Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. Moreover, in our opinion, full (250% of the regular position size) speculative long positions in gold are justified from the risk/reward point of view at the moment of publishing this Alert. We are entering a gold-miners hedge/spread in light of the good chance for seeing gold's rally back to the previous highs.

Two important things happened yesterday. And no, the ridiculous rally in crude oil wasn't one of them. Yes, it was ridiculous, because it was clearly based on just one indication from Trump that was not backed by anything, and in the crude oil market it is rather common to hear about the possibility to cut production, and then nothing happens.

Anyway, the particularly important things happening, were the rally in gold, and the rally in the USD Index.

Let's start with the latter.

The USDX and Gold Rallies

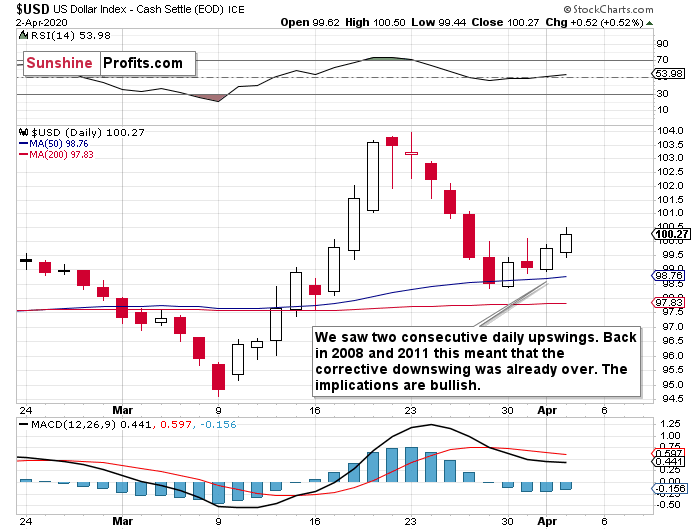

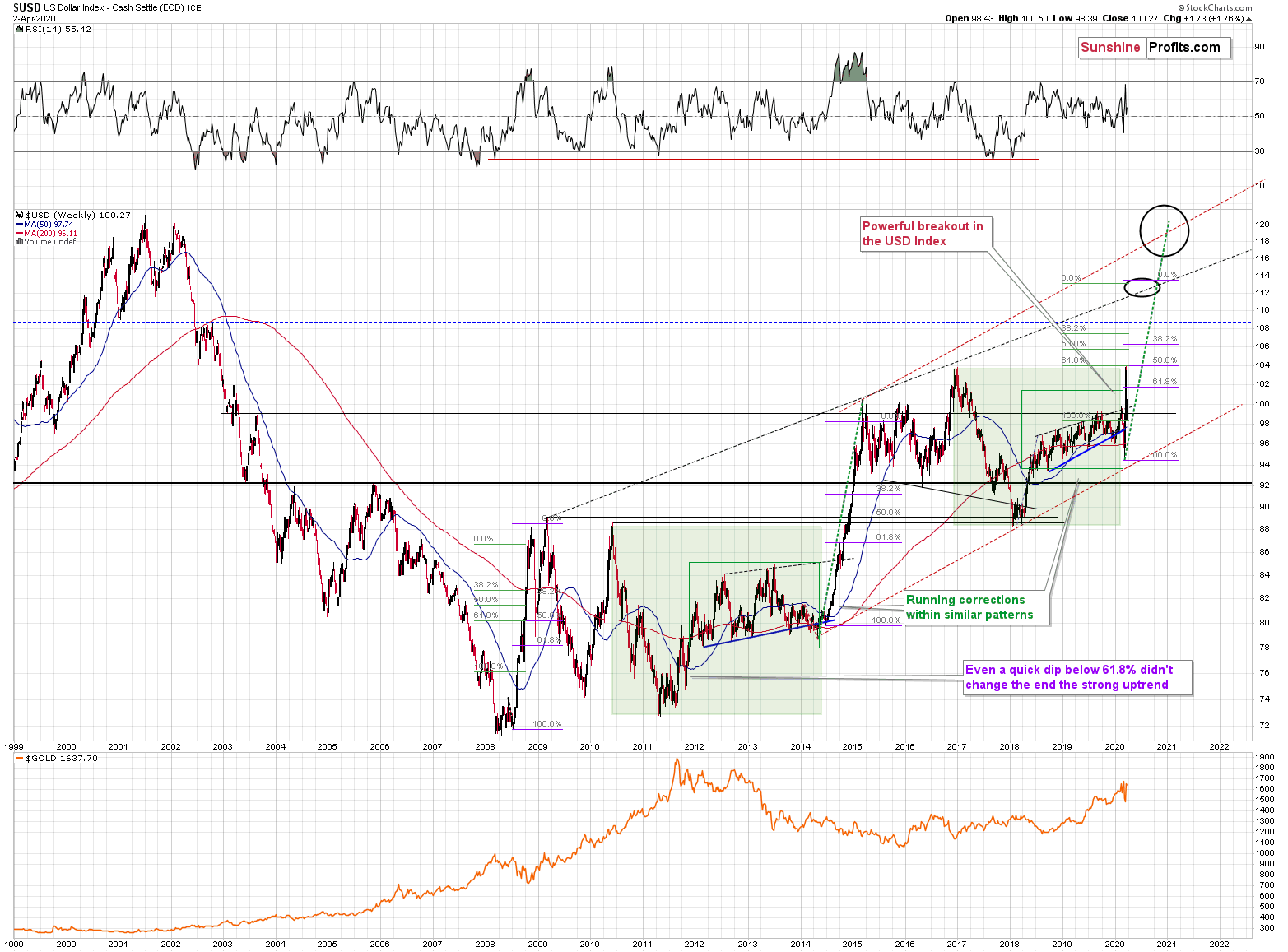

The USD Index just posted a daily rally and it was a second daily rally in a row. This may not seem significant at first sight, but it is significant, because that was what confirmed that the downward correction was already over in case of both similar price moves: the 2008 and 2011 one. As we described these analogies on Tuesday, we don't want to do so again today, but the key takeaway is that the USD Index is now very likely to continue its upward move, likely rallying to new 2020 highs shortly.

The good news is that since we know that the correction is most likely over, we can use Fibonacci extension tools based on the previous rally and the correction to estimate how high the USD Index is likely to move before this significant, yet short-term rally is over. Once the short-term rally is over, it would probably be followed by a more meaningful correction and then another wave up, but that's not the key information from the precious metals investor's and trader's point of view, because PMs and miners are likely to bottom even before the USD Index tops.

So, how high would the USD Index be likely to rally in the near term?

Back in 2008, the USD Index topped after it slightly exceeded the level that one would get by doubling the size of the initial sharp upswing. The first, initial top formed slightly above the level that one would get by multiplying the size of the initial sharp correction by 2.618.

Based on these techniques and the analogy to 2008, the USD Index is likely to soar to about 113 before correcting in a more meaningful manner. This level is just above the rising, long-term resistance line that's based on the 2009 and 2015 highs, which is at about 112, so conservatively we will view 112 as our upside target.

The USD Index is at about 100 at the moment of writing these words, so the upside potential is substantial.

And as we wrote in many flagship Gold & Silver Trading Alerts, big moves higher in the USD Index almost always translate into big declines in gold. One of the reasons that yesterday's session was important, is because it provided us with a confirmation that this big move higher in the USD Index has just started.

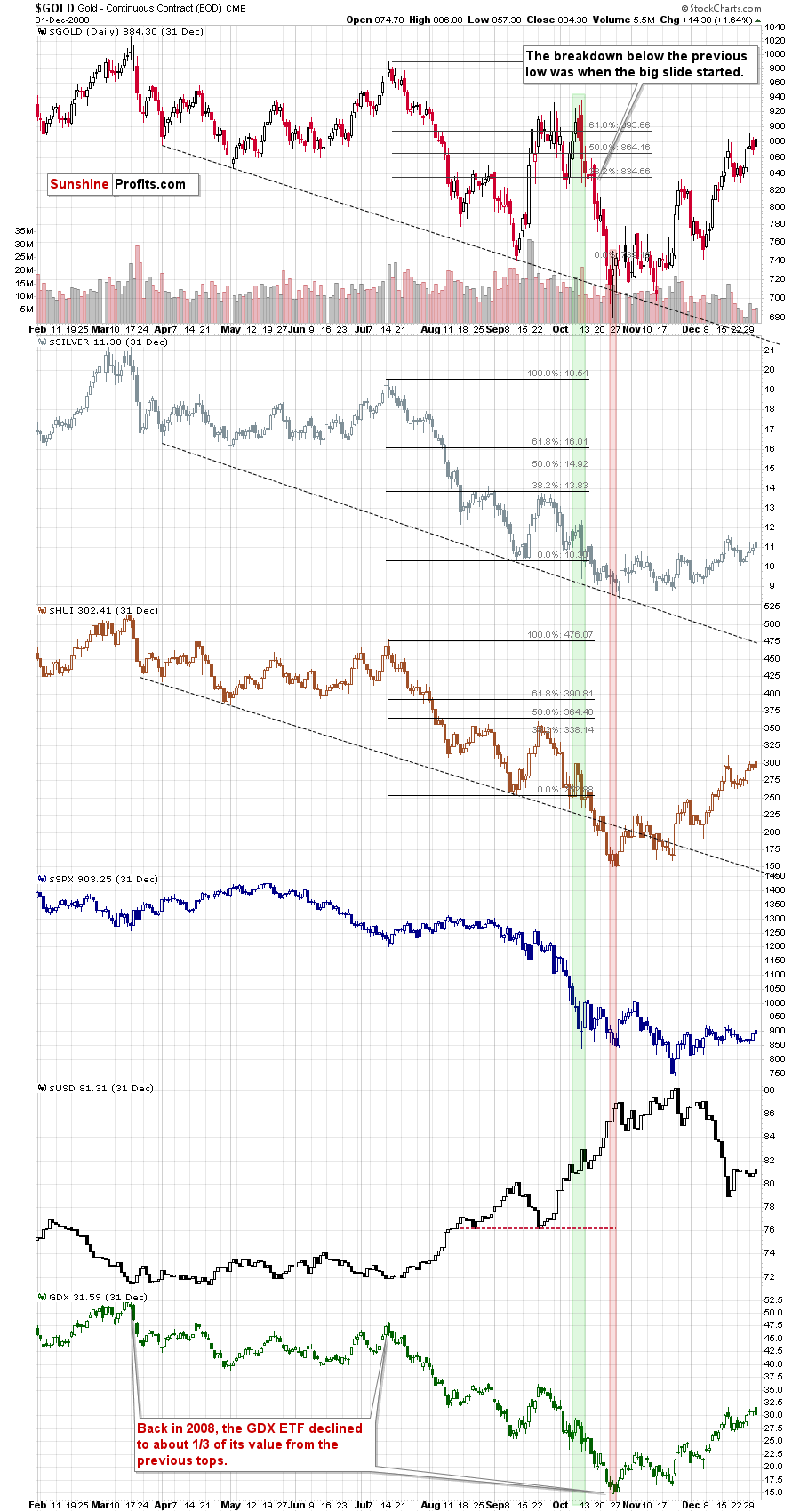

The second reason why it was important, is more of a short-term nature. Gold rallied and it rallied back up above the previously broken lows. This is important, because it changes the way we are looking at the 2008 - 2020 analogy. It now (based on yesterday's move) seems most likely that we have not yet completed the topping formation, but that we saw the initial fake move lower, after which gold could even move to new highs (not significantly, but still).

We previously wrote that it became less likely that gold would move higher once again, but that it could still happen. Based on what we saw yesterday, the odds for that significantly increased.

Furthermore, this means that our very short-term analogy in terms of time, would definitely need to be adjusted as it's no longer likely that we will see a major bottom in the precious metals market on Tuesday or close to it. Instead, it might be the case that it will be when we'll see the next local top.

Sounds disappointing? Why would it? We're adjusting our analysis to the information the market gives us and we're making sure that we are positioned correctly given all the clues, taking into account both what was available previously, and what is available now.

The key thing was that the precious metals sector was about to slide, and miners were likely to decline the most - and both forecasts remain intact. The only thing that changed, is the likely timing for this upcoming bottom. If we're about to make a gazillion dollars (of course, we can't promise any kind of performance, nor can anyone else) on that decline, does it really matter that we have to wait an extra week or two for that, especially while sitting on huge profits from the previous decline and the subsequent rebound? Exactly - we can definitely afford to wait it out. It doesn't seem that we will have to wait for long, anyway.

One More Look

Before yesterday's upswing, it seemed likely that we were in the part of the analogy when gold was already after the breakdown below the lower border of the broad top. But it seems that it is not the case, because gold invalidated this breakdown. That's not something that happened during the final slide, but something that happened right before the final top in gold.

Consequently, that was likely not the true breakdown. And since it was likely not the true breakdown, the adjustment in terms of time that we made previously this week, are no longer up-to-date. We will update them once gold breaks below the recent lows as that's when we would get the true breakdown. We might be able to update them earlier, once it's clear that gold topped for the final time.

In other words, we will update the short-term time analogy as soon as it makes sense to do so. At this point we have to adjust it, and say that the final bottom will likely take place later this month, but it might not take place next week.

For now, it seems most likely that we'll get the final bottom in gold close to the middle of the month or in its second half. Perhaps on Easter Monday, when trading is more challenging in many parts of the world (as the markets are closed there) - that's exactly when silver topped in 2011.

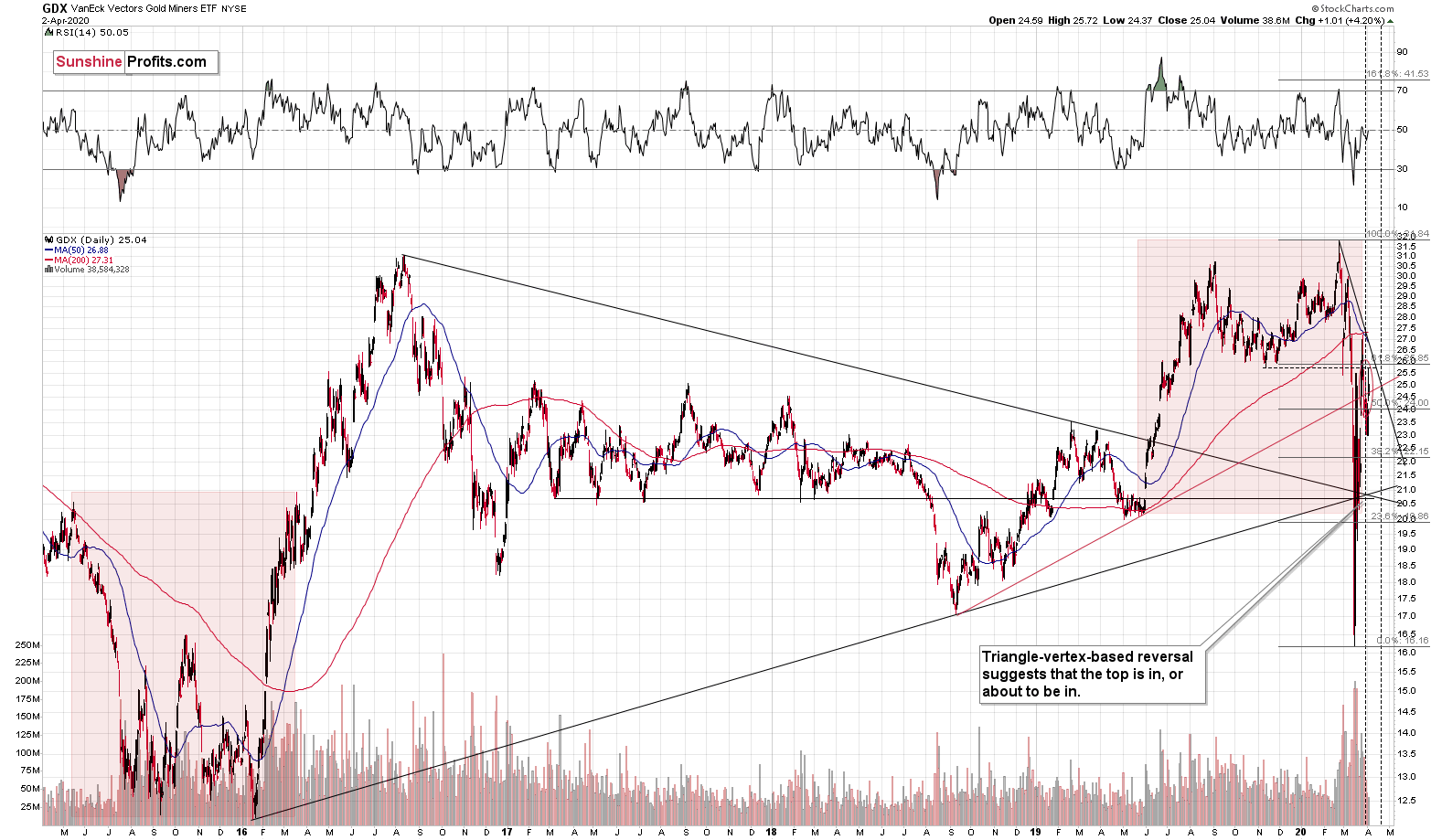

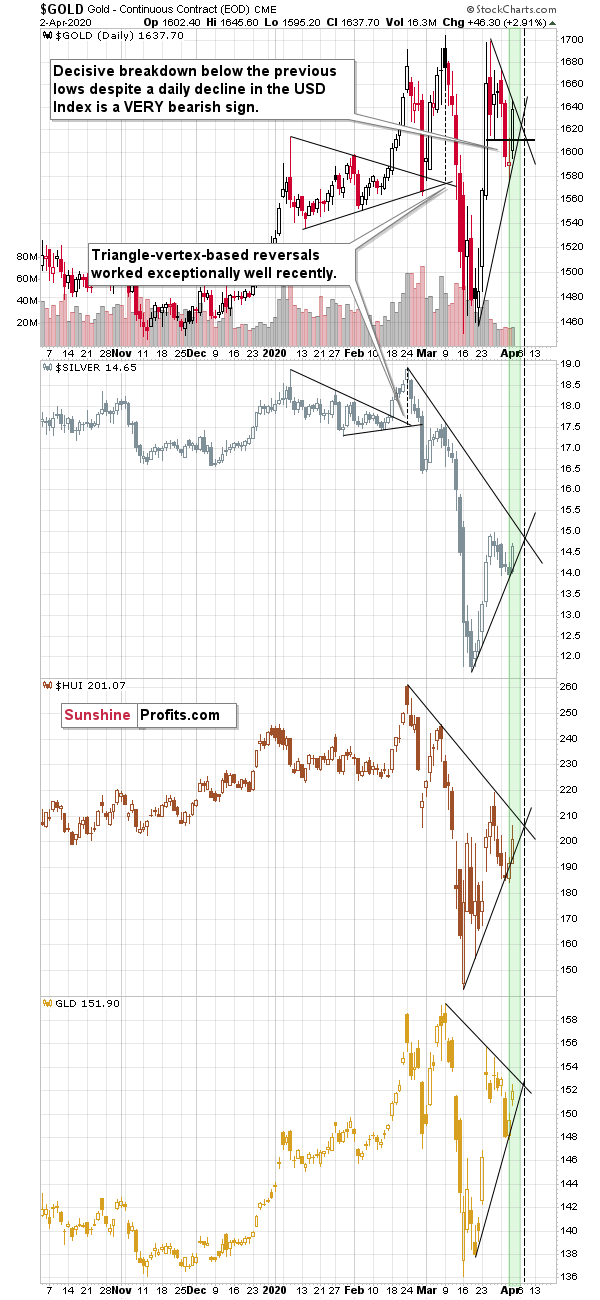

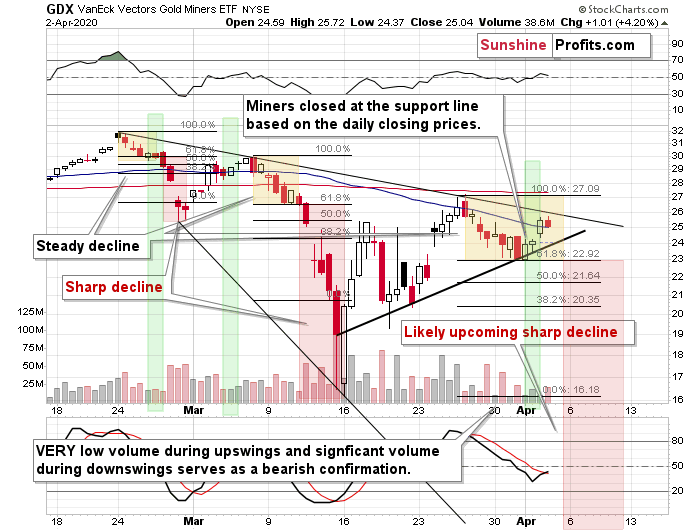

Also, let's keep in mind that we have a medium-term triangle-vertex-based reversal in the middle of the month in the GDX ETF.

Let's get back to the previous chart. What happened in other markets once gold rallied for the final time? Silver and mining stocks moved higher, but not as significantly as gold. Neither silver, nor mining stocks moved above their previous highs. The general stock market moved back and forth, mostly doing nothing, and the USD Index rallied.

What's happening right now in stocks and in the USD Index? The stocks are moving back and forth, while the USD Index is moving higher and it just rallied for two consecutive days.

Silver moved higher, but not above its recent high, and miners corrected about half of their most recent downswing. It seems that the two periods in 2008 and 2020 (both marked with green) are indeed very similar.

Note: silver might exceed its recent high temporarily as the market might focus on the industrial demand due to the upcoming infrastructure projects. That's unlikely to be anything more than a temporary development though.

As you can see, there are there are triangle-vertex-based reversals early next week in all key parts of the precious metals sector: in gold, in silver, and the mining stocks. We also get the same indication based on the GLD ETF.

This means that it's very likely that we'll see some kind of reversal on Monday or Tuesday. Based on the analogy to 2008, it's likely to be a local top, even despite the rally in the USD Index.

Ok, but how do you know that the decline is not over yet - maybe that mid-March bottom was already THE bottom?

Well, there are no certainties in any market, so we can't say for sure that this isn't the case. But we view this outcome as very unlikely. Technically, the situation continues to be just like in 2008 (with some slight differences, but still), the USD Index is likely so soar, which is very likely to translate into much lower gold prices, at least temporarily, and we also get quite a few short-term signs confirming that it's all just a pause within a bigger downswing.

For instance, the GDX ETF moved higher yesterday, but it did so on volume that was once again very low. This is what a pre-slide pause looks like. Please note that in case of the 4-hour candlesticks, the volume increased a bit (and it was the highest 4-hour candlestick of the month so far) in the second part of yesterday's session, when GDX finally moved lower. This is a bearish confirmation.

But, most importantly, the Covid-19-based catastrophe is far from being over. While this creates an excellent fundamental situation for gold in the long-term, let's not forget how the markets reacted when it became obvious that Covid-19 is not just a "China thing", but something much more severe. Stocks plunged, USD soared, gold, silver, and miners plunged as well. Once the situation gets much worse, we're likely to see a repeat of this type of reaction, but to a greater extent. The markets are now relatively calm as not much changes on a day-to-day basis and the scale of the evolving tragedy seems relatively stable. It only seems (!) stable, but it is not. The US death toll is likely to be in tens of thousands, and finally in hundreds of thousands per day. So far, it's in thousand per day (the US death toll increased from 5k to about 6k today). That's already enough to make coronavirus the third leading cause of death on a daily basis.

Ok, so... Do you think that waiting it out is the best course of action? Despite the good possibility that gold is about to rally about $100?

This was our first idea. But then came the second idea, which might be more appropriate to some traders / investors, and it seems that we will utilize it ourselves.

The second idea is not to exit the position in the mining stocks, but rather to hedge it. And we don't mean hedging it by engaging in option trades that would benefit from higher mining stock prices (although some might want to go this way). Instead of limiting the exposure to miners, we are going to increase the exposure... to gold, by going long in this part of the precious metals sector, while keeping the short position in the miners intact.

Theoretically, by being long gold and shorting miners at the same time, we are entering a spread, not hedging, but we don't really want to debate the linguistics or definitions. What we want, is to be positioned in a way that optimizes the risk to reward ratio in light of all the information that we have right now.

Why would we want to enter such hedge/spread? Because if the precious metals market moves higher, gold is likely to be the biggest winner. On the other hand, if the precious metals market slides, miners are likely to outperform on the way down. Whatever happens, we have the odds in our favor.

Keeping both positions for longer, would make this a true spread, but since our aim is to simply have a temporary protection against gold's possible upswing, we view it more as a hedge.

Why are we not keeping such a spread at all times? Because we think that the directional trades have much greater profit potential in the current market situation (the next several days being the exception). With chances for a huge slide in the following weeks this big, we prefer to have a full exposure to it, instead of having it limited by a hedge. Besides, the shape of the decline in gold might be relatively unpredictable, which would make profiting on such a hedge more difficult in the medium term. Still, as far as the next several days are concerned, it seems rather straightforward. We will provide details in the summary of today's Gold & Silver Trading Alert.

For now, let's move to questions that we received recently.

From the Mailbag

Q1: Could you please say a word about the consequences of the Russian withdrawal from buying Gold.

A1: That's great news, and it will be best if other countries would follow shortly. In the short term, it's bearish as people take this news at face value, and some may sell their precious-metals-related investments. After all, who would want to own an asset that governments (and surely they do know a thing or two about the value of the asset - after all, they employ many smart people) are getting rid of.

In reality, governments are often the worst investors (remember the Brown Bottom?) - they buy when the price is high, and they sell when the price is low. Consequently, the news that Russia stopped buying gold that could be followed by similar news, would be encouraging as it would tell us that we are getting close to the final bottom and the great buying opportunity.

This fits very well the scenario in which gold declines in the short run, but then soars in the long run.

Q2: It also seems that the physical gold market is still showing a lack of product vs. the paper market...

A2: Because relatively little time passed since the prices plunged. The physical market for individual investment products is still tight. It's not clear if the premiums will get significantly lower before THE bottom takes place. In fact, the premiums might even move higher during the decline as the market would become even tighter.

Q: Just a quick question regarding the miners. I am a subscriber and your timing has been impeccable. Is it possible this time around though that the miners will not follow the technical dictates but keep rising because of all the stimulus being perceived as good for gold and therefore the miners too?

A: It is possible, yet unlikely. We generally replied to the second part of the question earlier today - just below the "Ok, but how do you know that the decline is not over yet - maybe that mid-March bottom was already THE bottom?" sentence. Also, it might be a good idea to quote what we wrote about gold, interest rate cuts, and the likelihood of QE4 on March 2 (it was before the rates were slashed and well before the open-ended QE and the huge fiscal stimulus):

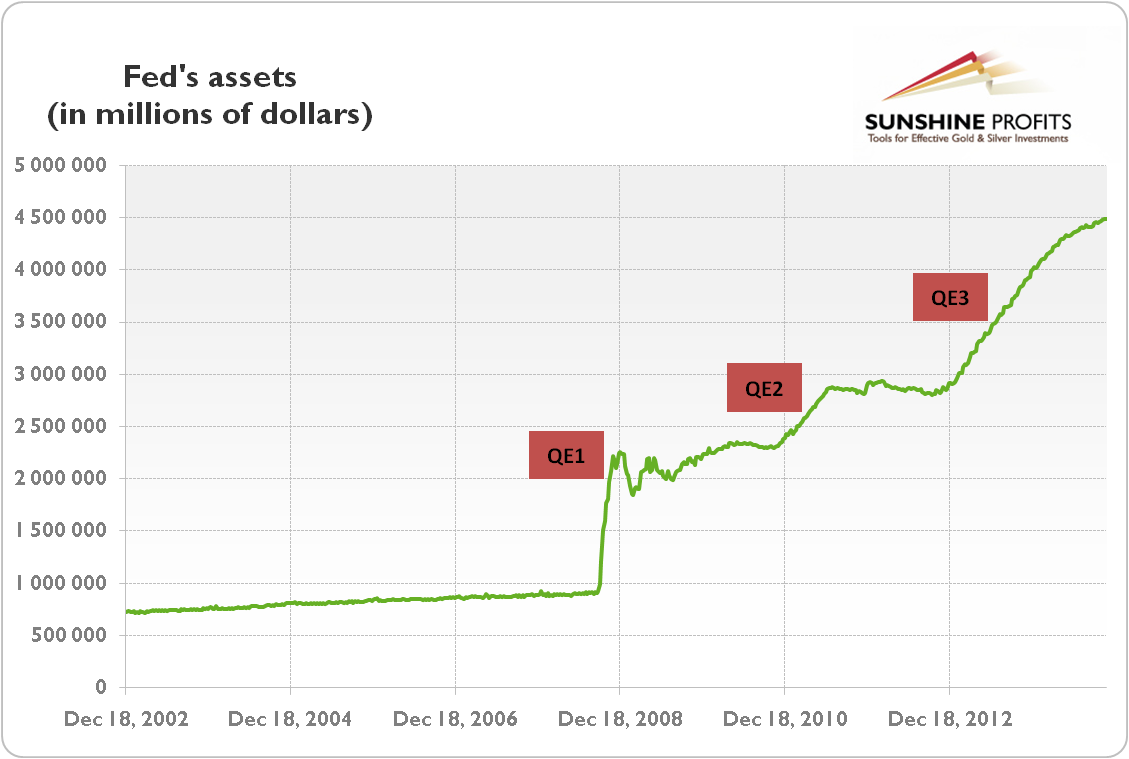

Well, let's see what the previous quantitative easing programs did.

Quoting from our explanation of the link between QE and gold:

"The effects of quantitative easing on the gold market depended on how it was perceived by investors. Initially, after the financial crisis of 2008, quantitative easing was positive for the price of gold. It was a new and unprecedented program, which undermined the investors' confidence and caused a fear of inflation or even hyperinflation. However, the U.S. economy recovered after some time and there was no inflation on the horizon. In consequence, the price of gold entered a decline in September 2011, just two months after the end of the QE2. As the confidence in the Fed and the U.S. economy was restored, the third round of the quantitative easing was welcomed by the investors. The increased confidence reduced risk premia and the bidding for tail risk insurance. Consequently, the stock market rose, while the price of gold declined."

QE1 was very bullish for the precious metals sector - the market was surprised, and the precious metals market was already after a huge decline.

QE2 was still bullish for the PMs and miners, but not as much as the first round.

QE3 started in the final part of 2012 and as it continued, PMs and miners declined profoundly. QE3 didn't prevent the decline.

Each round of the QE program was less bullish than the previous one. This trend doesn't suggest placing a lot of bullish faith in QE4 with regard to the precious metals market.

The most bullish QE was the one that was launched after gold had already declined severely for months. This is definitely not the case right now. What is the case right now is that gold just declined tens of dollars despite the dovish change in investors' expectations toward interest rates. This suggest than neither rate cuts, nor QE4 may be able to stop the decline that just started - at least not on their own and not until gold drops much further.

One more thing regarding the elections. Trump is the anti-establishment President. Perhaps the "establishment" actually wants the stock market to tumble this year, to make sure that the next US President will be pro-establishment. Consequently, perhaps the stock market won't be saved until it drops much lower, and until the US dollar is soaring much higher, proving that pro-lower-dollar-Trump was unable to get what he aimed for.

In short, the stimulus is excellent for gold in the long run, but it's unlikely to stop the emotional slide in the short term.

Summary

Summing up, based on yesterday's rally in gold and the invalidation of its recent breakdown, it seems likely that we are still in the topping formation part of the analogy to the 2008 moves, and this means that gold might rally to the previous highs before declining profoundly.

This doesn't change the likelihood that we'll see a huge decline in gold, silver, and - particularly - mining stocks, but it does push it back in time for several days. It also means that the targets will likely be reached later than during the following week. Middle of the month (April 13 - the Easter Monday) of its second half are the most likely target time-frame based on the information that we have right now.

In order to optimize our position given the possibility of seeing gold shooing higher along with a relatively smaller response from the miners, we are entering a hedge/spread, by going long gold, while keeping the short position in the mining stocks intact.

If, instead of opening a short position in mining stocks previously, one had opened a short position in gold, it might be better to temporarily close it at this time, and re-enter it later (once our exit price for gold is reached). If one had opened a short position in silver previously, it might be better to wait out the upcoming corrective upswing, as silver could plunge in a particularly volatile manner when it finally does start to slide (just like it did in March).

Finally, if the idea of entering a spread/hedge seems too complex and sophisticated, it might be better to just wait out the possible upswing in gold. We expect to get a lot of questions based on the above, but please note that we can't provide investment advice, and telling you - individually - how much of what should be bought, would be an investment advice. We won't be able to do that, but we'll be happy to reply to questions that are asked in general terms. Unfortunately, there are some limitations to providing the service through the newsletter model - while I'm making the trades (taking care of leverage, position sizes etc.) for the funds of accredited investors (and my own) in my private investment fund, I'm not able to do so through the means of our website and e-mail.

The decline that we saw in stocks and on other markets was most likely just the beginning. The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. It might peak when the death toll is in hundreds of thousands per day. At the moment of writing these words, the number of total confirmed cases in the US is about 246k and the death toll is above 6k and it's starting to accelerate.

It's 2008 on steroids.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks and full speculative (250% of the full position) long positions in gold are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $11.47; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $14.87; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Gold futures: profit-take exit price: $1,694; stop-loss: $1,547; initial price target for the UGLD ETN: $181.87; stop-loss for the UGLD ETN: $136.98

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway. In our view, silver has greater potential than gold does):

Silver futures downside profit-take exit price: $8.58

Gold futures downside profit-take exit price: $1,312 (the target for gold is least clear; it might drop to even $1,170 or so)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager