ones seem quite similar. The implication here is that once mining stocks break below their previous 2018 low, the following slide is likely to be volatile, just like the declines in 2016 were. In the light of the above, one might expect GDX to reach its late 2016 lows after such breakdown.

On a more short-term note, please note that mining stocks were also trying to break above the rising resistance line based on the March and early May lows, which is also the neck level of the bearish head-and-shoulders formation. Since there was no invalidation, the implications of this formation remain in place. Namely, GDX is likely to move at least to the mid-February 2018 lows rather sooner than later.

All in all, the short-term outlook for the precious metals mining stocks is bearish and it seems that it may become even more bearish later this month, after GDX breaks to the new 2018 lows.

Besides, another major proxy for the mining stocks shows that nothing really happened yesterday.

The HUI Index was up by a mere 0.12%, which is next to nothing. This confirms that the upswing is insignificant and that its rather inconsequential.

The USD Correction

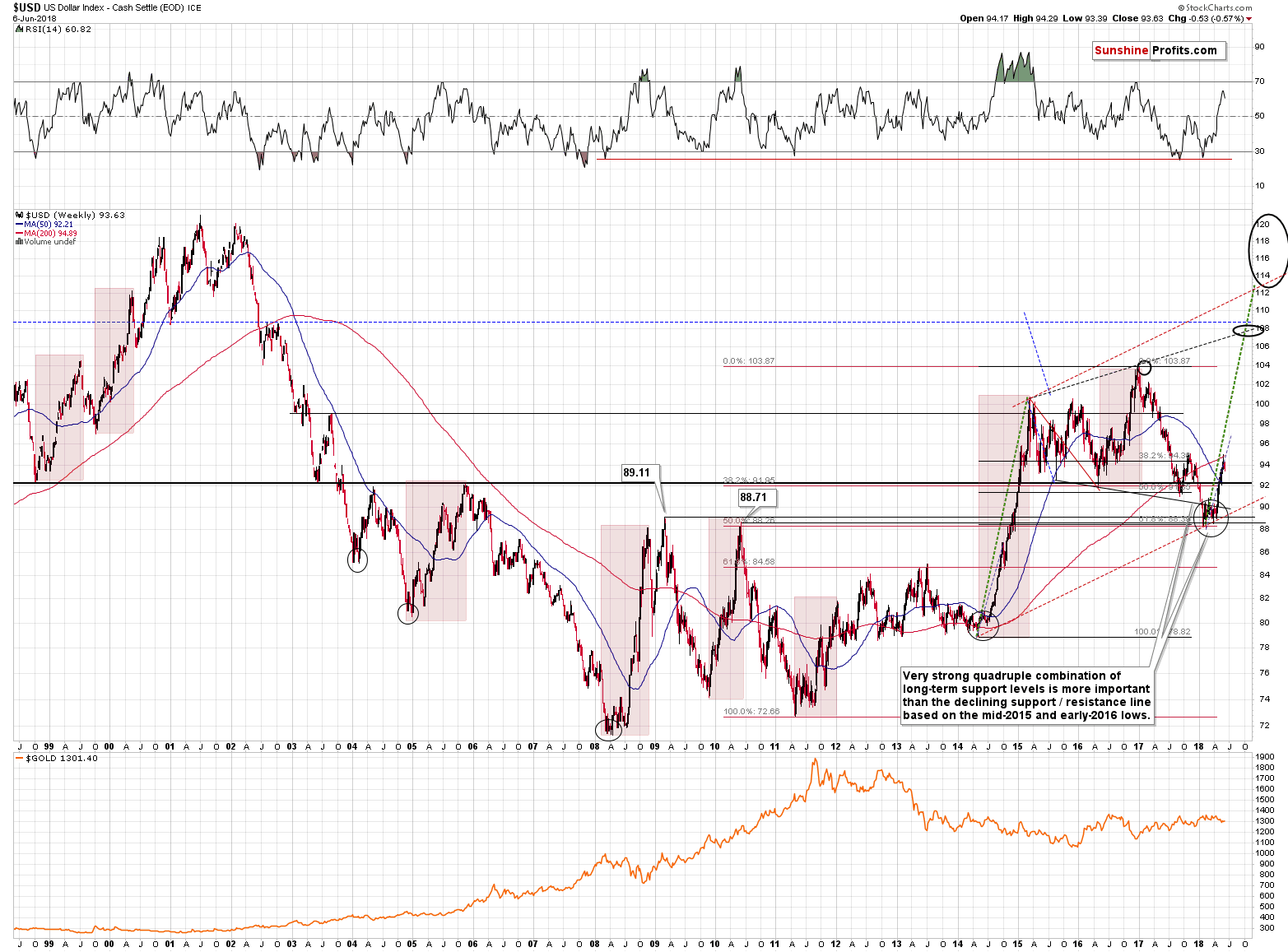

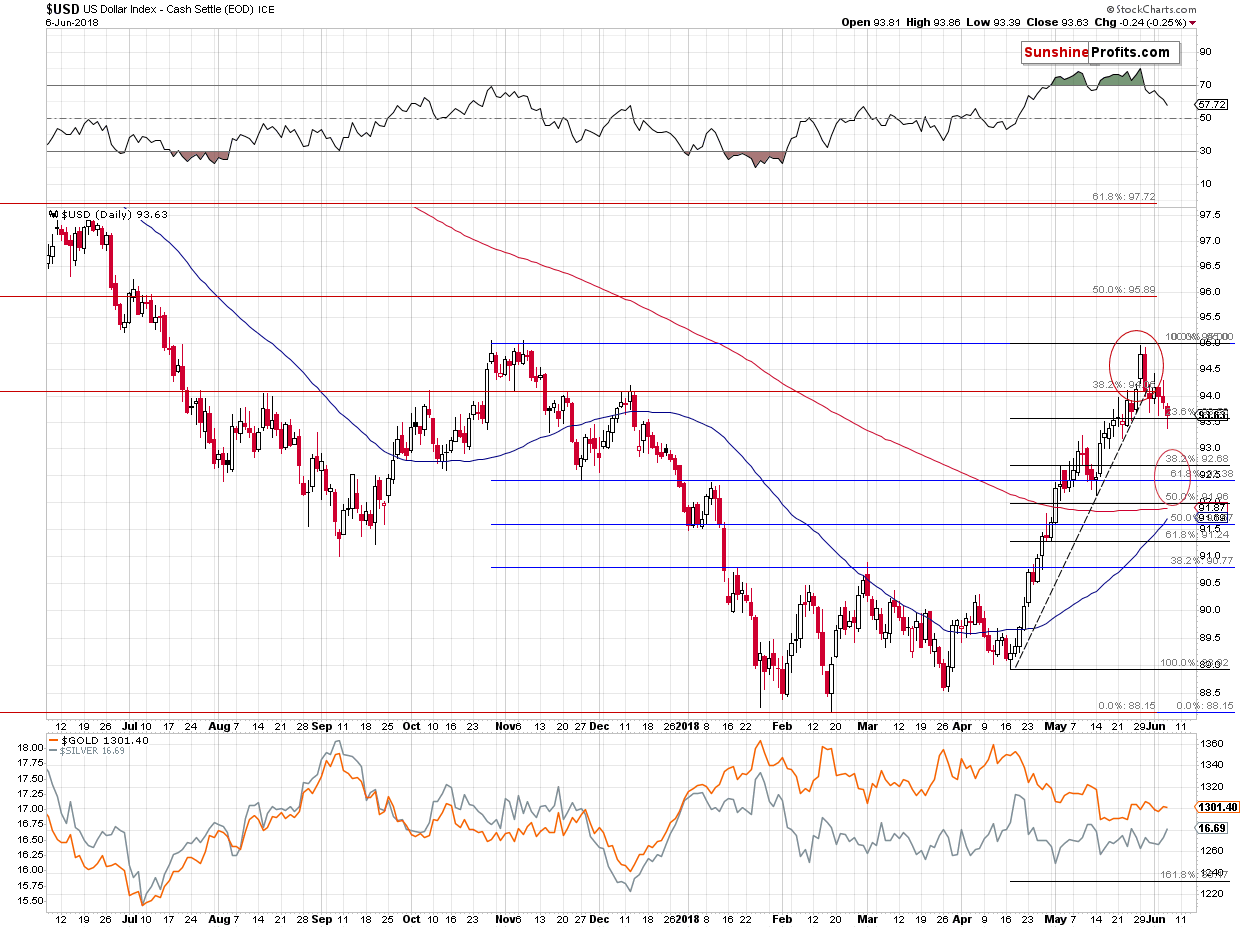

In the previous alerts, we discussed that the USD Index was likely to correct after (almost) reaching the resistance at the level of 95. That’s what happening and the question is when and at what price levels is the corrective downswing likely to end. To answer this question, let’s start with looking at the context.

The key context is that the USD Index is soaring just as it did in 2014, 2008, and 2010. If there was very significant similarity for weeks, then one should expect to see similarity in the future, at least in the next few weeks. On a side note, the self-similar patterns are a great tool, but their limitation is that it’s hard to predict when the price moves stop being aligned. Consequently, while the near-term predictions based on it are very useful, making very long-term calls can be less effective. There’s simply more time for the patterns to diverge, so the chance for it increases. That’s why we are not married to the idea of USDX reaching 113 or so based on the similarity to the 2014-2015 rally and we view a move to 107 or so, or even to 118-120 as possible. Since all these outcomes mean substantial gains, the medium-term outlook is bullish either way.

But, moving back to the short-term implications, there’s also the issue of recency that one should take into account. What happened last week is easier to recall than what happened several weeks before. For instance, your Editor practiced smithing(it turns out that arrow heads make quite nice pendants) a few weeks ago and while it all seemed familiar a few days later, it no longer does.

In case of the capital markets, the above effect means that what happened more recently is more likely to be similar to what happens currently. Investors recall the recent events more easily whether that is done consciously or subconsciously. To a small extent, their emotional reactions are also more likely to be aligned with what happened recently than with what happened a long time ago. On the fundamental front, the current developments are also more similar to what happened recently than to what happened many years ago.

Therefore, it seems justified to attribute greater importance to the analogy to what happened recently than to what happened some time ago. In case of the above USD Index chart, this means that the analogy to 2014-2015 seems more important than the analogies to 2008 and 2010.

Consequently, let’s see what happened in the former period in order to see what’s likely to happen now.

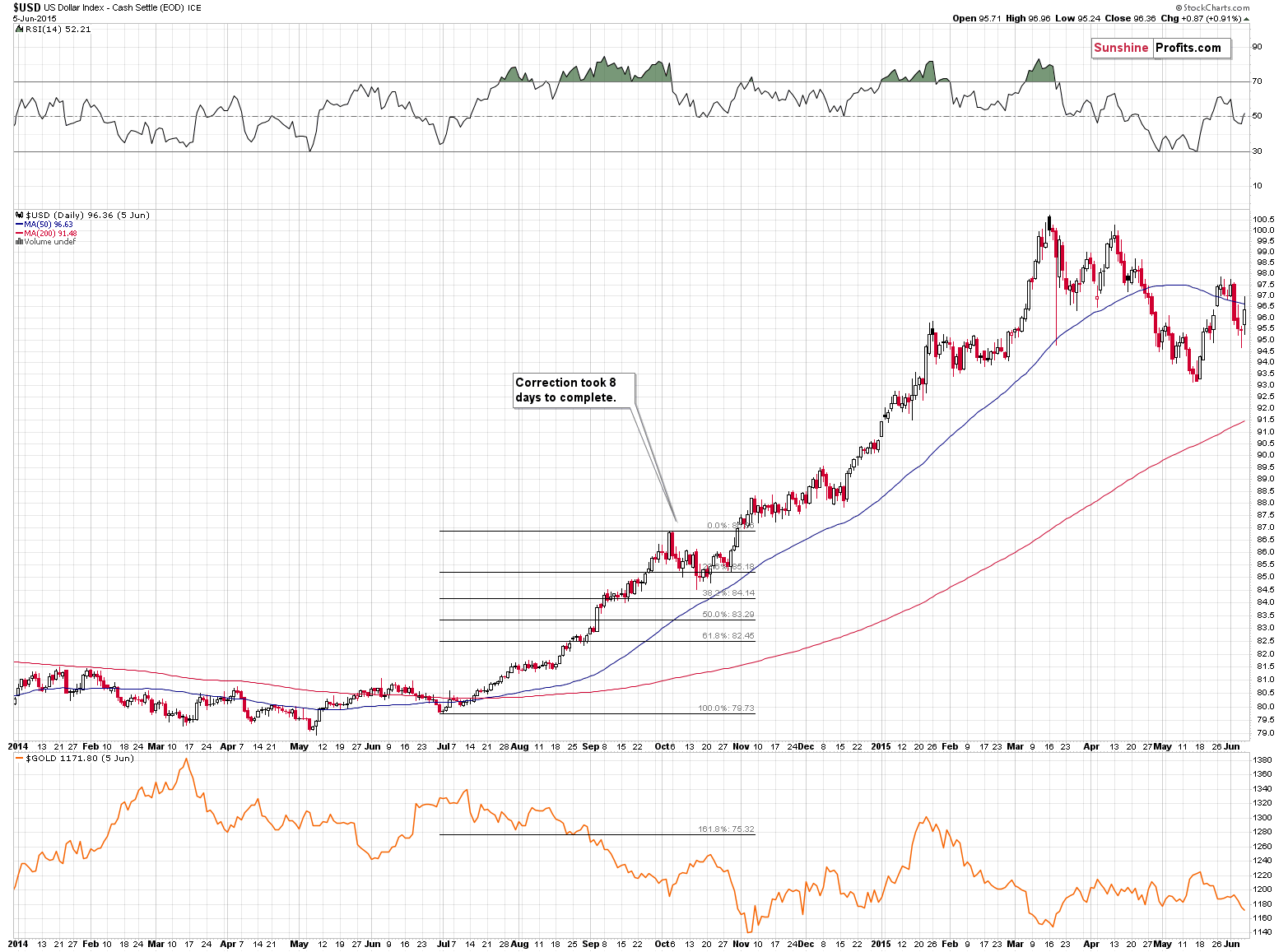

The first correction that we saw during the above big rally took place in October 2014 and it took 8 trading days.

During this correction, the USD moved to about the 23.6% Fibonacci retracement (not the most popular retracement, but it can work during the strongest bull markets). Precisely, USD moved below it on an intraday basis, and closed the session very close to it.

Now, the USD Index is after 6 days of correction and today is the 7th day. During yesterday’s trading, the USDX moved to the 23.6% Fibonacci retracement. Precisely, USD moved below it on an intraday basis, and close the session very close to it. Sounds familiar? Indeed, it’s what ended the correction in 2014 and started another powerful upswing.

It was only 6 days this time, not 8, but the preceding rally was also quicker than in 2014, so it all seems to fit quite well.

Therefore, while the above chart features a target area that we view as the maximum of the likely downside targets (maximum meaning the furthest price drop), it seems more likely that the bottom for this corrective downswing was reached yesterday or that it will be reached this week.

Yesterday’s silver outperformance suggests that the bottom in the USD is already in (assuming that both: USDX and PMs are going to turn around at the same time).

Summary

Summing up, yesterday’s upswing in silver was not a bullish sign, but a bearish one and together with the signal from the USD Index and True Seasonal patterns for this month, we get a very bearish picture for the short- and medium term. Moreover, let’s keep in mind that the analogies to what happened in gold and silver when the market was just as boring as it’s been recently suggest that if we get another very short-term and small move higher, it may be the final one before the move to the final bottom begins. The outlook for the precious metals sector remains bearish.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full short positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,251; stop-loss: $1,382; initial target price for the DGLD ETN: $48.88; stop-loss for the DGLD ETN $37.48

- Silver: initial target price: $15.73; stop-loss: $18.06; initial target price for the DSLV ETN: $27.58; stop-loss for the DSLV ETN $19.17

- Mining stocks (price levels for the GDX ETF): initial target price: $21.03; stop-loss: $23.54; initial target price for the DUST ETF: $28.88; stop-loss for the DUST ETF $21.16

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $30.62; stop-loss: $36.14

- JDST ETF: initial target price: $59.68 stop-loss: $40.86

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

Investors' sentiment continued to improve on Wednesday, as the broad stock market accelerated its short-term uptrend following Monday's breakout above three-week-long consolidation. The S&P 500 index gets closer to march local high. Will uptrend continue? There are still two possible medium-term scenarios, but bulls are much happier now.

Blue Chips Take the Lead, Enough to Push Higher?

Next week, the ECB will hold its monetary policy meeting. The bank was expected to start winding down its stimulus program at the end of 2018. However, Italian turmoil led some analysts to think that the ECB will remain cautious. Will the ECB withstand the pressure or funk? And what does it all mean for the gold market?

Will the ECB Withstand Pressure?

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold inches up as euro gains against dollar

Gold price: Investors are pouring $1 billion per month into ETFs

Texas just opened the nation's first state-run gold depository. Here's what that means.

=====

In other news:

Dollar's reign likely to be a short one: Reuters poll

Euro, bond yields extend gains on ECB while risk appetite grows

Fed clambers back to positive real rates, now debate is when to stop

Amid trade war fears, euro zone growth slowed on lower exports

Turkish Central Bank Unexpectedly Raises Rate to 17.75 Percent

Swiss to vote on 'suicidal' overhaul of banks

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts