Briefly: in our opinion, full (200% of the regular size of the position) speculative long positions in gold, silver and mining stocks are justified from the risk/reward perspective at the moment of publishing this alert. Due to the intraday volatility, we are moving the stop-loss level for gold and the UGLD ETN lower. Also, if today’s overnight move lower in gold closed one’s position automatically, it seems that re-entering it is justified from the risk to reward point of view.

We have two things to discuss today. One is what we saw yesterday in gold, silver and mining stocks – the decline in the former and relative strength in the latter. The second thing is the critical situation in platinum – it just broke below its 2016 low. Will platinum pull the rest of the precious metals sector lower despite multiple bullish indications?

Let’s start with the recent developments (charts courtesy of http://stockcharts.com).

Metals’ and Miners’ Short-term Decline

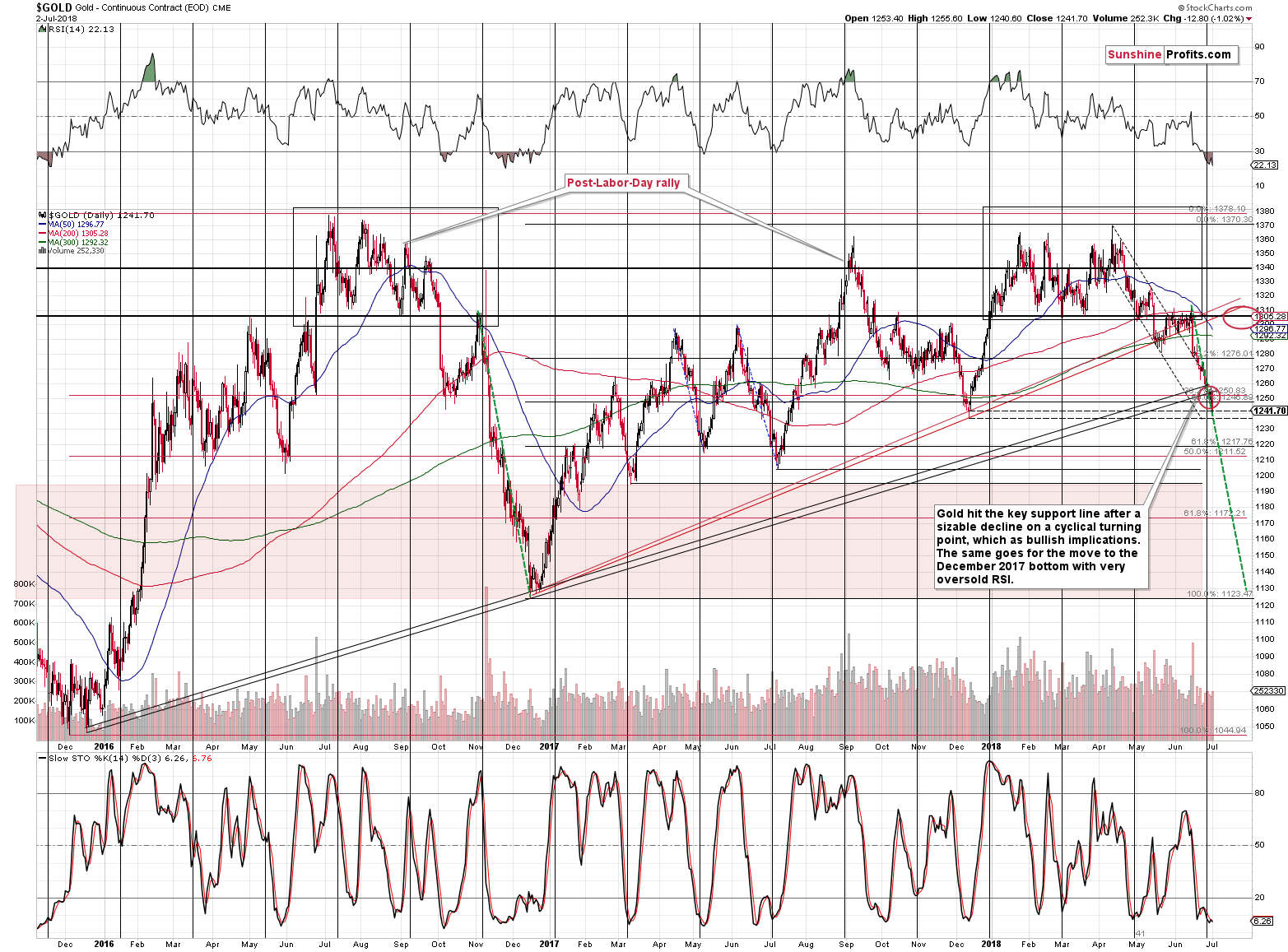

Gold moved sharply lower yesterday and it moved to the lower border of our target area. That was rather odd, because we had already seen a reversal right at the cyclical turning point and it appeared that gold was very likely to move higher. Yet, instead of soaring, it moved toward the December 2017 bottom. At the moment of writing these words, gold is trading at $1,250, so it’s relatively close to where it was previously. But, why did it decline at all and what does this change going forward? Before replying, let’s examine silver.

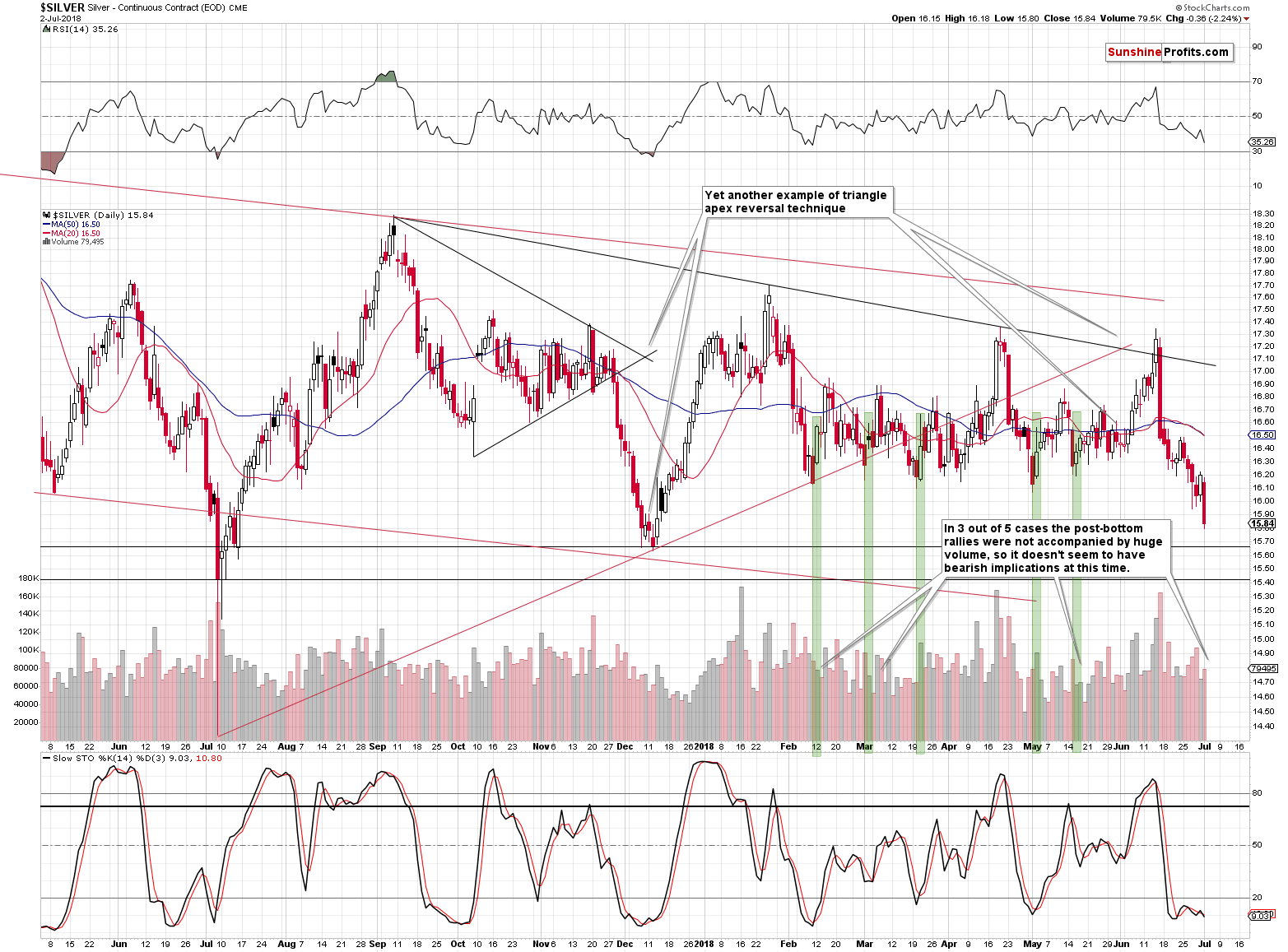

Silver declined on volume that was slightly higher than what we had seen on Friday, which is bearish. The fact that silver broke below the previous lows and closed visibly below them is also bearish. In yesterday’s alert, we wrote that at times silver started its post-bottom rallies on low volume, so it was not something to be concerned with. Yet, in all these cases (mid-February, early March, mid-May) the following downswing didn’t take silver to new lows and it didn’t take place on higher volume. Consequently, the analogy to the cases marked with green rectangles on the above chart is no longer up-to-date.

All in all, the implications of the above chart have deteriorated significantly based on yesterday’s session.

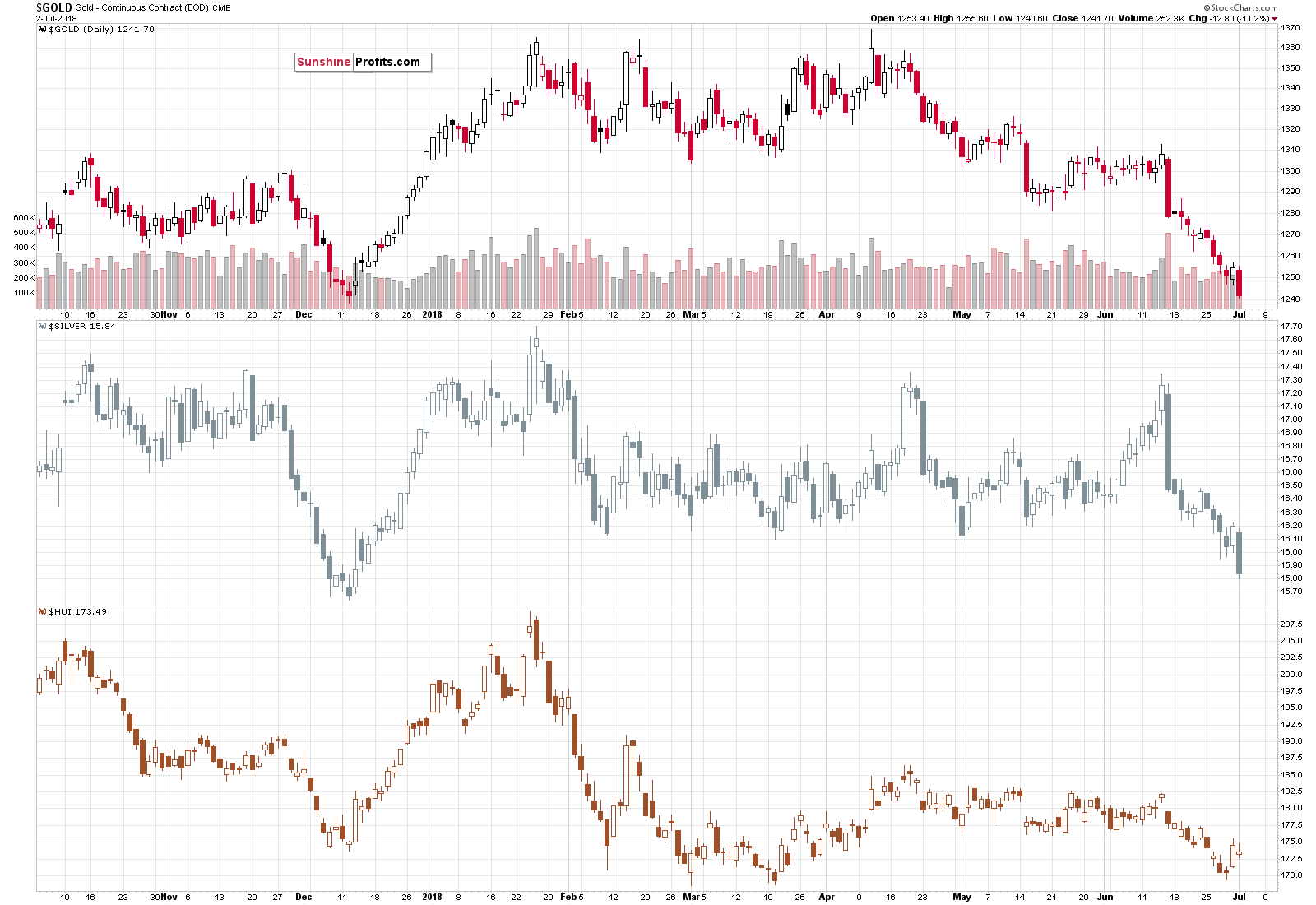

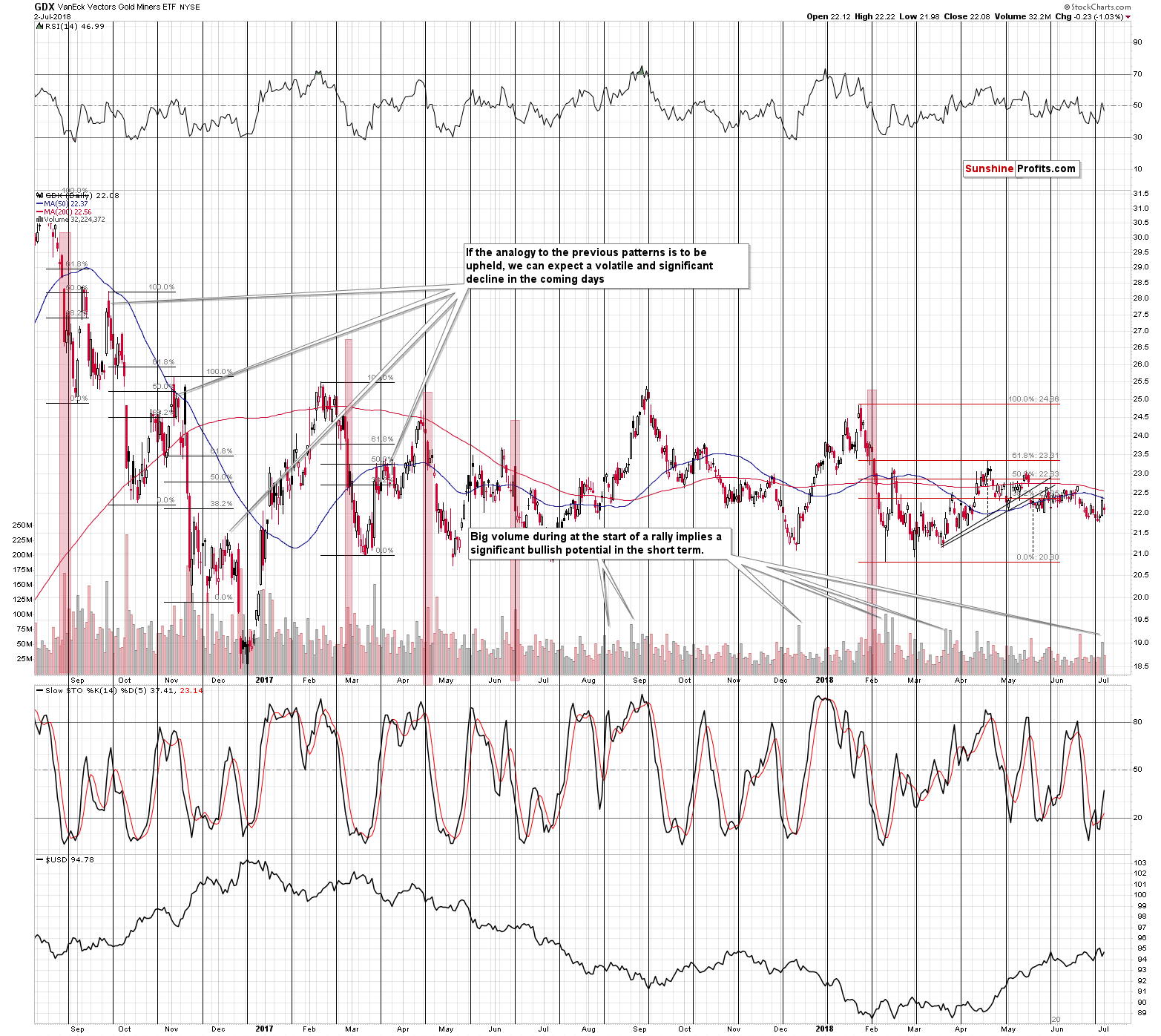

But, when we compare the performance of gold and silver to the one of the mining stocks, we see that yesterday’s session was actually what we look for as a confirmation of the bottom.

Silver underperformed, yet gold stocks showed great resilience and instead of moving to new lows, like gold and silver did, they just corrected less than half of Friday’s gains.

This is exactly what we previously identified as a perfect bullish set-up.

The volume that accompanied yesterday’s decline was much smaller than the one that accompanied Friday’s rally. The implications are bullish.

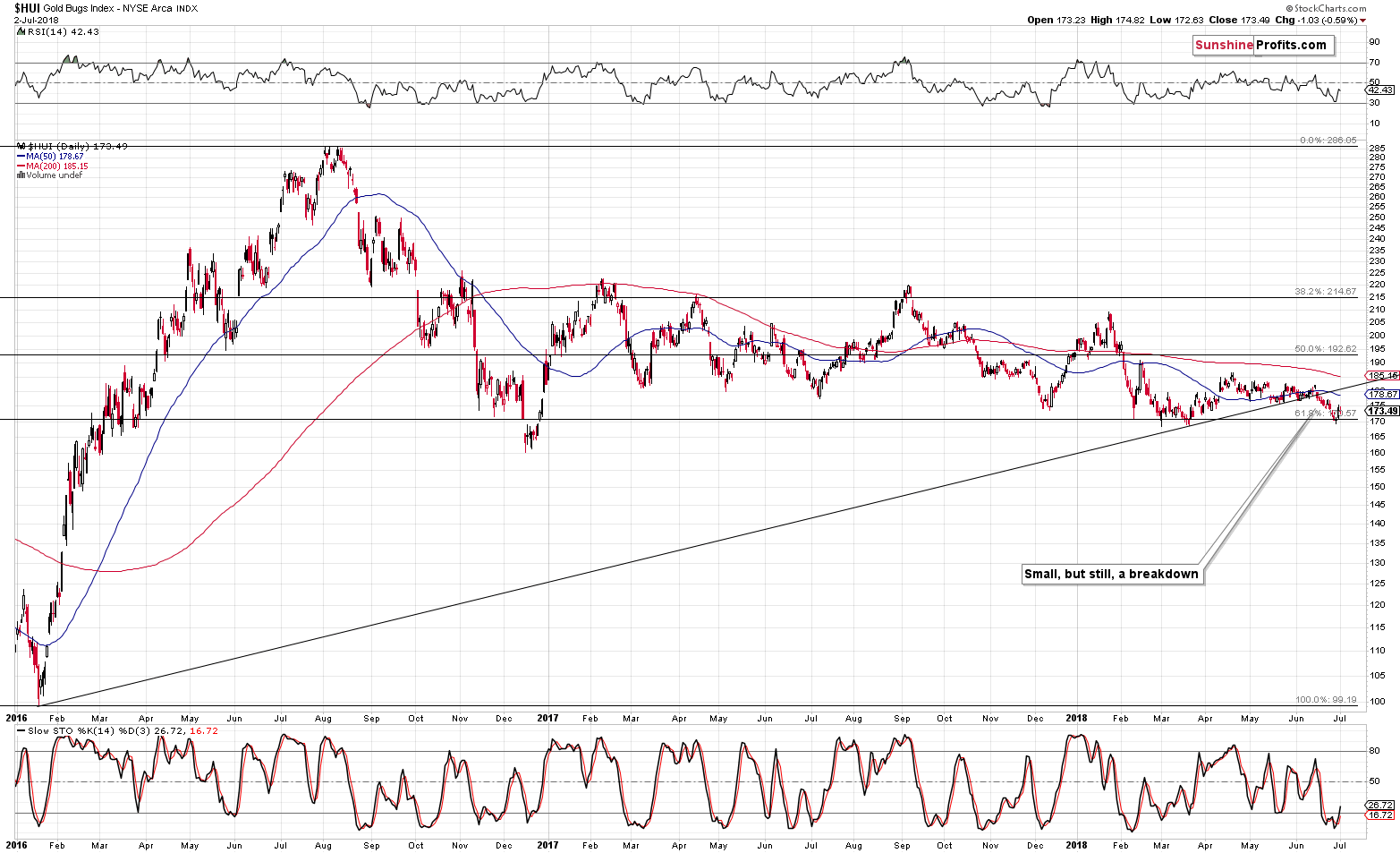

From the broader perspective, yesterday’s decline is not even visible in the case of the HUI Index. The strength that mining stocks exhibit is truly exceptional. Consequently, our previous comments on the price targets for the HUI remain up-to-date:

The nearest resistance level that we have on this chart that seems strong enough to stop this rally is the previously broken rising resistance line. It provides resistance at about 182. Still, we wouldn’t rule out a situation in which, we see a very temporary move above it – to 186 or so (the April highs). Which of these levels will finally stop the decline will depend on what gold, silver, and USDX do at that time and what kind of confirmations we get.

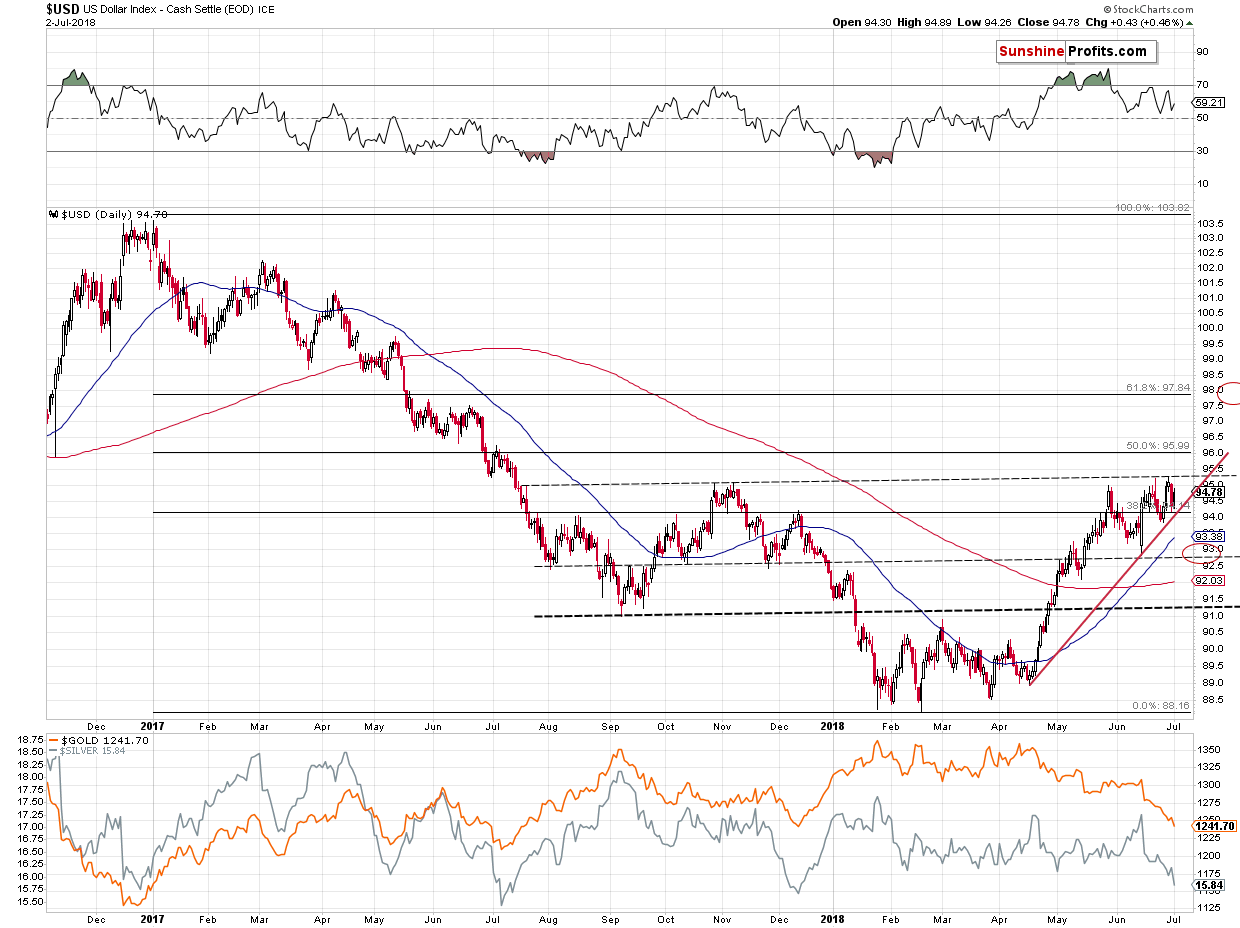

Now, as far as the USD Index is concerned, we saw a rally, but it didn’t mean a move above the previous highs. Consequently, a move to new lows in gold and silver is a sign we weakness in the PM sector… Unless there was a good non-forex reason that could explain why metals were so weak yesterday.

There was and this brings us to the second thing that we want to discuss today. Platinum’s performance.

Platinum Breakdown

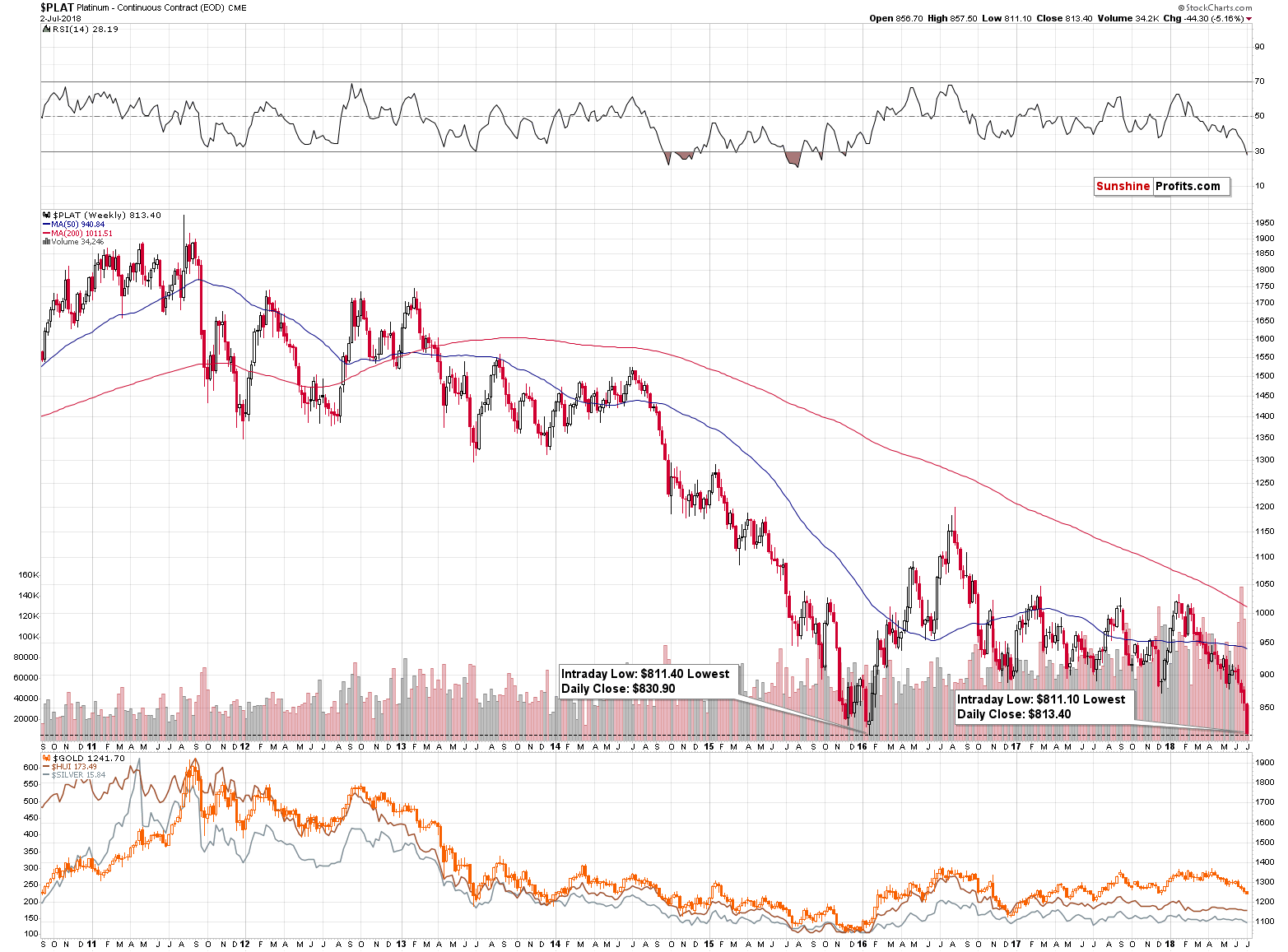

Platinum just moved below its long-term low of $811.40. The breakdown was very small (yesterday’s intraday low was $811.10 – only 30 cents lower), but still, it happened. The follow-up action is just as important.

Platinum even moved a bit below $800 in the overnight trading and it rallied back up – above $800 and above the 2016 intraday low. If it closes today’s session above $830.90, the breakdown will be fully invalidated from both perspectives: intraday and in terms of closing prices.

Platinum is already after an overnight rally of approximately $25, and only $10 below the mentioned level, and it seems that the mentioned invalidation is likely.

Now, the question is why is this important for the rest of the precious metals market.

The answer is: contagion effect and representativeness bias. The above links provide complex definitions, but to make a long story short, when people see that a part of a given market is failing, they start viewing the entire market as failing and they start selling, thus making this market fail for real.

For instance, there are no major economic links between Argentina and Poland, but both economies are somewhat similarand they are both viewed as emerging markets. A crisis in Argentina shouldn’t have any impact on the exchange rate between the USD and the PLN (Polish złoty – “złoty” means “golden,” by the way). But it would. A crisis in Argentina would make investors view “emerging markets” as risky in general, without them paying attention to details. They would simply exit emerging markets regardless of whether it really made economic sense with regard to countries other than Argentina. In this case, investors who had previously used dollars to buy Polish equities or other assets, would likely sell them and then want to get back into the USD.

In our case, platinum declined profoundly and it likely took gold and silver with it, through the mentioned effects.

If platinum kept on declining, the negative impact on the rest of the precious metals sector could persist, or slowly fade away. But, it’s likely that this effect will be reversed due to two reasons:

- Platinum’s decline was most likely a news-based effect and such effects are usually only temporary

- Platinum already invalidated the breakdown in intraday terms and it seems likely that it will invalidate the one in terms of closing prices as well.

The likely direct reason behind platinum’s slide is the Car-tariff threat. You can read the full story here and the long story short version is that there is a threat of a trade war between the U.S. and the EU with regard to cars. The EU exported $43.6 billion worth of cars to the U.S. in 2017, while $7.2 billion worth of cars were exported to the EU from the U.S. Consequently, a trade war with regard to cars would likely result in less demand for European cars but bigger demand for U.S. cars (U.S. domestic demand would likely increase if cars from the EU became more expensive for end users).

Gasoline cars dominate the U.S. market, while diesel cars dominate the EU market. Consequently, the above implies significantly less demand for diesel cars and since platinum is used in catalysts for diesel engines, the above means smaller demand for platinum. Therefore, the price dropped.

The markets are forward looking and thus they already discounted the above in the price to some extent, but let’s keep in mind that the risk of a trade war is not the same as an actual trade war. This is especially the case since President Trump is known to change his mind relatively quickly. Consequently, in our view, the market overreacted to what really changed.

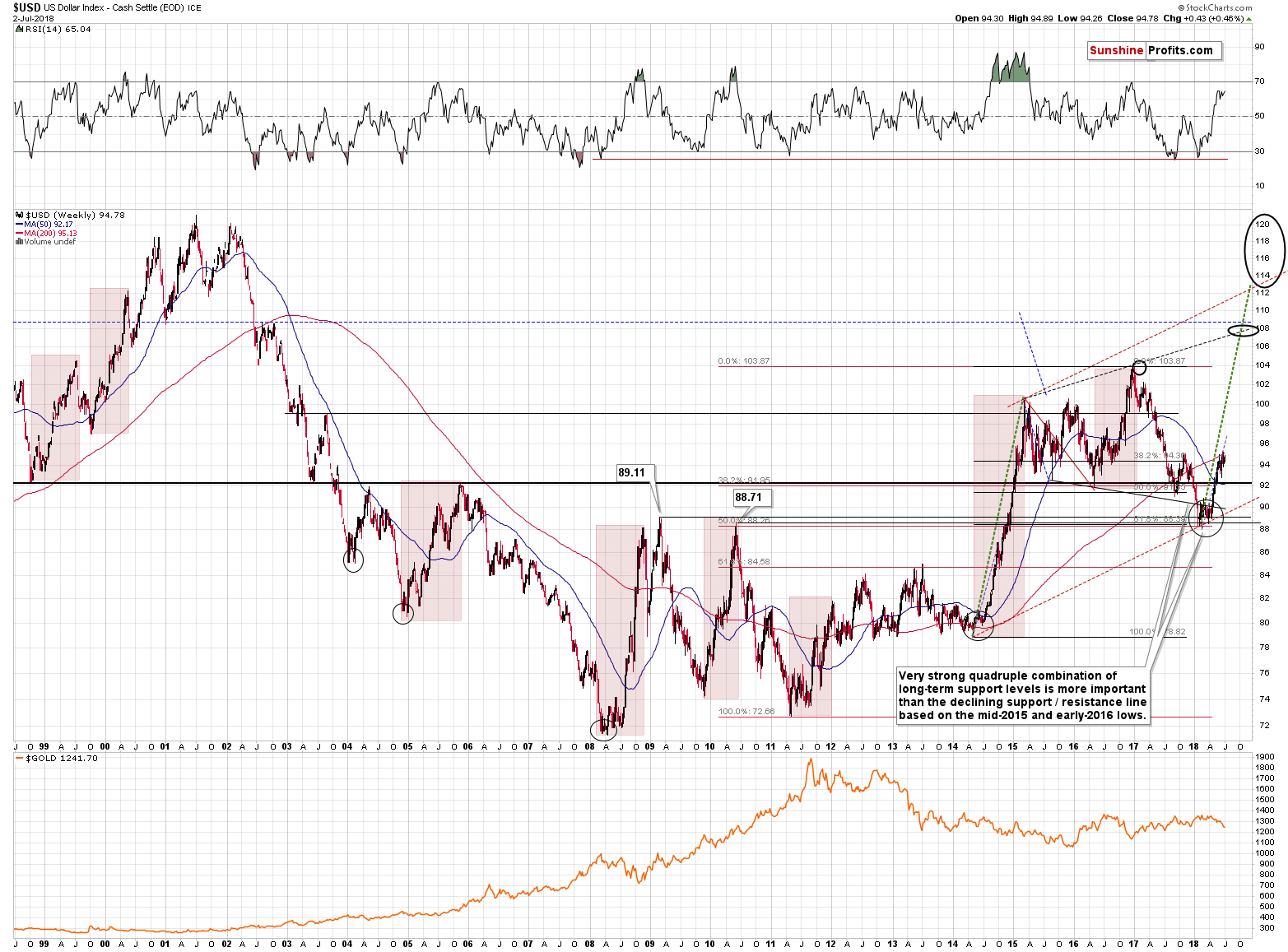

The situation is similar to what happened in the USD Index in January. Back then Treasury Secretary Steven Mnuchin signaled that a weak greenback was good for trade, which shocked the markets as that was exactly the opposite of what a Treasury Secretary is supposed to say. The USD Index declined profoundly because of this and it even briefly moved below the key long-term support levels.

But, this breakdown was quickly invalidated (and so was the “megaphone pattern”) and it turned out that it was actually a beginning of a rally, not a decline.

We have something similar in platinum – a big, news-driven decline after a decline and an invalidation of the breakdown below the key long-term support level. The implications are bullish, not bearish.

What does it imply to gold, silver and mining stocks? That yesterday’s decline was somewhat artificial and it should not be taken at face value. Consequently, even though silver’s short-term chart doesn’t look favorable, it doesn’t mean that the outlook changed. The same goes for other factors that might appear bearish based solely on yesterday’s session.

In fact, knowing what was likely behind yesterday’s price declines and seeing how this bearish factor is likely to become a bullish one serves as yet another bullish sign that further confirms our long position.

Summary

Summing up, yesterday’s session seems to have been bearish at first sight, but after examining what happened in platinum, why it happened, and what kind of action followed, it turns out that the outlook didn’t change at all and it remains bullish for the next two weeks or so.

Due to the intraday volatility, we are moving the stop-loss level for gold and the UGLD ETN lower. Also, if today’s overnight move lower in gold closed one’s position automatically, it seems that re-entering it is justified from the risk to reward point of view.

As always, we’ll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full long positions (200% of the full position) in gold, silver and mining stocks are justified from the risk/reward perspective with the following stop-loss orders and initial target price levels:

- Gold: initial target price: $1,298; stop-loss: $1,228; initial target price for the UGLD ETN: $10.37; stop-loss for the UGLD ETN $8.67

- Silver: initial target price: $16.72; stop-loss: $15.57; initial target price for the USLV ETN: $10.47; stop-loss for the USLV ETN $8.47

- Mining stocks (price levels for the GDX ETF): initial target price: $22.97; stop-loss: $21.47; initial target price for the NUGT ETF: $26.17; stop-loss for the NUGT ETF $21.84

In case one wants to bet on junior mining stocks' prices (we do not suggest doing so – we think senior mining stocks are more predictable in the case of short-term trades – but if one wants to do it anyway, we provide the details), here are the stop-loss details and initial target prices:

- GDXJ ETF: initial target price: $33.57; stop-loss: $31.58

- JNUG ETF: initial target price: $14.58 stop-loss: $12.38

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash)

Insurance capital (core part of the portfolio; our opinion): Full position

Important Details for New Subscribers

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that the in the trading section we describe the situation for the day that the alert is posted. In other words, it we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices, so that you can decide whether keeping a position on a given day is something that is in tune with your approach (some moves are too small for medium-term traders and some might appear too big for day-traders).

Plus, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn’t mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks – the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGLD, DGLD, USLV, DSLV, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as “final”. This means that if a stop-loss or a target level is reached for any of the “additional instruments” (DGLD for instance), but not for the “main instrument” (gold in this case), we will view positions in both gold and DGLD as still open and the stop-loss for DGLD would have to be moved lower. On the other hand, if gold moves to a stop-loss level but DGLD doesn’t, then we will view both positions (in gold and DGLD) as closed. In other words, since it’s not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can’t provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the “additional instruments” without adjusting the levels in the “main instruments”, which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels on a daily basis for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Additionally, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

=====

Latest Free Trading Alerts:

The recent couple of days have turned the short-term outlook on its ear for some traders. The last couple of months have seemed like sooth sailing, not something that could be said about the Bitcoin market too many times in the past. Now, we get a different reading and some might say that the tide has turned. But you need to go deeper than that.

What a fall! The price of gold dropped about $100 since mid-April, or about $50 since mid-June. What is happening in the precious metals market?

In recent days, oil bulls have accustomed us to fresh peaks. However, when we look more closely at the volume, their actions lose some of the glow. When we add the picture, which emerges from the relationship between crude oil and precious metals, doubts about the strength of the rally are getting even bigger. Is it possible that this interesting link tells us more about the future of black gold?

Crude Oil – Precious Metals Link and Its Implications

=====

Hand-picked precious-metals-related links:

PRECIOUS-Gold recovers from 7-month low as dollar eases

Platinum price plunges to 14-year low

=====

In other news:

World stocks rise off 2-1/2 month low, China soothes currency markets

Bank of England hawk says UK rates may rise faster than the markets are expecting

Oil climbs on Libya force majeure, Canada outage

Merkel and Seehofer make fragile peace

=====

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts