Briefly: in our opinion, full (250% of the regular position size) speculative short positions in mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. Those who can't or prefer not to take positions against mining stocks, might want to consider speculative short positions in silver.

First of all, if you haven't had the chance to read yesterday's analysis, I strongly encourage you to do so today - yesterday's extensive analysis includes all the critical details regarding the outlook for the precious metals market and it remains up-to-date also today. Today's issue is going to focus on some other points that we didn't make yesterday that are not as critical. We'll also provide a brief update on the 2008 - 2020 time analogy.

First of all, the thing that is happening today, is that the quarter is ending. Seems irrelevant, right? But it's not. Various types of performance are often calculated on a monthly basis, and quarterly calculations are used for a more broader overview. This includes the stock market performance.

The monthly and quarterly performance numbers are what is then automatically written about, what's shown on TV and what people use to then make decisions on regarding the future. One might say "my investment fund is based on a very sound strategy that's based on meticulous research, combines sector-specific indicators, is based on strategically changing exposures to various parts of the sector it specializes in, has special algorithms for individual stock selection, carefully handles leverage, and is very adaptable, should the circumstances change", but it would most likely not get the same kind of attention as "it seems that my investment fund is going to end this quarter over 140% higher after all fees".

The odds are that you yawned while reading the long sentence describing the approach, but the quarterly performance estimate generated a "whoa!" reaction. The next thought would probably be something along the lines of "hey, maybe I should invest in it". If that was a big negative number, you might think the opposite.

The Fed knows very well how it works. Trump knows how it works, and so does his administration.

Ok, so what? Everyone knows that quarterly numbers are important - what makes it something worth keeping in mind right now?

The thing that makes the difference is that while most people don't have the ability to impact the quarterly closing prices, the Powers That Be - do. We don't want to elaborate on the mechanisms through which this goal might be achieved, and whether or not they are legal (It's not market manipulation if it's done officially, right? Like interest rate management...), we just want to emphasize that it is something that we should expect. Of course, that is if the Powers That Be really want to prevent further declines on the stock market. And they definitely and desperately want to prevent them.

In our view, they don't stand a chance against the entire market that is slowly, but surely getting frozen by fear. Well, maybe not so slowly. The initial reaction was substantial, but the worst is yet to come. And it's going to be much, much worse than it is. But we already elaborated on that matter yesterday. What we wanted to emphasize today, is the very quick possibility of seeing higher stock market prices today, and perhaps some turbulence (in terms of intraday market volatility) in general. If that happens - please keep in mind that it's most likely only temporary and the market are likely to move lower (except for the USD Index) soon, anyway.

Also, if the Powers That Be are going to intervene and try to push the markets higher, you know which market is the one least likely to get support? The precious metals market. Gold could get some temporary boost (after all, in 2008 there was a third high that exceeded the previous two and we have seen that so far), but we wouldn't expect one in case of silver or miners.

Before moving to technical part of today's analysis, we would like to reply to a question that we just received:

I have been reading how the situation is very alarming and scary with numbers growing in multiples. Enjoyed reading your Alert today and also the April Gold Market overview report by Arkadiusz Sieron, PhD. I understand the point about on economically how difficult things will get, but with more than 25 top Pharmaceuticals and Bio pharmaceuticals companies https://www.clinicaltrialsarena.com/analysis/coronavirus-mers-cov-drugs, aggressively researching the Vaccine/drug for the treatment of coronavirus, and if they are able to come up with some kind of treatment by third quarter, will that change the way the projections for Gold and economy stand??

In short, no. We expect the situation to stabilize in one way or the other (either there will be a cure, or people will die relatively soon given how quickly Covid-19 is spreading), and whether it happens by the third quarter of not, people will still panic in the meantime, and the economy will be hurt badly, anyway. The stagflationary tsunami wave is likely to hit the market anyway. And the markets, being forward looking (which works most of the time, but not always), are likely to realize that owning gold and related assets during times when the problems and their consequences are being printed away is a quite good idea. That's what happened in 2008 as well - gold, silver, and mining stocks bottomed well ahead of stocks. If stocks bottom in a few weeks, few months or closer to the end of the year, doesn't make that much of a difference as long as we get the PMs' and miners' timing right.

Let's take a look at the charts.

PMs Right Now

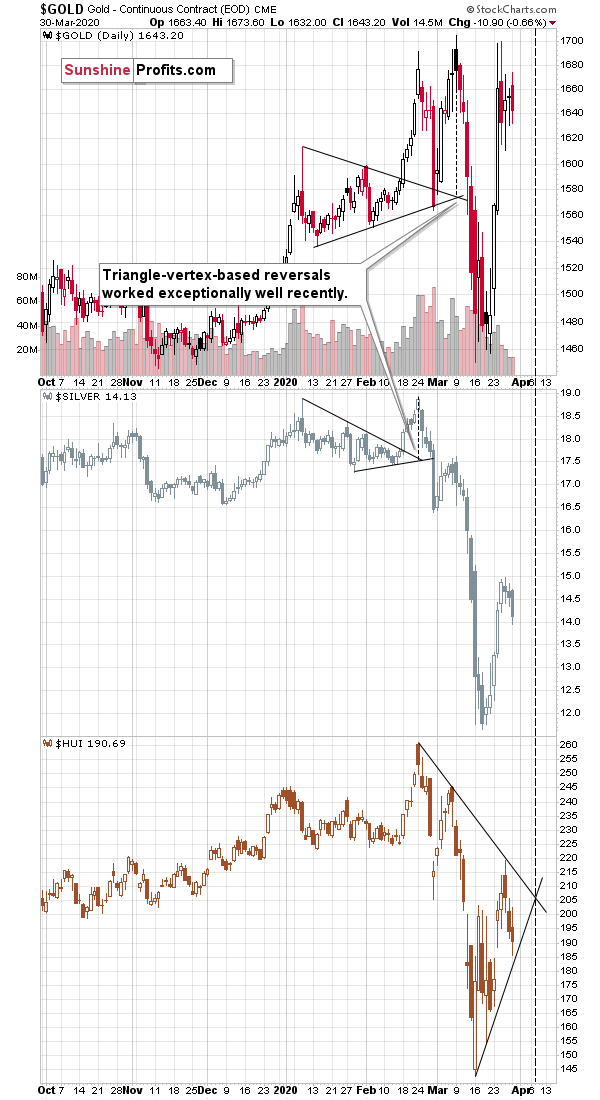

Yesterday's session was not that important at first sight as not much happened. Gold simply continued its back and forth trading, relatively close to the previous 2020 highs.

But at the same time, yesterday's session was actually very useful, because the markets already did what we expected them to. Silver and miners declined without gold's help. This is important, because that's exactly what happened in 2008 in the final part of gold's topping formation.

In Wednesday's Gold & Silver Trading Alert, we wrote the following:

We might have already seen the tops in gold and silver. Gold might not start its decline until tomorrow or Friday, but both silver and miners could slide sooner, especially if the stock market declines after topping - perhaps even today.

Silver and miners are indeed sliding sooner. And most importantly - they both declined yesterday while the stock market moved higher by over 3%. This is particularly important in case of mining stocks. They used to magnify stocks' gains during the recent run-up. This is certainly no longer the case. Overall, yesterday's session was a big bearish confirmation and a sign that the next move lower is already here. It's simply not that visible at the beginning. The first three sessions that we saw at and after the most recent tops, were nothing to call home about either.

Let's compare them.

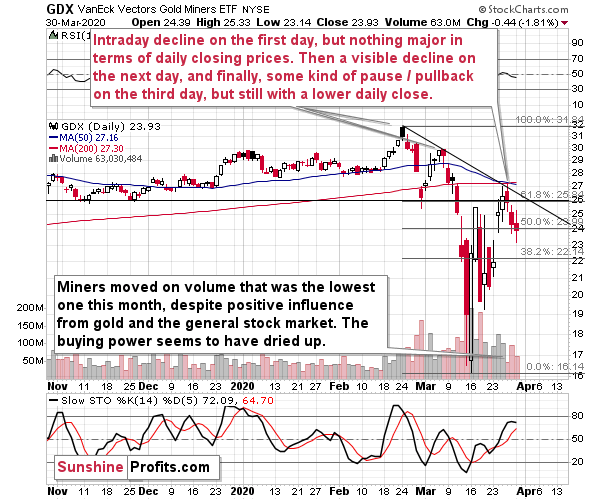

We saw an intraday decline on the first day, but nothing major in terms of daily closing prices. Then we saw a visible decline on the next day, and finally, some kind of pause / pullback on the third day, but still with a lower daily close.

These three cases are remarkably similar. What makes them different? The sizes of the moves.

Starting intraday high on Feb 24: $31.84

Closing price on the third day (Feb 26): $29.87

Decline by: 6.19%

Starting intraday high on Mar 6: $29.96

Closing price on the third day (Mar 10): $27.49

Decline by: 8.24%

Starting intraday high on Mar 26: $27.21

Closing price on the third day (Mar 30): $23.93

Decline by: 12.05%

They are similar, but just as the second decline started with a bigger move, the third decline also started with a bigger move than the second one.

The second decline was much bigger than the first one. Through analogy, perhaps the third decline will also be much bigger than the second one.

Of course, the above analogy alone would not be sufficient (far from it) to make the outlook bearish on its own. However, given all that we already wrote yesterday, it serves as a great confirmation of the extremely bearish outlook for the mining stocks.

Don't let the lack of volatility yesterday make you lower your guard. Right now, we are likely in the calm before the storm situation, and this calmness is not likely to last in terms of days, perhaps there are only hours thereof left. Gold might peak one final time, just as it did in 2008, but this might not happen as the topping formation already took more time (on a relative basis) than it did in 2008, and gold made two failed attempts to rally: one on March 26th, and one earlier yesterday. They both failed to take gold to new highs, and if the USD Index keeps on rallying, it's likely that gold will fall without the third intraday high.

Once gold futures slide below $1,600, we'll know (there are no certainties on the market, so let's say that it will be very likely) that the calmness is over.

Is the short-term correction in the USD Index over, and has it already resumed its rally? Another wave up in the USD Index would likely correspond to another wave down in gold, silver, and miners. It's getting more likely with each passing hour.

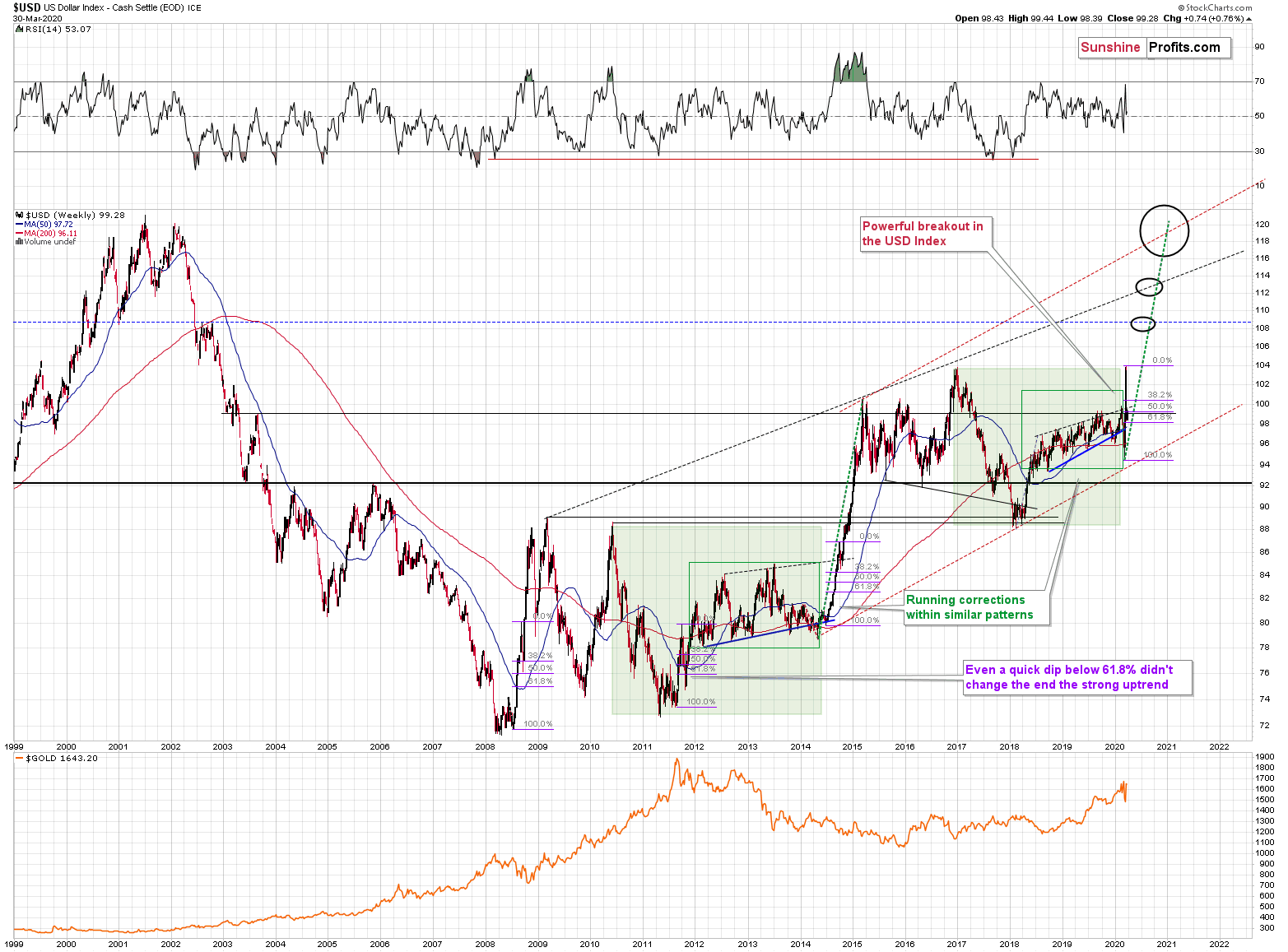

USDX Breaking Out

The USD Index already broke above the declining resistance line, and while the breakout is not yet confirmed, it's already a positive sign.

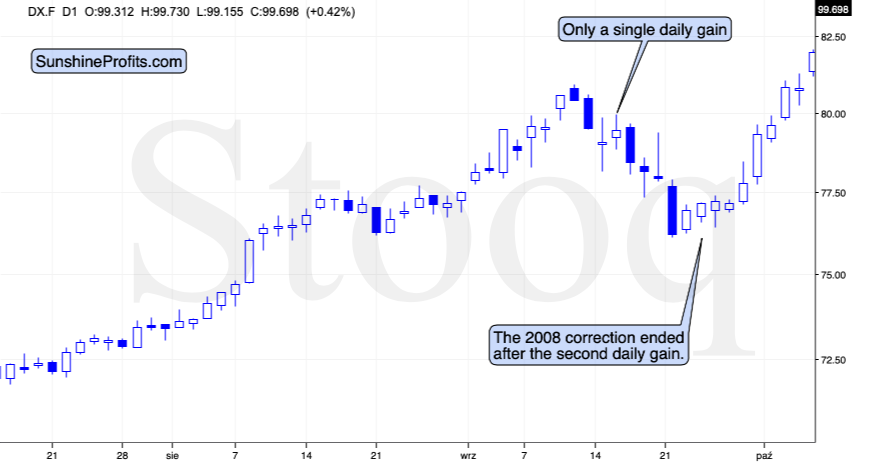

The second positive sign will be, if the USDX is able to close the day higher than it closed yesterday. Why? We compared the corrections in similar times and here's what we found.

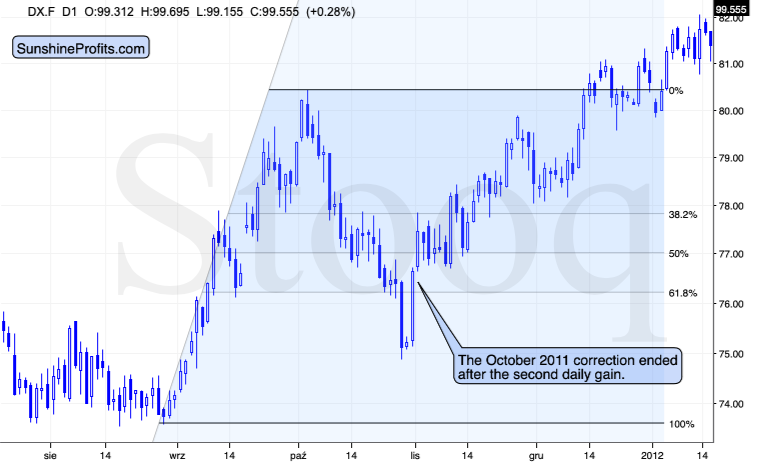

Based on the above chart, we see that there were two similar cases - one in 2008 and the other in 2011. These years are also similar due to the fact that in both cases we saw major tops in gold.

Given the size of the most recent rally, the 2014-2015 rally might appear similar, but the correction that we saw back then, was not big enough and the preceding rally was not sharp enough to be really comparable. That's why we're focusing on 2008 and 2011.

In 2008, the USDX corrected a bit below its 50% retracement, but not to its 61.8% retracement - just like it did recently. There were moves both up and down during the corrective downswing, and the thing that confirmed its end, was the second daily gain.

And in 2011?

Exactly the same thing was the case. The shape of the decline was different, and the decline was deeper (it moved below the 61.8% retracement but the USDX stayed there for just 2 trading days), but once we saw two daily gains in a row, it served as a confirmation that the decline was over.

The USD Index just posted the biggest daily gain in the last 7 trading days and it's moving higher also today. Unless it slides later today, it seems that we'll get the above-mentioned bullish confirmation today. This means that gold would be to likely to slide well below $1,600 soon, and... The "storm" would really begin.

Summary

Summing up, while it might (that's not very likely) be the case that gold will attempt to break above the recent highs today, it seems that the true tops in gold, silver, and mining stocks are already in. Any moves above the very recent highs should be viewed as temporary. In fact, they might be viewed as a good opportunity for entering or adding to one's positions aimed at profiting from lower precious metals values.

We had taken profits from the previous long positions in mining stocks on March 25th, and we entered new short positions in the miners on March 26th. Given yesterday's weakness in the mining stocks, it seems that we took profits from our previous long positions exactly on the day that the miners topped in terms of the closing prices, and that we entered the new short positions exactly on the day that the miners topped in intraday terms. This assumes using GDX as a proxy. If we use GDXJ, we entered the short position on the day when they made the second intraday top of their double-top formation.

The next slide lower is likely to be very sharp and very deep.

Overall, it seems that the next major reversal will take place during this or in the next week, relatively close to April 7th. This might even be THE bottom for the precious metals sector.

This rally might have made one feel bullish - after all, the prices of miners seem to have recovered to a large extent. Please be sure to keep in mind that what we saw, was the first big wave down of a much bigger move lower, also in the stock market. The coronavirus stock-market decline has likely just begun and once it continues - and as the rally in the USD Index resumes - the precious metals market is likely to suffer. Silver and miners are likely to be hit particularly hard.

The real panic on the US stock market will begin when people start dying from Covid-19 in the US in thousands per day. It might peak when the death toll is in tens of thousands per day. We hate to be right on this prediction, but we expect the number of the total confirmed cases in the US to be multiple times greater than the analogous number in China. At the moment of writing these words, the number of total confirmed cases in the US is about 143k - first in the world.

It's 2008 on steroids.

Most importantly - stay healthy and safe. We're making a lot of money on these price moves (and we'll likely make much more in the following weeks and months), but you have to be healthy to really enjoy the results.

Finally, we would like to remind you about the very important and very timely April Gold Market Overview report, which we have posted on Sunday. Until tomorrow, it will be available for just $1 (subscriptions - including this one - renew normally unless cancelled), so we strongly encourage you to read it, even if you previously didn't have access to these reports. Naturally, the All-inclusive subscribers have already received the notification about it yesterday, as soon as it was posted.

By the way, we recently opened a possibility to extend one's subscription for a year with a 10% discount in the yearly subscription fee (the profits that you took have probably covered decades of subscription fees...). It also applies to our All-Inclusive Package (if you didn't know - we just made huge gains shorting crude oil and are also making money on both the decline and temporary rebound in stocks). The boring time in the PMs is over and the time to pay close attention to the market is here - it might be a good idea to secure more access while saving 10% at the same time.

Important: If your subscription got renewed recently, but you'd like to secure more access at a discount - please let us know, we'll make sure that the discount applies right away, while it's still active. Moreover, please note that you can secure more access than a year - if you secured a yearly access, and add more years to your subscription, each following year will be rewarded with an additional 10% discount (20% discount total). We would apply this discount manually - please contact us for details.

Secure more access at a discount.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (250% of the full position) in mining stocks (but not in gold nor silver) are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Senior mining stocks (price levels for the GDX ETF): binding profit-take exit price: $10.32; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the DUST ETF: $11.97; stop-loss for the DUST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Junior mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $9.57; stop-loss: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the JDST ETF: $16.27; stop-loss for the JDST ETF: none (the volatility is too big to justify a SL order in case of this particular trade)

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one, it's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (DGLD for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn't, then we will view both positions (in gold and DGLD) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager