Briefly: in our opinion, full (300% of the regular position size) speculative short positions in junior mining stocks are justified from the risk/reward point of view at the moment of publishing this Alert.

Nothing changed over the weekend with regard to the tensions around Ukraine. The “supposed” attack is based (only) on U.S. indications that by themselves provide very little to no real backing behind the scenario in which Russia invades Ukraine.

I commented on that in Friday’s intraday Gold & Silver Trading Alert, and nothing changed in that regard. If you haven’t read that analysis so far, I strongly encourage you to do so today.

Now, let’s check what the market’s overreaction caused on the charts. Did the technical picture change, or did it not? Let’s see.

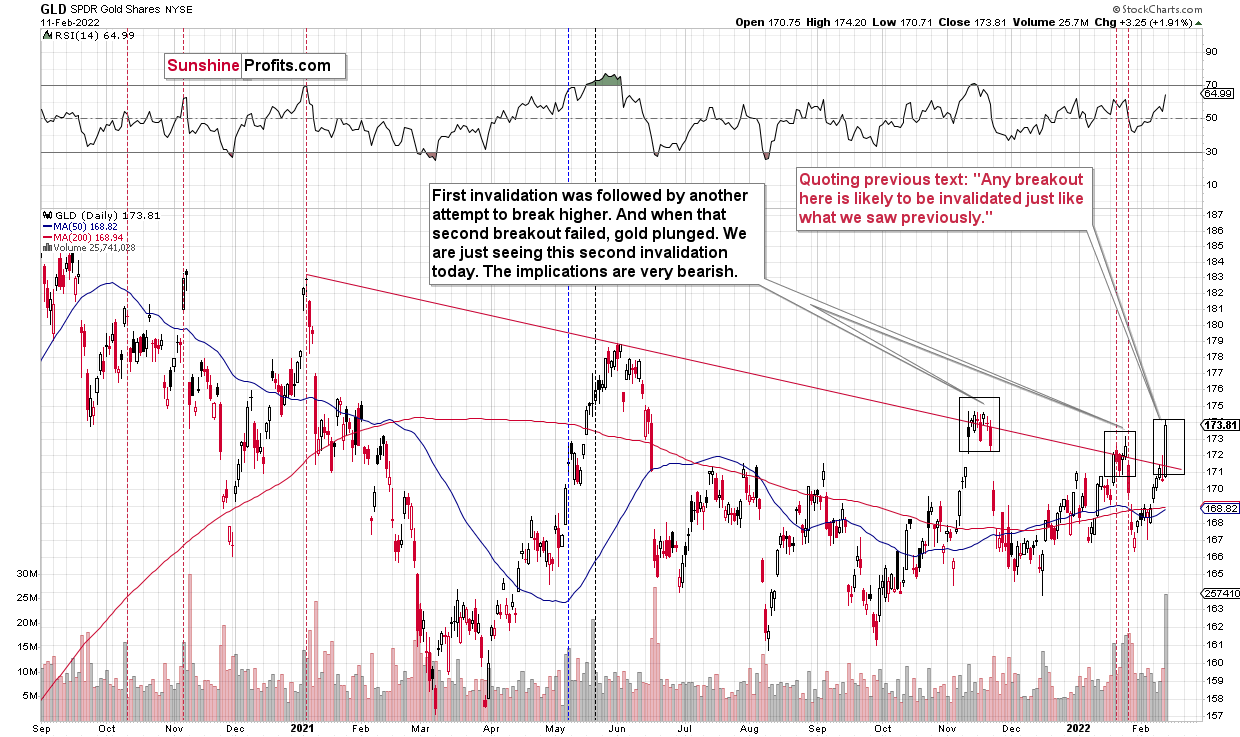

Basically, only two charts matter for the sake of that discussion. One features the GLD ETF, and the other features mining stocks’ proxy – the GDX ETF. I’ll start with the former.

The GLD ETF approached its declining medium-term resistance line, and I previously wrote that any breakout here was likely to be invalidated, as we saw earlier in November 2021 and January 2022.

Indeed, we saw a breakout, but it’s very unlikely to hold ground. Instead, a decline either immediately or after the top later this week and a decline shortly thereafter are much more likely.

The volume during Friday’s rally was huge, but is it really bullish? Let’s consider what happened in previous cases when we saw GLD rally in big volumes.

I marked those cases with vertical dashed lines. The red ones were great shorting opportunities, and the black ones had rather mixed implications.

Of the 7 cases, 5 of them were good shorting opportunities, and only two of them had rather mixed implications.

Yes, the GLD ETF moved higher on strong volume in early- and mid-May 2021, but in the first case it was a short-term top, and in the second case it was relatively close to a medium-term top.

Overall, with 5 out of 7 cases being bearish, 2 of them being unclear, and none of them being clearly bullish, the implications of Friday’s “strong performance” are actually bearish, not bullish. Looking at first sight might be encouraging, but it’s also likely misleading.

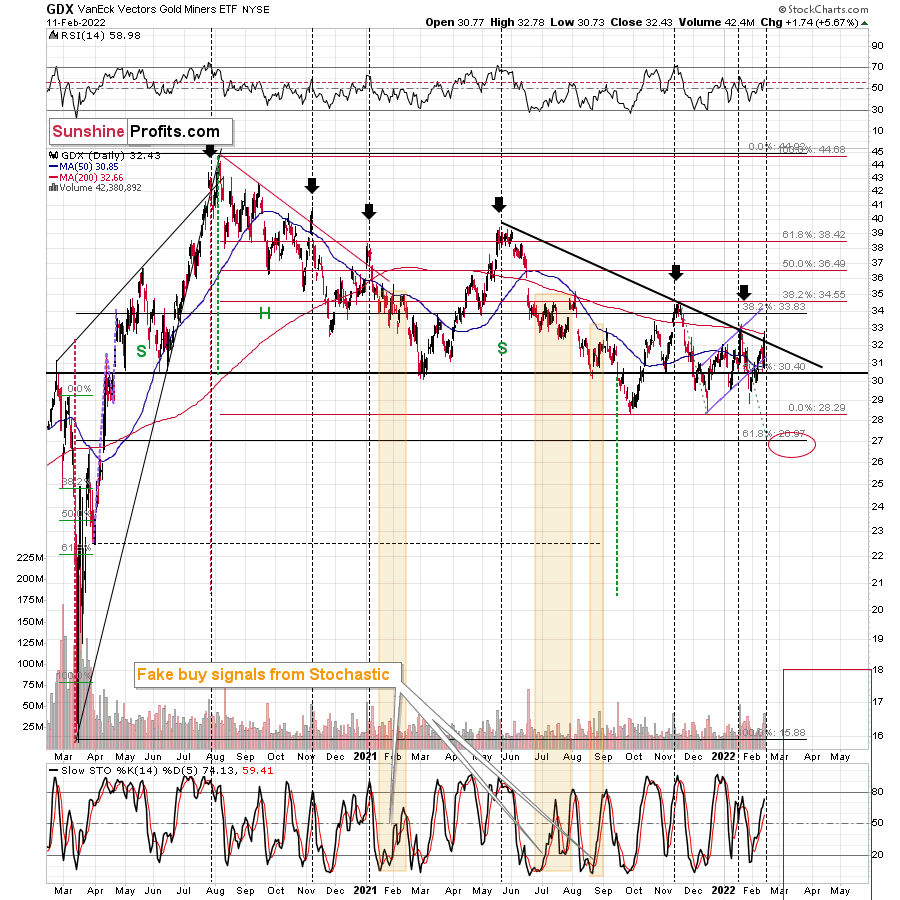

Especially since we have the same indication – from volume – in the case of the mining stocks.

Namely, gold miners have once again soared on huge volume. “Once again,” because the same thing happened about a month ago.

Big daily rallies on big volume in mining stocks (GDX) tend to take place at the end of a given short-term upswing or close to it. For example, we saw that on Nov. 10, 2021, Aug. 27, 2021, Jul. 29, 2021, May 17, 2021, and Jan. 19, 2021.

These were good shorting, not buying opportunities. It’s rather unlikely that right now – AFTER the daily rally on huge volume – we are at a favorable moment to go long or to close the short positions. It seems much more likely that we are in a situation where short positions are even more justified from the risk-to-reward point of view.

What should one do about this upswing? As always, the decision is up to you – it’s your money. I’m not doing anything with my short position in junior mining stocks. If I didn’t already have it in place (at my desired – significant – size), I would have either entered this short position or added to it.

All in all, we saw a rally, but it’s unlikely to be the start of a bigger rally. Instead, it’s likely that what we saw was either the final part of the corrective upswing that started in mid-December, 2021, or it’s close to the final part of the corrective upswing. Either way, I think that the short position in the junior mining stocks remains justified from the risk-to-reward point of view.

Also, let’s keep in mind that the geopolitical tensions are likely to only have a temporary effect on precious metals prices and that the current tensions around Ukraine are likely very exaggerated and likely close to “peak concern” (and thus a concern-based price peak).

Having said that, let’s take a look at the markets from a more fundamental point of view.

Buy the Rumor

With another dire warning from the White House uplifting gold and mining stocks on Feb. 11, Russia and Ukraine's “will they or won't they” saga has shifted sentiment. However, it's important to remember that geopolitical risk rallies often have a short shelf life and dissipate over the medium term.

To explain, I wrote on Sep. 21:

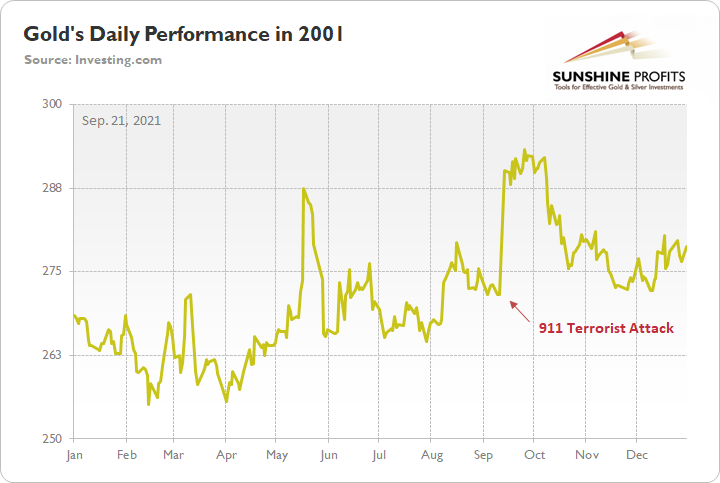

When terrorists attacked the World Trade Center roughly 20 years ago, gold spiked on Sep. 11, 2001. However, it wasn’t long before the momentum fizzled and the yellow metal nearly retraced all of the gains by early December. Thus, when it comes to forecasting higher gold prices, Black Swan events are often more semblance than substance.

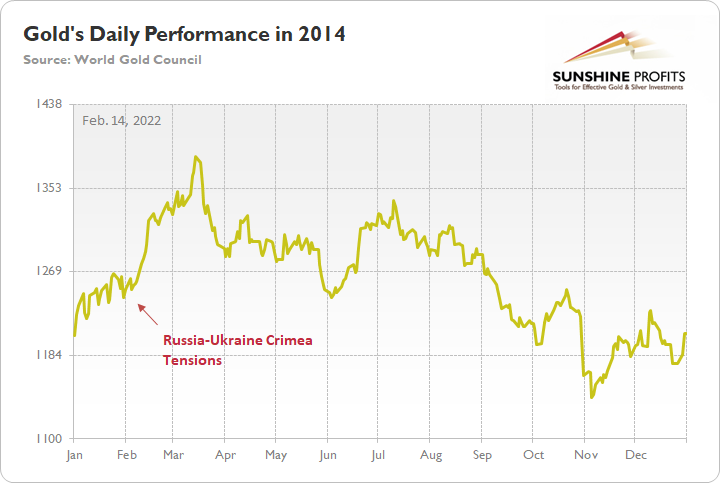

As further evidence, when Russia annexed Crimea from Ukraine in 2014, similar price action unfolded. For example, when rumors swirled of a possible invasion, gold rallied on the news. Then, when Russia officially invaded, the yellow metal continued its ascent. However, after the short-term sugar high wore off, bearish medium-term realities confronted gold once again. In time, the yellow metal gave back all of the gains and sank to a new yearly low.

Please see below:

Thus, while conflicting reports paint a conflicting portrait, the medium-term algorithms don’t care whether Russia invades Ukraine or not. With the rumor enough to pique investors’ interest, quantitative traders see it as an opportunity to capitalize on the momentum. However, once that momentum fizzles, history shows that the quants rush for the exits. As a result, is this time really different?

Let’s keep in mind that the above assumes that Ukraine would indeed be invaded, which, in my view, is unlikely, despite news coming from the White House.

To that point, the USD Index is also a major beneficiary of geopolitical tensions. However, in contrast to gold, the greenback’s rally on Feb. 11 aligns with its medium-term fundamentals.

To explain, while the EUR/USD has been in style in recent weeks, ECB President Christine Lagarde provided another dose of reality on Feb. 11. Speaking with Redaktionsnetzwerk Deutschland, she reiterated all of the points that I’ve been making for months. For example, when asked about inflation and why the ECB hasn’t raised interest rates, she responded:

“Hold on! We first need to understand the source of the rise in prices. Just over 50 per cent of it can be attributed to the surge in energy prices. Oil, gas and electricity have become more expensive. And as we import a lot of energy, these prices are, to some extent, beyond the sphere of influence of our economy.”

She added: “The second main factor driving up prices is supply bottlenecks: shortages of microchips, container jams, disrupted supply chains. Let me ask you: what can the ECB do about that? Can we resolve supply bottlenecks? Can we transport containers, lower oil prices or pacify geostrategic conflicts? No, we can’t do any of that.”

As a result, while euro bulls continue to hope for a hawkish shift, Lagarde threw cold water on that idea.

Please see below:

For context, I wrote on Feb. 8:

While the EUR/USD held on to its ECB-induced gains, the bearish fundamental realities confronting the currency pair were confirmed on Feb. 7. To explain, while euro bulls think that the ECB will have a hawkish awakening, I warned on Feb. 4 that the prospect is much more semblance than substance.

Investors have priced in two ECB rate hikes in 2022. However, with the central bank still planning to purchase bonds “from October onwards” and Lagarde saying that rate hikes will only be considered thereafter, short-term sentiment should crumble over the medium term.

If that wasn’t enough, Lagarde also highlighted the U.S.-Eurozone fundamental dichotomy that I warned about throughout 2021.

Please see below:

What’s more, ECB Governing Council member Olli Rehn echoed her sentiment on Feb. 11. He said:

“If we reacted strongly to inflation in the short term, we would probably cause economic growth to stop. It’s better to look beyond short-term inflation and look at what inflation is in 2023, 2024.”

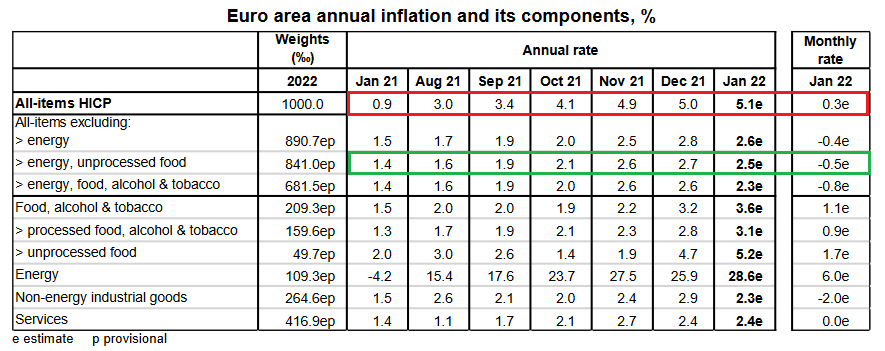

As a result, while the ECB continues to disappoint euro bulls, the reality is that the Eurozone fundamentals have never changed. I’ve highlighted on numerous occasions that oil and gas are the main drivers of Eurozone headline inflation, and more importantly, core inflation actually declined in January. To explain, I wrote on Feb. 4:

Follow the trajectory of the red rectangle above. As you can see, headline inflation (which includes food and energy) went from a 0.9% year-over-year (YoY) increase in January 2021 to a 5.1% YoY increase in January 2022. Pretty troublesome, huh?

However, if you focus your attention on the green rectangle, you can see that Eurozone core inflation (which excludes food and energy) declined from 2.7% YoY in December 2021 to 2.5% YoY in January 2022. As a result, while investors assume that abnormally high headline inflation will elicit a hawkish response from the ECB, the reality is that oil & gas remains the region’s only problem.

On the flip side, while the USD Index has suffered in recent weeks, Bank of America told clients that the Fed should win the "race to the top" when it comes to interest rate hikes.

"USD is no longer broadly perceived as having a strong monetary policy tailwind behind it. We disagree, less with the impulse to re-price global central banks (CBs) higher, and more with the failure of markets to preserve the Fed's lead," said Ben Randol, G10 FX & Rates Strategist.

As a result, Bank of America expects the EUR/USD to hit 1.10 in 2022.

Furthermore, RBC Capital Markets expects the EUR/USD to fall below 1.10 in 2022. Strategists wrote: “The question is whether late January marked the bottom for EUR/USD and we will stay at higher levels (end-2022 consensus is 1.14) or it will prove to be another false dawn and EUR/USD will make new lows. We are still in the latter camp.”

The bottom line? While gold often outperforms in the short term when geopolitical tensions rise, history shows that the momentum fades over the medium term. Moreover, with the recent rally contrasting gold’s bearish medium-term fundamentals, the ascent sets the stage for an even harder fall over the next few months. As a result, while the quants may “buy the rumor,” it’s often a mad dash for the exits once sentiment shifts.

As the Ukraine-related tensions subside as there’s no attack (in particular, there’s no attack this week), the precious metals market could start its decline quite soon.

In conclusion, the PMs were mixed on Feb. 11, and mining stocks outperformed. However, while the headline risk may seem monumental, fundamental factors like the USD Index and U.S. Treasury yields will hold more weight in the coming months. As such, the recent strength is likely a countertrend rally, and lower lows should confront the yellow metal over the medium term.

Overview of the Upcoming Part of the Decline

- It seems to me that the corrective upswing is now over, and that gold, silver, and mining stocks are now likely to continue their medium-term decline.

- It seems that the first (bigger) stop for gold will be close to its previous 2021 lows, slightly below $1,700. Then it will likely correct a bit, but it’s unclear if I want to exit or reverse the current short position based on that – it depends on the number and the nature of the bullish indications that we get at that time.

- After the above-mentioned correction, we’re likely to see a powerful slide, perhaps close to the 2020 low ($1,450 - $1,500).

- If we see a situation where miners slide in a meaningful and volatile way while silver doesn’t (it just declines moderately), I plan to – once again – switch from short positions in miners to short positions in silver. At this time, it’s too early to say at what price levels this could take place, and if we get this kind of opportunity at all – perhaps with gold close to $1,600.

- I plan to exit all remaining short positions once gold shows substantial strength relative to the USD Index while the latter is still rallying. This may be the case with gold close to $1,350 - $1,400. I expect silver to fall the hardest in the final part of the move. This moment (when gold performs very strongly against the rallying USD and miners are strong relative to gold after its substantial decline) is likely to be the best entry point for long-term investments, in my view. This can also happen with gold close to $1,375, but at the moment it’s too early to say with certainty.

- As a confirmation for the above, I will use the (upcoming or perhaps we have already seen it?) top in the general stock market as the starting point for the three-month countdown. The reason is that after the 1929 top, gold miners declined for about three months after the general stock market started to slide. We also saw some confirmations of this theory based on the analogy to 2008. All in all, the precious metals sector is likely to bottom about three months after the general stock market tops.

- The above is based on the information available today, and it might change in the following days/weeks.

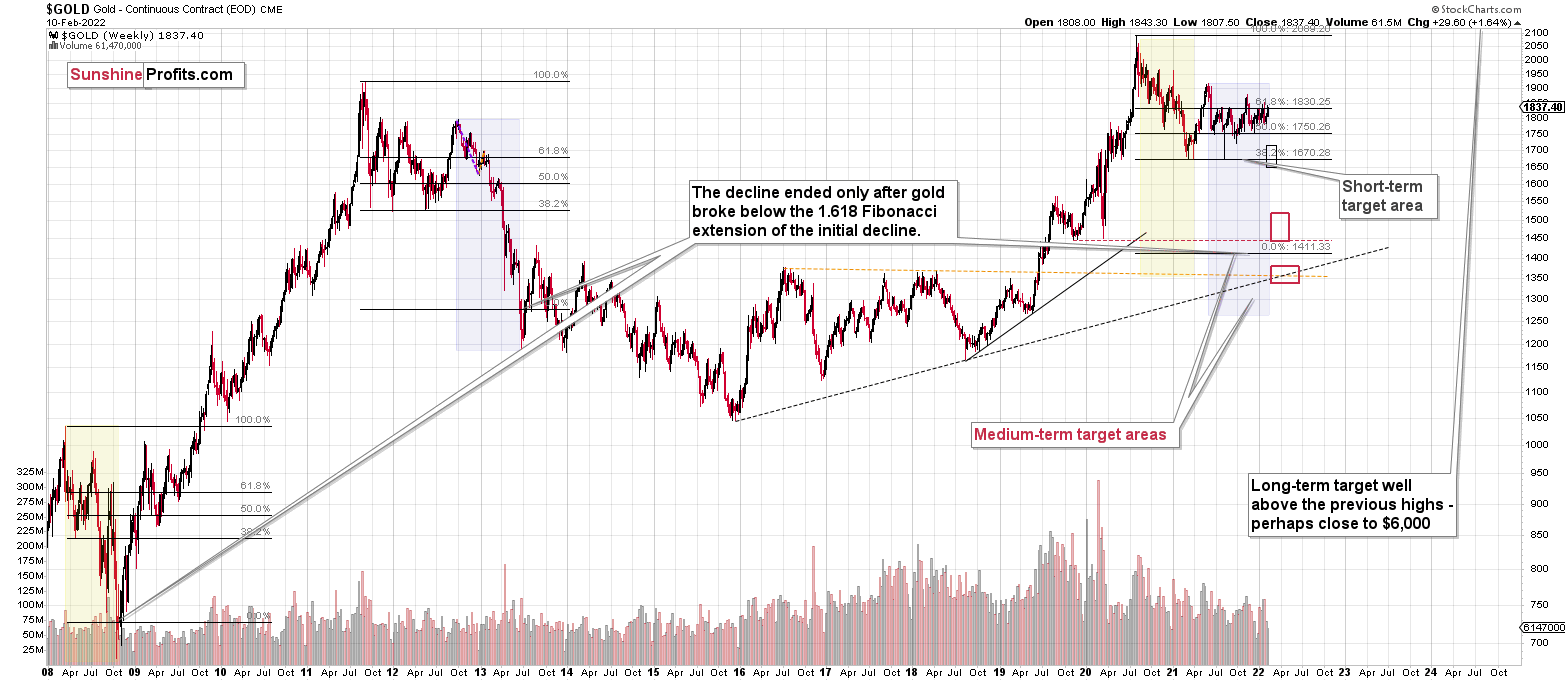

You will find my general overview of the outlook for gold on the chart below:

Please note that the above timing details are relatively broad and “for general overview only” – so that you know more or less what I think and how volatile I think the moves are likely to be – on an approximate basis. These time targets are not binding or clear enough for me to think that they should be used for purchasing options, warrants or similar instruments.

Summary

Summing up, it seems to me that the corrective upswing is over, or that we won’t have to wait too long for it to be over. Let’s keep in mind that there are triangle-vertex-based reversals in mid- and late-February, so even if we see more back-and-forth trading soon, it’s likely that the decline resumes later this month.

I continue to think that junior mining stocks are currently likely to decline the most out of all the parts of the precious metals sector.

From the medium-term point of view, the two key long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

It seems that our profits from the short positions are going to become truly epic in the coming months.

After the sell-off (that takes gold to about $1,350 - $1,500), I expect the precious metals to rally significantly. The final part of the decline might take as little as 1-5 weeks, so it's important to stay alert to any changes.

Most importantly, please stay healthy and safe. We made a lot of money last March and this March, and it seems that we’re about to make much more on the upcoming decline, but you have to be healthy to enjoy the results.

As always, we'll keep you - our subscribers - informed.

To summarize:

Trading capital (supplementary part of the portfolio; our opinion): Full speculative short positions (300% of the full position) in junior mining stocks are justified from the risk to reward point of view with the following binding exit profit-take price levels:

Mining stocks (price levels for the GDXJ ETF): binding profit-take exit price: $34.63; stop-loss: none (the volatility is too big to justify a stop-loss order in case of this particular trade)

Alternatively, if one seeks leverage, we’re providing the binding profit-take levels for the JDST (2x leveraged) and GDXD (3x leveraged – which is not suggested for most traders/investors due to the significant leverage). The binding profit-take level for the JDST: $14.98; stop-loss for the JDST: none (the volatility is too big to justify a SL order in case of this particular trade); binding profit-take level for the GDXD: $25.48; stop-loss for the GDXD: none (the volatility is too big to justify a SL order in case of this particular trade).

For-your-information targets (our opinion; we continue to think that mining stocks are the preferred way of taking advantage of the upcoming price move, but if for whatever reason one wants / has to use silver or gold for this trade, we are providing the details anyway.):

Silver futures downside profit-take exit price: $19.12

SLV profit-take exit price: $17.72

ZSL profit-take exit price: $38.28

Gold futures downside profit-take exit price: $1,683

HGD.TO – alternative (Canadian) inverse 2x leveraged gold stocks ETF – the upside profit-take exit price: $11.79

HZD.TO – alternative (Canadian) inverse 2x leveraged silver ETF – the upside profit-take exit price: $29.48

Long-term capital (core part of the portfolio; our opinion): No positions (in other words: cash

Insurance capital (core part of the portfolio; our opinion): Full position

Whether you already subscribed or not, we encourage you to find out how to make the most of our alerts and read our replies to the most common alert-and-gold-trading-related-questions.

Please note that we describe the situation for the day that the alert is posted in the trading section. In other words, if we are writing about a speculative position, it means that it is up-to-date on the day it was posted. We are also featuring the initial target prices to decide whether keeping a position on a given day is in tune with your approach (some moves are too small for medium-term traders, and some might appear too big for day-traders).

Additionally, you might want to read why our stop-loss orders are usually relatively far from the current price.

Please note that a full position doesn't mean using all of the capital for a given trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As a reminder - "initial target price" means exactly that - an "initial" one. It's not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade), we will refer to these levels as levels of exit orders (exactly as we've done previously). Stop-loss levels, however, are naturally not "initial", but something that, in our opinion, might be entered as an order.

Since it is impossible to synchronize target prices and stop-loss levels for all the ETFs and ETNs with the main markets that we provide these levels for (gold, silver and mining stocks - the GDX ETF), the stop-loss levels and target prices for other ETNs and ETF (among other: UGL, GLL, AGQ, ZSL, NUGT, DUST, JNUG, JDST) are provided as supplementary, and not as "final". This means that if a stop-loss or a target level is reached for any of the "additional instruments" (GLL for instance), but not for the "main instrument" (gold in this case), we will view positions in both gold and GLL as still open and the stop-loss for GLL would have to be moved lower. On the other hand, if gold moves to a stop-loss level but GLL doesn't, then we will view both positions (in gold and GLL) as closed. In other words, since it's not possible to be 100% certain that each related instrument moves to a given level when the underlying instrument does, we can't provide levels that would be binding. The levels that we do provide are our best estimate of the levels that will correspond to the levels in the underlying assets, but it will be the underlying assets that one will need to focus on regarding the signs pointing to closing a given position or keeping it open. We might adjust the levels in the "additional instruments" without adjusting the levels in the "main instruments", which will simply mean that we have improved our estimation of these levels, not that we changed our outlook on the markets. We are already working on a tool that would update these levels daily for the most popular ETFs, ETNs and individual mining stocks.

Our preferred ways to invest in and to trade gold along with the reasoning can be found in the how to buy gold section. Furthermore, our preferred ETFs and ETNs can be found in our Gold & Silver ETF Ranking.

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief