Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert. I’m adjusting the exit prices for our short positions.

Another day, another slide in gold… NOT. However, we did see one in silver and mining stocks, anyway, as the reversal in the stock market (you know, the one that I didn’t trust) turned out to be a fake indication. As stocks moved to their previous yearly lows, silver and miners declined too.

Will this situation make gold move lower in the near term?

That seems quite likely. The USD Index is on the rise, and gold seems to have simply taken a breather after a sharp decline. The triangle-vertex-based turning point is several days away, and so is gold’s combination of strong support levels.

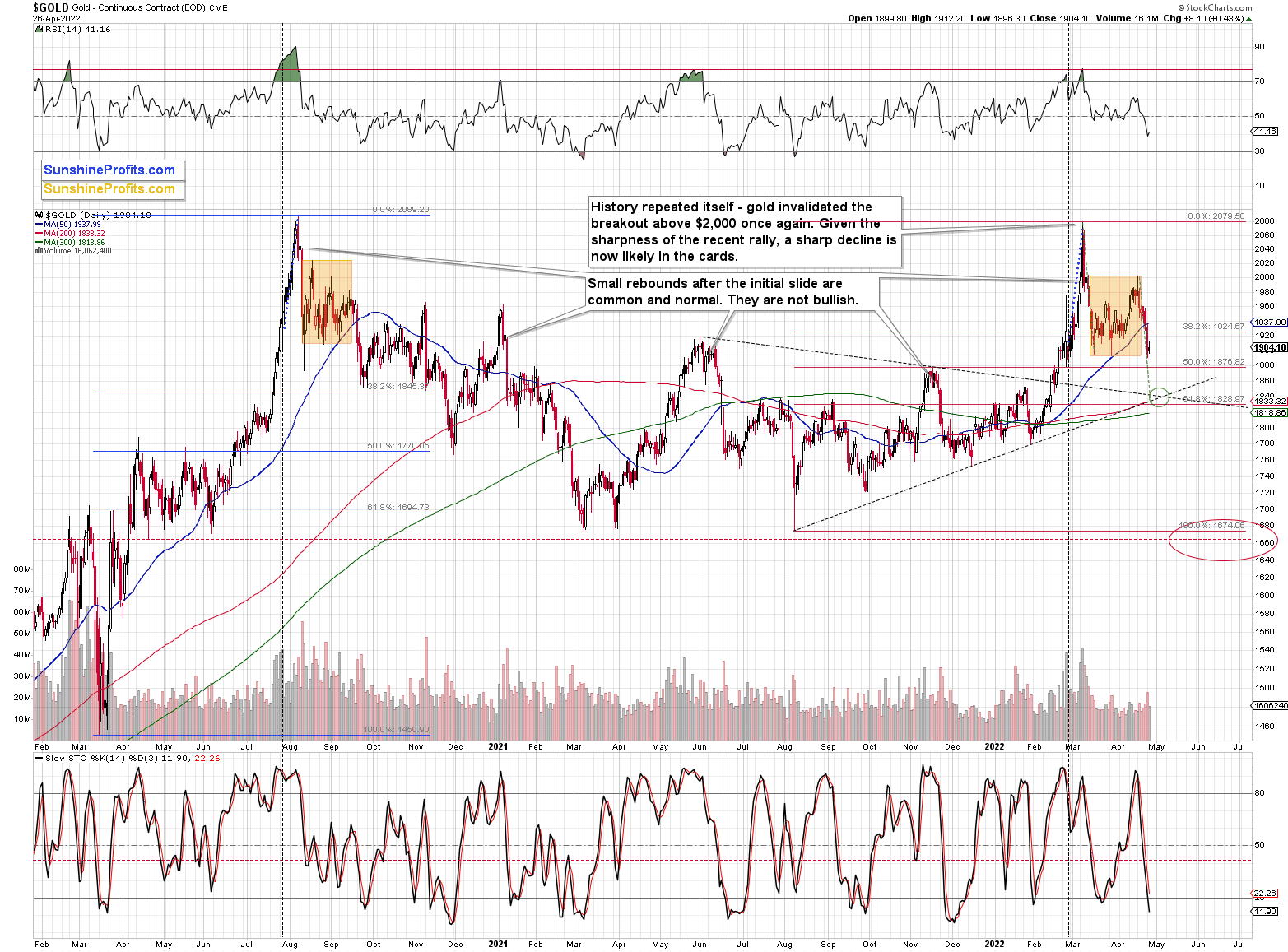

My previous comments on the above gold chart remain up-to-date:

Gold has a triangle-vertex-based reversal point nearby, which confirms the analogous point in the GDXJ. They both confirm each other.

In the case of gold, please note how it followed its self-similarity to the post-2020 top trading patterns. The yellow metal moved slightly above its initial post-top bottom, and then it immediately turned south.

The support lines cross at about $1,845, so that’s where we might see the next short-term rebound, but let’s keep in mind that it’s not likely to be anything more than that – a corrective rebound that is then followed by another move lower.

The ~$1,845 target is additionally supported by the markets’ tendency to repeat the move that took place before a given consolidation. In this case, a decline preceded the consolidation (marked in orange), so the consolidation is likely to be followed by one too.

In addition, this is what we saw in 2020, after the analogous top. I also marked the previous consolidation with an orange rectangle, and, as you can see, the move that preceded the consolidation was similar to the one that followed it.

In the current situation, the above supports the move to about $1,840, which is in perfect tune with the above-mentioned short-term target.

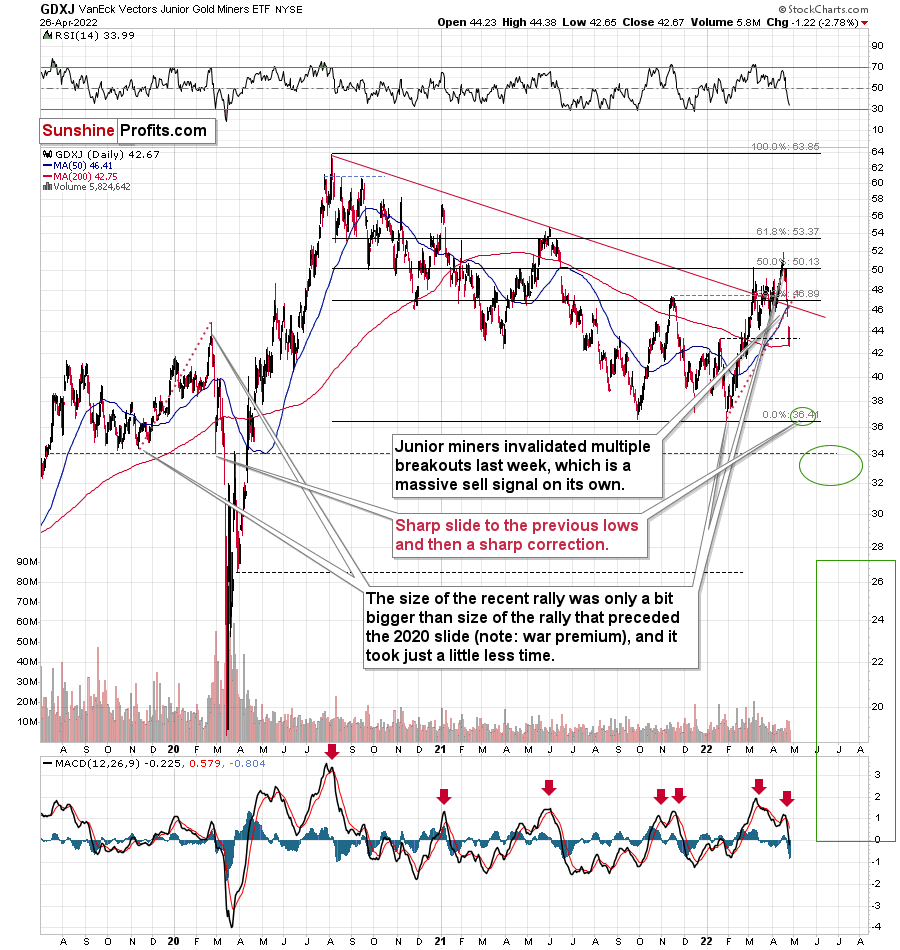

Speaking of junior miners, please note that despite moving to their January high (medium-term support level), they didn’t manage to end the day higher – even though gold did.

Instead, junior miners ended the day below their highest January close – the breakout is now clearly invalidated, which is yet another sell signal.

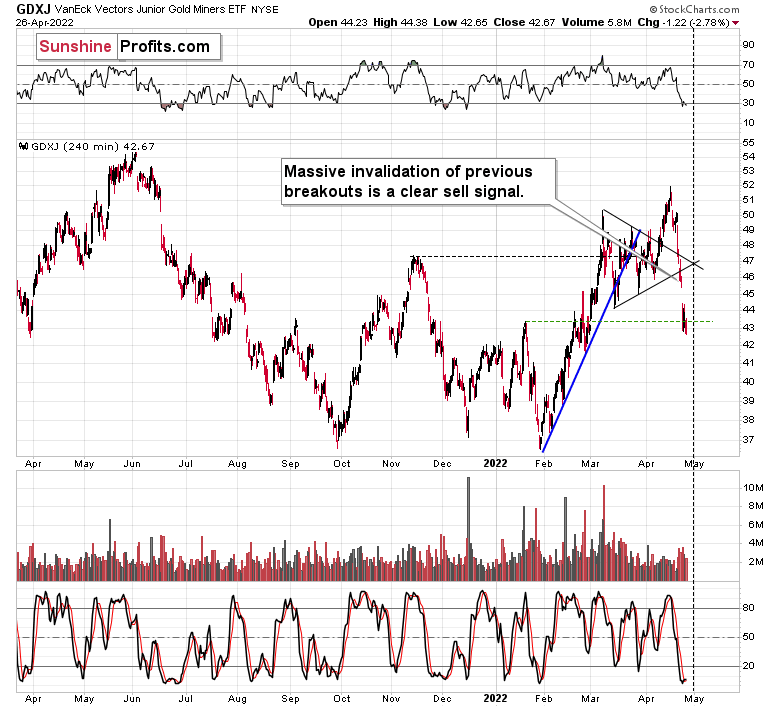

I previously wrote about multiple sell signals from the GDXJ ETF chart, and these indications remain up-to-date as well. I wrote the following:

The key thing is that practically all the seemingly bullish breakouts that we saw recently were just invalidated.

The breakout above the declining red resistance line was invalidated.

The breakout above the late-2021 high was invalidated.

The breakout above the 50% Fibonacci retracement level based on the 2020-2022 decline had been (earlier) invalidated.

The breakout above the upper border of the previous triangle pattern was invalidated.

The breakout above the lower border of the previous triangle pattern was invalidated.

That’s a sell signal on top of a sell signal, on top of a sell signal, on top of a sell signal, on top of a sell signal.

We saw sell signals from the GDXJ-based MACD indicator too.

Speaking of the triangle on the above chart, its vertex is at the end of April, so we might see some kind of turnaround then – perhaps a volatile comeback, which is then followed by another – even bigger – slide.

All of the above remains up-to-date. I would like to add two things, though:

- The GDXJ reached its January high, which provided support – that’s normal. It might or might not mean that a short-term bottom is in. I wouldn’t say that it’s bullish at this point.

- The 2022 rally is somewhat similar to what we saw in late 2019 and early 2020. I marked it with red, dotted lines on the first GDXJ chart. The rally was a bit bigger this year (war premium would explain that) and it was a bit shorter. However, the thing that I would like to emphasize is that back in 2020, the decline didn’t end until the GDXJ erased its entire rally, and the road to the initial lows was very rapid.

So, if the analogy described in point 2 continues, we might see another huge wave down before seeing a corrective upswing.

Back in 2020, the corrective upswing was very sharp, and if we see a decline that’s very volatile beforehand, I would expect to see a similarly volatile upswing.

Can GDXJ really decline to $37 within a week? That seems unlikely at first, but when one considers that it was trading above $50 about a week ago, it becomes quite possible.

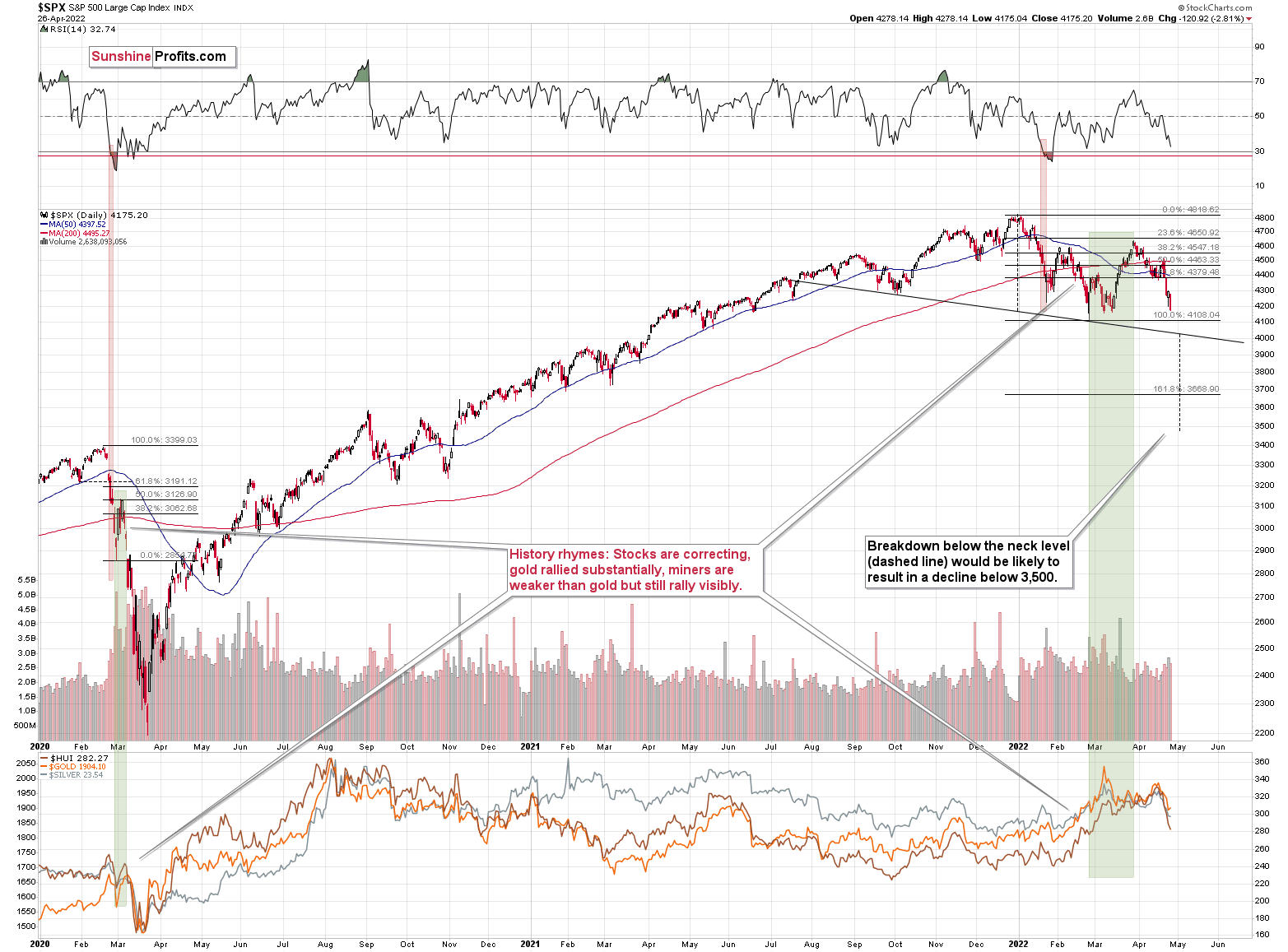

Will it really happen? After all, gold is only about $50 away from its short-term downside target. This might depend on the stock market.

Back in 2020 and 2008, mining stocks fell like stones in water because both gold and stocks were declining. If both gold and stocks decline, the mining stock bears will simply take no prisoners.

Therefore, the question is: what about the stock market?

The general stock market declined yesterday, despite Monday’s big-volume reversal. This reversal candlestick was bullish, and the stock declined anyway, which only emphasizes the strength of the bears at this time.

The next support is provided by the neck level of the potential multi-month head-and-shoulders pattern, slightly above 4,000. Will stocks break below the previous yearly lows and move to about 4,000? Yesterday’s weakness indicates that it’s likely.

Besides, please note that stocks could break below the neck level and then consolidate below it, thus verifying the breakdown, and it would be a perfectly normal phenomenon – from the technical point of view, that is. So, stocks could actually form a temporary bottom a bit below 4,000.

If gold is likely to move lower and stocks are likely to move lower, then junior mining stocks (seniors and silver too) are likely to fall hard. Consequently, a move to $37 is not out of the question.

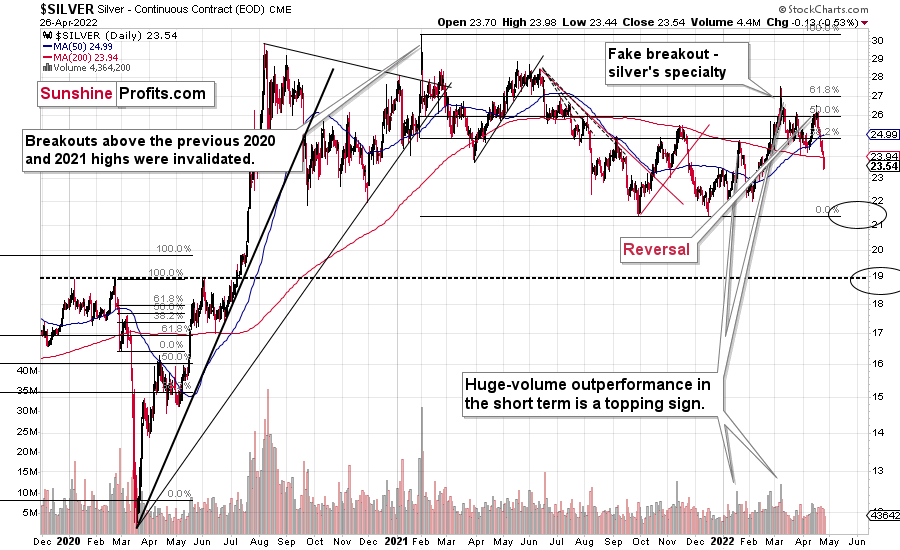

What about silver?

Silver declined profoundly recently, and just like miners, it invalidated multiple previous breakouts. Most interestingly, though, it now clearly invalidates the breakout above its January 2022 high.

The next strong support is based on the previous lows, close to the $22 level. That’s where silver might correct before moving much lower.

Provided that stocks continue to decline, silver and miners are likely to fall even more than gold.

Let’s keep in mind what happened in the previous cases when stocks declined profoundly – in early 2020 and in 2008. Miners and silver declined in a truly epic manner, and yes, the same is likely to take place in the following months, as markets wake up to the reality, which is that the USD Index and real interest rates are going up.

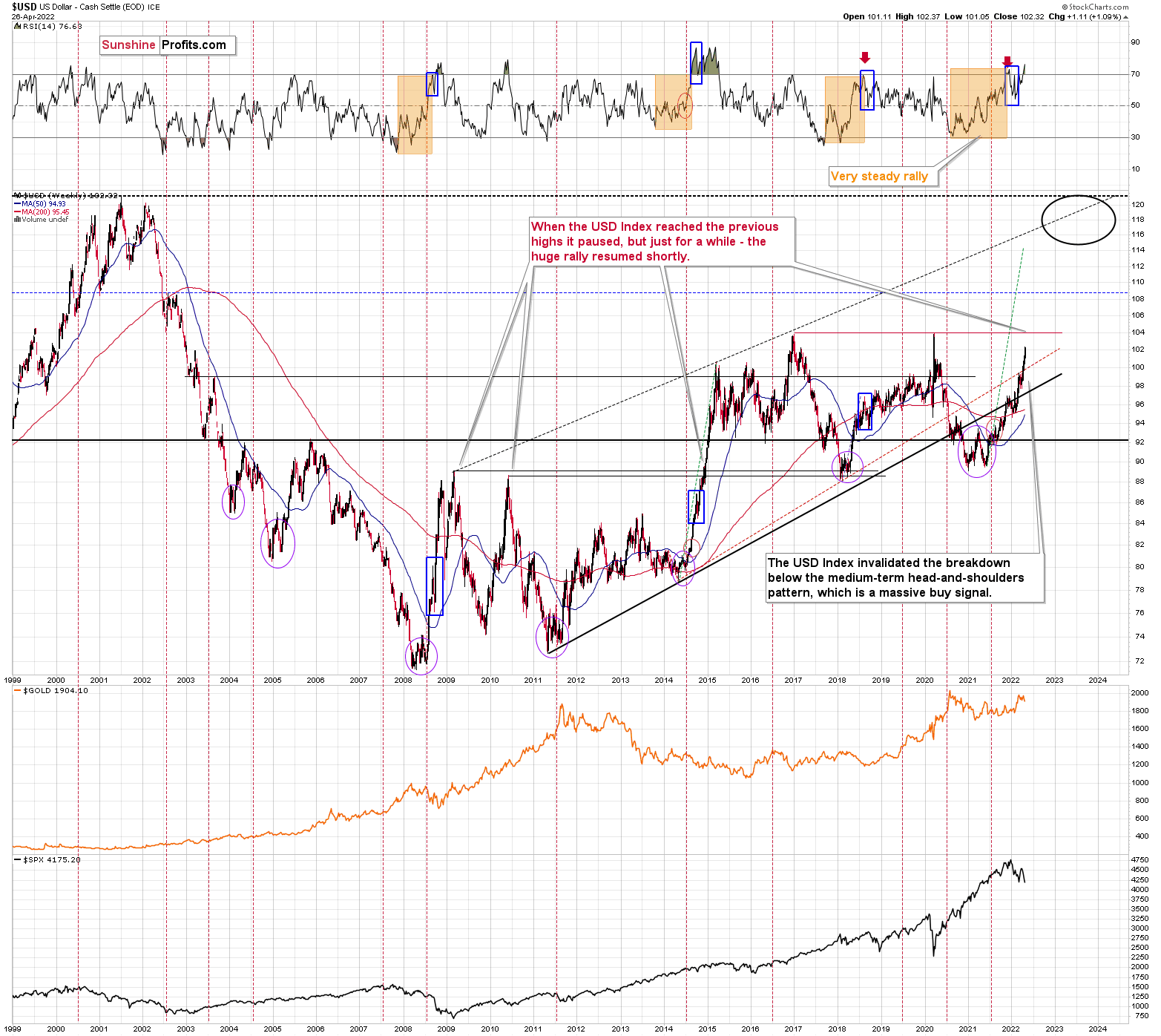

Speaking of the USD Index, after invalidating the breakout below the multi-year head-and-shoulders pattern, the USDX is poised to soar, just like I’ve been expecting it to do for more than a year.

The RSI is above 70, but since the USDX is in a medium-term rally and is already after a visible correction, it can rally further. Please note that we saw the same thing in 2008 and in 2014. I marked the corrections with blue rectangles.

The next strong resistance is at the previous highs – close to the 104 level.

It doesn’t mean that the USD Index’s rally is likely to end there. It’s not – but the USDX could take a breather when it reaches 104. Then, after many investors think that the top has been reached as the USDX corrects, the big rally is likely to continue.

The important detail here is that the consolidation close to the 104 level doesn’t have to be really significant (perhaps 1-2 index points of back-and-forth movement?) and it definitely doesn’t have to take long. The interest rates are going higher, and investors appear to have just woken up to this reality – it will take some time before everyone digests what’s going on. Before the late-reality-adopters join in, the USD Index could be trading much, much higher.

Back in 2014, when the USD Index approached its previous highs (close to 89), it consolidated so quickly that it’s almost not visible on the above chart – it took just a bit more than a week (from Dec. 8, 2014 – 89.56 to Dec. 16, 2014 – 87.83).

We could see something similar this time – and as the USD Index corrects for about a week, the same thing could take place in other markets as well: stocks and PMs. If junior miners were after a very sharp slide at that time, they would be likely to correct sharply as well.

All in all, the technical picture for mining stocks is extremely bearish for the following months, even though we might see a short-term correction close to the end of April.

Do I plan to trade this correction? It depends on how likely it is and where the prices of gold, silver, and mining stocks are. If they are close to relatively strong support levels while gold and miners are at their reversal points, I might indeed temporarily get out of the short positions. Of course, I’ll keep you informed.

Having said that, let’s take a look at the markets from a more fundamental point of view.

Who Could’ve Seen This Coming?

With reality rearing its ugly head recently, the S&P 500 and the GDXJ ETF have suffered mightily. Moreover, while I’ve been warning for months that investors underestimated the implications of rampant inflation, the chickens have come home to roost. To explain, I wrote on Oct. 26:

Originally, the Fed forecasted that it wouldn’t have to taper its asset purchases until well into 2022. However, surging inflation pulled that forecast forward. Now, the Fed forecasts that it won’t have to raise interest rates until well into 2023. However, surging inflation will likely pull that forecast forward as well.

Moreover, I added on Nov. 4, following the FOMC meeting:

With Fed Chairman Jerome Powell still searching for his inflationary shooting star, the FOMC chief isn’t ready to label inflation as problematic. “I don’t think that we’re behind the curve,” he said. “I actually believe that policy is well-positioned to address the range of plausible outcomes, and that’s what we need to do.”

The reality is: while Powell has taken the path of least resistance to help calm inflation (the taper), his inability to understand the realities on the ground leaves plenty of room for hawkish shifts in the coming months (interest rate hikes).

Thus, while Powell has shifted his stance materially and Fed officials now expect seven to 12 rate hikes in 2022, the financial markets initially ignored the repercussions. However, always late to the party, the consensus now fears that the medium-term outlook has lost its luster.

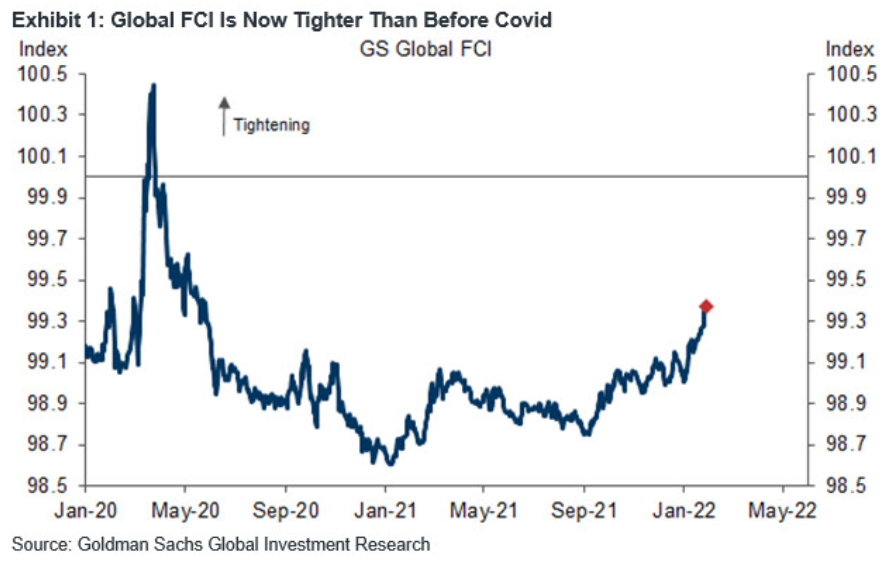

Please see below:

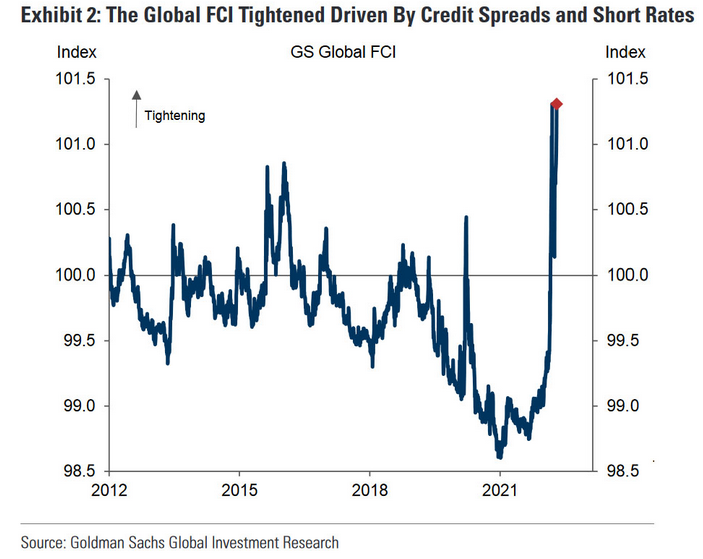

Likewise, while the fundamental implications have been loud and clear for months, sentiment doesn’t die easily. However, since reality is undefeated, the impact of evaporating liquidity is becoming too much to bear. To explain, I wrote on Feb. 2:

If you analyze the right side of the chart, you can see that the FCI has surpassed its pre-COVID-19 high (January 2020). Moreover, the FCI bottomed in January 2021 and has been seeking higher ground ever since. In the process, it's no coincidence that the PMs have suffered mightily since January 2021. Furthermore, with the Fed poised to raise interest rates at its March monetary policy meeting, the FCI should continue its ascent. As a result, the PMs' relief rallies should fall flat, like in 2021.

Likewise, while the USD Index has come down from its recent high, it's no coincidence that the dollar basket bottomed with the FCI in January 2021 and hit a new high with the FCI in January 2022. Thus, while the recent consolidation may seem troubling, the medium-term fundamentals supporting the greenback remain robust.

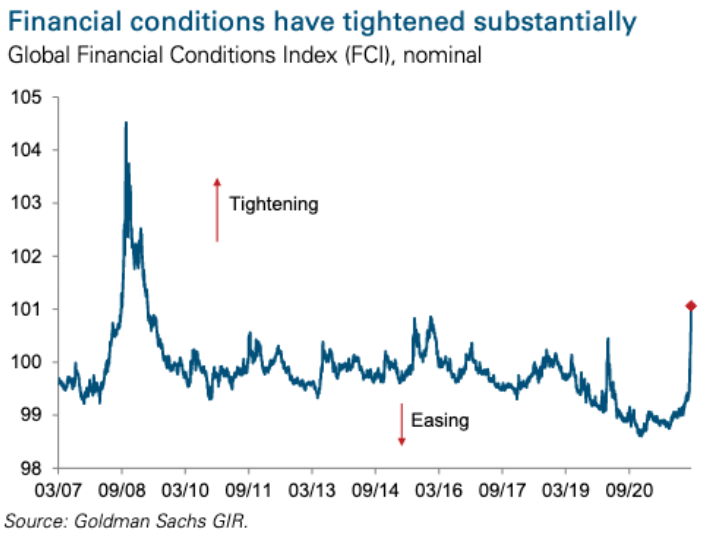

I provided an update on Apr. 13:

While the USD Index has surpassed 100 and reflects the fundamental reality of a higher FCI and higher real yields, the PMs do not. However, the PMs are in la la land since the FCI is now at its highest level since the global financial crisis (GFC).

Please see below:

Also noteworthy, the FCI made quick work of the March 2020 high from the first chart above. Again, Fed officials know that higher real yields and tighter financial conditions are needed to curb inflation. That’s why they keep amplifying their hawkish message and warning investors of what lies ahead. However, with commodities refusing to accept this reality, they’ll likely be the hardest-hit once the Fed’s rate hike cycle truly unfolds.

Surprise, surprise: after surpassing its March 2020 highs, the FCI has continued its ascent.

Please see below:

As a result, while the Russia-Ukraine conflict and misguided optimism disrupted our bearish timeline, the important point is that investors can only ignore technical and fundamental realities for so long. With a resurgent USD Index and rising real yields, which are profoundly bearish for the PMs, the latter have come down from their recent highs.

Moreover, with the general stock market's suffering adding to the GDXJ ETF's ills, the junior miners have underperformed their precious metals counterparts, which has been very beneficial for our short position.

However, the bearish medium-term thesis remains unchanged: inflation is problematic, the Fed is hawked up, and a higher USD Index and higher real yields should materialize in the coming months.

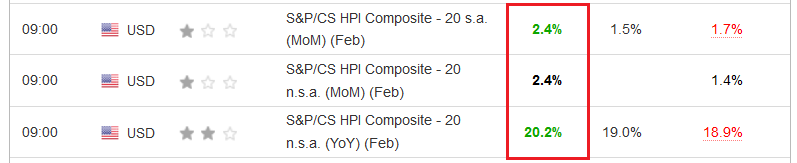

Case in point: while February's lagging data may not reflect the impact of rising mortgage rates, the S&P/Case-Shiller U.S. National Home Price Index surged by more than 20% year-over-year (YoY) on Apr. 26 and outperformed expectations (19%). As a result, the data is profoundly bullish for shelter inflation, which accounts for more than 30% of the headline Consumer Price Index's (CPI) movement.

Please see below:

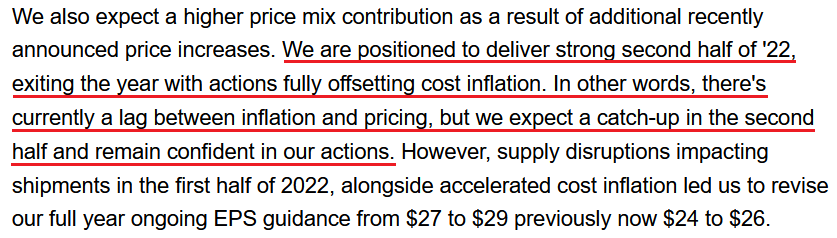

Also noteworthy, Whirlpool released its first-quarter earnings on Apr. 25. For context, the company manufacturers home and kitchen appliances like washing machines, dryers, refrigerators, and stand mixers. CEO Marc Bitzer said during the Q1 earnings call:

“As our industry and most other industries face historical levels of cost inflation, we observed over $400 million in the fourth quarter, or approximately a 10% increase on cost of goods sold. Despite this, we delivered over 9% ongoing EBIT margins and over 16% EBIT margins in our North America business, again demonstrating the earnings strength of the region and the actions we took, transforming margins over the years.”

“We now expect higher levels of inflation to persist throughout the year and have increased our full year cost inflation expectations by $600 million to $1.8 billion.”

However, is Whirlpool waiting for the Fed to solve the problem?

“Our first quarter results demonstrate that we are a different Whirlpool, delivering structurally improved EBIT margins no matter the operating environment. We have the right actions in place to deliver a solid 2022, including our previously announced cost-based price increases of 5% to 18%, addressing inflation across the globe.”

To that point, due to the time lag between incurring costs and implementing price hikes, Bitzer said that more increases are scheduled for the back half of 2022.

Please see below:

Source: Whirlpool/Seeking Alpha

Source: Whirlpool/Seeking Alpha

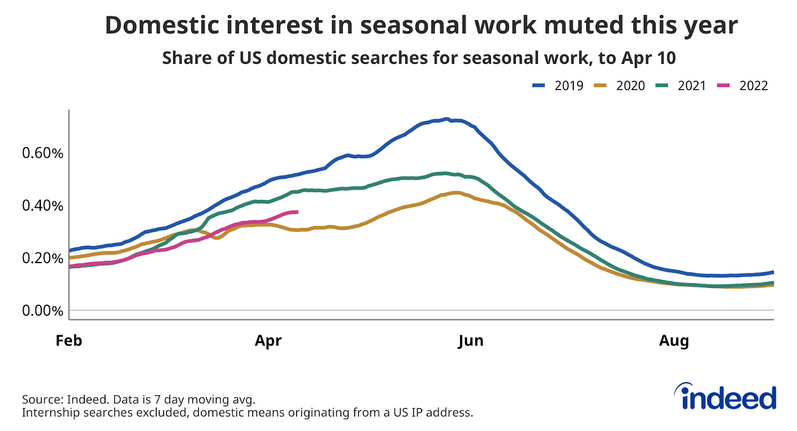

On top of that, Indeed released its latest State of the Labor Market report on Apr. 21. An excerpt read:

“Employer demand for seasonal work is growing in line with pre-pandemic trends, with summer job postings on Indeed soaring 40.1% above their February 1, 2022 baseline as of April 10 (…).”

“Seasonal postings on Indeed for spring and summer jobs comprise a variety of positions. Some of these jobs, like camp counselor and lifeguard, fit the traditional summer mold. But more general roles, like retail sales associate and cashier, make strong showings too.”

However:

“Domestic job seeker interest in seasonal jobs lags prior year trends. As of April 10, the 2022 share of domestic job seeker searches for seasonal work was respectively 27.6% and 16.9% below the comparable periods in 2019 and 2021.”

Please see below:

To explain, the blue and green lines above track U.S. citizens’ interest in seasonal work in 2019 and 2021 (before/after the height of the pandemic), while the pink line above tracks their current interest. As you can see, there is a clear underperformance.

More importantly, the combination of normalized demand and insufficient supply is extremely inflationary. With demand “growing in line with pre-pandemic trends,” while supply is roughly 17% to 28% below comparable periods, it should put upward pressure on wage inflation. Moreover, remember what I wrote on Apr. 22?

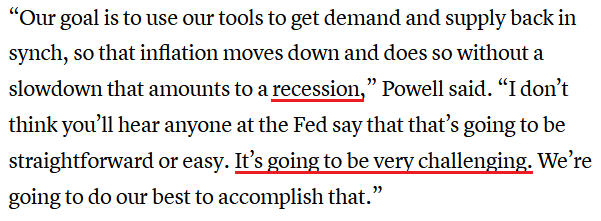

Powell said on Apr. 21 that the U.S. labor market is "too hot" and that the Fed needs to cool it down. "It is a very, very good labor market for workers," he said. "It is our job to get it into a better place where supply and demand are closer together."

As a result, he understands the problem. However, reducing 8.6% annualized inflation without impairing the U.S. labor market is like trying to hit a hole in one on the golf course.

Please see below:

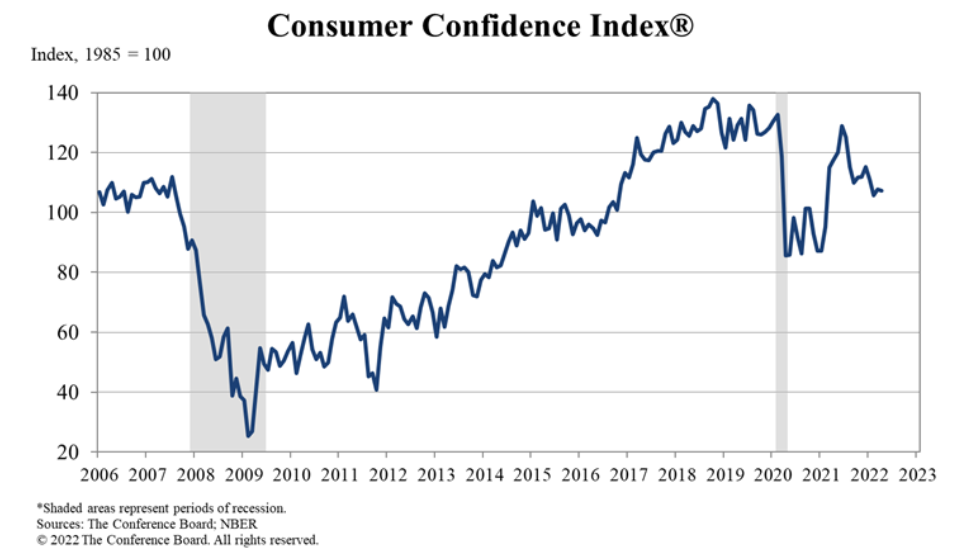

Finally, The Conference Board released its Consumer Confidence Index on Apr. 26. The headline index decreased from 107.6 in March to 107.3 in April, and Lynn Franco, Senior Director of Economic Indicators at The Conference Board, said:

“The Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early Q2. Expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.”

All in all, the data is largely inconclusive, as there are some good and some bad results. However, since “concerns about inflation retreated from an all-time high in March but remained elevated,” more QE is far from the right medicine.

The bottom line? While I warned on Apr. 8 that when sentiment shifts, the PMs will confront one of the worst domestic fundamental environments since late 2018, the troublesome developments are catching up to gold, silver, and mining stocks. However, despite their recent drawdowns, the PMs are still trading well above their medium-term-trend-based fair values. Therefore, more pain should materialize over the medium term. It seems that we might see a sharp rebound in the near future, though (after PMs decline some more).

In conclusion, the PMs were mixed on Apr. 26, as mining stocks continued their material underperformance. Moreover, while investors will likely remain in ‘buy the dip’ mode until the very end, lower highs and lower lows should confront the S&P 500 and the PMs over the next few months. As a result, the medium-term outlook for the GDXJ ETF is profoundly bearish.

Overview of the Upcoming Part of the Decline

- It seems to me that the post-decline consolidation is now over or very close to being over , and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first ( bigger ) stop for gold will be close to its previous 2021 lows, slightly below $1,800 . Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

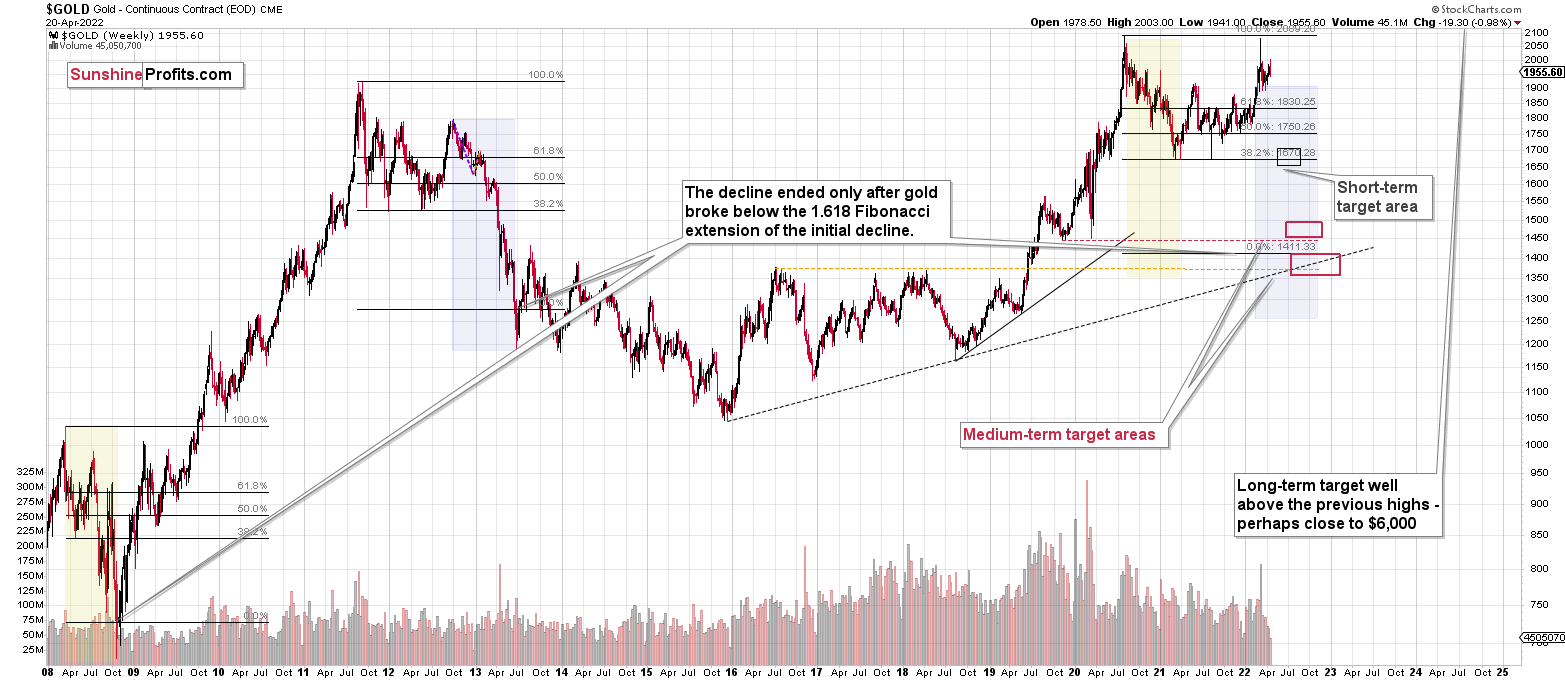

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Letters to the Editor

Q: Hi PR,

I hope you are doing well. I have a question in regards to your possible short-term plans. You mentioned in yesterday's newsletter that there could be an upcoming short-term correction of the USDX in April, and you could plan to trade the correction depending on where the prices of gold, silver, and mining stocks are at the time, and this would temporarily get you out of the short positions you currently have. In the Overview of the upcoming decline section, you mention that the first gold stop might be around the $1,800 area. As far as timing goes, do you think gold will go up next week, possibly change to long positions, and then keep declining to the $1800s you were referring to in the Overview of the upcoming decline section?

Thanks for your help, and I enjoyed reading your newsletter.

A: Thanks for the kind words – much appreciated. To clarify, the correction from the $1,800 level is still likely. I simply didn’t want to get too granular in the “overview” section with regard to details of other short-term moves, especially since I’m not as certain about this / next week’s reversal. It’s still possible that we’re seeing a pause right now, and that it will end at the triangle-vertex-based reversal points.

The Fed is likely to increase the interest rates on May 4 (probably by 0.5%), and it would be quite normal for the markets to “sell the rumor and buy the fact,” which in this case could mean that PMs would decline beforehand, but reverse and start a short-term rally once the rates are increased.

However, it would work out differently (PMs could consolidate now and slide based on the interest rate hike), and since it’s all not that clear, I’m not adding this to the “overview” section.

If we see a profound short-term slide soon, I’ll likely temporarily switch to long positions, but unless that happens, I likely won’t, and I’ll stick to the short position, riding out the temporary back-and-forth movement. The medium-term trend is very clear, so the biggest risk is being out of the short position, in my view.

Summary

Summing up, as investors are starting to wake up to the reality, the precious metals sector (in particular junior mining stocks) are declining sharply. The key parts of the reality that the market participants have been ignoring are:

- rising real interest rates,

- rising USD Index values.

Both of the aforementioned are the two most important fundamental drivers of the gold price. Since neither the USD Index nor real interest rates are likely to stop rising anytime soon (especially now that inflation has become highly political), the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

It seems that our profits from short positions are going to become truly epic in the coming months.

I’m adjusting the trading positions as I plan to temporarily (perhaps for just a week or so) switch from a short to long position IF we get a sharp decline in junior mining prices soon. In other words, if the short-term decline gets too excessive, it seems that it would be justified from the risk to reward perspective to very briefly (for probably no longer than a week) get out of the short position and enter a long one.

At this point, it seems likely that if juniors decline all the way down to their recent lows (about $37), then they would be likely to come back to more or less that current levels (about $43 in GDXJ)

Of course, the medium-term trend remains down, so if one wants to simply wait out the near-term corrections, it’s also fine. The upside potential for the inversely trading instruments is likely enormous, anyway.

After the final sell-off (that takes gold to about $1,350-$1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

As always, we'll keep you – our subscribers – informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $37.52; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $11.49; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $15.68; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $21.63

SLV profit-take exit price: $20.14

ZSL profit-take exit price: $27.89

Gold futures downside profit-take exit price: $1,853

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $7.68

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $21.47

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief